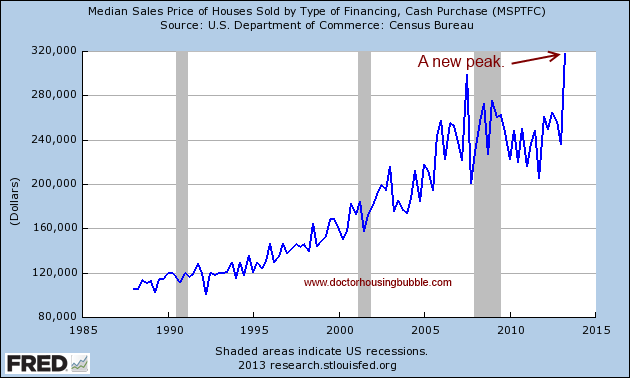

The investor trade is crowded: Median price for homes purchased with cash financing reaches highest level ever.

Investor demand for housing is largely responsible for the feeding frenzy in real estate over the last couple of years. Yet this unrelenting demand is unsustainable and it looks like cracks are forming in the investor trade. First, the median price paid by those using “cash†financing has reached an all-time peak. Not a revisit of an old peak but a brand new one. Of course this is happening while the typical US household has seen stagnant wage growth. Most understand this yet manias lure people in at the most inopportune times. A few other pieces of evidence are highlighting a tipping point in the market. Inventory is starting to increase and new home sales remain incredibly anemic. The refinancing boom is now being shuttered because of rising rates (as if a 30-year mortgage going for 4.6% is somehow apocalyptic). The investor trade is crowded and we’ve seen data showing how large the investor share of the market is in 2013.

A new peak for those cash buyers

For definition purposes, those categorized as “cash†buyers are those that do not use conventional financing. There has never been a market so dominated by non-conventional financing as the one we are seeing today. And those using this new way of financing home purchases are willing to pay record prices for homes:

This is a clear indication of the fever we’ve been seeing over the last couple of years. It also helps to explain the massive double-digit increases in prices in many metro areas around the country. Non-traditional financing is creating a new kind of housing market. Most families are not in a position to purchase a home via this mechanism. Even the typical 20 percent down buyer is being pushed out by this kind of buying. It was interesting to see the psychology of some analysts early in the game regarding cash buyers. For some reason, they believed in this myth that cash buyers were this tiny sliver of the market relegated to one wealthy actor or foreigner buying a home with all cash nestled in a silver briefcase. Well we now have data showing that roughly half of all purchases in 2013 came from this non-traditional road (more like a superhighway).

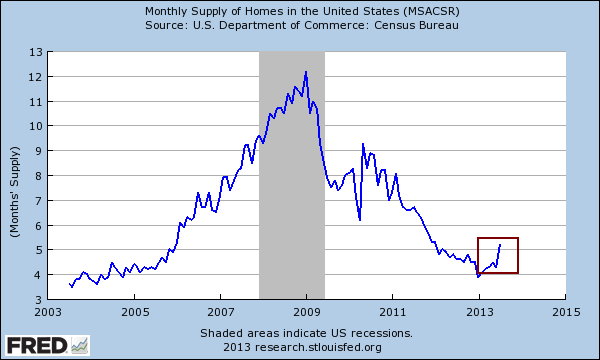

Another trend that is reversing is that inventory is increasing steadily:

We now have over 5 months of inventory. A “normal†market is closer to 6 months of inventory but we haven’t seen a normal real estate market in well over a decade. Real estate has now become something akin to a speculative commodity. It is a boom and bust vehicle. People now try to time it like a stock and speak in terms of “missing the bottom†or “missing the top†as if this was normal for a housing market. Easy financing has created this situation and of course, most people realize that the benefits are largely leaking out to financial institutions, not regular Americans.

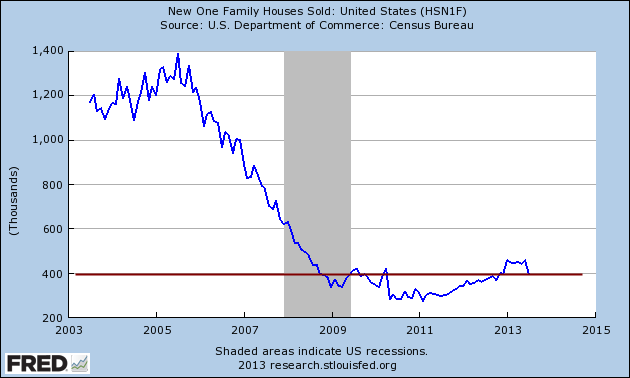

You would think with all this investor demand and prices increasing at a pace last seen during housing bubble 1.0 that new homes would be selling like pancakes. Â Let us look at this:

New home sales actually have dipped with the recent rise in interest rates. What you have is a speculative mania in the rental trade and now more commonly, in the flipper trade. It is an odd sort of logic here and even large funds catering to the rent play are having a hard time turning a profit (in fact are operating with losses). Real estate in the form of property management is a time intensive process that does not seem to jive with the culture that is Wall Street. Rents must be pulled by real world incomes and given our economy where part-time jobs are becoming more common, to think that you will have permanent tenants and a perfect stream of cash flow is just crazy.

