A case scenario in renting versus buying in Culver City – Rent a home for $2,800 or buy it for $600,000? 12 listed foreclosures while shadow inventory is up to 144.

I am happy to see that there is now a healthier debate between renting and buying in today’s market. Instead of mindlessly buying a home because it is the “right thing†to do people are being more apt to run the numbers before diving in. A mortgage can become an albatross especially when we have a decade of nonexistent home appreciation. Buying a home is a much easier decision when home prices rise every year like clockwork but what happens when that appreciation goes into reverse and breaks a multi-generation mantra? It is probably helpful to run an example in a mid-tier California city to highlight why prices are likely to go lower in the short-term. Today we’ll take another look at Culver City.

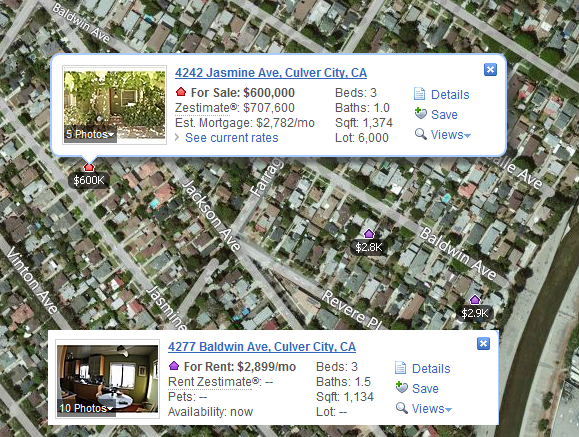

Rent at $2,800 or buy for $600,000?

There is a basic rule of real estate investing where you can calculate if a potential property is worth your time and hard earned money. Look at some hypothetical numbers:

Monthly rent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,000

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $200,000

$200,000 x 0.01 = $2,000 / monthly rent

This is the one percent rule of investing. If you can yield one percent or higher in this formula the property is worth considering. There are many other things to consider of course but this is a rule of thumb that many use. Let us examine a real live case in Culver City from this perspective:

We have a 3 bedrooms and 1 bath home selling for $600,000 and a comparable property a few streets down renting at $2,899 with 3 bedroom and 1.5 baths. As an investor, there is no way you would buy the property but of course this isn’t always the metric used to evaluate properties especially when you have emotions running rampant. For example, for it to be a good deal you would expect the $600,000 home to generate $6,000 a month. You can find properties across the US for $100,000 that will yield $1,000 per month. So you can understand if you were an investor, would you want to buy this home for $600,000 that is likely to get $2,899 in rent or would you rather receive $6,000 a month in rents? The answer is rather obvious on this metric from an investor point of view. However I doubt any serious real estate investors are buying in Culver City. No need to look too far since you have investors buying in places like the Inland Empire trying to run these numbers. So we’ll assume someone is buying this home as a starter home.

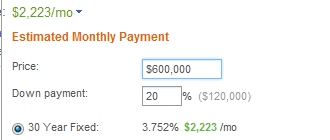

Let us continue with the numbers on the above scenario. Some seem to think that the numbers work well for everyone but the assumption of the mortgage payment is really too optimistic:

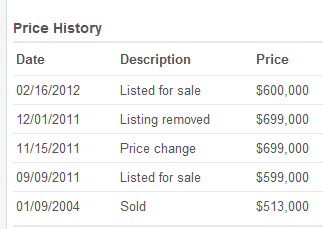

This assumes someone is going to put $120,000 down. Most of the people that have that kind of money are typically looking for a better home instead of a starter Culver City property. Look at the interest rate in the assumption as well and how insanely low it is. What about taxes and insurance? These are best case scenarios and yet the property is having a hard time selling:

The above home sold for $513,000 in 2004 and we were already solidly into a bubble at that point. They tried selling it at $699,000 and no one bit. The current list price is now $600,000. A household would need at least $200,000 a year in income to purchase this home. Do you think a household making $200,000 a year with $120,000 in cash is going to buy this starter home? Obviously others are seeing the same thing hence the price cuts.

