The worm is turning for investment real estate: American Homes 4 Rent posted a net loss of $14 million. Wells Fargo announces layoffs for 2,300 due to drop in refinancing activity.

It is no secret that Wall Street has been a big player in this current real estate run. The two biggest single-family landlords in this game are Blackstone Group LP’s Invitation Homes followed by California based American Homes 4 Rent (AH4R). The interesting thing about AH4R is that they own about 20,000 properties throughout the country where investors have been diving in head first. AH4R recently announced a $14 million loss and was also reported to be laying off people because of the recent loss. This is an interesting case study coming from the second largest single-family landlord in the country. It is also interesting to dig through the financials since it shows us that some are overplaying the rental game. Property management is an intensive business. Any investor with time in the business realizes that having one or two bad tenants can set you years back in regards to profits. The gross rents must look extremely appealing to those new to the game. Some are quickly going to realize that they may have overestimated their potential profits.

American Homes 4 Rent

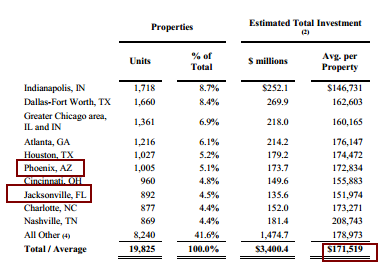

It is interesting to first see where AH4R holds their nearly 20,000 properties:

Source:Â American Homes 4 Rent

This is a fairly diverse portfolio. Based on the average price per property, you can see that they are buying at the lower range. However, in many of these markets, these are likely to be mid-priced homes. What you begin to realize is that there were definitely generous estimates on earnings here.

Even with the IPO in early August, there was a need to pullback:

“(Bloomberg) The real estate investment trust, founded by self-storage billionaire B. Wayne Hughes, plans to raise as much as $794 million in its sale of 44.1 million shares scheduled for later today. With aprice range set at $16 to $18 a share, the IPO is poised to be far smaller than the $1.25 billion amount estimated in an initial propectus by the Agoura Hills, California-based company in June.â€

Going from $1.25 billion to $794 million is a big deal. AH4R is currently trading at the lower range (last priced around $16 a share). The latest data is not all that pleasant especially after reporting a loss:

“(Bloomberg) American Homes 4 Rent (AMH) yesterday fired a group of workers, with a focus on acquisition and construction staff, after the housing landlord reported a fiscal second-quarter loss, according to a person with knowledge of the terminations.â€

Keep in mind the location of the properties here. These are in lower priced areas. Of course places like Florida and Arizona are incredibly over played by the Wall Street crowd. It seems like the rental game is not all that easy:

“Single-family landlords have struggled to turn a profit while acquiring homes faster than they can fill them with tenants. Hedge funds, private-equity firms and real estate investment trusts have raised more than $18 billion to purchase more than 100,000 rental houses in the past two years. American Homes 4 Rent, founded by B. Wayne Hughes, is the largest single-family landlord after Blackstone Group LP’s Invitation Homes, which has spent more than $5 billion on 32,000 homes.â€

Keep in mind that a weak underlying economy is going to directly impact the rental business. A large portion of the current action in the housing market is because of investors. Do you think these kind of trends are going to push more and more people in?

Getting out

I’m noticing more and more people getting out while the market is hot. There is an interesting post over at NASDAQ from an investor selling his property in Denver:

“(NASDAQ) Of course, all real estate markets are local markets. Until recently, I owned a single-family rental property just north of metropolitan Denver, where vacancies are at a 13-year low. Rents are also at a multi-year high.

I bought the property since 2003, and it’s been a solid income investment. It’s consistently provided monthly rental income of 15% to 20% above my costs. When my last tenants moved out, I could have negotiated a 12-month lease with new tenants willing to pay 20% more than what the previous tenants paid.

But instead of finding new tenants, I decided to sell the property. The reason was simple: I don’t expect real estate to stay hot much longer. Â

There are a few obvious reasons. Multi-year trends in both vacancies and rents are unsustainable. I expect more multi-family units will mean lower rents. That aside, the market simply looks and feels like it’s approaching a melting point. For evidence, look no further than bidding wars for homes that hit the market.â€

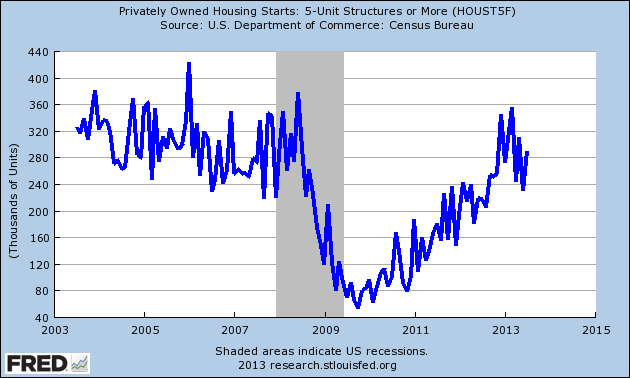

The above explanation ties in with the rise in multi-unit housing starts:

More and more rental housing will be hitting the market and people can only stretch their household income so much. What we are now seeing is investors selling into momentum; things are going up because they are going up. They are fully disconnected from underlying fundamentals.

