Wild examples of the mania in real estate: $200,000 for permits? Crap shacks galore? The mania is reaching a fever pitch.

The housing market is deep into mania. You can see it in the eyes of the house lusting buyers and the overweight Taco Tuesday baby boomers drooling at their mouth trying to justify why their World War II built crap shack is worth $1 million. The market has gotten unhinged and in this environment you keep hearing things like “crazy†and “insane†and “what the hell is going on?†over and over. That sure inspires confidence and stability! Yet people want to commit to a 30-year fixed mortgage on a dump. In a time when flexibility is key and being nimble in your mind is paramount, you have old thinking boomers trying to infect people with this old paradigm of how business is done. And the telling thing is what is happening right now is not any different from what happened in the last crisis. Mortgage debt is down because a large part of recent buying has come from investors! Of course mortgage debt in aggregate is down when many investors pay in cash – that is why the homeownership rate is also down. Duh! But overall household debt is up thanks to people loading up on student loans, auto debt, and credit card debt. Yet this is somehow better? Just look at some of the wild examples in the real estate market.

Seattle:Â $200,000 for a permit

A reader sent this example from Seattle highlighting a teardown that was bought in 2015 for $540,000. It was listed to sell at $745,000. Why the big price jump? Because they got permits to update the place!

142 NE 56th St

Seattle, WA 98105

2 beds, 1 bath listed at 1,130 square feet

“Attention Builders / House Hunters: Prime Green Lake / Tangletown location – Approved Plans/Permits ready for Immediate Construction: 4 bed, 3.5 bath house, with 3rd floor master suite, 2 decks and territorial views. 2 car detached garage, 2,884 square feet plus garage (260) for total area 3,115 sf. Prime location close to Green Lake, shops, restaurants in coveted McDonald Elementary area. Existing home sold as-is. Homeowner could purchase and sign fixed price contract for customized build.â€

And the place sold. Not for $745,000 but for $741,275. Here is the pad:

The only value added here was the permits. Yes, makes total sense.

Let us now go to California.

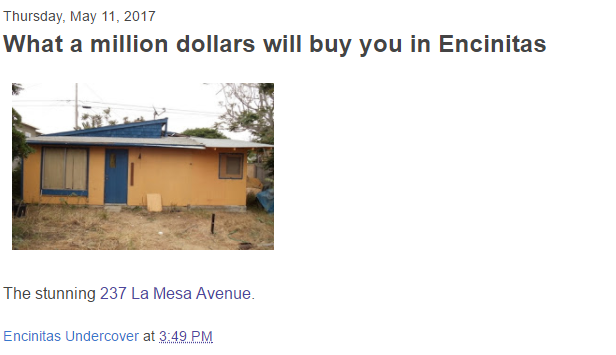

Encinitas:Â Crap shack testing the water

Someone wanted to see how nutty and horny people were when it came to buying a home. So this place was listed for nearly one million dollars:

After people were “LOLing†it was delisted:

Here is the Google Street View from 2012:

Yup, totally makes sense. You have cactus right behind the “Private Property†sign. Sounds like a million dollar crap shack to me.

We now have a reservoir of cases of why we are in a housing bubble. According to NASDAQ that knows a thing or two about bubbles (Economic Bubble definition):

“Definition: A market phenomenon characterized by surges in asset prices to levels significantly above the fundamental value of that asset. Bubbles are often hard to detect in real time because there is disagreement over the fundamental value of the asset.â€

Just look at the comments. It is a mind field of disagreements but the last two years there is probably a 3 to 1 ratio of bulls to bears. Even in 2015 to 2016 it was closer to a 2 to 1 ratio. Ironically most of those championing the “all is well†line are not in the market buying. If it made sense wouldn’t you be buying even for investment properties?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

144 Responses to “Wild examples of the mania in real estate: $200,000 for permits? Crap shacks galore? The mania is reaching a fever pitch.”

Sold my house in SoCal recently, and bought a house in Oregon, all cash. Could not be happier being out of La La Land. That photo of the Encinitas home you posted is just too funny. Thanks for sharing. I enjoy reading your blog.

For sure: This is a Seller’s Market. Great time to unload that property you’ve had all these years and then move out of state. My Dad and Stepmom did this very thing and can now retire (debt free for the first time in their life!). But they had been living and owning property in Cali since the 80s. But right now, it is definitely NOT a buyers market (unless you are a multi-millionaire and can afford to take a hit if values go down or don’t increase in value).

The question is, when will it become a buyers market again, it could be 5 years or longer.

I’m right behind you, except headed for Nevada. For me, it’s about more than just the overpricing. Just when I think it can’t get any worse, the traffic and congestion becomes ever more untenable, not to mention the tax grab. All of that and crime seems to be on the rise. The weather is nice enough but largely overrated and completely overshadowed by the other stuff.

We sold out and literally fled from So. California almost 40 years ago. We bought a beautiful large home and 8 acres in Oregon. It was like going from Hell to Heaven. Sadly after my husband’s death, I now have to sell my paradise. I’m hoping there are other refugee’s that want to flee from the madhouse of So. California like we did so many years ago, and would like a piece of paradise.

I’m sure your neighbors love you too. People in Oregon are getting priced out of their own state by people like you, selling their CA home then invading the north and outbidding locals with tons of cash.

I’m gonna enjoy laughing as I buy distressed homes during the upcoming downturn. Sorry snowflake, your 2 bedroom townhouse next to the freeway isn’t actually worth 800k!

But your crying now.

No crying… Just laughing at the false advertising / spin from the NRA and saving money, waiting for the change in trend.

*you’re

You’re welcome for the assist, snowflake. 😉

Jim, your time has come:

Black Knight states that delinquencies rose by 13%:

http://www.bkfs.com/CorporateInformation/NewsRoom/Pages/20170524.aspx

same here, cant wait to laugh at the sellers of distressed houses when i buy them with a 50% discount.

I hope JT doesn’t buy these houses before me!!!!!….:-)

I should probably call the agent, before JT adds 2 more houses to his portfolio. After all in 20 years he will be rich and the price he pays now will not matter in 20 years!…

Trump’s [insert policy proposal] will put so much more money in the pockets of [insert demographic] that they’ll rush to buy houses and keep prices rising for the next [insert desired time frame].

LOL. #fakepresident can’t get out of his own way. He may spout a lot of sewage but he is a RE developer at the end of the day. He and his Russian and Chinese “investors” want low rates. Check out the last debacle with visa offers to encourage Chinese buying RE in US:

https://www.nytimes.com/2017/05/19/business/kushner-trump-china-green-cards.html?_r=0

Fantasy!

