The zero down mortgage is back and it starts in San Francisco with Poppyloan: Need $2 million for a shack but don’t have the money? No problem!

The Taco Tuesday house humping brigade is having a tougher time denying that we are in another bubble. Sure, they keep pointing to prices going up and rents surging but what about stagnant household incomes or the stock market getting kicked between the legs? According to these delusional Kool-Aid drinkers, everyone is saving money and is perched on the fence ready to bounce on that piece of crap real estate that was built during the Great Depression. “But we don’t have no down payment loans!â€Â Of course much of the move in prices over the last few years came from investors, foreign and domestic, that drove prices into the stratosphere. In the Bay Area, with the typical home selling for $1.2 million, even high income tech households are unable to buy. And you really have a double bubble. Easy venture capital money is trying to find those next mystical unicorns (i.e, Twitter, Facebook, SnapChat, etc) but this is another symptom of hot money trying to find a home. All of this growth is predicated on prices only going up. With households broke, a new product called a Poppyloan is here to save the day bringing back the zero down option. What could possibly go wrong?

The zero down Poppyloan

The house couch humpers keep saying that there are pockets of massive demand just waiting to erupt like a volcano. However, when you actually look at demographics, Census figures, and grown freaking adults living at home that theory falls by the wayside especially when it comes to buying a $1 million crap shack.

But of course this loan was made for households with massive incomes and giant down payments stuffed in the mattress right? We have millions of grown adults in onesies roaming in their childhood home saving bags of money so they can have the privilege of living in a dilapidated piece of junk.   Uh, not exactly.  Here comes the Poppyloan.  As in this baby is going to pop!  We’ll let the credit union explain why they created this loan:

“(SFFCU) Why did we create POPPYLOANTM ?

We were seeing too many people interested in home loans, who were qualified in every way, and either didn’t have enough money saved up, had to tap into their retirement accounts, or needed to borrow from a family member for the 20% down payment required for a conventional mortgage loan.â€

Did you get that? No down payment funds stuffed in the mattress. Basically these prospects have in all likelihood, a career in tech companies with good incomes but have little savings. Some are so horny to buy, they tap into their retirement funds to get cash for a down payment. You realize even with a paid off house you still have taxes, insurance, and maintenance that go on forever? How are you going to buy all those tacos when you are old and barely able to get out of bed? That is why you have a retirement fund! This is another argument that you can have in regards to renting versus buying. If renting gives you more funds to save for retirement, this may be a better option. This is especially true for tech companies in the early stage that transform dramatically.

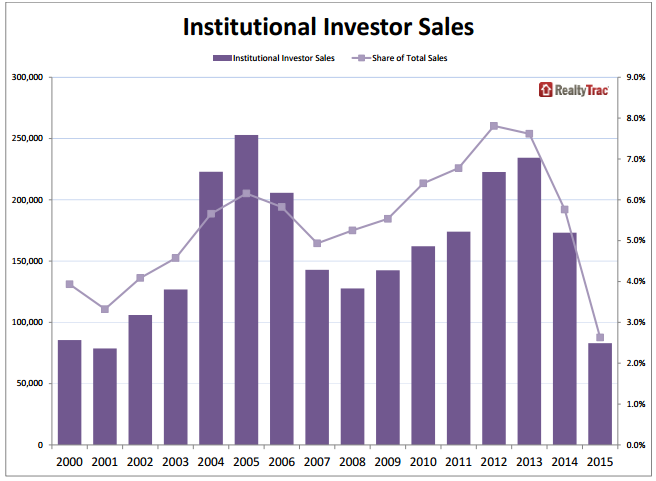

This loan has a market because the music is starting to run out on this inflated market. You are starting to run low on investors:

So with investors running the numbers and realizing prices are crazy, time to tap into the rental market:

“We also see Bay Area rents skyrocketing. It’s not that people can’t afford to make a house payment (look at the amount of rent that’s being paid!), it was the lack of funds or access to the size of down payment that is typically required. We wanted to find a solution to this growing problem and help our community.â€

Ah yes! Let us help the community by keeping prices stupidly high and putting borrowers into a precarious final situation with no equity from day one. The same argument all the house lusters make. Rent is flushed down the toilet so why not build equity? Then again, here you’ll be paying the credit union 30 years for a mortgage and what you get is the privilege of living in a crap shack. And again, this institution with a front row seat is telling us the biggest problem is people just don’t have the funds for a down payment. San Francisco is running a bubble in housing and a bubble in tech. The NASDAQ better have a good year or a correction is going to happen.

And that is another point. How stable are these tech companies going to be? The underlying assumption is that things will always change in tech. Yet you are willing to take on a 30 year mortgage with zero down for a $1.2 million crap shack?

In many cases, the big impetus to buy comes from actual house humping. People get into kid mode and all of a sudden all rationality is thrown into the wind. Do people realize how expensive child care costs are in the Bay Area? Some massively underestimate this cost. Have two kids and buy that home and you’ve suddenly added massive fixed costs to your budget.

“(Nuturelist) Though we’ve seen infant daycare rates edging above $2,000 per month per child, daycare continues to be the most affordable and reliable option when compared to hiring a nanny or entering into a nanny-share agreement. At an average rate of $24 per hour for a nanny in San Francisco, and assuming 50 hours a week and 4 weeks a month, a nanny will cost approximately $4,800 per month and is more expensive than daycare even when the cost is shared by two families. Additionally, nannies require a significant amount of management overhead from parents, are subject to greater risks of turnover and unexpected absences, and involve managing a relationship with another family in the case of a nanny-share.â€

You read that right. $2,000 per kid. So now you have an insane no money down mortgage for 30 years and with two kids on the way, you are going to be dropping $4,000 per month for a few years if you are both tech professionals.  And of course these professionals want the “best” so they won’t go for more affordable daycare in cheaper markets.  This is the tech rat race.  In the end, all you can afford is tacos for dinner! But of course for those delusional housing cheerleaders prices keep going up, therefore buy now or be priced out forever. The argument is that these people have good incomes – yeah, so long at the tech bubble keeps raging and people want to value non-profitable companies for insane prices. Also, their incomes were not good enough to stash away 20 percent down (or even 10 percent in many cases).

The zero down mortgage is back and ironically in the most overpriced area of the country. Â Go get those Poppyloans!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

136 Responses to “The zero down mortgage is back and it starts in San Francisco with Poppyloan: Need $2 million for a shack but don’t have the money? No problem!”

Housing TO Tank Hard SOON!!! The Big SHORT 2.0

oh wait, we need to see 103% loans before this really tanks

I seem to remember 120% loans pre-crash.

