San Francisco housing mania: Badly charred home that is uninhabitable sells for $186,000 over asking price.

I remember reading a book on the Dutch tulip bubble and could only shake my head thinking that people were trading property, jewels, and other valuables for what amounted to a basic plant that you can get at Home Depot at the checkout line. I’m sure when the mania was over many people must have thought “what in the world was I thinking?â€Â You see that facial reaction in Las Vegas when someone hunkers out of a high roller room with empty pockets. Yet today in San Francisco, you have absolute craziness going on. The median price for a home is over $1 million dollars and most are pieces of crap. But someone is paying for this, right? Of course. Someone paid a lot for those tulips as well just like someone bought at the top AOL stock or any other failed investment. I guess my point is that human psychology still hasn’t changed much over this short historical period. Need proof in terms of housing? Housing values were up in the stratosphere just in 2007 and the mind had every useful reason to justify prices. Today we highlight a home in San Francisco that sold for more than $186,000 and was charred like a forgotten hot dog left on the grill by a Taco Tuesday baby boomer.

When burning a home increases the value of a property

Thanks to readers for sending this property over. I’ve seen many places in San Francisco selling well above asking price in the spirit of this mania. A large portion of buying prowess is coming from the tech bubble – just look at the NASDAQ and the companies sprouting up in the area. There are incredible innovations coming from the tech industry but there is so much venture capital chasing losing ideas that at some point, the party has to end. Those six-figure jobs for programmers and engineers who are making apps on how to get pizza to your door in six minutes flat just won’t stand the test of time when the market has a real correction.

And speaking of making pizza, who is in the mood to purchase a badly burnt home in San Francisco:

171 Bright St,

San Francisco, CA 94132

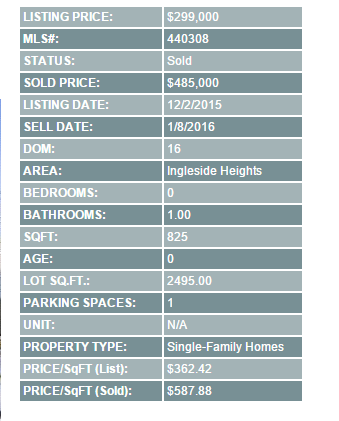

This place is badly burned but who gives a giant crap? This is freaking San Francisco baby. I love that this place is only listed at 825 square feet but has no bedroom listed! It probably got engulfed in the fire. Take a look at the details:

Did you notice the selling price? This was listed for $299,000 so I’m sure the house humpers were licking their chops when this came onto their radar. Then they clicked through and saw that this place was Kentucky Fried Real Estate. So what do they do? They bid the living daylights out of the property and push the price up to $485,000 – $186,000 over the asking price. This is the mania that is going on in San Francisco right now.

You might be thinking that the ad down played the fire right? Absolutely not! Read for yourself:

“A complete TEAR-DOWN! Beyond the external frame, this home is severely damaged/charred/burned from a fire last May 2014. No electricity so access is limited to morning hours only. All potential buyers to sign a Hold Harmless Agreement prior to access. Probate sale, no court, no death in prop w/in last 3 years. NOT in habitable condition, this is more than a fixer, it’s a complete tear-down!â€

This ad is as clear as day. This is prime time junk. I love that they state “probate sale, no court, no death in prop w/in last 3 years.â€Â Awesome. I’m sure that added $20,000 to the price. And the ad picture does this place justice. Here is the Google Street View picture:

The adjoining properties don’t look all that great either. San Francisco has enjoyed a massive amount of tech wealth from the recent mega run in tech stocks:

Nothing but roses in the last 5 years. That is until the start of this year:

This correction is going to toast some companies as well and you can certainly expect that this will runoff into tech bubble real estate. Happy house hunting in the Bay Area!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

86 Responses to “San Francisco housing mania: Badly charred home that is uninhabitable sells for $186,000 over asking price.”

Tulip Mania indeed. The big “R” is knocking on the door of the U.S. economy, and there is little grandma Yellen can do about now…primarily because she helped cause it! It has become obvious to many now that we have learned absolutely nothing since the last housing crash.

