Signs of Real Estate Overheating: More Realtors than Homes Available for Sale with Record Low Inventory.

In another sign of the real estate market overheating, you have more realtors in the market than you have homes available for sale. The number of realtors according to the National Association of Realtors (NAR) jumped to 1.448 million which was an increase of 5% from last year. However, at the end of February there were only 1.03 million homes available for sale. People are looking at million dollar crap shacks and are pulling out their trusty calculator and doing the math on a juicy 5% commission. Sell two crap shacks in a year and you are making more money than most of the country for an entire year of daily work. Where do we sign up? Of course, this is clearly unsustainable and shows how distorted the market has become with the Fed juicing rates lower, forbearance programs stalling inventory hitting the market, and rental moratoriums have created a giant pause to the normal machinery that makes a housing market healthy – which is good wages and good jobs for many. Let us explore some additional data here.

The last boom and bust

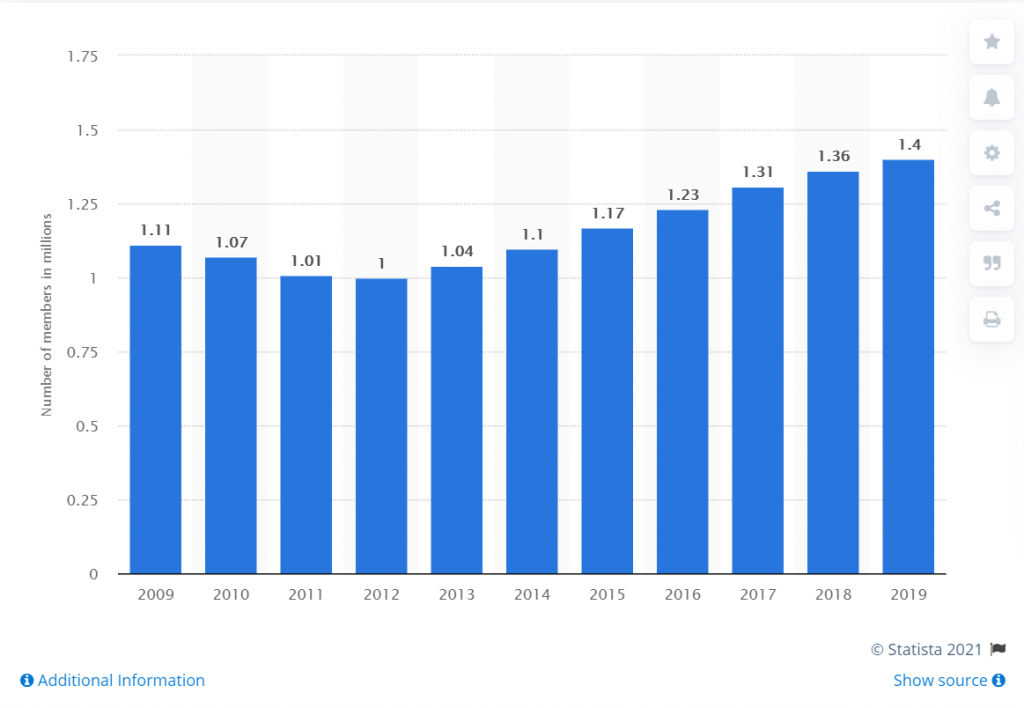

Back in October of 2006 we had 1.37 millions realtors in the US. Then the bubble popped and by 2012 the membership numbers dipped below one million. Here is the chart of members going out to 2019:

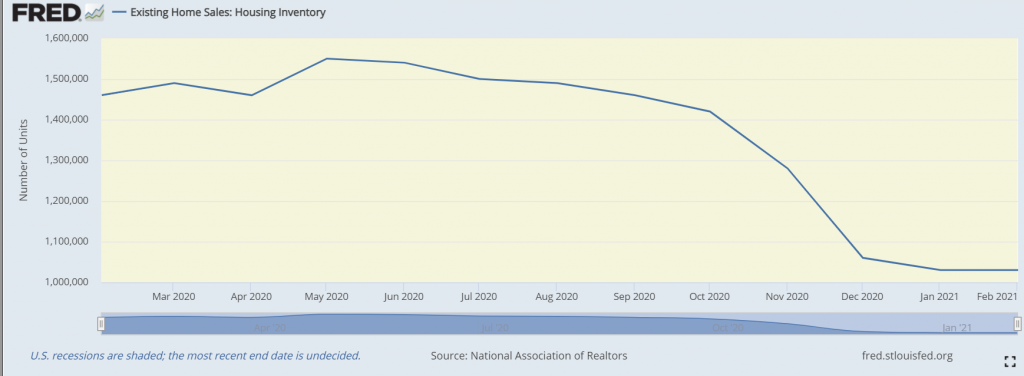

There are now 1.448 million realtors which is a record. You need to be able to sell homes at volume to do well in the industry. And right now inventory is at record lows. The number of homes for sale according to the NAR is 1.03 million, a 29.5% decline from last year. Properties are selling fast when they do hit the market because there are so few out there to be had and everything right now seems to be inflated.

Take a look at how bad things have gotten in the last year:

Prices are being driven up by a few factors that do not seem sustainable:

-Artificially low rates by the Fed (recently rates inched up)

-Forbearance holding off millions of properties from sale (in this market, even a few properties makes a difference)

-Rental moratoriums (this is also a temporary measure)

-People working from home because of the pandemic

All of these are going to end. First, artificially low rates have been around for a few years now and people have milked that for everything over the past few years. This is unsustainable. Forbearance has been going on for a year now and in some cases, will go on for 3 to 6 months more but there will be many that will need to sell or will think about selling in this hot market. Next, rental moratoriums will put an impact on the growing renter market as well. Finally, the economy will open up fully again and at this rate with vaccines, we will likely be good to go by August or September. This will bring back millions of people back into traditional workplaces.

On the last point, if you have any doubt that people will be back just look at travel volume for spring break, Miami, Las Vegas, and Disney’s website crashing when they put tickets for sale recently as they will open soon. The pent up demand and money that went into an artificially low supply housing market will lose some steam each month that passes. Places like Microsoft, Facebook, or Twitter for example with remote working policies does not really translate well into the bulk of the economy, especially in the service industry where most are employed.

Millennials are still living at home in record numbers and you can see irrational exuberance with stocks with no visible future of earnings exploding, crypto going wild, real estate going bonkers, and yet somehow, the typical worker is struggling. At some point reality comes into the picture and a correction happens. You have more realtors than homes for sale right now in the US, by about 400,000! Imagine walking into a car lot and seeing one car for sale and 40 people trying to sell it to you at the same time. Sounds like everything is working perfectly fine here!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

208 Responses to “Signs of Real Estate Overheating: More Realtors than Homes Available for Sale with Record Low Inventory.”

Sounds like reality to me — thanks for posting — have been waiting for a posting since the 2/10/21 post — enjoy your blog and information. Stay Safe!

Similarly, the volume of mortgage brokers trying to call me is is amazing.

One major lender has called me multiple times and I told them I just refinanced with them 4 months ago.

Apparently there is some rule that you cannot refinance again within 6 months. Even if it makes sense. But they keep calling.

There is no “rule.” It’s a contract issue between the lender and the broker. If the consumer refinances within 180 days, the lender claws back the broker’s commission, but that has nothing to do with the consumer.

Interesting!

I did not know that but it makes sense. Thanks!

it’s one thing to rationally the argument in regard to realtors/inventory but your stretch mortgage argument, implying there isn’t a lot of business to be had, is delusional. there is no debate the low interest rate mania has sent record amounts of people applying for refinances at the very least.

Don’t click the link for LendingTree and provide a phone number.

I did this 10 months ago, and I am still receiving calls from mortgage brokers and lenders.

I refi’d 4-5 months ago but their refi centers apparently have not received the word.

Even with the company I refi’d with!

Crazy times.

Bitcoin will hit 100k+ this year! 🙂 🚀

Worthless when the EMP bomb goes off.

Which won’t happen the next 200 years

I just read an article by EMP peppers, and it is pretty scary stuff. Buying a tin Lizzie (modified for propane along with a full propane tank without electronic controls since all gas pumps will stop working?) and a whole lot of tin garbage cans to put electronic stuff in, plus maybe a farm somewhere to run to…. plus tin foil to wrap all your spare appliances with. Giant Faraday cages around houses… this could get very expensive.

An EMP Bomb set off over the US would also fry electronics in Canada, Cuba and Mexico. I’m sure we could retaliate, but who knows.