I have a question for the TANK HARD crowd. Do any of you predict a national tank, or only a Los Angeles tank?

What about Seattle, which has a stronger economy than does L.A.?

Same as 2008. Tank all over no matter what, but massive tank in Bay Area LA. Prices that are currently closer to median US average will tank less. Those well above the median average will TANK HARD!

Get the presses ready Jim!

Apparently not so if they pull the NIRP rabbit out of the hat. Wolf Street thinks it’s already a done deal. http://wolfstreet.com/2016/02/02/negative-interest-rates-already-in-feds-official-scenario/

@tolucatom

In some ways I think the NIRP will almost force people to have to invest or hold real estate or other physical assets. Why keep money in a bank if they are going to ding you for holding it?

Question then what happens after NIRP? Everyone walking around with gold and silver coins or debit/cash cards? Sounds bleak what the future holds.

-all IMO

The biggest dilemma for all trying to buy (myself and my kids included) is the fact that to get into a job with 100K annual salary, one must have a college degree. College costs have risen to the stars under the Obama Administration, so the exiting student can now look forward to skyrocketing student loan payments. PhD’s and Master’s level students might qualify for those $100K annual salaries, but they are saddled with at least 1 1/2 years salary in debt (with Fed loans averaging 6 and 7% for the last few years.) Even if they made enough money to qualify for a loan, their student debt makes qualifying for a house in Cali nearly impossible.

They live at home because the reality of their situation demands it. They CAN’T qualify to buy a house, even if they WANT to. Just watch. The next financial crisis will be all those “irresponsible” student loan borrowers. Money at this point goes to paying everyone else and they still can’t afford to exist. Last time I checked, it was called slavery when everyone owned every dime you made and you ended up with zilch!

I agree. i think right now the student loan debt problem is a slightly bigger issue than affordable housing. Part of the reason housing is unaffordable is because of the large student loans people are paying off. If you have to pay $500-$1000 a month in student loans, even renting becomes difficult.

Good observation, Maria. I was saying on this forum many times before that life for most people in SoCal or SF is the life of a slave.

Those who contradicted me are welcome to enjoy that lifestyle if they enjoy being a slave.

Or… Learn to plumb, carpent, or hell, I think its possible painting signs. There are as many ways to make 100 gs in this valley as there are to make 2 bucks an hour and there are plenty of ways to make 2 bucks an hour, just follow whatever rules “they” tell you to follow.

“Be where they ain’t” – Mohammad Ali, I think.

Alex in San Jose is right. I have a PhD in biochemistry and make about $160K. My wife has a PhD in biochemistry and makes about $95K. A member of my family that didn’t graduate high school makes over $200K in sales. Don’t confuse education with intelligence or success. Any retard can get a PhD, you wouldn’t believe the dopes that came out of grad school with me. And I’m talking about a top-tier institution that you associate with crazy geniuses. By the way, I spend a good amount of my time firing idiot PhDs that get paid $50K and will never amount to anything.

Dawg I like your bark. In a first world country, where college attendance is based on ability rather than on social class and race, I’d have a PhD. But I’m in the Evil Empire so really, I’d have done the best financially by learning to sell things.

I somewhat disagree with you. I don’t think you need to have a college degree in order to make that 100k …I know of plenty of people and trades where they are making that and then some. Even as a degree holder myself I would say if people opened themselves up to more specialized trades instead of some cubicle job they would undoubtedly join the workforce with less debt, than all of us carrying those student loans.

I don’t know about Seattle, but SF and LA for sure. The rest of the nation in pockets, but nothing as hard as Cali unless the president decides to give $100k annual stipends to everyone in Cali.

I’m certainly expecting it to happen here in Portland. The incomes certainly don’t justify the 10%+ increases per year here.

p.s. and I don’t know why I used the word certainly twice. lol

Hey I live in Portland too. West side of town. I was looking to buy this spring but there’s no way I’m going in at these prices! They are ridiculous. Really hoping they come down soon.

The view here from Chicago says the Midwest will see a minor drop, but nowhere near what the West Coast will experience.

Now that the Feds are considering negative interest rate. They are doing anything they can to support the on going economy and house prices. I honestly don’t think the house market will tank hard within the next 3 years, no matter how much I want it to.

This time is different? Haven’t they always tried their best to prop things up and failed…or have they?

Your reasoning is faulty because you attribute God like power to mere men (from the FED).

If things would be so easy as you make them to be and if the FED would have God like powers, there would be no more recessions or depressions. Alas, their “short” history of 100 years is full of recessions and depressions. Even now, if they would state the inflation the way they used to, the depression that started in 2008 never ended.

The faulty CPI makes the GDP to look positive when in reality it was negative for a long time. Even all this massage to the CPI is not enough to keep the GDP positive, therefore they came up with Obamacare. Only in this bizzaro economy we can make a tax (according to the Supreme Court) to look like economic growth. The wealth transfer from the middle class to the insurance companies (owned by the Wall Street banking cartel, the 0.0001%) in this “NEW” economy is called economic growth. It helps to produce a 0.7% GDP growth which a quarter or 2 later is going to be revised downward. Without Obamacare the GDP would have been negative even with the false CPI.

All this massaging of numbers in a central planned economy fashion can not hide the fact that 47 million people are on food stamps (called “soup lines” in the other great depression) and the whole economy is in a gutter.

A “hope and change you can believe in”!!!!….

The prices in Long Beach, Torrance and Culver City areas are insane too. Even though they look tame comparing to SF, we middle class wageworkers earn way less than counterparts in SF. Renting surged and wages went stagnant, we have less money to buy, tbh.

Try to dissuade yourself of your illusions, the bulk of the population up here is making $10 an hour, and Glory Hallelujah if they’ve got full-time hours.

Just curious Alex – where are you getting that pay information? Is it anecdotal? Median salary data says otherwise – closer to $20/hour in SF for an entry level tech support job, which is the bottom of the barrel (there is no worse job in tech). $90-130k for an experienced developer. That said, I know that a lot of companies will lowball newbies to the work force with $10/hour, even in professions that require skills you can’t find in typical outsource countries – like competent English writers.

Sloop John D. – If I had an “in” I’d happily yack on the fone for 20 buckaroonies an hour. I’m a natural phone worker, have a good voice and volunteered for Arnie’s campaign. I situated myself in the the middle of the phones volunteers desks, and they picked up on my technique so I made them better.

But you gotta have an “in” to get paid to do fone work. 20$ an hour? I wish!

