The road to American serfdom via the housing market: The trend towards renter households will continue deep into 2015.

If you bought or rented in 2014 a larger portion of your income went to housing. Rents and housing values are quickly outpacing any pathetic gains to be had with wages. With the stock market at a peak, talking heads are surprised when the public is still largely negative on the economy. Can it be that many younger adults are living at home or wages are stagnant? It can also be that our housing market is still largely operated as some feudal operation. Many lucrative deals were done with big banks and generous offers circumventing accounting rules. This works because many perceive they are temporarily embarrassed Trumps, only one flip away from being a millionaire. Why punish financial crimes when you will likely need those laws to protect your gains once you join the club? The radio talk shows are all trying to convince people to over leverage and buy a home because you know, this time is the last time ever to buy. Yet home sales are pathetic because people don’t have the wages to support current prices. So sales drop and many sellers pull properties off the market. You want to play, you have to pay today. Rents are also rising and this is where a large portion of household growth has occurred. 2015 will continue to see housing consume a large portion of income and will lead many into a new modern day serfdom.

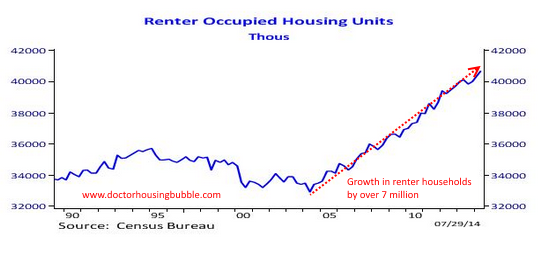

The gain of 7 million rental households

Over the last decade we have added 7 million renting households. Is this because of population growth? No. This trend was driven because of the boom and bust in the housing market. Investors crowded out regular home buyers in buying single family homes and now, we have millions of new renters out in the market. Many of these people are folks who lost their homes via foreclosure.

Take a look at the obvious jump in renters:

For better or worse, homeownership is a path to building equity. It is a forced saving account for many. Most Americans don’t even benefit from the stock market peaking because nearly half of the country doesn’t even own stocks. And many own only a small amount. Most Americans derive their net worth from their primary residence. With fewer buying and more renting, I doubt that on a full scale people are suddenly buying stocks for the long-term. But it is also the case that many are simply renting because that is all they can afford. Many young Americans have so much debt that this is all they can pay. Think of places like San Francisco where jobs pay well but rents are simply out of this world and home prices are nutty.

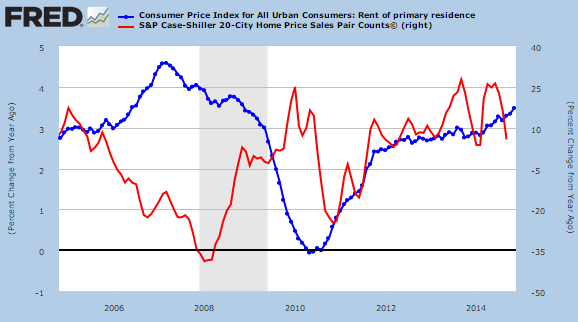

Rents more stable versus wild housing prices

Thanks to low rates, generous tax structures, and the American Dream marketing machine home values are operating in a casino like environment. This wasn’t the case in previous generation but take a look at fluctuations in rents versus home prices:

A crazy year for rents is when rents go up over 4 percent year-over-year. For home values we routinely had year-over-year gains of 25 percent in the last 20 years (including the latest boom in 2013). Rents are driven by net income of local families. No funny leverage here. But with buying homes, you have investors chasing yields, or loans that allow tiny down payments for buyers but then tack on a massive 30 year mortgage with a monthly nut that seems reasonable but only because of a low interest rate. Some of these people have no retirement account yet take on a $600,000 or $800,000 mortgage without batting an eye. So what we find is this psychological shift where some that want to buy are convinced that they need to start at the bottom of the ladder and pay an enormous price tag just to get in. To move out of serfdom, you have to embrace the cult of Mega Debt.

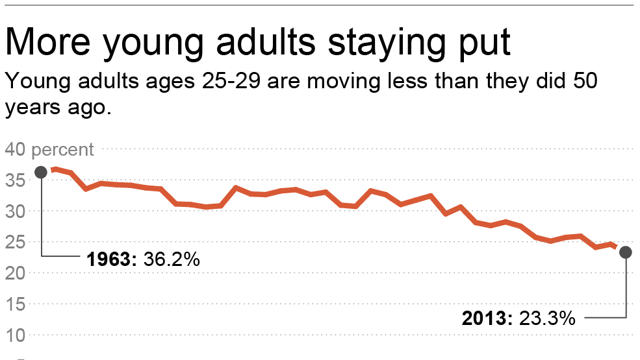

Young adults more likely to stay close to home – and rent

Young adults are facing the biggest impact of the housing crunch. Many are living at home because they can’t even afford current rents. Those that do venture out, will likely rent as their first step. A recent survey found that many young adults are planning on staying local. Say you live with your baby boomer parents in Pasadena or San Francisco. You want to buy like they did but good luck. So many have their network within said community and will likely rent (or live with mom and dad deep into their 30s and 40s):

I found this data interesting. People are simply moving less from their home area. So this will create more demand for rentals in these markets. In California, we have 2.3 million adults living at home. Pent up demand? Unlikely. The main reason they are at home is because of financial constraints. These are people that can’t even afford a rental. I’m sure this trend is occurring in other higher priced metro areas as well.

