The attack of the smallest homes in Los Angeles: Trying to ride the mania wave and getting rid of tiny homes that rival the size of a college dorm room.

Whenever you read dry economic articles on housing that attempt to justify high home prices there is always the fascinating lack of pictures. As they say, a picture is worth a 1,000 words and in the case of a crap shack, a picture is worth a thousand tacos. Some people are getting out of Dodge (or Compton) and trying to sell into the larger gentrification meme. I went to a few lower priced neighborhoods this past month to see if any deals were present. The one thing that struck me is the increasing growth of cars per house. It was already high before but the number this time blew me away. It would appear that 4, 5, or even 6 cars per household were common in these areas. The congestion on the street reminded me of New York parking absent the skyscrapers. You also have the standard car stationed on the lawn on a few homes on the block. Keep in mind these were in so-called hipster hoods where one Whole Foods was enough to justify a $700,000 crap shack. Ultimately inventory is rising and people are slowly coming to their senses. I’m always stunned that some feel they missed out on buying a crap shack. So buy today. If your plan is to stay put for 30 years, why are you trying to time the market? This is speculation and you might as well speculate with the stock market. Just to give you a taste of the craziness, let us go in search of some of the smallest homes available for sale today in Los Angeles.

The search for small homes

There is this interesting cross-section of hipster living, expensive food, and trying to justify small living as some sort of modern day eco-movement. Yeah, like those 6 cars are doing much good to the environment. In the end it is a late night pitch to have you part with your cold hard cash. Some of the small homes on the market put a nice bit of frosting on this cupcake of real estate insanity.

Let us take a look at our first property:

437 W 54th St, Los Angeles, CA 90037

2 beds 3 baths 318 sqft

“This 318 square foot condo home has 2 bedrooms and 3.0 bathrooms. It is located at 437 W 54th St Los Angeles, California.â€

I love it! More bathrooms than rooms in this property. How you manage to get 2 bedrooms and 3 bathrooms into a 318 square foot property is something even Houdini would have been impressed with. Look at all those beautiful wires hanging around the home. You can pretend you are part of a modern day version of Cirque de Solei, Hipsteranami!

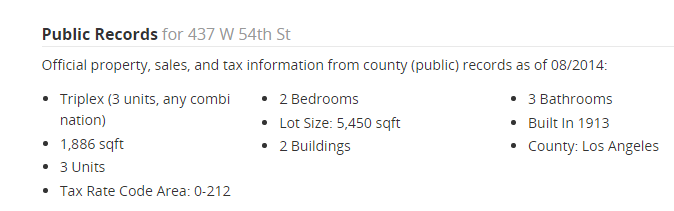

Update: Â Facts and Feelings points out that this is a multi-unit place. Â So does that mean 2 bedrooms and 3 bathrooms are spread out across 3 properties!? Â Why this isn’t listed on the ad is beyond me. Â On further examination:

Here is another perspective:

I’m not sure what qualifies as a condo these days. Â You also normally sell one “condo” at a time.

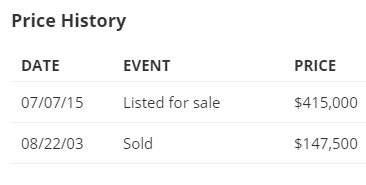

Good deal? Let us look at the price:

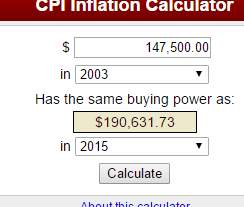

Someone paid $147,500 back in 2003. The current list price is $415,000. If we look at the inflation calculator this home should be priced at:

Oh, but I forgot. This is glorious Los Angeles! This home is part of the “global city†meme. Therefore, $415,000. See? This is how pricing works here. Onto our next property.

