The dirty secret of the housing market boom: Insiders are riding the low interest rate and low inventory trend. What happens when inventory and interest rates rise?

There has been some great discussions in the last few posts. Some comments are worthy of being articles on their own. One topic that consistently came up was the lack of public protests. First, Americans historically believe in the system even if it goes into full meltdown mode. Just look at the Great Depression.  While nations around the world switched to radical ideologies and turned the tables upside down, we simply went forward and elected another President. This belief is deeply entrenched. Or go back to the implosion days of 2008 when CNBC was caught off guard as if they were watching Ben Bernanke twerking on a Wall Street trading floor. Even a full market meltdown did not change things and this certainly wasn’t because of a lack of real-time data. So it is no surprise that we are left with policies that have favored the large banks. An easy transition from the foreclosed to the investor class. In truth, all of this has been a subtle bailout of those horrible loans that were made by said banks. A slow methodical banking chess game yet the impact is being felt on the middle class. The dirty little secret is that this housing recovery is fully artificial and a roundabout way of bailing out the banks.

If prices are going up so quickly, why are new home sales weak?

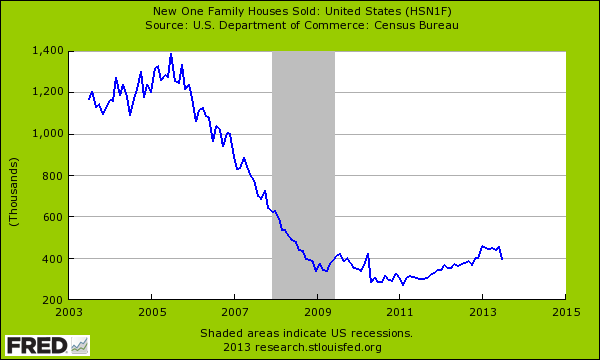

Home prices are rising at ridiculously fast levels. There is no underlying justification for this when you look at household incomes. New home sales provide an interesting perspective here:

Why is this figure so low? The large reason is that banks, gobbling up nearly 50 percent of all sales are going after lower priced properties. New homes are not the lower priced variety. New home sales typically reflect a healthier economy as well. New home sales carry a premium (a premium many American families cannot afford even with low rates).

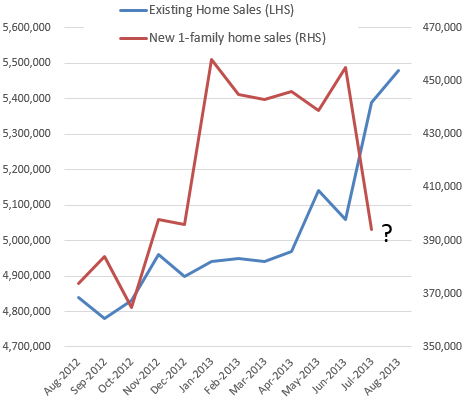

This trend is interesting because existing home sales have been hot since 2010:

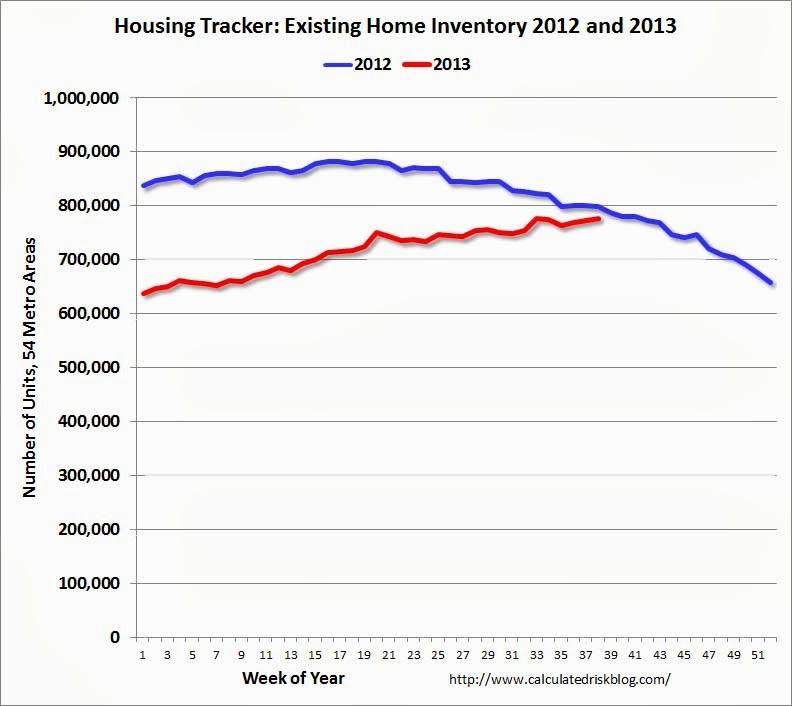

This kind of divergence is unusual but makes sense when you think of the makeup of who is buying here. Inventory while rising, is still low:

The trend is very clear here and it does look like an inventory bottom was reached in 2012. As more households shift to renting, it will be interesting if this shift causes any impact on prices and rents. Supply and demand theory would say yes but it is hard to factor in much when you have the Deus ex machina of the Fed morphing into the housing market and people waiting at their edge of their seats in terms of hearing the words “taper†as if a poet were reading some deeper meaning in the Fed minutes-mumbo-jumbo.

The market has been manipulated. I actually say this in the most sterile definition possible:

“To control or influence (a person or situation) cleverly, unfairly, or unscrupulously.â€

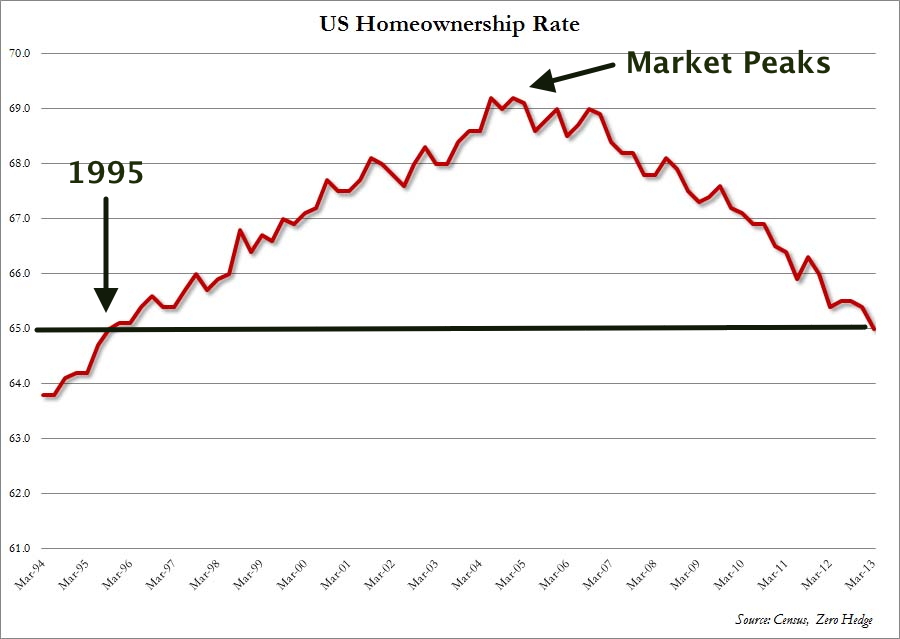

In this respect, the Fed has done a stunning job conducting a pseudo-bailout that continues to benefit the banking industry. In the mean time, the US homeownership rate continues to fall:

If households continue to see weakening income, if wealth is dwindling away for the middle class, then what real purpose is there in continually pushing for lower rates? It is abundantly clear that low rates have jacked up prices even higher largely mitigating any affordability that would have come from the low rates (and as we have seen, banks have tapped into large reserves of low rates and simply charge into the housing market like a bull in a china shop). If you think these low rates are for the public, you are out to lunch. Just look at student loan interest rates (still very high) but young Americans largely don’t vote so screw them is the attitude here.

You are seeing tiny shifts in more premium markets. For example, take a look at some data on Irvine:

Price reductions

February 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 41

May 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 86

August 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 232

New Listings  Â

February 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 226

May 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 377

August 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 361

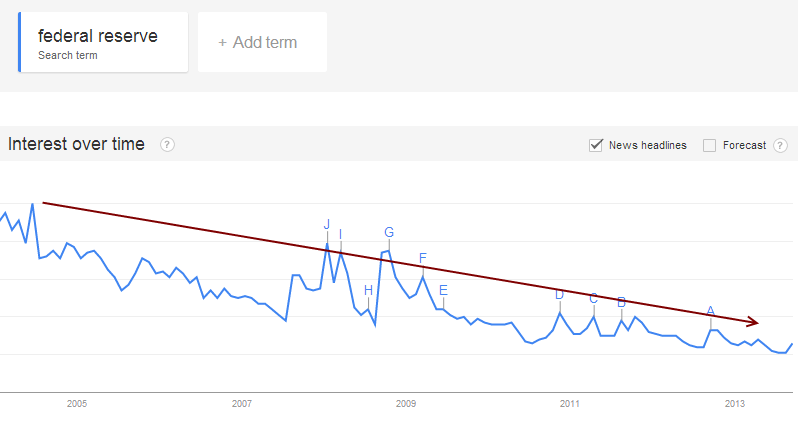

Keep in mind this is for a selective market. We are seeing more price reductions throughout California but the investor fever is still blistering hot. The Fed is going to taper like the evaporation of water in the ocean. The bigger impact will come when the confidence game of the Fed is understood more widely or more likely, when the next rush for the exits occurs. But when I see people rushing out for the new iPhone I doubt they’ll be searching for Federal Reserve info anytime soon:

Until then, long live the taper!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

70 Responses to “The dirty secret of the housing market boom: Insiders are riding the low interest rate and low inventory trend. What happens when inventory and interest rates rise?”

Several weeks ago the Federal Housing Finance Agency announced that after January 1, 2014 they would lower the limits on mortgages insured by Fannie and Freddie, below the current $417K conforming limit and $625.5K jumbo limit. This would be the government’s first step toward getting out of the mortgage guarantying business. They did not say how much they would lower the limits, just that they would start lowering them.

In response, the National Association of Realtors (NAR) is challenging the Federal Housing Finance Agency’s legal authority. (They were okay with raising the limits, they’re just not that happy about lowering them.) Let me see if I can summarize their position:

“OMG, you’re gonna stop using tax-payer money to cover the shoddy loans the banks are flipping in order to generate massive profits and keep this real estate casino in operation? If you don’t insure the loans, the banks won’t be able to package them into securitized, insured pools (Mortgage Backed Securities, MBSs) and sell them for more massive profits to reckless investors who eventually need bailing out. If the banks can’t sell the loans, they’re going to have to keep them on their books. That will add at least another point or two to interest rates and $100 per month or more in mortgage insurance to homeowners’ monthly payments. That will crash the entire party! How are we going to make a living? Oh no you don’t!”

A lot of politicians want the government out of the mortgage business. The problem is, as part of Quantitative Easing I, II and III, the government now owns billions and billions and billions worth of these MBSs, so they can’t crash the party or they’ll bankrupt the country again.

This is going to end up another bloody mess, worse than the first one.

well since the bank notes were fraudulent to begin with they should tell the banks to shove it up where the Sun don’t shine like Iceland did and now Hungary followed suit. that’s what they need to do in Detroit as well or should I say Greece 2? Welcome to the United States of Austerity.

“The problem is, as part of Quantitative Easing I, II and III, the government now owns billions and billions and billions worth of these MBSs”

The government doesn’t own shit. Teh FED monetized this toxic paper and when the securities go belly up it’s just numbers in their computers. That was the whole point of QE, monetizing (and socializing) the banks losses through inflation.

@DG1, you should read NihilistZerO’s comments.

The Federal Reserve is not part of the government nor is the Federal Reserve “the public”. The Federal Reserve is a private banking corporation, chartered by Congress, that is wholly owned by its member banks. The member banks who own shares in the Federal Reserve? Bank of America, Wells Fargo, Goldman Sachs, Citigroup, U.S. Bank, Deutsche Bank (U.S. subsidiary), etc.

Technically, these member banks of the Fed are owned by the public since they are traded on the stock exchanges but realistically the top 5% own most of the shares of these Fed member banks.

So, the Federal Reserve answers to the needs of its member banks. The Fed’s member banks respond to the needs of the top 5%.

Splitting hairs on the MBS ownership question.

Start

Banks = Fed = Gov

Goto Start

The idea of a pseudo or quasi-governmental/private entity is an attempt to have one’s cake and eat it too.

Yes, eventually the Fed’s debt will be reduced by inflation.

Regarding the structural relationship between the twelve Federal Reserve banks and the various commercial (member) banks, political science professor Michael D. Reagan has written that:

… the “ownership” of the Reserve Banks by the commercial banks is symbolic; they do not exercise the proprietary control associated with the concept of ownership nor share, beyond the statutory dividend, in Reserve Bank “profits.” … Bank ownership and election at the base are therefore devoid of substantive significance, despite the superficial appearance of private bank control that the formal arrangement creates.

