A new model of real estate – Economic recovery driven not by residential real estate sector. Are lower real estate values helping the economic recovery?

What I find fascinating about the recent positive job gains is that most of the growth is occurring outside of the real estate sector. This is an overall positive. Keep in mind that real estate values are still down by $7 trillion from their peak reached in 2006. So the trend of adding more jobs, although a far cry from a healthy economy, is still beneficial news that should be welcomed by all. But make no mistake, the housing market is a mess and part of this recovery is also being driven by lower priced homes being funneled out of the shadow inventory. This is why you have the unemployment rate ticking lower while home prices make all-time post-bubble lows. Is this cognitive dissonance? Not at all. You simply have an economy that is examining household incomes and as it turns out, having massive mortgage debt is not always a good stimulus for economic growth.

Some growth driven by lower real estate values?

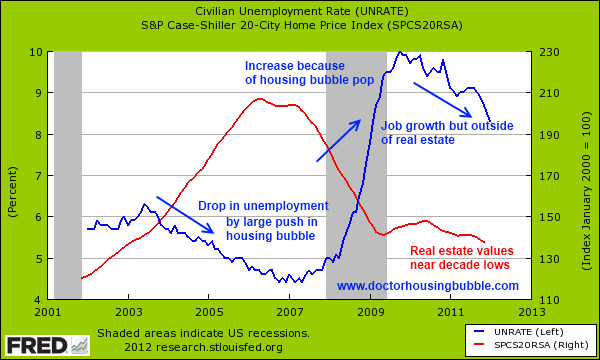

We constantly hear how it is important to keep home prices inflated. However, with record low home values, we are now adding jobs at a steady clip. Of course this goes directly against the argument that in order to have a booming economy we also need booming home values. The only way home values are going to go up is if household incomes increase. We can now see this drastic shift by looking at the unemployment rate and housing values:

You can see how the unemployment rate was pushed lower with almost precise correlation to the booming housing market. Much of that growth was based on household debt consumption (i.e., HELOCs, home sales, etc). As the bubble peaked in 2006 and 2007 you can see the unemployment rate spike up nearly in tandem with falling home prices. This decade long view simply reflects a debt based housing bubble. But something started changing with employment in 2011. Now, we have seen the unemployment rate trickle lower yet home prices keep moving lower as well. Real estate values are now at post-bubble peak lows. Yet the economy is growing. How about that for those that argue that permanently high real estate values are good for the economy and a prerequisite to lower the unemployment rate?

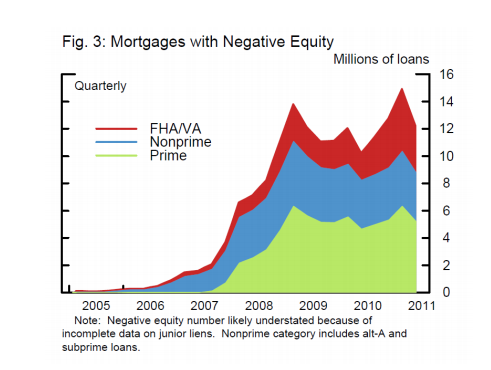

You still have over 12 million homeowners in negative equity positions:

The distressed inventory pipeline is still over 6 million properties but as we are now seeing it is very plausible to have an economic recovery with lower home prices. I guess that has been the point all along. Much of the last decade was an anomaly. Even during the baby boomer decades where the economy had fantastic growth home prices pretty much moved in line with incomes and the overall rate for inflation. This brought on the biggest middle class ever known to the world. Why in the world do people fixate on high home prices? If the typical household was making $100,000 then a $300,000 typical home price would make sense. Now that the typical US home price is down to $150,000 and most families pull in $50,000 home prices may not be so out of touch. Yet states like California still have their delusional pockets but as prices fall here, you will see little changes nationally.

