So you think you can flip? Proliferation of house flipping and rehab shows highlight a resurgence for big bucks in real estate and a general amnesia of recent financial history.

It is amazing to see the resurgence of housing flipping and rehab centered shows on cable TV. The shows glamorize the lifestyle of flipping forgetting how many people got burned in the previous downturn. Of course, many of the juicy flips already went to other investors and now many in the public are itching to get back into the game. Flipping works on a larger scale when the market is appreciating quickly. Why else would you assume the risk? In slow to declining markets, flippers are relegated to finding beaten down places and having to control costs carefully. You need a team and multiple flips per year to make it lucrative. From watching these shows, costs get out of control very fast and many seem to have a poor grasp of short-term gains and the bite taxes will have on their profits. There also seems to be a “mom flipping†trend. God bless cable television and the creative ways to promote real estate!

House flipping moms

A few months ago, I caught this piece on ABC Nightline regarding “flipping moms†out in the East Coast. The segment was in a lower cost state so for most California viewers, they must have laughed when they saw how far a dollar could go in other real estate markets. The jokes on them however since the sun only shines on the West Coast (#alwaysbeflipping). No $700,000 stucco crap shacks near freeway pollution on these examples. The segment even highlights how careful you need to be to manage your budget to be successful here. However the undertone of “mom flippers†is that “hey, flipping is so easy you can have a career, raise a family, and flip homes on the side!†Of course, the downside is you can have a flip that goes awry and it starts consuming your personal budget. Then again, that makes for boring TV. Take a look at the segment:

Source: ABC Nightline

And then a reader mentioned a recent show on HGTV:

“(HGTV) Jen and Barb, two business-savvy moms and longtime best friends, set out to undertake flipping a home in Southern California. From house shopping, to deal making, to decor selecting, and money managing, the two aim to learn every trick of the home flipping trade before this project is done. Pairing their own at-home learnings with a unique perspective through the mom-lens, Jen and Barb hope to, in the end, build the perfect family home AND earn a hefty profit on the resale. Though, as they’ll learn, in the world of the fix and flip, nothing comes without a fight.â€

The only reason something like this can occur is that the overall market has a hotness to it. These shows went in the dark after the bust and suddenly were up in Canada yet subtly didn’t mention the location change until viewers realized, “hey, that sure doesn’t sound like SoCal lingo! What kind of money is that?!†I recall watching some of these shows back in 2007 and people started making horrible flips that went down very quickly. Who cares about recent history. Tell me more about how to make money on flips! Ask and you shall receive.

SoCal flip example

When flipping goes mainstream there is a sort of mania permeating in the air. Because after all, what are we really doing here? Adding bells and whistles to a home. This isn’t a new industry adding millions of new jobs or revolutionizing the way we live like the internet. In the end, there will be an end buyer and it is likely to be a family going deep into mortgage debt to purchase a former crap shack with plastic surgery.

Flipping is hot in SoCal. A reader sent over this flip in Del Rey. Let us take a look at it:

12716 Admiral Ave, Los Angeles, CA 90066

5 beds, 5 baths, 2,600 square feet

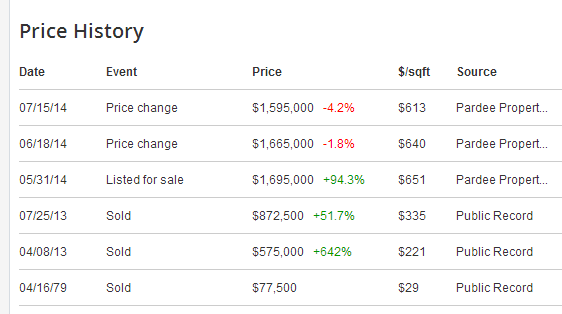

They went all out on this flip. These are professionals here and went out of their way to make this thing glimmer. You always sell the future and try to erase the past. Have you tried to watch 1950s or 1960s movies? They don’t exactly hold up well. Let us look at the sales history here:

You can see the heat in 2013. It first sold for $575,000 in April of 2013 and then for $872,500 in July of 2013 only a few short months later. It was then listed for $1,695,000 in May of this year. So far, no takers. I love that Google Maps archives street views since it gives you a brief snapshot into the past. Let us look at this place before it was redone:

A nice little crap shack right. Not bad and in a prime location. So this was a complete tear down and rebuilt. It’ll be interesting to see what this place sells for eventually. Yet this kind of action is rather common in top notch locations in California.

