Irvine built nearly half of the new homes, condos, and apartments in Orange County over the last six years. Certain sections of the city being bought by 80 percent international buyers.

It was no surprise that for the fourth consecutive year, building of multi-family units outnumbered single family construction in California. This is part of the renting trend that has gone on for nearly a decade now and builders are merely catching up. One interesting finding in the data is that for Orange County. In Orange County one city accounted for nearly half of all new homes, condos, and apartments over the last six years. That city is Irvine. What is interesting with Irvine is that parts of the city are being built to cater to a foreign audience. Certain subsections are seeing 80 percent of properties sold to international buyers; we are talking about new homes that are selling for $1 million or more mostly in all cash offers. It is an interesting trend. But what is even more telling is that most of the construction in Irvine was for apartments and condos. Even in an affluent market the renting revolution is occurring.

Building for the renters and the foreign money

I think the situation in Irvine encapsulates a lot of what is going on in the housing market.  The vast majority are priced out and the market now understands this. This of course is reflected by builders building multi-family units for the renting majority. Where single family homes are built in Irvine, it is very clear who their audience is. In some cases agents from China will bus in potential buyers that are willing to purchase homes for all cash. Even the way construction is occurring is to cater to this audience. It makes sense after all from the builder’s perspective. They certainly aren’t catering to domestic families.

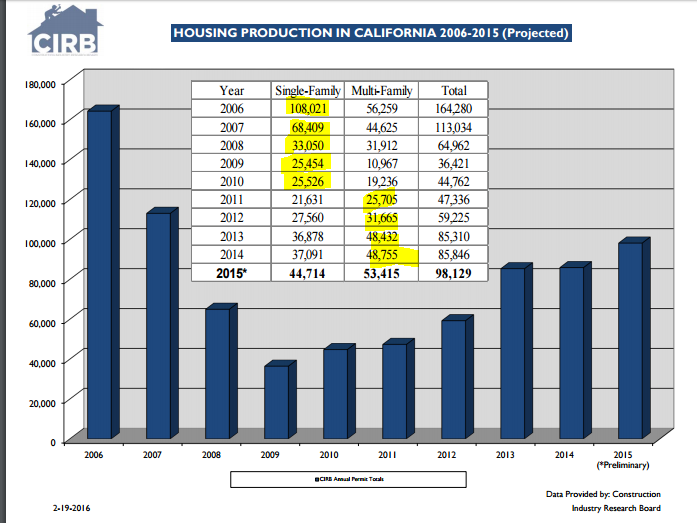

Yet this trend in Irvine is happening at a larger scale across the state. Look at home building by type over the last 10 years:

Source:Â CIRB

If we go further back, the last time we had more multi-family units being added versus single family homes was in 1985 and 1986. What is going on right now is rare at least if we look at historical records. And all of this makes sense. There is actually a lot of land in many parts of California away from the coast. But builders realize that incomes in these areas are not worth the headache. Sure, building is going on but the above chart tells you where most of the money is being placed. Builders think that renter households will continue to expand. When they do build single family homes, it is to cater to the affluent.

The fact that Irvine, one city accounted for nearly half of all new homes, condos, and apartments for Orange County over the last six years is astounding. Irvine now has over 250,000 people but Orange County has roughly 3.15 million people. And like we stated before, a big target audience for these new homes being built are buyers from China.

I know house horny cheerleaders are all about diving in but even if you were to save a 20 to 30 percent down payment, good luck competing against an all cash offer for a million dollar cookie cutter box. I’ve gotten emails from people over the last few years about being beat out by all cash offers. Not a surprise. All cash buying in certain California cities accounts for nearly one-third of all sales activity. Buyers from China are now the largest international buyers of all groups:

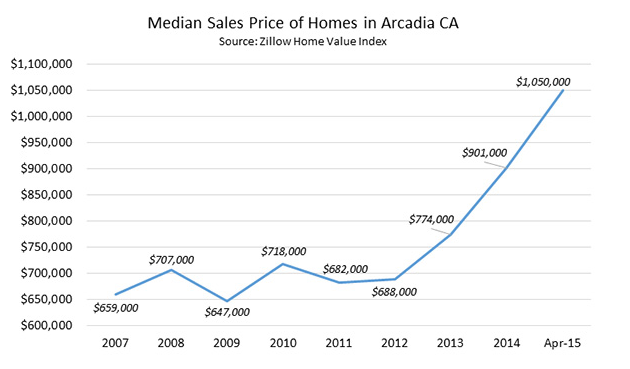

You can see the uptick in 2011. And some areas have benefitted tremendously from this:

There were many people trying to buy over the years in places like Irvine and Arcadia only to be priced out by all cash buyers. But look at the chart above and you would venture to guess that real estate only goes up. Make sure you bring your suitcase full of cash to the next open house and make sure you waive all contingencies.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

135 Responses to “Irvine built nearly half of the new homes, condos, and apartments in Orange County over the last six years. Certain sections of the city being bought by 80 percent international buyers.”

The affect of wealthy foreign buyers in desirable CA areas is just being understood. I personally wouldn’t want to live in Irvine, but buying RE there is a pretty stable play when most of your neighbors are paying cash. Is it ill gotten money? Probably, but the Irvine Co will be more than happy to take it.

The chatter about rates has died down lately. I checked bankrate.com this morning. A 30 year conventional loan is 3.58%. Wow!

“A 30 year conventional loan is 3.58%”

don’t care, still can’t afford a crap shack on my paltry never increasing income, and my rent is about 1/2 of buying, maybe less, so……

If are in a position of never increasing pay and rent is consuming half of your take home, why not consider moving out of the area?

A housing correction will likely occur with a job loss recession and/or much higher interest rates. Essentially a housing exchange between weak hands to strong hands. I don’t see it playing out any differently.

