Million dollar short sales – Huntington Beach sales surge while distressed inventory leaks out into the MLS.

Affordability is the name of the game when it comes to a sustainable housing market. Nationwide the US is witnessing home prices come in line with local area incomes. In fact, many areas of California are also seeing this occur. Yet the mid-tier and upper-tier markets still have correcting to do. In these markets the game can only go on if the perception of endless appreciation is part of the buying equation. In a mid-tier market like Huntington Beach there are many homes that are overpriced and are correcting lower. This isn’t simply occurring at the low-end of the market but with million dollar homes. Today we examine a million dollar short sale in Huntington Beach.

Million dollar short sale

6612 Doral Dr, Huntington Beach, CA 92648

5 bedroom, 4 bathroom, 1 partial bath, 3,300 square feet, Single FamilyÂ

This place looks like a recent MLS addition. The above home is a more expensive Huntington Beach property.

Is there a big demand for a home like this at this price range? Hard to say but this place is now one of the many short sales hitting the OC market. This home was purchased in the 1990s and had a lot of mortgaging activity during the 2000s. This place is now a pre-foreclosure even though there was an attempt to sell this place in 2010:

$1,799,000 was the initial list price? After chopping prices lower for nearly a year, the listing was taken off the market. The price seemed to edge close to the loans outstanding on this property. Now the lenders realize that they need to make the place move. The current list price is $1,295,000. Will this place sell near this price range? It should be obvious that chopping prices lower and agreeing to short sales on million dollar homes isn’t a sign that the housing market is healthy.

The Huntington Beach housing market

Let us take a look at the current housing market in Huntington Beach:

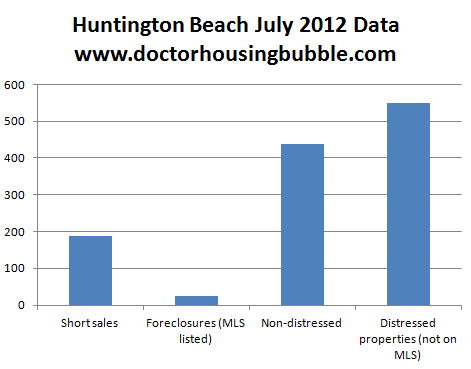

This home was recently listed and came out of the giant “distressed properties not on the MLS†pipeline. Some think that only bottom of the barrel properties are part of the shadow inventory. That is clearly not the case. Roughly 25 REOs are listed on the MLS while 187 short sales are on the market (representing 32 percent of all visible inventory). Of course the shadow inventory trumps all other categories.

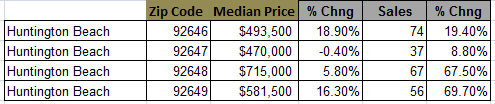

What is apparent is that banks are leaking out properties and agreeing to short sales even on prime properties. Home sales in Huntington Beach have certainly picked up in the last year:

If you think the massive jump in sales is occurring because of extremely wealthy households think again:

Huntington Beach

Median income (household 2010):Â Â Â Â Â Â Â Â Â Â $86,925

2009

Owner-occupied:Â Â Â Â Â Â Â Â Â Â Â Â 63%

Renter-occupied:Â Â Â Â Â Â Â Â Â Â Â Â 27%

2010

Owner-occupied:Â Â Â Â Â Â Â Â Â Â Â Â 59.9%

Renter-occupied:Â Â Â Â Â Â Â Â Â Â Â Â 40.1%

Owner-occupied data

Housing units with a mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 73%

Housing units without a mortgage:Â Â Â Â Â Â Â Â Â 27%

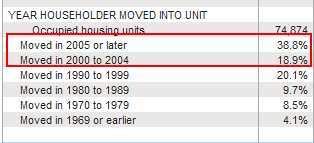

You can see that the homeownership rate fell by 3 percent from 2009 to 2010. Most homeowners are mortgaged in Huntington Beach and many bought during the bubble years:

Do you have enough wealthy households willing to pay high prices for homes in Huntington Beach? The answer is clearly no because you have a pipeline of homes in the foreclosure process that is larger than all visible inventory. Next to that, you have a good number of visible MLS properties being sold for less than the total current mortgage balance. While price metrics make sense in many other markets across the US Huntington Beach is still a market that is showing inflated prices.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

68 Responses to “Million dollar short sales – Huntington Beach sales surge while distressed inventory leaks out into the MLS.”

