The slowing down SoCal housing market: Sales drop 10 percent year-over-year and investors begin to pullback.

The year ends on a similar note to how it began. Low inventory seems to be the name of the game once again. The market has definitely softened here in Southern California. The latest figures reflect a shift from the blistering hot first half of the year. Last month sales fell by 10 percent from last year and the median price is no longer rising. In fact, the median price of $385,000 for Southern California is the same today as it was in June, right before rates moved up strongly. There seems to be a universal consensus that home prices can only go up from this point forward based on low inventory. Typically starting in January we see a steady stream of new inventory come online for the spring and summer selling seasons. That is yet to be seen since the year ended with inventory retreating rather strongly. Yet with foreclosure resales making up a small portion of the market, there can no longer be the excuse that the median price is distorted because of foreclosure sales.

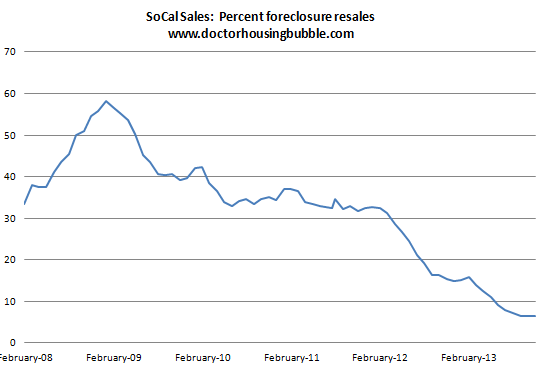

Foreclosure resales no longer a factor

Foreclosure resales are no longer an issue when it comes to price distortions:

Last month only 6.3 percent of all properties sold were foreclosure resales. Compare this to the nearly 60 percent figure back in early 2009. At this point, at least when it comes to foreclosures, there is very little foreclosures out on the market (after all, you can sell into this momentum as prices surged and the economy found its footing).

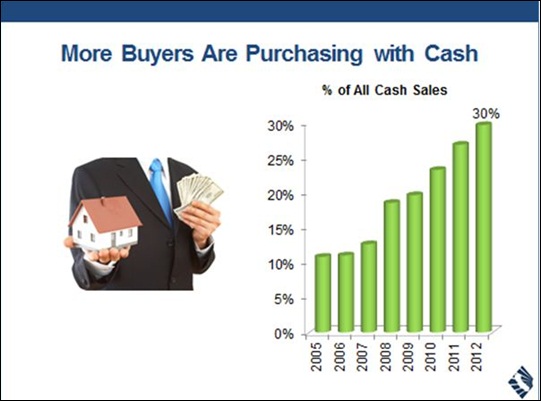

Yet there is also a pullback from cash buyers.  For Southern California the peak of cash buyers was close to 36 percent reached earlier in the year but the latest figures show it at 27 percent. The gap is being made up by increasing jumbo buyers, FHA buyers, and those taking on adjustable rate mortgages.

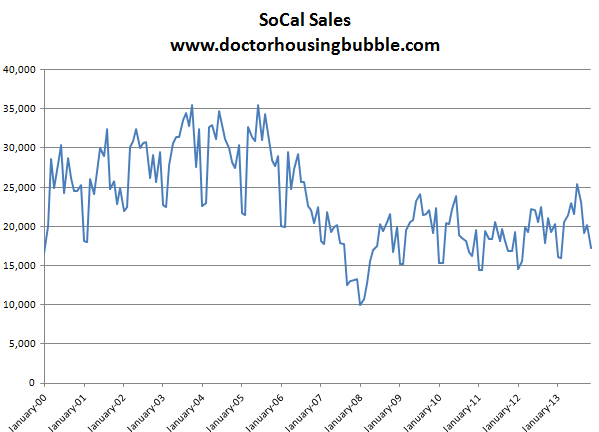

Weak sales

Sales follow a very seasonal pattern. During the fall and winter sales typically fall. This is why year-over-year measures are good to track. So the 10 percent drop in year-over-year sales is significant especially with the very low amount of inventory in the market. Take a look at the seasonal sales pattern for SoCal going back to 2000:

From 2000 to 2007 we only went under 20,000 sales per month a couple of times regardless of the season. That is it. The latest sales figure? 17,283 in the midst of the median home price increasing a whopping 20 percent from last year.

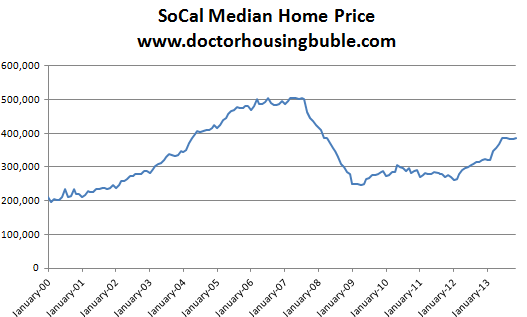

As I mentioned earlier the median home price has stalled out from June:

The current SoCal median home price is $385,000. Keep in mind that much of the investors that were buying were buying with the notion that prices would only go up. So we enter a self-fulfilling prophecy phase; will investors continue to buy while prices don’t go up? Obviously the stalling out in appreciation has caused cash buyers to pull back. The figures highlight this and with a massive amount of buying coming from investors this will have some sort of impact.