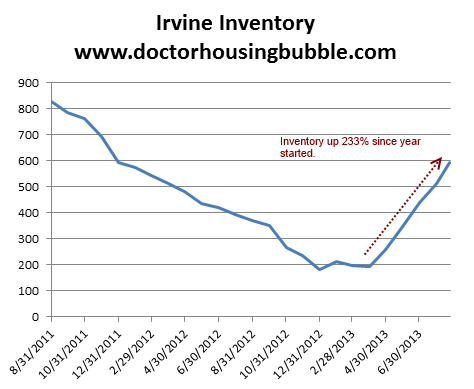

In places like Las Vegas, you have investors selling to investors in a game of musical chairs now. You are also seeing aggressive flips in California where people buy a place, slap on some paint and a few simple tune-ups and then expect a $100,000 or $200,000 profit. The disconnect is becoming more prominent. Even in unmistakably solid areas like Irvine we are seeing a major jump with inventory:

We’ve already shown that nationwide inventory is picking up but the above is a desirable market. At a certain point, the mania becomes obvious to some. Without a doubt all these signs point to a softening in the housing market. Given the boom and bust nature of our market, after this recent boom are we suddenly to expect that cooler heads will prevail and we will have a slow retreat? These markets are momentum trades and with investors being the largest players in the real estate game over the last couple of years, it should come as no surprise if they react like investors would in your regular stock market. Given all the technology now available, selling and buying houses is a fairly easy process. Heck, we have investors buying them by the dozen as if they were heading down to Krispy Kreme. The rental trade is looking very frothy at this point.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “The investor trade is crowded: Median price for homes purchased with cash financing reaches highest level ever.”

Investor meets reality: http://www.bloomberg.com/news/2013-08-29/wall-street-s-rental-bet-brings-quandary-housing-poor.html

Ah, Section 8! If you want to claw your eyes out of your head with how this program “helps,” please go to this link: http://www.biggerpockets.com/renewsblog/2010/11/04/5-reasons-why-rent-to-section-8-tenants/

Just a taste: “Not only are our rent payments guaranteed and stable despite a tenant’s hardship, but HUD is like the best the game in town when it comes to the rental rates. We’re able to get $1200-$1600/month in lower income neighborhoods (we don’t do war zones though….) where the purchase prices are less than $75K…”

And if taxpayers didn’t subsidize rents, the monthly rentals would need to find market equilibrium at a lower monthly rate. Tell me how this isn’t welfare for the rich.

If the GOP and Teaparty adovocates were serious about cleaning up perks instead of using to help themselves this is the first area that should be cleaned up. Also

eliminate tax deductions on second homes. Only primary residences should have the benefits. This would certainly bring rational back to the economy and perhaps cleanup the mess we have.

This was Wall Streets plan from the beginning. Between Section 8 housing and loosening mortgage requirements, those homes purchased by hedge funds and private equity funds will all end up in the hands of us taxpayers.

Story on mortgage reform gone bad and loosening mortgage requirements:

http://news.investors.com/ibd-editorials/083013-669443-regulators-mortgage-rules-subprime-securities-risk-retention.htm?p=full

http://www.mortgagenewsdaily.com/08282013_qm_qrm_dodd_frank.asp

Thanks to central bank hot money flows and supply manipulations, it is virtually impossible to assign a reasonable fair value to any asset class….especially real estate. A perfect scenario for 20 more years of boom/bust ! Witness Japan.

YOUR A GENIUS FOR UNDERSTANDING AND SHARING. BUT I’M THE GENIUS FOR TAKING PROFITS IN A HOT MARKET 27.12%/MONTH/IRR/NNN AND BUYING AT THE BOTTOM 1990s(9000 acres 8.7c/$) and 2010-2013 (5500 acres at 2.7c/$). Expected Irr about 30-40%/month/NNN from 2015 to 2021 at average cost of goods 1-2c/$.

What you say may be true, but for most folks the ALL CAPS nonsense makes you look less than intelligent…

What might be hard to swallow is that the JJC actually exaggerates a smidgen. Exhibit A: He claims to be a “…reader of 100-150 pages a day, 35000 per year.” Now, for having given us a range of page-reads per day, we must be grateful, as it shows some sense of “balance” in his GOGOGOGOGO life of poaching 1.5 cent acres of land to achieve “World’s Best” 40% monthly IRR. But, even when we multiply the high end of his range to get an annual (150×365) we only get 34,750 pages of reading! Say it ain’t so, JJC!! I KNOW I KNOW. It’s LOOKS like you are just rounding up from 34,750; but even on those off days were you can only squeeze in, say, 110 pages of reading, that essentially kills any hope to reach the 35,000 yearly total!! Please explain before my confidence is irrevocably shaken forever.