We have been waiting to buy a house since 2007. All we want is just a house with at least 3 bedrooms in a good school district in Los Angeles. It seems like an impossible dream to us because the price is still ridiculously high. We were looking in less than 500k range and now are looking for 700k but still no luck. It’s either 700k with only 2 bedrooms distress houses or 600k house in a not so good area. Seriously, why would I pay 700k for a distress house? That is ridiculous.

More ridiculous, we recently tried to get per-approved since nowadays no agent would even want to waste time to show you houses if they know you haven’t got one. So we did. And to our surprise (a little bit), the mortgage broker told us we can be qualified for even a million dollars house if we have 20% down. Usually our combined salary is around 180k – 200k. But because I took almost 5 months off last year due to pregnancy, out income was only 160k last year. And this year my husband just switched job so when the broker asked for pay stubs and year to day income, my husband only submited what he got since March because he just to lazy to spend time to dig out Jan to March pay stubs from previous company. So the broker thought our annual income is only 150k per year. And based on 150k they pre-approved 800k loan!! I thought in my mind this is ridiculous and that’s why the housing price is still higher than we can afford. 800k based on 150k annual salary, that’s more than 5 times of annual income. Not to mention PMI will be more than $500 for that kind amount of loan. One of my colleague just got pre-approval for at least 7-8 times of his annual income which is 400k. I know his salary was 50k 4 years ago and he’s still with the same employer without promotion or any sort of that.

Why is California so fuckup?

Can you change your handle? I have been using this for some time.

What?, I agree home prices are fucked up here in California. However, this will be a picnic compared to what is happening in the NYC metro area. See attached link with presentation from Keith Jurow. If there is anyway to short the NYC real estate market, let me know.

http://ochousingnews.com/news/house-prices-in-new-england-crashing

The market in California will be in shambles for years to come. Yes, there is currently a frenzy but I would bet this is just another head fake. The fundamentals all point to more downward pressure. It’s frustrating to be a potential buyer right now, but you’ll likely be able to buy the same house a few years down the road for the same amount or less.

I think older single family homes in Los Angeles County, especially in the upper middle income neighborhoods are overpriced, and will continue to carry a premium. The problem is that many homes in the affluent/good school parts of LA county were built a half century(or more) ago, and many of those homes are owned by the original owner or in some sort of a family trust.

That means that these homes are ‘protected’ by Proposition 13, which restricts the property tax increases assessed to those particular properties. It is not unheard of (actually fairly common) to have a house that has a current market value of $700k to be paying an annual property tax of less than $1,000. In contrast, the neighbor down the street who recently purchased a townhome for $350k is paying over $4,000 per year in property taxes.

Now combine that with the low rates we have today, so those “old money” homeowners who benefit immensely from proposition 13 can now refinance with sub 4% rates. This leads to a major disincentive to sell, further restricting the supply of homes in the market. This is why we have neighborhoods like west hollywood with fixer SFRs listed for close to a million dollars yet the average income in the area does not come close to being abe to afford something like this.

With that said, IMHO newer neighborhoods with good schools such as those found in Orange County appear to be a better value than say, Arcadia or South Pasadena (both in LA county) because OC neighborhoods were developed later (especially the 949 area code neighborhoods) and thus less sheltered from ancient property tax assessments.

Good luck in your search

Calculatedcondo, I recently went to visit my friend who bought in Palos Verdes a few years back. He mentioned almost all his neighbors adjacent to him are either original owners or long time owners (30 years plus). Palos Verdes is a perverse example of exactly what Prop 13 does for desirable areas. Many of these people will either die in their home or gift it to their heirs simply because of the property tax break they receive. We call them “Prop 13 bandits.” Prop 13 has helped distort certain CA real estate market in a BIG way. There will come a time in the future when the people who benefitted most from Prop 13 are no longer the majority of the voting block. We can only hope this unfair, discriminatory law gets overturned!

http://www.calwatchdog.com/2011/06/01/will-crashing-real-estate-kill-prop-13/

I got a good laugh at the last sentence “Prop. 13 saved California’s public schools from ruination.” Huh, California’s public school system has went from best to worst since Prop 13 has been in effect. It’s going to be pretty hard to argue against that.

