Japan Iwato and Heisei stock and housing bubbles – How the U.S. is following in the path of Japan. Real estate lost decade, technology stock market bust, quantitative easing, and mania inducing monetary policy.

Asset bubbles and economies built on inflated prices are nothing new. We have many lessons during the Great Depression that reflect boom and bust cycles. As policy makers try to look at historical references for guidance many are now turning their analysis to the Japanese bubble economy. Japan serves as a good reference since there are many parallels between their bubble economy and the one we are currently facing. Yet Japan never fully emerged from their bust. The decisions taken by the Federal Reserve and our government reflect many of the policy decisions taken by Japan after their Iwato and Heisei booms and busts. The first bubble was reflected in the stock market followed by a giant real estate bubble. You can parallel the NASDAQ boom of the 1990s and the real estate bubble of the 2000s.

Some will point to smaller countries that suffered rampant inflation after their central banks printed money but we have more in common with Japan, what was the 2nd largest economy in the world. In this article we will try to carefully look at research on the Japanese boom and bust and also take a look where we stand in our current financial crisis.

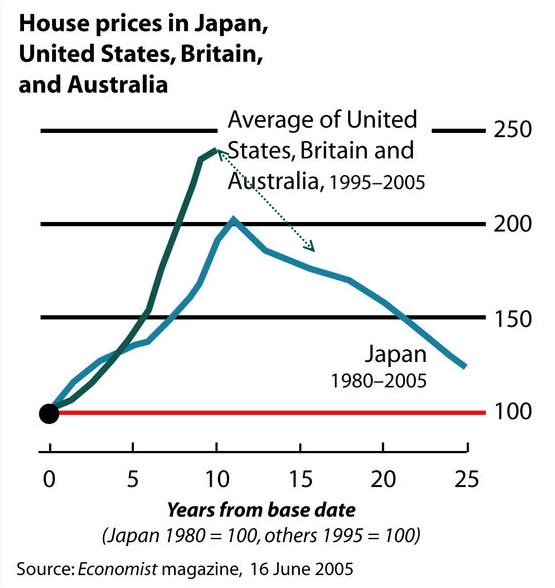

Source:Â The Economist

The first definite comparison we can make is with the rampant rise in home values. Japanese real estate values saw a massive ten year boom during the Heisei boom. The chart above clearly shows the trajectory of land values. Yet research shows that a large part of this was concentrated on a few urban cities. In this regard, the U.S. had a much larger and more pervasive boom impacting multiple cities across the nation like Miami, Las Vegas, New York, Los Angeles, San Francisco, Phoenix, and many other locations. If we separate Tokyo out we see that overall Japan did have a bubble but it doesn’t seem as large or as widespread:

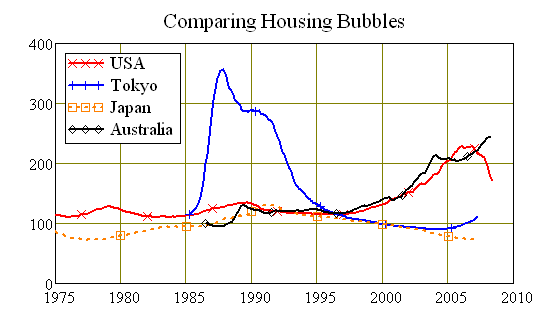

Source:Â Debt Deflation

The above is an interesting chart because it reflects a concentrated urban bubble. We had many suburbs popping up with home builders trying to create demand where there was nothing more than a bubble to chase. Many of these areas including the Inland Empire in California have large homes selling for half off (or more) with very little demand chasing after the homes. It is an interesting case study as to why values go up so quickly but miscalculations by the Federal Reserve and misguided policies led to the biggest and most widespread housing bubble here in the United States.