There will be no wage inflation as long as Congress and The POTUS continue to flood the labor market with cheap foreign workers. Cognizant Technologies just recently got a contract for Obamacare IT services and immediately filed Labor Condition Applications for many more H-1b visas in this tight labor market.

http://www.computerworld.com/s/article/9242648/H_1B_workers_in_line_for_Obamacare_work

Flooding the market with cheap foreign labor has been one of the strategies of the Federal Reserve for a number of years. In the following article from 2007, Alan (Easy Al) Greenspan recommends just this:

http://www.boston.com/business/globe/articles/2007/03/14/greenspan_let_more_skilled_immigrants_in/

Get your pitchforks in the ready position.

@DG1 wrote “… professor Michael D. Reagan has written that:…”

Unfortunately, Professor Reagan died in the year 2002, and your quote of his was written in the year 1961 and is from American Political Science Review, “The Political Structure of the Federal Reserve System”.

A quote from year 1961 is like quoting something from the year 1909 in the year 1961.

If Prof Reagan were alive today, he would completely rewrite what he wrote in 1961 as almost none of it resembles Federal Reserve as it current operates. Credit default swaps, derivatives and structured investment vehicles did not exist in the 1960’s. MBS’s (mortgage backed securities) are very different beasts under the Greenspan/Bernanke Fed than before. Also, bailing out Long-Term Capital Management in 1998 under Greenspan would have been unthinkable in the 1960s, the 1970s or even the 1980s.

In my opinion, I sense the next civil war is in the making. Perhaps this is what the FED and governments are leaning toward?

“Why is this figure so low? The large reason is that banks, gobbling up nearly 50 percent of all sales are going after lower priced properties.”

I assume you mean investors and not “banks”?

There’s a difference?

;o)

>> Just look at the Great Depression. While nations around the world switched to radical ideologies and turned the tables upside down, we simply went forward and elected another President. <<

I've often heard it said that the U.S. was close to some sort of revolution in the 1930s, but that FDR prevented it by instituting what has been called "welfare capitalism."

Isn't that why the Hard Left hates FDR? They believe he bought off the masses, giving them just enough to prevent revolution. This is related to the Marxist theory that "things have to get worse before they get better." And FDR prevented things from getting worse.

(Whereas the Hard Right hates FDR for other reasons. They see FDR's social safety net as too much redistribution, and unnecessary.)

The simple reason the US did not move to a radical, populist leader during the Depression is that he was murdered. Not the first time, nor the last as JFK found out what happens when you go against banking interests. Read the award winning biography below for a very seldom told story about the Depression. Forgive my indiscretion into “Politics” but the analytical analysis that the good Dr. has clearly and concisely laid out above of the great robbery has been facilitated by the Obama change and hope lie. The great unwashed masses have been duped to the nth degree. The Obama administration has the friendliest banking group in the history of the country. His only very minor screw up was with our people’s professor Larry Summers, who laid the foundation for the banks entry into the casino. But do not worry, Old Yellen not only has a strong physical resemblance to Larry but will be even more accommodative to the big boys and add an extra twist to the garrote around the necks of the once middle-class.

“Huey Long” by T. Harry Williams

Winner of the Pulitzer Prize and the National Book Award

Hyperbole much? It doesn’t serve your cause to be taken as an objective observer of “Politics” with unsupported claims like this:

“The Obama administration has the friendliest banking group in the history of the country.”

@DFresh

Hyperbole? If anything, it is an understatement. I would suggest if you want documentation you begin with the following two books, one by a Democrat and one by a Republican, and both recommended by “The Economist” that left wing, radical rag. This is a good beginning, but if you would like more bibliography, let me know. PS If you read these books, you better have a strong stomach.

Bailout An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street By Neil Barofsky

Bull by the Horns: Fighting to Save Main Street From Wall Street and Wall Street from Itself. By Sheila Bair. Simon and Schuster

Fulano, you kill me. “The Obama administration has the friendliest banking group in the history of the country” is an understatement? What’s your reference point? The history of the Western Civilization, then? History of the homo sapien since we first bartered beads. lol.

@DFresh

By suggesting understatement, I was addressing the inability of the statement alone to fully state the degree of harm Obama’s laxness in prosecuting criminal conduct by the bankers and the idiocy of Fed policy have brought on the country’s financial system. Why do you not address the issues rather than trying to be a smartass? Have you read the two scholarly books I cited? You seem to have a rather strange penchant for attempting to defend the indefensible with irrelevant left-handed comments on topics not really germane to the discussion at hand.