Yohnnie-dee, I didn’t answer you question, did I? OK I ride a bike around, ride the bus and light rail, and get around in general with the general public. The general public is getting by on maybe $10 an hour, part time. They’re living 12 in a house. Dad’s pushing an ice cream cart, moms got her barber license and is doing $10 buzz cuts, and the kids are out delivering papers or slanging drugs. Maybe washing dishes.

Washing dishes is a good job in this valley. I’ve considered going into that but was worried about getting cut ôn knives. Then I realized the cooks keep the knives to themselves. Then I was talking with a guy who’d been a dishwasher and he said the danger was in broken glasses, he’d had a finger nearly cut off. Damn. Dishwashers often get leftovers too. I just can’t risk it. I needs my fingers.

This flip is a good example of the insanity in LB: https://www.redfin.com/CA/Long-Beach/3235-Gondar-Ave-90808/home/7566772

Doc, you keep banging on “soaring rents” but you’re behind the curve on this along with the MSM. I’m continuing to observe a lot of weakness in rent price movement on the west side.

New Playa Vista development to release several thousand apartments between now and July…

New lease from the Irvine company and no increase in rent. Surprised me.

Agreed. Here in Irvine, the Irvine Company they have raised rents ~5% YoY in the past 5 years except for 2012, and possibly 2016.

My condo’s HOA fees went up from $733 to $762 a month in 2016.

Don’t know why. People wasting water or electricity? (All of which are included in the fees.)

My HOA fees went up from $335 to $355 in January 2016 too. I believe HOA never cared about saving people’s money…

Just curious, what do HOA fees have to do with rents?

Actually HOA fees have direct effect on rent increases. About 40% of units at my building are rented. If HOA fees go up, landlords will automatically increase rent for tenant. No landlord wants to run Negative Income rental property business. Property tax go up – same thing…rent goes up.

It doesn’t really work like that because there’s a lot of competition without this problem. Price is ultimately a function of what the market will bear.

If expenses directly informed revenue (which they don’t), it would be all the more troubling that asking rents are stalling whilst holding costs are rising.

Welcome to Sacramento, third highest rent increases in the country. Why is that? Record demand and not enough housing available. Plus, just because they can. Techies fleeing the crazy market in the bay area see sacramento as a boondoggle. Same thing happened during the 2000 tech bubble and the 2008 housing bubble. I am also seeing a lot of companies and LLC’s buying up all the available apartment complexes, tossing a a coat of paint on and tripling the rents. There is no rental laws or affordable housing rules in the city and beyond so its easy pickens in the downtown and areas near freeways. I am in the market for a rental home so its a crap shoot if I can get into one before rents rise again. Im closely watching the stock market secretly hoping it crashes and burns leaving the techs to flee. I know, it will also cause a recession, but since my income isnt rising like the rents I have no choice.

The housing frenzy continues in Nor Cal. I live (rent) and work in Sacramento’s Eastern Suburbs.

Last a local insurance company laid off over 400 staff. All at once…. Rumor has it more to come from nearby Intel, Sprint, etc. Could you imagine signing up for a huge mortgage and getting a pink slip the following month, just after you’ve unpacked the moving boxes in your new “dream home”?

It’s one thing to buy property in a shaky employment market – if you have a year’s emergency fund in the bank that softens the blow from layoffs. But I assume the takers of the “Poppyloan” don’t have a penny to their name since they are borrowing 100% of the purchase price.

Week before that I went to look at some model homes in a planned development near me. Tiny little boxes dressed up with granite and maple cabinets on lots the size of my driveway. 4 feet between homes,8 ft depth back yards – I mean you really cannot swing a cat. HOA fee is $175 per month. MELLO ROOS alone is over $300 a month. Starting price to buy one of these shacks? $445,000. The saleslady was telling me they are all sold and if I wanted to “reserve” one from a future release, I would have to go through the loan process with their in-house mortgage lender to “qualify”. It was laughable. The model homes and sales office was packed with people. I was stunned -people are actually still buying into this bubble.

It’s 2005 all over again. To add to the mix, lots of short sales popping up in my area all of a sudden.

Oh forgot to mention – this charming development is smack next to a sewerage plant.

I was just driving in the outskirts of San Jose near Hollister / Gilroy today. There is some pretty land out there. Not a lot going on. I saw some brand new homes built, and they were all packed togeather just as you said. I thought to myself, “With all this expansive land available out here what a shame.” The county life appeals to me. I saw some really nice 20 acrea ranches out there too. But I can’t imagine people paying for a brand new home as you said. Even worse is the people paying over 1 million for a Row House in SF. How is that any better than an apartment? I guess at least you don’t have anyone above or below, but jeez!

My whole mantra and point is this. Unless you are weathely (If you are, you are not reading this as it doesn’t matter if prices go up or down) but the rest of us, to afford anything decent in the bay area we have to strap ourselves to the wall. If I am going to become house poor it better be a a nice home with an incredible view and a large plot of land with privacy from neighbors. Until that is affordable I don’t see the benefit to owning for a lot more than the cost of rent? Seems to me, you lock in a lot of risk, with little added benefit to show.

Yes I know the whole, lock in your payment now, but I just don’t see rents continuing up much higher at this rate. I think a shiny stone would rise in value more to offest it 🙂

Crime and tinfoil hat nuttiness are off the hook in Gilroy and Hollister so caveat emptor.

Hey Dire Straits. There’s no stopping the lemmings. Don’t bother even talking to them. How could you be right when so many people were buying?

They have a purpose in society. Lemming meringue pie. Mmmmm. It’s what’s for dinner.

“people are actually still buying into this bubble”

and why not? based on last time, when the shit hits the fan just stop making payments and get 30 months of mortgage free living.

Ewww! Rio Linda, or Antelope looks nice now, after reading your post! LOL

Prime locations in LA are mostly north of 2 million for teardowns. Now that the Bank of Japan and the ECB are both doing negative interest rates, it will not be long before the Fed also does negative interest rates. With negative rates, real estate in prime locations will continue to rise, even if the economic slowdown. This is getting crazy.

Last week, I saw a few beach close teardowns with big price tags get hit with multiple offers. The central banks will never stop.

The ECB instituted NIRP over a year and a half ago, well before the BOJ did. I’m skeptical that the Fed would decide to not only reverse a month and a half rate hike but follow the lead of a lesser central bank.

“With negative rates, real estate in prime locations will continue to rise, even if the economic slowdown.”

Exactly how would that be the case?

In regard to mortgages, some European countries are experiencing higher mortgage rates correlating after the central bank went negative. Switzerland in particular.

Right. The negative rates are for the banks’ benefit, not the sheep like us.

