The renting generation – homeownership rate for those 35 and younger continues to decline. Overall homeownership falls in spite of rising affordability.

Going to any open house in Southern California during a sunny weekend will make you think that the entire housing market is on fire and that the homeownership rate must be going up. Obviously with all these buyers, the rate must be going up. Right? Well it isn’t because a large number of these buyers will be absentee buyers or will flip the house shortly. Another bigger reason comes from the lack of supply. The maddening crowds are simply hungry investors and regular buyers trying to out-bid each other for the limited supply of homes on the market. Low rates are adding fuel to this mania but the homeownership rate continues to decline. So what gives?

Renting under 35

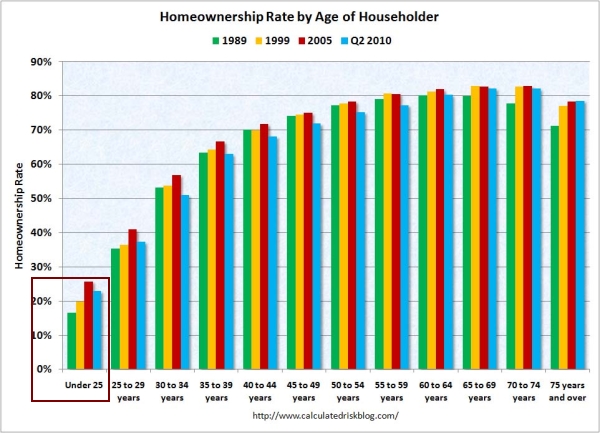

Younger Americans are having a tougher time buying homes in spite of the current prices in the market:

Homeownership rates for those under 35 continue to decline. This comes in the face of record low interest rates and record rates of affordability. But good luck trying to buy a moderately priced home in Nevada, Arizona, Florida, or even California for that matter where investors have swarmed like a California marine layer.

Recent data suggests that this trend is continuing:

This leads to a more important questions since the purpose of lower rates were to essentially help Americans to ride out the recession. Yet that isn’t entirely clear when it comes to homeownership. Investor demand in places like Southern California has been over 30 percent for many years now. That is a giant percentage when supply is so limited. It is clear that younger Americans are having a tougher time as well since many are deep in student loan debt and their wages are simply not keeping up with prior generations.

Homeownership rates by age

Every age range has seen homeownership rates decline but for younger Americans the fall has been rather dramatic:

The homeownership rate for those 35 and younger has fallen by 9.2 percent since 2004. Compare this with a drop of 3 percent for the entire pool of homeowners. For those 65 and older the rate fell by 0.7 percent over this period.

West coast homeownership

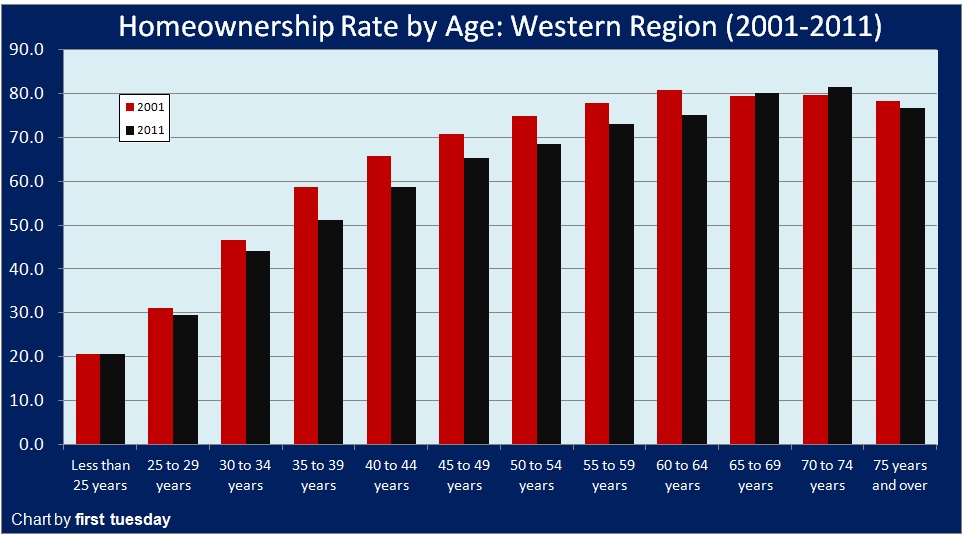

In states like California, homeownership rates are already low. The current homeownership rate is in the 50 percent range. Before looking at California, let us first look at the west coast:

What is interesting is that the only age ranges that saw homeownership increase in the last decade came from the 65 to 69 age group and the 70 to 74 age group. Every other age range saw solid declines in homeownership.

The California gap

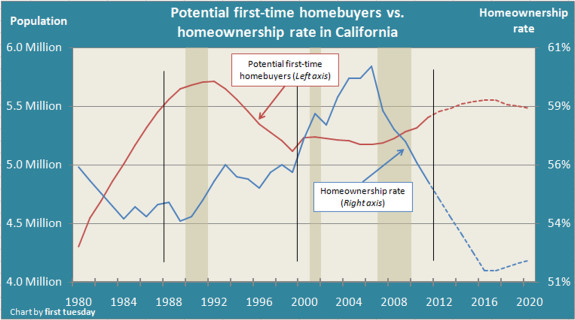

So with all this manic buying behavior, surely the homeownership rate is rising especially in California where prices are soaring upwards. Correct? Not exactly:

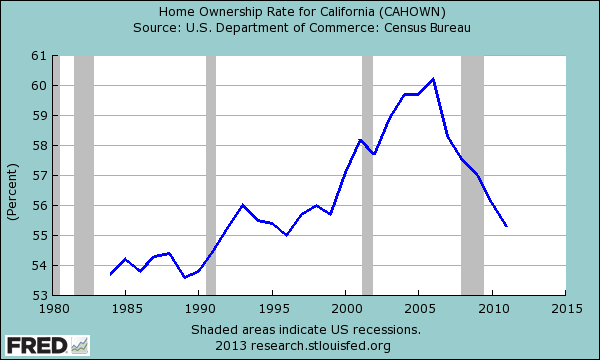

While the potential pool of home buyers may be increasing, the homeownership rate is decreasing overall. How can that be? For one, not many people are selling. Inventory is low. Second, investors are buying up a large pool of these homes. So this is why overall the rate continues to move lower. It is an interesting dynamic. This is why the homeownership rate in California looks like this:

Since our population hasn’t decreased, it is safe to assume that many more people have simply shifted to renting (Census data backs this up). Given current prices in many markets, it is a challenge for many young families to buy. The data supports this. Homeownership rates for those 35 and younger have fallen the most of any age range. Another important point to make is many of the properties that are purchased as rentals will be off the market for a few years, most likely. So instead of a more “normal†market where someone buys a home, but usually will list their home to add to supply, we have a case today where a home is brought to market, and then taken off the market with no subsequent addition to supply. If you missed the last housing mania and wished you had a chance to glimpse how it is to see a group of people go into a feeding frenzy, try an open house in Southern California during the weekend. The Wall Street hunger for rentals and easy money from the Fed are creating a big generation of renters.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

110 Responses to “The renting generation – homeownership rate for those 35 and younger continues to decline. Overall homeownership falls in spite of rising affordability.”

Average college grad has $35K in tuition loans. 25% of all tuition loans are in non-payment status. Assuming they get a job that pays above survival wage, it would probably take them until about age 35 to get into a mortgage.