Hopefully, I am correct, but my level of preparedness for the rest of my life does NOT include

!) EMP bombs(total nuclear armaggedon goes with this). I’d buy a tin lizzie and aluminum foil my house.

2) Biblical Noah type floods. – I’d buy an ark.

3) Massive asteroid strikes. I’d buy a trip on Elon’s rocket ship.

4) Massive earthquakes with CA falling into the ocean. Perhaps my ark would help.

5) The end of the world due to predictions by Nostradamus, Aztecs, or the Old Testament. So far predictions are 0/billion correct.

I base my investments based on everything but the items above.

It may be fatalistic, but if any of the above happens we are all screwed anyway and no amount of prepping will change it

Inflation is the new normal…until it gets replaced by a newer normal…deflation.

In any real estate market, 90% of the sales are made by 10% of the agents. As my dad would say “Get those commissions out of your eyes and learn to do the job right”.

did your daddy also tell you to not buy for the past decade? how did that work out for you? any other nuggets of wisdom your daddy wants to share?

The irony of the rise in homeless realtors. You can help, or you can turn the page.

The way I look at it The more money that the federal reserve have printed will increase the prices of homes that’s the reason why home prices are going up because the dollar is going down.

The way I look at it The more money that the federal reserve have printed will increase the prices of homes that’s the reason why home prices are going up because the dollar is going down. Is also in crease the price of Precious metals.

Gold has been a crap investment for the last 10 years. Unless you’re wealthy enough to drop $30,000 or more on gold then you’re wasting your time with it. Any little amount of gold you buy you’re lucky to cut even at a 20% profit.

Great story!

A 2700 sq ft estate sale house just sold for $35K over asking for over $900K about a half mile away from me. It hasn’t had any work done on it in years, although it is clean and the grounds are maintained. Built about 40-50 years ago. Bought by a 30 something single guy with a girlfriend, a good government job and parents helping. He’ll have a long commute, but may be able to do some remote work.

For typical homes in good condition (ie not $50M mansions or ghetto crack houses) 5% over asking price is what any seller should expect to pay.

Buying a house with a GF/BF is one of the dumbest things anyone can do. You’re saying you’re not quite committed to marriage but you’re committing to a 30 year loan with this person. Nothing good can come of that in the long run.

It’s not dumb to buy with a friend, GF, or BF, if you set things up correctly. Sadly, most people don’t.

You should agree by contract on each person’s percentage of ownership, and ownership should be Tenants in Common, not Joint Rights of Survivorship,and you should agree that if the relationship ends, or one party wants to sell, that the property should be sold.

It’s really rather cleaner with less potential legal hassle, than it would be if you two were married, as so many other things that have nothing to do with property, enter into marital breakups and cloud the picture. Just treat it as a straightforward business partnership.

We don’t know the buyer, just the seller. from what my Wife has found out, his parents are the ones helping with the $$. My Wife says he paid way too much in her opinion, unless you think property values are up 25% in a year. The house is maintained but no updates, and may need work. We heard that he was trying to get them to come down on price after signing the agreement because of antiquated 70s ceilings and other things he decided to change. And that was after the sellers threw in a lot of furniture for free. He’ll be out a lot of $$ if he tries to get out now.

Inflation, followed by hyperinflation and the crash….. Deflation…….

Inflation, followed by hyperinflation and then deflation.

This article explains the end of a hyperinflation:

https://mises.org/library/90-years-ago-end-german-hyperinflation

The Rentenmark mentioned in this article was based on the value of property in Germany:

“The newly created Rentenmark replaced the old Papiermark. Because of the economic crisis in Germany after the First World War, there was no gold available to back the currency. Luther thus used Helfferich’s idea of a currency backed by real goods. The new currency was backed by the land used for agriculture and business. This was mortgaged (Rente is a technical term for mortgage in German) to the tune of 3.2 billion Goldmarks, based on the 1913 wealth charge called Wehrbeitrag which had helped fund the German war effort from 1914–1918. Notes worth 3.2 billion Rentenmarks were issued. The Rentenmark was introduced at a rate of one Rentenmark to equal one trillion (1012) old marks, with an exchange rate of one United States dollar to equal 4.2 Rentenmarks.

The Act creating the Rentenmark backed the currency by means of twice yearly payments on property, due in April and October, payable for five years. Although the Rentenmark was not initially legal tender, it was accepted by the population and its value was relatively stable.”

Wikipedia

This is why Real Estate is such a popular inflation hedge along with gold and now Bitcoin (and other blockchain currencies with limited inflation built in). All have limits on inflation. You can develop more property, you can mine more gold, and for the next few years you can “mine” more Bitcoin. But the rate of increase is limited by the economic feasibility of each project.

Does your mortgage terms say repay in bitcoin? How about Property tax?

What about the US Bond ? Oil Futures?all priced in US Dollars

These all are what props up the $

Get a clue

Is surfaddict replying to my post on hyperinflation history and inflation hedges, or some other post? I stand by the statement that Bitcoin is being used as an inflation hedge, and I’ve always maintained the it isn’t particularly useful as a currency for day to day transactions due to its volatility. Maybe he meant the post for M?

PS I don’t have a mortgage and I have way too much dollar denominated cash right now.

I agree JoeR.

People are hedging and looking for stability. Gold/Silver has been replaced by Bitcoin due to the tulip/fad nature, but if there isn’t an equivalent with a stronger backing in the near future, Bitcoin will still hold strong. There is far more gold and silver in the ground to be mined than there is Bitcoin to be pseudo-mined. However, I can hold gold, hoard it in my fortified basement, and even wear it to flash my wealth. Bitcoin currently has wealth on my iPhone but it might as well be ethereum. It cost someone N number of dollars to mine with electricity, but I can’t say my muscles are worth nearly as much after I have dug so many ditches.

what Realtor makes 5% commission ? That’s not how it works.

A realtor who owns his or her own business, and represents both buyer and seller in a transaction, might earn 5%. Rare, I know.

Interest rates have been artificially suppressed by the Fed Reserve since the GFC of 2008 and they will continue to do so. Stopping now would crash the economy and send us into a Depression. Play the game. They can and will create more green paper and add endlessly to the debt. Not my way of doing things but I am not in charge.

Hi All,

Been reading this blog for a while, thanks for the great info and entertaining chat. Cali got totally out of control for us a few years back, so we packed our bags and left Calabasas (just outside L.A.) and headed to Georgia. Bought a nice home, 2000 sq ft, 3bd/2bth, in a nice neighborhood for $325K. Because of the size of the front and backyards, the same property wouldn’t even be available in CA. If it were, it would be $1.5M minimum, I would guess.

So here’s what’s happening in Georgia (suburbs north of Atlanta)….

Houses sell inside of 1 day. Often within an hour of posting. Some houses are bought site unseen by buyers in other states (many California). Someone from San Diego moving in across the street – he bought site unseen. Imagine that for a moment!!

Houses have been going for full asking for some time. Can’t go too far above asking as they wouldn’t appraise.

So what people are doing instead is offering cash on the side to the sellers.

The house across the street just sold in one hour. The buyer approached the seller and said – if you take our offer, we’ll wire you $20,000 non-refundable today.

Keep in mind – that’s just for accepting the offer! Not to go under contract.

It’s a whole other level of insane.

Keep in mind – that’s just for accepting the offer! Not to go under contract.

Huh? If you accept an offer, aren’t you under contract?

5% commission? Nah.

Buyer and seller agents split the money. So that 5% turns to 2.5%. And then unless the agent has his/her own brokerage, that 2.5% is split with the brokerage. Which takes that 2.5% down to 1.5% or somewhere in that area. Still good easy money in a booming market but there’s a world of difference between 5% and 1.5% per sale.

“Places like Microsoft, Facebook, or Twitter for example with remote working policies does not really translate well into the bulk of the economy, especially in the service industry where most are employed.”

Microsoft, Facebook and Twitter ARE service industry jobs. Most people think service = flipping burgers or whatever. But it also includes software jobs, engineering, lawyers, accountants, etc. Any job where you spend your day in front of a desk typing on a computer is a service job. And that job can be done from anywhere in the country, or the world for that matter. The bulk of people who have spent the last year working remotely are not going back to an office.

Mr landlord is back?! THE Mr Landlord?!

Welcome back Mr. Landlord. It’s good to hear some old voices of reason on the blog. We just had the worst pandemic in a century, world economies shut down, civil unrest…and RE prices keep going straight up. Don’t bet against the Fed. You will lose everytime!

