Santa Monica real estate enters correction mode – Prime California housing market enters correction phase. From $1 million to $865,000 and still in a bubble. 1 MLS listed foreclosure for Santa Monica yet 177 homes are in some stage of foreclosure.

Santa Monica is a great city in Los Angeles County but is also one of the most overpriced. People tend to believe that when bubbles burst they pop universally across all areas but that is not the case. There is little doubt that the overall California housing market has taken it squarely on the chin. An overall drop of 40 percent in the median price is significant and recent trends show prices resuming a move lower. Yet some markets remain stubbornly inflated even though they have come down in price. Santa Monica is one of those areas. This is one of those markets where shadow inventory is plenty yet the public only views a tiny glimpse of what is really going on. Let us examine the one listed foreclosure on the MLS and follow it up with the shadow inventory.

Santa Monica dreaming

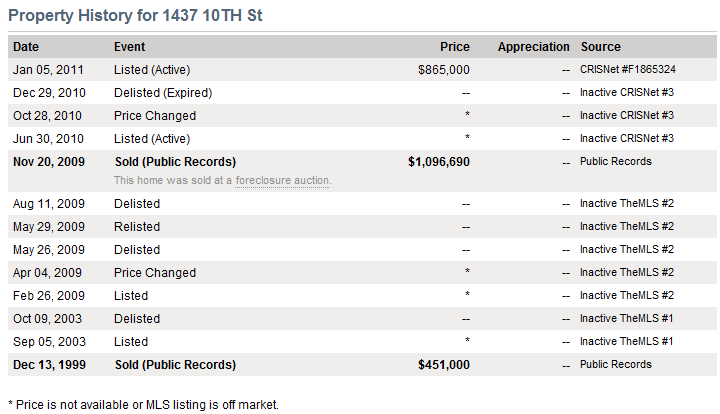

1437 10TH ST, Santa Monica, CA 90401

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â –

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â –

Square feet:Â Â Â Â Â Â 2,066

The listing doesn’t have the beds or baths listed but this is the ad:

“Huge reduction, looking to sell fast. Back units were recently painted. Great location and price, couldn’t ask for anything more.â€

Keep in mind this is the only foreclosure listing for a single family residential in Santa Monica. What the listing calls a reduction isn’t necessarily what one would have in mind:

Source:Â Redfin

Hard to believe that at one point this place had at least $1,096,690 in loans. This is astounding especially for a place that looks relatively average. These prime markets are starting to see non-prime homes take major price cuts. This is no longer a minor trend but we are seeing a large enough number of these homes taking price cuts that many banks now realize that today might be the best time to get out and still salvage some minor losses. A 50 percent price cut on a million dollar home is much deeper than say a similar cut for a $100,000 Inland Empire home. You might be wondering why the notice of defaults have fallen in the last few months of data. We might have some data on that.

BofA halts notice of defaults

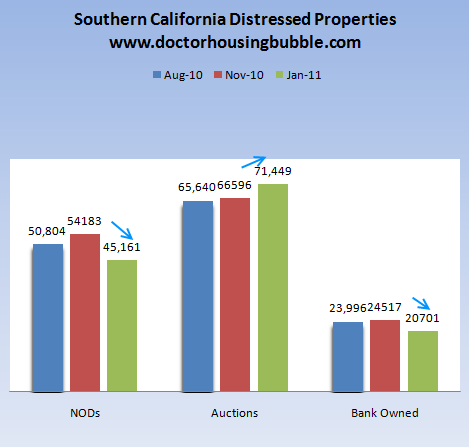

You can always lower your stats when you simply stop issuing notice of defaults:

“NEW YORK -(Dow Jones)- Bank of America Corp. (BAC) confirmed Tuesday that during its nationwide moratorium on foreclosures last fall, it also stopped delivering notices to delinquent homeowners that typically inform borrowers the bank is starting foreclosure.

The bank resumed foreclosures it had halted, along with notices of disclosure, in December.

That the bank specifically stopped issuing notices of default to borrowers during its moratorium is a new line in a story the bank longs to close. It is also not terribly surprising, given it was unlikely the bank would have initiated foreclosures during its review of its processes.â€

This is why we saw the recent dip:

So those that were claiming the recent dip was because of improved housing health are merely wishfully thinking. Bank of America just came out with the above press release having to accept that they flat out stopped filing notice of defaults. That is a nice way to boost the shadow inventory.

