The rise of modern day real estate feudalism: How a majority of Americans are missing out on the gains of the new rentier class.

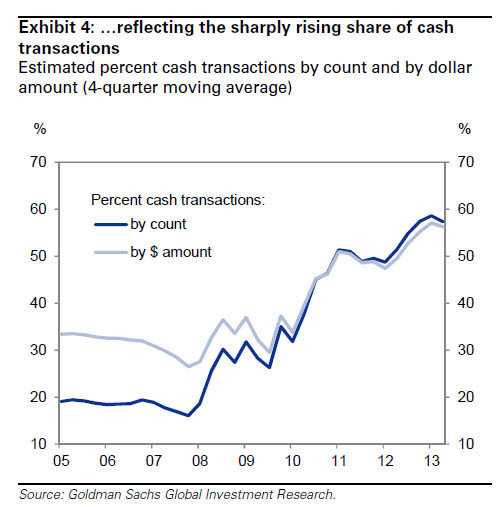

Feudalism was a set of customs in medieval Europe that setup a society in which relationships were based on holding land in exchange for service and labor. There is a modern day movement that is silently pushing out the middle class from truly owning real estate. In my view, there is no coincidence with the contracting US middle class and the massive expansion of “all cash†buyers. For most working Americans buying a home with all cash is so far removed from economic reality that it is not even an option. This used to be historically the case. However, since the Fed adjusted accounting rules and banks were able to control how inventory leaked out into the market, we suddenly have the highest number of cash and investors diving into the real estate market with alternative financing. People in Nevada, Arizona, and parts of Florida are competing with 50 to 60 percent of investors just to buy a home. In California the figure has been over 30 percent going back to 2009. Lower rates are a bigger pull for large investors since the safe trade in bonds or Treasuries is no longer there. So for this group, those 4 to 5 percent cap rate yields seem more attractive than the nearly non-existent rates on Treasuries. So we now have a system in place that is crushing the US homeownership rate and is shifting more property into concentrated hands.

First step, control that inventory

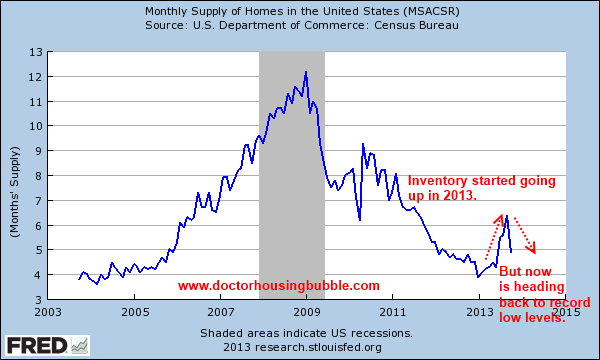

There was an interesting trend that started early this year. Nationwide inventory was starting to increase. Yet once rates spiked in the summer, that trend completely reversed:

Banks have an entire menu of methods of slowing down inventory that hits the market. Slowly since 2007, banks have figured out better methods of leaking out inventory. For example, freezing mark-to-market accounting and all the other programs that allowed for mortgage modifications. In some cases, the foreclosure process was dragged out 3 to 4 years! Yet the public face was to help average people but in reality, what has really occurred is a major shift from US household ownership of properties to investors swooping in and picking up properties on the cheap courtesy of modern day banking policy. In the end 5,000,000 Americans (and counting) still lost their homes via foreclosure and continue to do so. The massive spike in prices is allowing more people to exit mortgages they simply cannot afford by simply selling.

Yet the drop in inventory is adding pressure to a market where sales are still weak. What you have is a fully controlled “market†where the Fed is buying up virtually all mortgages and investors instead of focusing on companies or more productive economic activity are becoming large scale landlords.

Prices up and homeownership down

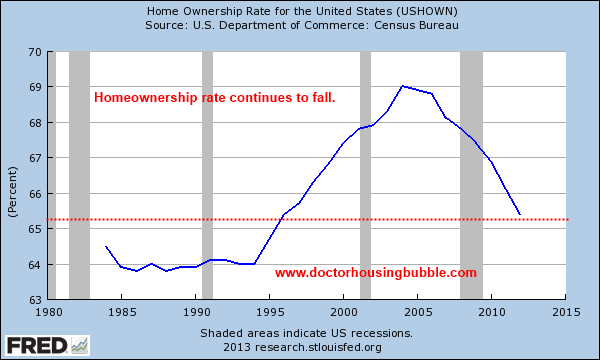

Prices are up yet the homeownership rate in the US continues to fall:

How is this even feasible? For one, you might have one investor, purchasing a ton of properties:

“(Bloomberg) The market for rental-home securities may grow as large as $900 billion, assuming 15 percent of annual home purchases are conducted by investors and 35 percent of those and existing rental-home owners turn to the market for financing, according to Keefe Bruyette & Woods Inc. Banks have been the main source of financing for new property landlords such as Colony Capital LLC and Blackstone, which has spent $7.5 billion on about 40,000 houses.â€

Instead of having 40,000 families buying those homes, you have a couple corporate owners. For nearly half a decade 30 percent of all US single home buying is going to investors. Historically, this figure was closer to 10 percent. That is a dramatic shift in the US real estate market. Did becoming a landlord suddenly become sexy for Wall Street?

With prices up dramatically in the last year including going up close to 30 percent in California, regular families are having a tougher time competing with the small amount of inventory available when investors are battling it out. What is interesting is also the number of rentals on the market has declined causing rents to spike. Household incomes are being eaten up either by higher home prices or higher rents as more households shift to renting adding pressure to the low supply of rentals. Ironically, we are not seeing a flood of these purchases hit the rental inventory market. Some are trying to flip which might explain the lack of rental inventory but this would add to overall sales inventory which has also fallen. This isn’t a full market so hard to guess what the next move is.

New home sales – make a fuss for nothing

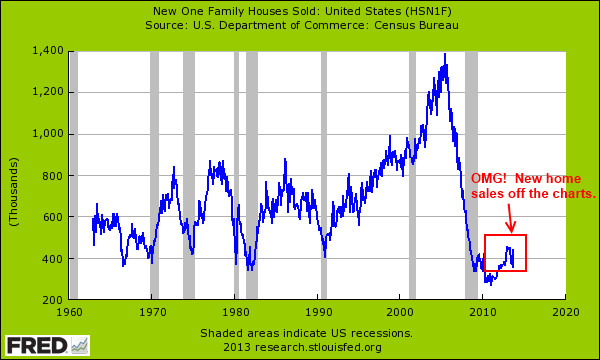

There was a big splash being made about the “massive†jump in new home sales. You want to see this big jump in context?

The chart above sums it up. All the action is happening in the existing home sale market and investors are dominating this game.

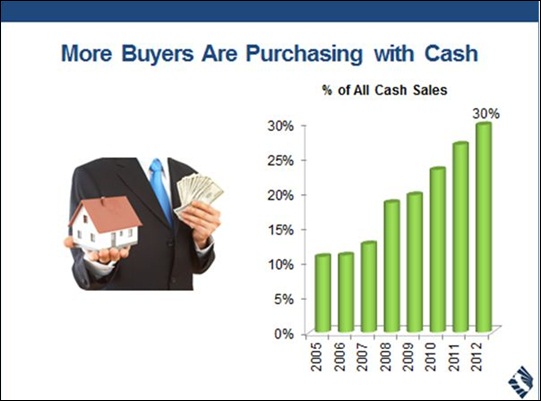

Cash buying

It is very clear that one-third of single family home purchases have gone to investors since 2009. However, some estimates put this figure a bit higher:

A safe number is one-third. In markets like Nevada, Arizona, and Florida it is closer to half. Even in Las Vegas, what regular working family is going to have $100,000 sitting around to make an all-cash offer? In California where a shack goes for $500,000 the game is even more bizarre. Yet people have to work and live somewhere. People for the most part are idle creatures. In California you have the conundrum of golden real estate handcuffs via Prop 13. People can sell and move to another state and have a healthy retirement but would rather eat cat food and live in a shack with low tax rates. It is an interesting trend especially with many baby boomers now seeing their kids coming back home with loads of college debt.

