Nothing Down Flamed the California Real Estate Bonfire: 40 Percent of First Time Buyers in 2006 and 2007 went with Zero Down in California. 4 out of 10 Purchases in California now Backed by Almost Nothing Down FHA Insured Loans.

There are many reasons why this housing bubble reached epic proportions. One reason was Wall Street came unhinged and securitized anything with a signature whether legitimate or not. Another reason involved a society slowly desensitized to the devastating power of leverage. Throw in a mix of get rich quick religion and it is no surprise why this bubble expanded to such gigantic proportions. It also helps to explain how institutions and banks ever thought it to be a smart idea to make option ARMs and Alt-A loans. This is one easy aspect we should all be able to agree upon. The no money down idea was shifted from the seedy late night infomercial crowd and became common place. We are hearing many ideas being thrown around on Wall Street and D.C. but no one will dare touch the notion that we should increase the down payment option.

I believe a big part of the housing bubble fuel was the ability for people to purchase homes with little to no money. In California, this was the accelerant that created the biggest housing bubble we have ever witnessed. For the lower end of the market you had subprime loans and for the mid to upper tier you had the Alt-A and option ARM products. There was a reason for a down payment. In this article we are going to try to trace the genesis of nothing down in California.

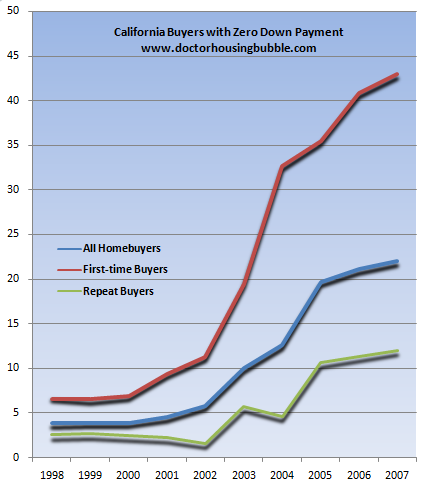

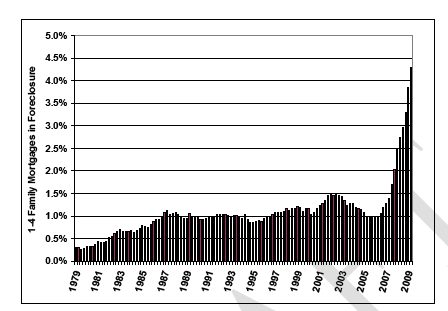

Some have been in the housing bubble world so long that they forget that nothing down used to be a rare occurrence. I tracked down data for the decade to put a start on this nothing down craze for California. 2007 was the last major year of nothing down but the FHA has stepped in with “almost nothing down†and is now dangerously pumping out loans to fill the market void. The giant leap in FHA insured defaults merely reflects this horrible practice. Let us first look at the California data:

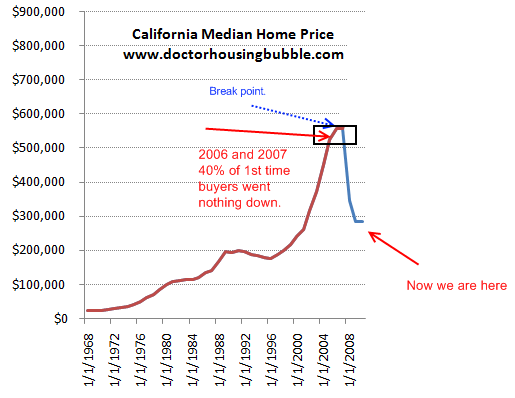

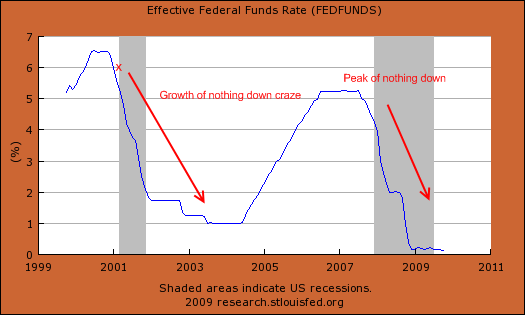

This chart is jaw dropping. The nothing down craze perfectly aligns with Alan Greenspan lowering rates to 1 percent. The exponential growth started in 2001. It expanded so much that in 2006 and 2007 over 40 percent of all first time buyers in California purchased homes with nothing down. This also applied to the nation where four out of 10 first time buyers purchased homes with zero down in 2005 and 2006. What is stunning about the above is that prices also peaked at the same time in 2007:

What is even more perplexing is the number of repeat buyers that went with zero down in California. In other words, people were selling their homes into the bubble and buying other bubble homes with no money. It was a Ponzi scheme that would make Bernard Madoff proud. Nothing down was a large culprit of the housing bubble. Don’t be fooled by those in the industry talking about how nothing down was somehow standard in the industry. It wasn’t. Not even close. It started in 2001 with the Federal Reserve dropping rates to historical lows:

As the Fed lowered rates to historical lows, Wall Street decided it would be a smart idea to securitize all the toxic mortgage waste and sell it off to any naïve investor that would take it. Rating agencies who were paid by the crony Wall Street bankers were labeling everything and anything AAA just to keep their bosses happy. Conflict of interest? Absolutely. This hunger for mortgages funneled down to the streets were mortgage broker charlatans were giving mortgages to anyone with a pulse.   What did they care? It wasn’t their money. Loan after loan was made with little thought about the long-term consequences. The fee structure was setup in a dynamic that rewarded those who got in as quickly for a short-term gain.

The problem with nothing down and the Wall Street securitization beast was that it disconnected reality from the mortgage. In the not too distant past, local banks made loans to local customers and understood even at a cursory level local market dynamics. This housing bubble broke all these tried and tested standards. What in the world does a New York banker know about Compton or Pasadena? Do you think they have any clue about Detroit, El Paso, Miami, or any other market that is outside of their tiny spectrum? They clearly don’t. Yet that is the way the system was setup.

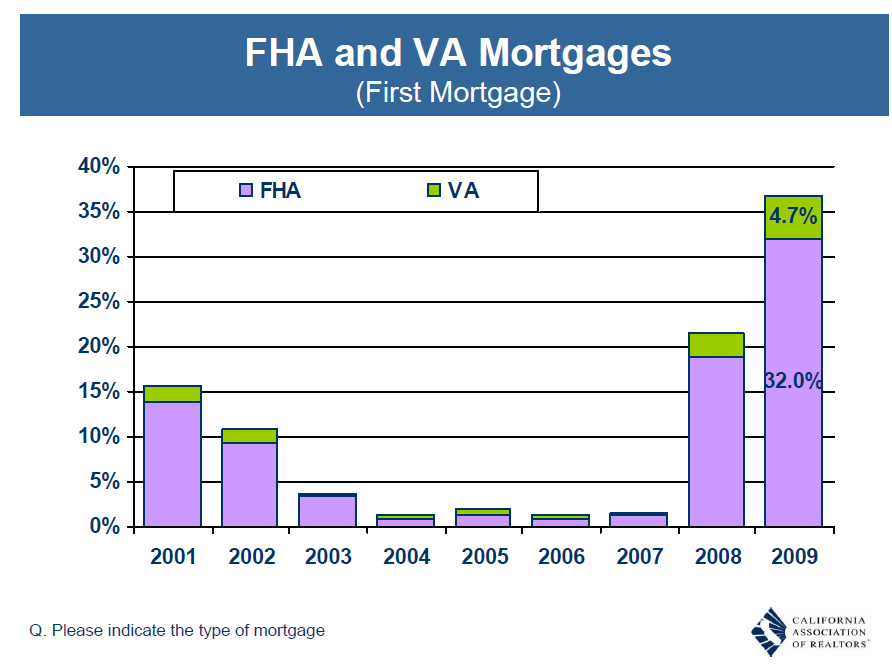

People keep asking for items that will stop something like this from ever happening again. One obvious solution is to hike up the minimum down payment. This is an important first step but the easy money crowd is even reluctant to move on this front. After the market imploded in 2007 and lenders started falling like flies, government backed loans started dominating the market. Now in California, nearly four out of 10 loans are FHA insured. Four out of 10 were no money down in 2006 and 2007 and now four out of 10 are FHA insured. Can you piece the puzzle together and see what has filled the vacuum?

