Young and priced out of the US housing market: Mortgage debt traded for student debt. The dramatic fall in homeownership for those 40 and younger.

The New York Fed issues a quarterly report on credit conditions in the US. The recent report highlights a continuing trend showing young Americans are going deep into debt to pay for their expensive college educations. In fact, student debt is now the largest non-mortgage related debt in the country. This problem reflects a big issue for young potential home buyers. It also helps to explain why the homeownership rate for young households continues to fall and why many young adults are living at home. Many are coming out of college with student debt levels of $50,000 or even $100,000 and job opportunities are not justifying the costs for many graduates. Yet given our lack of good pay blue collar work, going this road is perceived as viable given that non-college educated Americans have very limited opportunities. Given the recent rise in home prices and lack of wage growth especially for the young, it is likely that the homeownership rate will continue to fall for this group. In places like California many parents are finding it necessary to gift or provide down payment assistance for their children to buy even a starter home. This assistance isn’t a few thousand dollars but tens of thousands or even hundreds of thousands of dollars. The young are being priced out of buying a home.

Student debt

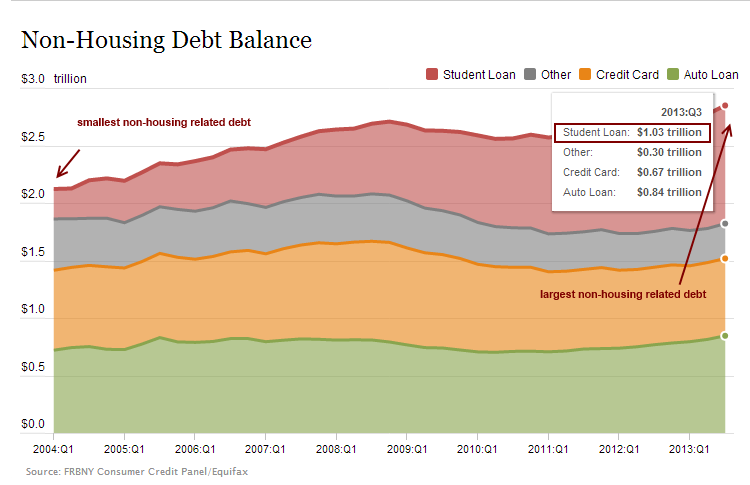

Only a decade ago student debt was the smallest non-mortgage related debt in the country. In 2004 $260 billion in student debt was outstanding.  Today? Student debt is now up to $1.03 trillion:

This is a dramatic shift. Also, we have the largest percentage of young Americans going to college. It is a good thing to get an education but at what cost? Also, when you get this expensive, you have to place a value on the type of degree you are pursuing and cost. This might be a big task for those 18-to-22 years of age. A few decades ago you make this mistake and you have a piece of paper and a manageable amount of debt (or in most cases zero debt). Today, you make this mistake and you enter debt servitude. It is clear that many are unable to pay their student debt:

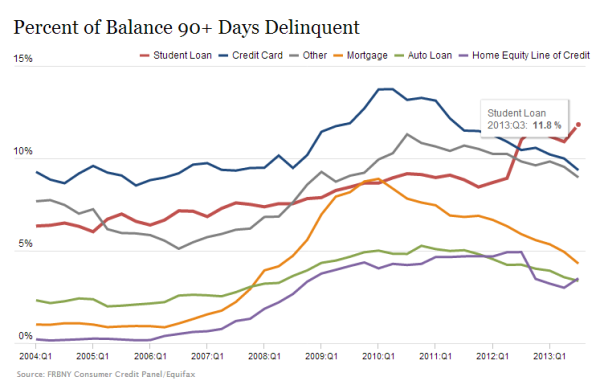

This is a startling reversal. Student debt is now the most delinquent debt class. 11.8 percent of all student debt is now 90+ days past due. As we just noted, this is now the biggest non-mortgage related debt sector in the US. Of course this is going to be an impact on the ability for young households to buy. Many young Americans simply cannot buy and given the current short supply of inventory, rising costs, and massive investor demand many have very little chance of buying a home. No need to speculate on this, we need only look at the hard numbers.

Ownership by age

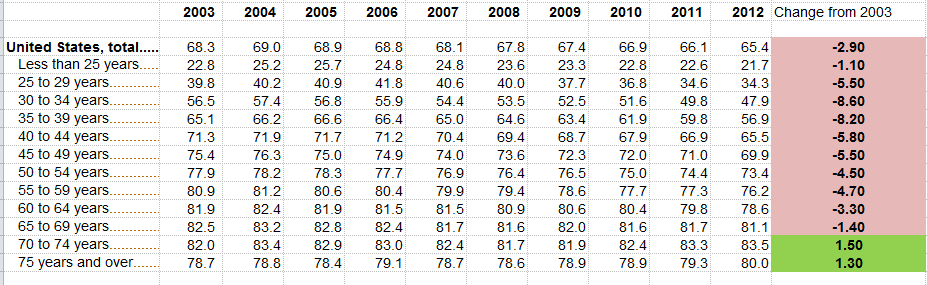

As you would expect, over the last 10 years the homeownership rate for all age ranges has fallen except for the old (those 70 and older). What is more important is the magnitude of the drop for those 25 to 29, 30 to 34, and 35 to 39 which historically have been the prime first home buying age ranges:

If you look at the data carefully, you notice a slight move up during the bubble years of 2005 to 2007, however this was built on NINJA loans and ignoring income. That was really the only thing that allowed this group to gain access to homeownership. However, this has quickly reversed given the weak employment market for the young and the massive amount of student debt being carried by this group.

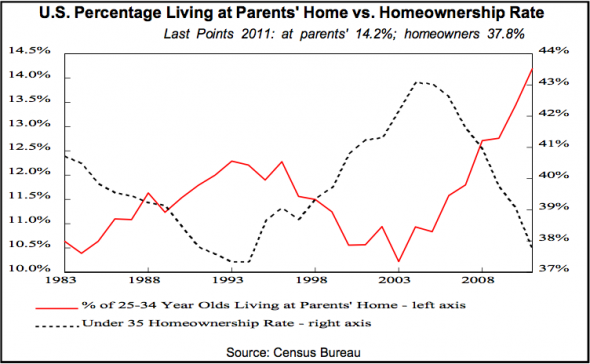

As you would expect a large number of younger Americans are living at home.

Percent living at home

Many young people are living at home given the current economic conditions at hand:

This is a major shift. Yet we are seeing a repeat of history. Some people naively think it is normal to save $100,000 as a down payment for an old World War II built home (as if this was normal). In fact, 20 percent down in many cases is equal to the gross income of a professional working couple for one year. Even in high income California, 72 percent of households make less than $100,000 (the median income being around $58,000). Even a decade ago a down payment was typically half or less annual gross income. So it is no surprise that low down payment loans are on the rise again given the current euphoria:

“(USA Today) Loans with down payments between 5% and 10% accounted for almost a fifth of the conventional loan offers that lenders made on the LendingTree online exchange in the first quarter, according to LendingTree.

That’s up from just 6% of conventional loan offers in last year’s first quarter and only 1% of the offers in 2011’s first three months.â€

In other words, the young have a hard time saving given their heavy debts and lower incomes so lenders are just dropping the amount needed to buy. In SoCal FHA insured loans with a 3.5 percent down payment are still 20 percent of the market. So you have the large investors buying with all-cash and then you have regular households stretching their budgets to get in. It is no surprise then that affordability has fallen dramatically even in the last year. The answer to this as it was during the last bubble is simply to increase the amount of debt shouldered by households. This continues to work so long as prices keep going up.

Do you know of anyone that is young (35 and younger) and buying in this current market? It would be interesting to hear your story in the comments and information since many are probably in similar situations.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

111 Responses to “Young and priced out of the US housing market: Mortgage debt traded for student debt. The dramatic fall in homeownership for those 40 and younger.”

Yes, my daughter is trying to buy a home but she just graduated from a university and is having trouble getting a loan because of the high amount of debt she has. Even if I cosign, there is still a serious amount of hesitation to give a loan.

