The allure of low mortgage rates – time to buy in Compton. Culver City and Arcadia continue mid-tier correction.

There is something deceiving about the current low mortgage rates. To a certain extent they obscure the underlying economic fundamentals that are hitting the state. Certainly no one is going to look at an underemployment rate above 20 percent and a budget deficit of $16 billion and claim that the economy is booming. Old habits go away very slowly. The bad patterns that got us into this mess are creeping into the market with flippers, low down payment mortgages, and bidding wars making their way onto the California scene. Yet as you will see, much of the last year of sales has been driven by the incredibly low mortgage rates we are witnessing and the controlled leakage of properties onto the market. When you look at Los Angeles County overall you do not get an inside view of what is occurring. Let us pick out a few zip codes and analyze sales data and also household income figures.

The current housing market in L.A. County:Â A snapshot

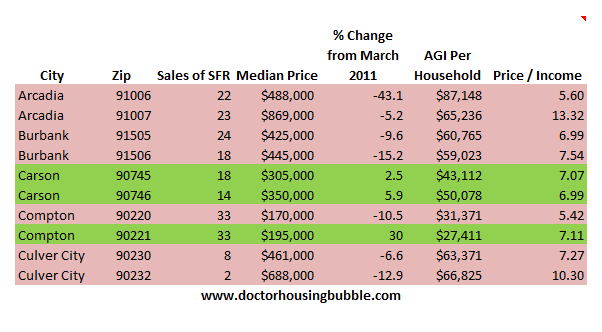

I went ahead and pulled five diverse cities and 10 zip codes in these cities to give you an idea of what has occurred over the last year:

I find data like this incredibly telling because we are matching things up with income on a micro zip code level. I am simply amazed by how little is mentioned about income on the mainstream press. Has anyone else noticed this? Can you imagine a car ad mention “this vehicle should only be a reasonable purchase by household incomes of $150,000 and higher?â€Â It would be prudent but maybe that is the point. Marketing is largely designed to part you from your hard earned cash. Just examine the income figures above. Even in prime areas incomes do not seem that strong. This is likely why zip codes in Arcadia and Culver City saw median home prices drop in spite of all the jawboning that prices are soaring into the stratosphere.

The bottom is here! Rush out to buy anything you can get your hands on! Of course most making this assertion don’t bother to examine these micro bubble markets. Sure, we’re at or close to a bottom nationwide because the median home price is $163,000 and household income is $50,000 (plus interest rates are below 4%). Doesn’t take a genius to make that claim. But what about a zip code where the median household income is $65,000 and the median home prices is $869,000?

A $688,000 home is way too high for a household income of $66,000 and would be better suited for a household making $200,000. The above sales and price data is gathered for March of 2012. Some of these absurd figures simply reflect micro bubbles.

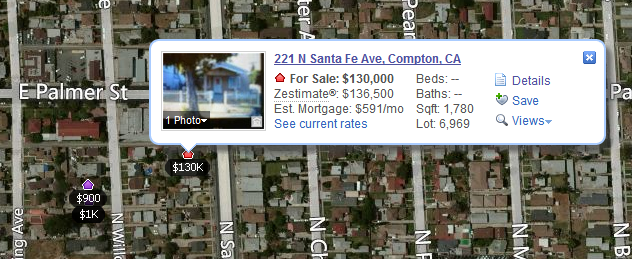

To the opposite end, take a look at Compton (90220) with 33 sales. Year-over-year however prices are down 10 percent even though the median price is $170,000, close to the median nationwide price. It does seem like more investor money is flowing in but also, with interest rates at 4 percent or lower some might be buying in these areas with FHA insured loans instead of renting.   Case and point:

You have two rentals on the market for $900 and $1,000 (both one bedrooms). Around the corner you have a home for sale at $130,000. With 4% down your PI is $567 and with taxes and insurance (FHA style) you are looking at a monthly payment under $800! Throw in the tax break and this place makes sense to buy. But who is buying? Good question. Seems like an easy buy for an investor right? The place has been on the MLS for 240 days. No bidding war here. My point is, people are starting to examine the market more carefully and are focusing on the overall economy as well.