What this article doesn’t touch on is the unintended consequeces of Prop 13. Essentially shutting out future buyers to many desirable CA locations…mostly due to Prop 13. Either you were born at the right time or you weren’t. That POS needs to be overhauled in a major way!

Prop 13 doesn’t die with the 30-year owner. There are many ways Prop 13 benefits can be transferred to other parties and even properties. The typical scenario would be a parent living in a house for decades with a low Prop 13 assessed value, who dies and leave the house to her children. The Prop 13 value can be transferred to the children too.

Forgive me if I am naive but I fail to understand your argument. I get it if the owners of these homes for 50 years as you imply hold on to them and pay low taxes. They will presumably benefit as well from a lack of a mortgage given the general mortgage term of 30 years. I say this because it is unlikely that anyone who bought a home 50 years ago is still involved in a full time career and will be unlikely to take on a current mortgage at 4%. 4 and sub 4% mortgages benefit higher home prices as the cost of money goes toward paying more for the home. The rub comes from your comment about million dollar home values in areas like Palos Verde. If your imagined condo owner is paying 4,000 on a 350K property what will your new owner of the PV home be paying? Quite a bit more. By the way PV has always been a high end neighborhood somewhat above the median. I don’t buy your argument. But as I said please show me where I could be off.

Wydeed, I don’t think I understand your argument. I’m not asking these long time owners to take out a mortgage. I’m asking that they pay more than 2K per year in property taxes when a new buyer for the exact same property pays 10K plus. Yes, many of these people are retired and will no longer work; however, when I see highend luxury cars in every driveway I don’t think many of these people are hurting for money. My whole argument is that Prop 13 seriously distorts real estate values in certain area (Palos Verdes is a great example). If you disagree on that statement, I’d like to hear your argument…

Keep Looking, there is hope. My wife and I were in the same boat as you, same income same price range.

We found 3br / 2 br in pasadena for 455k, but we had to sink about 20k in because it was previously owned by a hoarder.

You can find it, you just can’t be hung up on move in ready or prime prime neighborhoods. Just looking for a decent school might be a problem, but that is what charter and magnet schools are for.

…and in Pasadena you have to drop another 15-20K a year for private school since the public ones are a no-no.

If we can sell just one at the inflated price we can argue that all of them we are hoarding are worth what we say they are we’re still solvent and not really bankrupt. Then we can pay ourselves like royalty and collect the next bonus check. Sounds like a plan.

I think the numbers answer the question. The house originally sold for $781,500 and 18 years later is a short sale at $1,295,000. This speaks volumes of what was really going on. We all have heard how real wages have been stagnant for the past 20 to 30 years. The way these folks kept up their standard of living was to live off of their home appreciation along with their stagnant wages. This is the very reason I have no faith in the current head fake on housing. We need wages to start growing in real terms or housing to start appreciating in real terms or some other new source of income to continue the current standard of living. Math is math and it still doesn’t work…

More and more short sales popping up on the Westside of Los Angeles. Brentwood, Beverly Hills, Malibu, Bel Air and Pacific Palisades are all seeing short pays now, where 5 years ago it was nothing short of a pipedream. Distressed properties hitting the mid range and creeping into the high end now.

http://www.westsideremeltdown.blogspot.com

True. We live in Brentwood, so many for sale signs up, many are short sales. The issue is the homes are still way overpriced and they continue to sit. In our neighborhood, most the homes that are selling are for all cash, most are Persian buyers.

Why u pimpin yo blog when it is shut down?

i wonder when did these distressed properties in HB default.. to say that everyone in HB stopped paying their payments at the same time and all properties went into disstress together.. that’s slightly difficult to swallow..

i believe that the buyers and sellers are at the mercy of the banks.. today banks have picked HB as their area.. tommorow, it may be some other area .. some ares don’t have enough properties on the market and certain areas have a whole bunch of them .. sounds like selective manipulation to me..