The “average” grad around here is pretty screwed anyway. In areas where 45k gross you can live off (most of the IE?), the IBR payment on student loans is minimal or nil for a married couple. In more expensive areas (like the Bay Area), you need 65k+ for the same standard of living but suddenly owe more taxes AND 400-500/mo. payment even on IBR according to the calculations. This is because the federal poverty index it’s derived from is not adjusted for the higher cost of living (it’s the same for 48 states).

Add a flood of unqualified graduates (“unemployed? Go back and get a degree and you’ll be fine”), which have a poor employment rate even with a degree (MBA not what it used to be either), or at least there are so many that the employer can find plenty at a lower wage. I recall seeing something about enrollment increasing in recent years.

There is a threshold where it’s easier to just be a perpetual student (even if one has a job), avoiding the payments and continuing to borrow more. Some people use that to cover the gap in cost of living, to escape from poverty level wages as it gets harder and harder to survive. People that are “making it” but unable to really save for a house can just use student loan disbursements as a substitute mortgage loan on better terms (the higher interest rate is irrelevant with IBR).

However, what’s clear in either case is perpetual debt slavery unless you are at the top of the food chain; it’s just a matter of whether you let the debt bog you down or take advantage of the rules and entitlements. The more cash you can get before things implode the better options you will have later.

I am lucky; my job is more or less guaranteed for 3-5 years which is enough to survive with a bit of wiggle room (but not enough to get ahead). After a few years I will have plenty to buy a house for cash out of state, hopefully this is around the time things start to crash again and I can get more units.

My husband and I are 32, have no student loan debt, with decent jobs and we have never owned.

We are prequalified and have been looking/watching the market for years. We were finally going to buy this year until suddenly everyone else decided the same. There is no value in this market.

Even with our good jobs and no debt the numbers barely make sense for us.

The economy is totally broken for my generation.

I know what you mean,we missed a major dip and that will never come back! Word is telling us it’s a good time to buy,but the price range for me $350,000 in Socal is not gonna happen,the houses list for that maybe are ghetto,you could find the nice ones at that price last year,but now since supply is low they’ve moved them up to $400000 and they list a price and up it in an hour or people are bidding higher just to get it cuz there are no houses going on market!It’s so not fair or fun like I thought it would be,I’m 38 and ready to buy in cash and now I can’t find one to buy and so what happens next? I stay renting for the next 5 years til it dips again? Or do I fight for a house that sold for 300000 last year and pay 4500000 for it now,that doesn’t make sense,I thought this was a good time to buy,for who,the realtors?Not me,I’m screwed,let’s hope for some break but when that happens we will all be killing eachother for it,so theres no hope except to snag em when u see it on internet and it’s all because of this stupid internet that makes it harder.But,you should make a bio w/ a pic to personalize your offer to seller,you have a better chance and cross your fingers! Housing market now is like winning the lottery,you keep playing but will you win?

nothing a matter with being a renter. so many good things to being a renter. young people with money are not marrying and having children on the west coast. renting is just fine for us.

I have to vent. I am in the under 35 crowd that is renting. I was so close to purchasing in early 2012, but just missed out to a cash offer and have watched prices run away ever since.

Just this week i was seriously considering a major fixerupper, but when I contacted the realtor I found out they have offers 50% above asking already.

I know bubbles can go on, but it just seems insane to pay these premium prices in their parabolic run up in 6 months time. Way to dangerous to chase. Prices have to relax at some point. I think some people are going to get burned pretty bad. Its awful watching what is happening and there not being anything to do, but simply wait.

@Jim and other frustrated readers,

Don’t just sit back and take it. Make a lot of noise. Write to Bernanke. Rattle Congress’s cage. Get others to do the same thing. We’re all in this leaky boat because we think we can’t change anything. If we think like that, we won’t.

Hear Hear!! Let’s do this! Fired up! Ready to go! Yes We Can!

One has to wonder then….is there a perfect storm brewing, where millions of baby boomers start selling (dying?), investors start selling, and inventory shoots WAY up? This massive increase in inventory is being met by young people who can’t even afford to buy (or are choosing not to). And if interest rates go up at all….

I’m expecting that to happen eventually, but maybe not for the same reasons you’re thinking. Eventually, Prop. 13 and the mortgage interest deduction will be rescinded, and I think special “high-cost-of-living-area” treatment from Fannie/Freddie will go away, and California will see the same conforming mortgage caps as the rest of the nation. This’ll make living in California even less attractive, and I think many lifelong Californians facing the prospect of funding a retirement plan will decide to move to greener (and cheaper) pastures. Then the whole situation will flip around–plenty of sellers with no qualified buyers.

Good luck with that fairy tale KR

If enough people become renters and not owners, tax law will start to turn against ownership. And more rent control type laws will be enacted.

How is that a fairy tale? What part of “state that cannot afford its bills” and “state that resolves all budgetary issues through tax increases” is inaccurate? Where is everyone going to get all of these magical, six-figure jobs that will support current housing prices and future tax burdens? That’s the fairy tale, my friend.

I was just in beautiful Lakeway, TX (outside Austin) and the woman behind the desk said that (in her opinion) 1/3 of the new local residents are from CA. I also stopped a guy on the street near a house we were considering buying and he had relocated with his family from the OC 7 months ago bc of higher taxes/you get a 60-95 year old small box on tiny lawns in CA. he had money as he bought his house for almost 900k cash so a lot of hard working taxpayers that Cali is relying on to shoulder the pension burdens are bouncing. Doesn’t take a genius to see the future of higher taxes and regulations in CA and that those that have the luxury to move, whether individuals or corps, for cheaper taxes, often do. It all comes down to whether one wants to, or can afford to, pay the CA sun tax or not.

The fairy tale part being about repealing Prop13. Don’t sit around waiting for that to happen.

CA doesn’t have a revenue problem. It has a spending problem but that’s a different issue. And yes I agree with you that there is way too much taxing this state does.

FTB, while Texas does not have a state income tax, it has oppresively high property taxes. Buying that 300K McMansion in Texas might equate to paying 9K per year in property taxes. With extreme climates come extreme cooling/heating bills. Running that AC 24/7 for half the year to cool that McMansion doesn’t come cheap either. And it certainly is nice having some property and separation from neighbors, but those 1 acre lots require upkeep which can add up also.

Living in desirable parts of California is a lifestyle. The houses are old, small, have very little property, etc. However, there never seems to be a shortage of people coming through that revolving door who want a piece of the pie. And I personally do not see this changing anytime soon.

Higher taxes are definitely on the way. Most of the bozos voted for higher taxes just last year alone. I’m pretty confident Prop 13 for principle residences isn’t going anywhere. And that mortgage interest deduction might get pared down, but I highly doubt it will go under 500K.

I work with many boomers and these people are living high on the hog. Houses in desirable parts of LA/OC, rental properties, pensions, fat 401ks, Prop 13 protection on their properties. These boomers reaped the benefits of cheap education, cheap energy, cheap housing, plentiful jobs, cheap healthcare, etc. The boomers made out like bandits and the younger generation is utterly screwed because they are squarely behind the eight ball right out of the gate. These boomers don’t give a rat’s ass about the plight of the next generation. They got theirs…eff all the rest of you!