The communist and socialist parties of the U.S. never drew much support–even in the depths of the depression. The fact that these groups were dominated by eastern European immigrants and atheists was enough to doom them, regardless of whether FDR implemented any social welfare state. Upton Sinclair’s EPIC campaign for governor of California was probably the most radical leftist political movement in the U.S. during the FDR years, and FDR all-but openly sided with the Republican in that race. If you want to get a great feel for the wild politics of the 1930s, read Greg Mitchell’s “The Campaign of the Century.” You won’t regret it. Politics was every bit as factional and nasty then as it is today.

@Foolano “By suggesting understatement, I was addressing the inability of the statement alone to fully state the degree of harm Obama’s laxness in prosecuting criminal conduct by the bankers and the idiocy of Fed policy have brought on the country’s financial system.”

1) Then why didn’t you write “harm” instead of “friendliest banking group”? What does “friendliest” have to do with “prosecution”? Please, be more specific in your attacks if you hope to earn any credibility with your statements.

2) What does Obama have to do with Fed policy? Very little. Once appointed, the Fed head is impeachable. Obama simply re-appointed the Bernanke.

Defend the indefensible? Who was it that handed Obama an economy on the brink of the worst kind (not hyperbole, but absolute consensus) since the Great Depression? The man YOU elected…twice. Get real. You deny it? Then tell the board, you coward. You sound like so many ashamed Republicans who finally see what their party has done to this country and what their party has become…a freak show. You claim to despise Republicans as much as Dems, but you fail to disparage any Republicans by name.

That “heighten the contradictions stuff was Lenin, not Marx. Just FYI.

“Capitalism is like rain: too little and not much grows; too much and the crops are ruined, the town is under water, and there’s a whole lot of misery.”– Will Rogers

The feds appear to have turned America into a “command economy” nation much like the Soviet Union was; minus the “shared wealth” concept Marx espoused. No matter what, it will end badly. The precise moment can’t be predicted but it will happen. But I still believe we are a dynamic an versatile nation and at some point, the masses will restore order.

We WERE a dynamic and versatile nation and now the masses will only generate CHAOS when the financial bubble bursts and the entitlements and giveaways come to screeching halt.

Think Greece except remember our angry citizens will have GUNS to take what they want from anyone who has something!

The masses never changed a government in the whole human history. It does not matter the nation or the culture. The real fight always has been between the top 10% and the top 1% – the ones with some power. The remaining 90% don’t have any real power, at least for the 1% to care. I agree, that they can be used/manipulated by either the 1% from the top against the next 10% or the other way around.

If you don’t believe it, read any REAL history book (which tells the truth) and you will notice this.

“The masses never changed a government in the whole human history.”

Really? Like the French Revolution?

And you can bet the top 10%, including government, changed because these people beheaded everybody who was something, almost 20% from the top.

I see your knowledge of history is even more feeble than mine.

@Reply to flynnman

I would love to know what constitutes a “REAL” history book that tells the truth. Guess all those books we used in school growing up were all fakes. If you can give one recommendation I’ll read it….

Nothing new about the banks being more powerful than the people. That is why one third of the people sat home and did not vote for either Romney or Obama. Obama only got around one third of the votes, with another third for Romney. Romney and Obama would not have gotten to where they were if they were against their real masters.

When will the bubble pop? That is the real question. When will the rush for the door begin. When is the time to sell and get out before the crash? What will me the signs?

I think we live with a three party system:

Republicans, who rule over the uneducated poor whites and many of the educated rich whites with American Jesus, guns, flag waving and “free market” economics.

Democrats, who rule over the poor, minorities and most of the educated rich (of all ethnicities) with social welfare, education, equality, etc.

Then there’s the REAL party, the ruling party. Ideologically, they are neither Democrats or Republicans. They don’t care about social issues, as long as the little people are kept dumb, compliant and content and not a risk to their masters.

War and Peace, money and everything else of real importance in this country is controlled by them. Their flag is green and their one and only God (and their only allegiance) is the American dollar.

“If you want a picture of the future, imagine a boot stamping on a human face — forever.” – 1984

watch the bond market. since “no-taper” bombshell (lol) rates have backed up. however, if that reverses then that will be the first clear sign the fed has lost the bond market. that would be quite the catalyst.

(from CNBC)The Federal Reserve isn’t just inflating markets but is shifting a massive amount of wealth from the middle class and poor to the rich, according to billionaire hedge fund manager Stanley Druckenmiller.

In an interview on “Squawk Box,” the founder of Duquesne Capital said the Fed’s policy of quantitative easing was inflating stocks and other assets held by wealthy investors like himself. But the price of making the rich richer will be paid by future generations.

