Where did all the single family homes go? Half of foreclosed homes still occupied and big investors not reselling properties. Investors purchase $1 trillion in real estate since 2011.

The real estate market has slim pickings for traditional buyers. Funny thing that we have to use the “traditional†preface since the market is overrun with a hoard of investors. I am seeing this with my own two eyes. You are seeing it as well. In most ordinary cases a rise in prices would be accompanied with some sort of rise in supply. Yet this is no ordinary situation. Scouring over a few reports I found that nearly half of foreclosed homes are still occupied. In places like California and Miami this number is closer to 60 percent. When these homes finally get fully repossessed, they are likely going to big money investors that end up holding on to the property, removing it completely from the market. There is little doubt that investors are a big part of the market. Since 2011 they have purchased over $1 trillion in real estate. With razor thin inventory, this is a big deal.

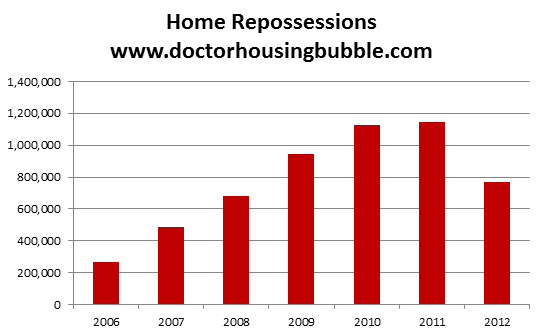

Over 5 million repossessed homes and counting

5.4 million completed foreclosures occurred between 2006 and 2012:

Source:Â RealtyTrac, Equifax

Many of these homes were sold to investors. In markets like those in Arizona and Nevada investors made the majority of purchases. I’ve tried finding a parallel reference point in history for our current real estate market with no luck. We are truly in uncharted waters here. Yet I hear people speak with such conviction and certainty. Once again we are in a new world of real estate and in no other time do you see investors taking on such a big role in housing. Applying market analysis will work if this were truly a market. It is not.  The Fed and banks have created an artificial real estate sector. This is how you explain a dramatic rise in prices with a subsequent drop in inventory.

The big story in 2014 will revolve around the appetite of investors.

Big money is not reselling $1 trillion in real estate

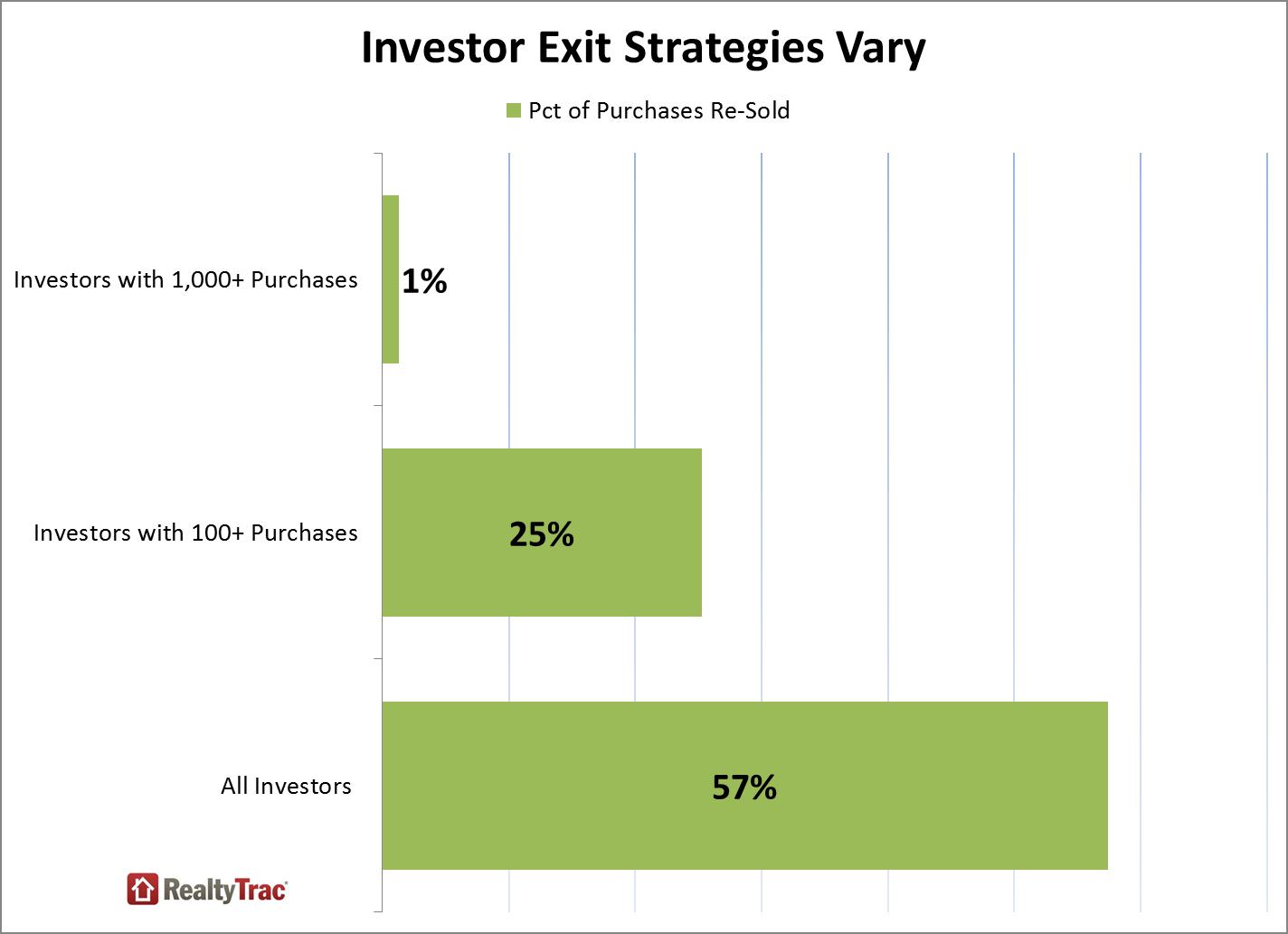

RealtyTrac put out an interesting report that essentially confirmed what I was seeing in various individual cases and various case studies. Big investors are not selling with an endgame of rental securitization or with larger profits as the big prize. Over $1 trillion in real estate purchases were made by investors since 2011:

One of the interesting finds also ties in with the drop in inventory. Big money investors are not exactly putting the homes back on the market to resell:

“(RealtyTrac) Among all investor purchases during the time period, 57 percent have subsequently been re-sold, but only 25 percent of properties have been re-sold by entities purchasing at least 100 properties, and only 1 percent of properties have been re-sold by entities purchasing at least 1,000 properties.â€

We are talking about a massive amount of real estate that was yanked off the market. The above chart shows that individual investors were more likely to resell after purchasing. The report only examined investor purchases between 2011 and 2013 so this is a small window since investors started diving into the market in 2008. Yet the behavior is indicative of what is happening with a large segment of the market and why inventory has declined so dramatically.

In a typical housing market each sale would likely generate another sale. For over a generation the US has been locked in a property ladder mentality. You buy your starter home, build some equity, and sell for a bigger place. So each sale also brought on another sale, two transactions. With this massive foreclosure crisis you have big money essentially conducting one and done deals. Buy a home and keep it off the market.

Not moving out

Banks pressured law makers to circumvent accounting rules that apply to you and any other mortal. These “measures†to help the average folks essentially transferred over giant chunks of real estate to large money investors holding onto properties like a pit-bull. One of the measures of course is the selective foreclosure process:

“(CNN Money) RealtyTrac estimates that 47% of the nation’s foreclosed homes are currently occupied. The percentage actually tops 60% in some hot housing markets, like Miami and Los Angeles.

Those still living in repossessed homes include both former owners and renters. Either way, their time in the homes is mortgage and rent free.â€

This is a big deal. This is another factor contributing to the lack of actual inventory on the market. Throw in unique items like generous tax breaks and you can understand why many baby boomers in places like California would rather stay put and eat cat food than sell their property. In economics, incentives are viewed as people motivators. If that is the case, the current market is incentivizing big leverage, foregoing saving, and gaming the system. It actually makes perfect sense why we have so little inventory on the current market in this situation. With razor thin activity pricing out most families, what happens if investors tire of the real estate game? Signs of exhaustion already appear in places like California. Wondering where the inventory went? Look no further than current banking policies and a grab bag of incentives.