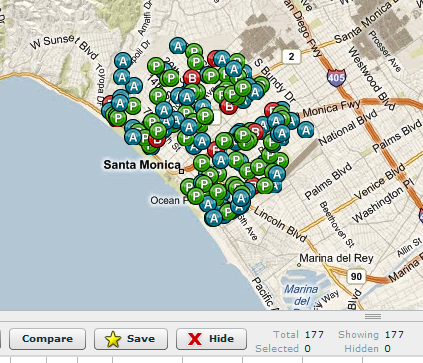

So what is the real reality in Santa Monica? Just look at this map of active distressed real estate:

177 homes have a notice of default filed, are scheduled for auction, or are bank owned. Yet only 1 home shows up on the MLS? Get your hazmat suit on because this housing backlog is ready to blow.

Today we salute you Santa Monica with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “Santa Monica real estate enters correction mode – Prime California housing market enters correction phase. From $1 million to $865,000 and still in a bubble. 1 MLS listed foreclosure for Santa Monica yet 177 homes are in some stage of foreclosure.”

I used to want to live in SM, but now I realize that there are some serious systemic issues with the place. Homeless are everywhere and the City Council seems to actively welcome them in the community. There’s a surprising amount of Section 8 housing too and with it gangs like MS13 and the Crips have taken hold in areas. Rich areas like north of Montana are almost as bad, with pretentious people eat/drink/playing their way to their version of the good life. Would much rather live in Pacific Palisades or Beverly Hills now.

I agree with the homeless issue, but where are the gangs you are talking about? I’ve been to Santa Monica many times and used to live in West LA. I think that’s a crock.

http://www01.smgov.net/residents/sgv/PicoNeighborhood.htm

This link talks about the different gangs throughout the city. If you don’t believe me, walk around the area right around Santa Monica College off of Pico at night and tell me what you think. Graveyard Crips are everywhere. I’m not going to say it’s as rough as parts of East LA, Boyle Heights, Compton, etc… but this is supposed to be “yuppie” Santa Monica!

It’s hilarious when people are stunned to find there are actually violent, hard core gangs in Santa Monica. There is plenty of cheap RENT CONTROLLED and section 8 apartment and multi-unit housing in Santa Monica, and where ever that sort of garbage is, the vermin abound. Sure, it’s “not as bad” as the ghetto areas, but that doesn’t make the crime any less violent and rampant. Plenty of gangbangers and criminals in the Santa Monica school system particularly the high school. Same with Beverly Hills High.

There are so many cholos and cholas at SaMo High and BevHills High it may as well be East L.A.

Oh ffs, better go and wrap yourself in the safety of a nice gated community then. Heaven forfend you’d have to rub shoulders with people who are less economically ‘blessed’ than yourself.

You’re right – Santa Monica is waay too rough for you 0_o

Not to mention the rampant homeless who are embraced by the Soviet Santa Monica City Council. They welcome the homeless and what does that bring? A QUADRUPLING of the homeless population. And the residents of Santa Monica get what they deserve for their bleeding hearts and electing these RAGING COMMIE PINKOS to their city council. Oh and good luck getting ANY sort of home modification approved by the city. Say you want to add another bedroom and bathroom to your shoebox bungalo by the beach? You pretty much have to add an additional room for a homeless person to get city approval.

Definitely gangs in Santa Monica, don’t kid yourself. The Pico area has been active for years. Then, you have your rival gangs from Venice and West LA, that are battling for territory. The other day I saw 4 different pairs of tennis shoes (Gang markings) hanging from the phone lines North of Wilshire on Euclid. Those who choose to ignore it, are just in denial.

Santa Monica is due for a serious correction. It just takes more time for the high end areas to be affected . Now, that eliminating debt is the name of the game, I doubt people are going to drop $1,000,000 on a 100 year old house, infested with termites that needs to be torn down. With bogus loans gone and prices dropping, these homes will get hammered.

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

Can’t wait to see the “used” home or “previously occupied” home sales numbers for 2010…

New-home sales in 2010 fall to lowest in 47 years

Buyers purchased the fewest number of new homes last year on records going back 47 years.

Sales for all of 2010 totaled 321,000, a drop of 14.4 percent from the 375,000 homes sold in 2009, the Commerce Department said Wednesday. It was the fifth consecutive year that sales have declined after hitting record highs for the five previous years when the housing market was booming.

Not living in Cali, I’m not sure I’m interpreting that $1.07M foreclosure sale correctly, i.e. was it a “real” arms-length buyer, or did the bank take it back because that was the min. bid they’d accept AT THAT TIME?? CON-fused in FLA..

But generally, in full concurrence w/ DrHB, that the extend-and-pretend has finite limits… TIMMMM-BERRRRR!

