Taking a gamble in the Las Vegas real estate market – 40,000 vacant homes while 9,500 are listed for sale. Are investors gearing up to bail in the Southwest?

The mortgage markets had one of their biggest moves in US history. According to Freddie Mac, the 30-year fixed mortgage rate posted its largest move in more than 25 years. No doubt this got the serious attention of the mortgage market. What is interesting is that each piece of good economic news nationwide is likely to add fodder to the Fed exiting QE. Yet moves like this make it much more expensive for inflated markets that completely rely on easy money flowing in and are built around crazy low rates. The Las Vegas market is one of those fascinating markets where hedge funds and investors have been going in hand over fist for the last few years. Yet when you look at the data, what you find is a market that is essentially trading homes to one another in a large game of musical chairs. I think it would be useful to examine why Las Vegas home prices have boomed in the last couple of years.

Step 1 – Make it harder to foreclose

There was a law, AB 284 in 2011 that essentially made it much more difficult to foreclose in Las Vegas. While good intentioned this law actually created a massive moral hazard that of course, did the exact opposite of its underlying mission:

“(Review Journal) What’s so astonishing about those figures is there is no real shortage. There are 50,000 vacant homes in the valley and average owner-occupants have slim to no chance of winning their offers.

After the passage of AB 284, many homeowners realized they could live for free for long periods. Thousands of homeowners are on years three and four without making a mortgage payment. Lender Processing Services reported a few months ago that the average person who stopped paying has been in his home more than 24 months.â€Â

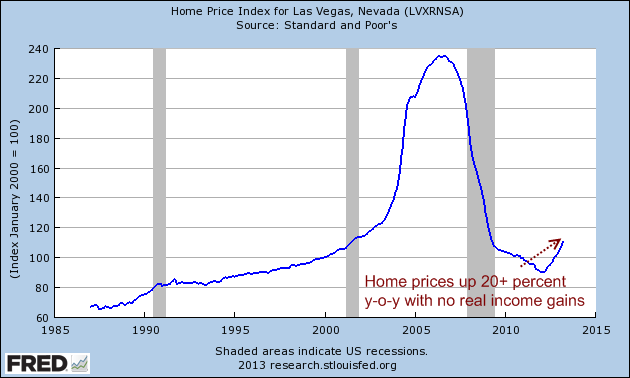

The above article was written in March but is definitely worth a read. Another study from the University of Nevada at Las Vegas found that 40,000 homes are vacant. However you dice it, there are plenty of homes that can be sold. According to Zillow, you have 9,500 homes for sale. Prices have done this in Las Vegas:

Yet over half of all purchases are happening from arms distant investors. The underlying economy doesn’t exactly look like it is booming to justify a 20+ year-over-year gain.

Step 2 – Stop paying on mortgages

This is where the moral hazard issues come out where people stop paying on their mortgage:

“The flip side of the coin? Las Vegas is enjoying a miniboom again. Having close to 80,000 homeowners not paying their mortgages has given a big boost to our local economy. Approximately 80,000 x $1,200 (average rent or mortgage) = $100 million a month going into our economy. This money ordinarily would not be disposable income. That’s $1.2 billion a year being pumped into our economy, and that is far more efficient than any government stimulus. It goes directly to retail, new cars, restaurants, etc. No red tape in the way.â€

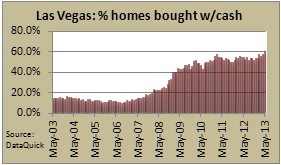

I find this very interesting. Even today, nearly 60 percent of all buying activity is going to investors (at record levels). Just look at the crazy level of all cash buying:

Source:Â DataQuick

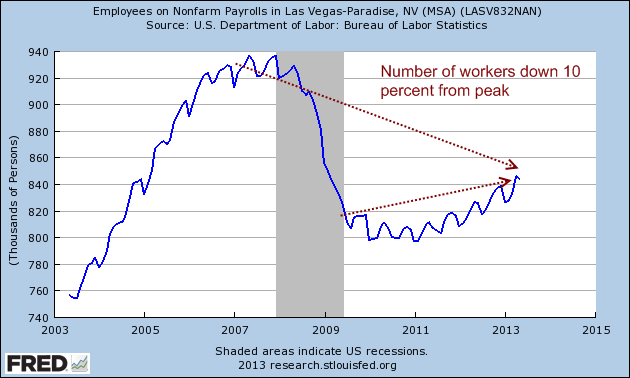

Investors are hungry for yield. Returns just got much more lucrative outside of real estate with rates going up dramatically in the last few weeks. Is it still worth it to chase these yields? It hasn’t been for a year or so outside of flipping to others for appreciation but we know how that game will turn out. Many are pulling back. The employment market doesn’t seem to justify this boom:

While it looks like it is slowly picking up, wages are not and for people that actually need a paycheck to pay their mortgage, it just got that more expensive because of higher rates. But did it really? Ex-investor demand prices would likely be more modest even with higher rates if investors weren’t crowding out average buyers looking for a place to live. Was the intention of low rates to create entire regions of flipping activity for big hedge funds and to punish regular buyers and renters? That is the end result.

Step 3 – Exit

I think this article sums up the next steps:

“It’s not rocket science to predict what will happen next. We will see another 20 percent appreciation in prices over the next nine months. AB 284 will be amended, the national settlement servicers will have sold most of their loans to new servicers who don’t have to follow the same guidelines. Vacant homes and delinquent loans will be converted to available inventory in the second half of 2014. The second bubble pop in less than a decade will begin.

And what of those hedge funds that are buying up homes with cheap money? Well, with tens of thousands of homes being converted to rentals, rents will drop, making the rent-to-price ratio fall. Housing yield will become far less attractive. The funds will find the homes are not generating the cash flow they had told their investors they would. The next step will be to sell off quickly and cash in on the higher price and 40 percent capital appreciation. Nobody wants to be holding the last bag when the sell button is hit.â€

We’re already seeing major pressure on rents in Las Vegas. Rents are paid via actual net income from a paycheck (yes, those pesky incomes do matter). With home prices skyrocketing, yields are already unattractive so why dive in? The move in interest rates will definitely have an impact. Las Vegas is an exaggerated case of what went down with stalling foreclosures, subsidizing Wall Street funds with low rates, and basically punishing those that saved and are trying to buy a home to live in versus flip, hedge, or convert into some income stream for a REIT. The fact that investor demand is still feverish and the economic fundamentals stopped making sense a year ago this market is safely into mania mode. Will anyone step in? Absolutely not. Our economic system seems to be “ride it until the wheels fall off†so put on your helmets because the RPMs are starting to redline.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “Taking a gamble in the Las Vegas real estate market – 40,000 vacant homes while 9,500 are listed for sale. Are investors gearing up to bail in the Southwest?”

If you don’t see it, you are not looking.

http://www.redfin.com/CA/Redondo-Beach/711-Esplanade-90277/home/7704320

Check the history.

Have to laugh as I’ve been watching that one for quite a while (I live nearby). The home next door–also for sale– is the worst thing I’ve ever seen.

What is the significance of this note?

“THIS IS A RARE OPPORTUNITY TO OWN A SIGNLE FAMILY RESIDENCE WITH ZONING THAT ALLOWS FOR TWO UNIT MULTIFAMILY RESIDENCES (VERIFY W/ CITY).”

??

I live in Incline Village, NV which is substantially different market than LV but may be interesting to readers. We sold into SF Bay Area CA frenzy and decided to leave when voters said “you need to give us lots more money for no services” and started emptying the jails.

This market is driven by a combination of second homes on LAke Tahoe, tourism service jobs and tax expatriates. Prices of homes (condos, SFR) range from mid 200,000’s to >$5m if you are on Lake Tahoe.

There is quite a bt of turnover in a tourism/second home dominated area but several things have happened over the last 18 months. The number of short sales went from common to unusual. Prices moved up a good 25%+ and inventory has dropped from about 350 last June to 250 properties this June.

Buyers at high end are obvioulsy dominated by Californians but a new source at high end are those from Washington state, which has no income tax, now has a big estate tax. Lots of other 55+ independents who have moved from many other places.

With interest rates going way up, it does not seem likely they will find enough suckers to buy these vegas properties.

But we are talking about vegas so if gamblers are stupid enough to let it ride in those properties then they deserve the blood bath that awaits them. A fool and his money are soon parted.

With all the crazed investors tripping over and clawing at each other to snag yet another place to park their ill-gotten gains at the expense of ordinary people, it’s interesting that renting is the smartest money move for young people Right Now. Great evil is always followed by great good. Hey, hedge funds, keep the party going.