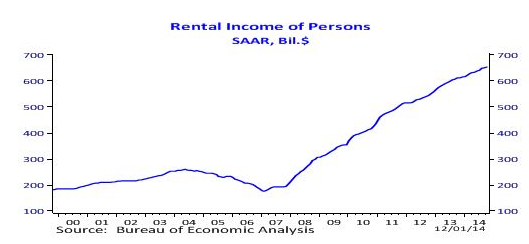

Rental income soaring for investors

Rental income has soared since the bust happened. The biggest winners? Those who bought properties to become the new feudal landlords. You can see by the below chart that there was a larger concerted effort to consolidate rental income beyond the mom and pop buyers of former years:

Serfdom is also occurring to many households buying. They are leveraging every penny into their mortgage payment. Think you own your place? Try missing a few payments and become part of the 7 million completed foreclosures since the crisis hit. 2014 simply saw more net income going into housing. Is this good? Not really since housing is a dud for the economy unless we have new construction being built but that is not happening on a large scale. 2015 will likely see this continuation of serfdom via renting or buying but at least you might save a few bucks with lower oil! The road to serfdom apparently runs through housing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

75 Responses to “The road to American serfdom via the housing market: The trend towards renter households will continue deep into 2015.”

Nearly everyone believes that jobs are good and full-time employment is better. As long as this remains the case, we need to keep various sectors of the economy ridiculously bloated to keep alive the dream of lifetime employment. Such employment is a form of servitude depending on one’s perspective, but it is the direct result of the values and beliefs that we live by.

As fewer and fewer people are needed in essential industries such as agriculture and consumer staples, we need to expand elsewhere, whether that’s healthcare, education, law, government, banking, the military, housing, or welfare.

Here in Las Vegas, home prices appear to have adjusted to the maximum that people can afford. Maybe that is to be expected, barring total economic collapse, but it was surprising to see the willingness of people to jump in and pay double for the same type of house in the same neighborhood compared to only a year ago.

This sort of thing happens with stocks because people are hoping for the 10 bagger or 100 bagger, but with houses?

I think we are more or less stuck with serfdom as long as we view working as a virtue. There is a German filmmaker who recently came out with a documentary called “Frohes Schaffen”, in which he depicts work as the religion of modern society. However, I haven’t heard anyone propose economic reforms that encourage people to work less. I don’t see any other way to keep a lid on all the needlessly bloated industries.

If you have no dependents you can afford to work less and not live in expensive school districts

“work as the religion of modern society”. No it is very Germanic. Remember the sign, Arbeit macht frei ? German society is very different than southern California society. The twine shall never meet, like East and West.

Work and jobs are outdated ideas in which the working proles and middle class are still brainwashed into believing. Kind of like a white bearded guy and streets in heaven paved with gold! Americans don’t need more jobs, higher wages, etc! Americans need and deserve WEALTH CREATION! Americans need to be bought into the, and given a bigger slice of the investment pie! Stock options, commercial real estate, land, tangible assets, I.E. CAPITAL! Supposedly a capitalist country can’t manage to spread its capital around to everyone. Capitalism for the rich and fascism for the poor! Instead paying McDs employees $15 an hour they should be given stock options. Not crappy 401k contributions but real shares of the company stock. America needs a 21st century homestead act. Anyone with a feasible viable business idea should get the help they need from the govt and Banks. Tax breaks, free land, huge discounts on commercial real estate. But our country exists for one purpose to fill the coffers of the rich elite.

>> Instead paying McDs employees $15 an hour they should be given stock options. <<

Interesting idea, and perhaps not without some merit.

But many McD employees likely can't do basic math, let alone understand stock options and financial planning.

I'm not exaggerating. I read a news piece many years ago, reporting that fast food retailers were replacing numbers on cash registers with pictures of the food. This was because so many of their employees were functionally illiterate.

What is wrong with so-cal surfdom? Wax the board, paddle out, take off, snake some valley kooks and all is good! I am down with so-cal surfdom…

Well, I don’t remember all of my 2014 predictions but I think I missed on all of them.

I think I predicted dow at 20,000, NASDAQ at 5,000 (or was it 5,500) and I have no clue what my S&P prediction was(most likely in the 2500 – 3000 range). I think I missed the housing increase as well (don’t recall the prediction but I am convinced it was a miss). The good news is that I still made money with my incorrect predictions and that is all that matters, right? I will run my mythological “economic” models and reveal my 2015 predictions in the near future… 😉

Don’t forget cash is trash and QE forever.

“Get him a body bag. Yeahhhh.” Grantham of GMO seems to believe the Fed will oversee a ‘fully-fledged stock-market bubble’ with S&P 500 going over 2250 and from there on, some serious declines possible, or, ‘reverting to mean’. Value investors “will win in the end†even in “our current congenitally overstimulated world.â€

Anyway this entry leaves me feeling cold on the charts and data. It’s really tough going. Financial repression for me, but I certainly have no sympathy for those buying real estate into it. Is there any segment of the rental sector weakening yet? eg: higher end?

