Millennials have the lowest homeownership rate in Los Angeles: Less than 18 percent of young adults own a home. Â

Los Angeles now takes the award for having the lowest homeownership rate for Millennials. As it turns out most young adults are either living at home with their Taco Tuesday baby boomer parents or are living like sardines in rentals. The options are limited short of forking over a massive amount of money and committing to living in a crap shack. You will have to eat rice and beans (and tacos) for a decade but at least you will own a piece of the California dream. That dream is clearly that – an illusion for most. The figures back this up. Of course the audience on this site tends to lean to higher income households and those with higher levels of education but the house humping rhetoric is still intense. Most realize that buying a home in the greater L.A. metro area is just one giant pipedream. Less than 18 percent of young adults own a home in the greater L.A. metro area.

Living the SoCal dream

The figures are startling but not all that surprising. You have crap shacks selling for ridiculous prices yet household incomes are still growing slowly. So what do younger people do? They either live at home with their parents or rent. The results are rather clear.

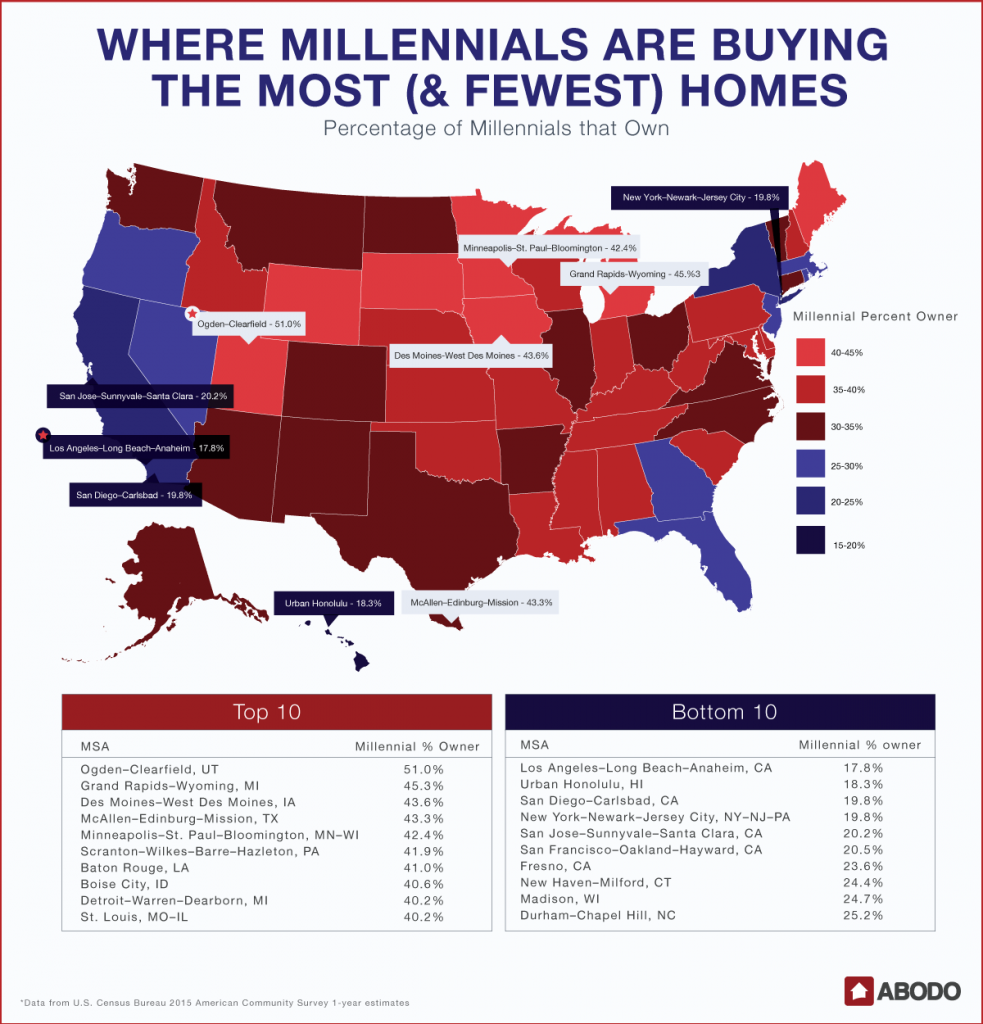

Take a look at this wonderful chart:

The greater L.A. area has the worst homeownership rate for younger buyers, even worse than tech drunk San Francisco. Why? Because in the Bay Area, even though home prices are insane so are salaries for young professionals. So even though the Bay Area is nuts and has a massive amount of tech froth, people do earn higher incomes. Here in SoCal especially in the greater L.A. metro area people don’t make high enough incomes to justify current home prices. Thus the low rate of ownership from younger buyers.

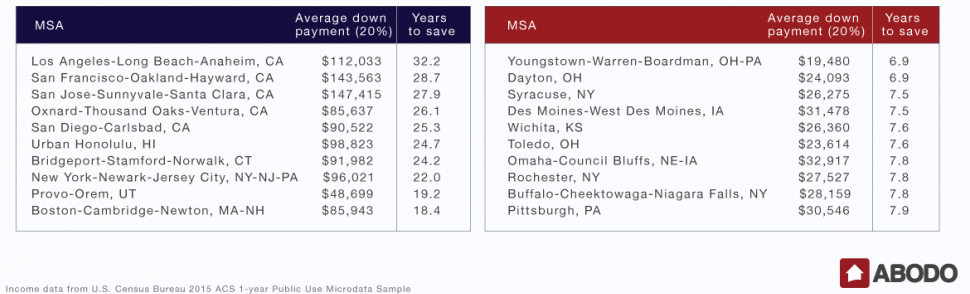

The data dug deeper and examined how long it would take to save for a down payment sans mom and dad loaning you all the money they saved from those Taco Tuesday blowouts:

According to the analysis, it would take the typical young L.A. couple 32 years to save for the standard 20 percent down payment. Hey, if you start at 30 you can buy when you are 62! Just around the time you can collect on your Social Security benefits.

So you have this weird trend going on where people are critiquing young people for eating avocado toast and other nonsense and that is the reason they can’t afford a crap shack that looks like a rundown property in Detroit. So that is the reason they can’t buy a $700,000 dilapidated box?

We’ve discussed in detail that Millennials were not going to save the housing market. What you have right now is a massive amount of NIMBYism, grandfathered in older buyers, and foreign money flowing into certain areas. That is keeping the market afloat but what has made the housing market healthier in other areas is actually allowing for young professionals to buy without going into insane levels of debt for World War II built stucco boxes.

So this data which is based on reality (not fake news) is showing the true nature of our housing market. I know house humpers will say “lay off the lattes!†to save for that down payment but it is more complicated than that.

Take a look at this:

2000

LA Median Home Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $226,000

Median Household Income:Â Â Â Â Â Â $42,189

Price-to-income ratio:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5.35

Today

LA Median Home Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $585,000

Median Household Income:Â Â Â Â Â Â Â $56,196

Price-to-income ratio:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 10.4

Even with lower interest rates, the bottom line is you are still paying a much higher amount for a home relative to household income. And that is why it is no surprise that you have a record low in terms of young households owning property in L.A. Now you have Taco Tuesday baby boomers confined to their gold plated granite countertop HGTV inspired sarcophagus with locked in low property taxes and their offspring moving in at record levels as young adults. On the bright side, that means more income under one roof for delicious gourmet tacos!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

234 Responses to “Millennials have the lowest homeownership rate in Los Angeles: Less than 18 percent of young adults own a home.  ”

“Now you have Taco Tuesday baby boomers confined to their gold plated granite countertop HGTV inspired sarcophagus with locked in low property taxes and their offspring moving in at record levels as young adults.”

You forgot the skylight in the kitchen. It even has the little electric eye that closes it when it rains, once every few years.

I have all the above, but I’m the tail end of the Boomer generation. My sons are 10, and 13. When will it end?

Damn kids be spendin’ allz dey money on tatooz!

Seriously, in 2000 I considered the SoCal RE market to be about fully valued. Not a bubble, but not cheap. Then it went nuts, and is back to nuts now. 3-4 it will have crashed again, so hang tight, eat out less and shave off that damn mustache! Everyone and their dog has one of those things now, its played out.

