Building for a nation of renters: Between 2005 and 2015 virtually all household growth was driven by renter households.

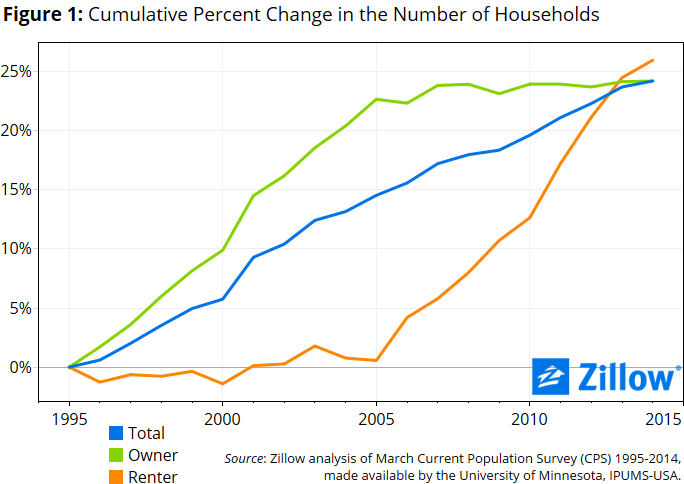

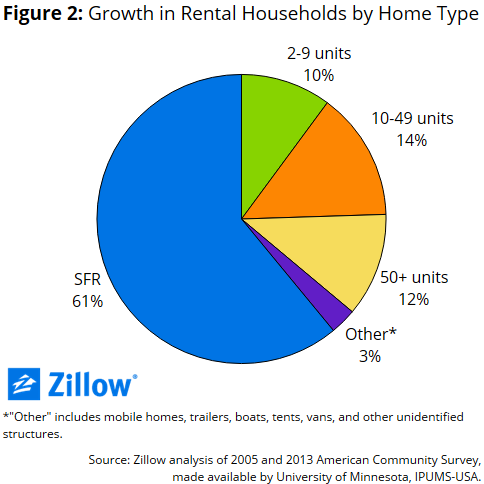

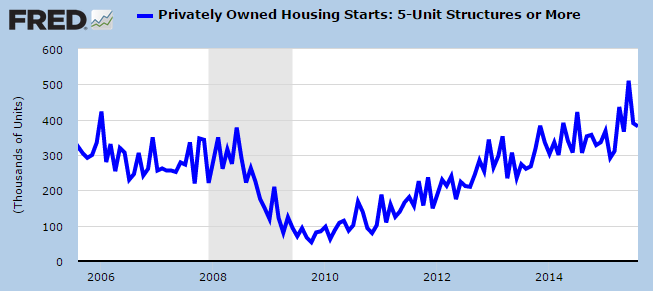

What a difference a decade can make. Over the last two decades the number of U.S. households has grown by 25 percent. But the growth has come in two distinctive waves. Between 1995 and 2005 nearly all of this growth came in the form of new homeowners. However, the subsequent decade saw something very different. Most of household growth between 2005 and 2015 has come in the form of renter households. It should come as no surprise that new home buying still remains weak. With this new trend unfolding, it shouldn’t come as a shock that multi-unit permits are surging as builders place their bets on rental Armageddon. While a few people can’t wait to dive into mega debt for a crap shack, others are simply renting either out of necessity or by choice. In fact, renting over the last decade has been the choice many have made (out of necessity or free will) contrary to the crap shack enthusiasts trying to talk up their poorly built piece of junk as some kind of diamond in the rough. Builders with deep pockets are betting on a continuation of the rental trend. It should also be no surprise that this decade saw a major surge of the “single family home†as rental unit.

Two decades with two different stories

We have witnessed continued household growth in the U.S. Household formation has increased by 25 percent over the last 20 years. However, each half of the last 20 years has seen growth come from two very distinct categories.