Thoughts on real estate inventory for 2014?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

126 Responses to “Where did all the single family homes go? Half of foreclosed homes still occupied and big investors not reselling properties. Investors purchase $1 trillion in real estate since 2011.”

I expect Jim Taylor will yet again post “Housing to tank hard in 2014.”

But I don’t see how that can happen if big investors keep inventory low.

Housing to Tank Hard in 2014!

Dude, I mean Mr. taylor, if you don’t have something meaningful to say, kindly stop wasting space here.

At least you’re consistent Jim…

Lol

If Jim Taylor ends up being right, we’ll look back and realize that his posts we’re probably some of the most meaningful.

DHB,

I wouldn’t worry about all this too much. It might take some time, but supply and demand will re-equilibrate. Nothing can stop this.

While institutional investors may buy up houses, they can’t create renters out of thin air. Also, how are they going to justify holding on to properties to their shareholders if the yield is less than 3.5% per year, given that the ten year treasury will probably hit that rate in a few months?

The markets seem to agree as Silver Bay and American Residential Properties REIT’s have been hammered the last few months while the rest of the stock market has boomed.

You nailed my sentiment exactly. Figure the math out on this one: I sold my house for $900k in San Diego back in October 2012. An investor bought it in an area that earns about $4,000/month in rent. Let’s assume he paid cash–minus what I know he has to pay in taxes, HOA and the gardener/pool guy, that’s $32k a year before maintenance. So, assuming the property is maintenance-free, that’s a 3.5% return. Really–that’s worth all of the effort?! I’m very curious how soon some of these guys realize that they’re hosed and can’t unload their “investments” without a loss.

Beautiful analogy. Also, since large institutional investors are not going to be property managers that is at least 10% off the rent rolls right there. Securitizing rent rolls is a nightmare waiting to happen but like PTBarnum said there is a sucker born every minute.

You graze a critical point. I can see how there would be a cascading dump of real estate at some point. I personally believe that is what the fed is taking into account more than anything else. In certain ways, I actually think the government knows and is actively throttling the recovery of the economy for that very reason.

If anything catches anyone’s eye that is just as safe and has an equal rate of the already diminishing inertia of real estate’s marginal returns and does not come with all the baggage and maintenance, real estate will be dropped like a hot potato; as fast as possible before the next guy can get around to it, which would crash the market and economy.

What would happen if some economic block provided a just as secure investment with the same or even just slightly better returns. I think there would be a flight from US real estate, right around the next bend. That would look like a flood of real estate entering the market with precipitous underbidding of competitors to get the real estate off their books as quickly as possible. It seems like a positive feedback loop is what makes the fed poo it’s pants from anxiety every time it enters their stream of thought.

What I don’t quite understand is why our accounting and cheap money policies are permitted to foster more development of more housing and even more office space right next to the mostly vacant buildings right next-door. Oversight? One of those things that have to watch happen because intercepting would draw attention to something you hope no one will notice or all hell will break loose?

Yes, it IS worth that slim reward.

That number beats US Treasuries… and provides some (feeble) protection against the Fedsury’s hyperinflationary money printing.

Folks, the big money is being FORCED out of Treasuries.

The Fed is monetizing the national debt — at 75,000,000,000, per month — going forward — whereas the national deficit is only half that figure.

Netting out: 37,500,000,000 per month of US Treasuries is being ‘forced’ into bank deposits. The amount of Treasuries outstanding — IN PUBLIC HANDS — is shrinking like crazy.

It can’t find a home in the corporate bond market… or the muni bond market. (As IF.)

Even oil and gas royalty trusts are too tiny — all of them. (BTW, even overseas bonds backed by oil and gas assets — denominated in US Dollars — are leaping in market price. See: Argentina’s ‘Dead Cow’ “Elephant”)

===

With the prospective value of financial assets (bonds, IOUs of every stripe) losing value — the big money wants real assets — particularly assets that generate a current cash flow.

This pressure will not end until QE / hyperinflation of the money supply comes to a stop.

I agree, Dan.

Blert, I don’t think we’re heading for hyper-inflation. I was wrong in thinking that all of the Fed’s money-printing would create hyper-inflation. It didn’t happen because the velocity of money isn’t there, i.e. businesses aren’t investing, etc… Now, we’re heading out of the policies of “Helicopter Ben” and interest rates have started a cyclical rise, which will last for something like 17 years on average. Interest rate increases typically aren’t compatible with either low capitalization rates or “affordable” housing.

blert,

a) Your quote from the last post…“The collapsing Federal budget deficit mandates that the Fed taper off the narcotic much more rapidlyâ€

b) Your quote from this post…”buying treasuries provide some (feeble) protection against the Fedsury’s hyperinflationary money printing.”

Maybe I’m missing something, but it seems you are trying to have it both ways. If you think the Fed is going to taper much “more rapidly,” then said hyperinflation will never occur. In which case, Treasuries will be a far superior investment over RE, all risk assets will trade lower, and the hedgies will get screwed.

But if you think the Fed is hell bent on hyperinflation, then they will not taper “more rapidly” as you have suggested.

I appreciate your comments.

KR – I completely agree with you about hyperinflation. See my post below.

Do not mention velocity to blert. He will have a meltdown and you will receive his version of the riot act that only he understands. I am not really sure where he stands or what he believes but I know he hates the word “velocity†when it comes to monetary policy…

TJ…

Real estate during rampant money printing/ hyperinflationary policy exhibits two dynamics:

During the early period — when the public does not acknowledge that the PTB are hyperinflating the money supply — the market is dominated by prior nostrums of how things correlate: the mild period is assumed to be merely inflation.

Lenders still extend credit today — to get brutally haircut by the time the notes are paid off. The longer the term, the more severely they get beat up.

Real estate trades in parallel to the mortgage market, as most buyers/ consumers are in no position to not use monthly payments/ mortgages. (Today’s market is very weird, of course.)

HOWEVER

Once government sponsored money printing gets past a certain threshold, lending shuts down, particularly real estate linked/ mortgage lending.

Hyperinflation destroys all of those holding financial assets nominated in the currency — as a WEALTH TAX.

Once this dynamic takes hold, real estate turns into a wealth disaster.

Everything has to sell for cash/ barter — right on the barrel head. This craters ALL real estate values. The whole market takes a plunge.

Great wealth is always associated with real estate — and rental income. ‘Bullet loans’ against real estate prove to be lethal. (A five-year note with 30-year amortization = a bullet loan. This is THE most common form of mortgage on commercial properties.)

Consequently, the wealthy are brought completely down to earth: every lender wants out of the market at the exact same time.

(Zell, Trump, et. al. come immediately to mind.)

====

As long as the players still think that current policy is not hyper-inflationary…

the game is played to the wrong rules.

(Cf. most hedge fund brainiacs… (John Paulson et. al. His bets were perfect for … 1971-1980 ie INFLATION))

Those slamming the real estate markets — especially SFH — are making ‘Paulson bets.’

The absolutely do not foresee that this market is uniquely vulnerable to a collapse in mortgage originations — and that ONE PLAYER is now solely responsible for such paper. (The Federal Government)

This means that they are taking on a ‘complicated bet’ — where everything has to line up.

Paulson found out, the expensive way, that every assumption has to line up to get the big pay off. It’s a lot chancier than one might think.

///

b) Your quote from this post…â€buying treasuries provide some (feeble) protection against the Fedsury’s hyperinflationary money printing.â€

I actually wrote:

“Yes, it IS worth that slim reward. [‘it’ pointing back to SFH purchases by institutions.]

That number beats US Treasuries… and provides some (feeble) protection against the Fedsury’s hyperinflationary money printing.”

===

Confusion is natural when you’ve inverted my meaning. There can be no inflation (hyperinflation) protection to be had by lending to the government long term.

The Fed is ALREADY running out of things to buy.

( A huge block of US Treasuries HAVE to stay in the hands of alien central banks… Bretton Woods.)

There are many, many, many, holders of US Treasuries that CAN’T substitute bank deposits — even if they were at the Federal Reserve Bank themselves. (Something that’s legally impossible, anyway.) These strictures date from the time of chronic bank failures/ insolvencies.

