The new Investing Psychology of the Southern California Housing Market: Hunting the SoCal Foreclosure Market. The New Rules of Southern California Real Estate.

Housing in Southern California is still trying to find a bottom. The market is flooded with distressed property, a tight credit market, and borrowers who are now more cautious than Bernie Madoff (that is, before he had his moment of catharsis forced by the imploding market). The one thing being missed by policy makers is that psychology has been forever changed. That is, we now have a generation that will never fully believe that real estate never goes down as many in the real estate industry were telling us.

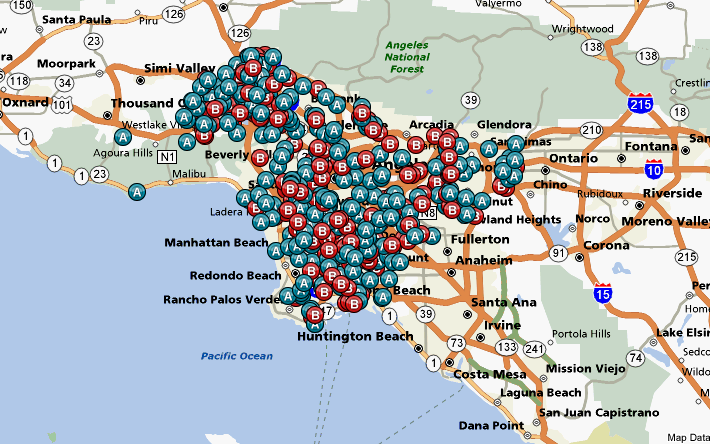

As we are now well on our way with 2009, we need to keep a close eye on how the recasting of billions of dollars in option ARMs will impact the bottom line of the California housing market. The first chart I want to show you is courtesy of Foreclosureradar:

*Source:Â ForeclosureRadar.com

You aren’t looking at some sporting event seating chart. What you are seeing is a market in full blown turmoil. “A” are auctions and “B” are bank owned homes. The entire region is flooded with these properties and you can rest assured 2009 will bring more of these online. Now think for a second what this does to other homeowners in the region. Say you live one block from a bank owned home. You think your home is worth $500,000. Well the bank owned home just sold for $300,000. Guess what? Your home just got a royal drubbing even if you weren’t planning on selling. What does this do to overall consumer psychology? On the most primitive level, I am certain it keeps people from spending as much. On a broader level, it depresses the economy and sentiment (this is being reflected in most economic data coming out).

Auto sales came out yesterday and they were pathetic. Across the board from Toyota to Ford auto sales hit the brakes and came to a screeching halt. In no other place is this more relevant than a car and housing obsessed Southern California. Let us take a quick look at the California housing market, with a deeper focus on Southern California:

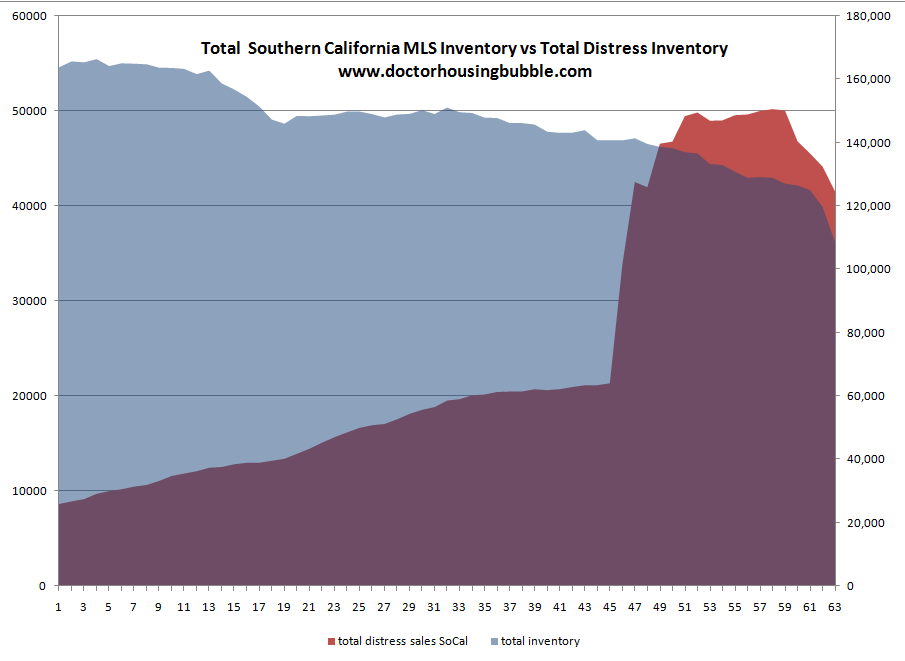

The chart above has market observations since September of 2007. The intervals are spread out on a weekly basis (typically) and go to the present. The point of the chart isn’t the dates but the overall pattern for over a year. That is, inventory is drastically falling while distress inventory is still very high.

What is also interesting about the chart is this includes the SB 1137 help which delays the foreclosure process but we should be seeing those effects drastically dissipate by the end of the first quarter. Yet like the first chart shows, when you have that much distress inventory on the market and over 50 percent of sales are distress, you can expect prices to go even lower:

It is hard for me to amend my prediction that prices for California will not find a bottom until 2011. I’ll give you 5 main reasons why prices will continue to fall in California:

(1)Â The pay option ARM recast tsunami.

(2)Â The amount of distressed inventory on the market.

(3)Â People moonwalking away from underwater homes.

(4)Â The imploding California budget (read the 2009 forecast).

(5)Â The worsening economic conditions in the state.

I could go on, but these are reason enough to keep real estate depressed for multiple years. Even if we are to see real estate inflation eventually, we may see it in other states that try to catch up. For example, many mid-west states have median home prices of approximately $100,000. So even if the median price of California drops to $200,000, we are double that of many states even though incomes are not double. Yes, I can hear the ever shrinking audience that whispers “but what about Newport Beach, La Jolla, or Beverly Hills?” I hate to break it to you but the other 99 percent of the population live in other parts of the state. Areas like the Inland Empire, Central Valley, many of the non-prime 88 cities of L.A., and rural parts of California.

The only thing I can think of more shocking than how quickly prices are falling is what happened to an unsuspecting soul in Poland:

“What are you doing here?”: man asks wife at brothel

That is a fantastic headline! This same kind of psychology of surprise is currently permeating the entire investing world. I’m sure the man and the wife might have both been angry for obvious reasons.

There have been many sob stories going around regarding the Bernie Madoff ultimate uber Ponzi scheme. I’m sorry, but investors didn’t want to ask questions that pried too deep when things were running at an unreal pace. Sort of like going to a brothel and seeing something you weren’t expecting. If you really want to be sickened, let us see those trillions of securities the Fed is now holding. You think $50 billion is bad. You have no idea. Most people in Southern California at a gut level knew prices were out of line but they didn’t want to believe. What we had is one giant global bubble.

I see people jumping up and down about lifting conforming loan limit caps.  This was spurred because in the east coast, we have already seeing the conforming loan limit come down. That is right, it actually dropped. As it should. The conforming loan limit was to keep pace with the median price of local area homes. Now that we know there is a bubble, it is only right to lower caps as the prices fall. Yet now we get more stupid ideas which will fall under the Super Ignorant Investment Vehicle (SIIV) about putting a bottom on conforming rates – that is, the cap can go up but never down because prices never go down right? This makes no sense. How is this relevant to Southern California? There are a few reasons.