419 1/2 E 76th St, Los Angeles, CA 90003

1 bed 1 bath 360 sqft

Let us look at the ad:

“The LOWEST PRICED single-family residence on the MLS within a 25-mile radius. You can’t beat this deal! Perfect starter home or rental. A beautifully remodeled and upgraded 1 bedroom/1 bathroom home is ready to be yours. This property is well-designed for the size, utilizing every inch of the home to your benefit. Brand new roof, new paint inside and out, new flooring, and new fixtures. Parking is available off of the alley in the back. Entertain in your gated yard or make a beautiful…â€

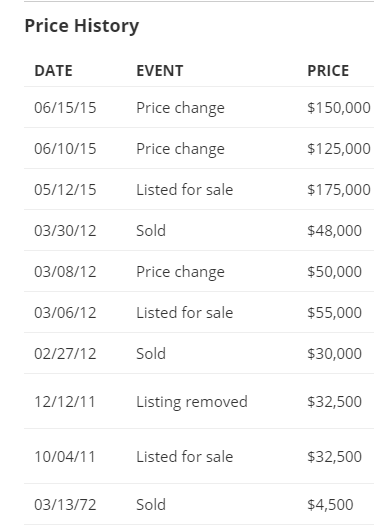

I love it! Lowest priced property within a 25-mile range on the MLS. That is a very strong opening. You can entertain in the gated yard after you park in the alley. Sounds like hipster living to me! Let us look at the price history:

The place sold in 1972 for $4,500. The more recent sales price was in 2012 for $30,000! It was then sold for $48,000 back in 2012 again! Nice quick profit there.  Now, three years later they listed the place for $175,000! Bwahahaha. No one bit. They dropped to $125,000 and then upped it to the current list price of $150,000.

This place has 1 bedroom and 1 bathroom. Here is the bathroom:

You know the dull Eat, Pray, Love movie? Here, you can crap, rinse, and shower. Don’t you just love Los Angeles? As inventory continues to grow and rental Armageddon hits, more people are starting to bring reason to their real estate buying.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

70 Responses to “The attack of the smallest homes in Los Angeles: Trying to ride the mania wave and getting rid of tiny homes that rival the size of a college dorm room.”

Love it. First place likely was expanded without permits so the 2 beds and 3 bath place is probbaly at least 700-800 qft, but still a dump.

Housing To Tank Hard Soon!

If you were my stock-broker I’d go broke!

That doesn’t make any sense because he’s been advocating a position of sell now before a supposed crash, how would that make you go broke?

if you ever bought you can’t sell

I think the first property is 1300 sq ft not 300. Has to be a typo.

Wow. Just wow. How can anyone live 318 sq. ft.?

My walk-in-closet is larger than that. Hey, some people prefer to live in a closet that part with an “international” city like LA.

Some residents in Tokyo or New York City would consider 318 sq ft to be HUGE.

Here’s a Manhattan apartment that’s 90 sq ft (including “kitchen” and “bathroom”): http://inhabitat.com/nyc/womans-impossibly-tiny-90-sq-ft-manhattan-apartment-is-one-of-the-smallest-in-nyc/90-square-foot-apartment/

And ten Manhattan apartments that range from 185 to 300 sq ft: http://ny.curbed.com/archives/2012/06/26/the_10_smallest_apartments_on_the_market_in_manhattan.php

In Tokyo they have it down to 54 sq ft: http://en.rocketnews24.com/2014/03/08/ridiculously-tiny-apartment-may-be-downtown-tokyos-cheapest-with-good-reason/

If that’s still too big for you, try one of Tokyo’s “coffin apartments”: http://www.dailymail.co.uk/news/article-2286069/Living-box-The-tiny-coffin-apartments-Tokyo-cost-400-month-rent.html

put me in a real coffin before you put me in a coffin apartment……

A lot of people in Manhattan already do and pay dearly for it.

The BEDROOM is likely 318 square feet…

And the rest of the real assets are deemed IN COMMON…

OR

That’s one dinky bathroom and bedroom that combine to 318…

And every other real asset is deemed in common.

Something screwy like that is the most likely answer to the listing.

Nothing as useful as a carport is inside the deal.

Very carefully……

LA County Assessor records show 437 W. 54th as having three units, one in the back of the parcel of limited California dirt @318 sqft, and two units in front totalling 1,568 sqft.

Meaning that the listing is even worse than it appears on the surface. Condo home – some newly made up bullshit term designed to mask how bad it sucks. Limited dirt? All dirt everywhere has limits.