I doubt it it will dip and if it does it will never hit that price to income ratio that it hit back in 2000. Please explain what reason it has to go any lower when the Chinese are buying into the current price. That foreign demand isn’t going anywhere anytime soon last I checked.

Because the Japanese were buying in 1989, and then in 1990, they weren’t. And then they started selling. This next RE downturn will start out more like the 1990-91 downturn than the last one. But the recession following will be just as deep as 2008 if not more.

Because all degenerate gamblers eventually go broke. Australian real estate is the first domino to fall as the Chinese factor there is diminishing.

Don’t forget about California earthquakes. We’re due for one, and prices plummet even in non damaged areas. SF was almost free in ’89.

https://www.numbeo.com/property-investment/compare_cities.jsp?country1=United+States&country2=Australia&city1=Los+Angeles%2C+CA&city2=Sydney&tracking=getDispatchComparison

Comparison between Sydney and Los Angeles. They’re pulling out after tearing the market to bits. Los Angeles, a much more investment worthy city than Sydney pales in comparison. It’s seems that the market has MUCH more to go in this increasingly globalized market. And the Japanese comparison is getting really old because they’re two completely different countries with different populations, different sources of wealth, operating in different markets, in two different time periods. I’m not saying “it’s different this time” I’m saying the game of real estate hot potato that we’re playing has different players with a different skill level and the potato hasn’t even heated up yet.

So in other words, it *IS* different this time. LOL…

There is nothing that guarantees that the pattern of foreign investment in Sydney, or any other parts of Australia, will be repeated in L.A. given:

– The maturity of the current credit cycle

– Increasing capital outflow restrictions by the Chinese government

– Current economic conditions

– Current level of indebtedness of investors (8+ years — longer for the Chinese — of gorging on cheap and easy liquidity)

Earthquakes… Riots…. Fires…. Floods

You don’t live in CA do you?

4th generation

Hey Doc… you say describe homeowners as ‘baby boomer taco tuesdays’.

With rental rates in LA, aren’t renters now also ‘baby boomer taco tuesdays’???

https://la.curbed.com/2017/7/3/15915416/los-angeles-rental-prices-rising-apartments

It’s “Taco tuesday baby boomers”

That must be fake news. We have several people here convincing us that rents in LA are going down. This is the perfect storm. The only new units being built are expensive luxury type. The middle class is going to get taken behind the woodshed!

The source basically admits the data is unreliable and skewed. Let us know when the county recorder starts documenting rent contracts as they do with purchases so we have accurate information. https://www.apartmentlist.com/rentonomics/apartment-list-new-rent-methodology

Funny. Last time I checked, the U.S. economy was consumer-driven. What happens to companies that offer products (i.e. luxury housing) for which there is no long-term sustainable demand? I’m willing to bet that many landlords will be taken to the woodshed when liquidity (cheap and easy credit) dries up.

Lots of LA is more like Downey or Compton. That is not that desirable. LA economy is mediocre and the burbs not LA proper make up most of LA. Most of the cities are lower middle class and not rich which means that one day the rent will not go up because people are not coming. LA has a huge outflow of domestic migration and if Trump changes the rules on legal immigration a lot less Latinos or Asians will come to the area.

Who cares about the price to income ratio? Is there a law that says that once it hits a certain ratio that prices must come down? This is a capitalistic and globalized country. If you can’t keep up with the big dogs (international and/or domestic), then kick rocks because those guys are showing no indication of slowing down.

JT’s got himself a new moniker. LOL

The best government the bankers can buy – by the bankers and for the bankers. The FED should have their license suspended and sent home. On Independence Day the bankers from City of London were kicked out for lower taxes than we pay interest to the FED for money created out of nothing to enslave the country.

As long as they create money out of thin air they can buy any politician. The whole government works for them not their constituents. The difference is not between red and blue or D or R. The difference is between the globalist bankers and the serfs. Soon, they will choke in their own created debt.

True, we are not the richest country in the world, like we were after WWII. I visited China last year, and this is not a country that I would want to get in a trade war with, they will kick our a$$.

Success is not easy, there is a lot of competition in the world.

Yes, absolutely. There is a part of LA that is international and global in RE values, and thus a higher floor, but that’s the 1% neighborhoods.

Economic fundamentals only count when prices go up — real estate cheerleading 101.

Anything to keep asset prices inflated. Millennials have been served a shit sandwich.

Don’t buy it! My Son moved to the midwest so he could get a good job and support himself! My Daughter and Son-in-Law, focused on careers in high demand and where they can virtually live anywhere, found life in the inland northwest, and do quite well. It is your choice to be a victim!

Word. Humans find comfort in being a victim. Releases responsibility for their lives.

“It is your choice to be a victim!”

You hit the nail on the head. There are a lot more places to live that are affordable than there are places that are unaffordable for millennials. Live with your parents in a coastal bubble, or live on your own virtually anywhere else. You don’t even have to go that far.

Just for fun, I compared the CA minimum wage and rent rates in 1990 with today in the same apartment complex (2 bedroom, 2 bath) where I lived at the time with a roommate. This is based on two people working full time, after taxes:

1990

Income 1,177

Rent 700

2017

Income 2,909

Rent 1,800

Granted we were both making more than minimum wage at the time, but I wanted to make it a fair comparison. It’s in a good if not great area, north inland San Diego county, a 25-minute drive to business-friendly Carlsbad and the huge numbers of tech jobs there. A couple hundred a month more will get you 5 minutes closer to Carlsbad and into the excellent San Marcos school district. I’m not seeing a problem with affordable rents in much of the southland.

“focused on careers in high demand”

And what would that be? You have to love the internet. Most people have “recession proof” careers or “high demand” careers and all make $250K+,

the best one is the guy in his 30 with “$1.5 million in retirement” and “250K in savings asking the rest of us if “do you think i’m an track” bullshit.

As if a person “worth” that income WOULDN’T FUCKING KNOW!!!!

My career was in high demand and paid well…..THAT’S WHY IT WAS SHIPPED TO CHINA ~!~

“Millennials have been served a shit sandwich.”

Yeah, but they Love the gluten-free bread.

Toast it and put some avocado on there. Then they’ll never be able to buy homes.

That’s ridiculous you can go buy a house in 99% of the US including California.

The sh!t sandwich is invented in your head, your choice to eat it.

I’m not a millennial. LOL. I call it as I see it. No I wouldn’t buy in CA either. Not really the point. The papering over of the economy after 2008-2009 is phony. It helped elders at the expense of youth. Not really debateable.

Sure you can buy an overpriced crapshack….you can always buy an overpriced crapshack. Of course, you would not buy one…if you are smart.

The millennials are generally lazy because they are fun loving and don’t have discipline like my German father.

Except that current Fed and government policies were meant to inflate the wealth of older generations at the expense of millennials and younger generations. Government entitlements usually benefits those who vote or donate the most — certainly not millennials.

Prince Heck got it. And some are lazy. And some can do the math.

Let’s be realistic here! While saving for that downpayment is a huge undertaking, unless you have some handicap, there is something wrong with leaching off of Mom and Dad, and something wrong with allowing your surroundings to consume you! Life is full of choices … Move, find a way to support yourself! How can you stand yourself if you are 30-something, or worse, 40-something, and still living with Mom and Dad or have roommates!!!!

Being realistic means facing the fact that $1800 a month for an apartment when you make $55,000 is not a good idea.

It’s a bummer. But it’s realistic.

Housing to tank hard! It will be like in Japan….declining housing prices for decades. Prices will never “recover” to bubble peak…..at least not in our lifetime. Back in the day the Japanese lost their shirt investing in California RE….same will happen with the Chinese!

Crash, crash, crash!

But every single time in history in CA when it’s crashed, it’s recovered past the previous high, even the 2008 crash. Are you saying…it’s different this time?

In Japan, prices have not recovered. Same can happen in CA, yes.

well it’s all about the FED. without the FED we would know. But as long as the FED keeps the pedal to the medal it’s any ones guess.

I am just one of those who are living like f*cking sardines in rentals in Culver City. 1750 for a remodeled studio and it costs me 30+% of my months after tax income. We are f*cked.

It is your choice to live like a sardine in Culver City. Nobody keeps you there by force, unless you are in jail.