I’ve mentioned the huge amount of empty space here but there’s also a ton of building. The old San Jose murky news property being filled in with condos, another big block gonna be a Sprouts market (yay!) and condos on top. I think San Jose is going to try to be European, stores at street level and dwellings above. The funniest I’ve seen is that people live over the Safeway downtown. So you see people with a cart full of groceries getting in the elevator to go upstairs to their home.

The nice thing is, its pretty reasonable to rent an office right downtown.

I wonder how this building frenzy we have here is going to lower prices when real estate slumps again.

Although I really dislike apartments due to omnipresent noise issues, I have to admit that having a nice grocery store an elevator ride away would be really nice. I go grocery shopping about once a week, and that would save me a ton of time on commuting to and from the store!

San Hosey is trying to be all about the bike. Public transit is expanding like crazy because who except the oligarchy can afford to run a car any more? People sk8 and shit too, people up here can’t afford to drive.

I love these hole in the wall buildings I see around here and hope I can become a go-to sign painter for downtown businesses, no internet involved. I hope I can rent a hole on the wall shop to work out of and pretty much ignore that the world post 1975 has happaned.

With the amount of cheap money available housing in the Bay Area will not tank until there are job losses, plain an simple. And even then, the Chinese are still out there, laundering their money in every hot US housing market trying desperately to get their money out of China.

Agreed, until we see layoffs across the board and large companies folding the bubble will grow and grow.

Yes on Chinese sheltering their money up here but the average person here is lucky tobe realizing minimum wage. 12 to a house, riding bikes, a backyard garden if you won the lucky sperm lottery and get to live in a house.

According to many reports, China has severely cranked up capital controls, which would suggest the opposite of hot money continuing to flood in from China. Then there are increasing accounts of wealthy Chinese attempting to liquidate foreign holdings in order to mitigate losses back in the homeland.

It just doesn’t square with yesterday’s news that Chinese are going to save California real estate. They might be just the catalyst which ends up hurting it the most in all of this.

Let the sell side have their one final frenzy of Chinese purchases. The sooner buyer capitulation occurs, the sooner the inevitable fall.

Another counter-trend could be the weakening Yuan. How great would it be to have purchased USD assets after exchanging RMB during the unsustainably artificial peg of yore, sell after massive RMB devaluation and exchange back to RMB. Quite possibly the arbitrage play of a few decades. It would provide a bit of cushion to even sell at a USD loss, therefore adding further room for downside movement.

A similar scenario has just begun with CAD/USD purchasers at the previous dip, and Canadian buyers were just as active in the past few years as were the Chinese, albeit geographical distribution of activity somewhat different.

They who do not learn from history are bound to repeat it. The Chinese are going to experience what the Japanese suffered through 30 years ago when overpaying for American assets.

Prince Of Heck I remember those years,we thought the Japanese were gonna own everything. Growing up in Hawaii, the Japanese were “whitey” to me and I was the n——. I hated the idea of the Japanese buying up America. Hell there was even a movie about it, Black Rain. I seemed to not mind riding a japanese-made Yamaha SRX-6 to go see that movie though. Geez I bought that sucker cash and I thought I was poor???

It cost a fortune to rent a spot at the Zoo Fence in Waikiki to sell art off of, because the Japanese tourists were loaded with cash. The mid-80s were weird.

There are real tales of woe out of Japan now. Economy stalled for decades now. Salarymen going back to farming. Of course we’re falling into the same kind of tailspin here in the US.

Don’t the Chinese see this coming? Economic vapor lock.

@Shawn, the flow of rich Chinese who could have moved their money out of Red China is pretty much over at this point. Capital controls were instituted about 3 years ago. Most of the red hot Chinese money leaked out of China from 2009 to 2013.

Job losses in the Bay Area are coming. Yahoo is going to cut 15% of its work force. Hewlett Packard is in the process of cutting a lot of jobs in the Bay Area.

I’m not aware of any Bay Area tech IPO’s in January 2016. So this looks like we are at market top.

I like the way you think Hotel California.

Also I’m so grateful to Doc for all the data crunching and cold logic entries about the market playing out.

Keeps me together. Keeps me focussed. Gives me hope. I hold the view a correction is ahead.

Two different commenters, Brain, although ernst and I do tend to be on the same page.

What’s Hewlett Packard even doing these days? Making shitty printers? Agilent is now called keysight, nobody’s stupid enough any more to buy hp computers, so WTF are they even doing?

Makes me glad I maxed out my tax-deferred accounts for all these years.

Someone always has an angle to keep the money flowing. I am a bit amused though. The irony is that the People’s Republic of California, touted for its social conscience/awareness and empathy for fellow man, appears to be much more about GREED! And really, who in their right mind pays $1.2 million for a crap shack, $2 million for a tear down, or even complains that they make $200k and can’t afford to purchase a house? If you’re doing that well, get some roommates, rent, work for 5 – 7 years, then move to Costa Rica and get out of that madness!

Based on anecdotal reading, for some people (maybe even most), moving to another (cheaper) country is nice at first, then reality sets in that you live in a third world crap hole. Then you have to go through all the trouble and expense of moving back to the U.S. I can see moving to a cheaper state in the U.S., but any country that has a substantially cheaper cost of living that the U.S. is probably cheaper for a reason. As usual, you typically get what you pay for.

I left California shortly after the crash.

$5 a month.that’s what I was able to make. $5 a month.

I decided this Californian would rather hitch-hike back and pick fruit in Mother Cali than live on food stamps and welfare in a red state.

I didn’t have to hitchhike back, but did an interesting cross country on a small motorcycle and I swear I will not cross the sierras again.

I’d rather be homeless, I mean real homeless not homeless Lite like I am now, here in the state of my birth than in a red state.

I know a few parties who emigrated to the US decades ago, worked, bought houses, raised families, retired, then sold their US real estate and moved back to their birth countries to retire (several from Mexico/Latin America, a couple from the Philippines, a gal from Sweden). Their California Real Estate lottery winnings enabled them to retire very comfortably outside the US. True, having lived originally in those countries, perhaps it was not the a culture shock it might be for an American. Some peoples values are different; not everyone considers life outside the US as living in a “third world crap hole”. Last I heard they were all doing well and very happy in their new homes.

Moving outside the US is not for everybody, but it works very well for some.

WeDontMakeThoseDrinksNoMore: I’ve visited a few places in the world, including many European countries (and hope to visit many more), Canada, Mexico, and many islands in the Bahamas/Caribbean. Many of those places were fantastic to visit. However, I’m not under any illusion that living in any of those places is better than the U.S., all things considered (although Paris is pretty nice). It’s probably why there are so many people trying to come here.

