Real Homes of Genius: Foreclosure in Manhattan Beach. Bear Market Sucker Rallies.

We’ve just witnessed one of the most potent and unrelenting bear market rallies in history. And all it took was 4-days. Over this 4-day rally, the Dow Jones Industrial Average is up 15.5% which is the biggest run-up since August of 1932 during the Great Depression. The S & P 500 has even done better shooting up 18% and the NASDAQ is up 16.4%. Taken alone, these would be excellent returns for one year. With such a strong rally, you would think that the markets would be back at par but nothing can be further from the truth.

So how are the markets performing for the year after this stunning rally? Take a look at this graph:

Even after this historic rally, for the year the Dow is down 34%, S & P 500 is down 39%, and the NASDAQ is down 42%. It would be one thing if this rally was fueled by excellent earnings, strong employment numbers, or superb retail numbers but none of this has occurred over this time.  Let us recap the excellent news over the 4-day rally:

Friday November 21: Big 3 automakers continue to beg with tin cup in hand for more money from an already broke government. Citigroup on the verge of going off a cliff.

Monday November 24:  Existing home sales come in at a weak 4.98 million while the market expected 5.05 million. Citigroup received a bailout over the weekend injecting more capital into the ailing bank while backstopping $306 billion in toxic mortgages, which comes out to be half of the already committed TARP plan. Consider this a mini TARP for Citi.

Tuesday November 25:  GDP showing even more contraction coming in at -0.5 when the market expected -0.3. Consumer confidence is still at record lows. Absurd bailout of consumer and mortgage back security debt which is already committed from the Fannie Mae and Freddie Mac bailouts.

Wednesday November 26: Durable orders fell a stunning 6.2% when the market only expected a drop of 2.5%. Unemployment claims are still running high at 529,000. Over 500,000 easily puts us into recession territory. Personal spending fell a strong -1% when the market was looking at -0.7%. The Chicago PMI got hammered into the ground while new home sales are at half century lows.

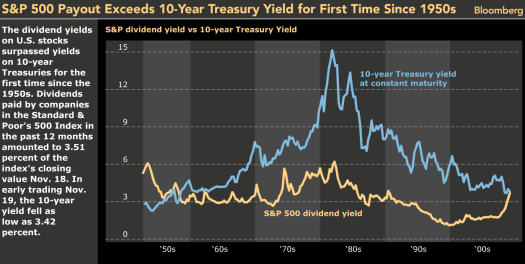

This was the fantastic news that made our markets rally. Make no mistake. This was a suckers rally. I’m sure many of you have been seeing this chart making the rounds showing the S & P 500 dividend yield and the 10-year Treasury note:

This is the first time since the 1950s that the S & P 500 dividend yield is higher than the 10-year Treasury yield. I’m certain many fund managers started dumping money into the market because of the following reasons:

(a)Â The above notion of value investing and trying to lock in short-term gains before the year is over.

(b)Â Big fund investors trying to play “guess the next bailout” and dumping money into certain battered down financials.

(c)Â Assuming many of the S & P 500 firms will have earnings in 2009.

I think the final point above is the biggest problem. This current notion that the yield is signifying a bottom simply assumes that many of these companies will remain at their same earnings levels next year. This is not going to happen. As I wrote in a previous article highlighting 10 reasons why this will be the worst recession since World War II, next year will be even worse than 2008. So the delusional idea that many of the companies will continue to pump out dividends is insane when unemployment will be rising and our crushing debt will force us into austerity.

The recent rally happened for 2 main reasons in my humble opinion:

(1) A leadership vacuum was filled. This doesn’t mean anything has materially or fundamentally changed. But the mere sense something new is coming along gave the market new feet.

(2) We hit technical lows. The market fell so quickly and breached so many technical support levels that we were bound to hit a retrenchment point. We did. The question that remains is whether this sucker rally has any legs. The news will continue to be bad so if it does rally, it will be based on purely speculative reasons and we know where that will lead us.

So with that said, let us look at a prime location here in Los Angeles County and show how the big are now falling in line with the small. Prime areas are now seeing tiny cracks in their edifice like the initial cracks we saw in middle class neighborhoods back in early 2007. Today we salute you Manhattan Beach with our Real Homes of Genius Award.

The View Just Got a Whole Lot Cheaper

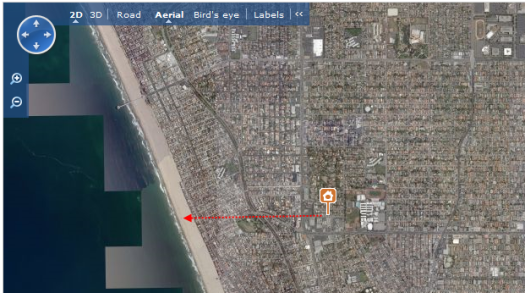

Manhattan Beach is one of those prime L.A. County areas located in the southwestern part of the county. 33,852 people call the place home and it does have some beautiful views of the Pacific Ocean:

But for these views, you will have to pay. The median price in Manhattan Beach is $1.5 million and is only down 9% from last year. The median income for a family in the city is $122,686 which isn’t much for someone looking to buy a $1.5 million home. But hey, take a look at this beautiful sunset:

The above featured home is currently in foreclosure. It should be stunning in itself that we are now seeing foreclosures in prime areas here in L.A. County but such is the nature of this massive bubble. This home is a 3 bedroom and 2 bath home on 1,787 square feet. Let us first look at the sales history:

03/13/2007: $1,250,000

02/20/2007: $940,000

Someone bought this home at the peak of the market. More importantly, someone made an awesome 3 week profit of $310,000. At that rate, you’d make $5.3 million a year! Bwahahaha! Someone has been starring into that sun with no Oakley sunglasses! Prices have been falling for one year and show no signs of stopping. I even noticed that in certain prime areas like Santa Monica this year that foreclosures were moving with simple price movements. A tiny drop in price was all that was needed to move the place. What is the current sales price here?

