Option ARMs for Dummies: Why 4.5 Percent Mortgages Rates will do Absolutely Nothing for these Toxic Assets.

I’ve been sorting through numerous e-mails especially after the 60 Minute show looking at Option ARM mortgages. If anything, I think the show has caused more confusion and I have even seen some articles posted online that are incredibly off base on this one subject area. Some now think that the 4.5% mortgage rate is somehow going to save those in Option ARMs. It is not that simple. In addition, there is a difference between a re-cast (as in, re-calculating your loan) and a loan adjustment on more bread and butter adjustable rate mortgages. The thing about option ARMs is they fly under the umbrella of adjustable rate mortgages yet are insanely toxic. There are many implications that are being missed and I feel it warrants and article to clear up at least the most elementary components of the loan.

What is an Option ARM mortgages?

The option ARM is a loan that is an adjustable rate mortgage with the added flexibility of a variety of payment options on your monthly mortgage. The gist of these mortgages was to increase the flexibility of your monthly payment. These loans have a low introductory rate that allows you to make very low initial payments and the low qualifying rate also allowed many people to buy more home than they could otherwise afford with more conventional mortgages. When I show you a real case example of an Option ARM, you will completely understand why these mortgages had no place in the marketplace.

The option ARM has four major type payment options:

(a) Minimum payment - the initial minimum payment is set for the first 12 months usually with the initial interest rate. After that the payment changes on an annual basis with payment caps that limit increases or decrease each year. Keep in mind the minimum payment was selected by many borrowers during the initial months and many times did not even cover the full interest of the principal balance which was deferred and any unpaid interest was tacked on to the initial principal balance. In other words, your mortgage can actually grow.

(b) Interest-Only Payment – with this payment option the borrower avoids any deferred interest yet this option was not available on all loans if the interest only payment was less than the minimum payment option. This payment option does not result in any principal reduction. The payment is based on the ARM index used to determine the fully indexed rate (FIR) for the mortgage. I’ll get into how these rates are calculated since I think this is where people are simply missing the boat with the 4.5% mortgage argument.

(c)Â Fully Amortizing 30-year fixed payment – In this case, you are paying both the principal and interest and keep your loan on schedule.

(d) Fully Amortizing 15-year fixed payment – We should call this option the “why do we even have this on the menu” option. Here, you are actually accelerating and paying off your mortgage on a 15 year accelerated time frame.

The number of people selecting option “c” and “d” is practically non-existent in option ARMs. In fact, from surveys I have seen anywhere from 70 to 80 percent of option ARM borrowers elected to go with the minimum only payment option.

Fully Indexed Rate

I think this is where people get confused. You need to remember that many of the option ARMs are based on a blended rate system. That is, you have a variable index like the LIBOR or MTA and a margin rate. For example, let us use the MTA (12-month Treasury Average) for November 2008 which came in at 2.053%. A typical margin rate is 2.75%. So the fully-indexed rate is 4.803%. Normally the FIR is rounded to the nearest 0.125% so the rate in this case would be 4.75%.

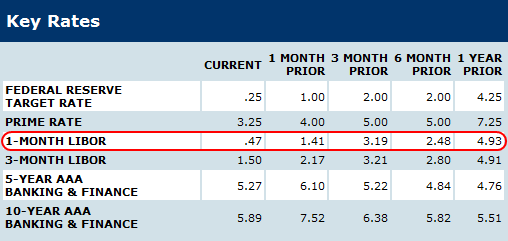

Why is this important? Because I’ve been noticing some article with a weird fixation to the LIBOR index alone:

Okay, without a doubt the LIBOR has fallen drastically over the past year. This is excellent news for those in more conventional adjustable rate mortgages. In the case of options ARMs, first, not all are indexed to the LIBOR but more importantly the margin rate is fixed. So assuming the 2.75% margin rate and the .47 1-month LIBOR the new blended rate is 3.22%. A good deal for readjustments but not for re-casts. And for the purposes of option ARMs, this does very little because keep in mind most people are making the minimum payment only and even if rates went down to zero (which they may) it doesn’t remove the margin or the fact that the monthly payment will be going up no matter what. Why? Because they are on a negative amortization schedule and even with a zero percent rate, the principal and interest will amortize causing the payment to go up.