The same greed and mania that is fueling the San Francisco bubble was also pouring into areas juiced by the shale oil “miracle” here in Texas. That mirage is now a distant memory, and home prices are tanking along with the price of oil. For now the price declines are pretty tame (only double-digit percentage drops). Once the “wealth” effect of the stock market evaporates…again, those areas which were once considered “economically diversified” are going to get soaked as well.

http://aaronlayman.com/2016/01/odessa-midland-home-prices-see-double-digit-declines-from-bubble-peak/

“The big “R†is knocking on the door of the U.S. economy”

True comment, except I would replace the “R” with a “D”.

Sadly, I have a feeling you are correct. The Fed has once again blown some seriously large bubbles. The unwind will be quite painful, but the economists and cheerleaders will once again claim that no one saw it coming even though many were shouting from the rooftops about the risks being ignored. We’ve spawned a cottage industry in America dedicated to ignoring facts and marginalizing anyone who doesn’t tow the line. Same song, different verse.

Hilarious that Recession and Republican are synonymous in some people’s mind.

Not that they’re incorrect…

I’m beginning to wonder if Trump would fuck things up any more than any of the other choices though.

Even the most liberal candidates love wars and starting them, offshorig jobs, and dismantling the safety net that allows the unfortunate a chance to climb back into the middle class.

Trump is more of a populist than anything else. Huey Long would be the last potential president who was a real populist. I still like Bernie Sanders best, but I’m not sure Bernie would actually do that much. Trump is like that kid in school who doesn’t back down. Teachers make a rule against cuss words? Kid leads a movement to invent new ones, and succeeds. Administration bans American flags on t shirts? (It’s happened!) Kid orchestrates a mass movement to wear American flags on everything. Brash, rude, but a hell of a lot of fun to have a kid like that around.

One could argue that we never really recovered from the last R! As this blog has pointed out before, new home sales and permits, are actually way below historical norms, still! Rather than being driven by easy money, this price boom is being driven by low inventory. And in places like L.A. or S.F., the lack of developable land within many miles of these cities also drives demand and price. The question in my mind, is at what point does affordability begin to dampen demand or has it already started? At some point, the realities of slower economic growth has to catch up even with real estate as this translates to more not less families fighting to keep their heads above water!

hilarious …the trash cans out front look to be in better shape.

Lazy realtards… I guess moving trash cans out of the photo shot or photo-shopping out the outhouse is simply asking too much these days for a listing broker.

Actually I dont think it is even the realtards taking the photos, it is probably hired photographers getting paid $25 for each home they take pictures of. Lazy photographers!

It’s “Google Street View picture”. Lazy realtards, has no control on it.

These days they’re being generous if they wait until the fire is out to post the listing.

That is, until you realize that a home in that neighborhood goes for 900k+. Build a house for 300-400k, and you still come out on top.

It would be an expensive and frustrating experience trying to get approval from the SF Planning Commissionto build a new house .

http://www.sf-planning.org/index.aspx?page=2804

That area is a mini generator thta I am very familiar with. It is near Ocean View Park which used to be the crack capital of that end of the City. Good luck to whoever purchased that dump!

Housing TO Tank Hard in 2016!!

According to numerous articles 2015 was the best year for US housing since 2006.

http://www.bloomberg.com/news/articles/2016-01-22/previously-owned-sales-of-u-s-home-surge-more-than-forecast

Way to go with the predictions Jim. As always, your spot on!

The “best” comparison is a previous year where volume was in the middle of a cliff dive.

Interesting how it’s not mentioned that this volume level also puts us back at year 2000, especially considering that was the last year of comparison which had an increasing trend.

Seven years after of unprecedented policy and monetary intervention, the “best” this market has been able to muster is a historically low homeownership rate combined with chronically low inventory due to immobilized previous era owners.

Is that a porta – potty on the side? Nice.

That’s NOT a porta-potty. That’s the au pair/granny flat/man-cave!

It’s an “en suite” potty.

Not a port-a-potty…. it’s a sub-rented one bedroom.

I see a highly lucrative AirBnB opportunity here…

“I remember reading a book on the Dutch tulip bubble and could only shake my head thinking that people were trading property, jewels, and other VALUABLES for what amounted to a basic plant”

Good book Doc! There is such a distorted sense of value in CA. People are willing to trade what is of REAL TRUE value (like family and children) for a crapshack. They are willing to trade a good lifestyle, free time with loved ones for a crapshack. Such an upside down world!!!!….