…but it does match his Ego well.

THANKS SOOOOOO MUCH FOR SHARING MR. CHUN!

The inventory “shortage” was temporary. A inventory shortage is not the same thing as a housing shortage. The latter can drive home prices higher for a long time. The inventory shortage as we see above is starting to flip just as demand is starting to wane due to higher interest rates-end of housing “recovery”

Housing starts averaged 1.5M per year from 1960-2000 but there have been less than 600k starts since 2009.

At what point does that lack of housing starts in the last 5 years begin to manifest itself as a “true housing shortage”?

Never, unless changes to immigration laws occur.

Baby Boomer retirement/passing away is starting to happen in full force. Effects will be massive. Take a drive around certain more established neighborhoods in any town or city. You’ll won’t see the hallmarks of young families – bikes, toys, etc. All old people, all about to leave one way or another.

You got it, LAer. That the amnesty talk and the homebuyer demographic deflation are converging onto each other is no mistake.

Look at household formation over the last few years; it too has been very anemic. Shockingly so. Also loo at area-under-the-curve for over-construction during the boom and area-over-the curve during the construction lull. The boom volume was bigger than the recession drop in construction. Those houses are out there somewhere.

Also, people make the false assumption that people buy and rent the same thing. Not true. Renters tend to take apartments and buyers tend to take single family houses. As the homeownership rate drops, this raises demand for apartments and drops demand for single family homes.

If there was a huge demand for houses, the new home builders would be all over it. Don’t buy the “we don’t have land, qualified workers and a line-of-credit” arguments builders spew.

The Gen Y/Echo Boomer population (80m) is even larger than the baby boomers (72m). By 2025, the majority of Americans will be under 40 years old.

Japan we are not.

Another way to think about it is in terms of total price demand vs. total purchase money supply. Right now we have tons more price demand than purchase money supply unless the banks and fed go crazy with making easy money available again. It’s not about providing money to buyers who are completely unqualified to buy a home. The real housing crisis was built with people who were qualified to buy a house, but the banks and fed gave them money to buy one or two classes above their punching weight. The sum total of all that overbuying was vastly worse than the NINJA loans. Right now all those buyers who bought above their weight class are trying to see if they can get out and break even, but the current evidence is that they cannot. Cash buyers cannot meet all the price demand. We’ll see one way or the other I guess.

No problem with the lack of starts. Just put more people in the house(e.g. 11 people). In Mexico, we had three generations living under one roof. Here we have two families. The cities do not enforce the number of occupants because that would be racist. The kids get free breakfast and lunch, so with all the government benefits, we keep the expenses down and can afford a house. California is the promised land(actually it used to belong to us, only taking back what is ours to begin with).

@MB – Doesn’t matter if millenials are equal or a little larger demographic. In my view, they will just replace the baby boomers, which for me means no net increase in housing demanded. Even if they are 8 million larger, we’ve overbuilt like crazy, there will be plenty of housing available.

Boomer generation was mostly homegrown. Millenials include a lot of immigrants. Minus the effects of immigration and you get negative population growth. Without opening up the country to massive immigration, housing drops like a rock

“Carlos,”

Nice try, Senor troll. Nothing new about poor, multi-generational immigrant households (Jewish, Italian, Chinese, etc.) in America, particularly in periods of urbanization like turn of 20th Century and Millennial.

So, “Carlos,” there are some words you may want to commit to memory next time you feel like cowardly unleashing your bigotry:

“Give me your tired, your poor/Your huddled masses yearning to breathe free…”

Yours,

DFresh

4th Generation Californian

Son of migrant farm-worker who served our country and became self-made millionaire

First in family to graduate from college

LAer:

“they will just replace the baby boomers, which for me means no net increase in housing demanded”

It’s predicted that in 10 years, the US pop will hit 341M people, and 365M in 20 years, more or less adding 2.5M people every year. Isn’t that evidence of more demand for housing in the future?

Even if you discount the census predictions, and think our population will hold steady, houses don’t last forever. Homes need to be replaced every 75 years or so, or about a 1% replacement rate, or with 130M homes, about 1.3M homes/year.

We have been way under that number for that last 5 years.

Even worse, the overbuilding that was done from 2004-2006 was mainly concentrated in Nevada, Arizona and Florida. The overbuilding in those areas does little to alleviate housing shortages in the metro coastal cities.

