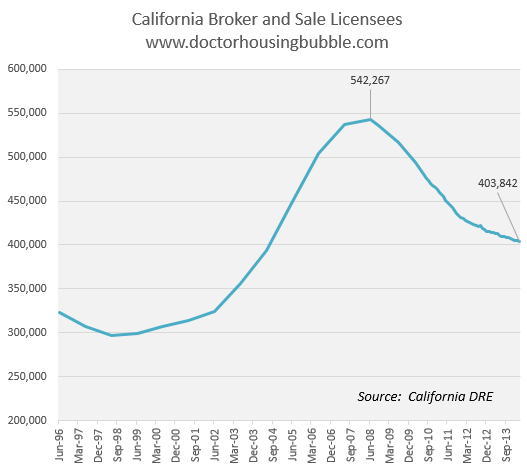

The disappearing real estate agents of California: From 542,000 in 2008 to 403,000 California Broker and Sale Licensees. Low volume and low sales continue to dominate market.

One of the more interesting sidebars of the jump in home prices in 2013 is that many real estate agents are not necessarily thrilled. You would think that with prices in some areas reaching near peak levels that real estate agents would be jumping for joy. Alas, money is made on sales volume. You make more money on five home sales at $400,000 than on one home sale at $600,000. Investors continue to dominate the market so even for loan processors, the volume for mortgage applications has been low. We have seen a continuing decline of licensed California agents and brokers. The peak was reached back in 2008 and since then, many have simply allowed their licenses to expire and new blood is not entering the game in any significant way. The trend is unmistakable and you would think the recent run-up in prices would be a call to action for many future agents and brokers. Yet with so many investors going straight to auction, working off the books, and the proliferation of real estate data the demand is simply is not there. Sales volume continues to be incredibly anemic and we have seen a recent increase in inventory this year but nothing dramatic. The reality is, for those looking to buy inventory remains thin and we still have a good number of house horny buyers.

Where did the agents go?

The peak number of California broker and sales licensees hit in 2008 at 542,267. Since then, there has been a slow and steady progression down. Today, we have 403,842 licensed brokers and agents in the state and every subsequent year since 2008 has seen a continued drop. What is going on given that in virtually every city of California prices went up in 2013? Prices went up because of a manipulated market, massive investor demand (waning), and house horny buyers leveraging every penny they have. Yet none of this is truly a sign of a healthy overall economy. Like roaches, folks are scrambling from the light trying to grab onto anything that potentially has the ability to generate yield (any yield).

It is an incredibly interesting trend because from 1996 to 2008 every subsequent year saw a steady increase in licenses going out to brokers and real estate agents. The bar is not a tough one to jump so this is a good indicator of an overall perception of the industry. Yet with sales volume so low, commissions have been slammed. Take a look at the data:

The furthest data I was able to dig up went back to 1996 so we almost have 20 years of data here. Things were fairly stable between 1996 to 2002 and then California was engulfed in a house lusting bubble that had every other person becoming an agent. From 300,000 to 542,267 was an increase of 80 percent between 1998 and 2008 (while the overall population increased by 15 percent during this time).

You would think that with prices going up, more people would be out and about buying but alas household incomes in the state are not hot. This is why investors and foreign money are all the rage in some areas (but overall this number is weak in comparison to the sales volume of the early 2000s).

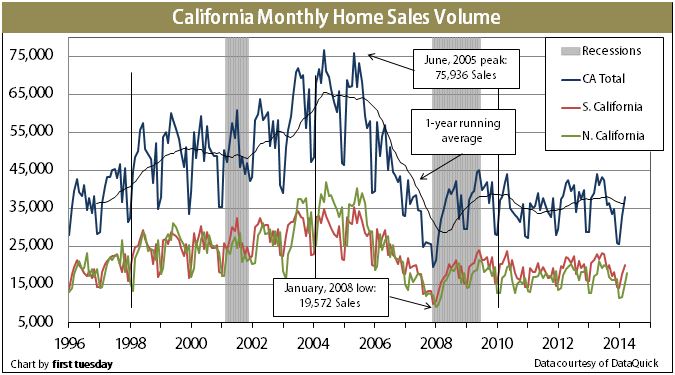

It might be useful to take a look at current sales volume in the state to address why the number of agents and brokers has declined:

The peak month of sales was in June of 2005 coming in at 75,936. Latest month sales figures? 37,988. More importantly, look at the one year sales average above. From 1998 to 2008 45,000 was the lower end of sales per month. We have yet to crack that number even in the best months of this constrained inventory market.

When you look at what you can buy for $600,000 you begin to scratch your head and realize this housing market is insane. For households in the area, this means living in a crap shack and shoveling a large portion of your income to a house with massive deferred maintenance if you want to compete today. Many are opting out, hence the increase in inventory.

First, it should be obvious that sales volume is incredibly low and inventory although up, is still low. So for those lusting after housing they are likely to confront investors in the market although investors are being much more selective in 2014. It would be one thing if money was flowing into targeted areas like a laser and this was the only growth markets but take a look at some of these areas and their annual price increases:

City                      Median Price    %Increase y-o-y

Artesia                $430,000             22.9%

Castaic                $480,000             24.2%

Compton (90220)$266,000Â Â Â Â Â Â Â Â Â Â 34.7%

El Monte (91732)$390,000Â Â Â Â Â Â Â Â Â Â Â 11.1%

Inglewood (90303)$380,000Â Â Â Â Â Â Â Â 49%

Lawndale            $394,000             25.9%

Palmdale (93552)$200,000Â Â Â Â Â Â Â Â Â Â Â 25%

Pacoima              $357,000             21.4%

You get the point. I really doubt that foreigners are targeting these areas and investors will be hard pressed to get good cap rates at these prices given market rents. So why the big jump in prices over the last year? The notion that somehow all of these markets are in the process of gentrifying is baffling because this would require actual higher income households moving in (or foreign money). Not happening. This is merely a halo mania of SoCal driven up by low inventory, low volume, investors, and folks straining their budgets once again. As happened in the last correction, these markets will be the first to turn when things pullback.

In the real economy, U.S. GDP actually dropped in Q1 of 2014. I’m sure if we look at real estate agent commissions being paid out they are a far cry from what they were in 2005 through 2007. The reason people are still questioning what is going on is because there is very little semblance of a “market†in housing right now. Everyone is simply speculating on what the Fed will do and what a shrinking middle class means to the future economy. Locking in for 30 years especially in a house you probably don’t like is a big commitment. In reality though, most people are simply following the herd and if banks were to give them 100 percent LTV no-down loans we would be back to the previous mania. The desire is certainly there but free lunches usually don’t last. Is it any wonder why the nation is largely becoming one of renters?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

113 Responses to “The disappearing real estate agents of California: From 542,000 in 2008 to 403,000 California Broker and Sale Licensees. Low volume and low sales continue to dominate market.”

One must be cautious with ‘thin’ trading statistics.

Inglewood is on the edge of gentrification, and some of the pricier transactions may reflect pretty aggressive speculations on such a trend.

In fact, thin markets are ALWAYS risky.

What few trades exist may simply reflect buyer insanity.

Certainly many under water properties are unable to move.

This clips the sales distribution, and may result in speculative players totally confusing themselves.

( If you lop off the bottom of the market — it being frozen — then the AVERAGE and MEDIAN would bounce straight up. This can happen if larger properties suitable for conversion to commercial use are trading out.)

Inglewood could work for Hollywood connected firms needing ‘back office’ space as the distance is workable and the price per square foot is not punishing.

One would have to really pound the pavement to know which way the wind is blowing.