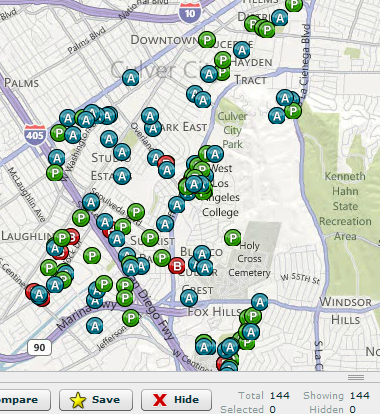

Culver City is littered with distressed inventory. 144 homes are in some stage of foreclosure:

Only 12 properties on the MLS are listed as foreclosures for the city! So the charade continues and the shadow inventory keeps leaking out all the while some would want you to believe the market is healthy. In mid-tier California cities prices will continue to go lower. Those that understand the math realize that the monthly nut is just a way to lure people into a massively overpriced asset and the Federal Reserve has been crushing the US dollar all for the sake of housing. How well has that worked out?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “A case scenario in renting versus buying in Culver City – Rent a home for $2,800 or buy it for $600,000? 12 listed foreclosures while shadow inventory is up to 144.”

I’ve actually looked at the $600,000 house! It needs about $120,000 worth of work–all new electric, new floors, new lighting (it has no overhead lighting), all new windows, new kitchen and bath, strip coating on walls, I believe a new roof, the garage is practically falling in, it needs landscaping, etc. But I laugh at the idea that this house would sell for $600,000. It’s in a neighborhood where homes in similar disrepair go for between $700,000 and $800,000. There was a bid of $679,000 on this short sale that didn’t go through for other reasons–short sale funny business (use your imaginations).

I rent a house for $3100 in the same neighborhood. It’s been very frustrating–houses in this area really seem to be holding their value. You can buy one of these for $720,000 or so, but those need about $100,000 worth of work. And yet, people keep buying! One just sold in a day or two down from my house–it was listed at $825,000. Not sure what it went for, but it was off the market before even the first open house!

The rental here is an apartment, I believe, so that’s not apples to apples

I know a couple that bought in Culver City recently… The majority of these buyers are all Ivy League graduated… There families have money… They are doctors and their wives are equally educated but since the husbands bringing in $300K they don’t work.. But could easily use their connections to snag a $100K job if they wanted to buy a 3rd BMW or vacation home in Belize.

Another thing.. Basically after the first $100K of income… Everything is pretty discretionary after that. So, while it would be unwise… A dual income $100K each couple could stretch an afford a $800K home.. They wouldn’t be able to drive BMWs and eat out all the time with their neighbors and go shopping in Beverly Hills.. But they could still live a comfortable, frugal life in Culver City on $200K.. in an $800K home.

They would basically live lifestyle wise like everyone else lives if they made $50K a year in another part of the country.. BUT, while it’s not WISE… and would drive me crazy… People still do it!

Check IRS records, there are far-fewer folks pulling-in that much cabbage than you think.

I visited that house last Sunday. I consider it a complete tear down. Interestingly, the neighbors in the rear are on a street zone as R-2. I could see the second unit in the rear.

My realtor told me that the Banks are purposefully withholding the foreclosure inventory in select markets such as Culver City/West LA. He agrees that there are many foreclosures hidden off of MLS and Banks will slowly trickle them out in order to keep house values near there current levels. I asked him why West LA and not other areas? He said that the Banks have more to lose if Culver City housing collapses.

Your assumption that you NEED $200K to buy a $600K home is the main problem Dr.

You get great schools in Culver City.. so no $200K private school necessary. And do you understand that after the first $100K in income… EVERY dollar is used for a WANT not a NEED.

The rent on that house is only $2800ish because the owner most likely owns the house outright and everything is a profit… No historical date and zillows data goes back to early 80s. So that home is long paid off.

I’m sure the Dr. could find out if Culver City homes used to sell for 3x income. If so, why is there a premium now and not back then?

Because the rates are lower. If you go by monthly payments, home prices should be about 1.5x higher than the standard 3x income, meaning that one can ‘reasonably’ afford a home that’s 4.5x income. Of course, the historically low rates cause some issues elsewhere, like increasing equity and trading up for a nicer home after 7 years or so.

I still have mixed feelings about the equity part though. While you will definitely be losing equity if you buy now, you’re also paying less interest over the lifespan of the loan, and also paying down more principle in your monthly payments. So while losing your initial equity sucks, I’m wondering if paying less interest and gaining more principle in your payments offset most of your loss (since you would’ve lost it to paying interest if rates were higher).

Ultimately, it’s a bunch of number crunching, but just a few thoughts…

ed- So did the premium rise when rates when from 15% to 8%, or visa versa?

Property Shark search shows this property was purchased 1/9/04 for $513K and financed with $461,700 ARM From Option One Mortgage Corp.; $98K HELOC taken out 5/05; 1/06 refi’ed WAMU ARM; 1/08 refi’ed $712 ARM; 7/13/10 NOD $46,542; 10/20/10 Notice of Trustees Sale.