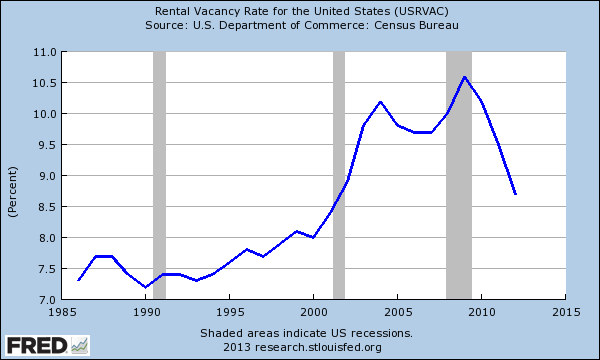

Rental market getting squeezed

The low supply and large investor buying is now causing a drop in the rental vacancy rate:

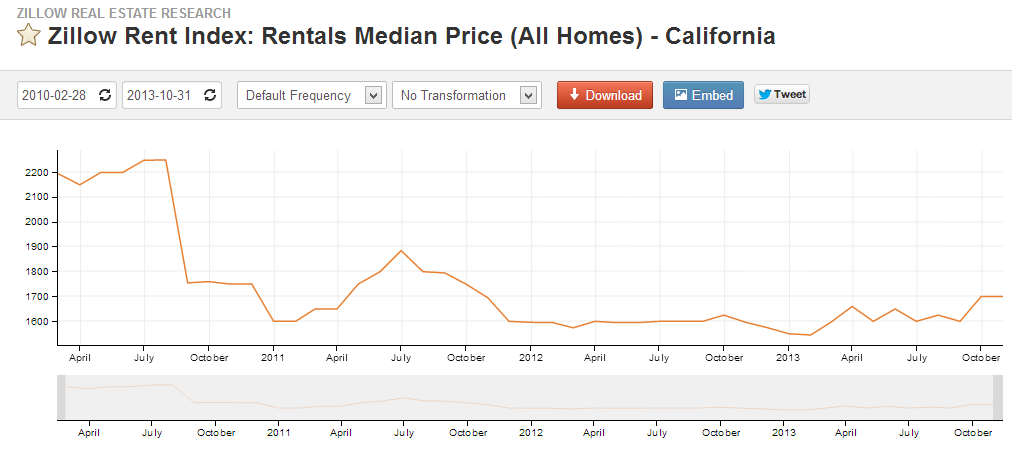

Because of this rents are moving up but in some markets are still below the record highs:

Source:Â Quandl, Zillow

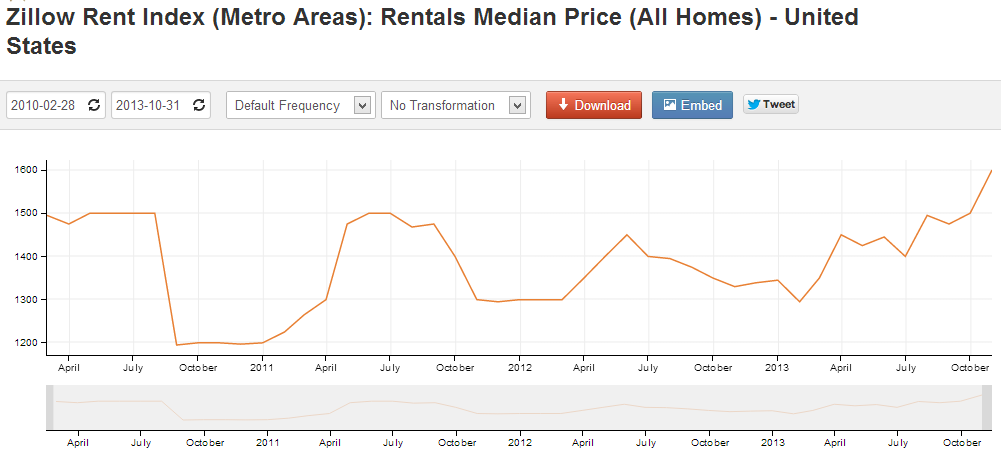

However nationwide rents are at an all-time record high:

Low inventory is a symptom of market manipulation. Too many odd incentives and banking shenanigans have created a distorted market. The Fed now owns 12 percent of the mortgage market and is essentially the only buyer of mortgage backed securities. Look at all the above data. Who do you think is really winning here? Rents are higher. Home prices are higher. Yet the menu of good employment opportunities is limited. Incomes are hardly increasing. The younger generation is massively in student debt and they are having a tough time finding good work.

What an odd game of real estate we are living in.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

110 Responses to “The rise of modern day real estate feudalism: How a majority of Americans are missing out on the gains of the new rentier class.”

“For most working Americans buying a home with all cash is so far removed from economic reality that it is not even an option. However… we suddenly have the highest number of cash and investors diving into the real estate market with alternative financing.”

Same story here in Austin, Texas. Only 17% of transactions, according to the guy in the link below, but that’s still got to be driving up prices for everyone else.

http://austinrealestatepost.com/post/4224952/is-cash-king-in-austin-real-estate-

Tell me again how this bubble “popped” in 2008 or so? It never went away here. Resigning myself to the idea that it may never pop in time for me to be able to own a home, myself.

We’re saving the 20% for a $550k house in San Gabriel Valley, East LA (Pasadena, Alhambra, Temple City, San Gabriel). Hopefully by August 2014 as we’re saving 4k/month. Our income $230k/year and we had 75k saved now. I think we will be priced out though! We have another house we bought in 2007 (20% down) but has zero equity now so we don’t wanna sell. Our jobs moved so we’re renting now. We have good tenant in our house for the past 2 years and that covers our mortgage. With second baby coming, I’m tired of this rising housing price!

If you prick us do we not bleed? If you tickle us do we not laugh? If you poison us do we not die? And if you wrong us shall we not revenge?

William Shakespeare

Yes. In spades!!

I guess its time to move in the whole family to afford rent. I am afraid as a society we would rather be taken care of then have freedom. America has lost its way.

Yeah….

Here is a thought experiment for you: What happens when robots become capable of doing nearly anything people do today, but cheaper? This seems somewhat inevitable. Presumably the 1% will own most of the robots and will collect the wages for their labors. I plan to be one of them. I expect everyone else to be largely SOL.

Now that /my/ robots have “your” job (and your 98 closest friends’ jobs), should we as a country take care of you and your Buds with government programs, or just let SkyNet “take care of” you all instead?

The same argument was made 200 years ago….the industrial revolution.

Nah, the rest of us will just “take care” of the 1%. Hack their robots to turn on them or disable them. Take a blow torch to them, steal them and melt them and sell the metals. You best be nice to the people that have been supporting the 1% parasites that have robbed the world via secret programs designed by and for the 1%. The 1% are like the tongue eating Isopods! parasites sucking the wealth off the body of the people that produce everything needed. The 1% are the entitled parasites and the parasite has outgrown the body. It’s now a giant tapeworm eating itself. Hope you are proud of yourself 1% slimy tongue eating isopod. You and Jaime Dimon suck! The 1% Better watch out for billions of people that want their heads to roll down a freeway, or perhaps

like Iran and Vietnam where they are hanging the banksters that are destroying the world. Or Iceland, they put the banksters in jail and told them to shove their fraudulent debt up their where with alls. The 1% think they are better! smarter! etc. BS. They just rig the game. We don’t forget, and we don’t forgive. Robots. Lol won’t need em when everyone has replicator in their home. 3d printing, end of manufacturing as we know it. Bye bye China jobs. Or perhaps we will have our own standing army of robots to fight the 1% ers robots? There are a lot more of us than you! I wouldn’t brag about it if I were you. If you have so much why don’t you create some jobs? Aren’t you a “job creator”? Lol what the Taxpayers 85 billion a month in QE stimulus isn’t enough for the 1%parasites to create some jobs with? Lol pond scum parasitic 1%er welfare babies that think they special. Give me. Break. Losers.

If we did reach a point where robots could do all the work, it would be time to simply establish a form of communism. Historical communism failed because human workers need a profit motive to work effectively, but tireless machines have no such limitations.

The great thing is, you wouldn’t need any kind of violent revolution to do this. With sufficiently advanced robot labor, you could establish communism entirely through the free market.

Once it became clear that robots were replacing almost all labor, you could just establish organizations that are akin to credit unions, but for general goods. These would be nonprofit entities.

For instance, I could go on Kickstarter or another similar site with a petition to raise capital for something I would call The Universal Cooperative Inc. Through donations it should be able to get together a few million in startup capital. I would use this seed money to purchase robots to manufacture consumer goods of one kind or another.

The company would then set off. It would manufacture ordinary products, and people would hopefully preferentially purchase them over others, knowing what the company’s mission was. The company would use profits to expand operations, buy further robots, hire what limited human workers are needed, and eventually purchase robot manufacturing facilities, mines and farmland, patents, etc. The company would also willingly accept donations.

Once the company reached a certain size, it would begin simply giving a portion of its goods away. As the company grew and grew, eventually it could start giving the vast majority of its produced goods and services away free of charge.

If I have a huge operation, where the robots mine the ores, refine the metals, manufacture other robots, lay down solar panels or other energy resources, etc, eventually this robot swarm doesn’t need additional funds to keep on growing. The only limit is the access to raw materials. The company could start at first giving away free cheap plastic consumer goods, but eventually expand to the point of offering free food and free housing (in the form of land-saving high rise, but spacious, condos.)