I left CA long time ago and it was the best move I ever made. There are employers and opportunities in other places, too. They may not be paying as much as in CA, but you don’t pay state taxes and the cost of living is a fraction than in CA.

Texas does not have income tax and they have low house prices, but you run your A/C 24/7 for 3 months and the bugs, the scorpions and etc. Don’t forget the humidity. We have a dry heat , except when its a little humid. Florida does not have an income tax but the bugs and the humidity is a killer. Don’t forget that California income tax is a deduction on the federal return.

What industry? What job? If it is so good, why don’t everybody flock there? Sounds too good to be true, unless you can give some evidence.

Eastern WA, does not have scorpions, bugs and humidity. Even if you run the AC in the Summer for 2-3 hours the energy is way cheaper than CA – 6 cents/kWatt. It is dry everywhere, more or less, depending where you are (the heat is always dry). Prop. taxes are like in CA but no state income tax. Some cities have lots of jobs and some less, depending on the size of the city. Yes, you do get 4 distinct seasons which many people love. The winters are way milder than NE US. Some work from home and commute one day per week to Seattle if they work in technology and employer allows it.

Flyover country is not just TX and FL although many flock there – I can’t understand why, but I am sure they have good reasons, or maybe family.

What are you talking about Ira, there are tons of places in SoCal where people have to run A/C continuously during the summer months. Hell just this weekend it’s going to be over 100 in the Valley. The humidity ramps up closer you get to the coast. I’m not saying it’s terrible but it’s not perfection either. Do you even live here? And the deduction for state income tax, what a hilarious laugh. Sure….pay a dollar and get a penny back, oh wow that makes up for it!!! Give us all a break will ya?

What a shock there are also bug problems in SoCal https://patch.com/california/pasadena-ca/mosquito-capable-carrying-zika-found-pasadena

It really is more accurately renter taco tuesday, no question about that.

Living with roommates in Sac for about 45% of my income, so I feel you. There are always people who will say “why don’t you just move to the midwest or something!?!” but it’s not always that easy when you are born and raised here and everything and everyone you know is here. Things would have to get a lot worse than this before I load up a U-haul and leave my friends, family and job(s) that I enjoy to go live by myself in some random town in Idaho.

There is a tipping point where friends, family and jobs will no longer be the stickiness that keeps the Millennials here.

The longer the high cost of living persists, more friends, family and jobs will trickle away slowly and then there will be an avalanche. Not to mention there is plenty of other large events that can set it off sooner.

Life is hard. It’s okay to admit you’re afraid of change.

But IT IS THAT EASY. You just don’t want to do it. Fine, if that is what you want, but you need to stop deluding yourself that it isn’t easy to do it. Millions of people immigrated from Europe and Asia to the USA and are still doing it. They are packing up and moving (or moved) nations, worlds away, in a time where they’d never see their homes again.

You can do it, you just don’t want to. To claim otherwise is self deception. As the great Eddie Haskell told Beaver Cleaver, “It’s one thing to pretend to be a big shot to others, but it’s something else to pretend it to yourself.”

“Eddie Haskell told Beaver Cleaver, “It’s one thing to pretend to be a big shot to others, but it’s something else to pretend it to yourself.â€

Great comment. Ward Cleaver was the perfect father of the 1950’s. And don’t get me started on his wife, June…

Nobody should have to move because of high housing cost. Just increase taxes and build affordable housing. Also, prop13 needs to go. Increase property taxes massively for homeowners and use the money to build multi-family skyscrapers just like in every other big city in the world. Problem solved. Sure….traffic will suck but these are your trade offs. Younger generation does not deserve having to move away. There are other solutions…..We need a Bernie Sanders in California to fix this State.

Smokin Dude, the house prices are distorted specifically because of government intervention in free markets (communist/socialist behavior) – you identified correctly Prop. 13. There is more than that; FED massive intervention in the markets through low interest and QE. All these interventions accomplish high concentration of wealth in the hands of 0.0001% and poverty for the rest.

Now, you want more massive government intervention. According to your logic, that would solve the problem. If a lots of government intervention made you poor, for sure more government intervention will make you rich – just look at North Korea.

Bernie is a self declared socialist (communist). All communist countries called themselves “socialist” not “communist” (maybe because of the bad connotation). However, the removal of free markets ALWAYS (no exemption) lead to poverty for the vast majority of people – government picks the winners and losers. The winners are those members in the communist party – the closer to the president the better. When the producers are preyed upon, nobody will produce anything (no incentive) unless the government uses force. The end result is mass poverty and no freedom – it is the same everywhere regardless of the culture and language. Listen to me as one who lived in a “socialist” (communist) country – it is hell on earth like you never imagine. I have good reasons I hate communists/statists so much.

For the poor and middle classes, the communist propaganda sounds good; however, they will suffer even more under communism. If I would have continued to live under communism, I would be poor (destitute). In USA, my family and I have everything we need (I did not say dream, but need and wants). Yes, it takes hard work, discipline and frugality, but there is still a way to get ahead. In a socialist/communist country you have zero opportunity regardless of how hard you work. The state determines where you should be, and take away everything you earn above that level. If the economy produces too much, they will bring in millions more from poor countries and still keep you at the same poor level.

For you, that is a dream. For me, it is spelled TYRANNY.

Flyover, my family also came from eastern Europe. It’s my understanding that those nations often used “socialist” and “communist” interchangeably.

The USSR was the Union of Soviet Socialist Republics, but were led by a Communist Party. Romania was led by a Communist Party, but Hungary’s ruling party was the Socialist Workers Party, and in East Germany it was a Labor Party of some sorts.

This makes sense. Words like socialist, communist, workers, and labor all have nuanced differences in Marxism, but no substantive differences. It was understood that they all connoted people on the “same side of history.”

Much like the words libertarian, classical liberal, laissez-faire, and free markets connote the same ideology.

Only in the West does Communist and Socialist connote significant differences.

@Smokin Dude

I second Flyover’s points. Government intervention in housing tends to distort the market in favor of certain groups at the expense of the many. The government and Fed needs to get out of let the free market function properly (allowing prices to return to local economic fundamentals).

“We need a Bernie Sanders in California to fix this State.”

Because the state has been virtually wrecked by the left, we should go FARTHER left.

Uh huh.

ADAM,

Dont be miserable, theres a lot of people in california in your position but moved to texas your life will be better

From the Table above, it takes nearly 8 years to save for a downpayment in Omaha and Toledo. I thought the Midwest was cheap! Americans have to be the worst savers on the planet. This society revolves around consumption whether you have the means or not.

Hey, they can always relocate to Panama or E Europe.

Panama, maybe. E. Europe, no. I’m from E. Europe and after half a century of communism they have even a more entitlement mentality than here. I am talking about majority not exceptions.

In most of Europe, people vote to use the force of government to steal from those who produce. The billionaires and the politicians keep the bulk of the loot and give some crumbs to the poor to buy votes to stay in power. It is the same model will see in this country more pronounced in the years to come. It is a sick model, because it discourage production of wealth till there is nothing to redistribute; then Venezuela outcome comes into place.

I’m excluding the Norway model which the left always bring. That is the same like the Saudis model – lots of natural resources per capita. The left never say that they want the Saudis economic system because it does not have good canotation. However, it is the same. Eventually, even that collapses – see Venezuela. In Venezuela it collapsed sooner because it has more people – mouths to feed – 10 times more than in Norway.

Flyover,

I’m a fan of much of what you write. But this comment was economically pitiful.

You badly need an education on the economics of things… namely the role that the FIRE sector plays in society. Read some Michael Hudson. The goods and services economy has been in the toilet for a long time. But gdp is rigged to include asset inflation as a part of “growth”.

People aren’t f-ing lazy en masse. And making generalizations about “millennials” and “baby boomers” is dumb as F and actually a big weakness of this otherwise fine blog. (Yes, I’m aware it’s not your blog, but your guilty of this thinking as well. No one feels like a carbon copy of anyone their age or in their neighborhood, and yet they have no problem lumping millions of others into one “hipster” person.)

Voters are irrelevant. The governments don’t enact legislation that mirrors the wishes of the voters. Try and give one example in the last 20 years wherein congress gave the people what they want.