We just had the worst pandemic in a century,

The “pandemic” was a big nothing. Just another flu. Many deaths attributed to Covid were not caused, or ever related to, Covid.

But shutdowns, and their resulting damage to the economy, social relations, psychological health — which helped fuel the riots, lootings, arsons, murders, and the stolen elections by the Left — yes, they were devastating.

“Don’t bet against the Fed. You will lose everytime!”

Truer words have never been spoken.

With their current policies, the Fed can no more stop inflation than a traffic cop can stop a runaway truck coming down a hill by holding up his hand and blowing his whistle!

Eventually they will need another Volcker, but will they look for one?

The one and ONLY!

“Millennials are still living at home in record numbers and you can see irrational exuberance with stocks with no visible future of earnings exploding, crypto going wild, real estate going bonkers, and yet somehow, the typical worker is struggling. At some point reality comes into the picture and a correction happens.” So true! 30 Trillion in national debt is NOT sustainable. There will be an economic ‘correction’. Will it be in the form of a recession or worse? Very probably. Now is the time to think about this and to formulate a plan. When it manifests it will collapse the status quo and affect everyone; including the piano player.

I think prices continue upward for the next 12-15 months. There’s almost zero foreclosures in the GSE maximum loan size properties because forbearance is 18 months since March 1 with most being April 1. So, that’s AT LEAST October 1 before anyone can be called delinquent. Add 120 days to that to get through loss mitigation and you’re early to mid-2022 and then put bankruptcy and the government is potentially holding illiquid paper to 2023.

This is the greatest real estate supply crunch and scam ever created where people can live for free for years with their 97% LTV loans and dump the property after that.

All of that is works until the foreigners funding our debt don’t call the bluff. Rates are rising. Commodities are rising. Eventually the fed has to contain a hissing price mania that threatens to increase inequality and re-create a populist movement.

I’m clearing all non-mortgage debt and saving cash for the impending bond vigilante call.

Maybe the fast appreciation in real estate prices will slow down soon. Experts predict that the 30-year mortgage rate might climb to 4% by Dec. 2021. Still, it is hard to see how home prices could every drop significantly with the Federal Reseserve buying most of the government guaranteed home loans and thereby putting a cap on mortgage loan rates and with lending standards being almost nonexistent.

Meanwhile, the mania continues. A nice Austin, TX home, just listed for $800,000, received dozens of offers and just sold for $1,200,000. Now that must be record for appreciation–a 50% increase in prices between the most recent comps and the last sale.

CDC extends federal eviction moratorium to June 30: https://www.cnn.com/2021/03/29/success/cdc-eviction-order-extended/index.html

I didn’t even know the CDC had any authority over residential rentals. I assume it was some other federal agency doing it.

Not that it matters everywhere. Many cities and states are ahead of the CDC curve. Santa Monica already extended eviction moratoriums to June 30 a couple of weeks ago, so the CDC is playing catch-up.

Exactly, get ready to pick up the pieces after it all hits the fan. People are acting like psychopaths with their spending right now. They’re afraid of inflation and rising mortgage rates. Act now or you’ll be sorry! Woah, hold up! Steady now, people. Yes, it is different his time. But no, reality has not gone extinct. It will return, as it always does. I don’t see how a soft landing is possible at this point.

Stay diversified,

Turtle

Does anyone think prices in coastal CA will ever come down? I remember 5 years ago almost everyone on this blog thought prices were about to drop. Does anyone think that could still happen?

No i don’t think it will go down…too much money out there and interest rates are propping up the market big time.

DL,

Sure, why not? $3 million houses on the coast may drop to 2.5 Million. Plus $100 Million estates will have a hard time selling at what the current owner paid. Rising interest rates will cause the first example and increasing taxes and disorder will cause the second.

I suspect a large percentage of those forced into a career change by the pandemic chose the real estate profession since entry is relatively fast and cheap. The lure of top dollar commissions could be a draw as well. The only real struggle is getting a listing. The lifting of forbearance and moratoriums may help with that.

Looks like the bears predicting a crash of xx% are gone?!

Which bear predicted a xx% crash?

I do remember YOUR prediction of a 55-70% “epic crash.”

I could see that kind of drop if aliens start attacking us with superior firepower. Or if the covid vaccine turns us into zombies.

I am in Corona/Riverside (socal) and inventory is crazy low. The last 4 homes that sold were 45-80k above asking, removing all contingencies, and closing costs. I just got off the phone with an agent/friend and he has a list of 20+ people looking to buy here in the 700-900k range. I would love to sell but where would I go. haha

It is going to pop, but when is the billion-dollar question.

I’ve had 7 realtors drop off business cards and 2 drop off nice folders with a picture of our house and all the latest comps, etc. First time seeing this, so I know the market is crazy hot. I work for the federal government and will be going back on an overseas assignment to Toronto, Canada. Just waiting on my report date and hopefully I can list my house sometime this summer. In this type of market, do you think RE agents would shave 1/2% off their commission? If each side did, I could sell for 4% commission. I’ve always been on the wrong side of the market and this will be a first.

Moratoriums and cancellations everywhere. Can’t pay your rent, don’t worry about it, fill out some paperwork and we will pay your landlord with some newly printed money. Can’t pay your mortgage or student loan. Don’t worry about it, fill out simple paperwork and we will hit the pause button on those payment. (Month 13 on pause now).

How will our economy ever work normally again when these expenses are legally required from people again. If it were up to the current administration these payments would never be required. The money required for these payments will take away from the economy being stimulated in other areas. Ex. (I haven’t had to pay my rent or mortgage and won’t be for the foreseeable future, and I really want that new Apple 9 iPhone).

A few stories. I know someone who is not the best with their money. Makes $200,000+ per year. Lives in one of those outrageously overpriced luxury apartment complexes in Los Angeles for 3k per month in a 1 bedroom. They are now 5 months behind, might now be 6 months at $18,000 past due. They have not received even a hint of trouble from the property management group. Eventually they will be forced out but it does not look like the day of reckoning is even close.

Story 2: My employer is a manufacturer in California with around 100 employees. We are currently down about 15 employees since pre-pandemic. Not because work has slowed down but Bc our company literally cannot employ for $17 per hour on the production floor right now. 20+ employees still staying home collecting unemployment since last April because it makes more financial sense for them to do so. Has forced ownership to go to staffing agencies and even that has been unreliable.

Will we see the last of the unemployment boost by September when it is set to run dry? How in the world will the Blue politicians be able to convince the American public that continuing on with this boost makes for great policy?

our company literally cannot employ for $17 per hour on the production floor right now. 20+ employees still staying home collecting unemployment since last April because it makes more financial sense for them to do so.

I thought that if a company called back its workers, the state would be informed by the company, and the workers’ unemployment checks would cease, even if they refused to show up to work.

$17 an hour on which you have to pay FICA taxes of 7.65%, which brings it down to $15.70. That is $628 a week. With the extra $300 a week from the feds, unemployment pays more than that by a wide margin, in every state. You’d have to be insane to work for anything less than $1000 a week these days.

Those moratoria will never end. We are in a post capitalist America now where the left controls everything. We have UBI in the form of so-called stimulus checks that will keep coming. And we have free housing in the form of rent and mortgage moratoria. And as we all know once a govt program is put into place it is never rescinded.

I predict not one person who owes back rent or mortgage will be required to pay a penny of it. Either the govt will force landlords and lenders to eat the loss (after all they are evil capitalists and deserve to hurt) or the govt will pay it off for the deadbeats directly. Either way the deadbeats are off the hook. America 2.0 is a place where being a deadbeat is rewarded while working hard and succeeding is punished.

Personally I have not been affected by the rent moratorium. My tenants are top quality who a) have perfect credit and b) have steady employment. The type of people who care about maintaining their good credit for future home purchases and employment opportunities. They won’t blow up their financial history to scam a few thousand dollars in rent. Not worth it in the long run. This is why being picky about who you rent to is the most important part of the landlord business.

I keep reading sob stories of landlords who are not getting rent. Well, I hate to blame the victim, but you should have done a better job screening your tenants. Or you should own higher quality properties that attract a higher quality applicant. Better luck next time.

They won’t blow up their financial history to scam a few thousand dollars in rent.

Until the government requires that non-payment of rents be wiped off credit reports.

After all, if you’re not required by law to pay rent, why should it be on your credit report?

Yup, that’s coming.