Interesting JK how CA has a spending problem in your eyes, but not a revenue problem, and there is no fear of prop 13 being repealed or property taxes raised. First off, there is no such thing as having just a spending problem as a state has a revenue minus spending problem or has a revenue minus spending surplus. This spending you speak of is actually guaranteed future obligations by law that can ony be discharged via bankruptcy of a public entity. That’s a bigger issue than a mere annual spending problem. Also, many people who move to CA do not file for CA residency and do not pay CA state income tax. Also, many people, who CA relies on for revenues are exiting CA and will do so more and more as it gets more expensive. Also, who cares just about CA property taxes only if you have a job that’s taxed in CA or if you buy goods in CA with sales tax or gas with CA gas prices? Most people I know look at their overall tax burden and dont just say well CA has low property taxes (on overpriced homes mind you so raw dollars of taxes are still high comparatively) so these high income and other taxes are irrelevant. You also admit CA has a spending problem, and you know CA taxes whenever it an get away with it, so if not raising property taxes, what do you see the solution at in this fairy tale?

LordB,

1-most outsiders/relocaters aren’t in love with CA/LA/OC; they are in love with the prospect of possibly living in beautiful weather near a beach for the most part. There is a tipping point for where people will not pay for that luxury as weather is very important (although less important to many) but it doesn’t trump everything, like affordability.

2-where I, and others tired of Cali prices are looking near Austin, in lakeway (wit zero state income tax), taxes are 2.04%, not 3%. They do go higher, but 3% is not close to the norm. Also, isn’t it about raw numbers and not percentages? Are you actually comparing total taxes on a 4000sq ft house from mid 2000s on an acre plus with a pool/jacuzzi 30 mins to Austin main center (also known as 3 miles in LA traffic) for $500-700k vs a 800-1800sq ft 1920s house with new hardwood floors and a toilet on a 6000 sq ft lot with your neighbors able to watch you use your toilet from their window for $700k-$1mil in LA proper or studio city? Even if you did compare those two properties the one at 700k at 2 percent is 14k a year vs a house for a million in LA with taxes of 12.5k a year.

3-are you a real estate agent? Me thinks yes….

FTB, no real estate agent here…far from it.

Like you said, comparing what you get in Texas to California is laughable. For people who aren’t tied to this area for whatever reason, I would highly recommend certain parts of Texas. From what I’ve seen in Houston and Dallas, 400K gets you a VERY nice house. I think Austin might carry a premium due to all the transplants flocking there. That 6000 sq ft. LA lot is actually on the large side in many cities. 🙂

Sounds like you should really explore the Texas option. If you don’t have family here, don’t need to be beach adjacent and can get employment in your line of work I would definitely give it a further look. Good luck.

Sorry, but you also exaggerate AC/heating bills. Since when was austin (or Florida) so cold in the winter that your heating bills would be so high? And, yes, it does get hot in the summer. Good news is you have a pool to swim in. AC bills will be higher June-sept for sure. Darn. Guess like everywhere else not LA, it ain’t as perfect. Did you mention the almost a dollar difference in costly gas per gallon? The lower cost of food and services? You can spend $100/125 a month and have a1.5 acre property manicured in Texas. Not sure LA prices but landscaping is needed here…unless you have no property, so is that supposed to be an advantage?

FTB, good to see your sensible posts on here. If I recall correctly, LB used to have a bearish tone but mentioned in a past post that he threw in the towel and got shacked up with some SoCal property. Ever since then, the tone has been increasingly rationalizing. What I’m getting at is that I don’t think he’s an RE agent.

As for the A/C comparison, ask anyone in the valley or east of the 110 fwy south of the hills how much their A/C runs in the summer. So tired of people getting shit twisted in order to try to justify their buy-in to the madness.

Cooling a 4000 sq ft McMansion isn’t cheap. I would guess several hundred dollars per month during the summer. In the grand scheme of things, that is peanuts compared to buying and fixing up some shitboxes in LA.

Joe, like I said many times it only makes sense to buy under certain circumstances. With the recent mini rally, it certainly makes less sense to buy compared to last year. Everybody’s circumstance is different, I’ll leave it at that.

I live East of the 110fwy and have a 3700sq ft home built in 2004. The insulation tech is superb, during the peak summer when temps are above 90f I don’t have to turn on the A/C until after 3pm the house stays cooler than 73f inside. After 3pm I leave it on for only about 3 or 4 hours the temps outside get cooler. During the 3 peak months my AC bill is about $250/month. The rest of the year it’s about $75/month. Does that answer your question?

I’ve been to TX many times and not my thing. But FL has a lot to be said for it. Just not much in the employment dept.

Save your money in CA and then move out to a place that’s affordable. Buy it for cash and live debt free as well.

Actually, YoBlah, your response supports the point that FTB makes. New construction is typically much more energy efficient and that’s a lot of what is out in Texas. 3/4 of a mil $ 70 year old lipstick on a pig flips in the valley and other parts of L.A. – not so much.

@Joe, perhaps but the part that I forgot to mention is that the the insulation only works when it is a dry heat. Once in awhile we get muggy soupy humid days similar to this past weekend the insulation doesn’t work at all. Fortunately the vast majority of the time it’s a dry heat and the insulation does its job well during that time. Therefore, this is anecdotal because I’m not an expert in humidity with insulation but I don’t think it works all that well under those circumstances.

I’m a born and raised Californian who spent 5 miserable, un-get-backa-ble years of my life in the wilderness that is Northeast Texas. Never…You can have it. I don’t care if they are giving away 4 bdrm brick homes on 3 acre lots. It ain’t California…..Period.

I’ve been struggling with buying a home for over a few years now, mainly because I do not have a large enough down payment to meet the 20% range on most of the homes in the area (orange county) and I do not want to just “get into a home” and pay more then it is worth at any cost, or go the FHA road. I am doing everything I can to save – paid off my $60k in student loans, both of my cars, and put 15% into my 401k each month, and $500 into a personal IRA for both myself and my wife.

I am 31 and have a son on the way, but can’t imagine sinking all of my hard earned savings into a home right now either! I hate throwing money away renting, but at the same time I don’t want to get tied into a mortgage (with interest) for as long as possible!

That said, why does it feel like I am so “behind”? It could be a California thing, but I don’t understand HOW people afford what they are buying. Obviously, not everyone can afford the lifestyle they display or the home they are living at, but I look at how much I struggle with a decent salary. It is very frustrating though.

Thank you Dr. HBB for the reminder that I am not alone in this frustration!

Yea housing is crazy and unaffordable in southern california. But I do think your expectations are unrealistic, if you expect to put that much away for retirement and save for a home. Even prior generations seldom managed to do that! (true that had pensions and so on so didn’t have as much reason to). But older generations, when they were paying off a mortgage, made it their top savings priority. I think if you really think homeownership makes sense and is a wise choice (if you think so, nothing in this reply is to be construed as investment advice) that you should cut back the retirement savings and start saving up a downpayment.

+1. Noble goal of putting money into a retirement plan and saving for a home deposit, but I’d commit to the home deposit more fully, if home ownership is your goal.

Houses are depreciating and disposable! Forget the house, save money so you aren’t eating catfood in retirement. Unfortunately the “American Dream” is a lie. You can’t have your cake and eat it to, and there is no free lunch. Forget the idiocy of chasing the high costs of housing, and rent a nice place. Freedom to move essentially whenever you want to (one can leave at the end of a lease term or negotiate a shorter lease as needed – -no guarantees but I have done it many times, at no additional cost). No maintenance costs, no real estate taxes, no property insurance (besides cheap renter’s insurance if you want it), no risk of losing your downpayment…there are so few reasons to buy these days, and risking hige savings (downpayment) at a complete loss, maybe having to go bankrupt…all for what exactly? Housing in CA is so overpriced…buying now is sheer lunacy! Just my opinion, YMMV.

