Option ARMs Enter the Eye of the Hurricane: The $189 Billion Recast Problem Targeted Directly at the California Housing Market. Of $189 Billion in Securitized Option ARMs $109 Billion in California.

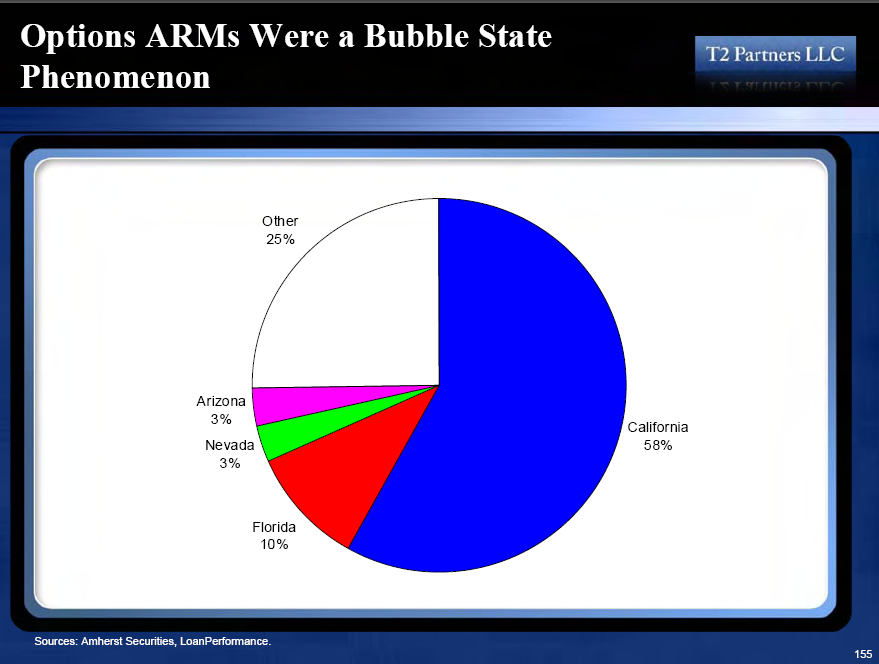

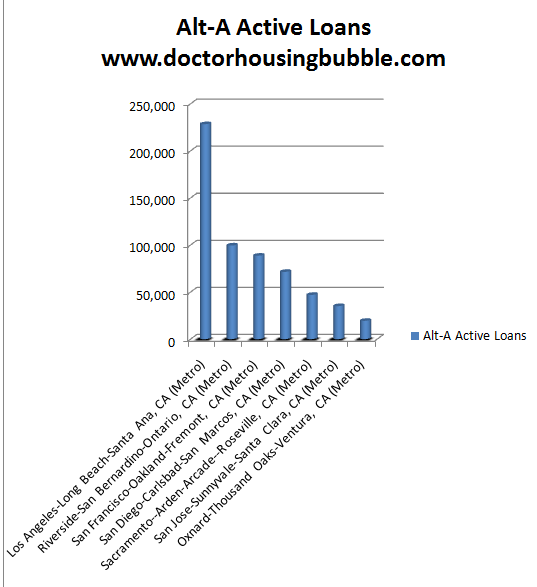

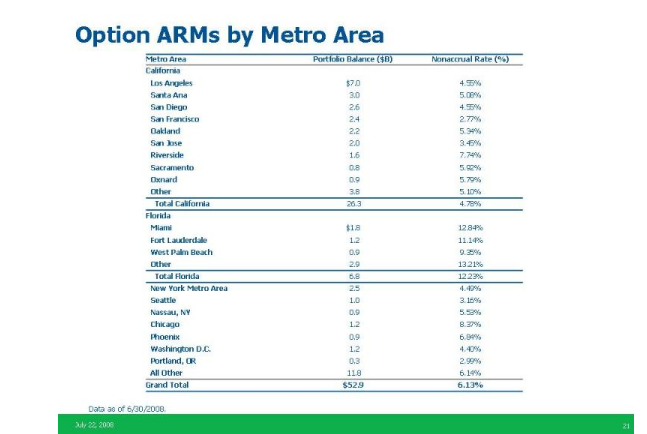

It is rather clear that the housing market is muddling through. However, nationwide there has been a spurt in activity directly related to the Federal Reserve holding mortgage rates artificially low and the very expensive tax credit. This is a nationwide issue. But what isn’t a nationwide issue is the option ARM problem. Option ARMs, those lovable furry toxic mortgages that you wouldn’t give to even your worst enemy are still lingering on the balance sheets of many banks. Unlike nationwide housing issues, option ARMs are largely a problem of four states; California, Florida, Nevada, and Arizona. 75 percent of option ARMs sit in these states and 58 percent of all option ARMS are here in sunny California. Option ARMs are a subset of the Alt-A universe. Alternative A-paper includes option ARMs but also includes 30 year stated income loans, interest only loans, and other questionable products that were below prime. Specifically in this article we will look at option ARMs, the amount of option ARM loans outstanding comes to $189 billion that is securitized:

Soruce:Â T2 Partners LLC

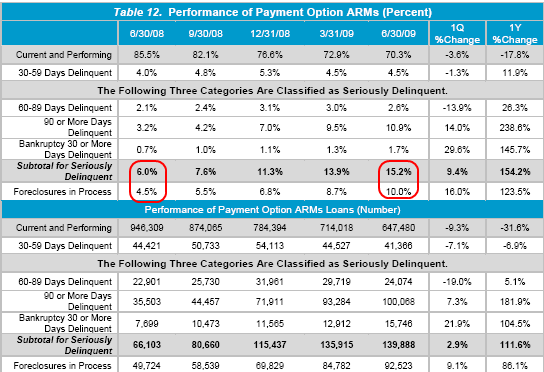

Now do some basic math here. If 58 percent of the face value of the active loans is here in California, we have at least $109 billion in option ARMs just in the state. Keep in mind this is the lower bound estimate since Fitch only looked at securitized option ARMs. If we look at the total universe of these loans, we will find nearly 900,000 loans – 92,000 currently in foreclosure and 139,000 that are seriously delinquent but that leaves the bulk out floating in mortgage purgatory:

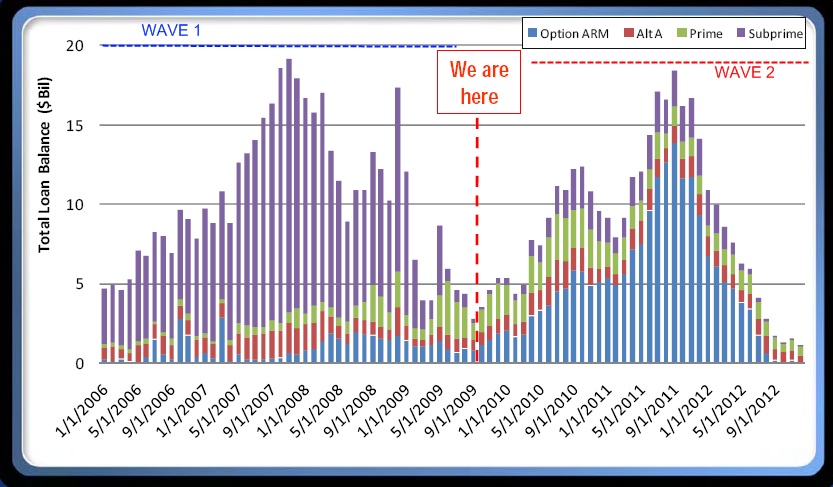

Option ARMs are largely a California problem. What is troubling beyond the obvious fact that these mortgages are absolute junk is that many of these loans are part of that infamous shadow inventory that we discuss and I will highlight why there is a false sense of security right now. Currently, we are sitting in the eye of the hurricane:

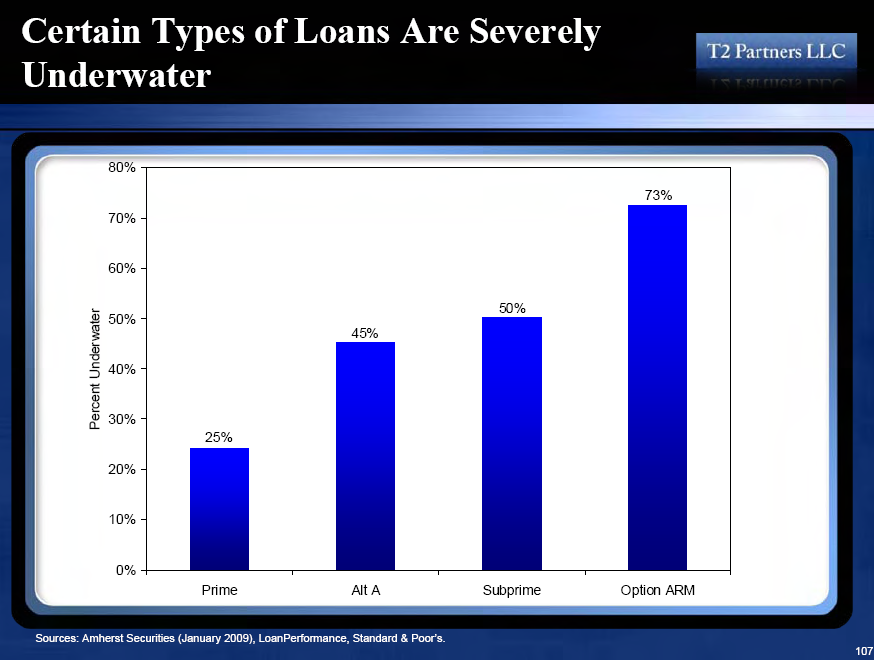

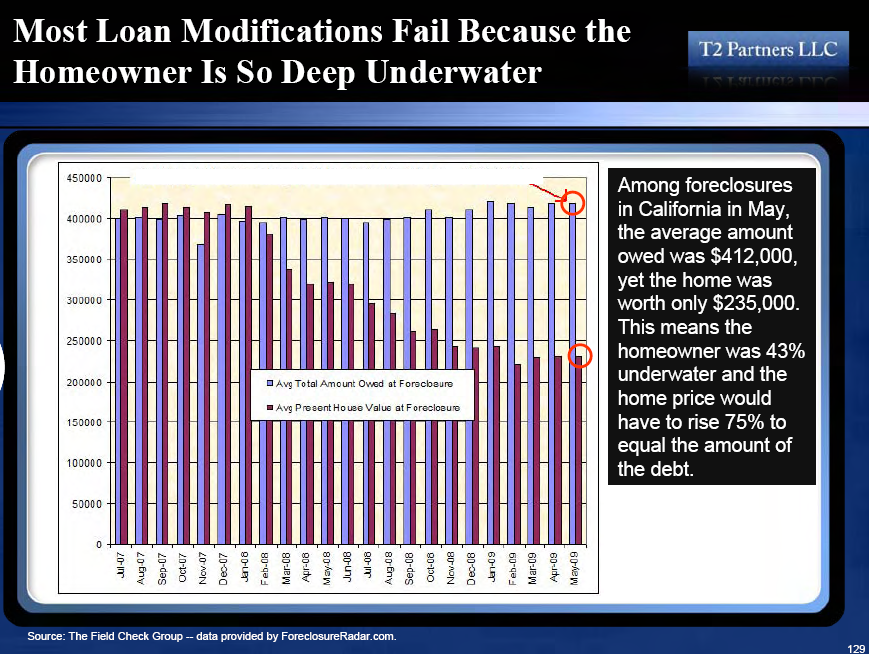

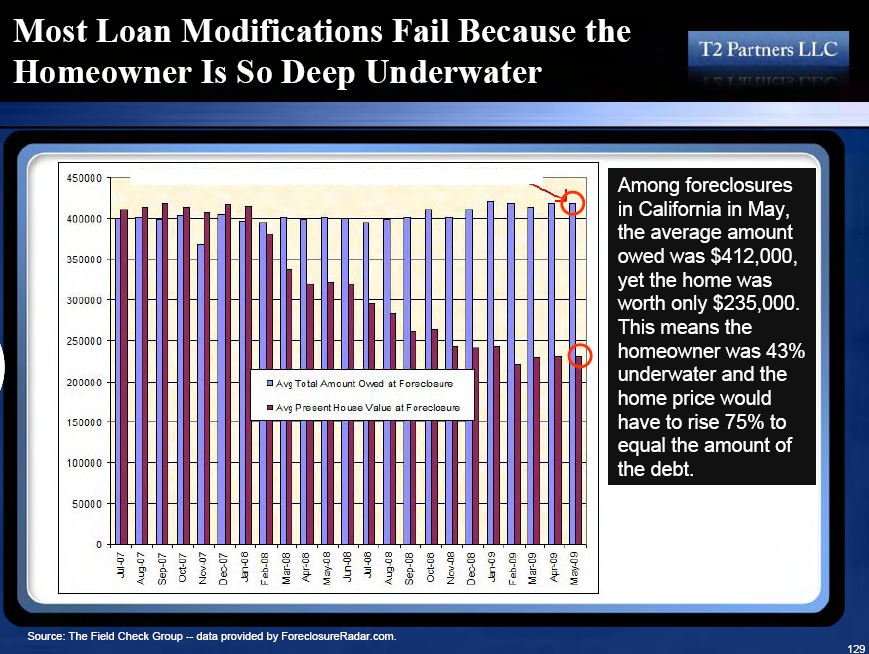

What is interesting about the above, is that we have largely moved through the subprime debacle which is wave 1 on the chart above. This impacted most states since every state had some volume of subprime loans. Yet the option ARM is largely a bubble state phenomenon. And there is nothing on the current table that is helping this out. This is largely a silent ticking time bomb that will go off in starting in 2010. Where a subprime loan can go badly slowly because of the lack of income from their borrower base, we can expect that many of these option ARMs will implode with strategic defaults. Why? Many of these were made at the peak and a large number are now underwater:

Soruce:Â T2 Partners LLC

As of January of 2009, 73 percent of all active option ARMs are underwater. In other words, California has $109 billion in option ARMs that have no remedy in this current market aside from foreclosure which lenders are obviously balking at. I would argue that even more are underwater because many of these were made at the peak with low or no down payment. They started out with little to no equity and this was before the California housing market imploded.

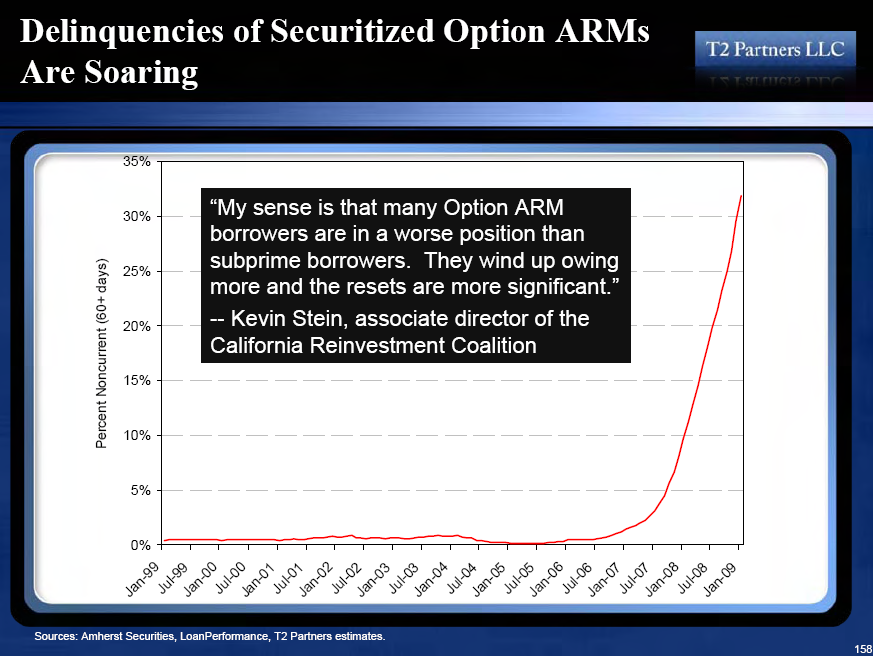

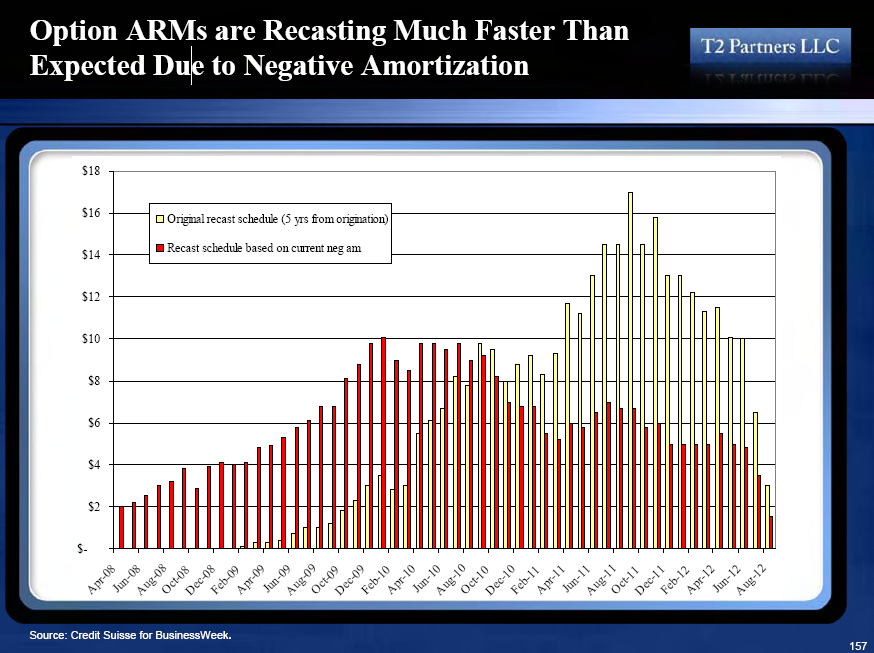

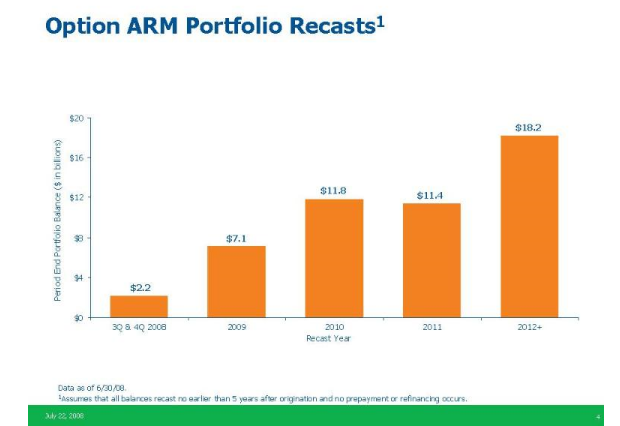

So we have established that option ARMs are largely an isolated problem and the majority of these loans are here in California. Many of these loans are going to implode not because of rate resets which adjust to interest rates, but the actual recast volume. Many are entering this stage earlier because of negative amortization caps being hit. Over 90 percent elected to go with the negative amortization payment option and this has actually increased the balance of many of these loans. At least with many subprime loans the balance didn’t grow.