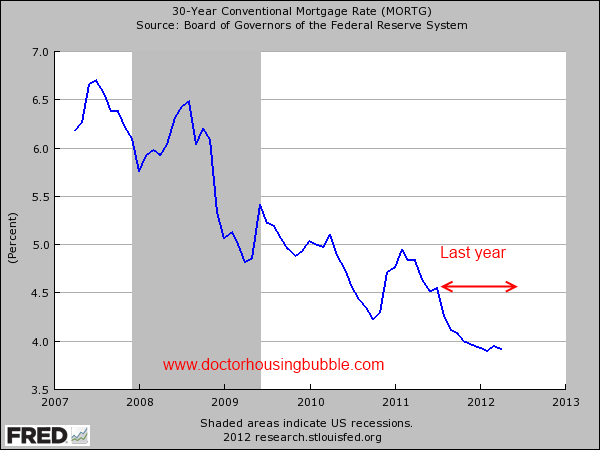

The higher priced zip codes of Culver City and Arcadia saw year-over-year prices fall. Prices might seem more alluring but this is only because of the temptation of low mortgage rates:

In the last year alone interest rates on a 30 year fixed rate mortgage fell from 4.94 percent to 3.91 percent (a 20 percent drop). For a $500,000 mortgage this gives you $300 more a month. Not bad when incomes are not moving up. At a time when income statements are being analyzed and DTI actually matters, a few hundred dollars courtesy of a mortgage rate can squeeze a buyer into a home. Yet this avoids the bigger picture of why interest rates are low. The Fed is artificially keeping rates low and the economy is weak with panic money entering into US Treasuries. In other words, the recent run we are seeing with real estate is being driven by the panic and economic distress of others and not local income gains or a strengthening economy. This is what caught me as being a bad move when the bubble formed the first time. The lack of real income growth that wasn’t derived from speculation in debt or real estate was startling.

Today, there seems to be a self-congratulatory attitude that people are actually exercising due diligence when making mortgages. Well, of course! That is their duty even though the entire market is virtually government backed mortgage debt (aka taxpayer backed). This is like being stunned that an engineer built a bridge that didn’t fall over after one car drove over it. The major default rates in FHA insured loans are going to create higher prices derived from non-interest related items like mortgage insurance. Here in SoCal, for the last few years one out of every three mortgages has been of the FHA variety. These just got more expensive practically canceling out the gains made by the drop in interest rates. What will be next? No interest payments for the first year? Maybe we can throw in a memory foam mattress for good measure.

I do agree with many that Americans are ultimately just focused on the monthly nut. However, this extremely low interest rate is creating a market very dependent on low rates. There is very little wiggle room and should rates go up (we are already going negative with inflation) prices are likely to move lower given this monthly nut mentality. Did I just give a buy signal for Compton? For those planning on staying for at least 5 years it seems to make sense. In other markets the fact that price-to-income ratios are still in double-digits suggest that prices are still inflated even with historically low interest rates.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “The allure of low mortgage rates – time to buy in Compton. Culver City and Arcadia continue mid-tier correction.”

Where can we get median prices and AGIs for other cities in So Cal?

http://www.usa.com has some fairly comprehensive figures for income, home prices, etc. I just pulled them for my (Northern CA) zip, and note that these are the price / income ratios: My zip and nearby: 2.92, 4.08. For CA and the U.S, the numbers are 4.45 and 2.85 (median home price / median family income).

It looks like safer bets would be in the < 3 ratios, but household poverty figures might be worth considering too. The lower ratios are in areas with lower % of population in poverty.

Anyway, an interesting exercise.

These numbers seem to be gathered from the 2000 census. A lot has changed especially for SoCal through the housing boom and bust. I wonder when they’ll update with 2010 numbers. A quick scan of the 2010 Census site is not helpful since they’re interactive map is taking a lot of time to render…

Median incomes of individuals and “households” as defined differently by each provider, are provided by the us census on their site, summarized by commenters in various places, and can be found in such places as CityData.com You can also get the 2000 information and thus make trend lines; citydata also was rating schools which turns out to be a key for many home buyers (all free). Citydata also provides some county wide median pricing and sales, as does zillow. Keep in mind Zillow’s numbers are widely recognized even by zillow as wild guesses, as the sales figures are adding in very disparate sales many of which are misreported, and often a foreclosure is booked as a sale. You can check foreclosures for free at realtytrac (pull up map) keeping in mind the inaccuracies and older information not reflective of what a buyer actually faces.

There are also private services and public, which detail any demographic you may want to examine, such as household rate, profile of buyers and sellers (from race to income to age) in each zip code. The big two are household formation (plummeting) and unemployment measured with the U-6 from bureau of labor statistics. Keep in mind that homes are bought by upper income stable households (mostly) and NOT by the median income earner as such; but the income spreads can be checked on city data. The problem is that a bank panic originating in France or Greece (thus negating bank capital worldwide) could occur and that may grossly affect all US banks, employers, and would be homebuyers as to interest rates, inflation, home prices, and cause a new recession, so check the Wall Street information sources (Spain is having a third leg down on their recession). Isn’t that easy? Capitalrisk blog is a great place to find detailed data charts and commentary (drhb is lots more fun and a much different perspective on the housing mess, and brings elegant and humorous well-written focus to very localized absurdities and demographic/debt analysis).