And if you don’t think that rates have an impact on the real economy, Wells Fargo recently announced layoffs for 2,300 workers because of the jump in interest rates:

“(WSJ) Wells Fargo & Co. said Wednesday it is cutting 2,300 mortgage-related jobs across the country, a sign that a refinancing boom that helped boost the U.S. home-loan market and bank earnings continues to fade.â€

Combine all of this with crazy talks of apartment-to-condo conversions and we are reaching some sort of tipping point. The fact that more than half of purchases this year are coming from non-traditional sources really highlights that this massive flood of money into the market may need to think twice on the rental game.

The fact that some of these big single-family landlords are producing losses at a time when real estate prices are booming should really tell you something.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

65 Responses to “The worm is turning for investment real estate: American Homes 4 Rent posted a net loss of $14 million. Wells Fargo announces layoffs for 2,300 due to drop in refinancing activity.”

The Wells Fargo mortgage layoffs really is the tip of the iceberg.

October home sales will be the number to watch as these will be for escrows that started in August when interest rates stabilized at +4.5%. The Case-Shiller index for October home sales won’t come out until either November or December. That will be another number to watch.

And foreign buyers (i.e. China and Japan) have been actively dumping U.S treasuries and bonds during the past month. If it weren’t for the Federal Reserve purchasing these bonds that the foreign buyers have been dumping, interest rates would easily be pushing on 5% on the 30 year mortgage.

What many real estate recovery pundits do not understand is that the run up in real estate was triggered by interest rates at historical lows of 3.25%. Now that interest rates will be pushing 5% this will cause home selling prices to plunge. When that happens look for REITs and investors to head for the exits en masse. The Wells Fargo layoffs is the canary in the coal mine.

All these investment companies have done is to out market qualified renters from finding housing. Many of these brokerage firms have added outrageous requirements to rental contracts. In search of a new rental I have encountered: Tenant must purchase & professionally install security system to rental property before move in date. Tenant must purchase $400. thousand home owner policy and make agency co-owner and benefactor. Signed contract makes all tenant’s heirs (children & grandchildren) responsible for meeting obligation of rental agreement if death occurs. The investor says, smart add on and protection for me. All these do is make the thousands of renters run from corporation investment owned properties which results in leaving these rentals on the market for month after month after month with no returns. I believe a 1 year lease with investment return is better than all these games corporations are playing with investors money. The housing spiral affects the rental units that investors buy and with results that families seem to end up back at grandpa’s paid up house valued at $58 thou. This additional greed is what makes the downward spiral from bankers, real estate, investors, landlords, and it all affects average American Joe Smuck.

Not sure exactly how this relates to SoCal… This fund may be based here, but doesn’t invest here. Real Estate is local for the most part. Location, location, location!

As for refi apps… I would like to see the data on he number of homes refinanced with long term debt in the last 5 years. It makes sense that apps decline as rates increase.

People that have purchased or refie’d with low rates are less likely to default or even move for that matter. Even if prices decrease I believe those with the low fixed rates will stay put.

I think anything less than 6 percent is still a great rate historically speaking. I remember thinking I got a great rate at 9.85 percent on my first house!

Yes the market will slow down… But it shouldn’t take 10 days to sell a house. 120-180 is the norm. We are just coming out of a reverse bubble where prices plummeted way below where they should have been. The market needs to stabilize and flatten for a couple years before the next boom and bust.

When you see new product come to market in mass (like 05-06) that’s when SoCal will begin to boom.

We are not there yet.

Yeah right. Nobody has any money. Homes are minimum 10% overvalued right now, and that’s at 3.5%. $150k U S.A. median is and will be a good thing.

Plenty of money around. Just concentrated at the high end. So, good homes in good locations will be in demand, especially since not back to prev highs, factoring in abt 20% inflation. But, since now in the normally slow home selling time until May, some slowdown is to be expected.

Excellent overview/insight!! I have been feeling this for some months now; similar, to what I perceived in 2005/2006; and as opined in my recent posts herein.

The thesis sentence in this thread is: “They are fully disconnected from underlying fundamentals.”

And in this regard, those underlying ‘fundamentals’ (coupled with this current investor dynamic), are at a much more diminished/fragile state, than they were prior to 2006/2007. IMO.

Hi SoCal,

I, like you, have developed a feel for the markets and now, they do not feel right, again.

My wife has a thriving property management business and I am a realtor. We try to be honest with our clients but some just do not listen.

I always tell my investor clients that the first person they should talk to is their accountant, the numbers have to work and it is all about timing, The difference between lettuce and garbage is timing.

My wife tells people that owning an investment property is a business that you cannot go into under capitalized. Vacancies and repairs can surly affect your return.

I currently tell investors to hold on to their money until the numbers work. I imagine that will happen after the next correction

YOU ARE SO RIGHT. THEY WILL NEVER LISTEN TO YOU 99.5 % OF THEM. REAL ESTATE BROKER CALIFORNIA FOR OVER 30 YEARS

As a retired contractor, when a tenant moves out i sometimes wonder what this would cost me if i had to hire someone to rehab this unit. Well for a fact i have a pretty good idea.

If i figured in labor my, last bad tenant cost me $7700. Since my wife and me do all our maintenance and repair this bill was reduced to a little over $4k. I if tried to figure in all the general maintenance (lawn mowing ect.) that figure would be much higher.