The listed median prices for Compton, etc. are insane unless the land is being re-developed. The actual buildings atop the parcels are positively ancient.

“Many words leading to no conclusions, as usual. Absolute scattershot whilst flinging a personal label of “logically confused†as your posts tend to do. Perhaps your blog comments really are the wind beneath central banks’ wings.”

@Anon/TOTBS

This was so good I just had to pull it forward…

Funny. Look who’s talking.

CAB – that really hurts coming from a fellow shill…

I thought this post by blert was both lucid and on point. YMMV

Bler_not_blet – I would say that blert’s longer response below to RentaLerker is way more on point and actually has a logical flow. I think this comment was a bit scattered and lacks the complexity of the majority of blert’s comments. The comment that I pulled forward was a late comment from “Tired of the BS” in response to a typical condescending blert comment on the prior post. I particularly enjoyed “Perhaps your blog comments really are the wind beneath central banks’ wings.” which was poetic and profound given blerts claims that the BOE lives by his teachings. None the less I am a closet blert fan and take his insults to my intellect with a grain of salt. His comments do force me to look up a lot of words though… 🙂

Albeit it has been a while since I spent any time in Inglewood. Hard to imagine that it has edges that are gentrifying. Are there some gated communities in or next to Inglewood (as in many parts of LA) a stones throw from a cracker-box tenement with clothes drying outside second story (4×6′) decks?

Gentrification and multi use development next to immigrant poverty in slums. Didn’t Randy Newman have a song about that?

Your description perfectly describes Sacramento’s ghetto circa 1995. By 2005 it was gone, totally destroyed by land value/ price appreciation.

CRA Policy did it in.

Strangely it, the Sacramento ghetto, was absolutely adjacent to very pricey, up scale residences occupied by white collar employees. (Not really workers in the usual sense, these were, virtually to a man/ woman, California state employees.)

Once price appreciation began to roll, all of the Section 8 tenancies were brought to an end: the landlords were selling out.

Inglewood looks to be identical in character to Sacramento’s ghetto. Some smarty real estate professionals may have noticed.

Keep in mind:

1) The land value is all that is left. The actual buildings sitting atop the parcels are ancient. (WWII vintage, Inglewood exploded to house government aircraft production employees. These were often illiterate rural Blacks imported at employer/ government expense during recruitment drives. Until WWII there were virtually no Black Americans on the West Coast. Their number one employer was the railroads: as porters and cooks. The Irish filled all of the step-n-fetch-it jobs. This reality is totally against Hollywood’s Wild West Narrative, so don’t look to see it in recent film.)

2) Land values even a few blocks over are drastically higher than the going values in Inglewood.

3) Many locations in Inglewood are ripe for commercial use. They’re so close to the I-405, all of the other freeway adjacent properties (within range) have been exploited.

4) Commercial users (and gays) don’t give a hoot about the tragic nature of the local school system. So it’s no surprise that these two buying forces have been, and remain, the primary drivers of gentrification.

5) A landlord with an apartment complex is sitting on enough land to make it a single transaction land buy for redevelopment. I strongly suspect that a trickle of such deals is skewing the statistics straight north.

6) Section 8 rents are NOT tracking the surge in land values. They track various indexes based upon what the politicians figure can be borne by the public. In real terms, Section 8 landlords can see that their situation is positively going backwards. Their rents are NOT keeping up with inflation, especially the inflation in the goods and services desired by the rentier class.

7) Even the prospect that Prop 13 protection is going to be repealed (for their rental properties, of course) has many a landlord spying the exits. By the time that it’s obvious to all and every that Jerry is going to break open the cookie jar — the value of their asset will have taken a terrible beating.

(way beyond the value of the next three years rents)

7) The prospect of collecting superior property taxes while NOT causing any tax drains for Inglewood during a period of intense (pension plan) crisis will motivate every Inglewood politician to say, “Yes!” to every redevelopment plan. They won’t be picky.

8) Figure on someone like Magic Johnson to come out of nowhere to enter the fray. It’s a one-way bet that always pays off.

9) Inglewood is hardly loaded with high-rise anythings.

10) Local and state government may take a hand to unify (eminent domain) land blocks. This would be a variation on what’s being vectored to Detroit.

Blert, Sacramento’s ghetto circa 1995 is back. The housing bust hit Sacramento hard. Foreclosed houses were bought on the cheap by investors. While the SF Bay area home prices have been soaring to new highs, Sacramento’s housing market has mostly remained flat. There aren’t a lot of high paying jobs in Sacramento. Low income people from the SF Bay Area have been fleeing that area’s high rents for Sacramento’s affordable rental housing that is readily available. Sacramento has become mostly a Section 8 government ghetto again.

I do not agree with you completely. Imperial County which borders Mexico and Arizona continues to grow. A number of builders need to regain their confidence for large sections of the California real estate market to rebound. There are still pretty great properties in California that you cna choose from.Just keep your budget in mind, opt for the right mortgage loan and if you are new to California thne you need to hire a reliable real estate agent too.

Housing To Tank Hard in 2014!!

Housing to go up 30% in 2014 and we are almost half way there!!!

Without a (national/international) liquidity crisis, prices can only back-and-fill in nominal terms.

But…

We all realize that you jest.

Do the bears realize that you’re mocking them?

“403,842 licensed brokers in California..”

That’s about 400k too many. The RE agent has been marginalized in the age of the internet but the NAR won’t have any of it. They want you to believe that REALTORS sell houses (no, houses sell themselves) and that only REALTORS can get you “top dollar”. This is ludicrous. The 6% commission eats into and through whatever extra coin their work gained you. They limit access to the public by way of the MLS and the MLS key. Brokers like Redfin are a step in the right direction of marginalizing, in practice, the NAR and its cockaroaches who skim off the top of every real estate transaction of hard working men and women around the country.

The financial incentives for a realtor does not align with their clients. This is the crux of how disgusting the industry and its “professionals” are. When an industry is built on diverging interests between the agent and its clients, you know its scumbag city.

Real estate agents are the 2nd most hated “professionals” right behind used car salesman.

I agree Mike B, houses do sell themselves. I have nothing against RE brokers/agents, but they are in fact a middleman in the transaction, and a costly one at that. It is just a matter of time before sellers wise up and start eliminating the middleman.

Nowadays, people pump their own gas, bag their own groceries, diagnose their illnesses online, manage their own stock portfolio, buy insurance direct, etc., etc.

Excellent TJ ,they are not needed in today’s RE tranaction. The sooner people realize they are giving up huge money at so called fathom 6% commission and

actually can lower their price to sell without the burden of the middle person who

says ” lower your price, but I won’t lower my comission, what a scam.

The RE industry is a cartel of smoke and mirrors and the biggest ruse of all The MLS, don’t get me started on this service.

They don’t offer a service this is only a tax you have to pay. You have to pay it because the NAR takes your 6% and keeps most of it, but they must always part with enough of that 6% into the campaign coffers or “your” elected officials to keep things that way.

If you don’t like it, you are farked because nothing will change this.

Ask Elon Musk how much fun it is getting a carbuncle off of government control of the way business is transacted.

Digital marketing has ripped the guts out of the real estate agent’s entire reason for being.

They don’t see it yet.

Eventually a move to flat fees will occur.

In all of this, the real estate ‘profession’ will echo that of retail brokers on Wall Street over the last two generations. Only the truly wealthy will use them. Bread and butter properties don’t need real estate agents.

Something like this is happening to automobile retailing. (c.f. Tesla) Expect further reductions in the number of dealers and their salesmen. They are going to be slowly replaced by salary-men.

“In all of this, the real estate ‘profession’ will echo that of retail brokers on Wall Street over the last two generations.”