Those DTI ratios calling “bottom” have feet of clay. Typical credit-worthy households consist of two incomes, and in many cases employment for one or both is hanging by a thread. Bernanke’s cynical ZIRP is pulling in a fresh herd of sheep…

If these socialst, communist, fascist leaders and bankers in NYC and Washington are honestly taking us down this path, then yes this is the time to buy. Welcome to the new Red America, land of controlled economy.

Why did my family even bother in WWI and WWII…

The Left in Europe is alive and well while the USA “Left” is dead. We have been slipping into Fascism for quite some time…

PapaToBe – You are suffering from cognitive dissonance; the “commie” bankers are just engaging in/are the recipients of crony capitalism. The just buy the congresscritters they need (often Republican, but Democrats are for sale, too) to stay in the money. Simple as that.

I can just imagine what the Born Again “No” Party would do if anyone (especially a Democrat) suggested that mark to market be re-instated…

Wrong. Using the gov’t to “save” institutions (via mark to market, bailouts, etc.) is supported much more from the left than the right.

“Wrong. Using the gov’t to “save†institutions (via mark to market, bailouts, etc.) is supported much more from the left than the right.”

Joe Average – wish you were right, but I really disagree with you. The bailouts happened because of the Dems, but trust me the Repubs would have stepped in to save their masters if the Dems had not had the Fed-induced panic attacks. Both political sides have endorsed all kinds of bailouts, destruction of regulation, and horrific accounting standards.

On the street however, neither the left nor the right support the bailouts. Some believe we would have had financial destruction without them, but even most of them think things have been taken way too far. The average calls (from the people – ALL the people) were 300 to 1 AGAINST our elected officials voting for TARP but our voices, left and right, were ignored by Congress. Again, they served their masters and it is not the citizens (oh, wait we’re now to be known as consumers.)

If you get rid of the left/right war and really talk to people on the street they may not understand all that is happening, but the vast majority know something is very, very wrong. We need to stop thinking left and right and we need to stand up as Americans to demand our elected officials represent us (the late, great middle class.) The left/right war is just a distraction so you (general you, not you specific) ignore what your politician does and they don’t have to be accountable.

None of them are working to bring jobs back to American, to create fair trade, to fight against the continued destruction of Constitutional right. None of them give a darn once their pockets are lined with the blood of the middle class. (OK, too early for me to be posting.) There might be one or two exceptions – it was nice to see R. Paul grilling Bernanke on destructive policies – but overall they all need to be tossed out and non-career politicians, who serve America and not corporations need to be put into place. Unfortunately, there’s no easy way to do that and it gets harder each day as the (bogus) culture wars reign.

San Diego RE Bear: Great post. I understand exactly what you’re saying, but I wholeheartedly disagree. What you call the “left/right” debate is a debate of philosophy, a debate about freedom, and most importantly about the role of the government in our lives and our communities. It is the only debate worth having.

@San Diego RE Bear,

You are correct. Regardless of motive, is a system that exists to serve the banking industry first, a healthy system at all? What is wrong with the USA and perhaps the world, when the needs of banks come first? How to hide something so hideous and incromprehensible? In plain sight.

I have to question your sales figures which show that Arcadia home prices have dropped by 43.1%. If you break out your data, I think you will find that the largest drops have been experienced by condos and PUDs, not by SFRs and certainly not by residential income-producing property. I check MLS regularly and wince at the few number of listings of residential income property in Arcadia. (As of 5-16-2012, there are only 8 listings, with prices ranging from $598,800 for a duplex in not-as-desirable East Arcadia to $2,300,000 for a 8-unit complex near the Westfield mall).

In reviewing property prices, you have to consider the demographics. Few people would actually want to live in Compton, as it is viewed as the stomping grounds of the Bloods, the Crips, and the Mara Salvatrucha, while Arcadia is a magnet for upper middle class East Asians (mainly from Taiwan and China), who have the financial wherewithal to withstand a prolonged downturn in real estate. Of the two types of residents, the ones in Arcadia have the greater means and the resources to dig in for the long-term and to refuse to sell until prices have rebounded back to more prosperous times. Thus, I do not expect to see any substantial drop in prices of SFRs and income producing properties in Arcadia in the near or even more distant future.

Just because you love your city, and don’t think values should go down, it doesn’t mean they won’t. Keep dreaming.

> Just because you love your city, and don’t think values should go down, it doesn’t

> mean they won’t. Keep dreaming.

Indeed. I would not mind the least if property values went down in Arcadia, because it would give me a chance to buy. From what I’ve seen, however, Arcadia owners would rather keep their properties off the market rather than sell at a reduced price. Consequently, there are very few bargains to be found. I keep looking, however,…and dreaming.

Since when are Mara Salvatrucha in Compton?

> Since when are Mara Salvatrucha in Compton?