If ur pay is not increasing Irvine is not for you. Most of the immigrant population (Asians, Persians, Indians) stay in Irvine whose pay starts with 100k plus…

Property taxes in California can not double or triple year over year because of Prop 13 which says: California initiative constitutional amendment approved in June 1978 that started an American anti-government tax revolt. The ballot measure set real estate property value for tax purposes at 1975-1976 market value, limited real estate taxes to 1 percent of that value, limited tax increases to 2 percent per year for continuing owners, provided for a full reassessed value base for new owners, required a two-thirds vote for legislative revenue increases, and made any local government tax increase dependent upon a two-thirds approval of the local voters.

Things have a way of appearing as a sure bet, until they are no longer. It never fails that vested interests are keen to parrot status quo cliches and trends du jour, although history ancient and recent alike is full of examples whereby unforeseen consequences upends the game. It’s a bit creepy when someone actively touts a “good bet”. Given all that, it could be just as likely Irvine experiences a significant correction, cash wealthy foreign desirable CA narratives be dammed.

I read that nationally the middle class is shrinking in large cities! The middle class is either being forced out by low affordability, or has lost so much household wealth, they are now falling below the definition of middle class. Irvine is a perfect example of catering to a monied client base, foreigners. And, there is no incentive to change this … those high prices, high valuations, mean more money for the greedy cities and counties via high property taxes. Cities like Irvine are rapidly becoming some modern version of a feudal system … those living in the right zip codes are living inside the castle walls, while outside, which is 90% of So. Cal. the people live in dirt floor, one-room dwellings, indemnified servants to the noble’s living inside the castle walls!

I just watched “The Big Short” and Requiem for the American Dream documentary. Great watches. Pretty easy to see the wealth and fraud going on. Of course the local and federal govts could care less if these homes are being bought by Russians, Chinese, or Indians, they all speak the language of greenbacks. It’s all good for property tax.

On the note of middle class, I cant believe my parents first home in San Antonio was $30,000 in 1987. Heck on the MS gulf coast, their brand new house was $97,000 in 1997, and then on the Fl coast, a brand new home once again in 2002, was only $120,000. I could deal with those prices, but now its just madness.

i refuse to watch “the big short” because of the fear that my head will explode….true story.

The “Big Short” movie fails to address the fact that Congress pushed Fannie and Freddie to make a bunch of loans that were imprudent. Democrats led by Barney Franks, Chris Dodd, Maxine Waters , and Greg Meeks were the ones who pushed the banks to loan to everybody. Obama as a Democratic Senator adamantly demanded that banks make more loans to low-income borrowers. Subprime loans became the great American rip-off. Obama and the Democrats both enticed and strong-armed lenders to give loans to people who could not repay them. In exchange, they hoped that grateful new homeowners would obligingly vote for Democrats.

Democrat President Bill Clinton ignited the fuse that led to the crisis when in 1998 he removed the barriers between commercial banks and investment banks. After Clinton repealed the Glass-Steagall Act, big banks suddenly had federally insured money to play with. Greed from Congress to Wall Street spread unabated.

The repeal of Glass-Steagall in 1999, after more than a decade of de facto inroads, super-banks have been able to re-enact the same kinds of structural conflicts of interest that were endemic in the 1920s – lending to speculators, packaging and securitizing credits and then selling them off, wholesale or retail, and extracting fees at every step along the way.

Indeed, we are fast becoming a “Downton Abbey” society. An aristocratic gentry living in splendor, while the rest of us are simply a service class of chauffeurs, cooks, nanny’s and maids. Extreme wealth inequality tends to have that sort of effect on things…

Even if you can afford the house you arn’t part of the aristocrcy. You still need money to pay for food and utilities. So the whole thing needs to come down.

maybe i’m just being naive but i think fraud will once again be prosecuted.

and most markets are now just all fraud, the RE market is front and center in all this, that’s how homeowners were allowed in stay in homes for 48 months without making payments……fraud.

I read a story about a property in Canada valued at $16 million that sold for $60+million in 7200 seconds….fraud is the only explanation that makes sense.

sooner or later market forces will reveal all this OR capitalism isn’t a viable economic system….you pick.

Capitalism is dead, it’s called corpacracy now…Moral hazard be damned…Laws be Damned…

The housing fix was the biggest transfer of wealth this country or the world has ever seen….A whole bunch of bernankevilles where your aristrocrat overlord laughs at the silly minnions desiring a home under 33% PTI….We will turn rents higher to force you to buy our hopium…..The sheeple let it happen, so now they will have to clean up the mess, it will not be cleaned up until you gut the system of all the fraud, protection of the elite etc….

I personally never thought they could fix the housing market but like everything else there is always a way…..bulk purchase of foreclosures to PE, HEDGE and BANKING which was not allowed before started the fraud

cd,

“bulk purchase of foreclosures to PE, HEDGE and BANKING”

There was an interesting story about this some years ago that the author claimed that, at the prices those bulk homes we sold for, the current homeowner COULD have stayed in the homes and made the payments.

you bet the owners could have stayed, better yet, why not sell to returning vets from the recent wars, brings stability to neighborhood while thanking them for putting there life in line..

instead we gave homes to the same ilk whom almost delivered the 2nd depression…heck countrywide vp is ceo at pennywise I believe, it helped the bankers create more CDO’s and REIT bond pools to increase lending and yield search…

bankers own us, corpocracy via Citizens U and other legal forays into citizen definition is creating serfdoms and Hedgievilles….

late stage capitalizm will just get uglier…Citizens will lose…

“maybe i’m just being naive but i think fraud will once again be prosecuted.”

Agree, as there is a lot of fantasy around the call for the end of times by both vested interests keen to have their heel dug positions eventually validated and non-vested parties whom have given up all hope. Looking out over the long tail of human history, the trend of righting wrongs has remained a constant. Unless… this time is REALLY different!

Irvine has many acres of undeveloped land (owned by the Irvine family). It makes sense that much of the building is happening there.