Flipper mania is back in the mainstream! Next we’ll have “Flipper Tots†and “Flippers in Tiaras†or “Flipping Baby Boomers†but that would simply be stating the obvious. Flipping ain’t easy but someone has got to do it.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

86 Responses to “So you think you can flip? Proliferation of house flipping and rehab shows highlight a resurgence for big bucks in real estate and a general amnesia of recent financial history.”

Hey! I am sure Christie Simpleton has much to add to this post because she is a single mom “investor” with “experience”… I can’t wait, it will be VERY entertaining…

Wow… 90% price increase in one year… I see no bubble here…

/sarc

Is it just me or is that 2,600 sq ft house sitting in a lot of about 1,300 sq ft?

It sure looks like it is.

Houzing to tank hard in 2014!!!!

I stopped reading after “Houzing”…

Yup that wasn’t the real JT above. But this it.

Housing to Tank Hard in 2014!!!!

You stop reading? By the way you post kid, I didn’t think you could read?

Just in case you didn’t notice, nobody cares where you stopped reading….

Okay, now I have heard it all. Little robbie is critiquing my writing skills… Yes ESL little robbie where he strings words together in such a way that makes absolutely no sense. I believe the end of days is upon us. Not sure which sign is ignorance rules supreme but we can check that one off the work plan…

I stopped reading after “Flyover”…

@Jim Tank, housing to tank hard in 2016

Guys, guys (and gals :)), housing will no tank until the stock and bond markets do. No way for housing to tank hard! Nowadays, the housing is a derivative of the funny money and ZIRP. The funny money stream has to stop and the interest rates have to go up. Remember, all that talk about the FED taper is BS, the Belgium keeps buying… If the FED would’ve stopped buying for real, the interest rates would’ve gone up significantly. Why are the interest rates (10 year yields) still so low if the FED is not buying, someone has to buy in order for the rates to stay low. The FED cannot just order the rates to stay low, the FED can only do it through flooding the markets with funny money. It is all BS, no taper here. no taper means now bonds and stocks crash, no stocks crash – no housing crash. It is a simple as that…

@a guy from Seattle,

the buyers of these bonds are pension funds. As soon as Baby Boomers start to retire this will take away one of the biggest bond customers. Peak boomers were born from 1950 to 1955, so interest rates on bonds should stay low for between the next 2 to 7 years.

It always amuses me when I watch Property Brothers, Flip this House and other like minded reality shows. Property Bros is located in Canada and one must be careful to read “WHEN” the other shows were taped to determine if it was before or after the housing melt-down and “WHERE” the episode was actually taped. I laugh out loud when I hear the “flippers” estimate unrealistically low rehab costs for their “camera projects”. NO matter where one rehabs a property, labor and material costs are similar and affect the bottom line of every project! I am also amused at a shows end if a property does not sell, that “if” the sellers receive $(fill in the blank) for the property they will make X# of Dollars for their efforts. Hardly ever does the flipper include Debt Service, carrying costs and seller costs in their estimates at the beginning of the show. I assure you that if A&E ever followed me around while I do my flipping, they would abandon me in favor of the ritzy, glitzy crap that would draw viewers and advertisers.

Doug what is obvious to me is the flipping shows try to make so many things look so easy by editing out much of the time consuming blood and sweat it takes to do the work. And every flip has to start with the same ole scene where the goggle wearing owners take a sledge hammer to the kitchen as if they are having a ground breaking ceremony LOL. My take is that the flipper shows are all about selling products for their advertisers e.g. Home Depot, Lowes and so on by making it look like anybody can easily make money flipping.

Two years ago, radio was already broadcasting flipping infomercials.

Lately I’ve heard radio ads for a flipping seminar hosted (or promoted) by a firefighter-turned-flipper. He talks about how little money he had, struggling as a firefighter. Then he turned to flipping on the side, and became rich.

Huh? I know firefighters have the time to flip — many only work three 12-hour days a week. But I thought they were well paid, with great overtime and benefits packages.

Something fishy about that allegedly financially-struggling firefighter, who became a rich flipper.

Today, all you have to do is short the stock market and you will make much more money that flipping.

Hope folks are NOT using leverage when doing these flips. That has turned out real nasty in downturns in the past RE crashes..