It’s interesting that people still view millenials as mid 20s fresh out of college. You know, the way the media talked about them in the late 2000s. But all those 25 year olds in 2008 are now 38 year olds, most married with kids. And 38 year olds don’t have the same needs or wants as 25 year olds. They’re buying homes, moving to the ‘burbs and doing everything that previous generations did. Only difference is they are doing it a little later than before. But they’re still doing it.

I think Millennials are those born from 1981 to 1995. The oldest of them will be turning 40 this year.

Zoomers are now all the rage with the media. Just like Xers were the rage in the early 1990s.

Absolutely correct. Not only are they starting families, but they got a good dose of reality last year when world went crazy. That nice, safe, leafy, non diverse suburb looks better by the day. As mentioned, they are no different than the generations that came before them.

The housing market is absolutely insane in the south bay. Everything and anything priced within reason is gone almost instantly. I had coworker recently buy a place. He had to content with 23 other offers and stooped low enough to even have his kids write a letter to the sellers. Making money in RE or stocks has never been easier!

Bidding wars mean the house was under-priced.

I’ve seen great houses throughout L.A. snapped up within a week — and great houses sit for months with no sale. It all depends on whether a house is priced right.

Under-priced houses bring bidding wars. Overpriced houses attract no one. A correctly priced house will get only one offer, but it will be for the list price.

A house that is priced 5% under market will get more bids OVER market than a correct priced home. An overpriced home will get no offers, go stale on the market and then get at least 1 or 2 price reductions.

I am selling a home in Northern Santa Monica and we will price it 5% under market.

With the current crazy market, even houses listed at market value will get multiple offers. Due to the massive housing shortage and the supply and demand exacerbated by covid, people are willing to overpay. This is very true in the nice areas. With the ultra low mortgage rates, signing up for another 100K of debt is monthly chump change.

Can ya’all guess where is one of the hittest housing markets right now…

Fresno. wasnt Fresno near epicenter for the last crash.

Well tons of San Francisco’rs who are getting out of the city but still want to be able to commute once in a while.

Democrats want to increase student loan debt forgiveness from $10k to $50k — via Biden’s executive order: https://www.dailymail.co.uk/news/article-9428627/Biden-asks-Education-Secretary-legally-cancel-50K-student-debt.html

Can you do an investigation on where most of these people over paying for houses are getting the money from?

Houses here in Woodland Hills selling for 35% over asking. Are banks lending this crazy amounts or qualifying at 95%? Or people really have $300K to $400K to over bid each other their future gains! Houses listed at $850K selling for $1.2M. Insane.

just one anecdotal experience while selling my house few months ago – 1) va loans aplenty. we had numerous (A LOT) of military and or ex-military who had preapprovals for $1million with 0% down. with the low interest at the time, i believe their payment for a million is ~$5k a month. Now keep that in perspective with the other 30 offers we got that were conventional who had $200-500k in the bank. We had proof of funds docs so we got a bit of introspection into their finances. The vast majority were foreign nationals or recent immigrants, who had a lot of funny money accounting. One guy , the only income shown was “door dash” , yet $500k in bank perhaps from selling his home? Nucleur American families were the minority these were all “new money” type of couples and or families , other than the VA loans.

The people buying that house for $1.2M were always in the market to pay $1.2M. But they know that the way you get a $1.2M house is not by biding $1.2M for a house listed at $1.2M. But by bidding $1.2M for a house listed at $850K or 900K.

@Grune – You hit the nail on the head. Banks are lending these crazy amounts. This is now becoming just like last time. When the music stops a lot of people will be left without a chair. We will see if .gov steps in again to blow the bubble up bigger…

unfortunately, it’s not like last time. last time was ninja – no income no jobs or assets. this time, at least the underwriting is still very strict for income and jobs. Assets, there is still a lot more skin n the game at least FHA and conventional still require min 3-5% so if you buy a 700k-1million home at the very least your skin is 20-50k out of pocket you’ll lose for walking away. I know you want to bend reality in hopes of getting what you want but unfortunately it’s not going to happen. There will be some correction, but it will not be anything like what you say in 2006-2008.

OC Register columnist Lansner has an article in his bubble watch series today. A double-double sales pattern is where both sales and median price are up 10%+ over the same period in the previous year. Souther California has had a double-double for the last six months through February. Double-doubles only occur 9% of the time. He says they are most common at turning points; either bottoms or tops. Interestingly, Orange County has not had one, which makes it the only one of the six big SoCal counties for the last six months without one.

Lansner has raised the Bubble Alarm to four bubbles, which is one below a maximum bubble situation. A Double-Double is a sign of a rapidly changing market. Over twelve months since 1988, a Double-Double was followed by a 3% drop in the six-county region. He sees higher mortgage rates coming which will cool off the market.

Last week I signed a contract on a home in “The South”. Close in 2 weeks. Cash buy. True story. Boy the realtor was desperate, let me tell you first hand. Broke and desperate. She is 72 yrs old and still working at it.

Not much I can relate that the Dr. doesn’t cover. I don’t believe I overpaid too much, but.. I don’t know what they built the place for. I passed up some overpriced junk. Also missed a few that were sold before I could even look at them. (the Dr. is right! Listed and gone in a day). Biden’s FEMA map program said two would flood when the climate changes. Tell me that wont influence things? Biden says your house will be climate changed out of existence even though you drive by and go: no way.. Tell that to State Farm. Game changer for anyone on or near water.

I think I got a bit lucky. Damn fine house.

I’m glad to be escaping Illinois. To hell with fat Pritzger, Democrats, or anyone who stands with them. This is going to be an ugly civil war. Those people are going to freeze, then starve, then migrate.

Come git some…

Welcome back Mr Landlord! We missed you!

I have to catch you up!

I changed my name from millennial to M.

M is a housing and stock market bull (and Bitcoin mega bull).

I bought a house during Q1 2020. Can’t tell you how many people came put and called the top! Millennial bought so it must be the top….so they said. Lots of cheering by certain people. now that I bought the peak my equity will evaporate. Fast forward and I am up about 80k depending on where you look.

I bought a new construction in SoCal in an earlier phase. Right after Q1 2020 interest rates started coming down. Covid did the opposite of what these bears thought it would do to the market 🙂

He received an inheritance and did a 180 but still has that crystal ball. It just tells him different things now. And so far, so good!

Nothing could possibly go wrong. And if does, just “buy the dip!” Tesla to the moon, Bitcoin to 100K and so on and so forth.

Correct! Tesla-NIO-moon-time and Bitcoin to 300k this year!

Whaaaaaaaaa? Millie bought a house??!?!?!

OK now I know the apocalypse is near. 🙂

Correction. Milie claims to have bought a “new construction” house, in a new San Diego development community that no one seems able to locate.

He was still a bear in January 2020. Announced a sudden inheritance late in the month, and his home purchase a few weeks later.

His purchase was so “new” that he was able to witness its construction, and attested to seeing the high quality of the materials that went into its bulding.

Yet by April he was all moved in.

There are more details regarding his contradictory statements, which were extensively debated in earlier threads.

Not all of us believe he actually bought a house.

Yep, any day now 😀

Welcome Back bro!

SOL:

Have you seen how fast some of these new builds happen? One day there’s nothing, then overnight someone is moving in. It’s an assembly line, builders knock them out like GM builds cars in factories. I have no idea if Millie is telling the truth or not, but buying in Jan and moving in April isn’t unheard of for a new build.

These are lies by SOL

“ He was still a bear in January 2020. Announced a sudden inheritance late in the month, and his home purchase a few weeks laterâ€

I announced that I will get an inheritance much earlier. He just missed it or wants to push a different narrative. Getting the inheritance money actually took over a year. Also, just because you post a bearish post doesn’t mean you can’t buy a house…..if you have lots of cash available you might still buy even if you think it’s high….. people have to buy at some point unless they want to rent forever. 🙂 I just got super lucky that prices appreciated so much after I bought !!

Remember how many people cheered when I bought and covid hit! They all thought it would crash! ROFL

In terms of nobody seems to be able to locate my community. What a bunch of trolling BS. SOL is dying to find out my location/address but I won’t give it to him on a public website. Sry buddy. North county San Diego is all you get.

Mr landlord is right.

“

SOL:

Have you seen how fast some of these new builds happen? One day there’s nothing, then overnight someone is moving in. It’s an assembly line, builders knock them out like GM builds cars in factories. I have no idea if Millie is telling the truth or not, but buying in Jan and moving in April isn’t unheard of for a new build.â€

However. I never, ever said that they STARTED building in Jan. The studs were already up. Again SOL is just crafting a lie. I don’t know why. For some reason he is mad that I switched from bear to bull. People change and grow up. I admit I was wrong as a bear and I am a much happier bull now. Go USA! Got stocks! Go Tesla! Go RE and freaking go Bitcoin!