This is actually a really big problem given what the retail brokers on Wall Street did in search of revenue after the cash cow started to wither. What might these real estate brokers do once the retail business starts to dry up? I believe it is when a business models no longer provides the required revenue stream that we see “creative” non value added(to the economy) business models.

I thought the most hated profession is lie-yor. I guess they lie their way down the rankings.

Mike B actually RE agents are much worse than car saleman, cars salesmen. Most folks can test drive, car fax, Blue books etc. you have a fighting chance.

RE agents are boycotters, price fx, and control blocks of homes. They have so called arrangements with appraisers when they want to steal your home they call the fixer appraiser, when the agent sell their own home or in there neighborhood they get the favorable price?.

In my many years I have taken charge of most of my dealings, I do the research , hire my appraiser, and then tell all agents they have90 days to perform and only get their3% if I get 97% of my asking price. When they say know I always found somebody who said yes, that is the desperate agent who hasn’t sold a home in 45 days. I never hire the star agen, they aren’t hungry.

They make sure they get all the showings, if you show that you are in on the racket they boycott you, a direct violation of RE law, nobody enforces it.

Inaccurate generalizations. Commenters above are likely not involved in the current market so you make comments that no longer apply. This is a changing industry. 4% total commission is commonplace in my brokerage and may very well become standard. 6% was the standard back when properties were selling for $20-40K.

I will take a listing @ 1% if the value is there. I regularly see the amount paid to selling offices as low as 1% also. Perhaps that’s why my brokerage has expanded significantly while others have let their licenses lapse.

And let’s get real here. The overwhelming majority of sellers can’t sell their own property. They get far too emotional about it. If you have ever been involved in a transaction where potential buyer and seller meet each other the tension is palpable. Many a deal have been killed by emotion and buyer-seller communication. This is why an honest, unbiased representative is needed. Do you mean to tell me the typical seller would be able to navigate the sea of contracts and legalese involved in a real estate transaction? Please. Take your ass back to watching the kardouchians. I’m barely scratching the surface here.

There is no collusion between appraisers and agents/lenders. Lender uses a 3rd party to get the appraisal taken care of. Appraisers are more skittish now than ever to push values higher, even in instances where value is there. Like car salesmen, lawyers and other professions, not all brokers are liars. The ones that are in it for the long haul know the need to remain honest and provide the best advice and representation they can.

“And let’s get real here. The overwhelming majority of sellers can’t sell their own property. They get far too emotional about it. If you have ever been involved in a transaction where potential buyer and seller meet each other the tension is palpable. Many a deal have been killed by emotion and buyer-seller communication. This is why an honest, unbiased representative is needed. Do you mean to tell me the typical seller would be able to navigate the sea of contracts and legalese involved in a real estate transaction? Please. Take your ass back to watching the kardouchians. I’m barely scratching the surface here.

There is no collusion between appraisers and agents/lenders. Lender uses a 3rd party to get the appraisal taken care of. Appraisers are more skittish now than ever to push values higher, even in instances where value is there. Like car salesmen, lawyers and other professions, not all brokers are liars. The ones that are in it for the long haul know the need to remain honest and provide the best advice and representation they can.”

CAB – You are hands down the best comedian on this site! I tip my hat to you brother!!!

CAB: “The overwhelming majority of sellers can’t sell their own property. They get far too emotional about it.” I agree with this 95% of the time. Every seller thinks their house is a palace and is worth much more than their neighbors. Most sellers take insult to REALISTIC offers.

“Do you mean to tell me the typical seller would be able to navigate the sea of contracts and legalese involved in a real estate transaction?” This is rediculous. Ever heard or using a RE attorney to complete the transaction (and yes they do all of the forms and disclosures). We’ve had multiple friends pay an attorney under $2,000 to take the transaction from start to finish. with no problems. In fact, our friends report the attorneys did an even better job than most of the RE agents they had used in the past, had ever done. Better than paying out $30,000 or so to one of these agent bloodsuckers.

“There is no collusion between appraisers and agents/lenders”. You think? Our neighbor was an appraiser for 30 years. He said from 2003 up until he retired in 2013, there was pressure on appraisers to “meet the price”. He said on all of the overpriced properties, the BANKS and AGENTS would send out fax sheets to all the local appraisers, saying if you can meet this price you have the job. He refused to even respond to these “calls”, and his business suffered somewhat but he said he would not comprimise his integrity.

The entire real estate industry is rigged to screw the consumer out of as much money as possible.

“Do you mean to tell me the typical seller would be able to navigate the sea of contracts and legalese involved in a real estate transaction?”

I agree with CAB It’s ridiculous blaming the real estate agents for what’s happening in the real estate market! And these people act like real estate agents don’t work or spend their own money for gas driving buyers around just looking loos and the cost to maintain their licenses and the amount of paperwork and contracts they have to keep track of give me a break oh and the MLS, Redfin, Trulia and all the other online internet access to real estate get all of their info from MLS that the real estate agentss pay to place there the public wouldn’t even have access to it if somebody didn’t pay to put the information and take the time to put it in there it doesn’t just magically happen. The real blame should be on the banks the banks that used the borrowers to sell their loan contracts and make 10 to 20 times the cost of the house the day the borrower closed escrow thus stripping the borrower of all their would be equity.

I agree! 400,000 too many real estate agents.

@ Calgirl-

Oh, now attorneys list properties on MLS for $2K? That one attorney is great evidence, Cal Girl, because attorneys have great reputations for honesty. They also make fantastic salespeople…that explains why my LARGEST lead source is ATTORNEYS.

Your 2 anecdotal comments (friend of a friend, my EX appraiser neighbor who was working in the bubble years, blah blah blah) fail to refute the facts I’ve stated above. Nice cut/paste job though.

Cab… I’m the last person that wants to see a industry or folks be out of a job, that said, you sound like a professional agent and if more were like you the industry wouldn’t have a bad name just like sales people, attorney’s etc.

It is been my experience with agents they are not interested in learning their craft they have consistently through the years I have worked with them to circumvent the rules and ethics and tell so many stories they forgot what they said two month ago.

Also, I can’t remember when a RE agent told me that if I didn’t sign up a 6% commission they wouldn’t show may property, which by the way means to me boycott black-list at their meetings, which is a crime, they don’t care.

CAB: YOu are on the wrong track. RE attorneys don’t list anything nor do they have anything to do with the sale price, finding a buyer, or taking commissions.

What I am describing is a seller finding their own buyer without even using the MLS or an agent.

The buyer and seller do the deal themselves. The buyer gets their own appraiser, their own pest inspection and any other inspections they require.

The attorney prepares all the paperwork and disclosures to send to the title company.

You should do a little research. It may shock you to learn RE agents are completely useless, bloodsucking leaches. Plenty of people do FSBO deals themselves, and pay an attorney to properly prepare the paperwork and cover their azz.

Sorry RE agents, but Blert is right. “Eventually a move to flat fees is inevitable”. And these comments about how “complex” the paperwork and legalese is, is a joke. That’s what Travel agents said 20 years ago, and we know what happened there. A decade ago you had to hire an attorney and pay thousands of dollars to start a corporation. Now, LegalZoom will that care of that for you for 149 bucks. The scam is drawing to a close, so you better brush up on your secondary skills.

Yep. I have had a few bad experiences with RealTards. They and Loan Agents always seem to have a mannerisms that are both off putting and tend to insult one’s intelligence with rhetoric and absolute claims that they cannot back up.

The purchase documentation and transaction can and should be streamlined in the information age. There is no reason that FSBO shouldn’t be the majority of home sales.

