Real Homes of Genius – Prime Bel-Air zip code lists only 1 foreclosure while shadow inventory has 56 properties, twice the entire MLS data. Chasing the market down from $1.5 million to $870,000.

Last week the California unemployment rate shot back up to 12 percent. Couple this with the underperformance of revenue for the state and we have heavy headwinds ahead. It will be a herculean effort for home prices to remain inflated in bubble markets as the economy and incomes slump. Part of what has held up the housing market in many areas is the building up of shadow inventory to control supply and try to increase home prices. This has been a dramatic failure and has cost the U.S. taxpayer trillions of dollars simply to keep the too big to fail banks afloat with financial swindles. There is no reason for this policy to continue unless we want to have another lost decade for our economy (this seems to be the path we are embarking on). Even prime locations are having a tougher time in this market. Today we will take a look at a home in the Bel-Air neighborhood of Los Angeles that is chasing the market into the bottom. Today we salute you Bel-Air with our Real Homes of Genius Award.

Bel-Air market not immune to correction

Listed   11/01/10

Beds     4

Full Baths            4

Partial Baths      0

Property Type  SFR

Sq. Ft.  3,656

$/Sq. Ft.              $238

Lot Size 4,800 Sq. Ft.

Year Built            1992

This place is definitely a more modest home in the Bel-Air zip code. The home has four bedrooms and 4 baths. It was built in 1992 and includes a nice kitchen:

Here is the text in the ad:

“Reduced! This will not last – hurry! Buyers purchasing a property as owner occupants may be eligible to receive up to 3.5% in closing cost assistance! Explore this canyon gem and you find 4 spacious bedrooms and 4 full baths including a master retreat with fireplace and reading/office nook, jetted tub in master bath, walk-in closets, upper level laundry, living room with vaulted ceilings, family room with fireplace off the gourmet kitchen with viking range, bedrooms on ground and mid-level. A must see, too many details to mention here! Termite clearance and roof cert too!â€

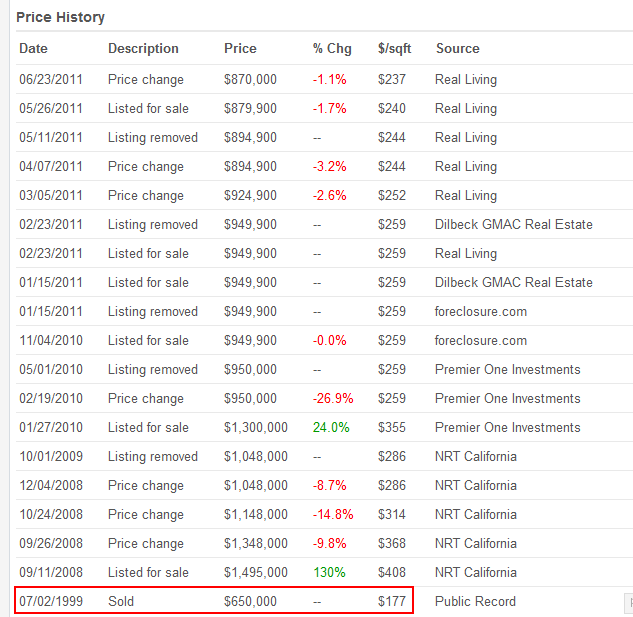

3.5 percent closing assistance in Bel-Air? This goes to my point that many in Southern California (most) actually do not have the incomes to support the outwardly expensive lives they live. Why would someone need closing assistance if they are purchasing a home in Bel-Air? This is like offering someone in Beverly Hills that is purchasing a home a coupon for a new toilet when they close escrow. Let us take a look at the pricing history here:

Here is someone that waited one year too long to exit the market. If this home was put on the market in early 2007 it would have fetched $1 million and more easily. Yet listing it in September of 2008 when the markets were imploding in historical fashion was not exactly good timing. The chase to the bottom is rather clear. It went from a listing price of $1,495,000 to the current list price of $870,000. Will this home sell at that level? Hard to say but you will definitely get interest in Bel-Air when you go under $1 million.