Today’s offering of what around 415K gets in other parts of the US:

http://www.trulia.com/property/1067833954-1627-Fawn-Blf-San-Antonio-TX-78248

http://www.trulia.com/property/3206829438-2215-Oak-Ave-Northbrook-IL-60062

http://www.trulia.com/property/1053511429-521-Via-Ernesto-Henderson-NV-89052

http://www.trulia.com/property/27562772-3156-Hickory-Ridge-Rd-Madison-WI-53719

http://www.trulia.com/property/3162193572-30-Brisbane-Dr-Charleston-SC-29407

http://www.trulia.com/property/1061686919-1101-Calle-Del-Ranchero-NE-Albuquerque-NM-87106

Of course, ain’t SoCal #worldclasscity #globalelite #100Ksalaries #tacotuesday

The definition of insanity is doing the same thing and expecting different results. Anyone who buys this postage stamp property in one of the worst neighborhoods in Los Angeles for 5xs the price of 2012 is going to get burned and deserves it. If this isn’t the poster-child of bubble 2.0, what is?

As you can see, there are so many other cities or states or even countries to live in besides Los Angeles

Many retiring Americans will move to Mexico in the future due to good climate, better medical care, lower cost of living, good food and housing that they can afford!

Here is an example of what $349,000 buys:

http://www.taxcomxvilla.weebly.com

hear-hear!

Sheeple are into following flocks, they are easy to herd. Media and mind games are at all time high when it comes to influencing purchases. Anyone buying at these prices will pay a price. For the time being the fed has fixed this market, remember this- 3/4 of all loans are being made by 2 govt. backed entities being wound down in receivership….if that doesn’t open your eyes nothing will.

I tend to see the same people saying the market will not go down that said the same thing in 2006…flocking is bad for your financial health as just like the market, a crowded trade makes for easy pickings from the Pigmen…

Pigmen understand how to confuse the sheeple and then they shear them….

Some friends in the Houston area were layed off by an engineering company (they canned 6000 employees!). They got another job with an engineering company in Kansas City. They put their house on the market on a Tuesday, had four showings Wednesday, and three offers the same day.

Good for them, but it really makes no sense at all to me. Maybe it is von Mises crack-up boom time(?) IDK. Only a few more days til Taco Tuesday, but I am tragically un-Hip.

People for the most part are just to sacred to move anywhere. Have relatives who live in CHICAGOLAND area and they can get out of there very old crime neighborhoods anytime they want. All they do is complain about weather, taxes, tolls. roads, you name it. After many years still there, 1500 sq. ft. storm door, chain link fence, spotty grass, and a huge tree. Like Cal. they know there are better places with better homes and taxes, quality of life, but they stay, millions stay, who knows why?

It must not be that bad if they stay.

Exactly – I hear this theme all the time here in Chicago – I hate it here but I ain’t gonna move cause I got kids, grandkids etc. My take – it is like dogs going in circles sniffing each other’s butts wondering who is going to be the first to blink.

News flash – I am moving out of this sh”’t hole becauase I hate the weather, taxes, tolls, politics (name your poison) and the kids are gonna have to figure out how to visit their old man. My sense – once I get moved – they are gonna move too when they realize this place is indeed a sh*t hole and wondered why even I stayed so long.

By the way the place in Northbrook posted by We don’t make those drinks here no more is in a nice nabe but 415 K is on the low end for that area – most homes on 1/4 acre there are in the 6 to 800k range and higher. Northbrook is not cheap by any stertch.

Chicago used to be very affordable – now – not so much – PITI here is going way past what the first timers can afford – many just rent and have their equivalent Taco Tues in downtown Chi town because they can’t afford the home.

In a few words….Don’t move here – you won’t like it.

“I am moving out of this shâ€â€™t hole becauase I hate the weather, taxes, tolls, politics (name your poison) ”

You mean you want to leave the utopia land where all Obama buddies are in charge – that means the most Progressive “brilliant minds”? And where do you want to move? Where all toothless hillbilies are in charge in the south?

