Is California gentrifying the middle class out of the state or simply making current families poorer? Why California continues to be a financially challenging place to live for middle class families.

The California housing market is showing signs of slowing down. Price reductions are now commonplace and you can go to an open house without feeling like you are entering an exclusive nightclub. There are signs that investors are pulling back and this should come as no surprise given the dramatic rise in prices over the last year. The fragile nature of the market was revealed simply by a modest rise in interest rates over the summer. That was it. The market took a 180 degree turn from the first half of the year. Since foreclosures are now a tiny part of the sales volume, we can expect that seasonal patterns will emerge and inventory will begin to increase once 2014 hits. Yet California is an unaffordable place for the middle class. Only one-third of families can afford to buy a place at current price levels and incomes. We also have an astounding number of people in poverty despite the economic recovery. Is California gentrifying the middle class out of the state?

California unaffordable to two-thirds of families

It is rough for a middle class family to purchase a home in California. In fact, only one-third of households actually have the income to buy your typical priced home in the state:

“(MortgageNewsDaily) Home buyers needed to earn a minimum annual income of $89,170 to qualify for the purchase of a $433,940 statewide median-priced, existing single-family home in the third quarter of 2013. The monthly payment, including taxes and insurance on a 30-year fixed-rate loan, would be $2,230, assuming a 20 percent down payment and an effective composite interest rate of 4.36 percent. A year earlier it required an annual income of $65,828 to purchase a median priced home of $339,930 in California with an interest rate of 3.64 percent.â€

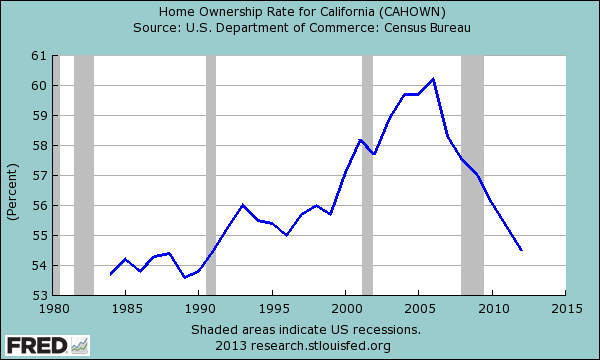

This environment has created a situation where investors have dominated home purchases and the overall home ownership rate has continued to decline for households:

California relative to other states already has a large renting population but this has now grown. With only one-third having the income to buy, what do you expect? Investors have been buying up properties for the last few years while most households had to contend with a low inventory market. A low interest rate environment has caused big money to seek out higher yields and Wall Street suddenly had an interest in being landlords.

Momentum has dramatically slowed down in the second half of 2013. Prices rose at levels last seen during the previous housing mania. For the last year speculation once again was a main driving force. The gritty details of income where once again ignored and papered over by massive interest rate manipulation trying to squeeze in households with stretched budgets.

Many middle class families wanting to own a home but unable to in more coastal areas have been pushed inland. This is why in places like the Inland Empire some 40 percent of workers make the traffic pilgrimage daily into L.A. and Orange counties.

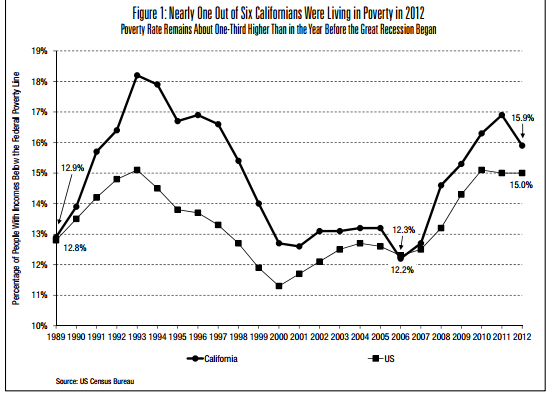

Large number of Californians in poverty despite recovery

California is largely becoming a state with a small portion of wealthy households and a large under-class. The middle class is shrinking. This isn’t speculation but we need only look at the facts:

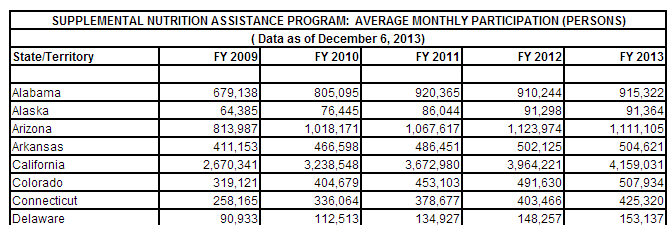

One out of six Californians were living in poverty in 2012 despite of the current recovery. We have a record number of Californians on food stamps:

The recession end in the summer of 2009 yet over this time food stamp usage surged 55 percent. We have 4.1 million Californians on food stamps. Many of the new poor came from formerly middle class California households. Industries downsized or structurally gone because of the recession did not come back in full force.

Clearly this group is not in a spot to buy and this is one of the fastest growing segments of California. Affordability is going to be an important trend over the next few years. California’s tax laws and programs are flawed and create generational lottery tickets for some and create poor incentives for young professional families. With a growing population of renters and voters, it’ll be interesting to see how long this lasts.