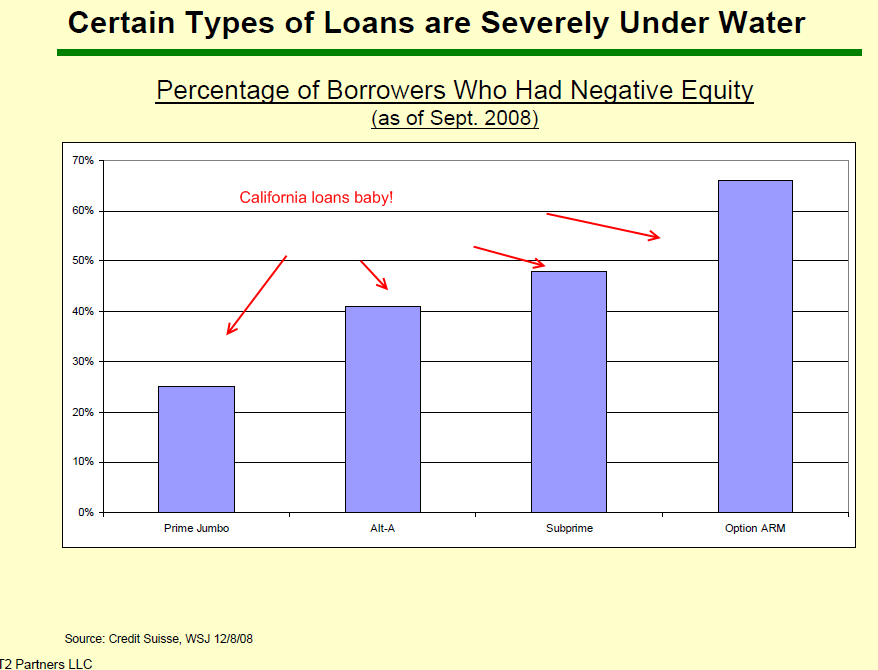

First, it will not help you if you are underwater. Take a look at this:

Over 60 percent of option ARM loans are underwater! The vast majority of option ARMs are here in California. Also, we have a lot of Alt-A, subprime, and prime jumbo. Here is a big newsflash. You cannot refi an underwater loan! Get that through your head. Let us assume that we lift caps. Okay. Yet we still need to document income. Go back to the 5 points above and read about the California employment situation. How many people are going to be able to afford $500,000+ homes with government guidelines? Many can’t. In fact, the majority can’t.

I have come to the painful realization that the vast majority of politicians simply do not get it. Well, they do get it yet they are disingenuous in how they present arguments. The fact that they want to raise caps while prices are collapsing is mind boggling. This is like the initial writing of the $700 billion TARP to eat up all the toxic assets out there. What they quickly realized is $700 billion does not go a long way and there is much more toxic assets than $700 billion out there.

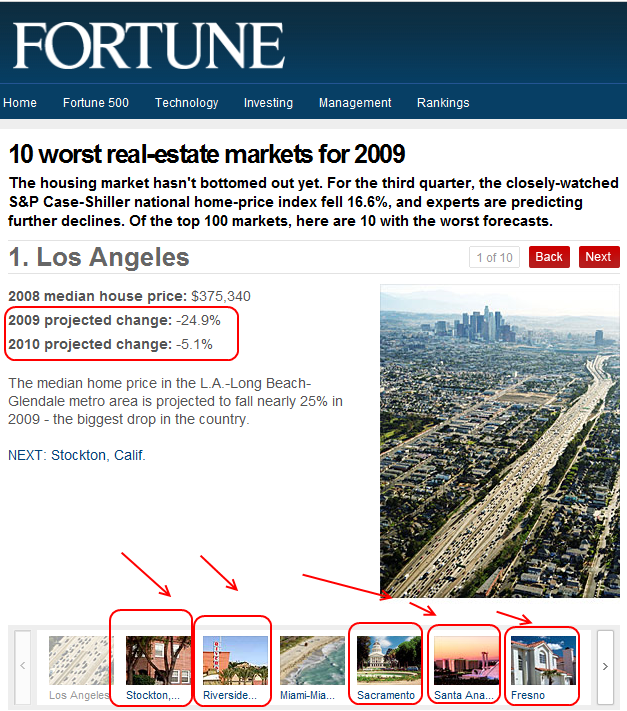

People in L.A. and SoCal still don’t get it. It seems like mainstream media sources are now putting a number to their pessimism looking similar to my own analysis which I have been saying for years:

