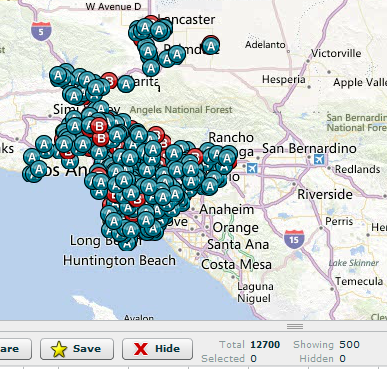

Los Angeles County has 12,700 distressed properties with loan-to-value ratios greater than 100 percent. How many homes are for sale on the MLS? 13,900.

One of the biggest predictors for future foreclosure is negative equity. In the current housing market, it is hard to tell how many people are still in a negative equity position. The challenge of course has been due to quickly rising home values brought on by investors and historically low interest rates. One interesting tool now added to ForeclosureRadar is the ability to search for current properties in negative equity positions.  In other words, the amount of loans on the property are worth more than the current market value of the home. What is surprising, in a county like Los Angeles where the median price is up 17 percent over the year, we have nearly the same amount of people in LTV positions of 100 percent or higher as we do for homes listed on the MLS for sale. Let us take a look at Los Angeles County more closely and try to get a figure of those 100+ LTV properties.

Los Angeles and negative equity

Negative equity is the number one predictor for future foreclosure. The discussion of underwater homeowners has largely been pushed aside because the housing market has been on a tear upwards for the last year or so. Yet we still have a very high number of people in negative equity positions. Let us take a look at Los Angeles County for the number of distressed homeowners with LTV ratios higher than 100 percent:

I really like this new tool by ForeclosureRadar. We went ahead and searched for properties where LTV is higher than 100 percent and that were in some stage of foreclosure (i.e., NOD, auction schedule, bank owned). For Los Angeles County 12,700 properties hit this criteria. Is this a lot? Given that the MLS only has 13,900 homes listed for Los Angeles County, this is a massive number and keep in mind this data is up to date and factors in the boom of the last year where property values have surged.

Based on the last month of sales data for Los Angeles, there is only 2.6 months of inventory. That is incredibly low. Normal markets typically carry 6 months of available inventory. Yet we have discussed the trend of the last two years where available inventory for sales has virtually disappeared. The fact that many are still underwater even in SoCal where many properties are selling at or above their peak bubble prices demonstrates the kind of leverage people took on. I should add that many first time buyers are diving into major leverage via FHA insured loans just to have a chance to compete against the all-cash investor pool. Even with that, many agents are preferring to work with all cash-buyers since the escrow close is clean and quick. Sorry regular buyers, you are now last in line in the hierarchy of home buying.

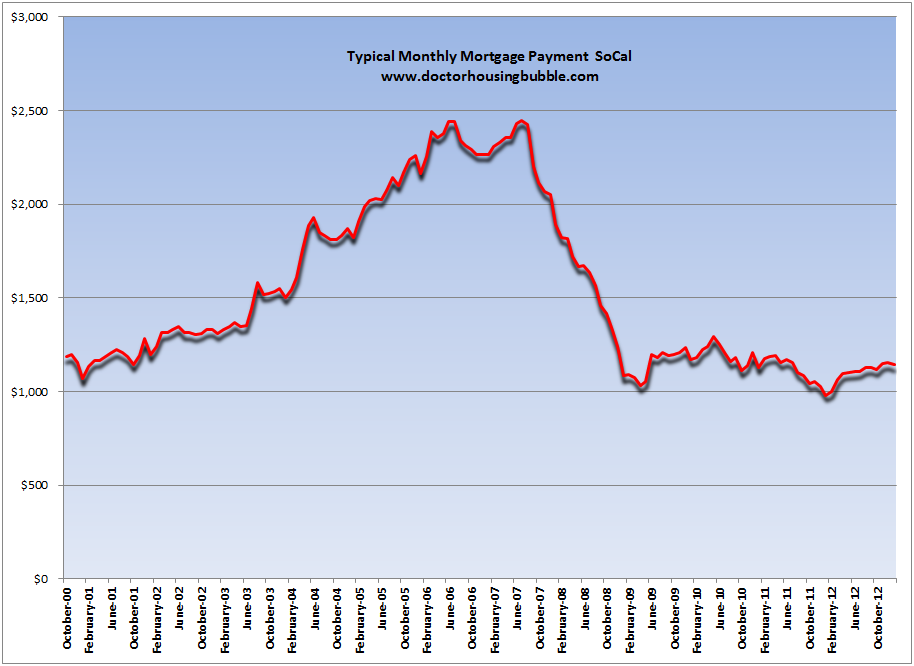

One of the more telling figures regarding what people are able to afford is the figures on the typical monthly mortgage payment taken by buyers. What we find is that buyers are very constrained when it comes to their monthly nut but lower rates have added a deeper level of leverage and of course the incredibly high number of all cash buying (in SoCal it was up to 34 percent last month). Take a look at the typical mortgage payment taken by those with an actual mortgage:

The typical mortgage payment is at decade lows. As we have seen from forums and the current mania, SoCal households are willing to leverage every cent they have into housing just to squeeze in. The above chart gives you a clear picture of what people are able to afford. Which of course makes sense, since household incomes have been stagnant for over a decade.

The LTV data is interesting but with low inventory and investors still out there in droves, we can expect more of the same in the short-term.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “Los Angeles County has 12,700 distressed properties with loan-to-value ratios greater than 100 percent. How many homes are for sale on the MLS? 13,900.”

The money-junkies keep homes off of the market to create an artificial shortage to drive housing prices up, to make more money on the financing. Were housing cheap enough where you could pay it off in just five years, you would be free of the bankers and they cannot have that. The goal of the bankers is for housing to cost so much you will spend a lifetime of servitude working to pay it off, finishing just when you die or are too old to be of any further use.

Well put Michael! So true. If only the consumer could withstand the pressure to play along and not feel left behind. Lower values make for a richer life for the individual in the end.

Well said to you and Michael.

You are so right – we are all slaves to the true 1% (Bush, Kerry, Soros, Kennedy, Buffet etc. and the elite group who control everything and get taxed little.

No one is putting a gun to your head to carry a large mortgage and be a debt slave. Anyone can move areas where housing is very cheap, $100 to $200K. You don’t need to spend a life time in servitude to the Banksters. However, it is easier said than done.

Hmmmm. From my experience, the locations in this country that have low-cost housing also have jobs that pay very low wages on the average, if such jobs exist at all. That is, these sorts of houses are in areas that match the local economy. Wages in places like SoCal and the Bay Area of CA tend to pay a lot more, and their housing is also more expensive.

True on how to not be a slave to the banksters. I think it’s easier said than done for two reasons: 1) Is the income high enough to dramatically lessen the length of the loans? 2) Hard to spend $100K in areas where housing should be half that and you have different weather/social atmosphere than what you may prefer.

I nominate you for President! You sir, have summed it up ever so perfectly. Years ago, I took real estate course because I wanted in invest in it and later did. I remember the graph showing a 30 year mortgage and the first 15 years the payments went primarily to lender and then split in the buyers side after 15 years. I thought “What a great scam!” The best thing you can do is a 10-15 year mortgage and concentrate your energy paying off as soon as possible. One problem is the bankers will then have less money to play with, at your expense, and the consumer driven economy would change as well (less money to buy junk you never use). Your comments were spot on, but the American public can’t think for themselves and no one is telling them the truth either. Congratulations, you are awake!

I think it is worse than that. There are people in gov’t who think private property is the problem in this country. With 95% of loans going thru Fanny or Freddy, the gov’t is really the biggest landlord. That is NOT a good situation. PROFIT is not the motivation for the gov’t to keep houses in inventor, CONTROL/POWER is.

As usual, thanks for this latest tool of analysis – but it still doesn’t really complete the picture, does it? There are so many contradictory sources right now, I’m glad I don’t have to decipher what’s really true and what isn’t.

“The goal of the bankers is for housing to cost so much you will spend a lifetime of servitude working to pay it off, finishing just when you die or are too old to be of any further use.”

That’s happening in EU too, FED has taught ECB well.

12,700 for a county of 9 million people? Over 2 million dwellings to live in?

If that’s the case, distressed properties are now a small number.

I think the Fed’s plan is to eventually wipe out 1, 2, 5 and 10 yr debt and make it all 30 years. Then they don’t have to worry about the interest rate going up on servicing the debt, and keeping this thing going for a good long while.

If we can’t figure out a solution in 30 years, we deserve Greece. As I’ve said before, a yet-unknown energy boom or the cure for cancer is worth trillions. Someone thinks something big up every 20 years.