Sorry Dr. HB, but you got this one partially wrong. Banks historically qualify debtors for mortgages based on gross monthly household income versus against the monthly mortgage payment. The average mortgage payment versus gross monthly income is 32.5%. That means that this $600K Culver City SFR, assuming a 20% down payment and 3.8% APR can be had by a family with a household income of less than $85,000 a year, not the $200K/year you suggest. The $200K/year you suggest is for when the 30 mortgage is pushing 9%.

That being said, it’s very unlikely that a family with a household income of $85K/year has $120K saved up. As you correctly imply, it is the Federal Reserve that is keeping mortgage rates artificially low just to keep the housing bubble inflated for a few more years in mid-tier markets like CC.

When 30 year mortgage interest rates go back to their historical averages of 8% to 9%, these $600K SFRs will be selling for closer to $300K. The monthly payments will not change but the debtors who buy at $600K will be stuck in these houses for the next 30 to 50 years as they will never get back their original note price.

Well i agree with Dr. HB. I also believe that one needs 200k income to buy a house worth 600k and plus. This is for those who would like to have a decent savings i.e around 30-40%.

Since interest rate can be kept low artificially, it won’t go up to 8 or 9% many years from now. When interest rate is let to be that high, inflation must be high. Then, inflation adjusted price would be much higher than 300k. Remember, at 10%, it takes just a little less 10 years to double the original price/principle.

Not necessarily.

For instance, in Massachusetts, housing prices went nowhere during the inflation of the late 70’s. It’s a false assumption that inflation will mean everything will rise at that rate. First of all, we have serious inflation now that the bureau of labor statistics, the BLS, (but leave out the L to get their final product!) is pretending isn’t there and what are house prices doing? They’re dropping.

According to John Williams’s site Shadow Stats which simply measures inflation the basically honest way that the BLS did it before 1994 when the Clinton administration screwed with all the numbers, inflation is about 8% right now. But home prices aren’t going up, are they? All prices do NOT necessarily rise during conditions of inflation. Economies worldwide, including the U.S., are undergoing credit deleveraging. The result of this is an inability to inflate the credit/housing bubble at the same time as prices overall are going up.

The other problem with your logic, Curious, is that you’re ignoring the fact that interest rates will likely be going up at the same time that inflation is going up. People don’t spend $300,000 on a house. They spend $X,XXX dollars per month on a mortgage payment. As interest rates go up from their historic lows, more and more of that $X,XXX is interest and less and less is the principle that someone paid you to buy your house. In briefest terms, rising interest rates = declining prices.

rethink your math – total estimated out the door on housing cost is roughly 2,912 with great credit, no HOA dues, 1.25% taxes, no mello roos, modest 65.00 homowners insurance and 3.75% rate. an 85k household income is gross 7083 month. at a 45% debt to income ratio keeps 275.00 for other debts like installment, revolving. since i have seen many of profiles what you speak of is very rare, possiable, but very rare. also, if you preform a net income and monthly budget, the household income needs to be much more maybe not 200k but it depends on thier lifestyle.

Whoa, hold on, what? You think a family pulling in $85k/year can live in a $600k house? That mortgage assuming the currently WAY low rates with the full 20% down, would run about $2,900. At $85k per year or $7083 monthly gross that’d be a 40% front end ratio in terms of DTI. This isn’t even getting into cars, kids, student loans, or ANY sort of debt. What bank would approve such a thing??? No wonder we’re in this mess…are they really approving 40% front end DTI??

My word to any West LA realtor is I do NOT pay for buyers remorse. I grew up in Culver City and Westwood in two of their best neighborhoods when prices were based on reality to me. I am shocked and horrified at what to me is nothing but the greed and suckers in the California market especially in my view in Culver City. Frankly I would never consider anything there or anywhere on the Westside at what are to me are grossly outraigous sale and rent prices reflecting to me a former buyers remorse. I don’t pay for buyers remorse. I know what a property would have to be worth in five years to just break even and at what I am looking at? I just don’t see it. I pass.

JL – I guess for those of us who grew up and are from LA we see the realities of the ridiculious real estate market and don’t buy into it. Agreed, it is so insane and it amazes me that people are still sucked into the whole “have to live the American Dream” crap here while making absolutely no financial sense. We happily sold our home on the Westside 3 years ago, rent here and will not buy here. Now just waiting a few more years to retire and get the out of this greedy city. So sad of what LA has become…

I’m with the good doctor too. Why would you spend $600,000 on an asset you know is only worth $200,000? I’d rather spend $72,000 to rent the joint for three years, then buy it at $150,000 when capitulation sets in.

