Welcome back to some of the housing inventory: Irvine inventory up 88 percent from March. Americans back to non-saving ways.

Nationwide the amount of homes available for sale is increasing spurred on by rising home prices and the healthy rise in home values. Yet many areas in California were still in a severe drought when it came to the amount of inventory available for sale. The rise in inventory started late last year nationwide but we are now seeing it in certain areas in California. Even in sought after areas like Irvine the amount of inventory has picked up. At a certain point the market will return and the current mania is making some reluctant sellers come out of the woodwork to offer their goods to the highest bidder. Home prices in areas like Irvine have gone up significantly and many are now being enticed to sell. At the same time, Americans are back to their non-saving ways so the current market seems uniquely familiar. Let us take a look at some of the inventory coming back into the market.

Irvine sees a surge in inventory

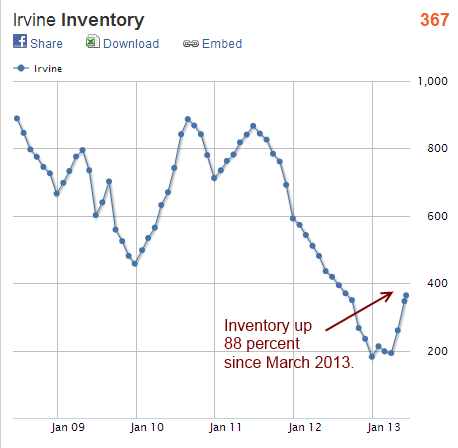

From early 2011 to March of 2013 inventory only went in one direction:

Source: Â Movoto

The number of homes available for sale virtually disappeared from the map in many prime areas of Southern California. Typically, inventory picks up in the spring in anticipation for the upcoming selling season. But for nearly two years this entire trend was bucked. That is why the recent surge is worth noting. Inventory in Irvine is up 88 percent from the low in March nearly doubling the number of homes on the market available for sale. Is this a turning point for low supply? Hard to say but what is certain is that more inventory is being added into the market and this was something missing for 1.5 years.

According to Zillow home prices in Irvine are up 22 percent over the last year and are approaching their peak levels from 2006. The bust of the housing bubble is still fresh in the minds of many. Could it be that many potential sellers are remembering a little bit of history and are trying to get out while the market is blistering hot? The Irvine market is manic at the moment with local families, foreign money, and big pocket investors vying for the same properties. All of this with low interest rates makes the current jump in inventory all the more fascinating.

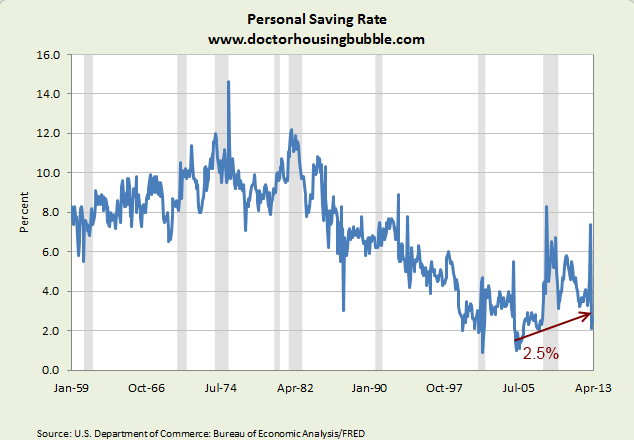

Americans overall are back to their non-saving ways:

The personal savings rate is 2.5 percent near all-time record lows. Even in California, higher incomes are spent on more expensive living. The cost of living eats away the paycheck of many professionals. Bigger mortgages and bigger leases. In Irvine the Zillow Home Index prices a regular single family home near $700,000. That is near the 2006 peak. The best selling month in Irvine was in 2005 when 629 homes were sold. Last month, a solid sales month 258 homes were sold.

It is hard to parcel out the investor share in one specific city. We do know however that last month 33 percent of buyers paid all cash for their home purchase in SoCal. This is much higher than the typical range of 10 to 15 percent. Foreign money is a big player in this region.