I have friends and clients that our out shopping and saying they are up against foreign cash buyers, investors and they come up last. As much as I am told to spread the word that the market is taking off, I refer people to DHB. Those that read this seem to be the only people looking at facts. Tell everyone to read DHB, post and share these articles. Facts, income and time are what will correct the market.

Foreign cash infestors — definitely the smart money…

One of the awesome things about this blog is the way DHB presents a subtle nuance to an existing fact set to help make sense of this madness:

“Do you have enough wealthy households willing to pay high prices for homes in Huntington Beach? The answer is clearly no because you have a pipeline of homes in the foreclosure process that is larger than all visible inventory.”

Of course, HB can be substituted for dozens of communities often lamented about here as bubbliscious.

A persistently massive shadow inventory in the face of historically low interest rates is as infallible a metric as I can think of to determine that indeed prices are still too high in the middle-upper tiers.

I think that the way to think about this is to consider the mechanics of price appreciation during the bubble years. During the bubble, wealthy people did not suddenly have more wealth and start bidding up the price of each others houses. What happened was that low and middle income people suddenly had more access to cheap financing and they started bidding up the price of each others houses. The increase in housing prices at the low end then pushed prices higher at the upper end. At the margin, that funding effected prices all the way up the scale. Price momentum then became self perpetuating throughout the market.

When the bubble funding went away, the top end of the “property ladder” more or less stayed where it was because, rich or poor, people don’t want to believe that their house has lost value. Poor and middle income people didn’t have the income to sustain their debt and that end of the market quickly lost up to 60% of the bubble values but wealthy people did and do have the ability to sustain their debt burden (or, rather, have that ability to a greater extent). That made the “property ladder” steeper. So that you now pay more for each increment of value. For example, an extra bedroom or bath may cost $100,000 more which used to cost $30,000 more. A “good” neighborhood had a 20% premimum over a nearby “bad” neighborhood, now the premimum is 50%, etc.

That is why “What?” is frustrated. She wants three beds in a good area. What she sees is prices which are maybe 15%-20% down from the peak instead of 40% or 60% she reads about. She can get what she wants by taking a “financial risk” (ie, paying more than she can really afford) but does know if she can trust the market to give her a stable price. The question is “is there another 20%-40% drop coming for those upper-mid range to higher range properties. Logically, I think the answer must be “yes” but logic and residential real estate prices have been disconnected for a very long time, who knows if they will ever re-connect.

“That is why “What?†is frustrated. She wants three beds in a good area. What she sees is prices which are maybe 15%-20% down from the peak instead of 40% or 60% she reads about.”

_________________

This provides a good basis for talking about the effect of the incredibly low interest rates on the total equation. Most people borrow a huge percentage of the purchase price of their home, so interest rates play a huge role in affordability. The massive drop in interest rates from the peak price era to today equates to a 25% drop in price – aka your payment on $1 mil today at current rates = your payment on $750K at peak at higher rates. So although nominal prices in some of the stickier areas may only be down 15-20%, when you factor in the impact of current interest rates you are looking at prices in real terms down in the 40-45% range. That is significant.

I am not cheerleading the market and saying now is the time to buy, but I am saying you cannot ignore the significant impact of today’s rates and what that does to valuation. Rates could go down even more and so can nominal prices, but right now I think for the heavily mortgaged properties in stickier areas we have seen in real terms a 40-50% overall decline.

I think the artificially low rates encourage speculation with cheap money above and beyond just comparing the change in prices based on equivalent monthly outlay.

Falcon

Yes, a reduction in interest rates reduces the cost of (financed) housing while supporting its price. The specific problem we are discussing, however, is the amount of price distortion in the real estate market. Presumably, a time will come when interest rates return to more normal levels. Assuming you are correct regarding the amount of support given to the market by lower rates, the 20% to 40% drop I suggested will be 40% to 45% (assuming current buying is based entirely on the monthly nut). Does it make sense for “What?” to buy now and “save” (tax deductible) financing to take a 40% hit in the value of the property later?

The sensible decision for What? appears to be to either move to an area they can afford or rent a property that suits their needs (assuming they can afford the rent).