The EB-5 (short for Employment-Based Fifth Preference Immigrant Investor) visa program began a quarter of a century ago as the federal government was looking for ways to spur foreign investment. The Immigration Act of 1990 — the last time Congress overhauled the immigration system — reserves up to 10,000 EB-5 visas each year for immigrants who invest at least $1 million, or $500,000 in high unemployment or rural areas, to create or preserve at least 10 jobs

It’s laughable that a dimwit like Gibbler would once again post a reference a link from NY Times (the epitome of fake news) and blame Donald Trump for a program that has been around for decades.

The EB-5 Immigrant Investor Visa Program was created in 1990 by Congress with the Immigration Act of 1990 and provides a method for eligible Immigrant Investors to obtain United States visas as a path to permanent residence—informally known as the green card—by investing from $500,000 to $1,000,000 in projects that create full-time jobs in USCIS approved Targeted Employment Areas or high unemployment areas (HUAs).

During the OBAMA regime in 2011, USCIS began making a number of changes to the program in hopes of increasing the number of applicants. By the end of the 2011 fiscal year, more than 3,800 EB-5 applications had been filed, compared to fewer than 800 applications in 2007. By 2014, the number of EB-5 visas granted had more than doubled since 2009.

In 2013, the U. S. Securities and Exchange Commission (SEC) issued an investor alert to warn investors about an increase in fraudulent investment scams that exploit the EB-5 visa program. For a twelve month period in 2015 and 2016, the SEC has successfully brought “enforcement actions against nearly $1 billion worth of EB-5 projectsâ€â€”a majority of them against “individuals or companies that misuse investors’ fundsâ€. In August 24, 2015 the SEC filed civil fraud charges against Lobsang Dargey for his misuse of the EB-5 Visa program by misappropriating about $136 million dollars from Chinese investors through his Path America entity.

The Trump administration announced that they would be auditing the program. Trump’s current tightening of all immigration abuse includes making sure this program was used within the legal guidelines. The overhaul would significantly increase the investment level needed to qualify for the program. Instead of raising $500,000 to invest, the new threshold would start at $1.35 million. This will help focus the program on pure business ventures and move away from only buying citizenship.

https://conservativedailypost.com/obamas-eb-5-program-receiving-focus-trump-congress-legislators-hammer-500k-loophole/

I’ve been in SD since 2008 and watched the market shift, and everything you’ve said is correct regarding crowd psychology and how people get so blinded. I have many friends who say exactly what you’ve repeated regarding housing purchases: it always goes up, renting is throwing money away, the market is hot it’s time to buy, I’m gonna flip a house and make $150k, etc. The more unwise people you see jumping into the market, the closer it is to a top.

That Seattle home is a joke, but bless the fool who “bought” it. We’ve seen this movie before and know how it ends.

I sold my place back in bubble 1.0 in Encinitas. It took 10 years for my place to recover its value, and thats not adjusting for inflation, so its still down from the peak. All the while theres a zillion more people and the resulting traffic and noise and TAXES. Clownifornia sucks big time, so glad I left.

This is what my Broker sent me in Burbank. “Multiple Offers and Over List price like we’ve never seen before. Priced correctly and fully presented to the open market your property at this moment will sell for an unheard of price. So high in fact that it will not appraise. The last 10 sales we had in this situation we were able to get the buyers to make up for the for the appraisal shortfall by bringing in extra cash and they took the properties AS-IS! “

That’s nuts.

Cheddar, the Mad Hatter agrees with you. The bubble is about to pop soon. What is the bubble full of? You don’t want to be around when the stuff splatters onto the bystanders.

I have been emailing with realtards since 2013 or so. Every year they make up a new story why this is the time to buy. Instead i rented and saved lots of money. Once we get a beautiful crash I will buy a foreclosure. You do with realtards/brokers/lenders what they deserve….waste their time.

I’m confused with your post. You are blaming realtards for telling you to buy since 2013. You should have listened to them, especially in 2013. Prices have likely been up over 30% since then and you would have paid off almost 5 years of principal, I would guess this would be much more than you saved in that time period. I would definitely be more leery about buying today, but 2013 was a gift!

@Lord,

Math is obviously not your strong suit.

30year mortgages are front end loaded, you pay very little principal in the first few years. The renters wins by far.

PMI, HOA’s, transaction costs, property taxes, maintenance costs and when you sell, realtards commission, transaction costs and taxes. The renter saved monthly, had no downpayment and invested the cash in stocks.

Sure, when you buy after the crash and prices are down 50-70 you get into a decent priced house. 2013 the bubble started. Investors paid in cash, government pumped billions into the system.

I’ll buy again after the crash…..have done that all my life….you sell high buy low. I know…its tough to understand when you are already confused with the math part. Let me know if i can help with spreadsheets/formulas etc.

@Tulu

LB likes to play both sides of the fence. He believes that you can’t lose buying So Cal RE — oh wait, it’s now desirable So Cal RE (i.e. beachfront property) — any time. So for him it was wise to have bought in 2013, 2014, 2015, 2016, etc. But on the other hand, he welcomes a 50% haircut (see below) — which would push prices lower than they were in 2013.

@Tulu,

Clearly you need the math lesson here. With ultra low rates, there is plenty of principal being paid up front (sometimes almost 40% of the mortgage payment). Factor in the tax breaks from owning and buying was a no brainer a few years ago. Listen to jt regarding inflation. Inflation is a way of life from now. Locking in a fixed payment is in your best interest.

Couple other things. Don’t buy in an HOA and have at least 20% down to avoid PMI and you will thank me down the road!

Lord is either masochist or a real estate agent.

“Inflation, Inflation, buy now!!” what inflation? You mean the housing bubble?

“Low interest rates, buy now!!” Low interest rates cause housing bubbles=overpriced house prices.

“20% down” opportunity costs? Ah, I see, there is only one investment….locking in 20% to buy overpriced houses and lose it during the next crash.

Talking to good ol’ Lordi is like emailing with realtards….nothin’ but cheap sales pitches, no facts and no buy vs rent examples.

@Tulu

In the past, LB rationalized that rental parity justified justified current RE prices if you made 20% down payment. Of course, the hole in this argument was that very few had the 100+K available as the initial deposit.

With low rates, are interest tax deductions even that big of a selling point?

The Lord is correct. For a 30 year mortgage at 4%, you are paying 1/3 (33%) of your payment to principal in the first year. By the fifth year, you are paying about 40% of your payment to principal. Low interest rates are allowing people to put more money into the piggy bank. Compared to our first house in 1988, we were only paying 4% to principal the for first year for a 30 year mortgage at 11%.

yeah, buying in 2013 and selling today to rent for a year or two would have been a brilliant proposition. If you have any investment properties, sell them now, put the money in something more conservative to weather the fall, then buy back in when the time is right. FWIW, the fundamentals right now put us on par with 2004-2005 in terms of pricing. We didn’t get the crash until 2007. A 30 year, 25% down situation will put the PITI between $2000 and $2100 right now on a half million dollar purchase. That is a feasible position for the current median wage. In ’05-06, we we still at about 6% interest rates so the the $650000 median home needed about $150-$180k per year to nominally service the loan. We not quite to that level yet, but we don’t have the same recklessness from the lending industry, at least not in the same way.