Most of my friends are in the same boat. I lucked out an was able to keep my three jobs while going to grad school to avoid loans, have no student loan debt and still can’t afford a home in So Cal. Bad timing since by the time I got my job after I finshed the degree prices shot up due to investicrats and speculators. Homes were 100k lower 12 months ago. No wage growth to support that.

The younger generation is getting screwed. The city where I live is full of older folks who bought their now million dollars homes for low 100ks or below. Their kids can’t afford to buy a home or even rent and move back to the area. No one seems to recognize that rising interest rates and no income growth mean we can afford less home, not the inflated prices being posted on MLS. It really sucks to save and do everything “right” (MA, no personal debt, sharing one car, no iphone etc.) and still feel just as screwed as the next guy.

Why would you want to live in city filled with older folks? Don’t you want to live in a place with alot of people your age? Have you looked into other places around the country where there are alot of younger people and the housing is more affordable than SoCal? Might be time to take charge of the situation, waiting around for housing to get cheaper is a bad bet, might be time to relocate and move on with your life.

Awww, poor thing. Guess she’ll just have to save her money in order to increase the downpayment, so maybe no iPhone (get a pre-paid for $25 month), no upper tier cable package (buy an antenna), no Outback restaurant every Friday nite (learn to cook honey), no new ride from Government Motors (you can repair the current ride, can’t you Dad?), no retail therapy at the mall every weekend buying the latest from asian sweatshops (learn to sew and repair what you already wear) and on and on.

Not sure who is worse, the current generation of consume and spenders or their doting, imbecilic parents. I’m leaning to the latter, but it’s a tough call.

OK it’s one thing to blow your money, which is not advisable, but it’s another when you start talking about the basics of

#1 it’s 2013

#2 not having to live like a pauper and being an actual American that our Vets fought for.

There is NO reason housing can’t be affordable for everyone

Tim, I pretty much agree. I have to blame the parents first, they brought them up. Looking at my friend’s kids, all so spoiled, parents bought them everything, paid for their college, BMW’s vacations, shopping trips, etc. So thankful my generation had to work hard for everything, still do and being independent. Yes, quite true kids today will have a more difficult time when/if they decide to purchase a house, most can barely afford to rent and still lean on their parents to help out, sad but that’s reality.

I bought a condominium in DTLA at the end of 2011 at the age of 27. Because the condo was straddling an area considered low-income, I qualified for a special 5% down payment loan with no PMI offerred by a particularl bank. This was helpful because I was only been working for 16 months since completing grad school. This was before the recent spike in prices, and I paid only $181K for a decent-sized studio. In the current market, the condo is said to be worth at least $300K — I was able to get in with only $9K plus closing costs. Admittedly, not many of my friends my age were buying real estate (none, really), and I had only my instincts and a great deal of studying first-time homebuyers guides to go off of (and a good real estate ageant). I am one of those young people with a large amount of debt (over $100K). Because the size of my payments are contingent on the size of my income, I was able to manage the mortgage, taxes, and HOA fees comfortably. Without a readily available low-interest mortgage, an income based repayment option for my educational loans, and a secure job, I would not have been able to obtain a mortgage, particularly not at 27. I consider myself very fortunate. Many others in my age group are not as lucky. (Side note: a year later I was able to re-finance from a respectable 4.125, 30-year loan to an outrageous 2.625, 15-year mortgage. I am renting out the condo for about the mortgage payment, and plan to do so until I own it free-and-clear).

If you can sell for $300k and pocket $100k, do it. Pay off your loans. You’re insane not to.

I am young. Looked to buy for over 3+ plus years. Prices in nice safe neighborhoods just did not get in my affordability range. So I litteraly gave up looking June 2012 once they shot back up.

Thank this Market now!!

I’m one of the 35s and younger crowd. I went to graduate school, got my doctorate in Pharmacy. It costed me $150K of student loan. I make about $135K a year, bought a house in 2011. Because of the student loan debt, the bank only qualifies my mortgage for $300K. It’s ludicrous to see how the home price kept climbing up at an unsustainable rate. The statistic won’t lie, and frankly, I want to get rid of the house and renting. Why? I’m working all the time and rather just share a room with some other single people than owning a big house, making payment for the flies and mosquitos to live in my house. And we’re talking about the house I bought were at rock bottom price with rock bottom rate. But still, I’m thinking about selling it and rent…

I hear things are not good for recent Pharmacy school graduates.

If the govt were to lower caps on student loans to, say, $10,000 per year of college, or maybe even less, then students wouldn’t be able to afford exorbitant college tuition.

That doesn’t mean students wouldn’t afford college — but rather, that colleges would be forced to cut back. No more six figure salaries for deans, presidents, administrators, or even some professors.

Lower the cap on student loans, and colleges would be forced to either cut salaries, or close. Almost all of them would cut salaries. A good thing. Being a tenured college prof would still be far cushier and secure than working in the free market. The profs and administrators would complain, loudly, and maybe even sue — but not quit.

Cheaper education is a good thing, just as cheaper housing is a good thing.

Stop subsidizing either, and the price will go down.

As someone who is apart of the University construct, I cannot tell you how absolutely ridiculous the pay scales are and how much waste there is on folks that do absolutely nothing getting paid salaries far exceeding their actual worth and nothing is done about it because everyone at the University is about “the culture” instead of actual accomplishment and doing the right thing. And this is just one department……

I am speaking from first person experience as someone who is in their early 30s and in the market. Currently making 125K a year and still living at home. I have debts save a very negligible student loan debt. So why still live here?

I’ve been in the market for almost a year at this point and I’ve watched the market in orange county rise considerably during this time in the 10 to 15% range. Early in the year prices were relatively high to my income, interest rates were low, and it was going to be a stretch for me to buy, there were 20-30 offers on even the most marginally desirable properties and those went to those with all cash offers or wanting to waive appraisal or some other voodoo I wasn’t willing to do. Then summer came, taper talk started, interest rates rose and the market literally came to a screeching halt. That lasted about 2 months until the latest round of we are printing forever talk. It’s been a frustrating endeavor. I am not willing to shell out my savings for some 20-30 year 1200 sq ft home in a decent area because “that’s the current market”. I’ve only seen two homes over the course of 12 months I’ve been interested in purchasing. Both went for far more than I was willing to spend on them.

The value proposition of owning a home in my mind just isn’t there right now and I am in the camp that believes that renting is simply hemorrhaging money that I could be saving toward a larger down payment – right or wrong- it’s what I think is the right thing to do so I am doing it. I’ve saved up about 150K in cash for if and when I find something that makes sense both as a place I can afford and as a place I will enjoy living in. I often wonder who is it that is willing to pay for these inflated prices that are currently in the market as I see homes go pending.

I feel everyone’s pain in my age group and situation. We can thank all the b.s. that occurred over the last few years that has gotten us into the stuck generation. Can kicking, money printing, squatting, and protecting the banks from themselves using taxpayer dollars. Well done TPTB.

I’m just happy for a few of my friends who got in on the cheap during 2010 and 2011. In the mean time, I feel like my strategy is spitting a bit of water and showing the middle finger to the entire construct that is expected for those in my age group to participate in – even if it means taking on huge sums of debt that would leave us eating ramen for the next few years every night – by simply refusing to play the game.

“Currently making 125K a year and still living at home.” “I’ve saved up about 150K in cash for if and when I find something that makes sense both as a place I can afford and as a place I will enjoy living in.”

“So why still live here?”

There is the hard question. Also what other things in life are people willing to sacrifice to buy a house in California? Best of luck to you.

Thank goodness for lots of bubbles and crashes. Great times for investors, while also great tax rates for investors…..like me, who exited the workforce decades ago, for that reason. And, never took out a mortgage. Cash talks, on everything.

There are many advantages to investing in real estate, even though many commenters still consider it to be toxic waste. The two biggest advantages are that there is no self employment tax, and you get to depreciate an appreciating asset.

Real estate is not toxic waste. It is simply mispriced due to central bank and government manipulations in the lending markets.

Consider Japanese residential housing ….. now selling at 1983 prices. It is not a stretch to imagine that the USA is setting sail on the same boat.

http://www.doctorhousingbubble.com/japan-real-estate-bubble-home-prices-back-30-years-zero-percent-mortgage-rates/

If you would have told me in 2009 that in 2013 that Gold and Silver are down for 2.5 years, stock market is at all time highs, housing has substantially recovered, and 30 year mortgage rates are at 3.5%, I would have told you that you are delusional.

