The euphoria in housing: 82 percent of agents now believe is a good time to sell. The continuing lack of inventory in the real estate market: Is record low inventory simply a part of the new housing market?

The spring season is now in full bloom and the real estate market continues to have a wickedly low amount of inventory for sale. According to the California Association of Realtors, annual home sales are now down about 6 percent while the median home price is up 24 percent. Inventory is still at or near a record low. What is interesting is that the number of real estate agents saying now is a good time to buy has decline while the number of agents saying now is a good time to sell, has spiked dramatically. While prices have soared in the last year sales have not. As we just mentioned, the annual sales rate for California actually fell year-over-year. Buying power brought on by low interest rates has caused two major shifts in the market; a big bounce in purchasing power in spite of stagnant income growth and a low interest rate environment causing big money to choose real estate as the investment vehicle of choice. Is this record low inventory simply a part of the new housing market?

Housing inventory

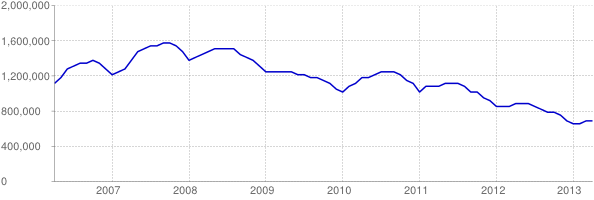

While on a monthly basis national housing inventory is up by 3 percent, it is still down by 20 percent over the last year:

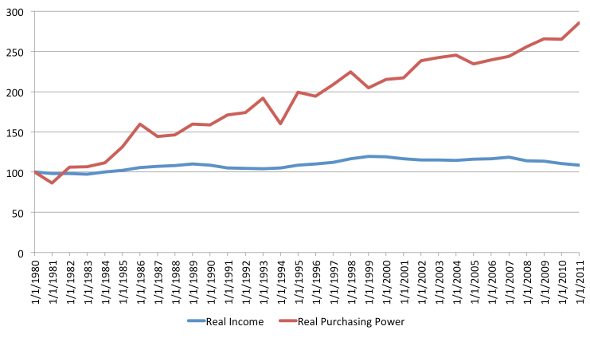

Inventory is down nearly 60 percent from the peak in 2007. Without a doubt, the Fed and government have decided to focus on increasing buying power seeing this as an easier choice than trying to increase household incomes. This isn’t a new trend. The decline in interest rates has occurred since the 1980s and has accelerated in the 2000s. The recent push has turned out to be more aggressive with the Fed openly buying MBS through QE3 operations:

This renewed buying power has put a bottom on prices for the nation. Yet in many markets especially in places like California, this added leverage has caused big money and foreign money to flood into niche markets crowding out local buyers.

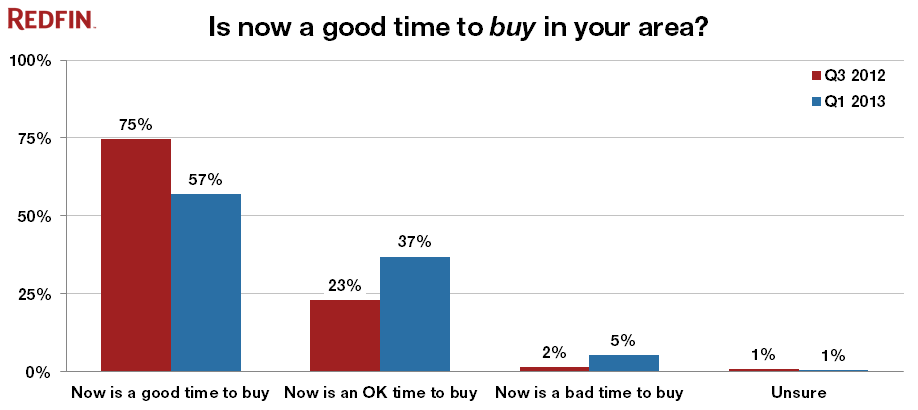

What is interesting is that many agents are now seeing this as a good time to sell and not necessarily a fantastic time to buy:

The number of agents thinking now is “a good time to buy†dropped from 75 to 57 percent from Q3 2012 to Q1 2013. Some are even saying it is a bad time to buy (up from 2 to 5 percent). Coming from real estate agents, that is a big deal. Of course, on the other side of the coin, those saying now is a good time to sell has jumped up:

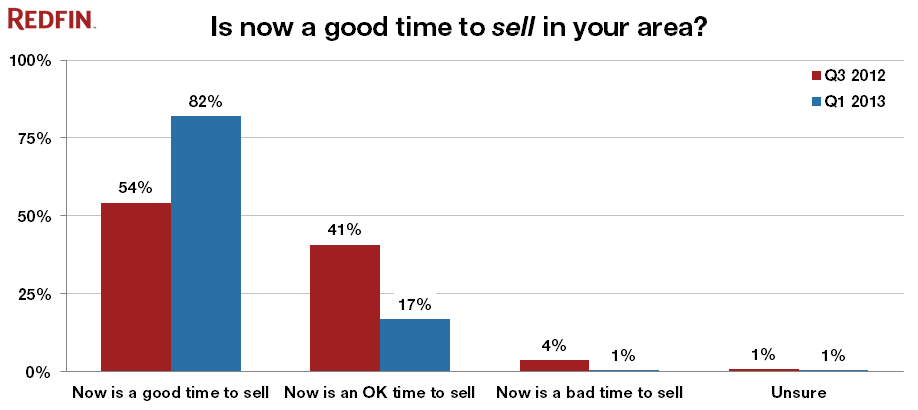

The number of agents saying now is a good time to sell went from 54 to 82 percent from Q3 2012 to Q1 2013. That is a near unison agreement that now is a good time to sell. Whenever an entire group believes something is a certainty, you have to watch out. Even when you look at historical stock market peaks, you see similar emotional trends.