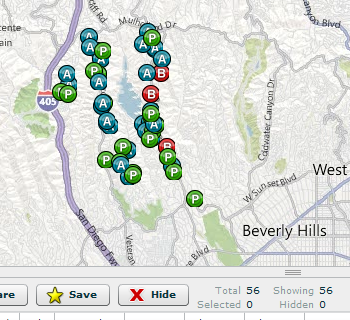

Of the 23 homes listed on the MLS for Bel-Air 3 are short sales and one home is listed as a foreclosure. Yet this does not tell us the entire story and this is the continuing saga of problems that we will be facing for years to come:

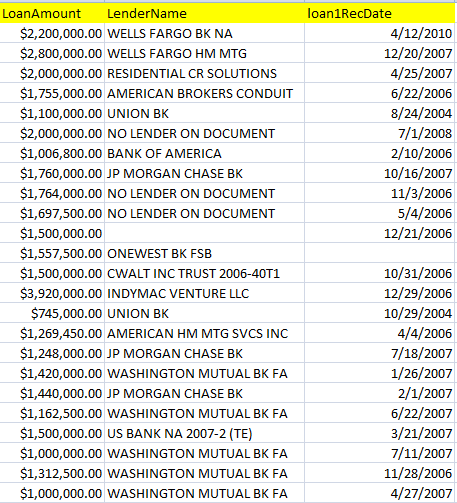

56 homes are in the shadow inventory for Bel-Air yet only 1 foreclosure has made it to the MLS! What is even more disturbing is that many of these homes in the shadow inventory were purchased right at the peak:

Ah yes, a very familiar list of lenders we see here. WaMu, IndyMac, JP Morgan, Wells Fargo, and Bank of America. Look at when the loan was recorded. Many of these shadow inventory properties were purchased during the mania in 2006 and 2007. This is only a sample of the 56 homes in the foreclosure pipeline. The shadow inventory is a big issue although the media wants to make it seem that it is only occurring in poor neighborhoods. Of course they don’t want to focus on neighborhoods where many of their executives live.

Today we salute you Bel-Air with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “Real Homes of Genius – Prime Bel-Air zip code lists only 1 foreclosure while shadow inventory has 56 properties, twice the entire MLS data. Chasing the market down from $1.5 million to $870,000.”

I was on redfin, and all communities I looked at were showing that, on average, houses were selling below the asking or listing price. Are there any so-cal zipcodes where this isn’t true. I only looked at around 20 over the past few weeks.

I’ve been tracking asking price drops in 4 different neighborhoods in and around Burbank since last December. Each area has dropped in asking price by about 5%.

Ouch, that looks painful. Should have just listed it for a reasonable price in 2008 and been done with it. Ahh, but humans are by nature optimists, especially Americans, most especially Californians. So they listed it for $1.5 Million in 2008 and have been trying to deny reality for the last three years. Things like this remind me to check my own innate optimism.

Or maybe the sellers are the smart ones. Maybe they stopped paying years ago and have been living rent free, making out like bandits and laughing at all the people like me still paying our mortgages.

I wonder if this is a Fannie Mae property. The 3.5% closing cost assistance sounds like one of the FNM programs.

SM

The banks don’t want to get into the rent-to-own business, but that looks unavoidable. Set up subsidiaries to handle the rentals. That way they can create some cash flows and wait it out before selling in 7-10 years into a more stabilized market. Also buys time to shore up their balance sheets for the ongoing carnage.

They’ll be forced to think outside the box come this time next year. Of, course that assumes they are thinking at all.

Nice to hear someone realistic about 7-10 years instead of the 6-12 months we’ve been hearing about the last 4 years. I don’t see it coming back at all.