I looked at a house like that one in 2004. So glad I could pass up on 515K so I could spend 150K renting for 8 years AND THEN spend 550K on that same house!!!

This whole thing makes me so angry! Years ago, I had visions of mountains of inventory at fire sale prices…all my years of patience rewarded. Instead, I see prices the same or higher than those I passed on, plus im 8 years older and out another 150K in rent.

It just wasnt supposed to be like this…

You could also have taken that $365k different and invested it in Apple back in 2004 when it was trading at $35 per share. That money would now be worth over $5 million and you could be living in Beverly Hills or some other fancy place.

Just count your lucky stars you didn’t buy that house or something similar in 2006/2007 when it was selling for $700k.

Or you could be a conservative risk adverse investor looking for stable dividends and bought $365 K worth of GE stock. It would now be worth $ 237 K and you could be living like royalty in Pacoima.

Or he could have bought silver when it was around $9.50 an ounce back then. It’s gone to about three and a half times that in the 5 years since and will likely multiply in value more than that many times again in the next 2 years.

Hey don’t knock Pacoima its lovely this time of year.

December home sales revised down 5% from +5%. January 2012 home prices down 2% YoY. The numbers don’t like, but NAR does. hahaha

http://www.marketwatch.com/story/sales-of-existing-homes-up-43-in-january-2012-02-22

Move to Florida. The opposite situation exists here. I am in the process of buying a home here in Tampa, FL. There are MANY homes for sale that are selling for about 25% of their peak sales price. Investors are snapping up the sub $50,000 homes so fast it is simply absurd. They are either flipping them for a quick profit or renting them and getting double, or more, their mortgage in rent income. I have seen many homes get a sales contract on them the day they were listed. It is making it extremely difficult to buy a home to actually reside in. I am having to pay above market value in order to be able obtain a home in a reasonable amount of time. There are numerous homes that sold for around 200k in 2006-7 and are now selling for under 50k. It is utter madness here.

Wow… Where do I start on this one…

First, we need to be very careful with simple rules of thumbs when it comes to economic decisions. It is true that in the past we would say 3 times annual income and that you expect to pay 1% a month. This was based on 20 year mortgages with 7 – 9 percent interest rates. If interest rates went up to 20% the 3 times annual income and 1% payment rule really breaks down as well. I think it makes more sense to look at how much of your take home income goes to housing.

Something else to keep in mind is that we need to change our understanding of what housing really is at this point. Housing is no different than transportation in that they are both consumption and not necessarily an investment. It may be true that the land component of “housing†is not consumed but the building component is consumed just like a car. I believe if we lose the investment mentality with housing we may make different decisions.

The most laughable comment “Basically after the first $100K of income… Everything is pretty discretionary after thatâ€. This is truly out of the mouth of someone who never made over a $100K. Now if we are talking about income generated by a job versus income from capital gains, then you are talking about roughly 45% disappearing instantly. So, that means that you get to keep 110K out of your $200K “incomeâ€. Now we need to take another 20% percent out of your “income†for retirement which is 40K. That leaves you $70K a year. This is a little over $5.8K a month. Now, let’s say you have rent/mortgage expense of $2.8K. This would leave you with $3K for all your other expenses (i.e. transportation, food, utilities, clothing, etc.). This may be a lot of money for the average person, but I assure you that a household income of $200,000 is not rich in many parts of the state of California, especially if you live in the bay area.

I realize that the tax impact is different for interest expense component of a mortgage payment versus rent and that if you save in a 401k you have a tax deferment for the first $11.6K. But when you get in the higher income bracket you hit something called the AMT and this can rob you of many of your deductions…

Hey What?,

What I said is accurate about everything over the first $100K being basically discretionary…. You won’t be living it up.. But it is discretionary… $3K after housing and medical insurance is just a little less than what we currently have per month on my income. The better half is in school getting trained for a field that will double our income in a few years…

We definitely are living frugally… But it’s all about perspective.. My parents and relatives would say we live an extravagant lifestyle by comparison.

And I made just shy of $120k this year.. so yes I have good authority of what is discretionary and what isn’t. I’m not contributing 20% to retirement… we’ll start doing that when the wife is working again.. But I’d say less than 1% of the population is contributing 20% to retirement.. so that’s a little absurd to say that is necessary. In fact, paying a mortgage down is comparable to retirement savings… It’s rent you won’t be paying when the mortgage is paid off.