And most of these option ARMs will fail to even qualify for HAMP because they are severely underwater:

So even a 2 percent teaser rate and 40 year extension will do little to fix these problems. The vast majority were stated income so good luck trying to get someone permanently on the HAMP when they have to verify their actual income via W-2s. The shadow inventory in higher priced markets tells us that people are already unable to make their payments on these toxic  mortgages and this is validated by some examples in mid tier markets like Culver City, where homes are in pre-foreclosure and simply don’t appear on the MLS or any public stats. But where do they appear? In distress data:

And the above data is actually optimistic. Data released by Fitch in September shows that 46 percent of option ARM loans are now 30+ days late! Compare the actual issues and deterioration even more carefully. About 16 percent of option ARM loans in September of 2008 were 90 days late. September of 2009? The rate has jumped to 37 percent and these are highly distressed properties. These loans have the default characteristic chart trends of subprime loans but with a balance that is much larger and more isolated to a specific state. The reason we are seeing the wave shift forward is because of negative amortization:

Soruce:Â T2 Partners LLC

It is hard to tell how many of these loans will implode. Most of the loans are here in Southern California, in Los Angeles County if you really want to get specific:

The issue here is that not much can be done about these loans. They certainly don’t qualify for HAMP. Homeowners in many of these areas are more likely going to be strategic. I’ve gotten numerous e-mails from people saying that they have an option ARM and know exactly when their payment will recast. At that time, they will stop paying their mortgage and build up a fund and find a rental before their credit score is hammered by the foreclosure. Rental prices are falling so not a bad time to be a renter either. They figure they can buy about a year of time before losing their home. Why would you even want to work this kind of loan out? The interesting aspect of the option ARM is that it calls the banks on the biggest bluff. You want me to stay and pay my loan? Lower my principal. Otherwise, I walk. The spiking distress data tells you everything you need to know.

Even take the HAMP for example. In many cases, even with a 2 percent teaser and 40 year loan, the payment will be much higher than the negative amortization payment via the option ARM. There is little motivation to move on these. Banks are just buying time on these loans. Their preferred method so far has been to ignore these problems until they come to full fruition. People think the second wave will never come. It is already here! We are already near a 50 percent distress rate for all option ARMs and we have yet to hit the peak recast points – and these are heavily aggregated in California. Yet this isn’t an implosion? These people are the folks that only believe in what they see one step in front. They deny the shadow inventory or claim the tax credit worked. The home buyer tax credit cost the U.S. taxpayer roughly $40,000 for each additional home purchase. Cash for clunkers? $24,000. Incredibly inefficient programs that paper over the real issues. What really has happened is the housing fixes are now more nationwide in appeal (i.e., tax credit, mortgage rates, etc) but certain egregious loans like option ARMs have been isolated to their respective corners. They are on their own to fend for themselves in the state that developed them, California. What more would you expect? 58% are here so why would the other 49 states bail us out on a loan that only greased the mortgage broker commission?

And for those looking at the Case-Shiller or other data showing a minor move up in price, remember that prices are still dropping but the way the data is calculated, it does show minor moves up because of the shift in market sales. Lower priced homes, that subprime and foreclosure wave, made up a bulk of sales for the past year. Now, we are seeing more expensive homes sell but for cheaper prices thus the mix is moving up. For example, a hypothetical home in Pasadena bought in 1998 sold for $200,000. At the peak in 2007 it would have sold for $800,000. The home currently sells for $500,000. The Case-Shiller will show a nice gain even though prices are technically off their peak by a significant number. You can adjust the prices but you get the point. Each additional sale adds to the overall data and the median is at $275,000 for Southern California so it tends to shift the price higher. The median is not a good indicator of future prices. When the bubble took off the housing industry kept pointing to this as proof of sustainable housing prices. We know how that turned out.

Option ARMs are a major California issue. $109 billion is not a tiny number given the loss severity of these loans and this is only on securitized loans – the number is even bigger if we look at loans that are on the bank balance sheets. These can go from current to non-paying in massive waves once those recasts hit. My belief is many will default because of the amount of being underwater:

So what will happen? Expect to see more REOs whether the banks want the home or not. I’ve heard of banks converting the place into a rental but I have seen very little movement thus far. If anyone has seen the rental vacancy rate what do you think this will do to commercial real estate in say, condo conversions that are now shifting to apartments? Unintended consequences galore. In fact, most of the option ARM holders in California are not home owners. They have no equity plus they are constrained to their current location. Are they really a home “owner†in the traditional sense with negative equity? I would argue that they are a homeowner in name only. Home ownership was a way to build wealth through a slow and long-term methodical process. Option ARMs were never meant to be held onto beyond a short period of time and were designed to give mortgage brokers a healthy yield for their corrupt work. The irony is that many of those mortgage brokers that made these loans are out of work and financially strained, while their handiwork is destined to wreck havoc for years to come.

Conclusion

It is rather clear that the option ARM issue is largely targeted to California. Given all the bailouts and moratoriums it is surprising that California is still in horrible shape. But what it boils down to is the fact that these loans will not benefit from current government programs. And they shouldn’t. These will continue to fail because if you haven’t noticed, the underemployment rate of California is now up to 22 percent. So now we are seeing big spikes even in prime loans. Until the job market stabilizes there is little reason to believe a housing turnaround is in store. Option ARMs will fail even if the employment market picks up in California.

JP Morgan Chase now owns Washington Mutual that was an option ARM expert:

And many of these loans are just entering their recast period:

Driving in Southern California you will notice all WaMu locations are now Chase banks. Some ads say welcome to Chase WaMu customers. No, welcome to you JP Morgan and enjoy those options ARMs as they recast in your balance sheet starting in mass in 2010.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

44 Responses to “Option ARMs Enter the Eye of the Hurricane: The $189 Billion Recast Problem Targeted Directly at the California Housing Market. Of $189 Billion in Securitized Option ARMs $109 Billion in California.”