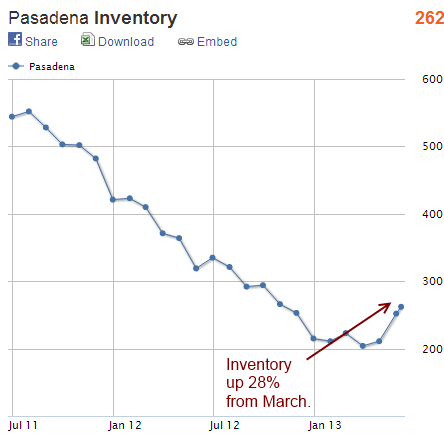

Is this trend happening in other prime areas like Pasadena?

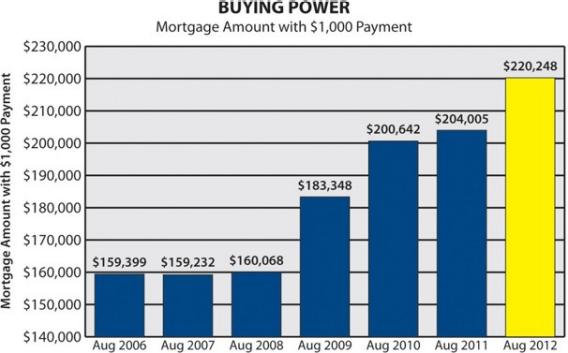

Inventory in Pasadena is up 28 percent from March. Certainly not at the pace of Irvine but a similar thing might be emerging (certainly nationwide). It looks like we reached an inventory bottom. The fact that lower interest rates provide major leverage is not lost on many:

Source:Â Slate

So you can understand why the recent rise in interest rates might be troubling for the housing sector especially in very expensive California. You have to ask yourself why is there a sudden addition of inventory to prime markets like Irvine. It isn’t for the lack of people wanting to live there. Could it be the 22 percent rise in home prices in one year and that it is nearing record levels? Or is it the fact that prices are out of reach for many of the local families trying to compete with investor money both locally and abroad?

A more balanced market is better for all concerned. No one wants to live in a market where housing prices are imploding one minute and sellers are begging for buyers or surging in a manic manner causing people to grovel at open houses. A feast or famine real estate market is not a healthy environment. Instead of financial institutions seeking out the next innovative idea or breakthrough in medical science to fund, hot money is trying to crowd out local families for a quick flip or a rental. Not exactly the best way to create a robust economy. The silver lining does appear to be that inventory is creeping back into the market and this is very necessary.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Welcome back to some of the housing inventory: Irvine inventory up 88 percent from March. Americans back to non-saving ways.”

Well the Bernank has successfully bailed out the banks by re-inflating values, so REO portfolios can be sold for small loses or possible gains. I am uncertain how the trillions in new debt incurred by the Fed to follow this mandate will be paid off down the road. Heck does it even matter? I am beginning to think that my normal fiscal sense is antiquated in the face of the “New Normal” that the Fed has created. Pretty much everything that has been done runs contrary to what I believe in, but only time will show if the Bernank’s fiscal policy was correct.

“I am beginning to think that my normal fiscal sense is antiquated ”

Welcome to the club!

The new normal is irresponsible behavior means a rocket ride to wealth and good fiscal sense means a quick sentence to the poor house.

The world has moved in tune with the movement of a ei economics towards

Sorry; iPad error. Just gonna say that American economics is now finance, instead of manufacturing, based which is based on banksters taking risks on capital so now we all have to take risks to keep up. Your salary wont be enough going forward. You need to constantly invest that salary in risk assets and roll the dice based on your own knowledge, or preferably by hiring the same banksters to invest for you (using you to help bigger clients get out of trades of course ). Life wasn’t stressful enough already. 😉

I agree Jim. I used to think that debt was something that had to be paid back, and that deficits were bad, but I am starting to come around to that fact that this old way of thinking doesn’t work in this world of modern finance. I’m not going to fight it, I accept that low interest rates, and QE will be with us for a long time.

