Real Homes of Genius: Santa Monica, meet Housing Crash. Prime Real Estate Isn’t so Prime Anymore.

Trying to follow the economic, housing, and financial news these last few months is like trying to drink water from a broken fire hydrant. Where to begin? Good news for you readers in the adult film industry, it looks like another group pitching a tent for a bailout is those in the porn industry. Larry Flynt stated that Congress must “rejuvenate the sexual appetite of America” and amazingly, this argument has as much validity as all the other ignorant and preposterous bailouts.

I know many people have certain moral feelings to certain industries but if the thesis of the bailout argument is to keep Americans working, then why not? That is the problem we now face. Why bailout auto workers and banks but not retailers and casinos? Or what about bailing out credit card companies? Either way, these are common problems faced when we go down the slippery slope of bailouts. By the way, the elasticity of the adult industry is vibrant especially here in Southern California.

Another funny thing being passed around is this new revived desire for cram-downs (we are not talking about the adult film industry anymore). You’ll be “shocked” as to who is now backing this. Citigroup. Isn’t that nice of them? Of course, our good buddy Paulson has essentially backstopped approximately $300 billion in questionable assets with Citigroup so what do they care if loans are crammed down? You’ll notice no small regional players advocating for this. The formula Citigroup is following is pretty simple:

(a)Â Make beacoup money on toxic loans

(b)Â Have your crony capitalist lobby for a bailout/insurance

(c) Market implodes. Use bail out.

(d)Â Once bailout is in place, talk about socially acceptable loan modifications and even cram-downs now that you are protected

(e)Â Smile, socialize the losses and privatize the profits

Don’t you love how the system works? Instead of backstopping that $300 billion, we should have allowed Citi to fail and allowed cram-downs in the first place. In fact, we should have started down the cram-down road years ago. You can take a wild guess who blocked legislation regarding cram-downs in the first place. You can do a lot of good with $700 billion in terms of helping out homeowners. So while some may applaud this action, it is basically us footing the bill so what is there to be all worked up about? It’s as if Citi is saying, “hmmm, let me think about how I am going to let myself spend tax payer money now that you have given it to me. I know, I’ll do what you were going to do anyway and give it back to you.” We’ve gone full circle.

As I discussed in detail on our Southern California analysis and housing forecast, the California housing market is flying off the deep end of the mosquito infested pool. At a holiday party there was a familiar acquaintance who always bragged about his condo flipping skills. As it turns out, this year he is losing his “awesome flips” since they are now down 50 percent in value. Now the good doctor does partake in schadenfreude, after all the Real Homes of Genius series is a glorious celebration of schadenfreude. I can tell you that he was subdued this year. He went from a leased Mercedes to a Honda. God forbid someone drive a modest car in California right? I didn’t delight that this guy failed. He is a moron and lost all of his money as quickly as it came. What I did take a slight delight is people are now being forced to live within their means. For those not from Southern California, that is like trying to get someone to speak Russian in a Peruvian bar. If you haven’t noticed, the group being punished the most in this global economic crisis are prudent savers. No bailout for them however.

To highlight this point further, today we are going to take a look at a prime area that just got a blind date with reality. Today we salute you Santa Monica with our Real Homes of Genius Award.

Santa Monica – The Red Carpet Housing Smackdown

If I hear one more time how resilient and immune Santa Monica is to the real estate crash, I think I am going to put my foot through a flat screen television. Over and over like a poorly shuffled MP3 song on my iPod, I could not believe how people were willing to listen to the same old tired tripe while the facts kept creeping up. As long time readers know, we realized that more prime areas were only going to take longer to come down. They are now coming down significantly.

This above home is the perfect example of prime area delusion. This 676 square foot 2 bedroom 1 bath home is exactly what I’m talking about. This same home would sell for $40,000 in many other parts of the country. But not in Santa Monica. Because haven’t you heard? Forget about the actual construction of the home, this is Santa Monica! Well let us see how this home is doing in Santa Monica:

Price Reduced: 06/04/08 — $1,085,000 to $995,000Â Â <–Â Bwahahaha!

Price Reduced: 07/16/08 — $995,000 to $949,000

Price Reduced: 09/11/08 — $949,000 to $895,000

Price Reduced: 09/19/08 — $895,000 to $849,000

Price Reduced: 10/15/08 — $849,000 to $749,000

Price Reduced: 10/28/08 — $749,000 to $695,000

Price Reduced: 11/14/08 — $695,000 to $645,000

Price Reduced: 01/06/09 — $645,000 to $625,000

One, two, three. Bwahahahahaha! I needed a laugh like that! Last June, someone actually listed this place at $1,085,000 for 676 square feet! Look at this place and tell me if each room is worth $500,000? Unless the interior decorator was Saddam Hussein and he installed gold plated floors and a diamond encrusted toilet, then no, this price is a tiny bit on the high side. As you can see, this piecemeal price drop is insanity. Ironically, if this seller just went from $1 million to say $750k back in June of 2008, he may have found another sucker to jump into the prime delusion Jacuzzi. Not this time. You’ll need a jumbo loan for this mini home.