California AG Wants Pay Option ARM Answers

By AUSTIN KILGORE October 29, 2009

http://www.housingwire.com/2009/10/29/california-ag-wants-pay-option-arm-answers/

(excerpts):

California attorney general Edmund Brown Jr. today sent a letter to 10 major bank and loan servicers in the state calling for the disclosure of their detailed plans to help certain homeowners manage the drastic payment increases on their pay option adjustable rate mortgages (ARMs).

“Homeowners with Pay Option ARMs are sitting on ticking time bombs that the lending industry has the power to defuse,†Brown said. “Unless these banks and loan servicers act quickly, hundreds of thousands of mortgages will reset across the state, creating a new wave of foreclosures.â€

I would be curios to know what would be the effect on overall housing prices if banks decided to start reducing principle on the vast majority of these loans. Would that stabilize prices or have a negative effect on the rest of us? I truly hope when all is said and done real estate will be allowed to fall and find it’s true bottom but clearly the banks and Washington are scrambling to extend and pretend anyway possible. I have read that Washington has threatened the banks and basically told them to rework loans and stop foreclosures or TAMP down legislation would be passed. That is why we see such a decline in foreclosures.

any thoughts?

Regarding the furor over government creating jobs, and whether actual job creation by the Gov is real or pure fantasy, please read from Bloomberg:

““Government job creation is an oxymoron,†said Bill Dunkelberg, chief economist at the National Federation of Independent Business. It is only by depriving the private sector of funds that government can hire or subsidize hiring.” (http://www.bloomberg.com/apps/news?pid=20601039&sid=aUuHhaDx8Hr8).

It’s easy to differentiate between jobs government can only do (safety, parks, some infrastructure, financial regulation, etc) and those fabricated at the expense of private industry. I don’t think AnnS can make that distinction.

I thought the Option ARM time bomb was $400+ billion in California? Is that not what the now famous Credit Suisse chart showed? (and the number all the housing blogs were quoting)

ROFLMFAO!!!! “Welcome to YOU JP Morgan”. Oh I love it. When I asked to get a loan workout in 2008, WAMU/Chase refused to work with me. When I edfaulted for 3 months, they put me on a “trial plan”. I completed the 3 month plan, met all HAMP reqs, yet still wasn’t sent the loan mod. Now I’ve not made a payment for another 60 days, still no loan mod. 150 days of no payments and no NOD. If they file NOD, I wait until 1 day before auction and I declare a bankruptcy.

They *could* work with us homeowners, but they are forcing the foreclosures. Big deal, if I get 12 months of no payments, I can mattress a ton of money. Just remember, YOU voted for these people who allowed this FRAUD to happen, now everyone gets to pay for it.

P.S. Anyone want to buy my condo that’s $100,000 underwater? I didn’t think so….guess Chase will suck up the loss…you always wanted to run the whole country JP Morgan….welcome to California, I’m glad you aren’t getting a dime from me 🙂

I second the comment by kel_mag. If principal reductions are made across the board what will this mean for house prices? Do they remain the same and essentially reward those who were foolish and punish the prudent who sat out the mania or do they fall to market fundamentals?

AG Brown wants to know what the banks are going to do to help homeowners who are underwater because of recasting loans they originally took out, when they were sure that the value of their home was going to keep going up and up, and they were smarter than all those renters and cautious people who didn’t take advantage of the money tree? What do you suggest, Jerry? Give them their homes outright? Reduce their principal by half, but keep the house on the balance sheet at full price, and hope that another wave of suckers will pay it and help all of you out?

All I want to know at this point, is whether the government–federal or state–will guarantee me that if I buy a house now, and the value later goes down, or I simply decide that the mortgage is too high to suit me, I will be bailed out, and allowed to enjoy my nice home free of being bothered by such foolish concerns. Because I have picked out a really nice $5 million house in Bel-Air, and am anxious to get started on enjoying hte California Dream. Just say or write something that will assure me that once I’m in there, I’m can stay as long as I feel like it, for whatever I feel like affording to pay, and I’m in. Owning a fancy house is a right, you know.

You’re the one that signed up for that mortgage, Swiller. You seem pretty proud of the fact that you’re sticking it to the tax payer.

I don’t get your argument. YOU signed up for the mortgage, YOU took the risk, and now that the market hasn’t provided you the endless wealth you obviously expected, YOU are walking away because the bank won’t lower your payments.

You should be embarrassed, not proud.

ROFLMFAO!!!! “Welcome to YOU JP Morgan”. Oh I love it. When I asked to get a loan workout in 2008, WAMU/Chase refused to work with me. When I edfaulted for 3 months, they put me on a “trial plan”. I completed the 3 month plan, met all HAMP reqs, yet still wasn’t sent the loan mod. Now I’ve not made a payment for another 60 days, still no loan mod. 150 days of no payments and no NOD. If they file NOD, I wait until 1 day before auction and I declare a bankruptcy.

They *could* work with us homeowners, but they are forcing the foreclosures. Big deal, if I get 12 months of no payments, I can mattress a ton of money. Just remember, YOU voted for these people who allowed this FRAUD to happen, now everyone gets to pay for it.

P.S. Anyone want to buy my condo that’s $100,000 underwater? I didn’t think so….guess Chase will suck up the loss…you always wanted to run the whole country JP Morgan….welcome to California, I’m glad you aren’t getting a dime from me 🙂

BTW I love your blog!

Swiller,

Why do YOU deserve a loan modification? Why does anyone? YOU got yourself in this mess and YOU got us all to pay for it while you sit in your free home saving your money while WE bail you out. Go F@#k yourself Swiller. I hope they ruin you.

Dr. HB, you might want to recall your recent post on MERS before making any predictions. As a result of the recent Kansas Supreme Court ruling that MERS is a strawman and cannot foreclose on any loans in its portfolio, the plight of foreclosures and indeed the world banking system is in a black hole. There are 60 MILLION mortgages registered in the MERS database just to give you a sense of the magnitude of this issue. You can bet foreclosure lawyers from every state including California are swooping down on this like ambulance chasers. This will take years to sort out from a legal standpoint.

Even if homeowners “win”, the bondholders who invested in the mortgages will then sue the banks for fraud which would have to pay them back at FACE VALUE (think bubble prices). This is a choice between jumping off a cliff or shooting oneself in the head. There will be no winners. All bets are off.

Be brave Comrades!