Comment found on other house price site the other day:

_____

When I do buy my cheap house in a year or so when it really bites I will behave like Lex Luther with a deposit. I am unsure yet as to if I will wear a victory cape but I will be an effing monster and they will rue the day. Will I make an Realtor get down on all fours and bark like a dog to make a sale? If I do I will video it.

I wish I could remain magnanimous and humble but after years of being patronized by life winners racking up debt and Realtors who had the people skills of a hand grenade I’m afraid I will now become a spectacular c**t as I strut around viewings with a large wad of cash or maybe even enough to be mortgage free.

This collapse will be beautiful, no sympathy, nobody forced them to rack up debt. Finally the theft from the young can stop, the sale of debt slavery can end, TV wont be full of ridiculous property shows, and we can live in houses and work for a living – while the neighbours, who bought a similar house in 2014, beg me to be allowed to nibble my hedges for sustenance. At which point, I’ll hit them on the head with my cane.

What? Predictions or jokes…ha ha. I thought you were joking with your predictions. You are really bad at predicting the future but your sense of humor you add to this blog is priceless. I like it when you quote your Econ class, if we could only access the chapter on Econ 2.0 on crack.

Winners and losers.. that’s what this world is about.

Landlords are winning this round. I remember, in the early 2000s, when there was a glut of rental units everywhere. Everyone was offering 2 months free with 12 months lease.

Since 2008 there was a net negative housing addition. I believe natural housing “attrition” from fires, dilapidation, etc is about a million units per year. We have not been building at that pace since 2006.

This drives prices for real estate, and it drives rent up.

For those of us who took a little risk over the last 10 years and bought rental units, it’s great times. For those who spent their money on iPhones and pot, instead of investing or saving sucks to be you.

What does it have to do with feudal landlords? In US everyone can make enough money to buy your own home, if you did not, you are either lazy or stupid.. or both.

Notice how deeply entrenched the work ethic is in our society? Some say, work hard, play hard. Others think it’s more virtuous to produce than to consume and blame those who consume too much. But the only reason there exists work for you virtuous overproducers is because those lazy and stupid overconsumers are paying you.

Workers in our society are angry at those on welfare because they ought to get off their lazy butts and work. I think they are dead wrong. Those of welfare are the honest, good people who promote the right kind of values by not working or by not working too much. Mostly everyone else cheats and lies to make money or spends more money than they have.

@Vegas, i am sure this was all tongue-in-cheek.

In all seriousness workers are angry not because welfare people don’t work, but because they steal money (with the help of IRS) from workers to support their lazy lifestyle. Aside from that that could seat on their asses all day and do nothing.

As of overconsumers – it’s their own choice. iPhones and pot and live at their parents or save up and invest.

In other words, you’re gloating because you had the foresight to buy based on the assumption that the government would enact the greatest financial (ongoing) bailout in history. You forgot to mention the real reasons for higher prices:

suspension of mark to market accounting

ZIRP

overspeculation

foreclosure moratoriums

toxic asset purchases by the Fed

So give credit where credit is due — we, the taxpayers — for your paper gains.

@Prince,

I don’t really care what the government does. My investing strategy is long term and is not greatly impacted by what they do. (By the way, I am pretty sure I pay a lot more taxes then you).

RE prices go up and down, stocks go up and down, just like any other investment.

Just be greedy when everyone else is scared and be scared when everyone else is greedy. I follow that every time, as to time my purchases, just gives a little more of an edge.

My whole point is – there is no serfdom, there is no “ruling class”. Anyone who wants to (and put forward effort) to own RE owns, everyone else rents and/or lives with parents.

Nobody forces anyone to do anything.

As I said, asset values have benefited from the greatest bailout in history in a very short period. You wouldn’t be celebrating your “cleverness” at this point in time otherwise. A safe long term view simply does not expect real estate prices to escalate at such exponential rates without real sustainable and supporting economic growth.

Notice I said *we taxpayers*. That means not just me, but my wife, my co-workers, and future generations. In other words, the benefits that you reaped from Fed and government subsidies are far greater than what you paid out by yourself.

@Prince

Asset values have benefited from fed policies (by the way, Fed does not use public money, in fact they return profits to the government – about $77bln last year).

Everyone who holds almost any assets over the last few years have benefited from it (aside from PMs)

Are you bitter that you have no investments? What’s your point?

“Everyone who holds almost any assets over the last few years have benefited from it”

Anyone who didn’t realize a gain from said holding of assets haven’t yet directly benefitted and only time will tell if they do so in real terms and to what degree most people do. If we’re contemplating the typical homeowner occupant, most people simply saw their balance sheets readjust to some degree. We may be able to argue that if comparable real rents rose with a net gain after adjusting for owner’s depreciation and expenses, there then exists an indirect benefit. Although if it takes the Fed’s historical intervention of massive proportions over the past few years to reach that which may normally be the case…other adjustments from that activity could have relative costs to bear. The jury is still out on this thing.

The homeowner still must sell to realize a gain, short of arbitraging leverage on their equity against some other investment. And then there’s the question of will they buy a replacement in the same marketplace they sold into, which is what most people do, thereby either using said gains and/or re-extending leverage, which in those cases is not necessarily a net gain.