I’m very grateful to have been born and live in the U.S., but I really don’t have any inherent need to tout the U.S. as a superior place to live, other than based on my own observations. In fact, if I found a better country in which to live, I’d probably have no qualms about moving.

I didn’t say that anyplace other than the U.S. is a third world crap hole. I effectively stated that any country that has a substantially cheaper cost of living that the U.S. is likely a third world crap hole. Sorry if you don’t agree.

Last year, I bought something from a guy on Craigslist (no, not sex lol), and he was telling me how he was selling all of his stuff and moving his family to Serbia because the U.S. was so awful. In his mind, Serbia was going to be paradise. He had a 4- or 5-year-old boy. I felt so sorry for his kid, who had grown up mostly in the U.S. You have to admit that Serbia of all places is probably not a superior place to live than the U.S. And for someone to think otherwise is perplexing to say the least. Btw, I actually read a bit about living in Serbia before making my judgment about living there.

At some point in the near future, I plan on buying a halfway decent 3-BR condo in Newport Beach [I have a wife and 1 kid (one and done)]. I can technically afford what I want now, but am waiting for a crash of sorts to hopefully maximize the value of our purchase. My goals aren’t all that lofty (I don’t even really care about having a detached house). Based on the places I’ve been in the U.S. and the world, living in Newport Beach is hard to beat- some of the best weather anywhere, no ghettos down the block like in L.A., the convenience of stuff to do in O.C. and L.A., and access to reasonably-priced food and products (as is typical in the U.S.). If you can advise me on somewhere better I can live for less than $800k or so, I’m all ears!

As someone who is from California and been gone for over 25 years, it is not all sunshine and rainbows in other states. I have lived in Idaho and Nevada, and while the allure of lower taxes may seem appealing, it is all about getting what you pay for. I am currently in Reno, NV and let me tell you what a hell hole it is. As a state, NV ranks 50th in education! Our fuel costs more than it does in San Jose and our roads suck! Car registration is about double what it would be in CA. I am looking to go back as I cannot stand it anymore. The jobs pay lousy, the schools suck, and the roads suck. The only benefit is no state income tax, but everything else we are taxed on more than makes up for it!

Responder,

I agree with most of you say in terms of life outside US but not so much with what you say about life outside of SoCal within the states.

I lived for over 20 years in other countries and traveled extensively. I believe that nothing beats US as a whole in terms of taxes, income and purchasing power. The combination of the three is unbeatable. On the other hand, for $800k you can have a wonderful life and house outside SoCal.

It’s sort of a America…but the Virgin Island is a good spot. My girlfriend was born and raised in Charlotte Amalie and we’ve gone back to visit friends and family a few times. We plan on retiring there someday…if we ever landed two jobs with a combined 120-140K salary we’d move in a heartbeat.

Compared to the Oakland area we could rent/buy a nice place. Not on the beach per se, but that doesn’t matter. Or we could fix up here parents place when they pass and live there.

She had great education in public school, enough so, that she got a scholarship to Howard.

Many of her friends moved to the States and hated after a year or two and moved back. It’s close to Miami via flights if you really need to come back. Large hospitals with American trained doctors in San Juan PR (she was born there, most pregnancies with complications the women are flow in San Juan’s bigger hospitals)…it’s a 20min flight.

Responder: “living in Newport Beach is hard to beat … the convenience of stuff to do in O.C. and L.A.,

I don’t see how living in Newport Beach means you have “the convenience of doing stuff in L.A.” Or even in much of Orange County.

I live in L.A. County — Santa Monica — and it’s often a traffic nightmare trying to drive to other parts of L.A. I’d never even attempt O.C. from here.

I could happily be street homeless in Newport Beach, its that excellent. I know the place like the back of. my hand. I could ma!e it well there though because I know it like the back of my hand. I know where the rent a cheap shop to work out of, where to but fish cheap, where and how to sell stuff.

Maybe one day I’ll just light out and go. Goat hill water but the rest is all good.

Most people born/raised in the US would have a hard time adjusting to the pace and lack of amenities in countries that offer a noticeablly lower cost of living. If you can do it, go for it, but spend some real time in the place before you go, read everything you can and go prepared. Give it a trial period of 1-3 years, and put your stuff in storage rather than move everything as that gets expensive, and really expensive if things don’t work out and you have to move back.

Other point is with the weak labor market and the crummy housing stock available, perhaps the best route is to save your money, be mobile to take advantage of interesting work and good rent (if you can find it) and then retire early in flyover or abroad, buying a place for cash. Thats my plan, I’ll be donezo before 50, focus on living life and not feeding the beast.

Flyover: just to be clear, I didn’t intend to imply that living in other states is somehow inferior to living in So Cal. I happen to like So Cal because of the weather and stuff to do (like amusement parks, beach, etc.), but that’s just me and it’s obviously entirely subjective.

@son of a landlord: we meet my wife’s parents in Glendale or Burbank somewhat frequently. Getting there is usually not too much of a chore on the weekends if we check traffic and take the least crowded freeways. Before we had a kid, we took the train pretty frequently to L.A./Burbank/Glendale as well. Once our kid has less of a need for long naps, we’ll probably start taking the train again to L.A. to hang out, meet with my wife’s parents, etc. Getting to many places in L.A. from O.C. is pretty feasible with a little planning and commuting at off-peak times.

Responder watch a movie is called “Trumpets Republic” Serbia can be pretty damn cool. Wealthy, no, but its got soul.

@JNS, no need to move to Costa Rica. Once you get away from the California coastal bubble areas of Los Angeles, Orange County, San Diego, San Francisco and Santa Barbara, non-coastal California real estate is priced very similar to the U.S. national real estate.

Not to mention real estate in Costa Rica is more expensive that much of the US.

(Excluding So Cal real estate, obviously.) But if you’re looking for a hot humid climate and a coastal lifestyle, there are lots of US cities (i.e. the southern & gulf states) with cheaper costs of living than Costa Rica. Not to mention you’d still be a native if you stay in the U.S…. in CR the native Ticas don’t take kindly to rehomed gringos. They’ve built their economy around taking advantage of the States (tourism)… and if you visit and decide to stay, they’ll hit you with high costs of living (real estate and taxes).

If you’re looking for a coastal paradise in CR, you’re about 20 years too late I’m afraid.

I’m a born californian but lived in Hawaii ages 5-25. I love the p!ace but good god the people. They flat out hate whites and there’s no changing it. Being there is like being black in the 1960s mainland us. Not. Too. Great.

I know how to live cheap there and I miss things about the place, but yeah, don’t move where you’ll have a target on your back. The. Mainland us is big enough that you can pick a climate, any climate.

