Real Homes of Genius: $258,900 for a Condo in Santa Monica? One Catch. It is 400 Square Feet. Attorney General Has Eyes Set on Option ARMs.

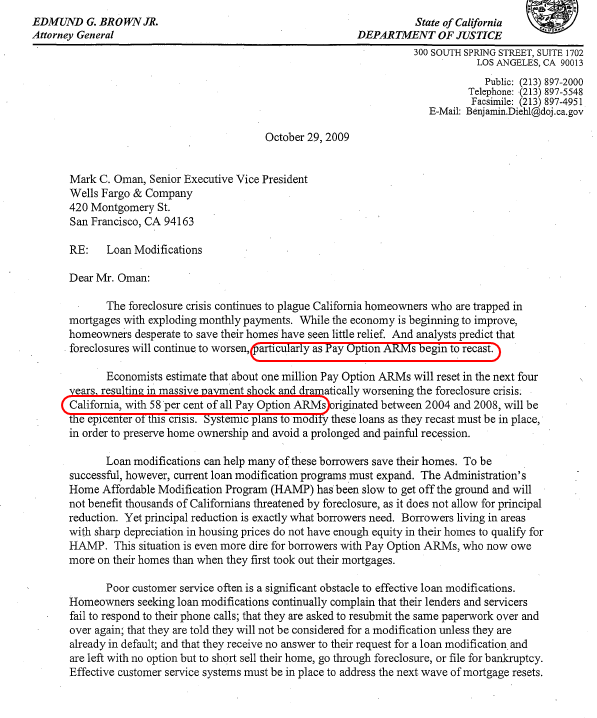

I have been covering the option ARM fiasco for a very long time now and as I have highlighted before, this is very much a California problem. Apparently I’m not the only one that has realized that option ARMs are a ticking time bomb just waiting to go off. None other than our own attorney general, Jerry Brown is going after the top option ARM banks and servicers. He has a few of the same questions that we have. How in the world are banks going to deal with the coming recasts? Have banks done anything since the crisis has started in addressing these loans? Inquiring minds would like to know.

The AG has been busy in the last year. He went after toxic mortgage poster child Countrywide successfully and recently, has gone after State Street. Jerry Brown recently came on CNBC regarding State Street:

Source:Â Zero Hedge

If anything, the AG is one of the few people that is actually going after the crony bankers and Wall Street for their financial robbery against the U.S. We should be saluting the AG for this. Instead, CNBC with their typical pandering and cheerleading for Wall Street tries to make a mockery out of the interview:

“I don’t dispute that $56 million is a lot of money, I don’t dispute the merits of the suit but you had a big press conference, you’re coming on C….N….B….C…. all this surrounding publicity over this $56 million, what do you say to people who look at this and say this is a perfect example of the demagoguery that attorney generals [sic] use when they want to run for governor.”

This is precisely what is fundamentally wrong with the financial press. Here we have a public official who has gone after Countrywide, is going after State Street, and is now openly questioning the practice regarding option ARMs that are arguably the worst loan products ever devised and CNBC has the gall to mock him for “$56 million†because in their journalistic circles, this is a tiny amount that only the proletariat would worry about. Contrary to their comrade circles, $56 million is a lot of money plus, there is the need to stop the financial thievery that has engulfed this country. Who else is going after these institutions legally? I realize that next year is a big election year and Jerry Brown is the front leading Democrat but come on financial press, we should be seeking out folks like this and Elizabeth Warren who are actually on the side of the consumer.

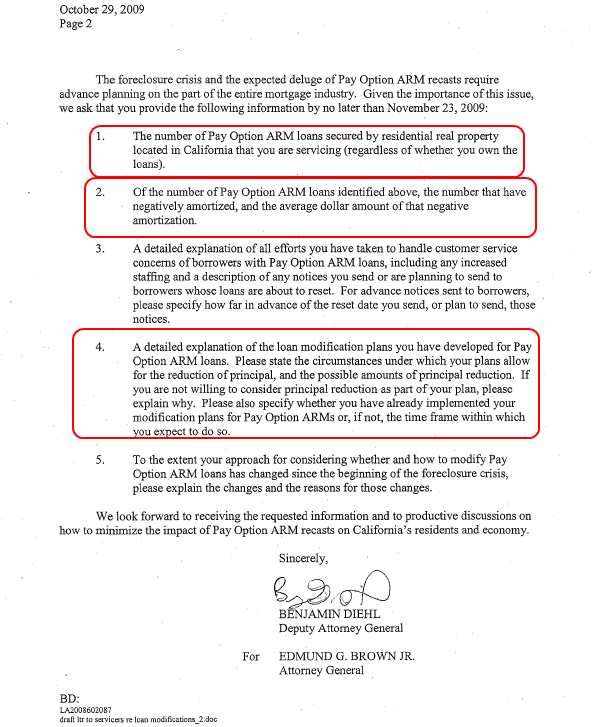

So what is in the letter you ask?

