San Francisco housing market overheats:Â Tech beauty is unable to modify the realities of the real estate market. Â

The San Francisco housing market is the most inflated and delusional market in the United States. It does make sense though at least from a psychological perspective. You have many people that are cubicle or open space programming junkies working away to create the new app or new crypto currency and somehow, they feel that “tiny†spaces are worth lots of money. It is telling but no surprise given the environment many work in. Then you have the case of people doing mega commutes into the Bay Area from inland locations similar to the morning exodus of people from the Inland Empire to Los Angeles and Orange County. Yet the market does seem to be overheating and some reality is starting to creep in. Apparently, no amount of tech enabled photo filtering is going to turn a crap shack into the Cinderella of housing.

Old homes in the Bay Area

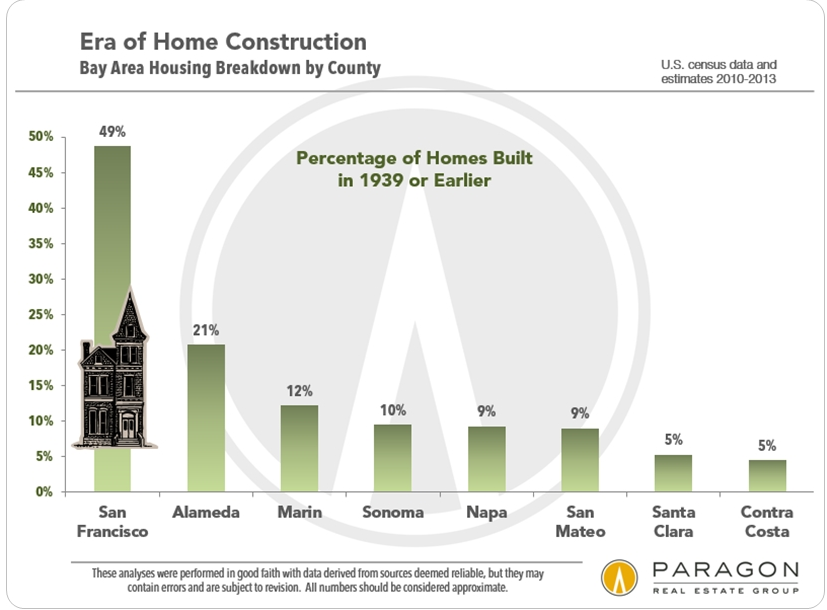

Let me start off that homes in the Bay Area are old. We are talking pre-World War II built old. Now of course we know that Taco Tuesday baby boomers now own the housing market in California but did you know that housing in the Bay Area is also aging and frail as well?

Don’t take my word for it:

San Francisco is old. The homes in San Francisco are old. But you are now starting to see some deals popping up in the market. And when I say deals, you have to decide what to make from that.

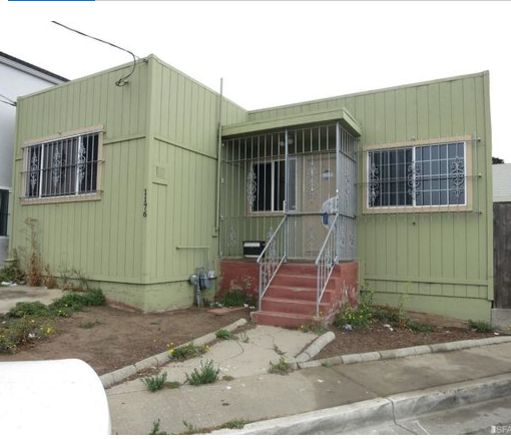

Take a look at this place:

1176 Quesada Ave,

San Francisco, CA 94124

2 beds 1 bath 891 sqft

This place has a beautiful backyard that is full of potential. Maybe you can incubate the next Uber or Facebook here?

Now I know what you are all thinking, “this is San Francisco. I know this beauty is going to be $1 million or more.â€Â Oh no my friends, this place is priced to move:

For only $699,000 you too can own a San Francisco home. It needs a little bit of TLC but nothing a few bucks from a tech job won’t remedy.

I always think that getting a Street View does better justice here:

Look at the drive in to the garage – it looks like it has been through multiple California quakes (big and small).

People want San Francisco and prices are still incredibly inflated (but so is the NASDAQ). We’ve been on a massive bull run since 2009. There is bound to be a correction and when you look at company valuations something is going to give. But you got to love San Francisco and the tech driven real estate mania.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

236 Responses to “San Francisco housing market overheats:Â Tech beauty is unable to modify the realities of the real estate market. Â ”

I’ve been working as a senior engineer in South Bay for 5 years for a super rich tech company. I want to start a family, and I am absolutely in shock at the market here. I love living here but I can’t stay if we can’t buy a home. I searched the west half of South Bay and the lower peninsula for a 3 bed 2 bath for 1 million or less yesterday and there were ZERO listings. WHO CAN AFFORD THIS??? WHO ARE HOARDING THESE HOMES? I hate this place.

Sr. Engineer, you should be pulling in $200K minimum. And after 5 years you are fully vested. You should easily be able to afford $1M+.

reality is completely lost in this madness.

$200K minimum. LOL, hahahahahahahahahaha.

so he should be making more or as much as a doctor for writing shit smell code.

no wonder they are importing HB1’s in droves.

importing H1b’s in droves….yes, exactly!

There are may jobs you can outsource which all companies do nowadays if they are a certain size. The remaining jobs will be replaced by H1b’s and the pay is much lower than what they pay a citizen. There are also other ways to employee skilled foreigners via loopholes but I dont want to get in trouble by getting into details.

bottom line is, there is enormous pressure on wages coming from global competition.

In the long run house prices can only go down as they are wayyyyy disconnected from the real economy.

What’s the use of being able to afford $1.1M when what that money buys you is something that would be boarded up and have a big fat red X painted on it in a normal city or suburb? I use the word “afford” loosely here, because you have to stretch an income of $200K quite a bit to pay $1M, even with 20% down. $650K would be comfortable for that income. What’s the use of making $200K, subjecting yourself to killer commutes, and depriving yourself of the savings you need to be safe, not to mention commonplace pleasures like a nice car or a few meals out a month, when you could live 3X as well on half the money almost anyplace else…. just to “afford” something that really ought to be condemned?

Laura – it’s culturism, seen more often in the young. Once you spend enough time in a living situation, places that are sufficiently different can seem beneath you or not worth a passing thought, unless the people there are like you. A downtown millennial hipster has nothing but condescension for flyover country, but feels kinship with (for example) Parisians. A middle class suburbanite who commutes to the city identifies with her fellow suburbanite wine girls, and will suffer to maintain that identity.

Of course some people can actually afford a coastal home, and just like it there. Nothing wrong with that 🙂

Joey, you come on over to Kerrville, and me and Kinky will get you a good place for 100K and throw in a few head of cattle as well.

You and Kinky need to rescue us from the roof tops of our homes. Have Kinky use his boat to help us evacuate this horrendous Texas flood. I Feel sorry for Tex and Kinky.

Jed, dry as a bone in Kerrville, temps in the mid 80’s and mid 60’s at night. Yes, Houston is in a whole another world in so many ways. See, Kerrville is a very nice place to live. We praying for you all.

Jed, the Houston homes will be uninhabitable for weeks or months or more. All the flooring must be removed. The sheet rock and beams in the wall must be cut at the water line and replaced. The soaked furniture is trashed, along with many possessions and memories stored at ground level.

If the house goes under, often so do the cars. The financial damage can be crippling, especially for homeowners without flood insurance. Some may choose to walk away and sell the house at a great loss.

Families that repair their houses need to find somewhere else to live in the meantime, yet owe property taxes for the uninhabitable home.

Texas will probably take most of California’s construction workers. I don’t think that we will get a border wall this year. Think of the demand for lumber and etc. Prices will go up until supplies can go up to meet the increased demand. Insurance companies will sell their stocks and bonds to pay for the claims.

Houston is a flat metro area of close to 6 million.

Joe, I understand your frustration. I mentioned on this blog before that a problem many people in high cost of living areas can not understand is this: they get a big $ sign on their eyes when they hear the offer and they get blinded to the reality.