The homeownership boom followed by the renter boom:

The chart above is as clear as day. You have the last hurrah leading to peak homeownership followed by a massive shift to renting as millions upon millions of Americans lost their homes to foreclosure. You need to remember what this has done to consumer psychology. Never in our lifetime have we witnessed a countrywide housing bubble. Housing before this recent crash never suffered one year of negative price growth. Not one. So this put a major dent into the untouchable perception of housing as a sure bet. It also didn’t help that over 7 million Americans actually lost their home to foreclosure. We now have a nice group of revisionists talking about these people “strategically walking away†but in reality, this was a small subset. The majority lost their home because when the economy contracted, cut wages and lost jobs couldn’t cover the mortgage payment. Research has shown that people will prioritize debt payments in crisis and housing gets pushed up to the top of importance. So losing a home is a big deal and certainly most people lost it for this obvious reason. But you have to live somewhere. Where did these people go?

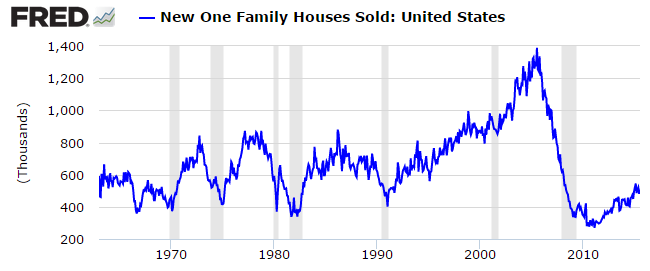

A large part of the single family home inventory got sucked up in the investor orgy to convert them into rentals. This took an already low supply of homes and made it lower. And builders simply did not build new homes in large quantities because new home sales continue to be pathetic:

Why not build new homes if supply is so low? The answer is clear and that is new potential households have weaker wages and new homes cost more. Why would builders construct an expensive product when the demand based on household income is for rentals? It is also the case that younger households watching mom and dad stressing their minds our to make the mortgage payment has left an indelible memory on their mind. Homeownership isn’t all that it is cracked up to be. Millennials certainly don’t have the taste for home buying like the Taco Tuesday baby boomer generation.

Which leads us to the bet home builders are making. Permits are surging for multi-unit housing (aka most likely rental housing):

You notice how the market didn’t react to the Fed? The Fed’s action merely speaks volumes in that they still don’t trust this “recovery†and household formation is telling us an even clearer picture. For all those that worship the Fed as their new religion your preacher just said “we can’t raise rates because the economy is still weak.â€Â For the last year or so home prices rising has come at the hands of speculation and stock market run-off. The stock market had a tiny hiccup and we are already seeing the impact on housing. People simply can’t afford to buy even with the Fed holding rates near zero.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

69 Responses to “Building for a nation of renters: Between 2005 and 2015 virtually all household growth was driven by renter households.”

My HMO health insurance just went up 6%. I have to pay $60 for each doctor for each routine health visit. Who can afford to see their doctors anymore? That is ridiculous. What’s the point of paying for your health insurance when you still have a ridicously high co-pay? Rent is not affordable and so is health insurance. The middle class is getting squeezed so much that we are now the definition of working poor.

Sorry.. I can’t type… For each routine doctor health visit ….ridiculously

One reason for high co-pays is to discourage hypochondriacs, who would constantly be visiting doctors of every specialty, every month, to check up on every minor ache and pain, real or imagined.

I only have catastrophic health insurance. I have no co-pays — I pay the full amount for every doctor visit. Only for expensive care/hospital care/emergency rooms does my coverage begin.

For the past 5 years, I visited my primary care doctor twice. Once for a physical exam for a new job and once for a specialist referral. The doctor spent less than 5 minutes each time yet I paid $40 for each visit on top of my monthly premium. I always had health coverage through my employers. Now I am on my own and realize how expensive it is to have coverage. These HMOs PPOs are making a killing. Health care system is so dysfunctional. We are paying the price for having pissed poor managers/executives to waste our money away. There are so much waste in health care. Health care system is not lean. They have so many Chiefs and not enough Indians. Physicians and nurses are overworked and underpaid. Deaths from medical errors are equivalent to several Jumbo planes crashes a week and yet we do not hear them on the news. Go figure.

How can you talk this way. Life has never been better under President Obama. He said that the cost of health insurance has gone down under the Affordable Care Act. The unemployment rate is very low along with interest rates. Times are good. With El Nino coming, we will have plenty of water again for our lawns and my gardener(came here to work) will be happy again because he will mow my lawn once a week instead of once a month. Everything is good.

