Real Homes of Genius: Two Garbage Cans, One Home. Three Foreclosures and Garbage Can Photography Housing Candidates. Today we Salute you Riverside. The Need for Foreclosure Advertising. Sunny Southern California has a County with 27.5 Percent Unemployment?

Southern California is a vast housing region. With 7 counties (let us not forget Imperial) it is home to the majority of those living in the state. It is also home to subprime lending and every other toxic mortgage product like option ARMs. I am fascinated that people think there is a tiny amount of shadow inventory floating in the market. In some areas, the number is simply daunting. We ran our estimate for Southern California and came up with a figure of 40,000 homes that are hidden on the bank balance sheet. We might be a bit optimistic here. I am glad that the Attorney General is now cracking down on shady loan modification operations. Here is simple advice for California loan modifications; don’t do it! And it didn’t cost you $3,500. Today, we are going to examine one zip code in Riverside where officially on the MLS 459 properties are listed but on foreclosure records, we see 1,319 distressed properties!

The Inland Empire of California has taken a devastating hit during this housing implosion. It was largely booming with construction jobs and finance jobs during the good days but has taken a major hit with the California housing bubble and budget implosion. Before we move on, let us first take a look at the overall region:

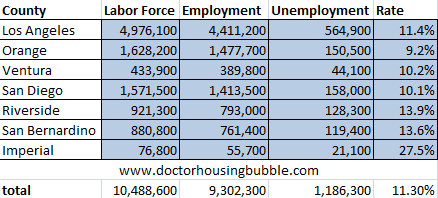

The hardest hit counties have been Riverside and San Bernardino.  People forget about Imperial County but this area has always been hit hard and this time is no exception. It is small in terms of labor force but people would have a hard time believing that in sunny Southern California we would have a county with an unemployment rate of 27.5 percent. Sadly, when most talk about Southern California they simply exclude this region that is part of our state. Let us look at the employment data for the region before we look at three Real Homes of Genius properties in Riverside:

The Southern California unemployment rate is a tad bit below the statewide unemployment rate of 11.6 percent. But make no mistake, some counties are taking the brunt of this housing bust. Many investors are now rushing out to the Inland Empire and purchasing properties to either flip or rent out. A few investors that I have talked to are going with hard money interest only loans and are planning to flip these homes in 5 years for “double the initial price.” I’m not sure about that. I look at areas like Michigan or Ohio where some cities have been depressed for decades. Both of these counties relied heavily on construction and finance for employment. With California battling massive budget cuts, do we really think another housing bubble is in the works?

Today we are going to look at three homes that are potential targets for these so-called investors. These homes utilize the time tested method of real estate marketing known as “Garbage Can Photography” that seems to be all the rage today. Let us salute Riverside with our Real Homes of Genius Award.

Riverside – Three Homes and One Garbage Can

Home #1

Our first home uses a unique blend of squint technology but even with that helpful camera technique, we are still able to see those nicely lined up garbage cans. This home is labeled as an “Investor special!!!” (exclamation from ad) and is listed as 3 bedrooms with one bath although we are then told “1 bedroom is not permitted.” In the bubble days, who really cared about those pesky permits! The home is fairly new being built in 1949 after World War II. Let us look at some sale history here:

02/15/2002: $109,000

06/19/2001: $95,436

…

01/06/1994: $72,106

Now what is the current sales price? $69,300. We just went back to 1994! This is a Back to the Future home. Maybe that is why the photography is a bit blurred? Time travel does a number on digital photos. Get your investor cap on and move forward because as people are saying, this is now officially the bottom even though we have $1.1 trillion in Alt-A and subprime debt still floating in the market.

Home #2

Sometimes you wonder if we shouldn’t take the heads of the U.S. Treasury and the Federal Reserve on a mandatory caravan tour through these places. Do you think they would be keen on dumping more money once they realize what they are making taxpayers bailout? Aside from that, our second home shows us once again that REO listings have a knack for garbage can photography. Common sense would tell you that taking a picture with a garbage can(s) on your lawn is not exactly the best way to market a home like putting up a picture of yourself with your ex on a dating site. This doesn’t exactly entice the clientele. Either way, I have seen this technique enough that it tells me a couple of things:

(a)Â Whoever is taking the picture simply does not care

(b)Â They think this is the best picture they have

(c)Â They are big fans of the school of garbage can photography

Aside from Oscar on Sesame Street, I’m not sure who enjoys being in garbage.  So this seems to be pervasive here. You would think that banks would try to get the most bang for their buck especially since many of these banks are recipients of taxpayer money. Let me ask you this, if this was your home would you market it a better? Like, oh I don’t know, moving the garbage cans before taking a picture? Just a thought.