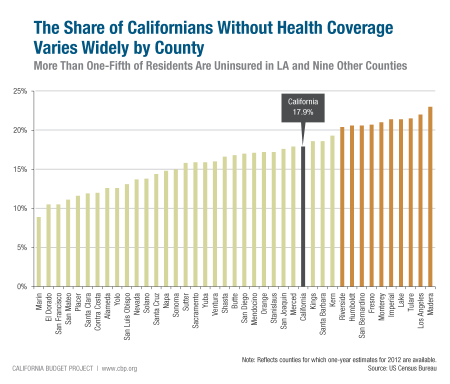

A large number of Californians uninsured

The new healthcare legislation will have an impact on the state given that 17.9 percent of Californians are uninsured:

This will extract money out of the economy and direct more funds to healthcare (either via new premiums or people paying the penalty). It is hard to say what impact this will have but having nearly 1 out of 5 Californians without healthcare coverage is not a positive for the economy. It also speaks to the challenges of getting by in this state.

California home values went up by 25 percent in the last year ($70,000 for the median priced home). Per capita income went up by 1.5 percent nominally (or $930). So think about that: the typical California worker saw their income go up by $930 but the typical house went up by $70,000 (more than the median household income). Does this sound like a good economic situation for middle class families?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Is California gentrifying the middle class out of the state or simply making current families poorer? Why California continues to be a financially challenging place to live for middle class families.”

ACA raises effective wealth of all underclasses, in addition to being healthie

I suspect this as a case of Shillus Interrpptus.

You’re on target: those closest to government largess are for staying…

Those brave souls making it out in the semi-free markets are going east.

===

One particular trend that surprised me: Black Americans are leaving the West Coast and moving back to Greater Atlanta.

A co-worker, buddy, of mine — with blood connections going back to the Classic Civil Rights Movement — opened my eyes. He told me that his entire, extended, clan was step-wise leaving California. Further, that his relatives were begging him to ‘come home’ — to the point of setting him up in his own SFH — out in suburban Atlanta.

(His clan was part of the rentier class — and was an out sized factor in financing Dr. King. Not known nationally, his kin provided the launch money for every manner of Dr. King’s campaigns. — They stayed out of the limelight, of course.)

He mentioned going back to his birth home — in LA — and being staggered by its Mexican shift. His culture was gone. Last I saw of him, he was packing up to go east… in 2007.

He was a most interesting fellow. He talked like a conservative and voted as a Democrat.

====

So the trends you’re describing may evolve towards a cronyist elite on the coast — and a Brown Collar agricultural– house gardening supporting population further inland.

Old time manufacturing jobs are being made either illegal or uneconomic. So they’re off to Asia or Texas, if not Mexico.

Without small manufacturing, how can budding talent ever make it into the wealthy ranks?

Big Government is devolving modern society back to neo-Feudalism, to social stasis.

But, big government can’t be financed….

Ok blert, I think I have you pegged. You actually think you are brighter than everyone else. However, the fact that you can not connect my sarcasm with the fact that Ronald Reagan would be considered a RINO in today’s post read my lips political environment because of his tax policy of 1985 makes me wonder. Also the fact that you can not answer a simple question on money creation while spewing complicated theory on the subject. I wonder if you actually understand it yourself. I come from a school of thought that you do not understand if you can’t explain it to a 3rd grader. Wouldn’t it be funny if a thousand years from now our current understanding of economic theory is looked on as silly superstition? How smart are any of us really?

Sarcasm is always touchy in blog threads… there are enough posters who actually believe extreme positions such that too often they’re cross-confused with sarcasm — and vice-versa.

===

This may be a reach for you: but there is no psychic gain to be had by overawe-ing unknown parties, never to be met, while posting from pseudonymity.

A truly condescending writer would use a 3rd grade writing style.

====

I provide web links to the readership. You give every evidence that you are self-confident enough to not pursue them, even as they provide the essential underpinnings for my musings.

Though I’ve stated that Milton Friedman’s math is gravely flawed — you still run with it.

You don’t provide counter-reasoning to Keen’s, a rebuttal required, in my mind, to anyone who sustains Friedman’s arithmetic.

You do not respond to the significance of the different types of money generation — indeed, don’t seem to recognize that different engines of money generation even exist.

This reality is at the heart of today’s confused public policies.

You also hold to pop-econ notions that CDO syndications create new money.

Fact: Tranching up financial instruments to make yet more financial instruments does not create money. That notion seems to have been floated on ZeroHedge without a whole lot of introspection. (The CDOs of issue are, of course, based upon FINANCIAL collateral.)

And, FYI, the Fed has NEVER counted CDO originations in any part of the “M”s. Even the Fed gets some things right.

===

On Wall Street, everyone gets plenty of opportunity to eat ground crystal balls. I’ve stubbed my toes more than a few times — usually by trusting my fellow man.

If I have one perverse gift, it’s guessing the future correctly, countless times. It’s become sort of a hobby of mine.

As you might imagine, I get a lot of heat for such an arrogant hobby, for who can tell the future? It’s obviously impossible.

And, yet… after years, and years, and years of astounding predictions coming true… my family and associates break out into three groups:

a) Those betting on my comeuppance. They take the opposite side of all of my advice/ recommendations — you name it. This commendable good sense has cost that crowd fortunes beyond description. They, of course, double down, and pine for the reversal of trend.

b) Those too spooked to bet on my comeuppance. They make no bets, take no winnings. They simply stand around, forever, in complete disgust that accident and chance keep making blert’s off-the-wall logic ban out — as the decades roll by.

c) Those credulous enough to take my advice, even without knowing why it keeps working, just on the basis of the over-long track record. These are the kind of folks who’d bet on Secretariat… just because.