@Seen it all before

“The Lord is correct. For a 30 year mortgage at 4%, you are paying 1/3 (33%) of your payment to principal in the first year.”

Conveniently, your example leaves out insurance costs, maintenance, HOA’s and property taxes (and PMI). When you get a loan from the bank to purchase a home you have to pay the above on top of interest and principal. Considering all costs you are paying 1/5 (~20%) to principal.

Also, you already paid 20% of the overpriced house price down otherwise you have PMI on top of the costs I referenced.

I know, once you bring reality and facts into the equation it does not quite add up for the RE cheerleaders, does it?

Not to mention: In a low interest environment you are paying more for the house which means larger property tax bill and higher down payment. Plus you set yourself up to lose more the equity in a recession. In a high interest environment you get a higher tax deduction and your purchase price is much lower which results in a lower property tax bill.

Its obvious that higher interest rates and lower house prices are much better for your financial situation than buying an overpriced house with lower interest.

….rates fluctuate….even if your interest rate is higher in the first years you can re-finance when the rates go down…..

They should put more effort to teach that stuff in school instead of brainwashing people with cheap sales pitches to get them to buy overpriced crap shacks.

LA just hit its record high in April, and it was great to see all the humpers explain why it’s different this time. Meanwhile, the Wells Fargo affordability index for LA is down to 10, meaning a median-income-earner can only afford 10% of the houses on the market. It was down to 2% during the last bubble, but the historical norm is around 50%. There is no better indicator of a housing bubble than when the fundamentals of affordability tank. Oh, and for those who keep insisting this bubble is real because of low inventory, inventory numbers are only down 10-15% since the quarters leading up to the last peak. It’s a lie, folks. We are in another bubble. And it’s not going to end well.

On the West Coast it is. Not for most of the country though.

It seems logical that the affordability index should be 50%, but it never is. In 30 years in Socal, I don’t think I’ve ever seen it below 32%. 10% is still far too low, of course.

The interesting piece about all these discussions is that people think houses should be affordable to the masses, when housing has been under-built for population growth… for decades. How could prices on homes possibly stay reasonable, not even considering the growth of lower wage jobs, loss of union labor, migration patters, etc? We’re making less money and there are more of us. If I’m not willing (able?) to take a loan from Mom & Dad or my 401k, someone else (apparently) is.

Not saying anyone should buy at these prices, but I can’t see how this gets better unless permitting gets substantially easier.

@interestingly

You can justify the demand & supply argument once borrowing costs are priced according to risk (i.e. interest rates are no longer suppressed). Until then, the overriding factor behind the lack of affordability is extreme speculation through cheap and easy credit.

In stocks, the phenomenon is called FOMO. Fear Of Missing Out. And is one of the human brain’s most dangerous logical fallacies. There’s a lot of mental training required to invest properly. A lot of counter-intuitive rules to learn or get burnt and learn by experience. But since RE investors are the least investor-educated class, it’s doubtful they’ve even heard of FOMO.

Private stock traders may make a dozen trades a week. RE investors probably make 1 every 5 years. So in they rush. Housing always goes up. Timing doesn’t matter. And the bet they make is a doozy. I would never buy $700K of one stock. And I sure as hell wouldn’t borrow money to do it. In fact, the bank wouldn’t even agree to lend me the money if I wanted to.

I can’t sleep cuz I am so excited to be in escrow on the selling side. Love the commentary and education. FOMO is a real disease. How do I know this? Because I became infected with the illness. Been almost ten years ago. Still get the shakes once in a while, but I know to ride it out and keep my checkbook at home and in the drawer. You might, you might find a needle in a haystack but I’d rather spend my time with the family or go to the beach. As a lender I have seen many regulatory changes restricting the flow of capital vs what Countrywide and Indy Mac back for us gluttons in the last decade. Can’t get a read on when and how bad but my shingles are coming back so I know we are gonna correct. SOS…SOS…

Renters, you have been warned. “Don’t fight the FED.”. Say that three times each day. The FED has lead the world’s central banks on the road to inflation. This has been going on for decades and decades. That is why SoCal real estate investors who bought in the right zip codes are wealthy. Anyone older than mid 30s had plenty of opportunity to build a real estate nest egg. And those that are younger than that should be in the real estate game. Short of an economic collapse, this same inflation story will continue long after everyone on this board is old and gray.

How are you actually fighting an institution like the FED? Would love to do it / know how to.

Also, whats wrong with the FED? If they keep raising rates house prices go down. Great!

Instead of “fighting the FED” people should consider fighting open houses/realtards…..how about occupying open houses?

@JT, The millions and millions of homeowners who bought before the last bubble said the same thing – “Don’t fight the FED”. Those who fought the FED the last time where the people feeling like a kid in a candy store after RE prices collapsed. It is very rewarding to fight the FED especially when the FED is fighting without amo (like a water pistol).

“Short of an economic collapse, this same inflation story will continue long after everyone on this board is old and gray.” The problem is that an economic collapse is coming; the math says so. We just don’t know when, although everyone expects it soon.

D1.

Fight the Fed. Fight the Fed. Fight the Fed.

Dont trust the realtards. Dont trust the realtards. Dont trust the realtards.

Dont buy an overpriced crapshack. Dont buy an overpriced crapshack. Dont buy an overpriced crapshack.

Wait for the crash. Wait for the crash. Wait for the crash.

The author has a very obvious chip on their shoulder. Boomers ‘infest’ huh?

Your Seattle example was a bargain. Do you follow that market ? You sound jealous. Outside of this blog thing, do you have any income ?

Author, How much real estate do you OWN? How about your rental portfolio ? What makes you an expert on value?

I thought so. Carry on.

In the 10 years I’ve been here, the Doc has never commented. Not once. So don’t get too impatient waiting for a reply.

You sound like a NAR employee.. If you feel the author is wrong, then provide your facts that substantiate your claim that there is value. By asking ridiculous questions, you just expose that you know nothing.

How about presenting some logic as to why the author is wrong instead of ad hominem?

Housing TO Tank Hard Soon!!!

economy is doing great *wink*, FED seems to be set on another hike 🙂 🙂

http://money.cnn.com/2017/05/24/news/economy/federal-reserve-minutes-may/

http://www.cnbc.com/2017/05/24/fed-signals-interest-rate-hike-coming-soon-but-doubts-remain.html

I would love to see 5-7% interest rates. Whatever helps to accelerate the upcoming crash and puts pressure on prices is fantastic news. Hike it baby! Hike it!

The hike in interest is not the whole story. The 4.5 Trillion FED balance sheet is the really scary story. The FED said that this year they plan to start liquidating that. That will be the mother of all money supply contraction in the history of humankind.