This home shows the lovable bubble mania of California. Let us look at some sales history:

06/27/2006: $375,000

10/15/2003: $189,000

07/26/1999: $90,500

Quadrupling your home price in 10 years is incredible (insane). It went from $90,000 in 1999 to the peak of $375,000 in 2006.  This is a 3 bedrooms 2 baths home built in 1958. What is the current listing price? How about $114,900. We go from $375,000 to $114,900 in three years. That is what you call a massive implosion, not a correction.

Home #3

Our third and final home appears to fall into the home #2 category. Peak bubble price and massive implosion. You would think that someone would try to move those garbage cans out of the way but it would almost seem intentional that they are leaving these in the picture. This isn’t like you selling a pet rock on eBay for $5. You are talking about tens of thousands of dollars here and the biggest purchase for many. Digital cameras are cheap. Manual labor to move the garbage cans is even cheaper. Yet, here is another Real Home of Genius leaving these in the photo.

This home is a 3 bedrooms 2 baths home and is one of the newer places built in 1972. Sales history shows us the bubble in action:

06/17/2005: $325,000

11/16/2001: $162,727

The current list price is $116,000. Now these seem like good investments to many that are accustomed to hyper-inflated housing prices. Yet look at the unemployment rate in these regions. Will you cover your rent costs? What about vacancies? Keep in mind that unemployment is still going higher. What if your tenant loses their job? California has strict laws on evicting someone. Do you have enough to cover the rent for many months as you battle it out in court? Now, most of the time you will have good tenants. But some think that becoming a landlord is as simple as subtracting the PI from your gross monthly rents. They forget to factor in taxes, insurance, vacancy costs, advertising, cleaning, repairs, and other unforeseen expenses. Sure, when you run the numbers like:

PI:Â Â Â Â Â Â Â Â Â $900

Rent:Â Â Â Â $1,000

Sounds fantastic on paper. Reality is much different. The Alt-A and option ARM implosion will largely steer clear from these areas and will have a bigger impact on mid to upper tier markets. After all, the average Alt-A loan comes in at $443,000.

Today we salute you Riverside with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

27 Responses to “Real Homes of Genius: Two Garbage Cans, One Home. Three Foreclosures and Garbage Can Photography Housing Candidates. Today we Salute you Riverside. The Need for Foreclosure Advertising. Sunny Southern California has a County with 27.5 Percent Unemployment?”

Dr.,

You’re right, as always….these people DO NOT CARE.

And why should they? The can do no wrong! They can steal from us, cheat us, ruin lives, cause worldwide misery, and GET PAID FOR IT!

House #2 dropped almost 70%, if it goes at list price. That is an amazing example of what unemployment can do in an area. Granted, it is at the bottom of their housing correction, but how much does the Westside drop once its loans fully implode? 40%, 50%, 60%, 70%? Only time will tell.

http://www.westsideremeltdown.blogspot.com

Great posts DHB. I’ve been thinking about getting into the investment property game for a while now, but just like you said: if your renter’s unemployed how are they going to pay you? Plus, you’re absolutely right about the crazy amount of red tape that goes into evicting someone in California. I had to do it once when the parents of a home seller refused to vacate the premises after I had closed escrow.

“The number of U.S. households on the verge of losing their homes soared by nearly 15 percent in the first half of the year as more people lost their jobs and were unable to pay their monthly mortgage bills.”

The mushrooming foreclosure crisis affected more than 1.5 million homes in the first six months of the year, according to a report released by foreclosure listing service RealtyTrac.

On a state-by-state basis, Nevada had the nation’s highest foreclosure rate in the first half of the year, with more than 6 percent of all households receiving a filing. Arizona was No. 2, followed by Florida, California and Utah. Rounding out the top 10 were Georgia, Michigan, Illinois, Idaho and Colorado.

Read More: http://www.housingnewslive.com

“The number of U.S. households on the verge of losing their homes soared by nearly 15 percent in the first half of the year as more people lost their jobs and were unable to pay their monthly mortgage bills.”