The reality is that it doesn’t mater how much you make; what counts is your purchasing power after taxes. In CA it goes like this – you need a very high income just to pay the high rents if you don’t want bullets to fly through the house. Because of the high income required, you pay a lot in taxes not just in absolute value but a very high %. You pay that to both, the FED and the state (in CA not in states like WA). After they take most of the money in taxes, whatever you get left you pay in high rents (rent which is not tax deductible). That pretty much leaves you a debt serf for the rest of your life unless you make over $500,000/yr and you are frugal.

If what you make is important, you have to remember that those in Zimbabwe make far more than you in their own currency (billions or trillions). However, that does not translate in purchasing power. In the Bay area, unless you are Zuckerberg, you are pretty much toast. I would never take a job there under $500,000/yr.

“unless you are Zuckerberg, you are pretty much toast.”

I’ve owned several homes in the bay area. Get the butter and jam, baby!

In the mom’s group my wife is in..in the bay area 70% own homes and about 30% rent.

Typical profiles is one of two things:

(1) Husband earns $250K-300K+ all in

or

(2) Husband and Wife both have six figure salaries

The people in group 1 tend to be happier

To be in group (2) in the bay area it doesn’t take much, essentially 2 low level project managers. Group 1 is happier because there is a stay at home mom instead of both parents maybe coming home by 6-7 pm with kids in child care all day.

The other key to happiness in the Bay Area is being in group (1) but working a job that is outside of either SF or Silicon Valley without a commute. Not easy.

“The other key to happiness in the Bay Area is being in group (1) but working a job that is outside of either SF or Silicon Valley without a commute. Not easy.”

Ideal happiness: working for a SV company but living in flyover. Same $200K salary, but with a cost of living 1/2 as high. The ultimate arbitrage. And it’s easier than you think to achieve.

Listen to Flyover. He is a wise man. It is not how much you make that determines the quality of your life and your eventual wealth — it is how much you KEEP.

If you want to own in good schools you will need to move out of state. At some point, your employer will leave anyway like Toyota did. Their move was revealed at the end to have been mostly about housing prices.

Who is buying? The wealthy including tons of foreign buyers dropping huge money on homes and then not participating in the community at all.

Case in point – you can buy a $2 million house in Newport Heights, Newport Beach, and still be zoned into a bad school. Many people who live here send their kids to private school to avoid the problems that come along with a shared school district between Costa Mesa and Newport Beach.

So, factor in an additional $1k – $2k per month, per kid, for schooling.

Invitation Homes, an arm of private-equity giant Blackstone Group and the largest player in the emerging single-family home rental industry, has bought homes all over NorCal and SoCal.

http://www.invitationhomes.com/market/los-angeles-ventura-county/

http://www.latimes.com/business/la-fi-blackstone-lawsuit-20140506-story.html

If you look at the picture of the house on Quesada you can just see some of the worst projects in San Francisco at the top of the hill in back. This is, or was in my day, deep in the ghetto. 699k is beyond ridiculous, I think Dr. Bubble he make joke, no?

This explains the copious amounts of wrought iron on all of the doors and windows on this “house”.

During the last tech collapse of the early 00s, real estate in SF only fell by about 10%. I know Millenial is convinced there will be downtown condos for $120K, but I wouldn’t hold my breath.

What people forget is that even if the tech bubble pops (and it will eventually), there has already been a ton of wealth created. All the money that has been cashed out of stock options since 2003/4 won’t go away. The hundreds of billions of wealth that has been created (not paper wealth, actual hard wealth) isn’t going away. People who cashed out and bought the $5M homes in SF or Palo Alto or Los Gatos aren’t all of a sudden going to lose that $5M.

People think if Amazon’s stock goes down 20% then everyone who ever owned Amazon stock is 20% poorer. Nope. It’s only current owners. But anyone who sold yesterday, doesn’t lose a dime. And there are hundreds of thousands of people who live in Seattle and the Bay Area who have done that. And that wealth isn’t going anywhere.

Yes, this is the mother of all bubbles. The collapse cannot be avoided. It’s just a matter of time. I expect 50-70% price drops in California (easily). We will see a panic in the stock market and housing market. Those who waited it out will win big time. Those who bought into this mania will greatly suffer.

Millennial… all you will need to do is stay employed during the 50-70% real estate and stock market crash!!!

When your prediction comes to fruition, that will be the hill you have to climb.

But hey… there’s always inheritance right?

Did you actually read what I wrote? In the last “mother of all tech collapses”, SF r/e barely budged.

After the credit expansion collapse; the deluge

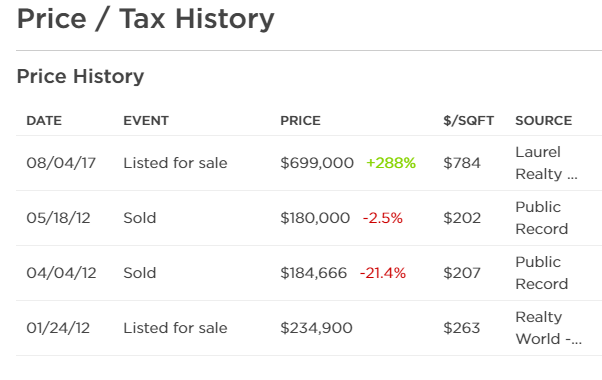

If you look at the house on Zillow and the Home Value section:

Dec 2007 – Zestimate – $681K

May 2012 – Sold – $180K (The Zestimate was $313K)

August 2017 – For Sale – $699K

It looks like this house went on a roller coaster ride during the last crash. Even by Zestimates, it lost half its value at the bottom. The pictures on Zillow show an updated bathroom and kitchen but not much else.

https://www.zillow.com/homes/for_sale/1176-Quesada-Ave,-San-Francisco,-CA-94124_rb/?fromHomePage=true&shouldFireSellPageImplicitClaimGA=false&fromHomePageTab=buy

But you’ll be broke as hell. Thats the way it works Einstein.

Tankinsight,

That was a silly comment. That’s the whole point of waiting for a crash. I would take losing my job and getting a 50-70% crash any day. That is a 100 times better than buying an overpriced house now and losing the house during the crash along with your job.

Yes, there is always inheritance as a long term hedge. It’s just a cycle of life. My parents inherited two houses. They own three almost outright. During the next crash they plan on picking up another rental. By the time I retire I probably inherit 3-5 houses. So why the heck should I but now during the worst bubble we have ever seen in our lifetime is beyond me.

What in the heck are you talking about?!! I have the Wells Fargo Housing Index up in front of me right now. Greater San Fran went from a median housing price of over $1 million during the last bubble down to 550K in 2011. It dropped in HALF!!! Today the median price is back over $1.2 million, and affordability is down to 7% of median income earners. Stop peddling nonsense. 10% downturn is fantasy.

Take a breath…..read what I wrote. I said during the last tech meltdown, ie the .com bust of the early 00s. Not 2011.

Sheesh

The place needs cosmetic improvements, no big deal. Only 700k. It is next to a commercial area, and also some apartments, 3 blocks from the bay, up on the hill, with a view. This place has potential.

Did you happen to notice the bars covering every window and door? That means it’s a safe low crime ‘nabe, right? LOL

Mr. Landlord & Flyover,

Is Spokane getting any better? An ex-GF moved back there years after graduating from Gonzaga and she cuddn’t stand it. Too many ignorant rednecks & in-breds. She moved to Cariboo Ranch in BC. I think Reno will benefit from the outflow from Socal; southern WA too. A retiree and can sell in Sactown or OC and buy some units for income while living in one… No state tax, instant income, lower costs of living… yes, hire a property manager even though you live there. I suspect many companies will exit Socal and SF, just as Buck Knives did when they moved from El Cajon to Idaho.

Its’ in hunters point

Some would call it the Bayview Jim, birthplace of O.J. Simpson, but either way it is the ghetto.

I agree with with Ira, it is a bargain, but remember, the asking price means nothing in the Bay Area, It’s what the greater fools over-bid it up to. It will go for at least 70K above asking.

My last home I sold in the Bay Area… 14 offers $120K over asking.

It’s in the ghetto. And it’s next to toxic Hunter’s Point shipyard. Sure it’s gentrifying but anyone who can afford this place will not feel comfortable living there.

