When $250,000 per year salary could qualify you for subsidized housing. 100,000 Apartments come online in Q3 of 2015, most since the late 1980s.

There were two housing stories that stood out to me today. One shows the pure absurdity of housing in California, in particular Northern California. As we’ve discussed before a home is expensive or affordable only as measured by incomes in the local area. Well for Palo Alto, it looks like having a salary of $250,000 per year could qualify you for subsidized housing. Of course having this income puts you in the top 2 percent of all U.S. households but in Palo Alto you might as well be eating Purina Dog Chow with a nice class of Manischewitz. The Bay Area is running on hot money from the tech industry. Another story focuses on the continuing rental revolution we are undergoing. In Q3 of 2015 100,000 apartments came online, the most since the late 1980s. And most were rented within 12 months. I think these stories really highlight the larger theme in housing – extreme money for hot enclaves and renting for the vast majority. The middle is being cleaned out like using a melon baller on a cantaloupe.

You are broke on $250,000 in Palo Alto

People in the Bay Area are so far removed from reality that $250,000 now could qualify you for subsidized housing. It is so preposterous yet in an area where tear downs go for $1.5 to $2 million, you would need a sizable income to buy a home here.

“PALO ALTO (CBS SF) — Palo Alto is seeking housing solutions for residents who are not among the Silicon Valley region’s super-rich, but who also earn more than the threshhold to qualify for affordable housing programs.

The city council has unanimously passed a housing plan that would essentially subsidize new housing for what qualifies as middle-class nowadays, families making from $150,000 to $250,000 a year.â€

This is simply mind boggling. First, there should be absolutely no subsidy here. This is nuts. If you look at the current political climate things like this only add fuel to the anger that small bubble areas are completely out of touch with most Americans. A third of this country has no retirement savings and yet we are going to subsidize households making $250,000? Also, large mortgage interest deductions truly only benefit the super wealthy. With more and more people renting, expect some changes if this trend continues. The standard U.S. house costs around $200,000 so most people get tiny benefits from the mortgage interest deduction once you factor in standard deductions. The vast majority of benefits go to high income households taking on giant mortgages, like for example in Palo Alto.

Perspective is also lost in the area:

“Prices have just gone through the roof, making it unaffordable for middle-class people, your firefighters, your teachers, and, frankly, some of your doctors,†Palo Alto Vice Mayor Greg Scharff said.â€

Since when was $250,000 middle class? Only in Northern California can you get this kind of thinking going on. On the other hand, since most Americans are living paycheck to paycheck renting is becoming the only option on the table.

100,000 apartments added in Q3 of 2015

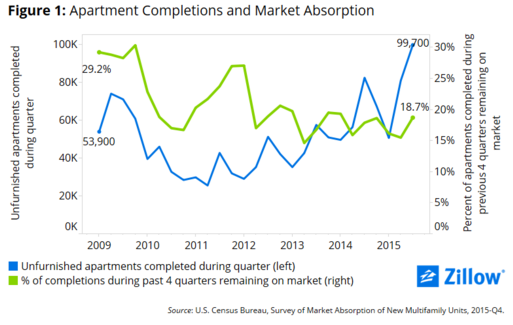

There is a big demand for rental units. In Q3 of 2015 nearly 100,000 apartments came online. Most were rented within 12 months:

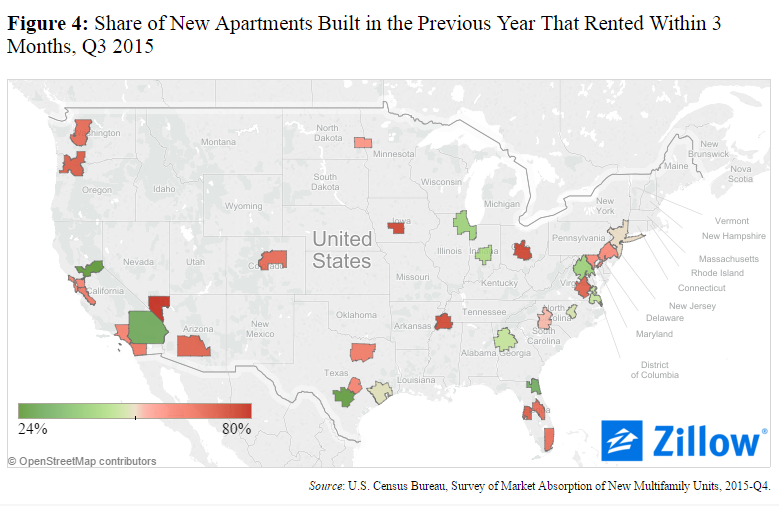

Hot rental markets are found in California, Florida, Nevada, Arizona, and Colorado (former bubble states):

Some flavor to the rental revolution trend:

“(Zillow) Renters currently have an insatiable appetite for newly constructed units, quickly gobbling up record numbers of recently opened new apartments, according to the Census Bureau’s Survey of Market Absorption of New Multifamily Units (SOMA).