Thank you William. Well said. And it have us all here in the office a good laugh!

Yes, these are a problem.

Funny thing is, the index plus margins now are a great deal!

If it wasn’t for the 115% number that made people go to fully indexed, this may actually work for people.

Banks will need to ignore the 115% and let people do the lower payments and continue the neg/pos am for years to come until values go up.

The more foreclosures there are, the worse it gets for each loan, so find a way to modify the existing notes and keep the foreclosures down.

It would be nice if renters got a bailout and got taxpayers to pay for it. I want 12 months rent free! Oh wait, I don’t get that, because I didn’t take out a mortgage I couldn’t afford and the landlord says the rent is due at the beginning of the month. And I’m not one of those “responsible” people (snicker, snicker, snicker) that is a “homeowner”, no I’m just an “irresponsible” renter.

I suspect that in the next several years the banks are going to trickle the foreclosures to the MLS for sale. I am afraid we actually may not see a major decline in prices in the Westside of Los Angeles.

You are correct, the MILLIONS of us who took out the loans, and are now underwater, are only asking for FAIR mortgage terms, not paying interest only loans that are 3-4 points above the fair market. I *WISH* the government would stay out from giving ANY money to save these underwater homes, but that’s not reality. All these homes should be foreclosed upon, all the banks allowed to fail, and everyone value on their homes should drop to 1998 levels or even lower in California.

Yes you are correct, I signed the mortgage…..and when I bring Chase to court, I’m going to make them PROVIDE THAT CONTRACT. But they won’t be able to, because it was originally from WAMU, and my title is rolled up in some securities. I’ll be a man of honor, I WANT to pay for my home, but the banks have no honor, and will not work with the homeowners, and cannot even provide truth they “own” your home.

Yet, here we are, having the sheeple try and victimize the victims. For everyone pissed off about those of us who got caught buying at the wrong time (my purchase was/is for my family not to flip), why aren’t you pissed off at the Wall St, the banks, and our elected officials for allowing the financing to get out of control, which FED the bubble, and made it far harder for all of us to actually own and develop long term stability?

I had to quote a poster from another site where about 70,000 of us feel we were lied to by our mortgage holders and the banksters.

“People here on this site are STILL convinced Chase and the Gov. will help people in need!! This is business folks! I 100% agree with Swiller…don’t pay a dime and wait for their response. If you can’t afford the home you live in now, then stop buying it. I cannot afford mine at the current payment. Either Chase works with me or I move to something cheaper. If the lender decides its better to foreclose over modify, then fine, move out. If you have equity, sell. If you can afford the place and like living there, pay for it.”

Comment by Swiller: Even better take 50% of the money from not paying your mortgage and short finanicial stocks. The fourth quarter is going to be a disaster for them since the shit is hitting the fan on all fronts – commercial, residential, credit cards, auto, student loans etc. They can extend and pretend for a while but the shit is everywhere now! Expect big market moves shortly.

Heard on Randi Rhodes show yesterday that the 8000 dollar incentive for first time buyers would be extended and that it was going to be opened up for use not only by first time buyers but also for folks who already own a home and want to move up into a more expensive home. Nice, huh? How will that effect the market?

Even more from CA.AG Brown’s letter to the banks, he’s calling for principle reduction for loan mods:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

http://ag.ca.gov/newsalerts/release.php?id=1828

Economists estimate that about one million Pay Option ARMs will reset in the next four years, resulting in massive payment shock and dramatically worsening the foreclosure crisis. California, with 58 per cent of all Pay Option ARMs originated between 2004 and 2008, will be the epicenter of this crisis. Systemic plans to modify these loans as they recast must be in place, in order to preserve home ownership and avoid a prolonged and painful recession.

Loan modifications can help many of these borrowers save their homes. To be successful, however, current loan modification programs must expand. The Administration’s Home Affordable Modification Program (HAMP) has been slow to get off the ground and will not benefit thousands of Californians threatened by foreclosure, as it does not allow for principal reduction. Yet principal reduction is exactly what borrowers need. Borrowers living in areas with sharp depreciation in housing prices do not have enough equity in their homes to qualify for HAMP. This situation is even more dire for borrowers with Pay Option ARMs, who now owe more on their homes than when they first took out their mortgages.

Must read story of the rise and fall of WaMu. Lots of goodies including those pesky option ARMs:

http://seattletimes.nwsource.com/html/businesstechnology/2010131911_wamu25.html

Corrupt government needs to get out of banking and real estate.

Losing a home is hard and affects many, should I feel bad, should I pay for the loss of someone else? Take a family that has only been paying only interest for the last two years and put nothing down, bailout? A couple where one doing contract work and the other cutting hair, now out of work, in a $750k home, bailout? My fav, a couple get a $450k mortgage and now owe $1million due to re-fi cash out or heloc, bailout? I’ve seen where some “claim” they didn’t know what an ARM was or they “never read” the note they signed, bailout? That’s the buyers.

Banks, lenders, those not already out of business, need to be shut down and punished. Yet these are the ones getting the bailouts. 3.5% down and 50% DTI loans the gubmint is still promoting are part of what got socal prices out of whack and the trouble we now see. As the Dr. has written before, these no down, stated income (liar), alt-A, interest only loans were never meant for J6P, home-ownership or the impossible housing down turn. These banks were pumping them, realtors leading the prey towards these toxic oops now “legacy” loans knowing, or should have, that default was probably high.

Force the banks to “mark to market” all loans on their books. Should that show them insolvent then shut them down. Require minimum 20% down and maximum 35%DTI, this will naturally control prices. Start foreclosing as opposed to just dropping a NOD in the mail box and playing “extend and pretend” nonsense.

How will this work out? Those like TARP for life BofA will be taxpayer supported. Gubmint will continue “cash 4 junk loan” taxpayer supported programs. Your underwater neighbor with the brand new cars, swimming pool, boat that have always been on a cruise somewhere will be forgiven. All paid for by some responsible schmuck that always lived within their means, maintained credit, saved and followed the rules.

Dr. HB,

WaMu got what’s coming to them. Now contrast that to Goldman Sachs: http://www.alternet.org/workplace/143573/former_wall_street_player_reveals_the_inside_world_behind_shady_bailouts_to_bankers

I guess it comes down to who you know, not what you know.