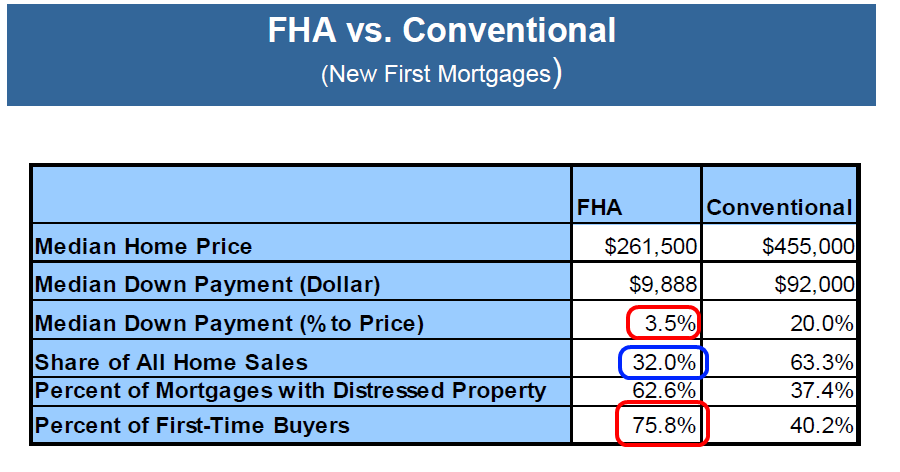

This is now the market for first time home buyers. First time home buyers utilized the nothing down craze and took it to 40 percent of the market. Now, FHA insured loans are the craze because they only require 3.5 percent down:

There has been recent talk of raising the FHA down payment to 5 percent:

“(SF Gate) Critics say 3.5 percent does not force purchasers to have enough “skin in the game” to discourage them from missing payments or risking foreclosure. Rep. Scott Garrett, R-N.J., introduced legislation last month requiring a minimum 5 percent down payment for all future FHA loans. Ed Pinto, who served as Fannie Mae’s chief credit officer in the 1980s and is now a mortgage industry consultant, says FHA needs to move to a 10 percent minimum.

But many lenders and mortgage brokers argue that raising the limit could scuttle FHA’s core purpose – serving consumers of modest means. Jeff Lipes, president of Family Choice Mortgage Corp. near Hartford, Conn., says a move to a 10 percent minimum “would effectively eliminate FHA as an option for first-time buyers.” A 5 percent standard would reduce volume, he says, but not exclude such a wide swath of currently eligible borrowers.â€

What a shocker that lenders and mortgage brokers are resistant to this change. In fact, the push now is to up the actual premium since the FHA is basically broke and will need a bailout soon. But who really cares right? I mean what is one more bail out in the scheme of the trillions flushed into the Wall Street abyss?

Nothing down is such a horrible idea. First, it takes away the actual punch of a home price. If you even needed 10 percent down, buying a $500,000 home would require $50,000 saved up. That would take time and show some financial discipline. The way things stand today, you would only need $17,500 to get leverage up to $500,000. Didn’t we learn with Lehman Brothers that maximum leverage can be devastating?

Another problem with nothing down is that it doesn’t prepare people for the financial demands of home ownership. If you can demonstrate that you have the ability to save 10 percent of your home purchase, it is likely that you can weather a few bumps in the road. If you need to go with nothing down or near nothing down, chances are you are not ready for homeownership.

Finally one tiny aspect that no one wants to admit is that the lower the down payment, the higher home prices can go. More people can play the game. The entrance fee is lower. Yet it also causes more problems because if you don’t have the money saved up for a down payment you are clearly entering a big purchase with no buffer. And why else is the foreclosure rate flying off the charts?

The low down payment culture is a prime cause of this bubble. It is the drug that allowed the Wall Street pusher to create a bubble that has brought the world to its knees.  Forget this notion about personal responsibility. If a local bank had to lend their own money they would think twice. Why else do you think banks are making loans that are backed by the Federal government and are hoarding bail out money? Banks don’t even believe in their customers but are more than willing to gamble taxpayer money via FHA insured loans.

The nothing down addiction is a reason FHA has now become the first time buyer choice in California. And enough with the “FHA is for poor and working class people†argument:

“(NY Times) Mr. Kurland and Mr. Bedar, who are employed full time, are the buyers of record. Mr. Rowland, a freelancer, will have his interests protected by a legal agreement.

Their building, for which they paid $963,000, is on a quiet street in the up-and-coming Hayes Valley neighborhood, close to fashionable restaurants they have already been trying out. The friends plan to live in the bottom unit and rent out the top. Thanks to rock-bottom interest rates, none of them will pay much more than a thousand dollars a month. “Everyone should have the chance to do this,†Mr. Kurland said.

Everyone may get a chance.â€

The FHA insured a million dollar place. And how much did these buyers have to put down:

“We were resigned to waiting another year,†said a second partner, Michael Bedar, 31. “Then we read about the F.H.A. I had never heard of it before, and couldn’t quite believe it. But it was the answer to our problems.†They put down about $33,000, split among the three of them.â€

Need more evidence that the FHA is filling the gap left by the nothing down crowd? Let me pull an article from August of 2007:

“(WaPo) No-down-payment loans are just about near impossible to get right now,” said Jennifer Bridges, a real estate agent in Woodbridge at ERA Blue Diamond Realty. “We’ll have someone all lined up and then without warning, the lender will say: ‘It’s gone.’ It’s terribly depressing.”

“It used to be that we would finance a loan up to $1 million with no down payment for a first-time home buyer,” said Daniel H. Aminoff, a senior loan consultant at Washington Mutual Home Loans in Alexandria. “But as of March, we will only finance a loan of $417,000 with no down payment.”

You might remember Washington Mutual, the poster boy of option ARM madness. They are now swallowed up in the gut of way too big to fail JP Morgan Chase Bear Stearns Washington Mutual. But no worries about that nothing down. Apparently the FHA is now backing near million dollar purchases in California with almost no money down. After all, what do banks care since it is the American taxpayer that will backup these adventures in real estate?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

81 Responses to “Nothing Down Flamed the California Real Estate Bonfire: 40 Percent of First Time Buyers in 2006 and 2007 went with Zero Down in California. 4 out of 10 Purchases in California now Backed by Almost Nothing Down FHA Insured Loans.”

The government wants low income people to buy houses. Sounds great. This is the land of opportunity. Everybody should be able to buy a house. Even people with no money. But wait. If you have low income, you do not make very much money, and you need money to pay the mortgage. Here’s an idea. Low income people should have the right to rent apartments.

It boggles my mind that no one at Moody’s, Fitch’s, and Standard and Poor, have been charged with fraud for giving MBS’s triple A ratings. These agencies control 99% of the market. They are private companies. Government agencies are continuing to rely on these rating agencies to sell bonds and buy securities. Lehman Brothers was a triple A rated company and then imploded!

I think Matt’s got a very good point, and one that I dont understabnd as well!? Why havnt these debt rating companies been sued to oblivion? After all, it’s their sole job to determine the quality of the debt they rate for securitization. And they get well paid for it, too. Could it be that they were complicit in fraud? No!!

You can bet that we will see more bailout funding for FHA loans, as they are nearly insolvent. We will see this additional support for the low down payment option, even though FHA loans are entering default at record numbers. The reason we will see this support is that, in order to provide support for current market pricing, the government will have no choice. If they don’t support the current market via counter measures, property values will drop further, and banks will lose even more money as they foreclose, leading eventually to failure despite anything Washington can do to prevent it. Rest assured, one way or another Washington has indicated that it will do anything it takes to support those too big to fail financial institutions.

–

Do you doubt Washingtons backing of their Wall Street cronies? Do you doubt they will be able to at least maintain the status quo? If you have no doubts about this, it is time to buy. Otherwise, wait for the coming crash.

Washington DC can continue to do whatever they want to try to keep the market propped up in CA. The real story is that the State is broke and so is DC. At some point the bomb is going to go off and this nation is going to be in a really deep depression. I often think that if the govt would have just kept their hands out of all of this, the nation would be slowly getting back to normal. Whatever the govt (state and feds) touch, it instanly turns to crap. I’m renting and have realized that owning a home anywhere in the US right now is not wise. At some point it will be, when is the real question that can not be answered.

OC, I don’t doubt that DC will continue to protect Wall Street. The USD is the world’s currency and USA is the world’s economic engine, so DC will find willing buyers of our debt-produced escapades to further enable Wall Street to kick the can down the street for years to come. Meanwhile, there’s is manipulation on both the supply and buy side of RE like never before.