Underlying ALL of this shadow inventory, and upscale areas being the last to deflate is the old truism: “When you’re delinquent on a $10,000 loan, YOU are in trouble, when you’re delinquent on a $1,000,000 loan, the BANK is in trouble (and is not likely to publicize it), lol.

Tax credits and other measures will all be moot if the Republicans get their way an edn all support of the GSE’s. That would be an epic blood bath.

Not sure it’s a good idea to be in a major metro when it happens.

About the gang situation in SM; I’ve seen activity along the waterfront area with drugs and people flashing gang signs. Plenty off the main drag as well.

I’m not seeing a lot of Asian buyers that aren’t Asian American’s that are buying cash with family money (basically the Ho family war chest).

Yes, that’s correct, this was the minimum bid that nobody paid at the courthouse steps, so the bank took it back. This is probably to total amount of debt owed to the bank + late fees + legal fees. This is not an arms-length transaction.

“extend and pretend has limits”. Normally, yes. But how would you change your projection if you knew for sure the the corrupted government would do everything in its power to support their cronies in the banking sector.

I bet there is no substantial drop in 2011. Problem is we are likely setting ourselves up for an even bigger full market bust/rebellion.

It will be better for us if we protest loud enough now to be heard and put a stop to these shenanigans.

Feel bad for the buyers who bought houses following the government tax incentives in 2009 and 2010. If the second dip becomes a reality they could lose part of or all the equity they put in barely two years into owning the darn house. This time it’s all government to blame.

The home buyers lose the value of their tax credits. If they default in the future, then I would assume it is bourne by the taxpayer in the sense of lost revenues. Of course, for those buyers who would have bought anyway without the tax credit, it is just a total loss to taxpayers anyway…..

The government gave the tax incentive because the Banking Industry asked them to (and remember that the banks spend heavily on lobbyists and making sure that their voice is the loudest in the echo chamber that is the US Congress, and Senate). The US Government is run by and for the banking industry.

Check out the book Griftopia for some insight into the government/bank/wall street relationship, guess whose getting ripped off?

Where’s my Xanax? My Prozac? My Valium? Lord Help Us! $865,000 for a house built in 1911? Oh, hell no! Insanity!

Well, by looking at the picture, it looks like the fence might be a little newer – maybe it was built in 1912, or 1913. What is wrong with this country? How many hundreds of thousand of dollars are needed to bring this home up to living conditions?

Just say NO! HELL NO! The housing bubble is dead. Anyone who would buy such a house at that price would be a complete FOOL. I await the return to sanity.

http://www.redfin.com/CA/Santa-Monica/1437-10th-St-90401/home/6774211

Well, based on sales in the last 3 months it looks like there’s still plenty of idiots out there keeping the Santa Monica bubble alive:

1941 home sold for $448/sf this month:

http://www.redfin.com/CA/Santa-Monica/1517-Grant-St-90405/home/6775485

1928 home for $461/sf in November:

http://www.redfin.com/CA/Santa-Monica/732-Navy-St-90405/home/6778328

Or how about $600/sf ?

http://www.redfin.com/CA/Santa-Monica/2330-34th-St-90405/home/6764935

We can even go higher: $811/sf for a 1916 home, sold in November:

http://www.redfin.com/CA/Santa-Monica/1211-Marine-St-90405/home/6776371

But my favorite is a round Million for this 1500sf beauty from 1938:

http://www.redfin.com/CA/Santa-Monica/1228-Pine-St-90405/home/6775232

At $420 sq ft ….This place has gold plated plumbing fixtures….right? I gotta have that at that price.

Anyway my Santa Monica story…I’m passing through on a winter Sunday and see a public park overlooking the ocean. There isn’t a car in the parking spaces…just some homeless with shopping carts a ways off on the lawn are the only folks in view. I park, use the public restroom, go look at the ocean and get back to my car in 15 min tops. There is a ticket on the window for $25 bucks for not feeding the parking meter.

I never heard of a meter that gets fed on Sunday. Dumb me.

Instead, of having lunch in the restraunt I saw from the beach view I left town. I will never stop in Santa Monica ever again. There’s 900 miles of Kahleeforneeha coast. I don’t need that section.

they gave me a parking ticket on Christmas Day once in Santa Monica.

Good on the ticket…it’ll keep our prop taxes down. Lol. Lucky to live here in rent control, but agree, severely over-priced.

Don’t want to defend them, but keep in mind, thankfully we live in a free country where you can blow your cash any way you want.