And speaking of index options, not everything is tied to the LIBOR (London Interbank Offered Rate). I’m not sure what is going on with this obsession with this rate and option ARMs recently. It is merely one of the many index options. Most commonly used are:

MTA: Monthly Treasury Average

COSI: Cost of Savings Index

LIBOR: London InterBank Offered Rate

COFI: 11th District Cost of Funds Index

And these rates vary anywhere from 1 to 2 percent which is a world of difference when you are talking about $500,000 mortgages. A big reason people have jumped into the market as well is the first time home buyer tax credit. It is important to get these details correct because we have a tsunami of $500 billion in option ARM mortgages that will flood the markets in the upcoming years. It helps to get the terminology right so we can better understand how these mortgages will hit the market.

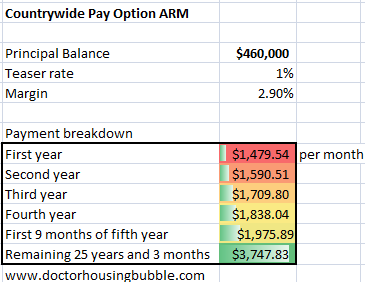

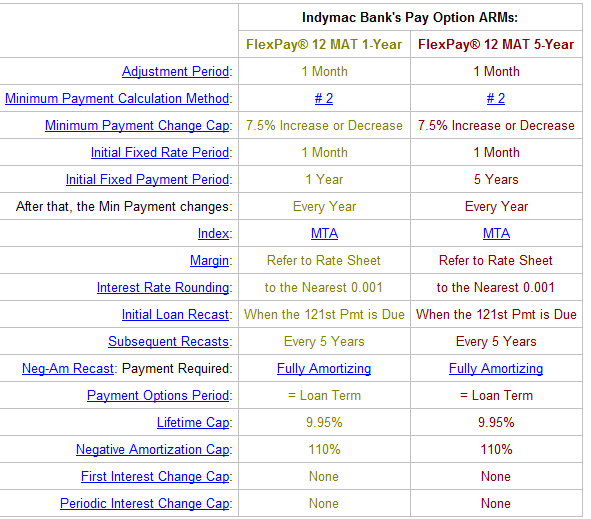

It usually helps to look at a real world example. In a lawsuit filed by the State of California against Countrywide, examples of some real world option ARM mortgages show us how absurd these loan products really are. Let us look at the details first:

I know at a quick glance, you are probably shaking your head at the absurdity of the terms above. We are looking at an option ARM with a 1% teaser rate offered by Countrywide. The margin on this mortgage is 2.9%. That is why you saw people spending like A-list celebrities because with the initial one year payment of $1,479 a month, they had money to spend even though the mortgage itself was negatively amortizing. Little by little the payment went up until it hit the 5th year and explodes to $3,747.83. How can that happen? Well the note negatively amortized such that the balance of the loan increased to approximately $523,792.33. That is right the note grew. Many of these notes had 110% or 115% re-cast ceilings but when you’re dealing with a $460,000 mortgage 10% or 15% is enough rope to do yourself in.

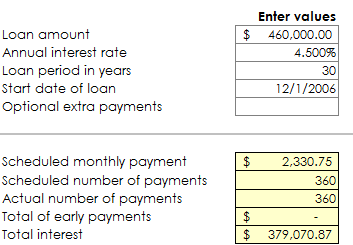

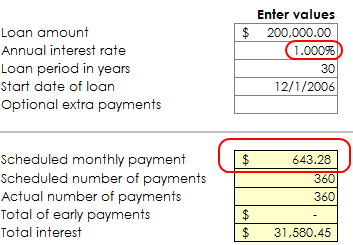

And just for giggles, let us see what happens if a borrower actually made the interest only payment for 5 years and then refinanced into a 30-year fixed rate of 4.5%:

Big difference from the teaser $1,479 monthly payment. Lower rates are a drop in the bucket for option ARMs.