Why we should be scared of the 3.5% GDP number: 1. it was driven largely by guv stimulus, the majority of which was realized in durable goods purchases; i.e. auto sales, not by organic growth. At the same time, our trade imbalance increased (cash for clunkers transferred wealth from US taxpayers to foreign auto makers- brilliant!) and personal savings decreased (digging the debt hole a little deeper) as a result.

2. companies improved their balance sheets through cost cutting (layoffs), not through increased sales. Continued downsizing creates a negative feedback loop on the economy.

Peter Schiff made an interesting point this week stating that GNP (how they measured it back then) grew 4 out of the 10 years of the Great Depression. My fear is that policy makers think that we are out of the woods at a time when the situation couldn’t be more dire. Welcome to the United States of Delusion!

I have to agree with Swiller. I feel bad that the taxpayer is taking on a lot of this, but that is the governments fault. I feel a sense of pride that I am screwing over the banks by allowing foreclosure. On the other side I feel bad that the taxpayer will be forced to shore up the banks balance sheet. The banks took all our money and used it to make record profits and give out record bonuses all while not working at all with homeowners. Lets not forget these crazy lending tactics of no money down and option arms are primarily what drove up prices. It brings a smile to my face knowing they will lose $250,000 when they foreclose on my home.

Comment by Matt: You’re right–no major price declines coming on the westside. The government will continue to work with the banks to suppress the number of foreclosures that hit the market in all areas. The government will never, ever allow the banks to sink the market, and that would definitely happen if all the homes that have been taken back were “unleashed” at the same time.

Comment by Gael: Continuation and expansion of the tax credit will continue to buoy the market. I have more buyers than I have properties. Bidding wars are back, and the tax credit will only serve to continue this. Low inventory and the tax credit is a mix that works well for the banks. Cash investors are pitted against the first time homebuyers. In most desireable areas (and even some that aren’t quite so), you have to offer at, or above, asking price. Even cash investors have stopped submitting lowball offers. What does that tell you about this market? The California real estate market was forever changed during the last boom. A ton of money was made by many either through flipping, pushing mortgages, construction etc…A lot of that money is now flowing back into the market and snapping up what little inventory there is. The genie came out of the bottle, so to speak, and I just don’t see how it’s ever going to go back in. This housing “crisis” will continue to be managed and manipulated to keep the market steady. Period. Interpret that however you like. So if you’re waiting for the tsunami, you’re in for a long wait. Won’t happen on Obama’s watch.

How much longer CAN the government manipulate this market by committing more money to bailouts and buyer incentives?

At what point does the treasury debt become unrepayable? At what point do tax revenues fall enough and treasury debt rise enough to make a treasury default inevitable?

And what will happen THEN?

We’re up against a wall now. Congress knows that the government has reached the end of its borrowing power. Inasmuch as 95% of all home loans are now backed one way or the other by a government agency, if the government cannot afford to continue to capitalize these agencies, they will not be able to buy more loans. And if they can’t do that, then the loans won’t be made.

Our politicians are in deep denial, but that point will be reached very soon, possibly this year. Watch what happens to prices when loans are no longer available except from the few solvent (and unwilling) lenders.

I feel sorry for the taxpayer but im underwater, whaaaaa. You shouldn’t have bought a home you couldn’t afford. PERIOD. It is an investment. You made a bad investment. Now go ahead and walk away like the low life all you people are. Since so many low lifes are walking away, I guess that makes it ok in your book. No one cares about your problems. Pay the amount you promised by signing the loan. PERIOD.

with all the money that has been pumped into the system, how is $189 billion going to change anything? they will print more money and bailout california and their buddies at the banks and wall street. if they did it for auto makers why wouldn’t they do it for housing?

No matter what the Gooberment or the Banks do,……..What happens when interest rates rise to 7%?

Will jobs in California allow your average home buyer deal with a 4300.00 a month housing burden? (PITI) and maintenance.

wanna know how deep the s–t pond is? go to http://cr4re.com/PBLOct3009.html

Question for SoCalRealtor,

You mention cash investors and first time home buyers. I assume these folks aren’t playing in the 1M+ range. What’s your sense in that arena?

What I am seeing in the area I’m looking at (OC). You have a bunch of folks sitting on 1-1.5M properties that sit–for months, for years, with no interest. The folks that sell are the ones selling in the 1M areas for 800K or the 1.5M areas for 1M.

I know those are more likely 1.5M and 2M numbers on the westside, but since you are in that market, appreciate what you are seeing in that range–if you don’t mind sharing.

Hmmm… are the resets really going to hurt home prices any further? In our area, people are falling over themselves trying to buy REO homes and there are certainly signs of prices increasing. (Yes.. a mini-bubble might be created from all of these subsidies in areas such as ours where prices were decimated before Making Home Affordable programs.)

People started flocking to buy when we hit a certain price level and now there is not enough to buy… Even if the homes with Option Arms hit the market as an REO, there are people waiting to buy them.

Personally… I think more emphasis needs to be put on the damage that the Govt. may be creating with all of the subsidies in play. I mean really now…. does anybody still think/believe that the peak housing prices were “natural” and we need to save artificial values?

This fiasco should provide for some interesting speculation regarding personal credit in the next twenty years. Certainly it’s inevitable that a large portion of underwater ARM owners are simply going to walk away and grenade their FICO. That leaves fewer and fewer people with 700 plus scores. I’ll bet that people who may be bitter now about bailing out irresponsible “homeowners” will have the last laugh. Even heartier if they know Mandarin.

Obviously the magnitude of this problem cannot be overstated. Everywhere you go, you see posts like Swiller’s above. He’s obviously one of very many who bought more than they could afford and, sadly, think they should be “gifted” their house courtesy of the taxpayer.

~

It’s funny, in a tragic sort of way, how these people will scramble for anything/anyone to blame other than themselves. “The evil bank forced me to sign.” “The loan contract was written in a foreign language.” “Nobody reads loan contracts.” “The bank tricked me.” “The realtor tricked me.” The list goes on and on.

~

Ask me to feel sorry after you tell me about your loan: Rate? Documented income? Price paid? Down payment? Any subsequent HELOC? I’ll bet it’s a no-down no-doc or “pay option” neg-amort on a $600/SF house, with uranium countertops either included or added shortly after the sale courtesy of a HELOC.

Does anyone else sense we are teetering here, only one big market event away from the avalanche? Perhaps a large bank failure? My feeling is the govt is like a juggler and they keep adding chainsaws.