*Source:Â Fortune.com

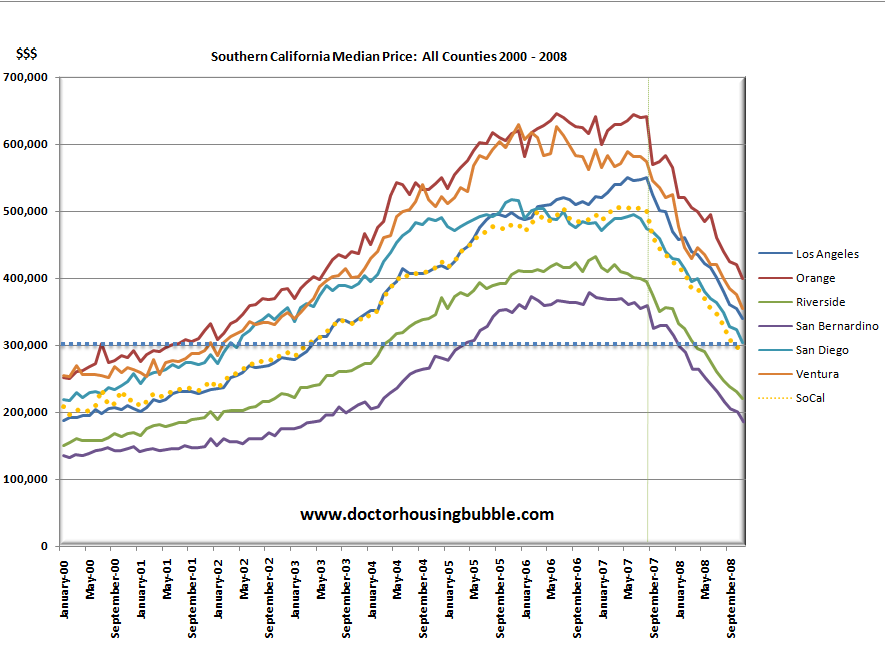

The worst real estate market for 2009? How about Los Angeles which is expected to drop an additional 25 percent! And you thought I was a doomer?! Most of the top 10 markets are in California and Florida. So this is the kind of mentality floating out there.

And even with the 25 percent drop, prices will still be too high unless incomes rise and the employment situation improves. That is why Fortune is predicting an additional 5 percent drop in 2010. I was early but my 10 Reasons Why California will not have a housing bottom until 2011 are now getting picked up by those writers/editors logical enough to understand basic math. There is a new calculus to real estate.

We’ve already seen 50 percent drops. The next stop is 60 percent. Take L.A. What are the scenarios?

$550,000 peak – 50% drop:Â Â Â $275,000

$550,000 peak – 60% drop:Â Â $220,000

$550,000 peak – 70% drop:Â Â Â $165,000

The current L.A. median price is $340,000. We will see $275,000. It is too early to say whether we will see a 60 percent drop from peak to trough but that is possible. You need to remember, the L.A. median price in 2000 was $187,000. $220,000 seems feasible and would actually bring prices in line especially since we are dealing with Japanese style deflation right now.

Like I said, we may see inflationary pressure in real estate in other markets across the country but California is done for a very long time.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

29 Responses to “The new Investing Psychology of the Southern California Housing Market: Hunting the SoCal Foreclosure Market. The New Rules of Southern California Real Estate.”

With info from Data Quick/OC Register. I tracked OC median home price for last 20 weeks. 15 seconds of iphone calculator math says by July should be half of peak, which was 645k. The rate of decline of the 2nd 10 weeks was faster then the 1st ten weeks. Its dropping $3450 per week. So in 116 weeks the median home in the OC will be free. That means zero property tax too. I can’t wait.

Foreclosure map is awesome… Nowhere to hide. Even Santa Monica 90402 is showing some pain. The Westside will take it’s shots this year.

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

This article makes many valid points but all it numbers should be re-checked for accuracy.

This is in the first part of the article:

recasting of billions of option ARMs will impact the bottom line of the California housing

If there are “billions of option ARMs ” in California then the question is who sold the homes to so many more people than there are homes ? If the “billions of option ARM’s do exist there is a massive fraud in California and all state and Federal regulators missed it.

Re-check the numbers in the article and publish a correction or an explanation of who and how billions of option ARM’s on millions of houses were sold.

Did I miss something or could each house be sold a thousand times ?

.

I don’t know Dr. H. Prices are certainly going down in the crappy areas like Valencia and Modesto and all those inland empire cities but not in L.A. Seems like prices are holding steady here. I think you should write a piece about L.A. housing. That’s where you get the true scope of the market.

GWBoucher:

Billions of DOLLARS, not billions of loans.