Few really want another RE crash (home owners, employees, employers, consumers, DC, trade groups, Wall Street, global powers, etc.). So, I’m very doubtful that we’ll get one. Instead, we’ll have a drip, drip, drip of stagnant to lower prices over the next 5-10 years in bubble areas like So Cal/Nor Cal. Investers with big skin will be first to snatch up desirable, distressed properties released by shadow inventory managers.

Maybe the best thing to do is to get into the landlording business — use our cash to buy in distressed areas where prices are indeed depressed — while the economy is kept out of depression, and jobs come back little by little.

What happened in 2002 to turn up the rate of zero downpayment first time home purchases?

Well, one thing that happened is that President George W. Bush started campaigning against downpayment requirements as part of the build-up to his October 15, 2002 White House Conference on Increasing Minority Homeownership. For example, in a July 18th speech promoting his upcoming conference, he said:

“Well, probably the single barrier to first-time homeownership is high down payments. People take a look at the down payment, they say that’s too high, I’m not buying. They may have the desire to buy, but they don’t have the wherewithal to handle the down payment. We can deal with that. And so I’ve asked Congress to fully fund an American Dream down payment fund which will help a low-income family to qualify to buy, to buy. (Applause.)”

The bigger problem wasn’t Bush’s American Dream act, but the message his speeches were sending to federal regulators, his underlings, not to worry about zero downpayment mortgages.

Here’s a snippet of President Bush’s speech at his White House Conference on Increasing Minority Homeownership on 1015/2002:

“Two-thirds of all Americans own their homes, yet we have a problem here in America because few than half of the Hispanics and half the African Americans own the home. That’s a homeownership gap. It’s a — it’s a gap that we’ve got to work together to close for the good of our country, for the sake of a more hopeful future. We’ve got to work to knock down the barriers that have created a homeownership gap.

“I set an ambitious goal. It’s one that I believe we can achieve. It’s a clear goal, that by the end of this decade we’ll increase the number of minority homeowners by at least 5.5 million families. (Applause.)

“Some may think that’s a stretch. I don’t think it is. I think it is realistic. I know we’re going to have to work together to achieve it. But when we do our communities will be stronger and so will our economy. Achieving the goal is going to require some good policies out of Washington. And it’s going to require a strong commitment from those of you involved in the housing industry.

“Just by showing up at the conference, you show your commitment. And together, together we will work over the next decade to enable millions of our fellow Americans to own a piece of their own property, and that’s their home.

“I appreciate so very much the home owners who are with us today, the Arias family, newly arrived from Peru. They live in Baltimore. Thanks to the Association of Real Estate Brokers, the help of some good folks in Baltimore, they figured out how to purchase their own home. Imagine to be coming to our country without a home, with a simple dream. And now they’re on stage here at this conference being one of the new home owners in the greatest land on the face of the Earth. I appreciate the Arias family coming. (Applause.)…

“To open up the doors of homeownership there are some barriers, and I want to talk about four that need to be overcome. First, down payments. A lot of folks can’t make a down payment. They may be qualified. They may desire to buy a home, but they don’t have the money to make a down payment. I think if you were to talk to a lot of families that are desirous to have a home, they would tell you that the down payment is the hurdle that they can’t cross.”

jc, You are right, the state is nearly broke, but they aren’t the ones propping up the housing market. Washington really can’t go broke, it can drive the dollar into the dirt, cause all other nations to avoid US investment like the plague, but they can print whatever money they want. Japan had a similar issue with it’s banks (see: http://www.mybudget360.com/american-financial-dream-deferred-how-the-us-is-mirroring-the-japanese-lost-decade-after-the-heisei-boom/ ) and it was able to sustain them for more than a decade. I am trying to figure out where things are going just like everyone else. Left alone, the market would certainly tank. However, with what seems to be a committment from DC to prop up the banks, my bet is that they will be able to sustain current prices (+/-10%). Interest is low, and it won’t stay low forever. Depending on circumstances, each percentage point reduction in interest is worth $60k to the price of a house. Historically, rates hover around 7% and has spent extended periods over 15%. My argument is, if you want a house, it’s time to buy. I’m looking for someone to talk me out of this with irrefutable arguments, but I haven’t heard them yet.

(PS – No I’m not trying to stoke the market, and I’m not a lying realtor – I’m just your average buyer trying to figure things out) – Cheers!

If we expect home prices to decline slow to crawl in the next few years instead of rapid declining in 2008 and flat or a bit rising in 2009 (I was very disappointed home price progress in 2009), I don’t think that it is a bad idea to jump in now if government intervention continues on and on and on.

I know Option-Arm and Alt-Arm are coming due soon, but we do not know how the government intervention keep the home prices hovering rather than dropping.

What do you think about the future home prices in the next few years?

God I can’t stand how the illegal aliens are ruining this country!

I Live in Los Angeles County, and so many of the homes that are foreclosed on are to Hispanic people, and probably illegal aliens. It is stunning that banks lent money to people who can’t even work here legally!

Last week I read an article written in 2007 about a Mexican illegal alien family getting a no money down loan for $720,000 to buy a house in California. The couple are farm workers and combined make a grand total of $2,400 per month!

My take home pay is $4,000 per month and I rent.

What is even more gauling is that we the taxpayer have to then bail-out the bank with the stupidity to loan money to these people. The American family had to spend more money to compete for housing with these illegals, Loose more money to help these freeloaders get a “Loan modification”.

Subprime loans were basicly made to minorities that have bad credit, low income, and no down payment. I am even angrier that a big portion of the sub-prime was made to illegal aliens and that hard working and responsible Americans were priced out of the real estate market, because our government wanted loans made to minorities!

The insanity of our Government elites is stunning!

Folks it is also outragous that Americans also have to compete with illegal aliens for education in our public schools, space in our hospital emergency rooms and even for jobs when our unemployment rate is at near depression levels!

Folks where is the outrage!

It’s evident the housing bubble took off in 2001 when Greenspan lit the fuse and then torched it with gas in 2004. We are headed back to 1999 or 2000 pricing, once the correction overshoots. Hold on, this bust still has some legs left.

Westside of LA should drop another 20% or more.

http://www.westsideremeltdown.blogspot.com

OC Hunter, you’ve based your argument on an assumption that housing prices won’t change more than +/- 10%. With all of the indicators out there that forclosures are rising, unemployment is still getting worse, Option-Arm and Alt-Arm are coming due soon, and the FHA just starting to talk about tougher lending standards, I’d put my money on prices going down.

You also mention that interest rates being low makes now the time to buy because it will buy more house. You aren’t magically getting more house because interest rates are low, if rates go up the prices will reflect what people can afford each month and the price of homes will go down even more. I think it’s even worse to buy now that rates are so low, because if rates do go up it will put a lot more people underwater. You can change your interest rate through refinance, buy not your principal. I’m not so certain that the fed will keep rates this low indefinitely.

“each percentage point reduction in interest is worth $60k to the price”

But is all given back through price inflation. Most people don’t buy houses, they buy monthly mortgage obligations.

You’re kidding, right Greg? First of all, as the Doctor has pointed out time and time again, this crisis was not caused by sub-prime mortgages only – it was a systemic breakdown. We white folks (I’m assuming that’s what you’re referring to when you refer to other people as minorities) were just as, if not more, responsible. If there’s one problem in today’s America that you can’t blame on illegal immigrants, it’s this one. This is a 98% American-made recession (I’m being nice to you and putting 2% of the blame on illegal aliens) and everyone played a part, not only minorities. It’s not that there’s no outrage here. There’s plenty of outage. It’s just not misdirected against a scapegoat group that has very little, if anything, to do with America’s current state.

Greg, you hit the nail on the head, no one wants to admit it, but illegals did play a humongous role in bidding up house prices, especially in LA, and now we all have to cough it up again to modify their damn loans. The illegals I know are all planning to default (if they haven’t already) the minute the deal turns sour on their end (i.e. recast, reset.) Many are now living rent-free in houses they could never really afford for months on end with no sheriff in sight. All courtesy of our lovely Republicrats and Demoblicans, who insisted on forcing the “minorities” (i am Hispanic) into the housing “game.” This is the biggest travesty / theft of all time. No I guess the fat cat bailout was. Whatever, it’s all one in the same.