If my math is correct, you still have not convinced me that anything over $100K is play money.

I hope you are on a pension because you are going to be in a hella hurt when you are too old to work if you are not saving 20%. The good news is that you will have a lot of company at the supermarket buying cat food to eat if you are correct about the rest of the US not saving for retirement…

Start growing fruits and vegetables in your back yard because you will need to pay a lot more than rent when you retire and I am pretty sure that SS will not cover all of your other expenses…

I have been reading this blog for last 3 years and was renting a 1480 sq feet home for $2200 in Cerritos for last 3 years. We have been looking for a house for last 3 years and spent lot of time on this task ( we could have used that time on something else). Doctor’s analysis does not apply in certain areas and Cerritos is one of them as this place is surrounded by less desirable neighborhood and there is huge demand. Finally I am leaving you guys as I closed escrow on 1624 sq feet home for $508,000 and It will need another 25K to make it look very nice home. My kids can walk to the best elementry school in Cerritos. I agree that this 508K home might fall to 450K but God knows it might take 3-4 yrs. You will be fooling yourself if you think this house will go to 350K or 300K (According to Doctor). My payment is 1930+500= 2430 and I was paying 2200 rent so basically I will be owning this place in same amount as I get some money back in taxes. So please stick with this website as there is loads of good information but try to identify your own unique situation.

I hope you did the math better than your post indicates, because it looks to me like even hitting the most basic items, you left out another $500 a month in property taxes you wouldn’t pay as a renter, plus maintenance (let’s guess $200/mo), and after you add those, your $230/10% more per month becomes $930/40% more. You’ll get some of that back as a tax deduction, but not all of it – still on the losing end as far as I can tell.

Oh, and homeowner’s insurance too! So there’s another hundred a month or more, now putting us at nearly 50% over the cost of renting, and I’m guessing I’m still not fully accounting for costs of ownership here.

Monthly Payment for a $600,000 Home with $480,000 Mortgage @ 4.0%

P = $691.59

I = $1600

T = $500

I = $750

———–

3541.59

3541.59/.28 = 151782.00

A household with $150,000 annual income and $120,000 down and good credit should have no problem buying this home. Perhaps with interest rates so low, the 3 times annual household income rule of thumb should to be adjusted to 4 times.

Monthly Payment for a $600,000 Home with $480,000 Mortgage @ 4.0%

P = $691.59

I = $1600

T = $500

I = $100

———–

2891.59

(2891.59/.28)*12 = 123925.00

The insurance payment was too high. A household with $125,000 can buy this home.

Able too buy this home and afford this home is two different ballparks. hell even FHA and Freddie Mac will approve a loans with a 54% DTI does not mean it is right. I can bet that if you completed a net income vs out going expense breakdown most would fail. hell even Dodd Frank bills see a bubble in high cost markets that is why they allow 40 terms in those markets only; that is why they have FHA and Conventional loans to 700k+; exactly why NAR fought to keep them for 2012. you take away high balance FHA/Conv and low rates these high cost markets will tumble. keep living the dream. Do not forget what Fuel prices did in 2006…….

Dude, you could buy the place with $125,000 income, but for real – the place is a piece of shit. 3 bed and 1 bath?!?!? In Culver City?!?!? $600K!?!?!?! F* that noise.

By the time the buyer builds up enough equity to move, there will be no takers for that place. They’re stuck in the starter home despite their income.

When the cost of rent is roughly equal to the amount of a mortgage payment, one must decide what the future holds for the investment. Renting doesn’t take a down payment and you don’t have maintenance costs either. You can leave when you want, too. Rent buys you time, whereas a mortgage payment buys you the house and the time. If you could avoid any real down payment, then it may be worthwhile. But housing as an investment is still not very good yet.

And if someone moves in next door with 5 kids, you can up and leave!

Gary Shillings’ latest analysis:

http://www.bloomberg.com/news/2012-02-22/why-renters-rule-u-s-housing-market-part-1-a-gary-shilling.html

There is so much more to the rent vs. mortgage decision than just the monthly nut. I was looking for an apartment or condo to rent in the Bay Area a few months ago. Came across a 2br/2ba condo in a nice area that was renting for about $1.6k. Looked up the place on redfin and found it recently sold, and at the selling price with 3.5% down FHA at current rates, the monthly P&I were about $900/mo. However, adding in insurance, taxes and association dues, the owner was close to breakeven at the rental price. But here’s the kicker – the exact same model in the exact same complex sold a month later for $47k less. The owner is likely breaking even, but I promise you he/she feels like shit right now.