Rents are trending lower, incomes are stagnant or decreasing, costs of rental maintenance, repairs, and evictions increase as the dollar devalues. More courts are closing, already closed or hobbling along with overworked, reduced staff at the bottom of the pay scale (vested and near-vesteds were canned, after decades of paying in to the system). Evictions take longer and result in (re-)possession of the premises, so re-rent to another and the cycle re-sets to zero.

If you’re a creditor without a judgment in CA courts, good luck. There are no default clerks anymore and the time line for reducing debts to judgment extends for years and years, up to 10. News to debtors: By then, your credit will be clear again!

Interesting times. Something for everyone.

We’ll see how it all plays out.

You think that the mania will continue for another 9 months??

“You think that the mania will continue for another 9 months??”

If the fed continues buying MBS, are rates do not continue going up by the day, it may last that long or longer. The problems come when the FED removes the free money punch bowl.

When that happens it will get ugly real quick. In the past few weeks just look at what happened when the FED just mentioned reducing the free money in the future.

You don’t want to get caught holding investment property when the music stops.

The CEO of Quicken Loans was on TV a few days ago saying how Option Arms are starting to make a come back because it keeps the monthly payment down even though rates are creeping up. So, if he’s not full of BS, the public could be taking the bait. The interviewed a young married woman who said she wanted to buy in before the prices rose too much more but could only “afford” the payments now if it was a ARM…….

Please be clear about what he said. He did not say “Option Arms” as those will be dead for a while(although they were a great tool for those seasonally employed). He was talking about regular adjustable rate loans. Regular Arm’s typically follow the monthly treasury yield which will be less affected by the recent rate rise. I do agree, someone should not use an ARM, if they can’t afford a fixed rate. They do tend to be good for rental properties as rents often increase when rates go up.

Yes, I think you are correct. My bad. But, my point was not the specific type of ARM, but rather the buyer was now justifying the use of a more risky mortgage product in order to chase a rising price for real estate. This may not take hold as the these still are measured in the new applications for mortgage figures and that number is going into the cellar.

If we’re gonna see steadily increasing rates, then now is a good time for lenders to bring back the ARMs in force. Lots of folks out there that don’t understand the pressures that drive the rates up or down, and lots of brokers out there willing to tell folks, ‘If the interest rates drop, you’ll be paying less!’ just to close the sale.

Honestly now who wants to live in a place like Las Vegas? That disgusting city is once again the bubble capitol of the world. In that city scam happens evey other minute.

We all know how all this ended back in 2008 with investors and speculators, what makes you think that this time it may end differently.

Reno is worse, which is sad, for me, because I thought it would be a great place to move to, since it’s at the most an hour from world class skiing and Tahoe in general. Checked it out last year, and recoiled in horror. Made my girlfriend cry, thinking I wanted to move her there. Looked at some awesome little brand new homes that I could have bargained down to 150,000 or so. Sigh. Location, location.

Just Google ‘HOA scam Las Vegas’ and look at all the stuff happening there. I read one story years ago that was several pages long (wish I had a URL, it was a good story), where condo hoa’s were being taken over by scammers that had ties to law offices, construction companies, and a police station. Folks were buying condos as ‘rental property’, etc. (but more like multiple names on the titles), then taking over HOA’s, often using physical threats and body guards to command control of meetings, then sending in construction companies to do unneeded, big money repairs, and somehow law offices, etc. were getting kickbacks too. One of the lawyers that was involved ended up killing herself when the scam was becoming exposed to non-corrupt authorities. The story read like a mystery novel.

http://www.businessweek.com/magazine/the-king-of-all-vegas-real-estate-scams-12082011.html

Boom! Found it.

“Las Vegas is enjoying a miniboom again. Having close to 80,000 homeowners not paying their mortgages has given a big boost to our local economy. Approximately 80,000 x $1,200 (average rent or mortgage) = $100 million a month going into our economy. This money ordinarily would not be disposable income. That’s $1.2 billion a year being pumped into our economy, and that is far more efficient than any government stimulus. It goes directly to retail, new cars, restaurants, etc. No red tape in the way.â€

Unreal. What’s the eventual endgame? Are we morphing into a society of needy, greedy hustlers, dependent on govt handouts and exploiting programs (many designed with pure intentions, but eventually morphing into absurdity), our existence not to create a meaningful, honorable existence, but to seek out and exploit the latest and greatest grift?

Drinks, I’m sure this “squatter’s stimulus” was part of the agreement made between banks and the government when the bailouts were handed out a few years ago. I have no doubt this was all calculated.