Just off the top of my head:

Alien central banks: mentioned above… trillions upon trillions

Pre-refunded bonds: their trust funds (can be municipal bonds, corporate bonds)

Escrow accounts: whenever huge — Wall Street’s parking lot

Insurance company deposits at the state level: no substitutes allowed

All states use Treasuries as a parking lot for big cash — typically by statute

And, of course, cross-governmental holdings…

Leaving the actual amount of US Treasuries in ‘trading hands’ well under $8,500,000,000,000… probably under $4,000,000,000,000!

Now keep that in mind when you contemplate $900,000,000,000 per annum in money printing!

At some juncture, this Wealth Tax will be apprehended by the market.

Even the Weimar Germans finally got the picture.

And all was chaos.

////

Dictionary definitions of hyper-inflation are sloppy, loose, — ignorant.

The government can hyper-inflate at 10% per annum, at 40% per annum, at 10,000% per annum. The process is IDENTICAL at every specific tempo. It ORIGINATES when the government decides to ‘counterfeit’ its own currency. And like pregnancy, it ALWAYS starts off very pleasant — and small.

Such fiat printing ALWAYS entails issuing an IOU — a government debt — with martial power backing up its ‘distribution.’

With time, the citizenry figure out that the only way to play is to pass the bucks — as fast as possible. This crowd decision is later described as ‘velocity’ by the sages. It, of course, can’t be predicted, controlled — or stopped.

///

So, real estate investing is complicated, r e a l l y complicated. Easy to get in — murder to get out.

It trades on emotion, leverage, (interest rates & currency abuse) the local economy, the national economy, the international economy, social trends (drug crime, gentrification), and luck.(earthquakes)

in depth analysis of the predicted 2014 housing market in this video. (predicted housing prices will get hit hard) Skip to 22:27 if you want to skip the precious metals info and go straight to housing.

http://www.silverdoctors.com/pm-fund-manager/#more-36711

Your link takes us to a website that appears to be in the business of selling precious metals. Naturally, they’ll slam all other investments.

I think I posted this a few threads ago, but stumbled upon it and read it again including the comments below the article, and thought its worth posting again. Some good stuff in there about how in the author’s opinion its a myth that homes are more affordable now in general as well as lots of other stuff that has been discussed ad naseum in the articles/comments on this blog. I’d be curious to hear some thoughts (note the author actually adds his own comments below the article so that section is a good read too).

http://mhanson.com/archives/1546

Btw, in regards to Jim Taylor, unlike almost every other poster here, he has had the balls to not only say housing will tank, but he gave his predictions tied to dates and %s in housing decreases, as well as numerous reasons to support his frank the tank premonitions. For the babyboomers out there, when it comes to jim how bout a little stripes reference instead: “lighten up francis.”

Thanks FTB 🙂

In regards to the realtytrak info posted I find this adds support to my prediction. When first looking at the 1% of sales in inventory over 1,000 it appears daunting as commentors have pointed out this removes available supply for purchase. But that is because prices have continued to climb and the investors are holding out for large gains. Once the tide turns and the investors see that peak prices have been reached they will race to the exits to realize their gains.

Once they catch wind of their competitors putting 10 properties up at time below market for quick sales the rest of the investors will dump everything and supply will overwhelmingly outpace qualified demand. Remember Doctors graph from ZH about the mortgage apps being down to all time lows. This is a prescription for a huge downturn. It is just going to take a small drop in prices or even just a levelling off, which we are already seeing, and just like in 2007 that will cause the thing to implode. Lower prices are coming.

Jim, using logic and critical thinking skills, I would agree with you, however, that is not how the system works. My prediction is real estate will drag along, it *may* lose up to 10%, but as our money loses buying power, and that real estate remains the SAME price, it is indeed, tanking. REAL assets at least give you something when the system collapses. Most investors already have at least one home. The problem is, not having a right to a home, which every American should have. Yes, you read that right, the RIGHT TO A HOME, the same as a RIGHT to have health care. Sorry for being a civilized socialist and not an unabashed, unrestricted capitalist which is causing all of the problems. When is the last time anyone heard the words MONOPOLY, or ANTI-TRUST….probably Reagan years, and they quickly stripped all the layers. Ayup, keep voting, shit is changing….not.

Swiller, so, too much capitalism is the problem then right? No, the problem is Crony capitalism. Socialized losses for the Cronies, which allows them to play with house money and to take on more risk, and capitalism for everyone else (the non cronies.)

Swiller, your prediction rests on the idea of a hyper-inflationary scenario. What if we actually have a bad case of the deflation?

JT…

One dares not use pre-2009 metrics (or econometrics) when the Fed is printing money like crazy.

The rule book has been shredded.

One is well advised to read up on Argentina and the like.

Even Cyprus, Greece and Spain have lessons for investors.

All classic defensive investments become treacherous.

A sound currency is the glue that holds our social contracts together.

Hyper-inflationary money printing takes resources away from the sane — and gives them to the profligate. (Congress)

On the whole, most Americans still believe that the US Government actually borrows money — and borrows it from the future. This last nostrum is completely false — while being parroted far and wide by the ‘GAAP/ CPA’ crowd.

Government is a creature that lives totally in the present.

It’s not obligated to follow prior laws — and can’t get its own laws to last through time.

Its rules are adjudicated inside its own courts — at no direct expense to itself. Its rules don’t apply to itself — nor its key players. (Insider trading is okay if a Congressman does it. The current restrictions will not last.)

Deficit spending is ‘financed’ by a wealth tax imposed upon the currency — and ALL instruments nominated in that currency — planet wide. This mechanism is used so that Congress can say “Yes” to the proles while on campaign.

Fiat spending == taxation of the national economy — right in the here and now.

Keynes was epically wrong.

You can’t turn around the economy by giving the big decisions to a central clique of ‘value idiots.’ (Congress)

Economic decisions revolve around trade-offs.

Politics is the art of the anti-economic, of force… with war being at the top of the list.

“Yet I hear people speak with such conviction and certainty.”

Well said, doc. It never ceases to amaze how quick some folks in the comment threads throw out the words “always” and “never” as if they’ve some crystal ball.

Abuse of the currency ALWAYS leads to troubles.

The actual denouement is NEVER foreseen by the Powers That Be.

http://www.zerohedge.com/news/2013-12-29/steve-keen-briefly-explains-why-janet-yellen-wont-see-next-big-one-coming

Because the PTB are totally corrupting the control signals within the economy, it’s actually impossible to used prior norms to predict (econometrically) how the system will breakdown.

Financial events will rhyme with — not quite replicating — prior fiascos.

We might reasonably expect:

Electronic banking runs on the money market…

Digital banking runs on the top tier (TBTF) banks…

A gold bullion scandal… as in a collapse of one or more bullion exchanges…

Digital-Financial warfare by way of ‘black’ hacking… now that 0-care exposes one and all to identity theft… which might lead to plastic repudiation — en masse — as plastic is systemically rejected in the same manner as Weimar banknotes…

A tidal wave of municipal bankruptcies… (would replicate the chaos of the Great Depression, BTW)… causing shocking leaps in civil servant lay-offs and a contraction in retail demand and lapses in rental cash flows…

[During the GD, once the ball dropped, the dynamic swept across the land. Losses in one city caused other cities to find that they couldn’t ‘roll-over’ their paper — even at ruinous terms.]

A sharp contraction in the economy would be enough to harpoon all those businesses with high fixed costs: the transport sector — ALL of it. This is the big downside for any firm that substitutes capital for labor: you cant’ lay off machines! At a second remove, the Big Banks would take a HUGE hit as countless locomotives and airliners would hit their ‘work-out’ books. (Repo man would be doing a bust out business, BTW.)

This last aspect is the REAL reason that so many homes have not been repossessed: they system can’t cope with that much volume. If the cash flow is there, the lender would much rather ‘meter’ the assets back onto the market — WITHOUT breaking the price level.

This is why California prices are so ‘sticky.’ The players can see a way through to unloading them in the out years at prices they can live with. A price collapse would destroy their own balance sheets and confidence in the management of their own firm.

Bear Stearns and Lehman Bros are still ever most in their minds.

Perhaps I should have been more clear. Always will and never will are different than always have and never have.

Dr. Housing Bubble your articles are the finest and most reality based real estate information available. It is obvious that the banksters and their special interest groups along with their enablers(government) are manipulating the real estate market for their own benefit. The odds of individual investors prospering in such a rigged market is slim indeed.

How does one win at 3 card monty? That’s the game we are being presented with. A rigged market. Whether we are discussing housing, oil, food, gold, natural gas, or what have you, it’s rigged. So how does one win a rigged game?

Obvious: Be the one running the game.