I just don’t understand that economy that we live in anymore.

QE drives up stock and housing prices while naked short selling drives down gold and silver

Well said. Unbelieveable what has happened. Time for this market to Tank hard in 2014!!

Classic parallel to the housing market.

The government decides everyone should own a home and go to college. They set up programs and loans that drive up the cost and cause defaults wasting billions in the process and enriching the banks.

The high levels of student debt is the outcome of our new entitlement era. Confidence and praise are no longer earned but handed out for free by parents. The goal is to give 100% of students a chance of higher education, even if only subset (e.g. 30%) of jobs require it. The unqualified that cannot pay back the cost of higher education have their debt forgiven (somewhat) by the taxpayers. So, as an example, for a college student sitting in a class room, look to the student on your right and on your left, one of you will be paying the student debt (at least partially) for the other two.

Now on paper, student debt is extremely harsh, and the government can essentially go after one’s disability even. But the reality is, the student will work out a plan w/ the government, pay a low interest for 10 years, and the debt will be forgiven.

I propose WHEN student loan debt is forgiven, it should be paid by the taxpayers in the respective age group. Each generation is responsible for their own short comings.

So stupid you can’t be serious.

Ok, my generation will take that deal IF the Boomers pick up the tab for the Iraq war, Bush/Cheney Boondogle, Helicopter Ben, Greenspan, etc.

Oh, and please pay back the greatest generation for the money they spent in taxes so you could go to school for free, and get good paying union jobs with pensions. That check can be made out to fund social security, which the boomer politicians have consistently borrowed from so they can claim it is bankrupt and try to give Goldman Sachs more customers. Thanks!

Nice!

My partner and I are in the under-35 camp and just bought our first home. It was a struggle to buy even though we are in the top 15% of income earners for LA/Long Beach and have kept our expenses low so we could save and work in jobs we actually like. The mortgage doubled our housing expense, but we want to eventually start a family and needed more space and privacy than our 700sf apartment with thin walls.

Re student debt: I have about $35k of student loans from grad school – despite my partner helping me out with living expenses while I was in school. Having both been with and without student debt (no debt from undergrad, and I worked for a few years after), it’s striking to me that people don’t see the problem with these massive debt loads. Instead of my disposable income going to my community (restaurants, retail, etc), it’s going to the financial industry which does not really aid in the economic recovery. In addition, these debt loads constrain the sorts of jobs that people can take. I was able to go into low-paid public service / non-profit with my elite undergrad education. Now with the grad school debt I *have* to earn a certain amount a year and that automatically eliminates a lot of jobs where I would be giving back to the community.

Re the house: We bought the house only on my partner’s income, and with about $15k help from the parents, because I feel extremely insecure about this “recovery” and wanted to make sure we could pay the mortgage even if one of us lost our jobs (despite neither of us EVER being unwillingly without a job, but this gives you an idea of how unsafe people in my age bracket feel versus boomers who did not have this sort of instability) . Our RE agent was very conservative and pre-qualified us for $435k purchase price. Everyone else – friends, family, coworkers, loan officers – kept pushing us to spend up to $700k!

“Buy as much house as you can afford” was what I kept hearing – but when i see my friends being laid off, see my own wages stagnating, see my parents’ carefully-planned retirement derailed by medical issues in a country that believes healthcare is a privilege and not a right, “affordability” takes on a totally different meaning. They told us we didn’t need 20% down, but we did, there was no other way any seller would have considered us in this market. They told us to buy a fixer to save money and get more upside, but we both work 10 – 16 hours a day, when would we have the time to fix up the house? They told us to buy in the valley to get more house than the WWII-era 2 bed 1 bath we ended up with, but all the jobs are in downtown or the westside, and with the aforementioned 10 – 16 hour days, a 1 hour commute is out of the question.

Every day I’m thankful we were able to buy a house, and I’m thankful we were able to do it in a way that doesn’t derail our other financial goals. But as hard we worked to get here, I also know it was partly sheer dumb luck, and I get frustrated every time I hear people denigrating my generation for “failure to launch.”

“this gives you an idea of how unsafe people in my age bracket feel versus boomers who did not have this sort of instability”

Whoa. Really? No sort at all? Yup, it’s all peaches and cream and Crystal and Maybach for us old fogies. Yup, pardon me while I light this cigar with a twenty………

I didn’t say “no sort” – I said “this sort”. Reading comprehension, try it.

Try getting laid off or fired, sonny. If you’re 55 or older, forget about getting another job. Now, that’s what I call unstable.

Yes, a lot of boomers are getting screwed, too. I have many friends 55 to 60 who aren’t old enough for Medicare/SS but can’t get hired.

It is one thing to get screwed when you are 55. It sucks, but most of my friends also had the opportunity to go to college for free or very reduced cost, screwed around in the 20s and even 30s quitting jobs knowing there would always be another waiting in the wings, bought a home on one salary, etc.

It is a very different experience to be getting screwed at 25 with the realization that if you can’t make it now, how are you supposed to make it for the next fifty, especially starting out with 30-100k in loan debt and jobs that when indexed for inflation pay less than what our parents earned, with living expenses that have skyrocketed thanks to the price of oil, food, insurance, education and housing.

We are all getting hosed. The basic social contract and the American Dream have been completely hijaked by Wall Street in the biggest heist in world history.

“It is a very different experience to be getting screwed at 25”

Yup, sure is. I was 25 once, too, and that was in 1977. Awful economy. But, hey, I was 25. Big whoop. I had my whole life ahead of me. Many ups and downs since then, but, even in your forties, you aren’t toxic waste in the job market like a 55+ year old is today. There are still second chances out there. Not for the mid to older Boomers. If your ducks aren’t all in a row when that pink slip comes, good luck. And, there are millions and millions of old people looking at a nasty, poverty filled “retirement” right now because of that. And, it isn’t as though they can take any old job to get by. Here’s a warning: You know those fallback jobs you think you can do right now just to get by at 25? You know, construction, warehouse work, landscaping, stocking shelves, and other physical jobs? Furgetaboutit after 55. You will not be able to do it. No matter how “in shape” you think you can maintain the old body. Trust me.

“It was a struggle to buy even though we are in the top 15% of income earners for LA/Long Beach”.

“$15k help from the parents”

“WWII-era 2 bed 1 bath we ended up with…”

Wow. All I can say.

Congrats, but…if people work 10-16 hours a day, how much time is spent in a house; sounds to me more like a place where most time is spent asleep? Start a family? How many hours in a day to spend with a baby/young child if parents work 10-16 hours a day, not to mention added expense? Kids need lots of love/attention/time, especially in those crucial first years of life. Perhaps loving, attentive grandparents/relatives are helping out? That can be a huge blessing! Best of luck.

Thank you, we’ll need as much luck (and hard work) as we can get. I totally agree that kids need a lot of attention in those first years – and this is why all my friends who are able to move to another country with better support for families, have (UK, Canada, Australia, Sweden to name a few countries where friends have moved to just in the last two years).

What I have found is that for my age bracket and profession, almost all good-paying jobs have a minimum 10-hour a day expectation; and I was explicitly told once I finished grad school to *not* wear my engagement ring, and *not* ever mention wanting to start a family, as that would knock you out of the running for jobs or promotions.

For people who have knee-jerk reactions to these “socialist” policies that support families such as maternity and paternity leave, I wonder whether they have fully thought through the economic implications of delayed family formation. You can see the stagnation caused at least partially by delayed family formation in Japan very easily.

Maternity/paternity leave is helpful; how long should it be? Three months? Three years? Should a stay at home parent continue to be paid their regular salary so they can afford payments on a house they chose to buy? Who pays their salary? An employer? The govt? Once parental leave ends, who cares for/spends time with a child while parents work 10-16 hour days to make the house payments, buy stuff to keep up with the Joneses? A govt daycare? If so, is it Joe/Jane Sixpack’s responsibility to pay increased taxes/fees to finance extended maternity/paternity care, and/or childcare for all, especially “the top 15% of income earners”, even if they themselves struggle to pay their own bills, cannot afford to buy their own house, cannot afford to have their own kids?