There might just be one such anti-capitalist company, or there could be a whole group of them. If people were willing to just slightly prefer to purchase goods from the charity company than the for-profit company, over time the current ownership class would be completely bankrupted. Owning means of production doesn’t mean much if people boycott your products, and no for-profit company can compete with free.

If robotics really does ever reach that point, workers can simply band together and establish a form of free-market Communism, as strange as that sounds.

You have got to be kidding me, tape worm sucking itself out? Why would we even need jobs when everything starts becoming low cost and taken care off by robots? Instead me and my “98” friends will probably be having fun while we are transported by, entertained by, and secured by robots.

Ollman, You are bragging about futuristic robots that you don’t even own. What makes your hypothetical robots better than anyone else’s? You sound like a kid on the elementary school playground, “oh yeah, well my dad can beat up your dad.” What a joke. And what is with war against fellow humans. It’s ok to be proud of technological achievements, but you don’t have to be an asshole about it. I hope your robots contract a serious virus and die. Not anyone else’s robots…just yours.

Didn’t Lynn Chase post in another thread about a bank foreclosing on several of her houses in Las Vegas? Is she mad at the 1% because she aspired to become one through house-flipping, and failed?

As for robots doing all jobs, if so, the future might resemble Kurt Vonnegut’s PLAYER PIANO. Most people had no meaningful jobs, but were financially okay, because the government subsidized them with pointless make-work jobs.

The real toll was psychological. Men felt emasculated because they no longer did anything useful to earn a living for themselves and their families. Instead, they showed up for pointless make-work “jobs” and took home “paychecks” that everyone regarded as welfare.

Well, to tell the truth, my 3D print company stock has quintupled since I bought it in the summer. With cheaper energy here due to fracking technology and the newly found wells in Montana and the Dakotas, maybe manufacturing in the good ‘ol USA is starting to make sense again.

I am still renting in a rent-controlled area, still commuting 130+ miles per day and still saving up for my son’s college education. I will not overpay for a house.

All we need is a higher minimum wage. Obama is almost done “fixing” income inequality.

Via devious means, the Fedsury is subsidizing the Big Banks (ZIRP comes to mind) such that these players can manipulate politically sensitive numbers — such as the going nominal price for SFH and the visible inventory.

The cost of carry is being shifted back to the general populace, stepwise, through the TBTF banks, F&F, the Fed, and then the taxpayers — and anyone holding US currency and dollar denominated financial assets. (The money-printing WEALTH TAX on financial assets – of ALL types: debts, pensions, annuities, bonds, money market, bank deposits…)

This perverse chain of abuse is massively facilitated because of ‘logical corruption’ in the political space.

The PTB actually believe that gaming the populace/ the proles has a net positive outcome — and that scaffolding a narrative can carry them through multiple election cycles. As IF.

So we now have fake unemployment numbers, fake housing statistics, fake banking statistics, fake inflation statistics… on down the line. Such corruption leads even the PTB off a cliff.

Famously, in the worst dictatorships of the 20th Century, the staffs stopped reporting correct information to the Big Man. Stalin, Mao, Hitler, Saddam, et. al. SHOT bearers of ‘bad news’ / aka reality.

The record shows that both LBJ and McNamera HATED to receive bad news — to the point that the generals just stopped sending it up the line. It’s commonly perceived that the generals went off the rails in Vietnam. Not so, the Big Men went off the rails. None of the generals wanted to fight that campaign the way that the American civilian administration did. Guess who won that fight.

What is of historical record in military affairs is VERY relevant to today’s economic war: for the major powers ARE in an economic war. Each one, in turn, wants the bad economic results to fall on the Other Guys. Every major player is racking their brains trying to figure out how to shift unemployment statistics — and trade balances in their favor.

In essence, international conflict has leaped past martial conflict in this atomic age — and jumped straight to currency wars and mercantilism — in a fiat era. It’s a strange landscape where the topology is made out of ‘rubber.’

===

Gorby lost the USSR largely because the feedback he received was TOTALLY corrupted. Just like the infamous dictators, no-one was sending truth up the line to the Big Man.

Such truth disconnects operate on the command structure as if the cables were cut on an aircraft.

http://en.wikipedia.org/wiki/United_Airlines_Flight_232

One only hopes that the machine has enough basic stability to get down without going vertical!

===

At this time, the President is pacing the deck of the Titanic / 0-care — in denial — even as the whole affair is showing the potential to sink the national economy — and take the rest of the planet with us.

Such a travail is an anvil of Damocles over the real estate market.

The medical-pharma cartel is such a HUGE segment of the national economy — and an export powerhouse — that the disruption induced in 2014 spells BIG TROUBLE for asset prices.

0-care functions as a massively regressive ‘pole tax’ — as it’s a per capita tax that taxes the lower middle class at staggering relative rates — while barely touching the elites.

Such economic policy is the absolute inversion of all prior Democrat and Republican policies.

Consequently, one should not be surprised if, then, the entire flow of the economy starts to go inverted. Liquidity is drained by the insurance cartel — at the same time the physicians — on the whole — are CUT OFF from their indermediation of funds. That is, the cash is piling up at the insurance office — but since the physicians are not signed into the program — they can’t tap the boodle.

The ONLY funding available for 8 out of 10 physicians is from the patients, themselves — and without borrowing, either.

The intent is to roll back doctor’s fees on an epic scale: aka wage controls. In every instance, this political gambit has blown up. Cf Venezuela, et. al.

===

So, the corruption of economic statistics is now to be matched by a cramdown against the medical-pharma cartel even as the real estate and debt markets are fulsomely corrupted by the Fedsury.

I see an epic train wreck dead ahead.

I don’t see a nominal decline in real estate prices. I see a horrific debasement of the US Dollar — and immense distress in the labor market. I see the Fedsury trying to paper over all of these epic top-down Big Idea follies until the dislocations/ malinvestments become so horrific that the wheels come off.

You have to know something’s wrong when Mexican illegals are fleeing back home to get away from American unemployment! Yes, that’s right, Mexico has better economic prospects right now than America.

Don’t look for nominal real estate prices to retreat. Expect that the heart of the economy to be hollowed out — and the traditional middle class of America to evaporate.

If you adjust the stock market indexes for the debasement of the dollar… then the so-called bull market trend goes flat to NEGATIVE. We’re not in a bull market at all.

This is the best explanation as to why the indexes keep going ‘higher.’ Like the Red Queen, they’re merely running twice as fast so as to stay in the same place. They represent the debasement of America — on a daily basis. That is all.

pole tax s/b poll tax.

Typing too fast.

If we’re undergoing such epic debasement I don’t see why the price of precious metals should be tanking. Also, overhead anvils are more Wile E. Coyote then Damocles, but hey if no sword is handy…

It’s PAPER gold and PAPER silver that is tanking.

When you try and actually buy the physical… no-one wants to sell at the same price as the commodities pits are posting. This is ESPECIALLY true for silver.

The US Mint is selling silver coins — at QUITE a premium to the pits. The Mint can’t keep these coins in stock!

BTW, the epic short position in silver, at some point, is going to blow up. JP Morgue is on the wrong side of a massive naked short that it can’t get out of / unwind.

Any attempt causes the paper price to vault into the heavens.

Bah. Gold is best used as a doorstop. It is tanking because the irrational fear is subsiding and people are once again getting around to notion that something that pays you for holding it or which makes a profit just might be better than something that doesn’t. 5 years too late, mind you — buy high, sell low, and all that.

Bert, it is easy to get ripped off by precious metals dealers unless you educate your self. For every decent dealer there are 6 who try to squeeze you. I know for a fact that you can buy silver for 1.00 over spot and gold 60.00 over spot without any problem. Yes you can go to ebay and spend 3.00 over spot for silver and 200 over spot for gold, but why would you do that?

Bert (aka “buy†not “byâ€) – since you were/are a broker… hmmm another interpretation of “broker” is “more broke”… funny how some things are right in front of your face like Bernie Madoff “Burn†“e (and)†“Made†“Off†or how about Dick Fuld as in the “Dick†that “Folded†Lehman or Lloyd Blankfein Blank Fine… No Fine… I could go on forever…

Anyway, question for you mr. “buy†not “byâ€, aka “more broke†aka “bertâ€. If debt is money, is it not the case that shadow banks were creating shadow money called CDO’s and since the CDO collapse isn’t it true that a large amount of synthetic money (not that any money is real) supply disappeared. I am not trying to support what the Fed did/is doing, but I would think a trillion plus is less than the loss of money supply during the collapse. Would it not be the case that in the mind of money supply conscious folks that we actually had deflation based on the collapse of the money supply and the Fed is simply replacing a portion of the disappearing money supply to fight deflation? That might explain the lack of velocity of money. I would think that you would need both to have inflation from a money supply point of view. I am not convinced that the money supply focused folks necessarily have it right but if we are going to talk “printing†it makes sense to clarify what is “printing†is…

“what printing is” not “what is printing is” “Too” not “to” many iseseses… I need to go back to sleep…

The money the Fed is printing is not making its way into the money supply. It is going to banks that are holding it and earning interest for nothing. They are not loaning it as they don’t have to. So it is not helping to stimulate the economy, create jobs, Or anything to do with reality. It’s propping up Wall Street and nothing is trickling down. Why sell reality when you can make money off of air?

