Real Homes of Genius: Costa Mesa Shadow Inventory. MLS has 172 Listings while Distress Properties Register at 489. 3 Bedroom Million Dollar Home in Costa Mesa?

On Friday we were served with a chilling reminder that the unemployment riddle has yet to be solved. Wall Street still managed to perk up. Why? Stock market cronies now believe the Federal Reserve will not hike rates for a very long time thus spurring a positive gain even though unemployment is now up to 10.2 percent. If we look at the underemployment measure of U-6 the rate soars to 17.5 percent (in California the rate is 22 percent). Yet there is this pervasive school of thought that housing prices are now set to boom even in the face of rampant unemployment. This is a carry over from the bubble halcyon days. In fact, I hear people talking about buying up foreclosures and flipping the home for a double-digit profit. This is reminiscent of 2005 except for the fact that our unemployment rate in California has nearly tripled but don’t let that get in the way of the gold rush mentality.

The real action is in the shadow inventory. As you might have noticed, those preaching the gospel of “no shadow inventory†are largely gone. Now their argument has shifted to the obvious that when banks have a REO, they move on it quickly. Sure. We can agree on that point. Yet banks are not moving to the REO stage. Moratoriums, delays, and flat out incompetence rule the day right now. REOs are but one small part of the shadow inventory. The real hidden inventory is with the massive amount of pre-foreclosures and homes that are in mortgage purgatory. That is, homes that are destined or prime for a strategic default or are already in default but the bank is simply holding back on even filing a NOD. As I discussed in the last article, Wells Fargo is jumping ahead of the option ARM freight train stating they will convert over $100 billion in Pick-A-Pay loans to interest only loans. Now why would they be doing this if these loans were in good shape? Try telling this to those so laser focused on housing that they fail to miss the fact that our economy is in the worst shape since the Great Depression.

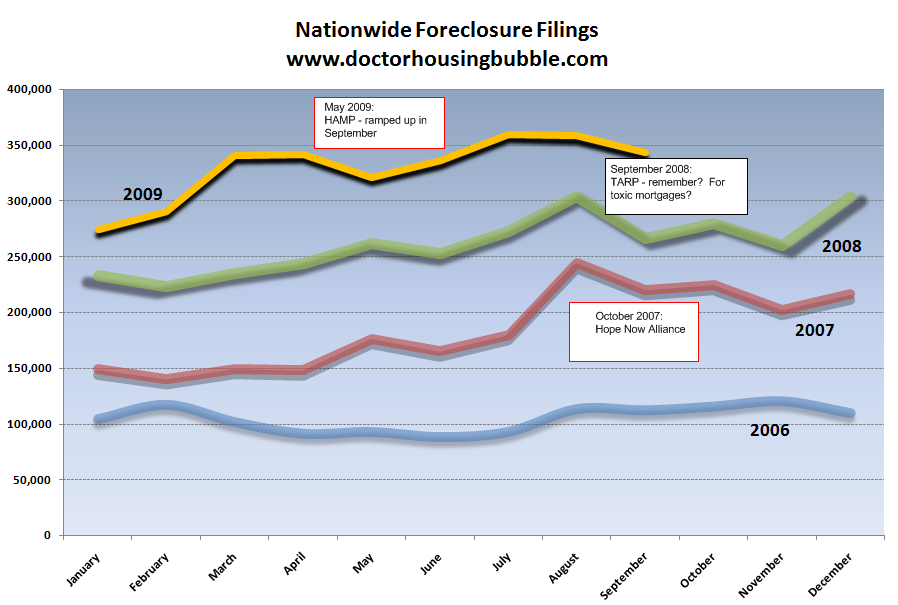

Before we examine our Real Home of Genius today in Costa Mesa, let us survey the nationwide foreclosure picture:

As you can see from the chart above, nothing has stemmed the rise in nationwide foreclosures. The only thing we have accomplished is creating the greatest generational wealth transfer we have ever witnessed. And it didn’t take a revolution either. Every program devised to help the housing industry has failed thus far. We have committed nearly $13 trillion in bailouts and handouts to Wall Street and the banking industry. With that amount, we could have paid off every single mortgage in the United States and still have some $2 trillion to go to Vegas and gamble! Then again, this isn’t really about protecting the American homeowner. This is about protecting the crony oligarchs on Wall Street. How much more data do people need?