You wrote “For people who have knee-jerk reactions to these “socialist†policies that support families such as maternity and paternity leave, I wonder whether they have fully thought through the economic implications of delayed family formation.”

I don’t think there’s any shortage of US births, as there is in Japan. Issue is, many US births are to people in poverty, some require govt assistance for months/years. Should Joe/Jane Sixpack pay more taxes to finance their life choices? Maybe Joe/Jane Sixpack will themselves stop working; easier to stay home, have kids, collect benefits, not worth it to work anymore. Will billionaires who whine that they don’t pay enough taxes volunteer to “do their part”?

I’m a 31-year-old single male. I’m fortunate enough to graduate with no debt and a $30K in savings (I worked three different part-time jobs while in college and recieved multiple grants/scholarships). After graduating, I accepted a job offer in San Diego and after two years of working, I was able to save up about $150K for a down payment so I started house hunting. Unfortunately, the housing market got out of hand then. Tired of hunting for existing houses only to learn later on that the house was sold way beyond asking price (which was already beyond the comps), I started the paperwork of buying a new house in Sorrento Heights. Everything went ok until one day before the release of the new phase, when I was informed that instead of $650K, the new price is gonna be $672K and the $12K in upgrade credit was not offered any more. To tired of this crap, I called it quit.

a 2% price increase and it’s all “forget it…” toughen up kid.

EG: >> in a country that believes healthcare is a privilege and not a right,<<

You can make health care a "right," as in Cuba, but that still won't make health care available.

"Health care" is not an inexhaustible natural resource. HEALTH CARE is the limited number of TOTAL WORKING HOURS of doctors, nurses, medical school teachers, the people who research and build medical equipment, etc.

There's only so many "health care working hours" available, despite unlimited demand for the BEST and IMMEDIATE health care for EVERYONE. Unlimited demand, limited supply, means that health care MUST be rationed. How?

The free market rations health care through pricing. Socialist regimes ration health care through waiting lines, death panels, and favortism. Either way, nobody gets all the health care they want or need.

What's the alternative? Guaranteed universal health care by law? They have that in Cuba. That is, they have the legal right to universal health care. They just don't have the health care.

Imagining that unlimited health care — that everyone should get the best health care, and as much as they need — ignores the economic realities of planet Earth.

Ah yes, I’d forgotten that Cuba was the only country in the world that offered single payer universal healthcare. Thank you for your well-informed rant about healthcare, of which I know nothing about, only being a healthcare researcher who has visited several other post-industrial countries and seen their healthcare systems. #redbaiting

Yes, Cuba is not the only country that has universal health care. But the other countries that do have it, and manage to provide it, are not the United States. They do not have our population, nor do they have the size of the needy population that would not be required to contribute in any way to the funding of the system (either by taxes or otherwise), nor do they have millions of non-citizens whose number grows daily, that would also be taking advantage of services.

Socialism works passably when everyone is paying into the system, and the system receives more funding than it puts out benefits. If that crucial equation is reversed, then the entire system falls apart. Costs either go way up to compensate, or, if the Government wants to artificially control rising costs, then you get shortages of medical care…and everyone gets put on a waiting list for treatment, procedures, medication, etc. That’s just economics at work.

If we could have made universal health care work by simply snapping our fingers (in a political sense) we would have had it decades ago. You can’t blame everything on conspiracies of greedy corporations or insurance companies. Making it all work is an enormous challenge, and the people responsible for making it work are not necessarily this country’s best and brightest. In my opinion, we will probably fall short.

Really? And do you know any nation where EVERYONE receives IMMEDIATELY, the BEST healthcare known to science? No waiting lines, no death panels, no rationing, no favortism, no bribery of doctors or officials, etc.

Most medical research and development is performed by US – not the other socialist countries. Also, the other socialist countries do not maintain the largest military – industrial complex in the world; more than double the rest of the world combined. You can’t have medical assistance like Switzerland and Sweeden or Germany for the whole population of US for many reasons:

1. Son of Landlord states very clearly that there is unlimited demand with very limited resources

2. When the president passed Obamacare, he had the white house, senate and the house in the hands of one party; he had the choice of cutting from military like in those countries you admire and divert the resources to single payer system. He didn’t do it and nobody in his party proposed this.

3. US does not have the same level of education like those countries percentage wise due to constant illegal immigration from the south which has access to those limited resources.

Son of Landlord just stated the obvious truth. It is just basic economics 101. The fact that you or I don’t like does not change the obvious truth. If the Democrats did not even attempt to decrease the military expenditure when the control 100% of the government, who do you think will decrease the military expenditure? Absent that, Obamacare will not solve anything – actually will make things worse. It is just an attempt to ration the healthcare, or exactly what son of landlord stated. I don’t like and you don’t like it, but is the reality and it is the truth.

I am in total agreement that centrally planned markets are generally a disaster but somehow America has designed a zombie system far worse than a centrally planned market or a free market.

Just FYI, Cuba’s health care vs. America’s isn’t a good case to make against centrally planned systems. For less than $200 per capita they have a longer life expectancy than the US that spends over $8000 per capita.

The Cubans have a long life expectancy for many reasons but chief among them are the relative unaffordability of a diet like ours. They are healthier because they eat far less – and much less meat. They also work a lot more at what we consider manual labor.

I suppose we could adopt this and be healthier and save a lot more. You might not get many takers. The Vegans and huggers would like the diet. Not so sure about the work.

I read these comments this morning and THANK YOU ER for coming back on here to defend your comment from tools who just regurgitate useless economic drivel meant to keep socialist policies at bay so that money can be redistributed to multinational corporations. Oh and might I add the generation us vs. them squabbling works great for detrActing attention from the real culprits. Multinational corporations and those who subscribe to the total BS that is Friedman economics. Health care should be a govt service, I’d rather have that then public schools for christs sake!

@son of a landlord

And you realize that Americans would not need all of this access to health care if they

#1 weren’t so damn fat/obese

#2 didn’t shovel all this garbage down their gullets

#3 didn’t spend most of their time with their butts glued to the sofa

#4 weren’t overly medicated to begin with

Since the 1960s, Americans have grown fat, lazy, slovenly. The reason SUVs and trucks outsell passenger cars is because most Americans are too damn fat to fit inside of a regular passenger vehicle. The wear and tear on the human body due to being fat requires significant medical resources. The prescription medication used to treat obesity in itself potentially causes even more health issues which creates the need for even more medical resources.

Prior to the 1980’s it was unusual for someone to be overweight. Today overweight is the norm.

30% of the U.S. population is on Medicare/Medicaid. 55% of the population has employer sponsored health insurance, +65% when counting family members covered on an employer policy. That means that 85% to 95% of the U.S. population has some form of health coverage.

With 85% to 95% of the population already covered, I don’t see Obamacare as adding to the health industry workload as I suspect many will opt for the penalty instead of getting coverage.

From earlier this year: “The number of uninsured people fell slightly to 48 million people in 2012…In the first year of the Obamacare coverage expansion, 14 million people will gain health insurance, the Congressional Budget Office projected in May. By 2023, there will be 25 million fewer Americans without health insurance than if the law had not been enacted, although 31 million will remain uninsured, according to the CBO.”

Politics aside, the goal of obamacare is to add uninsured people. The numbers above will likely prove false and I agree the penalties for now for the young may encourage many to pay the penalty instead, but millions will be definitely added over the next few years.

On the supply side, even before Ocare, many doctors were growing weary of reimbursement rates/their salaries being lowered and other headaches/limitations of insurance so are not accepting new customers, moving away towards accepting any health insurance, forcing patients to pay an extra grand or two a year to be seen basically on top of insurance costs (which reduces the supply of doctors bc I and many wont consider them part of my supply bc im not paying the extra money for just becauses) or retiring earl.y Now with ocare, the trends continue plus doctors are being kicked out of existing networks (which means less doctors in your local area, which for most folks is really their supply).

Seems like increasing demand and less supply in the healthcare system for the average Joe. Of course richie riches just pay $$$ so no worries for them. IMO, the biggest problems may be in states that used to discriminate based on pre-existing conditions as those folks will naturally likely be the first to sign up and require the most resources, thereby impacting existing folks. CA is one of those states that was able to previously discriminate based on pre-existing conditions; not anymore.