What?…….At least BLERT is not a Jerk.

You should change your nic to grammarian…

Live with the typos… it’s the price of blog threads.

CDOs and all the rest generated ‘tulip bulb’ asset amplification. But, any inspection of the real economy will show that said ‘funny assets’ did not spew circulating money into the real economy — as all other nominal prices moved but slightly.

Unlike commercial bank generated monies, CDOs and their ilk — in the main — produce BOTH debits and credits within the economy at the same instant.

While it’s not generally perceived, when a commercial bank lends money it essentially ‘prints it in cyber-space’ out of thin air. That is, the bank advances you credit — out of thin air, ab initio. CDOs don’t have that economic character.

For more on this concept study up on Steve Keen:

http://www.debtdeflation.com/blogs/2009/01/31/therovingcavaliersofcredit/

The above ^^^ blog post will take the better part of a weekend to absorb. By the end you’ll come to understand that Keynesians are beyond wrong — and are today’s version of ‘flat-worlders.’ The truly scary thing is that they’re in the wheelhouse of the Fedsury.

Most of your concepts, revealed in your response, are straight from Keynsianism. Tragic, then.

Getting some concepts wrong leads one entirely astray — and the differences can be subtle.

====

Example by analogy:

How does a propeller drive a small plane through the air?

1) Does it push the air backwards creating thrust?

2) Or does it pull the plane through the sky like a vacuum cleaner on high?

In the beginning, everyone went with door #1. The correct answer is #2 — with a minor assist from #1.

It took the genius of the Wright brothers to realize that a decent propeller was a spinning wing. So they invented the modern wind tunnel to produce an efficient profile. Until then, all attempts were so inefficient that nothing could get off the ground.

If you asked the general population, and every prior inventor, every last one would pick door #1. The vacuum effect is NOT intuitively obvious at all. The rest of the 20th Century — in aeronautics — consisted of discovering one counter-intuitive engineering result after another.

Keeping in mind that the money, the brains, the drive to solve aeronautics was at the foremost of human effort — look how hard it has been to grapple with it.

Now, off to economics…

====

We are lost in a lost land because economic truth is often counter-intuitive. So much so that 100,000,000 souls have perished because of economic ‘flat-worldism’ — which is still in evidence in the White House today.

For what is 0-care but an intellectual re-tread of the failed nostrums of the 20th Century. These, more than you dare believe, spring from ONE source: Frederick Winslow Taylor’s time and motion studies. It is the foundation stone of modern Top-Down management philosophies.

http://en.wikipedia.org/wiki/Time_and_motion_study

To a shocking degree, both Stalinist Russia and Hitlerite Germany were ‘re-tooled’ along Taylorism. What had been agrarian economies only a century earlier became fearsomely recast as assembly lines — of munitions — of death.

Assembly-line government is now everywhere. We accept it as the air we breathe. It’s hard to believe, but America got along right well without regimentation — clean through the 19th Century.

The mentality of Taylorism is now re-cast across the ENTIRE economic matrix. Let’s call it mandarin perfectionism — the idea that Top Down savants can tweak humanity to achieve Heaven on Earth — and in but one life time.

(This ‘hurry up’ was part and parcel of both Stalinism and Hitlerism, too. Walking too slow or arriving late to work was literally a death sentence during the war! Death Kamp policy is that “everything has to happen quickly.” Late to work meant you were detail to the suicide battalions. See: Aleksandr Solzhenitsyn, et. al.)

In this regard, Mr. Yellen has swallowed the koolaid.

Never forget that the velocity of money is a math result that is purely INCIDENTAL and can’t be controlled. It’s as consequential to generating proper economic policy as your favorite hair color; that is, it doesn’t even merit consideration at all. Such thoughts merely cloud the brain — like thinking that the Earth is supported by turtles all the way down.

Purge your perceptions by reading Steve Keen — and contemplating in depth. You will experience a sea-change in economic comprehension… sort of like before Newton and after Newton.

sarai – blert is a pompous ass who believes he has all the answers.

blert – thanks for the lesson in aeronautics. I am not sure I asked about how planes fly through the air or about human social economic structural theory etc…

I believe I simply asked if you believed that the destruction of CDO’s lowered the total money supply. Now I am a little confused that you would say in one breath that banks create money when they lend and then in another breath that CDO’s are not created money. The banks sold the loans to fund managers which did their magic to create a resalable item which still has the debt created money attached. Now if I have this wrong and the banks still have the debt on their books then I am open to being educated. It was my understanding that the banks created the loans and then resold said loans to allow them to continue the process because they had leverage limits and were making the real money in loan initiation fees not on the actual interest. So, if the loan goes bad and the CDO’s assets are not worth the total outstanding debt how is that not money destruction?

I think you may want to work on reading comprehension as well as grammar because I stated repeatedly that “I am not convinced that the money supply focused folks necessarily have it rightâ€. What does that mean to you?

It is my understanding that money supply only affects an economy if there is a demand for the money being pumped. If there is little to no relative lending/borrowing then money is not really being created by your definition and that is why velocity has an impact.

I think you should change your handle to PERIOD STOP. As if what you say has so much merit we should all blindly follow your belief system. Speaking of Stalin and Hitler, I belief that is how they conducted themselves…

It’s essential that you study up on Keen.

Perhaps then the differences between CDO origination and bank lending might become apparent.

Simply put, CDO origination does NOT create new money — not with the same mechanism as bank lending… which is why the Fed never toted them up in the “M”s… indeed, scarcely tracked them at all.

That you’re conflating the two indicates just how much you need to read Keen. See web link above.

INRE money supply theory…

I’m not a devotee of Milton Friedman. If you read Keen, then you’ll understand that Friedman’s entire conception of how the money supply is expanded is totally flawed.

Not withstanding that, you’ll see variations on his math just about everywhere.

Popularity does not make monetary theory right.

We are at a stage in economics in which NONE of the widely known theories fits all of the facts.

I guess I’m going to have to draft my on tome.

Keen is your best place to start. While he’s too enamoured with communism, his blog post has serious merit.

Warning: serious head shrinking will occur, as he debunks most of what you’ve been led to believe.

On s/b own…

Your working theory as to money being pumped into the economy is also off track.

The Fed has been pushing on that string for some years now.

Shades of the Great Depression.

Two threads back I posted about the types of money known to modern economies.

Give it some thought.

Don’t conflate money generated by commercial bank loans with money created by Federal borrowing. The first is pervasive through the economy, the second is a one-source spigot.

The resultant effect is profound.

I’ll leave the rest as an exercise to the reader, as I don’t wish to be too pedantic.

I rest my case with “blertâ€. The fact that he chose to pontificate versus answer my question directly shows that he/she is unable to answer a simple question. Not impressed.

“Any darn fool can make something complex; it takes a genius to make something simple.” Albert Einstein

That was a good one blert at 2:06 pm….and I am still pissed off about our military tactics in Viet Nam and political.

Relatively new reader here, I appreciate the Doc’s blog and the comments as well. Doc has discussed on many occasions how central planning is affecting the housing market, but has he ever discussed what is the endgame to all of this central planning?

I’m having trouble wrapping my head around all of this. What happens to the bankrupt GSEs (Fannie/Freddie/FHA?) How does the Fed jettison all of the MBS, let alone all of the Treasuries? What is the exit strategy of the specu-vestors? Will the TBTF banks continue to get even bigger? Does the US continue adding 10% to the nat’l debt each and every year with no consequences? Will we ever see a “free market” again, or is that a thing of the past?

Somebody please tie it all together for me. Because it seems that the central planners are just making shit up as they go, while the talking heads on t.v. are all saying that everything is peaches n cream, the DOW is at a record high, and home values are on the rise. I dunno…call me Kenny Killjoy, but I don’t believe this “recovery” is real.

TJ, here’s what I know. Back in 2008, the banking lobby got Congress to dump FAS 157 (mark-to-market asset valuation), and replaced it with mark-to-model (aka mark-to-madoff). This enabled the TBTF banks to hold on to their impaired GSEs until they could be bought by the Fed at full face value. Today, the Fed is sitting on over $1.4 trillion in impaired mortgages (CMBS and MBS), while the TBTF banks have all their money back.