Being a landlord for the last 30+, i can truly say i saw the handwriting on the wall when these REIT’s started and just wondered how long it would take before they got the message.

YOU ARE RIGHT. YOU HAVE (30+ YR IN REAL ESTATE ) A GOOD CHANCE FOR ADVANCEMENT IS CALL ( OPPORTUNITY OF A LIFE TIME TO COME FOR YOU AND YOUR FAMILY)

Going IPO is usually an exit strategy for big investors, not a move up in value for the underlying asset. Overly optimistic expectations on returns? Oh really? Never heard of that before.

Hi CAE,

One of my clients always says “show me performance, not proformas”

The writing was on the wall from the start. Buy up the distressed properties to initiate upward price momentum; then sell the inventory, not through the real estate market because that will cause prices to crash. No. Instead, sell them through the stock market through IPOs and leave the dopes holding the bag. Pump and dump – Pump and dump – Pump and dump. I hope they can’t unload and turn out to be their own dopes.

What we don’t know and likely never will, is who’s holding short positions on these REO to rental securities? I can’t help but wonder who.

Your analysis is right on target. The inter-market delays make it “work”, i.e. provide plausible deniability for the mouthpiece MSM outlets, and the platoons of financial “advisors”.

These “structural delays” aka “off-book capital reservoirs” aka “damping functions” are why it’s so difficult to model the real economy.

I guess at the proverbial end of the day, The Game only has to be good enough stay ahead of Duh clock-watching .Gov faux-Regulators.

Yep, just Ye Olde carny shell-game, with a fancy dress on… kickin’ the proverbial can, down the circular road.

Could it be maybe that the market determined that out of all potential asset classes residential housing was mispriced/undervalued and thus decided to jump in. The overall number of house sales remains relatively low compared to the historical run rate; mortgage lending remains tight and conservative; large portion of the sales that did happen were all cash/institutional buys; lot of people who would have liked to buy were unable to secure financing and thus had to rent and site on the sidelines. Market is now finding managing rentals is harder than expected. Pricing still remains lower than 2008 and a lot of people that would have bought between now and then have not been able to. The banks will put on their big boy pants, their greed will overwhelm their fear, they will get back into the lending game regardless of the base interest rates, and all that sidelined demand will show up. We looked at renting vs buying; buying was cheaper but financing was excruciating despite a flawless credit record and a big down payment. You guys I think way overestimate the impact of rates on demand. Doesn’t matter what the rate is if banks aren’t lending to anyone. The institutional investors saw this dissonance and exploited it. The Wells Fargo layoffs are a red herring; all refinancing people which is a lower risk business for them so of course they love it.

“You guys I think way overestimate the impact of rates on demand. Doesn’t matter what the rate is if banks aren’t lending to anyone. The institutional investors saw this dissonance and exploited it.”

I agree that institutional investors conducted arbitrage on the Residential RE market. But, it seems you are assuming that institutional investors already had all of their capital in cash just sitting around doing nothing. Most institutional investors got most of their capital from 1) equity markets (which are in a bubble due to artificially low interest rates) and 2) debt markets (which are in a bubble due to artificially low interest rates.) Low rates have an enormous impact on RE sales and prices…not only for ma and pa, but also for the institutional investors as well. Will the AH4Rs of the world continue to buy if equity markets drop or their cost of capital goes up substantially? Doubt it.

One thing I’ll agree with you on, is if the banks do begin to loosen up their standards once again, this bubble could go on for a couple more years. However, I don’t think they will do that this time around, because:

1) They know the public will not bail them out again.

2) Fannie and Freddie seem to be one step away from being dissolved, so the banks will not have anyone to dump the toxic mortgages onto.

3) I think the banks would rather continue hoarding cash, loaning money to multinational corporations, and making income in the rigged casino known as the stock market by investing in robots who trade algorithms with each other, and frontrun individual investors. That is much less of a risky business than residential mortgages.

I predict mortgage rates and Down Payments will continue to go up from here, whether the Fed tapers or not. Not good for prices imo.

They did, actually. All the PE guys, fund managers, etc were all sitting on hoards of cash, no money to make in corporate or government bonds, equity markets either at or above market, they were running out of ideas; best arbitrage opportunity was residential real estate, previously too messy and illiquid for that money. With the post 2008 overreaction suddenly all this great real estate was available for super cheap…houses beachfront Laguna at 40% discounts, etc. I’m shocked nobody figured it out before, actually. You can look at the % of holdings in cash among funds and see that the “hunt for yield” was a big problem. All starts with a low rate which is both a benefit to financing availability but a problem for people that need to generate a return.

TJ: “…if the banks do begin to loosen their standards once again, this bubble could go on for a couple more years. However I don’t think they will do that this time around…”

Yesterday:

“Proposed Mortgage Rules are eased

Â

“Regulators on Wednesday proposed easing a measure requiring lenders to keep a stake in mortgages that they securitize. The rules, designed to discourage the kind of risky loans that contributed to the subprime credit crisis, had drawn protests from housing industry participants and consumer groups.Â

The 505-page draft regulation written by six agencies drops a requirement that lenders retain a stake in mortgages with down payments of less than 20%.

The new version of the measure known as the qualified residential mortgage rule “will bring a measure of clarity and consistency to the mortgage market that will facilitate its recovery,†FDIC Chairman Martin J. Gruenberg said.”