@ernst blofeld – if someone asked me to put into print my views related to this idiotic UNafforable Care Act — I would have written exactly what you did.

Here are the upcoming changes to my privately purchased healthcare plan (Aetna). Starting Jan 1, the monthly premium will go from $270 to $457 (up 70%!). Yet, my health risk profile has not changed one iota. But now, the health problems associated with people engaging in #1 thru 4 on your list have become part of MY economic responsibility. That is plain wrong.

I’m reading these comments of 30-somethings believing in the “right” to good healthcare (even for the self-abusers, no doubt) and socialist this and that.

**Can we please be clear, once and for all, about the fundamental motivation behind socialist ideas? IT IS TO GET OTHER PEOPLE TO SUBSIDIZE YOUR COST OF LIVING! Period.

Once the government has a stake in your healthcare they can start dictating lifestyle behaviors that will impact their costs. Forget the death panel stuff that will happen covertly with cost controls – no big open meetings. The bigger thing will be a discussion about diet, exercise, large sodas, fast food, tobacco, etc. for starters.

This will achieve the goal frustrating “ernst bloefeld” but this won’t be pretty.

Do we want this level of central control over our lives? Aren’t there more liberty oriented ways to encourage the right behaviors?

@Fensterlips:

If the corporatized government intervenes in your diet it’s going to be more like: you haven’t consumed enough McDonalds/ADM corn products/Tyson chicken this week! Off to our corporate sponsor’s store NOW!

Son of a landlord-forget political beliefs and forget comparing healthcare country by country (you really can’t due to population sizes, %s of population that contribute vs don’t (combo of employment, wages and tax structure/incentives)’ etc, but your statement about the supply side of healthcare vs demand side is one of the most basic, yet smartest, comments I think I’ve ever read about the issues with our new healthcare system. I think I’m going to ‘borrow’ it from you when speaking with others. Maybe I’ll give you credit…..maybe. 🙂

The alternative is to expand Medicare to cover everybody. With this single-payer system, you just simply inform health field crooks that there will be a 50% reduction in whatever fees they’ve been charging to private insurers (more crooks) and that to expect more and more reductions each and every year. 1000 bucks for an MRI? Now it’s 500 bucks and by 2020 it’s gonna be a 100 bucks.

Don’t like it, health field schmuck? Too bad cause we’re gonna be turning out radiologists by the wheelbarrow full. No more med school just for the rich, our community colleges can produce alot of the professionals needed, not brain surgeons perhaps, but you get the idea, in this case radiology ain’t rocket science.

Back in the 1990s, in Los Angeles, I met a man who worked minimum wage jobs, yet claimed to be a radiologist. He said he couldn’t find work in his field.

I’ll never forget that, because I was shocked. I’d thought that just about any health field certification guaranteed employment in that field.

Of course, he may have held back some dirty details as to why he was an unemployed radiologist. But he said that there just weren’t enough radiology jobs out there.

“The free market rations health care through pricing”

Bullshit. How much will you pay for your life?

Everything you own? I would.

So talking about free market is bullshit, it’s “Steal everything you can”-market and a cartel to boot with.

I wrote this last year because the math was simple on the young

“The Young and the Renting”

http://loganmohtashami.com/2012/10/26/the-young-and-the-renting/

Looking at loan applications since 2000, I came out with one simple economic thesis in all my articles. We simply don’t have enough qualified home buyers and this has nothing to do with tight lending standards

-DTI

-LTI

-Light liquid assets

– The young have to deal with student loan debt for decades to come

I’ve been following this (and other) housing blogs since 2007. After educating myself, and saving (a lot) of money we decided to buy in March 2012. My wife and I (33 at the time) combined making about $150k, we were fortunate enough to have a family owned rental (read cheap rent) that allowed us to save the 20% needed for our house. I don’t plan on selling it unless it’s paid off. I know I own a loan, and a percentage of a home. My wife had school loans which we were fortunate enough to pay off early. Now 35, I look at my wife’s brothers and their friends (about 3 years younger than me) and they’re struggling just to find full time work. They’re all college educated, and some don’t even have a part time job…most still living at home.

Part of the problem I see with people (not generation related) is a sense of entitlement. From people in their 20’s to their 50’s, they think they deserve stuff. For whatever reason. No one wants to make sacrifices, or appear to be struggling. I don’t think these people know what it is to take the time to save money for down payments, cut back on unnecessary expenses, and pay down debt. The more debt they take on the higher they can appear to live. Eventually the house of cards will have to come down.

I am a 25 year old male living in San Diego. Over the past several years i’ve been steadily saving to where I can now afford to put down nearly $100,000 on a house and still have reserves. I have no debt and an income slighty over $100k. However, i’ve been watching prices rise out of control off of the bottom of 2010/11 when I initially started saving.

I’m taking a wait and see approach as I have no immediate need to own a home. I would love to buy, but just can’t justify these $400k plus prices for even a stater home in a decent area. I have no idea how others are buying homes in this environment considering the position I’m in and my hesitancy to pull the trigger. Some people are just itching to go into heaps of debt no questions asked I guess. It’s all very disheartening.

@Mike – Here’s the thing that perplexes me ….it’s how many comments I read from people in their 20’s and early 30’s who are just dying to buy a home.

1 – I can’t state this one loudly enough — at those ages there is enormous probability of your life changing significantly in the next few years. Marriage and job changes are the 2 big possibilites….and often, you’ll need to move elsewhere b/c of those. And, if you have a down RE market at that time plus the substantial selling costs, you may be setting yourself up to get HOSED at an early age.

2 – Why? Houses are a friggin ball and chain when you’re young and free.

3 – To quote a friend, “home ownership — the black hole for money”. Wait til you see how much it costs to maintain one.

I don’t get the love affair. In this era, I think there is much more risk than reward when buying a home for younger people, for all reasons mentioned above.

Sir, let me put it to you this way my father worked all his life the drop dead at64, my mother followed soon after. My uncle a doctor left his practice to retire in Sedona Az got cancer died 1 year later.

You know where I am going. Enjoy life, if you buy or lease that conv do it, if you buy that large home do it, if you go broke and on your death bed at least you can say had the best that life gave you no regrets. Can’t worry about every Tom,Dick, and Harry?

“Enjoy life, if you buy or lease that conv do it, if you buy that large home do it, if you go broke and on your death bed at least you can say had the best that life gave you no regrets”

Some believe the best things life gives you cannot be bought or leased, especially those on their “death bed”. Just some food for thought.

Some people work all their lives, saving for the future, then die just before they get to enjoy it.

Others live a carefree, spendthrift existence, enjoying their youth, then spend several decades in aged, miserable poverty.

You can choose either path — that of the ant or grasshopper — and still get screwed. You just never know.

Best post I have seen, eye opening comments. I am tired of worrying, just do it and see what happens.

I am 31 with a wife and 3 kids, I am a firefighter/paramedic w/ ot making just over 100k a year with no debt to my name. Gave up trying to buy a house in OC in 2009 because after putting in 50 offers and not having one accepted we went inland to Murrieta and bought a 3+2 1800 sq foot SFD for 220k and refi in 2011 for a 3.25% interest rate. Currently the house is being rented out and we are in a position to buy again with a max budget of 250K. Thankfully for me with my job I can live in Murrieta and work in LA. At the end of the day I was glad we didn’t buy in OC, we would have been house poor. I have co-workers living in venture and orange counties but they are working up to 6 days extra just to be house poor.

We recently bought in Newport Beach, and it took us a LONG time to get an offer accepted. We lost many highly competitive offers against all-cash, no-contingency offers. I checked on the occupants later and it wasn’t all investors or foreign buyers scooping up real estate. There are a LOT of people out there who have very high paying jobs in this country, and they have no problem buying “beach” houses near the coast for their second home. There are also a lot of young people whose parents have paid off their mortgage (congrats on winning the SoCal housing lottery) and provided $200k down-payment assistance to their kids. Or co-signed the loan so their social services employed daughter can maintain the lifestyle to which she is accustomed.

What would you rather have: A 1mm home or 1mm cash?

