Where is the real estate inventory in Los Angeles? With prices rising, where is the new added supply going to come from?

One of the oddest things about this current housing market is the dwindling amount of supply. For areas like Los Angeles and nationwide, total housing supply has been on a downward trajectory since 2010. While an environment of rising home prices, less supply, and hungry buyers would lead you to believe that more home building would be occurring, not much of that has actually happened. Only recently have we seen the trend reverse nationwide and some areas that are in full mania mode like Irvine and Pasadena are seeing some inventory expansion. This is an interesting trend because it really highlights the consequences of allowing banks to essentially circumvent historical accounting standards and the use of the Fed as some temporary bad bank for loans. Constrain supply and demand (certainly prices) will rise. Punish the dollar and make access to debt via low rates a method of growth. So builders are walking slowly into this new environment trying to read the tea leaves. Los Angeles inventory is still at record low levels however. Where is the inventory going to come from for a county of 10 million?

Los Angeles inventory

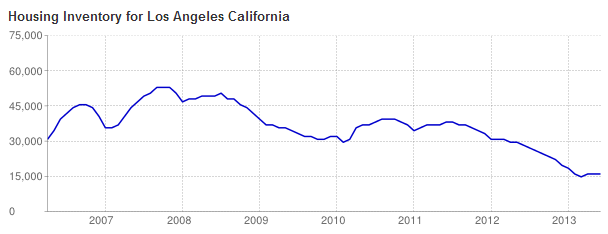

Homes for sale in Los Angeles area are down more than 50 percent from an already low amount of homes for sale in 2011:

It is interesting to read why others are buying into the market today. Reasons given include: can’t beat the Fed, never going to make more land in LA, incomes don’t matter, and everyone in the globe wants to live here and every other area is second only to LA. As an L.A. native, I actually enjoy living here. Yet some people are buying not because of it being a wise investment choice, but more of an emotional one. So be it, that is the housing market for you but that is different from buying a $150,000 home in many parts of the US versus a bathroom sized Great Depression built home for $700,000 and financing every penny into it. Of course, some people forget that Southern California is largely an open desert with massive importation of water and you only need to drive one hour inland to get a taste of what is known as desert living. So I don’t really buy that argument that suddenly people discovered that the weather is nice in Manhattan Beach or Newport Beach. What I do buy is that most people think they should live in very prime areas like Pasadena, Culver City, or even Irvine for that matter. We’ve already proven that when it comes to financial amnesia, we are willing to start another housing bubble on top of one that is still warm in the bed. People do realize that L.A. County and Orange County have hundreds of cities right?

So supply in very desirable markets is tight. This we know. We also know that people are willing to leverage every penny they have to purchase a home and leverage is very high thanks to low interest rates. Yet that game may be slowing down and hitting the bottleneck of incomes.

The demand at open houses while nuts, is not reflected in what people can pay. For the last few years we’ve had the fuel of big money investors, FHA stretched buyers, and those that recently discovered the added leverage of seeing mortgage rates drop from 6 to 3 percent. The typical 30 year fixed rate mortgage is now above 4 percent. So it is hard to see how much lower we can go given the rates we are seeing are now creating multiple years of negative real rates. This is largely why we are seeing supply in markets like Irvine increase.

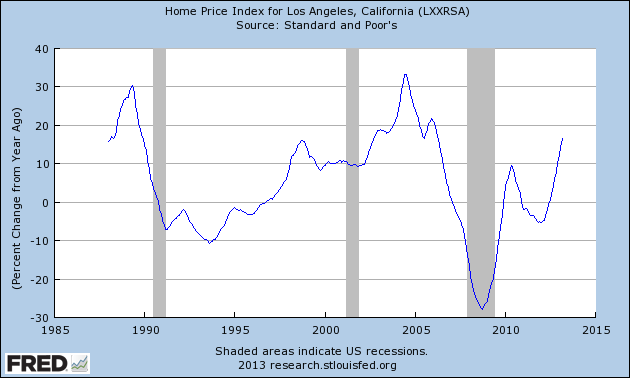

One thing is certain and that is that low rates and very little supply have caused real prices to go up:

For the Los Angeles area including Orange County, real home prices are up on a year-over-year basis by nearly 20 percent. This is unsupportable on multiple fronts for a variety of reasons unless incomes pick up or interest rates go below the 3 percent threshold. What we now see with flippers is people selling for pure quick gain. This can only go on for so long. Flipping at the levels we are seeing today reflect a market that is very close to overheating. Did we not learn that lesson from the last few years? Rationalization is a funny human tool.