“Today, all you have to do is short the stock market and you will make much more money that flipping.”

Please ignore this advice as it will make you more broke than any house flipper. We now live in the age of short squeezia. Remember that markets can stay irrational longer than you can stay solvent.

I had a pool remodel done by “Allure Pools” this guy was a fire fighter and he ripped off up to 20 people in different stages of new pools being dug in their yards. He took the entire amount to be paid from a family with a handicapped kid that was gifted to this kid by some charity.

There were about 20 known people that grouped together and went to the newspapers, the fire chief, the contractors board. He started various construction companies and took people’s money and abandoned them only to reorganize under a new name. This guy was the worst of the worst. He seemed so honest and being a firefighter people gave him their trust.

He had his job even after all the complaints and we heard that he was working under a new name again. He went to Hawaii and moved out of his house in the middle of the night. People were stocking him because they were so upset and angry with him.

This was not the first time he had done this either…he tried to explain that he just did not know how to run a business but did the same thing under three other names with the same results. He was bold and there was no shame in his game.

Tell me the name of this fire fighter/seminar that you speak of…it sounds like the sort of thing he would do.

I don’t remember the names of flipper promoters, as I have no intention of attending their seminars.

But the commercials ran on either KFI-AM or KABC-AM, or both, here in Los Angeles. Those are the main stations I listen to.

You can contact their advertising departments, and ask for the name of the sponsor and how to contact them. Act like you want to buy the product. Ad depts are eager to help, so they can tell their advertisers “Hey, your ads are really generating business, we’re getting calls from people who want to know more.”

Christie s…Good advice, we almost got rip off by a firefighter in Denver few years ago.

He said he was license I didn’t check seemed a fireman would not lie.

We had him do a rather large deck, about three weeks into the project a county inspector drop by. The fireman had no license, and the deck was condemned by the county shoddy work and material among other nuisances.

We had another company complete the job, but this man never was suspended or fired he just went on did several other jobs?

The only thing I know how to flip is burgers.

tolucatom… I rather get burned flipping a burger, then getting burned flipping property in these times. take care

What? I don’t do flips, I own condos….cash flow and appreciation. I don’t know why so many are negatively concerned with flipping homes as a source of income. Flippers fall on their own sword. They either make money or they don’t. I don’t see how making a house more appealing to buyers is a detriment to anyone.

It’s seems like people are jealous of their profits. If they have losses, well that’s part of the risk they signed onto. How does that hurt you or I or housing as a whole? The flips are usually the eyesore of the neighborhood. The flip only improves the neighborhood. This blog likes to point out the crap shacks but sees a flip as equally offensive?!

The flip shows are entertainment. We all know there is more to flipping than what they show. I don’t watch an hour of Top Chef and think I can cook just like them. I think the new flipping shows are obnoxious and funny at the same time. I’m waiting for “Flipping Nuns” doing Gods work one flip at a time…let’s all pray…

What?

August 1, 2014 at 11:54 am

My atf (all time favorite) landlord game is when the landlord schedules a viewing and they have their friends show up “acting†like perspective tenants who are interested in the place to get the real perspective tenant to move quickly. The biggest mistake that these landlords make is that children are really bad actors and always give away the game. This has happened EVERY time to me in the past five years. It is actually kinda embarrassing to watch at this point. I love turning the game around on the landlord by totally ignoring the “competition†and act totally cool showing no signs of panic. One time I told the landlord that it was a beautiful house, left and didn’t call back; they ended up calling me.

REPLY

Christie s

August 1, 2014

WHAT? Different landlords all sending out fake prospective tennants every time you have looked for a rental in the last five years.

Whoa, you have a conspiracy on your hands.

I’m glad that were able to ignore the competition when faced with the highly complicated task of finding a new rental…you showed them…”act totally cool showing no signs of panic”

Maybe you can get your own show…”Finding a rental with What?” That’s some drama!

Do you hear voices too? I think I know what they are saying…â€housing to go up 30% in 2014″

Christie Simpleton first line of defense is a good offence… Are you uncomfortable with the fact that I am revealing a text book NAR selling tactic?

Yes Christie you said that out loud… Remember if your mouth is moving you are most likely talking out loud…

When liar mortgages were easy to come by, flippers greatly harmed the housing market, driving up home prices to fake “bubble” levels. They bought houses no-money-down, drove up prices with each flip, and in the end left foreclosures and bankruptcies in their wake.