Almost 100,000 new apartments came online nationwide in Q3 2015 (the latest quarter for which apartment completion and leasing data are available), 21 percent more than a year earlier, 73 percent more than two years earlier, and more than at any point since the late 1980s. New apartment production has trended sharply upward since late 2010/early 2011, when new apartment completions hovered under 30,000 per quarter.â€

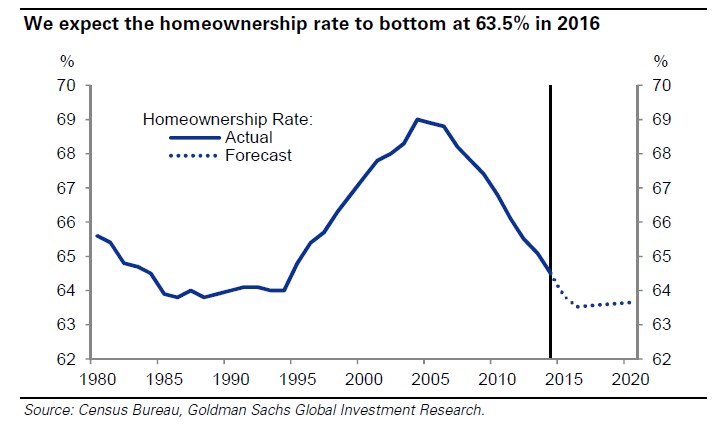

In other words, you have plenty of people that are in the market to rent, not buy. This is why the homeownership rate has done the opposite:

On the one hand, you have places like Palo Alto trying to subsidize housing for people making $250,000 per year and on the other, you have apartments being gobbled up like turkey on Thanksgiving. Welcome to the new American Dream – overpriced crap shack living or living in high density apartments.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

96 Responses to “When $250,000 per year salary could qualify you for subsidized housing. 100,000 Apartments come online in Q3 of 2015, most since the late 1980s.”

The fact that $250k puts you into the struggling middle class in Palo Alto, despite being among the highest paid 2%in America, should be a ‘BIG RED FLAG’! Not sure how realtors can spin this or others might say buy, buy, buy!

I recall hearing a couple years ago that you needed a minimum $131k in order to meet the current demands of ownership in some high end suburbs? Now it’s double. Feels like living in Venezuela.

Of course, it takes a high income to live in a “high end” suburb.

But I can remember a time when you didn’t have to live in a “high end” neighborhood or suburb to enjoy good schools, decent public amenities, and a high level of public safety. There was a time when anyone above poverty had these things.

Laura,

You are absolutely correct…. and that’s a big reason why the disparity continues to increase with higher premiums in the best areas with the good schools.

The middle class hardly exist anymore. Either you are working class or you make a high income and enjoy what the middle class used to enjoy.

This is what I repeated many times on this forum – it is irrelevant how much you make. What counts is the purchasing power of net income (after all taxes).

Some people say that they stay in CA for “well paying” jobs because the jobs in Midwest pay less. They forget that people in Zimbabwe get paid millions per month.

Again, as the article explains, it is irrelevant how much you make per year. Subtract all taxes and fees you pay for a living, see what is left, what are the prices and face the truth. The saddest thing to see are people who are not honest with themselves and live in a dream world.

people making $250K understand this like everyone else

but your outpouring of empathy is truly inspiring

Well holo, Flyover is stating facts. I am one of the minority that chose to leave CA for the ‘greener pastures’ in a flyover state.

You can of course choose to turn this topic into a touchy-feely lovefest, but other folks will choose to deal with numbers and data.

Middle class used to mean being able to own a house in a nice suburb with good schools, and making enough money to pay for a modest vacation and put away some money for savings and retirement.

That will take $250,000 a year in California these days.