A 2003 paper by the Bank for International Settlements (BIS) focused on the Japanese housing bubble and concluded the following:

“What should be noted regarding Japan’s experience is that the enthusiasm of market participants, together with the inconsistent projection of fundamentals, contributed to a large degree to maintaining temporarily high asset prices at that time. Such enthusiasm is often called euphoria, excessively optimistic but unfounded expectations for the long-term economic performance, lasting for several years before dissipating.â€

“It was thus excessive optimism rather than consistent projection of fundamentals that mainly supported temporarily high asset prices.â€

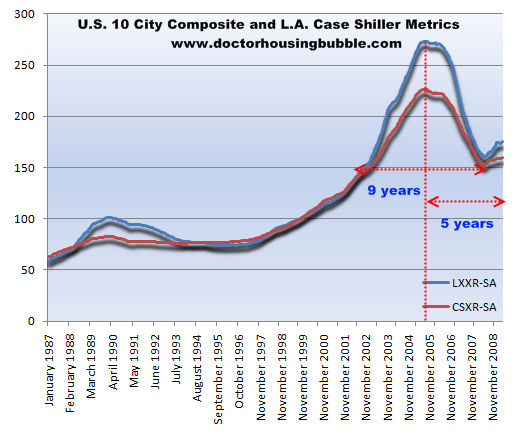

There is little to debate that what fueled housing prices in the U.S. was also ignited by euphoria for real estate that was largely disconnected from fundamentals. Let us construct a chart similar to the above with Tokyo and Japan but in this case, we will look at the Los Angeles MSA and the 10 city composite from the Case Shiller data:

Although it would appear that Tokyo had a much quicker and faster rise in prices, an area like Los Angeles saw a very similar trend. Yet what separates the two bubbles is that the U.S. as an entire nation also saw a massive rise in prices over a short period of time. Looking back, we see that the peak for U.S. housing values was reached in 2006 with the Los Angeles MSA also reaching a peak in this year. The chart above shows the clear decade long boom in housing values. What we find over this decade period is that home values in the U.S. increased by a factor of 3 while home values in L.A. increased by a stunning factor of 4. In other words, the U.S. housing bubble was equally as large in magnitude as that faced by Japan but much more widespread.

The BIS paper also makes the comparison that Japan faced nearly two decades of bubbles, one started in the stock market followed by the real estate bubble:

“First, at the time of the Iwato boom, when Japan’s economy entered the so-called “high economic growth periodâ€, asset prices increased rapidly, reflecting an improvement in fundamentals due to technological innovations. The real economic growth rate exceeded 10% per annum, driven mainly by investment demand due to technological innovations that replaced the post World War II reconstruction demand. On the price front, consumer prices rose while wholesale prices remained generally stable, thus leading to the so-called “productivity difference inflationâ€.

“Kakuei Tanaka, who became Prime Minister in 1972, effected extremely aggressive public investment based on his belief (remodelling the Japanese archipelago) that it was necessary to resolve overpopulation and depopulation problems by constructing a nationwide shinkansen railway network, which led to an overheated economy.â€

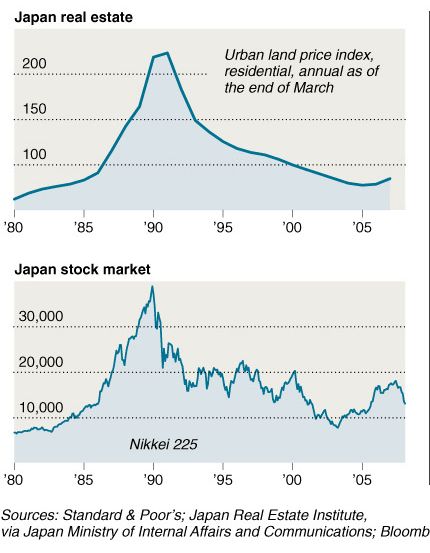

This economy is largely seen by the charts below:

We have a very similar parallel here with our NASDAQ boom of the 1990s followed by the real estate boom reflected on the previous chart looking at Case Shiller home values. If we look at the NASDAQ, we realize that even after the recent boom in stock values prices are nowhere near their peak:

On a nominal level the NASDAQ is still off by 55 percent from the peak reached a decade ago. Often we hear about the lost decade comparison. In stock values, we are already there. In terms of real estate values, we are quickly approaching that point. So we have more similarities in our booms and busts with Japan than many would like to admit. The 1990s saw a rise also in productivity brought on by technological innovation but this also paved the wave for an economy largely decentralized on a global level. This hit hard in the manufacturing core of our country. Someone made the argument to me at the height of the real estate boom that “you can’t outsource real estate†which is true but that is a double edged sword as we are seeing. The Nikkei peaked on December 29, 1989 closing at 38,915.87. Today it stands at 9,431, a drop of over 75 percent. Massive bubbles can have long lasting impacts on the economy.