Of course, if you believe that now is a good time to sell and agents are telling this to clients, then you would expect some bounce in inventory which we really haven’t seen. Also, if some are saying now is not a good time to buy, you would expect that the prospective buyer side of the equation would shrink somewhat. Yet with one third of purchases coming from big money, the agent is more of an afterthought. They are buying based on their own internal models versus your average buyer that probably is more swayed by those in the industry.

The decline in inventory is still very much a story. What I found interesting in the recent survey is that the idea that prices were going to go up in the next year has jumped:

44 percent of agents now believe prices will “rise a lot†over the next 12 months. This figure went from 11 to 44 percent from Q3 2012 to Q1 of 2013. That is a massive jump. Yet if inventory rises (time to sell) and demand falls (not good time to buy) you would expect prices to remain stagnant or even fall a bit. When we look at sales volume, we are already seeing somewhat of a bottleneck. We’ve discussed that some big investors are losing their appetite for housing given declining yields and we should find out shortly the impacts on the market with such a high demand of investor buying. The fact that we are seeing wild optimism coupled with declining sales and prices reaching bottlenecks, it will be an interesting few years ahead. Are you seeing any of this agent euphoria in the current market?            Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

93 Responses to “The euphoria in housing: 82 percent of agents now believe is a good time to sell. The continuing lack of inventory in the real estate market: Is record low inventory simply a part of the new housing market?”

My realtor admitted artifically low interest rates and Wall St. investment.

But she also clearly stated she just does a job. People want to sell? She sells. People want to buy? She helps buy. Kinda like a pawn or a puppet in the game. I guess that goes to show they are just glorified used car salesmen.

Even though she’s speaking honestly and logically, what worth does it have coming from a realtor? They’re no experts in their industry by any means. That’s like saying the cashier’s at Walmart are on the inside tip of corporate strategy.

forgive the un-necessary apostrophe. In before the grammar nazis.

Unfortunately, realtors have lost all credibility. Not once in the last 10 years have a heard a realtor (or the NAR for that matter) advise waiting to buy.

Folks need to spend time researching the numbers and facts and look at the general economy and their own situation. Is their job solid? Solid enough to lock in several hundred thousand dollar loan for 30 years? Will they be transferred in a few yeas? Is buying really cheaper?…and so on…do your research!

I’m sorry, how is that different from any other business trying to sell any other product?

I usually agree with you but this is nonsense. Realtors have to spend thousands a year to even work at their profession. They have a higher level of ethics than lawyers have! I worked as a Realtor in 2011 and I was a non profit organization. It cost me more to work for my clients than I made. I am sick of people blaming the giant equity stripping ponzi scheme on the Realtors! It’s stupid. The game is rigged and the Realtors do not control it. I as a realtor I had a website called the economic survival guide that detailed the whole securities fraud. I would explain all of the financial scheme to my clients. I told them how the game was rigged. It’s all about the banks reselling your signature on a security instrument period. So all this BS blaming Realtors is just ignorance. I quit the business because of the market manipulation. I couldn’t sell something I no longer believed in. If people understood what happened and is continuing to happen there would be and should be rioting in the streets. It’s the biggest crime of the millennium.

@LynnChase : Cute, very cute. Hahah

Don’t take it personally. For every one of you, there are 10 that could care less about ethics, and 100 that, in spite of their understanding of the game, will work towards a sale because it helps feed their families. Are realtors in general corrupt? Maybe not so, but they facilitate the transaction, and if they all understood what was going on and did it anyways, then they have fed the machine.

You should have spent some of that money on learning correct English and grammar.

I think admitting the market is rigged is about all realtors can do, and then leave it up to the buyers. Even people on this board do not tell the full truth; and the full truth is that this country is going to crash and burn. Well, if realtors said that, people wouldn’t believe them anyway… And until it does crash and burn, some people want to have a house.

Some people on this board may have it in their heads that prices are going to “correct” but they don’t seem to realize the “correction” may be more like everything totally crashing — electricity, gas, heat and water becoming unavailable, that kind of crashing — rather than us going back to the 70’s. So if you are assuming realtors should tell people to hold out for some sweet deal down the line, that is just as, if not more irresponsible than not saying anything at all. We are more likely go right from this artificial economy to a complete crash, as that is really the only way, short of some vast war, for the economy to “correct” at this point. Little cute corrections are not going to do it at this point.

“They have a higher level of ethics than lawyers have!”

And lawyers are so well known for their ethics!

Obviously, they’re either unethical or illogical. A majority of realtors in the survey think now is a good time to sell. A majority also think prices are going up. A very strong majority think it is at least an OK time to buy or sell. and I suspect that is always the case. I do think that most realtors are “sold themselves” like most good salespeople, but that doesn’t make them experts.

I would say realtors acted as catalysts in the bubble; a catalyst, as in something that causes a chemical reaction to occur faster, hotter, or more efficiently than it otherwise would without its presence.

Little suggestions like, “We have five other offers, you should probably adjust your offer up $10k”, when it was known behind closed doors that the other offers were from folks that really couldn’t afford the place. Or, “Are you really prepared to lose this place for just $5k? $5k is nothing – just a few extra dollars per month”.

My realtor, before I had even met with her, decided she would show me places that i could barely afford with a 5 year, interest only ARM loan. There was no prior discussion regarding what type of loan I was interested in. There was no, ‘I’ll show you what you can comfortably get with a traditional 30 year loan, or if you want to spend a little less or buy a little more home in hopes of larger appreciation, you could consider a 5-1 ARM. Do you intend to stay in your place long?’