As I just recently noted and the AG recognizes, most of the options ARMs are here in California. We also recognize that nothing has really been done to remedy this issue. The AG is merely asking the top 10 bank and servicers of these loans to answer what they have been doing in regards to option ARMs. They have until November 23rd to respond which is plenty of time for them to type in corporate legalese “we haven’t dun a damn thing AG!â€Â It’ll be interesting to see what happens since it appears the AG is diverting from the White House and Wall Street plan of extend and pretend and is actually pushing toward principal reductions. In other words, something banks have been fighting against vehemently.

I appreciate the AG understanding the issue before it implodes and recognizing that this is a major issue for the state. Sure, some realtor and housing cheerleaders have been ignoring shadow inventory and these toxic mortgages but I’ll side with the AG on this one. Instead of CNBC thinking $56 million is chump change, I’ll side with people who seem to be fighting on the right side instead of shilling for Wall Street.

And if you think the actual housing insanity is done in California, you have got to get out and smell the roses. Or if you prefer, you need to get your self into a 400 square foot condo. Today we salute you Santa Monica with our Real Homes of Genius Award.

Santa Monica – The Westside Miniaturized

The coveted Westside is on the radar of many SoCal blogger readers. Many forget that SoCal is a gigantic region with over 20 million people. Some forget that in the Inland Empire, it is easy to find homes between $100,000 to $200,000 yet evidently prices haven’t collapsed in their tiny niche markets so therefore the housing correction never happened. If we look at the Westside in terms of overall SoCal sales, it is but a tiny fraction of the overall market. And in this niche online force of readers, many are secretly lusting over their piece of Santa Monica real estate. Well the wait might be over for you my friend!

I pulled this place up on Zillow and it is listed at 390 square feet (ZipRealty has it at 400 square feet). Now really, are we going to argue about 10 square feet? The only one that may have an objection to this number might be your pet cat but otherwise, we are talking a rather small location.

Officially there is no bedroom on this place. It does have 1 bathroom which is useful in a home. For $258,900 I think most of us would expect that at the very minimum. But of course, this condo has the obligatory HGTV paraphernalia:

The place has been listed on the MLS for 179 days. Now you would expect anything under $300,000 to fly off the shelf in Santa Monica but it might be hard to show that you are a certified “baller†when you bring your date back to a 400 square foot condo. In the battle of location versus size, what will come out ahead? Only in Westside would you have these kind of battles.

At least we know that we have a bathroom though:

I may not be doing this place justice. Let us read the ad:

“Amazing asking price for this charming cottage style bungalow in the heart of santa monica. Subject to lende’r approval but approval is now in final stages of full approval and is imminent!! Do not miss, second & final negotiator has established this acceptance price!! Unit overflows with light and charm,bamboo floors,new eat-in kitchen with granite counters and new cabinetry.All new bath with pedestal sink & tiled floors. Huge private outdoor patio with redwood fence.Garaged parking space.â€

Huge private outdoor patio? Bamboo floors? Granite countertops? Where do I sign! One small thing of course. This is freaking 400 square feet for $258,900! You’d get more room by getting a roommate and a regular apartment. Let us assume we decide to buy this place with a FHA insured loan and 3.5 percent down:

Down payment:Â Â Â Â Â Â Â Â Â Â $9,061.50

Monthly PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,726

Now is this place worth it? You tell me. As a bachelor gig to show the “310†this might not be bad, but certainly no family is going into a 400 square foot place. The price is certainly doable for Santa Monica. Yet you have to ask whether this price will hold in the long-term.

In many other places in the country with $258,900 you’ll be getting a nice McMansion. But this is California and as we have shown with option ARMs, we do things very differently here.

Today we salute you Santa Monica with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

43 Responses to “Real Homes of Genius: $258,900 for a Condo in Santa Monica? One Catch. It is 400 Square Feet. Attorney General Has Eyes Set on Option ARMs.”

“The Dark Side clouds everything…” Yoda, from The Inland-Empire Strikes Back.