Didnt even look since I could care less about SF (or cali for that matter) but if its hunters point, thats a whole ‘nother level of ghetto. Got mugged there as a kid by the local shaka zulu tribe. Not uncommon to see car chases through the streets. Nighttime? You better be out of there by dark or have your obit written. And this is coming from someone who grew up in Stockton, which has a lot of the same tribes.

Five generations of welfare recipients have been living in the housing projects up the hill. They have been rebuilt twice since World War Two when blacks from Louisiana and some whites, later chased out, moved in. That neighborhood is going to remain ghetto for another 50 years, no matter how many multicultural festivals the city throws to try and fool itself. Google Street View the nearby intersections of Third Street for a real feel for the place.

I did a quick street view of the street. It’s in an industrial area and there are a bunch of homeless people camping on the street just a couple of doors down. The bible verse graffiti throughout the neighborhood is a nice touch too.

Those bars are on the window for a reason.

Ira you are joking or you are high.

Well, when all is said and done, it’s about acquiring that non-renewable, precious, costly coastal California dirt that can improved upon. It’s not about the chicken wire and the stucco mud and the faux roof tiles – those are relatively cheap. In the end, it is about the land.

Kind of expensive land (not too big) in a sketchy neighborhood with all that web of overhead power lines. If the area (which can not be changed by you) would be nice, or have view of the bay, then I can understand the price of a small lot at $700,000 plus close to $100,000 to demolish and haul away that rotten box. Also, corner lots are less expensive.

As is, it doesn’t look attractive to an investor; definitely not to me.

They are going to say – ” near the newly constructed Chase Center home of the Golden State Warriors as well as the revitalized 3rd St. corridor and the UCSS research center. BFD, it is the ghetto.

“…somehow, they feel that “tiny†spaces are worth lots of money.”

Therefore it should be natural for them to purchase a ‘tiny home’. I mean, why wouldn’t they just do that?

I bought a house today! Wanted to share my situation and experience as someone who has followed this blog for a very long time. This is not an argument for or against the housing bubble; just my situation.

The personal: Mid 30’s w/ wife and 2 kids; 7 yrs and 9 months old. Been living in a condo rental for 6 yrs in Newport beach (2-3 miles from PCH) with below market rent. We have a lazy east coast owner and out of sight/mind property manager whose main portfolio is in South Orange County (we are the only property not there). They could easily raise the rent 1k-1200/mo and get it in a heartbeat; so we’ve been very very lucky. 3 bed/3bath condo around 1900 sq ft in a gated community. Again; we have a great deal. But, for the most part the community consists of older retirees and just recently a couple families moved in. We have 0 yard, just a small patio; so the only outside playing my kid does is in the greenbelt. The old foggies and their HOA rules are annoying and they don’t really like kids. The condo does need to be updated; but, we never really complained due to the below market rent and we were model tenants.

We had been looking sparingly the past 2-3 years (as I was a housing bear) and ramped up the past 12 months when inventory started to tighten as well as the noose around my neck the wife was holding. We just really needed a house was the bottom line. Continuing to rent in current condo and sit, no longer became an option. That being said, we did in fact look into renting a house as well; but, so many of the rentals (again only looking at single family homes with yards near good schools) were dated and very expensive (3700-4500). This was our motivation along with the fact that my parents (who recently paid off their house) and parents of friends in CA (OC and LA), consistently tell us they will not be moving any time soon and have nowhere to go; really pushed me over the edge. I could not wait forever while my kids grow up in a condo and all the great memories we experience together happen in someone else’s place. I wanted something of my own, a house, a yard for my kids, a place to entertain friends and family; something to reward my hard work and a forever house.

The Financial: Now, I am pretty fiscally conservative and even though we made the decision to buy a house in this market I refused to get into something I could not afford. Here is my current financial state:

300k+ income

300k+ cash reserves (savings) and 75k 401k

0 debt (2 cars paid off, 0 credit cards, 0 student loans)

780+ fico score

Wife is stay at home mom (couple of years now); however, has 20 yrs experience in the medical industry and is constantly contacted by recruiters as she has lots of contacts. If she went back to work; could be making 80-120k.

Folks live nearby; so, worst case scenario if she went back to work we would have minimal child care costs. 7yr old will go to the new public school which is an 8.

The House:

Found a house in one of our target cities; originally listed around 900k. 5 beds over 3k sq ft, huge lot with great backyard and a pool and not backing up to a major street. Grew up in a house here in Socal with a pool and I’ve always wanted a pool and my 7yr old is crazy about swimming. House needed some updating: floors, paint, doors, etc… but a great house in a good area. My budget was the low to mid 800’s; so when I saw the original list price of 900k we didn’t even go to see it b/c I refused to get in over my head. After a week or two; it dropped 50k to 850k and now we’re in business, since it seemed the seller was motivated! I contacted the LISTING agent direct; told them I am in the industry they can “double end†the deal (no buyers agent commission to pay) and am writing my own loan and will close in 30 days OR LESS with 20%+ down and excellent credit. There was a little bit of back n forth negotiations and I was competing with 2 other offers (higher than mine), but in the end we had a deal in the mid 830’s (listing agent used some commissions to increase NET for seller). Come to find out later, seller was very motivated due to financial and medical reasons. Now; I am putting about 30k into it w/ aforementioned updates and based on some comps that I see closing past week should be “valued†around original list of 900k (at least). Appraisal came in around 850k.

The Loan:

200k down

4% 30yr fixed conventional loan w/ 9k lender credit to pay for all closing costs (since im doing my own loan)

P&I = 3038 Taxes (low 1%) = 705 Insurance = 70 (NO HOA or MELLO ROOS)

So PITTI = 3813 (this does not take into account gardener or pool guy which is TBD)

As a side note I think this property would rent for around 4200-4500/mo if worst came to worst. Definitely not the ideal ROI as there are better locations to invest in RE (im looking at you Flyover country), but, at least the rental potential could carry the property if something happens.

The other idea I played with was airbnb. My wife said absolutely not; but, a big house on a big lot with updated interior and a tropical backyard w/ pool/Jacuzzi in a good area could probably fetch a couple G’s for a prime weekend.

Conclusion:

I used to be a housing bear and believed that the time is near for a crash; but, my opinion evolved over the past few years. I try to read and think from both sides of the argument and especially being in the industry (mortgage lender) having access to additional knowledge and insight. I still don’t know if I am a bear or a bull; what I do not believe is that a monumental (50-70%) crash is just around the corner for multiple reasons and at the same time do not believe prices can continue their upward trend, maybe just a plateau with some minor corrections. Even if there is somewhat of a correction; the house I have picked and the financial piece works for my situation and I can stick it out in this house for a long time into the future. This is not a 1 size fits all market for people. If you are in your 30’s or 40’s and single and live with parents stacking cash and can wait, so be it, it works for you and you have time. Conversely, if you have a family and no longer wish to rent an apartment or condo or whatever, then jump in if it makes financial sense for you. I think it’s a matter of works for you from a life situational goal and present financial ability. Most importantly for me, I did not have another 2-5 years to sit around and try to predict the future. I want stability for my family, a backyard and pool for my kids, a great place for friends and family to gather and share experiences and memories.

Congrats, Dan, we did the same in January. If you can afford it, a forever home is a good move in any market. Kids + pool = good memories for all of you, and you can’t put a price on that.

Thx!

Cannot wait to take a swim with my son and teach my 9 month old the basics.

Going to be fun!

You have a tough case.

$1200/mo for a 3 bed / 3 bath in Newport Beach is tempting to just stay and collect cash.

What area is the 5 bed / 3 bath with pool and large lot? If it increased your commute time significantly I would not do it. If your commute time decreased and you had access to better stuff for your kids it might make sense. Having a pool in your back yard with kids is a lot of fun.

Correction and clarification.

Current rent = 2500

Market rent for unit = 3500-3900

Congrats.

You also forgot to include the income tax deduction, which for the first few years will be YUUGELY BIGLY YUUGE. So your PITI is actually a lot lower when taking that into account.

At some point you have to start living your life based on what you need, not what may theoretically happen in r/e in 1 or 2 or 10 years. If you found a home that you can afford, suits your needs and you plan on staying in for the long term, that’s what matters.