I think he’s simply referring to the total amount of $300 BILLION dollars in all of option arm loans collectively that begin re-setting this year. Think about it for a second, if a 10,000 homes are sold at $500K a piece, that’s $5 Billion dollars right there. These loans were sold over several years. All you need to do is look at the sales #’s for the last few years in CA.

My guess is he probably meant “billions of dollars of option ARMs.” Dr. Housing Bubble doesn’t always proofread his posts thoroughly. 😉

GWBoucher –

Probably meant billions OF DOLLARS of option ARMs?

Down here in San Diego the average house in a upper middle class has been going for $800,000 to $900,000 the last four years. Thousands have been sold in Carmel Valley in San Diego. There is not enough of a family income to qualify for a 80% loan. They are all option loans. Multiply 1000 loans x one million dollars and you get one billion dollars.

Prices have only dropped 5-10% in that area from its peak. There is no way that these homeowners will be able to make the new recast payments. Payments will go from $2200 to $5000 if they cannot get a new loan. Even if they get a new loan their payment will be $4500.

GW,I think it’s billions OF dollars worth of crap loans, not billions of individual loans.

Way to go, Doc. You have been far ahead of the curve on this bubble.

What is amazing is the absolute denial which still exists. Even those who admit that their homes have fallen by, say, 50% claim its a psychological crisis or an aberration which will correct. Most people have calmly assimilated and abstracted the bubble; the high prices were not “high”, they were normal. Therefore any drop is wrong.

To comrade Boucher’s point:

Actually, when you consider how the ARMs were converted to MBS (sliced and diced, pureed and poured into multiple vessels), there may be Billions of loans (if you count all the pieces). I suppose we’ll never know. But each dollar is a note, for all debts, public and private !

GW , the DHB has explained many times that there is loans for around $500 billions , where $300 billions of them is in CA. If the average load is estimated at $500 000 (my understanding is that Option ARM tend to be bigger than the average loan ) then we have number of loans at $300 billions / $500K = 600 000 loans. CA must have around 15 millions of housing units where this 600K loans make 4%. It is not much but the number of foreclosures and distress sales are not much bigger either and are still making good headlines even for the mainstream media…

GW it says “billions of dollars”.

“we now have a generation that will never fully believe that real estate never goes down as many in the real estate industry were telling us”

The memory of sheeple is highly over-estimated by this statement – it’s happened before, it will happen again. Sure, might have to give it 10 years – but “this generation” is one of the smallest in terms of population – beset on either side by the Boomers and the Millenials both of whom dwarf “Generation X”. The Boomers won’t be around to affect the next Bubble and the Millenials aren’t active enough in the market to learn the lessons that need to be learned. The Gen X folks (born before about 1980 or so) will be too few to make a difference and number of us will forget all about it anyway…

but what you call inflation has not been counted as inflation in the goveernment numbers for more than 15 years…thus avoiding the feds mandated job of price stability maintainence, and being a total rip off of the savers and those who worry about the value of their dollar……………….

I reread the part you are quoting, and you quoted it incorrectly. It says “Recasting of billions of dollars in option ARMs.” not “Billions of option ARMs.”

re: Comment by GWBoucher

You did indeed miss something.

Article reads “…billions of DOLLARS IN option ARMs…”

Fred, I agree with you. Any corporate packaged development areas such as Valencia, Corona, Chino Hills, Santa Clarita, etc. will get continued to get hammered for years to come. Those areas attracted the “little or nothing down” crowd. These types of people always wanted the several thousand square foot homes and the leased BMW’s. If they earned 120K a year, they would spend 150K. Areas such as Arcadia, Temple City, Walnut, S. Diamond Bar, etc. are holding up considering the doom and gloom news. These areas have high scoring school systems and the majority of home owners are Asian. I live in one of these areas and most home buyers in my neighborhood put at LEAST 30 PER CENT DOWN OR USUALLY MUCH MORE. With that kind of skin in the game, foreclosures are rare, at least for now. A lot has to do with financial discipline and commitment. Most folks around town drive a clean 4-5 year-old Toyota Camry or Honda Accord, but have a manageable house payment . This is self-preserving attitude has been lost concerning most Americans in Southern California. I think it will be a long road back for most to absorb the reality and live within their means.

@GWBoucher

Are you smarter than a 4th grader?