It’s no longer owned by the Irvine family, and hasn’t been for quite some time-

http://www.forbes.com/profile/donald-bren/

https://en.wikipedia.org/wiki/Donald_Bren

2 points here

1. Lived in Irvine since 1989, worked in finance here as well since 1996. My people at the builders shops here have expressed me 2 items

A. Chinese are still buying

B. Some Chinese are sounding unsure about the stability of their country, so they love Irvine

Irvine is the 7th highest median income city in U.S. and it’s #1 educated city in America

My new neighbors where I live in Quail Hill, Irvine. The new home owners have been Asian.

2. Irvine and So Cal prices are really stretching the debt to income ratios of first time and move up buyers as well. Not much has really happened since 2013 and the taper spike.

On a national basis, new home sales have had the weakest economic sales to inventory ratio we have seen this century

Don’t let anyone tell you the lie that it’s low inventory for new homes as well, way more inventory for new homes in this cycle than in any period from 1999-2005

Charts here are crystal clear for new homes and without the Chinese, Irvine would have some issues

“Time For New Home Sales To Show Growth”

Inventory numbers clearly show that it’s a demand issue

https://loganmohtashami.com/2016/04/23/time-for-new-home-sales-to-show-growth/

u talk too much …w/o real stats!!

Softness in the market is absolutely a demand issue. We (the govt) have spent the last 8 years pulling demand forward to offer the illusion of a recovery. Part of that illusion involves looking the other way to the influx of capital from China and other countries, regardless of whether it is laundered money or not.

Sooner or later everyone sits down to a banquet of consequences.

Still don’t understand why some give Logan such a hard time. I find his insights to typically be a helpful addition to the discussion.

Anyway, on the point about the Chinese/wealthy foreigner meme. It’s a potential huge red flag for locales such as Irvine. There appears to be a lot of fantasy around these buyers putting some foundational footing under the market. Sudden bursts of energy have a way of fading as quickly as they came on and such things don’t lend well to a long term investment landscape. Anecdotes abound on the intentions of these buyers but there exists no trusted empirical evidence. For the owner occupant debt funded buyer, that’s mortgaging in a casino. It could simply be a stack of shims that all fall out together once the first one fails to hold. No thanks.

Housing To Tank Hard Soon!

Housing to tank hard in 2014

I mean 2015…..

I mean 2016…..

Yes, that’s the ticket! Housing to tank hard in 2016!

…..or maybe 2017.

….Hell, housing to tank hard in 2023!

Darn Straight!

It looks like to me we’re starting to level off. I live in Studio City and seeing on MLS condos starting to pile up without going under contract. This is both at the higher and lower end. Now, it could just be a blip or maybe a small sample size but it’s a certain change from earlier in the year. Anyone else seeing this in the LA condo market?

I really hope this is true. We Buyers as a whole need to unite and say “Enough” to the price gouging.

I see the leveling off going on too. My zillow zestimate was down last month (perish the thought haha). More inventory all around at this time of the year than the last couple years. Prices should capitulate next.

Unfortunately, the stupid buyers outnumber the sensible ones…so I wonder when we run out of stupid house-horny buyers. It seems never.

I’m not sure what MLS your looking at. The properties sitting are those that are wildly over-priced. Everything within reason is going under contract almost immediately as soon as it’s being listed, even the total sh*tholes in bad neighborhoods. This summer is another sellers market. It’s brutal out there.

I dont know about that. I watch this particular market very closely and this kind of inventory increase has not happened in some time. Again, it’s just and observation but this is what will happen before the shift and you won’t be reading about it on the internet until 6 months later

Same thing has been happening to the rental market in “prime desirable” locales of SoCal for a year and is gradually picking up steam to the downside. The two bones are connected. Something has happened. Best not to count on those with large positions at stake to have a clue early on.

Is there anything such thing as housing inflation? Yes there are lots of jobs and pay is slowly going up, but then housing is so inflated that you cannot catch up and end up still behind?

Nothing new here. Foreign buyers are dumping their U.S. Dollars before the dollar crashes. In my neighborhood, many homes are sold to foreign buyers and just sit idle with no occupants for sometimes years. In the not-to-distant future, the gold-backed yuan will replace the dollar. A 401K, deferred compensation, IRA, etc., won’t be worth much when a loaf of bread is $100 or a new Honda Civic is $120K!

You have to think more deeply about the concept of inflation/hyperinflation. First, governments everywhere are scumbag crooks. They print money to make themselves and their buddies rich. They are unlikely to adhere to a gold standard for any real length of time and take away their ability to print. And don’t think I don’t like gold/silver, I started buying in May of 2000 and still buy on the dips.

The other part about bread being $100 and a car being 100K – that aint ever gonna happen either. Bread makers got bills to pay too, car owners got a lifestyle to support. They can’t just charge anything – people will make their own, bike, whatever. At the end of the day these guys make money selling bread, cars, whatever and that is unlikely to change. The areas that do have (artificial) pricing power – housing, education, and health care – are all government sponsored and protected cartels. The cartels must be destroyed, letting in real competition and the rule of law if this country is to survive.

Same goes for JC Penney, Sears, KMART closing all of their stores. They know that if they do the customers go to Amazon. They would rather keep their stores open at a loss to maintain their cashflow than start consolidating. Because eventually that means the end.

I agree with what you’re saying, but the cartels will not go down without a gargantuan fight. These sociopaths think they’re actually going to collect 100% on the derivatives they created. Take a look at Greece or Venezuela. That will be the future of the U.S. If we don’t start manufacturing things here. A lot of odious debt must be cut way back to start fresh. Negative interest rates, high priced homes are symptoms of worthless dollars.

After you factor out stock options and accounting gimmickry, amazon has never made a penny. Its locked in a death spiral with brick and mortar. In its favor are the millions of hood rats that use malls to fight, deal drugs, hook up, start riots and shop lift. Commercial real estate anywhere the scum have access to (and no legal concealed carry) is dying. Retail combined with services, like auto repair, is what I see surviving/thriving.