It was actually a variation of a tulip that attracted the runup in price. Hybrid colors and such. So the bulbs were traded like stock which could buy you a house. Sounds like SF for sure.

It was like fine art is now. Leonardo and Vermeer only became art superheroes in the last 100 years. Warhol and de Kooning and Stella are going to be forgotten in 100 years. (But jackson pollock will live on wherever there are house painters.)

But in the meantime if you have millions you can make millions trading in fine art.

“…no death in prop w/in last 3 years.”

Oh my goodness! In California, is it the law that only deaths connected to crimes be disclosed in a sale or also natural deaths occurring in a home? I noticed the bars on the door of the neighboring property which made me wonder if it was a crime.

In CA, any death whatsoever that took place in the previous 3 years needs to be voluntarily revealed to potential buyers. There was a suicide in our house 6 months prior to purchase, and even though she was officially “declared” on the way to the hospital, they told us just to be on the safe side of the law. And yes, it’s mildly haunted. We don’t mind.

Thanks so much for explaining that! That is very good to know. Mildly haunted?!! Do tell more!

You’re welcome!

Mainly lights turning themselves on or off at the wall switch, and knocking on furniture. It has been quiet for a long time – only one experience in the last year. It was creepy the first few months, not knowing what to expect, and I told my wife “if I see an apparition, we’re outta here.” It never escalated and we got used to it, talking about her like she was a roommate, since we know her name.

This is coming from an open-minded skeptic. I had to explain to a babysitter that the upstairs bedroom door slammed shut by itself because all the windows were open and it was windy outside. I completely discount excessive creaking noises, along with the dog staring at empty corners and growling, even though those events happened as well. Too many possible rational explanations for them.

However, wall rocker switches don’t change position by themselves 🙂

I used to live in SF…what seems like ages ago. I can’t believe that area is even still referred to as SF. It’s way, way out there.

Exactly what I thought. You may as well be in Daly City. In fact DC might be better for ease of getting downtown. That is the boondocks and though it may be SF on paper — it is psychologically a long ways from SF.

Is that a desirable area of San Francisco? If so, $186,000 sounds like a good deal. I might pay it and more.

I’ve seen a tear-down in Santa Monica, north of Montana, listed for $2.9 million. Nearly $3 million for a tear down.

I saw a tear-down in Santa Monica, north of Wilshire (but south of Montana) sell for over $1.3 million.

Compared to those tear-down prices, $186,000 is a giveaway.

No it’s not. Read my post above for details. It takes hours to get to the true SF of North Beach, The Marina, Embarcadaro, etc. No BART. Just a terrible location that was lower middle class not that long ago.

You must have been away from SF too long. The house is a block from an M-Ocean View metro stop. More like 45 min from downtown SF, not hours by any stretch.

You’re right though, that it isn’t a particularly great neighborhood, but it isn’t a slum, either. It’s still lower-middle class with a few Google-types moving in.

That was $186K over asking price.

Realtors are successfully selling the idea that Inglewood home prices will skyrocket, thanks to the coming football stadium.

On Wednesday’s Gary and Shannon Show, on KFI-AM, Shannon (who started as a radio journalist) was “reporting” that Inglewood home prices will soon skyrocket. As a source for her “news story,” Shannon quoted realtors — and on one else. She did observe for the audience that realtors are biased. Shannon treated realtors as if they were experts on the RE market, rather than biased participants.

The Argonaut newspaper has also picked up the story. They too are reporting on the coming gentrification, prosperity, and desirability of Inglewood, due the coming football stadium: http://argonautnews.com/first-and-goal/

From the article:

Westside real estate broker Monica Trepany, head of Playa Realty, said Inglewood is positioned for a new era of prosperity that could influence Westside property values as well.

“The stadium will be an additional asset that will bring in more revenue and more tourism. Housing prices will likely go up [in Inglewood], and there will be a stronger demand for housing. And that could have an impact on housing in Westchester, but how we don’t know yet,†Trepany said. “But it is definitely going to make a very favorable impact in Inglewood and surrounding communities.â€

Venice real estate broker Tami Pardee, founder of Pardee Properties, said the new stadium could generate even more interest in Westchester, Playa Vista and Marina del Rey — even after a 22% increase in property values last year — and bring long-overlooked Inglewood into the fold of the Westside success story.

