Real Homes of Genius – Palms Mar Vista correction. From $740,000 to $540,000 and still overpriced. The Westside of L.A. enters an accelerating correction.

The housing market is one giant game of musical chairs leveraged on the back of taxpayer dollars. The last ten years saw with the innovation of creative finance a housing market that went from being a relatively mundane investment to a highly charged vehicle of playing with other people’s money (OPM). Back in the early 2000s I remember going to a conference where every other word was OPM and how you could leverage your way to riches. Nothing down used to be a tiny part of the market even in the 1980s and I figured it would be a fad this time around as well. Of course, not only did this catch on but in many places in California this became the primary way of financing real estate since people had no actual cash savings. Today, the bursting of the housing market bubble is rippling throughout Southern California. Even the once untouchable Westside of Los Angeles is seeing six-digit discounts only after a few years. Amazingly with massive price cuts these areas are still inflated and will correct further. Today we’ll examine a block in the Palms/Mar Vista part of Los Angeles.

A $200,000 price correction will get our attention in a mid-tier location. Today we salute you Mar Vista with our Real Home of Genius Award.

Continuing with our trend that banks are now moving on mid-tier foreclosures, this home has only been on the MLS for less than one week. If this was a foreclosure last year, you could have expected some delusional starting list price trying to recoup bubble level prices. That is no longer the case. Let us examine the details of this listing:

12421 GILMORE AVE, Palms – Mar Vista, CA 90066

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1989

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1947

Listing price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $539,900

I find it interesting that the listing is seeking “cash only†buyers. Trying to move the sale quickly seems to be the game here. It looks like some work went into this place:

We don’t have much other information except that it sold in 2005:

Sales history

11/03/2005:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $740,000

A nice 27 percent discount over 5 years or $200,000 (the median U.S. home price is close to $180,000 for some perspective here). This place is still overpriced. Here is the actual street perspective in front of the home:

Nothing special. I think people have forgotten that $540,000 is still a good chunk of change for most people. This is even more of the case when the California economy is in a mess. Things are so bad that there are rumors that we can’t even refill toilet paper in our state parks. Yet this is the logic that goes into the Westside of Los Angeles where home prices disconnect from the real economy. Right next to this place we find a:

3 bedroom / 2 baths – 1,264 square feet home

Last sale price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 11/16/1999Â Â Â Â Â Â Â Â $236,000

Now let us run some numbers here:

$236,000 / 1,264 = Â Â Â Â Â Â Â Â Â Â $186/sq ft

$540,000 / 1989 =Â Â Â Â Â Â Â Â Â Â Â Â $271/sq ft

Now the square foot price of the current home is 45 percent higher than that of a neighboring home sold in 1999. Inflation over this time was 30 percent for the area. In real terms, this home is over priced by 15 percent. Yet we can say that the bubble started in 1997 and this would result in a bigger correction. After all, the carrying costs are still high if this place were to take on a mortgage (even if they ask for all cash). But let us assume a mortgage was place on this home. Let us run some numbers:

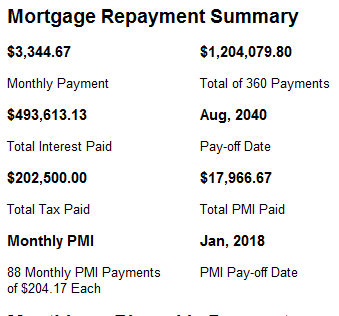

We’re assuming a 10 percent down payment above. Assuming that, the net monthly nut will come out to $3,300 which is no small amount. At the lower end a household would need to bring in $150,000 or more to afford this place. It is easy to do this with a toxic mortgage but not in the current environment where government mortgages are the only game in town.