When the DOW virtually hit 1000 in 1966 there was 15 year bear market until 1982 when we tried trickle-down voodoo economics and started the parade of fiat spending and reckless fed actions that led to the bankrupt state we are in now. (1983 was the depths of main street despair in that sharp recession, although Manhattan was doing OK). At that time, throwing darts at the stock pages was not considered a viable path to wealth, but real estate was. Now most intelligent folks realize it’s a minefield either way.

I expect there may be a few more dead-cat bounces, but we may also be on a perpetual downturn as the massive, inevitable Uncle Sam’s Club default is realized. The teetering banks are holding 1.5 Quadrillion in derivatives now (1.5 million billion)…think the housing bubble was big? There are only 7 billion humans. Do the math…

Are you just assuming that it’s inflation that will bring the prices back? Because if that’s the case… isn’t it better to be invested in something that holds up against inflation?

BTW, remember the late 80s. We didn’t hit bottom until 93. We hit the peak in 88. Five years. We’re just getting to 5 years on this one, and the drop is a bit larger. The bubble was a bit larger, due to derivatives, helocs, etc. (The 88 crash was due to the S&L crisis, which was the movement of money out of savings accounts to more lucrative bubblicious equities and other things. This latest bubble was inflated by money moving from high-risk investments like stocks into allegedly more stable assets like property.)

I’m starting to hear more and more mutterings from politicians about changing Prop 13. That would really help things along. Enough people lose their home ownership and the majority of voters may find this not too annoying.

Property tax should be completely abolished. It’s based on subjective evaluations and is completely unquantifiable. We already pay income tax, so why the need to double dip? If we must tax the value of the land, then calculate it by the square footage of the property, and not some tax assessor’s idea of what the tax should be. The bigger your property, the more you pay. Sounds fairly reasonable to me.

Currently they are talking about getting rid of prop 13 for commercial buildings not on primary residences. At least that’s what I read last week. Have things changed since then?

Please explain how eliminating prop13 would affect me. Would my property tax increase or decrease? Share your knowledge. The way I understand prop 13 is, it caps the annual amount tax can be raised. Will property tax still be based upon purchase price, as it is NOW?

Crap, what an ugly house. Is that the back, the front, where’s the front door? Is that garage thing an addition? It looks like it’s sliding downhill.

Have the kitchen cupboads been built across the windows? Very weird.

Over a million $$ for this abomination of a house. Egads.

There are places like that all over the region’s canyon communities. I’ve had occasion to visit many in my working life but I’d never want to live in one. The roads leading to them always appear on the verge of being rendered impassable by a bad rainy season, and often have.

You don’t live in one of those without planning for the possibility of being trapped there for a week or more.

I noticed the cabinets across the windows too! LOL

Its hard to believe that a competent remodeler would put cabinets across windows, or that a buyer will look at that without saying WTF!

Fancy cabinets are as much a belieft system as “real estate never goes down”

“Crap, what an ugly house. ”

At first glance, I thought it was an ancient house that had been added onto over the years by carpenters with no taste.

Instead, it appears someone intentionally designed and built this blight on the neighborhood relatively recently, perhaps in two stages.

And that poor garage looks like it’s going to collapse under the weight of what I’d guess to be the “Master Suite”!

Very ugly house, not the kind of place I associate with Los Angeles or a neighborhood like BelAir. Kitchen full of cheap cabinets and mismatched appliances, what a disaster.

So many beautiful houses for sale for prices no worse in areas like BelAir and Los feliz. By the way, is Los Feliz still considered to be a prime neighborhood? It is surely beautiful and historic, and the prices are getting reasonable.

Finally, some are starting to see the reality of the housing situation. We are in for a long haul, before we reach the bottom. No more 2009, 2010, 2011, 2012. It’s more like 2016, 2017, 2018 or 2019, before housing prices begin to rise again. With everything going on in the U.S. now, the housing market has forever changed.