M: I announced that I will get an inheritance much earlier.

Really? Can you link to your “much earlier” announcement?

I can link to the opposite. On October 15, 2020, you posted:

M: Do people post as soon as someone in their family dies just because they get an inheritance? I don’t!

Source: http://www.doctorhousingbubble.com/young-americans-moving-back-home-because-of-covid-19-nearly-40-percent-of-younger-millennials-say-the-pandemic-has-them-moving-home-again/

So, M contradicts himself yet again.

Mr. Landlord, if you’re interested in the question of whether M really bought a house, read through that thread. Particularly where me and a few other challenge M’s claims.

M: SOL is dying to find out my location/address

I never wanted your street address. Only the name of this mysterious new development community in San Diego.

Although, you did invite me to your house last May. Which you quickly backpedaled on when reminded by me in October.

Mr. Landlord can read about that on the same thread: https://www.doctorhousingbubble.com/young-americans-moving-back-home-because-of-covid-19-nearly-40-percent-of-younger-millennials-say-the-pandemic-has-them-moving-home-again/

M: Do people post as soon as someone in their family dies just because they get an inheritance? I don’t!

Exactly! Why would I do that?! At the point when I found out of the inheritance I didn’t even think of buying. I didn’t even have to mention anything about inheritance. Jesus.

And why is my new development mysterious? I just have no interest in sharing online where I live. North county San Diego is all I am going to share.

I can’t believe I live rent free in SOL’s head. He can’t get over the fact that I was a bear and turned bullish because I received a lot of money and bought my first house 🙂

M: Do people post as soon as someone in their family dies just because they get an inheritance? I don’t!

Exactly! Why would I do that?!

But then why did you just now say?

M: I announced that I will get an inheritance much earlier.

You contradict yourself in this very thread, claiming that you both did, and didn’t, announce your inheritance much earlier.

As has been proven in previous threads, M’s whole house story is full of holes and contradictions. No, he did not buy a house.

Yeah, there is not one contradiction at all.

You made it sound like that It all happened in a few weeks. You just twist everything to push your narrative.

You are pissed off because I used to be a bear and switched.

You just don’t want to believe me. You were not interested when I said I can send you some picture of the house while it was built. It’s all cool.believe what you want and keep going with your lies.

There is no motive for someone to say he/she bought a house (mainly with inherited money). Lol. It’s not really something that you can brag with. I changed….move on with your life. I admitted I was wrong being so bearish and I am so freakin happy and proud I bought my first house AND it did amazingly in terms of appreciation!

Btw, buying a new construction in an earlier phase is a great way to generate equity as long as you go easy on the options. You can do most of that yourself later for much cheaper and you don’t pay property taxes on it…..if my crypto plans pan out I will buy my first rental. Maybe even a new built in an early phase.

M, you said you announced your inheritance “much earlier” than your (alleged) home purchase.

You elsewhere said you didn’t announce your inheritance prior to your home purchase because no one does that.

That’s a contradiction.

You lie.

Actually you lie.

You keep saying I didn’t buy a house. Want some pictures?

M, you already offered pictures in a previous thread. As I told you then, anyone can swipe pictures off the internet and claim it’s their house.

If I sent you a picture of Brad Pitt, claiming that was me, would you believe it?

You don’t want pictures because you don’t WANT to believe it.

You want to keep pushing your fantasy story about me to draw attention. As I said before, I live rent free in your head.

I have pictures of when it was built & completed and the progress inside (built ins/Shiplap) and yard work that came later. If you would find even one of those pictures online I send you my bitcoins.

Here’s a new SoCal real estate scam: https://www.dailymail.co.uk/news/article-9449521/Siblings-43-38-charged-duping-hundreds-victims-6-million-scams.html

… According to the indictment, Schoneke and Gonzalez would find properties and claim that they were for sale but in actuality, they didn’t even have the authority to list them for sale.

The siblings would market the properties as short sales ‘providing opportunities for purchases at below-market prices,’ the release states.

Schoneke and Gonzalez used other people’s broker’s licenses to post the listings on Multiple Listing Service (MLS) and other real estate websites.

The indictment alleges that some of the homes were ‘marketed through open houses that co-conspirators were able to host after tricking homeowners into allowing their homes to be used.’

Co-conspirators took multiple offers for each property, leading victims to believe that their offers were the only ones accepted. Some victims were strung along for years as co-conspirators told them that closings were being delayed as lenders needed to approve the short sales,according to the release. …

BLM co-founder buys $1.4 million Topanga Canyon compound: https://www.dirt.com/gallery/more-dirt/politicians/black-lives-matter-co-founder-patrisse-khan-cullors-lands-topanga-canyon-compound-1203374803/patrissecullors_tc1/

After helping burn down much of America in 2020, she now collects her reward in the form of California real estate.

Now we know where all those corporate BLM donations are going.

It is odd, though, that she abandoned her “community” to live among the white supremacists of Topanga. Because, after all, as BLM has taught us, all white people are white supremacists.

You have to “repent” for your “whiteness” and try to be less white. How you accomplish that, it beats me; maybe Biden and Kamala can explain that. All of this “woke” talk makes me sick – I did not see Biden become any less white after all this crazy democrat language of “wokeness”. Or maybe Bob on this forum can explain that because only a democrat can understand Biden and Kamala.

They lost me long time ago and their talk along with AOC and Maxine is just gibberish to me. The other democrat, Keri, is asking me for lower carbon footprint from his personal Yacht and private jet. I thought I left the communists behind decades ago and I found CA full of them.

Oh!..and I forgot that Delta CEO who thinks that asking for personal ID to vote is racist but asking for one to fly is not!…crazy! and that MLB from Georgia moving to Denver, CO which is asking for voter ID, which is overwhelming majority white, because GA is asking for voter ID. That makes sense!….maybe for Bob, but not for me!…we live in a crazy world.

Maybe Biden and Harris are pointing out the absurdity of people like Flyover.

1) There are 11 hour lines to vote in GA, so the GA Republicans make fewer places to vote?

2) Not only do they make fewer places to vote but they make it a crime to deliver food or water to anyone waiting 11 hours?

Biden, MLB, Delta, only point out the obvious. Flyover can’t see it.

Trump told Pence all it takes is courage to overturn an election and make the US a Banana Republic dictatorship? I thought Flyover escaped a place like that. Now he wants to have it happen again??

Enough politics. Isn’t this a Housing Bubble Blog?

The question should be: Where did the head of the BLM get their money to buy a house? Was it how Trump did with stealing campaign donations?

Voter ID is an absolute must. Any advanced country has that requirement. I can see why they don’t have Voter ID in venezuela but here? This is the US, the worlds greatest place.

I am loving the new and improved Millie.

Thank you Mr landlord! I am loving myself as a bull much, much more. I am spending money on all kinds of stuff since I bought a house and enjoying my life. Also, Time in the market beats trying to time the market!

I have changed my views politically as well. I used to be not interested in politics. Seeing how some friends and family were totally okay with BLM and antifa burning down cities made me re-think and change. That crap is absolutely a no-go. These are terrorists. Some relatives tried so hard to alienate me because I speak up against violence from leftists and now they try to label me as a trumper. Someone asked why (because I never really talk politics) and they said, he has American flags everywhere. ROFL…..I had ONE in my man cave-garage but now that I know it pisses them off, I ordered more. Go USA!

Notice how all the big time socialists all have multiple $1M+ homes? Bernie Sanders has 3. BLM founder has several. Every Hollywood “star” has a summer home in Malibu. Zuckerberg has an entire island in Hawaii. Bezos owns homes all over the world.

Why it’s almost like they aren’t really socialists at all and just pay lip service to their idiot followers.

Taking a wild guess here, because their followers are complete idiots?! I know someone in the Bay Area. She and her boyfriend are dirt poor. She keeps following super left wing propaganda and wonders why her life doesn’t improve. She actually believes that voting for socialists will improve her life. You can’t fix stupid and the ones on the top take full advantage of these low IQ people 🙂 maybe we should be less honest and start our own movement?

Follow us and we will make your rents disappear!

Just donate here so we can help you live rent free!

Paying rent needs to be cancelled!

I bet this would work.

