Option ARMs Come Back into Center Stage: 350,000 Active Option ARMs with over 200,000 in California. 78 Percent of Option ARMs have yet to hit Recast Dates.

Option ARMs are the gift that keeps on giving this holiday season. As it turns out, these pesky toxic mortgages are still sitting waiting to hit recast periods. Like a street vendor taco these things went down nicely and appeared cheap but came with a hefty aftermath. The last option ARMs were made in 2007 yet they are still causing much pain in the housing market. Attorney General Jerry Brown has requested data from the top 10 issuers of option ARMs with a deadline date of November 23. It’ll be interesting to see what is released from the AG’s office. However, Standard & Poors issued a report on option ARMs last week and found that much of the problems with these loans are still to come.

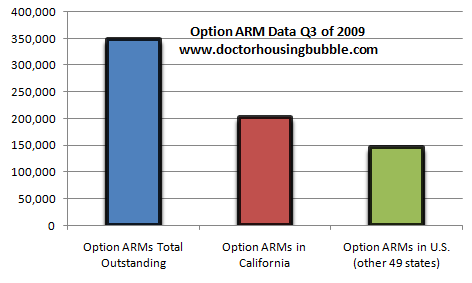

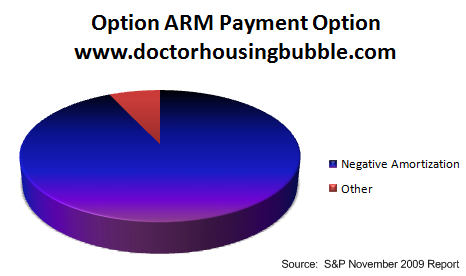

One of the stunning points found was that 93 percent of option ARM borrowers decided to go with the negative amortization option otherwise known as the “minimum payment†option. This is something we have established from many fronts and data sets. The bottom line is the vast majority went with negative amortization and this grew the actual balance owed. Yet one of the new findings in the report was that 78 percent of all outstanding option ARMs have yet to hit major recast points. Given that 58 percent of option ARMs are here in California, this is a one state wrecking ball:

In total, some 350,000 option ARMs are still active nationwide. Over 200,000 of these loans are here in California. The most risky option as we have established with option ARMs is the negative amortization payment:

Now why was this payment such a poor choice? Well as the California housing market fell by 50 percent from its peak, the actual balance on many option ARMs was going up. So not only is the home underwater from the initial starting point, the loan taken out on the home has increased on 90+ percent of these borrowers. This is like negative equity squared. So deep are these loans in negative equity territory that not even HAMP can save them. Oh, and speaking of HAMP, it is turning out to be a colossal failure as expected:

“(NY Times) Capitol Hill aides in regular contact with senior Treasury officials say a consensus has emerged inside the department that the program has proved inadequate, necessitating a new approach. But discussions have yet to reach the point of mapping out new options, the aides say.

“People who work on this on a day-to-day basis are vested enough in it that they think there’s a need to do a course correction rather than a wholesale rethink,†said a Senate Democratic aide, who spoke on the condition he not be named for fear of angering the administration. “But at senior levels, where people are looking at this and thinking ‘Good God,’ there’s a sense that we need to think about doing something more.â€

I know many delusional folks in California were thinking that somehow the quiet on the option ARM front had to do with the masterful success of HAMP. Of course, these loans never qualified for HAMP but that is beside the point. HAMP is failing because of a simple reason. Negative equity. Here in California, we have millions underwater. Those with option ARMs are not only underwater, they are going to have massive spikes in their monthly payments at a time when the California unemployment rate is the highest in record keeping history. The problem is Wall Street has sucked up all the taxpayer bailouts and for what? To keep the crony welfare investment banks ticking? Trillions of dollars out the door and the real economy is still troubled. HAMP had the naïve premise that the only problem was high interest rates and the problem with the housing market was toxic mortgages. Well, the actual problem is thousands of homes are still valued at bubble prices and with stagnant wages for a decade, people can’t afford homes without going massively into debt. Prime, near prime, and subprime means little when you have no income and that is why even prime defaults are spiking. The option ARM had such an allure for the gold rush California home speculator because it sidestepped that tiny little caveat of income. It allowed maximum leverage without the valid income support. 80 percent of option ARMs went stated income. In other words, people made crap up like saying they made $200,000 when they were pulling $75,000 to qualify for that $600,000 home:

“(CNN) There is another little problem that many option-ARM borrowers seeking refinancing would face: “Upwards of 80% of were stated-income loans,” said Westerback.