E.G. Dr. F. Sherwood Rowland… http://nobelprizes.com/nobel/chemistry/1995c.html

He had my track record: my ‘cume’ was four inches thick by the time it was sent off to Irvine. That and highest marks, the usual drill.

So when I implored him to tackle Fluorine compounds — R-12 and R-22 specifically listed in my term paper — with a twenty-minute private presentation — on the basis that he’d be “world famous” if he did so… he did so.

But, then, Rowland was a genius, so much so that he’d take advice from an under-classman.

That professor Rowland wanted a Nobel was a running joke in the department at that time.

And, of course, I still have the text from that class: Reaction Kinetics, Laidler, 2nd Ed.

As you might imagine, just because you started the ball rolling does not mean that you’re going to touch a Nobel Prize.

What’s odd is that I KNEW he’d get the Nobel — the very day that I pushed it.

Just like I KNEW that September 1, 1981 was an epic high for interest rates.

None of my track record, however truthful, is going to shift your position. I get that. I’ve run into such firmness of opinion ALL my life. The ‘Dr. Rowlands’ out there are quite rare. Most of humanity is just going to go some other way.

I’m only posting for the minority, those that don’t use popularity as a compass of decision. For, in science, new theories must start out from the solo position.

Hmmm…Blert – I am also scientifically inclined. That said, you are not alone in your thinking. However, why do you bother with these people? I feel like it is a waste of time to try to convince people of anything these days. They can’t recognize the patterns or decide what is right for themselves. Determining future outcomes requires that you understand what the dominating forces are, you can parse them, they can’t. They probably never will. They will either follow your lead or someone else’s, but they won’t understand why either way. I would say good luck, but it’s really all cause and effect isn’t it?

Blert

What part of “For all those who don’t understand, this is a sarcastic remark†do you not understand? That is clearly in my statement… Maybe you are not reading my remarks.

It has been my experience that it is a sign of insecurity when someone is always stating their credentials and/or dropping names. I have found that those who are confident will engage in a logical discussion starting where there is agreement and then follow a logical path to identify where the opinions diverge.

Let’s remember where this all started. †If debt is money, is it not the case that shadow banks were creating shadow money called CDO’s and since the CDO collapse isn’t it true that a large amount of synthetic money (not that any money is real) supply disappeared.†… “Would it not be the case that in the mind of money supply conscious folks that we actually had deflation based on the collapse of the money supply and the Fed is simply replacing a portion of the disappearing money supply to fight deflation?â€

Is the action of taking existing debt and securitizing it into MBS/CDO’s creating money? No. Is the action of creating debt to securitize into a MBS/CDO creating money? That is the real question. And when that debt disappears does the money supply go down? I was simply trying to walk down the path of the “money supply conscious folksâ€. You have never answered these basic questions.

If you are more secure responding with credentials or name dropping or brain dumps or posting links to random web blogs as proof you are correct, fine by me but I am truly not impressed. A real thinking man is always willing to walk his ideas down the aisle…

blert,

Far be it from me to doubt your credentials, but would you be kind enough to reference any of your claims to prescience? I’ve known a few brilliant folk and in general it seems that few of them spend much energy touting their brilliance (Big Dick Feynmann was an exception, but brilliant enough to get away with it).

In any case you have frequently posted assertions that most conventional economic theory is dead wrong while you watch, from your Olympian height, sadly shaking your head in the knowledge of the true way of things.

Hey, you could be right, but in my experience that sort of rant is more often the province of the quack than the prophet. In short, I’d like to see some real documentary evidence supporting your positions – not just endless opinion pieces on the web – evidence.

Sakman…

I fear that you are entirely correct.

===

My way-back machine:

August 11, 1982 — (Wednesday) Branch Manager’s session with the newbies is running out of investment products to talk about. I offer a bitter suggestion: since we’re about to enter “the biggest bull market of all time”, why not talk about stocks as an investment? Glowering, he accepts… since he’s hit the deck on everything else… and sales action stinks.

The Mexican Financial Crisis has Volker and the Treasury (Brady) in a twist. It’s flamingly obvious that Volker is going to have to relent on tight money — and that Brady is going to have to bail out Big Bank exposures to Mexico City.

There’s blood on the floor. It’s high time to buy. My months of waiting are at an end.

August 12, 1982 — (Thursday) The Fed relaxes. US Treasuries bolt 3 full points in a single day!!!! (IIRC — I’m getting too old) That’s a once in three life-times move. I’m busy trying to get my most aggressive investors into futures and leveraged T-bonds. New York puts too much of a haircut on my position — i.e. a $10,000 haircut on a $1,000,000 face value of 8% thirty year paper. The institutional rate was $87.50 at that time. (It’s far less today.) The NY trader dropped the phone when I called him on it.(!) Yes, it’s a true story. He killed my deal. — Greedy bastard!

August 13, 1982 (Friday) I start calling everyone in my book, everyone I’ve ever known, and new prospects I’ve never dialled. Not withstanding it’s Friday the 13th — this is their lucky day. A one-way bull market has just been launched. Yesterday was the bear market low. I’m in a highly agitated, voluble, state: the market is ready to launch.

August 14, 15 (Weekend) I come to the office — now entirely vacant — to redial everyone I can.

August 16, 1982 (Monday) The market is firm, advances are broad, but nothing is spectacular. I’m the subject of suspended ridicule from my peers. If and when the bear returns, they’re really going to open up.

And, in all this time, the smartest, savviest, investors — my clients — stand paralyzed. NO-ONE squeezes the trigger. I can’t even get anyone to buy IBM at the bottom, the bluest of blue chips — circa 1982.