That’s an interesting point – and if the government takes it’s foot off of the necks of the budding entrepreneurs who’ve always been the backbone of our country, we just might get there. To take just one example, recent developments regarding advances on the state of lithium batteries might be one thing to keep an eye on:

http://www.extremetech.com/extreme/134635-scientists-develop-lithium-ion-battery-that-charges-120-times-faster-than-normal

and has been pointed out before, the treatment of cancer is much more of a financial boondoggle than any “cure” would be:

“Of the nation’s 10 most expensive medical conditions, cancer has the highest per-person price. The total cost of treating cancer in the U.S. rose from about $95.5 billion in 2000 to $124.6 billion in 2010, the National Cancer Institute estimates. The true tab is higher — the agency bases its estimates on average costs from 2001-2006, before many expensive treatments came out”

By Marilynn Marchione, Associated Press

Updated 2/27/2012 2:49 PM

“As I’ve said before, a yet-unknown energy boom or the cure for cancer is worth trillions”

I hate to sound like a heartless banker but the cure for cancer is a feel good scenario that will not have a major impact on the overall economy. Reading D Fresh’s reply it may actually have a negative result. Disclaimer, I am a twice survivor of cancer.

My take is that cancer does not impact everyone in society. Energy on the other hand could be the cancer of the economic future. Energy is essential to each and everyone of us on this planet ergo it is a major driver. So an astounding breakthrough in energy generation and or energy conservation with staying power over time is worth trillions just in the short term.

An interesting anecdote on this; a major energy breakthrough gave the US the edge in winning WWII. That breakthrough – the astounding kilowatt capacity provided by the recently completed hydro-power dams.

FHA’s Mortgage Insurance for the life of a loan is sure to throw some cold water on a hot market.

Your search was for homes with 100% LTV AND were in some part of the foreclosure process. How about just all the homes in LA County that are 100% LTV or greater?

I understand your point being that This is almost as many homes that are listed on the LA county MLS right now. But it would be interesting to see how many are still underwater….

Yes, a large amount of homes underwater. But that inventory is constantly shrinking due to “17% per year home price increases”. I want to relocate(sell and buy), but as we know there is a lot of junk for sale(of course MY home is not junk) and the market is not good for buyers at this time for all the reasons we know. So I will sit tight for another year of so(until Uncle Ben pulls the plug?). In this market, it must be hard for buyers to get government lenders to appraise the property at the same price that a cash buyer is “ready and willing” to pay without the hassle of dealing with lender appraisers.

How many homes are under wanter, not paying their payments and the bank as not filed an NOD? There are still many people not paying a cent to live in their homes for years. The banks are depserately trying to reinflate the real estate bubble but will it work if people don’t have jobs? Companies are not really hiring due to health care reform and tax hikes. Negative growth in last report. When inflation hits 10% foreign investors will pull their money out of US and this bubble will pop.

Meant under water.

Solution is easy; just give more zero-down mortgages out with little or no job verification. Works every time! It’s so much fun my neighbor said he just may go shopping for 2 or 3 zero down houses next weekend in his brand new zero-down BMW.

Speculators have a Life of Riley these days.

My neighbor has not paid his mortgage in 4 years. His house has been listed as a short sale for over 16 months, pending short sale for 15 months now. What the heck? Why have they not closed? Or been foreclosed on? How is he pulling this off? BTW it was listed under market value.

On the other hand, I went to an open house on Sunday, in my area. It was jam packed and three families were scrambling to write offers on the spot. AND the property was $30,000 overpriced. It was listed for $399,000. Out of the investors radar in this area. The carrying costs of this property, thanks to huge HOA fees and mello roos, is a few bucks under $2,700 a month. I know for absolute certainty they would not be able to rent it for a dollar more than $2,200 a month.

So I asked the realtor: “what happened if it does not appraise for this price?” She said “you have to come up with the difference in cash so don’t bother writing an offer if you don’t have at least $50,000 in cash lying around”.

Are people really willing to OVERPAY on a house in this economy? Has nobody learned their lesson from Bubble 1.0 ? Are they nuts?

I shook my head and told her “I’ve been burnt before, I’m not overpaying for any property”.

“you have to come up with the difference in cash so don’t bother writing an offer if you don’t have at least $50,000 in cash lying aroundâ€.