The trend in job growth

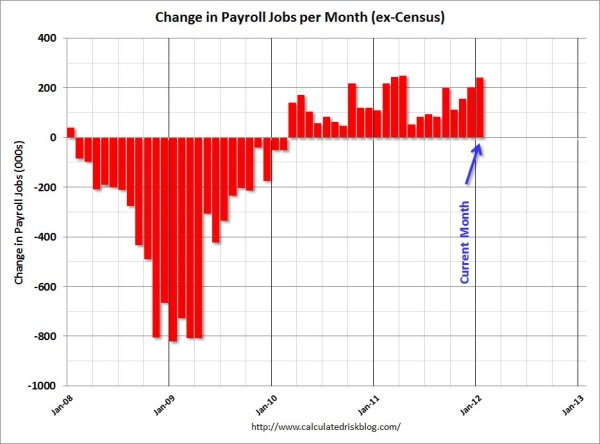

Without a doubt, the economy has been adding jobs over the last year:

Source: Calculated Risk

So it is fascinating that during this strong growth period real estate values have been falling. Why is that? Because many of these jobs pay what they did for the past decade. So you have more being able to purchase homes but at lower prices. Clearly there is little barrier of entry with FHA insured loans only requiring 3.5 percent down and mortgage rates are at historical lows. The irony of a growing economy is that economic growth may force interest rates higher putting additional pressure on home prices. But as we have seen, you can have significant job growth without having real estate values going up (in fact real estate values have gone down during this brief period).

Overall I believe real estate values that reflect household incomes are a good revelation for our economy. Higher home values without associated income growth simply suck away more disposable income from households that can be used in good producing sectors. With a younger population that will likely be less affluent than the baby boomer generation this is a good trend. Keep in mind the shadow inventory is still high in many high priced areas but with banks balancing out their revenues with most other states they may streamline the foreclosure process in higher-end locations. As we are seeing, you are witnessing more and higher priced properties entering the market with sizable price cuts.

Real estate values falling and solid employment gains? Talk about a stunning pairing for those who are obsessed with inflated housing values.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

34 Responses to “A new model of real estate – Economic recovery driven not by residential real estate sector. Are lower real estate values helping the economic recovery?”

I don’t know about anyone else on this blog.. But I’ve been doing my part of helping the economy.. I bought a home this past summer and instead of sitting on all my cash.. I’ve been fixing up the house/yard spending, spending, spending…

When i was renting i just sat on my cash…

I think I’m owed a big thank you for playing my part in this economic recovery! 🙂

CaliOwner – congratulations on your new home. I hope you got it at a good price! Home prices are definitely better than they were 5-7 years ago. However, we are not in an economic recovery as your last line suggests, and I believe that home prices have quite a bit further to fall. Nonetheless, there are good home deals out there and I hope you got one.

Another point: spending, spending, spending won’t cure our economic ills in this debt crisis we are in – saving and accumulation of capital will. Most people in this current enviroment would have to go into debt in order to spend any significant amount of money. In order for there to be an economic recovery, people and governments need to save money and spend less. Accumulation of MORE DEBT makes the problem worse, not better. Another thing needed for a true economic recovery is for home prices to fall to more affordable levels. I live in California. In some areas home prices are decent. In others, like where I live, home prices are still prohibitively high. Throwing good money at artificially high home prices does nothing but hurt our nation’s economy, taking money away from individuals who can put it to productive uses, and puts it in the pockets of the banks.