These are the so-called “liar loans” in which lenders did not verify that borrowers earned as much money as they said they did. Lenders may not be able to modify mortgages because many of the borrowers’ income could not stand up to the scrutiny. Borrowers may also not want to go through underwriting again because they could be held legally liable for deliberate inaccuracies on their original applications.

Add to those conditions the still fragile economy and high unemployment rates, and you have a recipe for disaster.â€

As people chime in about stabilization, California is still hovering near the bottom in terms of prices. The only reason we have seen prices move slightly up is because the massive jump into foreclosed homes, the home buyer tax credit, Fed buying securities to lower mortgage rates, and all these phony moratoriums that we are now seeing are basically delaying reality for many. Inventory is artificially low because of the shadow inventory.

People ask for a solution. Here it is: We should have (and still should) break up the banks into pieces that are small enough to fail. Bring back Glass-Steagall with some teeth. Commercial and investment banking should be put into silos that don’t even come close to one another. Banks that need to fail should. After all, the government now backs 90+ percent of all mortgages so why do we even need them? A quick assessment should have been made from day one on housing. Those that couldn’t afford their homes should have gotten assistance into rentals. Here’s a thought. Why didn’t we create a program where those who had no way of paying on an overpriced home were given a tax break to rent a place in an empty commercial real estate development? Right there you kill two birds with one stone. Of course, those on Wall Street and those in our government are two sides of the same coin. For the past three decades they have systematically neutered our government to the point of it being a bread and circus spectacle.

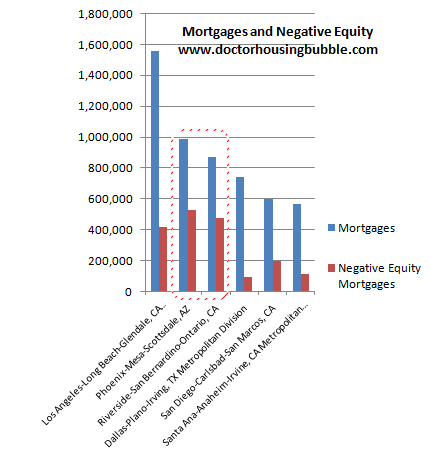

You think the 200,000 option ARM borrowers in California are sitting in a good spot? Let us look at negative equity rates for a few metro areas since this is the largest predictor of future foreclosures:

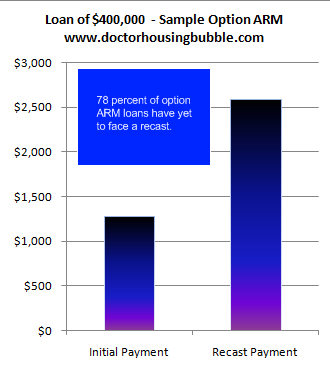

If you look at the Inland Empire and the Phoenix metro area, they virtually reflect one another. In fact, both areas have negative equity rates of 54% of all mortgage holders. This is incredible. Half of all borrowers are underwater in these big regions. But look at the largest block of mortgages in California clustered in the Los Angeles-Long Beach area. 1.5 million mortgages and 400,000+ are underwater. You think this is going to bode well for home prices as option ARMs hit their recast dates in stride from 2010 to 2012? I put in a more normal area of Dallas above and you can see what a normal market looks like. Even there, you can see that negative equity is still an issue. But compare that to California and it is another story completely. What does this mean? The middle market is certainly going to take major hits once these loans hit their recast dates. If they don’t qualify for HAMP, then what? S&P in their report gives an example of a hypothetical $400,000 mortgage:

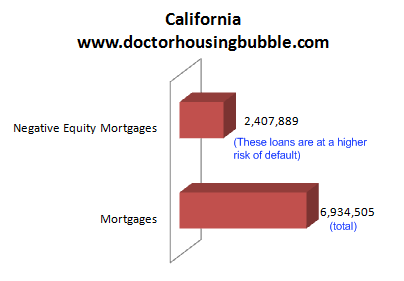

The payment flat out doubles at the recast date. Do you think people are going to be able to come up with an extra $1,200 per month with no problems? You know what the typical mortgage payment for a home bought last month in California totaled? $1,097. That is the price of the hypothetical increase in the priciest state in the U.S. So yes sales are happening but at a much lower end. How is this going to help those in negative equity on more expensive homes? Take a look at the raw numbers for the state:

34 percent of all California mortgages are underwater. You can rest assured that 80+ percent of those option ARMs are underwater. As the above highlights, those mortgages are still here and they are still toxic.