The mushrooming foreclosure crisis affected more than 1.5 million homes in the first six months of the year, according to a report released by foreclosure listing service RealtyTrac.

On a state-by-state basis, Nevada had the nation’s highest foreclosure rate in the first half of the year, with more than 6 percent of all households receiving a filing. Arizona was No. 2, followed by Florida, California and Utah. Rounding out the top 10 were Georgia, Michigan, Illinois, Idaho and Colorado.

Read More: http://www.housingnewslive.com

@Robin,

That is the thing that bothers me the most. There has to be some level of agreement that some things are right and some are wrong, but there does not seem to be. At the risk of sounding like a conspiracy theorist (like the banks and Fed haven’t proven conspiracy once and for all) I read where the mob bosses (bankers) offed JFK because he got the US Treasury to print money backed by silver so we wouldn’t have to pay the Fed interest on our money. But then the Warren Commission made such a compelling argument and built a water-tight explanation for the whole thing. We have been lied to about everything for so long is it any wonder we have become cynical? Apparently you can fool all of the people all of the time.

@ someoneelse last blog

Somebody said ‘government’ and ‘Federal Reserve’ as if they are one and the same. The Federal Reserve is about as federal as Federal Express, although the Fed and Treasury are thick as thieves…the Fed is a giant blood-sucking leech and we’re in the river with Humphrey Bogart pulling the Alt-A Queen out of the mortgage reeds. The part where we go over the falls is coming up next…

Houses #2 and #3 are priced at about what they’d sell for in Indianapolis. Depending on what incomes are like in Riverside Co. and how hard it is or is not to build in said county, these might actually be somewhat underpriced.

The Sacramento Bee has an article out today:

http://www.sacbee.com/static/weblogs/real_estate/archives/2009/08/nearly-1-trilli.html

>>Santa Ana-based First American CoreLogic just minutes ago released a grim look at the mortgage crisis, reporting that 32.2 percent of all U.S. mortgages were tied to homes worth less than the amount of their loans.<<

In places like San Diego it doesn’t matter if you have garbage cans or a gang shooting in the picture, the house will get 30 offers if it is priced right.

I can’t help but think that these homes when photographed were occupied by the poor people who are about to be or were slapped with an NOD/Foreclosure and the photographer wasn’t about to confront the occupants whether the tenant’s or “owners” to move their trash cans so their home could be sold out from under them. A sad state of affairs.

Thanks Doc. Keep up the great work.

Dennis

At least there are “green shoots” to keep people happy….:)

OMG Doc You had me rolling on the floor here. I think I’ll have to start a web site now called Garbage Can Photography and we’ll just take random pictures of the world with nice big fat garbage cans in them…

“Our first home uses a unique blend of squint technology but even with that helpful camera technique, we are still able to see those nicely lined up garbage cans.”

Nahhh Dennis, the people are long gone I’m sure – it’s cuz the “photographer” just did a trash out – and his arms were too tired to move those cans one more inch… ROFLMAO I swear to God it’s gonna be a new hot trend. Watch and see.

I bought Sesame Street Real Digital Camera a few weeks before christmas as my own present from http://www.dealsshoppie.com/product/search.php?ID=B000V9NG9C&product=Sesame+Street+Real+Digital+Camera! I love this thing and someone will probably have to pry it from my cold dead hands some day. There were 10 reviews with an average rating of 2.0. I found this information to be very helpful and give the product a thumbs down.

These homes make me think about the fanastic argument that prices absolutely cannot drop below replacement cost (based, of course, on 2006 peak replacement costs where carpenters were paid a gajillion dollars a day for pounding nails). So these homes are surely massively underpriced, right? Just like all the houses in Detroit being offered for under $100 dollars.

If I had the time and money, I would travel the length and breadth of the land, knocking on the doors of every moronic housing bubblehead and simply laugh loudly in their faces.

Home pic #2 definitely could have used some paintshop lawn greener. Is that art already out of style? Or only for the high end realtors?

Keep up the good work. I love your photography criticisms. Looking at Home #3 it seems they purposefully included the trash can and excluded the right side of the house in the picture. Possibilities:

1) The photographer is a former homeless guy with a penchant for garbage diving and cannot resist a beautiful can.

2) The can looks better than the house.