I’ve seen the argument made for rental parity many times but this usually only works if you come in with a large down payment (not many have this and those buying all cash are buying for flips or you also have some foreign money buying in targeted markets as a hedge for domestic changes in their own economy). A modest home in many of these prime areas would require a $150,000 to $200,000 down payment just to make this happen. Otherwise you are held to FHA insured loans and these are now very expensive causing the real monthly payment to be closer to what it would be with real rates at 6 percent.

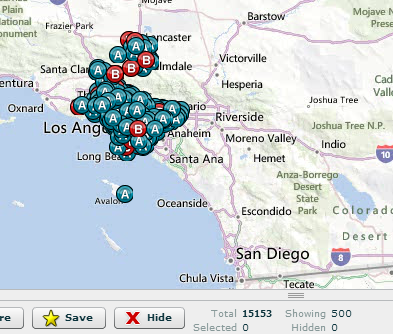

While inventory for the Los Angeles area inventory at 15,000 we find that over 15,000 properties are in some stage of foreclosure (the same amount as actual available homes):

Given the high prices in the market, I’m sure more banks are now going to push to sell select foreclosures given that they can jump into a very constrained market. Where will supply come from? Hard to say but these prices are certainly going to get the attention of fence sitting banks and sellers.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

56 Responses to “Where is the real estate inventory in Los Angeles? With prices rising, where is the new added supply going to come from?”

Here is how I foreseen how this next bubble works its course. Benny boy will not raise rate, Jenny girl who picks it up from Benny boy will try to hold the rate low as long as possible. What they are doing is intentionally building up cushion for property bubble to fall back on, if it inevitably ever go to burst. What they are hoping for is, “please dear bubble do not burst while I am the chairman of the FED, best luck to the next sucker who would have my job!†During the meantime, STAGFLATION intensifies. As the stagflation pressure builds up in the cooking pot of US economy, a ‘global event’ will trigger interest rate hike globally in the next couple of years (could be longer). A classic example of human manipulation of market overcame by natural force of market itself. Global interest rate hike will puncture property bubbles cross the world. Oh well, U.S. will suffer, but other countries will suffer much more. As long as we are the best out of the worst, everything will be all right. Who is suffering in this train of events? Average Joe who hold cash, or who buy ‘asset’ at its top price range.

Ben has recovered housing and established real estate price stability (simply due to high volume of cash buyers).

I would say housing has recovered. But, the next housing bubble popping will be due to a more catastrophic event, which Ben has successfully pushed onto his successor, which is US default either at federal level or large municipals, or both.

With interest low, Ben’s exhausted all his arsenal, now just hoping for a revolutionary new industry to save the economy. The odds of that happening is rare, but possible. So at a high level, there are two outcomes, in the next 10 years.

#1. 10% chance, that something revolutionary saves the economy. E.g., if “graphene” was able to be manufacturered at a large commercial scale, it’ll affect all aspects of our lives, and will create more jobs than it replaces. This can save the economy, and help reduce debt.

#2. 90% chance, economy does not generate enough steam, US defaults, triggering systemic panic, popping housing, and other asset bubbles. The next Fed chairman needs to start planning on how to sugar coat a US default, perhaps calling it something else. Hyperinflation will not be an option, the people won’t allow it. US is likely to default 5-10 yrs from now. China is already hedging a US default, by buying up US real estate.