California swings from euphoria to panic and this has been the case since the late 1990s with it accelerating in the early 2000s. The pace of stock market growth and also real estate appreciation seems unsustainable based on fundamentals. It is clear that on the price front, SoCal is starting to see some stalling out. From double-digit price gains to suddenly seeing the median price not move from June for the region. What is moving however is a drop in sales but also inventory. When you read media analysts they talk about “normal†seasonal patterns and if this is the case, we should see an increase in inventory starting in January. It is yet to be seen if this increase in inventory will be accompanied by more investor buying.

I’m not sure why some try to down play cash buyers because in California cash buying is now a big segment:

Contrary to the idea that cash buyers are buying up all prime properties many are looking for investments. This is why the median paid by cash buyers for last month was $342,750 (or 12 percent less than the overall median price for SoCal). The good news for would-be buyers is the nuttiness of the market for the last couple of years is starting to ebb. At current prices and with current interest rates it makes no sense for investors to buy in most of SoCal. If this group continues to pullback, it will be interesting to see if the market can stand on its own two legs given weak household income growth and higher interest rates. I think we are going to find out shortly.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

85 Responses to “The slowing down SoCal housing market: Sales drop 10 percent year-over-year and investors begin to pullback.”

So long as there are greater fools to sell to, prices will go up. The question is, how many greater fools are left? It is hard to nail them down. Most greater fools don’t acknowledge themselves as such. And if you conduct a poll, none of them will admit it. My hunch is, there is about 1-2 years supply of greater fools out there who are willing to buy high, sell low.

Housing to tank hard soon!! Tank it!@!

Hi Mr. Taylor. I noticed your posts on tanking houses and wanted to get your feedback and reasoning and when you think best time might be again to buy.

Yeah… because all of those people that are paying cash / have been paying cash for the past couple of years are going to dump their properties for a loss. Sure thing.

?

I am sure all those guys who paid cash will hang on to their properties and chase down the market as they cling on to their depreciating asset.

So just because they bought houses, just because they really really REALLY want prices to go up forever, that means it’s going to happen, JustanOGuy?

Heavy deflation is the only way I can see to kick the can down the road a little farther, short of the New World Order coming into being. Since the latter seems unlikely at the moment, thank God, I’d say the deflation should begin in 2016, like Jim says on another thread.

First they will subtly prepare people ( well, for many people people this will be a good thing, I really mean they will subtly prepare the markets ) for the idea, like they are doing now by scaling back bond-buying just a little bit.

Keep in mind this is just my opinion, this country could crash before it ever happens. But if we do last to 2016, that is probably what they’ll do, unless they have some other trick up their sleeve they haven’t shown yet. A lot of the faux-recovery since 2008 was engineered to help banks get their finances in order; to slowly replace bad loans with relatively good ones. Once they are positioned well enough, once the books are cleaned up somewhat, through all of this investing and through more stringent loans, they will probably let housing prices crash; the losers will be any investors left holding the bag and people who bought after 2008, as well as those who bought before 2008 and were counting on lots of equity. But at least the latter will have a place to live.

You keep spamming that same talking point onto every thread. Care to go on the record with specifics?

“tank hard”? Okay, HOW hard? 10% below current prices? 20% 50%

Tank “soon”? Okay, HOW soon? Spring 1014? Summer 2014? Autumn 2014?

On the record I believe we will see the beginning of the downward price action in March 2014. I think by the end of 2016 price will be 50% lower than they are today.

50% down even in desirable SoCal coastal areas? — Santa Monica, Pacific Palisades, Malibu, Brentwood, Venice?

50% down? Whoo-hoo! Here i come with cash to snatch me up some mo beach property! Doh…

Sweet, sounds like I can pick up that Manhattan Beach property for 50% off really soon. Something tells me that ain’t gonna happen…

I sold a house in Manhattan Beach and, it is true, I don’t see that area crashing any time soon, along with other highly desirable areas where foreign money will go.

However, do you really think prices in, say, Torrance, are going to stay this jacked-up forever? Culver City? Tarzana? Even Santa Clarita, where I live now, and many houses are over half a million, which is absurd? Malibu, Brentwood, Manhattan Beach, yes, they are insulated, for the time being, as long as they’re trendy. Many other places are clearly in a bubble waiting to pop.

You got to be kidding me. It should take a solid weekend to get a grasp on Steve Keen’s approach to economics? Aggregate demand equals income plus change in debt? That is a shocking concept? Oh shock, we are in a debt induced bubble? These concepts may be shocking to crack smoking Kool-Aid sipping political cronies (AKA mainstream economist) but it shouldn’t be a shock to any normal thinking person. I am by no means a genius and I do not need a solid weekend to get my arms around these concepts. Try a couple of hours watch a couple of lecturs and read a couple of pieces…

I may have a small advantage because I started out as a math major but I lost interest when the instructors started the first day of class stating that nothing we learn here will ever apply to the real world. Then I became an economics major but I soon lost interest when I noticed that the classical model was an exercise of bending reality to fit their models and the Keynesians approach was infeasible do to the fact that it required government to not only take their foot off the pedal but apply the breaks during the boom period of the business cycle like that would ever happen… I finally went to business school with the thought that at least I could get a job with a degree in business. I may have a very small advantage but there is nothing in Keen’s theory that should make any average person scratch their head in utter confusion. BTW – yes it took me nine years to graduate with all the major hopping… Like I said, I am no genius… Thank God education was way cheaper in those days!

I was the one that commented quite a while ago that the doctor was falsely categorizing non contingent buyers as all cash buyers. I stated that the hot money aka private debt was the cause of the “housing recovery†more than cash chasing returns. We all know rich are just as leveraged if not more than poor because of the easy access to debt. I wish I could search by my handle and find the quote.