Last time I checked the republican party has been in charge of congress for a few years now. Everyone is quick to blame Obama but what has the republicans done in the house or senate. Housing is going to be expensive in LA for years to come, even if you buy a shit box raising the rate a point or two won’t change that.

obama’s masters are the poor and stupid. that’s why the unemployment rate is so low. he doesn’t want you to look at the labor participation rate or the fact that the .1% got filthy rich during the past 40 years while the poor and stupid of all colors are enjoying forced retirement and or working at mcdonald’s

Yerderp: the Republicans were locked out of even the discussion of ObamaCare. It’s his baby. But, a pox on both their houses for playing politics with something so essential to us peasants.

That’s a hard one because the doctor pockets that $60 right away, so it’s hard to negotiate that down. When more of the fee came from the reimbursal, you could negotiate to pay cash for routine visits and keep a catastrophic coverage plan to protect in case of big ticket items.

Not only are we renting nation, but the renting nation has legs, if you look at demographics in America ages 12-29 are big, ages 21-25 the biggest, Huge supply of renting demand and single family rentals from the start of this cycle went from 13% to 17% roughly. So much of the new household formation is coming from outside the 25-34 group

Renting Nation Has Legs

http://loganmohtashami.com/2015/07/17/renting-nation-still-has-legs/

For three decades the average increase for my health insurance premiums has been >11%. They didn’t increase in 2011, 2012, or 2013 (after the affordable care act passed). In fact, I received a small rebate in 2011 and 2012.

Cool story Dennis.

Dennis what planet are you living in? Your data sounds fabricated. Or perhaps your employer is offering you garbage health insurance and you don’t even know it. Myself and others have not seen premium decreases only double digit premium increases.

I’m self employed with Blue Shield. “Obamacare” requires insurers to spend 80% of premiums on actual health care. If they spend less, they must refund the difference. It took three years for Blue Shield to accomplish this, and hopefully, CEO salaries were reduced.

I can honestly say obamacare saved my life. I was so opposed to government forcing me to insure myself, but my fiancé made me sign up. I was like wth I’ll just get the best plan so that I don’t get penalized on my taxes. Ended up getting a blue shield platinum level ppo. A month later I woke up with horrible pain in my stomach and had no appetite. I walked to my local emergency room and they ran tests and gave me orthoscopic surgery that day for my inflamed appendix. Blue shield just kicked in a couple days earlier so the procedure and 2 days I was hospitalized, which would have cost well over $30,000, cost me a few hundred out of pocket. I’m thankful and like being insured now.

I wonder how much of the lack of new home construction is due to the trend of moving and living in the city versus living in some far flung suburb? In a city like LA or SF is there really any space/land available to build new tracts of homes? You have condos being build left and right in DTLA but I’m not sure if that is considered the same as a newly built single family home. When you think of it, most new home construction happens in suburban areas like Ontario, Riverside, and Palmdale but in this city centered era, less people want to leave in these places.

Ontario, Riverside, and Palmdale, all are lands of the “rubes and yahoos”. From the standpoint of those in The City, all of southern Californians are philistines. A cultural wasteland that I would never want to live or visit. It is amazing how the masses fight over crumbs.

Ira: Just so you are aware, your post is very confusing, especially given that sarcasm doesn’t always translate well via text.

Maybe I’m just an unsophisticated prole, but you actually buy that façade of culture in LA? I guess taco trucks and going to the Getty center are important to some. Not to mention the auto racing in BH (by rich Sheikhs nonetheless) who wee! Way better than Fontucky with go fast and turn left, tell you what.

BooshiDooshi yes, me and Leland think that SoCal people have no class and are just a bunch of wannabes, especially some of those Westside renters that drive their leased BMW’s or live with their parents. In The City, we do not have posers.

It would be interesting to see these trends broken down “by State”.

Something interesting that I have read about Houston, is that a high proportion of all housing is rented rather than owned, and this has been the case since prior to the last bubble and crash. Yet in Houston, house prices are so low they make ownership far more possible.

There is a possible parallel in housing in Germany, which has for decades already, had a disproportionately high amount of renting. When people’s attitude to life is more utilitarian, they are not “living a dream”, but working prosaically towards a future for themselves and their families; and when local house prices do not inflate ahead of incomes as a normal thing, the “need” to “get on the home ownership ladder” is not so pressing in people’s minds.