Recovered? Depends on how you define ‘recovery’. If your definition is solely based on prices, then in some areas of the country prices are up. Should we really hope they ‘recover’ to the level they were at the height of the previous bubble? Is that really our measure of housing market health?

It cracks me up when realtors say, “Well, the price of this house may seem high, but it is not as high as it was in 2006…”

Right.

Solar energy is starting to reach grid parity without use of subsidies in places here and abroad. Iowa is kicking up its wind portfolio to around 25% of its grid and is projecting cost savings secondary to such. Old school utilities are starting to discuss in their reports that life as they’ve known it for the last 100 years is about to change and they’re in the very first ‘adapt or die’ stages. Third world countries are leap frogging fossil energy and going straight for renewables. There’s a private company over in Germany that makes batteries that can be charged in a matter of minutes and holds enough energy to push around a car for 300 some miles. Lots of disinformation still clouds legislation and the media, and there is a hero’s effort on the part of Koch Industries, Exxon, et. al. to slow down the growth of renewables, but it seems to me we at the very first step of a revolution.

If rates start to rise, consistently, this recent party will be over by the end of this summer. I’m seeing it start to stall in my area already.

Long-term, that definitely has to be the case. I just wonder what exotic mortgage products we might see to “help” the market. When I bought back in 2005, I got a “pick-a-payment” jumbo mortgage at 200 basis points over prime, i.e. 7%. $900k mortgage for about $2k a month if you went with the “negative equity” payment option. (Less than interest-only.) Maybe Fannie/Freddie has enough faith in the housing “rebound” to offer such products this time.

I saw Bruce Norris speak the other day and he said there’s no RE bubble in CA and that the price rises will continue for at least another year. He’s called the CA RE market very accurately for the last 15 years. I have to admit that lending is still conservative and cash buyers are all around….does a bubble need really easy money in order to expand? It certainly helps. I’m guessing that the RE market flattens out by Fall as hedge funds are about done buying and rent parity deal are getting harder to find while interest rates are creeping up.

I still think a lot of investors making 2% are going to have to rotate out soon or risk losing principal. The Fed is pretty clear on our trajectory on interest rates.

Dunno if you guys been watching but Keith @ Housingpanic made his first blog post in over 2 years. He called it on the dot with the crash, and then the bounce, and now he says it’s only going to go straight up in the near future. Those that waited on the sidelines are screwed.

Japan’s not the model, Vancouver is?

Keith of HP became an Obamabot in 2008. Changed the comment system on the blog and went libtard. I suspect that’s all he was from the beginning ayway….

The bottom line in what the true constraints in inventory are is total units vs total population minus what is siphoned off by multiunit rentals (fundementally different than residential RE) and formation of inhabitant superclusters (multigenerational households, boomerang children). Anything else is just lag time in inventory coming to market.

That said, I was expecting this echo bubble to top off in fall 2014, but I am starting to think, at least in CA, the top is now. What I am hearing at the coffee bean by everyday people is that it is a great time to sell, not a great time to buy. I hear about houses falling out of escrow. I get the sense that market sentiment has changed. The next three months will tell. It feels like late 2006.

It only matters what people THINK will happen. Belief that we are at the top will make this the top. Rising interest triggers a lot of people to think a phase change is imminent and they better get in front of it – so they do – and cause the phase change. Let’s hope panic selling begins, we need to get back to high inventory and a buyer’s market so we can flush out more quickly.

I wonder if the average seller actually figures all of that out. My guess it’s a function of what Zillow says their home is worth…”Hey, I ‘made’ $100k, so that means I can go roll it over into something nicer…'”

Ak, comparing 2013 to the 2006 housing market isn’t very relevant. During the bubble years, people where taking no down interest only loans and were easily willing to walk if things imploded. This was a no brainer back then because you could rent for much less than the cost of ownership. The same is not true today. Most weak hands in the housing market have been long gone for years. Most recent buyers have been cash, large down, great credit, etc. These people are not going to give up that easy. Another big difference between now and 2006 is that the monthly cost of ownership has went way down and rents have defintiley increased, so the “we’ll just rent for a few years strategy” doesn’t make that much sense anymore.