A few more quotes from The NYT article the good doctor refers to:

““It was kind of crazy we could get this big a loan,†said Mr. Rowland, 27. “If a government official came out here, I would slap him a high-five.—

My favorite – you just have to love youthful enthusiasm:

“But the idea of a house as an investment dies hard. Mr. Bedar, Mr. Rowland and the third partner in their property, Jordan Kurland, are all in the technology field, but their dreams of wealth do not feature stock options.

“We’re banking on real estate,†said Mr. Kurland, 24. “Everyone expects prices to keep going up.—

Not me. But, hey, what do they have to lose, right? No money down!

http://www.nytimes.com/2009/11/20/business/20limits.html?pagewanted=1&_r=2&hpw

Are you kidding me? There were about 20 foreclosures within one block of my house and 2/3 of them were white people. I don’t actually think any of them were Hispanic(I know one was a Black Family). Illegal Aliens are not to blame for this… the fat cats on Wall Street are 99.9% to blame. The good doctor has it right in that this problem mostly arose because of the no down payment. The lack of equity is what is causing all these foreclosures and people lack equity mostly because they put nothing down. People put nothing down because prices were too high for most people to save up 10-20%. It is completely stupid to say that first time buyers couldn’t buy homes if required to make down payments. If they weren’t buying homes then prices would come down to a level they could afford and we wouldn’t have had a bubble. In the IE 10% down is only $15,000 now which isn’t that much.. 2 years ago you would have needed $40,000.

The only people who do well with no down payment are theoretically the banks. This pushes prices up and makes people finance $400,000 and pay over $1,000,000 on a home that is actually worth $150,000. A lot of us college educated white folks figured out that we got screwed and now we are leaving the bank holding the bag. Have you actually looked at the stats on strategic default. The number of college educated people defaulting on purpose is much higher than non-college educated. Do you think a lot of those illegals have a college education?

What I can’t believe is why the world isn’t demanding Nuremburg type trials for the perps at the ratings agencies. They took investments from all over the world under the false pretense of “AAA” rated. This is the biggest fraud in history.

I tell you something, I was originating hard money before Wall Street took over the business. My private investors would look at me dumbstruck when I showed them what the subprime lenders would do. They would ask where all the paper was going. I’d say, “It went to Wall Street where their pockets are as deep as their underwriting is stupid.” And that was the familiar refrain for several years, “How could such stupid people have such deep pockets?” Answer: Because the investor had no idea what he was buying.

John in LA

I did not say that Illegal aliens were solely to blame for the housing bubble, or entirely to blame for the sub-prime devistation.

Think though that thousands if not hundreds of thousands of illegal aliens were allowed to buy property in the United States and thus Americans had to compete with them and bid up the price of property.

And it is illegal for them to work Here!!! And we are recapitalizing these banks for their losses!

Take for instance the story that I mentioned above, an Illegal alien couple that makes a combined monthly income of $2,400 and gets 100% funding for a $720,000 property. An American had to compete with these people for housing and they had 0% ability to pay.

My 28 year old neighbor whom I believe is here illegally bought a 1600 sqft. house for $536,000 in 2005. How do I know how much they paid?

Because right now they are stratiegically defaulting through a short sale to get their loan modified.

Folks if you cannot connect the dots that illegal aliens and too many legal immigrants are a huge source of housing default problems and a host of other problems you obviously do not live in Southern California.

John in LA Perhaps you are also blind to the overwhelming costs Americans have to shoulder both personally so they and their children are not overwhelmed by illegal aliens in the public schools and the neighborhoods, and blind to the social costs of providing taxpayer paid healthcare,housing, education, and social services.

Bottom line Illegal aliens and impovrished immigtrants are hugely proffitable to the private employers who are more than happy to undercut the wages of an American, and hugely expensive to the society in the form of social welfare costs and crime.

You are spot on DG! You must have got stuck in one of those corporate packaged developments like Corona…….

O C HUNTER – You write ” Interest is low, and it won’t stay low forever. Depending on circumstances, each percentage point reduction in interest is worth $60k to the price of a house. Historically, rates hover around 7% and has spent extended periods over 15%. My argument is, if you want a house, it’s time to buy. I’m looking for someone to talk me out of this with irrefutable arguments, but I haven’t heard them yet.”

>>

___

BTW, your math is inaccurate as to the cost of 1% interest. It is NOT a flat dollar amount of change. It is a change by percentage of value. On a $100,000 mortgage, a change of 1% upwards means a change in the payment of $68.46 a month or $821.52 a year. To keep the payment the same as before the interest rate went up 1%, the mortgage amount has to DROP 10% to $90,000. Every 1% change in interest means a 10% change in price. Period.

>>

The answer to your statement is as follows:

>

(a) Buy now in because of low interest rates ONLY if you KNOW you can stay in the house for the probably 10 -20 years. (And I don’t mean “expect” to stay in the house but really ‘know’, ‘guarantee’ and ‘are able to say nothing will change’ so you can stay in that house.)

>

(b) If, like most in the US, you will move in 5-7 years, then you need to worry about rates going up.

>>

You buy that $400,000 house now at around 5%. You have to sell in 6 years when interest rates are at that 7% (historically over the last 30 years it has been around 9.25% but we will use 7%.) That is an interest rate that is 2% higher than yours. Here is what happens:

>>

(1) To keep the payment the same, you will have to sell that house for $320,000. (2% rise = 20% drop in price.) You have to lower the price or you have to find a buyer who is in an income bracket a LOT higher than yours! That means fewer and fewer buyers……

>>

You lose. Oh whats that? Oh you think it will have gone up enough in value so you don’t have to sell for less? Do the math. Historically, houses have appreciated 1 -1 1/2% plus the rate of inflation. OVer 300+ years, it has been an average of 3 1/2%. Here is the math.

>>

You own it 6 years. At the end of 6 years with an appreciationn of 3 1/2% a year, it would be theoretically worth $475,000. Assume that incomes have stayed even with inflation. (Huge assumption as in faact they have not kept up with it for the past 30 years!). Now those interest rates went up 2%. That means to keep the same payment (adjsuted for inflation), you STILL have to cut the price 20% to $380,000. You still lose.

>>

(2) Interest rates have gone up 2%. You want at least what you paid ($400,000) or what you hope it is worth ($475,000). That means you need a buyer who can pay 20% more a month in payments that you can. If you had an income of $105,000 which could handle that $400,000 mortgage as 31% of gross income, you know need a buyer who makes $120,000 (in today’s dollars) . That $120,000 income today would support a $485,000 house – fancier than yours.

>>

The more you narrow your pool of buyers because those buyers need more income than you to buy the same thing, the fewer buyers there are.

>>

The total price per month to the buyer is made up of interest and principal. One way or another, house prices are going to go to the limit that buyers can pay each month in interest and principal. If you save on interest, the price of the house will go up.

___

>>

And here is a real world example. We bought a place back when interest rates were very very high. We got the best rate going back then – 10%. When we sold the place 7 years later, interest rates had fallen to 7%. We sold the property for 175% of what we paid. And the buyers had roughly the same payment we did when adjusted for minimal inflation-appreciation. And 69+% of the price increase (sale price – purchase price) came from the downward change in interest rates – not inflation.

>>

Moral is you can ALWAYS refinance from a high interest rate to a lower interest rate if rates drop. You can NOT reduce the amount of what you paid for the place if rates go up – or at least not reduce it without taking a loss!

>>

SO ask yourself: What happens if I have to sell in 3, 5, 7 or 10 years and interest rates have gone back to their historical norm? How lucky are you feeling? Willing to gamble oh what the house would be worth in a few years if rate go back up?

I’m in a “master planned community” a bit south of Corona. My estimate is that 50% of the homes in the community are either vacant or in some state of foreclosure. The community is new enough that most web sites still don’t even have the proper street layout when they place all the foreclosures on the map. When I look at the neighborhood vs. what I see online the reality is much worse. I think a lot of people around this area are realizing that foreclosure then rent is the best solution for the vast majority of people in this area. Its probably a great place to invest for anyone who wants to be a landlord. You can buy a place for 150-160k that rents out for $1500-$1800 if you can find renters.

As to the effect of immigrants on the housing market, let me point you all to a 2000 article where Nancy Pelosi arranged a special fund for immigrants with Fannie Mae and various banks. The program offered both low down payments and help with putting together that low down payment.