It was more 1) I get off the plane to go home viewing; 2) Realtor shows me crap I think I can’t afford; 3) I ask her to show me cheaper junk; 4) She strategically picks a cheaper place in gang territory; 5) She continues her mantra ‘You’re not going to stay in your place forever right?’ in hopes that she can sell me on the 5-1 ARM. She tells me she has a ARM loan for her place to make me feel more comfortable with the idea. I asked her what will happen when it converts? She said she would ‘pray’. 6) She only wants to show me things that are ‘close to everything’, i.e. in bubblicious places like Studio City, Sherman Oaks, etc.; I have no clue where ‘anything’ is, I just got off the plane.

We visited one set of condos where she knocks on the door and talks with a woman that she recently sold the place to. The woman said that they were doing good, and loved their place, but that they didn’t have much money left over at the end of the month, however it was still better than living in the ghetto they were in previously. They were in the process of remodeling the kitchen.

In my town of 70K people the inventory has been around 20 houses for the past 3 months. I looked at Redfin this morning and there are 44 homes listed for sale. 75% of them are listed between $500K and $800K.

Of course it is spring now, but that’s still about double compared to the last 3 months.

Oh, why are Realtors saying it’s a good time to sell?? Because they have no inventory to meet the demand they’re seeing. They get paid a commission. So they are far more interested in volume of transactions than whether or not someone gets $30k or $50K more for a house because there are not many for sale. Simple math.

Just like any profession selling something. Duh.

NO, you missed the point. There are lots of sales jobs that don’t have nearly the set inventory that real estate does. Software, cars, etc…all want no one to resell while they are producing new products. But houses have so few units produced, especially in nice areas, that without sellers, there’s no inventory.

This is why I don’t understand realtor sentiment.

Why is this a good time to sell? For whom? For flippers? For people who are looking for housing long-term and want to upgrade? For investors?

I had one realtor tell me that he sold his condo because he believes “we’re in a bubble.” Yet he upgraded to a bigger place. Which would be similarly inflated, if I’m not mistaken.

Am I missing something?

it only makes sense (obviously) if the numbers were much lower than what’s going on in the market. if anything, it’s more likely a better move to sell n rent til the bubble pops and market trends down to bigger bang for buck numbers. but ya, without details of the transaction and assuming the house purchased was average in trend, that’s a not so savvy move!

Realtor sentiment shouldn’t be taken for more than anything than an indicator of what realtors are concerned about. They can only make a sale when buyers and sellers meet. So when buyers are scarce, I expect realtor sentiment to be encouraging of buyers. And when sellers are scarce, I expect it to be more encouraging of buyers.

When you get a sales commission, its always a good time to sell. When you get a buy commission, its always a good time to buy. For whom you ask is it a good time?

For the obvious.

Now is a good time to sell if you leave the state and go to Rick Perry land. Don’t waste your time selling if you plan to stay in CA. The inventory on the market is unusually low quality and overpriced. Better stay put until we get a more normal market. Regarding the last article on Irvine, just wait until that fat boy in N. Korea makes the wrong decision, and then we will get plenty of S. Korean investors. Soul, the capital of S. Korea is ridiculously close to the crazy man in the north. California has a few more years before fat boy’s missiles can hit Irvine. May be it is time to move to Texas.

Austin’s on his hit list!

Why are you always trying to get people to move to Texas?

It was released today that Fat boy has ballistic missiles(with miniaturized nukes) that can hit Irvine, but as of now, they are not very accurate. Soon they will be. If you like living in Irvine with the fear of Fat boy, by all means stay. We saw the bottom of the housing market in Irvine. We will never see such low prices with such cheap financing again. If you can’t afford a house there now, you never will. If you really want a house now, go to Texas.

Cowboy Bob,

Can you please stop telling people to move to Texas, prices in Texas will rise rapidly and there will be no where left to go! I have my eye on Texas and what it offers – but it does not offer the CALI lifestyle – the best lifestyle in the world. From a middle class perspective, the affordability in Texas can not be beat. However, if Californians keep moving in prices will escalate – see Austin. Sometimes its best to keep the goodies to yourself! TY.

If you don’t have a lot of money(oil wells in Texas), the California lifestyle is just a dream. For most people this is the truth. Only move up people can afford the good areas. First time home buyers are priced out of the good areas. From a come to Jesus moment( face reality), if you don’t have the money(big equity in current home, top 5-10% of income), then Texas is the place if some one insists on OWNING a house(not all houses become real homes). Personally, I think that renting is quite respectable for many young people, and don’t forget to drive the leased BMW.

Not to mention the fact that Texas has extremely high property taxes.

What I love is that obviously at least 30% of realtors think that now is a good time to BUY AND SELL. Go figure… It’s always a good time to pocket 6% 🙂

but an assertion does not imply the opposite is true either…

Exactly. It’s their job.

Yup. I sold my condo in 2010 out of fear that I would lose a lot of the equity that I had built up in it and since then I’ve rented. When I first approached the real estate agent through whom I listed the condo he was all full of bluster, “great time to be buying” blah blah blah. This is a guy who is sort of an acquaintance as he’s worked for a few of my company’s clients, too. An acquaintance but not a friend. When I told him, Michael, I’m not buying. I’m very pessimistic about the economy. I want to save my equity and I’m going to rent. It was like I’d given him an injection of truth serum. “Oh, okay. It’s a terrible market out there. Prices are still too high. Nothing’s moving. People still think they’re going to sell at the early 2006 price but it ain’t gonna happen.” As soon as the real estate agent’s financial interest wasn’t on the line, the truth came out and it didn’t much resemble the get me my commission story.

It’s not very complicated. Take away if you think the market is going up or down in the future.