“People like to live near the home team if they can. It’s a connection that they enjoy, and because we haven’t had a professional football team for so long we’ve been missing that connection,†Pardee said.

Sounds like another Realtor who is a member of the “Every day’s a great day to buy a home.” set. Too bad the scat he’s selling is completely false, As this recent article points out, stadiums are often negatively correlated home prices, particularly if you live too close to one:

http://www.marketwatch.com/story/does-having-an-nfl-team-in-your-city-boost-housing-prices-2016-01-21

A new NFL stadium is guaranteed to accomplish two things…make the owner of the team far more wealthy, and stick the bill to the local residents who were foolish enough to approve the handouts.

i was going to post the same thing,

I’ve not read up on this scam but is the local population going to fund another stadium for a billionaire?

i sure which i could get the city to build me a new building ….imagine how much more competitive i could be.

I have no idea why a stadium would raise home values in the nearby area. Ever live near a stadium? It’s fun having traffic jammed before and after games and all the parking problems that go with it.

Stadium, No-Stadium, Inglewood is still ghetto.

Its not just the stadium, its the mixed use development, upscale hotel, restaurants, park with artificial lake that is planned with the stadium that has people thinking this way. Plus you have a new light rail line that will open up less than a mile away. So its not suppose to be your typical stadium just surrounded by a sea of parking spots.

I recently read an article in the local South Bay paper regarding the Rams move and RE prices. While the stadium and other venues may be good for Inglewood. The South Bay will also benefit nicely. Players, coaches, executives, staff members, etc will all be looking for new places to live. I highly doubt any of them will be looking in Inglewood. Many will be looking in the South Bay beach cities for homes. Just more competition that will likely drive up prices.

These realtors and newspapers are all smoking hopium.

There are 53 players and roughly 25 coaches on staff. The front office and back office on an NFL team adds about another 125 people. I would ignore the game day stadium staff as those are mostly low paid (i.e. minimum wage) part-timers. That means an NFL team is bringing about 200 people on board. This will hardly make a dent in the South Bay real estate market.

Toyota leaving Torrance for Dallas is taking 3,000 South Bay jobs. Factor in the ancillary ripple effect, this means that those 3,000 Toyota jobs is really affecting 6,000 to 9,000 total net jobs.

According to this report, there’s no reason to believe the stadium will do anything for home prices: http://la.curbed.com/archives/2016/01/nfl_stadium_inglewood_housing_prices_rents.php

That should be: She did NOT observe for the audience that realtors are biased.

The higher you fly, the harder you fall.. this will be a space shuttle free fall.. Im surprised they didnt try to push that suggestion of a lawn as acreage

A couple years ago, I was reading some blog (can’t remember) where someone described the moment they decided to leave SF. The person was walking with their young child down the stairs in front of their home, and encountered a discarded used s*x toy laying on the sidewalk. Their child saw it and asked, “What’s that?”

“discarded used” or “experienced and available”? The glass is half full.

I live in San Francisco, the way I see it. the median household income in SF is about $75 grand (Santa Clara 93, East bay 72 etc). So most households can not afford a typical SF home ranging from 1 to 2 million bucks. But dual income tech workers will be making between 200-300K which puts them just in the ball park of buying a 1-1.5 million dollar home.

On another note, the percentage of foreign, all cash purchases ranges between 20-30%. So it seems, tech workers and the Chinese all cashers are the only thing keeping home prices from tanking.

Even with the stock market tanking, it seems to be business as usual for bay area startups because the money is still flowing in for them. Let’s see, most startups choose to stay private for much longer than in the past, whether they can continue to do that in 2016 is an open question. Aside from Yahoo, there doesn’t seem to be any big tech on the verge of folding either. Will any of this change in 2016? I don’t think so, but it might.

Then there are the Chinese all cash purchases. China is the titanic and it’s sinking fast. More and more Chinese will be exiting a sinking ship to park/launder their money in US real estate. That’s not going to change in 2016 either.

So, overall, housing prices will probably plateau in 2016 but there is no indication that they will drop or tank.