Also, we have barely entered the FEAR stage of the Real Estate Cycle on The Westside of Los Angeles. That’s less than half way through the downside. At this rate, we will bottom out at 60-65% off 2007 peak prices.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

What they need to do is step aside and let a big washout take place. Yes, it would be painful. But it would also be short. A lot of banks would fail. What they need to do there is take the ‘too big to fail’ banks and other financial entities and break them up into smaller pieces that are NOT too big to fail. The alternative is a lost decade, or like Japan, two lost decades, and counting.

What if they step aside and let the whole housing thing collapse? Then people can step in buy, with 20% down, since 20% of 50,000 is a lot less than 20% of $130,000. People with one house will be way underwater, but they will be able to buy a second home, and that second home will not be underwater.

Once the deal bottoms, then builders can get a grip on the situation, in terms of the housing needs of the nation. Knowing that the bottom is in, they can build 1000 sq-ft starter homes, with the high probability that they will be able to sell them. Employment will tick up a little.

My guess is that the banks won’t let this happen, and the American people won’t elect independent politicians until the situation is much worse. Perhaps by Nov. 2012 the situation will deteriorate enough to cause real change, but probably not until 2016. Sorry for being so pessimistic.

With the banks keeping the housing off the market it almost sounds like an Anti-Trust case.

“This is like offering someone in Beverly Hills that is purchasing a home a coupon for a new toilet when they close escrow.”

-You succeeded in eliciting a spontaneous outburst of laughter from me which I was most ill-equipped to suppress Mr. Doctor Sir.

After reading about the cabinets, I looked at the picture again. Wow!! What moron build cabinets over windows?

Well the actual counting of the foreclosures in process in the Bel Air immediate area, shows that this slice of the “shadow inventory” is real. How timely: the mortgage bankers association today made clear that their method of reporting shows very little “shadow” of this slice in California. Florida, yeah, it is bad, but not in California. “the percentage of loans in foreclosure in California (3.6 percent) is considerably lower than states like Florida (14.4 percent)” . They also help define the depth of the national slices of the shadow inventory and I leave it to Drhousingbubble to issue a more pithy reply to MBA than I can, but even by their own numbers (however they claim to even know), the shadows are just huge. They do say it is worst in California and Florida, but as is pointed out here often, once the trend down accelerates all the factors make what follows worse and worse as is shown exactly by this post. So all you states who think you won’t follow the path of Florida or California or Arizona, don’t be so sure.

The “shadow inventory” has at least four slices, then, those post-foreclosure owned by banks and by flippers not listed, those pre-foreclosure over 90 days starting to be foreclosed on, those not listed for short sale or otherwise over 90 not yet foreclosed on, those in default under-90 that will be foreclosed on statistically, and the percentage of those not in any default that will predictably be added to the morass within a certain time such as a year. That leaves what is suggested as the OTHER great shadow, those who want out, aren’t in default, may or may not have equity, and will dump at the slightest uptick in prices (which uptick just doesn’t ever seem to arrive). Anyone got yet another “shadow” category to add?

These are mostly homes along Beverly Glen Blvd (or Roscomare), which are the 2 busy & narrow “thru” streets that valley dwellers take to get to the westside. Beverly Glen Blvd. in particular has very small crammed-together lots mostly with no driveways. Lots of run-down homes here.

Not that the general points about noplace being immune and hiding shadow inventory aren’t true, but THESE foreclosures are mostly not what people think about when they think “Bel Air”.

This ghastly house fills out 76% of the lot… kinda pushing the definition of SFR, lol. Also explains the very close cropped photo. NOT SURE WHY DrHB DID NOT INCLUDE STREET ADDRESS? He usually does.

Oh, and for those who are confused by this inarticulate house design, yes, the front door is right there in the driveway, just to the left of the garage door. What a Christmas card photo setting, eh?

The left wall of the garage might well be a foundation wall, and thus offer no entry to the house from inside the garage. Classy. At least the little overhang protects you from the weather, as you transition from your detached-attached garage to your bargain basement front door. Very upscale. 🙄

Between this entry door and the garage is a small black rectangle… not sure if that’s an intercom… or a gun port, a la armored cars, LOL.