At least that is the version the US propaganda outlets publish in the MSM. Get back to the MSM before you make the mistake of your life. At least, if you still decide to move, you better move to another bastion of enlighten progressives who were in charge for over half of century – Detroit. Those “brilliant” progressive minds will surely offer you a life on the highest pinacle of socialism progress.

I moved to LA from Chicago just over ten years ago due to job relocation. All I can tell you guys is that the grass isn’t always greener on the other side.

Flyover – LMAO – I have no intention of moving to said toothless – howdy doodie in say TN. Love Nashville – deal is can’t stand the heat and the snakes. So…..I am trying to find a nice simple nabe in a Western state – not Cali – went to school there – never going back.

Stay tuned.

Agree with Greener Grass that it ain’t always greener other places.

Taking my time and looking about – suggest that others in Chicago do the same.

In closing – take some time to read Illinois Policy dot org and see what it is that citizens who at least have a mind are dealing with here. Everyday it is something else – yesterday – a 1% hike in the Crook County sales tax making Chicago’s sales tax the highest in the country. In essence – the motte here – The beatings will continue until moral improves.

RJ I live in Chicago too. People groan and moan about the weather and high taxes yet Chicago home prices are booming. The entire north side of Chicago has seen home prices go past peak prices. A lot of rich well to do folks are moving in to the city. A lot of young people from all over the Midwest are moving to live in Chicago. This despite Chicago increasing it’s various “fees”. For some people they don’t mind paying higher taxes and higher home prices.

People say one thing but do another. The politicians are not entirely stupid. They know that and take advantage of it. Who knows, perhaps the rich will live in the city and the poor will be forced out to live in the suburbs or exurbs. I am though astounded by Chicago home prices zooming past peak prices of 2006-2007.

That is absolutely crazy (to anyone who doesn’t benefit) that Cook County is raising taxes to fund pensions. I like how the thought doesn’t even seem to occur to them to lessen pension benefits for existing retirees (boo hoo if that involves bankruptcy), or to do away with pensions altogether for future workers. Unless I work for the government, the tax increase is effectively taking money out of my pocket and transferring it directly into a government worker’s pocket. I didn’t think many places were worse that CA in that regard, but I seem to have found one such place! Pretty despicable…

I think @Nimesh Patel is right; unless droves of people actually start moving out of Cook County, the politicians will continue to act in the same manner.

http://www.chicagotribune.com/news/local/politics/ct-cook-county-sales-tax-0716-20150717-story.html

Yeah, we moved out of Chicago 6 years ago too. My parents are still there, but it was a good time to relocate the kids so they didn’t get stuck there too. Took the fam back for the first time in 6 years. It’s basically expensive, crumbling infrastructure and the weather sucks most of the time. I don’t regret moving. Career has done great in SoCal versus just standing still in the midwest.

Inertia: If a dog is sitting on a pile of dust and ask him to move to a sofa, it won’t because of inertia….

People stay because of familiarity. That’s the main thing keeping me in Santa Monica.

I’ve lived here for 28 years. I never go to the beach, or the pier, or the Promenade, or Palisades Park. I live across the street from Palisades Park, but haven’t been in it since 1996, when a friend was visiting from NYC and asked to see it. I haven’t been on the sand since 1993.

I care for none of Santa Monica’s unique amenities. I stay because I know the streets, the stores, the people, the service providers. Familiarity is comfortable.

At least with property #1, if your muffler goes bad, you can have them repair at your residence. But please don’t let your kids play outside, there’s a creepy white van waiting for them in the front.

I was watching one of those tiny home shows the other day and thought it such a head scratcher. Paying 20-30 grand for a shoebox that they still have to get towed from place to place. Was wondering why they just didn’t do this: http://rvs.oodle.com/view/2006-fleetwood-revolution-40-l/3960244736-irvine-ca/

Wow, that Fleetwood is infinitely preferable to an ugly little wood house on wheels. That is the beauty of buying something rather used, that has a tiny market of potential buyers. I looked up the prices of new Fleetwoods of the same model, and they list around $150,000. They last a long time with care.