I suppose flippers are less troublesome when liar loans no longer exist, because that limits their numbers. But I fear the return of liar loans, and with it, more financially baseless flipping and higher home prices.

The only problem I have with flippers or any other asset whore is that they are subsidized buy both the tax code and monetary policy. I am willing to bet that there would be a lot less flipping if ordinary income and capital gains were taxed at the same rate. Carrying cost are also significantly lower with short term interest rates being lower than inflation therefor carrying costs are almost free. We tax labor higher than investment gains so it makes sense why nobody wants to work for a living…

I agree liar loans hurt everyone and flippers overextend themselves when credit is easy. Hopefully those loans won’t come back.

Maybe next time I go look at a rental house, I can line up MY friends to act like prospective tenants too. Instead I will ask them to tell the landlord/prop manager “its overpriced, what a dump, you’ve got to be kidding” etc.

Two can play at this game!

Yes!

The rentals are still hard to find in my area, I mean a decent place at decent price. Everything is way-way overpriced. I talk a lot to the local people (at work, at my local gym, friends, etc), all of them complain that the rents just keep going up and nobody sees any increase in incomes. So, I don’t see how higher rentals prices will help a regular Joe to save more money for a down payment. Nor I see how higher rental prices help local folks to spend more money. You pay more for rent, you have less money left to go out (restaurants, local movie theater, shopping, etc). How are people supposed to spend more into the system to stimulate the economy if they have less and less money left after paying for gas, utilities, medical bills, rents, mortgages, etc. The second quoter GDP of 4% is a complete hoax, it is all inflation as far as I can see…

“The second quoter GDP of 4% is a complete hoax, it is all inflation as far as I can see…”

No, it actually is a hoax aka “forecast”. When the “real” numbers come in they will revise. Can you guess which direction? No need for an “artificial” inflation multiplier, we have a recession even by the commerce department’s phony math. We would need Q2 GDP of + 3% or more to not be in a recession. It will be a long time before the revisions get below 3%. This whole kick the can thing has become an art form.

Yep – the more I pay on rent/housing costs, the less I spend in the economy.

Target, Sears, Nordstrom, Verizon Wireless, Best Buy – they are all reporting lower earnings and planning store closings. Heck even Walmart is reporting lower earnings. If Walmart is suffering, that’s a good snapshot of the health of the economy and people’s disposable income after paying for a basic roof over their heads.

The govt. has really screwed America over on this one. In aiding investors and speculation to keep one area of the economy inflated, they have dealt a death knell to everything else.

>> You pay more for rent, you have less money left to go out (restaurants, local movie theater, shopping, etc). <<

You pay more for rent, the landlord has more money to spend on restaurants, movies, and shopping. (At least what's left after paying mortgages, property taxes, parcel taxes, utilities, city fees, insurance, and maintenance.)

Paying rent does stimulate the economy. Landlords don't sit on rent money. They spend it, same as do tenants.

“Paying rent does stimulate the economy. Landlords don’t sit on rent money. They spend it, same as do tenants.”

Ahhhh no. This is really a big misunderstanding of GDP growth. Say you have a 20 unit building and the rent goes up x while income is flat or falling. The amount of money the landlord spends has a WAY less impact on GDP growth than the loss of spending from the 20 plus families. Hence, GDP contracts in this scenario. We actually discussed these types of situations in econ. I remember the professor stating how many new t-shirts will the landlord buy versus the starving tenants. Velocity of the money supply contracts dramatically and the multiplier effect falls off a cliff. This is actually pretty academic. The belief that concentration of wealth is good for an economy really came from the neo classical charlatans who actually make the Keynesians look good.

@son of a landlord, You pay more for rent, the landlord has more money to spend on restaurants, movies, and shopping.

So, the solution as always, to raise rent even more? If something hurts a regular Joe, the solution to get even more of it. By the same token, why not to pay 100% of all peoples income if that stimulates the economy? Making one person richer by making 100 households poorer doesn’t benefit the economy in any way. This is why we have such thing as “medium” (household income, home prices, etc) instead of average because if one person becomes richer and 10 others become poorer, the medium will fall even though the one could’ve been 100s of time richer, the medium will fall if number of other folks become poorer.