It’s a good time to buy when supply outstrips demand. (see 2010-2011) Not too long ago the mantra was “If you’re not embarrassed by your offer, it’s too high” A good strategy at that time would be to wait 30-45 days for a price reduction before submitting a low bid.

It’s a good time to sell when demand outstrips supply. Sellers often can choose from multiple offers. They can choose offers that drop contingencies and will close quickly.

If you’re a realtor, you’re trying to convince people to sell because you’ll probably close a deal within a month as a listing agent. On the flip side, you’re probably wasting a lot of time as a buyer’s agent writing offers and getting outbid.

Yes! Realtors are not the ones controlling the market, they are simply trying to make a living with the cards they are dealt. They do not force anyone to sell or buy. People refuse to take onus for themselves and blame the low man on the totem pole. Like Realtors caused the housing collapse! LOL

@ Lynn I agree, there is little blame to place on the realtors. I recently purchased a home and there were 2 agents – the listing agent and (my) buyers agent and they worked their arses off to keep the deal together. Not because of unwilling buyer or seller, but because of appraisal problems, sewer line repair, a non-communicative escrow company, etc. The broker who represented me never said ‘buy now’ he never rallied me to believe anything other than ‘there is not much inventory out there’, he never said ‘prices will go up’…. etc. Every house we looked at he could just about tell what the house would sell for within $5K. Actually he restored my faith that there are good brokers out there.

Then we hop across the country to North Carolina, where the realtors’ lobby is/was trying to get the state to dismiss geophysics, oceanography, etc. in hopes that coastal property will not go out of fashion until that very last moment when small surges start to regularly flood the folks with front row seats to climate change.

Those realtors are playing the very dangerous game of making political friends with climate denialists, who are selling our country’s future energy security, social security, environmental security, etc. (senior military officials have stated climate change to be the #1 long term threat to national security) for a quick buck on tar sands, fracking junk, coal, etc. (and now coastal real estate commissions).

The market down in North County San Diego Coastal is on fire! Prices in my development are up 10-15% in last 6-9 months based on recent sales. I think some realtors have good insight on the market, the down payments people are putting down, the number of offers on properties, the amount of cash offers, etc. Why are people so negative all the time? I’m not a realtor but to imply that their opinion is worthless is silly. Yes, they are in the commission business, but they do have some observations and insights that can prove to be useful when navigating the marketplace. One just has to learn to filter the information.

You’re right, they do have insights and contacts. It’s all worth about 1%, not 6%. Their lobbyists and MLS monopoly helps to keep them at their current price point. Fortunately the liberalization of information distribution (the Internet) is slowly but surely eating away at their game.

I’ve bought and sold many houses over the last 20 years and I’ve never paid a listing realtor more than 2%. Commission rates are completely negotiable, by law.

Getting a listing is a slam-dunk for an easy commission. I’ve seen and heard many realtors do things that were very questionable. But that’s human nature. They only get paid on what closes. So beware, that’s huge motivation to make sure the deal gets done.

Another ignorant statement. Realtors make what the market will bare. They do not have a set fee of 6% but you obviously think that it is is set in stone by the NAR. lol Nope! As I stated above, I lost money working for clients as my costs outweighed the fees. So, go hire a lawyer, or do it yourself if you think the fee is so high! Realtors make a few thousand dollars every 2 months or so and it takes years to build up to making over 50k a year if you are very successful. People do some research! This was all manipulated and banks made a killing on the crisis. It was an equity stripping ponzi scheme! Still is! Money is created by debt! Learn what is going on and stop the misdirection blaming the lowest people on the totem pole.

Cut the crap, Lynn Chase. It’s not about what the market will bear when there is a listing monopoly and a lobby working hard to keep the scheme in place.

More folks are doing it on their own or through non-traditional sales channels as time goes on. Tell us something we don’t already know.

No one is disputing that most of the blame lay at the feet of the financial system. At the same time, the realtor crowd gets some of it too – no matter how many exclamation points you put on a sentence.

@King…

1) Yes, realtors can have SOME valuable insights.

2) However, very few had a clue about the bubble building in the 2000’s. I use as confirmation of this how many traded up their own home in that time frame. Or, if they did suspect, they would NOT have shared that info with you as a potential buyer.

3) Because, as CAE indicates above, their primary interest, from every angle of the deal, is their own wallet. Period.

4) I will state that — if you think your agent dealt with you completely honestly — fair and square — that just means that you don’t know how you got the short end of the stick.

Good luck. Oh and, you all might like to see this:

http://www.zerohedge.com/news/2013-04-10/housing-recovery-shifts-contraction

If you buy now, it is almost certain that you will be the owner when interest rates rise. Housing prices drop when interest rates rise. Your house will be worth less than you paid. Hope you do not have a problem with that.

Not if the equity markets crash in the next 6 to 19 months. If that’s the case, look for a Gov buyout of 401k losses in the form of 10 to 30 year T-bills locked in at less than 3%, with no redemption until you reach retirement age. They will also take the oppurtunity to roll the national debt over to sub 3% T-bills, thus kiss rising interest rates goodbuy and hello Japan-esque America.

I’d like to get one of those crystal balls a lot of people here seem to own. I’m not that worried about losing money on my next house since I plan to keep it for the next 10+ years. I don’t expect to MAKE money – its a place to live for my family. I bought a townhouse in San Ramon, CA in 1992 and tripled my money when I sold in 1999. I then bought a house in Carlsbad in 1999 and I’m up about 120% as of now based on recent comps. Yes, I’ know I’m not factoring in inflation. I’ve had good fortune but to say my next house will DEFINITELY be worth less 10 years from now is pure speculation and silly to be expressed with such certainty. I wish the dialogue was more mature.