None the less, I have lost all respect for you know who. I am thankful that the jackass turned me on to Keen but I would never want to sit down and have a bear with such an ass. What a pompous condescending ass. You might be shocked one day when you find the guy shining your shoes has a better handle on reality than you do…

your post makes no sense. Where was Steve Keen ever mentioned? Stay away from Jack Daniels before you go to bad.

Check the comments for the prior 3 posts… This is a carryover from prior conversations.

I was confused as well. I saw no mention of a Steve Kean, or who he’s railing against? who is you know who? And more importantly I wouldn’t want to have a bear with anyone.

Mmmmmm…Jack Daniels. I feel thirsty now

The prior three posts did not mention the Australian economist Steve Keen, which Austrian economists disagree with. Do you also know Johnnie Walker and Jim Beam?

Actually it is 4 posts back. I did not realize it has been going on this long. The real issue is that Steve Keen supports my point. Not sure why my friend was not willing to walk down the path of debt based money creation and how the very existence of securitizing debt accelerated the increase of debt and that the destruction of the debt/CDO caused a decrease in money supply (and GDP if you subscribe to Keen). If anyone can support the point I was trying to make it is Keen… I have read some Austrian work but was not all that impressed with the lack of replacing what they tear down. Keen actually replaces the old models that appear to have failed to do what models are designed to do and that is predict. No one saw this coming? I am a borderline retard and I saw this coming. I had no idea at the time about synthetic CDO’s and the multiplier effect they would have on the collapse as well as the interconnectedness of the financial system so I was surprised at the magnitude but it was obviously an asset bubble.

“What?”, nobody has mention Keen, the Australian economist. I suggest that you either take your meds or stop having the three friends, Johnnie Walker, Jack Daniels, and Jim Beam over for dinner.

I will provide a road map for you. Go to link below:

http://www.doctorhousingbubble.com/modern-day-feudalism-real-estate-landlords-wall-street-rental-buying-cash-buying/

Look for comment from “blert†on December 6, 2013 at 11:30 am where he states:

“For more on this concept study up on Steve Keen:

http://www.debtdeflation.com/blogs/2009/01/31/therovingcavaliersofcredit/

The above ^^^ blog post will take the better part of a weekend to absorb. By the end you’ll come to understand that Keynesians are beyond wrong — and are today’s version of ‘flat-worlders.’ The truly scary thing is that they’re in the wheelhouse of the Fedsury.â€

I completely have my meds in check… At least I hope so…

Ira, your homework for the next few days is to read all of Blert’s posts for the past 4-5 weeks. If you are able to follow along with his ramblings, and What?’s responses, then you’ll come closer to understanding this most recent post by What?. Good luck.

ah the Three Wiseman.

Want a really kick ass time???

Throw Jose Cuervo in there and make the Four Horseman. Lemme know how you feel in the morning…

What and TJ, I have something better to do over the next few days. But I will delegate the study task to my three friends, the happy Scotsman, Johnnie Walker, the Tennessean, Jack Daniels, and the man from Kentucky, Jim Beam.

This thread has me in absolute stitches! What? and blert were going at it over the past few comment forums. blert told What? to read Keen

Joe I find the following line from Ira much more funning than anything blert or I have said

“…It is these old timers who do not keep up their home who need to move out and let somebody, a flapper, come in and fix up the home, which is good for the whole neighborhood…â€

http://www.youtube.com/watch?v=3svvCj4yhYc

Now that would be a show I would watch. These ladies show up to a bidding war in full flapper getup on a 1920’s era house, outbid the flippers and then retro rehab the place. Put the place back on the market and make a quick buck and have a party at the nearest speakeasy to celebrate the sale…

The 100% basis move in interest rates stalling the Housing Bubble 3.0 pretty much validates everything I’ve been saying since the starting moving up in May.

Interest rates moving from 5.5% in early 2010 to 3.5% in May means that sellers could jack up selling prices by 25% and the monthly mortgage payment remained the same.

When interest rates on the 30 year mortgage went above 6.5% in 2006 that is when housing market had a heart attack and collapsed. Is this time different? I think not.

Ernst, interest rates are definitely the wild card. I highly doubt rates will be allowed to shoot up to a level where another housing crisis will ensue. I imagine rates will slowly be incremented up…and if we hit a rough patch the Fed will reach into their bag of tricks.

Comparing the housing situation we have today to 2007 isn’t very relevant. Back in the bubble days we had millions of people who had no right to buy get loans and drive prices up. Since they had no skin in the game, literally millions threw in the towel overnight when the shit hit the fan. The rent vs. buy equation wasn’t even, so it made no sense hanging on to the house boat anchor. Many of those factors don’t exist today. The quality of buyers from the past few years is much stronger, they have skin in the game and the rent vs. buy equation has tightened up significantly. Additionally, people now fully understand the stance the Fed/PTB will take to support housing.

For housing to REALLY tank, it will take another crisis of some sort. This is generally the time to buy socal properties…easier said than done.