“Nothing new here. Foreign buyers are dumping their U.S. Dollars before the dollar crashes”

i literally laughed out loud at that……..that makes total sense, buy shit valued in US dollars …….that’s going to crash in value…..

if the dollar crashes, inflation takes over and those in debt will lose, those with fixed assets will when….that’s why commodities, housing or any fixed asset will not lose as much as the dollar….

the Chinese are buying homes to get out of the renimbi which their central bank has shown is on a devaluing course with no end in site….in fact the strong dollar is killing their economy because of dollar peg…..The august sell off was directly attributed to their devaluing….

his message was correct but needed some tweaking

1.5 million dollar house sold over a year ago never hit the mls. Been vacant ever since . Pool man and gardener show up but no occupants ever. I guess someone is picking up the mail. Money sure is strange these days.

If people are wondering how to stabilize the cost of housing in this state, Irvine is an example of that. They have been building like gang busters for the past 5 years and there is tons more land to build on. If you compare the last housing boom to this one, Irvine home prices haven’t moved as much as most other desirable neighborhoods. Look at the new Villages and the Great Park Villages, prices have been flat for a while. Compare that to West Los Angeles and beach cities and prices have gone up 40-50% or more. For folks here who complain about how expensive and terrible Los Angeles is, Irvine sounds like a great option. Sure you might pay Mello Roos and HOAs, but if you are looking for safe neighborhoods and good schools, the value proposition is there. Honestly, if you are willing to live in a condo or townhome, you will likely find something you can afford there. If not Irvine, then try Mission Viejo or Aliso Viejo and surrounding south OC cities. They are all safe neighborhoods with stellar public schools. When people complain about housing being too expensive it usually means that they can’t afford the size of the home in the neighborhood they happen to want to live in. It’s all relative.

Complaints about cost of housing go deeper than that. The biggest problem is job access. A grueling two hour commute comes at a huge cost.

It isn’t exclusive to SoCal of course. North of Boston, along the Route 128 “Beltway”, people are still buying all cash on homes, only to immediately gut the place. One house in my town was bought for $380,000, within a couple days a 40 ft dumpster was in the drive and the roof was being torn apart. A friend of mine was recently outbid by an all cash offer on a crapshack, despite offering $10k over asking (peanuts I know). I’ve never seen such money before, since I grew up middle class (all around the southern US). To buy a 150-200 yr old home at a premium, mow it down or gut it, and put another $100,000 into it is nuts.

Dandroids, the 200-to-250-year-old housing stock in the northeastern states like MA, PA, and CT is some of the most coveted housing in the country. People lie in wait for decades for an opportunity to buy a little stone 18th century cottage in Pennsylvania, or a classic 200-year-old Cape Cod in Massachusetts. I don’t blame them. These houses are usually extraordinarily well-built, built by hand by people who were building them to last for generations, in societies where people didn’t see a home as a “starter” house, or feel like they had to keep up with every architectural fad.

And those places don’t have so-called perfect weather nor fantasy land allure of international desirable coastal prime blah blah blah, go figure!

Growing up in OC…I have watched gentrification on steroids in the area! When traveling to Irvine I’m just astonished by the traffic and high density growth, the amount of Chinese looking for a place to launder and hide their money from China is mind blowing, this is a global issue and by no mistake money from shells, tax havens, private equity and hedge funds are being pumped into housing to launder money and pump assets and force average working class to pay majority of income to the kings. The rentals and home prices are outrageous and a giant theft of average labor going to the top. This has been part of a overall plan and The Futures Modernization Act opened the gates to this speculation we have watched. “Glass–Steagall” served a purpose. Watching Alan Greenspan and the other Randian FED-Banksters lower rates continually after the first internet bubble from 98 on into the 2000’s people cheered as principle asset valuations pumped artificially regardless of reality or the effect it would have on future generations tells a story as to the generational aspect to our current illusion of a market. The road to 2008 was no surprise and it was manufactured front-end theft at the expense of our futures. Huge bailout, trillions at the fed window and zero% basically to go out and by up more assets after the crash. QE deals to help bulk purchases of housing, limited inventory as the banks control the flow of housing volume available, scarcity the and control. Here we are today the back-end theft in full-swing, pretend and extend in full swing and we all know at some point it will pop, setting the way for bail-ins …in Frank-Dodd and more theft?

“Chinese looking for a place to launder and hide their money from China is mind blowing”

Or they are simply speculating. It’s anybody’s guess.

This reminds me of a sponge. It sucks up all the water (the house humping cheerleaders) and then it gets to the point where you can not do a single thing to soak up more water than to squeeze the sponge out. The squeezing of the sponge is basically the bubble bursting. Until that sponge is completely saturated (every last house humper has their “dream”) nothing will happen. Eventually the sponge will become full and the GOV will be unable to clean up all the water fast enough.

Future prez Trump will for sure be blamed for the next housing collapse just like Bill Clinton was credited for such a successful presidency even though that was credited to the internet’s mainstream take-over.

Trump is a real estate guy. He hasn’t alluded to it but I can only imagine the shenanigans his administration would pull promoting housing debt as stimulus. I bet it would make GW’s ownership society BS look like a walk in the park.

I can see this becoming the norm pretty much in any “hot” real estate market. A majority of people will rent because they have obligations to the area- work, family, etc. Then there will be a class of people who can afford to have a stake in the area-foreign investors and upper class, not necessarily 1%ers but likely 10%ers at least. There will also be a small sliver of those who bought at the right time or inherited property- children of boomers or people who got a good deal.

Among my peers/coworkers (ages 18-35ish) very few actually want to own a home. The only homeowner among my friends inherited a house from his grandma just this year and even he’s thinking of selling it (valued at ~800k). His plan is to sell the house and travel for a year and invest the rest… Most of my friends are just happy renting and not having to worry about taxes, maintenance, insurance, etc. This is why I’m fairly certain future generations will opt for renting. In middle America, where values are different, we will continue to see a growth in home-ownership and prices.