The Housing Market in niche CA (Santa Monica, Palisades etc.) may do (a) the riverbed (bouncing along with ups/downs) as well as (b) It may also trend slowly upwards, where over 20 year spans, the nominal value trends up about 3% a year, or it might actually do what this blog has been predicting for several YEARS now, (c) collapse back in a spectacular bust to historical norms of 3-4x income for median prices. But keep in mind, we are not talking about a median neighborhood.

– Several observations: What happens in Cali overall, Los Angeles in general, and Santa Monica (or another niche) in particular are not at all connected, really. The demand for (certain) US housing has gone global, we seem to agree. But demand *in general* eventually needs to buy houses *in particular*. There is an endless ocean of people who would like to move from Palmdale or IE or China/India/Timbuktu to Santa Monica if only they could. Thus, the standard ‘macro’ thinking does not predict prices well at all in these communities. Local income stagnant? Taxes high in CA? Who cares. There is always money somewhere that wants to live the dream or retire in coastal So-cal. Even earthquakes only attenuate this effect transiently. Bottom line, factors that should drive down prices don’t have as much impact as predicted, and factors that drive up prices are magnified in the niche.

With inflation and time and limited supply of housing, Rent in the niche will surely trend upwards over time, perhaps dramatically so, in nominal value, when inflation eventually kicks in.

Accordingly, Interest rates will also likely be higher eventually than these artificial lows.

So while this will certainly make it more expensive to rent money from the bank or a house from the landlord, it may not touch the *demand* base as much as one might wish, and I doubt that prices in Santa Monica will *collapse* in the face of rising rates. It may just take a little longer to sell, or be a little easier to go house-hunting.

Meanwhile, seems to me that as soon as supply comes up a little bit in the niche, the demand is there waiting. Endless, unstoppable, global demand. I do hope that inventory will increase, but I don’t expect it to drop prices much.

So is now a good time to sell? Now is an *Easy* time to sell a house.

Is now good time to buy a house in the niche?

If the premise is a long-term hold (not trying to time a short-term peak/trough) and rates are incredibly low, then yes, it is. But it is a *Hard* time to buy. Crazy low inventory, crowds of money and herds of people.

Where is the inventory?

I know that listings are down overall YOY in L.A. but they fell off a cliff when you look at 3-4B SFR in Santa Monica (up to $1.25M, there are only 4 real listings) How about condos? I kid you not, there is exactly 1 active listing. (many more are Pending) Shadow inventory? Never seen it! Those flips for sale, well I certainly never saw one pre-flip at an open house that I could bid on. Only afterwards, when the insider/bank deal is done.

The game is rigged against the individual buyer. Barring social upheaval, the banks and government are effectively teammates (fascism-lite?) They are not going to lose the hand they are playing, and they change the rules as they go to ensure that outcome. (Imagine in a hand of poker if you could keep drawing cards until you finally have the 5 cards you need. And then, if you still manage to lose, not only do you get to keep playing until you win without actually registering the loss, but the House will pay for your losses, by forcing your opponents to cover them.)

So I don’t view buying a home as an investment I will profit from, winning the game. Instead, I want to minimize my long-term housing expense, while maximizing enjoyment derived from the expense. I have long-term income stability and money is cheap still. Renting a home in the niche is nuts. To blow that kind of cash on rent– ever-rising, down-the-drain rent– is unthinkable to me. Same nut, but on a mortgage, is money that is mostly back into my own pocket as the mortgage amortizes.

If I hope for supply to outpace demand, for rising rates to hopefully take the edge of prices… well, not only will that perhaps never occur, but the rates rising will probably impact my total out of pocket over the life of the loan more than the modestly lower purchase price. Only in the scenario of major upheaval, of a Dr. Housing bubble bust do prices drop enough that higher rates are welcomed by me, the non-cash buyer.

I’m prepared to pay out the ear up front, suffer tax-hikes to my “rich” income bracket, and probable loss of Prop 13, and likely lose my mortgage interest deduction, but I’d like to at least have a choice of houses to select from. Oh yeah, and I need to figure out if I want to really try and raise a family here in Los Angeles, rather San Diego or Colorado or Austin. Redfin makes me nauseous when i look out of state…

I do hope that inventory will increase, but I don’t expect it to drop prices much. Ditto for rates climbing.

Hi Dasher

This niche area you speak of,,, seems to me that it spans from Pacific Palisades, Brentwood, SM, Venice, WLA, Culver City.

and although the ekonomy is sluggish, there are thousands of small hitec companies migrating to the Westside.

http://latimesblogs.latimes.com/technology/2012/01/santa-monica-embraces-silicon-beach-dont-call-it-tech-coast.html

Thanks for the thorough analysis. The drop in inventory is across-the-board but most strikingly in lower tier price ranges. Investors have been “buying to rent,” i.e., positive cash flow, but are now turning towards “buying to hold,” i.e., capital gains. Positive cash flow is harder to find with prices up so much so fast. Banks are still requiring large down payments, especially for condos. Last year, condo buyers needed 30%. As the inventory dwindles, fewer condo complexes are in trouble and banks will become more willing to return to traditional down payments of no more than 20%. When that happens, we’ll have a “perfect storm” for real estate. The pool of potential buyers will expand tremendously, mortgage rates will remain low for at least a year, the last of the distressed properties will vanish and sellers will be in the driver’s seat.

A normal market is one in which the cost of ownership exceeds rental income, mortgage rates are 6% and 5 to 6 months are needed to sell. Until we get there, prices will continue to soar.

The time for real bargains ended last year. That is, properties that could easily be rented for more than the cost of ownership. Nonetheless, it’s still cheaper to buy than rent. There are still tremendous bargains for buyers looking for capital gains.

It is NOT cheaper to buy than rent just anywhere. Are you new?