I would say you need to be at about $180K-$200K to be middle class these days

when you add in bonuses that’s at least $250K in good years, but obviously not guarateed

This is either lower level dual income families…… or a top b school / stay at home mom

People think they are middle class, they want to believe it… but they are really working class

bonus? WTF is a bonus? I’ve never in my life worked a job that paid a bonus and I’ve never known anyone else that’s gotten a bonus.

and i’d say that $200K is middle class and if my income would have come close to keeping up with inflation I’d be making about $315K now but my income stopped increasing in 1993

Wow! Talk about lunatic housing policy. Their solution to inflated home prices is to subsidize inflated home prices???

I find it interesting that both existing sales and new home sales laid an egg this week. Once you peel back the curtain, you begin to understand why rational consumers might want to step back from this market…

http://aaronlayman.com/2016/03/census-new-home-sales-decline-6-1-yoy-in-february/

I think this is all a ploy to keep this current status quo looking good well into next year or further? Who knows, but I am willing to bet that all these developers building rental apartments don’t want to see jobs tank with a bunch of inventory they can’t book at current market rates. As long as jobs are there and companies keep throwing gobs of money at these people these rents won’t likely go down that much or flat line. Also home prices may just flat line for a while.

– all IMO

Palo Alto is setting a dangerous precedent with this move. How long before other cities, San Francisco, Los Angeles, San Diego, etc, start doing something similar!?

Nope, not a bubble here. Everything’s just fine. Keep those house prices going up! 🙁

NYC and SF have been doing this for decades… it’s nothing new

$250K is not what it used to be with low interest rate policy and globalization

This is insane. You can fix housing bubbles by carving out some land and letting developers put up high rises. Tax them appropriately for the privilege, so that the government can build the appropriate infrastructure. Eventually enough development takes place that housing equilibrium can be reached. Developers will keep putting up apartments until they are out of business.

The rich hippies in the bay area just don’t get it. With their protectionism housing policies, they are crushing the impoverished they love to pretend to be helping. Tax deductions for the richest 5%. Crazy!

they already built 100,000 new units which did absolutely nothing

rent and home prices still went up

demand is too high……. but there is plenty of supply 60 miles away at low prices

Pretty incredible developments!

I don’t see these house boats tanking yet. They are plugging the hole.

Fuck this shit. My household income is over $250K and I can’t afford shit in a decent school district of my city’s suburbs (Boston). Fuck the subsidies. Fuck the bailouts. Fuck the Fed. Fuck 1% deposit rates. Fuck 4% mortgages. Fuck the useless parasite politicians. Fuck AIG. Fuck GM. Fuck the neocons who transferred $2 trillion in wealth from the taxpayers to the MIC. Fuck the government, which should have let Mr. Market ass-rape all the idiots who chased hot assets in the 2007 bubble. Instead of a great reset, which is what your “Joe the plumber” needs, these fuckwits took MY FUCKING MONEY and gave it to fucking hedge fund assholes. Fuck them all. To hell with this fucking bubble.

After reading yodawg’s rant a second time, I’m giving it a 10/10 (first impulse was 9/10). Could be alternate lyrics to Learn to Swim by Tool.

Fuck ’em all! Make a great slogan, maybe you should run for Prez with that. I’m in for a trucker hat.

LOL, that should be Trump’s slogan! “Fuck ’em all!”

yodawg, I do agree with you. Now that you’ve identified the problems, what are you going to do about it?

The song is Aenima, but I will take my Tool references wherever and whenever I can get them…. Learn to swim….

Forgot to add: who do you think owns the MIC? Yep, its the neocons. MIC is just a washing machine for that money, with a little for the peons and the cannon fodder. Look at Feinswine’s husband, he’s just the tip of the iceberg.

What yodawg said.

puleaze…….. I’m in the exact same situation as you but living in area more expensive than boston…. life is damn good

you need a trump rally or wifely duties

Why the fuck would I want a Trump rally? I want a 50% drop on the S&P. My job is secure and I have a shit ton of cash. Wifely duties will be delivered this weekend, when she’s off the rag.

Oh, you mean join in on a rally where those inbred degenerates shout all sorts of bullshit and think that Trump can actually change something? No thanks. Not going to waste my time on politics.

Fucking A Yodawg ! You get a full 10 plus.

If yodawg is Alex in Sane Jose… it was a tremendous evolution, far more entertaining

AMEN!