I also found a 2 bedroom 1 bath home on the same street not too far away that is in pre-foreclosure:

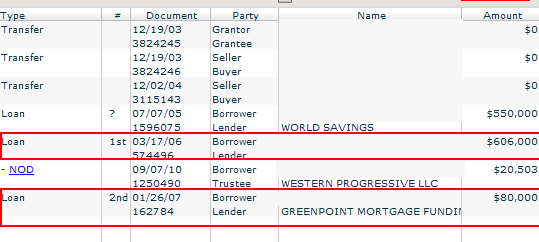

$680,000 in mortgages on a 1,200 square foot place. Of course the above place isn’t on the MLS. The MLS lists 4 foreclosures in the Palms Mar Vista area yet the shadow inventory is up to 100 here. The good news is that it seems that the foreclosures that are hitting the market are at lower prices. But we have a long way to go before people can call this a good deal.

Today we salute you Mar Vista with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

34 Responses to “Real Homes of Genius – Palms Mar Vista correction. From $740,000 to $540,000 and still overpriced. The Westside of L.A. enters an accelerating correction.”

“This place is still overpriced”

Its just nuts why people just dont get this.

Exactly, I don’t understand it either. The sheeple are totally brain washed into this “Must be a homeowner at any cost!” mentality.

It’s hard to break the illusion/delusion of the euphoric bubble years. People are still living in the 2000’s, some still think it’s 2005-2007. We’ve also had every delaying tactic thrown at the collapse/correction, all to no avail, but it has slowed the process tremendously. When the vast majority of the public is fearful of real estate as an investment or even homeownership, then will be the bottom and the time to buy.

The American public as a whole is always very slow to change perceptions, once they are baked in by the mainstream media. If you want to make money, you need to be ahead of the curve, which is not hard to do. Next money makers are green jobs. Just look at what all the community colleges are offering, as far as the latest certificates and licenses. All green jobs for helping to collect taxes from the citizeny, due to a broken economy.

Too funny. I live in Mar Vista now (HAPPY RENTER). Here is why I am a happy renter: I sold this Koreatown (90004) home in 2007 for $805,000; short sale listed in Aug 2010 for $500,000. The reason I sold this home was heavily influenced by Dr HB and Market Ticker’s blog. Thank you!

124 S. Hobart Blvd, 90004

http://www.zillow.com/homedetails/124-S-Hobart-Blvd-Los-Angeles-CA-90004/20780486_zpid/

Date Description Price % Chg $/sqft Source

08/14/2010 Listed for sale * $500,000 -37.9% $359 Newstar Realty

09/07/2007 Sold $805,000 -7.4% $578 Public Record

Way to go, Dean.

But protect that extra cash you have from selling at the top. They want it, and they just might get it via debasement of the currency… big-time debasement.

Better diversify into hard silver, some hard gold, Chinese yuan, and raw land outside the nearest metro area, where food may be grown in quantity.

I live in the San Francisco area. Homes in my area, if over $600000.,

are sitting on the market for months.

But a listing at $420,000. sold in 4 days, for full price.

Ray: It sold quickly in the Bay Area because it was 420!

I live in San Francisco and homes are still selling like hotcakes at 10% off peak pricing. Single detached small 2BR / 3BR homes are still still going for $800K+ in my SF neighborhood. So they are still chugging the Kool-Aid here in greater Frisco.

Cash offers likely because of the condition of the property. FHA may not be an option depending on what’s not showing in the photos taken by the Realtor.

This is in a very rough part of Culver City/Mar Vista. Not very PC to say, but when you see three lawnmower repair shops, a couple of wig stores and a pawn shop all in a 2 block radius, you know you’re going to have some interesting neighbors.

The only reason I head out to this place at all is because of The Submariner sandwich shop right around the block which have the best cheesesteaks on the West side.

Sakura Japanese has a great bento box lunch. Great sushi, there’s always a line for dinner.

But yeah, not a great neighborhood. I wouldn’t want my kids to go to school around there, that’s for sure.

State and local govt seem to be the next wild card for CA. If budgets really end-up being cut, govt lay-offs will have to follow. Real unemployment pushing 20% should prove disasterous for the CA real estate market.

Obviously whoever buys this house is a millionaire financier, coz look at that seven-figure mortgage repayment summary/total of PI.