Lower rental prices will actually benefit both, families and landlords. If families pay less for housing, they have more disposable income to either invest or spend. If rents are affordable, the household formation can increase, the same with rental demand. We currently have the highest number of multigenerational households living together because the housing is so expensive. Older parents live with their kids, older kids live with their parents, etc. The increased rental demand, because of the lower prices, will benefit the landlords. The landlords may earn less per unit, but they can potentially rent out more units, which, in turn, can increase demand for new construction, etc. Lower rent prices are better for the economy as a whole, they are not necessarily better for some landlords that cannot expend their business, but as a whole, the economy would benefit from lower rent prices.

Gut from Seattle: >> So, the solution as always, to raise rent even more? <<

I didn't say that. I was clear that, as far as the economy is concerned, it makes no difference whether the spending comes from a tenant or a landlord.

As for your contention that landlords would benefit from lowering rents — when that is so, they already do so. Landlords raise and lower rents, as they see their best interest served. What landlords don't need is advice from tenants on what is in the landlord's own best interests.

As for What's comment about "concentration of wealth," why do you assume landlords are always wealthier than tenants? Such is not the case.

What do you want, What? Means-testing on rents? Wealthy tenants pay more, poorer tenants pay less, for same-sized units in the same building? That too would alleviate "concentration of wealth."

One landlord going out to eat vs. 30 tenants going out to eat? Restaurant owners would rather serve the 30 tenants than the one landlord.

It’s median. Aye aye aye

“As for What’s comment about “concentration of wealth,” why do you assume landlords are always wealthier than tenants? Such is not the case.

What do you want, What? Means-testing on rents? Wealthy tenants pay more, poorer tenants pay less, for same-sized units in the same building? That too would alleviate “concentration of wealth.””

I never said any of that. Those are your words not mine. What I want is very simple. Stop subsidizing Ponzi scheme investing via tax and monetary policies. I am willing to see where the chips lay after the subsidies are removed.

Bubble Pop, why should landlords lower rents so 30 tenants can eat at a restaurant?

Why don’t restaurants lower prices so 30 tenants can pay rent? Thirty tenants pay more rent than does one restaurant owner.

Actually, What, you did say that. Specifically, you used concentration of wealth as justification for lower rents to stimulate the economy. I was merely pointing out that another way to reduce concentration of wealth was means-testing for tenants.

You said nothing about Ponzi schemes in the post I was replying to. Don’t imagine that my reply to one of your posts is a reply to your entire body of work.

Let’s review for the Slow of Landlord. I never said anything other than the concentration of wealth DOES NOT INCREASE GDP. Where in the statement does it say that we need to means test rent. YOU ARE A CLOWN!!!

These flipping shows all shoot from the same script. They buy the house and proclaim their ridiculous deadline (Open House day) which puts the pressure on everyone. Good dramatic device. Check.

Next, the flippers find horrendous things wrong that they hadn’t anticipated, or somehow missed during inspection. It looks like the costs are gonna skyrocket, and the flippers are gonna take a bath. Check.

(Commercial break)

Back to show, Flippers figure out a creative, inexpensive solution to the problem and continue on.

Last five minutes, flippers review their work, showing the before and after shots, admiring their flip. Then…. the Open House.. check.

Last minute of episode, show the numbers, the original cost of home, the rehab costs, the fees and commissions. (In 95% of the shows I have seen, the flippers have made money.)

The most recent episode of ‘Flip or Flop’, however, left them holding the bag for 500K ….

good times.

Hey Doc, in all fairness – the property you mentioned is a spec play than a fix-n-flip if the dwelling is indeed new construction. They are really different things since it is an all new structure and not just lipstick on an old crapshack.

I was thinking the same thing. There’s a difference between repair and replace.

Oh my God, I just had to pull this comment forward.

“Remember 0% interest on car loans everybody said can’t be done, sometimes to get the ball rolling you get creative in life?

I bet you can guess who made this statement. That’s right, our friend little robbie…

I don’t know where to start on this. Ahhhh how about they raise the price of the vehicle charge zero percent financing or cash back. The interest rate is built into the price… I have lost all faith in the world and especially with the mantra “a fool and his money will soon be parted”. Where is Darwin when you need him?

This guy is joking right? Please tell me you are joking and this has all been a charade…

California wake-up call: Extreme drought will lead to migration exit and real estate collapse

http://www.naturalnews.com/046289_California_extreme_drought_human_migration.html#ixzz39Hjn5Ihx

How is this for a flip? Lookin’ for a cool Million in 8 months.