2014 Housing Predictions Main Street America has to deal with all the housing Inflation created by the Fed, Cash Buyers and housing bubble hangover low inventory cycle

http://loganmohtashami.com/2013/12/30/2014-housing-predictions/ …

“many baby boomers in places like California would rather stay put and eat cat food than sell their property” The old baby boomers take out reverse mortgages and can keep the party going. Of course, if they have children, they are not pleased and wish that their parents would hurry up and leave this world before they spend all of their inheritance. Don’t knock cat food until you try it. The health laws require that it be at the same standards as people food since a large portion of cat food is consumed by humans. Popular Science, “Let’s take a look at the ingredients in a typical can of cat food: meat by-products, chicken by-product meal, turkey by-product meal, ash, taurine. Nothing too horrible, but in general, these things don’t constitute a healthy human diet, says Dawn Jackson Blatner, a registered dietitian with the American Dietetic Association. “That said, I’m fully confident that your body can handle kitty chow.”

I have to say you’ve made my day. Gave me a laugh, that one. Thanks!

Lmao! Thanks for the info. The future’s so bright I have to wear shades. …

I’m so curious to see what will happen if there’s a confluence of a) investors re-allocating out of housing in search of higher yields, b) “golden-handcuffed” retirees finally kicking the bucket in their 70s-styled homes, and c) Chinese reading the tea leaves, seeing the impending decline in So. Cal. housing, and moving their money elsewhere. Whether these things happen serially or in parallel, there are a lot of interesting headwinds ahead.

A good number of the houses I’ve seen in South Pasadena that have come up for sale are trust sales. I can think of 5 houses in the past 4 months that have were sold as such. The Doctor is right about people dying in their Prop 13 sarcophagus’ but these coffins are broken down houses that have deferred maintenance. Regardless though each ended up being bought by all cash offers. Two of the houses the wife and I put offers on.

You think eating cat food is cheaper than eating items from dollar manu from McDonald’s? Can you buy cat food with food stamp? Shut up if you don’t know what is the cheapest way to live.

Oh, my, my. No reason to be rude, eh?

And besides, it sounds like cat food is better for you than McDonald’s. (You did see the movie ‘Supersize Me’?)

DHB –

“I’ve tried finding a parallel reference point in history for our current real estate market with no luck. We are truly in uncharted waters here. Yet I hear people speak with such conviction and certainty. Once again we are in a new world of real estate and in no other time do you see investors taking on such a big role in housing.â€

I think you have a very myopic view of the world if this is what you believe. If you replace “real estate†with “stock certificate†then we have a very good example of this in the past. This is exactly what happened during the stock market crash of October 1929. You really need to study the run up to the great depression and what transpired during the great depression. I think the only true difference this time is that the Federal government is stronger now and has participated more in line with the financers. I am actually shocked at how similar the two events have been thus far.

I was watching a couple of youtube videos over the weekend on the different economic views that came out of the great depression Keynes, Hayek, and Marx and I am fascinated that we still have an economic view of the world that never saw this crisis coming. Compare this to other sciences like astronomy. How long would we subscribe to a model of the movement of the sun, moon, planets and stars that never predicted the change in direction of the planets. I wonder if the economists truly believe what they are saying.

DHB,

Those living in their foreclosed homes over 3-5 years ( I know many do) has saved enough money to buy cash if not % 30-50 down for a new home.

I think housing market will slow down little bit in 2014 ( tighter restrictions on home buying will kick in 2014) but there will be NO CRASH.

I think 2014 is the last opportunity to buy before we see a huge housing bull market till 2025- 2030.

Reasons : Elections, Population growth, Improved Economy thanks to QE to infinity, Feeling Richer effect due to increasing home equity, 08 crash is distant memory for many Americans etc etc etc

Curious…how do you figure? A bull market in real estate? Housing prices are already at inflated levels up and beyond the fraudulent highs of the real estate bubble from just a couple years ago. You really think that there will be a bull on real estate that is already now not affordable?

I think, we are likely to see a stock market crash in 2014 than a real estate.

Smart investors are cashing out of stock market only to buy homes CASH.

Ask yourself? How many Google ( $1109.46 each) shares can you buy with the money you have in your bank account right now??

I think stock market is over bought and over valued right now.

I bought a house in mid 2009 and missed an opportunity in 2011 and will buy again in 2014 before it is too late.

TR, in case you haven’t noticed, all risk assets trade in unison nowadays. If the Stock market tanks, so will RE, and vice-verse.

If you haven’t paid your mortgage for 3-5 years, wouldn’t that kinda screw up your credit and mortgage prospects?

Yes it will mess up your credit but with %30-50 down payment with higher interest rate you can get a loan.

FHA terms are very lenient. Seems to me that as long as you do not have any open outstanding collection against you then they will give you a loan as low as 3.5%.

In such a case, one might get the extended family to co-sign the note.

With a monster down payment, such a prospect is do-able for most.

The other angle is to get friends and family to carry the paper. They’re getting stinko interest rates on traditional investments.

A first mortgage on your home might be exactly what they need.

Further, once that mortgage is aged, it can be sold off to an number of buyers.

In some cases, the funds can come straight out of a 401-K — if the trust institution is set up for it — and if the familial distance is suitable.

Further, after a time, the note can be cashed out when the borrower’s credit score has improved. With such a massive down payment, such a borrower could tolerate a mortgage rate (still deductible) above the market norm — and STILL come out smelling like a rose.

For example: just nominate the note as 180 month paper, fully amortized.

If the property is bought out of foreclosure, no title insurance is necessary: that legal process extinguishes ALL title claims. The title cartel is making a killing on said fact, these days.

The shorter maturity would draw a reduced interest rate… but you pay the thirty-year rate — perhaps more. In 60 months, you’re looking sweet. Your equity and payments will have permitted you to either drive your debt way down… or refi to suit somewhere along the line.

There is an ocean of frustrated 401-K money looking for first mortgages of such a type.

There is ONE key: the desire to have a deflating mortgage debt has to be balanced against the very real prospect of employment upheaval/ cash flow nightmares.

The very situation that causes the Fedsury to hyperinflate the money supply is the beast that destroys job security.

A RE broker with an ARM wins the debt bet — and loses the employment/ cash flow bet.

He should absolutely HAMMER his debt at rates far, far, far, above the minimum — in the foreknowledge that his job will surely be lost during the years ahead.

Hyperinflation blows up landlords, far and wide. They are second on the victim list.

(Money lenders die first.)

It is my understanding that elections have been pretty consistent since the start of this country as well as population growth. I have not seen any proof of an improving economy because of QE measured by GDP. I have only seen asset bubbles reflated. There really is no empirical data that assures that wealth effect will take us all the way to 2025 – 2030. I don’t have a crystal ball but history tells us that asset bubbles are unstable by definition.

We live in boom and bust cycles.

Growing population will help to fuel RE prices.

Bull market for precious metals are over and now we are seeing final chapter of stock market coming to an end in a year or two.

Smart money sold precious metals in 2009 and bought homes with cash, then again sold stock in 2011 and again bought homes with cash and now they are preparing to fully exit stock market.

Whats left to make money on??

REAL ESTATE

Yes we live in boom bust cycles. But the bust never really had a chance to clear out the system so we are technically still in a zombie boom.

Like I said we have had growing population in this country since the beginning. I see no correlation with economic booms and busts with a growing and then non growing population because it has grown since the beginning…

I completely agree that the bull market for precious metals is over and I suspect we are at the final stages of a stock boom. I think your assumption that we will go to real estate from there is a stretch especially since real estate is already in a boom. This boom started in the 1990’s. These booms were all private debt financed booms and we are at a point were the private debt load is no longer sustainable regardless the rate or term…

@TR wrote “Those living in their foreclosed homes…has saved…% 30-50 down for a new home.”

Their credit is ruined. Bad credit stays on your credit report for 7 years, some cases 10 years. If they can get a mortgage, unlikely, they will need to pay 200 to 300 basis points above prevailing mortgage rates.

@TR wrote: “…there will be NO CRASH.

I think 2014 is the last opportunity to buy before we see a huge housing bull market till 2025- 2030…”

This all depends on interest rates, inventory, wage increases, transfer payments (welfare reform), employment rates and the next recession.

If interest rates on a 30 year mortgage went up to 9% by the end of 2014 (almost impossible, a black swan event) housing prices would collapse in the bubble areas by 30% to 40%. In the fly-over parts of the U.S., mortgages are frequently well below rental equivalent so this would have no effect on them.