It also doesn’t help that California and areas like Southern California are now quickly approaching a 50% reduction in home prices from the peak levels reached in 2007. So assuming the current rate declines, let us assume the person went zero down and the home was worth $460,000 when it was bought and now it is selling for $250,000. You can take a wild guess what little use the 4.5% rate is going to do.

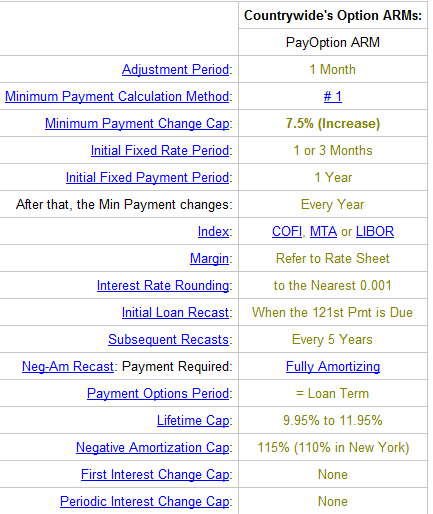

And not all lenders created the same option ARMs:

*Source:Â Mortgage-X.com

This is my point that not all option ARMs are created equal. Countrywide used a variety of index options and IndyMac went with the MTA. These mortgages are simply laughable. I want to make one point very clear:

The most important thing about buying a home is the price.

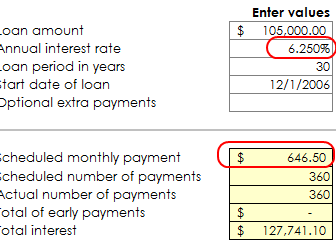

Repeat this to yourself ten times because I’m seeing people fixate on these index changes which mean nothing in relation to the option ARM disaster. It seems those that write the articles may not have any firsthand experience with these notes or investing in real estate. Any successful real estate investor understands that price is the most important thing in buying a home. Why? First, a good price gives you wiggle room even if you have a high interest rate. With a high interest rate, you always have the option of going lower through other financing. If you are at 3% or lower there isn’t much a drop to 1 or 2 percent is going to do. Let us look at a quick example to highlight this. And I’ll exaggerate simply to drive the point home:

Here we have the lower rate argument taken to the extreme. You’ll notice the monthly payments are practically the same yet one mortgage is $200,000 and the other is $105,000. As an investor, the rate is negotiable. You want a lower price because it gives you more flexibility:

(a)Â A lower price means you can sell the place much easier

(b)Â You can always refinance a very high rate

(c) You have the option of paying the note down faster. Any extra payment will take care of more principal on a lower mortgage

I think these misconceptions and the focus on the monthly payment or lower rates is one of the primary reasons so many people are losing their homes. Those dealing the loans didn’t understand that having a rock bottom rate leaves no wiggle room and borrowers are paying with losing their homes. If your rate is 1 percent for example, you have nowhere to go but up. Any future buyer is constrained to the same mortgage environment. But say you buy a home at a rock bottom price with a high interest mortgage, say rates drop then your home is more lucrative because when you are selling, all you care about as the seller is the final amount paid. As a seller do you really care if a borrower buys a home with a 4.5% new FHA loan? Of course not.

I hope this helps to clear up some of the confusion surrounding option ARMs. I felt it was necessary to clear up some of the details of these mortgages to put an end to any notion that lower rates are somehow going to buffer $500 billion in option ARM recasts over the next few years. It won’t. It is all about the price.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

25 Responses to “Option ARMs for Dummies: Why 4.5 Percent Mortgages Rates will do Absolutely Nothing for these Toxic Assets.”

This is PRECISELY what is blowing up now. The payments are on their way to more than doubling, the value is not there to refinance and even if the interest rate is zero, the borrower couln’t afford the loan balance divided by 360 (or 480 for that matter).

Price is price is price. If you pay too much, you’re screwed.

Unless I missed it, one of the scenerios you did not discuss is that most people in these Option ARMS DO NOT have till the 5th year for the huge adjustment in payment. My understanding is that making the min payment of your options, accelerates your time frame to around 36 months since you reach the 110% quicker.