August 17, 1982 (Tuesday) mid-day it comes over the broad tape: Henry Kaufman is as bullish as I have been. No doubt he’s been buying all these last days. Now that his clients are in the market — Kaufman goes public — to the WSJ.

The NYSE vaults 38 points on hyper-volume. This is one of the strongest bull jumps in the history of the exchange. (Do adjust for the fact that the Dow just bounced off of 776 on Thursday, prior.) My peers are utterly gob-smacked. They’d heard ME make all of Kaufman’s points for the better part of a WEEK — and stood like the herd.

August 19, 1982 (Wednesday) My boss re-convenes the newbies lecture. He has a dazed expression when he looks at me. After his pitch, when everyone is relaxed…

I explain to the crew that we’re going to see a THREE STEP bull market: up, pause, up, pause, up, pause — and then drift — with the all-time DJ high being taken out.

The boss is back to derision. After all, once is luck. And, you can’t get luckier than I just did.

However, for the balance of the year, the Dow follows blert’s projection — with uncanny accuracy.

As you might imagine: the rest of my peers are entirely disgusted with me. Like “Why?” they were just TOO smart and sceptical to run with my pitch. They ALL stayed off their phones during the first two awesome bull phases.

FINALLY, after 90% of all of the profits were nailed down, the entire office opens up: dialling retail clients far and wide. They could now, finally, talk without shame. For who could live down the horrific advice/ investments that they’d pitched during the bear market?

As my boss told me: “You’re too smart for this business.”

Wonderlic crafted the industry-wide employee-candidate test — going w-a-a-a-y back. EVERY licensed person (anyone trading securities: brokers, managers, floor traders, etc.) coming up through the industry had to take it. (Self-regulated industry — see NASD.) It’s top four sponsors were: Merrill Lynch, Dean Witter, Bache Halsey, E F Hutton.

If you scored 69 or below, you were terminated on the spot. Most candidates scored in the low 70s. It was a brutal test, as it doubled as an IQ test and memory test. Tougher than an LSAT. The highest score known was a 93 — with an implied IQ of 175+ — and very few ever scored above 90 — with thousands of college graduates taking it.

So you can imagine Wonderlic’s alarm when my perfect 100 hit their desks!

You guessed it: the President of Wonderlic immediately phoned my President — and threatened to sue for millions. He naturally dismissed my score as too absurd, beyond human ability. His conclusion was natural: my BOSS had cheated, had given me all of the answers.

To defend my firm, my president sent a high level executive to get the goods on my boss — and check on the whole office. If nothing else, it was high time to prepare for an ugly lawsuit that’d have the entire industry in an uproar. They were all using the same test — and now it appeared that millions would have to be spent to entirely re-draft it.

So Mr. NY comes to town. He has a fine time talking with all of the troops. I’m dead last on his list. By now he knows what “Why?” doesn’t suspect: that blert’s the real deal.

He informs me: “You’re too smart to be in this business.” He didn’t have anything else to say. If the matter were litigated, he didn’t want to have anything bite him.

As for Wonderlic… if a 93 = 175 IQ … a 100 just utterly ruins the grading curve. No value can be assigned.

It’s only later I discover that the whole office has been laughing at me. For you see, all during the testing period, I’ve been absolutely howling about the revealed answers. The score cards are slightly fake: some of the correct answers are set out as if they’re wrong answers. So, my 100s come off as 97s or 93s.

Naturally, I’m furious. I expect — as is my custom — to be getting perfect scores. When I whine about ONLY getting a 97, only getting a 93, … my boss is giggling. It took me y e a r s to find out that no-one in my entire office had ever scored as high as a low 80. They didn’t even know of anyone who’d scored in the 90s. Naturally enough, no-one wanted to leak their own scores — to me of all people.

====

The passage of time has always been my best proof of concept. I can assure you, those who know me best are sick of my track record, for it’s completely confounding. I have virtually no respect for orthodoxy — and have the socially awkward tick of staying with impolite realities.

With luck, at the end of the day, I have my friends pitching back to me my own ideas — now taken to be their own. Now, that’s vindication.

===

I rest my case. It is nice when the defense makes my case for me…

California is a one party state, the Democrat Party. How can there be so much poverty. Didn’t the Democrats increase the minimum wage and now most people can qualify for food stamps and free health care. I don’t understand this complaining in the red star flag state. I guess that prop 13 will have to go next year to bring in more revenue. Since the Democrats control the state, more revenue is not a problem to pay for everything. We are a good people that will take care of the unfortunate and unlucky and don’t forget the millions who come here to work.

@Ira wrote: “…most people can qualify for food stamps and free health care…”

This plus Section 8 is why California continues to grow and attract the have-nots.