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2000/04/21/MN85038.DTL

Watch the BUBBLE DECADE on CNN TV Thursday night at 9pm:

http://www.cnbc.com/id/33972968

Sorry, the BUBBLE DECADE is on CNBC, not CNN. Big difference.

Point to as many articles as you want. I’m on the front lines of foreclosure central and I can tell you first hand that most of the people I see are White English Speaking folks with American accents. Maybe the illegals did contribute to it, but they certainly aren’t even close the prime cause. We’ve had high illegal immigration to this country/state for a lot longer than the past 10 years.

In the entire So Cal Inland Empire, large parts of Ventura County, large parts of “The Valley”, the actual City of Los Angeles (The south central and eastern parts, not the west side/SM), along with many individual cities like Compton, Inglewood, Long Beach, Santa Ana, ….countless illegals were allowed to (tricked into?) “buying” homes that they had no, ABSOLUTELY NO, business bidding on or being in. (Hello, they’re not supposed to be here at all!)

Nationwide the illegal alien contribution may have been maybe 5?, 7? percent of the problem, but in Los Angeles the problem was very large and breathtaking in its scope when you see it at the street level the way I do every day. (I’m a hispanic in a real-estate-related field). I know that the following must have happened very often: An american family (one, just one) would have to compete with COMBINED, immigrant families (with multiple wage earners, often in relatively high paying, but fleeting, construction jobs) for the very same ONE-family house. Of course this meant the prices were in fact gradually bid up, up, up, and the typical single or dual wage earner families were priced out. Obviously this was not the cause or root of the bubble, since had the easy money not been there they could not have bought at all, but it was a very significant piece of the puzzle at least here in L.A. I believe that the illegals, through their willingness to live 4 and 5 wage earners to a single house, contributed to about 25% of the bubble here.

Anyone who claims Joe Blow or Taco Estarada are responsible for the housing bubble in Ca. or anywhere else is not paying attention.

Loose money caused the problem along wth banks and Wall street and greed.

If you are of meager means and little education or educated and a risk taker and someone comes along and offers you a 700K loan, you take it, and it goes bad………just whose fault is that?

Who has the ultimate responsiblity here? The guy who borrows it or the guy who lends it? Common sense dictates you only lend to those who can afford to pay it back.

For example……If you lend 1 million to a homeless man and the homeless man does not make good, who is at fault, who is the idiot?

How stupid would it be for Pedro (or Joe for that matter) to turn down a 700K loan on the American dream and, with little down side risk to boot!!!!?????

I myself have always played by the rules and and getting screwed by the Government bailing out everyone. So….. I am on the verge of taking out the maximum FHA mortgage allowable that I can and will only put 3.5% down (minus any first time buyer credit) and if housing goes the wrong way I walk, if it goes the right way I win.

The Federal Government is bending over backwards to get people to take risk that they will mop up should things go sour, so why shouldn’t I do what they want me to do?

DG did you read the speach above, the one where Bush was trying to target minority home ownership to increase it to by 5.5 million new minority home owners by the end of this decade, by forcing lenders to lower the down payment requirements, or the Nancy Pelosi initiative to specifically increase immigrant ownership, once again by lowering the down payment.

DG,I am not making this stuff up, take the link and read the articles for yourself!

Please also remember the Carter plan called “the community reinvestment act”. Specifically made for poor minorities.

All these plans and more, specifically targeted minorities and immigrants, to get them into houses by lowering standards. These programs were very large and did a huge amount of damage. Frankly to deny these facts shows you either don’t want to understand the problem or you want to be blind.

As for your statement that almost all the foreclosures around you are towards white people, seems odd to me because here in the California that I live in we are inundated by illegals in every corner,nook and crany, except for the most wealthy of areas.

You are correct that every one involved in the bubble was abusing the system and speculating, and the sooner these deadbeats get foreclosed upon the better, but the fact that Americans have to compete for a limited supply of housing, and the Federal and State government aids and abets these invaders to committ fraud and drive up housing costs is absolutely outragous to me!

The housing bubble was a disaster for every one involved, especially for the ones that refused to compete with the insanity and were locked out of the market.

Martin,

you are correct that any lender that loans big money to poor people desirves to loose. If you are reading this blog you are doing it because you want to understand what happened and what is happening. You are here because you want to understand.

In 1999 I bought a house in Chicago, with my wife who is a permanent resident from South Korea, in order to qualify for the loan the bank required that she provide her “green Card” documentation. in the year 2002 we sold the house and bought another, then reapplied for a new loan. This time there was no requirement for any documentation of legal status. IT was not asked.

Do you think any of these 0 down, 125% financed, sub-prime, alt-A and interest only loans had any requirement of documentation of legal stattus. OF COURSE NOT!!!!

Bush the Democrates and the globalist elites wanted more immigrant ownership. read the article above. At the same time banks like Bank of America were specifically targeting illegals to give them credit cards, while only requiring their Mexican matricular cards.

I’ll say this one more time so you get this clear, no one says that illegal aliens and poor immigrants were entirely responsible for the foreclosure crisis, but in the south West of the united states and in California it was huge. IT is also a fact that that prices of housing was driven up because Americans had to compete with them to by housing.

Greg in LA,

stopping blaming Hispanics for your own shortcomings. $4000 take up/month is a renter’s income in LA.

I’ve bought and sold many types of real estate from 1993 to 2007 and I can tell you that when the mortgage business came out with “no money down” and “no doc” loans, I knew the game had changed for the worse. This is because Wall Street got into it. They could securitize the paper and move it around the world to all kinds of investors. With the help of the big ratings companies, they could get buyers virtually anywhere in the world. And that’s how it got down. One could argue that the big push came because getting a decent return on your money was no longer available thanks to Greenspan leaving rates on the floor. But the Wall Street boys are the ones that made it all happen. And here we are today. And they got huge bailouts when the first wrecking ball took out Bearstearns and then Lehman.

Michael – As long as DC finds a thousand ways to support existing market dynamics, I don’t see how prices will drop 20%. My proposal is, now that banks have built up their reserves, their first order of business is to pay back the government, then unload distressed property slowly enough to prevent dramatic price fluctuations. I agree that without the external influence from DC, prices would drop dramatically, but from the Fed, to Fannie/Freddie, to FASB, to the trillions plus bailout, DC is bound and determined to prevent further degradation of the RE market because they know (or have been told) that major institutions will fail and the modern world will come to an end (scheduled for 2012 ya know?)

++

It is an interesting point about interest rates impacting price. As a property owner, I have only observed the world during the boom, and presume the market dynamic during this time was abnormal. Does anyone have a chart that demonstrates this co-relation?

Where did all the white trash racists come from? I have worked on wall st and can tell you that minorities had nothing to do with this. It was a targeted attack by the bankers, traders and structures to securitize anything they could find and make BIG bonuses doing it. Most people don’t understand how much money these people make. It was/is VERY common to have guys (and women) who are around 30 years old making a base salary of 150k to 200k per year and a bonus equal to 1 to 2 times that amount. So the total comp is anywhere from 300k to 600k for a 30 year old frat boy who runs excel macros and plays backgammon all day on the internet. I’ll say it again, minorities had nothing to do with it (just another soul to stuff a loan to).

Hey When,

Apparently $4,000 monthly isn’t a renters income. I just showed you an example of a couple with $2,400 monthly ( Illegals don’t pay taxes), and they bought a home for $720,000.

The defanition of a racist is…someone who is winning a debate with a liberal.

Interesting, you might or might not be a liberal, but calling people a racists because they bring up the connection between the foreclosure crisis and impoverished immigrants and illegal aliens that took out many of the subprime loans, particularly here in California, dosn’t make one a racist either. It just shows that you want to end the discussion because your argument is weak.

Ignoring the immigrant and illegal alien aspect of the foreclosure crisis is a bit like trying to solve the gang problem in LA without connecting the illegal alien population to that also.

Interesting, you are probably correct that to the lenders, these borrowers were just another soul to stuff a loan to, but the impact that these people have on the Americans that have to compete with them for housing is a lot more negative.

Interesting, did you read the George Bush speach listed above, or the Nancy Pelosi initiative. All large changes in lending designed to lower lending standards, down payments, all specifically to get poor minorities, and illegal aliens to purchase homes. The part I find most egregious is that Americans have to compete with this insanity and lawlessness.