Another advantage of the *price* of homes being low is some people might actually be able to put down a 20% downpayment and thus escape PMI. Whereas how many people have a 20% downpayment on a 500k house sitting around in an account that they can actually access without penalty? Not many.

I got some junk mail from Countrywide in 2005 and 2006 advertising these things. I looked at them, but did not like the math. The negative amortization feature was frightening. It was all there in black and white, if you just read the fine print. It looks like too few read or cared about the fine print.

I have been writing about how option ARMs were a horrible product for years, and would perform horribly. However, the CBS 60 minutes show was a bit misleading, and focused too much on rate ‘resets” (they meant recasts), which have now become a much lesser issue. With 1-year Treasury rates now at a rather silly low of 0.4% or so, if they stay there the “MTA” index (which is simply a 12 month moving average of the 1-year Treasury) will eventually move down to 0.45%. If that happens, the “fully indexed” rate on an option ARM with a 2.75% margin will by the latter part of 2009 fall to 3.2%. That rate decline does two things: First, it reduces the probability that the “neg am” cap that triggers a fully amortizing payment will occur next year; and (2) it reduces the “payment shock” that option ARM borrowers face when the loans face the “recast” period — for many option ARMs, 5 years after origination (though some are longer).

Of course, as I’ve pointed out numerous times, and as has been observed in the subprime and alt-A market, “rate resets” or “payment increases” have not been the major drivers of delinquencies and default on these loans. Rather, poor underwritring, quite a bit of fraud, and declining home prices have been the drivers. But the recent plunge in mortgage rates has altered dramatically the “payment shock” argument for more problems. Sadly, the continued deterioration in home prices has magnified the “underwater borrower” problem.

Excellent article illustrating the fact that the housing debacle cannot be solved simply by lowering the interest rate (as the MSM would like us to believe). Also, good emphasis on the purchase price as probably the single most important aspect to consider when buying a home. Too bad that JP6 is so easily swayed by the talking heads offering seemingly quick solutions – the results are ugly and all of us suffer from the consequences.

Indeed, unless the root problem is acknowledged, the leeches and voodoo won’t save the patient. But to acknowledge that would be to accept that social designs are limited by the foolishness of man. We must go through these cycles to shape our mass character or culture from time to time. No, market forces alone will not fix every problem.

There are some flaws in your argument. On the MTA Option ARM, with a margin in the low 2’s, as the interest rates have been coming down, 3 of my option arms are paying down principal even when I pay the minimum payment. This occurs when my interest only payment is lower than my minimum payment. You cannot pay less than the minimum payment. As interest rates have dropped, so has the negative amortization which has pushed back the recast to the full 5 year mark. Over the next several years, I will be paying a good chunk of what was added to my principal in the first couple of years when the rates were going up. So what happens after 5 years and the recast occurs? The mortgage becomes a principal and interest loan for the remaining 25 year life. I calculated my new payment on my three option loans and the mortgages will be going up, but not by the thousands of dollars per your example. With interest rates this low, and my option arm rate around 3.5% after the 12 month average sets in, I will only be paying around $300 per loan more than I do today, but I will be paying on a traditional principal & interest loan at that point adjusted each month based the MTA index. I agree that the price of your house is the most important thing, but there is nothing anyone can do about that right now. However, lower rates minimize negative amortization and in my case actually allow me to pay principal even when I pay the minimum payment. With rates this low, even after the recast, I can afford to hold on until the housing market slowly recovers.

Dr. HB: I think this is the first time in over a year that I actually disagree with you on something: It’s not all about the price of the house.

If i had to pick only one variable, I’d say it’s all about the INCOME of the purchaser(s) projected and actually earned over the next 30 years (or the length of the mortgage). Of course, really it’s about both and how they interact. But here’s why I’d say Income over price if I could only pick one: There’s not a house on earth that Bill Gates could be upside down in, over the next 30 years, even assuming Apple and Linux continue to make gains into their market share. So it’s possible to have a large enough income or enough wealth that no house, no matter how expensive, is out of reach and unaffordable (as long as they didn’t tie up all their assets with Bernie Madoff.)