Wage increases? Pay increases put a natural constraint on prices. Pay increases have been in the 2% range for the last 6 years so no bull market in real estate without wage inflation. This year it looks like sub 1% annual pay increases.

Recession? The last recession was 5 years ago. Recessions happen every 4 to 7 years. Recessions are bull housing market killers, i.e. 1980, 1982, 1990, 2000, 2008, etc. Housing crashes and recessions are joined at the hip.

Transfer payments (welfare and welfare reform): Congress punted on extending unemployment benefits. According to the CATO Institute the average Californian on welfare collects about $35,000 per year (updated CATO research paper is here: http://www.cato.org/publications/white-paper/work-versus-welfare-trade ) What happens on welfare reform (transfer payments) will influence the California housing market. At $35K per year in benefits, these Cali welfare recipients can sit in their houses for a long time.

Employment rates: the Los Angeles county U-3 rate is 10.2%, the U-6 rate is 20.1% (see: http://www.bls.gov/lau/stalt.htm ) These are depression level numbers that are similar to Las Vegas and Detroit. If it weren’t for generous transfer payments (welfare, see above), we’d be seeing a massive exodus out of California.

The few folks I’m aware of who haven’t been paying their mortgage over the past couple of years are flat broke. These are people who over-leveraged last time around with nothing on the table. Good luck with that.

I agree with AK. 3 years ago this blog was expressing concern about the so called shadow inventory that was going to be unleashed resulting in a drop in housing prices. Well, that’s been taken care of by investors. It tells me that thee is incentive in the market for that to occur or it would not be occurring. In the future investors will sell, but not all at once and others will surely step in to consume that supply. Isn’t that really how the markets work? If all the naysayers boought 3 years ago they would be far ahead and I would venture to guess that 5 years from now it will be the same story. Let’s not drink too much of our own bath water and start facing reality

The shadow inventory is still there. QE is for Wall Street not main street. A lot of the people still in there homes have not saved all that money you say they saved because they have lost everything and many are still unemployed. I personally know people wanting to leave but can’t because the banks are not completing the foreclosure even years after filling chapter 7 bankruptcy. The market is rigged hence we can only guess when the elevator stops, goes up, or down.

but, but, but Lynn, you KNOW everyone who defaulted are bad people, because that’s what the media tells us! They would never lie to the American public.

I *used* to be middle class, but now I see more and more of my friends and family not even having a decent savings account. They live from paycheck to paycheck, tossing and turning in the American dream…then they need to wake-up and go pee, and they realize, it really WAS a dream, so they go back and sleep in the bed that is owned by the people who do not work, same as the house, and their neighbors call them names and judge them.

America, where people work for the fat and lazy rich. Karma is coming for this nation, and it will not be avoided.

Swiller: >>but, but, but Lynn, you KNOW everyone who defaulted are bad people, because that’s what the media tells us!<<

Really? Which media? Most of the media I read blame the banks for the foreclosure mess, and say that homebuyers were innocents who were duped into accepting mortgages beyond their means to repay.

Frankly, I think the media has been letting buyers off easy. Many homebuyers over-extended themselves because they were greedy.

Just because you're poor doesn't mean you're not greedy. There are the greedy rich, and the greedy poor. Poor people aren't nobler; they're just not as smart at being greedy.

Like everyone else, I could have qualified for a mortgage before the first bubble popped, but I refused because I didn't want to over-extend myself. So I continue to live in my condo, though I'd prefer to live in a house. Some of us are responsible and live within our means.

I have no sympathy for people who bought more house than they could afford.

PS: I especially have no sympathy for people like Lynn Chase, who indicated in another thread that she had several houses in Las Vegas that were in foreclosure. She sounds like a house-flipper who over-extended.

House-flippers bear much of the blame for these real estate bubbles. These amateur Donald Trumps deserve to get burned. The only people worse than house-flippers are those fast-talking hucksters who sell books and tapes and seminars to teach people how to house-flip (but are too smart to do it themselves).

A house should be a home, not a speculative asset.

Not all is bad, I hear that you can get a good deal from McDonalds dollar “manu” and it is cheaper than cat food because you can use your food stamps. I know that CalFresh, California Food Stamps are for legal immigrants(and some illegal) and you can have a San Francisco house and a car(look it up yourself). California is a great state for my relatives. Some Chinese investors are buying up the bank owned property. The real estate bubble in China is too big, so the money is coming to Irvine, and along the California coast. Prices in the City are getting high, but still better than China.

We’re both speculating on how investors will think, but if you see a sudden decline in the value of your investment (SFR), most folks cut the losses and dump the asset. If I see a stock at the early signs of tanking, I’ll try to sell before the 20% dip even if it means giving up the 3% dividend.

Also, aren’t housing investments a replacement for bonds rather than stocks? If that’s the case, preservation of capital is goal #1.

Good post Sam. I bought back in 2012 and was completely content with the idea of no appreciation for the next decade. I bought for several reasons: rental parity, endless Fed/government housing support and all the intangible benefits of owing a home. The little run up we’ve seen in the last 18 months is just icing on the cake for me. The idea of buying today for massive future property appreciation or making a killing being a landlord is delusional.

Like you said most of the buyers from the past few years are sitting very pretty (even the 3.5% downers). Could we have a correction from today’s prices? Sure. A downright collapse (30 to 50%) that most on this blog are hoping for? Highly doubtful.

We’ll see how it all plays out in the end. Finding the perfect time to buy and picking bottoms in the socal RE market is a fool’s game. But crunching some very simple numbers told us that buying a few year’s ago wasn’t a bad move regarding socal RE.

How could the 1000+ investors sell their RE holdings if they securitized rental income from them???

They’re cashing out BY spinning off/ parting out the rental streams.

The ‘cap rate’ imputed to these monies is extremely low, by real estate norms.

Low cap rates = extremely high valuations.

In sum: they sold the pie plate and kept the pie.

Sweet.

Your right. How could they sell.

Now what could happen is that this secularized investment cannot make the scheduled payments because of low occupancy rates or high maintenance costs and files for bankruptcy. Then the houses can can be bought again by Blackstone on the cheap.

Ha! So true. Rinse, repeat.

This happens if a fund has more redemptions than purchases. The fund manager will be pressured to sell off underlying assets and liquidate shares. This actually happened last time around.

That’s what ruins hedge funds. Heck, that’s what ruined Madoff. When your clients want redemptions, you’re forced to cash out.

I am a single parent interested in purchasing a home to reduce rent (no expectation of appreciation during next 10 years) in Southern California. I’ve rented for nine years now, have a down payment in savings doing nothing, have 800 FICO score, and am only interested in properties that would cash flow as rentals in the area (in case my job moves me to another city during one of the unsellable times of the next bubble implosion). This limits my choices to severely distressed SFRs in my area. I found one a few blocks from where I currently rent, perfect for my family, schools, work, etc. It is on auction now but the auction company specifies “cash only” buyers. As this basically excludes everyone but speculators, I wonder if it is possible to file a class action suit against the seller for these rules. It makes me upset that all the affordible housing in my area is reserved for speculators while families are left out in the cold. Any thoughts on whether a class action suit would be viable? Mostly, I’m sick to death of speculators using housing for their bubble madness. Why can’t they use gold, diamonds, or something else that is not necessary for families just trying to get by? Why do they need to mess with shelter, food or heath care?

You’re not being discriminated against because of your skin color or sexual orientation–it’s because of the viability of you to complete the transaction. Cash buyers typically prove that funds are available, so the seller knows that a quick close will follow. You’re hoping that a third party will finance your purchase once they send a fourth party out to look at and inspect your purchase. There’s no upside to the seller to deal with that headache and the related delays, so they just won’t touch it. Nothing illegal about that.

@KR true and that 4th party (the appraiser) is more likely than not to undervalue the property and make it more difficult for the low-down-payment buyer. When I purchased my home the appraiser put the value at $440K and the purchase price was $470K. This initially worried me but I came up with the difference to close escrow. Although the listing broker and my buyers broker told me that appraisers usually lag values by a half year, I felt I had been taken to the cleaners. But when myself looked at comparables in the area, the purchase price was in line with all other homes sold in the area. Now, a year later, I see that what the brokers told me was true – the appraiser was covering his ass with a low appraisal price. And I could sell the house today for $550K. Further on this was that I was told that the appraisers were part to blame for helping the banks drum up higher prices in the prior bubble, and that the appraisal industry as a whole have tried to shed this image by chronic undervaluing home prices post-bubble.