The Agent is a member of a guild that has outlived its ability to add value to the transaction by a decade.

Negotiations, Documentation, Loan, Escrow, etc. can all be done either person to person or electronically with the possible use of either notary or Medallion Guarantees (if we are still unable to verify documentation electronically) in the coming decade.

Jesus – replace the Agent with an Android App.

Cal Girl-

I am well aware of attorneys handling FSBO transactions. In my market, FSBO deals don’t end up selling. I know because I market the sellers who end up paying me 2% total commission to take their listing (again, not all brokers will tax you 6%. if they tell you they won’t negotiate, find another broker). 1% to me, 1% to selling office. If value is there, it’s worth my time to list it, help stage it, clean it for all you filthy slobs out there, flyer the neighborhood, hold the house open and ultimately sell it.

As far as FSBO transactions go, your market may vary. In closing, your ad hominem attacks and generalizations truly expose the weakness of your argument.

Robert-

Thanks for the nice comment. Sorry for your experience with dishonest agents. I’ve heard many horror stories and I am happy to say I’ve always been fair and honest with my clients and it has paid off through referrals and the like. The fact is that if they are not the broker of record, their liability is limited, so they are a lot more likely to act unethically.

In fact, if you ever want to sell a high $ property, I would take the listing all day at 1%. I’m not greedy and my seller’s best interests are always of utmost priority. I hope that last line gives What a laughing fit since he seems to have it in for whomever does not agree with his asinine comments that are of no contribution to the discussion. I used to like reading his comments until he got annoying with the sarcasm. Now just gloss over them.

Some people take fiduciary duty seriously. Others do not. Same can be said of lawyers (lie-yers, love that one almost as much as realtards).

“I’m not greedy and my seller’s best interests are always of utmost priority. I hope that last line gives What a laughing fit since he seems to have it in for whomever does not agree with his asinine comments that are of no contribution to the discussion.”

So are you telling me that comments from shills defending NAR trolling housing bubble site are contributing to the conversation at this point? Really? WTF does “I’m not greedy and my seller’s best interests are always of utmost priority.” add to any conversation about anything? Yea and Lloyd Blankfein is doing God’s work. Let’s pretend that you are actually an upstanding guy. Who the F cares? All the insider deals and listing manipulations going on with realtors over the past 5 plus years has shown the industry for what it truly is. The financial incentives are not to put your client first. The financial incentives are to put the industry first at the expense of the client. It does not take a mathematical genius to understand that the incentive is to make the sale at any cost as that is how you get paid. Would you tell a “client†that now is not a good time to buy and to wait out the current market until things settle down? That is what a for fee adviser might say. The commissioned adviser would say it is always a great time to buy. So do me a favor and save the holier than thou BS for your “clientsâ€â€¦ This BS conversation is exactly the reason I mock shills like yourself because it is way easier to be a brain dead shill and support everything I say with NAR talking points versus actually “contributing to the discussionâ€â€¦

“The financial incentives are to put the industry first at the expense of the client.”

I agree. Welcome to America. It’s a rigged casino, but you can still make money. Similar to the stock market, in fact.

“Would you tell a “client†that now is not a good time to buy and to wait out the current market until things settle down?”

Absolutely. I’m primarily dealing with sellers. I’ve advised many buyers of this fact, negating the rest of your little angry attack.

“WTF does “I’m not greedy and my seller’s best interests are always of utmost priority.†add to any conversation about anything?”

Just responding to everyone’s generalized attacks. I’ve been posting here for some time and I don’t typically defend realtards. I concede that a fairly high % of licensees are lazy and stupid/uneducated, perhaps as high as 80-90%.

However, I’m not part of that group, do not fit that criteria and I just wanted to leave a few posts in the hopes that some might understand brokers aren’t ALL bad and some of us actually bust our asses to legitimately earn commissions similar to what mofa posted about an experience he had.

Would anybody buy a house with an FHA loan at this peak of the market unless you knew you were going to live there forever and die there (and it wasn’t under value e.g. a foreclosure or short sale)?

Should I call my local realtor and ask them what I should do? I wonder what they’ll tell me…

NAR’s loss is Starbucks’ gain.

@Mike B,

There’s no need to call anyone. Two days ago I received an email from a Sr. Mortgage Advisor (that I wasn’t even aware that she had my email address) telling me that she is available to answer any questions. Before that a mortgage loan officer sent me some listings I might be interested in. Can you believe that, the banks’ loan officer was sending me housing listings and the buying agent I’m working with hasn’t really been sending me anything. When these people are desperate to get you into a house things must be really bad. This makes me really hesitant to buy anything.

@cwa

they want to demonstrate how hard they are willing to work for you, of course. And it is hard. I’m sure logging onto the internet and driving around town is hard work. Realtors need to create the perception that they are holding your hand and assisting you in all these little ways so that they can perpetuate the myth that their services are vital to real estate transactions.

I came across a realtor and told him a little bit how I quit house hunting after searching all of 2013 due to 20+ bids on all decent homes. I reiterated to him that even though there is less competition now, prices are inflated and the inventory in my price range is terrible. The scumbag flat out told me there are great houses still, and I reminded him I check listings everyday so I know what’s out there. These leaches will say anything under any market conditions to get you to buy or sell.

You are right cwa, something is up. I stopped looking about a year ago but all of a sudden the agent and lender I was working with have started emailing me to see if I want to start looking again, even agents that I left my name and contact info with at open houses have started sending me properties. The BS is still the same though, prices going up, low rates, etc.

“We have seen a continuing decline of licensed California agents and brokers.”

I would like to take a moment of silence for my fallen comrades…

We will all miss realtors stopping their aged MB/BMW/Audi’s in the middle of an intersection, getting out, pulling open house signs out of their trunks, hobbling across the street to position their sign among all the others, hobbling back across the street and waving at the waiting motorist. What a great loss…

“The bar is not a tough one to jump so this is a good indicator of an overall perception of the industry.”

That is not true. It is soooo hard to take that two week correspondence class and then take that 30 question multiple choice test. The questions are really hard.

Example question:

What should you bring to an open house?

a) a parachute

b) a bunny rabbit

c) the keys to the house

d) all of the above

e) none of the above

Keep in mind that you need to answer at least 20 out of 30 of these questions correctly to pass.

I know someone who was pretty bright that failed the real estate license exam.

There is nothing wrong with trying to work as little as possible while still earning a good living (the American Dream) but most people with a soul wouldn’t if it meant skimming healthy portions off the top of American citizens. People who have poor work ethic, no soul, feel entitled and self-important, and want to avoid an honest day’s work at all costs are attracted to the RE industry. When the industry is set up to screw you, go figure, it attracts scumbags.

California’s RE industry is reputed to attract failed actors, and especially, failed actresses and models.

Look at all those realtor brochures, featuring realtors’ smiling faces. The whitened teeth. The shining blonde hair. Attention whores, for the most part.

I was sent an email from a Malibu realtor just to wish me a Happy Easter/Passover. The email featured a photo of his craggy, sun-burnished face, gazing out toward the Pacific Ocean, pondering Deep Thoughts.

Realtors used to be a perfect gig for aspiring actors/actresses, especially for those lucky enough to sell in Malibu, Bel Air, and other industry hot spots. Flexible work schedule. You’re the star of your own production, the center of attention as you escort buyers around the fabulous homes of the stars. You might even get lucky and make some contacts, leading to a film role.

I suppose the recent bubble pop shook out many of those actor-realtors.

“I know someone who was pretty bright that failed the real estate license exam.”

I’ve been pondering this for some time… The only logical (there’s that word again) sensible explanation I can come up with is that they were having dosing issues with their new medical marijuana prescription that they used for their test anxiety condition.