Btw, CaliOwner, have you checked out 15 year loans? They can save you a lot of money. Or, you can just pay extra every month toward your home loan and save a bundle! My favorite mortgage calculator is Karl’s Mortgage Calculator. It is truly the best one I have used. You can enter your loan balance, interest rate and term of loan and it will show your house payment. If you want to pay, maybe, $300/month extra, you can enter that number and it will show you how much interest you will save over the length of the loan, and how many years it will shorten your loan by. It’s an excellent tool! I like clicking on the “repayment chart” button (it will display a pie graph). Play around with it, make a plan, and you can save mega bucks by paying a little extra each month!

http://www.drcalculator.com/mortgage/

I got the home at a decent price… The market has dropped with the whole debt ceiling fiasco this past summer… So while the purchase price was $35k under the appraised value when I bought… I bet the appraisal would be closer to my purchase price now with lower comps. I have a 30 year mortgage but i plan to pay it off sooner when the wife is working again. Bought on my income alone…

I agree spending into debt isnt good… But hoarding cash, like the top 1% are right now isnt going to help either.

Cali Owner Congratulations and I am in the same boat. Homeowner for the first time in 15 years, no longer paying rent (well I’m paying rent to the bank for the next few decades, instead of paying a bank and a third party…).

Spending, spending, spending, stimulating the local economy instead of a bankster or broker’s bonus.

We have been in an economic recovery since about January of ’09. To say otherwise is just ignorant politcal blather.

Home prices are still too high in SoCal, but my mortgage/tax/ins is about the same as my rent was.

As much as I wish this economic recovery was real, I think we are just barely keeping our heads above water. The government has gone to unprecedented levels to keep the whole system from collapsing. ZIRP, borrowing 40 cents on every dollar spent, bailouts and stimulus packages up the wazoo, increasing our national debt to ludicrous levels, etc. Wages have been stagnant or declining for years now and many jobs are simply not coming back. It will be truly interesting times ahead to say the least.

Congrats to all those who bought a place that makes financial sense for them. I think we still have a littlte ways to go before we hit bottom. My plan is to buy a place with a 15 yr loan with PITI about equal to what I pay in rent for a 1 bedroom apartment. That will make financial sense to me!

The Old adage ” Copy success” applies here. If you want to be wealthy do like the wealthy do.

I’m hoarding cash. The 1% wants you to spend. Your spending helps the economy so I can to hoard more cash.

Thank you.

Exactly!

Dear Dr,

How is it that you see all the statistical nonsense about housing yet, you do acknowledge all the statistical noise about the jobs market? I find all the BLS data impossible to swallow given all the revisions and gimmicks that they use. Also how can we call whatever this is a recovery when all the major Central Banks hold 25% of global GDP in their balance sheets? print and pray will NOT work.

/rant off

While the job numbers are good, they aren’t recovery good. It’s basically the average monthly job growth over the entirety of the Clinton presidency. Job growth in a recovery should be better and faster. This is enough to make a difference, but not a fast difference.

BLS data is hard to swallow because it is BS. The labor force participation rate continues to drop and yet is never talked about. That means the real unemployment rate is closer to 11.5% just factoring this in. Further, much of the ‘increase’ is due to part time workers. Consider BLS data to be propaganda, not data or facts. Remember this is an election year. BLS data is cherry picked. Otherwise some simple 4th grade math and a calculator will give a truer representation of what is really going on.

http://www.zerohedge.com/news/record-12-million-people-fall-out-labor-force-one-month-labor-force-participation-rate-tumbles-

http://www.zerohedge.com/news/implied-unemployment-rate-rises-115-spread-propaganda-number-surges-30-year-high

http://www.zerohedge.com/news/final-nail-todays-nfp-tragicomedy-record-surge-part-time-workers

It really is not important that the BLS data has been politically corrupted. As long as the the same metrics are used over the reporting period in question, then the trend line will show whether employment is flat, increasing or decreasing.

Unfortunately untrue – they use an undisclosed and changeable “seasonal adjustment” that measures against what they think would otherwise have been gained or lost at this time of year in a “normal” economy, and in this case that falsely adds a huge number of jobs to the figure. The widely publicized U-3 is all but irrelevant at this point, the labor force participation rate is the number to watch and basically unchanged.