“This is fantastic for every rich person,” he said Thursday, a day after the Fed’s stunning decision to delay tightening its monetary policy. “This is the biggest redistribution of wealth from the middle class and the poor to the rich ever.”

“Who owns assets—the rich, the billionaires. You think Warren Buffett hates this stuff? You think I hate this stuff? I had a very good day yesterday.”

Druckenmiller, whose net worth is estimated at more than $2 billion, said that the implication of the Fed’s policy is that the rich will spend their wealth and create jobs—essentially betting on “trickle-down economics.”

“I mean, maybe this trickle-down monetary policy that gives money to billionaires and hopefully we go spend it is going to work,” he said. “But it hasn’t worked for five years.”

At my large, above average income workplace, ALL anyone has talked about the last 2 days is the new Iphone and ios7. I tell my kids to stop watching the Emmys and pay attention to more useful ventures, suddenly I’m a ‘bad guy’.

SMDH, what a ridiculous society we live in.

“SMDH, what a ridiculous society we live in.” quote PapaNow

+100. I have learned to keep my thoughts on these matters quietly to myself, as family, friends and neighbors think I am a loon, if I voice my concerns. I am honestly amazed at how long TPTB have kept the whole show running. Now I read Greece may have a budget surplus this fiscal year when I thought it would be the first of many countries to file BK.

We live in very interesting times. No use worrying about stuff. Just live your life as happily as possible, but keep your eyes and ears open for the big train wreak headed our way.

It’s the consumption society. Lot’s of stuff, lots of distractions, lots of ignorant people out there and/or clueless to what is really going on. However, most are excited see new bugfixes for their portable devices.

consumerism has distracted the general public from focusing on the important things. why worry about what the Fed and government are doing to screw up the future of this nation when you have the latest iphone right here, right now? or the fact that you could afford to buy your base level bmw or benz for under 30k, and you can roll around like one of the big boys? it’s so easy to indulge your fantasy of being one of the ‘haves’ by creating this facade for yourself, and your deluded ego will love you.

the big picture? doesn’t matter as long as your self-portrait looks good. how’s that for ridiculous?

“buy” your new benz/beemer? Ha. “Own” is spelled l-e-a-s-e in SoCal.

Wow Doctor Housing Bubble! I don’t always 100% agree with you, but this time I completely agree with everything you wrote in this piece.

I know this is a housing blog and not necessarily a macro economic blog but I think that line between the two is getting fuzzy. The macroeconomics of this housing bubble has been fascinating

I believe the only relevant question is what happens when we have our next recession? The Fed currently has the proverbial pedal to the metal. The purpose of these actions by the Fed is to “stimulate†the economy not to “be†the economy. Currently, each additional dollar of stimulus that the Fed injects into the economy only adds one additional dollar to GDP. What happened to the multiplier effect? This is the basis for Keynesian model. This appears to have been a lesson in dimensioning returns…

Comes out to a little less than dollar for dollar growth when one looks at debt to GDP, no?

“In a nutshell: the G7 have added around $18tn of consolidated debt to a record $140 trillion, relative to only $1tn of nominal GDP activity and nearly $5tn of G7 central bank balance sheet expansion (Fed+BoJ+BoE+ECB). In other words, over the past five years in the developed world, it took $18 dollars of debt (of which 28% was provided by central banks) to generate $1 of growth.” Source: Deutsche Bank

http://www.zerohedge.com/news/2013-09-12/five-years-later-18-dollars-debt-every-dollar-gdp-total-g7-debtgdp-440

I brought this fact up to CNBC’s Diana Olick and she noted it on her twitter and facebook page

We have never seen a bigger difference in terms of home builders confidence and economic reality ever in modern day history with this chart

http://loganmohtashami.com/2013/09/17/economic-denial-from-home-builders/

There won’t be any taper for a long time…maybe not until the whole house of cards collapses. The Fed has no more tricks beyond more QE (though they can and will create additional QE “programs”). The banks are to accustomed to the low interest with which they prop up their bankrupt businesses. Without QE, they would all be exposed as bankrupt. And yes, the low rates have effectively kept the housing prises from dropping and have even made them rise beyond the reach of most of us. The best thing that could happen (for the actual homebuyers) is for the inventory to increase and rates to rise as well. Prices are way too high and most people know it yet nothing is done about it. Nothing short of a crash will resolve the crisis. Nothing. The bankers, Wall Street, etc. have decided to avert their eyes and ignore reality – the reality being that most of us can’t afford to buy a decent house on our incomes. And those bankers do so at their own peril. The fat cat finance industry had better enjoy what they have, because it won’t last.