Bay area renter, houses may be depeciating assets in flyover country. Ask any of the boomers who bought 30 years ago in desirable parts of socal how their investment is paying off. Their homes are likely worth 5x plus what they paid. Obviously interest rates going from 18% to 3% had a large part of this. I don’t need to tell anybody here, property appreciation is like religion in California. And this faith isn’t going away anytime soon.

I’m 40, and you sound a lot like me at your age. Last year, I left California after living there my entire life. Life will quickly get very expensive for you with your family, and you’ll be looking at ramping up retirement and college savings even more. If you figure (generously) on living on a 6% return on your retirement savings, you probably want to have around $1.5 million saved up. My advise is keep renting for now and look for an exit strategy to Texas or Florida. I picked the latter and have no regrets. You’ll be amazed at how much “bang for the buck” you get here.

Chris, FHA wasn’t such a bad deal, but it’s about to start being one. Starting June 3 FHA borrowers are required to pay mortgage insurance for the life of the loan, not just the first five years. You may regret not getting this easy money.

My wife and I got an FHA loan recently. The interest rate was 3/4 percent lower than what a conventional loan would have been, so the extra mortgage insurance isn’t so bad; and our mortgage is assumable should interest rates rise. We can quit paying the mortgage insurance after five years.

FHA is changing their policy on mortgage insurance so that you have to pay it for the life of your loan for all case numbers dated after June 3, 2013. This is a big change. So you might want to reconsider, do the math, and if you have something you want to buy get your application in before June 3. After that, FHA is crap.

I completely agree that FHA is NOT worth it, which is why I have not used the program and do not plan to, precisely because of the changes to it. Getting into a home has not been my #1 priority, because a home will never pay for food, diapers, and whatever else – until you sell it.

I look around at my friends and family who have all “lost” in the housing market over the years. Expect for maybe one, everyone lost money in their investment. It doesn’t matter if it was present time or decades ago … I don’t see the value in it. There are other ways to get a return on investment.

Did you just say your FHA loan was assumable? Are they all like that? If they are that’s a hidden treasure for the next set of owners.

Yes,we are all out here! You know,renting isn’t all that bad,you don’t have to pay for water/trash or taxes,you just call your landlord whenyou have ANY issue w/ your house and he comes and fixes it for free!So,all these homeowners who go out and buy these 1920 houses for $400,000 on up thinking they snagged a deal,they’ve got themselves into a whole new level of debt,because unless those sellers fixed all the plumbing,electrical,etc. the buyers will be fixing it and they will be pouring their cushy little savings they got into it! So,don’t feel bad,renting can be good and it’s so stress-free,you never have to worry and all you do is pay a monthly fee,having a house also comes w/ baggage and stress and worry!So renters,stand tall,we are the ones relaxing til we’ve fattened our savings and wait til you homeowners have made all the fixings/remodels and then we will be buying your house for half of what you paid,hahahahahahah!!!!

Autumn, renters pay for everything indirectly with their rent check…water, trash, insurace, upkeep, etc. Rents have been going up and likely will be going up in the near future. If you can buy a place anywhere near rental parity and you plan on staying for at leat 10 years, it makes sense to buy. If you don’t want to be a stressed out homeowner, don’t get in over your head with your purchase. If the financial aspects of buying make sense, all the other benefits are just icing on the cake!

Throwing away money on renting? This is getting so old. You’re smart enough to recognize the lifestyle mirage that others are living around you, now if you can only get over the narrative that renting is throwing money away. It’s just not that simple. There’s no free lunch.

The only people buying houses these days are Flippers and Hedge Funds….I’m happy with my monthly rent….At least I don’t have to worry about my ass being MBS-ed to some dude in China….

http://wallstreetfool.com/2013/05/10/barclays-global-research-and-market-insights-for-may-2013/

Smart choice.

DHB

Always interesting insights. Also an article today in the NYTimes about a study showing higher home ownership rates may increase unemployment. (http://nyti.ms/10w5kgW)

While the narrative of owning a home is very powerful it does come with many unintended consequences, such as lack of mobility and low risk taking as one’s home consumes money, time and worry.

We recently sold our condo in Miami and moved into a rental. My blood pressure in much lower.

thanks again for your ideas and writing.

JVP

i’m 32. i make 6 figures, and have a little over 150k in the bank. i see no reason to buy a place. now i still see some of my friends “desperate” to buy. but a lot of people have gotten on to the thing that renting isnt a bad thing.

when you buy you end up committing to more space than you need, and a lot of young professional types these days under 35 dont have kids. many people dont want kids so who needs a big ass house.

i mean rent is actually really cheap right now, the apartment im in right now costs just as much as the one i lived in in 2006 when i got out of school. and mortgage payments even at these rates on a loan + maintenance and all the headaches. why bother with it.

theres no stigma to renting anymore, i think people figured that out. who wants to maintain a pile of wood and bricks anyway, when an apartment complex will do it for you more cheaply with no commitment?

Since the 1970’s, the #1 reason to buy RE has been constant and impressive appreciation of California real estate versus the rest of the country. If you had bought a place in 2010 or 2011 for $450k it would now be worth $500-550k. That’s $50-100k in a couple of years, which is what happens in Cal.

(H/E, many of us following the blog during that time period remember well the horror stories about phantom short sales. So, even when the getting was good, there weren’t a lot of easy-to-get homes in that “abundant” inventory).

I think you’re right, though, that the meme of “renting is for losers” is changing…not because we “wish” it to change, but because the real, hard economic realities of a global economy with indebted young professionals, no real wage growth for bottom 95%, less job security, etc. is forcing a cultural shift away from the standard SFR.

Look, people just want to accumulate wealth (to raise a family, afford a life-style of their choosing, retire, etc.), so as long as there are alternatives to California real estate, then people will rent away, accumulate wealth by other means (savings, stocks, bonds, small businesses, buying rentals in other areas, etc.).

LA is also changing. It’s getting denser. People still come, but they don’t build more land. We are in the process of Manhattanizing. People will expect less to live here. They will rent smaller homes, or townhomes, or apts.

After living in manhattan most of my life and now LA for the past 3.5 years, I definitely agree that LA is manhattanizing to some degree in that it is becoming more dense, but i disagree that there isnt any land here. Tons of properties in LA proper could be enlarged or torn down and rebuilt as the land is really not maximized for its best use. Still lots of SFHs completely surrounded by apt buildings that should/could become apt buildings. Lots of 2 story apt complexes as well that could be made larger too.

Keep in mind LA is also a renter place because its a city with a large percent of non-natives, who are more likely to rent when relocating. And then many of these people realize that although the weather is the best, the people are lets just say different than in many other places, and there aren’t a lot of high paying jobs/the sun tax is too high, so they go home….and then new relocaters come in to LA just as fast and the cycle repeats…

All that being said, many in So Cal that make low to mid 6 figures are starting to leave from those I spoke with/I read about. The taxes are just becoming not worth it, especially when property tax increases feel imminent. They’ll do Carveouts and keep certain people’s taxes low like they do in Texas for those over 65, surviving spouses, disabled vets, etc, but more taxes be coming whether its income, property, sales, sun, etc. eventually they’ll probably cap the max on the mortgage interest deduction too. Can’t eliminate it, but it seems destined to be attacked at some point…as this country is BROKE and thats before we swallow the boomers gigantic pension and health liabilities. Any thoughts from Californians, a democratic/pro tax/pro pension state, where the money’s coming from if not increased taxes?

FTB, you hit the nail on the head. I’m 40 and fit your demographic profile, and I left last year for Florida because the cost of living and quality of life keep moving in opposite directions. Unless California gets a bailout from the fed gov’t, there is about $1.1 trillion in state/local liabilities that have to be accounted for in coming decades. Forbes had a great piece on death spiral states last December–if you have to be in Cali, just rent, don’t buy. Don’t buy California bonds, either.