I too wonder how the changing of the dynamics of the recent buyers will effect things should home prices start depreciating more than just a few percentage points. I think LordB is right in that the more 20% down/30 year fixed or 10 year arm income qualified buyers you have, the lower the default rate when housing goes down and that should help with some type of floor. There are some, even rich, people who will say (like my friend who bought a 2mil+ home in 2013 in prime LA with a 7 year interest only arm) they will strategically default if sht hits the fan too hard, but I don’t know if that’s really true or tough talk. Regardless, I think its hard to argue that better qualified people, who feel like they have something to lose, helps housing, and many know from recent experience that banks have been asking lots of questions/demanding proof when getting a mortgage. I think its at least worth noting that the banks current ‘tests’ seemed historical and not forward looking, as well as tye fact that they are offering a lot of money/leverage to those they deem qualified, based on my and a few friends experience, and as many have said people often buy as much house as a bank tells them they can get. That could prove troublesome, but your point still has some definite merit.

I’ve also wondered about the mentality of cash buyers. I guess it would depend on who the buyer is and therefore I think it may prove hard to get a consensus on how they would act. Some cash buyers refinance right into a mortgage (although mortgage apps are down) whether money laundering or not. The ones that do launder might stay for a variety of reasons (kids in the states, visas, etc), but they might leave too. You always pay a fee to launder money so its hard to tell when they might sell, especially if someone owns more than one home. If housing starts going down, maybe you want to get out at 70 cents on the dollar or whatever if you think everyone else might want out too before its 60 cents on the dollar. Ditto with Wall Street. I agree they could be in for the long haul as it seems that some (at least today) certainly want to keep finding rental homes to securitize as they are now loaning money to small investors to buy homes to turn to rentals (with I’m sure a side agreement to allow blackstone, et al to securitize the rental streams). However many on Wall Street move in herds as we blert has said and just like they all want in when a trade is hot, they don’t want to be the last one out of a trade going sour. Therefore, It seems hard to see exactly how much of a higher floor has been established in housing/are we much better off than the last bubble, IMO.

The majority of people that got robbed by the gambling by the international banking crime syndicate had fixed 30 year mortgages and over 20% down payments and years of mortgage payments, propertytaxes, maintenance and upgrades into their houses before the crash and lost everything. The msm story blaming it on subprime borrowers was just a story to cover their crimes.

LB-can you provide some stats on skin in the game since 09? FHA financing has been huge since the last bubble. 56.9% max DTI for those buyers. Credit scores as low as 580, min DP 3.5%. Not exactly more skin in the game.

I see significantly more relevance to the last bubble that you care to mention. Mathematically, YOY increases as have been seen over the past couple years cannot continue. This is identical to the melt up that took place through 07. More telling is real incomes have stagnated and the percent of the population that is gainfully employed is at an all time low. Additionally you have the new QRM rules hitting in January: lower DTI limits for conv. financing, lower loan amount maximums, etc. Hard for me to see how this is bullish for housing. Of course the uber wealthy areas are likely to not get hit too hard, but look at everywhere else. Vegas is tanking and the last time that happened it was just a precursor before it got to the IE.

I state these facts and I was one who was fortunate enough to take advantage of a good deal by buying low and selling into the momentum. I actually had some nut job come in at 15% over my ask paying all cash about 6 months ago. That area is now flat to declining. I am quite active in the SoCal market and I see investors whom I deal with pulling back as there is no $ to be made on flips right now. To top it all off, organic buyers are just not there to buy at the prices that standard sellers are trying to get. At least, that’s what I see in my area of So Cal. I welcome your comments.

CAB, I’m not going to waste my time looking up stats for you regarding skin in the game. In the last few years, cash only deals have been significant…I thought it was close to 30% in CA. That’s more than skin in the game…that’s arms, legs, torsos, etc. Then add all the large downs, 20% downs and you have many people who will fight till the bitter end to keep their homes.

2009-2011 saw plenty of 3.5% downers. Those buyers are likely sitting on a 30% plus equity cushion right now. They are also likely at rental parity, so walking away lwouldn’t make any sense if we saw the “big collapse.”

I agree with you that buying investment property today in many parts of CA doesn’t make sense. We are likely near a top in pricing, but that doesn’t mean a crash is imminent.

LB-I think you are right in that 30%+ of buyers in ca are cash/have skin in the game; however, IMO, I’m not sure how one can then conclude that these buyers will not sell a home that is losing value. Just as buyers panic on the upside when markets are hot by overbidding, etc out of fear of ‘missing out,’ similar panic can happen on the downside, especially for those that paid with cash or low down payments. I think 20% down people are the safest bc many have other assets or wages and they fear banks might go after them (they probably will if sht hits the fan again). A cash buyer to me is someone who doesn’t have that same crutch thinking going on in their head and they also are likely wealthier to begin with. Many are also investors/speculators or maybe money launderers (I really don’t know how significant this is but it makes a good story/sells ads at the very least) and they think about $$$. If they think short down blip and then back up, sure, don’t sell. If they think down a lot, then of course sell. Go cash and try and get 2 for 1 later. But if you think small down and even flat for a while, then depending on the player (and what else is going in in the world investmnet wise) you may also want to sell. Investors like to make money, not sit in an asset that has holding costs like property tax, etc. anyway, all I’m saying is its not so cut and dry with the cash crowd (that doesn’t refinance) and I don’t think we can lump them in with the 20% downers automatically.

Not sure where mortgage rates go today (one would think up at least a little), but that forward guidance by the fed was I think? decent for housing. They basically said low short term rates at least are gonna be here a while by tying it to way under 6.5% unemployment. They gave themselves so much room its ridiculous. I guess that means bank accounts will be paying 0 forever. At least Big Ben is very proud if himself and told the world how QE has been all about helping Main Street.