According to Wikipedia,

http://en.wikipedia.org/wiki/Compton,_California

Compton is notorious for gang battles among the Bloods, the Crips, and the Surenos, where Surenos is an umbrella term for the Mexican mafia and affiliated street gangs, among which are the MS13 (Mara Salvatrucha).

After the 1992 riots, “many African Americans left the city. Meanwhile, many Latino and other immigrant families moved into Compton, including Samoans, Tongans, Koreans, Filipinos, Belizeans and East Africans.[32]”.

There are no MS13 sets in Compton that I’m aware of.

Arcadia is my ‘hood. Sorry, couldn’t help it.

One only has to walk up and down the streets such as Lovell, Baldwin, and Longden to see the empty McMansions. Some sitting there with for sale signs, and some that don’t as owners have given up trying to sell these monstrosities. On Lovell alone, you can count five or six on one block – all empty. They don’t even have the decency to put up blinds to prevent folks from peering into the empty shells.

Sure, Arcadia has great schools, and Asians love the area – but these over $1million homes are NOT selling. Anything between $500k and $700k usually gets snapped up pretty quickly, but good luck with anything else. You don’t see a lot of listings exactly for the reason you listed – Asians can weather this economic storm much more so than most folks. But even Asian money has it limits. How low do prices need to get before these East Asians, as you call them, turn Japanese, and liquidate en masse?

Don’t believe me? Take a drive down Lovell and the surrounding streets and admire the lonely McMansions.

I forgot one other thing. 91006 is the El Monte school district, but is still part of Arcadia. That is why you see such a huge price discrepancy with 91007. Again, the schools are the only thing keeping Arcadia in a bubble.

> Arcadia is my ‘hood. Sorry, couldn’t help it.

Then I guess we are homies. 🙂

Honestly, I don’t see these empty McMansions that you are talking about. I drive by and do business in Arcadia regularly. The prime shopping and commercial section of Arcadia has got to be the intersection of Baldwin and Duarte, where the Pavillions supermaket and shopping plaza is located, where Citibank, Wells Fargo, and BoF have their branch offices, and where the medical offices are situated.

Lovell Ave is a short street that runs from Duarte Rd to Norman Ave. Near Duarte, the homes on Lovell are unimpressive, though they get more luxurious the further south one travels. If there are empty McMansions on Lovell, I’m missing them. I’d actually like to know where they are, as that might help me in my business.

> Sure, Arcadia has great schools, and Asians love the area – but these over $1million

> homes are NOT selling. Anything between $500k and $700k usually gets snapped up

> pretty quickly, but good luck with anything else

I don’t think this is anything new. Asians are careful spenders and budgeters, but they are not made of money. The market for homes over $1 million is going to be very limited, no matter where they are located. The people who can afford million dollar homes can afford to be choosy, and the owners of million dollar homes can afford to wait until they get their price, … or until they give in. Thus, the low sales volume.

As someone who is married to one of those East Asians and with many East Asian friends, many have nice homes and nice cars and spen madly, but very few have the resources to weather any prolonged financial storm.

A number of friends of friends from the mainland, their money is from speculation on real estate in the mainland, which is starting to show cracks.

Most if not all are very worried. These countries need Europe and North America to be healthy for long term prosperity….

Well, you have to live in Compton!

This calles for a little Snoop and Dr Dre!

Gimme the microphone first, so I can bust like a bubble

Compton and Long Beach together, now you know you in trouble

Ain’t nothin’ but a G thang, baaaaabay!

Two loc’ed out *****’s so we’re craaaaazay!

Death Row is the label that paaaaays me!

Unfadable, so please don’t try to fade this

Fallin’ back on that a** with a hellified gangsta’ lean

Gettin’ funky on the mic like a’ old batch o’ collard greens

It’s the capital S, oh yes, the fresh N double O P

D O double G Y D O double G ya’ see

Showin’ much flex when it’s time to wreck a mic

pimpin’ h*’s and clockin’ a grip like my name was Dolomite

I told you I’m just like a clock when I tick and I tock

But I’m never off, always on, ’til the break dawn

C-O-M-P-T-O-N, and the city they call Long Beach

🙂 Who wouldn’t want to live there????

Home prices in Compton are offset by the cost of a Glock and body armor for protection. There is no house/apartment so cheap it can offset worrying about survival, or keeping ahold of your posessions. Unless you are a young adult just fleeing the nest and really don’t have much to be stolen anyway. (From someone who used to step over needles walking down the street …)

One problem I see is that these “affordable” areas with better ratios are turning into slums with high crime rates. Even The Atlantic had a serious article on how suburbs are turning into crime-ridden slums.

Renting is still King since it gives you low cost (no taxes, no maintenance, etc) and the best flexibility to move. Remember, the average American moves on the average every four years now….think of the 8%+ it costs to sell that house. More interesting is that rents are falling despite what MSM claims.

Good luck!