The fundamental issue is that extension of credit (debt) distorts the value of everything and this was the mother of all debt creation. In spite of the trillions ($24T, on Dylan Radigan’s report) M3 (which gov’t is too embarrassed to continue reporting) has been shrinking dramatically. In other words, no matter how much cool-aid they hose us down with, debt is contracting. It is amazing how they are fighting principal reduction, but in essence, once they open Pandora’s box, the whole deck of cards comes down. There is a tipping point, and like fighting tides, gravity, sunrise and CNBC cheerleading for the Dark Star, aka Manhattan, fundamental constants in the universe cannot change. Why do you think Dylan left CNBC?

The personal attacks on Brown are inevitable. You can’t take on the mob and not have retaliation. They’ll probably bring up something about Linda Ronstadt from the 1976 presidential campaign.

400 square feet is big enough, you just have to get liposuction first if you want to fit in the condo 🙂

Regarding principal reduction for option ARMs, it is quite ironic to reduce principal for a mortgage product that encourages an increase in principal. I realize Dr HB is in favor of principal reduction, but why can’t these homeowners/debt-owners become renters? If the banks foreclose on these debt-owners, the price of houses in these neighborhoods will come down and responsible renters could afford to become homeowners.

So there you go, finally someone in government is starting to go after the fraud. Yet even here on this site, there are those who will go after the victim. Yes, it was a poor decision to buy when the FRAUD bubble was going, but beating up those whom are already losing their 20% down, and their house, doesn’t fix the problem, it only makes you fellow neighbors and citizens very angry, both at the system, and now fellow citizens.

Attacking the victims who bought a house for a HOME and not investment, is tantamount to calling a date rape victim a slut who deserved being raped because they made bad choices in the attire they wore or who they went on a date with.

So the only thing Jerry Brown can expect to accomplish is a talking point for his election campaign for governor. This is grandstanding, pure and simple.

The REAL question is who provided the cash for those notes. Was it Fannie Mae, Freddie Mac, FHA? If it was a GSE or government then that’s where the fault lies. If it is private money then hair cuts are acoming.

Did anyone else read about the 52 IRS agents under investigation for fraudulently getting the $8,000 first time home buyer’s credits? Looks like 170,000 more are suspect. How many are connected with ACORN?

Doc, you really think that the banks should have to reduce the principal of these mortgages? That the government should force them to basically give their money to people (gamblers) who signed a legal contract?

If these properties had continued to shoot up in value by 20% a year, no doubt the mortgage holders would never share a penny with the bank that gave them the money to gamble on it. I’m disappointed you think the banks should have to just give away principal now in order to save a mortgage that has no business being saved.

You are now advocating for the manipulation of the market, that you’ve been decrying. Very disappointing. It’s time to stop manipulating the market, and let houses get their valuation solely based on how much they are worth to people who want to live in them. Not based on the old math, and the consequences of the bubble.

I agree with NickHandle on this one. Why is it that responsible people always get the short end?

Swiller, I feel the pain for some (not all) home owners who are under water. However, the real victims here are the those who don’t own a house or are not under water.

Dr HB, I admire your in depth knowledge of this housing mess. However, I sometimes have trouble understanding your proposed solutions. Are you on the side of the under water home owners now as opposed to the renters? I have no problem with priciple reduction as long as the same reduction is also offered to every home owner who is not under water and the same amount of credit given to every renter. I guess this will never happen, and it’s perfectly clear by now that bad behavior will always be rewarded. If you cannot save the responsible guys, at least don’t try to stop them from trying to save themselves by turning irresponsible. I know the can is being kicked down the road to us, however, who has the moral authority to say that this time we cannot kick it down further? That’s why the FHA with 3.5% down is still alive, giving some who missed the last party a second chance to default and get bailed out. One can argue this will ruin our economy. However, it the world comes to an end tomorrow, would you rather die owing a lot of debt or die after bailing out all others? Morals, ethics, and jokes?

Anyone who has more than one home, shouldn’t receive anything. Those whom have one home, and have been responsible, should be modified or foreclosed…period. For all those whom are against principal reduction…go ahead, let ALL the loans foreclose and see what your own home is worth, and what happens to the economy.

Those with equity are ALREADY being rewarded with rates so low they will never have to re-finance again.

“If these properties had continued to shoot up in value by 20% a year, no doubt the mortgage holders would never share a penny with the bank that gave them the money to gamble on it.”

You mean like the market has been for the last bubble? How come no one is screaming to get THAT money back? Oh that’s right, because all those Boomers feel they EARNED that money and deserve it. Hardly.