I’m with you all the way, yodawg.

Awesome! Said just right. But I doubt 50% drop will come again. Palo Alto will be always Palo Alto as New York will always stay New York. Meant to be expensive and suck your blood out…

Sigh. I agree

at least you are at the top 2% income club in this country. I make half of what you made, and still dealing with the same shit. It is not just housing, healthcare and higher education are in the same hyperinflational mode, and I am tired of fucking everything already!

Bro, if you’re making $125K, you SHOULD be able to have a fucking decent house, and the fact that you can’t means that SHIT IS FUCKED UP, and I feel for you.

Hi Tec companies are leaving with economic conditions like this. Also, when the earthquake comes, that will shake out the chickens. The Bay Area prices make the L.A. metro area prices look cheap.

My soon to be wife and I made over $200k last year and we still are afraid to make the plunge, though she sends me $700k listings everyday to look at. Yet another realtor told me today we are not in a bubble. Madness…pure and simple, nothing is going to change until the jobs dry up and people have to foreclose or some catastrophe befalls a west coast city. Don’t want to wish for either…

You need to make a spreadsheet that details all the income and expenses you have and do YOUR OWN rent vs. buy calculation. Unless you have a huge down payment saved up, $200K won’t support a $700K house if you want to put money away for retirement and you have to pay for day care. Unless you want to be house rich and cash poor, which then makes you vulnerable to economic shocks.

You need to think carefully about investing. I do not regret for a second my 403(b) contributions before, during, and after the financial crisis of 2007. I have somewhere near $400K accumulated in those tax sheltered accounts, and I’m 38. I may not have a house, but I have a good amount in equities and treasuries, and I will be able to draw on those investments in future years. Eventually, I’ll buy a house (I am holding $400K cash), which will further diversify my equity portfolio.

Prioritize investing over the house. You’re fucked if you have no assets that appreciate with time.

Well said yodawg. I’m a couple years your senior and we have always prioritized saving and investing over buying a house. Do your own calculations and determine what you can afford. We did that and took the plunge on a house last year. We can afford it, but honestly I don’t give a crap if it goes down. I would like to see normal people get opportunities and plus my taxes would probably go down too. We will keep investing and saving over the long-term and hope to limit damage in paying for kids education.

I’m a boomer from the Central Valley looking for a retirement home on the central coast. One of my closest friends just had to put her husband in a convalescent hospital for more than 7,000.00 a month. She said that she wishes she had put all of her money in an expensive house as your house is protected when all of your hard earned savings drains away. You can only keep around 109,000. plus the house. Something to think about.

We are in the typical CA cycle now….

in the next recession prices will drop 10% in premium areas, 10-15% in inland areas with good schools, 20%-30% every where else

It will be great when it finally happens as long as you still have a job

I love the crystal ball crowd that can tell the rest of us without one how much prices will rise or fall.

“It’s difficult to get a man to understand something, when his salary depends upon his not understanding it.” Sinclair

In simple Layman’s terms, I would call it professional malpractice.

In the 19th century mining boom towns the riches were ‘inflated’ away as prices soared for everything from eggs to whiskey. Miners with their pockets full of gold had no choice but to pay the ridiculous prices or leave the gold fields.

Now Mark Zuckerburg and other captains of tech firms may not feel the strain of unaffordable housing prices but their employees do and, at some point, those employees will, like most 19th century miners, conclude the game is not worth the candle. That the riches they thought were theirs are all going to others leaving them pauperized.

Palo Alto will never become a ‘ghost town’ but just as prices for eggs and whiskey eventually fell in those boom towns as the easy gold was scooped up so too will housing prices fall when the easy money and profitless unicorns become exhausted.

the stock option carrot is too great at facebook

as long as the stock price keeps going up these people are extremely well paid

otherwise, all bets are off

As the people in the Bay Area know, they pay a large percentage of California’s income , property and sales taxes. Those in SoCal should be thank full for their contribution. When the golden goose flies away, the state budget will be cut drastically, and/or your taxes will go up drastically. The golden goose will fly away eventually and since it is white collar and not manufacturing, it can happen fast.

Is there any real good data on Chinese investments in real estate in California. Bloomberg had a report that said Chinese accounted for 1/3 of all home purchases in 2015 for Vancouver, Canada. Of course the median house price there is around $1 million Canadian. The average detached home is over $1.5 million Canadian.

http://assets.bwbx.io/images/iAPuLujVD3cg/v2/-1x-1.png

San Francisco-Oakland is the third most unaffordable city in the world, with an average house price of $705,000 and a median income of $76,300.