“the reality being that most of us can’t afford to buy a decent house on our incomes.”

BAR, you need to couch your statement to your own backyard, or to down here in coastal SoCal. Most other parts of the country have good affordability right now. So, “most of us” actually CAN afford a decent house on our incomes.

What we’re experiencing in these desirable areas (BA and Coastal SoCal) is that we’re in a global marketplace in times of relative peace and a free-flow of capital across sovereign lines.

And, what’s going on in the Bay area with dot.com 2.0 (Google, Twitter, Facebook, LinkedIn, etc.) is dramatically affecting the numbers of home-buyer disposable wealth.

The same very thing is happening in every major metropolitan center on earth, whether you’re talking about London, Hong Kong, NYC, Moscow, etc…the “locals” cannot afford to live where they work.

@DFresh

“BAR, you need to couch your statement to your own backyard, or to down here in coastal SoCal. Most other parts of the country have good affordability right now. So, “most of us†actually CAN afford a decent house on our incomes.”

I assume we can refer to California and we can define “most of us” as more than half. If you look at the numbers below, you will see that the California home ownership rate is just above 50% and will likely continue to fall. As you point out, there are select areas where the “locals” cannot afford to purchase a home. The home ownership rate in San Francisco is 37%. The truth is that in most desirable areas, locals have very little change of ownership. And, I call bullshit on your overall premise. For example the home ownership rates in Fresno and Stockton are 47% and 53%. Two of the most undesirable cities in California.

“The percentage of Californians who live in homes that they and their families own dipped to 55.3 percent in 2011, the second lowest rate of any state, just ahead of New York’s 53.6 percent.” Source: US Census

Fulano says “home ownership rates in Fresno and Stockton are 47% and 53%. Two of the most undesirable cities in California.” Well, maybe not the most undesirable? There are some nice neighborhoods in those in those cities, and most importantly, those cities have fresh water from nearby rivers and they are surrounded by fields were food is grown.

On the other hand, many of us think that most of Los Angeles is a highly undesirable place to live. Except for cities along the coast east of the 405, LA is a crowded, dirty, gang infested hellhole with bad air. It looks like any third world city. Fresh water and food must be shipped into LA from hundreds of miles away. Imagine the nightmare of being trapped in the LA Basin if a major earthquake were to happen?

@ Fulano. I was referring to the entire country when I stated that affordability was high. That’s why I wrote, “Most other parts of the country have good affordability right now.”

People who call LA a dirty gang infested hell hole except along the coast are morons. Have they never been to South Pasadena, the rose bowl, burbank, studio city, montose, glendale, la canada flintridge, granada hills, porter ranch ect ect….

so what can we do about it?

Home-price growth slowing, Case-Shiller says:

http://www.marketwatch.com/story/home-price-growth-edging-down-case-shiller-says-2013-09-24

On a related note, Citibank to lay off 760 workers in Las Vegas. Citibank says the move is a response to a decreased demand for new mortgages and refinancing of loans.

http://finance.yahoo.com/news/citibank-lay-off-760-workers-140554701.html

Excellent analysis. My only real question is whether we are already in another bubble. I feel like the bubble never fully deflated in SoCal as it was. How do you have a city where the median income is $70,000 and median housing is $400,000. It has gotten crazy again. I’m glad I bought in 2011, but I feel for my co-workers who have a good job with strong pay, yet have no chance of affording a home by any reasonable metric in this market. How are kids graduating from college supposed to be able to afford these houses along with their large student loans all while being forced to subsidize medical insurance for people in their 50s?

@Dan G:

I think the student loan debt is major factor of the investor/bank scheme. They buy up these properties anticipating being able to an entire generation of student debt slaves that need a place to live and will never afford to buy. But they could still get themselves into trouble if renters stop paying rent just as owners stopped paying their mortgages.

Typo:

anticipating being able to “rent” to an entire generation…..

yes, we are in yet another bubble

http://www.globalresearch.ca/forces-bankruptcy-and-privatisation-of-the-city-of-detroit-law-suit-in-federal-court/5351205 a model for transferring the wealth from the middle class and working poor to the parasites sucking the body dry.

There can be no housing recovery without economic recovery, of which there is none.

The “recovery” as the author points out is nothing more than an extension of bailonomics that started back in 2008.