Still, I think BelAirHead is right, and that’s probably a VERY noisy “side” street.

Almost every window (and vent grate) is architecturally incorrect for that house. The garage door is a winning design… from K-mart. The kitchen cabs are SO run-of-the-mill contractor-grade they make me gag, and triply so in a house of that price range.

Would be illustrative to have the address, which leads to owner name… which leads to public records, incl (in FL anyway) court records, which would tell the real story of this sad house, and its tragic loan(s) and market history.

All of the above, plus… THE KITCHEN CABS COVERING THE WINDOWS, firmly cement this house in the “RHoG” Hall of Shame, LMAO! I must’ve missed the program-the-consumerist-sheeple HGTV episode where storage for dishes became more important than a view… unless the “view” is a neighbor’s wall, a mere 5′ away. =:O Is that the kind of zoning you get in Bel-Air????

D’OH! Due, no doubt, to the subdued green color and cloudy day, EVERYBODY missed it–even The Doc himself–yep, I’m talking about the crowning RHoG trademark:

The GARBAGE CAN as part of the OFFICIAL SALES photo! LMAO! I mean really, even for 3%, or even 2% commission, how much of a LAZY Real-Tard do you have to be to NOT move the garbage can… esp. when it’s on wheels. Lawdy.

The orange cone and jury-rigged chain round out the Beverly Hillbillies scenario. 😀

On the interior, the apparently incompletely installed dishwasher is displaying some kind of label on the right edge. The desperate owners definitely have obviously hired consummate professionals to move this Bel-Air gem.

I like the way CrisNet is clearly short for CrisisNet!

You… are… CORRECT! 1110 North Beverly Glen Boulevard, Bel Air, CA 90077

Wow, double-yellow lined street, near ZERO setbacks… presumably there are street signs “No Children Allowed”, lol. There’s also some VERY UGLY shacks/additions nearby. This very-thru-blvd. is also a major utility right-of-way, so you’ve got some intermediate/industrial sized power lines running feet from your front windows.

The GInormous size of the STORM DRAINS which are semi-integrated with the curb tell the story of how “exciting” things get on this VERY steep slope when the rains finally arrive. =:O

I’m NOT a local, but… that appears to be perfect setting for a RAGING SWIFT-MOVING CANYON FIRE… yes/no? Anyway, fairly harsh setting… NOT the image summoned by the words “Bel-Air”.

Something staggering occurred to me today…

The states where foreclosures are highly concentrated are California, New Jersey, Illinois, New York, Florida…

All of those states are in the top 10 state GDP producers for the US… In fact, those five states alone account for 35% of the US GDP.

Because the US makes up about 25% of GLOBAL GDP, those 5 states alone account for close to 8.75% of the GLOBAL GDP.

Think on it.

http://www.thecashflowisking.com

The states where foreclosures are highly concentrated are California, New Jersey, Illinois, New York, Florida…

hmm, strangely enough those are all the states with the most jews also, although i myself am jewish, but im just wondering it must be because jews invest more than others and probably put more money into their houses

Err, umm…

If Duh Jooz really are a “bloc” as you (facetiously) imply, then PUH-leeze call your “homies” at Goldman-Sachs and give them this message from We Duh Gentiles: “We surrender! Uncle!” =:O

What would happen if Prop 13 were overturned? Would it put more downside pressure on prices with an abundance of supply from people selling to go to a low tax state?

People who have lived in their homes a long time would be seriously sqeezed. Think of older, retired folks who live on a fixed income. They would be royally shafted. Along with people who are seriously in debt, and can’t afford the tax increase.

And businesses, too. They get a tax break on their property that they’ve owned for decades.

Prop 13, I feel, was unconstitutional.