In other words, you’re a lemming giving into mass delusion?

The end game for the Federal Reserve was always about taking the poorly underwritten, 100% financed loans from 2003 to 2008 and get them transferred to:

A.) All cash buyers

B.) FHA buyers

C.) Conventional 20% cash down payment loans to borrowers with pristine credit.

D.) When A, B and C didn’t work out then buy the garbage MBS from the member bank so that no loss was recorded.

Bernanke saved the Fed’s member banks but completely mucked up the economy for everyone else by a complete misallocation of capital. There’s a lot of retirees whose retirements have been absolutely destroyed via the actions of the Fed.

When the Fed creates reserves out of thin air to buy government bonds, they are effectively retiring that debt since they send most of the interest back to the Treasury. So the Fed doesn’t need to “pay off” anything. But it’s not inconceivable that at some later date they may have to unwind some of their QE if they can’t hide consumer and asset inflation by statistical gimmickry.

In response to,

” I am uncertain how the trillions in new debt incurred by the Fed to follow this mandate will be paid off down the road.”

Fools rush in where angles fear to tread!

Hey TT – good to see you back commenting here. I was wondering what you’re finding in your necks of the woods right now. Here in Portlandia, it seems the top has been reached and now the bubble may be beginning to burst (however slightly). In the last two months I’ve seen a plethora of homes suddenly on the market, and so far only a few have moved. Wonder what will happen when the OR law regarding an extended moratorium on foreclosures starts having an impact.

The Alameda News Group which distributes local newspapers in Alameda/ContraCosta Counties – East Bay gets its main advertising from weekly real estate inserts.

The featured real estate story last week was a broker welcoming back having a little inventory and going from multi-offer bidding frenzy to seeing house stay on market for several weeks. The growing inventory seems to be in mid-range which for this part of world is $400k to $700K for SFR

It’s the same thing as before: as long as people think they can make a quick dollar on flipping etc, they will ignore the warning signs and convince themselves (and others) that this time is different. But it is not different here in SoCal. Housing is once again too expensive for the average person so potential buyers and good paying jobs are leaving again for other pastures. People realize that our houses here aren’t special; all crammed together and on tiny lots. And people who own them like me, are looking at the possibility of unloading them to the sucker investor/flipper so we can take the money and run.

Anyone else notice the 300% inventory increase in Sacramento? Something is definitely going on there.

In Sac? I live in the Folsom area and no I didn’t realize the inventory in Sac has tripled. I wonder why? The investors bailing and selling or investors have pushed up the price so much it now doesnt make sense to buy as a rental, and the average Sacramento Joe can’t afford them now anyway.

http://www.deptofnumbers.com/asking-prices/

I have seen an increase in inventory in Thousand Oaks, especially homes over the 700k range. They are also staying “Active” for much longer.

Well in THousand Oaks, inventory has definitely increased quite a bit. I remember a couple of months back the 500K-600K had 3 or 4 houses. Now they are 40+. But the prices have gone up significanlty, all pretty much around $300 sq/ft, which was around $225 last year.

Also watching T.O. I’ve noticed a lot more listings as well. Properties over $500K are not moving fast but the $400K ones are.

Oops, typed too fast. The remark above should read:

Also watching T.O. I’ve noticed a lot more listings as well. Properties over $600K are not moving fast but the ones in the $400K-500Kish ones are.

unless you’re leaving the area, increased home prices are not your friend, you just have to overpay for another place and see your taxes increase as well

50 new properties for sale this week in San Clemente too according to Redfin! And many of those are asking above 2006 levels, two are asking double their 2002 sold price. Perfect recipe for having those new listings sitting for a long time. On the other hand 6 of the new listings are already marked as pending… Now is a great time to sell a house, wish I had one to spare 🙂

There has been zero increase in housing prices. The move is completely attributable to the drop in mortgage rates. That should tell you all you need to know about the real estate game. Those who pay cash at these mortgage rates are beyond stupid. You buy for cash when rates are sky high. Of course, the funds are using their clients money and don’t care about the coming loss as long as they get their commission on both the buy and sell side.