We bought a house in July (yeah, yeah, I am dumb I know, but we wanted our own place and I cannot live my life waiting for the market to fail) and I wonder what would happen if prop 13 was reversed.. I think it would destroy home values. I live on a street where 20% of the people have been there since the 70s. There are maybe 10-15% of us who bought in the 2000’s. The low income/disability payment neighbor families on either side of my half a million dollar shack would have to move, they couldn’t afford the taxes. (One family has a broken car they cannot fix, no money. They both have terrible termites with no money for repairs.) The 5% of houses which are practically tear downs and occupied by … I shudder to think what lives in those huts.. anyway, they would be gone fast without prop 13. It might take a while, some would take out second mortgages, some would not pay the taxes and there would be a tax sale and eventually they would sell at gun point, some might sell right away, but the inventory would flood the market, bringing down prices. I would be underwater, but I would stay, no place else to go. I would save some money on taxes, as I would re assess as fast as I could. The poor folks in my neighborhood would get pushed out to who knows where, AppleValley? The boonies past Santa Clarita? Maybe they would leave the state… but I doubt it. They get the free monies here is Cal, so they would stay. I would try to buy the house next door, I’d turn it into a rental and wall off the yard so I could have a bigger yard. The poor would leave and working people would move in! It might actually be great for Altadena!

what you said, that people who inhabit run down homes would leave if prop 13 went away, sounds like a good argument for doing away with prop 13. It is these old timers who do not keep up their home who need to move out and let somebody, a flapper, come in and fix up the home, which is good for the whole neighborhood. prop 13 is unnatural, just like the interest deduction that is nothing more than a subsidy for banks. Europe does not allow an interest deduction, it is so third world.

Shorter Ira…. “I’ve got mine. Screw everyone else.”

Typical Republic Party prattle. Please.

As has been said umpteen times on this blog, desirable coastal CA RE hasn’t been affordable for the middle class for decades. When you get away from the coast, housing becomes much more affordable…not to mention that giant swath of flyover country that is downright cheap. If you don’t like your housing situation here, hit the bricks and go somewhere else (2013 Copy Right, Falconator).

There is always Ventura county, which I think is built backwards. The wealthiest area is Thousand Oaks, a 30 minute drive to the beach, the middle class live in Camarillo, only 15 minutes to the beach, and the working class live on the coast, in Oxnard. Housing prices in Oxnard/Port Hueneme are the lowest of all Southern California coastal communities, from Santa Barbara to San Diego. Many readers may not be comfortable in a town where most of your neighbors speak Spanish, either bilingual or monolingual, but I expect that someone will bring me tamales next Tuesday. : )

Oxnard is a Mexican town, but it will change to rich folks in time, like all the coastal towns. Oxnard is a lot closer than TJ. North of Oxnard is Ventura(e.g. by the pier), and it is very different than Oxnard. Ventura county is very nice.

@Paul A,

Oxnard? Have you been reading the Ventura County Star newspaper? The first three pages are loaded with murders, stabbings, assaults, and rapes. If you are brave enough to cruise through downtown Oxnard, you will see plenty of vacant commercial rental properties due to rampant crime. If you are Hispanic and can tolerate steel over your front door and windows and are used to sirens going off at all hours of the night, you will fit right into the Oxnard scene.

Thank all of you posters here for introducing me to Oxnard, the next coastal CA community to ‘gentrify’. i am very interested in acquiring property there. After reading your respective posts about how horrible it is, I have to wonder how this beach community escaped the uber gentrification that has swept through most other coastal areas there. What is holding Oxnard back? Industrial ruins and pollution like old oil refineries and abandoned docks?

I don’t live in coastal CA. I live in Chicago. But I’m old enough to remember when Malibu was still SOMEWHAT affordable to those high in the the middle class, and I well remember when places like Torrance and Venice were “working class” or worse. And, of course, I have watched many neighborhoods in Chicago that were inner-city slums replete with housing projects and nightly shootings develop into super clean, safe areas of $3M houses and $400K one bed condos.

Where in this post is so-called “desirable coastal” specified?

Good grief, what a load of douchebaggery.

See. California Coastal Commission.

QED.

blert, you don’t get it.

I’m well aware of the Coastal Commission and their *current* sphere of influence.

I’m asking a rhetorical question, and by doing so, implying a statement.

===

Let’s break it down for you.

===

LB responds to the post in non-sequitur form. Another in a recent series of statements that go something along the lines of this (paraphrasing):

I was wrong before, but now I’m right. You shouldn’t have believed me then, but you should believe me now. My leveraged position is banked on it. By the way, if you don’t believe me now, leave the discussion because I don’t want to bear the thought of being wrong again.

===

LB continues to beat this dead horse, and it’s painfully obvious why. Therefore, I choose to call it out.

ACA will make the underclasses have more purchasing power and make them healthier, plus make healthcare companies more profitable, create more healthcare related jobs, etc, returning more tax revenues to the government. Plus, 2013 CA home flippers will be paying a lot of cap gain taxes to CA. Also, healthcare stocks are already booming, hence more tax revenues for 2014.

There is an economic boom going on, with only the underclasses lagging. But, with ACA and now the push for higher minimum wages, plus more jobs from all areas, even mansions for the wealthy create tons of jobs.

We’ve just entered a new stage of the boom, with just a pause, but the more laggers, the more to eventually participate. Just more proof the boom has only just begun.

I stopped reading after this first paragraph because you lost all credibility right there

Joseph,

I would say that you are conveniently ignoring the issue of who is going to have to pay for the ACA. I agree that there are individuals in the underclass who will be able to get insurance and low (subsidized) rates. But it’s the middle class plus small business owners that are subsidizing this. Their insurance costs are going up!

I would go as far as to say it’s just a redistribution of wealth. And since all of the insurance companies are still in the mix and there have been no efficiencies introduced by the ACA, the insurance companies have the most to gain. Big surprise there.

Once again, government gets involved and there is no net gain, but instead a net loss. There are winners and losers of course, unfortunately the losers are those that have had the means to get their own insurance. Their options are now all more expensive.

This “assualt” on the small business owner class is going to have a severe negative impact on the country, particularly when combined with larger companies continuing to find ways to reduce head count in the US by outsourcing and automation.