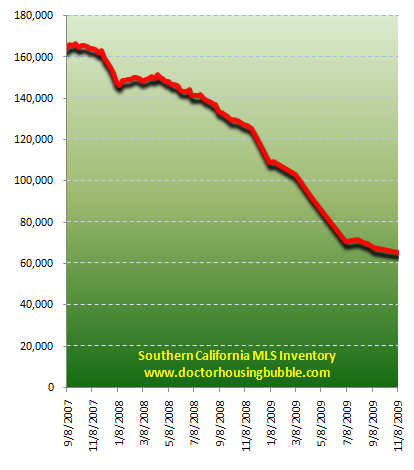

Take for example the current sham that is sucking a lot of people into the California housing expedition. Let us first look at MLS inventory for Southern California:

Wow, things are going really well! Forget about the $60 billion in budget deficits we just had to contend with or the fact that 1 out of every 5 Californians is either unemployed or working part-time for economic reasons. Housing is selling like pancakes. Or is it?

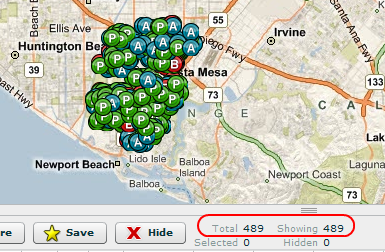

Let us do a mini case study on a middle class city in Orange County. We will examine the city of Costa Mesa. Doing a quick search on the MLS pulls up 172 listings:

MLS listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 172

Short Sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 40

Foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Not bad given that 61 homes sold last month. At that rate, we have less than 3 months of inventory. But let us look at some shadow inventory:

Pre-foreclosure:Â Â Â Â Â Â Â Â Â Â Â 205

Auction:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 235

REO:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 49

Ah ha! This is where the delusion sets in. The public can view 42 distress properties but only 2 are actual foreclosures. Banks own 49 properties. So 47 are sitting off the books. This is the tiny number. Those scheduled for auction and pre-foreclosure are the big deal. This is where we are going to see massive losses. Some need concrete examples so let us give them one.

Today we salute you Costa Mesa with our Real Homes of Genius Award.

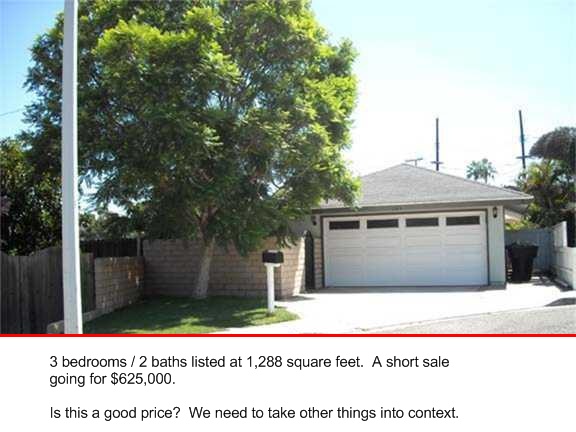

Costa Mesa – Million Dollar Home with 3 Bedrooms

Picture in your mind a million dollar home. Got that image? Think of how the property would look and where it would be located at. Let us show you a home that probably reflects your vision:

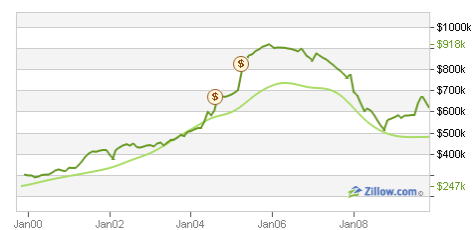

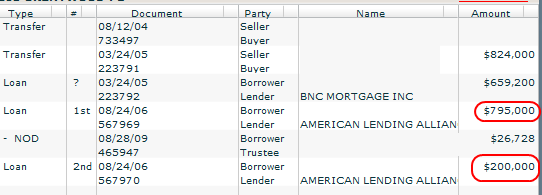

The above is a 3 bedroom and 2 baths home. Let us look at some sales history as well:

08/12/2004: Â Â Â $670,000

03/24/2005: Â Â Â $824,000

You would think that the above is incredible but if we dig deeper into the data. We see the power of the California housing bubble:

Did you get that? After the home was purchased for $824,000 in 2005 it was refinanced and the loan amount on the home totaled $995,000. This was done in 2006. Nearly one million for a 3 bedroom home in Costa Mesa. Incredible.