I thought that there’s an investigation now when it comes to all cash housing purchases from foreigners?

@RL: Only for select cities. https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwjw68ryitfKAhXEbT4KHZYEBU4QFggdMAA&url=http%3A%2F%2Fwww.nytimes.com%2F2016%2F01%2F14%2Fus%2Fus-will-track-secret-buyers-of-luxury-real-estate.html&usg=AFQjCNGZj5iS7KI9TIYbQzGMnmaR2ONAXA

Those non-sustaining unicorns have to continually get funding from private investors or from financial institutions. Uncertainty, rising interest rates, and the faltering global economy are already constricting lending. Some that went public for financing have already lost close to 50% of their value. Don’t believe that private lending isn’t going to be affected.

Sure, Chinese investors will want to escape their economic Titanic by pouring money into real estate. But we all know that it’s equally unsustainable as the outflow will be cut off by either their government or lack of funding from their faltering economy.

Those Chinese investors better also bring enough cash to cover the property tax and utilities for future years. Insurance and maintenance can be ignored, but not the tax man.

I’ve read — on this blog, I think — that China doesn’t have such high property taxes. Many Chinese buyers are unaware of the high tax bills California has in store for them.

That’s one nice thing about rich foreign buyers. They will contribute mightily toward our tax revenue.

Let’s hope so! It is really difficult to get an accurate picture of tech in the bay area because of the pervasive and arrogant cheer-leading mentality in the tech media that perpetuates a system that looks a lot like a ponzi scheme designed to keep founders and their friends employed while enriching investors and their friends. As someone who works in tech, it’s not about great ideas anymore but rather having any idea and spinning it such that you can retire once your company sells or IPOs to suckers who buy into your idea. Because of the amount of easy money sloshing around everywhere and the how dirt cheap it is to rent compute facilities in the cloud, unfortunately, companies and zombie companies can exist for years without having to sell or IPO.

I hope you are right, and 2016 is a day of reckoning for startups, unicorns and tech companies alike. California is a boom and bust economy and silicon valley is no different, every seven years or so the trash needs to be sweep aside to provide semblance of sanity (desperately needed in housing) in the overall economy.

Castro street, the main drag in Mountain View where Google is, has tons of wierd little startups with lots of x’s and y’s in their names, high end boutiques where people buy fake “antique” signs and shit, and the bars were all crammed. I ended up eating raw fish on rice next to a gal who works for Google. The place just has this boom town feel.

I honestly don’t know where the money comes from. I didn’t know yahoo was still around until a few months ago. Apparently it a sort of news page for people who don’t want their friends to see them using drudge report. It’s not better than drudge report. I use Google like we all do, but I don’t give them any money. I sureas hell don’t use any of these new mommy-replacing services that 20-somethings think are changing the world.

On, I forgot to mention I was there last night.

What will these kids be called after the who!e thing crashes down? Bubblettes?

About to end. Twitter is bleeding and the Unicorn field is about to be thinned by about 90%. RE will come down since it’s the Unicorns paying programmers 250K a year that have been the primary drivers in its rise. Did you know Polyvore was about to completely die off when Yahoo rescued it? Why would yahoo do that? Polyvore mgmt. went to the same schools and worked at Google like MM did.

http://www.businessinsider.com/seth-klarman-on-unicorns-2016-1

Speaking of scams, how about Wall Street CEO’s? They borrow recklessly to shore up the value of their stock (and their own compensation) instead of re-investing into their company.

Anybody making 200-300k, has no business buying a 1 – 1.5 million dollar home.

For a long time the national norm was 3X annual income. California climbed to something like 5X annual income, and in the last bubble it was 10X annual income.

@Alex in San Jose,

The whole home prices should be priced at 3x income is based on when interest rates on a 30 year mortgage were 9%. With interest rates on a 30 year mortgage at 4%, the multiplier becomes 6x income. The monthly nut (except for property taxes) remains the same. This is the joy of asset inflation brought to you by the Federal Reserve banking cartel.

“So, overall, housing prices will probably plateau in 2016 but there is no indication that they will drop or tank”

damn, that is almost word for word the same shit i read in 2006.

now i’m convinced, the top is in.