I have 2 small kids as well and I can’t imagine them living in an apartment. I know plenty do, but who gives a fuck? I don’t want my kids to grow up doing what “plenty do”, I want them to have the best life possible. In the summer my kids spend hours a day in our yard running around, playing with the dogs. Also the idea of pets in an apartment sends shivers down my spine. Also built them a swing set and playhouse and the mandatory trampoline :). Our backyard is better than any park in town I think, lol.

As far as the 50-70% crash, that’s fantasy. Just like it was fantasy the last time around. Despite the doom and gloom that was all over the news for 3 years, homes in good neighborhoods didn’t fall anywhere near 50%. It was more like 15-20% on average. Which is still a lot, but not the epic “I’m going to buy a house on the beach for $200K” wet dreams people have here. 50% happened in ghettos and out in the middle of nowhere exurb subdivisions that were 1/2 finished when the crash came.

Agreed.

I’m super excited to hit the pool with my family. Toss the pig skin with my 7yr old on our huge lawn in the back.

Have a whiskey with my dad pool side and hear his interesting life stories.

Watch TV outside in my cabana. Have a glass of wine in front of the fireplace in the backyard with the wife.

Fun times.

FYI the trump tax plan would double the standard deduction, reducing the value of an interest deduction. It hasn’t passed yet, just pointing it out (not arguing with you).

Is that part of Trump’s plan? I didn’t know that. Moot point though since that isn’t going anywhere, not with the useless GOP led my Mitch McTurtle and Paul Screetch Ryan.

All this talk of a pool makes me want one again. When I lied in a hot climate, I lived in 2 houses with a pool and it was great. Season up here is so short though it’s hard to justify the expense.

And don’t bother with a pool guy. With those pool vacuum thingies, it cleans itself. You just have to keep the Ph balanced and clean out the filters every now and then. 10 minute job. Other than that it’s pretty much on auto pilot. It’s not like the pools of 20-30 years ago that took a lot of effort to maintain.

If Trumps tax plan passed…Increasing the deduction would simply increase rent. Basically renters would have that disposable income and it gets transferred to the largest expense… rent. The rental market would love that tax change.

All it does is move cash around.

We live in the Bay Area. We’re in our late 20s, two kids both under 2. We have a similar profile to you.

Income: husband: ~200 + pension, me ~150 but taken some time off with the kids.

~500k in cash for a down payment

We’re waiting however because we’re worried that the current Bay Area economy is unstable. Most people who are buying or bought are able to because of the rapid rise of RSUs or two income families. Both of those aspects of the market will not last in a downturn. Job loss is common and RSUs will turn rapidly to shit. Many of these same people keep all their money in stock. In addition, all and I mean all of our friends who have bought have put around 10% down. When high income and well educated families (300k +) are only putting 10% down, Houston we have a problem.

Maybe we’re risk averse but we’ve seen how job loss and falling wages can devestate a household. We’re holding off, even though we’d love to have a place of our own. Our friends with no kids have all become flippers that’s how I know the end is near. Tech employment has been fallling the last two quarters. Hospitality is up, you know the shit wages that pays. Another bad sign.

Our timeline has always been, we need a house when our daughter starts school (~3-4 years). That’s our buy point – if there is no recession by then we’ll buy and hopefully mostly in cash.

Not sure where you want to live in the Bay Area but you’re right about the shift in employment. And pendings are down significantly in SF, San Mateo county and especially revealing Sacramento. Just hang in another year or two (or less). Once the credit expansion hits the brakes and employment trends reverse it sounds like you’ll be in a great position.

Bay Area Girl:

Why are you sitting on RSUs? You should sell those things as soon as they’re vested.

Just an aside. To your bigger point, if you’re afraid of a job loss, then you’ll never buy a house. Anyone can lose their job at any time. It’s like waiting for the perfect time to have kids. There is no perfect time. You either have kids or you don’t. There will always be a reason to wait and before you know it, you’re 40 and kidless. Same with buying a house. If you want to buy, buy, if you wan to rent, rent. But waiting for the magical perfect time to buy a house is useless since it will never come.

You’re in a Catch 22. If you buy during a boom, your job is relatively secure, but house prices are high. But if you wait for the epic 70% crash (that will never happen by the way), there’s a good chance you will be jobless.

Congrats! Even as a bear myself, if you are buying for the long term (forever home), and the monthly payment is not overwhelming, why not lock in a historically low rate for the long term. Even if the market crashes 50% and your underwater. If you love where you live and can keep making your payments, in 20-30 years it doesn’t matter.

Congratulations Dan!

You hit the nail right on the head with your post. Only buy when it makes sense to you. Everybody’s situation is different. With a family, providing stability and building memories is important. Sounds like your monthly outlay is very manageable. When accounting for principal and MID/property tax breaks, it may very well be cheaper than your old condo rental. Enjoy your home!

He didn’t have to put down $200K on the condo rental.

Just a thank you for sharing your story. My husband and I did nearly the same scenario, put 30% down, all closing costs paid, built a pool and installed all new landscaping. It’s a house I could live in or rent out if needed plus it is a next generation home with a separate apartment we can rent out in a scenario where we needed to. (Husband adamantly against it). Lol let us hope we can just enjoy our homes and sell for a profit one day, is that really too much to ask for?

Was your builder Lennar by any chance? We did the same, and the inlaws are living in the apartment. Once they’re gone, we should be fine without needing to rent it out, but nice to know we could.

You gave a little too much info to find the house! Enjoy Mission Viejo, my friend – Nice Backyard!

I am in a similar situation. I’m a millennial that has been reading the bearish news since 2012. I am about to close on a house and always considered myself a housing bear. We bought half the house the bank offered to lend us (1.2 million… really?) and put 20% down. If it all crashes again, I will be first in line on getting a condo or small single family rental.

Just remember if it crashes again, who is to say the fed won’t go to negative interest rates? What if we have 1-2% 30-year mortgages? If we have high inflation in the next decade, you’d be shooting yourself for not buying today. The price is all relative when factoring inflation. If you want to live here, might as well join the party and lock in your payment.

NACA loans are given to the severely under qualified population up to the amount of 417k in Los Angeles. Most of these people are on “survival” mode, not looking for the doom and gloom clouds like most of us here are. This creates surplus demand in the sub 417k range since anyone can qualify so long as they have verifiable income with no money down, no closing costs and sub market rates.

At the end of the day, each crap shack sold today with a loan is causing inflation. We’ve seen inflation more consistently than deflation so hedge your bets accordingly. In 30 years none of it matters anyway.

🙂

North facing yard with a pool may not get great light.

But I would say good buy

All very reasonable. People think that housing prices are insane, but if you look in places like Orange County, it doesn’t feel that way to me. If you check out some of the South OC cities like Aliso Viejo, Mission Viejo, San Clement, SJC, Ranch Santa Margarita, you can find very large, 90s vintage homes for $350/sf. These are homes in very safe neighborhoods with well paved streets, nice parks and public schools that are 9 and 10s. I honestly don’t see any bubble here, most of you on this board can afford these homes. If you can’t buy an SFR, there are very nice THs and Condos in the $400-$500k range. That’s very doable for the majority of people with a white collar job. San Francisco and West Los Angeles are really outliers.

San Clemente is awesome.

If your PITI is below the rent level and PITI is 15% of gross income, then what’s to snark about? Particularly since the underlying market rent in your past rental abode was higher than your PITI in your new mansion. Best wishes to you, wifey and the chillrens (sic).

I do wonder at people making blanket general statements regarding individual situations… but, when the last bears capitulate, its a sign of a top, not a bottom… i know I am old, but I remember the early higher interest rates of the 80s, 1990s, 2007-2008, etc… My first investment property in 1984-1985 had a 11-3/8% start rate (ARM) with a 5% IR max cap increase. So the two Know-It-All geniuses from PNW can stand-down from calling me Chicken Little. I’m looking overseas, but I am in no hurry.

Congratulation Dan!

I hope you can keep it and be able to pay it off. In your case the decisive factor were the nesting hormones and the family needs. I can not argue with hormones and feelings. They are there and we need those, too. After all, when I’ve got married I used hormones and feelings not my logical part of the brain; nothing wrong with that. My investor part of the brain does not allow any feelings and emotions for investments. It is driven by ROI alone. However, even my logical part of the brain understands that you bought a roof over your head not an investment. I also understand that due to the nature of your income, moving to other parts of the country would be detrimental to you. There are some occupations which make moving hard or impossible.