If you’re an Angelino as your handle suggests, you’re probably well aware that the SFH homes that are being built in California aren’t located in the city of LA, the majority are in the Inland Empire where land is still plentiful and homebuilders can still build tract homes. In 2008 there were 3539 SFH permits issued in LA County, 2131 in 2009 and 2385 in 2010.

Carlos, if you are really a Hispanic, then I am a Vulcan.

“California is the promised land(actually it used to belong to us, only taking back what is ours to begin with).”

…and when will you be giving it back to the Chumash, Carlos?

Gen Y and Echo Boomers don’t want to buy houses. They like to move around. They are entering the work force with $30,000 in college debt, which will take years to pay down. They are thrifty after watching their parents go through hell as homeowners. They will not replace the retiring Boomer population of home-owners.

Demand for home ownership will continue fall. That’s why the developers are building more apartments now, not single family homes.

Right on the money Doctor Housing Bubble!

The problem is that there is a new rationalization with “all cash buyer†mantra. The false belief is that an “investor†who holds an asset that loses value will continue to hold the asset because they paid “cashâ€. My answer is simple. What happened to the stock market last time around? I know many “investors†that panicked and sold at the bottom because they believed that it was going to lose another 50%. These same “investors†paid cash, lost half the value and still sold. I also hear that home prices are very “sticky†because it takes more time to sell a property than a stock. I would argue that this would cause more panic. This is the same as a run on a bank. What will stop us from having a run on housing on the next bust cycle?

Let’s assume that a good portion of the “all cash buyers†are agents purchasing on behalf of a REIT fund manager. Next, let’s assume that these REIT funds are then sold to pension funds, 401k funds, mutual funds, etc. Now, what happens when pension fund managers, 401k fund managers and individual investors’ mindset changes from greed to fear? They will most likely sell these funds. Well, what happens when you get more sellers than buyers? We all know that we get falling prices for the REIT funds. So what does the REIT fund manager do to stop the bleeding of his REIT funds? They freeze the fund and slowly redeem as they sell off under lying assets. This works the same way on the way down as it works on the way up. This activity is a virtuous cycle on the way up and a vicious cycle on the way down.

The rental income stream is another red herring as well. The assumption is that rents only hold steady or go up. I have seen commenters on this blog say that history shows that average rents only go up. I think we heard that about house prices not so long ago. As you have stated rents are paid with income not debt and income is stagnant at best during this “recoveryâ€. What happens during the next down turn?

What?:

“The assumption is that rents only hold steady or go up”

Here’s a chart of SoCal rents since 1979:

http://www.ocregister.com/lansner/percent-446987-div-year.html

Since 1979, SoCal rents have gone through 2 periods of declines, 1994-1996 and 2009-2010. The declines have been less than 2%. This despite the boom/bust nature of housing prices that saw prices drop rapidly. Now I’m not saying rents will never go down, they have and they will, but historically it’s been a minor blip down.

For the sake of argument let’s say rents decline 3%. Also for the sake of argument housing prices decline 10%. So instead of collecting 24k/year in rent they’re collecting 23k, and they’re losing 1k/year versus their planned ROI. After dropping a few hundred thousand dollars you think they’re going to panic and sell their investment at a huge loss because they’re down 1k/year?

If you’re a cash investor the rent you collected is profit. Now the ROI may not be as high as you had hoped? But would a 3% ROI instead of 6% ROI cause you to sell at a 50k loss?

Even if you’re not an cash-investor and have 20% down and are at rental parity. Declining rents cause you to take a $1k loss instead of breaking even. Would that $1k / year cause you to sell for a huge equity loss of $50k?

In my opinion, even a slight decline in rents over the next few years might cause RE investors to operate in the red for a few years, but not sell in panic.

Flippers or those counting on equity appreciation on the other hand? Those are the panic sellers that would be caught in another downturn.

If you read the article above, you would see that the problem is not a relatively small drop in rent money but the inability to rent the house in the first place because there are not enough renters. Landlords can control the rent, but they cannot control the lack of well paid jobs. How would you like to pay the overhead everyday for those 8,063 vacant houses?

“American Homes 4 Rent had leased 56 percent of its 18,326 homes as of June 30, according to an Aug. 20 statement. The company, which reported a $14 million loss for the second quarter, has cut about 15 percent of its workforce this year, a person familiar with the terminations said earlier this month.”

Fulano:

There are more people renting today then at anytime in US History.

It’s foolish to quote AMH’s vacancy rate @ 44% and assume the number is so high because they’re having problems finding tenants. They only started purchasing properties 2 years ago and until recently were purchasing and rehabilitating properties faster than they could possibly rent them out.

Now that have slowed down the rate of purchases they are laying off those associated with acquiring and rehabilitating properties and are focusing on filling the properties they own.