Commodities have been slowly crashing since the Federal Reserve began the scale-back of QE. Maybe the Fed is content with allowing the world economy to correct this time. The oil states look like they will be hurting in 2015.

“@Prince

Asset values have benefited from fed policies (by the way, Fed does not use public money, in fact they return profits to the government – about $77bln last year).

Everyone who holds almost any assets over the last few years have benefited from it (aside from PMs)

Are you bitter that you have no investments? What’s your point?”

These are the negative effects of the Fed’s policies:

– Creating asset bubbles, which lead to eventually crashes, which then lead to the inevitable bailouts.

– Devaluing the dollar, which leads to artificial inflation of basic goods and services at a time when wages are stagnant.

– Finally, costing savers close to a quarter of a trillion in lost interest.

That $77B is a pocket change relative to the costs to taxpayers. BTW, who holds the most assets? That’s right, the top 1%. Hence, the benefits of the bailouts were and are still disproportionate.

I find your self-gratifying comments extremely ridiculous and ludicrous. I see that you’ve even resorted to taking personal shots at me.

@Mik

BTW, I find it amusing that you admitted to benefiting from Fed welfare while deriding others for taking welfare. l

Siggy: “Although if it takes the Fed’s historical intervention of massive proportions over the past few years to reach that which may normally be the case…other adjustments from that activity could have relative costs to bear. The jury is still out on this thing.”

What the Fed giveth the Fed can taketh away within the blink of an eye. Hence, the consequences of reflating a real estate bubble.

Mike thanks for hitting that nail on the head. I have never been able to understand people that think I can buy it and rent it to them but they can’t buy it and rent it to me.

you are vile

What is your definition of winning and losing? There’s a reason they don’t have trailer hitches on Hearses. I have a former friend who is worth about 100MM, was born into money, and still felt the need to take me for about 7 figures (along with others). What a winner, right? Several houses, etc . BUT he has had to erase himself from the internet, hide behind dummy corps, and over the 10 years I’ve known him he has had a fibulator in his heart, is now on psych meds, looks like he’s 60, (he’s 40), and is (was) always complaining. To me, he’s a loser. To people who only see the material world, he’s a winner. We all meet our maker someday. None of us can take our houses, equity and stocks with us. All that’s left is the truth of who we are, how we lived our lives, and what we thought about it all. I could’ve been a fabulously rich guy but the company I co-founded started ripping people off. I walked away. I’ll work till I drop but I don’t have to hide, I can hold my head high, and I can say the truth of me is integrity. To me I’m a winner. To the material world I’m a loser. Go figure.

Housing to Tank Hard 2012… I mean 2013… Correction 2014… Well, let’s try 2015… Jim, I wish you were right, but it’s far more complex ,or should we honestly admit sinister.

Interesting dynamic revealing itself. One of high resale cost, high rent, and ever-evolving tax structures. I predict change, but the unpredictable types. Perhaps currency deflation, or relative inflation, or market correction, but no tanking likely, just evolutionary (ie slow, yet impactful)

Say this to yourself over and over for clarity’s sake.

the game is rigged,..

the game is rigged,..

the game is rigged….

Chronic and Bud Light make life much more managable than a stressful house. Chronic is legal is Cali ðŸ‘😎

> Rents are also rising and this is where a large portion of household growth has occurred.

At these prices, I would rather (temporarily) pay more to rent, rather than buy at these prices, in my preferred low/mid/high prime locations. I won’t be crying if residential REITS plunge in value, with a stock market correction, for their investors.

http://seekingalpha.com/article/2708815-2-reits-for-the-california-dreamer-in-you

As the Prince stated, this time around I was massively fooled by just how all in TPTB went to prop up institutions and markets that should have fallen much further than they did. As they say, you can not fight the FED and the FED has shown it will do whatever it has to do to allow it’s members to remain whole or better yet, have a substantial profit. I have no idea how this will all eventually end / be settled, but I would not hold your breath that it will be anytime soon.

Average nut each US citizen bears of total USG debt = $45,000.00

Let that marinate for a while.

What difference does it make in this day and age? When we had sound money, that much debt would be problematic, but in this day and age it literally does not matter.

When it it comes falling down it won’t matter if we each owe 45000 or 19 million each, the response from world central banks will be the same.

Don’t worry, we will pay the debt with finely engraved Benjamin’s. Those presses will really hum. The Empire has the biggest military to make the subjects kowtow and accept the pictures(Benjamin was not a president, but a interesting fellow).

Minimum wage in Australia is 18.70

Minimum wage in the USA is 7.25

Just saying.

Increasing the minimum wage would in many cases be just transfer money from those who eat at McDonalds to those who work at McDonalds and similar establishments. At worst it is a distraction from the main cause of both inequality and the low level of economic growth which is the vast shift in tax burden away from to rich and onto everyone else. How could you not get a vast increase in inequality when you make the tax rate on the types of incomes that the wealthy receive such as dividends, capital gains and corporate profits much less than the tax rates on wages and make 99.9% of all estates exempt from the inheritance tax?