I believe that there has been a trend to building more apartments in Houston, but this is not “at the expense of suburban McMansions” and is not because the usual buyers of suburban McMansions are priced out of that market – it is because Houston’s local economy is evolving in the direction where there are new agglomeration economies at the centre. A historical parallel, would be New York, where plenty of building “up” in Manhattan occurred even as suburban development was sprawling dozens of miles in several directions.

“Evolution” under true market forces, is quite a different thing to the distortions driving markets like the major CA cities – and indeed all cities around the world that have adopted anti-sprawl policies; the correlation between the adoption of these policies, and the onset of affordability problems and cyclical volatility problems, is undeniable. The major CA cities were affordable at one time, weren’t they – at the very time they were growing as fast as Texas cities have been more recently. This indicates that housing supply and market freedom, really matters.

It’s all part of Agenda 21-

http://www.thedailybeast.com/articles/2014/04/13/agenda-21-the-un-conspiracy-that-just-won-t-die.html

=)

google agenda 2030

I wonder how duplexes are doing? Are they still being built? Are old units filling quickly? The idea always seemed to be to buy the building, then live in one half while renting out the other to cover most of the cost …

@kingsnake:

Maybe duplexes might work for some people, but I would never want one to live in as you mentioned. I like having a healthy separation between me and my tenants- as in, they don’t even know my home address. What if you need to evict the tenant? Do you really want to live right next to someone (even temporarily) who hates you for kicking them out? That doesn’t seem like a very safe or desirable situation, especially for a landlord who may have kids.

This is true. My late father used a P.O. Box to receive rental checks.

And he had two phones at home. A personal phone and an “office phone.” The tenants never knew that the “office phone” was actually in our house. My father never answered in after business hours. He let the answering machine handle it.

Doctor, you make a very good case of being bearish on housing. But how do you explain despite all of the evidence you present, home prices have gone straight back to peak levels? In some instances even higher? This is exactly what the bankster mafia wanted and they got their wish. They own and control the economy lock, stock and barrel. How can prices come down when the economy is manipulated by the very uber rich exclusively for their benefit?

To WestsideGuest, I hear you brother or sister. But what are we little people going to do? The essential needs of housing, health care and education is all manipulated and no free market exists. We are simply serfs. Some know it and some have not taken the red pill.

People are attracted to the big cities for their perceived higher wage. Usualy that is not the case due to very low purchasing power. If you live in a studio and can’t afford to support a family, then you 6 digit wage is not high, it is very low. If you look only at numerical value, many in Venezuela or Africa have very high wages – 7 or 8 digit incomes. However, what counts is the purchasing power.

“How can prices come down when the economy is manipulated by the very uber rich exclusively for their benefit?”

Good point. However, no one is perfect, including the uber rich, as was demonstrated in the 2009 market meltdown. Us serfs just have to hoard cash during times of limited opportunity (like now), and then wait for opportunity to present itself.

Success is sometimes defined as the meeting point between preparation and opportunity. We are now in the preparation stage (at least I am). I’m just waiting for opportunity, whether it be a stock market meltdown (discount on stocks), and/or a real estate market meltdown (discount on real estate).

People who have money and feel that Wall Street is a rigged gambling joint rather invest in rental property. Housing is something most of us understand a little of. Besides having a duplex or two gives the family a rabbit hole during of economic downturns. Have done that for my daughter once already. Loss of rent beats having the kids under one’s roof.

Of course as they say, they don’t make land any more.

In today’s economy, the fate of real estate is closely intertwined with that of the stock market. Hedge funds have spearheaded the “recovery” through mass acquisitions of rental properties.

I do like the idea of a multi-unit property to help pay for itself. But not at current prices. Also forgot to mention:

This time it’s different.

Renting is throwing money away.

[Insert overpriced city] is now an international destination rivaling Paris, London, and New York.

The essential needs of housing, health care and education is all manipulated

Most of what passes for an “education” is not a “need.” Sure, if you want to be a doctor or engineer, you need a formal education. But is there really any “need” for a degree in English or Sociology — much less degrees in Gender Studies or Queer Studies?