I’m all for foreclosure and letting the economy collapse.

If principal reductions become the norm then this must be taken into housing valuations. It must be somehow a factor that is considered when a house is appraised. Otherwise…. it makes no sense to a free market.

@ LA -Architect,

My husband and I agree with your point here – but we are in fear that the banks will not disclose these reductions in principle (maybe only partial disclosure) which would keep the crazy valuations nearly constant. This may seem “illegal” but this would be in-line with their unregulated behavior!! I just wish people would stop paying these crazy prices – that may be the only control we have on housing valuations…

I agree with WWang…”I have no problem with priciple reduction as long as the same reduction is also offered to every home owner who is not under water and the same amount of credit given to every renter.”

I purchased my house in San Diego as part of a job transfer in mid 2007 right before the credit market seized up with 20% down and a traditional 30 year fixed mortgage. I have mixed emotions about the situation, because at the time I was thinking I did the right thing by turning down the $1.2 Mill Option Arm loan being offered to me by the trustworthy mortgage broker that “everyone was doing” and which made no financial sense and instead insisted on a fixed loan where the math worked for my income and downpayment – essentially 40% less. Of course I had to accept that the house “I deserved” was less as well. However, now I am feeling like the foolish one if principal reductions are in fact enacted because so many selfish people like Swiller gamed the system and then cry “poor me” when it didn’t work out ( is it a wonder why CA has the majority of these crappy loans given it is the home to the most selfish people this side of wall street). As others have pointed out, where are the principal reductions for the rest of us – the ones who are mature and responsible enough to pay off the debts we signed on the line to accept and follow through on. Instead, the whole f**ling ship is going down and taking the rest of us and our home investments with it – while the banks count on us financially conservative folks to keep the cash flow going by paying the mortgages on homes which are now less that what we paid for them because our conscious wont let us “strategically default” like so many “housing gamblers”. There was a day when gamblers that didn’t pay their debts were dealt with appropriately. Maye a visit from a couple heavy set guys might help some of these folks understand the severity of the situation they put everyone in just because “everybody was doing it”. So I too vote for no principal reductions unless they are across the board. And as an aside, I always thought it was ironic that my above board mortgage broker had an email address with “jcsoldier” in it…makes me wonder what would Jesus do if he were selling mortgages. Some soldier. At least his email address no longer works.

Essentially, what is happening is that the government in effect is trying to make anyone who wants to buy a house, as debt burdened at those gamblers asking to get bailed out.

Thankyou Dr. for this wonderful article. As a responsible homeowner that bought within my means when they start giving principal reductions I want one also. If it means witholding a few payments then so be it. And with that everyone who has the opportunity will do the same. If I’m going to pay their mortgage someone’s going to help pay mine. Principal reductions won’t work because of it.

Swiller: You are comparing Option ARMS victims to Date-Rape victims. What are you smoking? Also, option ARMS did not require 20% down payment, you idiot. Please stop posting your comments here as they are stupid and a waste of time. You were a fool to sign up for a toxic loan and you and the bank deserve to lose it all. No one put a gun to your head.

Myopic myopic myopic……that describes pretty much all of these posters howling for foreclosures and weeping and wailing that ‘someone is gonna get something that I didn’t” and ‘DOc you are advocating for blah blah blah….I feel betrayed.”

>>

The issue of principal reduction on loans that are so far underwater that the house must be at the bottom of the Mariana Trench is NOT ‘renters’ versus fools who took out option ARMs. It is NOT about ‘saving the in-debt-over-their-head-borrowers.’

>>

The issue is the banks balance sheets and solvency. (Yep it is most definitely NOT all about you and whether prices will come down to what you want.)

>>

Sooner or later the banks will have to deal with these loans. After all the blasted things are recasting (not resetting ie interest rate changes due to fluctuation in T-bills or Libor) and recasting to payments that are 30,50, 65% or more than the payments are now. Selling the place for enough to pay off the option ARM is about as likely as snow in July in Southern CA.

>>

The lenders have 2 options. (Sorry bad pun.) They can wait until the loan goes in to irreparable default, foreclose and sell it for what it will bring these days. And write off the loss.