The banks would let deadbeats squat for years without paying. This helped the banks avoid realizing all the losses at once and having an even steeper decline in real estate prices. In a normal world, people who fail to pay their mortgages are thrown out within a few months. This is something that was unprecedented and could not have been predicted. This was the tsunami of foreclosures that never materialized.

The government gets the added bonus of millions of people not paying their mortgage for years. This money trickles into the economy since we are largely a consumer driven society. People are buying cars, shopping, eating out, etc. This is helping keeping businesses open and tax coffers filled.

Who cares about the tax payers who payed for this mess and indirectly added trillions to the national debt. Being financially responsible in this society is NOT rewarded and likely won’t be from here on out. Everybody on this blog needs to accept that fact and base their economic decisions on that. I

Great post, Lord…agreed…its all really something to think about.

You hit that nail on the head as usual Lord. Personal responsibility has vanished from America. Here many people making 30k to 40k working in a mill so close to the bottom that they just drop out, and why not, free food, free housing, free healthcare, free utilities, hell you even get a free cell phone. No taxes now, you get earned income credit.

This nation is ruined.

‘Who cares about the tax payers who payed for this mess and indirectly added trillions to the national debt. Being financially responsible in this society is NOT rewarded and likely won’t be from here on out. Everybody on this blog needs to accept that fact and base their economic decisions on that.’

I’ve got an idea. Let’s get a money pool started behind a LLC or similar structure, where our personal assets and credit are sheltered. With this money pool we go into the Vegas market, by up as much as we can with little or no money down, then rent the crap out at $200+ LESS than comps. Here’s the rub – we have no intention of paying our mortgages on the places. We just rent them out for 2 to 4 years, and collect the rent, then let the banks foreclose. With that new pool of money, we start another LLC or whatever someone can think up to keep our personal assets and credit scores untouchable, than buy more houses, collect rents, don’t pay mortgages, etc., and keep repeating the process…

I propose the business be called ‘Leveling the Playing Field, L.L.C.’.

Heck yeah! I live in Vegas. It is a butthole, and I won’t be living here forever, hopefully! I have a good job, however, and have short sold my home several months ago. I’m just hoping that things will take a dump here in the housing market just in time for me to buy a bigger home for my family, pay it off, and move to Santa Cruz when I retire. Viva La Sewer that is Vegas! Viva La Housing Bubbly Number 2! And all you greedy maggots who preyed and are preying on soon to be homeowners who really shouldn’t be getting into a home but are being scammed into getting one, screw you!!

It will be 117 in Las Vegas today. Average electric bill during the summer: $500 a month. Very practical place to live. Throw in a very large floating population and generally very poor schools and you have a real winner.

You forgot about the water supply that, sooner or later, is going to run dry. Not really the smartest thing to do, building a metropolis like that in the absolute stinking desert, filled with fountains, lawns, and mega golf courses.

They’re doing it in Dubai, but the have the intelligence to use desalinized water

Vegas is what, 1500 miles from an ocean?

My Phoenix power bill was more or less 80.00 Jan, Feb, March, April, May, Oct, Nov, Dec.

June it would shoot up to 300, July and August 450ish and then drop to about 300 in Sept.

If you average it out it isn’t that bad.

One point……..cost per kilowatt was only about 11cents in Phoenix. If Arizonans and Nevadites ever had to pay California rates, it would crush their economies but as it stands now, all is fine.

Speaking of floating populations, I hear the same thing about San Diego. A large percentage of the residents are in the military (think about North Island Naval Station, Mirimar, Camp Pendleton, Point Loma, etc) and are prone to relocation every few years and a large Latino immigrant population working their way east or north away from the border. A friend of mine lived there and said it was the most difficult place to find friends of any city she lived in.

Really? According to the DOD San Diego has 93,000 military personnel stationed there. Total population of the County according to the 2010 Census is 3.14M. Sooo, that’s less than 3% and certainly only a fraction of those would be involved in the housing market so what is your point?

Don’t forget a large proportion of those military personnel will be younger people just starting their families. They could be a significant fraction of the potential first-time homebuyer pool.

good article, but AB 284 didn’t make foreclosures more difficult to anyone who was running an honest operation. While i agree the result was that most banks found they couldn’t go through with foreclosures at the same pace.. it shouldn’t be Amended.

all AB 284 states is that 1 employee of the bank must physically review (skim) all of the relevant documents, and have some proof that their entity has the legal authority to foreclose on that property.