Your anecdotal evidence of people saying it’s a great time to sell…what is their plan after that? Move out of state, rent, downsize? With all the economic headwinds we are seeing, I think many people will just stay put for the time being. This might lead to unusually low inventory for the forseeable future. Just my 2 cents.

As you point out, the reasons for the inflation of the current bubble (low rates, cash buyers, low inventory, etc.) are very different than the reasons the bubble inflated in the mid 2000s. Many of the buyers today have skin in the game vs. those that didn’t circa 2006.

Thing is, savvy investors will take their profits and move on when market conditions shift and better opportunities arise. We are already watching some of the bigger players roll thier properties into REITs and quietly head for the exit.

IF there is a race for the exit, this time by investors cashing out before they’re left holding the bag, the results could be similar to the last crash. The players are different, but the outcome might look pretty familiar.

You were told to STFU until you understood the basics of finance, which you epically failed.

There is no difference in bubbles when the causes are the same: cheap credit. Combine this with gallactic stupidity like yours and you have bubbles, whether they are in 2000, 2006, or 2013.

And look at the yields (especially the belly) now. The 10 year note is 2.5% Where is your “don’t fight the fed” mentality? The bond market *dwarfs* the fed and it is finally acting.

Look at you now – all back of the bus ‘n sheet. Complete idiot!

Variance doc-my hunch is you read zerohedge based on your financial language, like I do, and you clearly understand the fact that markets eventually dictate. However, im curious if your comment is specific to certain areas of the country or is a nationwide prediction? Your logic needs to tie together, imo, to local housing reality which is not necesaarily same as holding stocks or bonds. If housing does start going down, sure instituions could race for an exit or those that bought since the crash as they may be sitting on equity, but what about everyone else? Would or could the average joe (the bulk of every market) sitting on negative home equity sell? Are you predicting mass foreclosures again? Its not a piece of paper like a stock where someone can sell it so easily at ther whim and with no selling costs like a home. You also need a place to sleep regardless if you own or rent; stock is a luxury; not a necessity. Therefore, i see more downside home value risk depending on the type of buyer in ones local area since the last bubble crashed. If your area has more flippers buying from flippers or more big institutions, your risk is much higher, imo. However, most of the country isnt like that, although its hard to see that if you just read blogs like this.

Also, although i and you know we need to end qe for a variety of reasons, if the economy starts truly crashing, big ben (or yellen the ultimate dove) will try more qe (go look at marc fabers talk on bloomberg yesterday). It may not work (as qe is less effective each time as heroin addicts need more to get the same high), but legacies are at stake so to think stimulus ended last week by the fed speech, may prove naive. A lot of what is playing out could be testing market reaction.

Lastly, and not saying i agree with it, but banks could potentially lower lending standards to increase demand. Not sure if they want that risk, but a whole pool of folks are on the sidelines, waiting to buy (stupidly or not), if allowed to via access to credit.

As i write this i feel schizophrenic/bipolar because even though every ounce of me thinks housing should crash, especially in cali, i still see signs that it MAY not for some time, especially nationally. What if mortgage rates dont go much higher but level off under 5% and a bank account still only pays 2% on savings (punishing the hard workers and pensioners like the bastards they are)? What if a slowly dying america still looks like the best pig with lipstick? What if everyone who wants to sell, cant or gets cushy deals again not to sell and to squat?

Anyway just my rambles as i love when everyone acts so confident in the future, especially when we’re trying to talk timing and not just that housing will go down. On a lighter note, saw ‘this is the end’ last night. Finally some out loud laughs in a comedy. Check it out and maybe the housing stress will subside for 2 hours. 😉

Variance Doc, good god is your wife threatening to leave you because you refuse to buy? So you come to sites like this and blow off steam with anybody who doesn’t agree with your opinion. I mentioned this to you before, you did a good job of reading economics and finance books. Unfortunately there weren’t any chapters on what has transpired in the last few years.