When polled, most Americans, including Republicans and Democrats, prefer an income distribution that looks like Sweden. But they’ve been tricked into this false dichotomy of a political system. Read this study, it’s fascinating:

http://www.people.hbs.edu/mnorton/norton%20ariely.pdf

Small businesses are the lifeblood of growth and employment. And guess what? They’re irrelevant. The corporate monopolists and oligarchs have near complete control of everything- money creation, food production, telecom, natural resources, etc. Stop acting like the masses are guilty of voting for it. Instead, it’s criminal behavior and the weaknesses of financial capitalism that are the culprit.

Wilbur58, In a way I agree with what you say about our 2 political parties because I see both of them as statists promoting globalism with the final goal of one world central bank and one currency – the ultimate centralization of power and wealth and global enslavement. I guess I was not too clear that I see them as leftist with a D or an R after their name, puppets to the same money masters. For example, I see Bush, McCain, Romney and McConnell no different than Hilary and Obama. I see Ron Paul different than all of the above but he has no real power to change anything by himself.

I understand FIRE economy very well. While it does produces wealth, most of it goes to WallStreet not Main Street. Without a robust Main Street economy, the small businesses can not survive for too long. I have a small business and I’m close to retirement. I did very well mainly due to the FIRE economy. However, it is not a sustainable economic model. Just because I benefitted from it, it doesn’t mean that the newer generation can benefit the same way and it doesn’t mean that what I said is not true.

Wilbur58,

Maybe look into what capitalism is really all about. What we have right now is not capitalism. It’s not a constitutional republic either. The constitution prohibits income tax, yet we have it. We also have property tax so that you can never truly own your property. If you don’t pay your property taxes, they can take your property away.

You mention GDP being too high because of fudging the numbers. Well, GDP doesn’t really matter when the government spends so much more than all of it. It’s like saying you make 100k a year but spend 98k a year on living expenses. Well then you only have 2k a year left. Not gonna have a stable or rich life that way.

I agree our economy is bad. Government overspending and the big debt (probably around 55 trillion, not the 18 trillion they keep telling us. Just like unemployment numbers) are big problems. Taking away from poor and middle class (taxes) and the FED devaluing our dollar bills are big problems.

I’m an American and I don’t want income distribution. I just want to keep most of what I make, so that I don’t become poor one day needing government help and relying on the younger generation to pay for it.

@Flyover,

Your macro analysis of central banks is apt but simultaneously you say things like you see you differences between parties and politicians. This is, respectfully, a cultural blindspot that a white European male is able to maintain whereas a minority or someone coming out of a culture professes a deity other than the Protestant god or no god cannot. Having sensitivity to the aggrieved peoples under Trump’s administration is something that only liberals seem to be able to conjure although their sympathies are not always proportionately directed. As a non-white male the differences between the rhetoric of McCain and Trump are vast: one has decorous speech, the other is King Lear like irresponsible with his rhetoric and temper. The little Somali American girl in a hijab or the Mexican gardner is sensitive to this declining empire’s cultural crisis and effects of political rhetoric more than us privileged would be investor class type people. Being globalists and cultural marxists does not mean that the politicians are all equal, and this nihilistic assertion is untenable as someone not near the top of the power structure. Additionally, Michael Hudson has a very firm grasp on the macro picture and he navigates history quite well to the extent that he has published some very readable papers on the ancient history of how religious and political movements railed against the usury, avarice and financial domination of peoples. His points coalesce with your reading of the private nature of the FED and its antecedents, with the many attempts at subduing the US via finance prior to the 1913 vote. I’m sure you have watched “The Money Masters” or like documentaries and know all too well how banking families operate. So, as an observer you seem to be missing each other’s salient points.

Ekspat,

I don’t think we are far apart regardless of the % melanin in the skin. I am talking about substance and you talk about form and packaging. Besides that we are victims of the same banking cabal. They manipulate both the whites and the minorities to achieve their goals but they hate everyone.

For someone who is not white like you it is also hard to understand that whites are discriminated against, too; especially if they are males. I was discriminated not based on skin color but based on my accent in private sector and skin color for government jobs. My white son did not have anything to do with the slavery and the sad history of US (I am from Eastern Europe) and he was discriminated for admittance into medical school because he was white male. His undergrad GPA was 4.0, he had lots of scholarships, books published, hundreds of hours of volunteer hours in hospitals, MCAT score way above those admitted, excellent references from lots of doctors and professors and he was refused even the interview for the local state university because he was white male (like it was his fault he did not have more melanin in the skin). The percent of white males admitted was 10% in an area where most people are whites. Even those admitted were former vets. I paid hundreds of thousands in taxes to support that state university and then I had to suffer political discrimination (for the school to pursue their agenda). In the end he had to go to a private university which did not practiced discrimination but admitted students based on performance. Of course the price was way higher.

I don’t agree with any form of discrimination, but it is widely practiced for various agendas. I understand discrimination very well. Back in my native communist country I was still discriminated based on my beliefs and political views (I was not a member in a communist party). I left that country, came here and I have to deal with different forms of discrimination. It looks like this is something we have to deal with as long as there are people.

All this obstacles made both, my son and I, to work harder to overcome these forms of discrimination. I had to open my own business; in retrospect that was a blessing in disguise, because it was more financially rewarding. However, at the time it was painful.

wikipedia;CREDIT UNIONS – $ out of banks and into Credit Unions, put banks out of business by not doing business with them!

A credit union is a member-owned financial cooperative, democratically controlled by its members, and operated for the purpose of promoting thrift, providing credit at competitive rates, and providing other financial services to its members…

Credit unions differ from banks and other financial institutions in that the members who have accounts in the credit union are the owners of the credit union…

Insured by National Credit Union Administration (NCUA)…

When credit unions were first organizing in the US in the early 20th century, the banking industry was opposed, remaining so ever since. Banks and bank trade associations consistently put anti-credit union legislation at the top of their agendas…

Aqua Sea,

You missed the most important part. Banks can create money out of thin air whenever they’d like. They also run the Fed, a centralized PRIVATE institution that’s really just the central power of all the banks.

Credit Unions can only lend what they have… making them more responsible and healthier for society.

I don’t know why you compare LA housing to Detroit. There’s more than enoug shitty areas in LA to refer to.

Where? Please list some areas.

Just to list a few. West Hollywood. Highland. Culver City. I have lived or worked in all those places. Just come over to see how crappy it is.

South LA, Pacoima, Wilmington, Pomona, Fontana, North Pasadena, Compton, Lennox, Lynwood, Hollywood, Panorama City, San Bernardino, Westminster, Moreno Valley, Garden Grove come immediately to mind.

Yes, Burbank is an oasis amongst all the dregs that surround it, that is why the houses are so expensive.

@jt fact check @Ira

he forgot to mention Beverly Hills. Beverly Hills is located in the busiest area of LA surrounding many heavy traffic freeways and city roads. The air pollution around that area is pretty bad.

Adam, Burbank has its own airport where you can get out of down fast. Amtrak and Metrolink, Red Line, subway, not to mention the freeways.

I see so many comments on these articles with the tone, “No one is forcing you to stay, so move!” That kind of misses the point. Municipalities have a vested interested in growing their populations — the same way companies ultimately want to grow their work force — and they don’t want to lose human resources to other municipalities. So instead of blaming the millennials or any other residents, the problem can only be solved by examining how to change public policy and the practices of private industry. That involves re-examining Fed and banking policies, land development practices, foreign ownership rules, etc. Or we can do nothing and suffer the consequences of yet another inevitable bubble implosion.

How can you eliminate the FED???… Ron Paul was and is the ONLY politician calling for it and he was demonized by the whole MSM, all democrats and all the RINOs. JFK planned to do it and he was killed. So, how exactly do you plan to take the business license from a criminal enterprise???!!!…

The big elephant in the room is the easy money policy of the FED to reward their owners (the largest banks TBTF) at the expense of the millennials and future generations. The baby boomers do not have anything to do with the FED policies and growing inequality. Everything starts with the FED and ends with the FED. Obama and Trump are not going to change this and did not plan to.

It doesn’t have anything with red or blue. JFK was a blue president and wanted to get their license and Ron Paul was an aspiring red president and he also sees clearly the cause of the corruption and inequality. However, the vast majority of the population gets distracted by red vs. blue and forget the real cause – the FED.