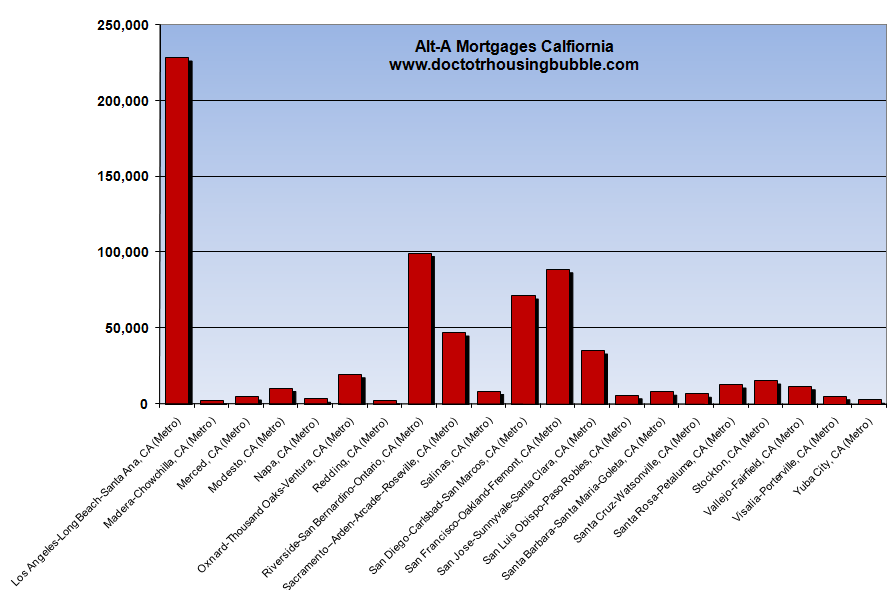

Option ARMs fall under a bigger umbrella of Alt-A loans. California has over 700,000 active Alt-A loans. The bulk of the 200,000+ California option ARMs fall under this category. But the bulk of these loans are also toxic mortgage waste. These will go off as well. These are actually part of the shadow inventory including those who simply stop paying but banks sit back and do absolutely nothing. Is that really a solution? Take a look at where the Alt-A loans are in California:

Los Angeles and Orange counties hold the biggest number of Alt-A and option ARM loans. Do you really think this is a bottom? It might be for a home in the Inland Empire selling for $100,000 or $150,000 depending on local area dynamics. But many cities in Los Angeles and Orange County are vastly overpriced. The above dynamics look similar to how subprime was building up in 2006 and 2007 before the market imploded. Yet somehow things are now different.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “Option ARMs Come Back into Center Stage: 350,000 Active Option ARMs with over 200,000 in California. 78 Percent of Option ARMs have yet to hit Recast Dates.”

So You’re Underwater, What’s Next?

Interesting comments.

I flipped many homes using this loan as it allowed me to get the money without documentation and make very low payments. Perfect for the job needed by me. But I as recall, they recast at 125% of original loan amount or at 10 years. Since the interest rates are very low, it could take a while to get to 125%. So it could be quite a while for the majority of these loans to hit a recast. Since most were taken out from 2004 to 2007. I’m guessing that most should hit recast in a couple more years, maybe 2014 or 2015?

The thing i see is that the LA/OC bubble popping will roll down values

in the Inland empire.

If prices decline in OC, why would people want to live in San Bernadino?

Suze Orman would have a cow, with all that negative equity! It would be interesting to see her address it.

@CAE:

Yeah everyone I know with one of these loans bought in 2004. I’m pretty sure they recast in 2014. I’ve read that the number one reason for foreclosure is job loss. Number two is bankruptcy due to medical bills.