Well reporting from Silicon Valley. Even with the slow end of the year 2015, and the Shenanigans of the stock market and Oil @ $30… everything seems Business as usual here. This new year is taking me an average 45 minutes to get home from work (10 miles) it’s up from the usual 25-30 in the past. Tons of commercial offices along the way my commute have been completed just last year and apparently they’re getting company tenants because is the worst damn grid lock I’ve seen since 2007.

**sigh**

Job openings…

http://www.largol.com/2016/01/06/companies-with-the-most-job-openings-san-jose/

It’s impossible to live here anymore.

My shop is just off of Brokaw and the rush hour traffic is nuts.

F#(#*#* @#*#*#*! I made an offer with 50% down. It was a “strong offer” according to my agent and the only thing that was stronger was a cash offer.

Well guess what, someone made a CASH OFFER.

congratulations!!! you my friend dodged a bullet and if i was you i would send the new owner a thank you card, but wait until the fall, when the reality hits.

Wait a couple years, you’ll be able to buy the whole thing with what was once a 50% deposit…

I’ve been waiting for a while. Home prices aren’t dropping. Maybe after the market crash?

Really hope for prices to “pop” to 2012-13 levels.

Saw this story that looks relevant. I see some stories that say the opposite, that the drop in Chinese stocks is going to cause even more money to flow into US real estate which doesn’t make any sense to me. I think the wealth effect of a high market has pushed higher housing prices for US tech workers, retirees or near retirees, and Chinese buyers. With the drop, people are going to hunker down and cling to available cash. I am assuming this will trickle down to impact other housing markets too.

http://abc7news.com/realestate/chinese-stock-market-woes-impacting-bay-area-real-estate-market/1170524/

I wouldn’t be surprised that wealthy investors would all simultaneously rush for the exits to create what would amount to as a blow off top for U.S. real estate purchases. As the term suggests, this action can’t be sustained.

From your article, Tunney must either be dishonest, ignorant of history, or practicing cognitive dissonance. “Real estate is a very solid investment that the markets can’t take away from”? Pleeeeease.

I’m not seeing any influx of Chinese investors. Most of the people here in Orange County buying “Cash” are Vietnamese Americans.

I was renting the upper half of a house in Franklin Village in Los Angeles 5 years ago. I looked at a house one block over that was for sale during the tanking market. The realtor and my wife often talked and she kept urging to bid whatever, but I was unsure of my job at the time so I didn’t.

It was a two story colonial. Great bones, very livable even without renovating. It ended up selling for $600k. Since then the house has been sold once more, then bulldozed and now is for sale as a vacant lot for $2.2mil.

So in 5 years, it has gone from 2 story house to no house at all and up $1.6mil in value? Yeah, there’s nothing wrong with this housing environment. No bubbles here.

That’s awesome! Can’t find a more shining example of the insanity of the housing market than this. Maybe the owner should turn it into a superfund site!

There is a house 4 doors down from me that was bought for $640k and demolished last spring. It was rebuilt with almost 1000 more square feet and listed at $1.27mil. It has been for sale for 55 days and had 3 open houses that I know of. Yesterday, they upped the price to $1.37mil.

It all makes sense to me.

This Redfin HOT HOME looks like a crack den: https://www.redfin.com/CA/Los-Angeles/9322-Sophia-Ave-91343/home/5721472

In the northeast Valley (a rather dumpy area), a Short Sale, selling for $460k. Looks like a tear-down. I don’t see how Redfin can justifiably call it a HOT HOME, which means that it’s a great deal that won’t last long.

The San Francisco tear-down sold for $485k but looks like a much better deal than this Valley tear-down at $460k.

son of a landlord, a Redfin “HOT HOME” designation does insinuate that the property is a good deal by any means. A “HOT HOME” designation has nothing to do with price, it does mean that the property is getting a lot of traffic and is being “Favorited” by a lot of Redfin users in a very short amount time. This generally leads to the property selling quickly. Just FYI.

The difference between past bubbles and today is that in the past once the bubble burst, prices collapsed. Today, when the bubble bursts and prices collapse, the government, The Fed, the media, all sorts of alphabetical national and international agencies intervene in order to circumvent the free market from doing it’s job.

Look, it isn’t rocket science. The governments of the world, corporations and individuals are awashed in debt. The only way to get out of the debt trap is to inflate our way out of it.