What goes up exponentially, comes down vertically!

While the FED pumped 4.5 Trillion the RE went up. Jt thinks that is going to continue the same way in the future. However, when the FED sells the 4.5 Trillion, the effect on RE prices is exactly the opposite. Depending on how fast they liquidate, the prices go down faster or slower, but DOWN they will go. You don’t have to be a rocket scientist to realize that money supply contraction causes RE prices to decrease.

To Alter Boyz, I currently own 3 rental houses and sold out VS one last year because we did not want any property in VS anymore. The paperwork and hassle are not worth it and I felt we were hitting bubble peak again. It sold over appraisal as described above. It is true that if a house is truly affordable and you don’t move you can inflate out of overpaying, but paying more than necessary is silly. As an investor the numbers do not work right now and I am sitting out until they do. All of this is cyclical and prices will drop when interest rates rise

Rents rising, home prices soaring, stagnatiing incomes, yet LA could use a half million more rentals….

WOW.

https://la.curbed.com/2017/5/23/15681418/la-county-affordable-housing-shortage-crisis-rental-prices

Another half million housing units for the six million families moving in :o)

The “report” says rents rising since 2000. Well how about that! They zoomed out nearly two decades to make that point. 500,000 rentals needed for the poors who pay no taxes while productive people continue to leave in droves. WOW!

Several commentators on here talk about buying a house when prices fall down to 50 percent of current value. However wouldn’t that mean a depression not recession? Most people would lose their jobs. Losing their savings/deposit because the bank their money is in is bust?

I

50% is conservative. In the last downturn I bought at 70% discount from the previous peak. That was a condo in a prime location. I bought also land (premium location) at 60% off.

Last time it was also a depression. The underlying causes were never addressed. They are still there, papered over with 15 Trillion dollar more in national debt and FED increase in balance sheet. The reason you did not see the soup lines is because of the technology – soup recipients now cary EBT cards.

All the government accomplished with the additional money is stagflation because the government never produces wealth. If printing money would increase the standard of living and quality of life, Venezuela and Zimbabwe will be number one and number two because of the number of billionaires there.

Yes, in a depression, millions are losing their jobs. That is the reason is not smart to borrow to your eye balls for 30 years and millions will lose again their houses. Patience and financial discipline are rewarded long term more so than borrowing long term.

Cromwell, the 2007-2012 real estate crash saw declines of 50% in many areas of California, yet there was no depression and few bank failures. The reason was that few people actually bought at the top so most losses were in the 15-25% range. Even after a 50% decline, most homes would still not be cheap by historical standards.

Cromwelluk,

I have said the same thing many times regarding “wishing” for Great Recession II. The working stiffs who need a mortgage will likely be worried about keeping their jobs, signing up for the biggest purchase of their lives likely won’t be a priority. Just like last time, people flush with cash and connections will get the deals.

I salute the renters on this blog for saving lots of money for their future home purchase. You are in the minority, most people (renters and owners) in this country can’t save money even if their lives depended on it.

I would welcome a 50% plus crash also, not buying my rental at these prices.

Last time I checked, each person was insured up to $250K per financial institution. So if you planned ahead, you shouldn’t lose your deposits. In case of a depression, everything will be cheaper. Savers — those who aren’t paying currently inflated prices — will be rewarded.

Yes, it will end badly. If you are renting you are flexible. If you bought a house recently and lose your job you lose your house/equity as well. The ones who trusted this system and supported the bubble by buying in to it will be hit the hardest. Life isn’t fair. Brace for impact.

Thanks for the comments everyone. I really enjoy reading the articles and comments on here.

I have a couple more related questions. In 2008 governments threw everything at the economy. To stop the worst side effects of the downturn. ( For example ensuring ATM’s still worked.) My worry is that they have no tricks left for the next crash. Surely if we get to the stage where ATM’s don’t work. People wouldn’t get their 250000 dollars? As the government would have too much to worry about. In that situation people wouldn’t be able to get food.

I agree we have depression problems but am I wrong to argue it’s not like the 1930’s?

Am I being too much of a prepper? Or actually a crash without a government intervention? Will be like the 1930’s.

@CromWellUK (Oliver?)

I still believe that the government should have let the gamblers (F&F, Wamu, AIG, flippers, speculators, etc.) fail or shrink their operations. Smaller, more efficient institutions would have been there to pick up the pieces. Credit would eventually flow once true — organic — demand picked up. Sure, prices would have been a lot lower than they were in 2009-2012. But a sustainable, stable RE market based on local incomes, rather than speculators and investors, would have been one of the long term benefits.

In the past, the country experienced much stronger recoveries without the “benefit” of extreme cheap and easy liquidity and other emergency policies. Such supply side response to an ailing consumer-based economy most likely worsened economic conditions rather than helped it for the vast 99.9999%.

I have decided to wait out the market. Only instead of renting and overpriced Crap Shack from some CA slum lord, I am moving onto my Motor Yacht that has almost as much (not quite but close) living space as said Crap Shack. Oh! and I am saving $1500/mo. with interest deductions and all that fun. Where in the world can you live on the water for way less than a million.

The value in that Encinitas property is in the landscaping and Frank Lloyd Wright spareness of the architecture.

Casting pearls before swine. Don’t you real estate Luddites get it ? sarc/.

Any newer home buyers out there consider buying some long dated out of the money puts on the home builders or picking up some inverse ETF like CLAW as some insurance against a housing downturn?

How? I’d have to borrow 10:1 to afford housing, and then what would I do, buy 5% as an ETF? You cant leverage enough with stocks for that to work.

Bought a new construction mcmansion in January, also have about $5k in SRS. Will quadruple that when the drop becomes obvious.

California just took a step closer to single payer, universal health care for all state residents: http://www.sanluisobispo.com/news/business/article152665654.html

Don’t worry, all you poor folk and illegal aliens. From other states, from other countries, from around the world, California taxpayers will fund your health care, so C’mon in!

CA is a sanctuary state. The taxpayers voted for the politicians and the politicians deliver what they want.

Jim Taylor only has 8 more years to wait http://www.extension.harvard.edu/inside-extension/how-use-real-estate-trends-predict-next-housing-bubble

Or perhaps the author is wildly inaccurate, especially when claiming that we are still in the expansion phase:

“For many cities and asset classes the expansion phase is well under way. According to Glen Mueller, Boston, New York, Denver, and San Francisco, for example, are already experiencing incredibly tight rental markets and robust new construction in apartments.”

New York and San Francisco have been experiencing falling rents as early as last year.