What isn’t being reported is that the TBTF banks are hiding behind their off-shore funds to buy up failing local banks. Here in my town, Cooperative Bank and Cape Fear Bank were bought by a Bermuda holding company, whose two principal owners were Goldman Sachs and PIMCO. The two local banks failed because they were forced to take TARP money they could never repay. The TBTF banks repaid their 6% TARP loans with money they borrowed from the Fed at .25%. They then had the cash from the impaired MBS sales to buy these local banks. It took me hours to follow their takeover trail. What’s clear is that the big banks have been swallowing the small banks, but the seeds of this consolidation were sewed in 1994, through the Rigel-Neal Act, which allowed the big banks to operate across state lines.

Now here’s a simple scenario to follow. Deutsche Bank lends Blackstone somewhere in the the neighborhood of $3 billion to buy single family rental houses in places like Vegas. Then Deutsche Bank underwrites the rental property securities deal for Blackstone. Then Blackstone, with help from Deutsche Bank, sells the rent-backed securities to pension funds, enabling Blackstone to pay off Deutsche Bank and make a handsome profit. Meanwhile, the pension funds will be stuck with rental backed securities that are no more solvent than 2008’s Gaussian copula driven CDOs. Rumor has it that the Vegas rental properties, that securitize the rental bonds, are running 50% vacancy factors.

On a much, much smaller basis, I actually buy REOs for cash. Without personal connections to bank asset people, i’d be shut out. There is a formula for buying these properties at serious discounts, but few small investors are aware of it.

Thank you Black Swan for your research and information. There were also a couple other key changes to the law that helped the banks rob our country. In 1999 The Banking Modernization Act that repealed Glass-Steagall and allowed brokerages to gamble with depositor money. And the 2005 Bankruptcy reform and consumer protection act that stripped a judges authority to lower a mortgage to current market value thus assuring when the bubble popped the loans that were securitized remained at full face value. This was planned decades ago. Banks have the luxury of time. This was a robbery plain and simple. The robbery continues. We were even fore warned about 200 years ago! If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. – Thomas Jefferson in the debate over the Re-charter of the Bank Bill (1809)

The debasement of the US Dollar has UNIMPAIRED the mortgages.

The mortgages were impaired by nominal asset declines — which have been reversed by ZIRP.

Impaired mortgages have been swapped out for impaired dollars. They no longer swamp the system.

This ‘corrective’ / rescue of the banks nominal balance sheets has been at the core of Fedsury policy lo these past five years.

I’m not an economist, but I think it just winds down slowly. Eventually, the private sector will decide it wants to buy new consumer loans when interest rates go up, and the government will be able to slow its buying. It might be able to unload some paper to investors, and may decide to if it sees it as a good way to soak up excess liquidity. Otherwise, there is nothing wrong with the government holding trillions in mortgages. It will make some money from them, lose some to inflation and otherwise service them like a bank would. Remind me again why we need the private sector to hold paper? I recall some whinging in the article about the rentier class. At least this way we are all homeowners, if not of our own properties, and we have some (very) indirect control over the guy booting us out of our home through the ballot box.

There is a lot of bombast I this article. Cross off everything that can be otherwise interpreted as reversion to historical mean, and the list of complaints grows small. Some outliers:

Fanny / Freddy hold a lot of paper. Not sure if this is really a problem or not.

Some investors swooped in and bought the foreclosure glut. Great! They helped us out when we collectively needed cash and reduced losses from what they otherwise would have been. Will it end well for them? Maybe. Maybe not. The Japaneese bought a bunch of losers in the ’80s. Will the Chinese or the REITs do better? We will see.

Other complaints like employment are just non-sequiturs. We enjoy jobless recoveries in the USA after every recession since 1980 because US labor costs are higher than the rest of the world, and jobs are exportable. They tend to leave faster in recessions. The good news? US labor costs are still higher than most of the rest of the world. You still get paid more. The jobs problem has nuthin’ to do with real estate, unless maybe you are in the construction trades.

I do agree with the complaints about prop 13. The tax policy just isn’t fair. At all. It is particularly unfair to those least able to pay. Prop 13 should be repealed in its entirety. I’d rather have the problems it was intended to fix. There would probably be a lot more affordable housing if some folks tax rates reverted to the rates paid by everyone else. In some cases they’d go up 10 fold. Holding property for decades isn’t an activity that I think the public needs to pay lavishly for.

Hit the books.

Without Proposition 13 the growth of Jerry’s government would be off the hook insane.

It was passed explicitly to stop Jerry Brown all those decades ago. Do revisit the history of the first two Jerry Brown administrations.

BTW, he’s a CLASSIC example of dynastic ‘talent.’ As in: the LAST person you’d want in the wheelhouse.

California has a monk as governor — and, more than you might believe, he’s a cross between a Puritan and a Catholic. Back in the day, he attempted to enter the priesthood, but fell into sin and became a politician, the scourge of all California.

His Puritanism is manifest in his affectations: driving his own Dodge and retiring the official limo, as if that made him a more efficient executive.

Shades of President Carter and his empty briefcase… remember? The prop that Carte used to tote from Marine One to the White House… discovered to be entirely filled with air by the White House Press Corps one fine day when he forgot to pick up his stage prop! That was the LAST time that fake was toted around Marine One. So much for the ‘man of the people’ gag.

The fact is that a top politician doesn’t have the time of day to drive himself. That’s why the public provides limos. They’re expected to work while rolling through the streets. Forget the movies — these fellows are on the phone virtually all day long — unless they’re in formal meetings. It’s the way politics is done.

The ethos of the Catholic Church is, and always has been, anti-economic. The English ONLY took off, economically, AFTER Henry VIII kicked the Church out of England. It’s NOT a coincidence that the famously Catholic nations are economic laggards. Even all of the loot of the New World was not enough to keep Spain in clover.

Even the Puritans had to utterly abandon their economic-religious philosophy in New England: they were starving to death. They found that they HAD to adopt the economic philosophy of their dire enemies: the Protestants! After that, they became astoundingly wealthy. This didn’t mean that they bent their religious orientation. Far from it; Puritanism is STILL a driving ethical impulse in modern America. It’s called everything else instead, of course.

Today it’s reflected in the Green movement and Global Warming, both of which would appeal to the old time Puritans — body and soul. For at the heart of their philosophy is the notion that man, himself, is corruption, and that he ought to not despoil the world — aka God’s work.

Which then evolves down to limits on man and his commerce… and all around plainness in living. It’s a creed that one can see embedded in every manner of ‘new wave’ thinking. Try really, really, old wave, instead. The idea that nature is sacred is ultra-ancient and surely dates back tens of thousands of years. It’s found running through the heads of every shaman any anthropologist has come to know.

Emotional logic has folded back upon itself.

Putting nature on top puts man some place below… which is at the heart of new wave abnegation. What was old is new again.

As for why you don’t feel like the recovery is real, that is because it probably isn’t

…for you.

This is a tale of two nations.

It is the best of times. It is the worst of times.

It is the best of times for you if you:

Have most of your net worth in stock. The market is up something like 2x since 2008.

Pay most of your taxes as capital gains. The tax rate is maybe half of what you’d pay if you earned it as income.

Earn most of your money from corporate profits? Corporate profits are higher than they have ever been.

Do you have an employer that cares enough to buy you a Cadillac health plan. Everyone else is taking yearly cuts to take home pay to pay for healthcare inflation. Your employer doesn’t want to pay more for it. So he doesn’t.

Have a high paying job that the robots haven’t figured out how to toss you out of.

If you don’t have these things, then you are probably not part of the thriving top 1-5%. For most, this economy likely has very little but belt tightening and bitterness on the menu.

Consider *very* carefully which party you vote for next election. Be brave.

If you are so wonderful why are you not creating some jobs? Isn’t that why the top gets all the breaks and deals? So you would rather suck off the rest of the working populace I guess? Parasite making money on off the sweat of everyone else’s backs. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. – Thomas Jefferson in the debate over the Re-charter of the Bank Bill (1809)

Wow Ollman, you sound like the biggest prick to walk the planet! You’re right, I am not in the top 1-5%, but i am in the 25%. I am barely scraping by with a family of 4. And if I’m barely making it, how bout the 75% below me? Not that you’d care.

You said be very careful who to vote for, why don’t you enlighten us.

Unlike stocks… debt securities are of limited term… meaning that the Fed need only STOP buying and its balance sheet starts to shrink. It really is THAT simple.

The Fed simply does NOT trade its balance sheet. It simply buys and holds to maturity.

From time to time (rare) some positions will be traded — but such antics are a joke.

The problem is that a shrinking Fedsury and shrinking commercial loan position would mean that the money supply, itself, is shrinking — and deflation would be out on the loose.