Lots of college students would be better off without the “education” they’re paying all too much money for. Better to go to trade school and be a plumber or electrician, or join the military and fly helicopters, or teach yourself computer programming as others have done.

the best reason to go to an elite college is to meet new friends and or your spouse

Ben, I’ve met new friends by attending events — political, professional, and religious. Often it didn’t cost anything. Sometimes a small convention fee. I’ve also met people at adult education classes (no credit, no degree, just to learn a skill).

WAY more cheaper than attending an “elite” university for four years, if all you’re seeking are some new friends or a spouse.

Discuss: with rents so high, why not buy? If you have a down payment and steady income. I understand the home’s value may tank or correct in the next couple of years, but how that compare to spending $2k on rent each month?

if you have the down payment is a very big if. i have friends who have the income but not the down to buy in torrance

You’ve answered some of your own questions. Being locked in a depreciating asset. the opportunity cost of buying lower. The opportunity cost of investing the difference between rent and a mortgage in higher yielding investments.

PassingThrough: Is it necessary to type “Discuss”? We are all aware that this is a discussion forum, and those that wish to discuss do so.

Anyway, you have a good point. To me, the answer (just like many things) involves a bit of guessing and a bit math. If you guess that housing values are likely to decrease by ±20% in the next 3-5 years (for example), then you would need to do some math to determine whether buying now or renting while waiting will yield the best long term financial benefit. As you know, taxes, HOA fees and/or Mello-Roos, maintenance, and interest are substantial potential costs to consider when buying. You may find that gambling on a housing adjustment of 20% or so might be well worth it. Or not.

I rent a house for $1750. If I have 20% down, I can mortgage same house for $2800/month. I can’t afford to save 20% nor could I pay $2800/month. Rent is high, but I have no choice, which is how I make the decision.

Sellers in much better postion to reject low ball offers, so the market is a standstill?

I stated this many times before, that Doc. is very accurate in what he is saying. I speak from my own experience; unless it is a custom home for some millionaire I can not make any profit on single family home for a spec. Therefore, all the spec building I am doing is in multi family – 100%.

When I stated before that I can not make a profit at current prices, many bloggers did not “WANT” to believe. They believe whatever they want to believe. They forget that in many cases the builder is a price taker on land the same as all buyers.

With land developers it is a different storry. Unless they are very well connected to politicians, they can’t make a profit either.

Again, for bloggers who don’t want to believe the reality, they are entitled to their opinion. However, that does not change the reality. I hit that everyday.

Your reality is not everyone’s reality. Nor is it every builder’s reality.

Just because you’re not smart enough to make a profit building single family doesn’t mean it’s “the reality”.

Your pompous attitude still isn’t winning you any friends.

And it continues to affirm the stereotype of builders. A reality which still seems to be lost on you.

Thanks for the insight. So are you saying you need prices to be lower before you can make a profit on spec single family housing?

“For all those that worship the Fed as their new religion your preacher just said “we can’t raise rates because the economy is still weak.”

Are you serious? Obama and all the democrats told us that the economy is good, that everyone found jobs, that the unemployment is as low as it can be….Now who is lying? Obama or Yellen?

“Last time I checked the republican party has been in charge of congress for a few years now. Everyone is quick to blame Obama but what has the republicans done in the house or senate. Housing is going to be expensive in LA for years to come, even if you buy a shit box raising the rate a point or two won’t change that.”

Yerderp,

First, for your information, the house and senate can pass exactly “zero” laws without Obama signature.

Second, The Congress never said that the economy is good and rebounding. Everytime, they said exactly the oposite. It was ONLY Obama and MSM who were saying that the economy is good and recovered. Now, Yellen is saying that it is not. You can pick who is lying. When two people say two oposite things about the economy, obviously one is lying. You are free to pick and choose.

I think when Obama says the economy is good, I think he is making more of a comparison from where we were when he took office. Compared to the last years of the Bush presidency it is easy to make the case that the economy is good. But that doesn’t mean there isn’t room for improvement as all of the “good” in the economy seems to have benefitted the rich instead of the last remnants of the middle class.

Obama only says what he is told to say via the teleprompter. I suspect he hasn’t had an original thought or idea how to fix things since taking office.