Well now that interest rates are rising again, I’m sure the inventory reflects the fear that all these manipulations are going to falter and things implode again. I’m hoping the banks panic and offload some of their crap, the more they can get out the quicker we’ll be done with shenanigans to support this market.

The RE market is red hot here in Rockville Centre, Long Island, a prosperous incorporated village 35 minutes by train from Manhattan. People bidding through asking prices, a frenzy, in the 700-900 range. Like time travel back 10 years.

My town of 70K people has been averaging about 20 homes on the market for most of 2013. This month it jumped up to almost 60. But, the median price is up about $100K from last year.

As a counter and not saying I agree with it, but for all the talk of non rising incomes, does it really matter? Are Americans prudent as a species all of a sudden? Did they became wise savers as a group, all of a sudden caring if they could afford their purchases today that will burden them tomorrow? The game for Americans in terms of spending money is having confidence (whether faulty or not, whether driven by artificial central govt means via wealth effect or not) and someone willing to lend them money, IMO. Imagine if banks do decide to lower lending standards again soon like they did in the past bc the refi market is dead and they can find investors to sell the MBS too. Then a whole lot more demand is instantly created, wage increase or no wage increase. As a CA housing bear in general, I just feel like playing devils advocate today bc for anyone keeps score, to say we’re in the 8th or 9th inning could be true, but this could also be the 3rd or 4th inning as well. Predicting bubbles is easy. Predicting timing is for geniuses after the fact.

Which investors are going to buy the MBS sausage this time? That’s what brought down the house last time. The FED is up to their ears as the buyer of last resort. Just how much do you think taxpayers will take?

http://Www.santamonicameltdownthe90402.blogspot.com

http://Www.westsideremeltdown.blogspot.com

Investors are all different and have different agendas and risk appetites, sometimes thrust upon them like a pension fund that must allocate x towards AAA rated stuff, etc if the rate of return is high enough then some hedge funds will invest. they may kick the tires more or demand certain additional covenants, but even subprime would find buyers, IMO, if priced properly. Funds should be better at pricing in potential risk of default as well. If you missed it, subprime auto securitization was red hot in 2013/early 2013, even though default rate of 25% was priced in. I’m not saying someone is going to put 100% of their capital in MBS, but for those that diversify and have many safe investments, they may think about a small portion in MBS, even sketchy stuff. Greed and short memories at play of course, but sometimes the risky stuff pays off. Have you ever bet on the underdog in sports and won? Ever bet on a riskier horse at the track and won? It happens often and pays well…

PS: I wouldn’t touch this crap with a ten foot pole, but I assume that wasn’t your question.

Taxpayers like all people bitch and moan about everything…and then put on the TV and do nothing like good little sheep.

IF YOU HAVEN’T PURCHASED YOU MISSED THE BOAT.

All these houses purchased with cash are not going up for sale anytime soon. For the Chinese investors they will take 20 years to get here. They’re all going to be rentals for now. The inventory is less due to that. We have the same problem in San Marino, homes hardly ever sell. Mark my words everyone on here will look back in 10 to 20 years and secretly wish we could buy these prices.

We were like cattle on this website as prices came down, staring them in the eye. Now they’re back up to bubble highs as no one here made a move. Your chance is gone. Irvine is similar to Beverly Hills, Santa Monica, and other high end desirable cities, its just not going down.

I admit defeat. I should of bought 2009 or 2010. But I listened to the masses telling me about hidden bank inventories. What a bunch of BS. Those banks are not sitting on many homes. Not in Irvine. I think the financial mess is in other non desirable states and cities. Like Detroit. In Southern California no way.

I think I’m now permanently priced out of the OC.

You should have bought in 1980. Then you’d be laughing all the way to the bank.