The Feds are terrified about trimming back their asset build-up/ Federal debt expansion as long as the commercial banks are not lending. For if the latter are not lending then they are contracting… the terms of their loans REQUIRE them to be paid down.

The PRIMARY source of modern American money is actually commercial lending. So, now that it’s FLAT to declining… the Feds are freaking out.

For further discussion visit the thread two levels back in time.

Lastly, the average maturity of Federal Reserve assets is surprisingly short. Uncle Sam finances the American economy on a CREDIT CARD! (T bills)

That assumes that the mortages that back the MBS’s are being paid down…

And if we had reality deflation would occur. Should occur! The paper is BS. The reality is there should be deflation. What do you have against Americans being able to buy a house with the wages they earn? The prices are high only due to manipulation and money printing and fraudulent rigged monetary policies. I repeat “If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. – Thomas Jefferson in the debate over the Re-charter of the Bank Bill (1809)” HELLO McFly! We are being robbed by these policies! The 1%are the slimy parasites destroying our country!

The mortgages ARE being paid down or REFINANCED. Period, stop.

But at a price: ZIRP.

So, it’s costing the citizenry PLENTY to make the balance sheets of America look good.

Said support is coming at the expense of the Profit and Loss statement — of the proles.

Hence, real wages are in retrograde.

But, THAT’S the problem. The Fedsury has got it’s priorities warped. It’s killing off Main Street to save the Big Banks/ Wall Street and the Political Class.

======

The #1 corrective is to raise the retirement age ASAP. Until that is done, the Social Spending drain on the Boomer generation is going to flat line the global economy. Americans are living too long. How tragic.

#2 the Medical-pharma cartel MUST be dis-established. It’s run on a COST PLUS basis. This was last seen during WWII for defense contractors. But at least WWII ended. The fight against premature death can never end. We have to get off of Cost Plus economic compensation for the medical-pharma cartel.

Did you know that the hospitals buy drugs directly from big pharma and then MARK THEM UP when re-billing / selling them to the US Government / taxpayers?

Did you know that some drugs run $300,000 per patient — not a typo — to extend life by a mere six months? (Cystic Fibrosis in teens)

Did you know that America is functionally SOLELY responsible for financing all of the new drugs to come on the market? No other nation on Earth is stumping up funds for the new stuff — they’re all waiting upon America. Yes, it’s THAT extreme.

Did you know that American hospitals do, in fact, charge 60x as much for a given drug as it would sell over the counter in Mexico?

Did you know that all foreign nations are thwarting the introduction of the latest and best medical technology — by a full generation or more — because said devices would have to be solely imported from America? (CAT scan machines being at the top of the list. They’re as common as Chicklets in America, a nine month wait for a scan in Canada! That’s right, Canada! Ditto for Britain, France, et. al. Their physicians must be working blind!)

THE driving force behind the Federal budget nightmare is retired Americans. Period, stop. It’s such a huge effect it swamps all other budge stories.

Defense spending is a comparative joke. If anything, we’re not spending enough on the DoD. It’s become THAT small as a budget item. BTW, DoD spending bounces back as Federal income tax revenue — since the vast bulk of said spending generates high income tax bracket returns. By contrast, spending on the retired bounces back practically nothing — as the elderly normally have no Adjusted Gross Income not covered by deductions.

Keep that in mind.

So DoD spending actually nets out to be a LOT lower than it appears — since it gets largely taxed right on back. Social spending is 99.5% a bleeder.

This effect is also seen in Davis-Bacon contract awards. The high wages paid to the blue collar / union crowd come bouncing back as income taxes. Driving D-B wages into the floor must cause said consequential income taxes to evaporate. So D-B is a very poor political fight: it’s impact on the Federal budge is largely a wash.

The above noted income tax bounce back is almost uniformly unrecognized by the punditry. I’ve NEVER seen a single sentence on the phenomena in my lifetime — anywhere.

Our politicians ought to prioritize medical device exports — NOT post excise taxes upon them!

We’re being led by idiots.

“The PRIMARY source of modern American money is actually commercial lending. So, now that it’s FLAT to declining… the Feds are freaking out.”

Blert, I agree with this statement. “What?” also agrees with this statement, based on prior postings. Then, I don’t understand when you disagreed with him, when you were making your case for inflation or debasement of the dollar in regard to fixed assets like real estate.

How do you put the 2 statements together? I understand you case for inflation for gas and food and I agree with that. What I don’t agree or understand is you case for inflation in general – particularly real estate.

If banks don’t lend, velocity of money goes down, credit money supply goes down (for many reasons you and other bloggers already stated and I agree) – how real estate prices continue to increase and stay high? They can go up because controlled inventory; but can it stay up defying gravity given what you, “What?”, I and many bloggers agree?

What is your take on that?

“If banks don’t lend, velocity of money goes down, credit money supply goes down (for many reasons you and other bloggers already stated and I agree) – how real estate prices continue to increase and stay high? They can go up because controlled inventory; but can it stay up defying gravity given what you, “What?â€, I and many bloggers agree?”

1st: Get “velocity of money” as a concept entirely out of your head. It’s intellectual garbage. No-one can control it, it’s a mathematical resultant from equations derived from a disproven theory of economics.

2nd: When banks curtail lending the debtors automatically” pay down their notes. Consequently, the supply of debt backed money shrinks at the exact same time and tempo. With a growing population, even flat banking activity (loan creation) is triggering per capita tightness. This quickly pressures prices across the economy.

The credit supply goes down not because of ‘velocity of money’ but because the terms of the nots DEMAND that the debts be repaid. The terms that dominate the system are those of mortgage amortization. Why? Because the shear size of mortgage debt is so epic. In contrast, all other debts are rolled over.

In the case of auto loans, the Big Three force feed credit at subsidized rates so as to keep the assembly lines rolling. They finally tumbled to the fact that they can’t afford to let the bankers stay in charge of expanding or contracting retail credit.

(They also carry back wholesale credit/ ‘flooring’ for their dealers. This development goes all the way back to Ford’s buy out of the Dodge brothers eighty-seven years ago. But, that’s another long story. Ford’s greatest invention was factory supplied credit, aka Ford Motor Credit Corporation. It’s been mimicked all across industrial America.)

======

Saying that the Red Chinese are NOT going to stop buying should not be conflated with the zany notion that they can lift California real estate into a perpetual bull market. Emotions are causing readers to jump to conclusions.

As previously posted, I expect most California real estate to merely CHURN from here on. The one-way bull move is OVER. Nominal interest rates will back up from here.

But, prices will be ‘sticky.’ When bidders back off — so, too, do offers. Real estate is simply pulled off the market. Because of ZIRP, the mega-banks have STRONG HANDS. They’re able to carry a staggering inventory because they’re being cross subsidized by the Fedsury.

They’re being subsidized because gaming housing statistics is all a part of the PTB’s master plan to fake out the proles. One need only listen to any of the financial channels to hear the spew.

E.G. Year over year employment — the absolute figure — is down. The absolute population is up. But since the increased population (2,000,000+ souls) has, technically, not been laid off; official unemployment stats are reported to be in decline!

The short form: the employable population expands by 2,000,000+, actual employee ranks shrink, unemployment is reported to be dropping. That’s doublethink for you.

Pulling real estate off the market — metering its availability — has been practiced in Hawaii for generations. Trust me, if the current owners have strong hands, they can keep the supply high and tight for generations. All they need is cash flow/ financing. The mega-banks have both. They also have the explicit support of the US Federal Government. Said support is not broadcast to the proles. You have to figure it out on your own.

Hawaiian real estate prices have defied gravity for the last fifty-years. That’s what strong hands can do.

You’d do well to study the Hawaiian real estate market’s history — for it’s a bell weather for what’s in store for California. Like California, everyone would love to retire and live in Hawaii… even more so. It’s just that the authorities have conspired to keep haoles back on the mainland — and their number one mechanism is keeping rents and land values in orbit. This makes it sweet for old money (the Japanese locals) while repelling immigrant Whites. And, yes, it’s official policy.

You’d not believe what prior governors have been caught saying on open microphones! Yes, it’s racism, over the top. They conduct it without even blushing. Come to think of it, they hate/ fear anyone who is NOT local — to include Japanese Americans born and raised on the mainland! It’s not a pretty picture — and never given MSM publicity.

The only time I’ve ever seen it addressed is on some of the old Hawaii Five-0 episodes — in a fictional setting.

The truth is that local (kama’aina/ aka son of the land — applies to all native born races) Hawaiians can’t get over the wealth that the visiting tourists throw around. It never occurs to them that the tourists are spending years of savings in a brief time to have a blast; that they’re looking at a complete aberration in spending behavior. This is true whether the tourist is coming from Tokyo, Vancouver or Des Moines.