The lockdowns/eviction moratorium have certainly aided this huge run up in housing. There is no inventory!! And record low interest rates. But it does not mean the industry is healthy. Big dollar deals but very little deal flow. Bad for agents and agencies.

If evictions are ever allowed again, and this new Prop 13 law with needing to reside in the property to take advantage of age old taxes, and inching up of rates all will put some pressure on the market at some point in 2022. But not enough pressure just enough for a possible flat year in 2022. This artificial man made asset bubble we live in has a long way to go. Dow to 50k, Bitcoin to 150k, housing another 10-20% all by 2022.

The single family home market is nuts.

I’m in escrow on a triplex in LA right now….seems crazy, but I got to diversify,and I think the stock market is overvalued. And I’m too old to be buying gamester or bitcoin bullshit.

I have a 1031 exchange to do and it was HARD to find a property to buy with a decent GRM….i’m a bit afraid of the ‘tenant friendly’ environment in LA county, but rents in the area i am purchasing seem stable, and with building codes so onerous for developers….not sure the market is oversaturated yet.

crossing my fingers….wish me luck? Or tell me I’m crazy!!!! Help!

Hello green groovy mom,

In reading your post I too am potentially in your shoes. Waiting for contingencies to be removed and then I will have to make a 1031 exchange or pay hefty taxes. What type of rents and the general area of where you bought? Los Angeles proper is in the ether when it comes to sales prices. Thx L

I was looking for a triplex or quad (for mortgage purposes, keep it in the less than 6 unit category) with a GRM of around 15…lower is better of course. But LA is a real bitch to find anything that isn’t insanely overpriced. You have to look away from the beach, and you won’t find a lot of nice redone places. Im not afraid of up and coming locations. This one is on the Eastside.

The Fed, banks and realtors all manipulating the housing market are turning America into a third world country where we have shanty towns next to million dollar home neighborhoods. These people make me sick. One day it’ll all come crashing down around them because even the Fed can’t control this market forever.

The 1.448 salespeople to 1.03 homes for sale is a bit misleading. The low visible inventory is due to the rapid turnover. Around 6.5 million will be sold this year, giving each salesman 4.5 existing homes on the average to get a commission on.

Like all other salesman

20% of the salesman make 80% of the deals.

Further, there are tons of ‘weekend warrior’ brokers who cant even secure any listings and being a buyer’s broker is a just a side hustle for their family and friends.

This may sound crazy… but it’s less crazy than this real estate bubble that desperately needs popping… here is the fastest way to sanity… Everyone who rents from an investor NEEDS to STOP paying. If everyone who rents perpetually, with no hope of ever owning simply stops paying and refuses to pay… bubble popped. Renters unite! These investors need to be left holding the bag, and then the banks that keep lending to them, need to feel the rage of the common man. These evil, elitist, greedy people who “make money†need to get back to work like everyone who earns an honest living. I cannot be more serious. EVERYONE STOP PAYING THEM. Stay where you are, don’t pay. Make them evict. They will have to rent or sell, but they won’t find anyone to rent to with a “good†credit history, because RENTERS UNITE! This is the only way to correct this evil system. Stop paying! This will only work if enough people do it. Otherwise, the modern day slavery will eventually overtake every future generation. It’s revolution time, and this is the one move they cannot defend against

DI

I am curious, are you part of the BLM/Antifa movement?

You’re suggesting that renters refuse to pay — but continue to live in the units? And continue to receive heat, water, and electricity, paid for by the investor/landlord? That’s justice?

And this is how the Communists won and kicked poor Flyover and his family out.

True capitalism is like a good game of Monopoly where there is one winner in the end who owns all of the money, houses and retail property. Everyone else is out of the game.

Good thing the US has free elections and can elect more moderate governments to keep this Monopoly game going. We saw this with Biden/Harris being elected. It has happened before with FDR elected under similar circumstances. If Biden doesn’t do anything, then I don’t doubt the next election will bring the extremists like AOC into power. Flyover had better be wishing Biden great success. The alternative of doing nothing is far worse.

The alternative is what Flyover experienced. A terrible revolution that murdered so many people and caused others to flee. The replacement governments were worse than the original and nobody owned any houses. You can’t have a Housing Bubble Blog under communism. I’d be bored.

History repeats itself and we have seen it all before.

Bob, I wish Biden would succeed, but I doubt it. Despite the rhetoric, he is not going to tax (as he claims) his billionaire friends who pay for him and his party campaigns. That is REAL life. Most of the people caught in his tax net will be middle class and upper middle class (like always) increasing the percent of the poor till we have a small number of people with all the political power and money. This concentration of power and wealth is what communists did and still do in China. The democrats at all levels are for more centralization of power in DC. The more power is decentralized (like in Switzerland) the more real democracy you have and bigger percentage of middle class and almost no poor. Also, using the same example, the more you enforce the borders and immigration laws, the less poor and crime you’ll have. Your democrats are doing exactly the opposite.

Also, don’t forget – inflation is the most REGRESSIVE forms of taxation; it is an invisible tax. What do you thing all the money printing will cause???!!!…more poor and more homelessness. Here, I agree that the main evil actor is the FED but democrats and all RINOs are all for it.

I agree with you.

The Fed is driving the economy. Which means the banks are driving the economy. I don’t think that is good. Every politician whether it is a Democrat, RINO, or Trump, has pushed to keep the party going.

The middle class pays for most of the taxes in the US due to loopholes for the wealthy. For instance, Trump made millions but only paid $700 in Federal taxes due to legal loopholes. Every tax change Trump made benefited him and the wealthy. I think Biden will change this. We shall see if he will cave to his donors or to his voters.

From what I have read, Switzerland has some good benefits. Universal Healthcare and Social Security.

Taxes are higher for all and RE is very high compared to the US.

I agree with the Switzerland model.

Switzerland has only some taxes higher than US. Overall, I believe there are lower. The property taxes are capped at $1500; in other words, you may have a waterfront castle worth 40 million and pay $1500 in property taxes. Switzerland does not pay billions for illegals like the democrats, therefore they have more to share for their own citizens.

DI

I can think of a couple of things DI stands for, but I won’t say them. Being a landlord is work. I rent out two houses that my family built many years ago. I mean literally built. My parents had us pounding nails for the siding, laying and side-nailing the oak floor, etc. That was the first house. The next house was much bigger and we put in the foundation, the framing and siding, the plumbing, the wiring, etc. My parents lived in one and rented out the other. When my Dad died, my Mom lived on Social Security and the rent money. We are now being paid for sweat equity by our tenants. Do you think I would pay one cent for maintenance of the houses if I couldn’t get rent? That would be adding insult to injury. I just paid close to $1000 for repairs on one house (which is more than the monthly rent) and I am getting bids for an upgrade on the other one.

Other people I’ve talked with bought property by working at something else and needed a good reliable source of retirement income. But the renter doesn’t go out and earn enough to do all that on their own. That is a choice. I’ve rented myself in some circumstances where I didn’t want to go way in debt for a place I didn’t need long-term.

When the government builds housing, there are cost overruns, shoddy construction, poor maintenance, etc. In your “dream” world, the reality would be that everyone except the commissars lives in shabby dilapidated government housing. Like in the Soviet Union or in Terry Gilliam’s movie “Brazil”.

A lot of these chubby kids with the kool aid colored hair are now adults and are figuring out that life is hard. Owning a home in a decent part of socal takes lots of planning and work (get a marketable degree or skill, work hard, sacrifice and save for decade, etc). Most people just aren’t cut out of for this. That’s why we see the talk of “greedy, evil investor landlords” and “I want free shit, where do I sign up or who do I vote for this?” Unfortunately this will only get worse as time goes on. Being the victim and blaming others for your circumstance is just too easy.

You are correct 100%. You may know this from books and inductive reasoning. I can confirm that in real life that is what happened all over Eastern Europe. I lived through that. People like DI and Bob think that the government can provide something for free or someone will build or maintain buildings with a loss.

FO

“You may know this from books and inductive reasoning.”

Yes and from pictures taken by relatives when they finally were allowed to go visit the old village in a formerly sealed off area after the fall of the Soviet Union. Massive damage by the Nazis was never repaired in about 50 years.

Sounds like somebody wants Communism. Lucky for you, you are in the right time and place in the history of this country. It all sounds so good up front. Everybody will have an equal piece of the pie and big uncle .gov will always be there for you.