It created a situation where future generations must pay for the debts of prior generations. Debts were incurred based on collection of increaslingly unfair property tax. Now those tax revenues are falling with crashing real estate market, and these tax revenues are no longer covering related state/local government debts.

According to GAAS, Govt. Accounting Standards,

it is illegal for one generation to burden another.

With the boomers and their parents benefiting from pensions, health beneifts, social security, tax benefits/cuts for the wealthy, nearly-eliminated-inheritance tax, allowing banking deregulation, and lapsing on loads of debt their generation incurred, boomers and their parents are now sticking future generations with boomer financial burdens. Where was the GAO (US General Accounting Office – the official govt. auditors) when budgets were reviewed each year???

Last we are increasingly feeling the effects of pollution/environmental damage to property and health which was caused by boomers and their parents but is left to future generations to clean-up. Take fracking (pumping 100 toxic chemicals (toxic waste they do not want to properly dispose of) below the ground and creating explosions to release natural gas (all the way up the coast from Ventura County on up)) for example, and what it does to drinking water.

DH if not “off topic” can you publish toxic hazard maps in LA/OC so property owners/renters can be aware, from the aquafer to the air we breathe, and show surrounding average price for SFR (exclude condos/townhomes). Start around port of LA/Long Beach, the refineries, McCall dump, that dump in So. HB, property w/in 1/4 mile from any freeway, etc.

DHf not “off topic” can you publish the effects on LA/OC of an 8.0 earthquake on San Andres fault and what that would equate to when it hits LA/OC after it compresses between San Gregonio and San Jacq. mtns. Also 8.0 on Newport/Inglewood fault.

You are incorrect. Property taxes get rasied every year. You obviously don’t know anyone that owns anything, and don’t own anything yourself. Start paying property taxes then get back to me. Prop 13 LIMITS the percentage PER year it can be raised, it doesnt HOLD tax to some 1950’s assesment. Wake -up. Note: Property tax is built into the RENT (price) you pay. No free lunch!!

Dude, Surfadickt, I have owned many properties. My point is I know many owners with appraised value of 2 mil that pay $600/yr in prop tax. New owners pay $20k/yr in prop tax. Yes prop tax goes up but not really.

I doubt Prop 13 will ever be entirely overturned – to keep poor old people from being forced out of their primary residence, which was the main reason why prop 13 was passed in the first place.

Prop 13 just needs to be cleaned up, i.e. it should be eliminated for

1) businesses

2) second homes

3) investment/rental homes

4) high net worth individuals (something like $10Million+) – no I will not cry over some old lady being forced out of her $50 Million Santa Barbara ocean front villa

Yes, some people will say that #3 will cause rents to rise, but I believe that rents can only be raised as much as the market supports it, so more landlords will be pushed into a negative cash-flow position, which will lead to more short sales and foreclosures…

Pretty sure that’s what is currently being discussed 🙂

Nice summation. You’ve basically described Florida’s “Save Our Homes” (SOH) Act, passed in the mid-90s, with the benefit hindsight, i.e. 15 years of what was oh-so-NOT-working-out with Cali’s Prop13.

One look at FL’s state budget vs. CA’s will tell you our system is working out a LOT better, and more fairly. Sure, I *wish* it applied to my little 2, 3, and 4 unit rental props, but no prob, since it’s UNIFORM and FAIR, and thus built into the rents. At the end o’ da day, PO-lice, schools, and drainage gots ta be paid for. 😉

And to add some numbers to the fire, check out the official FHA chart for California, from the beginning of 1991 to Q1 2011:

http://www.fhfa.gov/default.aspx?Page=86&Area=State&AreaID=CA&PurchaseQtr=1991Q1&ValuationQtr=2011Q1&Price=$729,000

If you zoom in, you’ll see that everything lately is all downwards. And this is with interest rates being at incredible lows.

Yes, buy now. At this rate, you’ll be underwater in no time. Sort of like buying Real Estate on the Titanic.