A 6% commish on $539K is still a damn good Brazil nut for whoever middlemans this place, wouldn’t you say? $32K with one sale. Damn, that’s about two years’ worth of full time minimum wage work in California.

Now take a look at the total interest in your scenario: half a million. That’s ten years’ median income-ish, right?

We always hear the magic ratio of 3:1 on mortgages. But think about how this mess plays out if the person buying this place is actually doing so in the corny old middle class way of down payment and working to pay the monthly nut, in any way resembling Doc’s scenario:

In the first 10 to 12 years of this sucka, the bulk of that half-mil in interest gets paid, and it goes to the lender for doing nothing at all but inventing money out of thin air with a crunchy crust of pixels and signed documents. Assuming the buyer has a steady job in that time, and it pays reasonably well, which are two big assumptions.

But in any event, the single biggest portion of the buyer’s paycheck is going to banks that s/he has already and will continue to be bailing out for the next bajillion years.

A good time to rent, I think.

That particle board garage door, or whatever it is, is truly inspired. That’s the equivalent of five to seven garbage cans, right there.

Yeah, I like the way you spell it out. I wish I were a bank and I could conjure up some vapor money. Unreal…

aimlow joe was here

http://www.aimlow.com

Anyone can conjure money (a symbol of value transacted with or in lieu of real goods).

With organized shared effort and a rational plan, anyone can establish a local currency. With enough local currencies, a critical mass of them, a completely alternative currency system can be built.

But in my experience getting that started and building it requires a lot of work. And an understand of what money is.

Easier just to use what the Fed peddles and complain.

Search the Web on these terms

local currency

local exchange trading systems (LETS)

scrip

mutual credit systems

ROCS

http://www.usatoday.com/money/economy/2009-04-05-scrip_N.htm

http://www.transaction.net/money/lets/

It is all about pricing it right. 918 Avon, Burbank, 1361 feet, went for $575k 6/29/10, one month on market. Another, 923 California, Burbank, 1080 feet, went for $550k 9/2 and listed 7/27/10. Both are Tudors, which rarely come on the market in Burbank. I will not repeat myself on why Burbank is a good location.

I would not be paying half a million for a home like that. As a relatively young professional who was born and raised in the South Bay of California, I must admit that people my age have been conditioned to believe that $500k is a small price to pay for a start home, no matter how crappy. Thanks to the Doc and commenters on this blog (to whom I will always be grateful), my eyes have really opened. I’ll rent for 15 more years if that’s what it takes to not lose money in this foolish game.

Great post Doc.

I live in Mar Vista and know all about this area. Even ten years ago, it was a joke to think that ANY house in this area would be worth a half million dollars. These are all old house that were built right after the end of WWII. They were not built for comfort or luxury. They were built to house WWII veteran families looking to live in a house. The streets are narrow, street parking is minimal, the area offers no ‘amenities’ except for a bakery and a couple of cheap restaurants. The lots are very small so you don’t get much beyond the actual house and a kiddie pool size backyard. i should know. I grew up in one of those houses in this area. Half a million dollars it ain’t!!!

In the metros of India and China, a lot of one thousand square feet will cost you USD 500,000.00. This is over 100 times the local median income of less than USD 5,000.00. Needless to say, the infrastructure around these lots is pathetic, yet costs way more than even in the major metros of America.

Interesting. I guess your post demonstrates where the real wealth in the world is.

Shortage of reasonable housing, a small number of people making far far more than the median, and growth prospects to help rationalize the multiple. For this to be palatable you need one of the following 1) the cost of the house to be immaterial to your total wealth 2) lots of broad growth and development to increase value 3) a bigger fool.

Let me share something with you – when all three of those fail to materialize, you get the mess California is in with one exception, they aren’t totally out of fools yet.

Someone needs to juxtaoppose the crime stats on this map. THAT would be interesting

Within a one mile radius in the last week:

4 thefts from vehicles

2 grand theft autos

2 aggravated assaults

1 burglary

1 personal theft

source: lapdcrimemaps.org

Unfortunately, their stats only go as far back as the past week, and (naturally) only cover crimes reported to the police. For whatever it’s worth, there has only been one reported rape and no homicides in the past in a 5 mile radius. Monthly or annual data would me FAR more telling, however.

oops. I meant “in the past week” and it looks like it was 2 rapes.