Walk Away: Why More People Should Abandon Their Homes

Study Finds Homeowners Fight Foreclosure Even When It Doesn’t Make Sense

http://abcnews.go.com/Business/shame-cost-homeowners-big/story?id=9120264

I want to hear your thoughts on all the people who were able to pass on the potato bag while it was hot. The people who sold their homes before the market crash and are sitting on cash. I believe it is these people who are waiting on the sidelines and keeping the market afloat. I personally know several families who has sold their homes in the peak of 2006-07 and are renting while waiting to get back in.

How long will it last? I don’t know.

Same question here.. how long will it last. I’m ready to buy. Not because I think it’s the absolute best time, but because I want to get out of the housing market and move on with my life. I’m ready to get into a place make it my own. For housing prices, I wouldn’t be surprised if at this point home prices went up or down here in orange county. It seems like there will continue to be some gov prop or some outside factor that hasn’t been thought of yet that will keep prices from completly bottoming out. This blog is world class by the way – thx Doc.

I was one of the people who saw the market crash coming and sold at the peak. When will I get back in? When it costs less to purchase the same home than to rent it over a period of let’s say 5 years. I see this taking another 2 years to happen while the slaughter continues.

I sold my Florida beachfront condo in December ’06. Made a fortune! Put the money into building an office building. Oh well, some days your the bug and some days your the windshield.

CAE,

Are you sure it is 125% of the original loan amount? I thought that it was 125% loan to value ratio. It may vary from loan to loan but 125% LTV would cause these to reset sooner than 10 years.

Pat,

The prices in the IE compared to OC have always been proportional and I believe you are spot on when you say the prices in the IE will continue to fall as the LA/OC bubble keeps deflating. I think the appeal of living in the IE is that it is possible for a single working parent to buy out there allowing one parent to stay at home with the kids. I work in OC but commute from Murrieta because I like having my wife home with the kids and the school in our area are very good. It’s a nice suburb to raise a family in even though it may not be as hip and trendy as the OC.

All you are saying is the can is being kicked down the road.

RIght now these Option ARMS are all underwater. What happens

to address this?

The debtholders don’t want to invest into the properties while they are

underwater. Maintenance gets deferred.

all you are saying is the properties are worse when they get foreclosed on.

the only hope for these debtholders is high inflation.

Harry,

Good point, I am one of them. It is very enticing to jump right now, in fact the ONLY thing that is stopping me is lack of inventory. I refuse to pay 600K for a house that needs 200K work! I will die as a renter first.

I think a significant portion of the “cash buyers” you hear about are those who sold a while back and eventually this will exhaust.

Hey Doc,

I enjoy your posts enormously. What I would love to see you write on would be what are the different scenarios to how this can play out. I think all of us who read your Blog can agree we are in a mess. We also know that government intervention and some fancy media spinning is temporarily keeping things afloat. My question is what if anything can they do to fix this. Turning all options to 30 year fixed? Lowering the value of the homes? Forgiving outstanding payments? What does that mean for all the people in over valued homes that are still paying on time? It is hard for me to wrap my head around these concepts and would love to know what you think.

kelmag,

They can do nothing to “fix” this. No fix exists. Banks have limited legal ability to modify loan under the rules of the pools of loans. The government can try to come up with all of the HAMPs they want. Banks will not follow through, as we’re seeing now. New money to fund refinances must come from securitization. Fannie & Freddie will not be crafting underwriting rules that allow 200% loan-to-value loans to people with no jobs & lousy credit. Get it through your heads, people. There’s not going to be a “program” that can solve someone’s being 170% financed. If your legs get cut off you can move on with your life or hope for miraculous regrowth. Barney Frank and Nancy Pelosi and Chriss Dodd and Johnny Isakson can dream up all of the programs they want. It will have no effect in the long run. No effect. Virtually all of these underwater homes will be foreclosed and eventually re-sold. Homebuyer tax credits, subsidized interest rates, government-funded down payment assistance programs are all designed to keep buyers from getting the deal the really deserve on these properties. The last of these loans will not have gone through the foreclosure/resale process until 2019. That’s 2007 vintage Wachovia Option ARMs, now serviced by Wells (with 10 year re-cast period) + 10 years + 2 years of dicking around. Most of them will have gone through the foreclosure process much earlier, however. Nader has it right: when the cost to own is cheaper than the cost to rent, it might be time to consider buying again. Should be 5+ years. Any upturn prior to then is a head fake.

I got 5/1 arm in 2005. It resets in Feb 2010, but my rate will now lower than before because of libor is so low. I rate went down to 3.375 from 4.75. I guess not all resets are bad. I should add my loan is not interest only or a no doc loan.