The people on this forum can keep yelling that prices don’t make sense, prices will collapse, reversion to the mean, etc. But that won’t happen because in today’s world, the few have the capability to control the many.

You count my words. In the next financial crisis, the greed politicians and governments of the world and the central banks will introduce negative interest rates. That is one way to keep this financial insanity perpetually going.

I am afraid that you are right, Nimesh. There is no such thing as a free market capitalism. The super rich will always have a bigger voice than common folks. They are the ones who benefit the most from this low interest rate environment. We all know that the trickle-down Reaganomics doesn’t work. Yet, the Fed continues to keep everything inflated. Before we all blame China for this market meltdown, we need to examine ourselves. U.S. debt continues to mount. The Fed continues to print money like crazy. True, China also has debt. The difference is that China can afford to bail themselves out because they have enough reserves and we don’t. Eventually, American taxpayers will be paying for all this fancy quantitative easing shenanigans.

forget negative interest rates…….it’ll be bail-in’s, it’s already in the cards.

Something has to give. The Ruble vs the dollar is at superlows. British pound sterling vs the dollar is really edging down. Making it more costly to visit for tourists. (Although my UK friends have some dollar exposure).

______

17 hours ago

Wow! Ruble at 84 to the $.

–

Bloomberg Business â€@business Jan 20

BREAKING: Russian ruble weakens to record low against U.S. dollar

—–

Not that I have any plans to go to Russia (whatsoever), but you can get a 50% discount on a capital city by currency plunge alone, over the past 12 months!

I suspect two forces in play. Mad bubble influx of foreign money for ‘safety’ of US at insane prices, but there has to be a recoil. Oil values, disinflation… the real-estate prices in SoCal are insane against wider unwinding. When the SoCal SuperBubble does pop, there can be no sympathy for SoCal real estate owners who regret not coming to market to cash out into the big money sooner. Greed and complacency.

That makes a ruble worth just about a penny, or a Brit penny anyway.

Check out this hoarder house in Berkeley:

https://www.redfin.com/CA/Berkeley/2284-Bonar-St-94702/home/712466

Wow

Blame Yellen and her useless minions. I would be pissed off if they resort to negative interest. I am not paying the banks to hold my money!

Wife and I found an affordable condo, recently dropped to 300k, my realtor calls and inquires about seller motivation etc. Their realtor said they have a 330k offer on the table so we best make the highest offer we can… lol. This was Saturday. As of today, it is not pending….

Why would they drop the price from 345k to 300k while a buyer offers 330k, then why is it still sitting there with no “pending” offer…

The only thing I can take from this is that their realtor is BS. Any input? Wife really wants the condo…

If you can afford it and think that it is a good buy, then do it. If not, don’t. I don’t think that anyone here can offer you advice. As for moi, I would walk away because I feel that real estate is super-inflated since 2009. The majority of buyers who are in the market are either flippers or investors. They are looking for an easy flip or as a mean to live/own the American Dream. These people are buying off of each other. Most people that I know already sold their property and moved to another state or city where they can live comfortably without having to pay 40-50% of their monthly income for a place to live.

We were tricked the same way when we bought in 2014 our condo…Listing was for $379K. Qw offered $395K. Agent kept telling us they have better offer….we bought condo for $425K. Seriously…..there was no better offer than $405 may be…..but we could not take a chance and really needed place to live and raise kids. I feel pissed to overpaying, but feel relieved from paying rent. My advise: offer $315 and stick to it.

Are you kidding me!?! How can someone possibly pay that price? Unless with a years worth of work you can double your money, which is probably the case.

I just can’t justify to pay that when you could get an entire acreage, WITH a house for that price. HA!

Great find!

Ashley

Ha-ha, whoever bought it back then got the last laugh! Evidently, the info posted here was not accurate. Look up the place on zillow. The house has 5 beds 4 baths 1,712 sqft and it was sold in 12/16 for 980K! Granted, I have a hard time picturing 5 bedrooms and 4 bathrooms given even this square footage, unless the bedrooms are little boxes, but that’s the way it’s described. It sure looks immaculate, though. You’d never guess it was a tear-down less than 1 1/2 years ago.

Leave a Reply to WestsideGuest