Missing asset bubbles and targeting inflation

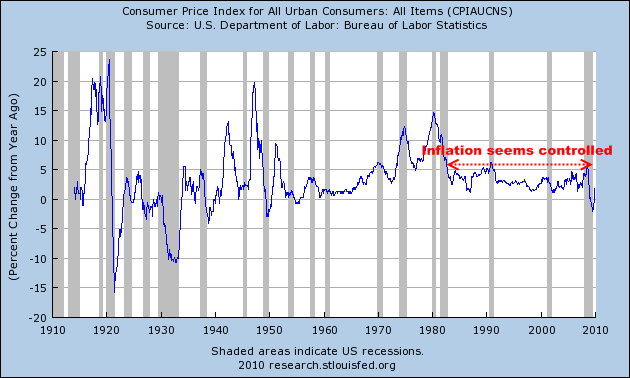

Another important comparison made in the paper is that of perceived stable inflation and how central banks can miss asset bubbles while they are happening. It is the mistaking of a bubble for real economic growth:

“Third, in the Heisei boom, asset prices increased dramatically under long-lasting economic growth and stable inflation. Okina et al (2001) define the “bubble period†as the period from 1987 to 1990, from the viewpoint of the coexistence of three factors indicative of a bubble economy, that is, a marked increase in asset prices, an expansion in monetary aggregates and credit, and an overheating economy. The phenomena particular to this period were stable CPI inflation in parallel with the expansion of asset prices and a long adjustment period after the peaking of asset prices.â€

“The decline in asset prices was initially regarded as the bursting of the asset price bubble, and an amplifying factor of the business cycle. Although the importance of cyclical aspects cannot be denied, further declines in asset prices after the mid-1990s seem to reflect the downward shift in the trend growth rate beyond the boom-bust cycle of the asset price bubble.â€

This is an important key point. The Federal Reserve publicly stated that during the bubble (it wasn’t labeled as such) that inflation overall remained tame and therefore keeping interest rates low was viewed as a prudent policy. If the economy is growing and is stable, then the central bank should keep liquidity flowing into the system to keep building up legitimate businesses. Yet separating real growth with an asset bubble can be tricky especially when the policies taken are part of the reason for the asset inflation. Japan viewed there measures as stable. We did this in a similar fashion but part of it was that our metrics to measure inflation largely missed the housing bubble. The CPI measures “owners equivalent of rent†which completely ignored the rise in home values. This measure is the biggest in the CPI so the data was skewed. Also, innovation in mortgage products with teaser payments altered the true monthly payment and understated it. The government for most of this time also only focused on OFHEO (now FHFA) which only looked at home loans secured by Fannie Mae and Freddie Mac and ignored the vast majority of subprime Alt-A, and option ARMs that fueled the last stage of the housing bubble. In fact, year over year changes in the inflation measure from 1980 to 2000 seemed to be as stable as they come:

During this time we saw the massive NASDAQ bubble and also, the subsequent real estate bubble. Inflation data largely ignored most of it because the measure was flawed when it came to measuring bubbles. Japan had similar problems and taking policy decisions on this data has given their economy two lost decades and their economy is still suffering. Then why follow that same path?

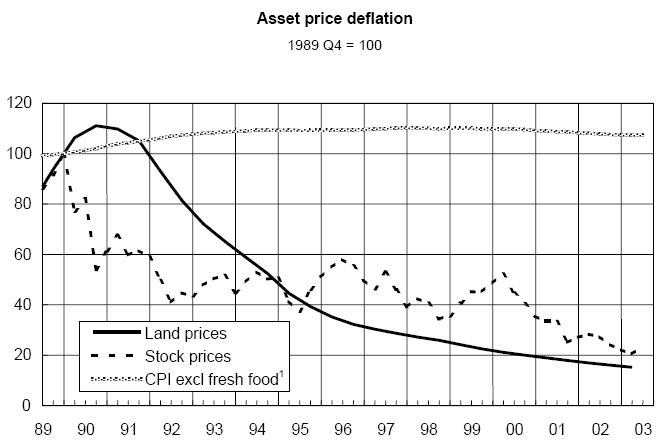

Japan gives us a working sample as to what can happen with asset deflation, a stock bubble popping, allowing banks to remain propped up by government funding, and massive government spending:

*Japan asset, stock and CPI measures

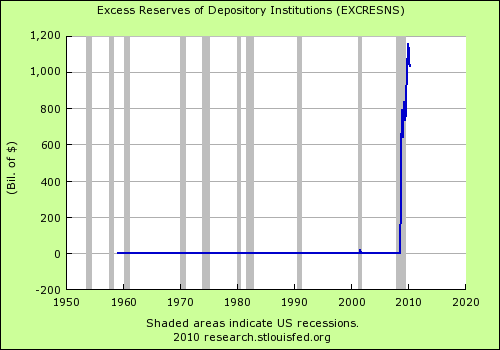

Some seem to think that Japan just sat back and did nothing during this time. There is nothing further from the truth. Japan was the first major economy to go down the path of quantitative easing. Japan also injected enormous amounts of money into their economy to stimulate growth. Yet the above chart is rather clear in the outcome. Some point to unemployment in Japan remaining low. This is more a sleight of hand with economic data. Although the official rate is low, nearly 1 out of 3 Japanese workers are considered part-time employed. That is, no security of long-term employment. We have seen a massive rise in the number of Americans that now work in a part-time fashion. No benefits, lower wages, and job security that is no longer an option in the longer term. It is easy to see why asset prices in Japan have remained depressed for so long. Prices in the U.S. are showing no sign of inflationary pressures because there is little mechanism to force wages up with such a giant over supply of labor in the market. This is possibly one of the major points missed by those who predict inflation or hyper-inflation in the future. Central banks can print but they can’t force wages up especially in a global market where cheap wages are the status quo. To the contrary, banks are following the zombie like behavior of Japan banks by hoarding funds:

Now that we’ve had three full years after the bubble popped, we can see what banks have done to “fix†the problem:

-Hoard money to fix balance sheet imbalances

-Suspend mark to market (Japan banks zombie like tool of preference)

-Ignore major commercial real estate problems

-Drag out the real estate problems (we have done the same with banks delaying the foreclosure process, stopped lending their own capital in place of government loans, and banks have turned inward with government bailout funds).

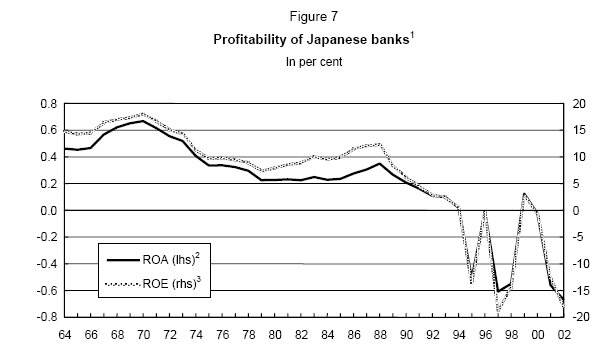

The above chart shows that banks are still sitting on an enormous amount of excess reserves. Now that due diligence is back (to a certain degree) who are banks going to lend to? 4 out of 10 workers in the U.S. are employed by the low paying service sector. Close to 15 million are officially unemployed and unless we go back to the easy lending mortgage days, they won’t be getting any bank money soon. We have another 9 million workers that are employed part-time for economic reasons (similar to the large employment base of Japan). You think this group is going to get a loan for a home anytime soon? Banks have turned their profits inward while the real economy is largely in stagnation. Yet if Japan is any indicator, these profits will start to go down:

While it is easy to make money right now since a large part of the competition has failed while a select few have been given government backing and funding, as time goes on this profitability goes away. And the real economy in Japan has languished all this time. The BIS paper in 2003 gives a wonderful synopsis of what led to the Japanese boom and bust economy:

“The intensified bullish expectations were certainly grounded in several interconnected factors. The factors below are often pointed out as being behind the emergence and expansion of the bubble:

• aggressive behaviour of financial institutions

• progress of financial deregulation

• inadequate risk management on the part of financial institutions

• introduction of the Capital Accord

• protracted monetary easing

• taxation and regulations biased towards accelerating the rise in land prices

• overconfidence and euphoria

• overconcentration of economic functions in Tokyo, and Tokyo becoming an international financial centre

Focusing on monetary factors, it is important to note the widespread market expectations that the then low interest rates would continue for an extended period, in spite of clear signs of economic expansion. The movement of implied forward rates from 1987 to 1989 (Figure 5) shows that the yield curve flattened while the official discount rate was maintained at a low level.â€

You might as well put this label on the U.S. Aggressive behavior of financial institutions? Doesn’t get more aggressive than giving a loan to someone with no job and no income. Progress of financial deregulation? What about repealing Glass-Steagall in 1999, protection we had put in place back from the Great Depression. Inadequate risk management? We need only look at AIG, Lehman Brothers, Bear Stearns, Fannie Mae and Freddie Mac, and many others. Protracted monetary easing? Does a zero percent interest rate and buying up of mortgage backed securities count? Taxation and regulations biased toward rising prices? How about giving new home buyers a tax credit when they were going to buy anyway? Over confidence and euphoria? Just go to YouTube and watch some of the real estate commercials from the peak days of the housing bubble.