Irvine like Beverly Hills or Santa Monica? Get a grip on yourself. If you thought you were going to get a deal in Irvine or San Marino you were out to lunch even if a flood of homes hit the market. If you really think prices are going to be higher in 20 years then you should have bought a few years ago or even now. No one is stopping you. If this move priced you out you never could afford these markets to begin with.

Move off the fence. Stop complaining like a little girl. You sound like a person crying they didn’t buy Apple’s IPO.

How can I buy in the 80’s when I was not old enough to work. Not crying but extremely frustrated by the fact that I can’t afford a nice home to live where I work. I know life is not fair, but I wish I had the tools at my disposal to earn more money to provide for a family. Yes, can always live the American dream in Texas, but that isn’t fair to family and relatives who want to see their grandchildren grow up.

Yes, I am priced out because the home that was 550-600k two years ago is getting bid up to over 900k this year and you need to be a cash buyer to win some of these bids. We are back at the 2005-6 bubble prices.

Figures this site was here to vent. Or should we all just sit around ad have a nice realtor type chat about the fantastic window in the kitchen. That happy positive chat seems to be more your style.

Sean said:

“Yes, I am priced out because the home that was 550-600k two years ago is getting bid up to over 900k this year and you need to be a cash buyer to win some of these bids. We are back at the 2005-6 bubble prices.â€

Does that seem normal to you? So basically you are going to whine that you didn’t time the market correctly. You want to live in San Marino or one of these markets. Spend 900k and do it. Even you acknowledge these are bubble prices. I think most reasonable people realize something is off with the market. You seem like one of the herd that goes into these open houses on the weekend with that look on their face that if they don’t buy, they’ll be unhappy forever.

Then you go on to say something like:

“Yes, can always live the American dream in Texas, but that isn’t fair to family and relatives who want to see their grandchildren grow up.â€

I’m sure the rest of the country is going to weep for you because you can’t afford a $900k home to save 30 minutes on the freeway to see your grandkids. Grow up. I’m sure you have grandparents living in Beverly Hills that need to spend a few extra bucks for this convenience. Most people are looking at the data and recognize something is off with the market. You just sound like sour grapes that you missed the recent dip.

Well of course I’m mad I missed the dip. I read this blog waiting for the pent up housing inventory to hit the market and drive the prices in line with income. Seems that never happened. Overall frustrated that buying a home isn’t treated like a prudent financial decision anymore, it’s much similar to buying stocks or gambling. I don’t need to buy at the low, otherwise I would want the price at which the house first sold. I’m just looking for a stable market in the area I call home.

There will be a couple more dips before we head into the remote possibility of anyone outside the top 5% being priced out of such areas.

“Keep calm and carry on” buddy

@ Sean: 900K for an average middle class home is too much to pay for, no matter where you live. It’s stupidly high. Sure, we have great weather and what-not, especially in the coastal areas, but we lag the nation in what’s really important like job and wage growth. And also be mindful of the school systems. Our public education system is an embarassment. Don’t kick yourself for seeing things for what they really are. That’s a sign of wisdom. You’re being smart by saving your money and giving your family the mobility to take off anywhere when it all comes crashing down.

Thanks. I guess that is the one positive, I have saved a lot of cash waiting for 10 years. I just have that cash burning a hole in my pocket with no where to invest it. I would probably rent forever if I could get a 6-7% return on my investments instead of 1%.

Look, man, that is a “buy now or be priced out forever” mentality. House prices have historically tended to track inflation over time with slight exception, so if you have patience, you can save money now and buy at the next dip. You don’t have to have your name on a land deed in order for yourself or your family to be happy.

http://www.zillow.com/homedetails/138-Orchard-Irvine-CA-92618/25502437_zpid/#hdp-photo-lightbox

What’s wrong with this little box? 480K 2b/2b 1000sqft.

Personally, I wouldn’t do it, but if you’re looking to compromise with the market, then…

Or wait ’til the next big earthquake, then buy on the dip, if dips do indeed occur after earthquakes. But then timing earthquakes is harder than timing markets.

House sales has frozen in my area. I asked the realtor why and she said, “the rise mortgage rates has scared people. Plus, the rise in mortgage rates means over $400/month more in payments for most houses in this area.”