A house is a money-suck. Wondering what/where your friend will invest in? Just curious, as I may be doing the same thing some day.

“If we understand property taxes as a lease from the local government for the right to gamble on another housing bubble arising, we see “ownership” in a different light. As the saying goes, buyer beware, especially if there’s no limit on how high desperate local governments can jack up their lease fees, i.e. property taxes.”

http://www.zerohedge.com/news/2016-05-12/dear-homeowner-what-exactly-do-you-own

American cities have a huge amount of unfunded pensions for firemen, cops, teachers, and other municipal employees. Many of then worked for 20 years then receive a pension for the rest of their life more than you or I will ever make working an honest job. A lot of these people get healthcare paid as a part of their retirement. Municipalities have no other source of income than property taxes. Expect your taxes to double or triple. Even without a mortgage, it will take a good paying job just to pay the taxes and utilities on your home when you are retired. Good luck with that retirement dream!

Prop 13 protects the homeowner from property tax increases. Another reason why California homeowners are in a good position.

Prop 13 also tends to privatize gains and socialize losses.

If housing prices skyrocket, your assessed property tax basis can only increase 2% per year.

If housing prices tank, your assessed property tax basis is on the new tanked value of your house.

You’re talking about cops and firemen; teachers and other municipal employees have decent but not lavish retirements after 20 years. It’s better than the private sector only because it has eroded so much in the last three decades — unless you’re upper management.

It’s naive to not assume that Prop 13 won’t be upended. Government always changes the rules in the middle of the game. People never learn.

@Lord Blankfein – unless you buy a house. Then you pay 5,6,7x what the previous owner paid. Right? So Prop 13 protects the geezers so they can sit in a house that much longer, slows down the market, and creates price hikes. In addition, Prop 13 means that since cities don’t get taxes from home owners, they stop zoning for home building but will sign off on commercial real estate. Am I wrong? Prop 13 has tuned into a great roadblock and it has changed the state in unforeseeable ways. Much of the pain around housing is directly relatable to Prop 13 and shortsighted people in the late 70’s.

tolucatom: Prop 13 means that since cities don’t get taxes from home owners, they stop zoning for home building but will sign off on commercial real estate. Am I wrong?

Yes, you are wrong. On two counts…

1. New homes mean new, higher tax assessments.

2. Prop 13 protects commercial real estate as well.

I wonder what Hotel California (fka Anon) thinks about this? Famously was arguing on this board about he real “scope” for foreign buyers and mocking the image of “suitcases of gold” coming out of China. Nice call, HC/Anon!

I don’t know about other commenters, but yes, I question the conventional meme that wealthy Chinese/or whatever related hot money flows is any sort of safety net. It’s quite often assumed to be a hedging play, but I suspect the vast majority are simply gambling. To date, it can’t be disproven either way.

Capital control regulations on the mainland, however, forbid individuals from moving more than $50,000 out per year. It’s a rule that’s often evaded

Middle class American are priced out in their own country what a shame foreigner mostly owned sige family homes in this country and to chines what a shame. Before Americans are the wealthiest people in the world that’s not the case right now homeless American are in the Rose esp in California politicians needs to work in their system. Too much greed will crippled the life of American people You guys need to wake up and fight for your rights in your own country foreign ownership need to stop if you want to improve the life of every American

How old are you? This is written by a child, maybe? (or your command of English isn’t good, but still, make the effort to use real sentences)

Steve my apology I’m a Chinese starting to learn English but I do own a couple of condos and one single family homes all rented by the American people I’m not good in English but I’m a good businessman how bout you

I wonder if there are any ancient Chinese phrases which correspond to the English idiom pride goeth before a fall?

Wang Bu and other Chinese are desperate to get their money out of Chine before the Chinese Government depreciates the Yen to the point where it becomes worthless compared to the dollar and/or the communist government confiscates all the ill-gotten gains of the upper class. They smuggle their money here through off-shore businesses and shady trade deals then buy US real estate for cash to hide the money they smuggled out. Basically it is their fallout shelter for when shit hits the fan back in homeland China. It doesn’t get them citizenship here, but that’s what the “Maternity Hotels” are for. Eventually the kid can sponsor the parents. It’s all part of their exit strategy.

Hunan you are dumb? How can we launder yen when our money is in yuan and us dollars.

Housing to NOT tank hard in 2016.

Rationale is simple. In ’07 REITs, Investment Capital firms, Fund Managers, and (the big one) Politicians invested HEAVILY in RE at a 10yr discount. Be assured, they’ll let EVERYTHING ELSE tank hard before their RE. I speak from a position of first hand knowledge… Is what it is…

Care to share your insider source?

fisher effect provide pathway…..

1. Logan Mohtashami, your posts are painful and full of unnecessary bullet points as if there is structure to what you are saying. You spam real estate sites all over the internet.

2. 18-35 year olds will normally disavow structure or the concept of ‘settling down’ and home ownership for a brief time.Then everything changes and they all buy homes. This generation is not an exception.

3. Real estate values are going to reverse and I will buy distressed properties from the bozo class once again.

still waiting for collapse? LOL, keep waiting…

“Bubbles” burst when confidence turns to fear.

This has been an ASSET inflation not a monetary one…otherwise interest rates would be soaring rather than plunging.

Gold and silver get a natural bid in such a circumstance…but nothing like energy since one need only look at the size of the market to say “buy.” I’m not a housing expert but I do pay attention to natural gas prices since I have found the massive energy boom inside the USA nor resulting in an economic boom but in fact a bust very odd indeed.

So one need only “Google” CNG and realize that energy prices have peaked at the gas station and could indeed plunge as commercial fleets continue to convert away from diesel.

Will plunging demand for diesel duel cause a property bubble to burst?

Its possible as these are small businesses and if there is no demand for diesel fuel, truck repair, tires, 53 foot trailers, etc that’s a lot of stranded capital.