I wouldn’t think that the Fleetwood would use any more fuel than pulling the tiny house with your truck, but I really don’t know. I’d like to see a mileage comparison.

The problem is, anything larger than a 300sq ft tiny home, and you have to have it towed by a commercial vehicle. The fleetwood, you just unhook and go, and the footprint is much bigger.

If you have opportunity to more or less stay where you want permanently, or for a long time, best to go with a tow-trailer of some type. That way you don’t have to worry about maintenance and servicing on all the engine/mechanics gear when it’s a combined RV.

This guy has a net worth of $820 million but has opted for the simple life by living in a trailer park (Aistream) in Vegas. There should be more high-end places like this as an option.

http://www.dailymail.co.uk/news/article-3167130/Zappos-CEO-Tony-Hsieh-cushy-net-worth-820-million-opts-live-trailer-park-instead-mansion.html

“Crap, Rinse, and Shower”? I’m sure that movie can be found somewhere on the internet …

@Jeff “If you were my stock-broker I’d go broke!”

Thanks for the laugh Jeff. I have been watching the Mammoth Lakes and Lake Tahoe markets forever in hopes of buying a second home and I am seeing some weakness lately in prices. I hope JT is correct on the hard tank, as I am likely buying cash, so rates do not matter. However, regardless of the koolaid the FED is selling, I don’t believe the economy is that strong, so rates can not go that high, unless the FED loses control of the bond market. We will see in the next 12 months.

Speaking of supply of small homes, builders aren’t building much of starter homes, can’t compete with cheaper older homes.

Did you see those housing start numbers out today!

Renting Nation still has legs and 5 charts here to show why it does

http://loganmohtashami.com/2015/07/17/renting-nation-still-has-legs/

Speaking of housing starts, the city of Glendora is selling any empty plot of land to developers. Since the bubble burst, there have been an average of 150-180 home for sale on any given day. IF the current building finishes (as many of these locations have barely finished plowing under the empty commercial property and homes that they bought out in order to build), that number will rise to almost 600 homes as there are at least 400 new homes that will be (half of which are already) in the process of being built in just Glendora alone. I can almost guarantee that even the lower end of these homes will not go for less than $450k. Now couple that in with the 100+ eye sore of an apartment complex that Avalon Bay just finished (of which there have been plenty of people at city council meeting complaining about) where the rent varies from a 1-1 of $1800 to $3300, http://www.avaloncommunities.com/california/glendora-apartments/avalon-glendora

and you end up with waaaayyyyy more homes for rent and for sale than during the last housing boom. Maybe I missed the part of QE whereby the laws of supply and demand no long matter for housing?

Correction. Just looked it up and it’s 280 apartments.

Bonzo: but, but, you’re not just living there, “you’re living up”. Do they take Section 8 ?

Hi Logan thanks for your occasional posts, I find your blog one of the more interesting in regards to the housing market. Keep up the good work!

Hey Doc. I was looking to buy a crapshack in Venice area in 2010-2011. I saw many 2 bedroom 1 bath in the range of $550K. Now selling for $800K or more…. I wish I had bought one of those crapshacks (location, location, location) .

Dude, the location of those was the same when they sold for less, just a few years ago. Obviously, they could in just a few years sell for less again. Your point didn’t make sense.

Steve, are you sure you can’t figure it out? QE laments not buying a Venice crapshack in 2011 and selling now. Was that so difficult?

According to the talking heads SoCal real estate prices are rising in a healthy pattern. Los Angelas home prices now average $500k. I guess the average family income most be around $150k?

————————

http://www.latimes.com/business/la-fi-home-prices-20150716-story.html

Southern California home sales soar in June; prices climb 5.7%

The Southern California housing market, known for its dramatic swings, is settling into a more normal, healthy pattern.

Home sales are up. All-cash and investor purchases are down. And home prices are rising at a more sustainable pace than in the last few years.

I live in Chicago and home prices have come back in a huge way. Home prices are back at peak prices of 2006-07 and some have gone beyond that! I used to be a housing and over all economy bear. A permabear if you will. Philosophically I am an avid Libertarian. I believe that the free market and the invisible hand should be the guiding force. Not the heavy hand of government that operates via special interests. Everyone benefits when all the market players are guided by freedom of choice. But let’s get real, that has not ever happened in real life and it won’t ever happen. The banks have become even more powerful and will not relent.