The home is now listed as a short sale selling for $625,000. The home has $26,000 in back payments so it is likely this home will be foreclosed. Welcome to big league losses here. That second mortgage is virtually gone. Now we are cutting into the first. You think this is the only home in this shape out of the 205 pre-foreclosures, many that aren’t even listed? Think again.

Today we salute you Costa Mesa with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

37 Responses to “Real Homes of Genius: Costa Mesa Shadow Inventory. MLS has 172 Listings while Distress Properties Register at 489. 3 Bedroom Million Dollar Home in Costa Mesa?”

So Dr., I’m confused. Is it time to get in on the low end? Or will further drops wipe out my down payment? Have they succeeded in reinflating the bubble, or is the new mini bubble destined to pop quickly?

That’s still over $485 a square foot, about double what it should be. When palaces in Temecula sell for $111 a square foot, you know the coast has a way to go.

United Deception of America. Scam country.

Gonna be fun watching this play out over the next few years. Is it possible that the US can inflate it’s way out of this? Can further losses be avoided? I doubt it.

Wages are falling and the Gubment admits unemployment will rise throughout the next year. Those W shaped recessions can be tricky…

Any of us thinking about buying can take solace in the fact we’re getting a couple extra years to grow our down payment.

How’s about it Dr Bubble are you willing to push your bottom prediction ahead to years to 2012? Maybe the Mayans we’re just predicting the end of the world for house flippers!

“So Dr., I’m confused. Is it time to get in on the low end?”

Dear God!Hahaha!

Confused(clueless),indeed. Here,have-some-good-advice: Rent! Do not buy for the next six months

to a year.

It’s too bad buyers on the Westside are jumping at the FHA bait for entry level properties. They will be sorry once it is proven to be another failed govt attempt to reinflate housing prices. Ultimately, it will run it’s course, where housing prices will be supported by average incomes for the area. With unemployment worsening, that might be a bit painful for those purchasing now.

http://www.westsideremeltdown.blogspot.com

Patiently waiting for the REAL crash…

So Doc has the government intervention that gave us this dead cat bounce pushed your prediction of a bottom ahead a couple years???

Maybe the Mayans were predicting the end of the Real Estate Industrial Complex! I figure it’s a win win for us savers and extra 2 years to build a down payment before the bottom.

appears that the best thing to do is buy a LARGE clunker suv, and move your family into it. with slow homebuilding, the likelyhood of finding refrig cardboard boxes is getting nil. not to mention a place to build on.

Thanks for all the hard work, Doctor. You are the necessary naysayer we need today.

I live in Upper Westchester county, NY, and work in Stanford, CT. commuting through gilded mansions, which is a much different market than the one you study in SoCal. No doubt it’s being floated by the new Banker Bailouts, but, I wish there was someone like you peering under the covers to tell us what’s happening. Who knows, many of the mansions may be heading for auction soon, for all I know. Do you know of any blogging about this market?

Do you know what’s going on up in Tahoe? Hey, I have to get out of here when I soon retire to lower my costs, and the no tax Nevada side of Tahoe looks real attractive to a skier like myself.