I used to work for Johnson and Johnson and had spectacularly good health insurance. Now I work for a small company (20 employees). The health care coverage in comparison is crap and is getting worse every year. Last year the annual deductible was $2500. This year it’s $4000.

The problem is that the current system is completely broke. I had a heart attack and was in the hospital for 48 hours. Trip to the ER, stent placement, then ICU/CCU for 48 hours and gone. What do you think that costs? How about $140,000? Does that seem reasonable? If it was $10,000, maybe that would be about right. It’s all the middlemen and administration and liability jacking up prices. None of that is changing with the ACA.

There is going to be a revolt over the ACA in a year or two when people see their true costs: $400/month for bronze insurance which only covers 60% of their bills. That other 40% is going to max out for many that have any issues, and that’ll be over $10,000 that they’ll be liable for. It’s absolutely crazy.

ACA is an INVESTMENT,….and will return more than it costs over time.Medicare is already starting to be more efficient. Plus, more use of technology. Already, patients are being strapped with electronic monitors and followed remotely, more preventative stuff, many more jobs. More use of lower level healthcare jobs like nurses, caregivers, drugstore clerks, etc. Plus, a healthier workforce. It’s called the multiplier effect. There is already a revolt….moderate GOP against crazy part of the party which wants to shutdown the government b/c they are driven by emotion, not reason.

@Joseph, about 85% to 90% of the U.S. population already has health coverage. I fail to see what impact, if any, ACA is going to have since most of those who are not covered are leaning towards paying the penalty instead of getting ACA coverage.

It’s primarily middle-class independent contractors who don’t have health coverage. The elderly, poor and underclass are already covered under Medicare/Medical/Medicaid.

worthless drivel Joseph

Is that shill l smell?

Housing to tank hard soon!@!

Good ol Jim posts. Short, sweet and to the blerting point. Lot better than reading how Blert believes he has a Nobel prize level brain, yet I can’t blerting understand his point 2/3rd of the blerting time (Sorry blert, no offense, I try, but youre a little scatterbrained/all over the map) or an increasingly cocky LordB who bought a home in my guess what he considers must be prime/beach LA so just keeps posting similar posts to feel better about himself for his purchase as the more things go up from his purchase price, the safer he feels he can weather any downturn. Keep up the good work Jim; frank the tank is counting on you!

FTB, as we all know I was a bear and I was wrong and I admitted it (unlike many on this blog). However, I did realize that the time to buy was at hand a few years ago and I acted on it. Buying cheap housing in this country has never been the issue. What people wanted was “affordable” housing in highly desirable areas. Affordability in some of these areas (monthly payment wise) clearly dipped into the buy range a few years ago and people should have acted on it instead of stomping their feet and wanting another 30% drop in nominal prices.

I am more than happy to correct some of the nonsense I see posted on this blog, all that does is confuse potential future buyers. I have quite a bit of local knowledge of some of the socal markets and clearly understand basic math/finance better than some of the bloggers. My question to you, why are you still posting on this blog? This is a socal housing blog, you should be enjoying your mansion in Texas. I knew you were very frustrated with the housing market here, but the market has been like like that for a long time. Small house, small lot, high price…nothing to see here folks that’s just the status quo in socal.

FTB – I completely agree until you get to LB. I use to love the old posts of LB and I believe at one time he was one of the best contributors. He has one of the best handles and I will always respect him for his thoughtful dialog. I agree it has been an experiment of skin in the game flips but hey he has been correct so far. Why don’t we wait and see. This is coming from someone who is still one of the biggest bears on this site.

What/lord B-as I have stated I am all for other opinions, especially on things like housing, politics, business, etc. I couldn’t tell you for sure how this stuff will all end up so I like hearing different arguments. however, the addition of cocky, IMO, douchebag statements like ‘if you dont like your housing situation here than hit the bricks’ is what annoys me. It assumes a lot and reveals a lot about the posters opinion of himself, others, real estate predictions, etc, IMO.

This is the only blog I actually post on. I found it when looking for houses in CA (which I could afford to buy, LB; the problem was not believing in the curent price/fundamentals). The articles are mostly CA, some Vegas, etc., but there really aren’t better housin blogs, IMO. I’m interested in asset prices (housing and stocks mostly) in general and I think watching CA and to some extent Vegas, phoenix, etc real estate is a good indicator for real estate in general as well as following investor/business trends in general as its about speculation in those places/they are often market leaders. Where I moved is a touted bubble market too. If you CA folk start going down, we may go down too.

Thanks for the support FTB 🙂

The thing about folks like LB is that they’re afraid of eventually being right about what they state as being previously wrong about.

It’s an especially peculiar thing when one has a large financial and emotional commitment on the line.

As FTB stated, comments such as hit the bricks and flyover country do really reveal a lot.

We’re heading home to the wife’s family in Wisconsin for Christmas, and are planning to take a day or two to look at houses, schools, job situation etc. I can’t say that I’m enjoying the potential move into a freezer or being too close to he in-laws, but as everyone knows who come here to read this blog, it’s unsustainable in L.A. for many reasons, even at a HHI of $120K.

This inorganic market created by fraud and greed has affected our lives in severe way, and I’m not happy about it. I hope one day when real change comes, an Icelandic style punishment will come down swift and hard, but it unfortunately feels very far away, especially after so many of us drank the kool-aid in ’08.

Sigh..