$630k in debt is scary. I don’t envy anyone with that millstone around their neck. I sincerely hope you can pay it for the sake of your wife and children. I am a strong believer in families with children.

Congrats Dan!

No one cares what you think Flyover… you don’t live here nor are you vested in the market. Go troll on your local real estate board. The guy is happy because he bought a home. Your primary residence is not an investment- it’s a place to live. He makes good money, put down an adequate down payment and plans to live there forever while locking in a good rate/payment. You sound like an old disgruntled divorcee raining on someone’s parade.

Assuming what Dan claims is true. His gross monthly income is 25K plus. His monthly gross housing nut is 3.8K. He could take a 50% paycut and still easily afford the house. There is simply nothing to see here, sounds like a well qualified buyer. Enjoy your house Dan!

Congrats Dan!

We took the plunge in Solano County almost one year ago. Pretty much the same situation as your family (except I make about 1/4 of what you make). But having the house for my kids to grow up in in a great school district is such an amazing feeling.

Dan.. Congrats on the house and thank you you for sharing your experience. Good words of wisdom!

Another sheep about to get processed and sheared.

Typical beta who is spineless…wife puts the “noose around his nick” pressuring him to get in huge debt to buy house. Of course she doesn’t work. She wants to be the brood mare. What a naive clueless moron. This guy thinks his wife will EVER go back to work LOL. Another sucker getting played by the predatory females of Orange County. Check back in in a couple of years after your wife divorces you, takes your kids, takes the house and financially rapes you for lifetime alimony and child support 🙂

You’re welcome.

You got played, SUCKA!

Oh, and she’ll be screwing the pool boy and gardener at the same time while your mark a*s is at your cubicle working for your indentured servitude wages.

The peasant class, even the “high earners”, never wise up.

Sounds like somebody is a little bitter here. I can only imagine some of the conversations between the resident bears and their spouses..”Honey, we’ll keep renting the cheap ghetto apartment for a few more years…prices are GUARANTEED to go down 50 to 70%. We have nothing to worry about.” He can easily afford it and wants stability for his family and can enjoy living in a nice house in a nice area. Dude is spending 15% of his gross income on housing, that is a walk in the park financially!

Wow, sounds like you’re speaking from experience. Sorry you couldn’t take care of business at home buddy, but, I’m not you (thank God).

Sounds like a lot of anger, maybe you need to re-up your RX.

BO$$ 24K, that is a mean spirited thing to say … he is a family man who is dedicated and decent. BO$$ 24K, Shame on you.

“I can only imagine some of the conversations between the resident bears and their spouses..â€Honey, we’ll keep renting the cheap ghetto apartment for a few more years…prices are GUARANTEED to go down 50 to 70%. We have nothing to worry about.â€

That’s funny. Some of the worst SOB stories I read and heard were from people who were upside down or being foreclosed on during the last downturn. Now, I see RE cheerleaders implicitly staking their beliefs on some higher power (government and Fed) to once again ride rescue and limit potential losses at 15%.

“Another sheep about to get processed and sheared.”

Found the divorced renter.

Dan

First congrats

Second

What happens when your your 300k a yr job goes up in smoke. This is my concern same as 2006-07. Many high earners are in tech or finance and their incomes are not sustainable. When the bottom falls out(which it will) homes will fall by 30-40% which is basically your down payment. If your in finance you know this is going to happen so why not wait until the inevitable occurs. Yellen has no idea what she is doing.

You could also drop dead tomorrow. I mean, impossible to predict the future

Can i ask what you do for a living that pays 300/yr? I know exactly how you feel about getting on with life and raising your family in a home. Its too bad something as basic as a home has gotten so expensive. I have a son 16 mo old and we live in the Monterey Bay. Were actively looking to move to North Carolina because of the absurd housing costs here. That being said, i think if our family was making 300k i wouldn’t be so worried about the cost of housing. Of course my kids would have to go to private school since the schools are shit around here.

Dan, congrats. In the short term, you may gain, or you may lose. But, in the long long term, you will do just fine. My advice is to save another down payment then purchase another. A few decades from now, you will be able to retire after paying the college bills. Good luck.

So if there is a housing downturn, your income will get hammered (insomuch as you’re in the mortgage business), and your primary asset will take a beating. I wish you luck; you have put your income statement and your balance sheet in a highly correlated and vulnerable position. Keep your cash balances high, and hope there is no bust.

What you say is certainly possible which is why I kept a good amount in reserve.

On top of that; I have no other debt and have a wife fully capable of getting a job rather quickly w/ her experience and contacts. She gets call from recruiters very often; however, right now we are in a position where she does not need to work.

Furthermore, if she went back to work; my parents live nearby and we would have minimal child care costs.

Lastly, once i fatten the reserves back up to 250k (i figure around 12 months); i will start making double payments on the mortgage to get the balance way down.

But I thought we were in a housing bubble? 🙂

Can’t fight the need to nest! It’s as strong as sin.

Sam

$300k+ income

gotta love that internet income……where everyone makes bank.

It may be hard for YOU to believe, but that’s just because you don’t know any of them. I’m not one, but I know a depressing number of them (dozens) personally. Most worked hard for it, a few got lucky. The top 5% of households in the U.S. earn $350k+, which is an awful lot of people, and many of them concentrated on the coasts.

Not sure what you mean; however, i actually understated it a bit. Thought a round number would suffice.

In any case; I have no reason to lie what-so-ever, believe me or not.

What I will say is that there are PLENTY of people in this county and state who make more than me. So, the whole everyone barely makes $12/hr argument is off base.

Congrats man!

You described my family’s situation. We finally bought in March. 4 bed 3 bath almost half acre lot with pool in Anaheim Hills. 275k down. Monthly payment with taxes is $2600. No HOA. I do believe the market will eventually turn down but we bought for our kids future, schools, quality of life. We are very happy.

Good to hear. Anaheim Hills is a nice area and at 2600 per month is easy peasy no worries if the value goes up or down

700K for a SF single family? That is not very expensive at all. How cam people complain about that?

No complaints about the price – but the fact that it looks like a prison outbuilding sorta puts a damper on the excitement. Definite teardown, but awkward-shaped lot won’t help the replacement.

Because it’s literally in the middle of the most crime ridden ghetto in San Francisco….shootings, robberies and assaults are all every day facts of life in the Bay View, along with the toxic cleanup efforts going on that will take decades more to complete. Unhealthy and unsafe. Not worth it at any price.

It is deep in the ghetto but it does have the best weather in the City, great if you don’t catch a wayward bullet while you are sunbathing.

Beautiful! It is now worth about 4X more than it was worth at the bottom in 2012.

This is why someone should wait for the next bottom when public elementary school teachers could afford a house in the Bay Area.

Looks like a little prison on a crummy street where people leave their trash and park RV’s which I assume they live in. Check out the street view. That’s a lot of trash.

https://www.redfin.com/CA/San-Francisco/1176-Quesada-Ave-94124/home/1928808

Here I found a less expensive house than the one listed by the Doc.. Choices, choices, choices!…

http://www.wallawallarealestate.com/residential/2620wainwright/2620wainwright.html

Damn; that house is bad ass. Downside (for my taste) is having to live in state of WA where it rains like 90% of the year. No thanks

Southeast WA. It gets half the rainfall of the national average. Great weather, actually. The downsides are really the prison (although crime isn’t that bad) and the borderline terrible public schools. Of course some of them look ivy league compared to the LA district.

Which makes me wonder if a prison draws the wrong culture to a town – families of inmates propagating the behavior that brought them there in the first place, spreading it to the schools. Kids with parents who aren’t interested in parenting.

Dan,

I was comparing the house from the article posted by the doc with that one I posted. What was your point? That the house posted by the doc, with higher price is more to your taste?

In terms of rain, in eastern WA rains less than where you bought your house in SoCal. The famous Seattle rain is just there on a narrow strip of land between Pacific and the Cascades, less than 20% of WA state.