I think that I’m pretty close to permanently scrapping reading these blogs. It’s too demoralizing!

welcome to the real world LA-Architect. being a high end cabinet and millwork shop owner. now with no employees, and no sizeable contracts in the last 8 months, id like to liquidate my machinery but i would have to take a 50000.00 loss because of no buyers. confidence is the name of the game now, and my past or future clients wanting quality products are scared sh–less of loosing anymore investment in this country. the work now is in compeating with bigbox stores with minimum wage designers and order takers, selling “you assemble,you install cardboard crap”. but i guess thats fine for a society, bound and determined to reside in a banana republic, with elected officials working 24/7 with getting re-elected and to turn america into another latvia. everything that was illegal is now legal. great place for the pushers of the “russian system of education”, thats almost a hundred years old now. they had to do it slowly, so we wouldnt notice. you can always hang up your drawing board and become a bulls–t artist. its the coming thing.

“We have committed nearly $13 trillion in bailouts and handouts to Wall Street and the banking industry.”

Where does the number of 13 trillion come from? Does anyone know?

re: dimwit…

I actually haven’t used a drawing board since university. All my designing and Architecture is computer based…. However… I totally relate to your business. Architecture sucks at present. Crappy builders wrecking houses and stupid people buying them!!!!!

Go figure….

However, I always need a good cabinet maker…. when I have work that is!

Doc: How do pre-foreclosures become public knowledge when at NOD has not been filed?

Mike, most economic blog sites like MISH, Mybudget360, Dollar Collapse, The Big Picture, etc. have detailed out the 13 Trillion figure for several months now. “We the people” got to vote on the “miniscule” 700 Billion part of the bailout (I recall we voted NO, but got it anyway)…and then the Federal Reserve, Treasury, and FDIC (of all things) voted for the other 12.3T. This of course, was done on behalf of our grandchildren, who declined to vote due to their inability to get out of their respective playpens.

Matt, I don’t even think the Dr. is including those people because, as you point out, that information is not publicly known. I think his “preforclosure” figures have always been in fact just those people who have officially received a NOD. As for late payers, Anecdotally, it seems many are willingly, or unwillingly NOT paying their mortgage right now. (I can almost believe that this fact is creating a lot of disposable income, and therefore some of this recent economic uptick) I am rooting for the late payer figure to dwarf the actual preforeclosure number. Without any stigma, and in light of the grotesque banker/wall street bailouts, I believe that walking away from your loan will soon become the new “in” thing to do. They’ve probably made an app for that by now.

Hey dim-wit, I need some cabinets in my house, maybe you can hook me up, thanks!

California is going down the toilet bowl. All this banking corruption will break this country financially, never mind we are already broke. The housing market will crash by summer 2013. Homes will go up in price again, making people jump in the Titanic that is surely going to sink. The banks will make their profits, save there money and let the housing market crash.

For those of you doubting the shadow inventory:

http://www.cnbc.com/id/33834317

>>

“Foreclosure Sign

CNBC.com

I’m back on the foreclosure bandwagon again, especially after getting the Treasury’s Home Affordable Modification Program status report this morning, and its glaring omission of any information as to how many borrowers are actually keeping up with the payments on their trial modifications.

Good news that more than 650,000 borrowers have been put into trial mods, no news that we have no idea how successful those mods are now five months after the program really got cooking.

It’s coming, that’s what the folks at Treasury say.”

>>>

In other words, that 650,000 number is bogus BS basically to pump up the “we are making bacon” idea that the government is helping. The only reason we have this many “temp” mods is because the $1,000 incentive which is a total waste of money and, is based on stated income. Great idea, no doc really worked out for the housing market before. No data on “perm” mods or any other useful data. Welcome to the shadow housing market.

Want to hear from thousands of people who are dealing with the Bankster/Wall St. bubble? http://www.loansafe.org

You can find out first hand what the banks are doing to either foreclose on the home, or help people. You might find out that they aren’t doing much, other than holding out for more taxpayer money. They are doing the same thing our politicians have been doing for years….kicking the can down the road.

If you can’t afford your house…stop paying, the banksters will either kick you out or not. If you can afford your home and want to stay there….pay on time.

No one is whining about the people who made money hand over fist while the bubble was going on, but now that the giant ferris wheel has stopped, you want to attack the riders instead of focusing on fixing the machine.

Only the riders that got caught NOW are open game. The ones who just got off and the are strolling away with millions…well, they DESERVE that $$ for working so hard and being savers. LOL!