I don’t agree with blaming the minorities for the housing bubble. Now while I believe it is true that the govt “strongly encouraged” banks to create loans which lower income families would be able to qualify for (thus opening the door to the housing market for several minority (legal and illegal) families), it also allowed white families with lower incomes to enter the market. I believe that politicians on every level wanted to be able to get on a pulpit and shout about what they had done to futher the “American Dream” for all low income families in an effort to increase their voter base and gain financial support from big banks.

–

What I have seen over the past ten years though is a perfect storm in SoCal. I grew up in San Diego and would have loved to stay there but it was just too expensive for a young adult to buy a house. So I, and several others like me, went to the Temecula/Murrieta area where homes were much more affordable. As the values skyrocketed due to the lowering interest rates and creative financing, people who were a bit late to the party started looking towards Vegas and Phoenix. These areas were not tooooo far from SoCal and were more affordable than the IE. Then those areas went crazy and people basically said enough is enough. Those markets started to tank, then the IE, and last but not least, San Diego will come back to reality. I think graphs of home prices in these three areas over the past 10 years layed on top of each other would like like a sequential series of mountains. It’s just a shame that so many people, most of whom I believe just want a place to put down roots and raise their families in a stable and affordable neighborhood, are having to chase employment and affordable domiciles all over the south west.

–

By the way, like DG, I live in the IE and I have seen many more white families walking away from their homes than minority families. In fact, the minority families in my surrounding area seem much more likely to add people to their houses in order to increase the household income and pay the mortgage than they are to give up and move on. I don’t necessarily think that this is the smartest move for these families, but they do seem to have much more determination to pay their mortgages and keep their houses. To put it simply, I think that the minority families have more dedication to paying their bills and white families have a more strategic way of looking at their mortgage. I don’t really have a problem with either view, just different priorities. I know these are generalizations, but it’s what I have seen first hand in my hood.

Greg: Just incase you are unaware: You are a scumbag racist. And completely wrong the cause of the world wide economic crisis.

Greg

I will say this too…one more time.

If the tens of thousands of illegals, in Ca., had to prove citizenship, would they have been out there buying houses in the first place?

Are the Illegals responsible for creating the demand or the people who lent them the money?

You say the Illegals , I say tare to blame, I say those who lent them the money.

Capitalism requires everyone work in their best interest. Who failed in the above equation? The Illegals acted in their best interests, lots of up side potential, little downside risk.. The Banks on the other hand did not act in their best interests. Not only did they lend to people they shouldn’t have but they lent money in a market that was clearly speculative. The Banks failed the test of Capitalism on two fronts!

So who is to blame?

There’s nothing racist about my comments, I was just highlighting a piece of the puzzle that no one except for peeople like Greg want to acknowledge. If illegal aliens were to be shut out of the housing market, as they should be, housing in the modest areas of So Cal would drop noticeably, as the pool of buyers would shrink by maybe a quarter.

BTW The correlation between interest rates and prices has been well established by history, and is really just common sense. If a smaler part of your monthly loan goes to the interest, you have the ability to bid up the price. If the interest portion expands, you must as a consequence reduce the principal portion in order to still aford it.

Politicians Catering to Minorities definitely had something to do with it:

– New York Times: Fannie Mae Eases Credit To Aid Mortgage Lending –

September 30, 1999

In a move that could help increase home ownership rates among minorities and low-income consumers, the Fannie Mae Corporation is easing the credit requirements on loans that it will purchase from banks and other lenders.

The action, which will begin as a pilot program involving 24 banks in 15 markets — including the New York metropolitan region — will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring.

Fannie Mae, the nation’s biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits.

”Fannie Mae has expanded home ownership for millions of families in the 1990’s by reducing down payment requirements,” said Franklin D. Raines, Fannie Mae’s chairman and chief executive officer.

”Yet there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market.”

In moving, even tentatively, into this new area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980’s.

”From the perspective of many people, including me, this is another thrift industry growing up around us,” said Peter Wallison a resident fellow at the American Enterprise Institute. ”If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry.”

In July, the Department of Housing and Urban Development proposed that by the year 2001, 50 percent of Fannie Mae’s and Freddie Mac’s portfolio be made up of loans to low and moderate-income borrowers. Last year, 44 percent of the loans Fannie Mae purchased were from these groups.

Martin I agree with your statement:

“If the tens of thousands of illegals in, CA had to prove citizenship, would they have been out there buying houses in the first place”?

Actually though it isn’t tens of thousands, it’s millions. Our own federal government estimates it is around 12 million nationally, other groups consider that estimate far too conservative, and place the number of illegal aliens at around 20 million .

Of course Illegal aliens wouldn’t have been buying property in California if they had to prove legality to be living and working here. that is just the point, the lowering of the lending standards and documentation (including immigration documentation), was partially a political decision to get politicians votes from HIspanics and minorities, as well as was a way for Wall St. to make more loans. Never mind the carnage and distruction that both parties caused to everyone who was affected by their horrible decisions.

Looking out for ones own best interests is important for everyone. I understand why Illegal aliens want to come to the United States, I also understand why employers like to hire illegal aliens (to under cut the wages of Americans), as well as politicians pandering to get votes, and banks looking for profit from the increase in population. Who though is protecting the interest of Americans?

Are laws are written to protect our citizens. We have many laws on the books that are designed to controll immigration rates and protect American jobs, all of which are utterly disregarded. The same applies to lending standards, which were also originated to protect Americans, they like wise were thrown out the window.

The elite are still protecting their interests, note: the trillions in bailouts for mortgage lenders. The special interest are still looking out for their interests note: the upcoming push for amnesty for illegal aliens, (despite record high unemployment).

My question though is: Who is looking out for us?

Well, I think you should sit down before you read this. Have a bottle of something good handy.

http://www.nytimes.com/2009/12/08/business/08ratings.html?ref=business

Martin , I hear ya. I will wait the next spring to see how things pan out (some expect perfect storm with expiring first time homebuyers incentives, rising interest rates, bank starting to reduce REOs and economy not really turning around). But if situation is same as now i.e. we all waiting for something to give up, then I am thinking to get the highest FHA loan I can with 3.5% down payment and head for Manhattan Beach. Talk about moral hazard? Why not I am tired of everybody around bailed out and the interest of the moronic buyer of 2006 preserved at any cost at my expense. As you said if thing go up I win, if things go down I leave my 3.5% and leave the building. My credit will be restored after 3 years (which I don’t really care since I have no debt at all) because in this scenario there will be nobody standing with good credit to buy anything , anyway , so banks will have to go further in their customer approval limbo… The problem with this is that there is a third way the things unfold – prices on Westside where they barely get 10% down will not see any rise for the next 10 years. I believe this is the most realistic scenario if the banks and the crony government succeed to hold on to their crooked plan. Then we are all screwed.

I don’t think that GregInLA is a racist, but I don’t think that he is correct in his assessment of blame. The facts are the facts and if they show that a certain demographic is a bigger part of the problem than another, well so be it. But I think that Bottom Feeder is right on the money. The problems were created by banks lending to people they shouldn’t have. Period. However, the govt was pretty much forcing them to do so behind closed doors which is probably why the govt feels the need to bailout the lenders who are getting killed by the inevitable downturn which is happening now.

As of the 2007 official US Census estimates, the foreign-born made up 12.6% of the US population.

Those people want a roof over their head and represent a demand for housing over and above the native-born population.

Think that external demand had something to do with increasing the price of housing in the US, especially in states like California and Florida that were preferentional destinations?

Think the our politicians would NOT want to buy their votes?

I don’t think that the illegal emigrants are the problem, but I think that the problem has a lot to do with legal ones. Less than 50% of LA county residents are born in US and barely anybody in LA… in such market the psychology is quite different than let say Nebraska (where the bubble is almost not visible). Immigrants legal or illegal are coming from very different places and they have very different expectation of their life and financial future. Almost everywhere in the world buying property is a struggle of your lifetime, so it naturally it has come here in LA with the people, the market participants. Think about the misery of India, China, Mexico, where people slip on the dirt at night. I have seen this with my compatriots, selling worthy properties with potential abroad (Eastern Europe) to get the American dream made of 100 years old wood and paper. I tried to explain many times the insanity of the situation, and only result is people declaring me insane if I don’t believe in the American dream as is, or “he cannot afford to buy, that is why…†(with family income of around 150K?! Really?) . I am not saying that there will be no reevaluation of the American dream, but this is the predominant psychology of the market in LA. When this people come here they are ready to make any sacrifices to get to the American dream, which are justified in their eyes, but not so for regular Joe. And Joe moves to Arizona and Las Vegas ….