Forget the Fed. Invest in Bitcoin. Cryptocurrency is the future. Decentralized currency and only a finite amount. The dollar’s days are limited. I’ve made a killing in the past 4 years.

If Trump pushes for the audit the fed bill, the fed will make a deal with him to back off…maybe pay for all the wars he is planning…

You are 100% correct! All over the net these housing threads have people on there posting “if you can’t afford it get the F out.”

I actually agree with this assessment. One should always live within their means and the best thing you can do for yourself if you live in an area with unaffordable housing is to get out.

However these people cannot see the big picture. For a strong and robust economy we need all levels of housing. Therefore for the individual it is indeed best to get out, but for the state and region as a whole we need to make housing more affordable to be competitive with other states economically.

Man you’re so right on, these assholes who like to post about kicking rocks or keeping up with the competition are eventually going to be stung by their own hubris. People and businesses are leaving. Eventually you’re left with a damaging productivity and social gap. Not good.

750 is the new 500

_sR

I’m sick and tired of hearing about Millennials and their all their whining. Check out previous generations that came through the depression and WWII. Not to mention the Korea and Vietnam era. People of earlier generations sucked it up and worked hard to get ahead. Today’s Millennials have much more opportunity than they did. As a matter of fact there are many many immigrants coming to this country who are doing quite well. Soon this generation of American Millennials will be doing their gardening…..

You are wrong about US Millennials in the fact we have to compete for jobs/income on a global scale, here in the US by immigrants (H1Bs), and globally (offshore outsourcing. Non-US Millennials DO have much more opportunity, evidenced by the rise in middle classes in other developed and developing countries.

The world now is very different than for earlier generations(globalization, technology, access to credit), the comparison is not accurate.

Don’t forget the **** eb-5 visas and foreign buyers picking up properties and leaving them vacant.

JD, it is true what you say about the change of circumstances. However, the only constancy in life is change. You change along, or you are eliminated by competition.

When life in my native communist country became unbearable, I left for US. I didn’t understand this culture and I did not know the language. I can not change my circumstances but I can change my attitude towards them. I came to SoCal. Cost of leaving was unbearable, especially if you want to have children and a wife to stay home with them, and parents not able to gift the downpayment. I moved to Seattle, although I had family and friends in CA. Back then, Seattle was not very expensive. 15 years later, cost of living in Seattle became unbearable. I moved again in Eastern Washington. The technology gives advantages and disadvantages at the same time. You just have to position yourself to take advantage.

I don’t know about your family, but mine could not support my family with 4 children. Therefore, I did always what made sense financially regardless of my dreams. I don’t regret ANY of my moves. Today I am where I am BECAUSE of those moves. I am in an excellent position financially. For most people life is not easy. You have to be willing to adapt, besides being industrious, hard working and disciplined. Just the last 3 are not enough in SoCal close to the beach, if you are a millennial. Blame it on the FED policies.

Curti, your posts always seem so angry and depressed. Who is whining? Its not the Millennials fault that we are in another housing bubble. Millennials did not have access to dirt cheap houses like the boomers. Millennials are doing the smart thing: renting or living with parents until the crash. Just deal with and dont get angry. Your life is too short….guessing you are already pretty old. Just enjoy this blog and wait for the crash.

Don’t confuse all millennials with the relatively few successful millennials in places like Silicon Valley. It seems that people actually think that all millennials are like the hipsters in car commercials. You know that’s not real life, right?

Signed,

Gen-Xer who refuses to do my own gardening

I’m sick and tried of people whining about Millenials whining. So there, we’re even.

Curt, YES, previous generations went through depressions and wars and ‘sucked it up’.

But they did it the same way that many of the millennial gen are doing it now- by living with their natal families for as long as a decade and working at jobs far below their expectations. My grandparents, born 1907 and 1909 respectively, were typical of their gen. They reached adulthood just as things started coming apart at the seems in 1929. Prior to their marriage in 1932, my grandfather was already work by age 14, being forced to drop out of school by his family circumstances- he was one of 10 kids born to a father who blew a massive inheritance (a dozen St Louis apt buildings) by gambling, and being unable to work because of issues with alcohol. My grandfather went on to become extremely successful by age 40, but the 30s were a lost decade for him, during which he was stuck in an entry level job for most of that period, and he and his bride were forced to live in with his parents in their big house packed with the younger kids. Most young people just out of the gate lived with their parents many years after their marriage during that time, while people who had come to the city from rural areas went back to their towns and farms.. and lived with their natal families. There was no disgrace in living with your parents even after your marriage and first child- that was how people coped then. My grandparents didn’t buy their house and first car until just after WW2- they couldn’t afford those things in the 30s,and houses & cars were not available in the war years because all production was geared to the war effort, no new houses or civilian vehicles were being built, and all non-essentials were rationed.

There is no disgrace in living with your natal family until you are financially established. In fact, the past 75 years have been anomalous in human history for the prosperity that enabled young people, whether single or newly married, to live on their own, let alone buy a place while in their 20s. A young adult who lives with his parents is not a “moocher” or “loser”, especially in an economy & society where you are forced to rack up debt equal to a mortgage to qualify yourself for middle-income employment, and where housing has become scarce and costly. The arrangement is often mutually beneficial, as adult children can contribute money, and assistance with housework, and with younger children and/or elderly grandparents. We need to accept that the exceptional prosperity and ease of the post-ww2 era were just that, exceptional, and adjust our sights and lifestyles accordingly.

This is very well written. I think its also difficult to compare each generation to another as economic situations, circumstances and technology are all so different for each one. Sure, my Grandfather was in the Navy in WWII and lived through the Depression. I am as tough as he was? Probably not.

But then again, he worked his way through UC Santa Barbara as a short order cook- tuition was probably close to free in those days. No way could someone do that now. After the War, the GI Bill subsidized the education of millions of returning soldiers and the Federal Government also invested massive amounts of money into building millions of suburban tract homes and accompanying freeways so the younger generations could start families and move out of inner city tenements. The economy was similarly exploding, and my Grandfather was able to support a wife and 5 kids on his single middle-manager salary down in Orange County throughout the 50s and 60s.

Nobody is living like this anymore. Millennials (and I’m not one) do not have even close to these types of advantages in terms of affordable education, cheap subsidized housing and an expanding economy.

A lot of people in their 40s have been wrong about the housing market for 20 years. During that time it has tripled everywhere and gone up ten-fold in some areas. It won’t matter even if it crashes. If people in their 40s did not buy a long time ago, they are still screwed.

Like usually with JT’s posts…its the opposite. People who bought during the last bubble are still under water. Buying barely makes sense unless there is a 50% crash.

Wrong. In most coastal LA and OC, if you bought at the peak day of the peak year 10 years ago, you still have a good sized profit. If you bought in the inland empire, or in a rough area, then you are underwater. But, better areas are up substantially since the last peak.

Jt fails to mention that you have to sell to have a profit. Sitting on potential profit is not the same as having a profit.

We get it already, you have some sort of personality disorder which manifests in dredging up the past and putting entire groups of people down (renters, people in certain age ranges, and so on) but the question is, buy now or be priced out forever?

So JT…..are you saying it would be a good time to buy in the Inland Empire because those properties are undervalued compared to the coastal areas? After all the prices will keep going up and normalized.

Ru82, you wont get an answer from JT…he does not really know what he is talking about….he is just babbling like our clown president. JT’s baseline is always buy now, buy now, buy now…..same old story.

I’ve made big money in California. Zero percent down is making its way back into the market. Prices will continue to increase. I’m sure there will be a crash or a slow down in the next few years. Monthly payments on 0% down are huge.

According to Dollartimes.com inflation calculator

2000 $226,000 home value = 2017 home value adjusted for inflation = $324,204.59

2000 $42,189 income adjusted for inflation = $60,521.54

but 2017 medium income is still only $56,196.00

(-$4,325.54)

So, if RE typically doubles every 20 years, $585,000 still needs to go up to $648,409.54 by 2020 which is an another increase of $63,409.18

Also, in 2017 a medium income of $56,196 is much less than the 2000 income adjusted for inflation which buys you 4,325 less $1 tacos on Tuesday….