With the home you owe about 12,500 year in tax. Likely another 5,000 in other assessments and association fees. As well as higher insurance and utilities.

With renting you pay about the same in rent as taxes and assessments for a smaller place but you have the 1mm cash to fall back on.

It’s not an easy choice. Even all cash buyers have to decide if there is value in that 1mm home.

That logic does not even make sense.

You have to have a place to live, so either you have this home, or you rent.

in a low interest rate environment you are lucky to make 2-3% return on your cash.

So you take a mil and make 2000/month from it.

Renting a $1mm house would cost you about $5000/month

Mik, thanks for saying that. Holy smokes, the financial bogeymen that some people can find in atrocious math…

@Mik, “…You have to have a place to live, so either you have this home, or you rent..”

You are assuming rent parity. This is not the case everywhere as real estate is very very local. In some areas the difference between rent vs. owning can be astronomical.

Case in point, where I live, I pay less than $1500 a month for a very large apartment. A similar size condo has a monthly mortgage cost of about $3000 per month. A small house in the area has a monthly mortgage outlay of about $5000 per month.

The amount of money I save by not carrying a mortgage I use to invest.

@ernst

Do you mind telling me where you live? Zip code?

I have not seen a market with such a strange rent/own ratio. In most markets rents have been going up for years, while housing has been going up and down.

Of course, if i could rent my house for $3000/month i would not be buying it with $5000 mortgage, that’s just common sense to me :).

The logic is the 1MM home really an investment when you can live for less then it costs to maintain the home? Yes, you won’t have a home, but you can have a nice 2br apartment without the hassle. And also the million in your pocket.

Sean, compare apples to apples. If you want a 2br apartment you don’t buy a 1MM house, you buy a 300k apartment, and do your cash flow comparison based on that.

No such thing in OC. At least not that I can find. The new apartments are much nicer than a 600k dumpy home.

34, wife and two little kids ages 2 and 4. Work as a lead engineer making 114k in Orange County. No student debt. First started watching the housing market in earnest in 2004. At the time I was 3 years out of undergrad at which point I decided the bubble was nuts and unsustainable (unfortunately it sustained itself for a great while longer than I thought possible).

In 2009 I thought we were in for a suckers rally and was justified when 2011 came. The 2013 run up surprised the heck out of me since we’ve still never hit the long run historic averages for home price/income ratios in LA. Everything I read said that in a typical bubble you would expect prices to overshoot on the low side of averages before eventually recovering a d stabilizing to long run trends (IE 4-5 times salary in LA, or 3x salary in less desirable areas.) FWIW per “rich blocks poor blocks” average household salary in my neighborhood is 84k. You do the math and we’re way out of line with what looks “normal” to me.

Is this run sustainable (or at least sustainable enough to jump in and not drown)? That’s the key question. I have some history at underestimating the power of the government to blow that bubble. I just want a housing market that’s free of intervention. Free of investors would be nice too but I know that’s a stretch and take some serious regulation (yes, you can argue that’s intervention of another kind).

The problem is that the Fed’s monetary policy shenanigans leave investors pushing and pulling all their money all over the place. At the moment too much is landing in housing. The problem is that bubbles make folks feel wealthy (IE the HELOC boom of 2002-2006). The funny things is that bubbles make me feel poor. The leaders in this country only listen to constituents shouting that the can’t afford their existing mortgages. However, neither party seems at all concerned with mortgage affordability (as in lower prices are a good thing).

Since when can’t a white collar engineer with a master’s degree and professional engineering license afford a home? That’s supposed to be the problem left to teachers and those working in non-profits! (No insult intended, but some career paths are self sacrificial in many ways).

FWIW My first ever letter to a congressman was to protest the $8k first time home buyer’s tax credit. The program was tailor made for folks like me and I vehemently didn’t want it. The next person to buy any house a first time buyer purchased wouldn’t have the credit, therefore each and every buyer suckered into the program paid at least 8k more than they would have without the credit.

Priced out? You betcha, or at least we are without some serious 6 digit help shared by both sets of parents (we’re talking). In the neighborhood where we rent the cost of a basic home is in the high 500s for a three bedroom. These are modest 1600 sq ft on 6000 ft lots in an average neighborhood. If you don’t mind bars on windows (I do) you can find this home in Santa Ana in the 400s. Run down the road to Irvine and the same thing is 700k. At the same time I’m spending 2,500/month in rent (30k a year) and at some point in the future I’d like to not have rent at all (seems like the only viable way to retire since I’m certainly not planning on social security being around).

One topic I’d love to see the good Dr. Bubble explore: Do rising interest rates effect pricing when so many Buyer’s are cash only investors (hence immune from interest)?

That’s a very important question in predicting the future as we face our go forward decision. We are sitting on some savings but I know this will be one of the bigger financial decisions we ever make and I’d love to be right when it mattered.

I’m sorry to burst your bubble…;) But this real estate bubble back on full effect exsist because the Government want it… they need more money in taxes. They need to get people to spend their savings, rents are going up and you need to live somewhere, so might as well buy an overpriced house or pay the investor his rent.

it’s a catch 22

Government do NOT care about responsible people like you… they actually want people to put the life savings 100K or more in down-payments and transfer all those savings to banks before the unplug the ship and let it sink

“The 2013 run up surprised the heck out of me since we’ve still never hit the long run historic averages for home price/income ratios in LA”

Here are the price/income ratios by year for the LA/LB/Santa Ana MSA

1990: 5.64

1995: 4.4

2000: 4.61

2005: 10.04

2010: 5.54

2011: 5.18

2012: 5.52 (most recent data available)

Mortgage Payment to Income for LA/LB/SA MSA

1990: .54

1995: .35

2000: .37

2005: .64

2010: .31

2011: .28

LA has always been expensive, 2011 wasn’t much higher than historical lows. If you do the calculation taking in the low interest rates into account, 2011 buyers paid the smallest ratio of the incomes in their monthly payments.

Of course you’re asking about 2014 not 2011 so here’s my take to your questions:

1a. “Is this run sustainable?

If you’re talking about YoY increases 10%+? Of course not, just as YoY declines of 10% aren’t sustainable.

1b. “or at least sustainable enough to jump in and not drown?”

That is dependent only on you. If you buy a home you’re willing to live in for a long time and can afford it it’s unlikely you’ll “drown” Assuming you take a fixed rate mortgage, you won’t make or lose money until you sell.

2. Since when can’t a white collar engineer with a master’s degree and professional engineering license afford a home?

For the heck of it, look at the sales history of some homes you would consider buying. If they have sales in the 90s, do a quick calculation of the monthly payment the buyer would need to make taking in interest rates during that time period. THEN adjust for inflation. I think you’ll find that many homes have been affordable for over two decades.

3. “At the same time I’m spending 2,500/month in rent (30k a year) and at some point in the future I’d like to not have rent at all”

I think THIS is the best argument for buying. When you retire it’s important to fix as many portions of your income as you can. Either you fix your housing costs at some point or you’d better be investing/saving very wisely to pay for housing into your retirement.

4. Do rising interest rates effect pricing when so many Buyer’s are cash only investors (hence immune from interest)?

Yes. Higher interest rates will affect investors since they will have a myriad of financial options to invest their funds. Nobody is immune from interest rates.

MB = RE shill

@PapaNow Usually I like your comments because you state the obvious. In the case of MB, I think he is stating the obvious, too. He may or he may not work in RE. However, what he is stating is the truth. I am not suggesting everyone should buy a home. It depends on each person circumstance. There are too many variables to consider. One size does not fit all. It is also true, that in this economic climate of South CA RE I would not buy and most should not. In terms of risk assessment there is more of a chance to loose than to gain. Just my 2 c

Papa, it’s pretty absurd calling somebody a RE shill when they present facts based on numbers. Meanwhile you wave your hands in the air and keep screaming “housing should be affordable.” Housing is affordable for much of the country, just not in desirable pockets of socal, get over it. From the numbers that MB presented, it hasn’t been affordable in some of these areas for decades!