IMO, what’s the rush to buy? Think the market is about to take off? You just said that you expect it to be flat. For the tax write-off? Is the risk of downside in your investment outweighing the benefit of a nominal tax-write off?

My objective is to reduce rent. A legal issue was recently resolved that will mean I am probably going to be in this area for another 8-10 years. I owned (not “mortgaged” but owned) until 2004 and then cashed out and rented. I am tired of renting.

Absolutely! Shelter, food, healthcare, utilities, gas, all things debt slaves need to survive to continue working so they can pay their debts should be off limits for speculators.

>> Absolutely! Shelter, food, healthcare, utilities, gas, all things debt slaves need to survive to continue working so they can pay their debts should be off limits for speculators. <<

Lynn, didn't you indicate in another thread that you had several houses in the Las Vegas area that were in foreclosure? Doesn't that make you a speculator?

I agree. There should also be a strong case against banks for violating Antitrust laws by manipulating housing inventory and running up prices.

Perhaps you should ask TR.

He seems to think everything is rosy! Bull market to 2030!

No citizen will vote to tax speculators or the rich because that’s class warfare!

Besides, when you get rich, you wouldn’t want to be taxed, would you?

Of course not, so while we wait for you to be rich (which is a guarantee mind you), don’t tax us!

Unfortunately many auctions are far cash, whether in housing, cars, storage lockers, etc and its legitimate. An auction company doesnt want to assume the risk that one’s financing (I.O.U) drops out when cash has no such risk/cost of litigation attached.

In terms of speculators, I think the scene from usual suspects sums it up:

“Verbal (kevin spacey playing both a cripple and the infamous Kasier Sose): But why me? Why not Fenster, McManus or Hockney? Why me? I’m stupid. I’m a cripple. Why me?

Agent Dave Kujan (the cop): Because you’re a cripple, Verbal. Because you’re stupid. Because you’re weaker than them.”

Because these necessities you mention like housing, oil/gas, etc are so vital to our lives is the very reason speculators mess with them. You are an asset to be exploited, nothing more. You make x per year and the TPTB want not only x, but x plus y (your future earnings via debt today). Heck, they’ll even take your collateral/assets if things work out “right.” They know you can cut back certain things like movie tickets or diamonds or gold (paper market at the very least is manipulated, btw), but you need a place to sleep.

As a practical matter:

Over bid the auction — by jumping ahead right now — if you can contact the selling party.

That might be the REO office of the lender.

With a FICO of 800, ANY REO officer would take your proposition seriously.

He can save the auction commission/ brokerage fee… by selling direct.

If this is not do-able… put yourself on his list of REO liquidations…

For such players, they’d be DELIGHTED to take back the financing on said properties — IF they’re been sold to STRONG CREDITS. — Which is what you are.

Stop shopping via the brokers — and shop via the REO offices. Every lender maintains such offices, they get no respect. If first class credits were to show up all the time, they’d ALWAYS prefer to negotiate deals — and save the broker’s commission. You won’t need to get title insurance, either: the property HAS to have clear title by way of the foreclosure laws!

Such deals, once done, produce mortgages that the bank can syndicate in the national mortgage market.

You may have to shop more than a few REO offices to get a working relationship. The smaller the bank, the better your odds. Have your credit paperwork all in order — his time will be pressed.

Thank you, Blert. I will look into this. I have a large down payment doing nothing in the bank and hope to use it to reduce rent. I will start contacting REO offices. When I tried this a few years ago on behalf of a public affordible housing agency, even they told me that only all cash offers would be entertained and set up rules that eliminated the program in favor of speculators. I guess cash talks.

As to your last point: the Big Money needs assets available in SIZE.

Gold, and the rest are TOO SMALL for the monies available.

BTW, only 0bama “invests” in health care. Prices are booming there because it’s a CARTEL sponsored by the Federal Government. Without directed legislation, the cartel would be open to legal attack: the Sherman Anti-Trust Act.

The cartel is in gross violation of said act… which is why prices are headed to the Moon.

Barry can’t figure that out… and the cartel is a HUGE backer of his campaigns. So, there will be no changes on that front.

Dave,

My husband and I (and three children) are in the EXACT same situation as you except we have been renting for 14 years. We have 25% to put as a down payment, 800 fica scores, solid employment, and not a single house available for families. They’re all going to investors with cash and the multitude of foreigners (guaranteed residency) with a 500k investment in U.S real estate. Were in So. California and I desperately want to leave this state. I was born and raised here but it truly feels like living on a Wall Street roller coaster. If my husband was able to relocate his business, I would move out of Calif. tomorrow. Homes should be for building dreams and securing families. Unfortunately, it has become a business for the masses. All the best to you.

Bottom Line is this, California Housing will always be Expensive. I was born and raised in Cali, I’ve seen the boom and bust cycle hit every 15-20 years. The difference is, when the bust happens in Cali, buyers step in and take advantage of the deep discounted values.

As long as Cali has beaches and great weather, it will always be like this. You will NEVER in your lifetime see a house in Irvine for sale for $125,000, if you do, THEN you know the Cali market has really CRASH.

Society has changed, all the jobs are being shipped overseas.I feel that last bullet the middle class has left to make so money is real estate, because people have to live somewhere. Robert kiosaki said your house is a liability, not in Cali, providing you buy in the right LOCATION.

Any feedback would be appreciated.

Wishing EVERYBODY A BLESS 2014

California Housing will always be expensive? How quickly some people forget? During the Great Recession, homes prices in the inland areas of California dropped like a rock and you couldn’t give some of them away. Even homes in prime coastal areas dropped in value.

Sonar, see the contradiction Goldie makes between paragraphs 1 and 3? “California housing will always be expensive.” Well, not really–it turns out that only in the NICE areas. So, here’s the bottom line: housing will always be expensive in nice areas. I hear also that nice cars are expensive, too…nice wines, nice clothing…

Sonar, The California Market is not immune, it goes through it’s Boom and Bust periods, the difference is when the the Bust cycle hits, buyers come in and buy up all the inventory in the “quote on quote” desirable areas.

I would love to see a depression style housing collapse in Cali, it would be a HEALTHY RESET to the housing market.

Sonar, thanks for feedback.

Unfortunately, California is losing population. It’s not different here. I have lived in five states, they all say the same thing. Wages determine prices and California is no different or spectacular when it comes to wages.

Where are all these investors buying? All I see in my area are Asian families moving in for the good schools and to be around lots of other Asians. Who has data that shows that it’s investors who are buying up north county coastal SD homes as opposed to owner-occupied? Like to see the data. Let’s see some supporting data for coastal OC and LA as well. Until then color me skeptical that the coastal areas are being propped up by investors looking for properties that cash flow.

Falconator, you hit the nail on the head with your post. I live in the LA South Bay and from my anecdotal evidence there are NO investors buying in this area, almost everything is owner occupied. The investors were/are swarming in the MUCH cheaper areas (Vegas, Phoenix, IE, etc). These places could likely get hammered again if investors pull up their tent stakes. As we have all witnessed, socal RE markets are all based on location and the laws of supply and demand. What happens in Modesto or Murrieta does not affect Manhattan Beach.

I keep asking the Bears on this blog, what would entice you to buy RE in socal? What percent correction, how about interest rates, overall financial health of the economy, etc? If people didn’t buy when things were at or below rental parity, I don’t know if a “realistic” buy scenario exists for them.

For the fun of it, I looked at condos in 90275 last month with a realtor. I kept being warned about how investors are snapping everything up and making them rentals. The nicer condo communities are “fighting back” and forcing all new buyers to not rent out any units for two years. They’re all around…

KR, that sounds like realtor speak of “buy now or else.” Do the simple math to see if those condos pencil out as rentals.

I sold my 92130 SFR to an investor. The house across the street (where Heath Bell lived) is a rental. Two houses down across the street: rental. One next door: rental.

KR, I never said there weren’t any rentals in the desirable areas…there are plenty. Most were bought many years ago. From your post above, even you questioned the investor buying your property because of the minimal return. From an investor standpoint, you want to put minimal down and secure the biggest return possible. The whole minimal down goes out the window for the desirable areas. Having hundreds of thousands of dollars tied up chasing small returns is foolish.