The Doctor is in! Once again, a lone voice of common sense in a hurricane of deception.

I’ve been a believer for the last 3 years, patiently renting and biding my time. I thought for sure by now all the inventory would be on the market, and the prices affordable. But with all the government intervention plus a lot of investors (rents are still high in So Cal) the demand is great and the supply small. So prices are edging up, and there is not much inventory.

I’m afraid I may just have to take the plunge early next year and buy something. I believe Obama will bankrupt the nation to keep housing and stock prices inflated. Who am I to fight that?

“ForeclosureRadar.com reports that outstanding foreclosure auction notices in Orange County rose to 8,895 at the end of September, the highest in this housing downturn and probably the highest ever.”

Look at that moral and ethical crusaders. We have 9,000 more people to insult, beat up, and generally harass. Make sure you send your bankster and Wall St. buddies christmas cards. You night even include a gift in there because their pay is so low compared to 2007.

I’m hoping they foreclose on them ALL, then housing will be worth half of what it is even worth now….the moral and ethical crusaders will then be underwater, and they can walk a few miles in the shoes of the “deadbeats” and “scum”.

Misplaced anger…..while you waltz to the voting booth to vote all republican or democrat…..never accepting that YOU helped create all this.

Just a quick question, doc. How did you arrive at the $13 trillion figure as the amount of money committed to this?

Thanks.

Mike M. – Real estate in Lake Tahoe area is still greatly overpriced.

The billionaires have pushed out the millionaires, and so the price increases have pushed out a lot of average people.

Think about Vancouver,Washington, right across the border from Oregon. Washington has no income tax, and Oregon has no sales tax.

You can live in Vancouver, and buy all your groceries, big screen tvs, etc.

in Oregon, with no sales tax, and get the best of both worlds.

Skiing at Mt. Hood is 60 minutes away.

The people who didn’t participate in the fraud and the greed are getting royally screwed!!!

La-Architect, i beg to differ with you on your nov 11 post. the (‘didn’ts) are forming new companies and b s scams to be your friend and save your ass from financial doom. they are making so much money, they can afford to advertise on the media, and, in some cases restore hair on any part of your body you choose as a bonus for you x on the line. a definite plus when american society de-evolves back up into the trees soon.

You are smoking some fine product if you truly believe that you didn’t participate in the fraud. Do you actively vote? Have you been voting the last “X” amount of years?

Have you owned/sold a home in the last 10 years?

Oh, you participated alright, you just don’t want to admit that your elected officials are screwing you, you know, the ones YOU and I elected.

JMHO…Banks won’t flood the market with these bubble priced properties; likely many “owners” will sign them back over to the bank, thus becoming “renters”. Or banks will somehow modify these loans. Bubble priced properties will stay valued as such on the banks ledgers. This strategy will prevent the market from being flooded with REO’s; allowing the bubble to reinflate right on schedule. Sidelined buyers will finally submit, believing it’s time to buy, spurred on by government programs. Business channel anchors will grind against their desks, moaning about record bank profits, Wall Street will surge upward. Unemployment will continue to rise, as companies cut staff to improve profits. Wise economists will advise that inflation shouldn’t be a problem, even though dollars are being printed at warp speed for bailouts and public programs.

It’s all good; don’t stress. It’s a level playing field. Believe, and obey.

Yeah, YLG. I hear ya. I’ve sat on sidelines renting last several years, make decent money in health care. I was poised to leave SoCal with median price in OC over 600K, looking at all the ads in real estate section at the peak with “starter homes” priced around 500K, thinking “what does everyone do that they can afford that? I know new grads right out of school aren’t making that kind of $, and I’ve been in my field almost 20yrs and still not making what would be an acceptable amount to make a 500K home comfortably affordable. Now we are seeing some more reasonable homes in North OC, but been outbid numerous times, underbid by cash buyers/investors, had a short sale that fell through (“seller” backed out at 11th hour as bank was to approve, “seller” hasn’t made a payment in over 2 yrs, and apparently did this same thing to another buyer last year- I guess bank will just let it go on indefinitely)and now being told to “watch what you offer, as appraisal may not come in at your offer, and you’d be responsible for making up difference in cash”. Who the heck in their right mind would do that and buy a home immediately underwater, and we’re not talking 10-15K here, we’re talking 50K difference between contracted sales price vs. appraised value… I ask a RE professional if they think this is a good idea, and get the run around. All in all, we are giving it a bit more time, but it does seem that the gov’t is hell-bent on protecting Wall Street/bankers at our expense.