I’m going to have to add an addendum to this. I’m thinking of the old Hawaii of 40+ years ago. Since then, they’ve elected a Hawaiian governor, a white governor, and I don’t know who’s governor now but it might just be the old cab driver, Neil Abercrombie. The generation that was so keen on kill haole day are all old fakas like me and its just not like it was.

Look at this place… http://www.zillow.com/homes/for_sale/Santa-Monica-CA/pmf,pf_pt/51582367_zpid/26964_rid/14_days/34.043538,-118.45341,34.020136,-118.498471_rect/14_zm/

I went to their second weekend open house, cute place but 830 sq ft townhouse it felt small. Lowest priced condo in Santa Monica, that is listed at 599k had been on the market for a week, has 7 offers already and the open house was so busy the realtors had people taking turns to go upstairs to look at the tiny bedrooms…in a rain and windstorm. It will easily sell for 640k or more…seems like a steal compared to the bay area but still…

It looks like Ikea built that apartment.

And named it the Smegma or something.

This actually doesn’t look that terrible, but it does seem a bit small and expensive for what it is. The 600-square-foot “private patio†seems really cool at first glance, but I think it’s anything but private considering the immediately adjoining units in the building, and also the apartment building abutting the patio area.

If you think that’s pretty cool for 600K then you definitely drank the Kool-Aid.

DP of 5%, 3.5%, or even 0% is a great Jedi mind trick by the powers that be to keep the ponzi going, but it will eventually fail. And when the housing market crashes, it will be much worse than 08-09, because sheeple will be left with 1) higher monthly mortgage payments 2) higher property taxes and 3) no equity to cushion the blow.

The question (as with most things in life) is the timing. To me it feels like 2004-2005

right now, and this silly season will probably last another 2-3 years before it all comes crashing down. I think when this finally comes to a head, it will be epic. Then NIRP to the rescue.

POPPYLOANS = Opiate Mortgages?

Hah. That’s the connection I was trying to make as well… but couldn’t recall the narcotic name.

From their website:

>> Proud Ownership Purchase Program for You – POPPYLOAN <<

Are you guys getting those ads for Rocket Mortgage on the radio in socal? They must have spent millions on airtime.

Think about this for a while; most of the large US corporations have been laying off hundreds of thousends in the past seven years. They’re so called earnings came from lay offs and cutting overhead and share buy backs! Manufacturing is already in recession retail is next.

With QE (free money) over there are more cost cutting and more lay offs to come.

Hedge accordingly!

Back in 2014 at the BNY Mellon Conference with Bloomberg financial there.

I talked about my model showing that

82% of the working population in California are priced out of housing once you exclude those paying cash and making 3X median income

CA market hasn’t really taken off since mid 2013 even though the economic cycle has continued and rates have been below 4.5% since 2013

Freddie Fannie limit of $625,500 limits even their reach for CA homes near coastal areas.

Even with this 100% loan up to 2 million. How many people can actually buy a home with that much debt on the books on a traditional non exotic loan?

Not many, Housing inflation story is not properly told in CA and across the country

Last year I went on CNBC and warned the builders and especially TOL ( Heavy CA Builder) presented no value

The stock had buy ratings $38-42 and the XHB was also over hyped because they were pricing too much growth

Well, TOL today $27 bucks, because the Housing Inflation story in CA is too expensive for the housing Nirvana bulls group that has been pushing this thesis for years now

http://loganmohtashami.com/2016/01/25/home-builders-new-homes-sales-and-the-affordability-myth/

Exactly! The housing inflation story has been buried in the press, and particularly in the real estate industry because there is always a sell-side bias. Here in Houston, the builders are finally waking up to cold hard reality.

‘Sleep, my pretties……. sleep……..Poppyloans will put you to sleeeeeeep………’

No, Logan’s idiotic posts will.

The Poppy Loan charges 1% in points over and above the current mortgage rate. So on a 1 million Poppy Loan one would pay 10K more per a year in finance charges compared to the conventional mortgage rate,

For people!e with shitty credit I’m guessing.

Chinese and cheating and deceiving…nothing new

http://www.cbsnews.com/news/china-busts-an-alleged-7-6-billion-online-ponzi-scheme/

Question from someone curious in FL, how is the rental/lease marketplace for commercial property?

He in South Florida, office space is really cheap to rent, retail in non class A locations is cheap as well.

15 years ago I rented a building for 12$ psf per year all in. Same building today rents for the same number.

So outside of housing, what are commercial rents/office rents doing in CA?

Buck a sq in flori-DUH I can beat that in the silicon. We’re paying half that. Walking distance to SFO.

I’m looking at getting my own office and might pay a buck a square foot. Maybe.

It’s a REAL fixer-upper: California home hits the market for $475,000 CASH… and it needs a bit of work

http://www.dailymail.co.uk/news/article-3425922/California-home-Northridge-Los-Angeles-hits-market-475-000-CASH.html

I posted that same house’s Redfin listing on this blog a week or so ago. Wonder if the Daily Mail reads this blog?

Northridge – it’s had an earthquake named after it!

They try to make Northridge sound nice — it ain’t so, Joe. It’s always been one of those places people don’t want to live. Remote and hot.

I agree, Northridge is not somewhere I’d live- remote and hot sums it up pretty well.

Sounds like garden Grove whose only redeemingvirtue is delicious delicious Vietnamese food.

Tolucatom: That looks like a cleaned up former hoarder house.

An open floor plan, granite counters and stainless steel appliances, laminate floors and it will have multiple offers. Power to the sheeple.

Here’s an interesting piece about renting in SF.

http://www.businessinsider.com/san-franciscos-real-estate-war-2016-1

Interesting and well-edited story- not really new or earth-shattering information, but interesting nonetheless.

What I thought was a bit ridiculous was that the artist guy was paying $735 a month for rent in S.F. for an apartment with basement (he had been there 34 years), and somehow expected that sweet deal to be indefinite. Then the new owners offered him and his roommate $135K to move out ($80K for him, $55K for the roommate). Seriously? This guy didn’t take $80K to simply move? He’s going to have to move anyway- might as well make some money from it. The words spoiled and entitled come to mind when I think about this guy.

I went up to the City to buy a laptop from a guy with the nickname Yoda, who was probably gay which doesn’t matter except the laptop has perma-glitter which it took me a while to figure out is not a thinkpad feature.

Anyway,after getting a nice cup of tea from the friendly caveman a the coffee shop, I had a little walk around. The area right near the Caltrain terminus see!med to have plenty of cheap storage, office, maybe almost r&d type real estate for rent.