This finds its echo in Californians who can’t get over the fat wad that Red Chinese real estate investors are throwing down to buy in. What they’re looking at are the extreme top-end of Chinese wealth — the equivalent to multi-millionaires in American economic culture.

Lest Californians forget: such hyper-wealthy Chinese are not THAT common. If every immigrant had their profile, America would have no problems in this world, for they are both bright and rich.

The one-way — Carleton Sheets — market has reached its end.

It can’t come back until the PTB decide that Main Street is more important than Wall Street.

Mortgage rates approaching a high for the year:

http://money.cnn.com/2013/12/05/real_estate/mortgage-rate-rise/index.html

All you really need to do is track the daily rates on the 10 year U.S. treasury. http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

Add 160 (plus or minus 10) basis points to the 10 year U.S. treasury yield and that will tell you what the 30 year mortgage rates will be in about one week.

Since 30 year mortgages are chopped up into 10 year mortgage backed securities (MBS’) this is why the 10 year U.S. treasury note is a leading indicator for the 30 year mortgage rates.

The average weighted maturity of 30 year SFH mortgages has been 7.5 years going back three generations.

This shortness of being is largely do to home sales which trigger a complete liquidation of the mortgages. Refinance during interest rate declines REALLY pulls the weighted maturities forward.

Now that interest rates are at rock bottom, refinance into lower rates can be safely excluded.

But, there is a hitch. Who is going to want to move on to a new job in a new city if it means abandoning a super sweet mortgage contract in the old home town? In most markets, even renting out the old home can’t pencil out: not enough equity — too much of a mortgage nut — for the rent to cover.

Figure on labor mobility to be repressed; suppressing economic performance in subtle ways across the national economy. That’s just perfect.

Cash buyers are going crazy in South Pasadena, CA. We just got outbid on 2 houses where we were offering 20% down by two all cash offers over list price.

Deflation is going to bring this entire complex crashing down. This is why metals are sliding.

I don’t understand how deflation can occur amid so much money-printing.

The velocity of money is really low–there’s a ton of money on the balance sheets of banks, and they simply sit on it rather than make loans. Therefore, business investment/spending remains low, so more goods are chasing fewer dollars. Same carries over to the consumer. An example is gas prices–in winter, they typically drop vs. the summer when more folks want to hit the open road, i.e. demand is higher. If everyone remains in an economic winter, there’s a threat that pricing will fall, overall.

See my comment above to blert. I am not convinced that money supply has really grown since 2007 it has just changed form. I think that you would need both an increase in total money supply plus an increase in velocity to have inflation. As blert said in another post the Fed is scared to death of deflation. I remember in my econ classes in business school the instructor stating that deflation has a way worse impact on an economy than inflation. When you can “buy†(not “byâ€) more goods and services with your currency on hand tomorrow than today there is an incentive to put off consumption. On the other hand, when you can “buy†(not “byâ€) less goods and services with your currency on hand tomorrow than today there is an incentive spend all of your currency on consumption today. The fact that happiness is measured “by†(not “buyâ€) the amount of crap you consume makes us prefer the latter. Not to say that “there†(not “theirâ€) are not a lot of bad consequences to inflation it is just considered the lesser of the “two†(not “toâ€) evils…

@son of a landlord,

We are living in this bizarre alternate universe of inflation in the things we need and disinflation in the things we don’t need. Disinflation should not be confused with deflation.

I see commodities falling because there is no demand, e.g. capital investment, by business. We are on this weird balance between deflation and inflation–I could make a case for a severe episode of either being around the corner. Hang on…

You’re not looking at classic deflation. Red China is simply slowing down — more as a classic Recession.

There’s no shrinkage in the availability of the yuan/ renmimbi. So deflation can’t be correct.

Deflation is ALWAYS associated with a retrenchment in lending against real estate — the dominant source of modern money creation — by far.

The vast, vast, bulk of modern money is established by putting mortgages upon real estate. The size of the ticket is large — the term of the paper is long.

In contrast, all other paper/ loans retire much quicker and are trivial in size — comparatively.

So, THAT’S why the economy hit a rough patch when real estate mortgage originations turned down in 2007. THAT’S deflationary.

Trimming down manufactures and intermediates causes RECESSIONS. They’re a totally different beast — and the one that the typical economist mistakes for what’s happening even now.

Duh!

Hence the farcical term: Great Recession. As IF!

Massive contraction in mortgage originations = Greatest Depression.

Period, stop.

Housing to Tank hard soon!

Mortgage apps at lowest levels since 2000!!!

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2013/12/20131204_mba.jpg

Check back two blog threads…

All-cash buyers have picked up the slack in the hot markets — which includes California.

Cash is buying half the market in Nevada.

Do re-read the OP at the very top: this is what you’d expect as neo-feudalism hits modern urbanities.

True that. But once investors fuly have taken their position, which I believe happened 6 months. Who is left to keep buying to move prices up? The retail buyer has panic bought to move this last wave of prices up. Once we hit a mild downturn the investors will jump out to realize their profits and the ship comes down.

JT…

Real estate prices are ‘sticky’… one lives inside a stock certificate… for most buyers it’s impossible to exit the market and stand on the sidelines — let alone short the market.

Hence, trading in real estate is confined to a very, very, narrow segment of society — more towards an mythic entity.

Because of the shear cost of exiting a position — and the leverage involved — most real estate positions don’t turn over.

The sole exceptions being flips in raging bull markets.

We’re now past that stage in all but a few markets — those dominated by foreign monies.

=====

Real estate is driven by the ability to carry a mortgage. Eroding per capita incomes DESTROY the ability to finance mortgages. This long term, bleeding, trend has been under way for many years now. On a short to intermediate term basis, the Fed can swamp that decline by gaming the mortgage market.

From this point forward, the Fed is looking down the barrel of a long term, multi-generational inversion in interest rate trends.

The last time I called for such a turn was September 1, 1981 with the insane coupons issued by WPPSS. They were 15.5% Federally tax free — and backed — de facto — by a first mortgage on Grand Coulee Dam! Actually, better than a first mortgage… but I’ll skip the details since these instruments are now all retired.

At the time I made the call I was deemed a green fool not wise in the ways of the world. As the years passed, my critics couldn’t look me in the eye.

We have now travelled entirely down the road that I foresaw all those decades ago.

From here on, the trend will be towards (nominally) higher interest rates for decades to come. (Hot war would terminate such a trend, BTW.)

=====

What the reader has to ALWAYS keep in mind is that the Fedsury is massively debasing the unit of account: the US Dollar.

If you’re stuck INSIDE the US Dollar world then the Fedsury is able to enact Financial Repression (Google the term) and escape is difficult.

Commodities prices are NOT determined by American markets. The marginal buyer is now Red China. She is NOT deflating. Quite the reverse — Beijing’s money stock inflation is off the hook — many multiples of the rest of the planet combined.

This astounding boodle is restrained from exodus by Capital Controls. We’re only seeing the leakage in California real estate. Should Beijing permit open flows the financial exodus would astound.

It’s because ALL of the Red Chinese real estate buyers are law breakers that you know that their monies are one-way flows. The vast bulk of these players have direct political connections straight to the top.

The Fedsury is rigging the mortgage market such that California real estate just can’t fall — in nominal terms. That doesn’t mean that — adjusted for hyperinflation — that real estate is holding its own.

All real estate bears want and expect NOMINAL prices to break. It does them absolutely no good if the nominal price stays the same — while the value of the US Dollar craters. They don’t have non-dollar asset exposure.

When I post that nominal prices will not decline, bears are frustrated.

It only gets worse when they realize that — due to the monkey business of the Fedsury — their own ability to stump up investment capital is being severely impaired.

The projected result is that they’re going to witness declines in real values in real estate — that they will be entirely unable to take advantage of.

This is but a part of Financial Repression.

In this environment, it will be the foreigners who come out smelling sweet.

I give you American buyers of German real assets in 1922-23. Be it stocks or real estate, Americans could buy up everything in sight for peanuts. You’d be shocked as to how cheap Daimler-Benz was selling vs General Motors. GM could’ve bought Mercedes for loose change from the till!

Instead of focussing on California real estate — zone in on the major trend: the debasement of fiat currencies on a global basis.

Finally, there are FOUR different modern mechanisms for creating money — syndicating CDO’s is NOT one of them. Such syndications don’t create new money. They’ve never been recognized as doing so by the Federal Reserve Bank, either.

LIquidity creation is NOT the same thing as money creation… not when you have to stump up financial paper to create the CDO.

Commercial banks make money, ab initio. Wall Street syndications DON’T.

Federal deficits papered over by the Federal Reserve Bank make money, ab initio.

These two, entirely different mechanisms, create visually identical monies — in the public eye — yet have entirely different economic effects.