Curiously, I have been seeing more ads recently announcing the return of “stated income” (ie, liar) loans. Have we come full circle?

YYZ… you got it right. Just look at historic affordability, still very low right now. Prices are still so low builders can’t even build a new house and make money.

@Whozit, “… Prices are still so low builders can’t even build a new house and make money…”

Wow…another real estate shill trying to drum up support on an artificially manufactured market.

If a builder built based on natural supply and demand, then they are doing fine. It’s the builders who bought on spec, and especially the builders who bought land and built on spec during the peak price years who are struggling.

1.) The number of households receiving food stamps (aka SNAP) is at an all time high.

2.) The number of persons subsisting on Social Security disability insurance is at an all time high.

3.) The national U-6 underemployment rate is 14%, not an all time but high close enough that it might as well be. California U-6 underemployment is at 18% and Los Angeles County’s U-6 is at 20.5% there is no true justification for naturally rising home prices.

If it weren’t for housing inventory manipulation by the banks, and interest rate manipulation by the Federal Reserve, home prices would be in an absolute free fall.

Builders don’t stop building because the cost of materials are so high they don’t make a profit . They stop building because of demand and supply. The materials and labor to build a house is not what stops builders. Never has been never will be

Robert,

Whozit is just stating a fact which is true and what you say is true, too.

What we see is a shortage of good buildable land in areas of high demand. Because of high demand and low supply, prices for land and building materials are going up. Whozit is saying that the total cost of land plus building cost is higher than the present market price for a house. I am a builder, too, and I know that to be true. Because there is a lack of construction in highly desirable areas, there is a lack of inventory of houses to meet the demand without pushing the price higher.

What you say is also true because the interest is lower than it should be in a free market and that creates artificial higher demand. Therefore, regardless of the reason for higher demand (both of us agree on the right cause), the demand is higher than the supply and that pushes the prices higher to the point where the cost of land plus the cost of construction is higher than the market price (we both agree that it is manipulated). That would allow a profit for the builder. Without a profit there is no construction. For the present, what whozit is saying is 100% true. In the future, it may not be, depending on how the market changes.

Sideline buyers, really? So those who couldn’t secure a loan with cheaper prices and low rates are going to swoop in and keep demand up? In CA most sidelines are priced out of the market so it is really up to investors to keep the bubble afloat.

While the real estate, itself, is not liquid, the REITs are. So the big fund guys, who already made their money when they took their rentals public, will do just fine. Their investors, however, and the mom and pop wannabe rentiers, who got caught up in the hype and bought too high, will get pummeled.

the great transfer of wealth continues…

When hedge funds and large investors “securitize” something, it’s so they can move out of it in lightening speed while making a hefty profit from both going IPO and then shorting it on the dump. This is so contrived and done so often that it’s a wonder the general public is not more aware of this scenario???

“This is so contrived and done so often that it’s a wonder the general public is not more aware of this scenario???”

Because Miley Cyrus’ rear end is quite distracting apparently.

I still think most of the REIT funds were bought by 401(k) administrators. It seems a very easy way to hide it, bundled with other funds.

At the risk of sounding dense, what’s a hopeful first-time homebuyer in the SoCal area with a decent down payment saved up to do at this point? Wait a couple months for interest rates to go up further and home prices to come down? Give up on this madness and rent? Know I’ll be screwed either way and go for it?? Advice would be much appreciated!

Hi NewBe

Do not stress over it, and do not follow the crowd and make a bad buy because it is your only choice.

Buying your home to live in should be based on your lifestyle for you and your family. The first question should be can you afford it without over extending yourself, the second is do you want to live there.

Buy location, buy what you can afford and buy to make a home for your family. Remember, renting is not that bad

I second what Bill said and add that you need to make sure you have a minimum of a 20% downpayment and that you can afford the payment. When/if you do buy, be ready to stay there or take a loss, the housing market is volatile in CA so think of a home as a place to live and not an investment. If you buy with this in mind you should be happy

Everyone has different reasons of buying or not buying a property at this crazy time. We just bought our first property last September. Our reason of buying might not suited your situation but I can surely share our story.

Me and my husband are both working since 2006/2007. We’ve missed the chance to buy a property in post bubble era before stabilized our income so we decided to rent for some time. We used to live in a single family house, 2 beds 2 baths plus a den, $1700/month, in a semi-getto area in Rosemead. Our street parking car got broke in once and got crashed into once during the time we lived there. We love our neighbors and landlord who is a handy man and always keep the house in a good shape in a promptly manner.

We were thinking of buying a property since 2010 but got really serious in 2012 after we realized we were still paying same tax amount as we were single. In 2012 we had to pay back 9k+ in tax because my husband changed his withholding (my withholding remained the same as I was single) in 2011 from single status thinking we should see the similar return since we have a new family member. Basically we got no tax break due to our income and no debt.

With a 417k load (max without going jumbo) we will be paying around $2800 plus property tax per month @2.85% for a 15 year loan. Our tax break will be around 450/month for first year. We found a condo, built in 2006, in a nice area and good school district, $140/ month HOA, move in condition, and after 20%down we don’t need to go for jumbo loan. Our payment including property tax and HOA and low maintenance it will be around $3100/month after deducting $450/m tax break. And out of that $3100/m we are paying $2000/m toward principle suppose we live there for 5 years. So we are basically paying $1100/m living in a much nicer area with larger space and newer facilities than $1700 rent we paid except we now have a smaller yard. To us it seems like a much better choice to buy than renting last year. But with the price jump up so high (at least 15% since last winter in my area) and up in interest rates right now, I am not sure if we would still make the same decision suppose we didn’t buy last year.