When houses are overpriced by every metric, and the average household has too much debt and dubious job prospects, the smart money is on renting. Buying is too much like putting all your money down on one bet at the casino. The risk is not worth it and you have no control over your life.

If buying makes sense financially, then there is no reason not to do it. If one can afford it, then buying is always better then renting. You will have a guaranteed place to live, fixed monthly payments, and will build equity over time. If one can afford it, then there is nothing wrong with buying today or any day for that matter.

All the historical metrics now show the market to be in a bubble, There is no good reason to buy. The prices will revert to the mean. They always have. It’s a certain as gravity.

Why would anybody want to lose their down payment and end up 30 % upside down in their mortgage?

Yes. You will always have a place to live. If you have enough money to purchase a house at today’s bubble prices, you can afford to rent anywhere. It’s a non-issue.

Fixed monthly price? Why, certainly. And it will stay the same when the value of the home drops 30%. Who wants to be in that situation?

Building equity over time? In CT in the late Eighties prices dropped almost 50% in some towns. It took TEN YEARS to come back to a break-even, no equity price. Once again, why would anybody want to do that?

Yes Roddy you should wait to buy and continue renting and paying someone else’s mortgage. And maybe in 2018 there will be a price drop of 20-30% and you will be able to buy at the 2015 current price. Even the majority of people who bought before the crash in 2006-07 are above water on their properties today.

Meanwhile mortgage rates will go up, and you will just get less house for your money. Those who can afford to are still buying homes today and are not hesitating.

“The prices will revert to the mean. They always have. It’s a certain as gravity.”

I guess real estate prices in coastal CA have defied gravity for decades. Most sane human beings simply can’t wait decades for prices to revert to the mean. Not saying it’s a good time to buy, but waiting for the next entry point is a big unknown.

Couldn’t agree with you more. It was interesting to see the sharp rise in prices here in Houston. Even more interesting that most local Realtors & economists seem surprisingly ignorant of what actually caused the rise in prices. They pretend we were the beneficiaries of a strong economy and strong demand for homes while ignoring the underlying distortions, fraud and manipulation that paved the way higher.

New home sales are already weak, but I think the damage that will be done with a significant stock market correction will be devastating for home builders. When the run-off from the stock market disappears, builders will be left with a giant vacuum on the demand side. I think the carnage in the homebuilding sector will mirror what we are seeing in the energy sector. Should be interesting.

The rising number of renters as opposed to home ownership isn’t a problem, it is the underlying reasons that are! Certainly, it is far better to have more renters, than high risk lending that leads to another mortgage crisis! But, it is the stagnation of household incomes combined with rising prices, that are causing a serious problem. Household income stats released a week ago showed clearly that incomes have statistically not increased since the late 1990’s! The cost of housing, healthcare, and many other needs, keep rising, and it is almost certain that the extra money going to these things means less is going into an emergency savings fund or retirement, creating future crisis! I would also be curious how many families in a place like L.A., are now multigenerational or multi-family households simply due to the poor affordability! And, how much of a place like L.A. is only a food stamp away from being truly third-world? That is not progress in America!

Is now the time to sell? It seems like a prime opportunity, it was just a commodity I’d do it today. But it’s also my abode and I’ll need to find a new one, at substantial markup. There are also personal pointing to: run for the hills (eg highly effed up HOA and hostile neigbors).

Interest rates will not rise until after future generations default on the current debt.

So long as interest rates remain as low as they are now (which we already established will be indefinite) The stock market will continue to climb. Free money, in the hands of people who know what they are doing, is very profitable. The beneficiaris of the stock market wealth will continue to pillage their retirement accounts to join the property ladder.

Current (permanent) interest rates allow said buyers to purchase 30% more mortgage. As such, home values will remain 30% overvalued.

Savers will sacrifice, in the short term(?), their retirement, non savers will look to FHA with paltry down payments and more affordable less desirable homes.

Those who’s incomes do not qualify will be left to rent.

The government cannot possibly service it’s massive debt with increased rates. So this is now the new normal for housing in Southern California.

I also don’t see a Fed rate increase, but I don’t think that necessarily leads to a permanent climbing stock market. Trees don’t grow to the skies. And leveraged assets can be susceptible to short sellers and margin calls. PE ratios will eventually frighten away investors, and leveraged buyouts at low rates will run out of steam. We’re already seeing a very volatile market this Summer.