We are already 5 years into this unraveling and many of the best areas are still very expensive. There is an incredible amount of market manipulation going on and there is no end in sight. Low interest rates are unlikely to sharply rise anytime soon. The market (in the better areas) is unlikely to be absolutely flooded by REOs as many have wished for.

My observation that the better areas are in real terms down 40-45% from peak was intended to spur some thought as to how much more of a discount from peak someone will wait for until they pull the trigger. 40-45% is not insignificant.

If interest rates had not changed and million dollar houses (peak money) in great areas were being listed for $600K they would be selling nicely. Well the ones that are now being listed for $800-850K are in real terms down in the $600K range due to cheap credit.

Not to be out done, the bankers were feasting on our hard earned money by manipulating rates:

http://buzz.money.cnn.com/2012/07/04/barclays-libor-email/

I think bmcburney is right on about this. In 2000 the westside was, say, $350,000 while mid-LA was $250,000, but right now it’s more like $900,000:$350,000.

That’s true. At the same time, neighborhoods aren’t static; they evolve and change like everything else in society. Certain neighborhoods were a known entity 20 years ago as infallible (think Brentwood, Beverly Hills, Manhattan Beach), but others weren’t. Some neighborhoods have developed into nicer, safer, more desirable, better school enclaves in the past 20-30 years (Santa Monica, Redondo Beach, Hermosa Beach, Torrance, West LA, etc.). These areas EVOLVED. Other areas (Palms, San Pedro, Huntington Beach(?), etc.) lost ground or stayed the same in terms of desirability. So, the new reality is that we can’t look at 2000 data for some of these areas like Santa Monica and expect them to come back down in line with relative metrics from 2000. It’s a new era!

I think the reason why Burbank and Culver City are often in DHB’s cross-hairs is the jury is still out if these areas have really evolved over the years to be truly better communities, or if they are just pumped full of undeserved post-bubble air.

Brentwood, Beverly Hills, Manhattan Beach took hard hits in the early to mid 90

‘s housing crash. They were definitely not infallabile.

Santa Monica, Redondo Beach, Hermosa Beach, Torrance, West LA, etc. These areas EVOLVED.

When you state EVOLVED, do you mean gentrification? Yes, these areas have much less trashy middle and lower class folks and much more affluent professionals.

I think a few of my family members are going to retire in Thailand. Money goes a loooong way over there. We know someone living in Bangkok on US$600 a month. He left L.A. because it was too expensive. Sorry, off topic, I know 😉

OK, we’re in the abyss of the “highest and best” multi-offer housing hell in Ventura County. We went over list in the first round, then up it went again for the “highest and best” final counter. That’s it, the extortion of our hard earned dough has ended.

We’re a cash & close, and quite frankly, this house is a fixer. List Price was a mind blower, let alone our offers.We’ll know by Friday. 7 offers, but the listing agent would not tell anyone how many she countered. F&@king insanity is an understatement.

We had met younger folks who are waiving their inspection. Brain dead!

Thailand isn’t an option for most people. Compared to US it’s hot, sticky, dangerous, and does not have the same level of education and medical care. So enjoy.

I think it’s wishful thinking for us to see any more huge price drops in the mid and high end market, there’s just not that many nice homes for sale. The house in this picture looks really nice compared to what else is on the market in the low million dollar range.

It is true there are a lot of cash buyers in Los Angeles as its a very wealthy city. Stop thinking about how expensive homes are and spend your time focusing on how you can make more money.

Sean, I completely disagree with your statement about wishful thinking that high end properties won’t decline any further. This is probably true for the mid tier…anything involving a government backed loan up to 729K. The higher you go above that number, the more price erosion will take place. Some of the fortress areas will be safe, but when you start venturing out from them…look out below.

We are seeing frustrating examples of people trying to buy 500K homes in decent areas. There is lots of competition. The 800K and up market will be the sweet spot in the future if can afford it.

Dear Lord,

I didn’t say any further, I said huge price drops. Big difference. You may be able to shave another 10 to 15% off of the nice niche areas, but the 1mm beach homes are not going to come back to a 500 to 800 range that everyone is dreaming about. And I was talking about SoCal not the middle of the USA.