It seems to me that renters are far more a victim here, than homeowners in foreclosure. The homeowners in foreclosure will get months of free rent and probably walk away without a scratch, whereas the renters in this country will (once again, as always!) pick up the tab.

re: surfaddict nov 10 , sorry, but im located in ore. i like this site, and am a native caleeforneen. left there in ’89. got out because everyone from mortgage brokers on down to the peon digging the foundation was whacked out on coke or the bottle. same here but with (till a year ago) the added retirees bailing out of ca because of crappy govt and shakey ground, with a s–tload of dough from selling their bought for thirty grand homes 20 yrs ago for a mill plus to no doc buyers. of course they like the clean air and no crap littering everywhere they go. //find a good builder w/ contactable references, clean record w/ cal lic bd., insurance, and good credit rating, that isnt selling cookie cutter crap to boost his profitmargin and working out of the back of his truck. also ask for a tour of his shop facilities (tells alot about your finished prod) as far as a contract goes— completion dates ,price and payment sched. are one thing. as far as the actual design, and (whatcergoona get) for your dough, request overall drawings and shop drawings before dropping a big deposit ( small charge ok- he has time involved for prep work). dial this stuff in, cause paper is cheap, its the materail and time that costs with mistakes. make sure you click with this dude, cause youre going be cellmates for awhile. this is if you are doing a high ender,and if your flipping ,hire a fly-by-niter,buy you cabs off a boat, and hope the ying yang shows up to install and rebuild straight to support your chinese fabed granite. hope i helped, and watch out for big fish w/ handles on their backs!

Prices are not really going back up, it’s just the Media and our “highly” educated realtors adverising higher prices. Prices are dropping daily in most areas, you just have to be very careful when purchasing, show up with money on hand and you get to see where prices really are.

“Look at that moral and ethical crusaders. We have 9,000 more people to insult, beat up, and generally harass. Make sure you send your bankster and Wall St. buddies christmas cards. You night even include a gift in there because their pay is so low compared to 2007.”

You can justify your choices all you want Swiller. Those of us waiting on the sidelines are not impressed by your pathetic diatribes. Sorry, but ignorance is not an excuse. You tried to make money in the real estate market and got burned. Now you want to blame everybody but yourself. “Walking away” will never be anything other than what it is: voluntarily choosing not to honor a commitment that you alone made, upset because what amounted to a stock tip from a realtor (“housing always goes up”) didn’t come true for you.

Maybe you should stop bitching about how this is everybody’s fault and re-evaluate. Stay away from stock markets and real estate until you’re old enough to realize that sometimes prices fall.

Lol Jackoffman! I don’t need to justify my position at all. I’m surprised you stay reading this site when the good Dr. writes all about how the FED, US Treasury, and our government caused this bubble by fraud.

It’s called a CONTRACT. That’s why they get the house….so if something happens (like losing your job…divorce, death, or even….ok get this….walking away) the banks have security. It’s part of the process, but I can see you are blind and you will only apply “morals” and “ethics” to the little guy. I think you should run for office, you would make a fine throbbing member of our congress!

The very funny thing is, I’ve probably owned more than you (and still do!), and probably am worth more than you (materially of course…we are all created equal). I have worked in Irvine for over 20 years, and I see the stuffed shirts all day acting like they are something because they wear a tie……while I don’t…and make more salary than many of them. I do think it’s funny that you are calling me ignorant while you back the corrupt system, that’s ripe 🙂

If you are so worked up about the situation, my suggestion is to get on in there and BUY BUY BUY!!!

Where can I get a hold of this information? I’d like to see how big the “shadow market” is in the area we looking to move to.

Leave a Reply to jja