I have been a real estate state investor of small rental properties for over 35 years. I can not imagine owning thousands of single families and being able to manage the detail it takes to be successful! HUD had sold their suburban inventories because they could not keep costs down in maintenance! Time to short these REITs!

As for apartments-to-condos conversions. In my area (Suburban Sacramento) I am seeing the exact opposite! There are a few big condo developments around me that started in 2007 – they built 2 blocks out of 16. Then it died and the remainder of the complex has been growing weeds ever since. About 8 months ago they started building out the remainder, about another 180 “condos”. Then the developer announces they are ALL for rent. Every single one. I was sort of shocked since the real estate market has been so “hot”. The rental prices on these “condos” are outrageous. I mean I rent my nice modern 3 bedroom house with a 2 car garage down the street for hundreds LESS than what they are asking for these tiny little condos with rooms you seriously can’t swing a cat in. No I don’t have granite or espresso cabinets but I am on a great street, have a nice spacious yard and plenty of privacy. I literally laughed when the rental agent told me the rent prices. They have been for rent for about 3 months and about 70% are still empty.

I looked at some new homes to buy on the weekend. Courtyard homes which I quite like due to low maintenance. Same story: Land had been developed 2005 or so, they built about 20 homes then the builder bailed. Been empty ever since. KB Homes bought up the remaining 150 lots and are now selling. They started selling in March this year and sold about 40 homes. The prices listed on the sales sheet this past Saturday was $305,000 base price. I zillowed the development and very recently sold models of the same plan have been closing around $250,000. Funny enough the sales agent said I could “make an offer”. Also – the place was DEAD – prime house hunting time on a Saturday afternoon. I suspect since the FHA PMI changes and interest rate rise… affordability has shifted once again for most people.

I am seeing that more nowadays: the builder has a list price on the sales spec sheet but they accept “offers”.

I am crossing my fingers prices start to come down more since I am planning on buying next year/2015. And I want to pay as little as possible.

Interesting times.

My growing thesis is that you want to buy where there is price inelasticity. I define that by:

* Majority of buyers are homeowners interested in occupying the property.

* Buyer is well-to-do and relatively insensitive to interest rate increases.

* The quality of life is noticeably above average.

* There is a supply constraint, e.g. there area is built out already and large swaths of new construction is not possible.

* Purchase makes fiscal sense by either a) being in an industry hub and/or b) tax advantaged (e.g. TX, FL, TN, etc…)

I acknowledge that some of these are subjective, but in terms of long-term sustainability, I’d argue that these are the key ingredients necessary.

Unfortunately, I believe that a lot of today’s pricing–particularly in Southern California–reflects old paradigms, and as those paradigms get re-evaluated in buyers’ minds, so will pricing.

To wit, for So. Cal.:

* Majority of buyers are homeowners interested in occupying the property.

A PUSH. Lots of investor-speculators, lots of people who would like to own, but a questionable underlying economy may not make this feasible.

* Buyer is well-to-do and relatively insensitive to interest rate increases.

NO LONGER ACCURATE. The job gains in So-Cal are in the service sector while manufacturing, engineering, etc… are declining. The low-wage job is replacing the high-wage job.

* The quality of life is noticeably above average.

PUSH. I know I’m going to hear a lot about the beaches and weather, so I won’t argue this point, other than to point out that most properties are less than an eighth of an acre, mapped to an under-performing school, and either facing crime or commuting challenges.

* There is a supply constraint, e.g. there area is built out already and large swaths of new construction is not possible.

PUSH. As DHB points out, condo conversions are back on the way, and how many of us have seen these jail-like apartment/condo complexes raise density through the roof?

* Purchase makes fiscal sense by either a) being in an industry hub and/or b) tax advantaged (e.g. TX, FL, TN, etc…)

NO LONGER ACCURATE. It’s no secret that California taxes and fees are high. Aerospace is a fraction of its former self, and even the reigning entertainment industry is battling to keep projects local. Port of L.A. is still a plus, but with the widening of the Panama Canal nearing completion, it’ll have to compete against lower-cost ports in the Gulf of Mexico.

KR: I disagree with some of the points you made in defining what makes RE inelastic, but I like the analysis and premise.

I think taking SoCal as a whole is a mistake given the diversity and the range of prices encompassed in the region.

The assessment would probably be more accurate if applied to specific neighborhoods.

Take some of the affluent neighborhoods in LA. Beverly Hills, Santa Monica etc.

– rent/buy ratio is decidedly in favor of renting, yet homeownership levels are high because owning is desirable and seen as a luxury.

– buyers are definitely well-to-do and as such, simple measures such as median-income do not reflect the wealth of the residents.

-quality of live is above average. This is subjective so I’ll leave it out, but desirable areas are termed that for a reason

-supply constraint. Condo-conversions are a small percentage of additional supply. Other than buildable land, the biggest constraint is zoning. As the areas get more affluent, you’ll get more homeowners opposed to extra building/density or even transportation options that would allow for more density.