I saw this property. As was said earlier this house is in terrible condition. It has to be completely 100% gutted. The agent showing the property was embarrassingly joking the entire time about it and it’s condition. Trust me, this isn’t a $600k house, not with what it would take to make it liveable. $750-790k seems likely when all is said and done.

Huh? Your comment makes no sense. It it’s not worth the $600K how will it be worth more than $700 later? By the way you should see the amazing new homes from 2200 – 3000+ Sq ft you can buy in North San Diego county for $600 – 700 K and even less. this house as some have noted should be worth in the $200s at best in good condition. It’s a working class tract home for cryin out loud. Please go read the linked Shiller article above for a good lesson in value and the state of housing.

I’m pretty sure that pixeltreat means that the *cost* of this home will far exceed the $600k asking price ($600k purchase + $125k-$150k in renovations), not that the *value* or sales price would be more than $600k.

@What? – where do I start indeed. Â

We have a combined income of 200k. Â It doesn’t go far in LA for a family of four. Â It gets taxed excessively compared to Mitt Romney. Â After healthcare and modest 401k contributions the take home is roughly 9k. Â I have mo idea how 85k brings home 8k a month. Â

Over 2k per month on tuition for two children in a school we’re happy with. Â The schools in Culver City are not all that so please stop touting them as such. Â

1700 per month on rent.Â

650 for two leased cars. Â Shoot me. Â No house and no automobile hassles. Â Plus 300 for insurance. Â Â Â

Student loan payments (required to get that income) are 600. Â We started with no help from parents, no previous means to save that kind of coin, spare me the community college bs cuz none of our coworkers got their jobs with a community college education. Â

Food and gas are another 2k easy.

Cell phones, gas, electric, some enriching activites for the kids, the balance goes quick. Â I’m not trading the tuition for a depreciating asset and an inferior education that will leave my children worse off than I started. Â

I never thought I’d actually make 100k a year and be married to a spouse doing the same. Â I definitely never envisioned having that kind of earning power and not be able to reasonably purchase a house.

This ain’t right. Â Investing in healthy well educated children first. Â If the market comes to it’s senses then I’ll jump in. Â Â Â Â

Here, here Goldhoarder – I am in virtually EXACTLY the same situation as you – except ours is a family of five and we make about 50K more. Otherwise, everything is nearly identicial. Before I married, I did have the opportunity to save up about 200K working a corporate job from hell and that money has saved me over and over again. I spend it down, then replenish it through investing, and repeat. If I had purchasd a house when everyone was screaming at me to do so, telling me what a fool I was wasting cash on rent, I WOULD HAVE NO SAVINGS RIGHT NOW.

It is currently impossible to save much of anything outside of retirment accounts on a 250K annual combined salary in LA. The state and federal taxes amount to basically 40 – 45% right off the top. We cannot even max out our 401Ks. Both parents working means full time childcare, afterschool tutors so the kids don’t end up being dum dums, maid service, and (excuse us) going out to dinner once in awhile. Since my wife makes 100K – it is ALMOST better to have her at home taking care of the kids rather than working, except that she would hate life.

Jay, you wrote…

“Both parents working means full time childcare, afterschool tutors so the kids don’t end up being dum dums, maid service, and (excuse us) going out to dinner once in awhile. Since my wife makes 100K – it is ALMOST better to have her at home taking care of the kids rather than working, except that she would hate life.”

Not to be disrespectful, but I’m curious what the motivation is to have three kids and buy a house when both parents work full time, the kids are in childcare full time, then go to tutors after school so they aren’t “dum dums”, and Mother would hate life if she had to stay home and take care of the children? Why buy a house when it seems it would be sitting empty most days, even a maid must be hired for housecleaning?

I have a question for you and other young families. I am not flaming you, just an honest question from a old guy that grew up in coastal SoCal in the 60’s bought in the mid 80’s before things got really wacko in the RE market.

Why do you stay in SoCal? You are obviously intelligent and well educated and probably have geographically transportable job skills. So, why stay here?

Even if you had to take a 20% pay cut to move, the real cost of living in another of the top ten MSA’s would be 1/2 of what you are paying to live here. In 10 years you will have flushed $200K down the toilet. That buys a nice house in a nice area in several cities. I just don’t understand why any young family puts up with this.

It’s not what you make, but what you keep–after all.