Again, I’m not saying they are a great company poised to make money, but let’s evaluate their vacancy rate in a couple years when their portfolio has matured and they figure out exactly how strict their credit standards need to be.

@MB,

You are such a tool for the housing industry. Really, defending American Homes for Rent? Did you notice they laid off 10 to 15 percent of their staff? Sure sounds like they planned this out wisely. Then you go on to say:

“There are more people renting today then at anytime in US History.”

We also have the highest number of Americans actually living in the country. So what? We also have the highest number of Americans on food stamps. Go ahead and pick up those housing market pompoms.

MB

As any one who has been in the rental business knows, you need more rehab work after you start renting than before you begin. If it takes two years for them to get fully engaged, it will take them years to make up for the lost cash flow over that period from empty houses. Yes, there are record numbers of people renting today. That means one of two things, either we are at the top of the rental cycle or the economy will continue to hemorrhage well paid jobs and even more people will be forced to look for low rent properties or double up. Neither of which portends a sanguine outcome for the rental property market. It has been pointed out numerous times here that this is the reason the “big boys” go to REITS. Take the cash and run. You always buy for terms and sell for cash. In this case, it has been free money from the Fed and now they are taking the cash out of the deal.

Is that you Jay Bird?

Jay: Please quote my “defense” of AMH.

I’m merely stating that it’s too early in the game to make draw conclusions on how they will do. It’s absolutely foolish to read that they have 44% vacancy rate and conclude it must be because they’re unable to find enough tenants.

Yes, we have the highest number of Americans in the country now. Yet our housing starts have been at historic lows for nearly 5 years. Furthermore as Dr. HB has pointed out a number of times, the trend of home ownership is declining with no immediate signs of turning around.

I wouldn’t touch AMH stock with a 10 foot pole; in my opinion they’ve invested in too many areas with excess distressed properties. However, I’m so blind that I can’t see the possibility of them turning a profit (if they were able to purchase in bulk at a steep discount, and partner with other companies to diversify their revenue stream)

Fulano:

“you need more rehab work after you start renting than before you begin”

Surely that depends on the condition on the property when it was acquired. If the acquisitions were foreclosures, I can see the initial rehab work to take some time.

I see more people renting not necessarily because they can’t afford the PITI, but because they don’t have the discipline to save 20% for the downpayment or don’t have the credit to qualify for a loan with the current lending standards. Furthermore, the stigma with being a lifetime renter is diminishing (not that there should have been any in the first place) as many young people have embraced the freedom of not having a mortgage.

Income inequality, which has long plagued many other countries is gaining a foothold in the US. I don’t think anybody can dispute that. Sadly, one of the byproducts of income inequality is a society where the cost of owning property becomes further out of reach of the average worker.

MB, regarding savings rates and the 20% down: the current savings rate seems to be about 4.4%. Not sure if that’s a “lack of discipline” or a reflection of the poor earnings power of the saver, but look at the numbers required to save, from 0, for a 20% down payment of a $400k SFR (a ‘middle class’ house in a ‘middle class’ area of SoCal): assuming a GI of $100k/yr, at 4.4% (saving $4.4k/yr in cash and the almost 0% passbook account rates today) savings rate it’ll take about 18 YEARS to come up with a down payment. If one were able to tighten their belt an save at 10%, it’s still 8 years to that $80k down payment.

If you want to come up with the down faster you have to invest with more risk. Still, you’re chasing a bubble market. That 80k down needed this year might be 85k next year.

The bottom line is that saving for a down on a SFR is, for most people, an endless chase now. That can’t result in a healthy housing market.

tangouniform:

“If one were able to tighten their belt an save at 10%, it’s still 8 years to that $80k down payment”

You’re right of course, it’s not necessarily all about discipline. With high housing prices many people have the requisite income to stay under 36% DTI, but saving 100k is a huge obstacle. In Los Angeles, nearly half of the renters spend 30% of their income on rent as it is.

Some observers believe this means housing prices must come down so that more residents can achieve ownership. I think it means that the homeownership rate will continue to fall and the wealthy will continue to extract rent from the masses. As Dr. HB succinctly stated earlier, we’re “reinventing feudalism” The rich will continue to get richer and the inequality gap is only increasing.

@Fulano

Based on your estimates on what it will take to come down with a down payment won’t stick if home prices keep appreciating what (10% / year). That would guarantee that investors want to make sure prices are always out of reach never to be bought by the middle class. A guaranteed rental market for the next decade or two depending where average income earners live. Only way this story ends is if rental prices outpace the cost of living. Then I’ll bet the investors will flock to Section 8 to fill the void.

Rents in Las Vegas are down 15-20% from what they were in 2006. The overbuying by investors has saturated the market with rentals. At the apartment complex by my house, a 3 bedroom used to rent for $995. Now they rent for $799. My 3 rental houses that used to rent for $1,100, are now rented for $1,000, $925 and $925.