I live, for free, here, because I’m friends with the building owner and the tenant, whom I work for. There are lots of little niches like this. There are people living in buildings all over this hood. Mainly you have to be neat, clean, and useful. If you can be these three things you can be an asset to someone, and exchange being yourself for a place to be.

So Mr. Artist Guy! Take the money and stash it and find someone who will let you love in their barn loft in exchange for keeping the horses and chickens looked after or something.

Yep those horses and chickens need some sweet sweet lovin’.

The tenant is basically orchestrating a shake-down while masquerading as a tenant rights activist. It’s very sad. Just because you live somewhere for 30 years and put up some drywall and paint, does not mean you own it. They also don’t mention that he pays around $700 rent for a place with market value of around 5K, and has been for years. It’s a sad day for this country when the masses dictate what one can and can not do with their own private property.

Furthermore this so-called “Artist” is unemployed and has not sold a single piece of “art” in years by his own account. No one can say what his source of income is including himself. This is a perfect example of why rent control is detrimental. This guy had years to save up and buy his own place while paying peanuts in a rent controlled apartment. Instead he milked it for as long as he could and is now blackmailing the new owners. He doesn’t not have a legal leg to stand on, but due to the liberal powers that be in SF he can drag this out in court for years costing the landlord tens of thousands of dollars. I was in a similar situation in LA with condo I owned. Cost lots of $ and time to resolve. There are plenty of renter advocate lawyers that will take this case up and literally make up legal BS to stall the eviction. And you never know when a judge will find pity on a renter regardless of the underlying legalities of a case. Because of this I I no longer buy rent controlled properties.

I was expected to become an artist when I was growing up. I surprised the hell out of everyone by going into electronics instead. Electronics surprised the hell out of the by turning out to be about the lowest paying thing I could do.

But what turned me off of art is, the huge number of people who call themselves artists and are not productive, don’t sell anything, etc. Van Gogh didn’t sell anything during his lifetime but he was productive as hell and oif he hadn’t shot himself would have been quite successful. I’m fairly certain Andy Warhol worked for peanuts at first, hell, be did window displays, but he put work in. Even as a success, between the wild parties and such, be was working his ass off on those soup cans and such.

But growing up i met all these lazy layabouts who called themselves artists, and of course they weren’t making money.

Now I call signs art with a purpose, and the exhibit of signs by the late Rey Giese was the only thing that got me into that awful kaleid gallery downtown.

I just finished and audit of a financial institution that serves clients from tech. These people have 200k, 300k and I even saw 900k of Alphabet and Apple stock plus large cash balances and they are liquidating at a record pace to buy RE. This type of liquidation needs to dry up before prices start a decline.

I’m not talking 1 or 2 people here, over 2 thousand and counting. That is one firm, I can’t imagine what else is out there.

Well boys it has started. Hong Kong housing is collapsing. People are loosing their shirts. I’m hoping this is going to make a huge dent in CA’s epic housing bubble.

“there is the far simpler Chinese response to the Fed rate hike which has sent shockwaves everywhere from the Chinese forex market to the Hong Kong interbank market where liquidity a few weeks ago virtually disappeared overnight as the PBOC tried to crush and squeeze offshore Yuan sellers. It also means that mainland Chinese buyers, suddenly facing a draconian escalation in capital controls, are suddenly unable to park hot money in the HK market.”

http://www.zerohedge.com/news/2016-02-01/hong-kong-housing-bubble-suffers-spectacular-collapse-sales-plunge-most-record-price

Double post- please delete above post

I wish housing went down. But honestly, if there are no Layoffs across the board from tech companies I don’t see how the housing will go down in SF bay Area and West LA + OC. All, I see is tech companies with the we’re hiring sign on their foreheads…

OMG! LOL! This is not going to end well.

I still think you are all looking at a fraction of a per cent of Californians, likely with inherited money. The average tech worker doesn’t make shit. The only way to make kinda decent wages here is to do work no one wants to do, like working at the tire shop up the street. A guy who hustles might make $20 an hour,there. Carpenters and mechanics might make more, but the only way for the average Californian to make anything above minimum wage is to bust their ass and be worn out at age 50.

Even then, they’re not going to be able to buy… anything. Property ownership is hereditary here. C!ass-based. About all you can do is enjoy the nice weather while you push your palateria cart 20 miles a day.

I just don’t know where anyone is seeing all this money.

I find it pretty crazy that so many people have so much money also, but at the same time, it’s not all that difficult of a formula to earn a bit of money and have a decent life if you don’t come from money.

Here are six basic steps (not necessarily in order of importance) that I think most people can follow to achieve some reasonable degree of financial success:

1. Don’t be lazy no matter what you choose to do.

2. Go to college, but only for something in the STEM realm. A graduate degree might also helpful.

3. Get a decent job (this is where education generally comes into play)

4. If you get married (which can be advantageous to your net worth), marry someone who also is college educated and makes halfway decent money

5. Only have one or two kids (or better yet, none)

6. Save as much money as possible, and don’t waste money on stuff like eating out at expensive restaurants, extravagant vacations, expensive cars, etc. Save it and (wisely) invest it.

1a. Dont get sick or your lose your ass

2a. Dont lose your job because your sick, housing bubble pops and you lose your ass

3a. Dont lose your kids and wife to a divorce because you get sick, lose your job and house and have nothing left but lose your ass

4a. Dont starve to death paying off those student loans at 10 % interest, get a low paying job, and lose your ass.

* Don’t get a car (maintenance: tires, breaks down and mechanic charges $95/hr. Or auto insurance is a waste of money unless you hit someone then you’re jacked. – so walk to work or bicycle to home to work.** you exercise and avoid paying the $40 gym membership.

** Don’t get divorced… wife will get everything and you won’t recover… paying child and spousal support will afford you a room in the east of the city.

*** Don’t ever go on vacation… Cancun, Hawaii… no way… go to the city park. Because I was reading an article that for family of 4 is more expensive to go to Disneyland than it is to go to Thailand, or Caribbean. I confirmed with a co-worked family of 4 for 3 days a Disneyland was ridiculously expensive. ** so if yo want a house stick to tents at the national parks

**** Only DINKS… no kids allowed… gulp gulp

***** don’t eat meat… only rice & beans

Ha, great points discgman. That’s primarily why I stated “most peopleâ€. I understand that circumstances arise that are often out of our control including those you mentioned.