Back in Europe, there used to be a law in which if you squat a house that was empty for more than 3 months then you could not be evicted. The solution to that was to keep some water running and the lights on so when morons like you squat I would have the police dragging their sorry asses out of my property and the judge signing on it. The morale of this is that, my little antifa moron, before you see any gain I would damn torch the house and let you live free in what remains of it. You will never gain anything no matter what. And there are plenty like me so if you think your little strategy can work…well think again.

“This may sound crazy”…

You’re right. That not only sounds crazy. That IS crazy.

However, it is refreshing to hear from a loony tune Marxist once in a while.

Or perhaps one suffering from full on psychotic hallucinations for whatever

reason. Or a stab at trolling.

My only criticism is that you didn’t go far enough to overthrow the “systemic evil

oppressive system”. After all, paying for my car’s gas is oppressive — I’ll quit paying

that. And who wants to pay for food anymore ? Or electric, or heat ? Unite slaves! So

we can all live like cavemen in the dark trying to avoid being eaten by a tyrannosaurus.

Or maybe you should just slink back into your Antifa cave before you come to your senses.

John Mauldin, an economics writer, showed data that the average first time buyer age has been around 33 for quite a while. Births 33 years before 2006 were in a downward trend. Births 33 years before now are in an upward trend. That usually is bullish for home buying demand. We already know about housing supply and it is currently low. Lumber prices are up and now housing prices are rising. Thousands of Biden “refugees” will be put somewhere, causing more stress on supply [my prediction, not Mauldin’s]. The government wants to keep interest low for the foreseeable future, and will buy longer dated bonds to keep interest rates down even in the face of an increase in inflation. Mauldin calls this housing bubble a “tiny bubble”. He sees a bigger problem in the demise of 60:40 stock to bond retirement investing. This is forcing savers into riskier ways to generate retirement income. (Bitcoin is an example, in my opinion; scarcity and fiat currency inflation are the drivers there.) Real bond yields are negative almost everywhere.

I like Mauldin’s free news. “Thoughts from the Frontline”

Also, Logan Mohtashami of OC writes that the real surge in house prices is because of demographics, which housing bears ignore

The largest swath of 24-34 yr olds are now on the house hunt and the US is short on housing by millions of units. My guess is these 24-34 yr olds have been living with mommy and have saved, further the avg internet engineer is making close to $100K.

These factors will keep housing running for longer than we can imagine.

I mean who woulda thunk that a year after Covid lockdown houses would be getting 5-20 offers at a price thats 5%-15% higher than a year ago. Unreal.

Housing bears – take a seat.

The housing bears have been on the wrong side of the argument for almost a decade now. And it looks like the party will keep going for a while longer. If you plan on owning for the long term and can comfortably afford it, just go out and buy. I’ve lost track of how many years I have been preaching this…

I would hate to be a housing bear in this market!

Couldn’t be happier with my house that I bought in Q1 2020!

Thanks to covid and low rates and low inventory, it appreciated massively!

Bob, if you want to stick to real estate and houses, lets talk about the BLM founder (and strong democrat supporter/operative) who bought 4 high end homes:

“As protests broke out across the country in the name of Black Lives Matter, the group’s co-founder went on a real estate buying binge, snagging four high-end homes for $3.2 million in the US alone, according to property records.

Patrisse Khan-Cullors, 37, also eyed property in the Bahamas at an ultra-exclusive resort where Justin Timberlake and Tiger Woods both have homes, The Post has learned. Luxury apartments and townhouses at the beachfront Albany resort outside Nassau are priced between $5 million and $20 million, according to a local agent.”

So who gave all these money to this democrat operative? Don’t tell me that she worked hard in a job to save all these money. Maybe a Summer of looting helped!…And us middle class are supposed to pay reparations to these democrat millionaires – at least that is what Biden and Kamala want. The average hard working black, of course will not see anything.

Flyover,

You seem to be turning into a Communist.

Are you saying black people can’t have money to buy expensive houses? Why?

What does BLM have to do with financial worth? Just because she is black and supports black equality means she can’t be a capitalist?

She is a professor who has written books. Maybe she is selling more books now? Are you saying she can’t make money on books? Should her income be distributed to less fortunate people like yourself?

What your saying is exactly what a communist would say.

Good thing I am here to shut down all this communist talk and go back to housing.

If Patrisse or Donald made the money legally they should be able to buy any house they want.

First, I am very fortunate and I don’t envy anyone.

Second, all the communist leaders “write books” to keep bribes (aka donations) legal. I don’t believe that type of work improves the society. The books are bought by the pallet and sent straight to the recycling center. Don’t get me wrong – I like books and I read a lot. I just hate corruption under the name of “book writing”.

Third, I support free markets and hate government interference. I also hate people burning and looting our cities so they can buy expensive properties where people are civilized and respect private property. For example, the daughter of Chavez from Venezuela (a socialist) became billionaire over night (of course, through “hard work” like our socialists), bought an estate in Switzerland and praises the virtue of socialism from a fiscal conservative country. If the socialism she and her dad created is so great, why is she not living in it? It is the same with the socialists from US, they create hell holes out of US cities, become rich “legally” by “writing books” and go to live elsewhere in fiscal conservative areas.

Just because I notice the hypocrisy does not make me a communist.

Bitcoin plummets 14%

https://www.dailymail.co.uk/news/article-9484317/Bitcoin-slumps-14-pullback-record-gathers-pace.html

Bitcoin fell by as much as 14 per cent to $51,541 on Sunday amid unconfirmed Twitter speculation that the US Treasury may crack down on money laundering that’s carried out through cryptocurrency.

The selloff meant the cryptocurrency reversed most of the big gains it made over the past week.

The latest dip meant it was trading at $53,991, which is a whopping $12,000 below record highs of above $64,800 set on Wednesday.

Smaller rival Ether, the coin linked to the ethereum blockchain network, dropped 10 per cent to $2,101. …

Whenever SOL posts anything you need to put things into perspective. SOL doesn’t like bitcoin because he missed the boat.

He never mentions that bitcoin is up 500% since October. Instead he gets hard on a 14% dip. Give me a break. It’s laughable

http://www.forbes.com/sites/billybambrough/2021/03/28/after-500-bitcoin-boom-heres-why-april-could-be-even-bigger-for-the-bitcoin-price/amp/

D.I. hasn’t reappeared to defend his position, so as blog aficionados

here, we should probably return to….well….Earth, and let DI remain

in orbit out near Pluto somewhere.

What many economists are reporting, is that rents and vacancy

rates are fairly stable with the economy starting to open up more.

Remote work has allowed some people to relocate to more affordable

areas decreasing or slowing some high cost urban rents. San Francisco,

for example — which is slowly recovering. Also, DTLA because of a glut

of new construction coming to market this year. And of course, NYC

because people are fleeing over taxation and lawlessness. Rents overall

are about to pre-pandemic levels. But it remains to be seen how all this

plays out. So far, the economy seems to be on the fast track to recovery.

Even Newsom dare not slow down Cali’s opening, lest he tighten the recall

noose that’s already around his neck. However, given the recent headline

below, shows his level of ongoing disconnect.

Gov. Gavin Newsom calls COVID-19 herd immunity ‘illusory.’

There is talk of another stimulus check. Cool, another trillion dollars printed. Hyperinflation here we come. If you DON’T own real estate right now you’re a fool.

And now there is the California stimulus check!

https://www.ftb.ca.gov/about-ftb/newsroom/golden-state-stimulus/index.html#Check-if-you-qualify-for-the-Golden-State-Stimulus

From CBS:

The money will also go to people who earn under $75,000 per year and use an individual taxpayer identification number to file their income taxes. These are people who don’t have Social Security numbers, including immigrants who were ineligible for the federal stimulus payments Congress approved last year.

Lumber increased 500% in one year with some types of lumber 1000%. Then people complain against builders for increasing prices. It is not just lumber – all construction materials went through the roof. Also, all government fees (soft cost) went balistic with change in codes to increase cost of construction even more. Builders would have to double the prices just to break even. If they stop building for the market to catch up, the supply of homes for sale will become zero.

As long as wages/stimulus and/or the stock market/Bitcoin go to the moon, RE prices will go to Mars just like Elon and Tesla.

When everything comes down to Earth, the day of reckoning will occur.

We are entering the second Roaring 20’s. My crystal ball is broken but we have all seen what happened before in 1929. The situation is similar.

Taking profits along the ride is key. Time in the market beats timing the market.

Nobody ever went broke by taking profits.

Spot on Mr landlord. Inflation is already happening (lumber prices, wages, gas, the list goes on an on. The only weapon against it is owning assets (RE, stocks, etc)

Waiting for a crash that somehow benefits the renters and people sitting on cash has been a losing strategy for more than a decade.