1642 Nilda Ave, Mountain View, CA

Last Sold: 12/30/13, Price: $1,100,000

For Sale: $2,088,000

Zillow:

http://www.zillow.com/homedetails/1642-Nilda-Ave-Mountain-View-CA-94040/19533213_zpid/

“It’s worth the money because Steve Jobs drove past the house a few times about 30 years ago. It’s historic.”

Let us pray…

Location makes all the difference. Mountain View is located in the generally affluent Silicon Valley which home to high tech companies. A hundred miles away is Sacramento which is a government town with many families living on welfare and living in Section 8 housing. Sacramento home prices are a fraction of home prices in the SF Bay Area and home prices have declined recently since investors have stopped buying.

Hello Doc. Apparently a lot of people think they can flip.

By the looks of these former sale prices, they were all back-room-bank-deals now hitting the market for the first time since their remodel.

http://www.trulia.com/property/3122180295-2702-Thurman-Ave-Los-Angeles-CA-90016

Sold for $398K one year ago, now $649K

http://www.trulia.com/property/1040739083-2234-S-Spaulding-Ave-Los-Angeles-CA-90016

last sold for $355K then listed at $799K now reduced to $775K

http://www.trulia.com/property/3064096179-2015-S-Curson-Ave-Los-Angeles-CA-90016

last sold for $315K now $675K

I think we have all been told it is better to buy a crappy house in a nice neighborhood, rather than a nice house in a sh*tty neighborhood. In this case it is the nice house in the sh*tty neighborhood.

I am sure these homes will see major price reduxtions, before a sale is consumated.

We all know flipping in SoCal is always smart. Houses just keep going up. And a nice 100k remodel will net you 200k profit. Why, because there are endless realtors ready to push the next greater fool into your home to line their pocket. Good times ahead! Buy buy buy.

Rent now or be priced out forever!

sean1…RE agents play a huge part, yesterday as I always do on weekends especially I start the hunt. House sells for 649k I saw two weeks ago, a much larger house with a golf course view has been on the market 5 months at 699K?

Yes you buyers are sharp alright or blind as a bat, why did the $649 sell instead, because when I visited this house two weeks ago the agent was smart as a whip and eager to tell me about this great $649 home. When I mention the larger house on the golf course he said it was corp owned he thought? and in foreclosure? two years ago because drug people he thought? owned it?

Great agent stupid buyers all the code words, corp owned, foreclosure, drugs, key word to protect himself “he thought” thus his $649 listing sells.

Here on the east coast, I flip infill lots. There’s no work involved, just cash to buy and cash buyers to sell to. All my buyers have been builders.

In Denver, on the other hand, it’s a house flippers paradise, if the potential flippers can find a house to buy. The average house stays on the market for 20 days, and over 50% of the houses go under contract within seven days. So who are the buyers driving this market, the hottest RE market in the country? Why they are California transplants. So once again, Californians turn a once affordable housing market into a market that is turning first time home buyers into long-term renters.

“So who are the buyers driving this market, the hottest RE market in the country? Why they are California transplants.”

Pot smokers with a lot of money. They love the weed but hate the paranoia. Denver, here we come.

If the real estate market tanks again, a lot of people are going to lose their shirt just like many did during the 2009 credit crisis.

Curtis, If the America gets another housing crisis, 911 scenario, Hilary Clinton elected, then swim to the nearest Island, this country will explode in backlash. The general population can’t and won’t put up with poor security again, crooked banks loans, another Clinton, who is now by her own admission a 1%, remember when Romney was vilified for being well off?

Is there any viable presidential candidate who isn’t a millionaire? Don’t get me wrong, I’m no Clinton fan, but particularly given her age her net worth isn’t that unusual for someone on the presidential stage.

She’s worth maybe 5% of what Romney is, and maybe 10x what Rand Paul is worth (and about the same as Palin). But she’s also 15 years older than Paul, and just through inheritance Rand is likely to cut into that gap pretty significantly down the road.

Lets hope the dumb money continues to go for rebuilds. The housing stock needs to be updated. Stupid time to do it since the demand is not there. Once a fool and his money are parted we can get along with the real economy.

“Once a fool and his money are parted we can get along with the real economy.”