Taxes and maintenance is rolled into the rent. Flexibility to move?? I can MOVE out of my place Today if i like. I grew up in da hood, but today choose to pay a premium to raise my kids in nicer area. Perhaps i am doing the kids a disservice: They take everything for granted, lack the survival mentality I was forced to develop. I could rent my place out, and move back, but Even at $100K, I am unlilkey to move unlessed forced to…

In what desirable part of Southern California are rents falling? They don’t seem to be any less outrageous anywhere that I’ve looked lately.

Agreed. To the next poster who asked about falling rents: I lived in Huntington Beach (in OC) for ten years until two years ago (in large complex, but an upper corner unit that did not share the noise or activity of the interior), when I moved up to Rancho Palos Verdes (ocean view penthouse condo). Renting both places. The last two years in RPV I am paying only 2/3 to half the carrying cost of the condo I live in, and my landlord seems happy to have me and is not raising rents. Units here are only slowly dropping in sales price. Equivalent unit to the one I live in sold near 850k at peak, now they list at 600k, but need to drop to low 400s. HOA is $550/mo.

In the complex in HB, the increase was always less than true inflation (usually only 2%/yr), and from 2008 to 2010 when I moved out it was first 0% then -3%! They dropped rates just to get you to resign the lease. Have not heard that it has changed, I still see signs offering a free few months of rent. BTw that place was in nice location only half a mile from the beach, not near downtown, surrounded by ‘million dollar at peak’ unremarkable stucco boxes, now selling for 6-700k range (I think).

When we were relocating two years ago we searched extensively to find the ‘right’ place, but had no shortage of nice options.

House rentals may be a different story, and I have no data points on that. When we looked around, no good prices in RPV since this is a high priced zip code. Oh, but there are a few vacant homes that have not moved for two years that I do know about. One is an overpriced mansion on a ridge with an open space below and a fabulous ocean view, but no yard – just a walkway for hikers right behind your house. The other is on a very busy corner, a tiny bungalow from 50 years ago that is very outdated. Sellers must be clinging to fantasy prices.

Dear Dr. Housing Bubble,

My question when I see a disparity in renting verse owning is what will happen for them to reach normal equilibrium. Prices could go up, rents could come down or a combination of the two. Do you have any thoughts on how to tell which path housing will taken in a given area?

Thanks

Low interest rates are the only thing supporting this. Prices will probably muddle for a long time, and the Fed can’t raise rates or else it won’t be able to service it’s debt.

Rents should come down eventually, it’s popular to rent right now as so many can’t obtain a mortgage because their credit is destroyed.

The only way this housing market stays afloat is if you have low interest rates indefinitely. If rates shot up to god forbid 6 or 7% in the near term, that would be the end of housing and the economy here in overpriced LA/OC. So the only question is can the Bernanke keep this house of cards upright? I don’t know, but it looks like “the powers that be” will do everything to keep this shell game going.

One thing that this low interest rate bonanza has created is virtually guaranteed NO APPRECIATION for housing for the next decade. So if you are in no hurry to buy a house and don’t mind renting, you won’t be losing any sleep anytime soon or hear the realtor garbage “buy now or be priced out forever.”

Compton is similar to Santa Ana in Orange County but it has a lot more blacks. Arcadia is similar to Irvine.

Can’t believe people are getting fooled again after 5 years. People need to do their homework or it is their own fault. Culver City has a percieved mini boom right now because there is no inventory, due to upside down mortgages. Condominiums are getting creamed at 50% off and more.

http://www.westsideremeltdown.blogspot.com

The condos are getting creamed because the FHA instituted a rule about two years that disqualifies the HOA from government loans when more than 15% of the units at the HOA are more than 30 days in arrears on their monthly association dues. Notice, this is not 30 days delinquent on their mortgage, this is 30 days past due on their monthly HOA dues. The first thing people at a condo do when they run into financial trouble is stop paying their association dues. So even people who own their place free and clear can cause the 15% rule to kick in when they don’t pay their monthly HOA fees. When the 15% rule kicks in that means no 3.5% down FHA, no 0% down VA loan, no Freddie Mac and no Fanny Mae loans. This limits the buyer pool to 20% cash down only.

I can’t believe people are falling for this “mini boom” either. So right, the only reason prices in some areas have gone up is because there is NO INVENTORY or problem properties, not because home prices are going up. If buyers think this is the time to buy, WRONG, and they will sorry when they buy a home out of desperation or because they think the market is going up. And we will keep renting until it makes sense, or not. Buying a home is not like buying a stock…you are stuck with a home.

Thank you DHB for your articles. We’ve been trying to buy for about 5-6 years now and if it wasn’t for your analysis, we would have lost tens of thousands of hard earned money if not hundreds of thousands. Although our down payment is sitting in the bank making less than 1% a year, that sure is better than losing 10% every year and more in the future. And we don’t have to worry about losing sleep at night over declining equity or get an ulcer wondering when the market will hit the bottom. But it sure is testing our patience waiting for the bottom … we might be too old to buy or care about real estate any more…

Does anyone have a recommendation for news website or blog that analyses economy / market condition like how DHB does for real estate?