Some people have to learn the hardway.

More like if you didn’t buy real estate several years ago, you’re a fool. I’d feel like a fool buying today (unless I were selling something I already owned), at least in places like SoCal where the rent to price ratio is off the charts.

Looks like Zillow will offer me 20% more than last year’s Zestimate on my house in Texas. We just might ditch out plans to move back to CA and put some of that cash into a boat. It’ll probably appreciate too. Seen the price of used trucks lately?

Strange times, indeed!

Boat=bring on another thousand

If you want to hold assets that appreciate, then buy Bitcoin.

The two happiest days:

https://arfinancial.com/2018/06/05/the-two-happiest-days-in-a-boat-owners-life/

It’s fun to watch your equity go up significantly.

“ Looks like Zillow will offer me 20% more than last year’s Zestimate on my house in Texas. â€

My house turns out to be a money maker. People on this blog told me that I will lose my equity because crash, crash, crash.

No crash in RE ever happened and my house appreciated significantly. Where are those crash cheerleaders now??

Ever since 2013 or so, bears have been saying the same thing. Buying X number of years ago was a good idea, but buying today is a bad idea. Ever year X increases by one.

Happiest day thing is for people who buy boats without knowing what they get into. It’s expensive to own a boat. If you don’t understand that going into it, yeah it will not be a good experience. I own a boat, nothing fancy. I bought it used and it’s now worth more than what I paid for it. But the annual cost is significant with moorage fees in summer, storage fees in winter, gas, maintenance, repairs, detailing, etc. Nothing associated with a boat is cheap.

Having said all that, it’s a lot of fun owning one. Just go into it with the right mindset.

No worries, fellas. Our little runabout is just an inflatable with small outboard. It fits in our SUV’s back and will go pretty quick with only 20 hp. Our vacation fund was not getting used thanks to the disease so we decided to use it for some local fun. The lake’s only 1.5 miles away and insurance is dirt cheap. Small outboard motor maintenance is reasonable.

Yeah, yeah, I know… if I had only put that $7k into Bitcoin, I’d be cruising the world in a mega-yacht by December. 😉

Los Angeles judge orders free housing for the homeless.

See where they’ll live: https://www.dailymail.co.uk/news/article-9501199/LA-ordered-judge-offer-shelter-entire-homeless-population-Skid-Row-fall.html

I predict those clean kitchens and bathrooms will be completely thrashed within a year.

Oddly enough, many cities have proven that when you house the homeless, there is a MUCH GREATER chance they get their life together and become self sufficient.

When you realize that the price of one USN aircraft carrier could house every homeless person in the US, you understand how disfunctional our policies have become.

America – a military economy, all others, get in line.

Why some people doubt that M actually bought a house:

M’s Fantasy Timeline

* 2020

Jan 31 — Still a bear. Advises against buying.

Feb 11 — Claims to have inherited money.

Feb 19 — Claims to have bought a house. (Fastest probate in history.)

April 16 — Discusses commute time from the new house, which is beautiful, brand new.

May 20 — Claims to have a tenant.

June 27 — Now claims he bought the house while it was under construction. House was so incomplete, he saw the materials that went into it.

Considering the short time between the inheritance, the purchase, and the move in, this was the fastest probate AND fastest construction in history.

Oct 15 — Confirms he didn’t announce his inheritance until Feb 11.

April 14, 2021 — Now claims he announced his inheritance “much earlier.”

Relevant quotes:

Millennial (Jan 31): “there is an incredible amount of inventory on the market and much, much more to come. Just obvious that sales and prices fall accordingly. … Boomers need to start paying their fair share. They barely pay any property taxes.â€

————–

Millennial (Feb 11): “I inherited from a boomer. A lot. Thinking of buying property. ? I have a very nice house in mind.â€

—————

Millennial (Feb 19): “Just signed. … Love it here already.â€

—————

M: (April 16): “Commute to my tech job isnt bad (25min). … [house] is brand new, no headaches and it looks beautiful as you can imagine.â€

—————-

M: (May 20): “My stranger [tenant] in the house knows she can’t have sleepovers or she will get a spanking. I do like she’s paying nearly a third of my mortgage …â€

——————

M: (June 27): “… the top line materials were used. We watched it being built which is a cool experience itself.â€

———-

M: (Oct 15): “Do people post as soon as someone in their family dies just because they get an inheritance? I don’t!“

________

M: (April 14, 2021): M: “I announced that I will get an inheritance much earlier.”

__________

Sources for the quotes:

http://www.doctorhousingbubble.com/the-cure-to-the-housing-shortage-may-be-retirement-homes-the-coming-tsunami-of-homes-over-the-next-decade-may-come-from-an-unlikely-source/

http://www.doctorhousingbubble.com/why-are-californians-moving-out-in-droves-to-texas-a-trend-that-goes-beyond-one-year-a-two-city-example/

http://www.doctorhousingbubble.com/the-forbearance-tsunami-4-7-million-mortgages-are-now-in-forbearance-with-an-unpaid-principal-of-1-trillion/

http://www.doctorhousingbubble.com/covid-19-and-the-impact-on-housing-socal-home-sales-hit-an-all-time-low-in-may-and-4-76-million-americans-are-now-actively-not-paying-their-mortgage/

Source: http://www.doctorhousingbubble.com/young-americans-moving-back-home-because-of-covid-19-nearly-40-percent-of-younger-millennials-say-the-pandemic-has-them-moving-home-again/

And this very thread: http://www.doctorhousingbubble.com/signs-of-real-estate-overheating-more-realtors-than-homes-available-for-sale-with-record-low-inventory/

I scroll past every one of M’s posts for many years now.

I think he is still in mum’s basement in Fontucky.

If M had never inherited money, would he still be here cheerleading for a crash?

Money made him flip. Free money. What if No Money? What then?

What would he be saying right now?

Would he still be here, predicting a 55-75% decline?

I don’t think M was ever a bear or a bull. He’s a troll. Back when he was playing the part of a bear he used to:

* Gloat about how he kept sneaking into the neighboring building’s pool.

* Gloat about how he tricked his landlady into thinking he was poor, so she kept his rent down.

* Gloat about how he hoped that Boomers would all die soon.

* Gloat that Prop 13 would likely be repealed and drive remaining Boomers out of their homes.

Like a troll, his posts are calculated to draw a reaction.

Like a troll, his posts usually take an exaggerated stance. He’s never merely skeptical or sanguine about anything. It’s always “Epic Crash!” or “Wow, housing prices are red hot!” From one extreme to another, on the flip of a dime.

Richard, I might have never bought without the free money! I might be still be a bear. Luckily I got free money 🙂

I don’t get SOL’s thought process.

“ Feb 11 — Claims to have inherited money.

Feb 19 — Claims to have bought a house. (Fastest probate in history)

Does he think because I announce on a certain day on the internet that I have gotten an inheritance, that this means I got the money on that day? 😂 probate took easily a year.

What Richard said. Wanted a house bad. Couldn’t pull it off. Got money from relatives. Pulled the trigger. Nothing wrong with that, but the reason for and timing of his change seems clear.

M: Does he think because I announce on a certain day on the internet that I have gotten an inheritance, that this means I got the money on that day?

Here’s the part you left out, in boldface:

Jan 31 — Still a bear. Advises against buying.

Feb 11 — Claims to have inherited money.

Feb 19 — Claims to have bought a house. (Fastest probate in history.)

If you long knew of an impending inheritance, why were you still a Hardcore Bear only 19 days before buying a house?

Because there was no inheritance.

And no home purchase.

M: Richard, I might have never bought without the free money! I might be still be a bear.

You were a bear only 19 days before your alleged home purchase.

“Feb 19 — Claims to have bought a house. (Fastest probate in history)

Does he think because I announce on a certain day on the internet that I have gotten an inheritance, that this means I got the money on that day? 😂 probate took easily a year.”

My mom died and she had all of her wealth and house in a Trust like MOST CA’s do.

There was NO probate and my brothers and I received the full inheritance immediately.

I don’t understand this probate argument. Anyone in CA will avoid probate if they are savvy.

Yet M doesn’t mention this. That makes me suspicious. SOL obviously doesn’t know what he is talking about.

Sorry guys. Having experienced my Mom’s death and sadness with it, there was NO issue in transferring inheritance wealth within days or weeks in CA.

My BS Meter has pegged off the charts for both of you.

Sol,

“Jan 31 — Still a bear. Advises against buying.“