There has also been a dramatic surge in the defecit and plunging revenues from tax receipts.

Id much rather buy Government debt at y8eld than an MLP or a REIT…but these things can always go higher I guess.

The only reason interest rates have not soared in the past 15 years is because of the “Fed put”. Interest rates have been artificially suppressed, generating one massive credit bubble behind the other. First it was mortgages and derivative instruments based on mortgages, and since that time it has been car loans, student loans, and most ominously, corporate debt- corporations have been enabled by artificially low interest rates in generating debt to buy back their own stock, inflating it artificially, while hundreds of billions have been diverted to otherwise uneconomical investment, such as shale oil plays.

At some point, interest rates have to be allowed to normalize- interest repression has gone as far as it can go and has inflicted incredible damage on our economy….. and is the major cause of the widening of the wealth gap since year 2000.

Laura the Federal Reserve and our government is not done with cheap credit. Now they have another trump card- negative interest rates. And if that doesn’t work then they will simply apply negative interest rates to your savings. So they can “stimulate” the economy.

Can someone explain to me why Chinese buying all cash is a bad thing? They are buying from American owners, who are buying another house or purchasing goods to help the economy.

If they buy all cash, they’s a slim chance they will default on it. Only way the default is missing property tax payments. They leave the house empty for years, so obviously they don’t need rental income to make payments. If there is a crash, they could just easily wait it out.

There’s an unstated, unwritten social contract between the old and the young in America. It goes like this: the young people will work hard and pay taxes to support the old. In return, the old will sell their housing stock to the young when the young start families and need houses.

That social contract is violated when the old decide they’ll take the taxes from the young, AND they’ll sell their houses to the highest foreign bidder. Suddenly, the young have no way to build wealth and form communities.

That’s what’s happening when we let tens of thousands of Chinese millionaires buy up all the prime real estate in America. The middle class young are getting screwed.

You could say that existing home owners are the sowing the seeds of their own destruction. At some point, foreign purchases will slow to a trickle because of stricter government oversight (as is happening in England) or weaker global economic prospects (i.e. China). With weakening foreign interest and domestic affordability at all time lows, sellers will have to make some concessions.

There’s an unstated, unwritten social contract between the old and the young in America. It goes like this: the young people will work hard and pay taxes to support the old. In return, the old will sell their housing stock to the young when the young start families and need houses.

FIRST time I ever heard of your social contract. Up till now, the social contract, as I heard it, has been:

Adults support children. Feed and clothe them. Give them health care. Put a roof over their heads. Give them a K through 12 education. All for free!

The young have received all their benefits by the time they graduate college. Now it’s time for them to give back, by supporting aging parents.

You’re the first I ever heard of senior citizens still owing anything to those younger.

@son of a landlord – it’s the “me first” and “I got mine, now screw you” attitude that perfectly captures the Boomer generation.

Hilarious. Social contract, right. Let me guess, you are a Bernie supporter? Let me tell you how things work out there, everyone is out to get a piece for themselves. No one gives a flying f about you or anyone else. What this country needs to figure out is how do you make good public policy based on that fundamental assumption. Democrats think that the government can somehow stifle that kind of bald self-interest, well it can’t, it’s an integral part of human nature and a product of millions of years of evolution. Republicans think that if you let everyone do whatever they want, things will work out, well, it never does, what you will get is extreme wealth inequality leading to people getting their heads chopped off. I’m not sure what the answer is, but neither Hillary nor Trump really have a clue either. The one thing I do know, however, is that there are worse things in life than letting foreigners overpay for your real estate, people had the exact same concerns when the Japanese overpaid for stuff in the 80s and guess who ended up with the short end of that stick? I say this so often because it is true, Americans have very short memories, which is why we keep making the same mistakes over and over again. I think it has something to do with the majority of this country being functionally illiterate. Here’s some free advice, don’t worry about what other people are doing, just go out there and get a piece for yourself, there’s not really any other alternative and no one else is looking out for you, not the government and certainly not the baby boomers, whose selfishness and narcissism can only be matched perhaps by the millennials.

All those foreigners over-paying for California houses … many don’t have a clue as to their property tax bill in the coming years. (I hear property taxes are low in China.)

So let the Chinese over-bid and over-pay. They’ll only end up over-paying in property taxes. And the nice thing about property taxes is that, unlike cash income, you can’t hide real property. You gotta pay. If you don’t, California will foreclose your house to pay your back taxes.

So the Chinese get to over-pay twice. First for the house. Then for their high tax bills.

Anyone here with a govt pension plan … thank the Chinese for paying for your retirement.

What do you mean the rich Chinese buyers have no idea what property taxes await them in the upcoming years? If you can pay 1M plus cash for a house, paying $1000 per month in property taxes is chump change. I doubt you can even rent a ghetto apartment for that amount. To think the rich Chinese have no other assets is stupid, they are no different than wealthy Americans.

We’re a some point before the prior inning of the money repatriating back to our shores. I’d bet on every single Chinese buyer thinking he or she is making the right bet. We’ll find out soon enough how many are prepared to ride out the next downturn or if they trample over each other in a scramble for the exit. Which would you bet on?

“If you can pay 1M plus cash for a house, paying $1000 per month in property taxes is chump change.”

Too many non-vetted assumptions input into that. Just as we have no reliable data on the intent of this buyer cohort, we also don’t have reliable information regarding their level of exposure to potentially mitigating circumstances.

We don’t know to what degree there is upstream leverage and/or triggering events involved. We don’t really know anything about this group. All we have are broad generalizations about a lot of liquidity from a particular region.

Then there’s unknowns about what happens later. Tax authorities in the U.S. have a reliable track record of changing the rules as conditions suit over time, sometimes drastically. It’s one type of naive to believe property tax benefits for owner occupant citizens won’t change to their detriment, but it’s a whole other level to not consider the potential for negative impact to foreign investors.

And why is it still legal for foreign buyers to own American property?