It ensures all of that by putting the person who signs, on the hook for liability / damages.

like oh here’s the loan agreement, here’s the payment history, here’s bank eagle home loan selling it to wellsfargo, here’s wellfargo selling it to fannie may.

Looking at all of these documents i see that yes we do have the authority to foreclose.

If the foreclosing entity , can’t look at all of those documents at the same time, they have no business foreclosing. That’s just wrong.

Don’t get me wrong. i’m not pro free loader , i think all those bums should be kicked out and banks should be FORCED to sell the inventory .. to once and forall get a big correction in the market. get our cost of living lower, and help us be globally competitive. (this would cause banks to go under) and they need to be allowed to fail…

If you look at the foreclosure rate in nevada, it dropped like a rock after AB284, but then its been on a steady uptick , ever since banks figured out how to play by the rules.

That is just not true.

“The legislature is in full swing and they will finally begin to tackle the AB284 language debacle.

For those of you that haven’t been following… AB284 made it tougher for a lien holder to foreclose due to the vague language of “personal knowledge†and other verbiage. Oh yeah… it’s also a felony if you mess it up.”

–www.renownres.com/ab300-to-the-rescue-redefining-ab284/

Although banks should be held liable in Civil Court if they foreclose illegally, having a poorly written law with unreasonable requirements is not a good thing, either.

Having banks unable to foreclose on the huge backlog of houses with squatters who fail to pay HOA’s, mortgages, taxes, maintenance and upkeep is NOT a good thing.

Thankfully, the legislature of Nevada does not agree with your assessment and, in recognition of its failure to legislate intelligently and reasonably, has implemented a fix for AB284 (i.e., AB300).

My take. You just patted your elected officials on the back for facing up to their incompetence and stepping up to re-do same incompetence. I mean if they can’t get it right the first time why should we the people have confidence in their ability to do right by us?

This opinion goes all the way back to Bush’s chant to fix the banks by Monday because they were to big to fail. The end result of that seems to be endless QE to float those banks at the same time they expand their ginormous size by double.

No one here is a friend of the banks, obviously. What does ‘too big to fail’ have to do with this discussion? Of course banks should not have been treated like they were ‘too big to fail’. Irrelevant point.

The point was that wreaking havoc with the market by legislating these people be charged criminally – sentenced like murderers – for not having knowledge or paperwork that, in some cases, is no longer possible to obtain, is ridiculous.

We have a civil court for a reason.

No one has confidence in the legislators, but yes, they had done a very, very bad thing with AB284, and it needed to be rectified. Is it perfect? Certainly not. But one of the main complaints that many people on this blog seem to have (including me) is that the housing market is manipulated in some pretty deleterious ways. We are seeing the results of this manipulation in the extreme price fluctuations over the past decade.

For the legislators to exacerbate this situation is not a good thing, but no one is suggesting they feed more to the pigs.

Just want to add no one is taking into consideration the Fed rules on large institutional investors hedge funds etc. In order to purchase these vats of foreclosure houses must hold these houses for a minimum 5 years as rentals with an option to extend an additional 5 years. So even if hedge funds banks etc want to get out, they can’t.

As for the supposed money going into the economy instead of to the mortgage payment to a servicer for a Note the banks already stole all the homeowner’s equity from. That to is assuming the defaulting homeowner’s are simply choosing not to pay as opposed to not having the money to pay. Big difference. My guess is they don’t have the money due to unemployment or under employment. I am working 2 jobs to make 1/2 what I made 6 years ago. I went from nearing retirement to starting all over again as if I was 18 lost everything to this bankster scam.

PS my power bill in the summer can be as high as 1500.00 on top of the mortgage payment!

“Just want to add no one is taking into consideration the Fed rules on large institutional investors hedge funds etc.”

Um, Lynn, haven’t you learned by now that the rules are written for the little people. Not them.

exactly – rules schmules

Lynn, my bill is nowhere near that but I finally decided to spread the pain out by opting for NV Energy balanced billing.

I am a frustrated would-be buyer here in LV. I am hoping Mark Hanson’s predictions will be correct.

Good lord! Do you people live in 5000 square foot homes? I live in the IE and have never had an electric bill over 100 bucks, and my thermostat is set at 77.

‘PS my power bill in the summer can be as high as 1500.00 on top of the mortgage payment!’