I am a renter, and I would love to see prices come down. But it’s just not happening. The banks have figured out how to trickle inventory and they’re not going to change their tactics. There are unlike consumers, banks can wait as long as they need to before selling. No one forcing them to sell the homes. Thanks don’t have kids that are going to college. Thanks don’t retire. Thanks can ride this out.

In Southern California income isn’t the only demographic you need to check as there are a lot of people who are cash rich. Many people in SoCal are business owners. They take a small income. But they can distribute a large chunk of money to themselves when needed.

But I’ll still wait for prices to come down I just have a feeling I’ll be waiting a very long time

It may never happen in our lifetimes, but if the government is unable to maintain near zero interest rates on its unfathomable and skyrocketing debt, and mortgage rates revert to historical norms, this will push prices down hard.

That’s really kinda funny, as it’s almost the exact same advice that the Mayor of West Palm Beach gave his residents in a speech back in 2005 addressing the COL in that area with particular respect to the cost of housing — something along the lines of: Quite bellyaching and get a second job if you have to!

Well I’m saying this post bubble. So if you can’t afford it now and maybe you are not cut out to be a home owner. Homeownership is not an entitlement. If you can’t afford it, rent.

In life some good advice is to focus on the things you can change. You can’t quickly change housing prices, but you can change your income. So instead of complaining about house prices focus on how you can earn more money. Yes I know easier said than done. But I’m sure it’s a lot easier to control your income than it is to move prices in the huge housing market.

I make not quite 150 a year (minus bonuses)…I may not always make that much, or I may make a little more. I don’t know. I think I’m pretty well qualified for a house of my desire if we had something like a level playing field. If you’re neither a filthy liar or totally deluded, then you would concur that the PTB are trying like mad to prop up the housing market, and if they were not doing, it would have corrected past the mean ages ago. Probably 2009.

Housing may not be in a bubble, but it has not yet hit the bottom…when rates are 7% and underwriting is not the exclusive province of the US.GOV, then we can talk about entitlements and who should own vs who should not.

Frankly, I don’t think anyone should have to rent, as I don’t abide by the idea of one human being beholden to another human simply because the latter has deed to a parcel of land.

You are wrong, sir. Thailand is safe, excellent medical care. Just ask the tens of thousands of expats who call it home. It is hot and sticky, that I’ll give you. Chiangmei in the north is cooler, and is home to people from all over the world. I think caution may be needed in Myanmar and Laos, but Thailand is very cosmopolitan.

You know…you’re probably a nice enough gal. A bespectacled liberal librarian I bet, with a wholesome upbringing and a cushiony life. Probably got an artistic side or a spouse with one. I know your bunch, and it’s a likeable enough bunch. However, if you think chasing off to a glorified third world country for some cheap Gang Dang is a realistic way to escape the crunch, then you’re not much of an American. We must all stick together and band against the the liars and eunuchs that have made the American way of life a mockery.

Sean, “the U.S. has better medical care and education? What planet have you been on ? You need to travel more or at least read more about other countries. The U.S. has dramatically declined on both education and healthcare. Just to talk about health care, there are now professional consultants who advise and research for the best and most affordable healthcare to consumers, most of these are out of the U.S. Turn your boob tube off man. And the myth about good schools? People, please research and read Elizabeth Warren’s research she did on “good school areas” It is a myth, buying a home in a good school district is a con to the public. Do your research!!

Exactly. Why are so many people in the USA traveling overseas for medical care? Elizabeth Warren for POTUS!!

Sweet. The first native American president. This country loves diversity. 🙂

Cost. I’ve never heard anyone say I want to go to India to get a heart bypass. When you need treatment you need treatment now and in the US many hospitals are equipped to handle complicated urgent care. Good luck finding this in remote areas of thailand.

You think they have 911 and life flight helicopters to come pick you up? LOL.

Elizabeth Warren is a warmonger. Do your research!

Regardless of whether your points have any merit, but using a source like “Fauxahantas” is truly ridiculous. Now we’re seeing here past scholarship being brought into the open – not to mention her class warfare rhetoric is completely hypocritical, since Ms. Warren is a multi – millionnaire who’s never had a job in the private sector in her entire life. Try harder next time.

