The Shadow Inventory of Orange County California. Median Home Price Still Down 33 Percent from Peak for County, Short Sales Make up One-third of MLS Data, Shadow Inventory over Twice MLS Inventory. $2.2 Million Ladera Ranch Property Selling for Half off.

The banking industry has proven that you can legalize financial corruption with enough funding to lobbying groups. The current banking industry keeps pointing to laws on the books, laws they paid lobbyist to write, so they would have a system that generously protects their interest. The first attempt to do something about the corruption comes in the form of a banking tax and the banking industry is none too happy. Ironically, it is the same taxpayer dollars that saved them from financially going into the history books. Yet they are having none of the tax and plan to challenge this measure. On the housing front stories are leaking out that banks are now colluding with crony insiders to create scams with short sales. In brief, a short sale occurs when a home is sold for an amount less than the actual loan balance. This needs to be approved by banks holding the notes.

The scam with short sales is merely one of the thousands of ways the financial industry is siphoning off money from productive sectors in the economy. What is occurring is that in many cases, during the housing boom people took out two (even three or four) mortgages on their home. Since second lien holders have possession of the property as well but in a junior position, they need to agree on the terms to make the short sale occur. Yet in places like California where the housing market has imploded the second lien, (as we will show with an example in Orange County today) are largely just lost bets. In other words the second lien holder will likely get zero but may hold up the sale of the property. However, information is now coming out (surprise, surprise) that the same FIRE employees are working their same magic that led to the bubble:

“(CNBC) In order for a short sale with two loans to happen, the second lien holder has to drop the lien.

If they don’t, and there’s no short sale, the home goes to foreclosure and the first lien holder gets the house because second liens are subordinated debt to the primary loan.

In short, the second lien holder gets nothing. In order to get the second lien holder to drop the lien, the first lien holder generally negotiates some partial payment to the second lien holder. The second lien holder doesn’t have to agree, but more and more are doing so.

That’s all legal.

But here’s what’s not legal and what’s apparently happening quite often recently. Since many second lien holders are getting very little, they are now allegedly requesting money on the side from either real estate agents or the buyers in the short sale. When I say “on the side,” I mean in cash, off the HUD settlement statements, so the first lien holder doesn’t see it.â€

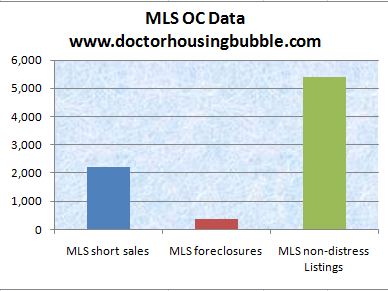

Good times. But of course some would argue that short sales are a tiny part of the market. In a place like Orange County short sales are a big part of the market that the public can see:

27 percent of all MLS listings in Orange County (of the roughly 8,000 viewable by the public) are made up of short sale listings. Now knowing what is going on with the industry, you can understand why so many odd deals are happening. I’ve gotten many e-mails of people putting in bids to homes that suddenly sell to someone else, even at lower prices. Take a wild guess what is occurring. That is why the entire financial industry needs to become like a utility. That is it. Break up the banks and bring back a new form of Glass-Steagall. This notion that bankers will somehow go to other countries with financial innovation is nonsense. When things are booming they are global citizens but when times went bad, they sure know which country will bail them out. And the insider horse trading with short sales is merely another reason of what is wrong with the financial industry.

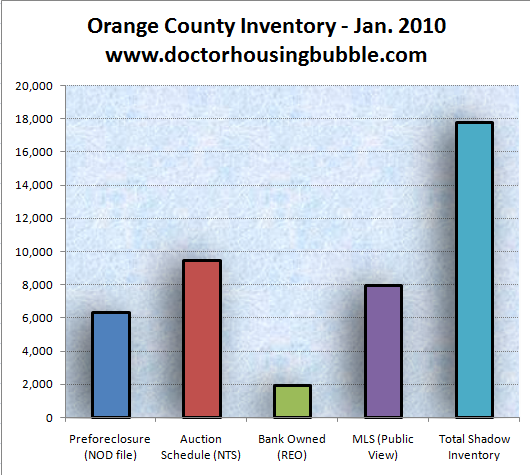

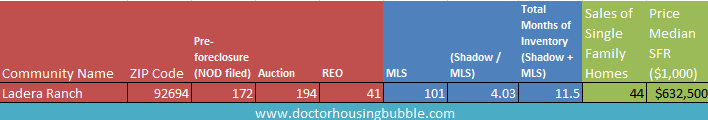

The amount of short sales in Orange County is large, almost one-third of the entire MLS market. But again, this does not factor in the shadow inventory. Some in Orange County think that they are somehow immune to shadow inventory. If anything, they have an equally large amount of shadow properties. Let us run the data for the county:

It is interesting that properties scheduled for auction dwarf the entire MLS public data. Total shadow inventory is twice the size of the actual MLS data. In other words, Orange County has many properties pent up in the pipeline. And here is the thing, those pre-foreclosures are people who have missed at least three housing payments and this number is as large as the entire MLS. Distress is deep in Orange County as well although like in some areas of Los Angeles people choose to ignore this data.

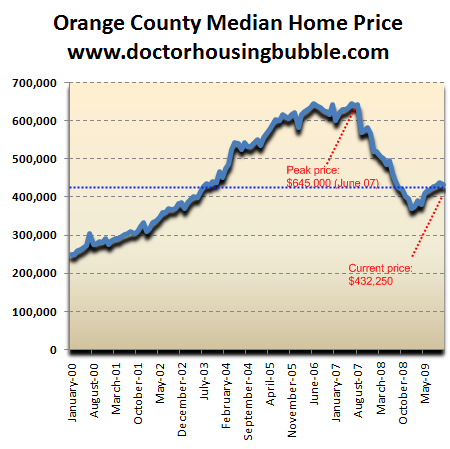

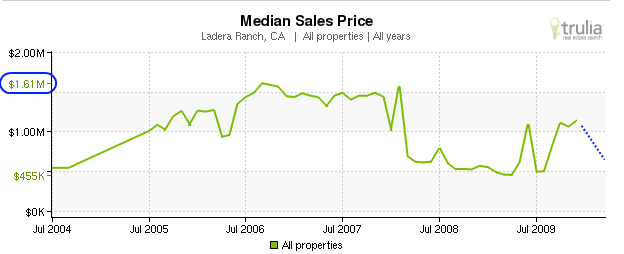

And Orange County hit the highest peak during the housing bubble in Southern California:

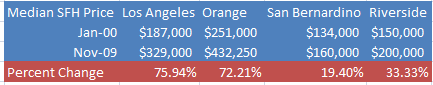

The median price is still down 33 percent from the peak. And just because prices fell hard doesn’t mean prices are now affordable or make for a good time to buy. Let us look at two counties that are still in bubbles and two that are not in Southern California:

That is why for those buying in the Inland Empire, prices may make sense. Prices have corrected sharply. But saying home prices in L.A. and Orange County are now affordable ignores the entire bubble decade. And like a narrowing path, some places in these counties are getting prices slammed like Palmdale, Compton, Stanton, and areas of Santa Ana. But the thing is people have narrow focuses on their tiny prime locations. Now if we assume the ratios to even out with L.A. and OC prices still have a way to go down. Interestingly enough both L.A. and OC had similar price gains over the decade; that of 70+ percent far outstripping actual income gains (zero).

Just because your small zip code is still in a bubble doesn’t mean that the overall market isn’t correcting. And eventually it will correct. Let us look at a “prime†area in Orange County, that of Ladera Ranch:

Here’s an area with supposedly no bubble and good values on prices. The MLS lists 101 properties which means only about 2 months of inventory are on the market. Yet if we include shadow inventory, this number jumps up to 11.5. You notice the median price? It currently stands at $632,500. At one point during the bubble in 2006 and 2007 the median price was up to $1.6 million!

And to show you that even high priced homes can fall let us now look at an example:

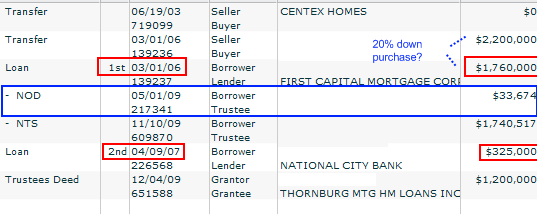

The above home has only been on the MLS for 9 days. The home is a 5 bedroom and 5 baths home and is listed at 5,118 square feet. This is a nice home. If prices were holding up in prime areas you would expect this home to hold up as well. This is a “prime†OC area. But let us look at some history on the place:

The home sold at the peak in 2006 for $2,200,000 and it looks like the buyers put 20 percent down taking out a $1,760,000 first mortgage. One year later in 2007, National City Bank decided to give them back that down payment via a second mortgage of $325,000. Of course, this was right at the point that the market imploded. The notice of default was filed in May of 2009, auction was scheduled in November of 2009, and now it is bank owned. So what is the current listing price?