>>

ALternatively they can try to rework the loan. Well HAMP sure isn’t going to do it! Extending to 40 years and cutting the interest rate to 2% is not going to fix a loan that is 25, 30 50 or 60% down in value from peak price. The borrower is going to have to pay the principal. And that is not bloody likely when it was all they could do to pay some – but not all – of the interest at a low teaser interest rate as many of these loans are. So the only choice the lender would have to salvage the loan is to reduce principal. And that my childen, has been, to date, as rare as that snowball in hell. They write down the principal and they have to book the loss not only of principal but future interest payments on the forgiven principal.

>>

The question isn’t whether the banks will take losses – huge losses – on these loans but by which means will they get to establishing the loss: foreclosure and sale at a far far lower price or reducing principal on the loan.

>>

Doc isn’t ‘advocating’ for one thing or the other. He is simply pointing out the very limited choices of the lenders and the fact that finally someone somewhere has said to the lenders ‘So wadda youse gonna do aboot it?”

Well you’d be paying at least a thousand a month to rent that place. Oh yes, this is L.A. remember, rents aren’t cheap here. So the PITI isn’t too bad considering. Of course a place that small is really best suited to a single person who intends to remain that way.

It’s not just the westside that hasn’t fallen Dr. Much of the eastside hasn’t really fallen either (the san gabriel valley and so on). But yes if you want to live a 2 hour drive from work you can get cheap housing in southern California. Well woop do doo, no wonder the middle class doesn’t want anything to do with this state.

@ Matt…you are correct, I WAS A fool…to prop up a system with people as ignorant as you are…so, I’m correcting my mistake by NOT PAYING. When the whole system collapses around you from “gamblers” like me who owned 3 homes over the last 20 years. You are correct, 20% is *NOT* required on interest only loans, but it was the only thing I could do to make the payment even remotely affordable. I should have RENTED….OR I should have bought that $750,000 home like the agents/brokers/banksters were urging me. Now that I see what kind of fellow a-holes I have as fellow citizens, I should have gotten into that big a$$ McMansion. I sincerely hope someone with your attitude comes around my house and starts spouting off. Thank God for the 2nd Amendment, so when it all comes down, I’ll be ready for people just like YOU.

Well, I can see that the majority of people cannot see farther than they can reach. The REASON I’m pissed off about fraud is because it was perpetrated from the top down. The Federal Reserve…the U.S. Treasury…THEY fed the bubble and kept it actively going in order to drain YOU (the american public) of your wealth. What better way to do that then supply a real estate bubble?

I’m thinking out of the box of most folk here, so I accept the fact it will be rejected. Be that as it may, I am still protected by SOME laws in this country, and I damn well intend on using them. YOU can choose to support the fraud, I will not. I’m not paying my credit cards either AFTER they jacked the rates to over 20%.

I almost always agree with the good Doctor, but I don’t agree with the idea of forced principle reduction at all. I don’t see any benefit to rewarding irresponsible behavior of “homeowner’s” who bought homes beyond their means.

There are plenty of people waiting on the sidelines that will buy Real Estate at Market Value. Just let the Market do its thing, and rid itself of these inflated values.

“Attacking the victims who bought a house for a HOME and not investment, is tantamount to calling a date rape victim a slut who deserved being raped because they made bad choices in the attire they wore or who they went on a date with.”

Very insensitive and flawed logic. At no point does a “date rape victim” agree to consummate any “deal”. They are forced to comply with another person’s demands; without their consent.

I don’t recall hearing of anyone who entertained the idea of buying a house, who got dressed, got into a car with an agent, viewed properties, then had a contract shoved in their face, with the agent saying, sign here…or else. You must buy this house; you have no choice. Your behavior clearly indicates you want to buy!

Seems to me most of these “victim” buyers were more than willing to comply. Heck, many of them were involved in bidding wars to buy houses. Hardly the behavior of “victims”.

To all those posters who feel that we are attacking those underwater, that is not the case. I for one, am merely pointing out that during the hey day of the bubble years, these same people gleefully told all how much their house had appreciated and that those on the sidelines were going to be priced out forever…..

Look, it’s a free market (or it was) and people are free to gamble on never ending appreciating real estate. However, when they lose they had not expect those prudent gamblers (just on the other side of the bet) to pay for their mistake.

Let the market correct itself!

We are seeing something unprecedented in American history, the unraveling of the moral thread which kept this country functioning. I am certainly not naive enough not to realize that there have always been gamesters and robber barons throughout our history, and that the “little guy” has always been taken advantage of by the rapacious and unprincipled. Even so, in the so-called heartland of America (and I don’t mean the Middle West, I mean the middle class streets in cities and suburbs across America), you could be fairly sure that your similarly economically situated neighbor was not getting a better deal than you. Everyone was expected to pay his/her bills, was responsible to living up to the econonomic bargains we made. People lived with that sense of fairness for many decades.