This ends bad……….

Westside will not be immune.

http://www.westsideremeltdown.blogspot.com

Follow up to Whattado: Your observations are correct. The high end is not moving in most areas. Feeding frenzy is occuring in roughly the $500k and below price range. Folks in the higher end can afford to sit on their properties and wait. They tend to have more resources to draw upon to keep them afloat and don’t need to take a loss right away. Lower end homeowners will run out of time and money more quickly, and need to unload faster.

While I still maintain that I don’t see a tsunami of foreclosed homes hitting the market from the banks, I am seeing a troubling increase in the number of short sales in the higher end, which I would say is a clear indication that the higher end ($500k and above) is starting to show some cracks. These properties are showing up in the MLS, however they don’t have lawn signs. So in your own neighborhoods, there may be more properties on the market than you think, but you won’t know it just driving around. You’ll only know by checking the MLS. The higher end homeowners don’t want their neighbors to know they’re selling short, so many are requesting that their agent not put a sign out front. Short sales that don’t get approved by the bank ultimately adds to the number of foreclosures…

So to any of you looking for real estate deals in the desirable areas (esp. the westside and OC), get a good realtor and have them find you a short sale. You’ll need a whole lot of patience because they can take 6+ months to get approved, however, you can sometimes get a better deal (and in better condition) than slugging it out over a bank-owned property that’s been stripped down to the studs. This will be the growing trend into the next year. To lower the number of foreclosures, the banks will start speeding up and approving more short sales. Saves them the cost of using attorneys for the foreclosure process; the home is left in better condition; and the former borrower’s credit rating will take less of a hit.

One big 10.0 quake in SoCal would put a quick end to all this talk of a housing recovery… It’s inevitable in the next 15 years… So don’t count on any home appreciation til then.

@YouAreAllIdiots:

Most people defaulting on their homes according to a paper mentioned on Mish’s sight are defaulting because they have lost their job. The majority of people in underwater mortgages continue to pay as long as they can hoping their home will appreciate before being forced to move. So your complaint that people are just deadbeats with no honor is incorrect and insensitive.

Look at those totals, 184,000 mortgages vaporized in 12 months.

The number paying on time, down 300,000.

The number delinquent and foreclosing, up from 116,000 to 232,000.

So the question is, will this cause Chase to fold and will the feds come in the middle of the night and sell it to citi. Of course these days $109bln seems like chump change.

“I’ll bet it’s a no-down no-doc or “pay option†neg-amort on a $600/SF house, with uranium countertops either included or added shortly after the sale courtesy of a HELOC.”

You would be wrong. 20% down, 5 year adjustable interest only. 800+ credit score, and this is the third house I lived in and fixed up over the last 18 years. Never had adjustable before this. So…now I’m out my $100,000 CASH, cannot continue to pay mortgage rates 3% higher than my neighbor who bought 3 years before me. Oh yea…same job for 20 years. Now I’m a deadbeat to society? If I’m going to get defamed and labeled, I might as well be exactly what you said.

Expect another house stripped to whats allowable BY LAW. Expect to see me living RENT FREE for as long as I LEGALLY can.

I agree with the prediction that Strategic Default will be the fate of many of these loans.

On the other hand, I disagree with the rationale(s) as to why these loans will not qualify for the HAMP.

Equity position is not a pre-requisite qualification (and is loosely-weighted in the NPV test) and the income documentation requirements are quite flexible.

With that said, it is somewhat of a moot point, as recidivism rates are (reported to be) between 50%-70%.

A case can also be made that making a loan “affordable” is not a sufficient motivator to keep underwater notes performing.

There is a great paper written on the subject….

http://www.brokerexecutives.com/walking_away_by_brent_white.pdf

well worth the read.

THE IMPLOSION OF THE OPTION ARM

The problem here is not the Option Arm, which has existed on the marketplace since the 1970s, but in the changing of the traditional terms of these loans. This change was generated by Washington Mutual (the largest opition arm lender over many years) shifting from holding all of these loans as portfolio product and viewing risk from a long term perspective, and the entry of Countrywide entering the opition arm arena with their jackal ripping at the carcass of the consumer approach to lending.

The critical changes were

Neg Amm rate;

Traditionally – start rate no lower than 3.5% with the neg amm calculated to fall under the 30 year average of home appreciation nationally.

Boom Market- start rate as low as .75% with the neg amm uncontrolled.

Consequence- Traditionally neg amm at worst kept the LTV stable as the market value of the home kept pace with max neg amm. Boom Market option arms are a time bomb with a short fuse.

CLTV

Traditionally-Max CLTV no more than 80% on a full doc, no more than 70% on a stated

Boom Market-100% of whatever the dumbest appraiser you can find calls the value at.

Consequence-Traditionally, even if neg amm exceeded market improvement in value there were many YEARS of buffer. Boom Market, most of the loans were actually upside down when originated.

Borrower Qualification

Traditionally-These were the last loans to NOT require credit scores. Not because they were higher risk acceptance, but because the qualifying parameters were so high. Borrowerers had to have lower DTI than prime loans, larger reserves than prime loans (3months of all payments fully liquid full doc, 6 months of qualifying income fully liquid on stated), longer employment history than prime loans, strict review of appraisal, etc.

Boom Market-scores over 680, can the borrower fog a mirror?

Consequence-Traditionally these loans went to reasonably sophisticated borrowers. Boom Market thes loans were being given to borrowers who belonged at the roulette tables in Reno.

Broker Training

Traditionally-Brokers and Processors had to be trained by WaMu or World Savings (the traditional Option Arm lenders) to be ALLOWED to submit loans.

Boom Market-If there are no real standards, why bother training?

Consequence-Borrowers were being pitched complex financial products by inexperineced salespeople who did not understand the product themselves. There was no concept of the risks of the loan.

In short, all of the protections for the borrowers and the banks both were stripped away in pursuit of profits on the secondary markets. These loans went from being a financial vehicle that allowed the prudent to shift cashflow from shelter into better performing investments to the payday lender for a ponzi scheme. The banks were complicit in this, WaMu and Countrywide died because of it. A large portion of the portfolios that they were carrying on their demise were Options Arms that were so obviously bad that nobody would buy them.

Brokers did not create this situation. The banks did. Banks define product and decide who can market it. When they removed all safeguards everyone paid.

your rational comments are welcome at PSGute@aol.com

Leave a Reply to gael