Money is rushing into grade A houses. The rental backed securities are in mediocre houses that the lower classes live in. Although I think the big hedge funds are about to dump in the next year, the grade A product has room to grow. Money runs into residential real estate as a haven when it’s high grade real estate. And that’s what we’ll probably see for the next few years.

The astounding concentration of Arizona real estate makes one think that the hedge fund crowd is buying ahead of the retiring ‘snowbirds’; a demographic which is now ramping exponentially.

The baby boom bulge is on the cusp of retirement. 1949 started 65 years ago. A slew of GI Bill graduates were married from the Summer of 48 — to produce new Americans less than one-year later.

So, for the next five years, there will be a retiree bulge to beat all.

It’s hard not to note that practically none of the big boys are putting their bets up in the snow belt.

===

You are entirely correct that lower middle class, bread and butter, homes will trade flat to declining in real terms. The hedge fund angle there is to short the mortgage/ part out the rental streams.

Borrowing, in size, at 1.2 % when the Fed is debasing the currency by 5% per annum… is a financier’s dream come true.

The risk is that the proles will no longer be able to pay the rents… which is to be expected when the economy is abused enough. (Cf Spain, Greece, et. al.)

I’d rather live in an RV in California than a palace in Arizona, Nevada, or (god forbid) Texas

shellz says “I’d rather live in an RV in California than a palace in Arizona, Nevada, or (god forbid) Texas?” Maybe shellz needs to venture outside the California borders? There are some really nice areas in Arizona (Sedona and Flagstaff), in Nevada (Lake Tahoe and parts of Reno and Las Vegas) and even Texas (parts of Austin and parts of Dallas). On the other hand, there are plenty of hell holes in California that most people wouldn’t want to live in. Take Los Angeles for example. Unless you can afford to live near one of the beach communities, most of Los Angeles is an ugly, smoggy, third world gang infested ghetto. No thanks!

In my area in Southern Cali, I know plenty of folks who got non-qual loans were for props in the ranges of $200K-$400k in areas that make no sense for investors to get at those prices. Without predatory lending and jobs scarce and income levels barely budging- and nowhere in relation to the rising prices of living, WHO’s gonna buy these props in 2014 for those prices?

In my area, nothing has changed. Thousands of people still line up for 100 jobs.

So who’s going to buy these props now with tighter lending and rising rates?

I live near Palm Springs where prices have risen, on average, 23% since last year alone (in my city).

Enact rent control and also increase property taxes on property held for investment as opposed to primary residence. Enact an additional tax on property bought with foreign money. This would raise revenue for local muni people as well as help stabilize the market. In fact, the tax breaks should be solely for primary residences and nothing else. This might help stabilize the housing market and allow it to correct to normal.

Rent controls don’t work. Rent controls create shortages and decrease the quality of housing. Rent controls reduce the incentives to build new rentals. Renters in rent-controlled units are less likely to move – there are always long waiting lists at rent controlled places. Demand outpaces supply because new rental units are not added. Landlords can’t raise prices, so they begin to create strange standards for renters and stop responding to renter’s complaints.

No to rent controls!

just fyi Sonar, I’ve been to all fifty states and 19 foreign countries, I stand on my statement re AZ, NV, and TX. Only state that could tempt me out of living in California is Washington, and then only half the year.

All that government intervention ever accomplishes is market distortion. Be careful for what you wish.

Berkeley and New York City have worked a variation of your scheme for decades.

It has worked out brilliantly — for the wealthy.

The average Joe has had to leave town. That’s why NY is loaded with millionaires and welfare dependants: the ‘middle’ is gone. (To the ‘burbs… hence the absurd commutes.)

I own several rental properties in several very nice solid white middle class areas in Texas. A couple I’ve owned since the mid 90’s. Property values have dropped to what they were 15 years ago and, while stabilized in the last year or so, are showing no signs of coming back. Still 40% below 2006/2007 peaks.

On the other hand, I have a number of close friends and family who own homes in top 1% areas and have seen their property values positively soar in the last 3 years. A good friend of mine in particular has flipped 3 homes in the $2-3 million range in the Dallas area and has made between $300K to $500K each time with the holding period only 4-6 months. Dallas is a great example. The very best area, Highland Park, has seen 50% appreciation since the bottom in 2009/2010, and thye middle class areas are still dropping.

Residential real estate is a microcosm of what we are seeing all around us in the economy: anything to do with the middle class is dropping in value, including businesses that serve the middle class (JC Penny, Olive Garden, etc.). And anything serving the top 1% is doing like gangbusters (Tiffany’s, Aspen real estate, 1970 Chyrsler Barracuda’s, Picasso’s).

Inflation for anything the top 1% wants or has and deflation for everybody else.

Very good observations.

This is true.

I think the problem with this expansion in wealth for the 1% that pisses people off is this: our definition of what is a 1% area has expanded. I agree that a house in San Francisco could only be for the rich, but a house in fucking Oakland should not. Beach front Santa Monica housing – yes, again, only for the rich. But a normal West LA house on a busy street with no ocean breeze? That’s also only marginally less expensive than a house in Pacific Palisades?

A point that is often missed is that at least for several years, transactional volume in housing will be low due to:

A) Underwater owners. They will be neither buyers nor sellers.

B) The group of people who got an “awesome” deal on their mortgage rates. They will not want to move as the new home will have a higher mortgage. Again they will neither be buyers or sellers.

C) The dropping home ownership rate. More renters will mean less people who are buyers or sellers.

You will have to look at the months needed to sell current inventory more than you can look at absolute numbers for sale.

I am a housing bear, but three issues concern me:

A) There truly is pent up demand in household formation. Some, though many, of these new households will actually be able to afford buying a home (most will be renters).

B) Builders are underbuilding SFH because, in their hearts, they too know they are in a bear market.

C) Mel Watt is an idiot and in the pockets of banks. This dirt bag is the FHFA head as of now. I guarantee he will loosen lending standards to help out his banker buddies at tax payer expense.

Please email Mr. Watt and tell him what a POS he is. It only takes a few dozen emails on one topic for a politician to take note.

Have a great new year everyone.

Good points AK.

Re: b) Sellers don’t want to trade in their low mortgage rate for a high one….

I agree, but I believe the sellers mentality may shift, if/when their home goes up in value. There will be a point at which locking in a capital gain, will trump wanting to retain the low mortgage rate. I do not know what that math-a-magical number is, it may be different for each person…after all, “everyone has a price.” If we get another 1-2 years of 20%+ price appreciation, those sellers will move off the fence, regardless of how low their mortgage is.

Me personally, i will not trade my 2% mortgage for a measly 5 figure cap gain. But if the cap gain goes to low-mid 6 figures, maybe i will cash out the equity (tax-free), and rent until another buying opportunity presents itself.

I wish I could short real estate brokerage houses.

Even gently rising (nominal) interest rates will be more than enough to paralyse house swapping.

Unlike the Great Depression, modern mortgage term ALWAYS call for the extinguishment of the note upon sale. So there’s no dancing around the issue with ‘creative financing.’

The harsher terms that any new mortgage must entail will drive the sales price down.

For highly leveraged home owers — they’re destined to be as trapped as was seen four-years ago.

The capital losses incurred by the selling party won’t make it to his 1040.

It was an epic error for the Feds to spew out 30 mortgage paper.

During this era, all mortgages should have been pulled back: 15 years amortization… maybe 20.

As for ARMs — they’re a complete disaster. They only ‘work’ if the Feds accelerate hyperinflation — and the ower doesn’t get stomped on by the resultant economic chaos. (ie… hangs on to his job)

Back, in the early 90s, when I was just out of college, I started collecting older and small but well located home in LA and OC beach cities. At that time, all the arguments were the same as now. Prices are too high and unaffordable. But, I started collecting homes with subprime mortgages. So, here we are, nearly 20 years later, and I am still buying. And, I am still hearing the same arguments. Frankly, betting against the southern California beach cities is like betting against inflation. The FED will make sure inflation never drops, so any drop in SoCal beach city real estate should be bought. As for myself, I am quite wealthy, but I am not any happier. So, if you make big money on your real estate, you might find life is no better.

“I am quite wealthy, but I am not any happier. So, if you make big money on your real estate, you might find life is no better.”

I suggest you give some of your money to those less fortunate, that way they can be happy, and maybe you can be happy to help others. A win-win.

Yeah. Fine. Beach Cities. Go nuts.

I don’t want to live on the beach, I want to live in a normal area that’s quiet. Why does that have to cost just barely less than living on the beach?