“..It is not just a coincidence that tax cuts for the rich have preceded both the 1929 and 2007 depressions. …. ….Equally unhelpful in terms of addressing the income and wealth inequality which results in the overinvestment cycle that caused the depression are various non-tax factors. Issues such a minimum wage laws, unwed mothers, globalization, free trade, unionization, problems with our education system and infrastructure can increase the income and wealth inequality. However, these are extremely minor when compared to the shift of the tax burden from the rich to the middle class. It is the compounding effect of shift away from taxes on capital income such as dividends each year as the rich get proverbially richer which is the prime generator of inequality…â€

http://seekingalpha.com/article/1543642

I’m from Australia but have lived in the USA for 10 yrs. Yeah the min wage if $18+ BUT dinner for 2 at a crappy Sizzler will set you back $65, a cup of coffee is $8.00 and gas is $5.20 a gallon. Basic compact cars are $25,000, clothing (made in Asia of course) is astronomical – $30 for a basic t-shirt, $100+ for a pair of Levi’s. The cost of goods and services has increased so much in the 10 yrs I have not lived there its mind boggling.

The unions and labor advocates have made everything so expensive inflation just runs madly behind to keep up. Not always a good thing to increase min. wage.

Good anecdotes. You can change the markings on the yardstick but that doesn’t change what’s being measured.

Interesting situation. We live in Northern Calif. Our 26 year old daughter abd heer boyfriend of 6 years live in Los Angeles. They are both architects abd have jobs locally. They rent a small one bedroom apartment in the Hiollywood area and split the costs. Although both have jobs buying home is totally out of reach for them. They are lucky to be able to save each month after expenses. Additionally, both are frugal. We, all of us, are now saving for adown paynet for a home int future. I could easily finance a home for them but what I see for the money is overpriced garbage. I don’t believe this market will stay in this grossly overpriced mose forever.

Unfortunately, the current trend is to grossly inflate home values. We saw this first hand when we sold our home in San Jose last July. It literally sold in minutes for $100000 more than asking. Foreign buyers with deep pockets are able and willing to pay. Some cities in Silicon Valley are over 90 Asian in population. We are selling our beautiful country to outsiders that, in many cases, have zero interest in America or our culture.

Where we live now there are numerous young to middle aged adults living with their parents in our neighborhood. I know many of these and in fact both next door neighbors have adult children living with them. The youg man on the one side works in an auto bodyshop and is barley making it with his parents help. The female adult on the other side is atotal loser and will always be a leach and she is atrained nurse who can”t hold a job. The parents don’t get it or don’t want to admit the facts. There are others around me with adults living at home. One man, who lost his wife some years ago, has his looser grown son living with him. He has been seeing a nice lady and wants to get married but she’s smart enough to know it won’t work with the son living with them. There are other adults living with parents in the area and the few I have met are unimpressive and don’t seem to be motivated to move on. This adult living at home with parents phenomena is not entirely due to high rents. I too pray for low rents and maybe some of these ADULTS living with their parents will move on. I somehow think however that many are comdortable leaching off the parents…..

@Curt,

You stated your daughter is 26, so she’s been out of school for 3 or 4 years. It’s very uncommon for people that age to buy houses in decent parts of LA without major help from their parents. Most first time buyers that I know were in their 30s. That’s just how it goes here.

You also mentioned that your daughter and her boyfriend are both architects. If they are both gainfully employed, they likely can easily buy a house. The caveat is they likely can’t afford one in the area that they like. They are young, tell them to keep being frugal and keep saving. People who do this are rewarded in the long run. The dedication to save and sacrifice is what separates the pretenders from the contenders.

Two architects are financially strapped living in a one-bedroom apt? I guess architecture was a crappy career choice, unless they’re just starting out and have substantial future earning potential. If the latter is the case, then it would seem relatively insignificant if they struggle a tad bit for a few years until they earn the big bucks. My wife and I make between $130k and $160k or so per year (it fluctuates year to year), and we save plenty of money living in a decent condo in OC, even with one kid.

Regarding selling away our beautiful country, perhaps it is deserved. European settlers stole it from the natives, and we will have it bought/stolen from us. So it goes…

@Curt — You nailed it with the Asian invasion of the Bay Area. Not all a bad thing if you are a current property owner. Silicon Valley tech companies cannot fill the jobs lining up and they are looking to the East to fill the positions. This lame duck president has fast tracked the issue by loosening visa and immigration restriction.

Combine workers coming from Asia with the one million new millionaires per year in China that need to invest in the USA and where do you think they will invest?

The Chinese are by percentage the largest group of tourists to Pebble Beach. I see them every day by the busloads. 10 buses yesterday. They love California, this is their destiny. Hold your property, buy more Bay Area property if you can. This party is just starting.

As for the little guy, my kids for instance and the majority of their generation. Sorry Charlie, there are other regions like Texas and the South. California is headed for the Asian landlord and the Mexican tenant.

Please don’t help your daughter pay for a house. This is part of the problem with LA wages and house prices – mommy and daddy’s money. Without it, workers could get better wages and house prices would have to fall to income. When I worked in LA, a lot of my co-workers were supplemented by rich parents and these people were always used as the example of someone who never asked for a raise when the rest of us did. Out of the 10 people I know in recent years who have “bought” a house in LA, 6 of those were with parents’ money. The Chinese aren’t the problem, it’s the apron strings.