Btw, to be fair and forthcoming, I do miss that SoCal weather. I’ve been to lots and lots of places, and if youre not a four seasons guy, you just cannot beat that weather, IMO. Sorry, i digress; Cali stinks (JK). 🙂

“CAB, I’m not going to waste my time looking up stats for you regarding skin in the game.”

In other words CAB, you’re probably onto something.

Please Joe stop it. If anybody has been paying attention to the news or reading any RE blogs they would have known that cash only buyers made up a huge percent of the sales for the past few years. Read many of Dr. HB’s blogs from the last year if you think I’m making this up. Uninformed amateur buyers like usually get hung out to dry…as usual, somebody has to look out for them. 🙂

Yep…..Some buyers who purchased in the early part of this year are already asking did they pay to much and what will happen to home prices if the rates keep going up?……

Houses are gonna be down right free soon.

Highlights from a CNBC articles this morning titled: “Mortgage applications plummet amid uncertainty”

“Mortgage applications fell 5.5 percent in the past week, to the lowest level in more than 12 years, according to a weekly report from the Mortgage Bankers Association released Wednesday.”

“More borrowers have been heading to ARMs lately, seeking lower rates amid rising housing prices.”

“Total mortgage applications are down 56 percent from a year ago, with the plunge in refinances leading the way. Purchase applications though are down 10 percent, mirroring a slowdown in home sales in many previously hot markets.”

“California Realtors reported Tuesday that November sales fell 15 percent in Los Angeles and 13 percent in San Francisco year over year.” (I believe Doc said 10%?)

“With credit still tight, and Fannie Mae and Freddie Mac announcing fee hikes, fewer borrowers can afford a home loan.”

“Compounding this, the government’s mortgage insurer, the Federal Housing Administration, has lowered loan limits in hundreds of local markets starting in 2014. That will make thousands of potential borrowers ineligible.”

“The share of all-cash buyers remains high, accounting for more than one-third of home sales in October, according to the National Association of Realtors.”

I think it would be interesting to see a breakdown, if it exists, on the median price of homes in CA at different price levels and locations. Based on many comments here you would think the median price should still be going up in every price level or location the never ending rich Chinese with suitcases filled with gold are looking to buy in as they are a large enough purchasing group to dominate/control the market. I guess the stats may still be misleading bc it would be hard to isolate the chinese as being or not being the driver at those levels/locations (could be other buyers, etc), but it would still be interesting. If there is any decrease in home values at said price points/locations, it should at least show that chinese buying alone cannot keep up home prices (as nothing kept it up).

Regardless, its all about the fed. We could taper…or they could dove us today and rates could actually go down a little, bringing back life to housing. Its so close to Christmas, does the fed wanna risk killing the shopping season? Who knows. As Ernst said, demand goes away at certain interest rates. ARMS, etc work to a point to help with affordability, but at some level they become too expensive as well.

Don’t you find it rather fascinating that this slowdown is occurring while the fed has the pedal to the floor? Interest rates have risen without a single actual change in fed policy. I think the fact that we hit an interest rate bottom might have something to do with this slowdown. Not sure how the fed tapering or not tapering will change anything now. I am not even convinced that increasing the amount of monthly QE will save us at this point. We’ll see.

And so it begins at least. 10 bil a month taper total with 5 bil in MBS….so only 75bil a month in accommodations. You know the US is doing fantastic now bc we went from some made up mythical 85 bil a month (not year) to 75 bil a month in purchases and now its time to feel good. Kinda funny if it wasn’t so serious. Stock market likes it so far at least. Havent checked mortgages/rates yet.

No effect on rates as yet. No midday price deterioration or improvement. Conventional borrowers with 20% down are still looking @ 4.5-4.625% for a 30 fixed.

never ending rich Chinese with suitcases filled with gold

Wrong, it’s actually Gold covered Chinese with golden suitcases filled with gold plated dollars.

Everyone knew when the rates went up, the market would soften. This society is driven by maximum leverage. ” I make “X” dollars, so the calculator says I can buy “X” amount of house, PER MONTH. And that’s what people do. Only the Dave Ramsey listeners would actually buy less than they “can afford”. It’s only logical that higher interest = higher payment and/or lower principal price. The same garbage is going on with cars right now.

Next year, stricter mortgage rules and higher fees for those w/out 20% down come into play. There are also the mandatory payments on Obamacare. I don’t see home prices rising anymore.

They are also not going to taper today, or next year. It’s an election year. Expect stock market gains, and maybe for once after 6 years corporate purse strings will begin to loosen up. There’s your only chance for housing gains.

A couple of things that are very similar to the market in Las Vegas:

1) California Homeowner’s bill of rights. — No reason to short sell, takes forever to foreclose on people not paying their mortgages resulting in a trickle of distressed homes entering the market.

2) Less Inventory = Less Sales. Can’t have a sale if there are not good homes out there to buy at a fair price. Inventory might have gone up a little but the asking prices tend to be 10%+ higher then market values for the vast majority of the new listings.

3) Investors pulling back: In many evaluations for current inventory available for sale, it certainly makes no sense to purchase for a true investment. Doesn’t mean that the investors are completely gone — just sitting on the sidelines and if the prices drop, they’ll be right back in snapping up everything.

Analysis — Expect median prices to remain stable. Homeowners foreclosed on or short sold their properties a couple of years ago are now getting back in the market and qualifying for home loans again. The ones waiting and sitting on the sidelines “for prices to drop” are going to be joining the ranks of everybody else (investors) sitting on the sidelines waiting for the “second bubble to pop” which is a ridiculous notion when you understand the basic financial fundamentals of residential real estate investing.