Might be time to call up Solar City or Sun Run or the like. Or at least consider some efficiency retrofits or something…

$1500/mo?

Yeah, but how much are you making selling all that weed?

How does the news report 50,000 vacant homes but at the same time tell me the owners are living in them without payjng their mortgages for 2,3,4 years. How can the home be vacant and still have someone living there. The banks that own these delinquent mortgages have strong balance sheets, and they will NOT flood the market with inventory and destroy the valuations of their foreclosed homes.

The flipping continues here in LA, LA, LAnd. Just a coincidence that both are on the undesirable street of Wellington in the Crenshaw District. In any case take a look at the price histories. Both appear to be backroom deals from banks to flippers to first time FHA homebuyers?

Sold for $255K 2 months ago and after major makeover now $429K

http://www.trulia.com/property/3096066751-3520-Wellington-Rd-Los-Angeles-CA-90016

Below, sold in March 2012 for $155K now $420K

http://www.trulia.com/property/3091743147-3003-Wellington-Rd-Los-Angeles-CA-90016

These two houses epitomize everything about LA. Almost half million dollars to live in a gang infested barrio that is heading south. Take a good look at the street view and you will see what you are buying into. I especially like the neighbor with the dog runs. Hope you can speak Cholo. These places were not even worth the original “deal” at $220,000. As matter of fact you could not pay me to live there. And, I am Hispanic.

http://www.youtube.com/watch?v=T8ch4rsMmZI&feature=player_detailpage

Clearly what is happening in that area is that the flipper vultures are banking on Expo line proximity to bring in the desperate leveragers.

With so much overpriced garbage on the west side, there are sure to be those who will sign-up with dreams that ghetto lite will yeild to gentrification.

In the meantime, there’s a “bonus” white metal security fence to go along with your HGTV trim. LMFAO

Have a look at the high number of rentals in Las Vegas on Craigslist.

No David, there are 50,000 vacant homes AND on top of that there are people who have not paid their mortgages in 2, 3 and 4 years. These 50,000 homes are different homes from the ones where the mortgage has not been paid.

The housing situation in Las Vegas is a very complicated one.

While we do most likely have 40,000 vacant homes as was found during the UNLV study of 6 months ago that was conducted by asking NV Energy how many properties did not currently have active electric service. (the theory would be that who could occupy a home without Air Conditioning.

We also only have 4,000 homes on the market that are actually for sale…. the zillow number takes into count the pending sales as well as available homes.

The homebuilders have hundreds of homebuyers waiting on lists to get the opportunity to buy a home. By the way… homebuilders are currently only building at a pace of 8000 homes per year which is 100% more than 2012 when they were on pace for 4000 a year which is all that they achieved. The new homebuilders cannot find any available land to buy at prices that will work to make a profit… and the BLM (government) owns most of the rest of the land that you now see vacant and will only release it when petitioned to do so which means that one must prove that there is a need for it.

Homebuyer Affordability is still one of the highest in the nation here in Las Vegas and a homebuyer can currently purchase a home with FHA (3.5% down payment) financing and still have payments that are equal to what they would pay to rent the same sized home.

Speaking of rental properties… We have a shortage of those as well because many of the previous rentals are what the banks have foreclosed on over the past 4-5 years. Las Vegas has seen the available rental pool shrink by 18% t0 20% per year for the last 3 years. In other words we used to have over 10,000 properties available for rent in the local MLS and now we have approx. 5,000 available today.

I have been a real estate broker for over 20 years and have personally represented over 2,500 transactions in my career so far. The Las Vegas market is only returning to where it should have never gone down below. The Las Vegas median price will most likely increase another 15% to 20% before it SHOULD slow down to a more modest pace of 4%-6% annual appreciation. If it goes much higher or doesn’t slow down to that pace by 2015… THEN and only in my opinion THEN… we will be at risk of overheating the Las Vegas market.

At the peak Las Vegas foreclosure market of 2008, 2009 we experienced and average of 3,000 to 3,500 REO sales per month in the LV valley. RIGHT NOW we are only seeing 500 per month. Even if the banks were able to increase their staff and try to release more if AB 284 were amended… the banks would have a 100% increase if they got to a pace of 1,000 a month. A 200% increase to get to 1,500 per month. The Las Vegas market can easily handle that kind of an increase which would take care of those dreaded vacant shadow inventory homes that everyone has been so worried about for the last 5 years that have never shown up yet.