In the last housing bubble, the ratio of cost to own vs cost to rent got totally out of whack. You couldn’t make a profit buying and renting a property because the market was in the Ponzi phase of the investment financing cycle. In other words, the rental market was stagnant while the housing market was on fire. That isn’t true right now for SoCal and the Bay Area. I do believe that Real Estate here is overvalued for most buyers, but the underlying value of properties is going up in SoCal because the rental value is going up. I know someone who rented out a house they own in a desirable LA county neighborhood about 3 years ago on a 5 year lease for a bit over $2K/month. Now houses around there are going for almost double that as rentals, and they’re kicking themselves because they are stuck for two more years. We will only see a really big correction if rental prices plummet along with house prices.

Rents are high now because many rentiers overpaid for their properties and needed to cover their costs. Real estate represents a narrow selection of relatively attractive investment options that the hot money can chase during a prolonged period of repressed interest rates.

Covering costs has nothing to do with what you can rent something for. I know this because I am a landlord with high maintenance cost rural property. Low wages in more rural areas and the fluctuating cost of commuting has made renting 25 miles from the nearest major town less desirable. Old landlords with paid for property like me, but in desirable areas can charge the moon and the stars just like people who buy today and try to rent. Rental real estate is less given to mania and more supply and demand. That’s why the rental market is a better gauge of the property true intrinsic value than the sales market. We passed on lowball prices for our out-of-state property seven years ago, hoping to get more in a couple of years. Boy was that a mistake.

@JoeR

Your argument would make sense if high rents were truly isolated to desirable areas, and not entire regions as they are now. I can assure you that a substantially higher income demographic is not one of the reasons why Santa Ana or Garden Grove housing costs are greatly higher they were a decade ago. Heck, I see luxury apartments springing up right next to commercial zones. Have the constant sounds and smells of 8-wheelers become enticing?

Who says Garden Grove or Santa Ana aren’t desirable to renters? Not to the people who populate this blog, but to Mexican and Vietnamese working class people who want to live near the jobs that Orange County can provide, they are very desirable and beat the hell out of living in South Los Angeles or Watts. (I’ve been to both of these neighborhoods in the last year; have you?). Housing near jobs can command big rents when there are lots of jobs, lots of workers, and relatively few good rentals. Rural areas without jobs, and with surplus houses have low rents. I remember back in the late 80s some people I know bought an old farmhouse in North Dakota for $500 to use as a center for a family reunion. When farms were 160 to 480 acres, there were a lot of farmhouses. Now that they’re 2000 acres, who needs them? (Unless they find oil nearby, that is!)

housing to spike hard soon!!!buy now before it too late!!!

Where is Alex From San Jose?

Alex moved over to other blogs. I saw him on other housing blogs.

Probably tired of people calling him out on his laziness, alternative facts, and soviet-style communism dreams where we all give him part of our income.

Alex from San Jose’s comments were my favorite ones!

One year ago, it was fairly easy to get a home in Dana Point in the high 500s. These homes were often in very good locations ( not close to freeway or busy road ). Now, good locations available in the 700s are far and few between. And, they go fast. I have never seen inventory so low.

Without listings, the number of sales is absolutely going to drop year over year, and prices will rise. A lot of factors contribute to the lack of inventory, but unless that situation changes, these trends are likely to continue. We are entering a super hot market where “prices are going up because prices are going up”. I still think the big home price rally will end by 2020, but we might be looking at a 20% higher price level before this ends.

bubble already popped dude. there is only one way for housing from now on and thats downhill….but, if you cant see the forest for the trees…go out and buy a house soon. Good luck….lol

Many on this blog follow the market and expect a crash. On the outside, people are genuinely surprised about recent news. They were told the housing market will be hot this spring. The truth hurts sometimes especially if you expected the opposite of whats happening. Instead of housing to rise, prices turned negative in April.

http://www.zerohedge.com/news/2017-05-24/san-francisco-home-prices-turn-negative-first-time-2011

Now, people are worried and potential buyers are asking “what if in May the price decline will be even worse”?

Mania’s can quickly turn the other way. Things are not locking well for housing. Will we see a panic soon? What will you do? Sell and cash in the profit before its to late?

Is it a mania? The mania popped in 2008 and since then it’s been a giant shit show with nowhere else to go.

The mania was dying in 2009-2012 until Bernanke and Yellen revived it with massive injections of its lifeblood — cheap and easy credit.

Now here is the perfect house for the first time buyer. In a 15 or 20 years, you will be up by a solid million. Perhaps more. I almost put a bid on it but decided to hold out for a bigger lot. This one is a gem. What are you waiting for?

https://www.redfin.com/city/4641/CA/Dana-Point/filter/sort=lo-days

Here is the proper link.

https://www.redfin.com/CA/Dana-Point/33871-Pequito-Dr-92629/home/4985270

@ jt…good location, but small square footage and no view right? Some of the HOAs in DP will not let you add a second story to capture an ocean view and the lot is small, so pushing out would eat up your small yard…

Would cost $200k easy to rehab this in current condition. Total gut job. I say pass…

you nuts? 750k for a 3b crapshack? Who in their right mind signs up for this money wasting hole? You can pick this one up for 300k after the crash. Wait until 2018 or so. We already reached the peak.

Personally, I think this is a cute beach cottage which is simply overpriced. I wouldn’t hesitate to buy it around $550K as an investment.

Just talked with the realtor. The home already has multiple offers, some are all cash. Beach close homes with a back yard turn into gold mines over 15 to 20 years. The only negative is a 4 unit condo building next door. But, if 750K is your price level, this is a good one. If you want it, just make sure you write the offer with the listing agent so you get an edge in the multiple offer situation.

Nice. People buying overpriced during bubble peak means less competition when market tanks.

Go out and buy! JT is right, this is a gold nugget. Bid 120k over asking to secure this treasure! Too bad,

Another Housing Bubble?

http://www.counterpunch.org/2017/05/25/another-housing-bubble/

In summary, rents and home prices may remain over inflated in the big cities, therefore a large amount of the productive class will leave for greener pastures leaving behind the poor masses and longtime holders to enjoy each other stronger together at the beach.

The productive class needs work and it’s only available in the city.

A house not too far from where I live is pending for $649K: 4 BR 3 BA ~2100 sq ft. And it is on a busy street with a 40 mph speed limit (residential across from a church). 7400 sq ft lot. Maybe 3 or 4 other houses for sale in the general area covering 40+ acres. At 6 per acre, that’s more than 200 houses. Mostly ’60s tract houses. Rents are from mid $2000s to mid $3000s from what I can get off the internet.

There may be a foreclosure or estate sale near us soon. Old lady lives (or maybe lived) there. and some of her trashy looking relatives from the prairie were around for a while. Saw a female sheriff there one morning and then the house cleared out. Those types of deals can be good or bad depending on what went on there. Worst thing is a cat lady.

The problem with this bubble is it is a result of the Federal Reserve rather than the first bubble was the result of liar loans. This could keep going another 10 years.

One good sign….on Million Dollar Listing N.Y an investment firm is going to dump 100 brownstones in Brooklyn in 6 months. They bought them in 2099/10. Maybe they know something?