If rates go higher, prices (and sales) will tumble more.

Do you survey and comment on the Central Valley and its larger cities such as Sacramento, Stockton, Fresno, Bakersfield, etc? And/or do you comment on Central Valley ‘hot spots’ such as Davis and other small communities with colleges? Or is this information to be found in another newsletter or commentary you write? Thank you for the present information. van

Although inventory is still relatively low in Reno, NV, we are finally seeing houses coming onto the market at a much greater rate. Price reductions are also occurring on the MLS.

This should be an increasing trend since the Nevada legislature as much as admitted their idiotic mistake two years ago with the passage of AB284. They only meet once every two years, unfortunately, so the havoc they wreak on the economy, housing market, etc., can only be fixed after a lot of damage is done.

They have now implemented AB300, which repeals/revises the mess from the previous attempt at housing market manipulation.

We should see inventory increase very soon now — banks probably will start the foreclosure process again. We have a number of empty REO’s in our neighborhood that are coming on the market after a very long wait.

Excellent news! I was wondering how that would play out. http://www.leg.state.nv.us/Session/77th2013/Bills/AB/AB300_EN.pdf , final bill. I guess this loosens the restriction for the current servicer trying to get the chain of custody of the title as long as they can prove they have current title. I look forward to seeing how prices and inventory react to this change. I am looking to get the hell out of Cali in 3 years and go to Reno where I can actually buy a home with cash. Seems like that market is a little less insane and the price inflation is directly tied to lower interest rates so as they rise we should see good discounts finally.

I don’t know if this will do the trick but I’ll give it a try. You must get away from looking at housing purely in terms of selling price. Interest rates back in early 2009 were 6.5%. They are now 3.5% and raising. Here is an extreme case but within memory. In the early 80’s mortgage rates hit 16%. Recently, they hit a low of 3.5%. The mortgage payments on the first rate for a $300,000 house are the same as a $900,000 house on the second. Now do you get the picture?

Although spouted off in basic econ classes on college campuses, I dont believe the facts actually support such a direct correlation between home prices going up when rates fo down and vice versa. There have been times throughout history that home prices rise as rates rise bc rising rates can signify confidence in the markets (risk assets) and most people buy into rising asset values (which could be incorrect) and dont buy when assets are going down (which could also be incorrect). Life isnt econ 101 and sorry to economists, but ecoconics is not techincally a scientific field.

I don’t know if this will do the trick but I’ll get it a try. A 900k house needs 180k for 20% down and a 300k house needs 60k. A 900k house at 1.25% has an $11,250 (937.5/mo) annual property tax while a 300k house has $3,750 (312.5/mo). How long would it take to save $60k vs 180k, plus extra for closing costs? And a 300k house at 6.5% interest can be paid down quicker or refinanced. Now do you get the picture?

On mars do many homes go from 900k to 300k because they often dont in america regardless if interest rates skyrocketed. Maybe i dont understand what youre saying, sorry. All i know is if you guys think home values decrease every times rates go up, youre incorrect. Rates are one of so many factors. Houses havent gone down almost anywhere as rates went from 3.5 to 4.5 which is an approximate 25% increase in rates. How high do you think rates can go? Govts need low rates or how can they make their payments on debt? I just cant personally see rates go THAT much higher. anyone really smell above 6% rates in the next few years? This is not an endorsement to buy a house in cali, btw, but i think a lot of people here act very sure of the future when its impossible. Big ben could come back in a few montha and increase qe after one attempt at tapering gone awry. Agreed its all a house of cards, but all of geniuses called for the crash for so long already that we should know by now that things can be propped up for a long time before the crash.

FTB, your posts are starting to sound somewhat similar to my thinking. This charade can go on longer than most are willing to wait. It will never be a “perfect” time to time buy a place in any desirable location in Socal. The last really good buying opportunity in the ’90s was a result of a national recession, 100,000 local aerospace jobs disappearing virtually overnight, throw a few big naturnal disasters in there and people were very leary of buying overpriced real estate.