@ dtwn……excellent observations on the validity of BLS data, especially in a Presidential election year. The unemployment headline number is the most political number in Washington, D.C. Therefore, it is reasonable to assume the number is liberally sprinkled with ” fairy dust “…..also known as seasonal and birth/death assumptions, which can vary widely because they are discretionary figures.

The guy at Trimtabs is suspicious, and rightly so. Remember that campaign ‘ silly season ‘ is underway and BLS is a division of the Department of Labor. run by an Obama appointee who would like to keep her job in ’13.

http://trimtabs.com/blog/2012/02/03/bidermans-daily-edge-232012-is-bls-data-skewed

JiminSF is correct.

Do you know what the actual, unadjusted numbers were for January? They showed a loss of 2.7 million jobs. 2.7 million jobs!!

After “adjustments” the BLS reported a growth of 243,000 jobs.

Try to imagine doing that with a straight face in your profession. Imagine if you ran a business and you said, “Well, we lost $2.7 million but it was January and that’s always a tough month, so . . let’s adjust that a bit and . . . there! We made $243,000!”

There is some point to the seasonal adjustments, but when the adjustment dwarfs the final result, you know you’re in the land of arbitrary statements. 10% less adjustment and we have a flat out negative report. 20% less adjustment and we have a catastrophically bad report.

There are multiple easily cited factors that might have made this report risibly incorrect. Most of the U.S. has had very good winter weather. Here in Mass., we’ve had fairly warm temps and almost no snow. These unusually good conditions are very positive for business. The BLS loves to cite unusually bad weather to try to explain poor results. You didn’t hear them cite unusually good winter weather for this, did you? Also, a lot of online writers have noted that the BLS’s typical expectations that X job losses in January translates into Y typical job losses might be inapplicable for this long, grinding recession with little credit available to small businesses. The assumption that those jobs will come back might have been good in other business climates but not now.

Anyway, how confident are you that the 2.7 million jobs lost can be forecast with confidence to *really* be a gain of 243,000 jobs? I don’t trust statistical manipulation that much.

Dear Doctor, you state “Without a doubt, the economy has been adding jobs over the last year:”. I don’t believe the economy is adding jobs but only new retirees. In order to add jobs,the economy needs to hire new population, replace retirees, and actually hire the uemployed. The economy needs to add at least 400,000 a month for a meaningful start of a recovery. The civilian employment population is at 30 year lows

I agree with Ivan Drago. Don’t be so quick to accept these latest employment numbers as being real. The fundamental weakness of our job and wage situation is not really being addressed. Remember, this is an election year, and the powers that be will paint the rosiest picture possible with any little shred of info that suggests any improvement to the economy.

Any predictions on where we’ll be one year from now?

I agree 100% that we have finally entered a jobs recovery. The private sector has deleveraged back to trend, and has been adding jobs virtually non-stop for the last two years. The negative jobs numbers have been the result of government workforce reductions. All those people who want “smaller government” ought to be pleased. In case you were wondering, this is what smaller government looks like. To my next point….

“Why in the world do people fixate on high home prices?”

It’s because the brain is a lazy organ, and doesn’t want to spend the energy coming up with new ideas, learning new skills, making new connections, adapting to new environments. That’s energy that can be better spent popping out another baby.

The result is that people want to get rich, but they want to do it their way. In a market economy about 1% of the population gets to make lots of money the way they want.. It’s about the same in a command economy from what I can tell.

Let’s be straight up–it doesn’t take a lot of brains to say “I’ll just buy a house and sell it when it doubles in value”. Real Estate-Finance system is a well-greased pipeline. Easy to find a house–easy to finance a house–and you’ll get rich! Might as well send your money to Joel Osteen and buy a copy of The Secret.

There will always be suckers, and always people willing to relieve them of their cash. Such it has always been and will always be.