OC, in a similar vein to DHB, but dealing more with the general economy: http://www.mybudget360.com/

Looking at the price to median income multiples makes me want tp puke. 10 times annual earnings? Once upon a tyme long ago and far away. the magic numbers were 2X and 3X and maybe 4X if the property was really hot. How does a family support 10 X annual median earnings prices? Dealing in funny stuff? Strange interest only mortgages?

The answer is two-fold:

#1) Dr. HB is printing median household income in those zip codes, not mean household income of people who are taking out a new mortgage.

#2) Dr. HB is printing single family residence selling prices. In the mid-tier areas like Culver City, Burbank, Sherman Oaks, Torrance, etc. two bedroom condos are now selling in the $250K range. Household income required for a $250K mortgage at 4% is about $45K per year. The price/income multiple is closer to 5.5X, which is still steep but low interest cheapens the value of the dollar and keeps home prices artificially inflated.

Do you know where we can find median homeowner income? That seems to be the holy grail for determining if an area is still bubblicious. Vast tracts of multi-family dwellings near the 55 can skew the 3x 4x income multiplier on the outside.

Agreed, and I had been thinking about how to reverse-engineer the relevant incomes.

For example, if you knew that an area was all SFRs, and all owners and renters came from a group that had the same income distribution, then speaking of ‘median’ incomes will not depend upon whether you were speaking of owners or renters.

But it is more likely that the two groups have different income distributions. So even if each group has a unimodal distribution, it is tricky to back out the ‘median’ of each class unless you are willing to make some assumptions.

One first needs to make an assumption about the distribution of incomes (unimodal or perhaps bimodal, since there are two ‘classes’ of households, one being renters and the other being owners).

Second you need to back out according to property type what the fraction of owners versus renters is.

One means would be to look at number of multi-family dwellings (assume 100% rentals), number of condos (maybe at 20-40% rentals), and number of SFRs (assume 5-10% rentals). The % rentals in each category would likely vary according to zip code.

The useful bit of hard data here is that one should be able to back out the proportion of housing units of each type in a particular zip code. At least this may bound the error in estimating the median income for the renter class vs. the owner class.

Just an idea of how to parse it out.

People are still willing to sign on with the Big Banks despite everything that has happened. Unbelievable.

Low inventory is completely fabricated by the mortgage holders. They are the sell side of the market now. If they don’t want to sell, there’s low inventory. If they don’t want to approve short sales, there’s no sales. I think there’s going to be a lot of these REIT deals coming up in the near future. This would explain why there’s a big hold-off of inventory in the last few months. There’s a bigger deal coming down the pike.

The low inventory is also exacerbated becasue the move up buyers have been completely eliminated. To move up the housing ladder from a 500K house to a 750K house, you will need lots of equity which most “owners” simply don’t have. Also, those 750K and up houses require much more stringent financing which rules out the majority. I don’t see this changing anytime soon. Back in the good ole days here in California, building equity via housing appreciation was guaranteed like clockwork year after year. From here on out, building equity will be done the old fashion way…paying off your mortgage principle. No more free money for doing nothing!

Well, look what’s actually happening across the country with foreclosures:

http://www.zerohedge.com/news/american-foreclosure-process-has-ground-halt

Something’s about to “happen”…….

And its going to be real hard for someone to move up from a starter home to a family home, and from a family home to kids gone home, and from there to a retirement home because the people who should be buying the starter homes can’t because 1) they are saddled with huge education debt and 2) can’t find salaried professional jobs (instead relying on Mickey D burger flip wages)

CAE – “Low inventory is completely fabricated by the mortgage holders.”

The bankers plan to hold back inventory to increase prices is working so well that home builders are starting to build again in the Bay Area.

Ahhh…Compton. Both sides of my family have Compton roots; some good people do live there. It can be a dangerous; take a tour courtesy of NWA (clean version)…

http://www.youtube.com/watch?v=lAxP5oy2Ox4

*Foreclosure Moratorium in Ca

*Defaulters staying for free

*Mark To Market -Banks can reflect bubble prices on Balance Sheets –

higher bonuses

*REO (Foreclosures) Bulk Sale- rentals in the future

*Crony Capitalism – tight inventory is a fake bottom

*Slow leak down like Japan did

(The Supply Side, not the Demand Side)

A long term friend was talking to a loan guy (my friend doesn’t consider loan folks part of the REIC), and they guy was feeding his naive brain some factoids that were true, but didn’t bother to really give him a macro view of what’s going on. My summary above was part of my email to him.