Sure, it’s someone else’s fault — an entire city’s, in fact — that you can’t read a parking sign.

We’ll still never know how many people are waiting in the invisible line for their notice of default. Sure, the banks may have resumed issuing them, but at what rate?

The funny thing is that the delinquent debtors are still probably on Facebook sputtering about how great their last vanilla chai decaf soy latte was and how they’re contemplating taking up yoga. They continue to live pretend lives and present themselves to all their friends and relatives as if everything is just hunky dory.

Who says “face” is only an Asian phenomenon? Americans are the biggest bunch of fakers out there.

Re: “Who says “face†is only an Asian phenomenon? Americans are the biggest bunch of fakers out there.”

In the US it seems as if admitting to others or yourself that you can’t afford something is a bad thing. Bottom line, everything costs something and we all have limited resources at some point. People need to budget and prioritize. It’s not that you can’t have some things, but you can’t have everything at once. And that’s okay, there’s no problem with that. It’s what people need to come to grips with. Everyone should have learned this as a child but apparently our society has carried this game into adulthood.

People need to stop trying to keep up with each other (many of whom are faking just as much as they are so you can never really know the bogey) and start enjoying what they do have and appreciating life for what it is rather than collecting crap and comparing amongst others to prove station/worth. At the end of the day this is all just a manifestation of fear. People are trying to prove to themselves and others that everything is good/okay. Life is just what it is – some people need to take a deep breath, let go, and start living rather than trying to prove something to themselves. It’s okay, it’s just life. Enjoy it for what it is.

We are conditioned to consume, which makes sense in a society that produces things. Now that we don’t produce anything anymore, it makes a certain sense to spend less.

However, that is a band-aid — just enough to keep us from bleeding to death before we starve. We can’t restore prosperity by pulling our belts ever tighter. That is specious reasoning.

We need people creating useful things, and that can only be supported when other people buy them.

So true. Everybody was trying to keep up with the “Jones” and would throw down the credit card in order to do so. What they didn’t realize is that the Jones’ had been maxing out the HELOC on their house.

Good post. Just as an extra data point FYI, 25 to 35 years ago it was much more acceptable — and much more commonly done — to say you couldn’t afford something. I know this because I’m pushing 60 and I was there. This problem is one manifestation of a more general problem; much of the populace has been insulated from nitty-gritty reality for a long time.

Is California down 40%? So, another 20% to go, I suppose. I remember reading this blog when the bubble was still expanding. Back then the market was never going to drop. Everyone wanted to live in California. It was special. They weren’t making new land. Blah blah blah. Insults. Death threats.

And now, they are all whining like spoiled babies. And, most astonishingly, they are still claiming every day that the decline is over, that houses are hugely affordable, that you must buy today or be priced out, that foreclosure prices “don’t count”, that their city/neighborhood/house is different.

Keep up the good work, Doc.

“40%”? Nah, I bought a 2004 duplex in 2010 which was exactly 1/3 the price it sold for when new. Rents haven’t changed much. Henceforth, the first buyers were doomed to incur incredible losses. Now the $ 115 k investment ($ 110 k purchase plus $ 5k repairs) nets $ 1,390 gross rent minus 10% PM fee and in some cases a 10% CA state withholding). 724X Murray Lane in CA 92284 Yucca Valley. They built 30 such duplexes and most ended up as REOs. So do not buy the statistical average, select properties are down to 1/3 their peak value. Keep up the good work, Doc!

unless I am wrong this is a house at the front and a bunch of rental units behind, so its not really the pokey house in the picture but you have a garden full of slumdwellers paying you rent thrown in ?

I live down the street from this place. All I have to add is that the picture makes it look much nicer that it actually is. Its about to collapse. Its very close to the apartment next to it on one side. There is an office building across the street. there is a liquor store 3 doors down. Your photo could not make it look any better!

That’s so sad. It bothers me to see historic homes allowed to rot. It’s also horrible to see them overly “done up” by renovations. Part of the charm of the past is that it was rarely up to the hilt in “the best” or black granite counter tops {BARF}, the little old homes get all yuppified.

Stayed in Santa Monica in 07, right around the height of the bubble. Two bedroom house across the street, 1920 vintage, sold for over $1,000,000, only a few blocks from the oil storage tanks.

Downtown has a ton of overpriced restaurants, botiques, and high end furniture stores, populated by Paris Hilton clones.

Very pretentious area.

Since “The bank resumed foreclosures it had halted, along with notices of disclosure (sic), in December,” I guess that must mean the inventory is coming out from the shadows?