I was born in Northern California and always wanted to return. However I realized I never will be able too. The country is falling apart on many levels. People are pissed off and tired of the non sense. I just don’t think this will end well.

I voted for Obama in 2008 and I would like to apologize to my fellow Americans for that tragic error in judgment.

2/3 of the entire state is already priced out of the market place median incomes to median prices and this with rates 4.75% and under.

Everyone remember the bulls saying that the sideline home buyer would rush into the market place when rates spiked. Well, it didn’t happen because there is no such thing as a sideline buyer

http://loganmohtashami.com/2013/07/18/housings-sideline-buyer-the-new-bigfoot/

Alan, the nicer areas of the Bay Area are primarily for the rich and those who want to feel like they are, that being rich didn’t pass them by. I count muself as one of those latter wanna-be types. As hard as I try to keep thinking that I will some day be able to afford a nice place in a nice area (yes, “nice” is vague, but I’m not trying to be more specific than the proverbial “white picket fence” scenario) in northern or southern CA, I am slowly getting close to throwing in the towel. I could buyt a nice house in flyover for cash. My wife wants to stay in coastal CA, and I don’t know if I will be able to ever convince her that, financially, we would be able to live so much better if we could halve our rent (and have a small mortgage instead, until they get rid of the interest deduction, which may or may not be on the horizon but it sure is being talked about). The weather here in CA is phenomenal and it’s hard to imagine giving up the ability to take daily hikes year round. At this point, I don’t think the economy here will improve any time soon, to the point where housing is truly “affordable.” So little on the market now in Marin- -and what little is on the market still sells for inflated prices (there are just enough people with the money to go “all in” and pay ridiculous prices – -over 1.0MM for a 3 BR on a semi-busy street on a postage stamp 5K lot with crappy public schools). I can’t compete with those who overvalue the housing I’m surrounded by, and I can’t see staying much longer.

you people are sooo dramatic. living along the coasts have always been expensive. you know why? because it is desirable.

now with emerging markets expanding wealth (china), they too want to get into the housing market. where do you think they want to live? the same places we do. competition sucks but to all those people pushing the free market, this is exactly it.

we are no longer just competing with other californians or even other americans for our housing but everyone else who has money from around the world.

is it because it is foreign money pushing people out or the fact that we can not compete that is really upsetting folks? there is hints of bitterness from either point.

if you are going to blame the government for something, it is for not focusing on education and getting us ready for the competition.

Josh, excellent response! You have a good understanding of what is really going on here in California.

To say that the disconnects and distortions going on in our economy are due to “competition” and “the free market” is naive at best.

We don’t have a free market anymore. The Fed hit it over the head with a club, rope tied its limbs, duck taped it’s mouth, and shoved it into the trunk of a black Lincoln Town Car.

Agree

Well said, TJ. Its interesting to me when people talk of free markets and capitalism being alive and well in the USA currently. Shouldn’t it be a currently centrally planned around pumping up housing and stocks market and crony capitalism. Key word being currently. Heck if I know when/if QE will end (when it should end and when it will end are not the same, unfortunately), but I do believe it will end as the wealth/income gap is exacerbated by it and even though politicians/the fed are bought out by the wealthy/banksters, I think they are still cognizant that its one vote per person and at the end of the day, the unwealthy really outnumber the wealthy and many are armed. No, I’m not saying full scale riots are coming, but the class disparity issue in america and throughout the world is more and more rampant in the MSM, as are its links to QE/low rates over extended periods of time. Also, devaluing one’s currency does not lead to nice relations with other countries, where QE is hurting them. Not really sure if the powers that be controllig. America care about that stuff or not, but maybe that’s a consideration as well.

I also have to agree with those that say coastal housing isn’t going from say a million to 150k….but how many people on this board believe that notion or post about such drastic downturns? I read the comments here and i dont see lots of ‘Malibu is going to be worth 15 cents on the dollar!’ talk. Its almost like someone posting they believe the weather will be colder this year in LA and then someone saying back, sorry idiot, but the weather in CA is never going to be 4 degrees.

One final point, if NYC housing can go down temporarily, so can coastal CA. Just like someone may not want to buy the all time high in stocks, they may not want to buy the all time high in home prices (in many CA markets and other select markets in the US), especially with the uncertainty of where the fed is going. For those that bought in 2010 or 2011; congrats. With the recent run ups of 30%+, you may have gotten a good/great deal when you look back on things when you’re ready (or forced) to sell. At the very least, you got a bigger cushion of equity that can protect you if some or all of the gains from the past few years based on artificial stimulus go away. However, its not 2010 or 2011 or even 2012 or soon to be 2013. Its about to be 2014. We’ve had a long bull run in houses, stocks, etc. I would think those that bought in 2010-2012 may have different advice today than when they bought and i would think thats the advice thats relevant.

you make it sound like we are the only ones who have to deal with federal oversight. i am sure there are countries in europe that are much more restrictive. let alone try starting a small business in china and see how much money goes to bribes.every country has it’s own situation and there are people who still find a way to thrive in it. we should stop trying to look for pity and accept the fact that we are just not dominant as we once were. we were sitting on top of the world for decades and instead of staying motivated, we got complacent. we can not get upset when the rest of the world catches up.

also, with the dollar racing to the bottom on value to boost exports, our housing looks like an even better value for those with rising currencies.

The sheer amount of entitlement on DHB’s comment board never ceases to amaze me. Let me see if I get this straight – when Venice Beach, Manhattan, Newport and Laguna were isolated/undeveloped and a little “rough”, nobody wanted to live there, and prices were cheap. Now that decades of development have made them the “hot spots” people are grumbling that prices are too high? You have nobody to blame but yourself for missing the obvious – walking access to beaches is valuable.