Great Quote from P Bear:

“So long as the dollar weakness does not create inflation, which is a major concern around the globe for everyone who watches the exchange rate, then I think it’s a market phenomenon, which aside from those who travel the world, has no real fundamental economic consequences.”

Alan Greenspan, November 18, 2007

Scales on your distressed inventory chart are a bit misleading. Also the bump at week 45 represents the REO flag being added to the MLS. Distressed sales were higher before this point it just wasnt accurately represented in the MLS.

Looks like Malibu, Thousand Oaks, and San Juan Capistrano are doing fine with no auctions or bank owned property. It’s good to know TARP is helping someone! 🙂

Hey retards. Once one person makes the clarification that everyone agrees is the correct one…It’s time to move on…

Dr’s latest entries suggest only one comment:

“I think we will have a North American UNION. The US, Canada and Mexico will pay off all their debt when hyperinflation takes over the dollar and the peso. With debt eliminated, there will be a new currency (the Amero). We then tell the world, if they want to do business with us, they can come on back aboard. And if you don’t like it, we do have the B1B bomber!!”

@ DL you are right about the Asian self-preserving attitudes. In some households you could find up to 3 generations of Asians and multiple families making it work BUT us Indios we also have self preserving attitudes but they are not seen in the same light.

We convert garages, laundry rooms, basements, attics, even garden shacks into living spaces and rent them out for 250 a person. The problem with us though is that we drive 1975 cutlass oldmobile or a mid-80’s banged up truck with a cow on the door or we drive a brand spanking new Ford f-150 double cab with 24 inch rims, and the loudest booming system on earth which we proudly park in the car port at our apt complex. Agh!!

But our behavior is not deemed self-preserving it’s deemed – poor behavior with all of it’s negative conclusions

Mucho love,

Dangerous blog! Madoff’s “moment of catharsis” made me laugh so hard I fell off the chair. ‘Course I *was* leaning over on a wheeled office chair to pet a chicken when I read it.

~

Between that, the “seating chart,” and Polish headlines about part-time sex work, I need some of that Sesame Street Peyote Doc was talkin’ about a few weeks ago. Sunny day, chasing the clouds away….

~

I saw that Fortune list misself. It seemed about right. All the cheerful talk seems like nothing so much as whistling in a graveyard, as is stuff like pushing UP conforming loans, calling a bottom in 2009, etc. As the earth said while shoving zillions of cubic miles of snow and rain through here in the past few weeks, “Rebalancing is painful when you get out of wack.” Like falling off chairs. ;D

~

Speaking of the economy leading to injury, here’s a perspective from WC Varones:

http://wcvarones.blogspot.com/2009/01/greenspans-body-count-adolf-merckle.html

~

Adolf Merckle chose a very Anna Karenina-type ending, didn’t he?

~

rose, reaching for the Garbo DVDs

I’d like to buy a vacation condo in Palm Desert area. Not luxurious, 2BDRM. 1,000 ft. 10-20 yrs. old.

Prices have fallen, but don’t seem to reflect the 50% drop.

Does anyone know about this area?

I’ve been taking the advice and waiting. Sounds like I’ll be waiting about 2 years longer.

My stocks may even improve by then. I suppose if I’d bought sooner, I’d be in a similar postion anyway. You can run, but you can’t hide!!

Come on GW, even I know the Dr. meant billions of dollars, not billions of loans. Give it a rest. When the Dr. is on a roll he doesn’t often stop to proofread.

Doc –

In the first paragraph you state: “The one thing being missed by policy makers is that psychology has been forever changed. That is, we now have a generation that will never fully believe that real estate never goes down as many in the real estate industry were telling us.”

They were probably saying the same thing in the last housing downturn which was what…..a decade ago?

People believe what they want to believe and they believe what others tell them. In another few years we’ll have people on the “real estate always goes up” bandwagon, conveniently downplaying or forgetting altogether this market crash.

Why does your graph look so much closer to having reverted to the mean than this one does ?

http://www.housingbubblebust.com/OFHEO/Major/SoCal.html

By December 2009, the average cost for a home in LA County will be around $310,000, I predict. Homes will average in LA County by middle of 2011 around $235,000.

Leave a Reply