The united states has excellent healthcare as long as you have insurance. People from Canada come down to the US to get treatment. Why people go to other countries? It’s cheaper for elective surgery and you can get organs that they don’t allow here without an extensive waiting list. It’s all about supply and demand more than it is quality of healthcare.

As for education, I’m talking about university level education. In general we have a very good college education system. That’s why people from all around the world travel to the US to get educated.

As for elementary, middle, and high schools, yes they’re a mess. But that has more to do with parents not being involved in a child’s education and it does the quality of the teachers. There’re so many more contributing factors and just teachers and books.

I’ve never seen such an unpatriotic group. Why is everyone on the US housing bubble when no one really wants to be here and everyone wants to move to another country. Feel free to take the next plane to Thailand. Enjoy.

The U.S. has evolved into a country where the constitution once limited the government’s power and no longer does so, where the politicians collaborate with corporate interests to rob the people blind to support their own power, where the police state has discarded even the flimsiest of protections for its citizens and yet the politically connected flout the law without consequence.

The America we were raised to believe in is GONE, that is why many of us want to leave. But just because this place is now an utterly corrupt police state doesn’t mean we will go to just any other hellhole – and immigration to another country is harder than just finding a job, since many of the desirable locations won’t let you move there. So we’re stuck in this place that at one time was a model of freedom, success and innovation, and has now collapsed into a morass of government overreach, corruption and cronyism.

Sean, plenty of people go to India and Thailand to get very complex medical procedures done-it is called medical tourism.

The Indian Government just announced it is giving free generic drugs to all its poor-that includes cancer, HIV, diabetes. You think you cna get that here?

This country is a nation of immigrants-aka opportunists. If it declines much farther, it is only natural they go looking for opportunity elsewhere. It is obvious our politiicans won’t do anything to stem the tide. Globalisation and free trade are here to stay.

Jim and Caboy,

What a bleak picture of America. Sad. I don’t know at any point in history where the rulling class made life easy for everyone. I see that I continue to have a good life even with the corrupt government and evil corporations. Sure I would like to see a perfectly fair and just society, but I have a life to live too.

I don’t discount moving to another country, as I might have to with the poor return on stocks. Speaking of that, why is my stock portfolio so poor if the corporations are in bed with the government? And I am not looking for a great return, I would be happy to make 5 to 7 percent or 4-5 percent over inflation.

ok and you all will want to leave we are global now people will live anywhere its safe affodable

the markets are designed to make suckers of the greatest number of people and 75 percent house debtors seems about right rumor has it, but the bailed out fractional reserve bank system that prints up on average 38 debt dollars foR every dollar borrowed that compete equally with every dollar of savings and bid against savings in the buying processes being bailed out makes high prices a welfare type payment if they can be sold, but bailout prevents the destruction of those competition from those 38 extra dollars and prevents the unmanipulated value from being the last highest sold price devided by 38 ………………….an unimaginable occurance the alteration of the financial debt based dollar system …………….

to calculatecondo post.

True about mid price homes that have been in a family for decades. My mother inherited a 3 bd 1ba house North of Montana Ave in Santa Monica. Here mother and father bought it in the mid1950’s for $16K. Current property taxed are around $2K. List price today would be about $1.6Million… doesnt that tell me that the new owners would be paying around $15,000 in annual prop taxes? Anyway, if mother were to die seems like we are faced with 2 things. Inheritance tax which is 55% of everything over $1million (around 55% of 1/2 million) OR mother ‘gifts’ me the house which means LA County Assessors come in and hit me with $15,000 a year in taxes…. anyone familiar with the inheritance versus gifting arrangements welcome to reply and thanks.

Daniel, if the house gets gifted to you (parent to child), I think the Prop 13 tax basis stays the same. Here is an excerpt from an article regarding this (look on pg.2):

http://www.businesslawyerslosangeles.com/T&E_vol1_no2_rev2.pdf

“In addition, transfers between parents and children enjoy a more limited exclusion: An individual may transfer his or her primary residence, regardless of its value, and up to $1,000,000 (total) of other property to a parent or child without triggering reassessment.”

Sounds like you can retain the 2K property tax bill. Some new schmuck would likely be paying close to 18-20K per year in property taxes if the house is indeed worth 1.6M. Congratulations, you won the lottery!