In terms of schools you have to remember the demographics. Like always, most of the white and asians study hard and take electives and go to prestigious universities but there are also many children from Mexican families who don’t have any desire to study. I am talking about percentages not all of them. The later group lowers the overall score for the schools. That is nothing new; You living in SoCal should know this by now. By and large, schools in eastern WA are better than most schools in SoCal.

Flyover,

Re-read my post, I was complimenting that beautiful house which obviously is a million times nicer than the one the doc wrote about. My only point was that I would prefer not to live in WA.

Prices are high, yes; but, I still prefer to live in socal (at this time).

All the cheap housing is gone!

Welcome to the New Feudalism, hope you like roommates, and lots of them!

Oh, and a robot just took your job, while your government was busy talking about how to bend you over for the Deathcare industry.

Have a great life!

When I first saw the picture along with a few others, I actually thought it was the edge of an industrial area and someone had done a good job of turning a few containers into a home with some wooden facade…. and those lots near a corner can be an awful nuisance with the noise of cars accelerating by.

LOL. Los Angeles homeless problem out of control. But hey man, the weather is awesome and lots of terrific Mexican food. So it’s all good, yes? At least you don’t have to live with all those yucky white people in the midwest right?

http://www.dailynews.com/social-affairs/20170823/las-response-to-homeless-encampments-isnt-working-councilman-says

“Amid rising homelessness and mounting outcry from residents and business owners, a Los Angeles city councilman said Wednesday he wants to take a hard look at the way the city responds to the increasing presence of encampments and recreational vehicles.

Residents and business owners have taken to social media, such as the Saving San Pedro Facebook page, and in some cases submitted petitions and organized protests to demand that city leaders enforce existing city policies that are aimed at removing illegally erected encampments and hauling away large vehicles that are improperly parked on city streets.”

The initial reaction will be to try to “get rid” of the homeless. But they have nowhere to go, so the end result will be large slums. Tent city slums are already established in many parts of Los Angeles, and I doubt they are going anywhere. People will just get used to it. Housing is too expensive for the homeless and they want to live where there is mild weather and beaches just like rich people do.

Any severe action against the homeless will trigger retaliation by the ACLU.

“LOL. Los Angeles homeless problem out of control. But hey man, the weather is awesome and lots of terrific Mexican food. So it’s all good, yes? At least you don’t have to live with all those yucky white people in the midwest right?”

Shhhh…the more that stay and try to live with/through it the better!

Things aren’t even bad yet with 78% percent living paycheck-to-paycheck:

https://www.cnbc.com/2017/08/24/most-americans-live-paycheck-to-paycheck.html

I can’t wait until I sell my 4/3/2 SFH on 1/4 acre and head to “greener” pastures, where the criminals haven’t installed pathetically corrupt leaders to run the state into the ground 😉

It’s shocking how broke Americans are. Sometimes I feel like most people are infected by a disease. That disease forces them to get in more and more debt. Some even believe it will be fine when we get higher inflation. They actually think you can inflate away your debt.

From the article you posted:

“56 percent said they were in over their heads. About 56 percent also save $100 or less each month, according to CareerBuilder. ”

Here is another article about these great savers:

https://www.fool.com/retirement/2017/05/30/almost-half-of-americans-die-nearly-broke.aspx

from the article: “only 37% of seniors 65 and older claimed to have $1,000 or more in the bank.”

Breathtaking.

No, it’s not all good. It’s sad actually given a huge portion of these people are mentally ill and are on the streets due to a failed system. And you’re a fucking troll. But what would you know? You live thousands of miles away and have nothing better to do than trash our state. Go bleach your sheets for the next meeting or something.

SoCalGuy: Go bleach your sheets for the next meeting or something.

You think everyone in flyover country is in the Klan? Or that anyone who wants to live in a safe neighborhood is in the Klan?

Some people just don’t want all the social ills that come with “diversity.” Nothing wrong with that.

It white folks are so awful, why is everyone trying to move into white neighborhoods?

> Some people just don’t want all the social ills that come with “diversity.†Nothing wrong with that.

> It white folks are so awful, why is everyone trying to move into white neighborhoods?

So you’re honestly saying that life is better when you don’t have to live with brown people?

In Los Angeles whites are moving into nonwhite areas in droves.

Landlord’s posts are consistently bigoted. And I don’t know why he posts here either. It’s miserable to read his remarks.

Cheers

Actually white people are moving into the “colored” (bigoted comments are ok if you surround them with quotes apparently) areas. That’s what is driving up the rents and forcing the people who were barely hanging on into the streets.

why do you have to resort to Ghetto talk to express yourself?

It’s not the “system”‘s fault that these people are incompetent, lazy, addicted or mentally ill, but their own genetics, dysfunctional families and most of all their OWN personal shortcomings. I for one am sick and tired of these fuck ups and their enablers like yourself constantly shifting personal responsibilities into some mythical “system” that somehow still allows hard working 3rd world immigrants to thrive in the US with simple work ethics and discipline at school. East Asians, Indians, Middle Easterners and many Hispanic immigrants have proven beyond the shadow of a doubt that you can still make it today in the US and they are the first ones to move to SAFE white neighborhoods and good schools as soon as they can by the way.

Most of the gentrification you are talking about only takes places AFTER majority-minority and our own white losers have ravaged entire neighborhoods with crimes and violence to destroy home values and schools, get it kiddo? Nobody is moving-in to kick out minorities, but instead to REBUILD what has already been devalued and/or wrecked in the first place.

The most hilarious thing about your ignorant anti-white post is how you conveniently ignore the fact that a significant portion of gentrification in California is done by ASIANS and GAY families who are actually doing an excellent job at restoring normalcy after the white working and middle class flew your liberal insanity that turned entire neighborhoods and forced “integrated” schools into complete shit holes years ago.

You’re beyond clueless and the worst kind of hypocrite I ‘ve ever read on this board.

“Ignorant anti white” is an ignorant statement within itself. I’m not anti anything. I certainly don’t judge an entire group of people by the amount of melanin in their skin. I also do not feel guilty or responsible for people (not my relatives) have imposed on factions of our society. I am smart enough to understand the socioeconomic impact on a portion of our society that has created adversity not experienced by other groups of immigrants and is still going on today.

Why don’t you look up the history of the FHA and redlining then get back to me. But you’re right, the system has nothing to do with it. Separate but equal right? I’m not talking about 200 years ago, this was 1968.

Mentally ill people should be held accountable for their DNA? WTF are you talking about?

The only hypocrite here is you my friend unless you have Cheyenne or Sioux in you. You forgot to mention native Americans on your list of “immigrants” who have come up in our society. 50 million plus wiped out due to manifest destiny. Perhaps your revisionist history class you took in school glossed over that fact with pictures of a big turkey dinner. I mean, we gave them prime land in New Mexico and the Dakotas. And they have all those Indian casinos! Why can’t they be more accountable like Asian immigrants? Damn whining native Americans. They won’t let us pollute their drinking water with an oil

pipeline.

You have to wonder about a country where we have more people locked up in prison per capita than anywhere for else. Also, who the hell other than America has a for profit prison system? In CA, we spend 2.5X more on keeping people locked up than on education. We still have draconian Reagan era drug laws putting people in prison for victimless crimes- longer than sentences for child molesters and murderers. Which do you think is worse?

So now take the poorest neighborhoods and purposely dump cocaine into them (CIA funding their Nicaragua operations in the 1980s, see Gary Webb and the crack epidemic). Some white guy (because I’m sure you’d agree black people are too dumb to come up with this) takes cocaine and mixes it with a little baking soda and the crack epidemic explodes. Then someone decides to change the laws so $20 of crack gets you 20yrs. Then CA institute 3 strikes you’re out law and for-profit prisons pop up. I’m not a conspiracy theorist but you must be drinking some real good kool aid to not believe this system was rigged.

I hope one day when you are old and destitute, Medicare is gone and there’s no room in the old folks home, they let you out in the streets once dementia has set in so you can live like the sewer rat you have become. Must be that bad DNA. It’s a pre existing condition.

SoCalGuy, please refrain from all this racist talk here. We are here to discuss real estate. Please try to stay on the subject.