We have a lot that is similar to Japan and their boom and bust economy. If their path is any indication of our own, we have a long road ahead and getting home prices back up is probably going to be the least of our concerns.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

40 Responses to “Japan Iwato and Heisei stock and housing bubbles – How the U.S. is following in the path of Japan. Real estate lost decade, technology stock market bust, quantitative easing, and mania inducing monetary policy.”

Don’t send your kid to an expensive college. In this prolonged downturn,it is a waste of money. One of my neighbors sent his son to a private,well known “prestige ” college in the Ivy League. $44,000. a year. This year, after graduation, he is working in a retail store, only job availiable.

Many people have the mistaken idea that BECAUSE you go to Stanford, Harvard, etc. you will be successful. No, many people who become sucessful do go there, but they succeed by drive and determination, not because of their fancy diploma.

If your kid is “undecided”, send them to a community college for 2 years, while they “find themselves”, and put the difference in the bank.

In this economy, anyone who thinks a degree is an automatic passport to the good life, is sadly mistaken.

I noticed that all the pre-bubble housing shows are still being broadcast (reruns) Property Ladder, and Flip This House, and many others on TLC. I can’t understand why they would still broadcast these shows every Saturday. It’s almost like there are forces (NAR) that are encouraging the same mentality to buy, as before the crash… It’s a different world now, yet the same pre-bubble message is still being pushed upon the unwashed masses. In reality, countertops would be a waste of time for someone who lived in a refrigerator crate. Same with travertine floors and stainless steel appliances, which wouldn’t make a tear-down that much more appealing..

Ahhh, the good ol’ days…

The best way to make money is do your own business and save the money…….

Make money & save the money…… I went to one of the top school but school is just a book thing like a-z, 1+1=2…no need to go to school to make money……

Dear Doctor,

You are depressing me. Can you please find some news to spin positively? A tiny ray of hope? Or perhaps we just take solace that we aren’t crowded into Tokyo, waiting for the fast train to nowhere…

On a serious note, I must wonder why we aren’t at least taking advantage of our idled construction workers to rebuild some of our crumbling infrastructure. It isn’t like we don’t have the need for heavy equipment operators to dig up defunct waste water systems or engineers to determine where the fresh water supply leaks are. Or, how about us actually constructing a few fast trains to link us together better? Throwing just a couple of possibilities out there out of many…Dallas to Houston or… Portland to Seattle?

A shame to have so many idle hands when there really is work to be done besides beautifying or replenishing our foreclosing housing stock….

We couldnt just let the blood flow we had to pull a Japan.

Problem is we are no where near as patient as the Japanese.

not even close they had a 14 year downturn and were in our 3rd.

@Ed

I overheard a student at an east-coast major university saying there aren’t any jobs so all the kids are going to grad-school. More debt, more over-qualification. MBA will soon mean Move Burritos Asshole…

@Polo

Now that the FHA is doling out subprime loans, it’s party on Garth. Forclosure only happens to other people…never underestimate the number of gullible, ignorant Americans. We got millions.

@Edy

A lot of uneducated people got into real estate and gave us all an education. Except the Fed–they’re trying to do what got us here before to get us out?

@Patrick

Here’s a rainbow from behind: It’s not real money–it’s just accounting entries in computer memory. It came from the ether and will go back to the ether, and there’s an infinite amount of it. We just have to go to war with every country that calls our bluff. Since Iran and Venezuala are hip to our tricks, you can bet they’re on the agenda. North Korea likes the dollar so much, they make their own. All that talk about the Euro becoming the next reserve currency? Didn’t take long to destroy the Euro, did it?

Manhattan is not in the US–it is an entity all its own and the rest of the US is a colony. At the height of the crisis, that became obvious when GS, the ruling party of Manhattan, commandeered the Treasury and sent the 50 colonies down the path to obvlivion.

The world is not the way you think it is.

HGTV still at it too!