This last point baffles both the brainiacs at the Fed and more than a few posters here.

For commercial banks inject monies throughout the economy — generating INFLATION across the entire gamut — particularly wage inflation.

The US Government does not inject monies throughout the economy — just through the Primary Dealers. It’s a SPIGOT of currency. They get to touch it first. Main Street is left out of the money creation loop.

Right there, in a few sentences, you have the ENTIRE explanation as to why the bankers are pulling away from the rest of society.

As for those teeing off on the velocity of money — you’re utterly lost. VoM is an entirely useless metric. It’s a residual math valued used to make wrongful economic theories ‘add up.’

Larry Summers is a devotee of such nostrums. He’s also the same fool who lost staggering amounts of the Harvard Endowment Fund — buying assets I wouldn’t have touched with a ten-foot pole.

Even a brilliant mind — equipped with wrongful nostrums — can’t produce good results.

Again, read Steve Keen’s blog post.

BTW, he has a chat with Max Keiser — now up.

Trouble is, it’s too chatty and presumes that one’s already entirely up to speed. Consequently, even above average investors are going to be left spinning… he’s covering too much ground… and the conversation veers into a social call.

One CANNOT live inside a stock certificate… whereas homes…

Granted its only been 1 year since I purchased a home here in LA, LA, LAnd, I dont see any indications it was not a good time to purchase. People ranted and raved about how home prices would crash and how rental rates will plummet and how there will be a wave of inventory coming onto the market, and how home prices will drop when PMI on FHA loans will ride for the life of the loan and how higher interest rates will kill the demand for housing. Anyway, house prices will drop ‘someday’ but no one knows how/when. In the mean time, even if prices do drop 20% in 2014, prices have risen 15% this past year alone. Go figure.

QE, we’ve been hearing RE will crash big in 2010, 2011, 2012, 2013, 2014…….

Meanwhile, people who bought a few years ago are sitting very pretty. They are locked in at absurdly low rates, likely below rental parity and are sitting on quite a nice equity cushion. They are not going anywhere!

RE should have been allowed to go much lower, but it wasn’t allowed to for a myriad of reasons. For anybody to think that economic normalcy will return in the near future is truly insane at this point. It is different this time!

Interestingly, you left out years prior to 2010.

“Meanwhile” doesn’t help hedge for the future.

Hope you’re stocked up on wood and wine for the endless warm and sunny weather we’ve been having.

Ok, Joe you got me there.

I’m going out on a limb here. There were essentially 3 years in the last 20 where RE in desirable parts of Socal should have been avoided at all costs. Those years were 2005, 2006, and 2007. Anybody who bought in any of the other years with a 20% down and didn’t stretch themselves to the max should have absolutely nothing to worry about.

Regarding the weather. It’s been cold for socal standards. Turn on the news and see what it’s like in flyover country. I’ll take 55 degrees with rain showers anytime compared to that crap.

Lord, how about 1993, 1994 and 1995? Didn’t it go down then?

Yet, here you are, bringing it up. Is it making you feel better yet?

If the titles/properties being ‘bought’ are not alloidal its a moot point. The government still owns your land if you are still paying property tax. Ya’ll missed the point. Even the author. Show me anywhere outside of some places in Texas etc. that still have no property tax in North America (outside Mexico) and your land can not be stolen by outstanding property tax or eminent domain. Duh…

Thank you Lance! True that! No property rights left. Renters all. Fake property ownership. How would you like to buy a tv and pay tax every year for the rest of its life or lose it if you don’t keep paying tax on your purchase every year? Lol that’s property “ownership” today. How the Hell did we allow our so called representatives to thoroughly screw us over like this? Were we all asleep?

This is hands down the most important point. I try to make this time and time again with those folks who believe that when Armageddon comes at least I own my home. Well if there is a mortgage, the bank owns your home. If there is no mortgage, there is nothing to stop governments from taxing you out of your home by the means you suggest.

Just like a monetary currency, a land deed is ultimately only as good as the military which backs it. It’s simply a claim that the government recognizes. In a lawless scenario, it doesn’t amount to anything.

“there is nothing to stop governments from taxing you out of your home by the means you suggest.”

What?, I think most would agree that property taxes are too high, and they never feel like they are getting much bang for their buck. But to say that municipalities can tax you out of your house? If that was the case, the city of Detroit would not be bankrupt, because they’d keep jacking up tax rates to the moon. If taxes get too high, people don’t wanna pay…they just leave.

Eminent Domain may be a compelled sale — but you’re to be compensated.

You’re correct that property taxes go wild when the local authorities overspend their bounds.

Take a look at the Detroit tragedy. That blighted city kept raising property taxes even as residents fled. At this time Detroit property taxes are absurd — yet still unable to support the pension drain — let alone ordinary services.

This impulse is typical for economies in their death throes.

Take a peak at the zany taxation during the decay of the Roman Empire. It ultimately destroyed itself by way of taxation.

Like the mythic Tara, many an estate will be lost to the tax man during economic disruption/ hyperinflation.

BTW, when hyperinflation really gets rolling the authorities can’t re-jigger the figures fast enough to catch up. They will often start to use the utilities bills as a second stab at your wallet. (see Greece, 2012)

Blert wrote: “Like the mythic Tara, many an estate will be lost to the tax man during economic disruption/ hyperinflation.”

Blert, is the “mythic Tara” you describe the plantation in Gone With the Wind? Tara was never “lost to the tax man”. Scarlett O’Hara was going to ask Rhett Butler for money to pay the taxes on Tara, but since Rhett was in jail, she quickly married Frank Kennedy, who gave her the money to pay the taxes on Tara.

True enough, Scarlett — in so many words — had to prostitute herself. At the time of the novel, her acts were more scandalous than being a porn star in 2013.

Her first attempt was a bust.

So, she hooked up with Mr. Kennedy — gold digging plain and simple.

Perhaps the best synopsis of what the housing market has become.

Actions speak louder than words.

Even back in 2012 all the major players in housing were betting on a rental class demand follow through for the next few years

http://loganmohtashami.com/2012/04/02/housing-actions-speak-louder-than-words/

How bad will things get before people just go bezerk? If things continue this way another 10 years we will likely have world war III or a full-scale civil war/revolution.

I bought into that in 08 and it never materialized. People WILL trade their liberty for security. Socialism, here we come.

Historically, that would be very much against the odds.

Cf Weimar Germany, Argentina, Russia 1998…

When every other nation is wracked with disruption you just don’t have WWIII….

BTW, WWIII has come and gone: it’s known as the Cold War.

We’re already inside WWIV aka War on Terror.

So, you must be thinking of WWV.

Even civil war would be WAY out of the historical norm.

What really happens is the entire nation goes into a funk.

There are no enemies for the army/ militia/ citizens to march against.

Ideologically, everyone is lost. No-one knows what button to push.

See: FDR, his ‘lost’ first two terms, a swirl of confused government meddling.

Back in the early 70s, my Dad was able to buy a nice 3BR/2BA spanish style house in Long Beach (Belmont Heights), 8 blocks from the beach, on a little over 10 percent of his income as a fed. employee (single income). I am now 50+ and have absolutely no chance to buy anything close to that nice of a house, and I make well over double what he made in income (not adjusted for inflation). I have no debt, one child in college and one at home, and a single income. Yet, the “American Dream” of doing better than your parents is nowhere to be found for me, despite being debt free, fiscally sound (nice 401K, if it is worth anything by the time I retire), an advanced degree that my Dad didn’t have, and cash savings. That house he bought in the 70s is probably well over $1.0MM (assessed $936K). I couldn’t come anywhere near to buying that house today, despite my advanced education and professional career. I sure hope my son figures out how to do “better†than I have, and he will leave college debt-free (unlike me). This is the scenario that so many of today’s youth will face going forward. It’s extremely difficult to duplicate what their parents did, and even harder to duplicate what many of their grandparents did.

True.

Middle class incomes have been in retrograde for two generations.

Thank you OPEC.

That’s where the wealth went.

When we were kids CA had about 18M people. Today it’s over twice that and with many more high paying jobs then in the 1970’s. So there’s a lot more demand and the supply has not changed too much over the years.

leave California

Rental Backed Securities are the next thing to hit the market and then implode. This is how Wall Street and the big banks make money. Securitize tons of garbage that Moody’s gives a AAA rating to and then exit stage left. Watch what happens to all the pension funds in the next few years as they buy this crap and other instruments on the market in order to get to their much needed 8% return number in order to be solvent. This will be one huge catastrophe for America as 78M Boomer came into retirement age…..and not much will be there for them.

Boomer retirements will be delayed on a massive scale.

Thank you ZIRP.

This trend is now well under way.

With the cutbacks and cut ups of Medicare, what citizen now wants to retire?