Now we are seeing right before our eyes, all sorts of examples of our figurative and literal neighbors getting a better break, mostly because they were greedy, foolish and manipulative. Some of them played the bubble well; flipped, refinanced, and made out great, while many of us didn’t, because our quaint concept was one home per family, and you lived in it and paid the mortgage on time. Then many of them overplayed their hand, refinanced once too many, bought too big. But instead of justice being served, and these people having to suffer the economic consequence of their bad deals, we are seeing the frugal and responsible people actually forced to pay to allow them to walk away unscathed, or even better, get to stay in their house at reduced principal and low interest. And this travesty is not only unconscionable, it rips apart the fragile enough thread which bound our country together through many difficult times.

This is worse than the “moral hazard” economists talk about. It is making it very obvious to everyone that this is all a rigged game, and that being responsible gets you absolutely nowhere, except in your conscience. I would not be surprised if we start seeing millions of more people stop paying their mortgages, their credit cards. I expect to see all sorts of new scame and frauds in the housing market. What is the price for any of this, vs. the reward? This is far more than my personal sense of outrage, it is a lament for a kind of morality of honesty and decency which is every day being shown to have been a dupe and a propaganda to keep the masses in line. People are not stupid; they adapt their behavior to what they see rewarded. The government has no idea what a Pandora’s box it has opened.

Well written, William. I agree.

This fragile thread weaves through our society. Financial institutions make horrible choices, with consequences that darn near bankrupt our country; they’re bailed out courtesy of the US taxpayer. Embarrass yourself and your kids on a reality show; become famous and wealthy. Release a “private” sex tape, become a celebrity. Buy a bigger house, a bigger car, go for it! Notice me, I’m important! If it doesn’t work out, declare BK and start over. Obviously it was someone else’s fault that things didn’t go as planned. Everybody else is getting something for free, where is my free “something”? And so we go, down the slippery slope. Where will it end?

It seems that our economy is based upon people buying things they don’t need and can’t afford with money they don’t have. What if the music stops?

Principal reductions are ridiculous.

Let’s see a bunch of idiots who think the market never stops going up take out bad loans and jack up the price of real estate for everyone else. When things get bad we say oh, you deserve a principal reduction, which does nothing to reduce the price of housing, just let’s these idiots off the hook.

You want to save the economy and save face. Do the loan mod to reduce the principal balance on a temporary basis to make the payment manageable. IF the value ever goes back up they pay back the principal and all that lost interests. These homeowners should NEVER get the BENEFIT of a principal reduction.

If the value doesn’t go up, let them do a short sale to a responsible buyer.

CNBS is…let’s just say looking at their ratings, dying on the vine.

On the option arms, this may not be popular but we can’t have a principle reduction policy or program. Either under BK or on an individual lender/borrower basis. The fact is these loans went bad when the economy went bad, now they’re stuck and need to pay the consequences.

Of course principle reduction will happen, all debt will be forgiven and paid for by taxpayers.

I need a support qroup!! Does anyone know of a place where “the frugal and responsible people” are meeting…(LA/OC??)

I think that the music did stop…

I am like many of the people here wanting the market to correct itself. Personally, I am a renter, even with my good income, my wife convinced me that we couldn’t afford to buy at these inflated prices even with me being a physcian and my wife an engineer. I listened to her, and maybe there is a lesson in that as well in listening to your wives. However, when I talk to people in real estate from a psychological perspective, people are at the first stage of acceptance of a loss, which is DENIAL. This, unfortunately, is happening with some of our fellow bloggers, and to real estate owners who don’t want to hear that there property is worth significantly less, and the banks. Their is a psychological dimension to this issue that has to be understand and felt which at this point hasn’t sunk in yet. Midway through 2010 will be a different reaction I suspect….

I don’t have a house, so I would like an equivalent tax reduction to substitute for the principal reduction that the rest of the mo-fk’n entitlement society receives.

Thank you.