In Australia non-resident foreigners generally cannot buy residential property, except for some brand-new condo projects. Still it doesn’t seem to have stopped their housing prices (relative to incomes) from shooting up to even more ridiculous levels than Southern Cal.

I was there in March on a hike/surf trip, and it is indeed insane. Most of the speculation outside of the cities is retirees leaving the cities for one of the 1000’s of beautiful beach communities; I think a fair amount of chinese money has wormed its way in to the cities. I’ve read that lenders are starting to cut back on their dealings with foreigners, so cracks are starting to appear.

Apparently, foreign Chinese can buy houses in Australia, not just condos: http://www.mingtiandi.com/real-estate/outbound-investment/chinese-billionaire-buys-home-of-aussie-casino-king-james-packer-for-51m/

http://www.realestatebusiness.com.au/blog/7598-how-to-sell-real-estate-to-billionaires-from-china

The buying frenzy that has seen local residents in Australia priced out of the market by foreign investors appears to be slowing, as a toughened stance from the banks and regulators takes effect.

http://www.news.com.au/finance/real-estate/buying/banks-and-regulators-have-created-the-perfect-storm-for-chinese-property-buyers/news-story/35003738f3197171baf8b92341dfe942

Partly because it’s a great channel by which we repatriate the dollars we sent them in exchange for all of the junk they manufactured for us over the past couple of decades.

Trump 2016! #stoptheinvasion

FEEL THE BERN 2016!

Love The Bern!

Feel an old communist putz like Bernie if you want the U.S. to end up in a bankrupt mess like Venezuela.

@frebay you did not get it do you or you are ignorant to what will happen if all the properties in the us will be own by Chinese or foreigner they bought properties in cash which means American will be priced out first time home buyers cannot compete with them Americans are priced out in their own country that’s not acceptable in your own country what America needs right now is stop or limit the foreign ownership of the house below one million dollars politicians here are dumb and a puppet of the fed

I have no idea what Wang Bu is trying to say. All I can tell is that she is angry at grammar and hates punctuation. And I can’t get this song out of my head…

Everybody deed in lieu tonight.

Everybody Wang Bu tonight.

Hunan r u dumb

Hunan my apology I’m Chinese and just starting to learn English even though I don’t speak and write like an American I do own properties n America how about you you spoke perfect English but r you perfect there’s a lot of racist here like you and steve

Wang Bu, let me put this into terms you will understand…

You very smart…

You buy house…

You rent to dumb Americans…

You good business man…

Me no give a sh*t.

Hunan eat your shit hahaha

Wang bu, assuming you’re for real and not a troll, you’re likely falling right into a trap. When our government changes the rules and you suddenly find your American housing position not so appealing any more, you can’t take it with you back to China and good luck finding a buyer to bail you out.

There is no free lunch. Is there a phrase for that in Chinese?

Theres a lot of dumb buyer out there my friend

Hunan is the kind of person we call a “douchebag.” Douchebag is a word you can add to your expanding English vocabulary.

^^^^^^^^^

THIS is what is wrong with America letting foreign scum bug American real estate

Stop buying foreign made crap

People keep forgetting — American sellers benefit from foreign buyers. They get more money for their houses. Only American buyers are harmed by competition from foreign buyers.

So if you want to pass legislation limiting foreign purchases of American real estate, you’ll be pitting Americans against Americans. Americans looking to sell now will be harmed. Americans looking to buy now will benefit.

It’s not an American vs. foreigner issue. It’s American vs. American.

So American sellers won’t make AS much. But American buyers will own homes in their own country. Sounds reasonable.

Alternatively, foreign buyers can become foreign sellers and sell to other foreign buyers. Then it won’t be an American problem at all.

Except for the fact that Americans won’t own homes.

legislation is not needed, foreign buyers are drying up, proof is in my upper scale hood… newly built McMansions and no sales so they are empty empty empty

Nope, the foreign buyers are causing an artificial high issue, they should not be allowed to buy in the US, no different than in most countries, try buying in Mexico?

The problem has and always will be the monied interests, the banker cartel, the biggest heist of wealth in the history of mankind….

Thanks banker pigmen, you all need to be hung….

Great for speculative sellers such as flip artists, but sellers who are selling to buy a replacement residence (likely the vast majority) are also getting screwed. Speculative price rises make the transaction costs higher than it would have been otherwise. That far too often tends to be overlooked.

Teapot: So American sellers won’t make AS much. But American buyers will own homes in their own country. Sounds reasonable.

No. It only sounds reasonable to first-time home buyers. To sellers, it doesn’t sound reasonable at all.

“To sellers, it doesn’t sound reasonable at all.”

Only for sellers of investment properties. Not sure how owner occupant sellers would consider it reasonable to pay more to move due to hot monied interests’ gambling in the very type of assets one has to live in.

Only for sellers of investment properties.

Also for sellers who are longtime owner-occupiers, and want to California and retire to a cheaper state.

“Also for sellers who are longtime owner-occupiers, and want to California and retire to a cheaper state.”

It’s not a like kind replacement in those cases. They are losing the equivalent difference of value in whatever benefits the location confers to the higher price of the property they are selling.

IMO the most probable catalyst to a decrease in housing prices (besides a natural or man-made disaster) would be a dramatic increase in interest rates. Artificially low US interest rates are propping up the RE market. That being said, based on a current environment of historically low global interest rates I do not see the feds aggressively increasing interest rates any time soon (I’m talking 2%+). Doing so would prop the value of the US dollar so far above other global currencies it would result in trade deficits and the corresponding deflation would have negative effects on the stock market, 401K’s, pensions, etc.

Guess what I’m trying to say, is that barring any unforeseen disaster, I don’t see any bankable decrease in the RE market any time soon as it will take years for the feds to reach their proposed 2% rate goal.