I can’t speak for all young families but I can give you an honest answer why my husband and I have decided to raise our family in socal. My husband and I are both from Huntington Beach and have good memories growing up here. We both surf, SCUBA dive, and we have a sailboat. Probably most important both our families are here. Childcare is expensive, grandma and grandpa are free. It is worth it to rent so we can have our son grow up close to our families.

In our case, deep family ties to Los Angeles keep us here. Plus the weather is great and the hassle and uncertainty of moving. Also, our careers have been established here and it is difficult to “build yourself up” somewhere else. Plus the kids are enrolled for free at a top school here (not saying you cannot find excellent schools elsewhere).

We Don’t Make Those Drink – It is complicated to answer your question and probably not appropriate for a public forum, other than to say my wife and I have both been married before. We own a home but basically cannot afford to live there and it is in an impractical location (Malibu), and so we rent closer to work.

People cannot move because of work and/or family. My husband works for Nasa, we must live where the job is. His PhD would be under utilized if he didn’t work his current job. I work flipping foreclosures, SoCal is the best place to be. Yes, we rent. Would we like to leave? Yes, but we make the best of it.

JS

Good luck to you on your new house.

If you pay 508k for a house and put 20% down (to avoid PMI), this is 102k plus you said you needed 25k to repair. So besides monthly expense you had to sink 127k. BTW many people can afford 20% down, so congrats.

In addition to tax and insurance you have maintenance, this is a few hundred per month.

Finally if you move and sell you end up paying 6% of 500k plus some other junk, you pay 30k transaction cost.

I don’t understand this area or your situation, I live in an area where you can buy a house w/ good schools for 300k easy. But then again CA is much nicer weather and has higher paying jobs.

The key is what happens in future, and I sure can’t predict this with 100% certainty, if I could I’d be as rich as Buffet.

Owning a home years ago used to be a good investment. A house was seen as a place to live and not as a symbol of success or a means to retirement. Americans, in general, used to purchase modest homes and invest money elsewhere. We currently have huge homes with very large maintenance/ remodeling costs. Most people I know spend a disproportionate amount of their after tax income on mortgage payments and seasonal projects (new kitchens, bath, deck, landscaping, painting, etc.) around the house. Americans have been sold on “a house is your largest investment” and waste thousands of hours of free time worrying about updating it to maintain value and impress neighbors. If one would calculate the amount of resources dedicated to home ownership (money, time, labor), it is a very poor investment for most. A renter has the freedom to move quickly, and the time to research and allocate capital towards worthwhile investments.

The government and corporate America want to sell us on the American Dream of home ownership. It is what keeps the machine running. Buy a big house, the builder makes money. Get a big mortgage, Banks make money. Buy lots and lots of stuff, big box stores make money. An unbelievable percentage of our economy is based on the “American Dream”. The American Dream should be about freedom. All of the debt incurred and time devoted to buying, owning, maintaining, and selling a house diminishes freedom for most. This is not to say owning a home is always a bad idea, just that too many Americans have the wrong belief about what a home should be. Simply put, it should be viewed as a place to live, not a real investment. ~ from the internets…

“The American Dream should be about freedom”. Great statement and great perspective.

I think you can you can make a better case for buying, versus renting, if you go the route of a 15 year fixed, instead of a 30 year fixed. 30 years is a long time for a neighborhood to decline, or school districts to get into financial trouble, or other problems beyond the control of the individual.

With respect to the actual home itself, if you buy a nice home, or fix up a recent purchase shortly after buying, you will still have a pretty nice home 15 years later, with normal maintenance. Maybe a paint job in there somewhere. Over 30 years, it is a different story. And of course there is the issue of technological advancements. Notice how older homes have about 1/3 the electrical outlets that we need, chuckle, now-a-days? Now it is coaxial cable and internet stuff. Maybe in 20 years it will be ‘beam me up, Scotty’ portals. The older your home, the less built in technology you will have. And the half life of these ‘improvements’ is getting shorter.

Once you own the home, free and clear, after 15 years, it will eat into your equity if interest rates rise substantially, but you can still sell and get out of the neighborhood (state, country, planet?). If you are in a 30 fixed, you are pretty much stuck.

Adding outlets isn’t a big deal…

Or better yet, put a power-strip in each grounded outlet and turn them into six or eight outlets.

Uh, you missed the point, Lora. If you buy a house today, it is tomorrow’s innovations that will give you trouble. Also, there is the no small matter of elected officials with lots of time on their hands.