“What happened to the stock market last time around”

Did you just equate selling stocks with selling real estate? Last time I checked, my brokerage didnt charge me 6% for liquidating my portfolio.

And I’m ok with that. No all assets need liquidity. Higher the liquidity, higher the volatility and speculation (gambling).

These are homes, not black jack tables.

ZigZag, you have it exactly right. With so much (financial industry, Fed, and FedGov)manipulation in prices, supply, interest rates, etc. there is no way to determine any accurate value for a house based on fundamentals (incomes, wages, etc.). As a potential buyer who wants to own a residence to live in, all you can do is pay prevailing prices or wait (I’m in the latter camp). If prices ever revert to being in line with fundamentals, everyone who bought during these heavy manipulation years stands to lose a ton of money…enough to prove ruinous for a lifetime, given the high cost of housing in many places, especially desirable areas of CA. I want to buy, but not at these prices…if it keeps up, I may never buy another home. At least I’ll never have to worry about replacing a leaky roof, a broken dishwasher, etc. or property taxes!

@Bay Area Renter,

The goal of the Federal Reserve was always to get the bad loans off of the balance sheets of the Fed’s member banks. FYI the Federal Reserve is not part of the government. The Federal Reserve is a private corporation (banking cartel) that is owned by its member banks, i.e. Bank of America, Goldman Sachs, Wells Fargo, CitiGroup, U.S. Bank, etc.

The Federal Reserve by pushing overnight interest rates to zero (ZIRP), essentially pushed all the money market and certificate of deposit (CD) rates to zero which is well below the rate of inflation. The Federal Reserve by maintaining ZIRP is subliminally trying to force these cash-equivalent holders into real estate and as such take the bad loans off of the hands of the Fed’s member banks.

The Fed’s policies are working. The only people buying real estate are now all cash or people with pristine credit (i.e. FICO scores above 750 and +20% cash down payments).

When enough of the garbage mortgages of the mid 2000’s have been liquidated via all cash purchases or people with pristine credit, the Federal Reserve will pull the plug on quantitative easing (QE) and ZIRP. And then you will see selling prices crater and inventory rise to normal levels.

Dr HB

Over here in Miami, inventory is small and prices a little higher than what Zillow “estimates”. My assumption is if investors were selling to investors, or an investor to a flipper, we will see homes coming up for sale in the next year at a reduced price as those flippers and investors forgo their profit and sell for what they can get.

A recent distressed sale in our neighborhood of Coconut Grove just came up as a rental. A very small 3br/2ba for $3,250.

At that rental price you could afford a mortgage on a much nicer home in the same neighborhood (assuming you have the down payment, etc)

So we shall see how this all plays out.

I swear I got sucked into a Donnie Darko, style worm hole and traveled back to 2006 LOL! So if the script holds again (ans I think it will) we’re looking at a total market freeze next year with no transactions, and the next collapse in 2015. But at least Ben allowed the big banks to clear some of that inventory of their books… Victory to QE 🙂

“Real estate has now become something akin to a speculative commodity. It is a boom and bust vehicle. People now try to time it like a stock and speak in terms of “missing the bottom†or “missing the top†as if this was normal for a housing market.”

Nothing new here in California. Real estate has been mostly boom or bust for the last 30 years with a few short periods of normalcy mixed in. I remember when my parents bought a house back in 1986. By 1989 it had supposedly doubled in value and then the bottom fell out of the market in the early 90s. And all this occurred before the Fed/government/PTB/Wall St./flippers/investors/cash buyers/foreigners/3.5% down crowd became involved with RE. I doubt this market will ever revert back to a norm that we once knew.

Half of all homes bought all cash:http://www.marketwatch.com/story/nearly-half-of-all-homes-are-purchased-in-cash-2013-08-29

The last owner of a flipper property in an over-flipped housing market is no longer a flipper. He/she is a bag holder.

Not a lot of investor trade going on here:

“Egg Harbor, New Jersey

The mayor of one New Jersey town is actually moving out because he claims he can’t afford to pay the property taxes there.

Egg Harbor Mayor Sonny McCullough bought his home in 1985 for about $350,000 and according to him, now he is officially taxed out.

In 2012, Egg Harbor property taxes were increased by 60% making his home now worth $1.1 million and that comes with close to a $35,000 tax bill.”

my understanding about lone rates is that for personal homes your rate for the loans are at the low end.for business its a few points higher now if you lie that its for personal use but end up renting for business the banks can call in the loan. then what?

a good article in the NY Times on what the specuvestors do to neighborhoods…though there is no mention of how they have shut out many buyers trying to buy for the right reason (to LIVE in the house, happened to me in norcal several times but maybe that is not so common in Memphis)

http://www.nytimes.com/2013/08/29/business/economy/as-renters-move-in-and-neighborhoods-change-homeowners-grumble.html?ref=business&_r=0

According to the elite and the Georgia guide stones we will be reduced to a much smaller population . Sounds like a glut of houses sooner or later . Unless the elite end up in a bunker with a nuke dropped down the hatch.