Here is a first mark down the date I agree with What? Even though he has called me a R E shill, if he really knew what I think of RE agents.

robbie, how can we mark down this date when we do not know which robbie we are talking to? Is this coal miner’s daughter robbie? Is this Sicilian robbie? Is this pimp my house robbie? Is this I bought back in the day robbie? Is the ESL robbie (based on the grammar)? Is this Merika free speech robbie?

I want to speak to the little “r”… (free prize to anyone that can guess what movie this line is from)

Salesperson license exam is simple.

Broker license exam, not so much.

Toe-may-toe tah-mah-toe

And agents or brokers who pretend they are lawyers and that they “know legalese,” um, not so swift of a move. Practicing law without a license much? Most agents talk the big talk, but when you ask the relevant, hard questions, they back off and run like a cockroach when the light comes on. Agents and brokers should just focus on knowing the areas, schools, communities, etc. and knowing all about houses (differences between private and public sewage, etc.), but they should leave financial questions to financial advisors and legal questions to lawyers. To do otherwise could be fraudulent, and to pretend to be anything more than a door opener and knowledgeable about house basics and communities is really misleading.

C’mon now, CAB. Do you really want us to believe becoming a broker is tough stuff? Maybe I’d believe you if I didn’t personally know so many brokers with very marginal intellects.

Do you also hang your GED on the wall?

I’m usually dropping those signs off from a Prius. And, um, I don’t think I’ve ever stopped in the middle of an intersection and exited my car.

Just proves that you are a rookie! The busy intersections theater is part of the sales process. Are you sure you passed that 30 question multiple choice test?

I do like the low carbon smug cloud ride angle. The Pry-Ass would be a great selling point up here in SC county. I am going to make a mental note on this one. I like…

SOL – medium? I think you mean median, which is the middle point. Perhaps Lynn meant the average is @ 90. Either way the difference is negligible. She makes valid points.

If I have to tell you the difference between “shrill” and “shill”… (ahem, what?)

CAB – Now I admit that you are adding to the discussion by… ahem… correcting grammar/spelling. I am not convinced that anything you have said in this post or any other recent post is adding any profound insight to the discussion. I have never professed that I am adding any significant insight. I simply make comments and read other comments. I take all with a grain of salt at this point. The reality is that nobody really knows anything and the majority of comments here are either masturbatory in nature or reflective of the confusion wrought by our current “economy”. So, I am all ears if you actually have some profound insight.

you’re so funny! You obviously have never study to be a realtor are you would know they don’t have any correspondence classes and you obviously have never seen the test which a lot of people fail. You probably also are not aware that Realtors have a higher standard of ethics they are supposed to uphold than even attorneys must abide by. I can’t believe the lack of research from the comments today on this site when the banks have robbed America blind and still are and lots of people are sitting here blaming Realtors it’s ludicrous. By the way I’m not even a realtor but I know several Realtors and I know how hard they work but then they’re also honest and ethical people that I know so perhaps I’m just fortunate. And all the rest of the realtors suck. Even if that’s true, they are so far down the food chain of what is the cause of our current manipulated real estate market. Or from the cause of the housing bubble and collapsed in 2008. And it wasn’t even subprime borrowers fault. That’s all the lies that we are told from mainstream media. But if you do some research you will find it was the partnership between large brokerages the Federal Reserve brokerage banksand our government Fannie Mae and Freddie Mac na made a bundle, and the party is still rolling on again! Thanks to the Federal Reserve Program put in place so that large banks could buy up all the foreclosures and turn them into rentals. They had it posted right on their website, all you have to do is go read it. It’s not a secret that people are too dumb and lazy and like platitudes and blaming Realtors. Well the average IQ in the United States is now 90 it used to be considered mentally disabled but they lowered the bar so now it isn’t. Just saying.

I don’t know what you mean by “average IQ,” but the medium IQ is 100. It’s ALWAYS 100, by definition, regardless of whether the population is getting smarter or dumber.

Unfortunately I know a lot of realtors. Even some family members. I was born and raised in Santa Monica and the majority of the people I grew up with that became realtors had a very similar make up.

First criteria was that they were never known as the brightest bulb on the tree. Not one of these guys/gals were in any advanced courses in school. None of these guys/gals went to college.

Next criteria was that they were very lazy. Hard workers chose construction every time. Actually the ones that went into construction were to some degree smarter. A close friend of mine who was a room mate for a number of years who was a real estate agent rarely got out of bed before the crack of noon never mind actually work.

Next criteria was that they were very shady. Many of these folks were borderline criminals prior to getting into real estate.

The test is not difficult. The only reason folks failed would be the same reason folks fail the written drivers test. Too lazy to crack open a book…

A good read, as always. If only the surviving Realtors/Estate Agents could work out that lower prices will also be to their gain. The agents who’ve dropped out of the market should have been campaigning for lower house prices, to stop the complacency and get more sellers coming to market.

_______

Reuters (Feb 25, 2014): The newly announced job cuts in mortgage banking raise the total number of mortgage cuts the company originally called for by year-end 2014 to 17,000. Many big banks, including Wells Fargo & Co (WFC.N) and Bank of America Corp (BAC.N), have been laying off mortgage workers as higher interest rates in the second half of 2013 made refinancing less attractive to homeowners. Mortgage lending at JPMorgan fell 8 percent in 2013 to $166 billion, but refinancing fell three times as much.

http://www.reuters.com/article/2014/02/25/us-jpmorgan-investorday-idUSBREA1O0X120140225

________

Brain – Let me run this idea by you.

We have seen the power of governments buying their own bonds (QEInfinity). Interest rates at all time lows.

We have seen the power of S&P 500 companies buying their own shares (stock buy backs). S&P 500 at all time highs.

The logical (somebody please look up the definition of logical as I have forgotten what it means) next step would be for Fannie and Freddie to buy SFR’s. We are always fretting about where are we going to find new buyers (aka greater fools). Why not holders of the mortgage? They can pay themselves and that would assure that there are no more missed payments or foreclosures. A couple of key strokes and voila, payment made and received instantly!!!

This has to be the one of the best ideas if I do say so myself!!! The good news is that Janet is watching and the odds are very good that she will take my idea and sell it as her own word for word!!!

Lol What?, I don’t see why not. Especially in worldwide ponzi-capitalism, and no end of yield hunters willing to pay ever higher prices for anything and everything.

In fact the banks should set up an offbalance vehicle to do just that, then they could float it on the market in a big juicy high priced IPO for yield hunters.

Actually US and UK banks have somehow managed to do something very similar recently…. they’re doing a roaring trade in selling a lot of non/unperforming mortgages back to market recently in CDOs/CLOS (collateralized loan obligations) – as investors are going wild frenzy hunting yield.

___________

Bundled debt demand reaching levels of height of crisis

Financial Times-by Tracy Alloway-18 May 2014

Sales of bundled US corporate debt known as collateralised loan … about underlying collateral that are meant to make the securitisations safer.

(that’s a pay-site, but free info here about the very same: http://www.cnbc.com/id/101683631 )

Fannie and Freddie – Bill Ackman wants heavy involvement there, it seems, and “we preserve the housing market for people.”