The Fed is under pressure from foreign Central Bankers not to upset the QE applecart. Higher rates would strengthen the Dollar and cause an inflow of foreign capital into the bond market to feed on higher interest rates not available elsewhere. A lot of manufacturers would suffer from increased prices of what they make which would slam exports. That wouldn’t help the stock market or the union workers in some industries who are a big (though shrinking) part of Obama’s base.

Well put. I believe that external economic turbulence will ultimately trump ZIRP and the Fed’s machinations. Global turmoil, not just the uncertainty cause by Fed decisions, has played a major role in the recent stock market volatility.

Even if you’re right, that’s still 30% more in down payment, which isn’t exactly easy to pull off.

This was the single-most rational explanation I’ve seen for the overall financial future of America and housing in general in years…thank you.

“The irony in Wall Street profiting from a foreclosure crisis they helped create is not lost on anybody,”

http://www.sgvtribune.com/business/20150628/reports-detail-housing-woes-for-southern-california-residents

Thought this was as a good read on this same vein.

I’ve been a long time reader, first time poster on this blog. Lived in OC CA ever since moving to the US from out of country 15 years ago. Married with young kids, wife and I make ~200k/yr. We’ve been looking to buy, ready to put up to 200k down. If I was on my own, I’d be out of CA in a heartbeat. But for various reasons, I’ve resigned to the fact that it’s going to be OC for us for the long term.

So… we are itching to take the plunge, but to me it seems like OC RE is at the same crazy level as at the last peak in 2007. I would hate to jump in and see our home that we poured our savings into, plummet in value like they did the last time around.

I agree. The ongoing bubble is a reflation from 2007 as OC RE is back to ludicrous levels due to over-speculation enabled by the government and Fed. To me, $200K as a down payment is a substantial risk for a middle class family unless the ROI warrants it.

Looking at nominal 2007 prices is misleading. Interest rates in 2007 were in the 5-6% range, they are sub 4% today. And we’ve had 8 years of inflation, that’s right you read that correctly. Rents have gone through the roof in those 8 years.

Not saying it’s a great time to buy, but do not mistake this for 2007.

You are looking at this the wrong way. In your case, a home is not only a investment, but it also provides a service. A home puts a roof over your family’s head. Regardless of whether it goes up or down in value. So if the numbers make sense, and you plan on staying in the same place for 7-10 years, there is no reason not to take the plunge.

If America is on it’s way to become a renter nation then it is just one more nail in the coffin for the working middle class. At a certain point the working class in this country is going to have enough and they will fall in love with socialism. I think for now that is why Bernie Sanders is popular. The working class feels that the uber rich legislate benefits for themselves. So why not as the working class vote benefits for themselves?

Unfortunately that is the road we are headed towards. In my view, the best path is for true Libertarian free markets. But that is a pipe dream.

We already have socialism. We’ve had socialism for 80 years now.

Yes, we also have a rich oligarchy who runs our socialism. But that’s been true of every socialist nation — the Soviet Union, Cuba, Red China, Ceausescu’s Romania. ALL of them had a rich oligarchy who socialized the wealth, kept the lion’s share, then threw leftover crumbs to the underclass.

“We already have socialism. We’ve had socialism for 80 years now”

False. In socialism the elite is rich but only relative to rest of the people, not absolutely.

Comparing that to the situation in US where the richest 5% personally own 90% of everything is patently false: In socialism even the top people personally don’t own much: The position they are, owns. Personal property at top is for dictators and kings.

Also the property difference between peons and the ruling class is only few percents of respective difference in US.

So no, US doesn’t have socialism, you have quite pure feudalism, where ruling class buys the laws and voting doesn’t mean a thing. Or the president.

It’s not even capitalism as FED basically owns housing market and does what the feudal masters want with it. Voters aren’t asked either.

Socialism has never been able to kill off Mr Market. It just contorts markets and creates Black markets. Just like the Fed can’t fix what’s wrong in the World. (See my post above). Pure free markets have never been popular with established government or business as was duly noted by Adam Smith.

Leave a Reply to Logan Mohtashami