The most unaffordable major city in the world is Hong Kong, with an average house price of $4,024,000 and median household income of $270,000

fuck the ave house price of h.k. no wonder my classmate carol li net worth is 10b

Hebert Asbury, the author of “Gangs of New York”, also wrote a companion volume about San Francisco’s underbelly during the 19th Century, “The Barbary Coast”. I remember reading in detail how Gold Rush miners would pay today’s equivalent of something like $100 a night, simply to sleep in hammock- or even a wooden plank mounted across two sawhorses. How ironic that history repeats itself in this town, again and again and again…

Our government is bought and paid for by the campaign bundlers and lobbyists. We have moved into the worst form of crony capitalism in the last 20 years. Makes no difference what party or whether state or federal.

These lobbyists are bailed out by our helpful (and owned) legislators which is why the crash didn’t sort things out. The unelected California Coastal Commission doesn’t want more houses and prefers restrictive policies so it’s uneconomical if even possible to build more houses and apartments are harder.

Supply and demand and there’s virtually no supply. Why is anyone surprised?

I am 33 yrs old white male. (I am hated in the bay area) I have a MBA live in the Bay Area and never thought I would ever say this…but Oakland has some very nice areas and is a great place to live. I make 100k – I work in Healthcare…my job is secure. I have probably 80k in stock/cash/assets. I have no debt. I consider my self to be an above average millennial. and the sad part is…I will never be able to afford a nice house in a decent area (I will not live in East Oakland or Hayward) I do not see how people aged 25 to 35 are going to be able to become home owners at this rate. None of my friends have more than a couple grand in their saving accounts and all have debt. The few friends that I do know that own property in California had extremely rich parents who footed the bill to the tune of 500k to 700k to “help” their babies afford to buy a home. Living in California is not expensive if you can figure out your housing. I hope the market tanks and the people that bought in the bubble get screwed. All of them!!! I am thinking about moving somewhere new..Where it does not rain or snow and the housing is cheap? But I am not sure where this is other than my home town of Tucson AZ ( there are no high paying jobs in Tucson)

so Tucson has nice weather and stuff. I have heard that the crime rate in some parts of town are not low, but then again, the same can be said of L.A. AZ is open carry, so at least in Tombstone you can protect yourself, unlike in L.A. where only the gangsters get to carry, unmolested by the police.

Tucson is not bad…As far as crime…I did not see much of it when I lived on the Far North east side of town near Mt Lemmon. The Foothills and the Far North East side of Tucson have no real businesses in the area. The scum can not afford to live in this area of Tucson – 1 because there is no public transit and 2 the home prices are considerably higher. I never went to school with anyone that was not white until my senior year in HS. This could be a good or bad thing depending on how you see it but there was very little crime in my area of Tucson. No gangs and the parents were very involved in the school but not to a Palo Alto standard. FOOTHILLS/ NORTHEAST you will find no homeless and the area is clean. Go near the campus or downtown or southside west side and thing are different. Little Mexico…As for homes 300-400k will buy you an amazing home…If you spend more you are looking at 4 car garage pool yard with an acre plus of land. Good luck finding a job making 150k+ as those jobs are far and few…and yes all of my HS friends/ parents friends conceal and carry. It is very common.

http://www.bloomberg.com/graphics/2015-stem-jobs/

Here’s your answer. Be open minded. Very nice quality of life. Easy living and not a rat race. You will be able to easily afford a nice house and be able to travel and still save money. Nice, smart people from all over. Amazingly diverse if you care. And you won’t be “hated” here.

I have no idea about what the rest of the US is like. I only know about AZ, SO CAL, VEGAS and the Bay Area. I wonder what life is like in places like AL, FL, GA.

CO is too cold. Utah scares me with all the Mormons. Portland and Seattle are to rainy and grey. I would never live in Chicago or anywhere that snows. Texas seems like a place I should do more research on.

I just need to find a place that has good trees like The Bay… big companies the shell out 6 figure salaries… no snow and a ocean or lake near by that I can take my boat. The more I think about it California is sure hard to beat. I really hope the market tanks before I end up leaving.

Duganator: I would never live in Chicago or anywhere that snows.