If you want a good deal, you have to take a risk. Where are the areas that have more potential? Are you willing to take a chance on a slightly dodgy neighborhood for a future payout? Or do you only want others to do the work for you, and then hand you the keys for cheap?

IMO this is a symptom of the entitlement disease in this country, and it has infected the younger generations as well.

Bullshit. Who’s claiming entitlement to what? We’re discussing the fundamentals that influence CA RE and analysing what “access to the beach” is really worth in a given scenario.

That’s what we’re talking about here. Perhaps you have some other agenda.

Who’s making the claim that coastal RE is not “expensive”?

No one is.

You’re presenting a strawman argument. One that doesn’t exist.

The discussion centers around whether or not the price levels are fundamentally sound.

When will folks understand life is not fair especially when you live in a capitalist country. For the people who can afford to live in well off zip codes they could care less if the majority of Americans can’t live their dream.

You live a high-end Cal. or sunbelt lifestyle you have it made, my wife and I recently observed very exclusive restaurants packed with people and valet parking not BMW Or Benz but Bentley and Aston Martins etc.

Lots of folks in a country of 300 million can afford such surroundings, they have learned to play the system.

Like Karl Marx predicted, capitalism eventually pancakes the middle class, it really is a pyramid scheme that the well off learned to manipulate, the bank holdings and wall street fuzzy math over the last 20 years, it went unchecked. Your Federal reserve was suppose to protect society from this they didn’t, thus most pay the price now.

It is so out of hand and the gov’t knows they let it grow to a uncontrollable cancer they can’t undo it, thus the middle class must go by the wayside.

That 1200 sq. ft. box house in San Jose that sold for $1.2m, forget it ever coming back down to $125k?

$125K in San Jose?

No one on here is calling for a loaf of bread to come back down to a nickel. Stop with the exaggeration already.

Mr. Blert-

I have been reading your posts with some interest. Uncanny, really…I agree that we are in WWIV already; WWIII having been the cold war. I haven’t heard many (any?) say that before… except myself.

What will be the mechanism for high/hyper-inflation? I don’t see a way to transmit to wages; where it must get to, right?

Also, basically, the QE program is represented as an asset swap; the “money” being “created” being very well “sterilized”. (Note- I have read Keen and many of the others on this and still don’t have a clear mechanistic understanding.)

By the way…PhD, Physical Chemistry, University of CA, 1986.

Thanks,

wkevinw

I would say that we are not in WW3 or 4, we are still fighting WW1. WW1 was a battle of empires: UK, France, Russia, Germany, Austria/Hungry, Ottoman/Turkey. Everything, literally everything that has occurred worldwide from economic ups and down, geopolitical shifts (communism all the way to the hippie movement and ultra-progressive agendas and fascism/Nazism) is a direct result of this clash of empires starting in 1914. The disasters of the middle east resulted from idiotic map drawing post-war. The financial up’s and downs from the costs and then (oft forgotten) reparations which Germany JUST paid off. The shooting was not constant but like the 100 Years War historians shall look back at the 100 years since the Federal Reserve started (coincidentally?) and WW1 began as a non-stop global conflict waged between empires of economies, not just empires of territory or people. The mess ‘we’ in the USA are in began in 1914 with what shall also go down in history as the stupidest war ever fought.

Justaguy – where are your credentials? (sarcastic for all you that can’t tell) Actually I completely agree. I was reading a long time ago about WWI and it was somewhat of a family feud. Many of the European royalty where related because of the cross empire marriages made in the past to sure up relations. This actually makes it even more odd…

Posted this on another thread but no responses. Curious to see what input you all have (especially you DHB) about it as I cannot see nominal values perpetually increasing:

I have yet to read anything on here about the QRM (qualified residential mortgage) rules that are coming into play this January as part of the Dodd Frank nightmare. Reductions in max loan amount (esp. large reductions for SB and RVSD counties), LTV, DTI, and fee restrictions should definitely impact the organic market (around 70% of buyers).

I think you said it all right there. Kinda intuitive until another federal program comes along to loosen restrictions and lock buyers into overleveraging themselves even further.

I totally agree. I am surprised no one has mentioned that on this blog. Next thing you know, neg ams will come back.

There’s been links to the headlines on it posted in a couple past comments. It would be nice if Doc posted something about it.

Sure would. At a bare minimum the McMansions in the IE are going to get nailed as a result. Max FHA loan amount over there is dropping to $355K. Max conventional $417K. Any loan amount larger than $417K will be max 80LTV. In addition conventional max DTI front/back is dropping to 43%.

Yet another common sense piece with facts that slam you in the face-rising home prices outpacing incomes 25 to 1 !

It’s tiring hearing people cheer on rising home prices. Do they cheer on rising gas prices? Food prices?

Gas price “recovery” would sound ridiculous.

Here are some reasons rising home prices are NOT a good thing:

http://smaulgld.com/the-dark-side-of-rising-home-prices/

Are the California banks still sitting on a lot of inventory or have they unloaded it to the investors in this latest run-up? Second, is an off-the-wall question, could the government force a condemnation of a foreclosure based upon a 4% cap rate (resulting in a much lower price) than, say, a market rate and then turn around and offer back to the prior owner at 30 yr-fixed, all financed by industrial development bonds? Does this sound off-the-wall?

Leave a Reply