I can partially understand why people are so against principal reduction, but at the same time look at how burned some people got by the bubble. Sure I guess that makes us idiots for not seeing it, but I never experienced the housing bubbles of the 70s and 80s as I was a baby. Why would someone get an equivalent reduction that didn’t get burned by the bubble. I truly believed in 2006 that if I didn’t buy I’d be priced out of housing forever. I realize now after coming across sites like this that this thinking was dumb. If this stupid bubble hadn’t taken place I would have bought a house for $160,000 in 2006 (inland empire) and suddenly I wouldn’t be an idiot at all. Somehow I was supposed to know about the bubble I guess. In the meantime there is no way I’m going to continue paying $400,000(and 56% of my gross) for a house worth $160,000 and eventually pay $1,000,000 or more after 40 years of financing. I made 2 horrible assumptions that many were making when I bought my house. 1) Incomes will always go up 2) housing will always go up.

@ William:

Your conscience is all that matters. Take heart.

RL – the frugal and fiscally responsible people will be meeting at that 390 square foot Santa Monica “estate.”

Principal reductions:

First of all, principal is spelled ‘al’ not ‘le’. You may not agree with the principle of principal reduction but at least spell it right.

Secondly, there are four kinds of principal reductions, two of which are not yet in existence today.

The first form of principal reduction is the Principal Balance Deferral which is fairly rare. The lender agrees to forbear, not to collect, a portion of principal balance. If the home is sold the borrower has the repay the full amount of the loan including the forbeared principal.

The second form of principal reduction is the lien stripping in Chapter 13 bankruptcy. Now I only know how this works in the 7th circuit (IL, WI, IN) and not your CA 9th Circuit but it works like this: I buy a house for $100k with an 80/20 loan. $80k first and $20k second. Today my house is worth only $75k. I file chapter 13 bankruptcy to ‘strip’ the second lien. You can only do this when the value of the home is less than the first mortgage, making the second completely unsecured. When you strip a lien you turn a secured lien into an unsecured lien and repay it at 10 cents on the dollar. In the example above the borrower repays 10 pc of $20,000, or $2,000, over 36 or 60 months, and then the lien is stripped from the property and the remaining debt discharged, leaving the borrower with only $80k in mortgages to pay! This happens all the time in chapter 13 bk in the 7th circuit. Maybe there was a benefit to having a second mortgage!

The third principal reduction, not currently in existence, is the ‘cramdown’ whereby a bankruptcy judge permanently reduces the balance of a mortgage to the current market value. Using the 80/20 example above, the judge would discharge the 20k 2nd mortgage (not repaying anything all) and then reduces the principal balance on the $80k first mortgage by $5k to $75k, without requiring any repayment.

The fourth example is out right principal reduction. In the example above the lender writes off the $20k loan and 1099’s the borrower (for tax purposes which the borrower doesn’t even have pay) and the $80k is voluntarily reduced by the bank to $75k.

I’m all for making the banksters EAT the bubble priced homes. I’m NOT the one who voted OUR tax dollars to finance Wall St., the banksters, and all the other fraud that happened…..but it’s done, YOU voted those people into office.

The only thing I am looking for now is stability. Please take the house, in the meantime, I will save to pay off other debt and a small savings in case of emergencies. You all want “people” who bought the homes to “pay the price”, but that will not…indeed, it CANNOT happen, if people could continue to pay without going bankrupt….most would. Many will elect to “walkaway” because it will be the best financial decision in their lives. The whole scenario was controlled by the FED banksters. Here’s a novel idea…if you don’t lend money on ridiculous terms, you don’t rick having a massive default rate. However, the $$ was too too good, and they kept propping the system, and the ignorant keep attacking the victims. Don’t get me wrong, there are plenty of scammers out there, but the majority of us who bought one house for a home and not an investment, are so behind on equity, it’s silly.

You talk about fairness huh. It’s pretty fair when the guy next to you paid 40% less than you because he bought 3 years earlier. On top of the smoking equity he has, he can now re-finance for the lowest interest rate this country has ever seen. Yet, YOUR morals and ethics dictate to those whom cannot afford to make the payments that they are “less” than you. People got duped, and then you have others who hurl insults at the backs of the people who are leaving thier homes in droves. Make no mistake, their is anger brewing in the country, and I wouldn’t so readily poke, prod ,and provoke people who just lost everything financially, it could prove hazardous to your health. But then again, those morals and ethics some of you so righteously hold up, will hold your character back to provide compassion and understanding rather than insults. You want the truth…follow the money…and it doesn’t lead to single homeowners.

Keep in mind that in many cases principal reduction doesn’t come as a freebie. I’m not advocating for this “free money†by the way but you have to ask why banks are so resistant to this. As Ron Tough above points out above, there are a few ways for principal reductions all which directly impact the bank bottom line (i.e., they pay for it and it will show up on their balance sheet). In a few cases, you would have to file for actual bankruptcy to get this benefit (since 2005 it has become a lot harder to file thanks to banks and now there are median income tests). People think that cram downs are free money. They are not. These are done after you file for bankruptcy or at least that is how they were done in the past. Even after that, you are not safe from foreclosure given that if you filed for bankruptcy, the likelihood of your financial situation is shaky.