The aforementioned “niche CA” is a perfect example of where it is cheaper to rent than buy.

where’s that convenient +1 rating for this comment?? spot on for almost all your observations EXCEPT for living outside of so cal! dry cold extremes of CO or lovely humidity of TX?? once so cal (even coastal), you’d have to enjoy living in a cave to even consider anywhere outside of beautiful/perfect weather SoCal… traffic? live closer to work or telecommute ;).. friendlier peeps? find a virtual community and make fb friends! 😉 if you’ve got the money n stayg power, SoCal is the place to be! just a fact (of my opinion)! haha

I, for one, can’t stand the warm weather here in the valley side of the Hollywood Hills. Now that my business has gone completely telecommuter, I’m thinking about moving to the midwest, where there are seasons and the houses are beautiful and inexpensive. Better schools, too.

Dasher, great post. These niche areas will likely never go down much in price. There is simply too much demand and not enough supply. The niche areas barely budged in price during the blowout back in 08-09. It would take a collapse far greater than that to get these areas much lower in price. There is too much entrenched money and an endless supply of “rich” people who want to move there. I am truly amazed at the amount of cash buyers out there, this tells you that the top 10% is doing much better than anybody thought.

The substitution effect is also playing a big part in this. The ultra high end (Malibu, Palisades, Beverly Hills, Newport Beach, etc) has proved a very limited market to get into. The next wrung of the ladder (Irvine, Torrance, Redondo, etc) is the next logical place for people wanting to buy, these areas have held up quite well also.

Buying is tought right now. But if you have excellent credit and a nice down payment (and a good local agent)…it is doable if the numbers make sense.

Although we’re a cash & close from Sept 2012, I like to keep abreast of the east Ventura County SFH market. In Simi Valley between $350k to $450K there were 9

4 bdrm homes on the market (Sunday- looked it up). And btw, I consider this new “entry point” price point serious money. Since when is $450K the higher priced “starter home”?

We paid $400K in 1998 for a 4,000 sq ft new construction view home. We sold our starter home for $239K in 1998 in a great neighborhood, beautiful 2,000 sq ft charmer.

Inventory is exceptionally low. This is going to be a long journey for all you buyers out there. My heart is heavy for you.

1998 was a good job market and salary time frame in So Ca. You’ve got to admit, the sob’s inventory plan worked!

while 450k is not exactly 239k in today’s market, it’s close enough for a starter home. since when?? since we are living in 2013 and w given low rates, a starter home near 450k today is allllmost entry..ok..maybe 350k-400k is more like it.

>>

What cost $350000 in 1998 would cost $489391.29 in 2012.

Also, if you were to buy exactly the same products in 2012 and 1998,

they would cost you $350000 and $251542.80 respectively.

<<

source:

http://www.westegg.com/inflation/

when you consider 3-4% mort… it fits ur range for starter…

I wouldn’t consider $250K in 1998 or $350K in 2013 as a starter home price, either. How many families in their mid-20s can afford that? I make around $140K, only have one child, and have no debt, and I’m not really interested in a house over $400K. If I’m looking at starter home prices, then what are the families doing who make the median income in the mid-$50Ks?

There’s really no such thing as a starter home in SoCal. My cousin, who lives in the “trendy” neighborhood in Indianapolis, is a single, elementary school teacher, and she bought a cool little 2 bedroom house with a double lot for under $100K a few years ago when she was 28. THAT is a starter home.

Spot on, GH. It seems that some folks’ definition of “afford” is to spend as much as the bank is willing to lend.

We paid $138K for our first home. The one we sold after and S&L bubble deflated for $239K. I have to agree, a starter home in the real world isn’t a 2,000 sq ft on a hill, with a clubhouse and community amenities. I lost my mind.

Our new home is a cutie pie, and is our final home. We’ve lived in fancy and now we live in average. We’re the happiest we’ve ever been. Of course we remodeled it, and that accounts for our elation. NEVER MOVING AGAIN!

In our Marin ‘hood, one came on the market recently at $1.1MM, and it was under contract within a week! It is a crappy faux 4BR (i.e., add-on, not organic 4BR, and a crappy add-on at that). There is one across the street that is nice but at $1.2+, it is a total rip-off, so the $1.1MM one seemed like a “deal.†This is insane. The house is a Brady Bunch look-alike, but not as nice, and on a corner/busy-ish street. A real price would be mid-500s, on a generous day. A sucker is born every day though. The same 20-30 people looking to buy in Marin make the area agents salivate, but there is so little real demand, and even less inventory, so it makes the itchy agents feel like “demand is outstripping supply.†Well, to a point – but sales volume is so low, it’s only the truly desperate or independently wealthy and 1%ers who can but in sought-after ‘hoods. It’s hard to know whether this will be the landscape for a long time or not. I keep thinking it can’t last (after all, who doesn’t want cheap and affordable housing for everyone – you never hear the government say “sure, let’s get prices affordable†as all they know is “let’s make loans ridiculously cheap and you can debt-slave your lives away, keeping the bankers happy), but the government and the bankers seem to find new ways to milk the cow (the rest of us) time and time again.

One always needs to consider the source and follow the money trail.

Realtors collect commission on sales. Realtors collect commission on purchases. Right now the low inventory is curtailing the amount of sales that can be transacted in the market. So it is not surprising at all that a huge portion of realtors think its a great time to sale – they stand to make a direct financial benefit from increased sales.

When I was out looking at homes and talking to realtors it was interesting to hear their attitude about splitting the commission with a buyers’ agent. Some listing agents are extremely cooperative with buyers agents because they know the buyers broker likely has a relationship with the buyer and has made sure the buyer is prequalified and ready to go so as not to waste the buyers brokers time. On the other hand, some listing agents are determined to make their own ‘double ended commission’ deals. In order to do that, they will not have any open houses for a couple weeks period in order to try to find their own buyer. In this market, that tactic works since they are more buyers than homes. Another way they do that is by not returning emails or phone calls of buyers brokers, unless of course they havent sold the home for a few weeks, then they will cooperate with a buyers broker.