Does Dollartimes.com inflation calculator take interest rates into account? Most houses are bought with loans and interest rates can change numbers dramatically. Interest rates in 2017 are about half what they were in 2000.

And are Dollartimes.com inflation numbers based on bogus government CPI? Real inflation runs much higher. These numbers can be very regional also.

Does Dollartimes.com take into account supply and demand, no more buildable land, etc?

There is plenty of land to build on. And even if there is no more buildable land….look at Japan. A tiny island with a strong economy and declining home prices for decades.

I know….reality hurts and does not fit the realtors narrative.

The upcoming crash cant be avoided, its just a matter of time. Americans are broke and houses prices are far disconnected from wages. In California house prices will easily fall by 70%.

Fundamentals only count when prices go up. The “lack of land” meme was used prior to the last downturn as well. Unorthodox demand (because of cheap and easy credit) was the primary driver as well.

Prince while I think that things that don’t necessarily make sense can have a way of going on for a very long time, I agree with you that indeed the no more land justification is something we’ve heard time and again. Many times just prior to major corrections and suddenly the justification falls out of vogue only to come back again next time around. It’s such a classic famous last words sort of thing that anyone trying to present a good argument for continued exuberance should be too embarrassed to use it.

@Avi1985

“Lack of land” is indeed pure hogwash. I’ve seen dilapidated malls and vacant lots being rehabbed into small communities during the current and past RE cycles. The mania is evident in the outrageous asking price of these new properties when they are packed tightly together like sardines

Exactly. Its well stated and shown that incomes have actually dropped since the 2000s. Housing, rent, and good has all inflated beyond what the median income should have inflated to in 2017 USD….

Millennials, while may be judged for dumb financial decisions, are dealt a bad hand in the macroeconomy in terms of conditions.

Great post hmmm!

Mistake. You need to adjust for the lower interest rates. If you do then your story comes apart.

We have lower interest rates because there is no inflation. Housing bubbles have nothing to do with inflation. Its just a mania that lives short term. Look at these poor souls who bought during the last bubble and are still underwater. Is there a dumber way to throw away your hard earned money?

100% wrong.

Low interest rates are the only thing keeping the whole ship afloat, from consumer debt to government debt. Anybody who bet against the Fed and their low interest rate policy was utterly destroyed.

Lordi,

You seem disconnected from reality. Are you really denying we have low inflation?

“Stocks Hold Higher as Yellen Makes Case for Rate Hikes Even With Low Inflation”

https://www.thestreet.com/story/14224365/1/stocks-higher-as-yellen-backs-gradual-rate-increases-balance-sheet-unwind-in-2017.html

If you really think that the housing bubble means we have inflation I cant help you…..

Of course the low interest rates are the life support of this economy…..because this economy is not growing….an economy that doesnt grow means low inflation…..gas prices? Oil? Groceries? Cheap crap from CHina? The list goes on and on…..just because we have a housing bubble mania (just like last time) has nothing to do with inflation….that was my last try to talk some sense in you….the only recommendation i have for you is to google crude oil prices in 2008 and compare them to today’s prices. Maybe that will ring a bell.

My 1st comment on this blog been keeping up with it since last yr comment section be too juicy lol. Ima a millenial in my late 20s currently renting in la but thinking about moving to vegas to get more bang for my buck with housing just would need to find a decent income source/job out there since Im currently a wage slave in cali lol… Were in a everything bubble, stocks and housing in bubblish territory youtube vid explains all https://www.youtube.com/watch?v=w0Oz2R0u4VM

I always have to chime in when a good millennial bashing comes out, because I have a great vantage point. I am a ‘millennial’ engineer who graduated with no college debt. I got a good paying job right out of school in the southeast US. Yes I could have saved better but I’ve always saved and contributed as much as possible to my 401k (10%+), and yes I enjoy $5-8 craft beers (my one vice). But this current setup in regards to the housing market is rigged for the grandfathered in older gens. Coupled with foreign hot cash, they keep the prices inflated by utilizing HELOCS to then buy other cheaper houses and use as 2nd homes/rentals/vacays. So not only are we fighting a low interest and continued easy credit environment, but incomes have been stagnant since 2001 (when adjusted for inflation.) So with higher rents, stagnant incomes, and generally more expensive food, how could one save for the age-old standard of 20% down and compete with 2.75% HELOC boomers and Xers? I tried a brief stint in the Northeast/Boston metro area to try a new job and change of scenery. I knew it was an expensive area, but man, just watching 75-100 yr old shacks fly off the market in <1 week, for $350,000+ and requiring $50+k of work was INSANE. Granted, not Cali insane, but out of whack none the less. Needless to say, I ditched that place and returned to the more affordable SE USA, and am waiting for the next major dip to reevaluate my entry into the housing market.

The best (and sometimes the only) way to win a rigged game is to not play. Sock your money away and retire early in another country. If youre a SW engineer you should look for gigs that allow you to work remotely. F the (((pigs))) who created this mess and all the zombie participants.

This^ is good advice.

I wish I could work remotely but as a contractor that isn’t possible. For those that can there is a lot of cool places you could live if you didn’t have to worry about being at a workplace or job site everyday. The game is rigged for sure.

Millennials are just like any other generation before… only difference is the extreme cost of living now. I work with many millennials and they are hard working, smart, and still have no future here in LA.

@Oceanbreeze

I agree with you. The mainstream media has been mostly lazy in its reporting. The same vices that millennials are accused of could be applied to older generations as well. Selfishness is deeply ingrained in human genes regardless of age.

I’m on older millennial with a six figure net worth as I’ve mentioned here before so we’re not all idiots as many in the media suggest. I don’t mean to toot my own horn but I want to give some perspective to my opinions. I have yet to buy a home because I’m still single and I have a job that requires me to move every few years. And, quite frankly…home ownership is a LOT of work!

What I see within my circle of friends is

1. Parents helped them with the downpayment

2. The most successful ones can afford the downpayment themselves

3. The couple can’t afford the downpayment because of student loans, car loans and jobs that aren’t paying enough for the city they live in.

4. Some of them are just bad with money.

In my Scottish family saving money is a game: How can I spend the least and get the most?

Consider my family a clone of Clark Howards’ family.

The sad truth for millenials is that unless they have a rich family or extremely good jobs($200k plus) they are screwed!!! I am a millennial in my early 30s making $100k and here in the Bay Area I would have to triple my income to buy a 1950s crapshack and the truth is most jobs here don’t pay close

To that unless you are in tech, I can only make that running a small business working 6 days a week.

All of my friends have decent jobs, are hard working natives/locals and many are college educated or they get decent pay in a trade like plumbing or electrician, they all rent apartments or a boomers back yard granny cottage or if they are lucky they rent a 50s rancher crapshack for mucho$$$ and live with their boyfriend/girlfriend/roommates and split all the bills. Nobody I know under 40 in California owns a house except a couple of people that admitted to me that their family helped with a huge down payment amount as a family investment and to help them out in life and essential price them in to their hometown area to stay near the family.

Most of us are sardine canned with our gf/bf in a small rental for 50% of our income trying to convince ourselves that CA is a more European,sophisticated yet simple good life when really we are miserable that we can never have our own home, a yard or any real privacy unless we start making $300k a year or win the lottery.

The wages today aren’t even close to what it takes to rent a house let alone buy and the arguments here against millenials are stupid.

In my area a 3bd/1ba crapshack rents for $3,500-4,500 a month depending on the neighborhood and it sells for $800k-1.3mil, requiring a $150-250k downpayment and then still costing $4-6k month for the payments and taxes.Even parts of California like SLO that are 4 hours from a real city you can’t get a house under $600-800k and the far boondocks where there are zero jobs aren’t affordable either, places like Ukiah you’re still looking at $500k for anything livable and there hasn’t been a job in Ukiah(excluding weed grower) since like 1975.