Are you for real? I can’t believe you wrote this.

“Please don’t help your daughter pay for a house. This is part of the problem with LA wages and house prices – mommy and daddy’s money. Without it, workers could get better wages and house prices would have to fall to income. ”

You are asking someone not to pass their wealth to their offspring so you will be able to buy your pathetic crap-shack and not have to compete with them. Give me a break. The majority of the wealthy in this country inherited it. That is the way of the world. Grow up, accept it, and blame your parents for not being wealthy. And stop being a cry-baby.

Long time reader of this blog, and have lived in So Cal six years (from Monterey County). We are renting a big, old, wonderful house in Sierra Madre for WAY under value (landlord loves us). Bad kitchen though and bad back yard. Being a renter I can’t fix those things and they really do make me a little crazy. Until recently we could fairly easily afford to buy, but have been waiting all this time for prices to come down. Well, just inherited Mom’s estate and now we can REALLY EASILY afford to buy (could put 50% down) – but – I’m so afraid there will be another crash. I don’t want to be paying for a house that just lost $200,000 in value, especially since we will probably be moving back to Carmel Valley in 5-10 (own a house there) – some of you are pretty darn smart here, any advice?

IMO, life is short. (depending on how old you are) If you really have enough money in reserve, so that taking that hit wouldn’t devastate you, and you found the “perfect” place of your dreams, that would make you ecstatic for the next 5-10 years, I’d go for it.

I think the Monterey County is likely going to weather these real estate ups-and-downs a little better possibly since it is not crowded as So CAL and maybe not as extreme on prices yet. Also the weather is not as hot as other areas from what I have seen and heard. Might be worth looking into owning if you can. IMO

Unless you’re a flipper, it doesn’t matter if the house you buy suddenly loses $200,000 in value. Short term, house values rise and fall. Long term, they generally go up.

So if you like the house and the area, and plan on living there a while, buy it and enjoy. Years from now, if you plan to sell, it will have risen in value.

It doesn’t matter if it loses value to the tune of $200,000 !? That is big money for almost everyone. And if it’s $200,000 mortgage debt you could have avoided by buying for less in the future, then it works out at around $400,000 or more over 30 year mortgage term.

You’re also extrapolating house price inflation from the modern era, in that it generally rises. Look at the 1930s, when it gave back all the gains of the 1920s and more. There is no reason why low-mid-high prime couldn’t have a serious long-term readjustment.

In the commercial world, at the moment I’m having fun watching 3 US vulture funds getting heated that their $550m investment in junior bonds might get entirely wiped out, after a year of losses, and another US vulture fund looking at buying senior debt, at a cheap price (the bank has invited bids), wiping out shareholders and junior bond holders. Some market forces are reasserting themselves.

If you’re buying a house to live in longterm, then no, it does not matter if its value rises or falls. The house’s living quarters remain the same.

Buy a house if you like the house, like the neighborhood, and can afford it. Then ignore its Zillow value. It no longer matters. It’s now a home, not a house.

Of course, I’m assuming the buyer is looking for a home, not an investment. I’m assuming the buyer is old-fashioned enough to want to pay off the mortgage — and not keep borrowing against the house by taking out new mortgages.

I am biased Pammy because I live in Carmel. If you already own a home in CV then you know the vacancy rate on the Monterey Peninsula is under 3%. I’d buy a rental here and find a good tenant. Meanwhile keep soaking up the SoCal sun in your great neighborhood paying under market rent. You are very fortunate all considered. Best to you.

“I don’t want to be paying for a house that just lost $200,000 in value, especially since we will probably be moving back to Carmel Valley in 5-10 (own a house there) – some of you are pretty darn smart here, any advice?”

Will you listen to your instinct or those with a vested interest in getting you to join their party? There’s a reason for why you’re here.

If your timeframe is 5-10 years – you buy.

There are way too many advantages of homeownership.

Even if there is no appreciation over the next 10 years (which is highly unlikely), you have tax write off, you pay off your mortgage, etc.

You can do your own math with upside and downside scenarios.

From personal perspective you make your home your own, unlike a rental.

the warmer parts of the us will get more immigration from north europe, canada, north asia.

what countries are in north asia?

Media thinks Millenials will buy in 2015:

http://money.cnn.com/2014/12/28/real_estate/housing-2015/index.html

Yeah, right!

Wealthy Russians are bailing out and the ultra high end is getting impacted.

http://money.cnn.com/2014/12/29/real_estate/russian-homebuyers/index.html

What happens if the Chinese bail out if their economy stalls?

Millenials might buy in other parts of the country that are lower priced, but I cannot see that happening, to any degree, in coastal California.

Many of my friends, late 20s/early 30s fear being left behind in housing and have or are looking to buy a house. These are well educated, from top tier university, people. These are people from both the bay and LA.

I too am in this group that fears being left behind, but the numbers tell me not to do it. It’s easier for me to not dive in because I live in a rent controlled area so rents cannot be pushed up very high. That being said, I want to be in a bigger place but the market is currently inflated.

The problem I see is there are many transplants and new buyers in the market (foreign investors) which has in my mind never happened before. The main issue I see is that the FED keeps lowering rates and additionally banks are allowing low down payments. This means it may be another 4 years for a market correction. Don’t want to wait that long..