When I complain about the reflation of housing prices some folks ask why I didn’t just buy in 2010-2011. I did look during that time and there were a few deals, but the big emphasis is on FEW. Very few foreclosures in my area actually made it to market and very few homeowners chose to sell when prices were so depressed. The market I saw was made up of mostly insider deals and some utter basket case REOs that were made available to ordinary buyers.

In short I think that the “market bottom” of 2009-2012 was largely illusory – composed of crappy tear downs and fake insider deals that skewed the apparent average selling prices to the low end. Among houses I’d actually want to live in, prices among the few that were available during this period were at most 10% lower than they are now – hardly an epic drop.

APOLITICAL……I could have written that! Nail on the head experience for me too.

Totally agree. I you live modestly, rent a smaller place and invest your money wisely, you can come out just as well and better than pouring your money into a house. You just have to be disciplined in your spending habits.

I’m in the same boat as you, in fact, I have eerily similar stats to you. I *just* turned 30 make 6 figures, I too have about 150k in the bank and I also would not touch the current market with a ten mile helicopter benobama pole.

It’s not the stigma for me, I don’t feel there is a renting stigma. My biggest problem is the pissing money away problem – because that is exactly what renting is any way you slice or rationalize it.

I want a place to live in, and when I am ready to move up be able to sell it for at least what I paid for it. I don’t see that happening with the recent run up in prices. Hence, I’ll sit on the sidelines and piss money away because I’m not going to down payment wager on this crock of shit being trotted out by the fed, banks, government, and wall street.

I am waiting for the next correction and all of us in this boat need to pray the money printing doesn’t inflate the dollar like the yen destroying our purchasing power. I’m betting we’ll make it, I guess we’ll see.

Renting is NOT wasting money! If the alternative is spending more on a house…you have to live somewhere so living somewhere costs money. I pay $48K a year for a nice house in a nice hood. If I bought a place, my PITI would be less, but not a ton less (maybe $500/mo.). Then tack on taxes, maintenance, repairs, HOAs, etc. And commissions when you sell (6%)…with only modest appreciation right now and no guarantees for the future…buying doesn’t make financial sense. Meeting emotional needs maybe, but not good financial sense. And the downside risk on buying a million dollar place? Losing your 200K downpayment for starters. The music can stop at any time, and unless you can find a chair quick when it does, you WILL get screwed out of your hard earned down payment. Renting, like someone else said, lowers the blood pressure!

If you don’t have a good income or money, you have no choice but to rent. If you have the ability to purchase, buy a single family home. It’s never too late and you’ve not missed the boat. My sister bought a brand new house in 1994 for $194K. I didn’t listen to her and waited and waited, but finally jumped in and bought a brand new home in Irvine, CA for $369K in 2000. It went up to $950K at the peak in 2005 and crashed down to $650K, then go back up in the last two years to $750K. I refinanced into a 15 years mortgage many years ago and have been paid extra to principle from time to time. Next thing I know, I only have 2 more years to pay off the mortgage. Gold was around $300/ounce in year 2000 and it is around $1,500/ounce in 2013. My house has gone up twice, but gold has gone up 5 times in value during this period. Is it possible for my house to go up even higher to catch up with gold price and inflation? Absolutely YES based on our current money printing policy. You buy a house because it’s the best way to hedge against inflation and preserve your wealth. Imagine yourself 15 years from now…. You’re still renting and your $150K in the bank is now worth only $30K. In addition, it’s not even safe to put money in the bank as the government and the bank can take your deposit to bail themselves out. All they need is to pass the law, allowing them to do so, similar to financial crisis in Cyprus. Have a vision and a dream. Buy something to keep and pass it on to your children.

Keep up the good work Hans!

Smart choice. We rented for six months after moving from CA to FL. Yes, you don’t get to think of the place as “your own,” but the savings benefits are substantial. Robert Shiller has said that investing in real estate is effectively a zero-sum game, long-term.

Hans you are doing everything right and that is the quandary. You can do all the right things and still get screwed. Save for retirement and the market which is due for a crash will set you retirement savings tumbling. Put your money in a bank and with all the money printing makes it so you lose money if you keep it in the bank. Invest in housing and this bubble will bust also leaving you upside down. Hard to be nimble in a market with no place to go.

“Hard to be nimble in a market with no place to go.”

International is the way to go.

Unfortunately I’m unqualified to say where, but I’d buy Norwegian state bonds: They have spent much less than they earn and having your own oil wells is a good guarantee for money stability for a small state, even if the money itself is not based on anything, on paper: In practise it’s backed up by oil.

My 2 cents would be that you need to make sure you are financialy sound before any investment. Otherwise you keep failing to reach your ultimate goal witch nobody likes. Only the strong survive its nature as they say .

This is the type of stuff that makes no sense:

$749 for this property:

http://realestate.slocountyhomes.com/idx/3482/details.php?idxID=239&listingID=196437

Or $729 for this property:

http://realestate.slocountyhomes.com/idx/3482/photoGallery.php?idxID=239&listingID=195743

Hmm, which one should I choose?

I’ve lived in a rent controlled apt for 16 years. Now with 2nd kid on the way we have to move and can’t find anything decent that is affordable. Daycare will eat up 3300 a month for 2 kids… can’t rent or buy anything in this city…

Can you move out of state? Seriously. Vast majority of individuals moving from CA to other states are middle-class individuals who find the cost of living too high.

For $3,300 per month you could hire a person with a bachelors or masters degree to come live with you and take care of your kids full time. That’s a 40k annual salary.

A person with a bachelor’s degree to come and live in my one bedroom apartment? And this would solve my housing issues how? 😉

You have obviously not looked for a nanny recently, most without bachelor degrees require $15+ + you have to pay overtime and taxes. If you work 40 hours a week and commute to your job that means a nanny has to be there 47 hours or so…that makes 3300 alone before taxes. Add a bachelor’s degree and you’re looking $$

So yes… I can’t move out of state either. My profession isn’t hiring much in other states, I’d be looking for highly urban areas again like NY etc..

Don’t know what kind of nannies you are looking for but I’ve never had to pay over 2500 a month. Forget hourly pay. Go salary based and make an agreement. If you are serious about those numbers yet you live in a one bedroom apartment something is wrong

Well Ed, paying a nanny a salary is illegal. I know people do it but I would also like to get the tax benefits of spending 30K+ a year. Like the FSA @ work…

But to humor you, paying 2500/mo for housing + 2500K for a nanny + lets say…2500 a month in bills, food etc… means you have to make + 110K a year just to rent. And forget your 401K or saving for a house. Reason we stayed in our 1bed rent controlled apt was to save for a house. Well…we saved, but still can’t find one.

Now I hear people think 3K a month rent is low???

Yes, there is something wrong…

I commend you for going ‘legal’ on paying for childcare, but FSA credit is a joke. I’ve gone down that road before, and the overall tax benefits are not worth it, not to mention having to do the paperwork yourself (or hire an accountant to do it for you).

Hopefully, you are not spending 2500/month on a 1 bed apartment. Not very frugal at all, especially if you are trying to maximize on your tax credits. Sort of like having a diet coke with your burger combo.

I think the reason ownership is Lower for young people is not because of lack ob demand, but for four main reasons.

1 over the last five years, home priced have have been depreciating. One who is inexperienced with RE cycles would be very sceptical about entering the market, therefore young buyers will tend to be ore cautious and old back. After all they probably seen their parents lose money in the real estate market.