@JP, I read your post and have some questions for you. Does your wife work or are you the sole bread winner? If you are the only income, things are going to be pretty tight. How about down payment, I assume you have something saved up since you have been working for almost a decade. And you are paying quite a bit in rent. Your equivalent total monthly housing nut for owning would be close to 3K. The market turned very quickly, buying back in 2011-2012 timeframe was an absolute no brainer. As MB pointed out, housing affordability (monthly payment) was at its best in decades.

Going forward, I think this little mini rally has run out of steam and prices will likely stagnate. Your goal should be buying at or near rental parity (this includes a nice down payment). As we have seen, housing prices can swing very rapidly, rents generally don’t. Buy at rental parity, plan on owning for a while and enjoy your house. Do that and I think you’ll be happy. This should be the ultimate goal. Good luck.

My family’s situation is almost exactly identical to yours, just moved here a couple years ago. My wife works as well which puts our household income in $120-130K range.

Our 1950’s neighborhood in what SHOULD be a very middle class part of Torrance is also priced now in high $500’s. Haven’t bothered to look to purchase here, since right now we have a pretty good rental deal for the area. We were lucky to negotiate a few hundred off our rent in exchange for signing a longer term lease. Our landlord inherited the home from his original owner parents, along with the $80K tax appraisal, so is making bank regardless.

We have no family ties to California though, if the market never corrects itself to be more in line with the median wage, might start putting in for job transfers to more affordable parts of the country. Its a shame because we do love it here so far.

Hey Ryno, Torrance resident here. Yup, middle-class Torrance has become a destination for the rich, the wannabe rich and the foreign cash buyers who want the safety and good schools without paying Palos Verdes prices. I’ve lived in the south bay for many years and got mine when the gettin’ was good. My advice to you is to transfer out. Up and down the California coast, the south bay is the cheapest coastal property and people have taken notice of that. Every inch of the coast is going to be like Manhattan Beach/Orange County before long. I see it. Go somewhere where you won’t feel like a second-class citizen – where the schoolchildren don’t drive Beemers and Benz and act like aholes.

It is deceptive to see all these post-war fixers and think it’s affordable here. We’re getting a Ferrari-Maserati dealership on Hawthorne Blvd. soon. Time is ticking. Go somewhere truly affordable and sunny like Reno. Convenient airport, lots of stuff to do, close to Tahoe and northern Cali for visits to the wine country. My two cents.

Ok, I’m just a little over 35 but this post is a perfect representation of me, more or less. I graduated from college with about $40K in student loan debt and $15K in credit card debt and then I took on a $30K car loan and I also rented. So… I just remembered the first 5-8 years of working, I wasn’t struggling financially but I wasn’t able to save at all because I was just working to pay off my $85K debt. I even started feeling depressed like I was some debt slave who was trapped in this debt game. So, it wasn’t until after my 7th year out of college that I finally paid off all my debts and it was only then when I became debt-free that I was FINALLY able to start saving some cash for a down payment for a possible home purchase.

I think for many college graduates, these are the same fate that they will be faced with but things may be getting worse. Many are coming out with much bigger student loan debt because of increase tuition cost. Inflation has driven the cost of living up meanwhile income has not kept up. Home prices have also gone way up due to government’s manipulations. Jobs are disappearing. The US economy is not looking good with only part time jobs being created. The US dollar is losing its world currency status. It’s going to get very bad when this QE infinity doesn’t work anymore. Accept it people, the good old days are over. Wake up and welcome to the new reality.

QE infinity might actually work to hold off a big depression but I see big inflation over the next 10 years from this. The main reason we can’t get our stuff straight is a government spending and subsidizing all manner of business and interest groups. Party doesn’t matter, they each have their pets. It’s really ugly. Bernanke is just papering over their inabilities with the one tool he has. I don’t envy him. RE might be a good hedge just for this if precious metals don’t work for you.

California is being priced out completely for the coming generations because of insane land use policies. Dr. HB may have written about this in years past but it needs to be re-visited. California is turning into a 3rd world economy with rich older people and poor people and migrants doing their work for them.

A perfect example is Santa Barbara. There are fewer and fewer young families. The median age gets older and the houses are priced into the stratosphere. No one can afford them. All of California, especially the coast, will be like this in the near future.

The future is in other states with a less interventionist government. Too bad they don’t have our glorious weather. Oh, well. Look at Arizona or Texas for opportunity.

Having lived in Santa Barbara for 10 years for my bachelors and teaching credential I will tell you the income disparity between the poor and rich is astronomical. And there are no decent paying jobs. (all service industry) Just to make rent which ranges between 2-3k for a run down slumlord owned house you have to have three roommates or work 3 jobs. That’s how they want it. Beautiful weather and you pay for it. Santa Barbara is a playground for the rich.

33, bought in 2007, only to have the economy go to crap and in 2010 lose the home my wife and I bought after she lost her job and we could no longer afford the payments. I have worked like crazy and we have built up a $125k down payment toward purchasing again. I am still the only one working, we have 2 kids and I am happy my wife can stay home with them, but we have sacrificed a lot to save as much as we have. No entitlement here, we rarely even go out for a meal, we have eaten out of the house 2 times in the last 2 months, both of our cars are more than 1 years old, no students debt…

It is ridiculous trying to live in so cal…oh well hopefully things will crash soon and truly qualified buyers will be the only one allowed to purchase, this will bring prices down to reasonable levels, and allow the economy to flourish, if everything people make goes to their payment they are spending in the community. We are currently trying to purchase something in the under $600k range with PITI at $2500 or less monthly, we shall see…

The US is trending towards a 3rd world economy. Many jobs that don’t pay anything and no one can afford a home. So, lots of renters barely able to eat and keep a roof over their head. The wealthy are landlords. Oh joy

JP, if we had a housing market, financial markets, and a gold-based monetary system free of government intervention, we would not have anything like the number of investors in the housing market we have now.

Prior to this country’s departure from the gold standard in 1971, there was very little interest in housing as a “speculative” investment. Investors were interested strictly in rental cash flow and their vehicle of choice was the multi-family dwelling. It was extremely difficult to get financed for rental property, even more so than for an owner-occupied SF house, which was difficult enough- you had to have a down stroke of at least 20% and unblemished credit. God FORBID you have so much as a delinquent store charge plate on your record.

When we closed the gold window, this country became a pit of rampant speculation and the Fed became the slave of the financial markets, its purpose no longer to stabilize our currency but to make sure that the financial markets stayed levitated at ANY cost to the economy as a whole and to enabled evermore credit-based speculation.

I strongly recommend David Stockman’s new book, THE GREAT DEFORMATION, for a history of how our country’s currency was destroyed and every market in the nation turned into a debt-financed casino.

What happens when all the student debtors vote on special props that allow forgiveness of debt down the road. Already public servants get debt forgiven after 20 years. My hunch is the taxpayer is going to be stiffed with a large bill down the road.

Parent of two millennial kids here, age 25 and 30.

The 30 year old is married and they are living in University subsidized campus housing at no cost.

The 25 year old and his 21 year old girlfriend live with us, for free. They both work at steady jobs which pay cash.

None of these 4 people are participating in the corporate US economy. None have expressed any desire to buy a home.

Whatever America used to be, the America we grew up and lived in, is over.

I have no idea what the future holds for my kids, but I do know that it won’t look anything like the past.

30, single, in US since 2003, engineer in LA, $138k/yr salary, graduated in 2009. I have paid off my student loans back in 2010. Bought a duplex in 2012 for 420k with 5% down +PMI. I live in one of the units and rent out the other one. Refinanced in spring 2013 for 2.625 % 15 years, no pmi thanks to rising home values.

I just took the risk, I guess, and the market was on my side due to luck.

A lot of people write that the life quality is dropping here in US and that the middle class gets squeezed. I agree, but this is inevitable due to globalization of the economy. Just keep in mind the the life quality and house affordability here in LA or CA is still one of the best in the world compared to other places with similar amenities. Look at the prices in Moscow, Beijing or Deli for example.

I am from eastern Europe and I believe the life in LA is very good for reasonably educated people. I just wanted to provide my perspective because many Americans tend to underestimate how relatively easy it is to be reasonably rich in US with respectful education compared to other countries.