I just love the fiduciary responsibility of realtors. Bother to warn you that the property is advertised for at least 12% more than it’s worth (estimated from the numbers provided at 50K over the 399K asking) and you will be risking your money by purchasing it? Nah. Just shame you by telling you to put up more money than it’s worth or just go away. And if you are going to be the purchaser please throw 50 grand at it so they can sell it at the maximum they can state it’s value at – which is probably still more than it is really worth in a free market.

Wyeedyed, just remember to whom the listing agent owes a fiduciary responsibility, and it’s not a prospective buyer.

The listing agent always represents the seller, and an honest one won’t pretend otherwise. Her first responsibility is to the seller, and if she is doing her job, she will protect the seller’s interest, which means getting the highest price the traffic will bear for the property. If the traffic is stupid and delusional, well, that’s just great for her client.

i think there are a lot more homes on the books of the banks…I believe the banks are trying to get the last remaining suckers in before this market starts down again. Everyone talks about rates being low but what about having a job and what about taxes going up as well as energy, medical etc…what happens when companies cut employees hours below 30 so they don’t have to pay the Obama Care Tax?

Let the suckers buy. I will buy things that will matter over the next 4 yrs as our dollar continues to devalue… Food, Gold, Silver, Ammo as well as staying Debt Free…

To all those who believe there’s a huge conspiracy to prop home prices up by the banks.. You sound a little delusional. Housing is expensive because it’s a necessity and it’s an asset that holds it’s value better than most other assets historically.

I’m sure all the other 1% who aren’t in banking as a profession..would prefer Americans had more money to spend on their products rather than mortgage payments. Why are the bankers any stronger than say.. the entertainment industry 1% who would rather you go to the movies more often, the restaurant industry 1% who would prefer you eat out more often, the car industry 1% who prefer you have more monthly nut toward a car payment… ect. ect..

Having people underwater on mortgages or barely affording payments doesn’t grow our economy… so why would banks collude to crash our economy and GDP?

A banker by the name of MA Rothschild said, ‘Permit me to issue and control the money of a nation, and I care not who makes its laws’.

Woodrow Wilson once said, ‘Some of the biggest men in the US in the field of commerce and manufacturing are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they had better not speak above their breath when they speak in condemnation of it’.

Those other industries you mentioned are very reliant on the perpetual ability to grab credit at any point in time that it is needed. Those cars sitting on the car lot, waiting to be bought by consumers – they aren’t there because the lot bought all of them, hoping to resell them. The lot doesn’t own most of them. They’re there because the lot has an agreement with the bank. Same with Coca-Cola – it may have lots of money on the books, but it still needs a line of credit to cover payroll, etc., since that book money doesn’t flow as easily as the instantaneous creation of money (debt) by the bank in one of Coke’s accounts.

I was shocked to read the Co-op story a guy had a few posts ago on here. He said something like ‘How much is a place to live worth if it cannot be bought via debt (cash only) and has to be used to live in by the buyer (no rental)?’ Turns out some of those condos were only $40k or something.

Has anybody been following the real estate bubble in China? There are ghost towns (ghost cities) of newly made highrise apartments and skyscrapers, with not a soul in sight. Lots have been purchased by folks as an investment, yet there are no renters. Newly made super malls with not one merchant renting space there. Ain’t good. Looks like they overestimated demand then got addicted to the economic growth secondary to real estate building.

What’s going on in China right now is the logical outcome of a dictatorship engaging in a command – and – control economy. Not that I’m gloating – we’re not doing that much better with our gov’t intervention into every sector of our own economy, and since China owns so much of out debt, what happens if they decide to call it all in?

Here’s an excellent short video by Dateline Australia that shows the China property bubble as it was building (pun intended). The video was produced a few years ago (2010 or 2011?), so the bubble has been apparent for quite a while.

http://www.sbs.com.au/dateline/story/watch/id/601007/n/China-s-Ghost-Cities

That’s easy. The banks control the currency, and he who controls the currency holds the power. Those other industries are mear fodder that are a result of what excess is allowed.

There is a reason the Founding Fathers tried to prevent bank slavery, which is what we are going through now. I guess the only thing they couldn’t prevent is someone NOT following the Constitution, because if they did then this would not be happening.

Housing was a necessity before the housing bubble yet it wasn’t grossly overpriced.

The banks also finance the entertainment industry, the restaurant industry and the auto industry.

The banks love debt slaves. They gave people enough rope to hang themselves with. When the people were choking and about to die (default), the banks loosened the noose ever so slightly via loan modifications, lower interest rate refinancing, principal forgiveness just so the people would keep on paying and paying and paying….like the good slaves that they are.