My guess is that you will never see a mass dumping of any homes since most of the banks have chosen to sell their REO assets off in bulk to buy and hold investors. These PRIVATE sales have restrictions to not to sell them for 36 months which would give the market even further time to return to a balance.

On the topic of water… Las Vegas receives 85% of its water from Lake Mead which is on the Lower Colorado River system. Las Vegas is the ONLY large city that can receive its water from that system… use it to take a shower… send it back through the sewer system… treat it and return it back downstream of our pick up tube back into Lake Mead for a gallon for gallon credit. Try to do that in southern california and see what happens. CA receives 4,300,000 million acre feet a year from the Colorado River, Arizona receives 3,200,000 million acre feet a year from the Colorado River… mostly to irrigate farmland West of Phoenix, go figure why they do that…. Las Vegas only receives 400,000 acre feet a year from the same Colorado River system but gets to recycle water for currently an additional 80,000 acre feet a year. By the way Las Vegas is only using about 360,000 acre feet a year of its allotment right now and banking the rest so… no we are not running out of water. CA is using 100% of their allotment.

Vegas is also looking forward down the road and working on an aqueduct source in northern NV the same way that southern CA did and when that comes through… it will take care of some of the future needs.

AND MOST importantly…. NV can offer CA to put in a Desalinization plant… give CA the desalinated water in a gallon for gallon exchange to NV which would give NV the opportunity for 100’s of 1,000’s of acre feet a year from what is currently being sent down the river to CA. SO again… WE WILL not run out water.

On the other hand… the Colorado River system is in a stressful state and Lake Mead is about 100 feet below capacity… it was 130 below capacity a few years ago so this in an improvement. THE MOST important thing for someone to know is that there is a DEADWATER level for Lake Mead. The deadwater level is the bottom level at which the intake towers at Boulder Dam will reach. If the water is below that level … the water basically does not have the ability to travel down the river…. guess what happens then…. No Lake Mojave at Laughlin… no Lake Havasu… and no water for the aquaduct to AZ and Southern CA.

So who really has the water problem… Las Vegas just installed a new intake tube that reaches down to 860 feet above sea level… and is able to pump water with the current pumping station down to a level of 1000 feet above sea level which is what the current intake tube #2 is at. http://www.reviewjournal.com/news/water-authority-digs-deep-third-intake-pipe-lake-mead …. also check out http://crc.nv.gov/docs/iolll_0410/Todd%20Tietjen.pdf

Deadwater sits at an elevation of 895 feet above sea level. The dam stops generating Electricity for Southeen CA at 1050 feet above sea level… So again… good luck to Southern CA and AZ if this happens… NV will still have access to water.

So there is just a few comments on what I have seen posted here by some who seem to be a little less aware of what is really going on in Southern Nevada and the Las Vegas Real estate market.

That’s all for now.

If there is an award for the most epic BS post from a real estate agent in this forum, you win, sir. Almost delusional.

All the straws in the upstream drink mean the Colorado is dry down stream, no longer reaching the Gulf of California. And the situation is not getting better.

Las Vegas has turned into a ghetto city with homeless people everywhere and rental units in every neighborhood. By far the worst place to live in America.

Real Estate Agents in that city are criminals.

I saw Michael Moore’s Capitalism movie and it made me rethink a lot of things. I’ve been reading this blog for maybe 8 years and it has also changed my understanding of the mechanism behind our corrupt system. Capitalism does not have the answers, but what does? Every step to cure the disease without addressing the cause just make’s it worse.

The problem is not capitalism. The problem is corruption. Take any system and introduce corrupt people into it and you will always end with a failure. It like a bad person moving into a good neighborhood.

“Real LV”…. Very interesting post.

What are our your thoughts/info on the squatters (stratigic defaulters)?

I have lived in Las Vegas since 2002. I moved over here from San Diego. I owned my home there too. I also retired in 2002 and was seeking a less expensive lifestyle for retirement. I bought a home in 2002 in Vegas, sold it in 2005 (tripled my $), bought into another one, just recently sold it (spring, 2012) to downsize after a divorce. Took a big loss on that one though.