A base has been set with all of the cash purchases and there is a magic number where investing in residential real estate is a no brainer which is right in the area the market is sitting at right now.

People hoping to purchase for the 10%+ below market value / instant equity have missed the boat. Double digit appreciation rates are probably over but that doesn’t mean the real estate market is going to crash. It just means that it might return to sanity.

I think you have a few flaws in your logic. First is the assumption that we actually deflated the debt bubble in 2007. That is actually incorrect.

http://www.businessinsider.com/us-debt-hits-a-6-year-low-2012-10

The second assumption is that an asset bubble can find stability. The very nature of an asset bubble feeds on market instability. Asset bubbles need continued greater fools as the real price/cost of the underlying asset is valued higher than the useful value of the asset by definition.

I am not saying that SFR on the North side of Santa Monica is going to tank anytime soon as I do not have a crystal ball but I would not bet on a stable housing market anytime soon.

“a ridiculous notion when you understand the basic financial fundamentals of residential real estate investing.”

I’m sorry, did that not apply during the last price level reset or was that time different?

“missed the boat”

Would this be the last boat or are we now out of boats?

But YET new home starts are way up. Was the artificial low interest rate environment sending a false signal? http://smaulgld.com/increase-in-new-home-starts-and-new-home-permits-a-false-signal/

Median prices will fall, it’s just a question of when. And contrary to a few self-described sages, it’s not a given that once prices fall, sideline sitting buyers will have to compete with investors. Investors have been buying a LOT of CA RE these past 5-6 years and especially the last 2-3 years. When prices go down, the properties those investors bought in the past number of years will also go down in price. They aren’t going to be selling at a loss and then turning around and buying more RE, only to watch it continue to drop. They will be washed out. RE investors tend to run when they get burned. It happened in 2006-2008, and no reason that it won’t happen again. People (investors or end users) who bought RE in 2005 and on and then lost their $$ are not necessarily going to do it again. There aren’t that many RE investors with cash, waiting for prices to drop. Most of them have already gone in and bought property, and they don’t have piles of cash sitting around as they did a few years ago. So bring on lower prices, let’s see how savvy those investors were these past few years.

Following the comments and insights from this blog, I purchased my first home in Baldwin Hills in Q4 2012. Why did I purchase, given all the doomsdayers on this site?

I realized no one can predict when house prices will fall. I was an unhappy renter and also unhappy living far from the beach (grew up in Santa Monica) and was renting in Pasadena. Educating myself on this blog allowed me to purchase a home with ‘eyes wide open’ (as to the possibility of losing money if house prices were to fall soon after my purchase) but being darn sure my mortgage is affordable. Since I and the wife are self employed we are 95% sure we can live in our house the rest of our lives without the need for career relocation. Given this positive aspect of self employment, I consciously gambled that drops in house prices of up to 10% would have no impact on my long term decision. This coupled with burning thru $20K per year in rent and a $10K per year tax savings (as homeowner) I think I was able to make a good decision. Baldwin Hills got me about 6 miles from the beach for about $270 per sqft for a mid century home. Anyway, I just wanted to share with you my rational for purchasing a home. Also, for those educating themselves on affordability in LA, check Baldwin Hills it has less crime than Fairfax District and Beverly areas but half the price and 1-2 miles east of Culver City south of Jefferson.

Here we go again with the Baldwin Hills promotion committee.

Yes, you’ve told us now on multiple occasions how great of a personal decision you made. It’s the you show.

Back in reality, most of us aren’t claiming downside timing abilities (aside from the “going to tank hard” guy) although we sense a spoiled egg when we smell one.

How do you come up with $10k/year in tax savings? From the interest tax deduction? Not sure what your tax bracket is but if you’re buying in LA it must be pretty high, to get $10k in savings you’d have to be paying a ton in interest. Every time I’ve looked at the math the tax deduction is about even with the property taxes which you don’t pay when renting…

I thought that amount to be a bit odd as well, wasn’t going to make a statement on it, but since you mentioned it…

When rates fall, the mortgage interest deduction matters less because not as much interest is being paid at a relative price level. The Fed giveth, and the Fed taketh.

I can’t speak for QEA, maybe he was using the standard deduction before. Now itemizing, you get to deduct mortgage interest, property tax, state income tax, charitable donations, vehicle license fees, tax prep and he said he worked from home…there are tons of deductions for having a home office. Yet another perk of home ownership. It’s certainly not fair, but it ain’t changing anytime soon.

Owning a home does push many into itemizing, however you don’t need to own your home to take a home office expense. You can take it as a renter too; the deduction is based on its proportional cost regardless. Don’t know exact scenario here, but once you work from home and make even decent money in CA with its high state taxes, those two expenses alone may already push you into itemizing, even if you work for someone else. A large majority of people that work from home have their own business/are self employed and are already itemizing as they know the tax advantages. In other words, regardless of this particular case, if you are already working from a home office and making six figures plus (which one would if they are buying a decent CA home), you are likely itemizing already and taking all those deductions, minus the interest/prop tax ones.

Today’s and yesterday’s housing market reports were quite deceptive.