List Price: $1,100,000

A perfect 50 percent discount from the 2006 sale price. And keep in mind this is a recently listed home. In this place the first lien holder isn’t even getting their full balance back so the second lien is largely a distraction. In cram downs, this is what normally happens but instead we have insiders making their own deals with others so even if you put in a competitive bid you have no idea if some deal was already made.

So is Orange County in a bubble? Absolutely. Just like L.A. is but OC will artificially look higher because they don’t have zip codes like those in Palmdale or Compton where home prices are now in the five digit range. So clearly this drags the median down. Yet the overall math is similar. A large hidden amount of shadow inventory while prices in prime areas remain stubbornly high but prices are coming down. If things were back to the good days why isn’t the above home selling for $2.2 million like it did back in 2006? Some people in California still have a hard time understanding why 2010 is still a poor time to buy a home.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

32 Responses to “The Shadow Inventory of Orange County California. Median Home Price Still Down 33 Percent from Peak for County, Short Sales Make up One-third of MLS Data, Shadow Inventory over Twice MLS Inventory. $2.2 Million Ladera Ranch Property Selling for Half off.”

I would like to see the Median SFH Price chart with San Diego County included. I expect the numbers will look a lot like LA and Orange Counties.

W.C. Varones – on of the oldest and most vehement bubble bloggers has capitulated and bought a home.

http://wcvarones.blogspot.com/2010/01/how-i-learned-to-stop-worrying-and-love.html

And another one bites the dust….

Dr. H-B wrote:

“That is why the entire financial industry needs to become like a utility. That is it. Break up the banks and bring back a new form of Glass-Steagall.”

No. No. And No.

What’s need is for financial institutions to know, with absolute certainty, that they will eat every penny of their losses, and there will be no government back-stop if they implode.

Further, if your elected representitives want to make crazy rules about lending to unqualified people, the government (i.e., taxpayers) should fund it directly. After all, these are your wishes, merely carried out by the people you selected.

But really, do people honestly believe banks were under regulated? Do you think you could have opened a bank in the last twenty years without massive government intrusion into your business?

Comment by Alex

January 18th, 2010 at 1:40 pm

W.C. Varones – on of the oldest and most vehement bubble bloggers has capitulated and bought a home.

http://wcvarones.blogspot.com/2010/01/how-i-learned-to-stop-worrying-and-love.html

And another one bites the dust….

>>

___

>>

All that sounds like from the blog link is 2 things:

(1) The person is incompetent at the history of interest rates (average closer to 9% and excluding the early 80’s, average is around 6 1/2 -7%) and/or has no understanding how low interest rates drive up prices and high interest rates drive down prices.

>>

(2) The person still has the delusion that house prices will go up even though households still earning an income took a 1.6% drop in income when adjusted for inflation. Where or why these sucker thinks prices will rise without household incomes also rising is beyond reality and mathematical probability.

I have a friend who tried to buy several short-sale and foreclosure homes. Never got anywhere until he dropped his realtor and used the one selling the house. Realtors will do double black-flips to get the double commission.

AnnS,

You’re right if this were an economic issue, but it’s not.

It’s a political issue. Banks and homedebtors will be bailed out at any cost, including destruction of the dollar and/or bankruptcy of the Treasury.

I am shocked, shocked to hear that there is corruption in the housing industry.

I am finding the same thing bz. Been trying to buy a low end place in the inland empire for a little while now. Suddenly after I used the seller’s RE Agent on this last one he got the seller to accept my offer even though it was lower than some investor.

It is far safer for politicians to give away money that will eventually be worthless than it is for them to practice tough love. So look for further money debasement with every crisis.

“But really, do people honestly believe banks were under regulated?” YES YES AND YES.

Reagan started the dismantling of the regulation over business. His basic idea of less government was correct, but too bad republicans interpreted “less government” and less regulation to control the elitist wealthy that manipulate the market. America is crony capitalism, and it will not stand because it is not liberty, but rather, a controlled form of slavery. We will crumble from within and in the meantime we will have idiots arguing with each other that the “other” party ruined America when in fact, it was BOTH.