I don’t understand some people’s fear of snow. I saw snow growing up in New York City. Not enough, but some. I loved waking up after a heavy snowfall, then looking outside to see a Winder Wonderland. Everything blanketed in pristine white during the day. Clouds glowing pink at night due to the city lights. Beautiful. Felt like Christmas.

Duganator: Utah scares me with all the Mormons.

I’ve been to Salt Lake City. Mormons are a very nice people. Law-abiding, clean, polite. You can do much worse for neighbors. Much worse.

Duganator: Portland and Seattle are to rainy and grey.

I love rainy and gray.

PS: I suppose one can overlook that you’re using the English spelling for “grey” as opposed to the American “gray.” But it’s “TOO rainy” and not “TO rainy.”

I travel and am in a tech job. We currently are in SoCal which is a pretty good situation because there are ton of tech jobs between LA, OC & SD and the competition is only so-so. Other places to consider living for us would be Phoenix, Colorado, North Carolina, or Texas.

North Carolina is probably first on the list because it has lots of jobs, is cheap and weather is decent. Texas has a lot of jobs but just not impressed with the cities. Colorado doesn’t have a ton of companies and Phoenix just gets too damn hot.

Just some anecdotal feedback on locations for anyone who might care. Your mileage may vary.

I suspect you’d be better of making $75K in Arizona or Florida than $125K in the Bay Area. You could at least buy a nice house. The drawback is you have to put up with 3 or 4 months of very hot summer days ( but air conditioning is available).

I retired from the Bay Area to Sarasota because, despite your claim to the contrary, California is very expensive. I have no state income tax in Florida, sales tax is 6.5% and it costs $1 to cross the Sunshine Parkway bridge if I want to go to Tampa/St. Pete. Best of all there is no ‘gridlock’. You can buy a convertible, put the down down and the summer months are not so hot.

Homeownership Increasingly Difficult For Average Americans

Home price growth is exceeding growth in wages.

(Reuters) – Home prices are rising faster than wages in most of the United States, making homeownership increasingly difficult for average Americans in some of the most populous areas of the country, according to a report released on Thursday.

The report found that home price growth exceeded wage growth in nearly two thirds of the nation’s housing markets so far this year, with urban centers like San Francisco and New York City among the least affordable.

Home prices in 9% of the U.S. housing market are now less affordable than their historic norms, the report by RealtyTrac found. Home buyers need to spend more of their incomes on housing, leaving less money for other purchases.

(more)

http://fortune.com/2016/03/24/homeownership-prices-average-americans/

She keeps says RealityTrac. Jeez.

2 bedroom apartments in Westwood (WLA) tops $4K per month!

http://www.laweekly.com/news/heres-the-most-expensive-rental-neighborhood-in-la-6751325

While browsing for a used tent on a popular online classified site – I came across a fully employed engineer who was looking to camp in someone’s backyard.

You know the market is insane when-

With the Chinese market and other foreign markets declining – I can’t see foreigners continuing to buy up real estate in the US. The crash is coming withing the next few years. I also saw a study that showed the majority of Boomers are planning to sell their home to help fund their retirement funds. That should be fun.

A co-worker in the 90’s had the brilliant idea to drive an RV to the Bay Area and park it in the parking lot while working for a Bay Area salary. This isn’t a new problem but likely it is worst than the 90’s.

Reminds me of this story about the Google employee that lives in a moving van and he parks it in their parking lot!

http://www.businessinsider.com/google-employee-lives-in-truck-in-parking-lot-2015-10

They can always move to Trona, Ca. Fixer-uppers starting at $10,000.

http://www.trulia.com/for_sale/Trona,CA/price;a_sort/

there are so many affordable options only 40-60 miles away

but people feel entitled to live in the best neighborhoods… while they rent $4000 apartments for more than the cost to own

You often get what you pay for. I’m guessing there may be few jobs, little to do, high crime, or some combination of the foregoing in your suggested locale. So if you keep your job in civilization, you’d have to commute 40-60 miles each way. No thanks.

Home prices can not rise more than the wages that support them. So, if home prices are moving up while interest rates do not change, then wages are also moving up. The problem is some of the studies showing wages as not rising are bogus. Political types often cite bogus wage studies in order to gain power.

You want to direct us to some links to support your bogus theory?