Rebuilding our infrastructure should be a top priority….I thought that it was when the president was elected…

@ Ed in Pasadena,

I work at the largest community college in CA – unfortunately we are turning students away in record numbers. We have an increase in applicants while at the same time a decrease in course offerings and services due to budget cuts. Maybe you happened to catch the article in the LA Times a couple of weeks ago about how the profit colleges are taking advantage of this situation by opening the door to these displaced students with a mostly on-line education paid for by massive student loans – this seems to be the worst case scenario!

@Patrick – great comment. After the Depression, stimulus-like funds put unemployed people to work (eg; Hoover Dam) to create things that benefited our infrastructure. I wish the current administration would have put more funds towards things like that.

I also agree – I’d like to see a positive post on this blog here and there. I love the blog for telling the truth, but would also like to see some ideas to make things better.

Hello Patrick, it is what it is…Dr just tell like it is…… its the reality pal! Get with and live with it……. There’s no other like Dr and his blog is the best so far……

I know, I am a fan, reader, and doing internet marketing as profession so ….learn to appreciate his info like no other and you should be one day at a time learn a new thing 🙂 Peace!

@Native P,

I thought I heard the gov crowded out most of the private lenders from student loan-shark industry. Bad for business to offer people an alternative…please refer to my comment about Manhattan running the whole show in the US. I read more and more of this stuff and I’m believing it. If they thought of themselves as Americans, would they be cannibalizing the rest of the country? We’re at war with these guys and only they know it…if there’s a stooge in the room and we don’t know who it is…we’re it.

Doc,

More damning metrics. I think we’re about to go over the cliff and Lassie can’t save us.

Funny how the MSM must read this blog because they report the stuff you talk about 6 months later, like they just found it out. Great research and reporting.

Hello there Mr…Darkages…… What you think that because of the uneducated people, housing is a mess? Come on man…. all people who purchased the house for greed and wall street croonies made the mess…… Greed destroy the housing and its just the begging…..

The “Asset Price Deflation” graph looks pretty much like what we’re seeing since the stock market crash in 2008. CPI is holding steady while the stock market has about topped and in a trading range…real estate looks to be heading back into a downward direction. Both will probably be lower six months from now.

patrick, in SoCal, the construction workers were from Mexico. They went home when the construction fell off. We did not need the Arizona law, economics took care of the problem. The freeways are faster and the school enrollment is down. This is some good news to cheer you up patrick.

@Realistic Optimist – agree, I thought we’d be building solar panels and high speed rail. I also thought we’d be building out our public transit system to reflect what is needed in today’s society. The only thing that happened is that transportation somehow got more expensive.

As for ideas on this blog to make things better, I think what the Dr. is doing is presenting the facts, real facts, not BS MSM propaganda and laziness. Knowing the truth of the situation will allow all of us to make better decisions in our lives going forward. Making things better is up to all of us and not only the good Dr.

Great post Dr this topic needs wider discussion here in the states but doesn’t get enough press. One item to add is that Japan and the U.S. banking system shared a history of RE collateral for loans. This dependence upon real estate both commercial and residential as the basis for lending has left both systems lost in time and space so to speak, as RE declines in value lending power fades and the entire banking system either collapses or requires constant government nursing to survive. Its clear both countries require RE asset bubbles to spur significant lending by the private banking sector to drive GDP growth but Japan shows that once RE loses its collateral lending karma then the modern economy dependent upon credit growth tends to flat line at best or just to slowly rot.

@Edy

That is not what Darkages meant. The opposite.

@Darkages

Great comment. Just one error, the situation as of late is precisely how I knew the world to be.

@Darkages

I think you got me confused with someone else, or my comment showed up in the wrong place 🙂

@Edy

I know what you are saying, but there is no way to force Manhattan to give a damn about us. We are all just a bunch of fools for not seeing through their Madison Avenue marketing. As the Doctor repeatedly points out, there are time-tested metrics as to whether or not one can afford a home and whether it is a fair value. Most of us went with neg amatorization when given the option. You can lead a dork to water, but you can’t make him think. The Manhattan Kazar’s know how the game is played and if we don’t learn from this, they will keep doing it. We can gripe about Wall Street or we can use our heads. I think I know what we’ll do. We’ll wait until the house we want is only $150k more than it’s worth and get an FHA loan and a gimmick rebate, then plant our RHG trashcans out front for a facebook photo to show to our friends…