Any listing agent engaged in such practice is not only violating board ethics, but is in breach of their fiduciary responsibility to their seller, unless they have a specific agreement with the seller to withhold the property from the MLS for a period of time.

We are tenants purchasing the house we’ve been renting. The seller’s listing agent is doing exactly that [trying to secure dual agency]. She is trying to force us into not letting anybody cut into her share from selling a pre-MLS listed property. We refused and are now being forced to pay our buyer’s agent out of pocket. Unethical? Absolutely. Illegal? Probably not, but boy is it sleazy.

Robert, what doesn’t make sense is that you even have a buyer’s agent when you already know which property that you’re buying. Unless you’re looking at other properties there’s no need for a buyer’s agent.

The coarse is set for the Fed’s complete destruction of the American Republic. Everyone knows the US is hopelessly in debt and is propped up by financial gimmickry. The only question is when is the crash. We’re all like people that live so close to the dam that we don’t even consider it may break. I guess as long as the manufacturing world still takes our American Express card, so to speak, the party goes on. Sort of like reverse robbery–“take this money or we will occupy your country”. Works for me.

I don’t understand why the government or anyone for that matter sees rising homes prices as a good thing. Home prices should track inflation…. nothing more. All rising home prices do is either a) Keep young families from ever owning a home. b) Make it so those who do buy homes pay a much greater percentage of their income towards housing. TO me rising home prices are a terrible thing and I’m a homeowner. If you think rising prices are great then you must not give a crap about your kids future.

+1

The government doesn’t care about future generations, all they care about is serving their money masters at the banks that are now deemed “too big to fail.” This is the revenge of the baby boomer generation (of which I’m part of), a large – scale strategy to beggar later generations in order to fund their paltry retirement accounts.

Only reason I’ve ever heard reported of why Greece is folding is because of “Sovereign Debt. Sovereign default is a failure of the government to pay back its debt .

We are at the economic end game. There are very few playing pieces left on the board. Government is in hawk over it’s head. Doubling the value of your home means double the property taxes your local government will collect. The more your local government collects the less the fed has to collect.. Yet the Fed wants more. That means they are not in good shape.

A low interest rate decreases the cost of spending the borrowed money. The unescapable natural law of Supply and Demand holds fast to cheap money results in higher prices, which in turn increases the taxes collected. You pay a property tax on a percent of assed value. The higher the value of your home the more money they will take. Your government has no interest in stable market values. If the market stabilized around reasonable value, the government would be forced to file bankruptcy.

This is why we have Home And Garden Television . HGTV. So we will be conditioned to watching newlyweds pay a half a million for heaps that belongs in the dump. But after the host spends 50K more on the remodel you can live in the polished turd for only 580k.. Most of the old folks pretty much know it’s Bull . I’d bet my last buck HGTV is government sponsored propaganda. Count all the adds for Joining the Army while your watching HGTV.

PS. It is easy these days to determine who cares about children.

I believe I have got it right. I believe my simple explanation can help you understand.

Good fortunes to you my friend.

@DG wrote: “…I don’t understand why the government or anyone for that matter sees rising homes prices as a good thing…”

Many city and local governments in California are broke, running a deficit or are contemplating bankruptcy. Higher home prices mean higher property taxes. In the city of Los Angeles, public safety employees (police/firefighters), their costs are over 50% of the city budget.

Pension funds (i.e. Calpers) have budgeted returns of well over 7.5%. But with interest rates at close to zero percent, these public employee pension funds are missing their targets by a wide margin. So higher home prices means higher property taxes. This allows the government pension funds to offset the abysmal interest rates.

Rising home prices create the holy grail of all things to the Fed, the Wealth Effect. People will get further into debt and spend more money they don’t really have if they feel their assets are rising in value.

It was for whoever sold this one. It actually sold. Original asking was 795k.

http://www.redfin.com/CA/Culver-City/4230-Revere-Pl-90232/home/6722472

Sorry. 749k was the original asking.

http://www.redfin.com/CA/West-Hollywood/562-Westbourne-Dr-90048/home/6816965

Original asking: $749k

Oh, I just can’t help myself! And, I’m really am not inclined to rain on anyone’s parade but, REALLY?

I live in the Georgia and have visited No & So Calif many times. And I’ve traveled extensively worldwide. But, I can still never get used to the deal out there.

– – I looked at both of those Redfin links. The 2 houses are nice. But are you f**ing kidding me with over a quarter of a mil $ for 700 – 900 sq feet?!! Hey-zus!

– – In the L.A. metro…..that thick crap forever hanging in the air? Folks….. it is not FOG (locals always shrug and call it that). Hello – it is grey in color…it is SMOG. You are sucking in volumes daily and raising your kids in it.

— No comment needed about the ungodly traffic or the airheads or the TAXES. ETC.

I guess the commentaries in this thread and others about the unparalled lifestyle in Cali are what people need to believe to justify the insanity. No wonder my Pasadena friend calls it: LaLa Land.

I have lurked for years on the blog. Once in awhile commenting. Here is my take.

The one thing that I think most people are wrong on is the course of interest rates. They have been trending down for 30 years. Every time we think they won’t go any lower, they end up going lower. If, as some think, productivity is slowing structurally, that will continue to impact interest rates negatively. When interest rates fall it makes long lived assets a better use of funds. High interest rates drive funds into shorter termed investments with a shorter payback period. This is textbook economics. Perhaps what we are seeing is a move to purchase long lived assests (houses) with a reletavily low rate of return.

addendum:

In fact what people may be doing is shifting their portfolios towards longer lived assets, namely they do not have “enough” long lived assets. In the aggregate they are holding on now to homes where in the past they would have sold and gone to higher yielding assets. That would explain a decline in housing inventory as an adjustment to the changing returns on investments.