______________

May 5 (Bloomberg) — Bill Ackman, who runs the $15 billion Pershing Square Capital Management LP, explains why he is bullish on Fannie Mae and Freddie Mac: http://www.bloomberg.com/video/why-bill-ackman-is-bullish-on-fannie-and-freddie-AfzF~58nT1G91bXB8L6wfg.html

Bill Ackman: “The answer is I think, you know the administration has had kind of a general statement that we have to wind down Fannie and Freddie, and a lot of that I think came from the fact originally the Government injected $185 Billion in capital, and thought they would never get paid back. The interesting thing is one of the great investments of all time, by our math the Government puts in £185 Billion and will take out something approaching $600 Billion dollars…”

______________

There’s also his 110 Slides video on how Fannie and Freddie so great an opportunity . Obviously I’m not as smart as these hedge fund top guys, but I wonder if they make too many assumptions about the demand for new mortgages (at these current values/prices going fowards) – although there’s a lot of existing debt to run down. Also what’s this proposed solution, which could see basis points rocket up? Has it been decided?

I know this much: *You can’t print capital. It is all too simple to think that central banks have magic powers. They don’t. They can create liquidity by creating debt. But this is not the same thing as creating capital. Any time a central bank monetizes an asset by buying it, in essence, with printing-press money, it also creates a liability. Only the market can create capital by valuing assets above liabilities. Turning on the printing presses at a higher speed destroys more wealth than it creates.*

Yet the QE and other measures, in US, Japan, China and UK, seems to have put a floor under their new reality, Gov becoming the market in some ways, and created perverse capital for those setup for bailout policies. One way or another, with bail-outs, QE, etc, I think cautious savers, and younger prudent generation, have be denied opportunity, with the ponzi kept going, for older-involveds, prime home-owners, landlords, flippers, Vested-Interests, Wall St – instead of having allowed a crash / rebalancing. It’s certainly increased the debt on the public part of the balance sheets. Got to wonder if that will ever come to be a dampener on growth, or even a crash.

RE: BrainOfEngland

The CDO data is interesting. I’m starting to wonder if 2014=2006 as opposed to 2007. We’re definitely in the “mania” phase of the investment wave, but the crest could be a bit further off if the institutional investors ride the “monetary meth” high for longer than we think. The FED is done shooting them up (QE ending) as they know it’s killing the patient. However if large investment groups seek to stave off the comedown by chasing CDO shit, then this game can stretch a year longer.

Ultimately means a correction of greater velocity so I don’t really mind. Whether 2015, 2016 or 2017 the next downturn WILL happen. It always does.

I would say that we are closer to 1637 than 2007. 2007 looked more like 1929 where you had a large cross section of the population leveraged to the hilt attempting to cash in on the mania.

It is my understanding that in 1637 it was mainly the Dutch elite who had access to the tulip bulbs due to the fact that they were a luxury item. The Dutch elite traded the bulbs among each other. The rest of the society didn’t really participate in the tulip mania spreading across the land of wooden shoes and windmills.

The funny thing is that many of my comrades would argue that this time is different and they are both right and wrong. This time is definitely different than our prior collapse but we have a much longer history of bubble mania then 2007 to present. I suggest reading up on how tulip mania worked out for the Dutch elite…

Lawndale homes going for $400k correlates with truly crappy crap shacks in Lawndale renting out @ $1,800, mostly to extended families or other such “mulitples” situation.

Living in a shit shack in a South Bay ghetto is expensive as fuck, brah!

P.S., just for you Doc, the glamor pic they chose is a house of genius version of “between two ferns”

http://losangeles.craigslist.org/wst/apa/4493519055.html

@DFresh, $1800 per month is at the upper edge of affordability for Lawndale.

City of Lawndale: median household income $45K per year. Limiting rent to no more than 33% of household income puts median rent at $1250 per month. $1800 per month in rent would require a yearly income of a minimum of $65K per year. That is closer to Burbank/Glendale/Anaheim.

But hey! There are millions of uber rich Chinese carrying suitcases full of gold and silver who are just dying to live Torrance adjacent.

ernst, ernst, ernst… I thought we had you in our clutches and you go and say something like:

“median household income $45K per year. Limiting rent to no more than 33% of household income puts median rent at $1250 per month. $1800 per month in rent would require a yearly income of a minimum of $65K per year.”

Come on! You KNOW that incomes have nothing to do with rent or anything for that matter!!! REALLY??? We need to go all the way back to square one???

I want you to write “incomes do not matter” 500 times. When you are done, then you can come back and participate with the rest of the class…

Sorry your area of expertise is the affordability of Lawndale…not a gig for the gun-shy, churro vendorphobe or crack-ho adverse. Have at it!

Anyway, Lawndale is more Redondo Beach adjacent than Torrance…but, whatever; the thrust that wasn’t clear enough to you is that rental tenants in Lawndale are comprised of multiple immigrant occupants (ex-wife used to live there and unfortunately know this hood well), who don’t figure into local hh income stats. Does it look to you from that photo you like landlords give a fuck what the place looks like?? Haha. Do you think the LL gives a crap about the occupants as long as they can scrap together $1,800 to live like a minimum-wage rat motelers?

So, yes, ahem, let me be clear, median hh income stats don’t matter a fuck in Lawndale. Thank you.

In my area I’ve seen quite a few rental listings have been reworded to ‘rent can’t exceed 50% of gross monthly salary.’ It’s insane.

Traditional notions of affordability have been thrown out the window. Despite it being a pretty tight rental market, landlords just want to know that you can technically pay the bill for a few months. They seem to realize that if they really held to a traditional standard of affordability demand would drop off.

Only the higher end listings care that you can actually pay full freight for the long run.

@DFresh, Lawndale must be advertised as Torrance adjacent not Redondo Beach adjacent otherwise Lawndale will never attract the Red Chinese commie bastards with bazillion dollars of klepto-graft laundered money. The gold encrusted Chinese want to live near people who look like them (think San Gabriel Valley, Irvine, San Francisco and DTLA). Torrance with a large population of Japanese and Koreans is more palatable to these Chinese rather than Redondo Beach which is filled with white people.

Do this and soon Lawndale will be the next Malibu. In five years the average starter home in Lawndale will be $5 million dollars as the flood of crooked Chinese communists with backpacks of gold turn Lawndale into the New Shanghai of California. Jobs wont matter in Lawndale. Incomes wont matter in Lawndale. Fundamentals wont matter in Lawndale. The flood of foreign money from Red China will turn Lawndale into the next Malibu by the 405. Buy now in Lawndale before you get priced out of the market forever!!!

cue blert rant on all things esoteric about Koreans/Chinese/Japanese you won’t find in a textbook in 3, 2, 1…

I have a good one for you, RE agents sells is home on the golf course for 1.1m. The neighbor two doors down is told by the same agent that his house which is a carbon copy on the golf course is worth 989k?

When asked why he should get more the agent says, my house sees all of the 9th green your house sees about 95% of the same green thus you can’t get 111k more.

That is one expensive sand trap, you see the trap blocks 5% of the green, you still see the putt and if it goes in or not. This is classic rip off , snow job.

BTW I counsel the neighbor he listed for 1m.89k and recieve a offer of 1m65k. Needless to say, good thing that agent moved, he would never get another listing in the area nor should he ever be allowed to snow another client, but he will.

My uncle bought his house brand new in San Carlos for $38k back in 1969. Nice, but small little house located on a cup-de-sac in a hilly area. It’s worth around $1.24mil now. The house next door is the same exact size & condition, but has a view microscopic of the Bay Bridge out the kitchen window. That house recently sold for $1.5mil.

$250k extra to be able to see a bridge from far away. Crazy.

This is how bad it is in L.A now:

http://www.redfin.com/CA/Malibu/18366-Clifftop-Way-90265/home/6850667?

Look at this listing and take note of the quote “perfect STARTER HOME in Malibu”. Really? Since when was a $2 MILLION dollar home a starter home? In california you would have to save up at least 30% down ($600K) and have a salary of $400K/yr to afford that house. If you were bringing in that kind of money, would you want a tear down like that?