I’m a progressive, so in general, I don’t mind higher taxes to pay for social services, but I do think your point is well taken and it is the fact that our educational system hasn’t done a very good job at teaching “life skills”. I mean, I’m 37, so when I went to high school, I think they had already dropped the “home economics” course. So I don’t really know or pretend to know what the heck that course was supposed to teach you, but I think we need to come up with a home economics course for the 21st century and it would include a lot of the things you talk about and some others. Let me give it a shot:

1. Time value of money. I think this is something that your average American has no concept of, but it is critical in understanding any sort of financial decision you might make.

2. Opportunity cost. If you don’t understand that not working for 2-3 years to get a graduate degree in English has real costs associated with it apart from just tuition and books you’re not going to be able to properly assess if that degree is actually worth it.

3. Compound interest. Again, if people understood how powerful this is, they would be less likely to incur credit card debt and more interested in saving and investing.

4. Learn Excel. I think I read somewhere that if you want to increase your salary by X% next year, just learn to use Excel proficiently, not just learn how to use it, but understand how to build a basic cash flow model, that is just huge.

5. Budgeting. This something that I think people used to learn in Home Economics and maybe it’s because they dropped it that this country is broke. There is a great skit I still remember watching on some comedy sketch show where a Susie Orman character was trying to explain to a frumpy average Joe American that you can’t spend all the money you have and he just wasn’t getting it no matter how she tried to explain it. You shouldn’t be living within your means, you should be living BELOW your means.

6. Basic writing. I am a lawyer by training, and as useless as that degree can be, what it does train you to do is to be a disciplined writer, certainly not a creative one, but at least one who can express ideas clearly and succinctly. It teaches you how to write in a structured manner, and I think that is probably way more critical in this society than the dream that you are going to be next David Foster Wallace, cuz you’re not going to be and he killed himself.

7. Delayed Gratification. I have read about some studies which claim that one of the best indicators of future success in children is the ability to delay gratification. I actually think it is the most critical life skill you can teach your children. More consumption today necessarily means fewer resources will be available for consumption in the future. It sounds like such a basic concept but it really is what separates us from animals.

8. Time Management. This might sound stupid, but I don’t think most people know how to do this either, and the problem is, if you want to achieve any goals in life, you actually need to set aside time every day to do that, and it involves a lot of the other things above too. Some people say this as a platitude, but time really is your most precious commodity because it’s the one thing you can’t make more of.

This stuff presupposes that you have basic reading and math skills and some degree of self-discipline, so that already excludes large swaths of kids these days. But I do want to second Responder’s point that if possible, you should pursue a career in a STEM field, as difficult as it may be for some people. It seems obvious that the key to succeeding in the middle class of the future is tied to jobs in those fields. I’m a child of immigrant parents, and I think that a lot of the children of native born Americans have forgotten that the only way to ensure long term economic success in this country (which I think still provides anyone with the best shot to achieve that in the world) is to build capital, and the primary way to do that is through savings and education. The formula is pretty basic, it’s all in the execution. I am all for spending money to help people get on their feet, but what we’re not doing is giving people the skills and the direction to do that.

Responder,

You are right on what you say. I failed on some of the things you suggested and I am still multi millionaire in my low fifties.

I came here to US as a young adult with zero dollars in my pocket. I worked hard but smart, too. It is not enough to work hard, you have to use your brain, too. When I came, I did not speak English. I came as a legal immigrant.

I have 4 children instead of one, therefore my wife had to stay home with them all her life. I was always the only income earner and none of us inherited anything. My parents could not help me with a $1 even if they wanted to.

The key is to apply common sense, delay gratification, make a difference between dreams and reality, always live below your means, take care of your health because ONLY you can take care of yourself. It is not the government responsibility. Yes, I had to pay a lot in tuitions, medical health (never below $10,000/yr due to 6 people).

Alex wines a lot on this site. I agree that for living well in SF you have to be born in wealth but nobody forces him to live there. It is his choice and his only. Asking for Sanders to bail you out of your poor choices is not fair to the rest. It looks like he is about my age and never had to support a family and he never matured. Maybe having to support a large family of six helps someone mature faster??!!… You say.

Dean,

Good points! My parents never taught me that. They were always poor. However, I applied all of them in my life because they are just common sense. Raised 4 children, send them to college with no financial aid (they never qualified because my income was always too high), my wife never worked outside of home and I still ended up a multimillionaire. Yes, I did take vacations. When the children grew older I went to Hawaii on vacation with all of them every year.

Yeah don’t don’t ever have random shit you have no control over over happen to you

@ Alex… Man I don’t know how you figured that but people make a lot money in the silicon Valley. Even paper pushers working for the City or county or State make lots of money. People working at 100s of tech companies from south SJ to SF make good money. Indian Engineers on visa probably make like 55K… but locals 70K+ to 150K on average. Team manager 180K+

even some receptionist answering phones at these companies make the $20 an hour you claim is difficult.

The problem is most people are living paycheck to paycheck house or no house. I have co-workers whom haven’t been on vacation for 3 years because they can’t afford it.

I don’t understand how living paycheck to paycheck is a way to make a living. What a shitty parent I would be if I cannot provide sufficient needs for my family and have some sort of buffer! Have we all forgotten what debt is?

Tiquillllllil I – two words -:government and unionized. Basically class and race based. Trust be I’d work for the post office or the DMV if I had an in.

What effect does a negative interest rate have on home loans? Traditional 30 year mortgages? FHAs? If the fed implemented them one day to quell a recession would that be able to prop up a housing market?

Milenial,

You can not answer that question without considering hundreds of other variables. All you can do is

“If x, then Y, all other things being equal”

The reality is that all other things are never equal, and you can have all kinds of unexpected outcomes.

The FED with all their supercomputers have a hard time answering that question because regardless of your algos, the result is as good as the data introduced in the computer – garbage in, garbage out.

The biggest wild card is the consumer psychology – you can not quantify that regardless how hard you try.

The FED is changing ONLY the overnight rate and by that they influence (not dictate) the 30 yr mortgage bond market.

I could say, that by using NIRP, the inflation expectation increases and that would raises the 30 yr mortgage by influencing the bond market. However, if the overall consumers are depressed given the economic conditions for the middle class, the 30 yr rate could go down because the demand for mortgages plummeted. How can the FED quantify the thoughts and feeling of the people? They can’t. This shows the complexity of the system by introducing ONLY one or two variables. In real life the system is far, far more complex than 3 or 4 variables.

I hope that helps.

Banks loan at three times income. A couple in High Tec in The City can have the income to buy the $1.2mil homes. High Tec has changed the culture of the city. Prices are made at the margin. As long as California has High Tec to fund the California government, life will continue as we know it.

Interesting to see that these predictions of a massive decline in Bay Area prices have not come to fruition five years later.

Leave a Reply to millenial buyer