Someone explain to me how QE 3 is hyperinflation if it is true that it simply an asset swap program as described in the following article.

http://www.forbes.com/sites/louiswoodhill/2013/10/02/we-dont-need-tapering-we-need-full-termination-of-qe3/

I am not convinced that this program has done anything significant to the money supply or the economy as a whole. I believe it has forced investors out of the bond market into the stock market and real estate market because of the negative returns. The overall GDP and/or money supply has not really increased. The banks are not lending based on the new reserves. Hyperinflation is defined by 50% or greater inflation for at least one year. I have not seen that…

I fulsomely reject the the definition of hyperinflation as being price increases of 50% per annum on up.

To make such a statement is to conflate inflation mechanisms with hyperinflation mechanisms.

That I’ve lost you, and many another, on this point is patent.

===

Woodhill is completely unable to comprehend that many of the players CAN’T accept bank deposits — no matter what the rate spread — for sovereign and legal reasons. These just happen to be the biggest players in that market. Duh.

You can toss his analysis into the circular file.

ANYONE who conflates INFLATION and HYPERINFLATION is lost, truly lost.

They are as alike as an elephant and an elephant seal.

Woodhill is also totally wrong about the ramp in the money supply. The money created by Federal debt circulates through the economy just like the money created by commercial debt transactions… with the restriction that it jets into being via a spigot — not a rain.

It’s this hyperinflationary expansion of the money supply that’s powering the stock market, the real estate market, and the collectibles markets. Duh.

Without the Fedsury, these markets would be in a tailspin. For commercial lending/ real estate lending is flat.

One area that shows the direct impact of Fedsury debt issuance: student loans. The Fedsury is the bank of first and last resort for academic loans. Look what’s happening in the ‘sheep skin cartel.’ Prices are — for the top tier — still strong — if not running away.

As you’d expect, the proles are being deflated. At this end of the scale, it’s now obvious that the associated debt can’t be paid off in a prole’s lifetime.

====

The abject refusal to believe that the Fedsury is creating money when it creates debt — while accepting that just such is so for commercial enterprises — such is MMT.

As for money velocity: it’s a totally useless metric that’s BACKED INTO. As a dependent function, it has no predictive power. It’s spouted off more as an excuse — closure for equations of a mythic monetary scheme.

====

The real reason that the Fed needs to taper is that it’s printing too much liquidity.

That liquidity is being used to purchase ASSETS because those with the liquidity have already met their own consumptive needs. This is particularly true for sovereign wealth funds and central banks.

Get it?

It’s this SPIGOT effect that is concentrating astounding price moves AWAY from wages… near and far.

=====

The American rebellion was triggered by a severe cash drought subsequent to the end of the Seven Years War/ French and Indian War.

The Crown had financed Frederick the Great by issuing gilts in record quantity during the conflict. During this period, the Colonies exported raw materials/ commodities at full prices to Britain. America was flush — particularly the American South. (Cotton, tobacco)

After the war ended, the Crown was in a fantastic position to expand its mercantilist trading bloc — and to pay off the war bonds/ gilts with consumption taxes — at the wharf — aka import tariffs.

This promptly caused many treasured imports to explode in landed cost. (Dutch spices…) The Yankees promptly built out a commercial sailing fleet and ducked these tariffs by dealing direct. The Crown was in no position to go after its long time ally, Holland; so the King levied specific taxes upon the Colonies to raise revenue without collecting it at the wharf.

Back in England, the taxes collected were recycled as gilt pay downs — right back into the island economy. There was no liquidity crisis — though times were still pretty hard. This surge in investment capital/ liquidity at the top of English society was no small factor in launching the Industrial Revolution — in style.

In the Colonies, no-one had ever purchased gilts in the first place. Tax revenues raised to pay them off meant that cash left the New World for the Old. In VERY short order, NO-ONE could find a penny to pay even trivial taxes: America was THAT short of specie. The Colonies had no mines to speak of: her commodities boom was a bust. Cotton and all the rest had crashed in price. Even beaver pelts fell in value. Critical items only available from England ramped in price: shot and powder.

This was a pre-peat of the 21st Century. Those at the top weren’t hurting. The average Joe was getting absolutely hammered. It was impossible to do anything legally, since the associated taxes to the Crown were impossible to be had. Rabbits, chickens and bags of grain were NOT acceptable payments.

B. Franklin sailed to London to renegotiate the terms of trade with England. He left as the Colonies’ foremost ‘King’s man.’

He sailed back a Revolutionary — and sponsored Thomas Paine to travel with him!

===

The blindness of our maladministrators is epic.

We’re headed towards upheaval.

0-care has been so maladroit that the fracture is in sight.

====

The Revolution was so unforeseen that it had to be launched by a ‘King’s man.’ For that’s exactly what Franklin did when he brought Paine to America. Paine spelled it out.

TL;DR

Here in lies the problem blert. There is never a meeting of the minds if we can’t agree on the definition of words.

http://www.econlib.org/library/Enc/Hyperinflation.html

Hyper comes from the Greek word huper which means over or beyond.

And guess what! Inflation means inflation!

So put the two together and what do you get? Over inflation! Weird how the English language works.

Once again my friend you do not answer the question. The act of QE is not creating money. The act of creating the treasuries is creating money. Kinda how the act of securitizing mortgages into MBS/CDO’s does not create money rather the act of the initial loan creates money. Now if you where to argue that the outcome of QE is that the money supply grows then that is the point of the article above. The point is that corporations have become their own banks and have huge cash reserves. Individual households are already pretty maxed out their debt. The government is the only one growing debt compared to GDP at this point. So I am not really clear how changing the reserves at the banks is growing the money supply if the banks are not lending on the reserves. They may be speculating with the reserves hence the stock market rally etc. but I do not see proof that you are correct and this article is incorrect.

I really do not see any value in the rest of your rambling response…

I’m not sure what the plan is for those that ultimately end up with the inventory. Rent the properties out? The youth of America and many families can’t even afford to rent and are living with a ton of roommates and adding sheets as walls to create extra bedrooms.

blert is right about hyperinflation. It is the loss of faith in the currency, which we are fast hurdling toward, not a percentage price increase. On a side note, we will see how well coastal CA real estate holds up when the radiation from Fukushima which is taking out large swaths of Pacific Ocean as we speak, washes up on the coast within a few years.

Em…no…Blert is not right about hyperinflation. It may happen some day, but a lot of bad things may happen some day. Look, I am no fan of the Fed, but right now they are able to print gobs of money and stay at near zero inflation, because our economy is so weak, and because hundreds of billions of dollars are being destroyed due to so many loans in default (RE, consumer, autos, student, c.c., etc.)

I don’t know where you shop, but everywhere i spend money, business owners still accept the US dollar in exchange for goods and services. Right now, the US is still reserve currency, and that doesn’t appear to be changing anytime soon.

The incompetence of NEPCO is epic — and unending.

If NEPCO ruins the Pacific Ocean — where is one to hide?

On their record, NEPCO has ‘managed’ their atomic plants with all of the savvy of the IJA at Guadalcanal.

I still believe in atomic power plants; I don’t trust them when they’re sited, built, owned and operated by idiots.

I must say I was shocked to see that Tokyo had permitted ANY atomic plant to be located on Honshu’s east coast — particularly its northeast coast.

Tsunami residium lies 200 meters up the mountainside along that coast!

How could anyone build there without considering wave physics and the history of the place?

It’s also becoming very apparent that the local soils don’t permit most remediation schemes; everything is fissured. (!)

I guess that’s how the mountainside got put there.

Japan’s resultant crude oil thirst is impacting global politics: Iran.

Her NEPCO crisis has swallowed up all of the net output of the fracking revolution.

Amazing.

NEPCO? You mean TEPCO?

Hey u scum bag flippers out there, I hope the market does crash again and u drown.

Making money off the middle class that is currently being pancakes by the top %.

Go save ur pennies and flip homes that are vacation homes for the rent.

Why people make money off shelter, food, and education is freakin’ beyond me.

Stupid. I hate you flippers.

A LOT of flippers ARE middle class, or even lower middle class.

They’re basically rubes who’ve paid a lot of money to attend flipper seminars at the local Ramada Inn, and now think that they’ll become the next Donald Trump. They borrow “Other People’s Money” from banks, and crash and burn when prices tank.

Because it was easy for people of little means to qualify for mortgages, it was easy for them to play the casino by flipping homes.