How about, once robert and his money are parted we can get along with the real economy?

Who says robert has much money or if he is a fool. If you sell houses you have to work harder these days to get people to fork over their financial freedom.

The market can crash and still you have these old timers telling you how it was back in the day. Like how much they made in the early 2000s. Or how they swooped in and got a property open to few people in 2011 and look how much it has gone up. The housing freaks ate a lot of pain in 2007-2009, and they don’t want to talk about that (except maybe the free rent til 2013). Just like I never tell people about how much I lost on bad investments, people don’t want to look stupid. I did some stupid things I hope not repeat and don’t enjoy mentioning them. Though I will tell people about the fast 500% gain that happened like once.

Overall I crunch the numbers and can live with myself, and know that I am doing well respective to others. I only wish it is not a battle of DHB versus robert, but that people decide what is best for themselves. If you believe that this can happen then you worry less about the imbalances and the crazy people that cause and try to profit from them.

Not everyone plays the same game or is efficient at it. I know an entertainer that makes plenty of money and dabbles in housing. To him at this stage of life everything is free money. If I invested like him, I’d be bankrupt. He plays the game and gets mixed success, but is happy. Everyone that helps him manage things are very pleased. He probably will never loose. No calamity will befall him. Though it would be foolish to take anyone in SoCal that makes under $300K/ yr to emulate him.

“Who says robert has much money or if he is a fool.”

He does and I thought the fool part was apparent.

Blah, blah, blah, how many “where are they now” stories does it take for us to realize that all fools end up broke in the end?

leaf… I actually agree somewhat even What? has a point. I do have money because in the past my timing was excellent and luck also plays a part. I do have risk because I have most everything paid, my two houses have no mortgages but I have a ton of cash invested in these homes, if I was like other losers I would have only put down 20% and if these properties take a major hit I would walk.

I wasn’t raised that way, but in the end yes I must admit, if it all comes crashing down I stand to lose a lot of money, if I was to sell these homes., being paid for helps of course, but homes like these are and have to be maintained.

My cash makes no money 1% doesn’t cut it, all my cars are beautiful machines (no classics though) they are cars a devalued asset to be sure.

So yes to be total honest, people like my wife and I who pay everything off could be a curse, who ever would have thought, we played the game right and you still my lose.

Let’s take an extreme example for demonstration purposes.

Let’s say a crack whore on Lincoln and Rose wins the lottery. Let’s say that the winnings are 300 million after taxes. This person would now be considered a “success” to many. What kind of “investment” advice do you suppose you would get from this very successful “investor”? Sell your body to whomever is willing to pay. Take your income and purchase crack to fulfill your drug habit and buy a lottery ticket with whatever is left over.

Now is this sound financial advice? Probably not, but some would say that you should listen to those who have made it. To each his own…

Christie s…These loans in 2004-2006 won’t come back because the people who did the dirty deeds are long gone should be in a (playboy prison another subject).

This country did suffer a depression Fed fund’s rate 0 that is not recession. Today words are carefully chosen ( housing bubble is one of them), in 2014 we are still in a mild recession, I believe loans will ease up somewhat and creative financing another code word might creep up, it all depends on this qtr. for housing. The Fed is watching it with baited breath.

Jobs report is again skewed numbers, overall business not interested in good paying job creation till they get their crop tax breaks, certainly not from this administration.

The future is rather easy to see, when GDP keeps raising, jobs keep on a consistent pace, The Fed start a slow rate rise then we are out of recession, right now uncertainty rules the day, not good in decision making at any level of buying or selling anything.

This housing blog and others like it shows a concern for Americans having their dream of affordable homeownership and even cheaper rents in good areas, a legitimate worry.

But look at the world, nothing but poverty, unrest, and war dominate lives of so many.

WW11 was the ultimate we thought, stop the Fascist and Imperialism, 2014 hate prevails everywhere, have to wonder if the end is near for humanity, nobody will have to worry about CA. real estate again?

The defense rests your honor…

Desperation: http://www.redfin.com/CA/Culver-City/5021-Purdue-Ave-90230/home/8136377#property-history

The do nothing flip: https://www.redfin.com/CA/Los-Angeles/4431-Don-Ricardo-Dr-90008/unit-18/home/6878708#main

@JoeJane

In regards to the Purdue property, I cant quite decipher who is the bigger fool… the flipper who thought he could get $895K for a home with the freeway in the backyard or the listing agent who didnt have the balls to tell the flipper that his asking price was insane. I think a true real estate professional (there are a few) are the ones who will have the comps to rationalize a high list price and then to boldly tell the flipper his price is insane… you know the $895K, then the $749K, then the $725K, then the $699K, then the $625K, now the $599K!