On a side note to the poster above that posed the question on the dependence of the house prices from the interest rates. Surprisingly, the house prices and interest rates show very small correlation in US for the last 30 years. Anyone can easily verify that by downloading these two time series online from open sources and calculating the correlation in Excel. I’ve been reading this blog for 3-4 years and I don’t believe the author of this blog has ever explained this phenomena. Moreover, the author claims that the higher interest rates will lower the house prices, which is not what the US housing market has exhibited for the last 30 years. Any economists want to provide their explanation?

Well, I’m not an economist but it seems to me supply and demand is tied to cost. Obviously the purchase price the biggest determinant but it’s really all tied to the monthly payment. I’d love a $1,000,000 house if it’s only $3000 a month (that’s a little over .6 percent interest) but when it’s 6 percent the payment doubles – and I get half the house. This has to change the pool of potential buyers and what people buy. The supply is still there and the demand dries up. You have to reduce the price to find buyers who can still afford your property.

I am 34 with a wife and a 6 month old. I put myself through undergrad and grad school with some scholarships and student loans. I lived at home until I was 30 years old and drove a car built in 1971 for 15 years because that’s all I could or wanted to afford. Until I was 26 years old I lived on approximately $5,000 per year. From age 26-31 I made about minimum wage during post doctoral training. We bought a house in March 2012 in Orange County for $746,000, after saving for basically 7 years. We didn’t like having a big house or any of the carrying costs and sold it in Semptember, 2013. We now are renting in an 1100 sq foot apt while searching for a place to “downsize” to. I am much happier now and would happily live in the apartment forever but my wife has other plans sadly………….

34, graduated law school a few years back. Now make 300k at a big firm in LA, all pre-existing debts paid off. Single. Bought over the summer for 800k+. sub 4% interest rate, 20% down, 30 yr fixed. But all is not well. Not going to make partner and praying for two more years of work at the firm to give me a fighting chance of setting myself for whatever comes next….And I guarantee that 300k salary is as high as it will ever get for me, and probably going substantially lower.

I’ll be sure to call the wahhh-mublance for ya, with $300k income.

Yeah seriously. Try being a teacher who has not had a raise in 7 years. Feel so bad for your over a quarter million dollar salary. Must be rough.

Save everything you can like your life depends on it. Live well below your means. Skip the new Beemers and restaurants every other night. It’s amazing but it all works out.

You’ll be surprised how the stress drops off too. Good luck.

I’m 30, single, and was raised in the Antelope Valley (Lancaster – Palmdale.) My family was definitely lower middle class – my dad averaged 30k a year through the 90s, and then passed away when I was 18. I’m the oldest of 4 and was forced to find some way to help support the family. It took me 8 years to get through college – 4 at the JC, and another 4 at a Cal State school. (Average tuition costs at CSUB were $600 per quarter, and that’s without Pell grants or scholarships) It took me awhile, and I had a full time job the entire time, averaged about $25k per year, living in a 120sf dump, but I managed to get through it with no debt.

While home prices here never reached the obscene levels of most of SoCal, they were still outrageous when compared with local average income. When the bubble burst in 2007-2008 I took on a second job delivering pizza, sold my truck and bought a beater, quit eating out and going to the movies, and saved every penny I could. In 2010 I bought a 1500sq 3+2 for $120k in a decent neighborhood. I rented out the two extra bedrooms for $450 each and took the $8k first time buyer credit, and 9 months later I was able to get a 60s era investment property for 75k, and then rented it for $1100. I’ve kept at it for the last 2 years and now have 4 SFRs, all 3+2 and between 1200-1500sf. Each one nets between $400-$500 a month. It’s been back breaking work. Most of them have needed TLC, and I’ve done it all myself. I quit the pizza job almost a year ago, coinciding with a significant raise at work.

I’ve read a lot of articles lately about millennials vs boomers, entitlement vs opportunity. It definitely seems like there is less opportunity out there for people in my age range. We have to work harder to accomplish the same things. However, this is still America, and there is still opportunity out there for those who are willing to work hard for it. I had to put in over 100 offers for my first home purchase in 2010. I ate Romen and worked 80 hours a week. It’s paid off though.

I COMPLETELY admire your hard work and dedication, no doubt about that. But you are right and it SHOULDN’T be that hard, and that way. At least the Midwest and South are still affordable and not that hard.

Just too add a little perspective of the Southeast. It is still possible to live the 1950’s standard here.

I’m 27, make approx. $75k and am married with 2 kids (3 and 1). Grew up in a middle class familiy (got 2 years of college paid for but never got a car or spending money from the parents). Got my driver’s locense and first car, a ’93 subaru for $2500, when I was 20 years old. I worked various jobs through college averaging about 20-30 hours to stay almost debt free. My senior year I got a paid accounting internship at $20 per hour plus lots of overtime which allowed me to pay off all debts. The firm also offered me a job, paid for me to return for my masters (1 year program) and take the CPA exam.

My wife and I were married at 23. She is from from a upper middle class family and got all of college paid for as well her first car at 16 (’01 civic). When we married we were debt free and at 25, managed to save around $10k for a downpayment plus got a very generous gift of $8k from her parents.

We were able to purchase a 4/2.5 2000 sf ranch about 25 minutes from downtown in a very nice neighborhood in quickly growing city of approx. a million people. House cost $184k. No debt and fairly priced housing means she is able to stay home with our children. If money ever got too tight, we could fall back on her health care adminstration degree.

That is spot on. You did exactly the right things. My story wasn’t much different. It’s amazing how you can get “lucky” when you bust your hump and work hard saving all you can. We had our double jobs, Ramen dinners and renting out spare rooms too. Unfortunately too many today think it should just fall in their laps. When it doesn’t they whine about not being able to afford a starter 2400 square foot home in Irvine.

I’m 30, hubby is 35. I have 70k in student loan debt, partially was expected. The other part my hubby got very ill medical bills, had to leave his job etc.

I make 120k a year, hubby is still finishing school for new career since he can’t physically do his old job. We keep wanting to buy, but realistically, even being very budget conscious, cheap phone plans, no eating out, cheap older cars, etc, I don’t see it happening as soon. My tax guy and my cousin who is a broker keep pushing me to buy. But who can really afford a basic house that’s going to easily be 400k in Northern California when my student loan payments are 730/month and daycare for my son is another 650/month.

Live in the central valley, and new housing builders are coming out of the woodwork again and sprawling everywhere on new and older vacated lots from the 2008 bust. So all the families who either could not find what they wanted, given such a low quantity and quality inventory, or could not compete with investors will now get sucked into low down payment, no competition new build starting at 250k for 1,650 sq ft (not including upgrades) to live in the outskirts of town….in FRESNO CALIFORNIA wow.

Same thing happening in Sacramento area. But the builders have already missed the boat. Starting to see huge price drops on new builds just the past 2 mths. $15,000 reductions, then another $20,000 etc… Central Valley incomes can only go so far.

make buying homes like having kids in China — 2 SFR per person, please. But the Fed doesn’t want home prices to reflect wages, it wants people to believe the value of their home will never go down — that is what spawns economic activity. I wonder how many of these boom/busts I will live through in my lifetime. Five years later after the biggest RE bust ever, we are back to early 2009 prices.

In a big way, our economy is following the footstep of Japan’s economy. So what we are going through, Japan has already gone through in the last 30 years, from feeling so rich to feeling like we are just trying to get by. We can learn a little from them. Japan’s government has so much debt that they are doing QE infinity to inflate away all their debt, thus ultimately killing the yen. Japan’s home prices shot up so high and then burst and then is back to the 1983 prices and has stay low. The Doc even wrote an article about it.

http://www.doctorhousingbubble.com/japan-real-estate-bubble-home-prices-back-30-years-zero-percent-mortgage-rates/

Anyways, in Japan now, the cost of living is so high that the younger population have been force to make their job/career their number one priority just to sustain a decent life. Aren’t we seeing that more in the younger generations who are living at home now because of financial reasons and not by choice? What is interesting is Japanese people are not hooking up. Nobody is getting married Japan anymore and having kids because kids are expensive and marriage is also a liability. Japan’s population is getting older now and their population is experiencing the most negative growth and will decrease even more in the next decades and two. Just watch the beginning of the youtube video below.

http://www.youtube.com/watch?v=qpZbu7J7UL4