After being without a home for 9 months (renting) which by the way, my rent would fluctuated about $100.00 every month, as I wasn’t under any contract. I was able to finally get into a home in Dec, 2012, while everyone else was busy with the election finals. i say that because up until then everything I made an offer on was overbid on by who knows who! I went through 4 Realtors! Sometimes my offers were not even replied to by the other Realtor! Sometimes I wouldn’t even hear from my own Realtors for weeks until I contacted them, only to be told houses were difficult to come by here in Las Vegas but they were really busy and just hadn’t been able to get back with me…LOL. This is when anyone could see nearly every 4 houses were vacant in lots of neighborhoods!

Finally, I sneaked under the wire by “overbidding” on a house by $18,000.00 that was in a short sale. I was approved in less than 2 weeks by BOA (short sale bank) and moved in within 60 days of my offer. I was fully qualified with 100,000.00+ down payment. The banks seem to really move when motivated, I guess.

Anyway, after being in the system the last couple of years I can tell you something is really wrong in the Las Vegas housing market. Never in all my years have I ever experienced something so controlled. It just isn’t right! I consider myself the average home buyer and I certainly wasn’t treated very well in this market over here. There appears to be these mysterious “cash buyers” that Realtors hold out for and jump over hoops for. Even as a Seller I was told a “cash buyer” would probably buy my home…..and they did!!!…..Eventually, was fortunate to find a Realtor who was legit enough and kind enough to go to work for me.

My home has since increased in value but I don’t look for that to last. Nothing has really sold to warrant the dramatic rise in the prices. Jobs certainly haven’t come back and incomes are not rising. There is just a bunch of “hipe” on the news about how well we are doing. Well, I don’t think we are and not many people here believe that either. I’m in here for the long term now. I’ve come to understand that purchasing a home will be much more difficult in the future for the average Joe here in Las Vegas. I feel fortunate to have been able to get in when I did last fall, because I believe that is when it really started to change.

Yes, you can believe Las Vegas beats to a different drum and to only “certain” folks.

To Hot Las Vegas – on behalf of whatever realtors are left in LV, I humbly apologize for the lousy service you received.

During the bubble years, there were 30,000+ realtors in LV. When I started in ’09, it was 9,000+, today it’s 3,000+ and probably less now because our NV State License was due 6/30 and lots of agents fall off the grid when dues are due.

Las Vegas is very expensive to be in RE. Believe it or not, CA is cheaper. A lot of LV realtors are working part-time jobs and can’t keep up with the realtor professionalism.

Glad you got your house.

JAWS

You don’t need to be a genius to know what’s happening in the real estate market or to predict the future. Drive around your own neighborhood. I live in a high demand, modestly priced Phoenix neighborhood. During bad times, 6-8 homes will be on the market in this 350 home historic subdivision. I drove the neighborhood this weekend. There are 17 homes on the market, most of which are flippers. There are more with HUD signs in the windows, but not yet on the market. Some of these homes in cherry condition have been sitting for months. Yet, investors are still refurbishing and attempting to flip. I disagree with the article in one aspect. The end is nearer that you think. Oversupply will cause declining prices. Declining prices will cause investors and investor groups to put their units on the market, further flooding the market and causing further price declines. Many of the investors who paid cash have refinanced and cashed out. Are lenders going to take it in the shorts again? Yes!! Apparently the equal and opposite reaction to the last crash is already in the pipeline.

Being a realtor in LV, I saw that “9,500 listed for sale” and wondered where are they all. Today, there are 4,168 residences available on the MLS and that’s condos, SFR’s, mobile homes, townhomes, just LV, not Henderson.

As usual, there are 8,347 in Contingent status which is basically just a contract signed between buyer and seller, nothing else. Some of them have been in Contingent status since 2011.

There are 1,305 in Pending status; they’ll most likely close sometime this month.

From what I’ve physically seen, a lot of cash sales (many stuck in Contingent status), are from Chinese to Chinese who give real estate to friends, kids, siblings like they are gift cards.

The “investors” are CA and Canada jonny-come-lately’s that will probably lose.

I’m with you on the tons of zombie houses, some with new families in them and some just dripping goo from the 2nd floor laundry room onto the 1st floor make-believe hardwood. It’s green and buckled.

NV does have a Constable that will throw the squatters out but during the winter the squatters usually burn the house down – my new listing – $35,000.

I know there is enough sh*t to hit some fan somewhere but this rodeo just keeps bucking along.

As for big WS investment in desert houses, I’m just not aware of any in Las Vegas. AB284 was amended a couple months ago so that whoever signs it won’t go to jail.

But, the big LV inventory is in Contingent status, not active. Just stuck.

Leave a Reply to M