All the boomers I talk to bought their houses or past houses they sold for a profit to get their current house for staggeringly low prices. Many boomers payed $50-100k in the 70s and 80s for houses that are now $1mil. Even with higher interest rates and inflation adjustment that it isn’t comparable, the only way to get into a house here now from ground zero with no equity is to be very well off financially. Millenials will continue to be angry, frustrated and ripped off with high rents until they leave CA or something happens to this overpriced, competitive, low inventory market. If things don’t change here CA will sooner or later just be the wealthy and their kids, the techie/yuppie class, the taco Tuesday boomers and the servant class Mexicans doing all their work for them. Honestly sometimes I feel it already is that way but there is still like this small fabric of real working middle income people scattered about that gives hope to each other but probably knows deep down they will end up living in Phoenix, Oregon or Fontana one day when they throw in the towel and can’t stand paying $3k a month anymore for an outdated apartment.

PricedOut, I understand you perfectly. I was talking about this outcome of FED policies for years now.

Unlike what millennials believe, the boomers were affected by the FED policies, too. They could no longer use the interests they depended on for their old age. They were not affected “as bad as” as the millennials, but they were affected. Many had to get a job again in old age, just to pay the bills. When you get inflation caused by money printing, that is the equivalent of the most REGRESSIVE taxation; so the poor and the millennials are affected the most (but all affected, except the 0.0001%).

The FED is by the banks and for the banks; not ALL the banks – only those TBTF which own them. They also buy all the politicians. The whole insanity started in 1913 but went on steroids in 1971 when they decoupled the dollar from gold. From 2008 to 2017 they went to a new level of insanity. These actions basically enslaved the whole nation to the 0.0001%. Now, all the bankers wars we have to pay for are for the purpose to expand this gig to the whole world. They have to fight those who oppose.

I definitely understand these things Flyover and they make me want to move to a mountain too village in colombia and live off of the land in a makeshift tent. The policies are all corrupt and the destruction of the middle class doesn’t seem to matter to anyone except the younger generations of middle class barely treading water in the hopes they can live like their boomer parents one day which will never happen unless they are tech tycoons or doctors. Heck, apparently only 14% of doctors can even afford a house in SF and many parts of the peninsula.

PricedOut,

Have you ever thought about moving to greener pastures? I’m not saying that as a knock, it likely is the best thing to do in your case. There are certain areas in this country I would never think about moving to (NYC, Bay Area) even if they doubled my salary because I simply can’t afford it comfortably, you are likely in the same boat. Get a plan and stick to it. It won’t be easy, but it hasn’t been for decades.

Yes, I do all the time. Sickly enough I have been considering moving to SoCal in a cheaper area of San Diego like El Cajon where it looks like a deal seeing houses for $350-450k vs the standard $1mil for crappier shacks with smaller yards up here in the Bay Area. I’m in a bind where I am a contractor working outdoors so I would have a tough time in cold winter areas or rainy places like Oregon and also hotter than hell summer areas like Phoenix or Vegas being able to work and making a good income 12 months a year. I am also involved with a Bay Area native girl who refuses to leave, not even to San Diego so I have to end my relationship if I choose to relocate as well. If I find myself single again I would definitely move to another part of CA, out of state or even another country at this point, problem is any safe, civilized country with decent weather is facing the same housing issues as California. Look at Australia and NZ and see the absurdity of the Bay Area mirrored!!! The one comment about friends, family and jobs leaving is true too, many native CA buddies are always murmuring about Bend,OR or someplace that is cool and liveable and 1/10th of the cost of here, most stay and rent $3-4K garbage from boomers, a few have left over the years to various places for better or worse. My mom is always talking about cashing out on her house here after retirement and moving somewhere cheap like S. Oregon and we can see many businesses leaving and empty store fronts throughout N. California, for every succcesful trendy brew pub or whatever there are 50 failures or old places closing down shop.

Life is short. If you can afford a good piece of real estate, then you are stupid not to go for it. And, if you can’t afford that, you just can’t, and you should just go on living life. Don’t let real estate rule your life. But, in the grand scheme of life, a good solid relationship is the most valuable thing in life, so I recommend you forget about the real estate, stay where you are at, and keep the girlfriend. If you lose the girlfriend, then you should think about other cities.

You got it! It’s all true.

$100k salary puts you in the top 90% in the U.S. for an individual salary. That also puts you in the top 75% for household income. So you are blessed.

I am not sure why people just do not move away to greener pastures. You can buy a 2400sq ft house, 3 car garage, 4 bed room house in the midwest.

The writing is on the wall for all middle class California millennials. $2-3k a month 1 bd apartments, $4-6k a month rancher crapshacks, $700-800k condos, $600-1.5mil 50s 1,200 sq ft rancher crapshacks all spell make $200k or more a year or suffer and live like a peasant or get out!!!! The Mexicans have the section 8 and cheap housing on lockdown and will work way harder and for way less money than you and live 10 to a unit, the rich kids, trustafarian fake new wave organic granola people and techies/yuppies can pay sexy San Francisco or LA $8k a month rents or buy a $990k starter home and an Al Merrick surfboard to mount on top of their Audi or Subaru Outback and the taco Tuesday boomers are sitting pretty in a giant cushy LazyBoy recliner right in the middle of the party with a cold one in one hand and a trip to Tahoe in their classic weekend cruiser car lined up next week with a huge grin that their house they paid $70k for is now worth $1mil and their “other house” they bought as a rental back in 91′ is being rented to some loser millennial cubicle slave and his for $4k a month.

You reached the correct conclusions. Good observations. Just look at the root of all this which I explained above.

Real estate in California is so overpriced that it is hard to believe that prices can be maintained. Sooner or later the older generation will start to die off or move to retirement homes and start to sell. Someday, there has to be a recession again. Someday, all the mania bubbles in stocks, real estate and the bond market will pop and common sense will return to the American economy. This is almost a prayer because the alternative is an America with less opportunity than a 3rd world country.

Sooner or later the older generation will start to die off or move to retirement homes and start to sell.

And plenty of rich foreigners and REITs will bid up the prices on those houses.

Those rich foreigners and REITs will first have to find money to borrow during a period of credit contraction.

Unfortunately, we are headed for a 3rd world country status. Wages are being depressed because of supply and demand capitalism. Look at India and China where people are making 25 cents per hour for manufacturing, and gardening. We have joined a world economy without any bit of European socialism. We will have the wealthy who can have the barnacle scrapers for their yachts and to manicure their gardens at minimum wage, That may be 25 cents per hour if we eliminate minimum wage like some politicians want.

The situation in California has been getting progressively worse over many years. Overcrowding, stifling congestion, more and more taxation, increasing cost of living, one party rule emboldened arrogant politicians, and so on. I respect the tenacity of those holding out for a big dip on the housing cost front but it’s wise to be as objective with oneself as possible and ask, what indications are there that this situation will get better enough anytime soon? Seriously. Just like the weather is not enough, holding out for what you think is right and just to happen is not enough. It’s not a real plan. I submit to those suffering in the throws of this to consider getting out of your comfort zone and start thinking of options that don’t involve sticking around hoping things will change for the better anytime soon.

^ this. Same issues and price points in Vancouver. Except substitute tech jobs for moar Asian immigration. And moar debt for locals.

Priced Out, why don’t you tell us how you REALLY feel?!

ROFL! Merrick on an outback, damn thats good stuff. Anyway, focus on doing things instead of owning things – get out of this country! Yeah, you wont have a whole foods open 24/7 within walking distance, but you will be alive. Central, south america or somewhere in BF asia you can live cheap and tell the parasites to KYA.

I feel you junior_kai. I’ve never been about possessions and agreeing that living life is more important. However, the big issue these days, especially in California is it’s hard to enjoy living when you’re rent keeps getting jacked up and you’re always on eggshells as a renter in a hot market. My busied landlord just decided to sell their rental cause the market is hot, they just moved in 4 months ago!!! So this guy gets them into a lease for a lot of money and they try to get comfy and make a home and now they have to move.

My belief in owning a home has nothing to do with money gains, that is what I keep making fun of the boomers for. They love saying how much their house is worth vs what they paid and although they aren’t responsible for the housing prices they react to them like a day kid in a candy shop.

I want to own a house so I have a stable place to live at a stable price without being told what I can and can’t do. Look at all these rental ads now, $4k a month, no kids, no pets, no couples, no music, no nothing! It’s like renting from the 3rd Reich when you’re paying them top dollar. If you own you can paint the walls any color, do whatever you want to your yard, have parties and a pet or two, you can live a life locally with your friends. It is hard to do that as a renter here nowadays. And like I said the constant rent increases and evictions to sell bring no comfort or stability to a CA renter. If you own there is responsibility and repairs but I will take that any day for a stable payment, actually having equity and doing whatever I want vs a landlord controlling my fate.