Fraud from the top down, yet some shill in here would rather throw rocks at his fellow citizen. Too bad you can’t get a really good throw with those short manacles on.

Dr. HB,

Will you do a shadow inventory feature on the Santa Clarita Valley?

You write: “The insider horse trading with short sales is merely another reason of what is wrong with the financial industry.”

Yes, I agree; it is downright illegal …. but money under the table is the lubricant that greases all things and gets the deal done … Sick, sad, pathetic, ugly and evil … but true.

Oh, Yeah, BZ. Agreed. We were looking for the last year. Have been outbid, underbid, all sorts of seemingly shady back door deals. Actually had one creepy listing agent say with his arrogant swagger “yeah- the only way you’ll get into a house is if you sit down with a listing agent like me and write an offer on the spot.” We finally decided to stop looking for now, told our agent we’re done, gonna meet with our tax/financial planner and re-group. Likely end up renting a house, as we are currently in an apt with limited yard area (we have a young child) and some rude neighbors above us. Otherwise, we’d be in no hurry to move at all.

In todays L.A. Times, Alejandro Lazo claims that real estate prices are going up, and quotes some dumbass realtor who says that “it’s going back to what it was six or seven years ago with people bidding up the prices” blah blah, don’t be left out blah blah.

How on earth could a decent journalist take part in such horseshit?

My husband and I too decided to rent a house for at least another year. We are paying 2600 a month in Irvine for a 4 bedroom house. The mortgage on that sucker would be almost 4K. sucks to be waiting for so long to buy but hopefully it will pay off in the long run. We have been waiting since 2006.

Hi All

Prices are falling but not for real people. I have been waiting for last 12 months and no luck. Inventors/Flippers will never let us take advnatage of falling prices. I can give you number of examples.

12933 Andy Dr Cerritos CA 90703 — Someone purchshed this home for $338,000 in December and now back on the market for 499,000. I have 30% down and would have paid 389,000 to the bank. I understand investors make money all the time but I will call this a fraud if banks are breaking the law. I gave up and signed a lease for another 6 months.

JS wrote:

“Prices are falling but not for real people. I can give you number of examples.

12933 Andy Dr Cerritos CA 90703 Someone purchshed this home for $338,000 in December and now back on the market for 499,000.”

——

Previous owner purchased this property for $255,000 in 2001. If it just sold for $338K, are prices falling? If it sells for $499K, are prices still falling?

Prices are falling from 05-06 levles.I hope this helps.

In case anyone missed this article entitled “Bank of America to release homes” from last week:

http://www.lvrj.com/business/bank-of-america-to-release-homes-81453352.html

“Bank of America expects to release about 6,000 foreclosed properties into the Nevada housing market in 2010, or about 500 a month, an executive with the bank said Wednesday.”

Now if they’d just do the same thing here in Southern California.

The elimination of liar loans and destruction of ARMs will ultimately bring the real estate indusrty to it’s knees. Just as it has in the Inland Empire, it will ultimately spread to more affluent areas like the Westside, when the “real” demand for houses pales in comparison to the “true” inventory, both listed and in the shadows.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

2 weeks ago I found this property on one of the foreslosure web sites and it was showing that BOFA owns this property. I am pre apprived by BOFA and I called the loan officer and told him about this property. I was dead seriuos to buy this property but could not get anywhere. Today I found out that this property has been sold for

$ 520,0000 what the fu…..

18333 Parkvalle Ave, Cerritos CA 90703

3 br | 3 ba | 1,939 sqft | Single-Family Home

Sold for

$520,200

on Dec 29th, 2009

I am very sure in next 2-3 weeks this property will be back in the market for 599,000 or more.

Alex – Wow, that is interesting, I didn’t follow that blog, but this is exactly the conclusion I’ve come to. I did read in a finance blog that there may be a scenario that could break our government’s resolve to support the financial sector at any cost.

**

If foreign investors lose confidence and invest elsewhere to seek better returns, the Fed may have to raise rates. If they raise rates, then housing prices should begin to decline (this is the theory anyway – not sure it would work in this heavily distorted market). If housing prices start to decline, banks may jump in to unload as many houses as they can before values get to low. This could be the tipping point that causes the crash the market needs to equalize.