Read the post from Sean above. He is frustated that he can’t buy a decent place here for a decent price. Texas isn’t an option because grandparents won’t see grandkids grow up. It’s stories like this that keep prices elevated here. For every guy like Sean who can’t/won’t pull the trigger to buy, you have 10 other people who will to stay in the area for whatever reason.

I spoke to a coworker who recently bought in the South Bay. Similar story to mine. Sick of paying overpriced rent, sick of getting yearly rent increases, sick of moving every few years uprooting the kids. Stability counts for somethings…people are willing to pay a premium for this here.

Forvever, Exactly, spot on right. This scenario in housing will set in motion of existing homeowners upgrading into better homes/locations, (if their salary supports) Thus adding MORE inventory into the market, beside the banks inventory that must be unloaded. But again it all goes back to JOBS/SALARIES. No money, no honey.:(

Without an increase in inventory due to new construction, banks dumping garbage or changes in household formation/population growth, how does someone simply upgrading into a bigger home increase inventory regardless of they were previously a renter or owner? If richie rich moves from his little blue house to a big green house, sure the blue house is increased inventory, but the green house is now one less inventory. Pretty sure its a zero sum game.

Also, many people, unfortunately, do not buy houses or anything based on antiquated notions such as jobs or income or an understanding of basic finance. Its more Charlie and the chocolate factory style of “I want the world; I want the whole world.” I totally get the argument of banks wanting to switch no down payments for cash or 20% down payments, etc to get em off their books, but to think lender standards may not decrease (Obama is pushing this btw) which will mean people who can’t afford to buy homes based on salaries, will absolutely buy in. Why wouldn’t they? They just were taught that if they mess up in overpaying in housing, the govt (aka me and you) will help bail them out. I sense they will soon lower the jumbo mortgage standards too as they are now a hot MBS product again. Govt also knows that without housing GDP is in the toilet so they will try to pump it more. Popcorn on me to watch it play out as its gonna be a fun journey.

FTB, couldn’t agree with you more. I highly doubt we will see any meaningful decline in housing prices in desirable Socal areas. Yes, rates have gone up in the past month. But let’s look at the monthly payment. I know I sound like a broken record; however, this is all that most people (probably 95% of Americans) care about.

Borrow 417K @ 3.5% for 30 years = $1872/month

Borrow 417K @ 4.25% for 30 years = $2051/month

I highly doubt that less than $200/month will be the deciding factor whether to buy or not. Money is still extremely cheap! I think we would need to see interest rates break 5% before we see people unwilling to buy at current prices.

The Fed/government/PTB have made it very clear what their intentions are. Betting against these powers has turned into a fool’s game. For the people on this blog waiting for the big collapse so they can score a bargain in a nice area…I think your chances of that happening are virtually nil. If the hypothetical collapse comes, I think the elite, connected, cash buyers, investors will have first dibs on any bargains to be had (I doubt anybody on this blog fits into that category). Nobody can predict the future. Use the information in the present to determine whether buying makes sense or not.

35% cash sales makes financing a moot issue right now but $200.00-$500.00 will knock many deals out of equation based off PTI and DTI…

Once the cash sales slow, the market will go down, a temp price spike will not last long. Hot money gets burned too…6% rates will kill any recovery..

when buying a house the only thing to consider is can I afford this payment and will I have my job for 15 years? Tops are bad things to buy into…

It doesn’t matter if the average salary is going down, the inventory levels are so low you only need a few suckers who can qualify for ridiculous loans. Price goes up, banks start to offload, suckers (regular folk with $) buy, and investors desperate for some kind of yield dig in.

Interest rate rises in combination with rising inventory and better investment opportunities (or perception due to rates, bonds, etc), money shifts locations. When prices begin dropping people will lose interest in chasing a falling asset class and hopefully that triggers more inventory building up from panic sales, reducing prices even more.