And as much as I hate negative amortization — the bigger point you make constantly is the loss of jobs. Even if you’ve got a 30-year fixed at 5.3%, if one or both of the mortgagors lose their jobs, they’re screwed unless they bought way under their means. And we’re in for a world of hurt not just because of the Alt-A or ARMS recasting… but because GM and Chrslyer, and all their suppliers and dealers and car salesman and lot managers and dealer owners, and on and on are going the way of the Chicago Tribune.

Thanks for the article. That really helps to explain that all the option arms are all different and only a percentage will be saved because of the fed but that there are so many different kinds out there that the underlying problem with all of them is not the rate but the across the board drop in house prices. Keep up the great articles.

The lowering of interest rates will help only the prudent. Anyone who opted to pay the minimum, negatively amortizing monthly payment was not a practitioner of prudence. Only rabid speculators and those ignorant of the perils of debt would choose such a payment.

The mainstream media will continue to predict a bottom for housing and will continue to predict that our bankers and politicans will save us all, much as they will continue to tell everyone to buy stocks instead of gold, despite returns for gold over long periods of time (like 67 years in recent history) that are better than stocks without the associated Madoff-type risks:

http://goldversuspaper.blogspot.com/2008/12/taking-out-trash.html

I’ve said it before, Dr.HB should have Paulson’s job.

These shitty loan products should never have been allowed. It was sheer idiocy, bound to collapse. The people who thought up this crazy crap knew very well that they were bad products and that people would default. Our government failed us, and Wall St. sold out America. I’m stunned by the Fed trying so hard to prop up the ridiculous prices, when it should be obvious to anybody with a brain that high prices are the main problem.

I’m really worried about hyperinflation down the road. Peter Schiff has been very accurate all along. I hope that he is wrong…

Thank you & well put.

I’ve been completely stunned senseless at the magnitude of savage, brutal immorality involved in this whole twisted nightmare.

God save the Queen!

Lettuce prey.

I have to say that anyone that took one of these loans was either mislead or stupid or both. I read these for information purposes as I do not understand most of this stuff. The idea that people believe realtors and bankers on how they can overspend and overborrow is beyond me!

My wife and I purchased half the house our realtor and banker told us we could afford. we took a 20yr variable rate mortgage out in August 1990. We paid that little ranch house off in October of 1998. We did not run out as all the people we saw around us doing and buy the big house we “deserved”.

Now who’s laughing!

Good posts very informative.

I am beginning to think the option ARM problem is overblown.

Right now, ARMs resetting to LIBOR are coming out to 1.75%. This is beginning to look like a vindication for Greenspan who told everyone to take out variable rate mortgages.

The whole operation of the Fed for the next 4 years will be to hold down mortgage interest rates to ridiculous levels, even if they have to buy every piece of mortgage paper in the US.

printfaster waxes sci-fi: <>

Laughing till I vomit — sputtering & spewing through the hurling chunks, I humbly suggest, might it be a wee bit LATE for any sort of happy new beginnings?

Just a wee bit, eh??!!!

God save the Queen!

Lettuce prey.

Comrade Housing Bubble,

Just to add emphasis to your point that the Fed’s 4.5% rate won’t solve the problem, it will actually make it worse. Here’s why: it’s a hidden transfer of wealth from the working masses to the upper class. To get this low rate, you have to have exceptional credit since banks are not required to lower their underwriting standards (thank God). The only people that will qualify are those who are faring pretty well during these tough times. The working masses probably won’t see a nickel of the money but will get stuck with the bill. Sound like TARP? It’s just insanity. The American taxpayer is being robbed blind in broad daylight.

You’ve just made the case that these things aren’t an immediate threat by proving that Countrywide and Indymac only made option arm loans with a 10 year mandatory recast. Low rates will take care of the non-mandatory ones. Game. Set. Match.

You lose . . . badly . . . . embarrassingly so.

Comment by printfaster

December 20th, 2008 at 5:25 pm

I am beginning to think the option ARM problem is overblown.