Looking closer, within a 5 mile radius, approximately 20 violent crimes in the past 7 days. Extrapolated out, that would only be about 100 per year assuming the rate stays constant (although the heat has probably decreased the crime rate in the past week). I don’t know what the population numbers are in the same radius, but that doesn’t seem like a horrendously large number of crimes.

DangerMike, the 1 mile radius is really informative, but 5 miles? 5 miles east of Mar Vista is Crenshaw, and is at the doorstep of inglewood to the southeast. I wouldn’t be surprised if the results of that kind of search brings up more dire criminal incidents. The same idea can be applied to hancock park, one of the more affluent neighborhoods in LA, which is around 5 miles off from skid row and some other poorer neighborhoods in LA that stretch from downtown to Hollywood.

From my own impression of Mar Vista (I commute to work from MDR to Miracle Mile), it doesn’t look anything near a prime area. Some parts are ok, but nothing to make me want a home there for anything over 500K

That block of Gilmore Street is mixed with apartments. And, being next to commercial on Centinela it has a double whamm.y It looks like someone literally got taken to the bank in 2005. That house needs to come down into the 200s to be worth it.

http://www.westsideremeltdown.blogspot.com

LA needs two more years for prices to drop. Its the one hold out in So Cal. Every balloon loses its air over time. Its just seeping out slower in LA. Where I live in Riverside county (Temecula) the bubble popped suddenly and drastically. I mean 50% off in less than two years. I think now its actually stabilized, here. I certainly can sell my house for more than I paid in Jan 2009, but I plan to own it for life. Some bubble buyer paid $400k for it in 2005 and I paid $230k in 2009.

It had “gone up” to $460k then fell like a fricken knife.

Nothing is happier than owning a wonderful house is a nice clean, safe neighborhood and having a mortgage of $1,300 a month. Some day LA county may experience that feeling as well, but not for a couple of years, at least.

Only in the ghettos or varrio can you get a mortgage for $1,300 in LA county.

John: I would not say LA is the one holdout even if you mean the whole county and not the city. If you check the prices in Ventura, San Diego, Orange and some of Riverside (Palm Springs) you will see prices that are well above the rate of inflation.

In response to DR HB comment “I think people have forgotten that $540,000 is still a good chunk of change for most people.” The price is 8.8+ years of the medium income. Isn’t that roughly 4 times more than the ratio in 1968?

DHB, I’m interested in learning your take/projection on the impact of the mortgage securitization title cloud issue.

What an absolutely GORGEOUS GARAGE DOOR that house has!

What a piece of crapp.

I live in Texas and own a 4br/2.5 bath/2 car garage on 3 acres north of Houston and it’s appraised value is $210,000. Are you people nuts? You couldn’t pay me enough money to live in Mexifornia.

Here’s what I think is going on: Since a majority of people are owners and have a vested interest in seeing prices go up, they will always say that prices are at a bottom or ready to go up again. I just had a conversation in the lunchroom and the guy was saying “prices can’t go down further.” I’d bet dollars to the 75 cents doughnuts that he would NEVER say anything else. He has a house and wants to believe prices can’t go down further.

And in a way, he’s right. Homeowners have two reasons not to lower prices: 1) It hits them immediately. The buyer can finance their greater burden over 30 years but at the time of sale, the seller gets hit with the emotional and financial impact of a reduction immediately. 2) Strength in numbers. There’s lots of them with the whole government behind them trying to prop up prices.

It’s rather amusing that with all that raw power behind them… they’re still dependent upon the likes of me buying. As long as I say “no”, I win. “You should buy now! Prices only go up!” “NO!” “Prices can’t go any lower.” “NO!” “You’re throwing away money on rent!” “NO!” No! No! No!

No is such a beautiful word!

Leave a Reply