Well…if you look at it on a sufficiently long time scale, sure…

At some point these institutional investors will bail out of their investments and liquidate their portfolios. The smart ones will go first, while they still have unrealized gains, and before their fellow investors flood the market and depress prices.

Unlike an owner-occupier, these investors aren’t “consuming” shelter – this is an investment, and they have to be cash flow positive or have unlimited money to fund losses.

Once they realize this business model won’t produce positive cash flows (because renting single family homes is not a business model that will work for institutional investors who rely on employees/third parties for everything), they will scramble to realize any capital gains they can so they can at least return the initial investment to their investors.

I give it two years, max, before the first of these investors throw in the towel.

I predict Blackstone will be one of the last, and will be forced to bail out at substantial cost to their investors. Not before paying themselves enormous management fees for a couple years, of course.

@Stryker and many others over the last few months — as a former Wall Streeter, I have to say it’s a bit comical that many of you think you’ve thought this gig thru as well as the Blackstone’s of the world have.

Those people are wicked smart and are so far down the chess board, most can’t conjure it. They make mistakes, they take losses…..sure. But, it’s the NET that matters and they are in a league way beyond most of us.

My money says, they will land on their feet… and with a positive return.

Somehow, I do not doubt you. These companies, and Wall Street will come out smelling like roses because that crowd will do what it always does with something about to head south, which is foist it on a gullible and stupid investing public via public offerings, as usual. The muppets will soak up the losses, as always, and Wall Street firms will pocket their usual billions in underwriting fees and commissions, while the principals of these firms will get themselves in the clear and pocket their billions dumping their shares on the “muppets”, including a lot of people who ought to know better, like pension fund managers.

In my opinion, I wonder if the purpose of these companies like Blackstone to go public with the REIT IPO is to short the stock then collect the profit and use to cover their expenses or early losses. Then re-inflate the stock afterwards with a dividend return until they completely fill all units? After all units are filled I am curious how long they will remain landlords? Any ideas from Wall Street? The HUD won’t save them if more full times jobs disappear or the properties happen to be in lack luster locations. However, I could be wrong. Maybe they did their homework to ensure that rentals will stay afloat regardless of the economy.

I tried to short American homes for rent but couldn’t.

Spoken like a man that’s never owned a rental. It’s a mom and pop business for a reason and those of us who have ventured there know the intangibles of why that is. I’m not saying that it doesn’t look ripe for securitization on paper but the last time Wall Street jumped on something that looked great on paper we all suffered. I’m not questioning the IQ level of anybody on Wall Street but they are using the housing market for purposes other than its intention. It may take a few more bailouts to get through to the quants but they’ll get it eventually.

@ Prediction Reality Check

Yes, front running, insider trading and bag holding your clients, and, of course, outright fraud do require high levels of cognitive skills comparable to your analogy of chess. Just a few: Paulson (brilliant gold play), Madoff, “Stevie Cohen”, GS Mr. Fab and on and on. Anybody who has worked on Wall St. know full well that the money is made on the comiss, mostly 2/20.

@Fulano — yes, you are correct. There is a lot of corruption in the financial industry, at every level. It’s one of the reasons I’m no longer a part of it.

My point was purely that it is doubtful that anyone on this blog even comes close to having all the info or the detailed strategy that those guys do. They are very good at protecting the downside. Yet, many commenters on here seem to think they are chumps and will get their heads handed to them. It’s funny…and naive.

@ MB

“Income inequality, which has long plagued many other countries is gaining a foothold in the US. I don’t think anybody can dispute that. Sadly, one of the byproducts of income inequality is a society where the cost of owning property becomes further out of reach of the average worker.”

This is what happens when you conjecture rather than investigate. Homeownership in Mexico, our neighbor with one the highest income inequality rates in the world, is 84 percent. The US is around 65% now. And, Germany, that great bastion of income equality and wealth, has a homeownership rate of 41%.

http://www.housingfinance.org/uploads/Publicationsmanager/0212_Hom.pdf

Fulano:

Why do you think the homeownership rate in Mexico is above 80%? Because they have very little land-use regulations (zoning) combined with plentiful land. Much of the houses are self-built and despite lacking infrastructure or title it still gets counted as “ownership”

Look at a map of income:home price ratio and you’ll notice that many of the areas with high inequality also have an absurdly high ratio. This isn’t correlated perfectly of course, but the correlation is there.