This is a good thing. The sooner the blood letting begins, the better so the economy as a whole can get back to normal functioning.

People live in Santa Monica and pay these prices for the lifestyle and their neighbors. Riverside has different demographics(anybody seen a Redneck in Santa Monica recently?) There are high paying jobs in Santa Monica, unlike the jobs in Riverside. Also, it is close to the beach.

I’d take a redneck any day over the pretentious hollow people in Santa Monica.

Haha..there are so many posters here who make themselves out to be so superior now that the market is low. You are behaving no better than those that you are mocking..just from the opposite point of view.

Regardless of whether you made detrimental personal choices during the housing bubble or not, the popping of the bubble, the “economic downturn” and subsequent government bailouts hurt us all…no matter where you live.

Get over yourselves.

Anyone seen a redneck in Santa Monica? Yeah, about 25,000 homeless ones scattered about the place. Another 25,000 non-redneck homeless too for the sake of diversity

Seems a lot of movie industry ppl live in SM. That industry is humming along churning out bad movie one after another. You and I are supporting SM housing price in a round about way by seeing those crappy movies.

I can’t afford to go to the movies. Took the family out to see Yogi bear 2 weeks ago, it was over $120 with popcorn…now I cant afford to put fuel in the car for a few weeks having to eliminate my commute from Chino to the ocean so I can surf!!

Wow, did you take out Octomom??

Take a walk at the Pier and enjoy the ocean breeze on a cool summer night. But you need not live there. Just drive there and go back. ** Check out rents and how many years it will take. I know a renter whose LL will have to wait about 25 years! People who rent houses out for less than hypothetical mortgage payments are not uncommon in S.M.

Great article and terrific graphics. I do have one question. When a house goes into foreclosure who pays the property taxes to the town? Is it the owner in foreclosure, the bank or does the town have to eat the loss of revenue? Any input appreciated. I’ll check back in a few days and see if anyone responded in the comments. Thanks.

RE: “When a house goes into foreclosure who pays the property taxes to the town? Is it the owner in foreclosure, the bank or does the town have to eat the loss of revenue? ”

There is NO LOSS of revenue to the local government. Taxes ‘run with the land.’ If the taxes aren’t paid (by borrower bank or Sanat Claus), the local government does a tax foreclosure which takes priority over any mortgage.

Typically when the buyer defaults on payments, the lender gets busy and makes sure the taxes are paid – even paying the taxes itself when they come due. It is very very rare for a lender not to be on top of the property taxes.

After the foreclosure auction if the lender has ‘bought it back’ at the auction, the lender becomes the new owner of record and gets the tax bills directly. They have to pay up like anyone else or the property goes into tax foreclosure.

Property taxes NEVER ‘go away’ just because someone bought a place with outstanding property taxes. That is why you always run a records search and verify the status of property taxes when you buy a place.

And if you decide to get adventurous and buy a place at a foreclosure acution, you buy it subject to any outstanding property taxes and the tax bill is yours and you have to pay or face tax foreclosure.

I would cherish any advice from you gurus out there. I’m a young homeowner in Los Angeles (Woodland Hills to be exact) and in light of all this forecast pessimism, I feel the desire to sell my house this Spring and get out before shit hits the fan. There’s $230k left on the mortgage and if I sell it now I could get about $650k. The other option is to rent it out and weather the storm for the next few years. Any advice to this neophyte would be MUCH appreciated!

Thanks,

Coop

`breadearner said…

“Feel bad for the buyers who bought houses following the government tax incentives in 2009 and 2010. If the second dip becomes a reality they could lose part of or all the equity they put in barely two years into owning the darn house. This time it’s all government to blame.”

If they lose the house within 3 years, they must pay the Feds back their $8,000!

Ha, another Santa Monica 2 bedroom, 1 bath, 1922 special, only a million dollars. For what? Traffic and homeless people and crime and bad schools? Bleech, you know what that kind of money can get you elsewhere?

I live on the year-round warmest stretch of beach in the continental US (Miami-FtLaud), and never understood the over-hyped draw of the COLD water beaches of So-Cal… pretty much wetsuits all year out yonder…

I assume it has more to do with the endless supply of GORGEOUS babes who flock there from all over the PLANET, to be “in duh movies”… OMG, there’s at least a 1,000:1 ratio of women who “show up” vs. those who make any kind of full-time living in the “entertainment” biz… LOVE seeing all the magazine-cover-quality honeys working as greeters/seaters at the restaurants along SM Blvd… So-Cal must be pure hell for the merely avg-looking or slightly overweight ladies. =:O

Leave a Reply to Tim