This place is now a short-sale. I love how the ad tells us “You can get views of palos verdes from the top of the lot.” Well I can also see the Financial District from Skid Row in downtown L.A. but that doesn’t mean I’m going to pay $1 million to live in Skid Row. I’m telling you folks, this is the kind of logic we’ve had to live with for a decade here in Southern California.

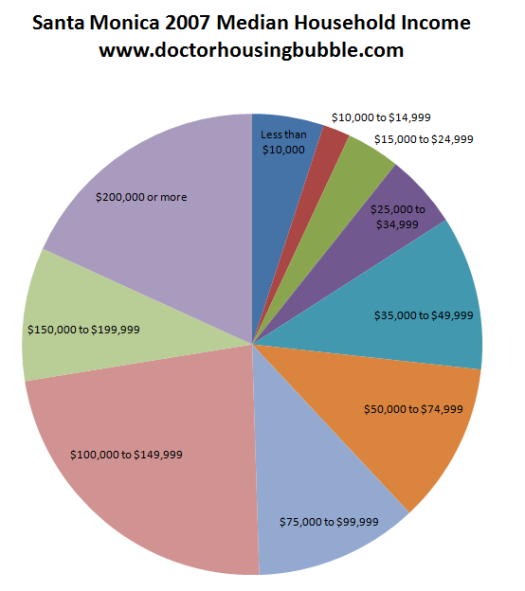

And stop with the everyone in Santa Monica makes a million dollars. Here are the stats for Santa Monica:

Let us back track to that $1 million asking price. A family would need to make over $200,000+ a year to even be considered and yet only 18 percent of all households in Santa Monica actually make this much.

Here is more data to chew on:

Santa Monica Median Family Income:Â Â Â Â Â Â Â Â Â Â $100,657

Santa Monica Mean Family Income:Â Â Â Â Â Â Â Â Â Â Â Â Â $151,261

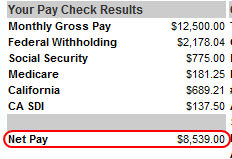

So let us use the high range with the mean and run the numbers which people still don’t do and assume this hypothetical family is buying this home at the current market price:

Price / 10% down payment:Â Â $625,000 / $62,500

Loan Amount:Â $562,500 at 5.5% 30-year fixed rate

PITI:Â $3,844

(PITI $3,844 / net pay $8,539) = 45 percent of net pay goes to monthly payment

You would have to go by gross income to fall within the more conventional debt-to-income ratios of one-third. So only 27.6 percent of the families living in Santa Monica currently have the income to support this home. And you think someone making $200,000 is going to live here?

Today we salute you Santa Monica with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

22 Responses to “Real Homes of Genius: Santa Monica, meet Housing Crash. Prime Real Estate Isn’t so Prime Anymore.”

I read to many blogs, maybe it was this one, but people are leaving CA. I wanted to move back to CA when I retired, but even with prices falling, it simply doesn’t make financial sense. I am willing to pay 20% for the weather (and this is Fresno weather !!!) but not double or triple! I don’t know if people in CA understand how overpriced housing in CA is. Look at the Santa Monica house, and look at this texas house

http://www.realtor.com/search/listingdetail.aspx?fhcnt=30&loc=abilene%2ctx&usrloc=abilene%2ctx&ml=8&mnp=100000&mxp=110000&typ=1&sid=c3fc694155fe4d898da4256ad39499e8&lid=1103632918&lsn=1&srcnt=33

kind of speaks for itself

I just have to salute you again Dr.! You provide very serious information and make me laugh so hard with your writing style! I’ve been addicted to your blog for over a year now! Please keep it coming!!! :->)

Kudos. I have been using this same justification for years and it has kept me out of the market. You can easily figure out what a person needs to earn to support payments on any given house, and it’s not hard to figure out whether a person who makes that salary is in a position in his/her life where that house would be attractive.

DR. HB. As Fresno points out. Due to massive job losses in construction and real-estate there must be a mass exodus out of California happening right about now. It would be interesting to see what that is going to do to the housing market in CA. Food for thought.

My mistake:

http://www.santamonicameltdownthe90402.blogspot.com

Thanks again Dr HB, for providing us with FACTS about Santa Monica. It seems to be the top of the pyramid here in Southern California. Unfortunately, the pyramid is now crumbling. Yes, wealthy individuals can hold out longer, but there comes a point, when it’s time to cut their losses, based on future propects. That time is now, with the current disentegrating job picture.

Santa Monica, along with other high end areas will be hit hard in 2009. Even, 90402, the prime of prime, is now declining. As reality emerges, we will see massive declines in Santa Monica, as it is one of the most overinflated areas left.

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

saw nicer houses auctioning in stockton for 56,000 dollars on television a FEW WEEKS BACK, BUT NOT SANTA MONICA.

Spot on Dr. Bubb!

Jason

Santa Monica and the other high end areas have been resistant to the crash, until recently. It’s a measure of how severe things have become, that values are now finally falling even in these most desired areas. What I want to know is when places like Santa Monica will see the bottom, so I can step in. They’ll be the first to recover.