I remember how from 2008 to 2011 there was an abundance of foreclosed houses for sale. Then in 2012 that inventory suddenly disappeared and the banks just let a trickle out at a time. Then like lemmings, a lot of people got into bidding wars and the housing market/prices went back into hyper drive mode. The housing market and the over all economy is not on solid footing. The fundamentals do not support it. But let’s face it, if home prices or the stock market plummets, the government will just change the rules- AGAIN. When home prices are going up, the government and banks love it. Because it benefits them. But when prices are coming down, they intervene. The profits are private and the losses are public. I was stupid to even think we had any semblance of a free market. Now I know better.

The conclusion that can be drawn is this- the government and the banks structure is build around inflation. Not deflation. They will never allow deflation to take root. If it does happen, just like it did in 2008 to 2010, they will just change the rules. Plus most of our citizens will cheer them on or won’t care.

@Nimesh Patel: That’s a simple and accurate description of the situation, as best I can tell. The only thing I’m skeptical of is how long TPTB can keep up this juggling act? I think it will probably come crashing down at some point (maybe not a dramatic crash, but a crash nonetheless). Maybe I’m wrong and the government (i.e. special interests) have everything sufficiently well tuned at this point. Then again, when has government ever done anything well?

In the interim, I’m just stashing money away in the hopes of being able to use some of it to buy again at some point when prices become somewhat reasonable.

Bravo, well said Nimesh. Other people on this blog need to realize this is the new normal. But we still have holdouts thinking economic normalcy is right around the corner. Yippee, we’ll get 5% returns on our CDs and the middle class will make a roaring comeback and will easily be able to purchase RE in nice parts of socal. Sooner or later everybody needs to accept reality, the world you live in has changed and you need to adapt to it.

Yeah the new normal. The middle class is not coming back, no more middle class manufacturing jobs. Just a few middle class government jobs. Most of the government jobs pay $40,000 to $80,000 jobs not factoring in benefits. Like son of a landlord says, only the one percent of government workers make $200,000 a year. But one percent of private sector makes over one million a year according to the docs pie chart.

@Lord Blankfein

In other words, this time is different — for the 3rd time in the last 15 years. Heard the same before the stock market crashed in 2000 and in 2009. And also before the real estate market started crashing 6 years ago.

Funny that those previous new normals didn’t produce the elixir to keep overbloated asset values up.

“Other people on this blog need to realize this is the new normal.”

There’s nothing new about anything he wrote.

“But we still have holdouts thinking economic normalcy is right around the corner.”

No we don’t. Most of us agree that it will continue to be messy, what we disagree on is where the chips may fall.

“…easily be able to purchase RE in nice parts of socal.”

No one outside of the trolling fringes are making that claim.

We ceased to have a free market system in 1913 with the creation of the FED.

Since then we have central planned economy, planned by Wall Street and the FED.

Sad but true.

Got an amazing new real homes of genius in Culver City. Total sack of crap – check out the pictures. Really?

https://www.redfin.com/CA/Culver-City/3540-Schaefer-St-90232/home/6721359

Haha, wow. Total tear down. But even if you rebuild, there’s the crappy apartment next door and the small lot to contend with. I don’t get it, at all.

But, but … according to the listing it is a “fixer”! ;-p

(Seriously, that might be the saddest place I’ve seen yet on here, especially given the price. “Wow”, does not do it justice …)

America, the land of suckers. This is just like HGTV’s ‘Tiny Home’ … they hype and glorify the lifestyle of living in a shoebox! The people buying admittedly are doing so because most can’t begin to afford a real place, and amazingly become enamored by their bed being in a loft where you hit your head when you sit up in bed! Combine slick PR and hype with a mostly gullible, financially illiterate America, and you have a cash making opportunity!