I’m with Olaf. I mean, c’mon, kelmag…we’ve got an unwinding here that’s kind of like California’s profligacy with water, or humanity’s disregard for hydrological thermodynamics. A great big complicated engine of something or other has been running for several decades now, goosed along by Greenspan Shrugged this decade. And now it’s coming unraveled like some dadaist self-destructing machine.

~

DHB’s role is to lay out what’s happening, stripping bare the housing hype. Not to come up with fixes. All he’s trying to do is keep rational, responsible people from getting pulled into the twentieth or thirtieth tier of Housing Suckerhood. The hype-bots know it’s a Ponzi scheme, anybody with sense can see that, but unfortunately housing is a deeply emotional thing, especially in a time when things often feel scary on all sides. Around here I’m seeing hype of exactly that sort. “The security of home in uncertain times.” Attached to a new ARM-type scam designed to strap people to debt they obviously cannot afford.

~

Though I do agree with Doc’s observations that the wall between banking and investing has to be rebuilt and shored up. But that won’t fix anything that has already unravelled, it’ll just keep more evil of that particular sort from happening.

~

The question I have is: I understand all the pontificating about renting being the way to go. I rented till my mid-40s, and it was fine. I bought mainly because it was cheaper to buy than rent, given my household’s financial and employment circumstances. It also allowed me the possibility of home-based productivity and income that I couldn’t have as a renter.

~

But all those rentals rely on landlords, i.e., property owners. And what’s going to happen to landlords when THEIR houses of debt begin to collapse? That’s what I’d like to hear Doc consider in a future column.

~

rose

“Like a street vendor taco these things went down nicely and appeared cheap but came with a hefty aftermath. ”

Good job Dr, putting it terms that we all can relate to.

“Greenspan Shrugged.”

PERFECT.

A lot of the World Savings/Wachovia option ARMs recast after 5 years, not ten. Since most of those were made in 06/07 the recasts dates are coming right up.

Martin Armstrong suggests the year 2033 as the bottom, with an intervening “relief rally” beginning in 2012. Happy hunting!

Lots of these had a reset of 110% so they are already resetting, many that I have seen had Interest only seconds behind them to 95 or 100% LTV from the original appraised value. So many of these people owe double what their homes are worth now its crazy. The good news is that buyers should have plenty of inventory to chose from coming up.

I don’t think they are being all that strict with the 125% LTV ratio for HAMP. My loan balance on my first is about 300k(another 85k on the 2nd) with a house that is worth 150k and they offered me a HAMP mod. Of course HAMP doesn’t address negative equity or my 2nd so I’m probably not going to accept it.

@Jag

The ‘Reset’ is not the problem. The ‘Recast’ is. Many took out loans with negative amoratization, meaning the equity in the home is becoming more negative. They can recast on a timeline, or it can be triggerred by an event, such as debt-to-equity. (In engineering, you cannot divide by zero, but you can in voodoo banking-realty ‘math’). The recast recalculates the entire loan and you have to pay principle and interest going forward, plus anything else in the contract, because if you got one of these, you damn sure were too stupid to read the contract and have no idea what you signed.

What pulled the world back from the abyss was not the bailouts, it was changing the accounting rules from mark-to-market, back to mark-to-freaking-anything-I-want to. Now the banks are technically no longer insolvent, although we all know they really are. If housing were truly marked to undistorted market, all hell would break loose.

Derivatives are now over a quadrillion, or more than 10 times this planet’s GDP (which is a fabricated number). Honestly, when these formulas reach the end point do you believe the Fed will back-stop a quadrillion? Remember algebra and a parabolic curve? They look awesome, until they don’t. Whatever you’ve heard, a derivative is not ‘derived’ from something. It is a calculus formula: Dx/Dt, or a change in quantity x with respect to delta-time. They play the rate of change rather than the integral of accumulated value over time. The end-game is a retrace as violent as the one that got them there. As x approaches infinity, the formula begins to fail. Maddock approched infinity. There was no where else to go…

you have great information and especially charts. I have an assignment to collect data or create a chart showing ARM Originations with in California counties since 2004. Can you direct me to where I can acquire this info? Or… better yet, do you have a chart that you can forward?

Thank you so much,

Sherri

Leave a Reply to pat b