Thank you Dr Housing Bubble for explaining the demand side. You’ve been a great teacher and human being. “Mensch-hood” to you!

Many of the items you mention are exactly what has ANSI is happening to Japanese Real estate, especially Tokyo.

Especially Mark to market and crony capitalism.

Tokyo is filled with large empty spacious condos and town houses, but builders have all kinds of tax incentives to price hem what they think they deserve then what the real estate market says it should sell for.

We waggled our fingers at Japan for all the shit they pulled and here we are doing the same damn thing.

10 to 12 times income is the norm in Japan.

Nearly bought a house in suburban Tokyo for a cool ~ 1.2M. The crazy loan terms were 1.1 % for first 10 years and 2.5 for the next 20 years.

You can check Tokyo Mitsubishi UFJ English web site for current rates and I’m sure there around that still.

Only reason anyone buys because of the. Crazy low interest rates.

Matt,

You can get a lot of price info from Redfin and it’s current.

The http://www.usc.com site is way out of date. Things have changed a lot since 2000. I pulled my zipcode:

21,713 (2000)

Population Density: 2,657.05/sq mi

Median Household Income: $52,890 at 2000

Median House Price: $495,600 at 2000

I went to Redfin and pulled up a house for sale nearby & then I went to their demographics site that’s listed near the bottom of the listing’s page. The income is now up from $52,800 to $73,991. I went back to the house listing and looked at the median house value for the area and it’s now up from $495,600 to $1,199,000. House price percentage increase is clearly way above the income jump, but inventory is low now and people are buying the homes at asking price and higher for decent properties. That low interest rate is working as an incentive. I’m not a realtor. I’m just seeing it and watching with dismay! I have noticed that the condo prices have come down a lot and seem to still be dropping though. You can also look at some of the other data listed in the Redfin demographics such as the percentage of people who own vs. rent their homes. If there’s a large percentage of renters, then the income numbers could be skewed.

I was just in a suburb of Salem OR. 2225 sq ft. 4/3 built 80’s. 250K! Made me cry.

This just goes to show how uneducated the average person is about money and debt.

http://thebasicsofliving.com/money-vs-debt/

Another source for zip code income data is Mellisa data’s zip code tax return lookup. It has ten years of time history but I think gives the mean. However it is based on all income tax filings, so I think pretty accurate.

Other interesting tidbits on that Compton house: it sold in 1999 for ~75k and today is still assessed for over 200k yielding property taxes of more than $4k or four months of equivalent rent. Buyer beware!

California real estate is generally overpriced, but one thing this blog overlooks is that the post-WW II housing model is terminal. The communities with good public transit and pedestrian-oriented infrastructure have weathered the housing crash better than the exurbs. Culver City is indeed overpriced, but the extension of light rail westward will mitigate future price declines.

Central Houston is a better measure of nation-wide trends than Southern California. From May to mid-October the climate sucks. It is just a flat, humid, subtropical plain with none of the beauty of Southern California. Central Houston’s population density has been increasing for the past 25 years and real estate has proven to be immune to the falling values of suburban Houston. Proximity to large employment centers, higher density, reduced parking minimums, better walkability and seizing motor vehicle lanes for light rail construction account for the discrepancy between the center city’s price resilience and the suburbs’ decline.

The “new” market for real estate is actually the traditional one. Aging boomers and impoverished millenials are no longer seeking acres of trees buffering them from their nearest neighbor. There is a huge, untapped market in North America for the pre-1950’s model of development. Hopefully The Doctor will factor this in to his calculations.

http://youtu.be/ISDd1fTBCwg

Actually, Houston is doing worst than the burbs. Houston is home to more lower income hispanics and blacks. The more suburbian counties in Texas have higher prices. The best real estate in Texas is Sugarland and Plano wealthy suburbs not Houston, Dallas and Austin. Burbs like Plano which Forbes considered one of the safest cities is growing while the big cities in Texas like those in Ca are losing the white population and gaining more minorities with less bread.

Depends where you are in “Houston” (within 610 Loop), the most expensive price/sq ft is still within the Loop. Either you are inside the Loop, or outside the beltway 8 loop where the growing suburban areas she is talking about are. Those are the gaining areas.

Good news: Mortgage rates at all time low

Bad news: Mortgage insurance rates at all time HIGH

just like all other forms of information available lately, we only hear half the story.

http://www.hardcorecloser.com/9-things-every-real-estate-agent-must-have-just-to-be-in-the-game/

Austin in particular is pretty dumb unless you’re talking Round Rock or some other far-flung exurb. It is experiencing the California-effect. Went to an open house the other day: four couples lined up to see the place which I knew was overpriced (500K — sold for 143K in 1999) but wanted to see because the architecture.

That any town in Texas could appeal to anyone coming from So-Cal so much is telling. It reminds me of Seattle in the early nineties, but at least Seattle isn’t in…Texas.