The housing bear is actually growling now:

http://seekingalpha.com/article/1905461-housing-starts-and-builder-sentiment-the-housing-market-mirage

I’m aware of so many stories very similar to this one playing out…wealthy Boomer parents, and their middle aged children/grown grandchildren who rely on Grandma/Grandpa’s continued financial help. Golden handcuffs…will their be much wealth left to inherit? Will Grandma/Grandpa spend it all traveling, shopping or dining out, or will they perhaps spend much of their lifetime savings supporting adult kids/grandkids?

http://www.bloomberg.com/news/2013-12-18/at-61-she-lives-in-basement-while-87-year-old-dad-travels.html

For every story like this there’s another about Boomers being squeezed by having to care for their indigent parent in their final years (often along with their own unemployed spawn). In my own case I can tell you that neither I nor my wife inherited a cent from our folks – and are just fortunate that we didn’t breed.

Indigent parents, unemployed spawn, seniors spending their savings, middle aged people living in basement apartments, college kids boomeranging home with student loan debt and sub $15/hr jobs…remind me who will be buying the massive inventory of California “golden handcuff” properties? Is there an endless supply of foreign investors lugging cash filled suitcases eager to engage in bidding wars for 700K ranch fixers?

Boom goes the dynamite!!!

Fed will start the slow pull back of QE to 75b a month in Jan 2014….the balloon is leaking, will be interesting to see how fast it runs out of air.

It just might be possible that the fed is “losing control” of interest rates and this is purely a theatrical exercise to make it appear that the fed is still in control and they “meant to do that”…

“What?” is correct: http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2013/12/Fed%20perspective_2.jpg

They cut 10b, because it doesn’t change their balance sheet at all anyways, but makes us think they are not trying to monetize the debt.

..and then a day later: “A day after taper, claims (for unemployment) spike to 9-month high” : http://www.cnbc.com/id/101285563

hmmm…so QE back on in Feb to 85bil? 🙂 I dont know WTF is going on anymore in the world bc true price discovery for almost any asset is now impossible, but I do know that the data points of unemployment/inflation set by the Fed feel like bs smoke and mirrors/diversions/excuses to keep this turd plan going as long as they say fit. All this central manipulation, IMO, is causing way too much uncertainty (the exact opposite of their goal) bc you never know when the heroin stops. I know lots of people (the risk averse ones like lawyers, doctors, etc or ones that took money out of the market before the last crash and havent found a dip point to buy) who are just sitting in cash. If the markets healthily went down 20-30%, theyd all come back in. Until then, BTATBH (buy the all time blerting high (copyright zerohedge + blert)) sounds dicey to many.

And this one out just now where even NAR just WS quoted as ‘its a clear loss of momentum for home sales’ after existing sales just dropped again. Nice timing by the Fed with all the wonderful news today.

http://www.cnbc.com/id/101198658

Let’s put it this way – if you can smell ocean water, maybe prices have no room to fall.

But if you are in Covina, or Corona, or Eastvale…there is no reason for an average home to be over $250k. It’s not fundmentally sound to those areas.

Heaven knows they have never been worth more than that, but that didn’t stop many from overspending.

yeah holy crap, i cannot believe some of the prices folks paid for RE in the IE. youve gotta be kidding me.

but hey, at least it’s a castle at least an hour away from civilization!

Mrs Blert and Mr. What? Please keep it coming as there is something special here.

Yup

all cash buyers answer to no one,especially banks. there is a reason they have cash.

It depends on your definition of “all cash buyer”. The problem with this term is that everyone seems to confuse it with non-contingent buyer stats. Non-contingent buyer simply means that the buyer does not need to get the sale approved by a bank/financer. I have no proof but I would hazard to guess that way more than 50% of the non-contingent buyers simply have financing prior to coming into the purchase. The majority of people I know who have bought houses in the past 10 years have done this. It makes the sale much smoother.

BTW the last friend who just sold a house in Nor Cal for $700,000.00 and bought in PA for under $400,000.00 kept the over 500,000.00 in capital gains in the bank from the sale and is financing the new house on a 15 year note. The sale was an “all cash sale†which was then refinanced after the sale. This person had the cash to purchase outright but decided to finance the place because real interest rates are basically negative and they also get the benefit of cash flexibility.

the taper is here, interest rates have increased. People think that sales will go down and prices will not go up. The investors will move on to the next bubble area. The Fed had to taper because the Fed is made up of banks and they could not handle the large balance sheet anymore. Time for house prices to go down because the banks have unloaded their bad loans and property. The Fed accomplished their mission.

The Fed is still increasing its balance sheet, $75B every month.

The Fed’s ultimate mission has been inflation creation…and at that they’ve failed miserably. Now, they’re abandoning QE and will focus on doing whatever possible to keep interest rates low to cover over their failures. Creating inflation in a low interest-rate environment…hmmmmm.

Meanwhile:

50 million on food stamps

11 million on disability

26 million unemployed or underemployed

I know for a fact from a source at BofA that they most certainly have not cleared their shadow inventory. They recently downsized some foreclosure operations and moved several of the remaining folks over into the area responsible for unwinding CDO tranches of MBS. Remember that? Yeah, it’s still a problem and that it is still this unresolved after five years should clue you in to just how vast the scope of it was and continues to be. Their in-house counsel is in fits over compliance and it’s taking forever to work the cases.

So, no the banks have not completely unloaded their toxic assets.

What about all those rich French with suitcases full of money or Germans or English or Americans or Italians. For god sakes, the “I” in PIGS” Italy is creating more new millionaires than China.

http://www.cnbc.com/id/101099732

It’s good to know that the rich Italians with suitcases of money will save our housing market!

I bet they have super fashionable suitcases full of money those Italians.