@Pat – Idle Hands

It is maddening that we are doling out checks for 99 weeks, welfare, a million in prison–can’t somebody do something? The way our system works and the powers that game the system, the unions–no one sees the greater good and just focuses on themselves and their business, so they stay with American’s Idle. Many believe that unfettered capitalism is a completely self-automating system and that any intervention or oversight will bog down the wheels of prosperity and derail economic progress. Got a clue for sKudlow and Company–unfettered capitalism leads to uncontrolled oligarpy, cronyism, and serfdom for the masses. People will not automatically behave morally without the threat of jail, just because that’s what they should do. If one thing should be learned from the housing disaster, with wall street foxes watching the henhouse, we’ll all be eating turnips and mustard greens….all the chickens will by hauled of by farmer Paulson in his Goldman Sach.

Folks, the purpose of an Ivy League brand name is to get one’s foot into the world of management consulting or investment banking. That’s about it. And a way of doing that cheaper is to attend State U for college and a 1 yr masters at Columbia or Stanford to get an interview at a management consulting firm.

If your kid wants to be a doctor, he should attend his regular State U, focus on getting A’s, and doing some medically related volunteer work.

Agreed that we are turning Japanese, except for one important point. The Japanese were and are high savers, which has helped them live through these recessions of the last twenty years, but Americans, as we all know too well, are borrowers, and, unfortunately, are in much more trouble as we head down the deflation road. One half of all Americans have no money saved for retirement, and one third of the Boomers have zero. Now that the one asset that they thought would make them rich and secure is heading south in value, I’m afraid that, unless we invent a new industry that will employ the middle class at a nice comfortable wage, we are heading down a much more bleak and dismal road then the Japanese have been traveling.

What Mike M said. Sadly, this is not going to be a good ending for most of Americans. I can only hope that some have bucked the trend over the last 20 years or so, and invested in savings and built something and avoided buying large screen TV’s and BMW’s.

@Mike

~

Agreed. There are several politically incorrect reasons we’re much, much worse off than the Japanese.

@Mike

Truer words have seldom been spoken. I read a piece a while back about how the the Soviet Union was also much better prepared to face economic collapse than we were. Like Japan, there is mass transportation. How do you think our mega-commuter society will get to work if fuel is not readily available? We have almost no mass trasportation to speak of. We go nuts when our football team loses. How will we ever cope with actual difficulty? Grow our own food? Who will repair our stainless appliances, hot tubs, BMW’s? How will Japan and China fare if someone figures out that ultimately their US debt is worthless if we falter? They going to send all their exports to Ethiopia? The masquerade must go on.

The main weakness of the US is that it has forsaken the “melting pot” for multiculturalism and not only have allowed mass immigration but even sponsoring “native” language education so at least 3 generations of immigrants did not have to leave their ethnic enclave and learn the language!

When life in the US gets harder it will be “every clan for itself”. The US will become much more like The Democratic Republic of Congo than Japan!

I wish they can build a web of high speed rails throughout so cal and long distance ones too, just like what they did with highways 40 years ago.

@fajen

Perhaps that explains why all desireable neighborhoods are gated communities with bars and security systems. This is not BS: When I grew up we did not lock our doors at night or cars, the shed–it just did not occur to us that we were not safe in our own house–even after the ’68 riots. We believed Oswald shot Kennedy, the moon landing, everything they told us on the TV. It did not occur to us that we might not be hearing the truth.

Now if the weatherman tells us it will be sunny tomorrow, we’re just not sure.

Balkanized state. Everyone that shouldn’t have a gun has one. Wouldn’t have a clue how to get to work on mass transit–afraid to get on a bus anyway.

Now the foreclosure mania is like block-busting. Somebody bought a Mc-Clone-Mansion on your street for 150k less than you did, and they don’t speak your language. No problem? We’ll see…”The times they are a changing”

“I thought I heard the gov crowded out most of the private lenders from student loan-shark industry. Bad for business to offer people an alternative”

If Obama was to discover the cure for cancer, some people would say that he’s “bad for business” and that he hates the Medical-Cancer-Research Industry!!!

Can’t please these people 100% of the time, regardless of what we do…

@Ohiogal

I’m afraid people don’t learn from the past. Maybe for a few weeks or a year. Look at the $4 gas: Now that it is only 2.50-3.00, many people are back to the guzzler, while hybrids languish on the dealer lots. Savings rate went up for a bit when things got scary. Now that the Fed and Friends have fixed everything, it’s back Walmart to load up the SUV with SH*T and get back in bondage.