You’re joking, right?

jt – care to explain the current real estate market? I think everybody is wondering what you’re smoking…

In my opinion, nominal wages are rising and at all time highs, and you can find some studies that show this. Add low interest rates and limited supply and you have rising prices.

It is fairly easy to get a mortgage, so that helps.

One day, prices will start to drop, and the drop will be on the order of 20%. They could start to drop in one month from now, or they might not drop for many years. But, they will drop. No one knows when. But, the people that purchase just before the drop will have substantial financial damage.

What to do? You buy and keep your fingers crossed. And if you buy just before a price drop, which no one can predict, you are screwed. That is the game. Fortunately, I purchased homes and prices continued to rise for years after I purchased. This was not skill. It was pure luck. And, I wish all of you the same kind of luck.

Except that you haven’t established a correlation between the exponential growth of RE prices and the minimal rise in median incomes. In real terms, the RE price growth rate has far outpaced median incomes growth.

For a few years, nominal wages and nominal house prices have both been rising. Nominal wages pay for nominal house prices.

Will this continue? Who knows. A housing crash could be starting shortly. Or, it might not happen for many many years. Or it could happen anytime. No one knows. If you are renting and prices crash tomorrow, you win. If prices don’t crash for five years and you are renting, you lose.

The only certain statement is they will crash in the future. No one knows when. Buying a home is a gamble. If the price crash does not happen for years, you win big if you buy now. If you buy and a price crash happens shortly after, you lose and lose big.

Some renters hit it big time … they are renting during a crash and they get a super deal. That is possible .. my guess is 25% chance that will happen.

Good luck in your future investment in a home.

Jt, do you mind explaining why I lose if I rent and prices don’t crash for five years? Please don’t tell me it’s because I am missing out on appreciation.

Wtf? House prices only increase if wages increase? A 1-minute google search will prove that this isn’t the case, at least in CA. Will the Easter bunny also be visiting you this year (as long as we’re conversing about preposterous notions)?

250k in subsidized housing politicians are dumb and ignorant of what happening around in their neighborhood. Keep the Bay area housing strictly for local. Foreigner and investors should be barred buying real estate in this area. They are the culprit of this really insane house prices and keep americans owning their homes in this area. American will be owned by the foreigners twenty years from now if the government did not do something about it.

Fatima,

I hate to break it to you, but politicians are there for themselves, not to represent you. They are a self serving gang, living off the middle class till it’s completely gone.

More than that, the globalists we keep electing (with a D or R after their name), they don’t care if they drive the whole US economy to the ground. Many of their houses are not in US anyway. For them, there are no US citizens and foreigners – there are only citizens of planet Earth. All coming from CFR are globalists. Few examples of globalists are: McCain, Romney, Clintons, Cruz, Bush, Sanders – regardless of what they claim, they pursue globalism with a vengence. Kissinger and Brezinsky were among the architects of globalism. The downfall of US started with construction of global architecture of a New World Order. Based on this NWO, the final stage will be a global elite of 0.0001% controlling the whole world and global financial system and 99.99% of “equally” poor people with no hope and opportunities – not even the option to vote with their feet.

The sheeple are too blind to see that they are led to the slaughter regardless of their “choice” in voting. They have only 2 choices: compete with slave wages from oversees or die. Till globalism is fully achieved, the middle class will be forced to “share” with the poor in order not to upset the apple cart. They will be forced till all are equally poor – communism. The propaganda against NRA and 2nd amendment is part of this policy of globalism. Crooks and psychopaths don’t like resistence and opposition to their plans, but the sheeple are too blind to see.

Wonderful- people who make $60,000 a year in San Fran and can barely afford to rent a storage container to sleep in, will pay taxes to help people making $150K-$250K get in far over their heads, even after subsidies, in houses priced at $1.2M or more that are unfit for human habitation.

All this San Fran subsidy will accomplish, is to drive housing prices there further into the ether, while pricing more people out, and triggering more tear-downs of small homes, more conversions of rentals into ownership only units, and driving up rental rates.

Are there more than 5 people in our entire population that begin to get that subsidies only benefit the sellers, lenders and other entities positioned to collect the “skim”, and that they only drive up the prices of everything while making the general population poorer?

Government subsidies have turned every system and industry we rely on for our lives, from medical care to education to housing, into a financial racket designed to squeeze as much money out of assumed beneficiaries as possible, while giving back the minimum, if anything.