3) Neighborhood is best photographed at 30mph for personal safety.

I think that fashionable garbage can photography is preview for interior of the house. One can only imagine. I work as remodeler all during “the bubbling years”.Transplanted here in 1998 from Pa., We bought in 04/2000 in Simi, thanks to the Dr and few other bloggers e.i. Mr M , Mish , and others that did not this was not going end very well, sold in 09/2006 and went back to farm. Most people close to me thought I was crazy. Yes I was making a gajillion dollars a day, and yes Dr H, installed many granite counter tops, something I could never see justifing the cost. I install formica type counter top in my own kitchen.

After what has happen over the last 3 yrs, I dont have many regrets. Keep up the good work, with that little bit humor added.

The garbage cans are one thing but what about the great toilet pictures? My particular favorites are the ones that are single toilet shots with the toilet seat up! Put the lid down at the very least, you idiots! Is anyone out there really saying, “Hey that’s a great toilet. I really want to buy that house!”

Eddie Izzard observed how supermarkets put the “fresh fruit n veg” at the entryway so people go in and say, “Everything here is FRESH! I will do well here!” You never, he observes, see the toilet paper and brushes first. “This is a POO SHOP! Everything here is MADE OF POO! I’m not shopping here! I’m going to Azerbaijan!”

~

http://technorati.com/videos/youtube.com%2Fwatch%3Fv%3Dhh5a0ucs8kQ

~

Good advice for RealTorz…and most I’ve met could use a little classic-Izzard fashion sense as well.

~

RealTorz hate these houses. They hate the people who live in them. They hate having to sell them. They include the garbage cans to relieve psychological stress over the marrow-deep sense that they are peddling basura. Not that all these humble little houses *are* basura, but they are repellent to someone whose notion of the ultimate life success is 6% on a series of $27 million Schmuck Barns.

~

Satsumas for everyone!

~

rose

Another area people aren’t talking about is part of the housing price is based on what’s around the house: schools, streets, parks, and other services. With the tax receipts cratering in CA you know that the streets/sidewalks/etc. maintenance is going to go down dramatically, school quality will go down, fire/police services will be cut back, parks won’t be maintained and may be closed altogether, garbage collection and other services will be degraded, crime will go up, businesses/malls/strip centers/restaurants/other CRE. in the area will be going belly up, area job opportunities will be going down, homelessness and street beggars will increase, etc. etc. etc. Some of these areas are much more likely to end up looking more like Detroit than returning to the wonder times of 2006/2007.

Have you considered showing street addresses and zip codes for the houses you cite? It makes further research a lot more fun.

“Let us not forget Imperial”

Why not. Imperial County, as you mentioned has always been “hit hard,” that is if you happen to be Hispanic. The Anglos generally do just fine there.

Sold two houses there this decade. At the time, it seemed like we may have given one away to a long-time tenant ($50K – don’t laugh, it was a 1/1 house made of sticks), since we might have gotten $100K out of someone else. However, as it is now, the buyer is still employed, and making the payments, and the house may be worth less than $50K.

Don’t think there aren’t any houses in SoCal that go for Detroit prices; there are, in Imperial, Holtville, Westmoreland, Brawley, El Centro, and Calexico, and Seeley. I think I’d still rather live in Brawley – I prefer the heat to the cold.

Sorry, but I have no idea what “PI” means (other than 3.141592654…), and I thought I knew RE pretty well. If I were ever to buy-and-rent landlord, I’d naturally include the costs of vacancy, taxes, agent commissions, repairs, but what the heck is PI?? Do you mean the interest on a loan? It never occured to me to borrow money to buy one of these things, that’s nuts.

Also curious why you don’t included the addresses of these places, so readers can follow and see where they actually sell. Asking prices are typically dropped multiple times, multiple months before the place actually sells.

J.

Well I’m not a murcan JP, but I imagine that the PI means principal and interest. Correct me if I’m wrong Doc. Slan go foill!

One of the best websites for bad real estate photography — http://www.lovelylisting.com

Some real WTF moments.

There is a condo for sale in Portland Oregon where the realtor took a picture of the toilet. At least the seat was down. LOL Nice condo though.

J.P.,

PI stands for Payment & Interest. The other standard acronym is of course PITI: Payment, Interest, Taxes & Insurance

Leave a Reply to latesummer2009