As soon as a “slave” defaults on his/her debt, that slave is free. The banks want to keep the slaves on the plantation.

To begin with and weasel words such as “delusional” aside, you’re painting everyone here with the broad brush of conspiracists which come across as pompous. A lot of us understand that the reasons for what is being observed are more complex than simply “a huge conspiracy to prop home prices up by the banks.”

Your remaining comments come across as naive; as if you have all of the answers. Do us all a favor and keep your head in the sand along with your trust in the idea of banking system face value logic. The rest of us will continue to spend time on truth seeking regardless of your opinion.

So they can make profits.

Watching home prices climb 25 to 50 percent last year to this year makes me think bubble. But maybe they were undervalued. All I know is that I can not find a nice updated or newer single family home in Irvine for 600k or under. Even around 600k everything is junk or old. A few months ago the same 600k home were 400k. I am not sure I have another 10 years to wait around for a deal again. I really need to get on with my life. Please, let the new home builders go wild for a while and build up the Irvine area. We need more supply to reduce home prices.

There’s the whole Great Park area, Orchard Hills, Tustin Air Force Base, and even Portola area available for building new homes in the area. Woodbridge has a new home development opening this weekend. University Park has a new development Spring 2013.

In other words, expect a lot of Irvine area construction over the next few years adding new home supply to the market. What that does to prices (if the economy remains tepid and rates remain low), I don’t know…

We might be nearing another crash, the current bubble being used to sucker any last few people who still believe in the “old normal”. It’s amazing how much QE, manipulation, obfuscation has to happen just for the appearance of “normality”. No one has benefited from the QE and other distortions in the marketplace, except of course the 1% and TPTB. My income is back to income levels of 8 years ago, while prices for everything have gone up. The government and their cronies like it this way of course but you can only defy gravity for so long…

Dow hits all-time high

http://www.chicagotribune.com/business/breaking/chi-dow-record-high-20130305,0,341534.story

Lack of inventory causing a new bubble

http://www.worldpropertychannel.com/north-america-residential-news/housing-homes-foreclosures-6567.php

“My income is back to income levels of 8 years ago”

i’ve yet to surpase my best year ever…..1997…

Interesting comments from Trulia (although there mls is lousy)

http://www.calculatedriskblog.com/2013/03/trulia-asking-house-prices-increased-in.html

Inventory and prices affect each other in three ways:

1.Less inventory leads to higher prices. That’s because buyers are competing for a limited number of for-sale homes.

2.Higher prices lead to less inventory – at least in the short term. Everyone wants to buy at the bottom; no one wants to sell at the bottom. When prices start to rise, buyers get impatient while many would-be sellers want to hold out in the hopes of selling later at a higher price.

3.Higher prices lead to more inventory – in the long term. As prices keep rising, more homeowners decide it’s worthwhile to sell, especially those who get back above water, which adds to inventory. Also, builders take rising prices as a cue to rev up construction activity, which also adds to inventory.

In the short term, the first two reasons create an “inventory spiralâ€: less inventory leads to higher prices, which leads to less inventory, and so on. But the inventory spiral can’t go on forever because eventually rising prices will encourage homeowners to sell and builders to build, which add to inventory and breaks the spiral. The critical question for the housing market – especially for buyers fighting over tight inventories – is how long until that kicks in? How long do prices have to rise before sellers and builders start adding to inventory?

Read more at http://www.calculatedriskblog.com/2013/03/trulia-asking-house-prices-increased-in.html#wcE4WfJ5LrVfYz2y.99

Housing should not be this expensive. It is only truly affordable to very few. Really, a decent 3 bedroom home should not be $600K, even if you do make $200K/year. If you make $200K per year, a 5 bedroom stellar property should be affordable to you.

Unfortunately, there are markets that are outliers to fundamentals, like NYC, SF and now apparently OC and West L.A.

Considering housing recovery as “oh good, houses are still selling for hundreds and hundreds of thousands” is not good for anyone, except financiers. Why has the public been duped into seeing this as a good thing when very few can actually afford a home?

(Affording a home is not working in constant fear that one job loss in the family means default on the loan and no savings for retirement.)