Wow. I plugged in the numbers of a friend’s house that was bought with FHA last year. They paid $708K, now it valued at $660K! I knew they were nuts having put down only like $21K.

Why is that “nuts”? In this market, and at these low mortgage interest rates, that was SMART. They’re probably underwater, and will probably get more so, but it’s mostly THE BANK’S MONEY… that’s smart, i.e. walk-away ready… may not be moral, but it’s as moral as the bankSters want us to be. 😉

Can anyone steer me to a good site on the state of affairs in multi-family real estate. I am leaning towards buying a 4 or 5 unit building in WLA and living in one of the units. Although I lose the amenities of a front and/or backyard I have residual income for the rest of my life. Of course I would hire a property manager because I am under no illusion that dealing with a few tenants would be easy.

Doesnt seem to me that apartment building prices have come down much because rental rates have not come down much.

Patrick.net has some (allegedly) good rental rate info out your way, for a pretty low subscription price–doesn’t cover my area, never used ’em. Also there’s pro sites like Core Logic and RealtyTrac. Also check out the cash flow site mentioned in the comments above.

Best is just walk the ‘hoods you’re interested in, early evening, talk to folks. Also pose as a prospective tenant, just call mgt. company # on sign and ask what unit X rents for, deposit amount, what’s included, maybe meet up for a showing, etc.

I had to give some rent reductions back in 2009, when “For Rent” signs were at a max here in Fort Laud, FL, but now those signs are fewer, and rents are firming up again as the squatters are FINALLY booted from their Countrywide Alt-A Bogosities, and stimulus money make-work (stadium) projects FINALLY get shovel-ready. 🙄

Dealing with a small number of tenants is no problem IF YOU SCREEN THEM EXTENSIVELY. (Atenantscreen.com is a gem.) Set up a website with secure/SSL online application, which makes clear that applicants WILL have their background checked for: criminal, civil, domestic and eviction actions, along with FICO score and employment history, previous landlord references, etc…

Don’t even put a phone # on your “For Rent” signs or ads, just your website… YOU call them… AFTER their app checks out. I mean who doesn’t have computer access? Ex-convicts, parolees, registered sex offenders, homeless addicts, motel hookers, the criminally insane… I mean, I guess if you’re going to be living there YOURSELF, you’ll do all this in self-protection, lol.

OTOH, if you want to slumlord–obviously there’s a market there (Section 8)–you’ll give a big chunk of your profits/blood pressure to a mgt. firm, collection firms, your attorney, the clerk of courts, the drywall guys, etc… but Duh Fed reimburses you for SOME of it… I hear.

I live at my rental property but have a really great management co.

I’ve been thinking the same thing also, purchasing a multi-unit, or at least a duplex. Lot’s of places have tenants in place already, paying below market rates because of rent control. I think those buildings are lingering on the market because of the tenants and the frothy if not bubble asking prices. I hope sellers will consider that a negotiating point, but you might be looking at buildings that are empty.

Prop 13 passed in 1978 and was seen as a very good thing, back then. It may have turned into some unfair monstrosity, but that was not the initial elan.

Prop 13 was placed on the ballot because government (state and local) was using RE tax as a major source of revenues. A few years earlier the price of homes had started to take off. [ I recall a LATimes headline saying that in some parts of OC real estate had gone up something like 40% in one year.] This is also when RE gained the ribbon with “it only goes up” written all over it, in CAPITAL letters.

Consequence of the ever larger tax-bill, many people were priced out of their own home, which was already paid for or nearly so. No doubt, some recall the cases of people having to sell their home (which were very over-water, naturally) in order to pay their tax bill. Retired citizens that had lived decades at the same spot. Priced out of their neighborhood. To rub yet more salt into the wound, there were around some remnants of the Big Society Welfare Programs and people just got pissed with the scene.

Again, Prop 13 was initially very desired. Now, it may be another thing. It looks like it is time for another Proposition in the ballot.

Leave a Reply to Skepticus Maximus