Unlike California, most houses in Michigan have basements. With rare exceptions, new houses come with unfinished basements (bare concrete floors, walls). And tiny little 1′ X 2.5′ windows. Then, recently, most states came out with laws that say you can’t do squat with a basement without an ‘egress’ window. This is basically a window that can function as an escape hatch for any one under 300 lbs.

As part of my basement renovation project, I put in one of these windows for $1000, doing most of the work myself. Call a contractor and you pay $5000. Most new houses now already have one of these egress windows.

Who knows what it will be next. I would guess that within 30 years there will be systems that automatically compost any vegetable waste that passes through your sink’s garbage disposal, and other similar innovations. Maybe redundant utility backup systems. Lot easier to do this stuff during initial construction than adding it on.

Michigan? Thought this was a SoCal blog…nevermind.

I love this 15 year mortgage talk. Doesn’t a 15 year mortgage cost more than a 30 year in fees? And your payment is locked in at a higher rate, right? Most people can’t do that. They are as are all American consumers trained, sold on and forced [via price competition with the next buyer with a dollar more] to pay top dollar for their purchases. That’s all thanks to the Harvard Accounting and Marketing MBAs running the financials on their super computers.

But picture this – You can make your own 15 year mortgage out of a 30 year mortgage. It actually comes out a year or two longer but all you have to do is pay double the principal every month. All over payments apply to principal so it works to bring down the principal and more of each monthly payment goes to principal. Under the law of compounding you have paid half of your principal in roughly 10 years. All of that on easily affordable extra payments. Plus if you run into a monopoly scenario commonly known as an unexpected crises you can pull back on the double principal payment. You can’t do that with your 15 year fixed.

They don’t tell you this when they sell you the loan. Hmmm I wonder why.

Hey Dr Housing Bubble. Love your web site first time comment. I was curious if you could do an article on Staten island NY. Everyone is always saying NYC is different when it comes to real estate. Would love to hear your Opinion.

Who in their right mind would pay $600k for this tiny little stucco dump?

You have to go and bring up the crux of the issue – who in their right mind, indeed. That’s how we get bubbles and tweaked by marketers. Virtually all of us are susceptible to emotional judgement.

When you pay a mortgage, the payment is comprised of principle and interest. The principle portion is you turning cash into an asset (paying down your debt which means you build equity in your home). So in a rent vs. buy analysis, the real cost is the rent vs. interest payment + other expenses. You also have to factor in the opportunity cost of allocating the down payment to an investment, the tax benefits, and the fact that rents generally rise over time (especially in desirable areas).

On a 600k property with 20%, you’re looking at approx. $920 in monthly interest payments after tax savings assuming a 28% tax bracket. Add in a generous $1080 in property tax, insurance, and maintenance and you get $2k per month. Add back in about $200 per month in lost opportunity cost on investing the $120k down payment in a low risk investment and you’re at $2.2k. Yes- you armchair hindsight investors can argue bigger returns on the investment but not everyone is at “never a down day Goldman Sachs” level.

Now, I’m not saying THIS property is the right buy but on a pure financial basis, if your other option is to rent at $2,900- this is not a bad financial move. Over time, rents will increase so over time, your savings will also increase.

Of course, you can argue that prices will come down, the dollar will crash, or an asteroid will eventually hit the planet (it will) but if rents are comparable to buying there is much less need and stress for prices to come down. In the real world, this is what buyers are experiencing. If you factor in inflation, $513k in 2004 is $615k in 2012. Again, I’m not saying that THIS home is the right buy- I’m just providing the additional data points that potential buyers need to consider.

your scenario doesn’t make sense — nobody is putting 20% down on these houses, these are all fha loans with 3.5% down.

One thing not considering in the example is the high quality of schools in Culver Cities. I know people looking in the area specifically for the proximity to work & family, and the excellent schools there. Their down payment is coming from both sets of parents (business owners and doctors) and their family income lets them easily qualify for the monthly mortgage. They’ve been outbid on the past 7 offers by cash buyers offering up to 20% over list price. From anecdotal evidence, I would think that all of these cash buyers are foreign residents just looking to park their money in a safe place where they can visit once a year.

Hilarious post. This house last sold Jan 2013 for $842,500; the Zillow estimate for what it could rent for today is $5,400/mo.

http://www.zillow.com/homedetails/4242-Jasmine-Ave-Culver-City-CA-90232/20433203_zpid/

I hope everyone who sneered at paying $600,000 for it is in a happy home today though!

Leave a Reply to Talia