Ha! Looks to me like someone slipped some pocket money to someone along the way to get a small mixed use commercial building rezoned to R-1. The bars probably predate that change when people actually attempted to do business there. It brings to mind a bit of dialog from the W.C. Fields movie I’ts a Gift from 1934:

Mr. Bissonette: It’s listed as a ranch house

Mrs. Bissonette: (shouting with sarcasm) A ranch house! It’s a shack!

The demographer Wendell Cox on the New Geography website today said that most of California missed their population growth expected targets. Be patient. What can’t continue won’t.

Emotional buying aside, its very easy to see the SoCal housing cycle go around and around.

Look at the 2008 recession, look at who was buying. Look at who is starting to show up to open houses today. Keep an open ear at work, what people are buying? Sure you got a handful of big earners who can afford it no issues there. But listen to people ask questions. Tell them you want to buy a house and listen to what they say. One person at my work has 1 foreclosure under his belt only a few years ago and i heard him talking on the phone in the break room yesterday about buying a place (sounded like he was talking to an RE agent).

Listen and observe IRL, online people will tell you anything. Of course everyone here wants a home and wants to own. But its a cycle and when you start to see certain people buying, you have to wonder if it is the right time. Always be skeptical, the housing market is 100% a cycle, don’t set yourself up for failure. Thanks to absurd credit the days are gone where the rich man in town had the nicest car. Pretty much anyone can have that nice car, house, boat, watch etc. for a few months, maybe even a year or two.

We think we are so smart and have this GREAT SYSTEM in place but really we are just monkeys spinning around on a hot rock.

“Thanks to absurd credit the days are gone where the rich man in town had the nicest car. Pretty much anyone can have that nice car, house, boat, watch etc. for a few months, maybe even a year or two.”

Exactimundo. And they front SO hard, don’t they in their S-classes and McMansions with Juliette balconies and cantilevered blah blah blah.

The repo man is going to be VERY active – that is for sure.

Cracks me up when I see online comments about the housing market and why people believe you should buy now (“buy now or you will never retire, buy now-trump is a real estate guy, buy now-the upcoming pot boom, buy now-millions of Asians are coming”). Somehow, these comments get crazier and dumber as the bubble nears its end.

I also enjoy those comments by recent buyers. They need to post it online to seek affirmation by other online posters that they did the right thing. The RE cheerleaders are quick to applaud and cheer. All that during the biggest asset bubble we have ever seen.

Same at work….this one guy told me about his tiny, way overpriced crapshack he bought. A few months later he tells me its up by a 100k (zestimate). This guy is way over his head with debt and needs to constantly tell himself its the best investment ever and he somehow gets rich. I had a real hard time keeping a straight face and not to laugh at him.

It will be a rude awakening for a ton of people when the crash happens.

Personally, I think anyone contemplating the purchase of coastal California real estate in this market, is literally crazy! Having owned a true location, location, location, home with a city/ocean view in So. Cal., and watching 3 real estate cycles come and go, and watching the perceived value of my home yo-yo during those cycles, I can assure you, only a fool would believe someone who would say ‘oh don’t worry, a correction will only be 10%’. Fact is, nobody knows. You could get lucky, or you may not! I do get a chuckle at some of these comments and people trying to convince themselves to jump in!

San Francisco can’t be done right unless you’re making the big bucks, and $250k isn’t the big bucks. Piker money. You need the Diane Feinstein Russian Hill income. You need a Bechtel CEO husband who can secure govt. contracts and make millions. Only then can you sit in your bubble bath with your pearls on, in a bath tub carved from a block of solid marble, and enjoy your view of the fog hanging over the Golden Gate as you maniacally giggle and giggle, thinking about how many people you pulled one over on.

Nothing sadder than some Millennial with a scarf on his neck buying a burrito in the Mission to take back to his dark, dank, cracker box apartment that he shares with room mates. That’s not the real San Francisco. Pretenders all of them.

Couldn’t agree more! There is an irony that seems lost on most! Those on the left coast aspire to that lifestyle. Those that achieve it, especially the Hollywood and Silicone Valley crowds love to talk social justice, income inequality, all that empathy … while laying in their soaking tub … or enjoying their walled estate, their multi-million dollar pads, $100k Tesla in order to ensure the illusion, all while paying their peon immigrant help peanuts to maintain their gardens, clean their toilets, wash their dishes, pick up after them in their homes … quite the hypocritical life!

San Jose is almost as bad. But people should no worry. We have literally millions of Asians moving into the area paying top dollar for properties. The current Millennial generation, with their mostly useless degrees, are working at Starbucks, while the highly trained and willing Asians are getting almost all of the high paying jobs in the tech industry in the Bay Area. The Snowflake generation doesn’t have a clue, although many think they are entitled. Many are waiting for relatives to die so they can inherit wealth. There’s a wake up call headed their way!

San Jose is almost as bad. But people should no worry. We have literally millions of Asians moving into the Bay Area and paying top dollar for properties. The current Millennial generation, with their mostly useless degrees, are working at Starbucks, while the highly trained and willing Asians are getting almost all of the high paying jobs in the tech industry. The Snowflake generation doesn’t have a clue, although many think they are entitled. Many others are waiting for relatives to die so they can inherit wealth. There’s a BIG wake up call headed their way!

I agree Curti,

these Asians coming here to California and working at Tech jobs are a great benefit. A lot of my colleagues are Asian immigrants. These Asians tend to be smart and hard working. I cant really say that about some of these old farts we still carry along at the company. I wish there would be an effort to push them out. Some of them are really lazy and think someone else will do the work. You don’t deserve respect just because you are old and overpaid. The good news is, the clock is ticking and more and more old peeps vanish from the workforce.

You are a prime case of “youth is wasted on the youth”.

Pretty funny you’re saying that, as many Millennials will be replaced by automation and AI; but I guess it couldn’t have happened to a nicer fellow

@Jeff, its actually: Youth is wasted on the YOUNG.

@Dan, I completely agree with you. At our Tech company we are already outsourcing to other countries like there is no tomorrow. Add to that automation and you can easily see why housing prices in California can go nowhere but down in the future. At some point the high paying jobs are gone for most industries in California. You can manufacture for a fraction of the price somewhere else, you can easily automate fast food and grocery purchases, you can easily buy more stuff online or much cheaper overseas. In the future California will still grow fruits and vegetables. That won’t go away but its only staying solvent because all of the field workers are illegals without receiving any benefits. A State like California where its extremely expensive to do business in cannot win against the pressure coming from globalization and deflation.

Yes, you sir are correct!

the IE is starting to trickle out price drops and uptick in listings.

yep, I am noticing the same.

Which areas specifically? I assume you’re referring to the Riverside/San Bernardino areas?

What do you think of this SF listing … seems like a decent area.

https://www.redfin.com/CA/San-Francisco/1231-Quesada-Ave-94124/home/741130

Hard to imaging gettin something at this price in a good area in coastal SoCal

Notice the taxes on this house are $934. Bought in the 70’s for 30K. Beware

Dan, congratulations! I grew up when life in Southern California was idyllic, complete with backyard pool, and there is nothing like it! Your babies are going to grow up faster than you can imagine, and you have to act NOW. Wishing you happiness and health in your new home, and thank you for sharing the story with us.

I agree with Laura, Dan. Time flies by fast. Enjoy it with the kids and grow equity now. Congratulations!

Thanks. I’m super excited!

Thanks. I’m extremely excited!

Thank you Laura.

Cannot wait to build great memories in my new place.

“I think what a lot of white folks take for granted is that you can pretty much go to 95% of the country and not feel out of place. If that’s not a privilege, I’m not sure what to call that. But honestly, I hope to live behind a tall gate one day if I can afford it, seeing how things are going in this country.”

Dean,

No, that is not privilege. That is an MSM narrative to push a political agenda. The whole country is open to everyone regardless of the % melanin you have in your skin. Yes, they are some crazies out there (a very tiny %, less than 0.0001%), and they can be everywhere regardless of the color of their skin. Sad, but that is life. Yes, the MSM is trying to blow it out of proportions to get clicks and push an agenda of divide and dominate.