Why pay $1mil for some shack in an LA ghetto? $1.1m could get you this iconic house in a very nice suburb of Chicago: http://www.chicagobusiness.com/realestate/20140529/CRED0701/140529740/after-five-years-ferris-bueller-house-finally-sells

That is one very exceptional, choice modern house in a very, very prime, toney North Shore suburb of Chicago. Highland Park is one of the best suburbs of Chicago. It is close to the lake, has excellent schools, beautiful homes on tree-lined streets, a wonderful downtown area with easy access to the Metra North Shore commuter rail line. And it’s adjacent to even fancier suburbs like Glencoe, Kenilworth, Braeside, and Lake Forest.

Houses in even prime suburbs are losing value relative to prime city neighborhoods like Streeterville, the near north side, Lincoln Park, and even Lakeview, though. If this house were in Lincoln Park, it might fetch more. But, of course, you will not find a site like that- a beautiful wooded hillside on which to build a house that cantilevers over it- in flat-as-a-board City of Chicago, except, perhaps, way south in neighborhoods like Jackson Park.

I would like to give a shout out to all those shill haters in doctor housing bear land!!!

http://www.zerohedge.com/news/2014-05-29/mainstream-media-meteoronomics

Proooooof that I was right from your own gloom and doom site!!! My new slogan is “it’s the weather stupid”. Are you ready for the spring thaw? Brace yourselves gold hording fear monger gloom and doomers because the eConOhMy is about to take off into the stratosphere!!! My GDP growth prediction is 7% for Q2. All that “pent up demand” and “cash money on the side line” is about to get crazy!!! You better buy that gas grill now or you will be priced out forever!!!

I’m still waiting for housing to Tank Hard.

This Pasadena house was listed at $779k and sold for $831k: http://www.redfin.com/CA/Pasadena/864-Victoria-Dr-91104/home/7205058

I was thinking of going to the open house, but I didn’t, because I figured it would go over list price. It did. House horny buyers are still bidding up prices, and I refuse to get into any bidding wars. I won’t pay over asking price, just on principle.

Have you noticed this new trend of painting interiors all white? It can make some of the arts and crafts and tudor homes in the area look less dark and more modern, but in some cases, I think it’s meant to hide a multitude of errors. I wonder what the wood ceiling and fireplaces in this place looked like before they were painted white.

Love the simile Dr. HB –

“Like roaches, folks are scrambling from the light trying to grab onto anything that potentially has the ability to generate yield (any yield).” Who says writing about RE market forces can’t be poetic.

Bond yields are shite thanks to QE forever and the stock market is full of speculation at risk levels that under normal valuations people would be scrambling to exit the mousehole before it shuts down.

With all irrational markets the herd is the mover – both stock and housing are full of bull roaches trying to catch the last spike of capital gain and/or yield at the peak of this cycle. I guess they believe that the best defense is a good offense?

Maybe housing will stay level or slowly climb for another couple years? Maybe the DJIA will hit 20k by the end of 2015. The fundamentals in both markets support neither and a massive pullback to the mean would match the historical trend for both stocks and housing.

Don’t let history muddle any animal spirits however, history never repeats itself.

I think there is a correlation between market tops and the formating of Realtor advertisements.

The size of the glamour head-shot photo in relation to the total area of the add increases as the top of the market approaches. I think I’ll put a suggestion to FiveThirtyEight.com to look into this.

It almost as if they are admitting that nothing is happening right now. Remember my face when you decide to jump back in.

Hi Doc. Interesting to see the drop in real estate broker license drop over the past decade. But more curious is how many were full time full fledged realtors and how many were ‘weekend warriors’ those with a day job (or no job) and just hoping to represent a buyer (a family member or friend of a friend) as a part time realtor. I heard that most of those who left the business were hoping to represent a buyer someday but were not at the level of professionalism to win listings or correctly price a home for sale.

Yes, You make a great point!!! We most likely only lost the agents that never sold anything and they now have so many other opportunities in our current eConOhBombIt “recovery” that they let their licenses expire. The makes perfect sense!!!

A real estate attorney is the only way to go. Much cheaper, far less shady.

Let me get this straight.

We are saying that an ATTORNEY is “far less shady” and “Much cheaper”.

Isn’t this the final sign of the end of days? I need to go pack an extra pair of underwear for the rest of this ride…

Doc, I think most of the decline in licensees was due to 60% of the mortgage brokers getting out of the business between 2009 and 2012. A RE license is required for that profession and it has been hammered.

What? This is Sicilian Robert, I don’t know who I’m suppose to be anymore?

Anyway I agree with you and the posters that RE agents are dinosaurs not needed in the sell or buy of a property.

The old line,”I can list your property for a given price”, then 3 months later they tell you it was always over priced so before my listing is up give it away, of course I don’t discount the 6%? Or they tell the buyer, I have a 4 bedroom to show, you when you told them I only want 3 bedrooms. This nonsense has worn out it’s life, time for another way to do business.

new model = list house on ebay/craigslist/amazon backbone, use legal zoom for paper work and throw in a call center for process/technical questions. The guy that puts this together will make bill gates look like a pauper.

Oh and I forgot that you should be able to connect your account to the mortgage originator to qualify you as a buyer. Of course the loan application would be completed and approved prior to making bids. “Cash buyers” if there really is such a thing would have to verify the “cash” prior to making bids.

Now, the open house/walk through needs to be dealt with as you really can’t do this on line as well as the inspection. How about you can schedule viewings with the seller and the seller can accept or decline. Once you schedule a viewing the seller can see your info and decide if you are worth the time. Sellers can also advertise open house dates as they currently do on craig’s list for rentals. I really think someone much smarter than me could work all the kinks out and and invent the next etrade/ebay/etc. Too bad all the talent in the Valley is working on the next useless social media IPO…

Thinning of the heard is not always a bad thing. As others here have mentioned the agents out for a quick buck and no passion for their trade will usually bail at the first sign of work. As a broker with over 25 years I know first hand how much the “job” has changed. Discount, fee for service, flat fee, etc all have their place in a hot market but good old fashioned contingency fee brokerages will be the sellers choice when it takes longer than a few days to sell. Having worked with over 900 sellers and buyers I agree that they are emotionally attached to their own transactions.

There are good and bad in every profession. I even know a few bad cops believe it or not

REALTOR bashing is a very popular sport. One of the few groups of people who can be trashed just because of the title on their business card. Some of us actually passionate folks who are trying to help others and make a living to feed our families just like you.

It is very interesting that when there is a post on a site called Doctor Housing Bubble titled “The disappearing real estate agents of California: From 542,000 in 2008 to 403,000 California Broker and Sale Licensees. Low volume and low sales continue to dominate market” that all of a sudden RE brokers/agents are coming out of the woodwork defending their “profession”.

Thank you. I can’t wait to see some arm chair realtor sued for one of the MANY potential violations of one of the many fair housing regulations or failure to disclose or for removing a fixture. Etc.etc.etc. lol realtors don’t do anything. Lol that’s funny. Sure there are scam arTists everywhere but seriously with all the major corruption going on in the world blaming all this on realtors is retarded.

I don’t think anyone is blaming this mess primarily on realtors, but many do have dirty hands. And they are often the ones telling lies about fake multiple offers and ascending markets in order to wedge up prices (if the client is a buyer–the opposite if the client is a seller) and make a commission.

They are the henchmen of a corrupt market, and the decent ones are few. The problem is bigger though, of course.

lynn…..Of course to blame all the mess on the Real Estate industry is weak. Buy hope you do agree that with such a large tranaction as buying and selling RE agents should better trained.