I think the reason for the popularity of Tiny Houses, and other alternative living solutions is because people are desperate to not be house-poor and stuck paying sky-high rents. I think we need to get back to modular, prefab, sustainable construction. In areas (like SoCal) where land is at a premium, I think there is a serious desire for modern, condo-like structures that allow customizable interiors, have extremely low maintenance (HOA fees) and are cheap to build (and hopefully cheaper to buy). Lack of landscaping and industrial design, doesn’t have to look like a prison. People are desperate for a solution.

The issue isn’t construction costs. The issue is greed and a system that favors rentiering

Building Costs Are Higher in California. Aside from the high cost of land in California, three factors determine developers’ cost to build housing: labor, materials, and government fees. All three of these components are higher in California than in the rest of the country. Construction labor is about 20 percent more expensive in California metros than in the rest of the country. California’s building codes and standards also are considered more comprehensive and prescriptive, often requiring more expensive materials and labor. For example, the state requires builders to use higher quality building materials—such as windows, insulation, and heating and cooling systems—to achieve certain energy efficiency goals. Additionally, development fees—charges levied on builders as a condition of development—are higher in California than the rest of the country. A 2012 national survey found that the average development fee levied by California local governments (excluding water–related fees) was just over $22,000 per single–family home compared with about $6,000 per single–family home in the rest of the country. Altogether, the cost of building a typical single–family home in California’s metros likely is between $50,000 and $75,000 higher than in the rest of the country.

http://www.lao.ca.gov/reports/2015/finance/housing-costs/housing-costs.aspx

I agree the construction cost is bit higher but does it justify such a high price for housings in socal ?

dont think so..

50k to 75k is nothing. neither is 20% more. we are talking inflated prices if 3x to 5x in caliufornia

Why buy a tiny crap shack in LA? Look at what $390K will buy you in the Greenhaven pocket area of Sacramento:

http://www.thealfanogroup.com/homes-for-sale-details/48-Parkshore-Cir-Sacramento-CA-95831/15023274/6/

The ranch style house built in 1979 has over 1,900 sq. feet, 3 bedrooms, 2 bath, an open floorplan that has a huge great room that leads into the backyard which is filled with mature trees and a nice pool/spa combo. The home is also across the street from a park.

The only problem with this neighborhood is that the schools are so-so and it’s next to the high crime neighborhoods of Meadowview and South Sacramento.

Our son lived for a couple of years in a 400 sq ft studio apartment while doing his med residency. If I threw out everything and only had digital books, music, and videos, I probably could live there.

Actually, considering the mess in our house, might not be such a bad idea.

How can a potential slowdown in China affect the U.S. housing market, especially So Cal, since most of the investors have been foreign money?

Additionally, to what extent can a change in the currency wars currently going (IMF set to re-evaluate its basket of SDR currencies and potentially include the Yuan) affect the value of the dollar and what it can buy? Obviously, the global trend has been towards de-dollarization and I’m assuming at some point, we in the U.S. will feel the weight of the government’s huge debt in the trillions when the banks fail again. Will we have our Greece moment? What will happen to these $500K crap shacks?

They will double in price if the dollar is devalued via a greek moment. Hard assets and not US dollars will be the thing to own

“IMF set to re-evaluate its basket of SDR currencies and potentially include the Yuan”

i’d like someone to explain to me how the Yuan can be included when IT’S PEGGED TO THE DOLLAR? That makes zero f’ing sense.

They have to unpeg or as with rates rising the dollar will be strong for their imploding economy…..China is going for hard landing…it will shake the world, the stock market and housing….keep the popcorn warm for 2016…

As it stands right now, LTV, PTI and DTI are not inline with housing prices….

The Fed has only bubble blowing and deflating to lean on now….

next deflation is right around the corner…

Hey Doc

Here is a good article from LAT on gentrification – the places it is really happening in LA (may need LAT access)

http://www.latimes.com/local/westside/la-me-adv-view-park-20150719-story.html#page=2

and not one comment on the drought….this again proves people are out of touch with reality, their hopium and savior is a little christ child event continuing in the Eastern-central pacific.

Pray for them…

hot and humid

storms

flash flooding

fires

mudslides

PERFECT WEATHER!

Leave a Reply to eMan