Right now, ARMs resetting to LIBOR are coming out to 1.75%. This is beginning to look like a vindication for Greenspan who told everyone to take out variable rate mortgages.

The whole operation of the Fed for the next 4 years will be to hold down mortgage interest rates to ridiculous levels, even if they have to buy every piece of mortgage paper in the US.

______

Sigh…..there is a HUGE difference between an ARM that is fully amortizing and an option ARM or hybrid Option ARM.

>>> In a fully amortizing ARM, the borrower is ALWAYS paying back principal and however much interest is accruing. The only thing that varies is the rate of the interest that is accruing each money and that they have to pay.

>>>> In option ARMs they can pick the payment. 80% do NOT even pay an amount equal to the interest that is accruing. And yes, while the amount of interest that accrues can change, they are typically still not even covering that. It would be highly unusual for the accruing interest to drop below the minimum payment level. Odds are on that their mortgage has grown since they took it out.

>>>> Sooner or later, they will have to start repaying principal as well. And that is what will break most of those borrowers. If they can’t pay principal and interest now, they won’t be able to do so then. The loan may reset earlier if they have hit a cap on LTV. The loan may reset after a certain number of years. It may be a ballon with all principal due at one time which means refinancing (Good f’ing luck on an appraisal and more borrowing.) But reset to include principal it will – and then the borrowers are sunk.

Hybrid Option ARMS are loans that are Option ARMs for usually the first 3-5 years and then reset to a fully amortizing ARM. A lot of those are due to reset from options to amortizing ARMs for 25-27 years. And now those borrowers will have to ante up the principal as well.

Doctor,

Great blog, I read it constantly. One thing I would love to see is an article aimed at the higher end of the market. Homes in $3-$5 Million range in West Los Angeles have been pulling in but at a much slower rate than the low and midlevel markets. Will the ARMs fallout have a greater effect on this market? I know that in time the price of more expensive homes should drop in accord with the prices in less expensive neighboring markets, but will the ratio be the same? I would love to know your forecast for the West LA market.

Thanks and keep up the great work!

Robin,

Per your comment about hyperinflation; I am pretty sure that is what the government thinks the solution is. If the government does manage to prop up housing prices (which I doubt they can), this does not solve the problem that the majority of Americans can then no longer afford a house using “normal” lending practices. The government would have to find a way to increase the median household income to a level that would be able to afford the subsidized/inflated home prices; and I am afraid that inflation is their answer.

Not to mention that inflation would also make it a little easier to pay off all the $trillions that they are adding to the national debt to prop up housing in the first place.

Don’t forget to consider that treasury yields and LIBOR can go much higher. When I figure out my worst case, I look at the rate cap. I think we have at least 1 year before we’re at higher rates than we are today. I expect that in 2 years, we’ll be back at 5%. In five years, I think we’ll be at 8%. Now is the time to send a couple hundred extra per month to knock down principal.

I currently have a PAY Option Arm and have being paying interest and little of the principal for 3 years now. My property value is down and I’ve pretty much lost the 25% down and then some. My intent was to refinance in a couple of years to a fixed or sell. I love my property and would like to continue to own it. I’ve review the financing with couple of agents and they told my best option is to go back to the lender. The lender Countrywide/Bank of America and encourages me to miss a couple of payments before they will talk to me. I’m just tired of calling them and spending days on the phone with them talking to various departments. Each time have to explain what I want. Oh I continue to receive the junk mails encouraging me to call them to get out the Option Arm loan. One thing they are not able to tell me is what my interest rate will be fixed at after 5 years. My documents seem to indicate 9.5% but I think that is the CAP. Anyone have any thought on what I should do, stay with it for 5 years and then hope to convert it to a fixed.

One rate I didn’t see mentioned is:

Discount Rate – Federal Reserve Bank of San Francisco

The California state usury law is 5% over that rate at the time the rate is set for non-consumer loans and 10% maximum for consumer loans.

http://www.loanback.com/category/usury-laws-by-state/#California

This link gives a lot of different rates including that one which is currently 0.75%:

http://firsttuesdayjournal.com/current-market-rates/

Leave a Reply to Borax Johnson