The house in Compton is a Duplex so the demand could be less. Also you cannot find this listing in the MLS (I looked), not even a previous listing. However this does show in Backup according to Zillow, based on their mortgage history this is most likely a Short sale so your time frames are skewed. Better to show an example of a Standard sale or even an REO that is an SFR to give your thesis more validity.

I work w/ investors that buy at Trustee Sales and the bidding is intense. There is a lot of competition. In Rancho Cucamonga/Alta Loma there are only 293 units (SFR & Condos) for sale. As with all Real Estate you cannot make a broad prediction of price increase nor decrease, each area has it own dynamics. I hear agents in this area state there is a definite lack of “Good” inventory, if the house is priced “accordingly” and in good shape and least within certain areas of the Inland Empire homes are selling.

I reside in Compton. I reside in calm area, homes are selling for 225,000. My neighbor asked me yesterday if it was a right time to buy, he currently rents a 2bed and 1 bath for 1500 plus bills, I told him depending. I asked him how much he made, he said that he makes 52,000 a year, and his wife makes around 38,000 a year. He wants to buy a foreclosure for 180k. If he buys it, his mortgage payment will be lower than what he pays of rent. He should buy something that would be cheaper what he pays for rent. Note: The rents for single-homes in Compton are going up. While the rents at apartments complexes (few in Compton) are not moving up or down.

Compton is has nice areas and not so nice areas. So far this year, there has been 5 murders. Some neighborhoods of Los Angeles, which are smaller in size of population have had the same or more. For example, Historic South Central, a neighborhood of 50k there has been 5 murders .

I reside in Compton. I have a B.A. My neighbor is going to start her PhD in Pepperdine University this Fall. So please do not generalize all Compton. There are nice neighborhoods and bad neighborhoods. There property as big as one acres (horse property) to condos.

Yesterday, there was a shooting in Compton. A resident, who is a deputy, found two burglars in his house in Compton, and he shot one. http://abclocal.go.com/kabc/story?section=news/local/los_angeles&id=8674698&rss=rss-kabc-article-8674698

Look at this house. It just came up for sale. Supposedly it sold for 22k March and now it is for sale for 209k. http://www.redfin.com/CA/Compton/1804-N-Grape-Ave-90222/home/7350043

I grew up in Culver City. In my opinion anything over 200K is insane to me. I would never get into 500K or more there or for any average house on the Westside. The income is just not there it is not afforable in my view. There is nothign that will change my mind when I see a 300K place in the late 90s trying to get 600K now? STOP. How many fools ARE out there? Jeez, the masses are asses.

This is a bit late but thought I’d chime in as we recently left our condo in Monrovia (which borders Arcadia). Bought in 2007 at 410k. We both were set in our careers, first time home buyers, and ready to get our own place. All we heard was that housing is the best investment and can only go up. We were conservative and got the condo thinking it was a starter and, 5 years from now, we’d be able to buy up. Fast forward to the present; we up and left our condo after our neighbors short sold theirs (identical unit) for 250k. This was not a quick decision and, honestly, should have been made years ago. We never re-fi’ed (couldn’t with our negative equity anyhow), our loan is an 80/20 (although we still put a little down) and all non-recourse. I love when I hear “they used their homes as ATM’s;” yeah, baby–put in new countertops and a sliding glass door with my teacher salary, which I will never see again. The entire time we were in our condo, we had been socking away money for a down payment for our next place. When we actually started to look for a place about a year ago, we realized we had at least 10 years until we recovered any equity. Coupled with a balloon payment, due in 4 years or so, it was a lose-lose. A short sale was unlikely given our income and savings, which we do not care to share with the banks. Plus, lots of things to repair in the condo and a weak HOA. We did not even bother to stay in our place; we rented a house at a lower payment than our condo. Haven’t even received our NOD.

This was not a decision we would have even imagined or entertained 2 years ago. We had perfect 800+ credit in our mid twenties, paid for college, grad school with our own money, no exorbitant debt, live within our means. We still have a beautiful down payment that will continue to be socked away as we will be in the foreclosure penalty box for some time. This was not an emotional decision; it was a rational and financially savvy one.

I share this because I have obviously learned a lot and I realize that a down payment and income should be the primary indicators of who purchases a home. Even with the falling value, had we put down at least 80k on the condo, we probably would have stuck it out. Even with our looming default and foreclosure, we are better candidates to purchase a home with 30% right now than half the people with 3.5%. I imagine there are TONS of people in our situation, stagnant, great candidates. We make 140k (which will rise each year with our education levels) a year and have managed to save 100k for a down payment (make that 200K in 3 years) but won’t be eligible to buy for 7 years. HA.

We actually look forward to renting around the SGV.

Leave a Reply to Robert McCorkle