It’s not just about tapering, interest rates, prices, unemployment or any of the other usual suspects. The human speculative element now plays a bigger part in RE. Remember “irrational exuberance?” So as the first poster remarked, as long as buyers believe prices are going up, the more it tends to become a self fulfilling prophesy. Interest rates have driven demand, and lack of supply has driven prices. The burning question is, and has been for a long time, where is the inventory? If sellers are waiting for prices to increase, then you’d expect them to sell now since prices have leveled off. You’d expect the same with investors who can only justify investing in CA when prices are going up, since very few homes cash flow let alone provide an alternative source of fixed income to say bonds. Since prices in CA didn’t correct and by many estimates remained 20% above historical levels after the bottom, you’d expect some sort of reversion to the mean at some point. The problem is we are nowhere near a recovery of all the elements that go to make up a ‘normal’ housing market, and a generation may well be priced out. Home ownership rates may fall given rise to a rent class as you see in other countries. In some respects that is probably a good thing, but the price paid for saving the economy from total collapse is yet to manifest itself.

Mortmain, nominal prices in CA certainly didn’t correct. Real prices did. This was a very important piece of information many people missed. Back in 2011, housing affordability on a monthly payment basis was the lowest in decades. Couple that with very limited supply and we had a hard bounce off the bottom.

I don’t think the majority cares if an entire generation is priced out of the market. This has turned into a society where people look out for number one…that’s all that matters!

“monthly payment basis”

At some point, we all sell.

The problem with focusing on lower monthly payments is that a buyer won’t care what your monthly payment is.

If you need to sell in a down market, a lower monthly payment doesn’t mean much, but the outstanding principal does. It’s better to buy at a higher rate/lower real price level than a lower rate/higher real price level. Not only does it cushion you for selling down the road, you can refi if rates go down. Whether or not rates are going to get any lower than they did in Dec 2012 is a whole ‘nother argument.

Joe, I’m sure everybody on the blog agrees that it’s more favorable buying at high rates and low prices. It’s been over a decade since we’ve seen those variables. Rents in socal are usually very consistent and don’t fluctuate like home prices. If you can buy at below rental parity…DO IT. End of story.

I am not convinced that we saved the economy. You know there is still heated discussion among the economist if asset bubbles really exist. Not sure these folks can solve a problem they don’t believe exists. They are still debating the existence of the poster child of debt created asset bubbles…

http://en.wikipedia.org/wiki/Tulip_mania

I have been reading about Eugene Fama and his belief there are no bubbles.

While his idea about market efficiency is at least thought-provoking, if not entirely accurate, I think that this part of his philosophy is really a matter of semantics. He says there are no bubbles and then contradicts himself and says that you only know a bubble in retrospect, after it has popped.

Okay, this is more or less correct. If a bubble doesn’t pop, it wasn’t a bubble — because bubbles all pop. If something comes along to save this economy, like the Antichrist, then, it wasn’t a bubble. Pretty convenient, eh? I can see someone thinking “There are no bubbles until they pop, therefore, this isn’t a bubble, so let the good times roll.” There is nothing real, go with the flow…

But again, this is just semantics. Bubble or not, it is a grotesquely distorted economy. Fama may then say “Define distorted and when is a market not distorted.” Fair enough. It is at this point that common sense has to take over; let others get tangled in useless arguments.

More on blackstone’s rental stream securitization plan. Cant believe 60% if it is AAA rated. Must be backed by promises to sell the homes to pay them if need be. Interesting how little that tranche pays-a whopping 1.3%. Even the worst F unrated junk only pays 3.8%. 29% of the homes they bought were in CA; behind Zona with 43%.

http://www.zerohedge.com/news/2013-12-20/meet-wall-street-your-new-landlord

At the bottom it said the total return was 5.1%. It seems like an awfully complicated way to make 5.1% especially when the stock markets are going nuts right now.

The whole scheme seems crazy to me too. However big boys just view things different I guess.

Blackstone knows that lots of funds (hedge, pensions, sovereign, etc) by their by-laws, to keep clients who dont pay people to sit in cash, etc. often need to invest x% of their assets under management at all times ‘in the market’ where x is often above 90%. The bylaws or just ‘prudent’ portfolio management means these entities (less so with hedge funds) often need to allocate large portions of their investments to non-equities, often in Aaa rated debt (especially the pensions). Then on top of it all, is the pressure to get returns that beat set metrics like inflation, indices, ones’s peers, etc. So with that constant demand for non-equity yield, banks (and blackstone with Deutche’s help in this case as well as the rating agency who determined the rankings of each tranche) are constantly trying to create new financial products (supply) to meet this demand. blackstone knows there will be less MBS for these entities to purchase because of the trend in the US from home ownership to rental. So basically they fill the gap with a new ‘housing’ stream securitization (just went from mortgage payments to rentals).

Of course we all know rentals is a different/harder game to play, but not sure if blackstone cares that much. Blackstone isn’t investing in housing anymore quite as much. They are invested in finding investors with DB’s help to buy their new product/risk. That’s why they are lending to mom and pop investors who want to buy rental properties for as low as $500k. They just need more rental stream to package and sell. The second they lend to mom and pop, they’ll just sell that loan too. Why keep the risk either.

Btw, I think the 5.1% was a little misleading. Its not even inclusive of debt service payments, etc. so an investor needs a lot of faith with that type of expected return to blackstone and a 10% vacancy prediction with an (unlisted) amount for repairs (when renters don’t act as responsible as homeowners in its cases). Banks and blackstone are just doing the lords work anyway so maybe you don’t need faith. Just trust in thee and goeth all in.

Leave a Reply to Ira