Martin, you are correct but give too much credit to the FED. They are way more limited in what they can do today vs. 10 years ago.

These days, they don’t talk about expanding the balance sheet (QE) but reducing the balance sheet; that means moping the liquidity from the market – in lay term (removing the punch bowl). That, on top of the interest increases (not much room to decrease like they had 10 years ago).

“The problem with this bubble is it is a result of the Federal Reserve rather than the first bubble was the result of liar loans. This could keep going another 10 years.”

Once again, subprime was to not to blame for the last downturn; high prices is the reason for real estate bubbles. At the heart of the previous and current price run ups are cheap and easy credit policies by the Fed and government. The last runup didn’t last 18 years. So don’t expect the current one to be any different.

@Prince : Scam loans and easy credit were a massive driver of the high prices and the catalyst for the sudden pop. (When prices stalled, the zero-introductory-rate loans could no longer be refi’ed to kick the can down the road)

@ Martin….Wake up baby. Are you actually thinking that a BRAVO TV SHOW IS REAL??? They have to come up with story lines or no one would watch! Your developer ‘unloading 1/2 his portfolio and wants it done in 6 months’ story is a big phony!

(How did Brett get those houses—located in and around Bushwick, Bed-Stuy, and their environs—pray tell? He “purchased homes from the original owners during the recession.†Hmm, yeah right!?

It’s encouraging to see there are some sane people who have decided to sell, take their winnings, and leave! I had the opportunity to move back to So. Cal. in 2014 and take over the home I grew up in, and passed! Not the place I grew up, or had fond memories of. Despite the hype, those South Bay beaches like Redondo, Hermosa, RAT, just aren’t the same as they were in their heyday …

Another “prime” area where prices started to go down. Same for SF and NY.

What do I know; in LA prices go only up because it is super prime:-)

http://wolfstreet.com/2017/05/24/toronto-house-price-bubble-pops/

Great post, Fly. Any market with shaky Ponzi financing is a candidate for bubble mania. I really need to see some good data on how many cash and 20% down and more loans are going on in each market declared to be a bubble. That and the rent cost to buy cost ratio are the two best stats. It would be nice to have a one stop data mine that gives the breakdown for these in every potential bubble market.

People with big unassailable positions in a piece of real estate can weather an economic downturn. Areas with lots of homes like that won’t be flooded with short sales and panic selling in a recession. Rental properties that are owned outright or have well-hedged loans can also keep from going under. But bad times can turn a hedged position to a speculative position and a speculative position to a Ponzi position. (See my previous posts for definitions of these three kinds of financing.)

Personally, I think real estate has more upside in this rally. But, I also think we are in the 7th inning. Some cities like Boston, Seattle, and Southern California are running very hard. Boston and Seattle are on fire. However, SF and Silicon Valley are beginning to struggle. Areas east of SF, which offer affordable homes for professionals, are still doing well. So, I don’t know what to make of that situation. If you see the problems spread to the area east of SF, then I would think we are in the 8th inning of this real estate rally. Stay tuned.

This time is truly different

The housing prices would never go down at-least in SoCal. So what the prices are weakening all over the prime cities of the world but in So Cal , it can never go down because this time is really different

The insults just keep spewing for anyone who isn’t a millennial. I’ve come back here a couple of times because the topic interests me, but when I’m constantly referred to as overweight, greedy, selfish, and apparently too stupid to live just because I’m older than the author of these articles, it’s a distinct turnoff. You want to blame someone for the housing crisis? Try the 0.0001 percent and the banks that have ripped off everyone in every demographic in the U.S. since the last housing crisis. Yes, they tend to be white, baby boomer men, but not all of them. Some are your age. Many of the people who run finance in this country or who serve as VPs, etc., are millennials.

Oh, and guess what? Ya ain’t getting any younger. One of these days you, too, will qualify for a senior discount.

Is this time different? This time, many (20%) of all homes purchased in past 10 years have been bought be investors. Will these investors be more likely or less likely to sell than flippers or regular homeowners during the next recession and/or real estate market decline?

I have this feeling that we will soon hit an iceberg. Francesco Schettino says that it is time to fall into the lifeboat again. I will not go down with the ship, I am getting into the lifeboat now, before Francesco.

The market is too crazy to participate in it. Better to get out a year early than a day late. Everybody for themselves.

These examples are teardowns. The “crappiness” of the existing house should be irrelevant – it’s going to be torn down. The ridiculous examples of this kind of thing are the landscaped pergraniteel teardowns – which mindbogglingly often get substantial premiums over similar “crapshack” teardowns even though all those upgrades are destined for landfill.

(Though I agree – $1 million for Encinitas?)

That hous in Encinitas was foreclosed a few days ago …

^ * house. Tho maybe appropriate to leave a letter off.

Sigh. So many people quoting high density rental construction. Take a tour of some of these buildings. They are more vacant than they are occupied. And many many many more coming online. Something similar happened in the late eighties and early nineties. They’re almost all crack houses or worse now. Century old businesses getting bought and shut down for the dozen acre lot. If that’s not a warning indicator …

everyone thinks its a bubble = it’s not a bubble. nobody thinks its a bubble = its a bubble. this has legs

What does the media say?

Why do so many erroneously believe that a RE bubble can only be a subprime phenomenon?

Why do so many rationalize high prices as being a demand and supply fundamental while ignoring other economic fundamentals?

Why does the all cash purchase meme continue generally unquestioned?

Why does the Fed continue to suppress rates?

Why is the investment generally complacent about votility and risks?

*votility = volatility

Been away from this site for quite a while. On returning I see the phrase “Taco Tuesday Baby Boomer” in many articles. Can someone explain what that means? Appreciated.

Taco Tuesday baby boomers are people born during the baby boom that have already mostly paid off their homes and live on a budget. A lot of Mexican restaurants have specials for cheap tacos on Tuesday, hence the nickname. The point is that many of these people would never be able to afford to buy in their neighborhoods today due to the crazy price increases. Everyone thought they would cash out sell their homes and move into more affordable housing. Instead most are staying put with many having their adult children living at home, since they also could not afford to rent or buy in their neighborhood.

Change in mortgage rates causing prisoners in their own homes

http://www.businessinsider.com/housing-market-sellers-prisoners-dilemma-2017-5?r=US&IR=T&IR=T

excerpt

The housing market’s comeback after the financial crisis has turned out to be a mixed bag. Prices have recovered to pre-housing-crisis levels. But with slow wage growth, that means there are fewer affordable houses available to buyers, especially in bigger cities.

On the surface, the price trend ought to be good news for existing homeowners looking to sell. However, the likely rise in mortgage rates from historic lows means that there will be less incentive to move, according to Mark Fleming, the chief economist at First American.

“You do become a prisoner in your home because of rates,” he told Business Insider.