We’re in our 3rd bubble in less than 20 years. Every time there were arguments that it could not burst, that this was the new norm and to get used to it. I don’t think interest rates have to go up to crash this pig. I think a decline in the economy (like 5 consecutive quarters of declining revenues for the S&P 500) and a sizable increase in housing inventory is more than enough to bring this b!tch down. I think we’re seeing that already, just not in all markets. Its like the internet meme “Soon” – just go to google images. Its coming.

I agree. ZIRP couldn’t prevent the fall of commodity prices and associated economic markets. The stock market is wobbly due to global economic uncertainty despite a coordinated suppression of rates by central bankers. At some point, there’s only so much debt that lenders will tolerate before the alarm bells sound. We are quickly approaching this saturation point after 8 years of runaway borrowing.

cd is right…. may be we need to stop this flow of Chinese buyer in oc, i don’t know why they all the sudden interested in Irvine….30years ago there were 99% less red Chinese than today…. they don’t have green card just cash for 2 to dozen houses??

The age old blame the foreigner argument. Housing bubbles are caused by not building enough new housing. We let those that already own, vote for zoning limitations, affordable housing taxes, and NIMBY’ism, creating an artificial shortage of housing. If Chinese want to pay Americans to build homes, then that helps the economy. A smarter government sells the homes to Chinese buyers, and then allows developers to build enough to support that demand, creating pricing equilibrium.

Prop 13 has led to defunding education to such an extent, that supply and demand economics are not understood by the general population.

Prop 13 and the defunding of education have nothing to do with the toxic collectivist philosophies that have dominated academia and our educational system for the past 100 years at least…. or the economic theories derived from those philosophies.

It takes many generations for a philosophy or less-defined “belief system” to be first accepted by a society’s intellectual elite, then work its way down through the ranks of policy makers and educators, and finally become so commonplace throughout the general population, that most people accept it as a truth not to be questioned, and have no idea of its provenance.

The idea that government apparatchiks and economists can, by policy fiat, create a functioning economy that does a better job of mediating the desires, needs, and means of hundreds of millions of people and entities, better than the natural checks and balances of the “invisible hand” of supply and demand, long ago became the default belief of most of us, and vanishingly few educators are equipped or empowered to question that belief, any better than they are the belief that throwing evermore taxpayers’ dollars at school buildings designed by prominent “starchitects”, and “innovative” methods of teaching basic subjects that completely defy the normal functioning of young minds, actually improves education.

Agree with Oz. It’s real easy to blame someone else, but it’s our own choices, ex. prop 13, NIMBY’ism. entitlements, etc that created this predicament. Instead of looking to blame someone else, one just needs to look into the mirror to see the guilty party. Sad but true.

Here’s a nice flip. Purchased for $380K way back in March ’16, back on the market in May for a whopping $680K. Who doesn’t want to spend almost 700K to live “in da hood” with bars on your windows and horrific schools?

https://www.redfin.com/CA/Los-Angeles/3429-Potomac-Ave-90016/home/6889110

I’ve seen this area already as I looked at 90016 properties before. This is not a good neighborhood to raise a family. The crimes are high and it also has a lot of sex offenders living in the area.

Man, do I love listings like this one! You could just take the down payment and rent in another (nicer) country for 5-10 years. A lot of phantom wealth is going to get vaporized over the next 6-24 months.

You could take the down payment for that crap shack and BUY (as in all cash) in many parts of the country. What is stopping people?

When I bought my place in Irvine the nice old lady who lived here “wanted to sell to me” over the competing Chinese bidders. I was a divorced dad with a daughter, both of us born here.

When I sell in a couple of years I will refuse to sell to the Chinese, even at a higher price, even at all cash. We are still free enough to prevent forced contracts in this society – but not for long.

The number of Americans who will whore themselves out to foreigners isn’t really surprising – we are a society who puts money over everything, including community, our shared history and our fellow countrymen. It’s why the US is doomed to failure.

Yeah but how do you know whether the *Chinese* buyer is truly *Chinese* or whether they are actually Americans with *Chinese* surnames?

Sorry pal buy you just dropped me from your list of potential buyers that you wanna deal with. Thank you very much, Mr. Trump.

Lots of fluctuations on the asking price for this Shadow Hills house: https://www.redfin.com/CA/Los-Angeles/10529-Art-St-91040/home/5491691

Sold last year for $671k.

Relisted this year at $879k, then dropped to $599k, then up again to $829k.

It illustrates how nobody has a clue as to this house’s actual worth. (Or the SoCal RE market as a whole?) Like it’s anybody’s guess what the appropriate asking price should be.

Prop 13 means that since cities don’t get taxes from home owners, they stop zoning for home building but will sign off on commercial real estate. Am I wrong?

Yes, you are wrong. On two counts…

1. New homes mean new, higher tax assessments.

2. Prop 13 protects commercial real estate as well.

I’m not sure about OP’s original premise but regardless of a similar increase cap for commercial projects, there is the potential that commercial developments provide a greater immediate injection of new tax revenue. Another consideration is that residential and commercial RE are different enough animals so that the degree of impact the cap has in decision making processes of respective vested interests matter more or less so. I don’t think it’s a stretch to accept the possibility that municipal governments would favor commercial projects as a result.

Sorry if this sounds a bit racist, but can someone tell me how the hell all these Chinese people have all this money? Nobody in China inherited money because there was no money a generation ago. You see one of these middle aged couples walking around he Bay Area and they have this dead zombie look and barely act like humans. When you see someone with money that’s American, you get a vibe about them like they are charismatic or intelligent or at least slimy. These Chinese I see I just have a hard time picturing a situation where they somehow built a business empire or whatever they’re doing. These are not the middle class there, they’re obviously not high powered executives.. the difference in incomes is so huge there that these people paying $1 mil sight unseen is like an American with tens of millions.. that’s pretty rare. WHO are these people??

This is definitely true. Cash is king.

We have built a new website that offers information on Orange County real estate –

http://www.orangecountydream.com

thanks

Leave a Reply to IFALLALOT