The places that fit the above criteria you’ve given aren’t limited to SoCal, and I’m sure there are pockets in TX, FL, TN that fit the bill as well. Historically you’ll probably find that these inelastic neighborhoods aren’t immune to price swing, but usually fall the least and recover the quickest.

>> As the areas get more affluent, you’ll get more homeowners opposed to extra building/density or even transportation options that would allow for more density.<<

The opposite is the case in Santa Monica. Houses in the most affluent areas — North of Montana, and even North of Wilshire — are pricier than ever. Yet there's also a corresponding, continuing development of condos, and even subsidized low income housing. Plus, the Bergmont train station is due to open in 2015, bringing L.A.'s train system into Santa Monica.

Despite the rise in affluence among homeowners, tenants control the city via the Santa Monicans for Renters Rights (SMRR) political group. SMRR has allowed developers to build ever bigger condos and apartments and retail outlets in Santa Monica, in return for agreeing to also develop additional low-income rentals, to keep the SMRR voting base large and active.

Homeowners don't like it, but even their wealth can't fight the lower-income SMRR voters, who've long ago reached critical mass and are politically savvy enough to keep it that way.

Son of Landlord:

Even in Santa Monica you can see the differences in the neighborhoods. North of Montana where the ultra-wealthy live you’ll primarily find R1 lots of at least 5k sq ft, and height restrictions of 32ft. Demand here is very inelastic. You’ll have a hard time finding comparable rentals, nor will interest rate fluctuations or local employment have as large of an impact here as the other areas.

Yes, the expo line does run through Santa Monica, but not coincidentally, the Expo line runs nowhere near that area instead running near the downtown (commercial) and mixed-used districts. Of course these areas would be more prone to be affected by interest rate hikes, employers in the area, and rent/buy ratio.

It’s a little to early write the obituary for AMH.

Given the infancy of AMH, obviously the cash-flow isn’t going to keep up with the number of acquisitions they’ve made. They still have a 45% vacancy rate after all.

You can see that they’re starting to switch the focus away acquisition/rehab by the parts that are being laid off.

I’m not advocating a purchase of AMH by any means, but in this early stage it’s way too early to use it as a barometer for the institutional SFH rental scheme as whole.

Buried in their SEC filing is this GEM that I quoted in my blog post

“At June 30, 2013, we owned approximately 17,949 single-family properties, approximately 9,882, or 55%, of which were leased.â€

We wish them luck in renting out the remaining 8,067 homes in a timely and profitable fashion.

http://smaulgld.com/the-recovery-is-worse-than-the-recession/

Bob Shiller warns on the the flipper mentality these days…20 city index is up double digits for 4th straight month…housing market in Cali is up and down decade by decade… the last time we had a normal housing market was the 1960’s…less interest in suburbs, more interest in living near public transit… housing market is catering to speculators and not healthy…

http://www.zerohedge.com/news/2013-08-27/bob-shiller-warns-none-real-housing-market-has-become-very-speculative

Been watching the market for a few years and this is what we are seeing in our area. Homes in south OC sitting longer, prices being reduced, a few sellers willing to throw in a flooring allowance, etc. Not the same scenario as it was in the spring. We are seeing more homes, from original owners, coming on the market. Went to several Open Houses this past weekend and many were already vacant. No big crowds either. Didn’t have any realtors telling us to “bring a check or don’t bother” as they did in the spring. New homes being built in Irvine and Rancho Mission Viejo to compete with resales. Perhaps this change is the end of summer slow-down but it sure isn’t a buying frenzy anymore.

@ Son of Landlord and MB:

I lived in Santa Monica from 1975 – 2011. Just my 2 cents – The city of SM has done a good job of coming up with so many onerous codes for the manufacturing and industrial businesses that they are leaving the city. You may notice that most of the industrial properties (formerly low traffic and low residence areas) along the Broadway, Colorado, Olympic corridors are being transformed into mixed use and low income housing corridors. More taxes for the city coffers but horrendous traffic problems for its residents.

>> The city of SM has done a good job of coming up with so many onerous codes for the manufacturing and industrial businesses that they are leaving the city. <<

I think Santa Monica wants to replace manufacturing with entertainment and high tech companies. Santa Monica claims that it's widely known as "Silicon Beach" because of all its high-tech industries, though I suspect that that's just their own PR.

Wired magazine did a story a while back on all the cities around the world claiming to be Silicon this or that. There are several claimants to the Silicon Beach title, including Santa Barbara and some city in Australia.

I live in a Santa Monica condo. I'm looking to move, but can't afford a house North of Wilshire, much less North of Montana. I can afford some of the houses on Dewey Street, in Sunset Park, right at the end of the airport's runway — but what idiot wants to live at the end of an airport runway?

I'd appreciate any advice from Dr. Housing Bubble on cities not experiencing a bubble. Like many Californians, I think about moving to Portland or Seattle. Don't know if I will.

I love this blog and am currently saving cash and waiting until housing prices in the La Crescenta area at least somewhat makes sense (near rental price parity). As I try to read the tea leaves I’m hoping some of you far smarter than me can help me understand what may potentially happen with the REITs when prices soften and their share price moves even lower? In my imagination I see home prices really dropping when REITs dump their inventory back on the market they overheated. Is that likely at some point or will REITs just not investing anymore cause prices to crash? Do they have to sell inventory if their share price moves too low? I haven’t been able to find this info anywhere on how REITs implode so I’m hoping someone out there can pain a quick picture for the rest of us. Thanks!