Not only is the Purdue property beside the 405, the neighborhood doesn’t look so cool on Google street view. (Can’t even get the actual street on Google street view.) The area looks more like Del Rey than Culver City.

Realtors/flippers are promoting (hoping for) two myths about CC:

MYTH: Culver City is prime/top tier.

FACT: Culver City is mid-tier, like Pasadena, Sherman Oaks, and Woodland Hills. It is not prime, like Malibu, Bel Air, or even Santa Monica and San Marino.

MYTH: All of Culver City is great.

FACT: Parts of Culver City are pretty good. The area immediately south of Sony, and near the revitalized downtown are not bad. But other parts are pretty sketchy, particularly areas near the 405 and Culver West (which is surrounded by Del Rey, the crappiest part of the westside).

You are correct. There are a few who tell the flipper their price is too high. I’ve said it myself many times and don’t take their listings. But for every broker who tells them there price is too high, there are 10 waiting to tell him they will sell it for at or over that price.

https://www.youtube.com/watch?v=FODPzxzdaEs

Workin’ on the rollbacks

Prices goin’ down, down

Workin’ on the rollbacks

Whoops, another goes down

Always

http://www.redfin.com/CA/Culver-City/3938-Tuller-Ave-90230/home/6726682#property-history

Hey, DHB. I am reading that there was a huge sell off of US Mortgage Bonds this week. What do you see as the significance of this? Leading up to this news, we have heard that investor money is “pulling back” from the real estate market and even that China is putting a clamp down on domestic capital flight into foreign real estate acquisitions (US Home purchases).

We all want to know what signal will presage the next Housing market collapse. We know that the news stories I mentioned seem to correlate with the slow down in home prices and slight declines we are already seeing.

So, can we look to Wall Street for today’s best signal of the next big collapse? How long should it take for these sell offs from this week of bundled Rental Backed Securities to trickle down to the street level and a flood of home sales and decreased home prices?

We’ve been following house prices in Roseville which is a generally nice city just northeast Sacramento. One house we looked at was a 3 bedroom, 2.5 bath home with 1832 sq. ft. that was built in 2002 and originally sold for $256. It was owned by a couple from the SF Bay area that rented it out. They put it on the market in April 2014 for $355K. There were no offers and the price was reduced to $346K. They relisted it in July 2014 for $337K with a different broker. There were no offers and the price was reduced to $334K. A couple of weeks ago they reduced the price to $324K. On Friday, they took the house off the market. The broker said that the owners want to rent it out for now and that they may try to sell it in a year or so.

http://www.zillow.com/homedetails/1872-Granite-Way-Roseville-CA-95747/59369534_zpid/

Only two things can let current prices and the housing end user co-exist. First, is low interest rates. Every one percent less interest rate makes the house look 10% cheaper. Second is, NINJA and liar loans. So long as either of these are in existence (number one is currently around), it is hard to see a hosuing crash.

Somebody need to take a math class and learn a) what an exponential growth curve looks like, b) what it takes to feed and exponential growth curve and c) what is the outcome of an exponential growth curve…

Rent prices falling in LA. Very unusual for this website too. They are usually all hype. Everything is the hippest, hottest thing all the time.

http://la.curbed.com/archives/2014/07/los_angeles_rents_now_starting_to_fall_from_crazy_highs.php

In the beach cities, housing prices are the highest they have ever been. It is like the collapse never happened. My view is the housing collapse was a head fake engineered by fear and panic. It was the buying opportunity of a lifetime. Prices jumped right back up because the economy supports those prices. I doubt prices will ever come down again. Instead, they will just keep on slowly rising for many years. In a decade, prices in Santa Ana will be higher than Irvine is today.

The Frightening Growth of Suburban Slums

http://www.slate.com/blogs/moneybox/2014/08/01/suburban_poverty_it_s_becoming_more_concentrated.html

Too bad Property Ladder was canceled. I could watch Kirsten Kemp talk about flipping all day long.

Leave a Reply to Jim Taylor