2. Sellers, distressed or nondistressed, would generally prefer to sell to a cash buyer especially in the depreciating market. Therefore young buyers are unable to acquire at the same rate as when inventories are plentiful.

3. Financing has become extremely tight, And underwriting standards very strict. Many young people simply can’t qualify.

4. Accumulating cash thru saving in the worst recession since the Great Depression, is hard for working people much less young people. zero down and 125 percent HELocs are a thing of the past.

Feels like a top in the market, looks like a top in the market and smells like a top in the market. Smart money has begun to bail on real estate already. We now live in a manufactured bubble economy. Get ready for the next financial bubble somewhere else, as this one is getting long in the tooth. What a country!

http://Www.westsideremeltdown.blogspot.com

Owning your shelter is what separates most of the have’s from the have nots.

The only real problem with home ownership is property taxes. Because this makes the govt the real owner of your property and you can never pay it all off. And it may rise on you as well.

The current game is rigged with all the usual players in it right now, the banks and hedge funds. Mom and pops are following close behind.

CA is burdened with a very high percentage of people on govt assistance as well as govt retirees. Both groups are growing quickly and are poorly funded.These two factors alone, could cause huge financial problems for the govt and they will be needing increased tax revenue to solve these problems.

I suppose it’s easier to reflect from the finish line, seeing as I’m coming up on my 35th birthday. We own out home, purchased in late 2012 at $179sqft, we have two children, I do not currently work and my spouse makes approx 70k year. The caveat, we have a mother in law suite and my mom lives in and shares the mortgage burden with us. The reality is that things are tough when you are independent from community and help and family. I despise land lords and anyone with authority over me. The issue I’m seeing is alot of the same, people need to be the change, not just groom their kids to replace them as cogs in this machine, think outside the box otherwise you will see your children in the exact same boat in 30 years. What good is saving for their education if when they graduate its still more of the same? What good is saving for retirement if the market collapses? Learning to roll with the punches, building a community and learning unique ways of surviving are the keys, no one knows what the future holds, there is alot of fear, you cannot possibly plan for every scenario. You only live once and money is not a tangible useable object, enjoy your lives people!!

When those hedge funds decide for what ever reason to sell their houses it will not be to individual buyers but to large foreign companies or sovereign funds

The American Dream will be owned by foreigners who will become the landlords of millions of Americans

Serfdom at its best!

“The American Dream will be owned by foreigners who will become the landlords of millions of Americans”

I had the same idea … Chinese have trillions of dollars, in cash and no place to put it except US property, let’s say houses. I’d suspect that many or even most of those hedge funds are operating on international money.

They’re also getting low interest money from here in the US that supposedly was intended for the masses.

Eventually they will find out the headache of being a landlord for 100’s of thousands single family homes with tenants that cannot pay their rent due to an unraveling economy. The buyers of last resort will be big foreign money, especially if the dollar crashes.

Can you say “Fire Sale”?

Another perspective on the Bernack and his creation of the ‘rentier’ economy.

Federal Reserve Chairman Bernanke is a Reverse Robin Hood, robbing from the lower 95% and giving to the financier class.

Let’s take rental housing as an example of this Fed-driven rentier economy. The financiers borrow $1 billion in nearly-free money and use these funds to buy thousands of houses for cash. Since they can offer cash, they beat out households with approved mortgage applications.

This is the story one hears anecdotally: potential home buyers have a mortgage application approved, all they need is to have their offer for a house accepted. But the house is sold to an investor with cash.

So while the Federal housing agencies are offering low-interest, low-down payment mortgages to marginally qualified (or flat-out unqualified) buyers, the Fed is enabling the financier class to outbid conventional homebuyers.

http://www.oftwominds.com/blogmay13/rentier-economy5-13.html

Myself, a homeowner can see the concern that renters OR homeowners have…. Renter – Will I forever be a renter? Homeowner – will my home value decrease?

Single family homes should not be an investment opportunity. The single family home market should be made up of only buyers that are going to live in the home. The selling price should be be determined by the purchasing ability of the families that want the home to live in, not investors income. Investors should be encouraged by the tax code to invest in multi unit housing. All tax benefits on single family homes should be eliminated for investors.

We should make it more affordable for qualified families to buy single family homes . For more information hoe to increase home ownership of people under 35 years go to http://www.foreclosurecrisissolved.wordpress.com

Single family homes should not be an investment opportunity. The single family home market should be made up of only buyers that are going to live in the home. The selling price should be be determined by the purchasing ability of the families that want the home to live in, not investors income. Investors should be encouraged by the tax code to invest in multi unit housing. All tax benefits on single family homes should be eliminated for investors.

We should make it more affordable for qualified families to buy single family homes . For more information how to increase home ownership of people under 35 years go to http://www.foreclosurecrisissolved.wordpress.com and how we can help eliminate the boom and bust roller coaster ride our economy has been on for the last 100 years.

So,who is the person that should buy a house? Or should anyone at all buy in California? We all know it will never be “affordable” in Cali,so what do we do,all move to Florida or Texas? Well we can’t,so therefore we have to eventually buy,because renting for the rest of your life is a waste.If you have the cash to purchase a home you really like or has potential,then DO IT!Because either way,it will appreciate and you will be happier!You can leave it to your kids so that they can have stability or rent it for that nice monthly paycheck later on if you wanna move.Either way,housing cost are going up and will continue,so if you want to be negative and not buy,you can or you can think positive and OWN something that makes you happy! Now,do I think prices are going up too much,yes,so you could wait years and wait for the new homeowners to remodel or fix whats needed on these 1920 houses and then sell them to us for half the price because of a dip,or we can buy now and just be happy we did.I live in an affordable housing apt. in La Costa ca. I’m snuggled in w/ the rich and I pay only $662.00 for 2 bdrm,but I’m dying for a home to call my own cuz of pros and cons of living in rentals for my whole life,but many will say stop whining you pay nothing,but my Mom wants to buy a house for me and I pay the same I’m paying now in rent as my mortgage,so what should I do?

Well it’s easy to say move out of California. But reality is California has the most no of jobs in engineering and research. All major companies have offices in CA. Here one can jump. That won’t be the case if people went to other states. They would be stuck with one company for the rest of their life.

That’s a ridiculous assumption to make in this economy – rare indeed is the company that has to stay in one location these days, regardless of what kind of business they’re in.

People already ARE moving out of here in droves.

http://www.manhattan-institute.org/html/cr_71.htm#.UZFqrLWG3Tp

“In 2005, foreign immigration ceased to make up for the drop in domestic migration to California. Since that year, California’s annual net migration has been negative—more people leave the state than come to live in it. Natural increase in the resident population—births minus deaths—cushions the blow of this out-migration, but that, too, is falling.”

I wish I had some research, but I keep hearing that companies are relocating facilities too. That doesn’t really surprise me.

If you have some money saved up and can get 3x the property in cheaper states .. well I’d rather take my money with me. Unless you are making six digits around here, but then it’s still probably a better deal elsewhere.

I’m tired of hearing people waiting and claiming rates will rise. It’s not going to happen. Ben already made the commitment down the path of inflating out of debt and he’s not going to change his mind. Changing his mind will enrage more than it alleviates, without yielding concrete solution near term. Every decisions made now is of the lesser evil. If rates are kept low, there’s threat of inflation. If rates rise, US defaults on it’s debt. So which one’s worse, inflation or default? I believe the latter, but it’s anyone’s judgement call. It’s like asking is blue or red a better color?