“There’s going to be a growing challenge of an increasing financial penalty caused by the rate lock-in effect over time.”

Since the 1980s, the long-term drop in interest rates created a built-in incentive to move, Fleming said. Even if a seller’s income was unchanged, it was possible to effectively move into a lower mortgage rate, and so be able to even afford a slightly bigger home.

30 year mortgages Andy Kiersz/Business Insider

Now, the likelihood that rates will rise from historic lows has spurred the so-called rate lock-in effect: homeowners don’t sell because of the perceived or actual difference in their monthly mortgage payments if they swap their old rate for a new, higher one, Fleming said.

This is a nice description of our financial system at the present time:

http://charleshughsmith.blogspot.com/2017/05/how-debt-asset-bubbles-implode.html

Gravity eventually overpowers financial fakery. Yes, the FED is not omnipotent, although for a short time they may seem that way. Long term nobody can overcome math and gravity, regardless of what they try. They have only 2 paths to the present fakery- inflation or deflation – and they both lead to the same outcome – total collapse.

When you replace free markets with central (banks) planners, the outcome is the same as when you try collectivism.

Yep, small business is dying and debt is choking everything in the crib. In my neck of the woods I think the bloom is off the housing bubble already, but the truck bubble is still going strong. A woman who cleans the office I work in drives a yuuuge truck – bigger than any of the office employees who make multiples of her. This is not unusual around here as people try to look like theyre more than they are. But what is most interesting is she is missing quite a few teeth. And right in the front too! So the big truck is more important that her not looking like she got hit by one. And before you say maybe she needs the truck to carry her cleaning supplies. Nope, she could easily pop her stuff in the trunk of a carolla or similar. Ah, priorities.

This is why the current cycle of financial engineering/manipulation is bigger than the last one was. There wasn’t nearly the same amount of new car plates prior to the last downturn. Global debt is at all time high — and yet some still cling to the belief of all-cash transactions, especially in RE.

Nostalgia for LA in the 1950’s…

Lakewood became the archetype of the American suburb of the 1950’s. Standardized building components put together in an assembly-line fashion enabled developers Louis H. Boyar, S. Mark Taper, and Ben Weingart to construct 17,500 tract houses in less than three years. Affordably priced at about $7,500, they sold immediately.

https://www.youtube.com/watch?v=zfGG1IbwpZg

Anchoring Lakewood was the largest shopping center of its day, which offered everything needed for modern living. Lakewood Center was designed by A.C. Martin and Associates in 1951. Surrounded by acres of parking lots, this shopping center was the architectural and economic anchor of the master-planned suburban city of Lakewood.

https://www.youtube.com/watch?v=G8ZBddgYYpg

Motoring through LA in the early 1950s one’s shocked to see freeways that are wide open, streetcars, a bustling downtown and the first malls, there were Ford, Chrysler, and Chevrolet Factories, and it all looks so clean!

https://www.youtube.com/watch?v=n77NxU0CHPw

https://www.youtube.com/watch?v=3ix2GiENpXY

In its July 13, 1953 issue Life magazine ran one of many photo essays on the city of LA. This one focused on the immense population and development growth the city and surrounding area encountered in the late ’40s and early ’50s. A gallery of the most interesting photos that went into its story called “400 New Angels Every Day.â€

http://www.grayflannelsuit.net/blog/time-capsule-los-angeles-development-boom-of-the-1950s

The post -WW2 era was a true golden age in Los Angeles, as well as the rest of the United States. New houses were cheap, and stayed cheap while wages were high and continued to rise in the 50s and 60s.

Los Angeles was a cheaper place to live than St. Louis at that time. Those Lakewood houses were cheaper and better than the similar ,but inferior, house that my parents bought in one of the subdivisions being squeezed out of a cookie press in a deteriorating former farm town across the river from St Louis. Their house cost $10,000 in 1956 vs $7500 for a comparable house in sunny Lakewood. What was amazing is not that so many people were lured to sunny Socal, but that more didn’t come, because it was easier to make money more quickly there than almost anywhere else.

By the early 70s, the party was over, as our manufacturing started to move offshore- millions of high-paying manufacturing jobs disappeared between 1975 and 1990, hundreds of thousands in California alone. In the late 70s, with inflation rampant and wages beginning to stagnate, the first ARM loans were introduced, and about that time, there was also a massive movement of the population from the northeast and midwest, to the southwest. House prices inflated rapidly everywhere, but disproportionately so in Socal.

I imagine a lot of people didn’t make the move from the industrial Midwest due to their skillset and industry not necessarily being in as much demand elsewhere and adding in family ties. One wonders how many people in St Louis at the time could imagine the soon to be turn of fortune for the area. It’s interesting how history tends to rhyme, because what you wrote about Los Angeles being a more affordable alternative back then is what could also be said about the new era growth cities today in the mountain west and south. It’s as if half the people think their home area is impervious to competition while a critical mass of others quietly make their move outbound.

At that time, St Louis was riding high on exactly the same industries that were making Socal the golden land: aerospace, defense, and automobiles. Additionally, St Louis still had a thriving shoe & garment industry, which were the first industries displaced, mostly because they could not compete with the lavish wages being paid by aerospace and defense. After all, though McDonnell- Douglas had a large presence in Socal, being the main support of the families that bought in Lakewood, it was still a St Louis-based company and had an even larger campus there, which still exists and is bigger than some towns. It’s Boeing now, of course.

In fact, the cause of the area’s stagnation and decline was its dependence on aerospace, defense, and auto assembly, while Detroit had an even worse case of one-horse-town syndrome with its almost exclusive dependence on auto. The same thing that made these former behemoths of the Midwest among the richest cities in the country then- Detroit was the richest city in the country in 1950- wrecked them in the late 60s and forward, as whole populations of working-age men who had migrated north in the “great migration” of the 30s and 40s, were suddenly stranded with no hope of ever again obtaining the high-wage jobs of the post WW2 era. There’s nothing like great success to create great failure when conditions shift suddenly, because those who profited the most from the old paradigm and are in leadership positions will cling obdurately to what made them successful, and continue to invest in a winner suddenly become a loser. That’s what both the leaders and the larger populations of these cities did… and that’s what our national leaders and our population is doing now, which is why our politics have become so irrational and our leaders so grotesque.

Buy now before it is too late:-)!!!….

http://www.zerohedge.com/news/2017-05-31/pending-home-sales-crash-most-3-years-hit-double-whammy-price-inventory

Everyone I know is saying we’re in a bubble. Crashes only happen when most are not prepared. Everyone I know is prepared for a crash and hording cash for penny rentals. Markets don’t work that way. They only reward the bold. The masses will not get rich. Ever.

“Everyone I know is prepared for a crash and hording cash for penny rentals. ”

Everyone you know. And then there are all these other people buying houses right now. People bought yesterday, some buy tomorrow and the next day. But everyone YOU know is waiting and THAT’S why there is no bubble. AAAH! Got it!