Yes, in a normal market a fund manager will freeze/lock the fund and you will have to submit a request to sell and wait till the fund is able to sell underlying assets to offset the redemptions if there is a massive net sell off. I know this because it happened to me the last time around with a commercial REIT. Luckily, I made a large amount of money and exited relatively early so I came out on top. But the majority of investors did not do so well.

This has been my concern from the beginning with a large amount of “All Cash Buyer†fund managers selling the crap back to us, but a strange thought just crossed my mind. What would stop the Fed from purchasing shares of these funds to stop the bleeding on the next crash? Just a thought!

True2it, I agree with you that rental parity will be the ultimate measure of when a good time to buy is. If you have all your other ducks lined up in a row (down payment, stable job, emergency savings, housing DTI in the 25 to 30% range), if you are anywhere close to rental parity…it’s time to start looking. Others on this blog are hoping for huge price drops in desirable areas, good luck with that. Hoping that today’s 600K house will sell for 300K sometime soon will be a fool’s game. Good luck.

Agreed. In todays world of fiat money and global capital movement, desirable real estate in CA will always attract money. Too many people and too few areas, equal a level of demand that’s always waiting in the wings to purchase something. Plus, many of these areas have people with enough money to weather many storms and thus will not be forced to sell. It’s the middle and lower class areas that get hammered as they represent the real economy……and that’s in the toilet.

I hear what you’re saying Blankfein. My tea leaves tell me that the current price increases are completely unsupported and we will at least return to 2010 levels or below fairly shortly. Depending on rates, prices were starting to become somewhat sane before this current boom so I’ll keep renting and saving and see what happens in two years and then pull trigger no matter what. If prices are still high, I’ll believe they are supported and jump in to get what I can, and if they have fallen out of the sky I will be glad I waited. Thanks for the feedback and good luck to all in these crazy times!

We’ve been debating on whether to keep saving and buy something here in L.A., or move to another city/state (I work from home,) but we may stay put for a while and feel things out. We’ve been renting a 1400 sq. ft. house in the hills of Studio City in a great K-8 school district, and home prices have shot up so much that our rent is probably $1.5k-$2k less than a monthly payment on the same home would be if we were to buy. We’re only spending in the 25%-30% range of our income on rent, so I think we’ll just sit tight and see what happens over the next few years. Plus, our landlord is great and she’s yet to raise our rent.

It’s tough to keep holding our cards, but this market just seems crazy.

Id stack my chips. I cant see a huge advantage for you to buy under your circumstances. Markets are breaking down everywhere. Even the MSM seems to note that housing is overpriced more n more. The risk of purchasing now outweigh the benefits. I keep hearing to buy when ur near rental parity, yet no house in LA or studio city is near rental parity. Its like saying buy a house as long as you see a unicorn grazing on the lawn.

One more quick point. Its bs that homes in prime areas dont go down in the 600k to 1mil+ range in LaLa during downturns. My friend bought for 900k on bronson right next to paramount during bubble 1.0 and his house was in the 600ks when the crash happened. Another friend on edinburg and a little north of 3rd saw his 1mil house go down a lot as well. I wouldnt call those folks middle class. Sounds upper middle or lower upper to me. Cant speak to bev hills, but my hunch is less than 1% of the folks on this board are looking to buy a bev hills level home. Im not saying i can predict the future, but lets at least get past facts correct. People are looking at this board for advice on life changing decisions. Its not right to be so misleading.

Thanks, I think you’re right. Our current Studio City rental was below rental parity when we moved in a couple of years ago. Now the difference is just absurd.

FTB, rental parity was there in many areas in the 2011/2012 timeframe. I would guess to venture anything 600K and lower in somewhat desirable areas was at rental parity…this can’t be refuted. When we start talking about properties valued in the 1M plus range, forget the rental parity equation. You are paying and always will pay a premium to own in these price ranges. People wanted blood and insanely low prices, due to the super low rates those prices never materialized.

I am seeing more properties come on the market in my neighborhood. Sellers are getting greedy and they are starting to sit longer. However, they all eventually sell for quite tidy sums.

Lord b-its 2013, not 2011-2012 (which you seem to focus on in many of your posts). No one needs advice on how to purchase a house two years ago. They need to know abou purchasing 2/3 of the year into 2013, after houses are up over 30% in a year (even more since 2011). Rents have not risen the same percentage.

FTB, people didn’t get the message a few years ago and will now have to wait. The big question is “how long will this wait be?” 6 months, 1 year, 5 years.

I previously gave an example of what has happened in the last year regarding monthly mortgage payment. With the price increases, rate increases and having to get a jumbo loan instead of conventional…payment went up over 40%. That is astounding. The message every potential buyer needs to understand is that the next time homes are anywhere near rental parity…YOU NEED TO BUY PERIOD.

Since REITS are liquid assets, investment firms can quickly take advantage of the gain in home prices by passing the debt onto smaller investors who think REITS will increase in value. Once home prices go back down, the large investors can sell the properties at a loss, thus passing those losses off to the small investors who originally invested in the REITS.

The game never changes, it just presents itself differently.. They’re always in search of the greater fool, and trust me, he’s out there.