**

AnnS – The way to protect against a future increase in interest rates, is the “Assumable Mortgage”. Nowadays these may be nearly impossible to come by. I was counting on a VA which is required to be assumable, but the bottom VA limit just dropped by $200k, so now I’m looking at FHA.

“But here’s what’s not legal and what’s apparently happening quite often recently. Since many second lien holders are getting very little, they are now allegedly requesting money on the side from either real estate agents or the buyers in the short sale…”

This is exactly what’s happening to me on a short sale I’m trying to buy. They keep coming back to me and asking me to lower, then raise my offer. Definitely something fishy going on with the bank holding the second loan and the short seller’s agent. I drove by the house the other day and the house is now empty. The whole process has been weird and secretive. Not the way I wanted to buy my first property. If it ends up that this doesn’t go through, I’ll keep renting for a long while.

I have a hard time believing that institutional holders of second liens would systematically shake down brokers or short sale buyers. Just seems too blatantly illegal–and too easy to get caught. And why risk losing your job (and criminal penalties) if you are a W-2 employee in the residential workout department of some has-been lender in receivership.

I can believe this could happen in situations where the holder of the 2nd or 3rd is a private investor or hard money lender.

js wrote:

“Prices are falling from 05-06 levles.I hope this helps.”

—————-

My point in showing the actual sales history of the property you mentioned was to give some idea what the longer term trend is. I run into a lot of people that think “falling prices” means they’re going to get something for 1999 prices.

Perhaps in Fontana or Palmdale that’s true. But anywhere you’d actually want to live that’s closer to the Los Angeles or Orange county metro areas, 1999 is probably never coming back.

Comment by OC Hunter

> “The way to protect against a future increase in interest rates, is the “Assumable Mortgage”

>

Good luck on that ploy. FHA are not usually assumable anymore or, if assumable, very difficult to get through. Closing a VA on a loan assumption is nearly as tough as closing on it originally. The VA will put you through the wringer – income, assets, inspection (not just appraisal) of the property.

>

Whenever a real estate transaction came into the office and it was a VA, FHA (back then really tough on the condition of the house) or a VA assumption, it was break out the bottle of scotch.

>

There is no ‘minimum’ loan amount with the VA. There is a maximum on the amount guaranteed by the VA. It varies from county to county and by state for certain high cost ares ie: such as most of California. For loan amounts over $144000 in those counties, the VA only insures 25% up to the cap. http://www.homeloans.va.gov/docs/2010_county_loan_limits.pdf Otherwise, typically the max for a VA loan is $417,000. (4 times the amount insured by the VA.)

>

And many who have used a VA loan do NOT want to do an assumption when they go to sell. It ties up their eligibility for a future loan unless one of 2 conditions are met (1) the loan is paid off or (2) the person assuming the current loan is also a veteran who is eligible for the VA loan benefits. If the person assuming the loan defaults, the prior owner’s eligibilty for another VA loan is affected and until the amount owed on the loan is paid, they can not get another (or at least reduced if less is owed than the total eligibilty amount.)

>

When clients ask, we alway recommended against selling through a loan assumption because of those kind of problems. Too much risk in the future that could adversely affect the seller.

>

And keep in mind that if the loan is less than the price/value of the house, you will have to come up with the cash.

Comment by CB

January 20th, 2010 at 7:22 am

I have a hard time believing that institutional holders of second liens would systematically shake down brokers or short sale buyers. Just seems too blatantly illegal–and too easy to get caught. And why risk losing your job (and criminal penalties) if you are a W-2 employee in the residential workout department of some has-been lender in receivership.

>

___

>

(1) Their boss tells them to do it because his boss’s boss told him to do it because the boss’s boss’s boss told him to do it….. The line workers certainly are not making this procedure up all on their own. They do as they are told and don’t inquire. Never underestimate the stupidity of the US public.

>

(2) Possible criminal charges maybe in the future if the prosecutors go after the little fish just following orders rather than aiming at the giant shark (Citi, BOA, etc) versus definitely getting fired for insubordination and misconduct if they read this blog, say ‘hey I can’t do that’ and refuse, and thus no unemployment and no references.

>

Pretty much a no brainer as to why the W-2 wage slave at the bottom of the food chain does as they are told.

If a property has a second on it, the second holder will be looking to recoup some loses. By being the spoiler, I think they have a shot during a short sale to do this as their alternative is to lose it all at foreclosure.