Again in my many encounters with agents I find I did most of the homework and they got the commission with little or know effort, except to agree with everything I said.

But folks like Cab who seem to be very ethical it is ashamed they work hard at their profession so certainly not all. I was in the car business so you know how that goes? Take care

When I bought my home as a FSBO 20+ years ago a realtor who had been trying to sell me a house tried to dissuade me by warning that, “Sales by owner never work, 90% of them end up in litigation”, and other such lies. I didn’t need a realtor to buy a house then and I don’t need one now. They are simply parasites sucking 6% of the value out of a transaction that should be going directly to the buyer and seller.

While I still regularly drive the areas in which I’m interested in buying looking for the elusive 4SALE BY OWNER lawn signs, these days this isn’t really necessary. With ubiquitous Internet access by sellers even this small utility of realtors in advertising has largely vanished.

If RE brokers were serious about wanting their services to add value to the transaction, they would be all in favor of a flat fee, like Redfin.

RE agents can never be honest and candid about the financial incentives of the industry because doing so exposes how their role, as much as they sincerely try and help their clients, is pitted against the clients they espouse to help.

Charging a commission based on sale price is ludicrous as a matter of principle (e.g. think tipping at restaurants) and it always punitively punishes the customer.

When I was searching for a house from 2009-2011, I had a private, part-time broker with a SAHM wife who did a lot of the legwork. About 1/3 of the places we looked at were properties they were interested in, whether as potential rental properties or just looking for remodeling ideas (they’re a bit obsessive about remodeling), and 2/3 were places for me. It wasn’t two years, it was more like 18 months, but the key thing was that they were low pressure and looking for a place that would fit my needs; other people I know were basically dropped (or ignored) by their Realtors after five or six months, whereas my RE broker and his wife would go through places, pointing out to me where there was evidence of water damage or unstable foundations that I wouldn’t have noticed, and would regularly open windows so I could hear outside noises.

The properties we’d visit that they were interested in provided a fascinating learning experience. Everything was about finding evidence of damage, determining if improvements were high quality or low quality, potential for future improvements and overall liveability.

When my backup offer on what is now my house was accepted, the broker’s wife turned into a crazed wolverine when dealing with the listing agent. If you’ve never had a crazed wolverine acting to protect your interests, it’s gratifying and a bit terrifying. They ended up with a $16K commission for 18 months of working with me, taking me to places from Long Beach up to West LA, and then five weeks of MMA fighting with the listing agent. Because it was a distressed property and we’d had our own inspectors go through everything, I knew the place needed about $25K in repairs before I could realistically move in, and my eyes were open throughout the whole process.

I’m of the opinion that they earned their commission, but I’m also aware that they are not typical RE people.

Speaking of Inglewood, new study shows harmful particles from airplane landings occur up to 10 miles away from airport.

http://www.latimes.com/local/la-me-0529-lax-pollution-20140529-story.html

The research, believed to be the most comprehensive of its type, found that takeoffs and landings at LAX are a major source of ultrafine particles. They are being emitted over a larger area than previously thought, the study states, and in amounts about equal in magnitude to those from a large portion of the county’s freeways.

It further concludes that areas affected by aircraft exhaust at major airports in the U.S. and other parts of the world might have been seriously underestimated.

Yes. Often people worry about the noise from airports but not about all the contaminants they’d be ingesting. And there are smaller airports all over LA. Trying to avoid flight paths and major roadways around housing is quite a challenge here. Then there are the refineries and various superfund sites leftover from California’s grand aerospace/military history–quite the toxic mess.

Oh and it all blows over the “prime” SoCal beach cities during Santa Anas.

I suppose you might be able to lessen the car fumes if you lived up in the hills (Topanga, Laurel Canyon, Beverly Glen, etc.), but then you must worry about forest fires.

I’d hate to live up in the hills. I’d feel trapped with all those narrow, curving roads. And living amid those dry trees and brush — I can imagine a major fire breaking out, panicked cars trying to escape while emergency vehicles try moving in the opposite direction.

“Then there are the refineries and various superfund sites leftover from California’s grand aerospace/military history–quite the toxic mess.”

20% of the particulates in Socal originates in China.

“And there are smaller airports all over LA. Trying to avoid flight paths and major roadways around housing is quite a challenge here.”

Here in the west SFV no immediate airports nearby and yet the sky is almost constantly blaring with jets, planes and helicopters. This is particularly bad and quite noticeable for someone like me, who has a recording studio which is not sound-proofed.

Speaking of harmful particles did you know that kale is both and antioxidant and detoxifier?

http://www.mindbodygreen.com/0-4408/Top-10-Health-Benefits-of-Eating-Kale.html

“Kale is filled with powerful antioxidants. Antioxidants, such as carotenoids and flavonoids help protect against various cancers.”

“Kale is a great detox food. Kale is filled with fiber and sulfur, both great for detoxifying your body and keeping your liver healthy.”

What? Excellent post from otherwise the village idiot. Thanks! 🙂 Kale is awesome!

Christie , Christie, Christie,

Someone else has already earned the title “village idiot”. I will have to seek an alternate title as I have no chance competing for it in this space. There was actually a reason for my what would seem to some like a random comment. I sometimes wonder if others are just pretending to not understand the real meaning behind my comments or if they really don’t get it. I really hope it is the prior and not the latter…

I think this was first show in 2010.. into the property standoff/malaise (still at very high house prices), before raging house price reflation.

Estate agent infestation – (BBC: Stewart Lee’s Comedy Vehicle)

http://www.youtube.com/watch?v=Fu8pIeeoZcg

I think this was first shown in 2010.. into the property standoff/malaise (still at very high house prices), before raging house price reflation.

Real Estate agent INFESTATION – [2 minutes, 19 second clip]

(BBC: Stewart Lee’s Comedy Vehicle)

http://www.youtube.com/watch?v=Fu8pIeeoZcg

Brilliant!!!!!

Yes it is!

Thank god for the realtors. For a while I was trying to get an offer accepted on a home in a great Newport Beach area. I was using redfin, and I kept on getting outbid.

So, I contacted a realtor who is a known expert in the area. He went and knocked on doors in order to turn over a willing seller. Then, he worked a deal between us. After we had a signed deal, the house was put into the MLS for backups. The multiple offers came flying in, but it was too late. The home was mine and the backup offers were hoping I did not close. But I did.

Here we are about 16 months later, and the home has skyrocketed in value. Up at least 500K, which is about 35%. And, I continue to get letters from people wanting to buy it from me. Not a chance. It is being rented out. I will never sell it. The realtor was worth every penny.

jt – you are making my point…

What? What is your point?

“He went and knocked on doors in order to turn over a willing seller.”

(BBC: Stewart Lee’s Comedy Vehicle)

http://www.youtube.com/watch?v=Fu8pIeeoZcg

“The Realtor was worth every penny.”

Every penny? What penny? You didn’t pay a freakin’ dime for your realtor’s services. The seller had the honor of fitting your bill.

Whenever someone tries to justify a Realtor’s worth their writing quickly devolves into illogical gibberish

Get ready kids: http://www.latimes.com/business/realestate/la-fi-re-jpmorgan-mortgage-lawsuit-20140530-story.html

LA County is suing JP Morgan Chase over predatory mortgage loan practices

@ JT….some of these bubble heads have just stupid bone head comments and should be taken as that. RE will always have a niche, perhaps not like the good old days but they will, as well as the internet start ups to capture some market. Everyone wants a piece of “any” pie, welcome to free capital folks! Change, improvise or improve, or else you’ll be history. That’s why I ignore 95% of the comments on this site 🙂

Leave a Reply to GenXer