Some argue by keeping rates low, Ben’s screwing over savers, but it’s savers that store savings in cash. If rates rise, housing collapses, he’s still screwing over savers, but those that store savings in real estate. And the latter group screams louder.

Jason, definitely agree with you. The Fed has made it ABUNDANTLY CLEAR of what their plan is. They have been successful for five years, I have no doubt this charade can go on for another 5, 10, xx years. People only have a finite time on this planet, pacing around a lousy apartment hoping that rates skyrocket and home prices plummet is not a good use of those years. As they say time is money, this time needs to be accounted for in any rent/buy cost analysis..

Read the changes in the fed language in the past week on cnbc, wall street journal, etc. They are slowly testing the market for their QE exit. Think December-ish.

FTB, if home prices start cratering the Fed will change course to prop up values again…I have no doubt about this. This is a game where the rules can be changed in midstream, the Fed can move the goal posts at their will to attain whatever outcome they desire. This is what has frustrated so many people!

LordB. I think you are very intelligent, but, IMO, you may be making some false assumptions based on unique circumstances in history/hope on your end as you have a vested interest as a homeowner. You view what the Fed and govt is doing with QE/low rates/HARP, etc as a signal that they will FOREVER protect ALL ‘homeowners’ IN EVERY LOCAL MARKET from suffering ANY SIGNIFICANT losses in the value of their home. I think that is a possibility as everything has a statistical percentage of likelihood of coming true, but to assign 100% probability as the future scenario seems unwise, especially as if there is a new downturn, the landscape would not be the same as before.

We had a scenario first off that was unique in that banks lending standards were so low that they didnt get enough in down payments to protect their insolvency and in all of their securitization models they built in that housing can NEVER decline nationally all at once. These two items are very significant in terms of banks (who control fed action by getting to vote in 6 of 9 fed directors in each local fed office) managing risk and their exposure to a new downtown. We are slowly allowing banks, with the suspension of mark to market, to get crappy no money down loans or properties off their books and giving them cash (we all know the stats by now of over 30%) and down payments of 20% and 10% down (with some sprinkles of FHA loans). We have also changed foreclosure laws to become, at the very least, more known/standardized, which is really what corporations want at the end of the day (hence why many incorporate in Delaware). Once they know how the law will work exactly, they can start learning how to get around its toughest provisions with lawyers or minimize impact via lobbying. So this will be the new reality come the. next downturn at the very least. I already can’t predict the future in that scenario, but you seem to be able to with pinpoint precision.

Now toss in other things like: what if the govt can’t control rates and QE stops or keeps losing effectiveness? What if its just the extra bubbly (aka sunny with not nearly as many high paying jobs as they need) areas like LA, Miami, Phoneix, Vegas, etc go down a lot and not other areas? What if unemployment stats keep going down (even though it really goes up) and the govt is buying stocks in the market (which it is most likely) so things seems rosy and banks are solvent, could rates not rise and house prices go down? What if rents don’t keep going up each year (even though they personally did for you the past few years before you bought yor home)? International dissaray and changes at play with their central banks going down unwalked paths, mixing with our stimulus or at some point lack thereof lurking behind the scenes affecting international hot money flows as well…

The point is I could list a ton of scenarios that could happen or not and then still miss the most important thing that effects real estate in a positive or a negative way, locally, hyper locally or nationally in the next 3 days (a war in the pacific amongst Asian nations) or 5 years. So what your left with is that no one has a clue about the future. IMO, its dangerous to spew off that just say because you peronally interpret the events of the past few years of x which caused a govt (or really a Fed, quasi govt agency owned by banks) response of y, that every future downturn in housing will also be x and will cause a similar response of y. Just to be clear, all I know is that I’m smart enough to not be able to predict the future. If you find a house that you love, have a 10 year hold time, really trust your future revenue stream (dont lie to yourself ;)) and can rent the home for the ownership costs if need be, might as well go for it, but is that really how its working in LA currently from anyone’s observations? I see people stretching themselves to buy less than they wanted in homes they have zero chance of renting out for their ownership costs of just mortgage and property taxes (many of which forget to add in maintenance and other costs on top of it, which stresses the budget now, crimping retirement, as well as future losses if one had to rent it out) with jobs in industries that will soon be devoured in the next 10 years by the Internet, 3d printing, robots, etc. just do YOUR research as they are NO experts before the fact with a crystal ball and whats right for YOU and YOUR family. Don’t get caught up with the Joneses who can afford to buy and dont be ashamed to rent if that’s what right in your circumstance. Renting and ownership have positives and negatives, and then pluses to one may be viewed as minuses by others and minuses to one might be viewed as pluses by others.

Arrived in the Bay Area in 2007 and went into sticker shock. Looked to rent and went into sticker shock. Rented a room from someone and was a workaholic for awhile. Picked up a condo in 2010, picked up a SFR with my fiancé n 2012 and now rent the condo, cash flow neutral, on a 15 year mortgage. She has a place as well which is rented for cash flow neutral but is still 6 figures underwater. We’ve been incredibly lucky from that standpoint, albeit one has to wonder why. Neither of us really ever wanted to become “landlords” but the only thing banks will loan on is property, vehicles and student loans….and only one of those can be resold for a gain.

I’m not knocking renting. I totally get the freedom and the ridiculousness of thinking that what I do today is what I’ll be doing 30 years from now. It’s just the only thing the banks seem to actually give leverage ability to individuals for. I can’t borrow against my 401K (some can) or my IRA. My car depreciates. My degree is, from a collateral basis, worthless. Only my after-tax purchases not in a Roth are available to me….after the CA/Fed take of about 50%.

So, really you have to choose a path. If CA is going to hell (see Detroit), then you would not want to buy and probably want to find someplace you want to move to so you can buy there. If CA is amazingly ridiculous but will eventually pull it together and you will stay gainfully employed, then you should at least buy your primary residence. Either way, buying a place generally makes sense because it can be leveraged…and because it’s harder to get laid in a rented room. (maybe just my anecdote)

“And because its hard to get laid in a rented room.” Ha. Like the close. Wait until you’re married a few years and not just engaged. Then it will be hard to get laid in an owned room too.

@Jason wrote: “I’m tired of hearing people waiting and claiming rates will rise. It’s not going to happen…”

You are giving the Federal Reserve and Bernanke way too much credit for the low interest rates. Baby boomers control almost 70% of the wealth in the U.S. and they have about 30 trillion US$, which completely dwarfs the balance sheet of the Fed.

The efforts of the Federal Reserve is keeping interest rates maybe 50 basis points lower than what the rates should be. The first of the baby boomers are about 66 years old. As boomers retire and and die off you will see interest rates move up. Then there is the cost of health care for the baby boomers. All of this will eventually dry up the excess cash floating around which will then cause interest rates to rise.

The Federal Reserve will not be able to run the printing presses fast enough to counter baby boomer cash getting pulled from the system.

In the meantime, I expect interest rates to be very low for the next couple of years, and then I suspect we will see a reversion to the mean, i.e. 9% interest on a 30 year mortgage by the year 2020.

it’s not baby boomers and their financial activity that will determine the interest rates. it will be the profitability of banks, investors and select wealthy elite. you could argue many of these are indeed baby boomers, but that’s not quite the same thing.

What Jason and so many other’s don’t realize is that rates don’t even have to rise to pop the bubble. In fact the FED keeping them low is what will destroy Housing Bubble 2.0. The more inflation they create in food and energy while simultaneously increasing the available rental inventory will/is driving down CAP rates on SFHs. All these bubble cheerleaders are clueless. The Bubble is screwed either way. Pick your poison. What little is left of the free market will discipline you in the long AND short run.