List Price: $867,700

That is the nature of the new game. This home in Manhattan Beach has seen a 30% drop in 1 year. And that view above? Well you’ll have to do some walking since this place isn’t even one of the prime places in Manhattan Beach:

This is the insanity of California. People simply bought homes in prime areas even if the home wasn’t prime itself. We are now seeing a shift here. People still want prime areas but also want prime homes. Long gone are the lines of people looking to buy a home and dumping hundreds of thousands of dollars to get it up to speed. Sure, you’ll have a handful but it is nothing like it was even late last year.

I had a conversation with a friend who is in retail and discussed Black Friday with him. He mentioned how the bait of low priced items in limited supply was the ultimate lure for shoppers. Someone that wanted to buy a cheap television will then be told they need HDTV cables to go with it, a DVD player to match for quality, and a very expensive surge protector to watch out for lighting strikes which we get so many of here in Southern California. By the end, they have spent a few hundred more. He would say that 8 out 10 times people would buy all the additional accessories because they are in a shopping trance.

Will people go back to buying real estate in California like they once did during the mania?  Hell no. Some would love to go back to zombie real estate theatre where everyone would buy a home without thinking for two seconds and having a pulse was optional.  But now that people are slowly waking up out of their trance, the reality is setting in, even in prime areas. The sun is definitely drifting over the gorgeous horizon.

Today we salute you Manhattan Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

8 Responses to “Real Homes of Genius: Foreclosure in Manhattan Beach. Bear Market Sucker Rallies.”

By coincidence, I spent a week in Manhatten Beach very early in 2007.. We were staying at a motel near the oil refinery storage facitlity. There was a small house, around 1,250 sq. ft. across the street, being prepped for sale. Since we live in San Francisco, we are used to insane prices, but even this one blew me away. Built in the 20’s, modest upgrades,at least a mile from the ocean, no view- only $1,450,000. Of course, I whipped out my credit card, but it was slightly over my limit. Darn- another great opportunity lost!!

Prime property in Los Angeles is the next wave of declines coming in 2009. Mostly unscathed, we have begun to see some significant pricedrops along the edges of these areas. With the housing meltdown working its’ way up the real estate fodd chain, the high end won’t escape. People seem to forget that, smaller transactions effect bigger transactions etc.. etc.. Now with Prime and Alt-A Loan defaults accelerating, the writing is on the wall. Just look back at the early 90s, and you will see the same pattern. No different this time, if not worse. Manhattan Beach in particular, has show weakness, as of late. In addition, Santa Monica, Brentwood and Beverly Hills are leading the Westside down.

2009 marks the year of big declines to high end real estate in Southern California.

http://www.westsideremeltdown.blogspot.com

at what point does the median income vs median price structure break down? For example 90210 has a median income of $112,572. I think its safe to say that entire zip has always had homes that are WAY out of the price range of that median income. But 36% make >$200k according to http://zipskinny.com/index.php?zip=90210

So that has to break down at some point. The question is where?

This house is not beautiful. It’s an ordinary utilitarian “midcentury modern” that even in prime areas of L.A., ought not to fetch at dime over $400K, which would make the extremely average house pictured here affordable (sort of) to someone making $122K.

i think it’s not a big deal.

even the house price fall 50%.

it is still higher than 1980’s or 1970’s.

will donald trump lost all his money?

will robert kiyosaki bankruphy?

Be honestly,”fear””greedy” make the trends.

when people fear…

when people greedy…

Re: Comment by Phillip Katt

Classic, a San Franciscan who dodges addict’s needles and feces on the sidewalk while nostalgically visioning Herb Caen’s column in the Chronicle finds the real world of a Redondo Beach area oil refinery to be the death knell of life. Has he ever driven through Hercules, Calif. on I-80?

L.A. has the spin, is the go-er, the mover, the reality, the industry, the motion, the REAL happening, S.F. had it but now thinks itself too elite for the common worker. S.F. has killed itself, Hippie Died in the early ’60’s, officially and figuratively. Even Herb Caen realized that the “City” was dying. Redondo Beach, now, one can still get a shark sandwich at Captain Kidd’s with a good cross section of the entire world on a bench for $6, no corking fee!

I live in Manhattan Beach and read http://www.mbconfidential.com as religiously as this site. It’s getting pretty chippy in the comments section these days. The bulls argument keeps getting modified. They would point to the fact that this isn’t a prime location/ house. That’s true. But it used to be never in LA. Then never in the South Bay. Then never in MB. But prime properties are taking a hit (foreclosures aren’t part of the equation yet). The last stand for the bulls (in MB) is everything is fine if you live “west of Highland, South of the Pier and on a walk street.” It reminds me of a scene in The Jerk when he’s working at the carnival where you can win “anything between the napkin dispenser and the toy soldier, anything in this tiny area, here.”

Of course, the “west of highland, south of pier, walk street” homes are under pressure too.

“The only way to overcome today’s economic turmoil is to motivate and encourage worried or cautious housing consumers to enter the marketplace,†said NAR President Charles McMillan. -November 18,2008

~

Let me take a stab at what the NAR’s self-serving statement means:

1. Bring back toxic mortgages!

2. The bubble hasn’t burst, it’s just halftime!

3. Click your heels three times and repeat, “there’s no place like home”!

4. Supply and demand is a quaint but antiquated concept!

5. Ditto for debt!

~

Note to self, whatever the NAR says, do opposite.

Leave a Reply to Laura Louzader