“Are there more than 5 people in our entire population that begin to get that subsidies only benefit the sellers, lenders and other entities positioned to collect the “skimâ€, and that they only drive up the prices of everything while making the general population poorer?

Government subsidies have turned every system and industry we rely on for our lives, from medical care to education to housing, into a financial racket designed to squeeze as much money out of assumed beneficiaries as possible, while giving back the minimum, if anything.”

—————————————

I could not agree more with the above. Subsidies make everyone poorer on multiple fronts. Not only do our taxes increase to pay for these subsidies, but the cost of the subsidized housing/service/widget increases (as you noted). So we realize less net income, and we pay more for stuff we need. And don’t forget, these welfare programs have to be administered by someone- more government employees to pay for! Now that I think about it, I should really look into getting a cushy government job… Never mind, I’m competent, white (well, I look white anyway), and I don’t have any inside connections; guess I’m out of luck.

I think yodawg should have included subsidies in his rant!

Yodawg is at least slightly more intelligent than a slime mold and understands that Laura’s assertion on subsidies is probably correct. And that’s why yodawg said “Fuck the subsidies” in his rant. Fuck everything about this market.

Haha, my apologies for overlooking that, yodawg!

Bank knows that this is the last chance to sell!

All of these came on the market today (March 25th). Overpriced flippers in Pasadena would receive no offer until all of these are sold.

https://www.redfin.com/CA/Pasadena/265-Plymouth-Dr-91104/home/7193056

https://www.redfin.com/CA/Pasadena/1361-Garfield-Ave-91104/home/7193058

https://www.redfin.com/CA/Pasadena/1371-Garfield-Ave-91104/home/7193059

https://www.redfin.com/CA/Pasadena/290-Grandview-St-91104/home/7193060

Those are some spectacularly bad homes!

Check out the street view on the last one. They have 5 satellite dishes on the roof of one three bedroom 1200 sq ft. home. They must get ALOT of channels!

On a serious note, all of those properties look to be in crappy neighborhoods, but I’m sure people house-horny for Pasadena will snatch them up quickly.

Yeah, those houses are all in northwest Pasadena (north of the 210, west of N Los Robles Ave). Pasadena’s gang-infested area.

Plus, they’re all one bathroom homes.

My ideal rule of thumb is that one bathroom is needed for each occupant. That way, if someone blows up one bathroom, another one is available for use until the former one decontaminates.

the third home looks pretty nice

but at only $550K…. your life must be in danger every day for such a low price

Yeah, the 3rd looks to be the best opf the bunch. But how is it possible to have 1,925 sq ft with only 2 bedrooms and 1 bathroom spread across 2 floors? It doesn’t make any sense.

And don’t forget to check out those school district ratings, 2, 2, & 4. Ouch!

Anyone want to make bets on how long until those properties go pending? Considering they are bank-owned and the agent is probably getting paid bupkis & will need to wait for the bank to approve any offer, I say within 3 weeks they all go pending. If they were being sold by owner I would have said 2 weeks. According to Redfin there are slim pickings in that price range and zip code.

I am guessing we will other areas of the U.S. start to see home price appreciation. The last housing bubble started in California?

South Florida housing market barrels toward unaffordability. Looks like double digit home price appreciation YOY.

he South Florida housing market is barreling toward an affordability crunch, a report published Thursday shows.

Despite homes being more affordable during 2016’s first quarter, which runs from Jan. 1 to March 31, compared to levels dating back to 2005, median home prices continue to outpace wage growth, according to a home affordability index crafted by RealtyTrac, a service that aggregates national housing data.

In Miami-Dade, median home prices in 2016 jumped 9 percent year over year, while wages have grown by a mere 4 percent.

In Broward, median home prices rose even greater, 11 percent higher in 2016 than the previous year, and wages rose a paltry 3 percent.

Read more here: http://www.miamiherald.com/news/business/real-estate-news/article68087142.html#storylink=cpy

Would someone be interested in investigating how many Chinese seniors are living in subsidized senior living apartments in Palo Alto who moved here from China to be near their wealthy children working in Silicon Valley. That certainly seems a bit unfair to seniors on the Peninsula who don’t have kids who can support them and need subsidized senior housing.

Income taxes steal nearly half the $250k, then inflation is eating away at the rest. Then normal living expense see are rising. To add insult to injury you have some tech company kicking you out of your own neighborhood.

I say buy golds while it’s cheap

Leave a Reply to Hedda Lettuce