@NihilistZerO,

Agree with you there. We currently have three bubbles churning at the moment: the stock market, the bond market, and the mid-tier housing markets in SoCal, the Bay Area, Seattle, Portland, NYC, Boston, northern Virginia/Washington D.C.

This looks like a repeat of the housing crash of 2007 and the stock market bubble of 2000 rolled into one.

This will not end well.

SoCal is OK but it’s far from God’s finest creation. I’ve lived east of here and won’t hesitate to go back if that what the employment situation dictates. It’s that simple.

I can’t tell you how many hours I’ve spent the last 12 years debating people (and winning) about how over-rated SoCal is and how weather isn’t everything.

Some people have awesome job security and that’s great! Some people need to stay liquid. Both need to have a savings account. Other than that, viva life! 🙂

Is it really a matter if So Cal is better or not or what makes a person the happiest? One person might like to live close to the beach (me). Another might like the mountains. Others don’t mind the snow and like the change of seasons more. It’s a matter of what you like and what fits you.

Same holds true about either buying or renting. I don’t think there is a right or wrong. Everyone has to judge their own situation.

@ JK

Very true.

And refreshing to see, around here, that kind of reasonable acceptance and understanding of differences of taste, preferences, & lifestyle.

My eyes sometimes get sore while reading comments here, from rolling them, when people rant on about how “of course everybody loves pistachio ice cream, after all, it’s my favourite, it must be the best”

ha ha

That’s why I thought it was funny reading that study that Maximus linked to earlier in the comments…

All of the states that were the biggest destinations for people moving out of California had a lot of climate commonalities with various parts of California.

Yet the study cited “business climate” as the big commonality & big reason for people heading to those states. LOL

Big facepalm to that study, I say. ha ha ha

I’ve noticed something in the Los Angeles rental market lately which bodes well for buyers. Nice small houses, 1400 sq feet in select areas are going for $3500, and there aren’t many of them, but houses 2200 sq feet which were placed on the market anywhere from $4300 to $5000 a month are not moving. I’m watching houses in this range drop $300 to $1000 each month they sit vacant.

These are absurdly high rents, and yes this is partly greed and market confusion, but my guess is investors set these high prices because they had to. Which means it won’t be too long before they realize that rental houses are a bad investment and unload.

Keep an eye on the rental market and negotiate every opportunity you get. I’m in a rental now, put on the market at $5500 they took $3800. It’s crazy out there and nobody knows how to valuate anything.

“because that is exactly what renting is any way you slice or rationalize it. ”

Nope. Do the math: For any amount of cash you are supposed to have at least few % interest, net.

For $600 000 and 3% it’s $8000 per year. As it’s obvious bubble going on, there’s no way your house will appreciate that amount on yearly average for mortgage period, 30 years.

And at that point you are losing money compared to renting as it doesn’t need the capital, therefore, no cost or lost profit for the capital either. It’s all about alternative cost and costs by themselves: Having $600 grand tied into a house is a huge capital cost and if you count that, all of your calculations are off.

Imaginary money of course, but if you have $600 grand in cash, lost profit is as much a cost as any real cost.

“You buy a house because it’s the best way to hedge against inflation and preserve your wealth. ”

No way: Nothing that is heavily taxed will preserve your wealth. And property tax will only go up.

Even gold would be better choice as you don’t pay huge yearly tax from owning gold.

I agree totally.

My brother was telling me about his house in Paradise California, he bought it for 55K in 1985 and sold it just a few year later. He noticed it was for sale all these years later for 135K.

Imagine owing it all those years, how much in tax, how much in upkeep? Surely more was paid in taxes and upkeep than the “profit”.

L.A. and San Diego are not exactly Paradise California and they will always be more expensive but things are way way out of whack at the moment.

Why do people think FHA is changing their rules where you have to pay the MIP for the life of the loan? The powers that be know what is coming down the pike.

I am on board in thinking this is all about making the banks healthy and once all of the the risk has been removed from the banks and put on the shoulders of the Tax Payer, the housing market might be in for some cold, hard reality.

The madness might continue for some time but the cost of a house in relation to income has never been more out of whack but I think the plan is to have inflation take care of the imbalance.

If housing rises 3% a year after interest rates rise while inflation rises 5%, that is more than a 20% real price reduction in 10 years. And I know there are arguments about inflation “there is””there isn’t” any inflation. Don’t forget the FEDs bag of tricks are deep and since the entire system is at risk in deflation (or so they would have you believe) I don’t underestimate the craziness that lies deep in their bag of tricks. When you can literally print money and send it to the population, anything is possible.

“I’m tired of hearing people waiting and claiming rates will rise. It’s not going to happen.”

Well, even the US has to buy a lot of stuff from outside world and if they can’t sell dollar based bonds or pay with dollars, there are not many options left: Either raise the rate or let dollar collapse.

It has been taking a while and it may take another while, but there’s a hard limit.

So it’s not all up to Ben to decide.

Even if that was a reasonable cause… other countries have devalued their currency more. USD has been getting stronger

I bought a house last year.

If I were looking right now I would no longer be able afford to buy my own house.

WTH?!

Grab some popcorn guys. The party is just about to start:

http://www.marketwatch.com/story/fed-maps-exit-from-stimulus-2013-05-10-191031815

Bond market to take it on the chin:

http://blogs.marketwatch.com/thetell/2013/05/13/this-stocks-vs-treasury-chart-shows-how-qe-throws-bond-prices-for-a-loop/

My favorite quote from the article: “How levered is this market to expectations of policy shifts at the Fed? We’re in a suspension of gravity mode as long as the Fed doesn’t alter its course,â€

If you do the NYTimes Rent vs. Buy calculator on NYTimes and plug in realistic assumptions with property price growth of 1-2%, it is still better to buy then rent in most socal markets. This includes high price neighborhoods such as Newport Beach. However, if you want to make a quick buck, this is not the time for you as your appreciation is unlikely to meet your transaction costs and holding period returns.

In short, buy homes if you want to live in them in a place you want to live for a long time.

I have been reading this blog for years. We sold our house at what we thought was a high in mid 2004. We sat and waited….and waited…. and waited for prices to revert to the mean. We saw massive intervention and finally realized that the forces that work to make “buying a house” the pervading current were stronger than the so called economic logistics. Minimal inventory, widespread insider deals for short sales and foreclosures. We were lucky to be the winning bid amongst twelve others and finally closed June 2012. Now, I hear from friends that 2013 is even worse. It is a horrible process, however once you are done with it you can enjoy your own home!

Just bought a beach front condo in Rosarito for 200k. Property taxes are 200 per year. Sentry pass on the way for 10 minute border crossing. Problem solved.

Just talked to a sales person at a local home builder’s office. She says people have tons of cash coming in because they are happy to tell her (!) that they have been saving for years because they are squatters in their homes to be foreclosed and have not paid rent for years.

Others tell her after getting a loan modification — lowered principal by 100k, say, and extended to 40 years hence lower monthly payments — that they were able to rent out the house instead of foreclose and go buy another.

We’ve been hearing a lot of anecdotal stories like this one, yet I haven’t seen any real data to confirm this trend. Anyone have anything of substance on this subject?

Can you talk about this:

Income restricted: CANNOT MAKE MORE INCOME THAN:

1 person $38,340

EQUAL HOUSING OPPORTUNITY

Rental Parity people! We dipped below rental parity in 2011 in LA county. And we are currently bouncing hard off that bottom. It is as simple as that!

Leave a Reply to Leonard