I am happy. I hope the whole market collapses, and rents/mortgages drop to prices that are sane. I am unhappy that the corrupt Treasury, the corrupt President, and the corrupt banksters will *not* allow this to happen. What they ARE doing is manipulating the market to keep prices artificially high by not releasing froeclosed properties. They are also using the corrupt crony system to benefit themselves and their financial lovers, while the public picks up the tab.

Where’s the Pecroa trials? Where’s the investigation? Why aren’t banksters and others going to jail?

I hear Massachusatts just voted for more of the same….this time from a republican. With a voting base like it is, people are stupid and deserve…DESERVE to be ripped off by banksters and defacrats/banana republicans. Maybe when you don’t have a house or enough to eat you might get motivated enough to make CHANGE happen, and not the false “change” Obama promised. If you vote republican or defacrat, you DESERVE to be defrauded out of your money and freedoms. Stop crying and take your medicine from your voting past, present, and it appears, the future.

Thank you for highlighting the county I live in.

My god, just when I thought Schadenfreude didn’t come in Super-Size portions, you come along and start sharing the cornucopia of good news about short sale corruption, second lien holder angst, a massive pent up SFH pricing correction and Alt-A and Option Arm recasts. Man, I feel like I could just collapse from the massive rush of joy to my brain.

I got a flyer from an OC realtor just yesterday saying that 2010 is going to be a good year for the OC housing market.

Not if you end up in jail.

My point in showing the actual sales history of the property you mentioned was to give some idea what the longer term trend is. I run into a lot of people that think “falling prices†means they’re going to get something for 1999 prices.back.

In “real” terms, prices WILL return to their 1996-97 valuations, though not necessarily 1996-97 prices, due to unpredictable inflation. This decline may or may not come about from the current Alt-A, liar loan fiasco, but it WILL come once the generational dump occurs in say 7 to 15 years. The Baby Boomer generation, whether they like or not, HAVE TO be able to sell their their houses to the generation behind them, which is, unfortunately, significantly smaller and undoubtedly much poorer, if employed at all. The math is undeniable.

You wrote:

January 20th, 2010 at 7:22 am

I have a hard time believing that institutional holders of second liens would systematically shake down brokers or short sale buyers. Just seems too blatantly illegal–and too easy to get caught. And why risk losing your job (and criminal penalties) if you are a W-2 employee in the residential workout department of some has-been lender in receivership.

I can believe this could happen in situations where the holder of the 2nd or 3rd is a private investor or hard money lender.

***

I nearly fell off my chair laughing.

I’ve been in the short sale investing business since before this mess all came crashing down – and I can tell you that while this went on BEFORE the melt down it was nothing like it is now.

I will list for you here banks that have demanded an outside of escrow payoff in excess of 5K in the last year from me or the sellers of the home:

Citi

B of A, Countrywide etal

IndyMac/OneWest

Wells Fargo

Chase

I am trying to decide if the standard now is the extra cash – as it happens so often it is well close to 50% of the time.

Get a CLUE! Why WOULDN”T they demand extra money when they have the power to kill the deal and there is NO ONE TO REPORT THEM TO. What are you going to do? Call your congressman? The SEC? There is NO ONE regulating ANY of this in case you had not noticed…

I have had to spend $$ for attorneys to represent homeowners in order to get the lenders to drop “Cash Contributions” from homeowners for short sales when the homeowner was out of work, with a child in hospital! There is NOTHING they will not try – and usually get – because no one has any way to stop them.

Swiller is dead on – the banks MUST be regulated – not buried in BS paperwork requirements that make it impossible to own banks but actually REGULATED and overseen so that they are not allowed to speculate with other people’s money and markets – we need all the old regs back that were stripped out and then some form of State Banks like North Dakota has – look into it they are the only state that is NOT in financial meltdown because their State bank is owned by the PUBLIC and not a private debt sucking bank… pretty amazing story.

As for prices going UP? Forget about it! If they do at all it will be short lived and only part of more manipulation – prices still need to reflect economic reality of the community where they are – and they still don’t and now that there are no liar loans to buy the overinflated houses with the prices, will, eventually have to conform to the local income ratios – and we are still LOSING jobs not gaining them, so that is not exactly a forecast for increased prices.

The only real question is how long the banks and govt can keep fiddling and keep them over inflated by that fiddling… and my guess is not forever no matter what they THINK they can do…

Leave a Reply to TakeFive