“The problem I see is there are many transplants and new buyers in the market (foreign investors) which has in my mind never happened before.”

This time is not different. This has happened before time and again, what changes are the actors on the stage and their props, but it’s the same ol’ act and ending.

Sometimes I think it just takes experience and maturity to really get it.

I get confused because of silly reports like these – Housing 2015: The return of first-time home buyers: http://money.cnn.com/2014/12/28/real_estate/housing-2015/

As an in-between cohort of Gen X and Gen Y, what should I be doing? Is investing and renting the key or owning?

From that article…

“What they will find are much more favorable conditions than they have seen in years, including lower down payment mortgages, looser lending standards and a bigger selection of homes to choose from”

Sounds like what led to the last crash. If it crashes again…there’s no way to prop it up this time.

Don’t think so Nathan, rent is getting higher and higher, new standards will require stable job and money in the bank this time around. 3% down, 620 credit, 4%, 30 year, why in the world would someone who has to qualify for a quality rental anyhow not look into buying a home, when these standards take full effect in early 2015, a young couple or even a singe would be crazy not to at least take a look?

Nothing like your own place that pays down rather then making these corporations richer by renting a small apt with more rules then a prison.

But lending standards are still very very stringent. “looser” means a return to standards normal honest folk can actually meet; a far cry from the sub prime mess of a few years ago.

“Don’t think so Nathan, rent is getting higher and higher, new standards will require stable job and money in the bank this time around. 3% down, 620 credit, 4%, 30 year, why in the world would someone who has to qualify for a quality rental anyhow not look into buying a home, when these standards take full effect in early 2015, a young couple or even a singe would be crazy not to at least take a look?

Nothing like your own place that pays down rather then making these corporations richer by renting a small apt with more rules then a prison.”

If you consider Redfin a reliable source, according to their survey homebuyers aren’t having a problem with lending standards, it’s the price and what’s available for the price. If that’s truly indicative of the majority sentiment out there, will the reinstated 97% LTV product move the needle for owner occupants beyond the typical seasonal factors? If first timers continue to remain a historically small share of buyers, and Redfin’s respondents are correct that “not enough savings” and “can’t get a loan” aren’t significant factors, how could it?

It seems more likely that a young couple or single is saying “it’s the prices, stupid.”

http://www.redfin.com/research/reports/real-time-market-sentiment/2014/buyers-concerned-about-affordability.html#.VKMW18aFWrI

Tall Tales. Take it from a person who at 22 starting the buying and selling game at which there were many cycles of feast and famine.

I also was a landlord of commercial and some rental property so I know both ends. I retired at a young age and to this day once in a while see a good deal no matter what the experts say, a good deal is a good deal somebody always needs to sell.

With favorable relax lending standards coming if you have 3% down and a steady income take at look at a house in the best zip you can swing. Nothing like parking your car in your garage, close your door, and don’t have to answer to weird renters and lousy landlords or corp. owned rentals, WHO JUST AS EASILY CAN RUIN YOUR CREDIT IF YOU MISS RENTAL PAYMENTS, sorry I had to capitalize because renting is no easy bag either, it is fraught obstacles also.

“With favorable relax lending standards coming if you have 3% down and a steady income take at look at a house in the best zip you can swing. Nothing like parking your car in your garage, close your door, and don’t have to answer to weird renters and lousy landlords or corp. owned rentals, WHO JUST AS EASILY CAN RUIN YOUR CREDIT IF YOU MISS RENTAL PAYMENTS, sorry I had to capitalize because renting is no easy bag either, it is fraught obstacles also.”

I think what you’re confirming is that it comes down to the price in the end. Platitudes to the effect of where you park your car don’t pay the bills. A 1.5% down payment discount amounts to a few thousand bucks for most borrowers and contributes to a higher monthly nut. Is the problem that people don’t have that last few thousand bucks or is it that the monthly burden doesn’t pencil out as advantageous relative to the alternatives?

http://www.mortgagenewsdaily.com/12242014_millennials_rental_market.asp

“In the 25 counties where the millennial population had increased the most between 2007 and 2013 renting that three bedroom apartment in 2015 will require 30 percent of the median income but buying will consume an average of 36 percent.”

Maybe income does matter in places where the potential bottom pyramid buyers are increasing most. Interestingly, not one SoCal county is on that list.

Thanks Robert for your reply. I guess I’m on the right track, good credit score, at least 3% down, employed 7 years… Unfortunately most areas around where I live have outrageous asking prices $700K+. With kids now starting elementary school, the school district around where are live are almost off limits to the middle class (10s on greatschools.org).

I’m currently paying $1300 for rent. Who said rent couldn’t be cheap? After consulting with friends, people have mixed opinions. Some people think that I’m crazy for trying to leave and buy a house given my current living arrangement. Right now, saving up money couldn’t be easier because of cheap rent and good schools.

I guess I’m one of the more fortunate ones with this kind of dilemma.

robert – i think you should have left your assets to your kids in a living trust. the standard of living for your kids will be lower than yours

Interesting notes above. Both insightful as well as mean spirited.

Agreed. Until you sell there is no gain. The trick is to keep moving from one wealth parking place to another. The problem is that our retirements and homes are now tied up in this game that has been crafted for the wealthy elite.