>>>

The over arching point of this is that it will call banks on their bluff. They will be forced to recognize the real value of the note. What are they doing now? In many cases, these Alt-A loans are being priced at face value even though we now know that many (45% of option ARMs) are now 30+ days late. In most cases, I would imagine that principal reduction would not even be in the equation. Why? First, some of these borrowers can pay for the loan but selectively choose to default (i.e., strategic default). So why would they want to file for bankruptcy if the only “bad debt†that they have is a big loan on an overvalued home? The AG is merely calling out banks on this.

>>>

The way things stand right now, banks are having it both ways. Sucking the taxpayer dry with bailouts while maintaining billions of toxic debt on their books at face value thus boosting their so-called profits – this has been done through suspension of mark to market and also, avoiding foreclosure on non-payers. The HAMP program merely buys banks a few more months until Q1 and Q2 of 2010. I would venture to say that HAMP overall will be a failure in California. So the principal reduction may seem like “free money†for the irresponsible but keep in mind that you have to file for bankruptcy in many cases (that is if we are talking about say a cram down). Even from stories I have heard, I can tell you that many in this underwater spot will not go this route because they do have the income and assets and simply do not want to pay on a lower priced asset. Others are so underwater that a bank would never agree to their principal reduction terms (given the options available). So for them, they are playing chicken with the bank. I won’t pay, you foreclose on me. We’ll see after November 23rd what the banks and servicers have as a policy. At least we’ll see in writing that their “strategy†is to sit back and do nothing while leeching on the taxpayer.

>>>

It is insanity that the financially responsible are stuck in the middle of this battle of extremes. During the boom, it was rewarding everyone that got into massive debt and now, it is the failures like Chase, BofA, Wells Fargo, Goldman, Morgan Stanley, AIG, and other banks that get bailed out.

who in their right mind would want to live in caleefornicate anyway? happy income tax increase!

And they wonder why people have lost confidence in the financial systems, and the ability of the “leaders” to lead. Who can trust any of these “leaders”? There is a pervasive idea that these problems aren’t fixable now, which adds to the moral hazard burden. My money is on the whole system still collapsing, despite the machinations of the Fed, Wall Street, or the consumer who is in “post-crash denial”.

Sorry, swiller, but your interest-only loan indicates you bought beyond your means. You are angry because you got caught, yet you proudly parade your immorality with long-winded harangues about how it’s anyone’s fault other than yours. Sadly, there are many parasites like you who feed off decent society.

@AnnS

Yeah, that was what I was saying, only it sounds much more intelligent when you say it…banks mark-to-market and it’s another March to S&P 666 (pun intended)

Angry that I got caught? Hardly…angry that the system is being gamed, I call it out, and “moral crusaders” such as yourself attack. People like you are one of the reasons why Americans are perpetually in a state of debt slavery.

Well here’s some more news so you can go back to your rock and gnash your teeth. My MODIFICATION came in the mail today. No principal reduction but…2% for the 1st 5 years, and then 1% step increases that max out at 5% from year 6-30. 30 year standard loan….which is what I wanted from the beginning, but Chase would not work with me when my credit score was 800.

But yea…I’m a leech. Same job 20 years. 3 houses all owned (and lived in!) and fixed up better than when I purchased them. I’m thinking we need more parasites like me. If your angry, turn it towards the ones who manipulated this whole fiasco…the FED banksters and U.S. government, or even those people you think are “holy” and “moral” men…the investors.

If decent society is people like PSPS, I’d rather not be a part of it thank you very much.

Actually you can get away paying extremely low taxes in CA, if you bought years ago. There’s people that bought in the 70’s paying $1000 a year in property taxes on 1/2 million dollar homes. Now if you happen to work for a living and want to buy today or you rent, forget it, you’ll be paying a ton in taxes.

That makes the two of us!

Housing Credit was extended and expanded? How will this effect your estimate for a 2011 bottom in the housing market?

$8000 credit for singles making $125K and up… (i qualify now). Also $6500 credit for anyone buying a home that has owned it for more than 5 years.

Will this stall a drop in home prices this Winter into 2010? Until buying season resumes in the Spring?

Leave a Reply