The lack of inventory is staggering.

I have been looking for a condo/townhome in Brentwood or Santa Monica area.

A unit we like came on a market at 800, we bid 880 (one of 20 some offers). Got a counter at a MINIMUM of 910. Now we have to counter again..

WTF is going on?

You don’t “have to” do anything. That’s part of the problem. Instead of people getting used to the idea of living with less in the face of a global deflation, the blind keep bidding up for their wish list.

Keep in mind that the Federal Reserve is conducting a grand experiment. So far the experiment seems to be working for the majority of people by a slim margin.

And/or is it working for a minority of people by a huge margin?

True… You could go categorize those who are benefiting from the grand experiment. A slim minority is making a killing…

I keep watching the growing number of people on food stamps and disability. The number is growing at an alarming rate. I believe 1 in 6 Americans.

We are so grateful our deal closed in Sept 2012. Inventory was even low back then in our area, east Ventura County. We are watching this insanity continue. We were up against 5 other bids, and due to condition, our cash meant something.

Housing is now broken for good. This can’t be fixed. This is beyond Japan’s game. Am Itoo pessimistic?

Who can afford these prices? The real cost is the price of the home, and the financing is secondary imho. (Yeah, I understand the inverse.)

Inchbyinch do you also post under ID Mad As Heck, Nick of Time, HappyasaClam? others? Why all the posting ID’s? Seems I read the same story over and over again under multiple ID’s. Why?

A few anecdotes here —

#1. Spoke to a co-worker who overpaid (now) $75k for their place in Long Beach. He said he doesn’t care, he just wants to pay on it for 30 years and be done.

#2. Spoke to another co-worker. He’s been through the ringer with an ex and kids. In fact, he pays for his ex’s kids too! Poor guy. But anyway, being known to sleep on couches, the housing market is the farthest thing from this guys mind.

#3. Have another co-worker, he inherited his Cerritos home from his mom. I guess nuf said.

#4. Have many co-workers, transplants, with nothing except a degree and a paycheck. Very hard to make any moves in that scenario, most rent in South Bay cities. Many move away because of this.

And that’s the view from down here!

#4 sounds like the scenario with the least friction against making a move.

Not much to choose from in downtown L.A. right now either 🙁

AWESOME TIME TO BUY!!!! buy what?? I saw 4 homes in 4 months that were decent. They each had 20-80 offers on them and all sold for cash. Just found out tonight that the short sale we bid on just HAD TO go through in 20 days, so they didn’t even have time to counteroffer. there’s nothing out there to buy…

Oh, and Betty, I would bet your lost deals were dual agency deals. We came upon that fact all the time. When deals closed I looked up the buyer and listing parties, and most of the time, same corp umbrella, and usually even the same office.

I’m convinced that’s what it is. how do i look buyer/seller agent info after closing?

Betty

I’m bummed for you, Short Sales we looked at were using offers to slow down the process of getting on w/ it, so I would not feel to bad. Over and over we were used. The game might have changed w/ the Ca Homemoaners Bill Of Rights, but I doubt it.

I know the feeling of no inventory. I hope your agent is well liked (but mostly respected) by other 25+ yrs in the business agents & brokers. That helped our homerun.

So, all the Asians are the reason there is no inventory in San Diego and Los Angeles? If that is so, why is the inventory just as thin in Portland, Salem or Eugene Oregon? I lived in Oregon for 25 years and it rains half the time, cloudy 300 days out of the year. I can’t believe people would be as desperate to buy in Portland as they are in San Diego.

I think this is all boils down to Central Bank zero rate policy. The good news is I see cracks and we are about to see some serious unintended consequences coming home to roost.

I live in Portland and it is indeed a similar scenario here, for most of the same reasons put forth by the owner of this blog. Additionally, the state legislature recently passed a law called something like the “Oregon Homeowner’s Right’s Act,” which is a sop to the large banking interests to hold onto their foreclosed properties an additional six months, if not longer.

“I think this is all boils down to Central Bank zero rate policy. The good news is I see cracks and we are about to see some serious unintended consequences coming home to roost.”

Explain please.

Where Mortgages Go

To Die, Their Being Bought

Not At Market Value, A

Long Honored Tradition

Of Recent Treasury And

Fed Leadership.

http://pages.citebite.com/o1k4n4j0u8ojs

http://www.youtube.com/watch?v=kXJjNRIZNZk&feature=related

Also Why QE.

http://www.youtube.com/watch?v=RbOQZ-92pqc&#t=13m15s

(Location Sets After Ad)

The Reason Why That’s

Only Part Of The Story Is

We’re Still Siamese Twins

With Compulsive Gamblers

Who’d Happily Steal Candy

From A Baby.

Splitting The TBTF Banks

Would Compartmentalize

Any Damage

(Think: Flooding Compartments

On The Titanic (Forget That

It Sank.)

When you sell Mercedes and Yugos

one year and only Mercedes the next,

the result is a higher price avg.

That’s “price dispersion.”

Keith Jurow’s documented comparisons

using price per sq. ft. have been

consistently heading down through the

present time.

But even that does not reflect the above

described price dispersion.

Once the toxic assets are more fully

purchased not at market value

the already present large number of

pre-foreclosures will be joined by the

Mortgage Release Program.

http://caliscreaming.com/2012/10/30/where-is-the-shadow-inventory-right-here/

Have a nice day.

Leave a Reply to martin