The public wasn’t “duped,’ per se, but once the regulations governing Fannie were relaxed and their MO changed to get as many people as possible (no matter their financial fitness) into housing ownership the shackles were off the bankers subsidizing the loans. It’s a similar dynamic that’s currently being played out regarding the college financial squeeze – and the endgame for that fiasco is also being dragged out.

“…houses are still selling for hundreds and hundreds of thousands†is not good for anyone, except financiers. Why has the public been duped into seeing this as a good thing when very few can actually afford a home?”

Let me count the ways:

1) Majority rules. Most American families are already “owners.”

2) Of those renters, I’d wager the majority are the perpetual renter class, and a very small minority is the prospective owner class.

3) Of the real, prospective ownership class (mostly young professionals), they are saddled with college debt and a weak job market, so they “making do” and putting off getting married, starting families. Taco Tuesday’s is a great day (Happy Hour only) to see this class talking about their true ambitions, which is to get tickets to Burning Man and train for the next marathon.

4) Most Americans have most of their wealth tied to their primary residence. So, rising home prices is the #1 financial impact in their lives.

5) The “owners” are wealthier, more educated, and powerful and thus are more influential on their elected officials than the renters.

6) I don’t know for sure, but I’d guess elected officials are +90% “owners” themselves, giving them a vested interest in that asset class being inflated.

7) The housing market is often cited (correctly or not) in the media as the industry most closely correlated with economic recovery. So, the propaganda gets pounded into our heads that rising home prices is good for the economy.

8) As poor savers, rising home prices allows families to use their home equity as ATM’s (HELOC’s) and become mini-Bernanke’s.

9) The national news media, as a conglomerate, is part of the wealthy ownership class that benefits personally from rising home prices.

10) In California, with the tax bases so closely tied with spending and RE, rising home prices is great for its depleted coffers.

11) Much of California’s economy is underground/cash economy. These are largely immigrants with weak ties to the general, overall community. Real estate is a great place to launder all that cash and provide safe haven for their extended families who are still in the process of integrating into the tax-paying populace.

12) etc.

no f’ing way i can get a house within 50 miles of my job with a payment of $1200 a month

What I’m finding interesting is the relatively low level of homes actually SELLING. Lots of homes immediately go pending on MLS, then sit there without closing for 100+ days. Financing issues? Appraisal issues?

With the DOW headed to new highs and the RE market moving up as well, the wealth effect should start to kick in for all those that still have reliable employment.

This is a classic case of capital flows out of low yield investments. Big money is now convinced that low risk investment are not going to pay anything near the inflation rate for years to come. The Fed is now winning.

Scared money leaves Europe and hunts for yield in US real estate and the stock market. Retail sheeple to follow. I give it 2 to 3 years as nothing has changed for the common man.

There have been many discussions about home prices and commute times. Here is an interesting study with primary image of SoCal. Lots of other data links as well.

http://flowingdata.com/2013/03/06/average-commute-times-mapped/

Homes for Sale:

During any outing searching for sale or rental properties in LA County, you are sure to run across plenty of LA homes which will require a very large dumpster should you choose to move in.

Welcome to “Irrational Exuberance Part II”, at least here in Los Angeles. My wife and I are first-time buyers, have just enough cash to come up with 5% down and are preapproved from a direct lender for a conventional 30-yr fixed loan. Available inventory in our budget is in the SINGLE DIGITS! Last week, we placed an offer on a property that needed lots of updating (est. $10-15K of work, but without a real inspection or appraisal). Offered at 106% of list and we weren’t even considered because of multiple cash offers at 110%+! Listing agent asked us to remove appraisal contingency before the offer was even submitted. Placed 2nd offer on a REO at 104%, maxing our budget, heard there are over 20 offers submitted. Didn’t even bother to write offer on a HUD home because listing agent said cash offers were already on the table at 120% of list! Looks like the RE hacks have their 2004-2006 blinders on again.

This market is only setting up middle-class buyers for another fall. Interest rates have nowhere to go but up, which will bring prices/values down. Paying over value now locks the buyer into a loan that can’t be refinanced later to offset the falling value. Result? A whole new slew of underwater properties in a couple years.

Perhaps the Federal budget sequester, looming shutdown and debt-ceiling battles will be the much-needed splash of cold water in the face of this price run-up insanity. Rest assured, the banks will do everything they can to fuel this fervor – since now they know the government will rescue them from their own self-inflicted apocalypse(s).

I think my financial advisor friend summed it up best, “Hollywood loves a sequel.”

Leave a Reply to DMac