Where I live, the vast majority are whites. However, there are some from every race. Nobody keeps those different races here by force. They CHOSE to live here, because they enjoy living among civilized people. Many of them are educated or have their own businesses and frequently they have over $200,000/yr household income. I do business with them all the time and I respect the fact that they have character, work hard and they are very good at what they are doing. My computer guy is a black fellow and he is the best in town. All other businesses hire him and no one is thinking that he is black and they are white. He has his own business, his own family and he lives civilized like all other people. I respect him and he respects me. If he would start acting like those from south Chicago, Baltimore or Ferguson, I would not like him regardless of the color of his skin, black, yellow, red or white.

In terms of privilege, I would say that those with darker skin have a way higher chance to be admitted in prestigious universities and good government jobs than white males, even when the white male is way more qualified; it is called affirmative action. If you deny that, that means you don’t live in the real world. My son, with straight 4.0 GPA and very high MCAT score could not even get an interview for a public medical school. Over 75% of those admitted were less qualified than him, where considered minorities and they were in an area with over 75% whites. If that is not white discrimination and black privilege, I don’t know how to define it. He still went to medical school at a more expensive private university after I paid massive taxes for the public university. It was like being taxed twice. Nobody in my ancestors was a slave owner; I am from Easter Europe.

Such an absolutely perfect and tone-deaf example of white privilege perspective.

Is this finally the post where it’s clear he’s just a bot? Beware.

Classic rebuttal from a liberal fart-sniffer

The world is imperfect. Creating battles over privileges is a privilege.

So many heart breaking stories here with people a family income of $300-350K trying to afford there first $800K home. Must be tough.

Technology can’t fix this problem. Technology just allows us to make decisions on how to work around the problem. Either way we have to face reality sooner or later.

Hi Dan, congratulations! This is my first time posting.

I don’t understand the negative response people have towards you. Low DTI, over 2 years cash reserves, plus the potential reserves you’ll build from your income, no car payments, no debts. Like some people here say, that every ones situation is different. The memories you will build with your kids and your dad will be priceless. You can always make more money, but you can never get that time back.

I was in the same situation as you. I closed escrow 2 weeks ago. Congrats again!!

In my experience here, new homeowners will post because they’re happy they found their forever home, happy about the stability and the memories they’re about to give their family, and some people apparently translate that as “buy now! You’ll regret it if you don’t!” when that’s not what they said at all. Very few here have actually posted that it’s a good idea to buy on the coast at the peak as an investment, and no one takes them seriously.

Thx. I know the pro-crash crowd, cannot understand why I do not wait, but, my feeling is that I can absolutely afford this purchase, got a decent deal (in my opinion) and want to enjoy my time with my family in my own house. I cannot predict the future, whether it’s a RE crash, hyperinflation, a mad Maxx world, or dropping dead tomorrow; so I want to enjoy each day with my family in my house.

If the market drops I stay put and enjoy tax benefits.

If the market surges, I continue paying down the principal (sometimes with double payments) and work toward that free n clear asset to retire in and pass on to my kids to make their lives easier/better.

If noting else, a swim in my own pool and having a whiskey in my cabana is worth it 🙂

Absolutely good for you! Congratulations on your new home! Enjoy your new pool and cabana for the next 7+ years and you will be happy.

“…a swim in my own pool and having a whiskey in my cabana is worth it”

I hear you. I designed my pool with a half moon shaped booth in the shallow end, with seating, a table and umbrella. Weekends I’m there with an IPA in hand, “supervising” the kids.

The beginning of Dr HB’s article states:

“Let me start off that homes in the Bay Area are old. We are talking pre-World War II built old. ”

then:

“San Francisco is old. The homes in San Francisco are old.”

Not a single comment on this in this whole blog can I see.

I am personally biased on this point. They used to build ’em like brick outhouses. Now in SF itself, there are not a heck of a lot of 19th century homes due to the Frisco Fire. But they still did a good job up to WWII of solid craftsmanship. That does add a certain amount of value to the SF home inventory that isn’t present in SoCal suburbia. Maybe $50K to 200K per in my opinion (depending on the size and quality of the digs). Here in Orange County, some of the old neighborhoods have nice older homes. But all of OC only had 150000 people before WWII. Those older homes in the nicer towns do carry a premium over post-War construction houses.

I agree with you. I also think houses made around or before 1930 are just so much more pretty. After that its downhill and starting 1960s the houses look terrible. I think Orange County has some of the most ugly looking houses in America because its full of those 1960s homes. There is a few gems here and there but its either in a ghetto on a 6 lane street or its 4 million dollars.

Generally the homes built in 20’s and 30’s in LA are solid construction. We used to jokingly call our last LA home “bulletproof”. The problem with many of these older homes is that over the years multiple owners put band-aid over band-aid over band-aid trying to cover up prior damage. It’s hard to find this during the initial inspection. After living in a older home for awhile it gets to the point where you’re afraid to touch anything or fix small things because you might expose bigger problems. At which point you can fix it right and pay for costly repairs or cover it up again and pass it on to the next owner (which most people do).

My wife (30) and I (38) each make approximately $300k and own 4 rental properties worth $2mil. We do not own our primary residence. We currently rent a 3 year old house in Orinda CA worth $1.3mil with a $350 HOA for $4300/month. It feels a lot safer this way in the current Bay Area real estate environment although we constantly have to defend ourselves for renting since that is considered “throwing your money away”. Not willing to overbid on a property by 20%-30% to get a house right now.

Since I don’t know what you owe on the $2 million in properties I can’t be absolutely sure of this, but I’d say you’re pretty heavily exposed to real estate; you can think of your circumstances like someone who rents a hotel room instead of “buying” a timeshare when on vacation. Just have a good time and don’t worry about the potential downside of the investment. Paying interest on a personal residence is the same loss except for the tax deduction which could go away soon anyway. Plus maintenance costs are someone else’s problem.

Thanks Joe. 100% agree. Many people just don’t get it.

Off topic but lots of smart readers here and would like their opinion.

How come no one is talking about the fact that this hurricane will help tremendously in dealing with our huge illegal immigrant problem. Since fema and Trump won’t help them rebuild they will have to go back to wherever they came from. Houston has the 4th largest illegal immigrant population and now the problem has basically been dealt with. I do not mean to be callous just want laws to mean something and we have 11 million bloodsuckers mooching of this country and sending billions of dollars back to countries who support terrorism, and don’t support basic human rights which is why the illegals are here in the first place. Get rid of the illegals and the housing problem goes away, wages rise, and underfunded pensions, underfunded schools, and underfunded hospitals are no longer struggling because the people using them are actually paying for the services they use.

Build that wall!

Here is a reality check for you. Pretend for a minute we enforce to deport illegals. All illegal field worker bees and construction workers disappear. The fields and construction places are empty. Now, the farm owners will go out and try to hire Americans to do the work. No applications will be received until you offer a significant higher wages and benefits. In order to generate a profit these owners will increase prices. Americans are already broke, think about what will happen if we see grocery prices inflate. The economy crashes instantly. Now, think a minute about our insolvent social security system. The illegals pay with fake ss numbers into the system but don’t receive anything. Pretend for a minute we don’t have illegals stop the life support for our current system. A while back I had a conversation with some illegal Mexicans. They said when they are stopped at checkpoints they show their expired Mexican driver license. They get a pass every time. California does not deport illegals because without them we are instantly fucked. This will not change anytime soon. I am willing to bet my life savings and investments in it. (450k)

Millennial

Thank you for your response, but your argument is ridiculous. The fact is by its very nature capitalism means economic booms and busts. Eventually the economy will crash and then rebound and then crash again. Illegals have nothing to do with it. Our fiat based credit supported banking system is what leads the excessive risk taking and economic crashes. The illegals need to go because they are here illegally bottom line. With 11 million people no longer here we no longer have a housing problem so we don’t need new homes to be built. We are having less children then any previous generation and living at home longer so obviously we have enough houses in this country and the fact is we export more food than we consume so obviously have way more farming production then we need. What we also have is a disappearing middle class because automation and the fed bailing out the banks and insurance companies is keeping the bulk of the currency in the hands of a very few. What you and every other millennial need to do is some research about the people you are putting into office. Most of our politicians and all of our bankers are criminal and the only way to get them out is to vote them out. Make smart decisions and the future can be bright. Put your head in the sand and act like everything is ok and were all fucked. Stop giving all your personal information away on social media and go out into the world and make a difference.

WTF,