We could have many cycles of a certain price range as banks continue to offload and liquidity is poor, I think it will for the most part move sideways for several years until most of the garbage loans are flushed out. However in the meantime it has to go up and down enough to generate churn and commissions for those in that industry. Mis-pricing and bubbles redistribute wealth, and to do so by definition is to violate common sense economics.

Inventory where I live in San Diego is at its lowest point, ever. Its down 30% since April of this year and 50% since June of last year. The few Houses left on the market are at 2004 price levels and small, run down, single family fixers sit on the market for well over 400k. The same run down fixers would not sell for 225k in 2011.

Anyone who buys in this market should be committed to a mental hospital.

Chance of global recession:

http://money.cnn.com/2013/06/12/news/economy/pimco-recession-forecast/index.html

Fed’s other Trillion dollar problem:

http://finance.fortune.cnn.com/2013/06/12/federal-reserve-bank-deposits/?iid=Lead

We are seeing a surge in home prices and yet a drop in inventory in the San Juan Capistrano area. It’s crazy what cash some investors and buyers are bringing to the table. Talk about a bubble, it’s swelling fast.

Jim and Forvever_Sidelined echo exactly my observations and feelings about the housing market in general. During the first bubble (and since), I’ve also been waiting on the sidelines in San Diego, assuming fundamentals would eventually kick in. I often read the Dr’s blog, agreeing with his sound logic and analysis nearly every time.

However, I now believe fundamentals & logic are not reality, but perception is reality. If the Govt, Realtors and all the housing cheerleaders in-between can alter people perception of reality, then it becomes the truth.

So, despite sound financial logic by the Dr. such as; incomes don’t support the prices, prices continue to skyrocket. I’ve come across articles on the internet discussing how houses are actually “affordable†simply because prices are still “down” from their peak in 2008. (As if those inflated prices were realistic in the first place.) But people are buying into it.

So after watching the first bubble, and enjoying the new one (currently upon us), I believe that reckless use credit, booms and bubbles are the new normal. If you aren’t in investor with millions at your disposal, then you need to be buyer that enthusiastically takes on huge amounts of debt to buy over priced homes outside of your ability to pay.

If you aren’t comfortable with the buyer scenario, (like myself), you will be left on the sidelines, renting for life. I accept it now, I have given in and I now believe the hype.

agree 100%. I am on the waiting list for one of the new Irvine Company homes. I don’t want to rent for the rest of my life while reading these blogs and so-called experts. I live in Irvine. Many of my friends live in Irvine. I haven’t seen any unhappy residents here. The only unhappy people are those who do not own in Irvine.

Because the way society is going for a couple years is the way it’s always going to go, right? Gotcha 😉 Tell that to the Romans, the Nazis, Europe in the age of the plague, Europe before World War I, etc.

Yes, the bankers are manipulating reality. But what makes people think this is some kind of permanent state? Climb out of your provincial sandbox and take a look at what is going on around the world, huge unemployment in Europe, China being a giant with feet of clay, the deindustrialization of America… This will not last. I don’t know what’s coming next, but the world as you know it is already on its way out, will not last, and cannot last.

Interesting articles about CA pension costs about to go up (or actually be reported as truth instead of under reported) and how municipal lifeguards can make over 100k in pensions plus health benefits. Hang 10 dudes.

http://www.foxbusiness.com/government/2013/06/11/california-on-brink-pension-crisis/

http://articles.latimes.com/2011/jun/16/local/la-me-lifeguards-20110616

Here’s how I suspect the California legislature will plug these and many other budget holes now that the Democrats have a super majority in the Senate and Assembly:

Leave Prop 13 alone and circumvent Prop 13 by creating a new law called “Son of Mello Roos”. “Son of Mello Roos” would allow the government to selective target those who have significantly lower tax assessments than comps in their neighborhood. They could cloak this new law by declaring it would only be used in emergency situations. And by leveling the tax assessment paying field, the state legislature could claim they are acting in fairness and the will of the majority.

Interest rates might be low, but they are starting to creep back up. (NYT even mentioned it.) Good luck off loading that bubble house in the future …

Leave a Reply to FTB