47M people on food stamps. 10K/day people going on SSI. How long until the masses start to feel like there’s no future for them and want something different? Or maybe they’ll go quietly into that good night…..

or perhaps they will rage

I been thinking about this for a long time, perhaps there is a new social contract here in this country. I think that we have evolved as a society where you don’t have to work to survive, you won’t starve or die in the street. It doesn’t matter if you are old, disabled, mentally impaired, drug addicted, or just plain lazy, there are programs that will give you food, shelter, medical care, and some pocket money. You can survive on these programs, it won’t be a great life, but you can get by, many people do. Yes, Social Security Disability is easy to get, its designed that way, if you have come to that point in your life where this is your best option, go for it, it’s there for you. The sad thing is that once you get in, it’s hard to get out, you are stuck at the margin of society, without much hope that things will get better, you exist.

+1. No rage, no revolution. You’ve described what I believe will be the new norm for many.

Like it or not. Less fortunate people are simply a number in a journal that serve the greater good of someone else’s vision. Time to claim that vision and reverse the role.

Just this last week, I’ve seen two homes for sale (where I’m looking) that are investor-owned, not investor-occupied, that are anxious to get out. Fire sale on one property that had a stream and small lake, large modern home on 5 acres offered for $599k. As is sale, no TDS (total disclosure statement) because owner had never been in the property. Two out of about 125 offerings in the small town I’m watching.

@itwasntme please give us some context for your post…. where, what city, etc.

On the other hand, many of us think that most of Los Angeles is a highly undesirable place to live. Except for cities along the coast east of the 405, LA is a crowded, dirty, gang infested hellhole with bad air. It looks like any third world city. Fresh water and food must be shipped into LA from hundreds of miles away. Imagine the nightmare of being trapped in the LA Basin if a major earthquake were to happen?

Well, I thought that Santa Clarita was not bad for the La Area. People will go to some tough areas, I’m surprise that housing is really increasing in value in Santa Ana but they do have a nice museum and a small group of hipster types. I’m not certain whether its investors, signing people up on bad loans or hipster types moving in since the same thing is not happening in Anaheim which is somewhat similar to Santa Ana in demographics.

Interest rates just dropped from the Fed announcement they will continue to indefinitely buy back bonds to keep rates down. Those on the sidelines who are waiting will continue to wait for a very long time.

This is an insiders game. The Fed tells the banks, who tell the hedge funds. They all have had inside information. If you know what the Fed knows, life is good. For the rest of us, we are left guessing. Sure, if we knew that the Fed wouldn’t stop at QE1 or 2, or 3 or 4…if we knew in advance, we’d know to just buy all the fucking assets we could get our hands on. That is the problem. Why is the entire economy run by one cartel? And why are we at their mercy? It just shows you what a fragile system we have for one institution to be basically controlling the entire economy. Why even go to college to learn economics? Just know one thing “don’t fight the Fed.” The more I learn about this country, the more I think it is a sham.

Just goes to show you that the internet and these blogs help reveal the reality of everything more effectively. Probably would be a lot different world without it now.

However, there is always a gut check when dealing with the FED.

Yes, sorry, I’m looking in San Diego County, CA

We are surprised to hear Las Vegas and SoCAL are still really high because something is REALLY happening here in Reno — the price reductions are rolling in daily — 15,000 – 40,000 price drops each time.

Inventory is sitting longer than ever.

To be more specific – we are watching the 250,000 – 500,000 price range in south Reno.

I think it has been explained very well by one of the realtors in his article about Torontian mortgage fear and its effect on home sales. People are behaving exactly as the bigger financial institutions predict them to behave. Lower interest means that some of them go crazy about buying, and enter bidding wars without even having money to take a proper mortgage. I think this situation corresponds with the graph you posted here.

Maybe the good doctor is on vacation – no new posts. But I mention again today, like I did above last week, I am seeing yet another property in SD CA County that is investor owned being dumped (no disclosure statement because owner has never lived in the property). This time in a much more tightly controlled area (controlled by the banks) in terms of letting distressed houses on the market. The investors are bailing in SD County, this time in a very controlled market. This house isn’t a flip either, but did have some work done. I hope the good doc reads this and gives us some heads up about what may be happening the in Cali market. Very interesting developments where I am looking.

Here’s the wording from the realtor dot com site:

Seller can close as quickly as buyers desire. Property is being sold AS IS and no requests for repairs are expected by seller. The seller has never occupied the property, has limited knowledge of property and surrounding areas. This home is being sold in its current “as is” condition

Time to bargain hard with these fools? Hmmmm.

Low ball them 😉

Leave a Reply to John B.