Guys, take this from a legal immigrant. Why America invited me here I have no idea, but sure I am eating the bread of somebody local, although sympathetic with you and waiting for the market to tank…

What politicians don’t understand is that by “easing” the lending rules to allow “lower income” people into the housing game, you actually just end up making housing more expensive for everybody, and put those same “minority” and “underpriviledged” people into greater debt servitude than if they had just left things alone. The banks LOVE affordability programs, because it creates more people with larger debt levels and more interest payments, even if the actual rates themselves are low. These programs are the most evil thing possible, even if they may have started with “good intentions”, which I don’t even think they did. I think the banks cooked them up from the start. bottom line is, a certain percentage of any population (up to 40%?) is and always has been destined to just rent their shelter. That’s not a crime or a sin.

A big problem I have with the illegal alien/immigrant/minority argument wielded by Greg is that he mixes all three as if though they were interchangeable. They aren’t. Pelosi’s and Bush’s programs were not intended for illegal immigrants – they were designed for legal ones and for minorities. There’s a huge difference, namely because they are Americans (or at least legal residents) too and therefore, Greg, have exactly the same rights as you do (or, f they’re legal residents, most of those rights). Please keep your facts straight, i.e., don’t say that a program designed for minorities was designed to help illegal aliens when it wasn’t, and maybe people will be willing to take you a little more seriously. No one here likes irrational rambling and willful distortion of the facts, which is probably why you’re getting the response you’re getting.

It’s been interesting to see all the arguments going back and forth on this board about who’s to blame. Fact is almost everybody involved with this Real Estate mess shares the blame. Almost everybody is looking out for their own best interest. Everybody wanted their piece of the pie but nobody wants to take the blame. Did the illegals contribute to the problems in SoCal. Of course, but so did all of the other people (legal immigrants, local residents, investors, rich and poor alike) financial institutions and government. From our government to wall street and main street, everybody wants to win but nobody wants to be held accountable if things don’t go well. Accountability is so severly lacking in most parts of our society nowadays.

First and foremost, the Fed and Wall St. are to blame. Without their manipulations, there would have been no bubble.

That said, there can be no doubt that poor Latinos played a big part in the SOCA bubble. Maybe they didn’t factor in so much nationwide, but here they DEFINITELY played a big role. I know because a Latina friend of mine worked as a mortgage broker and made huge money catering specifically to that sector. Of course, today she is out of work.

The blame for the mess goes to Wall St.; the rest of the population simply got sucked in.

I do not think that making this obvious observation has anything to do with racism, because it’s information that everybody knows about if you live here in SOCA.

I live here in San Jose. For what it’s worth, I know people who have lost their homes, and are about to lose their homes. These people are not illegals. Some believed all the hype that “real estate only goes up in Ca,” and thought they’d make investements. Bad decision. Others played by the rules, and due to layoffs are suffering from the fallout. By the way, are the illegals responsible for all the foreclosures throughout the rest of the country? Answer…….no.

I’m fine with living in the IE as my job is here and I’m sure once the housing mess gets cleaned up it will be fairly nice again. I, unfortunately, was late to the housing party(late 2006). If I was mildly underwater I’d stay, but being 250% underwater to the tune of $250,000 is not happening. I don’t know that many Hispanic people, but I do know a few of White people in my age range(late 20s/early 30s) that bought a house when I did and almost all of us are strategically defaulting. It would be financially foolish not to strategically default on a no-money down home purchased in 2006. You will end up blowing your retirement and kids college education all in the name of giving some wall street fat cat a bigger bonus. Like someone else said… the Hispanic people are more likely to put 10 people in the house than to default. This is all Capitalism at its finest.

Illegal Immigrant bashing is simply retarded. It reflects badly on the poster and undermines anything sensible they might contribute to the conversation.

We are a nation of immigrants, many legal and, throughout our history, many illegal.

The fresh blood and determination generation after generation of immigrants have brought us have fueled our greatness from the beginning.

Racism is an easy charge to throw around, but it’s a personal matter, and something that only really matters in church.

Who cares about that here? We’re interested in understanding what has happened, what is happening and what might happen in the housing market because some of us are investors, and, the majority?, others just need an effing place to live in an economy that offers a radically diminishing quality of life.

I don’t have a good argument to offer on the merits of the subject today… but that stuff about the immigrant community is just as stupid as it gets.

Accountability has it right, the blame is very spread out from the greedy lenders to the greedy / foolish / really smart? housedebtors. In my case, I just want people to know that the problem of illegal immigration – which has historically contributed to things like overwhelming demand for social services (tax money) and lower wages for the working class – has, in the last few years, ALSO contribted noticeably to the insane housing bubble. It is irrefuteable, without the illegal aliens in our country bidding up houses, the bubble would have been smaller. Only the scale is debateable. I am Hispanic and I am not opposed to any “legal” minorities owning or bidding on homes. The two groups I am opposed to with regard to this issue are 1. illegals, who have no right to be here, much less compete for our housing resources, and 2. The “underpriviledged” people (regardless of skin color) who needed/insisted/abused that the government lend a hand to get them into the “mean and unfair” housing market. Generally, these people are what the world refers to as RENTERS. The effort of shoehorning them into the undeserved category of Homeowner created at least 50% of the whole housing/financial debacle we’re experiencing.

Martin and Greg, I don’t want to insert myself into your arguments involving illegals since I’m frankly not interested enough on that topic. However,

I totally disagree with Martin’s statement that “The Banks on the other hand did not act in their best interests”. I believe, the only think the banks did was to act on their best interest (with zero consideration of their customers’ interest) and they had been extremely successful. They’re the ones who made a fortune during the housing bubble, who got bailed out when things went south, and who are still paying big bonuses today.

The anwser to Greg’s question “Who is looking out for us?” is: NO ONE!!! By now it should be perfectly clear that no one is looking out for us (if you can really define what US mean in a divided nation called America).

The only one who might help us is ourselves. However, in light of the mess we have, I don’t see civil unrest or revolution coming. We have already degenerated into a nation of cowards who easily believed that if we didn’t bomb Afganistan and Iraq we’d be all wiped out by terrorists, and that if we didn’t bail out the financial institutions we’d have no tomorrow. Well, so much for the home of the brave, and the land of the free…

As long as we the sheeple cannot pull ourselves together to change the goverment (in a real way) and the money machine that owns it, the whole discusion of accountablity and moral hazard is moot. Since everyone is for himself, one maybe better off doing what Martin suggests. This is, if you cannot fight them, join them. If you drop the useless moral burden, you may be the next winner in the next bubble that the government is so desparately trying to create. The time of responsibility is OVER. I you’re still not conviced, what the government will do in the coming months will likely make you a believer. Of course I may be wrong, but it’s better to be prepared to cash in the new era of irresponsibility. Be optimistic, we could get even and then some next round!

If any one is interested please go to:

http://www.sfgate.com/cgi-bin/article.cgi?f=/g/a/2007/04/13/carollloyd.DTL

Please read this golden 2007 article by the SF chronicle “Minorities are the emerging face of the subprime”. Honestly everyone you can’t make this stuff up!

It is meant to be an immigration sob story. Sorry,but I just don’t see it that way.

If you are interested please also google the words “Minorities and the subprime”.

It seems like the statistics that I found will anger a few, and few don’t want to take their rose colored glasses off, but It seems that 40% of all subprime mortgages nationally were lent to Hispanics and around 50% to Blacks. I am not sure what the default rate on all of this was, but I think you can guess it was pretty high. It is kind of an ugly truth, but that is what it is.

In my Google search most of the titles were like: Cnn 5/1/2002 “Subprime lenders target minorities” and Usa today “Minorities depend on subprime”. 3/16/05.

A few snippits that sum it all up for me in the articles were:

“Credit worhiness”

“A new type of buyer that didn’t exist a decade ago” I think that meant illegal aliens

and “Neither speak English”.

Do the google search and read the SF Chronicle article and judge for yourself.

It is undenyable that the politicians played a huge part in lowering lending standards to get the poorest into home ownership, basically to placate ethnic lobbies of Blacks and Hispanics.

Lenders and the Realestate industry did prey on the very uneducated and often illiterate. With out a doubt the entire crop of subprime borrowers are the largest group of financially illiterate people to walk on this earth and It amazes me that one can be so financially illiterate and be living in the 21st century.