The biological clock on the elder Millennials is going to go into alarm mode. Just in time to roll the next bubble. This will be fast and furious. And disastrous.

When it crashes lots of turmoil brewing will come to the forefront. If you think the election of a black president stirred up racial tensions just wait for what happens to newly immigrated vs born here when this thing crashes for real. 2008 was merely the warm up act to make everyone believe the worst is behind us.

And there is a premium on tech salaries in the usual suspect regions as well as newbies like Austin. That will be bloodbath.

Poster above calling for the DOW to hit 20k is spot on. It’ll likely happen in 2016. When it falls don’t fret locking in a “loss” at 18000 on the way down. It’s going below 10k. And then gold and oil will exact their vengeance.

Deities save us all.

It would appear that Californian’s will pay any price to live ‘the dream’! However for most, that dream is living paycheck to paycheck, barely being able to come up with the monthly rent or mortgage, barely making the minimum payments on credit cards, and sacrificing their futures to live for today! What a lifestyle to aspire to!

As rents soar and the supply of rental housing remains constrained, 2015 could be the tipping point, pushing more renters to home ownership.

While younger Americans may prefer the flexibility of renting, home ownership is becoming more enticing, financially. Fannie Mae and Freddie Mac recently announced new low-down payment loans, mortgage rates are still very attractive, and renting is just plain more expensive than owning in many metropolitan markets.

Shiller: `Correction’ in U.S. Home Prices a Possibility

Dec. 30 (Bloomberg)

Shiller & Greenspan

Video: http://www.bloomberg.com/video/robert-shiller-greenspan-on-u-s-housing-fannie-freddie-RzL7omGgQ32L06OZC~dPwA.html

____

The anchor guy in the studio asks what would happen if Franie Mae and Freddie Mac were no longer involved.. Shiller speculates prices would fall below construction costs (something I’ve seen in other countries… whilst noting construction costs themselves have also risen during bubble conditions, and no reason can’t fall back again… after all, what were construction costs in 1990s/80s/70s)? Construction costs can fall, just as as commodity prices can fall.

Shiller says people wouldn’t feel the same need for giant houses, but more modest quarters – that it’s the trend anyway. Greenspan acknowledges home ownership rates going down even as market prices been rising… reason he gives that an ever increasing number of single family units are now rentals. Says same reason people are eschewing home ownership is the same reason they are cutting back on capital investment. He highlights the discount rates applied to incomes, both imputed incomes and real incomes for far distant pay-offs are ‘extremely high’… can see it in the spread between the 30 year bond and 5 year note. Highlights single family construction only a 1/3rd of what it was in 2007.

_____

For me, I wouldn’t apply for any mortgage in low-mid-high prime, as prices too high and I expect them to fall.

From Today’s LAT.

Not sure if the link will work, so the article is below.

http://www.latimes.com/business/realestate/la-fi-case-shiller-stability-20141229-story.html

—————————————————————

Home prices climb, but slowly, back to late 2007 levels as 2014 draws to a close. Home prices tick up 0.7% in L.A. in October, according to new Case-Shiller data Stable is a good thing, economists say. And the housing market these days is pretty stable.

The Case-Shiller Index — which tracks prices nationwide and in 20 major cities – reported prices grew 4.6% in October compared to a year earlier. That’s the slowest pace since September 2012, but one which many economists say is healthier for both buyers and sellers than the double-digit growth seen this time last year.

From September to October, prices climbed 0.7% after seasonal adjustments are taken into account, though some economists say those adjustments are overly generous. Of the 20 cities Case-Shiller tracks, gains were strongest in San Francisco and Tampa, Fla.; weakest in Chicago and Cleveland.

In Los Angeles, prices were up 4.9% year over year, also the slowest annual gain since September 2012. Prices here ticked up 1.6% in October after being basically flat the last three months, and now sit at levels last seen in December 2007.

The report suggests that the housing market is hitting a good balance heading into the new year, said Stan Humphries, chief economist at website Zillow.com.

Soaring home prices are primarily coastal phenomena that have left the growing states of the American interior virtually untouched. The places that are building have little housing price appreciation and the places that have housing price appreciation are not building. Housing requires both…

“Housing definitely came back to Earth over the second half of 2014, and we welcome and expect to see more of the same as we look ahead at 2015. A slower-moving housing market is inherently more stable, more balanced between buyers and sellers and more sustainable over the long term,” he said. “We’re ending 2014 on a good note, and this momentum will continue.”

—————————————————————–

I dont think should be surprising to anyone, as many of the real estate economists (Bruce Norris, Bob Shiller, Nadeem Walayat, Logan Mohtashami, etc) predicted a +/- 5% increase in home prices for 2014. Their predictions for 2015 vary from flat to +4% for 2015.

Its classic precursor to deflation. Nobody buys because they are waiting for lower prices.

The old ways are new again http://www.cnsnews.com/news/article/barbara-hollingsworth/expert-another-housing-bubble-very-likely-if-we-don-t-change-our

Remember me? Just wanted to chime in and say that after buying my townhouse with cash in march of 2012 it has now trippled in price. Woooooooooooo!

Leave a Reply to Jed