I respectfully disagree with the following statements

“I agree 100% that we have finally entered a jobs recovery”

Labor Participation – High School dropouts: http://research.stlouisfed.org/fred2/data/LNU01327659_Max_630_378.png

Labor Participation – Bachelors Degree:

http://research.stlouisfed.org/fred2/data/LNU01327662_Max_630_378.png

“The private sector has deleveraged back to trend”

With enough data one could make that argument either way but personally I don’t believe the deleveraging theory given how the global central bank balance sheets are exploding to the upside

http://blogs.r.ftdata.co.uk/gavyndavies/files/2012/01/ftblog201.gif

As long as money velocity is at/near one could make the argument that their balance sheets are irrelevant but what happens when they DO become very much relevant

http://nowandfutures.com/images/velocity.png

if we are talking about jobs, we need to address the pink cow in the room. were did all the capital for those jobs com from? The variable, we do not know how many federal dollar are being loaned at ZIRP or just given too these companies. Green sector companies are a perfect example, huge loans, no layoff, then bust. more or less a bailout/stimulas for jobs. for example, a real life situation, a company has an employee, they pay for the employees new skill sets training and certification. then, they terminate the employee! the company rehires that same employee the next day because they now get federal funds to pay for that new hire and we get +1 in positive jobs data. we will see how many of these jobs are just goverment backed jobs within the private sector. somthing just pop’d into mind, we have a large increase of former military, moving into federal funded private contractor work within the mid east. do these US based companies report as private sector new hires…..hmmm.

“What I find fascinating about the recent positive job gains is that most of the growth is occurring outside of the real estate sector. This is an overall positive. Keep in mind that real estate values are still down by $7 trillion from their peak reached in 2006. So the trend of adding more jobs, although a far cry from a healthy economy, is still beneficial news that should be welcomed by all. ”

And so it would, if only it were true. It is not. It is manipulated data, as believable as Soviet-era TASS “news” articles and when examined closely, shows a loss of jobs, no “gains.” The usual election year propaganda to re-elect the Wall Street puppet masquerading as president.

They’ve spent a ton of money to place him there, that’s a fact. It’s paid off handsomely for the Fraudsters…and continues to do so.

I’m suspicious of the ‘jobs created’ number. State and local governments are laying off workers, new home construction is at recession levels, Europe is not growing, China is showing signs of moderating growth, etc.

Remember, everyone whittling wooden duck decoys in their garage is ’employed’.

Furthermore, those trends will remain in effect, regardless of interest rates. With each passing day, state and local governments face ever greater underfunded pension problems. And of course the student loan debt issue has been discussed here at length. Bottom line, there won’t be any sizable increase in first time buyers for the time being.

The other component to housing is repeat buyers. This group will remain under pressure for years, if not decades, as well. In order to be a repeat buyer, you almost always need to sell your current home first. There are two headwinds here. First of all is the lack of first time buyers to buy your starter home. The second head wind is the lack of equity you have in your current home. Even people with a few thousand in equity are in no position to move up. It takes lots of equity to pay the RE agent, help the first time buyer with closing costs, and still have money for a down payment on the larger home, not to mention moving expenses.

And that doesn’t even take into account the demographic trend of boomers starting to downsize.

“In a market economy about 1% of the population gets to make lots of money the way they want.. It’s about the same in a command economy from what I can tell.”

That’s where the comparison ends, though I would say that a market economy rewards merit and achievement more than a command economy. I’d call command economies “kiss ass” economies because you get ahead kissing the ass of some totalitarian politician. The real comparison between the two forms of economies is that the majority of people are much better off in a market economy.

Many of the jobs that were in the home building industry were not those with skills that transfer to other industries. We will never be at the level we were at building homes no one can afford.

Those folks will have to find other work, probably at lower pay. Driving nails in frames will not buy a Beemer anymore.

Let’s just cut to the chase here, shall we? It is B.S.