I can honestly say that It truely makes me sad and embarrassed to see how many uneducated people there are in this country. And the cut throat world we live in.

The msm portray’s the subprime borrowers as the victim, but I think it was all of us Americans that had to compete with this lowering of standards and lawlessness who really got robbed.

Who wrecklessly borrowed and destroyed the south and westside of chicago? Urban wasteland of foreclosures.

Who lent the money to create these wastelands?

Everyone needs to take a long hard look in the mirror before answering this question.

We are all responsible.

Of course minorities played a big part in subprime, as well as a big part in the runup here in SOCA. Countrywide was known for preying on minorities.

But you can’t really blame the bubble on them; that was pure Wall St. greed.

The involvement of illegals/minorities probably did add to the huge bubble here in SOCA, since it meant more buyers in the mix, adding fuel to a fire that burned out of control. I think that Indymac also catered to crap mortgages and low income borrowers. Yes, those folks should have stayed renters…

Prices in financial markets are supposed to represent the outcome of a continuing struggle between the bulls (optimists) and the bears (pessimists). In the mortgage market, however, both political parties, with the announced goal of narrowing racial gaps in the homeownership rate, demonized as evil racists lenders who were pessimistic about minority borrowers. Not surprisingly, this drove out the pessimists and opened the door wide to optimists, such as Angelo Mozilo, who used their huge minority lending totals to justify to regulators their boiler room tactics.

The federal government doesn’t track the race of people who pay back their mortgages, but ever since 1975’s Home Mortgage Disclosure Act, which is available online:

The numbers are found on pp. 13-14 of “Lending in Low- and Moderate-Income Neighborhoods in California: The Performance of CRA Lending During the Subprime Meltdown” by Dr. Elizabeth Laderman and Dr. Carolina Reid of the San Francisco Fed.

In this sample of 239,101 mortgages made in California in 2004-2006, blacks defaulted 3.3 times more often than non-Hispanic whites with the same income and FICO score. Hispanics defaulted 2.5 times more often than similar whites, and Asians 1.6 time more.

Presumably the unadjusted default rate ratios, at least for blacks and Hispanics, are even worse. After all, blacks and Hispanics tend to have lower income and lower credit scores, so the Laderman-Reid adjustment makes minorities look better.

Even without being allowed to know the raw ratios, we can infer that minorities accounted for most of defaulted mortgage dollars in California. After all, they accounted for a majority of home purchase mortgage dollar borrowing in California in 2006, according to the HMDA. Hence, with their much higher default rates, minorities must have accounted for a landslide majority of default dollars in the Golden State.

And California alone accounted for a sizable majority of defaulted dollars. California plus the other three sand states (Nevada, Arizona, and Florida) amounted to about seven-eighths of the losses that kicked off the economic crash.

We know from the HMDA database that in 2006 in California, minorities borrowed 77 percent of subprime home purchase dollars and 56 percent of all home purchase dollars (not counting borrowers of uncertain ethnicity and couples of mixed ethnicity).

Judging from Laderman and Reid’s adjusted foreclosure rates, minorities accounted for at least 70 percent of the dollars lost in California.

And California accounted for a sizable majority of all the defaulted dollars in the country. So California’s minorities alone might have accounted for about half the lost money. (Of course, huge amounts of the blame should also go to Wall Street rocket scientists who leveraged mountains of debt upon pebbles of probability that it would be paid back.)

For documentation, see

http://vdare.com/sailer/091101_foia.htm

Awesome find/post Steve Sailer. You’ve stated the facts that everyone knows, but are too scared to death by political correctness to say out loud. Political correctness killed innocent soldiers in Fort Hood, and is going to end up killing our country and way of life before too long. Look at Europe, now they’re really starting to regret having been so accepting of the Muslim invasion over the last 3 decades.

OMG!!! The Dr. said “walking away is the right move”, all the “ethical” and “moral” crusaders should be calling out to tar and feather him!

You go Doc. I have little to no hope for america to change, especially in light of some of the posters here.

Regardless of the outcome of increasing minority home ownership, I think it is really hard to determine who initiated it. Was it purely a government initiative to try to increase home ownership rates amongst lower income people? Or more realistically could it have been an initiative by the investment banks that saw an “untapped” market to exploit? By devising financial instruments like sub-prime mortgages and mortgage-backed securities which spread the risk across the world, they could make a ton of money with very little downside for themselves. So with a little lobbying effort on their part, they could convince the government to change lending policies which would allow all of this to happen while making allowing the govt officials to look benevolent in the process. I guess we’ll never know…

Of course Illegal aliens wouldn’t have been buying property in California if they had to prove legality to be living and working here.

Wow, really? Working, sure, but living? How would you enforce that? Should we all have to stop and “show our papers” to the police from time to time to prove we have the right to live here?

Re: Steve Sailer.

If I’ve read this correctly, the information you present reflects 2004-2006 studies. I’d be VERY interested in the updated statistics for 2008-2011 when Alt-A & Option s can be accounted for. I’m willing to say out loud during 2004-2006, the American Dream was made to look attainable for the “less-fortunate” populace (read: lower income, non-whites) –all a part of the master plan since Wall Street didn’t/doesn’t care who gives them the dollar, it’s still green and negotiable whether it came from a black, brown, yellow, red, white, or purple borrower.

I believe the color scheme will take a dramatic turn with the Alt-A & Options coming up.

@ DG, Yo, come hang out with us at Loansafe.org You can find the best way to put your lenders nutsack in a vice. You will also find various strategies to help get you ready to rent. And btw, I agree with your posts, but then again, I’m upside down just like you, except I’m in OC AND I put down 20%. F the banksters, and F the people who back them by trying to cast judgement on us homeowners who are only trying to survive in this fraudulant country.

The hispanics are not to blame. The POOR are not to blame. The people in homes are not to blame. Wall St., The Federal Reserve, and your elected politicians are SOLELY to blame. They control the money (lending, interest rates, etc.), hence, they control the economy. The bubble was master planned, I don’t know by who, or why, but it was planned, it could not have been any other way. They KNEW what was going to happen and fed it.

Steve Sailer, did I read that correct, the San Francisco Federal Reserve bank says that Blacks are 3.3 times higher than Whites to be foreclosed on and the Hispanic foreclosure rate is 2.5 times higher than Whites!!!

How did that statistic make it past Nancy Pelosi and the political correctness police?

Of course the MSM will spin this as the outcome of preditory lenders preying on unsuspecting minorities and immigrants. If their preditory lending claims are true, then what I want to know is what makes these people such easy prey?

“did I read that correct?”

Actually, those stats understate the reality, since they’ve been adjusted for differences in income and FICO. In other words, for borrowers with income of X and FICO of Y, blacks borrowers in California during 2004-2006 were 3.3 times more likely to be foreclosed upon by, I believe, 2007, Hispanics 2.5 times more likely, and Asians 1.6 times more likely. Since blacks and Hispanics have lower average incomes and credit scores, the actual ratios were worse.

I have filed a Freedom of Information Act request to get the unadjusted ratios from the Federal Reserve, but Kevin M. Warsh, a Governor of the Federal Reserve Board has written me a letter denying my request, claiming that the Freedom of Information Act does not apply to the San Francisco Federal Reserve Bank because it is a private entity.

Laderman and Reid of the San Francisco Federal Reserve Bank wrote on pp. 13-14 of their report:

“We also find that race has an independent effect on foreclosure even after controlling for borrower income and credit score. In particular, African American borrowers were 3.3 times as likely as white borrowers to be in foreclosure, whereas Latino and Asian borrowers were 2.5 and 1.6 times respectively more likely to be in foreclosure as white borrowers.”

http://www.frbsf.org/publications/community/wpapers/2008/wp08-05.pdf

Who is to blame?

Clearly, in a disaster of this magnitude, there’s much blame to go around.

For example, consider the symbiotic relationship between Angelo Mozilo of Countrywide and Henry Cisneros, Clinton’s Housing and Urban Development Secretary and then a member of Countrywide’s Board. Mozilo and Cisneros egged each other on, convincing each other that lending ever more money to minority and lower income borrowers of marginal creditworthiness was an all-around great idea, great for America in the fight against racist redlining and great for the stockholders.

http://www.vdare.com/sailer/090622_mozilo.htm

But the Bush Administration was even more flagrantly pushing zero down lending to minorities as a key component of the fight against racial inequality, as witnessed by the White House Conference on Increasing Minority Home Ownership on 10/15/2002.