Ya gotta love Dr. Housing Bubble, I read every one, sometimes out loud to my wife and kids and we laugh hysterically….. Keep it up!

In Michigan we would call that type of home a trailer. This must be a trailer park in California that you have pictured here.

Looks more like a trailer. This must be a trailer park in California.

Doctor, like the data.

I live in Redondo Beach 90277 and have seen a lot of properties sell in 90278 – SFR’s selling in the mid 500K’s. I looked closed sales for SFR’s in 90278 from 10/08 to present, and I would say about 35% are financed on FHA loans. So they are putting down 3% and financing the balance. Seems crazy they can write loans with so little down – I am sure that the market in 90278 be down 3% by the end of February and then the loans will be underwater.

I also noticed that the other 65% of the loans looked pretty good with 10%+ down. With 20% down in the 90278 market, your payment is pretty close to your rents.

My question is, if you can get a mortgage payment for the same or close to a rental payment, don’t you want to be a buyer?

My wife and I want to buy a property in the South Bay and some of the numbers start to look like that can work for us. When I read your blog, it sounds like we are in for a lot more depreciation.

Hey Tim…I am familiar with the area you are looking at, and I would advise you to wait longer. 90277 and 90278 have a ways to come down, probably around 20% more between now and mid 2010. You may want to start looking seriously at the end of 2009. Of course you should be monitoring the market regularly but I doubt it will stabilize before the end of this year.

Just tell me that I’m immune. Yes I bought at the height of the bubble craze(2/06). Please tell me I’m not a knife catcher. Please, someone assure me that it’s going to all be ok!

Thanks for you info “To Tim”

I agree with your opinion 90277 and 90278.

Would it be fair to say that if I am trying to buy a place in 90277 or 90278 that an offer 20% – 30% below the average price would get me close to where we may be by the end of the year?

I know their are people out here looking to make deals and I want to be in the loop if one is made. Recently, I saw a SFR on Prospect (3bd 1 bath – 1100 sqft) sell for 480K on a double lot (6100 sqft) with city views. This was about 150K below anything comparable in the area – with 20% down and today’s rates, this would have been cheaper than renting and upgrading my living standard.

90277 does not have many SFR’s with big lots left (in my price range) and I am afraid if I wait I may miss out on some good opportunities. If we make any offers, they will be low and reasonable and based on future value than today’s value.

Dr. Bubble…

You saved me. I almost bought this gem as it dipped into the low $800,000s. What a deal.

Then I saw that it didn’t appear to be ADA approved.

Dang Gummit. Almost gave a plus price offer for the gem. My wife really likes the window treatments. Now, I’ll have to find some aluminum blinds at the local dump and spike them to my window frames. Lots of work, but maybe it will increase the value of my trailer too!!!

Toray99 in Michigan:

Believe it or not, this is not a trailer park and I’ve seen worse. The market in SoCal is that goofy. If I could get a job somewhere else I would be out of here in a heartbeat. Miserable place to live unless you are fabulously wealthy.

Comrade Housing Bubble,

Another fine post! All this talk about cram downs has me wondering what the pros and cons are. It seems to me that the underwater loans are unrealized losses on the lenders books and somehow they need to be realized. Isn’t that what normal Ch. 11 bankruptcy is designed to do? Why not just let the homeowners file and do the workout the way the system is meant to work? Those taking the risk would bear the burden of the losses. Your divine insight is needed!

I’ve even heard rumors that Barney Frank wants to use TARP to buy down the underwater balances. How does the taxpayer benefit from taking on the loss? People keep saying that if we just solve the foreclosure issue, that will stem the tide and everything will be hunky dory. Personally, I think it makes more sense to just bulldoze some of the excess inventory, especially the crack shacks you show in the Genius series.

What worries me about these “cram downs” is that they will be used in a way to essentially “gift” a McMansion to someone who bought it using a liar’s loan (no-doc option ARM.) In such a scenario, any “renegotiating” would be useless. The borrower would never qualify because they don’t make enough money. That’s why they went the liar’s route in the first place.

~

The other alternative would be to declare by fiat that the McMansion is really worth 40% of the purchase price and that figure will now be the principal on the “renegotiated” loan. The payments would then be lower, perhaps even affordable to the liar. But that would leave the lender with a loss presumably covered by TARP, and this would also end up having the taxpayer buy the liar’s McMansion for him.

~

Neither of these scenarios is palatable and would also have the negative effect of continuing to distort housing prices higher than they should be.

~

So just what good is a “cram down” anyway besides being just another way to funnel taxpayer money into the pockets of the criminals?

Interesting math doctor.

I did the same calc a while back for the area I want to buy in (Carlsbad). Historically, the median house price has been 5 times the median household income. In 2007 (@ still delusional prices) the median house price was 9 times the median household income.

I want to buy a home real soon. But reading your blog inspires me to wait just a little longer. Thank you.

Interesting to know. I am still waiting for the same to happen in San Francisco.

Leave a Reply to Jason