If you really want a house…overbid it in those low inventory multiple offer areas. When the appraisal comes in way short. (which it will ) you can negotiate. If you tell em your all cash you can’t do this. Unable to finance due to dicrepency of appraisal and price will get you out of contract if they won’t negotiate. Play the game. Chances are the seller will realize that another go around won’t yield much better results and that they will have to start the whole damn listing/ showing process again.

That’s quite a gamble. What if the appraisal comes in at asking (as it did for this person)?

http://forums.redfin.com/t5/Los-Angeles/Offer-is-high-hoping-for-low-appraisal-Need-advice-please/m-p/318955

Plus, for a couple of homes we considered buying in “hot” low-inventory areas, we were required to remove both the loan and appraisal contingencies if we wanted to put in a bid (which we weren’t about to do).

Remove those contingencies? That’s crazy..

We did try the gamble – overbid to hope for a low appraisal, it didn’t work. The appraiser see your contract and he will just make up the right figure. In our case, the appraiser even made a mistake on the lot size, actual lot 2500, he used 5000 in his formula, what the heck!

The thing is if the bank knows you can afford, then their appraiser will just give that number, they are all in the same shoe, despite what they say.

Don’t write checks you can’t cash! If you offer asking, or slightly above and beat out the competition, you gotta be prepared to pay it. All I’m saying is you get the property and a chance to get it at a lower price. If you go in low you will get outbid and you are done. Period. In Burbank there is no inventory. If you don’t go in strong forget it. If you can’t afford the prices, take a Hawaiian vacation and forget about it.

Gerry got it wrong, sorry buddy. Since Dodd-Frank, the banks can’t choose appraisal personnel. It is an anonymous pick. Appraisers have no skin in the game. This is why it has been such a problem. Google it and you’ll see tons of articles about it. No more slam dunks!

Lastly, you ultimately have the contingency period to back out of the deal or get a substancial price reduction. Any home has “problems” that need fixing’!

God help us all… First of all, I have NOT been looking for a house since 2007 because that is an exercise in futility. Any frustration would be due to an inability to perceive the current environment and act in a way that will lead to gains. Signing up for a 30 year mortgage does not provide me with any gain. The banking system will gain though my servitude, but not me. I cannot understand how thinking people can look at the current “market” and feel left out because they are not allowed to sign themselves into life long servitude. You are upset because you can’t choose the paint on the walls where you live? Really? You got to be kidding me! This is how Madoff worked. Only special important people were allowed to be scammed by him. Gee, if only I could give all my money to Madoff, my life would be so much better. This must truly be the end of days….

I paint apartment walls all the time. The $400 deposit is much less than losing 300K on a home or the 16k year on property tax. Or the $450 month association fee. Or the ….

Paint away.

Interesting. I am seeing priuce declines in the Conejo Valley. Some houses in the Conejo Valley for below 400k-ok houses. Now if they come below 300k-perhaps it might be a bottom?

Hi CABOY: It’s Valley girl. Pleae let me know..Where in the Conejo Valley do you see prices 400K “OK” homes?

Hello Valley Girl,

I just searched on Redfin and Yahoo real estate and put in Thousand Oaks and searched max price of 500k. It pulled in a few below 400k and quite a few below 500k. I was as surprised as you . I am looking at buying, below 400k, is a risk I am willing to take-especially in that area. These are Single family homes.

I was as surprised as you are, as during the peak, houses in the inland empire were selling for the same price. I haven’t contacted the brokers yet-but am thinking of doing so. I have to live somewhere and instead of a dinky apartment, I could be living in the home for the same payment.

Depends on your definition of “OK”. I live in a tract of smaller older homes (built in the ’70s) on the west side of T.O. (nice quiet neighborhood near schools/parks). Sizes range from 1200 to 1500 sqft. and recent prices from $380K to about $440K. If you can live with a small footprint then ~$400K certainly is available in T.O. If by “OK” you mean 2000+ sqft. then I agree that $400K in the Conejo would be difficult to find.

Compare the cost of a paid off home to the cost of renting. Taxes + maintenance versus the rent payment. Where I live, renting comes in last place by a good margin. Fast forward to when you are 70. Another month, another rent payment.

Leave a Reply to CC