Hurry up and lever yourself up for as many properties as you can. There are quite a few rocket mortgage loans waiting for your signature.

No one I know thinks we’re in a bubble. They think I’m crazy. I’m beginning to believe them

I am a millennial, newlywed and have a pretty good job in the biotech world. We used to live with my in-laws which saved us tons of cash. Then, we actively looked into buying a house. I kept on going on Zillow and Trulia to see how much these sellers would gain if i buy it. They want to sell their shacks for double the price than what they bought it for…..and i kept saying…why would i make these old bastards rich? I want to be in that situation where i buy it cheap and sell it high. Unfortunately, older farts tend to had that opportunity after the crash. Millennials on the other hand are supposed to pay these greedy prices (5-10 times over median household income)?

Then, i googled “housing bubble” to see peoples opinion and if we are repeating the 08 crises….after a few clicks i found this blog and other blogs….now its pretty clear….NO FUC**** WAY WILL I BUY! Unless this all crashes down again. So, thank you internet and Dr. Housing bubble for confirming what i felt all along….this is a total bogus market and the devastating crash is inevitable.

Is the Sub-Prime 2.0 Crisis About to Begin?

As we keep pointing out, the sub-prime auto-loan industry will be Subprime 2.0: the first red flag that the next major debt crisis is here.

The 2008 crisis was a debt crisis brought on by excessive leverage in the economy and banking system. That excessive leverage created the housing bubble. When that bubble burst, the first sign was the collapse of subprime mortgage lenders.

By way of contrast, this crisis will be a GLOBAL debt crisis in numerous asset classes. Globally, we’ve added over $60 TRILLION in new debt since 2008.

Put simply, Central Banks have created a bubble in every asset under the sun. And once again it will be the collapse of subprime lenders that marks the beginning of the crisis.

This time, however, the subprime lenders work in auto-loans, not mortgages.

Fewer subprime borrowers are paying off their auto loans early, a possible sign that consumers with weaker credit scores are struggling more, according to a report by Wells Fargo & Co. researchers.

Borrowers are making fewer extra payments on loans that were bundled into bonds in 2015 and 2016, compared with loans in 2013 and 2014 bonds, according to Wells Fargo analysts led by John McElravey…

Source: Bloomberg.

There it is folks, Subprime 2.0 in all its glory…garbage loans packaged up into bonds and sold through the banking system.

It seems that either the market anticipates too many savy buyers/investors are just waiting to gobble dozens of properties up for pennies on the dollar and are just dragging this out as long as they can along with the FED’s slow/uncertain thinking process or maybe there is a flush coming to your neighborhood soon? Might need to check the Enquirer for my answer.

People on the sideline waiting for RE and stocks to crash so they can gobble up assets for pennies. Not going to happen. There is nowhere else to put money except US stocks and RE. Big money is coming in from around the world, not leaving. It will take 10 years for global investors to finish their move into the US markets. RE will probably double from today’s values by 2020. Stop looking at US economics, fundamentals and perspective. Stop thinking about the 2007 crash. That was a local phenomenon. We’re now a global market. We no longer own America. I went to an E Bay open house recently and I was the only non foreigner.

Peter Fan, in layman’s terms: This time, it’s truly different.

“China’s mounting bad debts might constitute a nightmare for Beijing as it tries to ensure more stable growth. But they are also fueling an emerging market that could be worth at least $3 trillion for foreign buyers of distressed assets.”

http://asia.nikkei.com/Politics-Economy/Economy/China-debt-could-prompt-7.7-trillion-asset-sale

Peter Fan?

Housing will double in price. Sure, why not…the bigger question though….why are you hear telling us this sure-to-be-rich-secret? Go out an buy as many houses as possible? Dont waste your time with us?

While i’ll keep waiting for the crash you will soon be filthy rich….but only if you buy now. Dont waste anymore time!!!

Friend of mine whom I always have the housing bubble debate with, made this video.

What are your thoughts on the data presented?

https://youtu.be/9gZAqGBBIG4

Dan, that video is actually very topical and seemingly very accurate. I agree with the conclusions and assertions. There is a lot on this blog that can be persuasive. I first came here 5 years ago, and the same arguments are still being made. They will eventually be right but when and how much appreciation will have occurred vs. the inevitable correction. The unfortunate part of this is that no one knows for sure when this reversal will take place. If we all had crystal balls, know one would ever make a mistake, but we do not. Inventory is super low right now, and there are simply more people wanting to buy than people willing to sell. That is the market, yes there are contributing factors like interest rates and among other things, but there are also a lot of people that make a lot of money and can this afford to buy at the current prices. The thing to truly look at is the inventory. Right now it is too low, once it begins to swell, and not get bought up that will tell when the top is near. With jobs reports and incomes looking stronger in forecasts, it could just mean this is the beginning of the run up. While at the same time, a political or natural disaster and or a financial collapse could be days away at any given time.

One thing most would, or at least should agree on is historically in the long run buying makes more sense than renting, but in the short run, renting and waiting to buy can be a very wise decision. Unfortunately the right answer can only be revealed in time when you look backward.

Why all the hate for Realtors on this site? Just wondering…

If anyone actually has a question for a Realtor, I am happy to give an honest answer.

OK, has there ever been or will there ever be a better time to buy than now?

@ PoH of course the best time to buy is when the house is the absolute cheapest in terms of nominal dollars than it ever has been and ever will be again. The best time to buy often is not right now, it either has already happened or will happen in the future. But given that know one knows when/if a better time to buy will present itself, each person needs to make that decision of whether they are in a good financial position to buy and hold on their own.

when everyone wants to sell everything, there’s a spherical buttom forming.. delisting won’t be an affordable verb! you ever played a game of musical-chairs? i use to be expert in it as a kid with my hands behind my back, i could tell if the dj had rhythm or not. well here we are, brokers are whittier than ever with their listings (not one listing is automated with only assessors info) (heck they all might work in Hollywood too, the way the listings are composed, they sound like a never ending movie) (well i’m watching this like pluto watched the candles in pluto’s christmas tree 🙂 i’m in Vegas, got here from Texas, well i got to Vegas when music stopped 2007 and bought in 2009.. let me say, its freaking hot summers and freezing cold winters here but here’s 2-4-1-buffets and i’m ashamed to say you less than burger-priced junkfood at some casino-buffet if you’re local! so all you need here i a good ac-repair-friend and money! did i say it’s hot here (even roaches lift a leg stopping at a waterhole 🙂 when i check weather i check yours too, you’re no weather-complainers though 😉 whomever got my chair over there might as well enjoying and hollering to your Hollywood-dj to play your song because you wont hear the fat lady sing anyway… but if’ya need luck, then good luck to-y’all!!!

Leave a Reply