According to Charlie Biderman, who tracks IRS tax collection data, 2.9 million jobs were LOST in January, and the BLS ignores the available data to use “adjusted” data no one can decipher to come up with this “job gain”..and I’d urge anyone interested to give a listen:

Top article, video embedded

http://jessescrossroadscafe.blogspot.com/

Annecdotal evidence – As a seller of durable goods to the residential housing sector; our sales, buyer inquiries, and trade show attendance have all been gradually improving for the last 1.5 years. Having endured late 2008 and 2009, I can unequivocally state that our consumers mood and optimism have greatly improved.

We are beginning to get sales from those individuals who purchased distressed or deeply discounted homes. At the more affordable prices these home owners now have more disposable income and can afford to buy products and services. This helps everyone in the economy.

11,000 SFRs and condos are being built in the outskirts of Irvine, CA, the heart of crazy SoCal pricing. When the owners of capital decide it is time to build again, the macro economic outlook has to be more positive than negative?

Perhaps Big Ben promising to keep interest rates low till 2014 is related to the resurgence in building activity happening in various locations…

Are the new payroll stats as good as we hear ?

http://jessescrossroadscafe.blogspot.com/2012/02/charles-biderman-on-us-non-farm.html

So many people cherry pick data to talk their book or confirrm their bias or justify their purchase or decision. People perpetually lie and omit facts contrary to their spin. Half the country pays no federal income tax an 50 million are on food stamps

. We r a nation of squatters where millions make no

mortgage payment. We r increasingly s nation of part

time and full time temp workers.

Many on food stamps work but get paid so little they r eligible for hand outs. We borrow trillions per year just to function as a society. The recovery is no more real than the housing bubble. How many pieces of shit claimed housing was sustainable and a non bubble. Expect increasingly rosy economic prints all thru this election year and invest accordingly. Just do not believe them for a second. You will no if there is a real recovery the minute the fed begins raising rates and real cuts r made to fed spending. Only when people r truly starting to get ahead and make real wage demands willthe punch bowl be taken away. If the fed is telegraphin zero rates to 2014 u know how brutal tungsten really are.

I believe the economy has improved primarily because banks, stock market have been flooded with cheap, easy dollars courtesy of Uncle Ben. Good news, bad news, the market wants to rally. Greek debt crisis, Euro crisis, all that matters now is hope. People getting back to work, but many aren’t making what they did…but as long credit cards still work, greenlight the bathroom remodel, the trip to Bali. Everybody wants to get back to the lifestyle they grew accustomed to and deserve, 2005 style. Austerity sucks.

Supposedly there’s no inflation. Bought a frozen pizza the other day, haven’t bought one in a year. Same price, surprised when I opened the package, it was about 3/4 the size it used to be. But nobody notices, right?

2013 is going to be really ugly. This is an election year. So the BS is flying high.

We’re on a vectored path that’s completely unsustainable.

I agree there is inflation going on….the other day we went to costco to buy a brand of body soap that we had bought one year ago….we got four bottles then n now 3 at the same price….sure people are not noticing that…

The problem is not one of whether jobs numbers are improving or not. It’s one of who to believe. The timing of this data is suspicious, but that just makes the opposing arguments equally shaky. However, the general premise that the economy should not be dependent of housing is correct.

I would argue that low home prices are directly correlated to low unemployment. As you stated, when you have a high home price, so much of your income is funnelled into a non-productive asset, your home. For example. A family has $1,000 to spend. Scenario 1. spend $800 on mortgage, $200 on everything else Scenario 2. spend $800 on everything else, $200 on mortgage. What family will prosper? Likely Scenario 2. Spend less on the home more on other items, buying investments for retirement, taking a vacation, upgrading the car etc. A high home value and the high mortgage that bought it is a real drag on the economy. Let’s never get back there again.

Where do we park our money while waiting for real estate to come down to reality? It seems to me everything else (stock, bond, gold) are currently overpriced, probably due to high inflation, high amount money injected, but low interest rate – lower than inflation. Thanks

Leave a Reply to Daniel