The last depression was so bad, that generation never forgot it. By the time this is over, people will get it.

Been reading Jared Diamond’s “Collapse”. We are heading in that direction because we don’t learn and we don’t behave for the greater good or the future of our nation–just today’s buzz. Funny, people think China is going to save the world economy–Diamond points out China is probably the trigger to the global collapse and the next Dark Ages. They have trashed their country to make a few guys rich. They’re in terrible danger of collapse and all MSM can say it how great that 10% growth rate is–like money is the only metric in our existence.

@cambridge02140

not sure what you’re saying, but I’m definately not a fox-news-blame-Obama-for-everything guy. I like him. Voted for Ron Paul as a registered Republican, but not a typical GOP, not that either party is anything I recognize. The world is too complex for anyone to solve the big problems–we just have to avoid collapse and war. The rest, we’re really on our own.

You know, I listened to Blankfein and I actually liked the guy. I hate that Goldman is such a menace to the world, but personally he seemed OK. He’s just drinking the Wall Street wallbangers and thinks he’s really doing God’s work perhaps, but Mozilla from Countrywide–I hate that guy. He should be pulled out of his mansion and turned over to the people he destroyed, like Saddam (although I think what we did there was insane).

We are walking a thin line and if we don’t start cooperating and working for a better future, we are all in for a serious crisis. No society has every survived diverting critical resources and trashing the nation to build monuments to ourselves. Jared (not Jamie) Diamond notes that if some societies had spent their time recording natural disasters and how to prepare for them instead of just recording all the king’s conquests and achievments, maybe they would have survived the next multi-year drought. At least their monuments survived, even if all the people died. What if we built useful infrasturcture instead of sports arenas?

Just think of the monuments out in the inland empire that will be there when SoCal goes MadMax in 10 years. All those never occupied McMansions. What will the Planet of the Alt-Apes think when they see the Inland Empire Strikes Back…”why did those humans build all these houses that nobody wanted”? “They all perished in the mega-depression of 2007”.

You guys are right….perhaps I misunderstood…… keep up the good comments and make this blog fun place to be….

If you read about the Argentina collapse around 2002, people in the city were safer than those in the country. Roving gangs of well armed young men scoured the countryside, invading houses, and torturing people to find out where money was stashed. People in the cities had neighbors, and some level of protection.

Despite what the Rambo types say, you are not safe in the country. Bullets can easily penetrate any house, and one or two people inside with guns can not hold off a dozen well armed men. Sniper rifles are no protection- all they do is reveal your position.

Those of you who still believe in the left/right paradigm…you are the definition of clueless.

The government set a fixed rate for Stanford loans, about 6.5 percent, and for Parent Plus loans, about 8 percent. To give banks liquidity and a hidden subsidy, the DoEducation has bought a bunch of these loans and hired 3rd parties to service them. No idea how much profit besides the 4 points the banks made for holding these loans, some of then just for a few months.

While 10 year Treasuries, a balloon debt are at 3 percent, you can pay 8 percent on an amortized student loan.

Seems there might be a market opportunity since student loans are only slight less interest than personal loans.

Doc,

I can explain how you *may* be wrong about deflation/inflation. You’re argument is that globally, wages are low and that the effect of a large labor supply and low wages outside the US is deflationary to US wages. That is true- if the value of the dollar is constant, IE the dollar remains at a stable exchange with other currencies. However, should the dollar continue to decline the relative cost of foreign labor increases and wage deflation In the US would ease or be non existant. However, this should not be cheered, because inflation would lower the standard of living for most individuals but is politically the easiest way to deal with credit bubbles/deflation/low wages.

Anecdotal evidence should not guide one through life. The data indicate that an ivy league education along with the connections made there, leads people to more success.

If your kid is undecided, he or she is a loser and probably does not belong in a good school.

A degree is not a passport. However, it is a ticket in the door. Try getting an engineering, law or nursing job without one.

I’ll finish with an aphorism…

The graduate with a Science degree asks, “Why does it work?” The graduate with an Engineering degree asks, “How does it work?” The graduate with an Accounting degree asks, “How much will it cost?” The graduate with a Liberal Arts degree asks, “Do you want fries with that?”

you’re=your

I originally wrote “you’re arguing that…”

Leave a Reply to cambridge02140