Article from Reuters on US housing easing up on lending regulations:

http://www.reuters.com/article/2013/08/28/us-usa-housing-regulations-idUSBRE97R05L20130828

Hey Doc, check out this for flipper mania..

This house in the shabby West Adams sold for $355K in April and now with a remodel is listed at $720K. Wow, this is the most insanely priced flip I have seen in the Western LA area yet. And looks like they removed the bars on the windows as part of the remodel… but that neighborhood warrants bars on the windows and double glazing for freeway noise too!

http://www.trulia.com/property/3114060951-2232-S-Orange-Dr-Los-Angeles-CA-90016

Doctor Housing Bubble,

Current times remind me of how things were prior to both recent crashes. There seems to be almost a religious fervor on the belief that things are different this time. I am sure you remember the discussions about how PE ratios don’t matter anymore or how income doesn’t matter anymore. We now replaced the mantra with “all cash buyer†as if a supernatural all cash buyer will ensure an endless boom. Busts are so 2007. Everyone is pumping their own asset position. Real estate investors rambling on why housing will be stable, bond holders explaining why bonds will have lower yields going forward and don’t get me started on the stock market pimps.

All the while we seem to be up against the Law of diminishing returns with Fed intervention. The Fed creates a dollar of new debt and the economy only grows a single dollar. The idea of stimulating economic growth is based on the multiplier effect. Are you really getting anywhere when you spend a dollar to make a dollar?

The Fed has been moving deck chairs on the Titanic and I am not clear how these actions can stimulate sustainable economic growth. The reality is that wages have been stagnant for many years maybe even decades. There has been quite a bit of economic activity based on the growth in debt but debt growth is not sustainable. I wonder if we are at the end of the great debt boom.

The problem is that there really is nowhere to go to protect yourself in the next downturn. All assets where inflated with endless debt. This means that, like last time, most asset classes will slide at the same time. Further, what can the Fed do to stimulate the economy when the next crisis occurs? Interest rates are at zero and bond buying is no longer stimulating economic growth. World markets are already showing signs of fatigue. I am not claiming an end to the world but I just can’t see how the Fed can get us out of the next recession which by my clock is just around the corner…

Man, you guys way overthink things. The primary determinant of demand is going to be if the traditional lenders (and subsequently the whole non traditional world) start lending again. They’re just not right now. If people can get access to credit they are going to borrow money, plain and simple. The institutional guys are going to stop putting money into residential once the arbitrage opportunity goes away and/or/if they can find a better yield elsewhere. I would say that’s happening right now. The median LA house price middle of 2007 was lower than now, and that was at a fed funds rate of around 5%. The run rate as per # of transactions was about the same.

Sorry, that should read LA house price middle of 2007 was HIGHER than now.

YYZ:

I’m also focused on the 600k-1M market in West LA, which I believe we agree is by local standards not quite even upper middle-class.

Consolidating previous comments, I think your thesis is roughly as follows:

1) Institutional money inflow is tapering because at 3Q2013 house prices, there are better yield opportunities –> demand impact is only somewhat negative, as local cash flippers will take up the slack.

2) Despite a) many markets being mispriced relative to fundamentals such as local “rent parity”, (i.e. due to the ability of “desirable” locations to attract buyers independent of local economic fundamentals, ACTUAL rent parity in places like WLA will simply NEVER occur) and b) the poor performance of the AH4Rs of the world, do not expect housing already owned by institutional money to be dumped on the market. The end-game is to offload the risk to groups of investors who will never be able to coordinate sufficiently to make the call to cut their investment vehicle’s losses (as we have previously seen in the RMBS market). Therefore, current mispricing and poor investor performance –> supply neutral.

3) “The taper” and related rise in base rates –> demand neutral, because lending was already “off” and most of the sub-affluent targeting the 600k – 1M market were already experiencing down payment lock-out, which is why sales of existing homes to unconventional buyers is at an all-time high, while those to first-time buyers is at an all-time low.

4) If proposed rules allowing lenders to pass on 100% of the risk of a zero-down mortgage (provided TDTI Demand impact very positive.

So on balance within the local market we’re interested in, you do not expect a flood of inventory to hit the market, you do not see demand taking a big hit either due to institutional inflow easing nor due to rising rates, so the real wild card is lending, and which way this goes is purely policy driven.

The way I see this last point is that it’s a no-brainer that we’re back to the races. Banks want to get their risk-free fee-generating machine back, the US gov’t will do anything to help banks earn their way back to solvency (hence financial repression) and as rising rates will have some impact on affordability and therefore prices for the 50% of current sales to non-cash buyers, relaxed lending standards is an attractive short term policy because this new demand will offset the taper in its impact on keeping the bubble inflated. And that the bubble *should* remain inflated is a given, because this allows us to remain in the land of “backdoor” bank bailouts rather than direct ones. Unwinding this “safely” (via a level of inflation acceptable to the bond vigilantes) is probably a 20 year project, so I’m not expecting what seems like “fair” prices anytime soon (unless I move to Akron Ohio). Once bank balance sheets are solid, chain of title issues have long since been papered over, and a significant proportion of baby boomers have cashed out of the market, only then would I expect to see the government attempt deflate, tuning lending policy and interest rates such that the market goes sideways in nominal terms (down in real terms) for an extended period.

Is this all your view, more or less?

Leave a Reply