Ps. I apologize for all the spelling errors in my posts. It look so like my iPhone decided to spell check and change certain words and I posted before checking it. So it’s supposed to say “My buddies landlord”, not busies lol

In 20 years from now, rents, house prices, and wages will be triple or higher and everyone will be talking the same old story. People will be saying how cheap house prices and rents were back in 2017 … the good old days.

Along with the price of bread, milk, cereal, fuel, health care, education, etc. Wonder if those are any less important than owning real estate?

If fast food joints have to start preparing for living wage increases possibly. However, before that happens I think the fast food and other services may start automating these services going forward.

If it’s truly that simple of a formula there would be no need for you to keep telling us. Not sure which is worse, the people who keep saying things are going to tank tomorrow or the people like you who endlessly deny the complexity and difficulty of the matter.

Just a rhetoric question. Why do we call the housing price growth as a “recovery”? We call the cost of the food growth as an inflation, the same with the rent growth and so on.. But what is the difference between these ones?

We do not use this “recovery” when we calculate an inflation as well as the rent cost, BTW.

One more lie..

It’s good news for RE cheerleaders and the mainstream media financed by them. Popular news pieces don’t like to exposes the crippling effects of juiced up housing costs.

You have a point. Why did the fascination with price increases indicate we are in a recovery? I think it is a farce. Price is marked in everything we purchase. So there is no escape in avoiding this since that is all everyone is fixated on. Plus it is an easier measurement for a wider audience to make a decision on I guess. However, the argument that should be really stated is how many properties are owned compared to where we were since 2009? Price is a result of a transaction between a buyer(s) and seller(s). So if there is growth in real estate then I would guess we should be mute on price going forward and just discuss home ownership vs renting. If someone can’t buy then maybe it’s because that renter didn’t time the market correctly? If someone tries to time the top of this market will that person forever be a renter or a savy investor?

Because the housing marketplace has a higher number of potential sellers than most other industries.

The next housing correction probably should be titled “Crash different this time.”

Didn’t you get the memo? A maximum downside of only 15%. Millennials, REIT’s, and foreigners will quickly jump back in like they did last time *sarcasm*.

This was published last week:

“From Tyler Durden: Ecclectic analyst Ronnie Moas, better perhaps known as the one-man show behind Standpoint Research, ventured into the field of cryptocurrencies this morning when, in a note to clients he predicted that Bitcoin will double to $5,000 in 2018 – roughly in line with Goldman’s recent bullish outlook which sees Bitcoin rising just shy of $4,000 in a best case scenario — then hit $25,000 to $50,000 in the next decade.”

The only real use for cryptocurrencies that I can see is for organized crime and wealthy entrepreneurs in emerging markets to move money around without Government controls. I’ll admit that’s a pretty good reason for them, but it also is a good way to create a bubble to sucker in folks who have no business being into this “investment”. Bitcoin seems to appeal to small investors from the Millennial generation.

MY question for you is this:

Which will pop first? Hot US market real estate or Bitcoin?

80% of all Bitcoin transactions are based in Asia. Essentially Asia miners control bitcoin now. Any price appreciation is going to help them buy more real estate in California. LOL

The U.S. will need to create their own crypto.

What … lots of people have posted since I put this question out there, but not one person will commit to which is the bubble of the year (decade…century…)? C’mon… is Bitcoin better than Hot CA real estate? Are either of them for real? Really?

I posted this before ru82’s very good post appeared.

Most people here do keep clinging to the “crash is coming!!!” hope and theory but you’re right, it isn’t a way of life clinging to that, its kind of like waiting on a winning lottery ticket. And this time around even if a crash does come there are millions of people and investors flush and ready to buy at reasonable prices. I don’t see a big crash personally, there just isn’t enough inventory and the rich liberal NIMBYs, politicians and Taco Tuesday boomers are fighting any kind of new development handnover fist. Any new construction you see as well is craptastic overpriced townhouse/high rise condo junk with HOAs or $2mil plus luxury custom homes. I don’t see any new ranchero crapshack neighborhoods being built like the old days, that is why a 60s rancher or split level crapshack is $ 900k with some Home Depot granite and flooring slapped into it. Also another sign of the side liners is check the MLS. Any nice house in a cool area that is even remotely priced well is Contingent/Pending about 30 seconds after it hits the market.

“And this time around even if a crash does come there are millions of people and investors flush and ready to buy at reasonable prices.”

I’ve been saying this for years. This sentence alone refutes every prediction made by 99.9% of the posters here. I’m looking you at you Flyover, who knows everything there is to know. So keep waiting until you’re dead, or move somewhere cheaper.

Jed, don’t you cry for me. No need. I have millions and almost no debt. I still work but I don’t have to. I can live anywhere I like, including SoCal, next to the ocean, with today’s prices. I’m set.

If you want to cry, cry for the new generation and the once to come. With few exceptions (trust babies) they are for the most part hopeless. My children are set very well, too (one is doctor). That does not change the validity of what I am saying. What I am saying is not out of envy but out of pity.

Waiting on the sidelines until the crash is the smartest plan one can make. Buying an overpriced crapshack during the bubble the dumbest thing one can do. Its pretty simple. The fact that so many boomers fear whats coming shows me this is the right move….wait and get the popcorn ready!

“And this time around even if a crash does come there are millions of people and investors flush and ready to buy at reasonable prices.”

Investors yes, especially with rates where the Fed has them now. I’m not sure about middle class people. Last time, the bargains went to insiders. But we don’t know how high rates are going this year yet. They are higher, but still very low now.

“I don’t see a big crash personally, there just isn’t enough inventory and the rich liberal NIMBYs, politicians and Taco Tuesday boomers are fighting any kind of new development handnover fist.”

That is true in coastal California but not in the inland. This will perpetuate the divide between the drop in prices in upper, middle and working class neighborhoods that we saw the last time.

“Any new construction you see as well is craptastic overpriced townhouse/high rise condo junk with HOAs or $2mil plus luxury custom homes. I don’t see any new ranchero crapshack neighborhoods being built like the old days, that is why a 60s rancher or split level crapshack is $ 900k with some Home Depot granite and flooring slapped into it.”

There is an inexorable urbanization of coastal California. That means higher density, but not necessarily low prices. Look at the cost of co-ops overlooking Central Park in NYC. Building ranch houses probably will go on in the central valley another such flyover California locations where they are economical. High rise LA co-ops better not be built like crap or they will be tombs for many in the BIG ONE.

I think the term crapshack is my least favorite term used in here. I remember driving through Red Mountain CA back in the 80s and looking at the places people were living in. Or the shacks I saw in San Felipe BC back in the ’60s. Compared to those my ’60s vintage modest ranch house is a palace.

“Also another sign of the side liners is check the MLS. Any nice house in a cool area that is even remotely priced well is Contingent/Pending about 30 seconds after it hits the market.”

I’ll give you this one, although I’m not really looking at much outside OC. This could be foreign money, too for all I know.

Also….the rising price of housing…etc….is not the boomers fault. It is the Wall Street. Wall Street made billions during the housing bubble. Lots of banks and pension funds were invested in the housing bubble. The FED need to re inflate the housing bubble to bail out the banks (both U.S. and foreign) and pension funds. To keep their billionaire buddies (Warren Buffet..etc) rich and keep the status quo.

The stock market was inflated for the same reasons.

Boomers and millennial are both getting squeezed by the bailouts and low interest rates.

Low interest rates have been hurting people who are retired and forceing some to go back to work. I think boomers and millinials should not be blaming each other…..many are being hurt by low interest rates and high housing costs.

Good Post ru. Pension fund insolvency is the big Elephant i the room. I know a guy who just got his fixed benefit pension cashed out on him. He turned 66 but isn’t yet retired. When I hit 62, my fixed benefit pension from a former employer informed me that I would have to start drawing it at the rate for age 65. I had planned to hold it until age 70 and draw on it at the higher rate the tables said I was entitled to. Interest rate uncertainty makes keeping the liability for pension payments very dangerous to companies. So they’re transferring the risk to us.