A high ratio = “cost of owning property becomes further out of reach of the average worker”

@MB

You have no idea what you are taking about. Over 80% of the inhabitants of Mexico live in very active seismic zones. The Valley of Mexico, including Mexico City, contains over 25 million people. There are frequent events every year over 5 on the Richter scale and over 6s and even 7s are common. If the houses are so poorly built, they would have to rebuild them every year. I would not like to see what many areas of

California would look like if a monster quake like the 1985, 8.1 of Mexico City hits. Again, you making conjecture on a topic you know little about. I have lived in Mexico for 20 years and am familiar with the zoning laws, which do exist, and quality of home construction. You are dead wrong. Homes in Mexico, for the most part, are made of cement block and rebar. I will take that over your particle board and Chinese drywall any day. Take a look at the pictures of California construction after the 6.7 Northridge earthquake.

As far as your “correlation” that “cost of owning property becomes further out of reach of the average worker†this is also off the wall. Just by eye balling the graph in the article I sent you, one can see that there is a reverse “correlation” to wealth and ownership. Four of the five wealthiest countries have the lowest homeownership. I would also suggest you take an introductory course in statistics. It would help you understand that correlation is not causation.

@MB

Here are some graphics of your “top notch” California construction.

http://www.nbmg.unr.edu/nesc/bobcox/slide2.php?id=16

Fulano:

Please read what I write. Provide a quote where I said the homes were being poorly built? I said nothing of the sort, yet you blather about construction quality and Chinese drywall. I said many of the homes were self-built. That is a fact.

Let’s try this again: Since you’ve lived in Mexico for over 20 years, what percentage of homes are self-built? what percentage of homes have multiple generations of families living in them? and how would this skew the homeownership rate?

My previous quote was “one of the byproducts of income inequality is a society where the cost of owning property becomes further out of reach of the average worker”

How would you evaluate whether the “the cost of owning property becomes further out of reach of the average worker”? Would you look at simply look at homeownership rate? Would it matter if countries that had generational families living in a single household skews the rate upward?

Perhaps a better measure of whether the average worker is getting closer or further away from future homeownership is the median wage to housing price.

@MB

I think you will find that the US side of the border has a more pressing problem with “self-built” homes. http://www.sos.state.tx.us/border/colonias/faqs.shtml

As far as Mexico, the term makes no sense. “Self-built” can be high quality construction or a lean-to. The Mexican government estimates state that one million families live in substandard housing. If you read the article above you will see that there are over 400,000 residents of colonias in Texas alone. This does no include the housing standards on Native American reservations. “There is a housing crisis in Indian country. Despite the Indian Housing Authority’s (IHAs) recent efforts, the need for adequate housing on reservations remains acute. One legislator deplored the fact that “there are 90,000 homeless or under housed Indian families, and that 30% of Indian housing is overcrowded and less than 50% of it is connected to a public sewer.†(March 8, 2004, Indian Country Today). ” This is in what was until recently the wealthiest country in the world.

The point you are missing is that there is NO correlation between income level and home ownership. In addition, there are close to 2.5 million illegal Mexicans immigrants in California and in total there are just as many Hispanics in California as “Whites”, 39%. Would this not skewer the home ownership rate in California upward due to their propensity to have multi-generational households?

Fulano:

I’m not sure what your infatuation is with the quality of self-built homes. Yes, they can be substandard or high quality. The point is that with the option of self-built homes, lax zoning or inadequate infrastructure, the homeownership rate will skew upwards. For example, Navajo County and Apache County, two of the largest indian reservations have homeownership rates exceeding the national average at 72% & 76%, but as you stated, many of the houses are inadequate.

In the former Eastern bloc countries, you’ll find amazingly high homeownership rates because state-owned housing was rapidly privatized allowing many citizens to simply occupy their former state-owned homes. Homeownership rates might be in the high 90%, yet their price/income ratio is in the double digits.

Closer to home, the homeownership rate in the US peaked in 2005/2006, yet I’d find anybody that would say 2006 was a good measure of “cost of owning property [becoming within] reach of the average worker” Far from it. I’d say homes were more affordable in 1995 when the homeownership rate was 5% less than peak, but the P/I ratio was only 3.

If we’re trying to determine a measure of whether or not a home is within reach of the average worker (which was my original point), I believe price/income ratio is a better measure than homeownership, don’t you?

Another I.E. price change alert today on a nice home, one of several the past two weeks, from Trulia and Redfin–this one on the market now for [76] days; and thus more anecdotal info, that the winds may have already started to change their vector?

Corona/Eastvale–more inventory, more days in play, more open houses, less frenzied activity etc.. I am sure there is some (late to the game) seller nail biting going on now….post-Labor Day.

…..Price Alert: Changed from $519,000 to $499,000

Upcoming Open House

Saturday, September 7, 2013 11:00 AM – 2:00 PM…..

Leave a Reply to What?