The 10 yr at 2.5%. Holy crap that means rates are at 4.25%. It truly is the end of world. 🙂 As I have preached before many times, buy at rental parity or below…AND YOU MISSED THE BOAT! I sleep really well at night knowing my payment is locked in for the next 30 years in a prime area for a little over $1800/month.

So when your little fantasy world of economic chaos plays out and rates skyrocket, what is your plan? Do you plan on scooping up that 50% off bargain in Manhattan Beach? You likely won’t have a job if all hell breaks loose and you won’t be buying anything unless you have all cash (which I highly doubt you do if you are wasting time on this site). I think I hear your wife yelling at you again, you better smooth things out with her…maybe a nice vacation to distract her housing wants. 🙂

As a reply for Dom regarding “savy investors will take profits…” I guess the investors really showed up in lower priced areas, I see NO signs of big investment groups scooping up properties in the prime areas. Again, these areas will be insulated from big losses just as before.

@FTB

Yes, ZH is a good site, but there is a lot of smoke ‘n mirrors and BS there too. You cannot take too much of that seriously. At the end of the day, you have to look at the data. That is, the real data, not the .gov data, which has been twisted enough to tell/sell the corporate/government fairly tail to the narcissistic, delusional and math-challenged serfs that occupy the US. You must also apply sound economic reasoning a-la the Austrian school to the data (which they do not do; much to their failure, but that is a whole different story.)

Stop drinking the real-a-tard cool-aid. Repeat after me, real estate is NOT LOCAL. Sure there are variations, but at the end of the day, wages are GLOBAL and that is what matters for price level support. Let me repeat: price levels are a function of wages, that is, real production; credit is NOT money!!!!!! What you see now are severe distortions of this economic fact by the cheap credit available.

The wages for the same types of jobs are roughly the same throughout the US. So when you look at the median household income in SoCal vs. the mid-Atlantic, they are roughly the same, yet median housing prices in SC are much higher (the median is a robust statistic which measures central tendency; much more telling that using the “averageâ€).

How is there this discrepancy? Easy, it’s leverage; especially cheap leverage in which there is virtually no shortage of stupid people to buy in; people with slick sounding phrases “Hey, you have to live somewhere…why not buy…housing is only going up, better get in NOW.†Look, there is no problem with buying a house if a person’s balance sheet allowed the purchase and that balance sheet reflected a safe capital reserve against losses (i.e. a devaluation of the house, a.k.a a consumer durable – not an investment!) However, the reality is that households are in no position to buy houses at these elevated prices – just look a wages vs. housing prices for a start. Look at the labor force participation rate – where is the recovery again? The US savings rate is pathetic.

What cannot continue for ever, will not continue for ever.

In a nutshell, the private Fed will not stop QE. Ever. They have painted themselves into a corner. Soon (I will not put a time or date stamp on when – that is a fools errand), there will be only two things that will happen. One, the Fed takes away QE, markets tank, interest rates rise (selling of bonds – the market goes bidless ‘till pennies on the dollar) = game over. Two, these guys print ‘till they wake the dead (read – average ‘Merikans) leading to a loss of confidence in the dollar (hyperinflation), interest rates rise to reflect the true price of credit = game over. These are the only two possible scenarios. People who are not hedged with globally recognized assets (e.g. PMs, energy products, productive land, etc.) will be wiped out. Worrying about the number of foreclosures, who is going to repair the pot holes, etc., is just picking up pennies off of the rails in front of a two mile long freight train.

Hedge accordingly.

I can decipher bs stats and nonsense as well on zerohedge, but i have to say that you are regurgitating bits and pieces from articles there, whether intentionally or not. Talk of precious metals, farmland, etc with a hint of acopolyse. I get it. its hedge to productive assets (although some would argue if pms fit as well (will people trade food for a shiny rock if the acolyspe is here (maybe/maybe not). So then is it just rich land, farming and oil barons? If people cant afford things now, how are they buying a farm. D paying fo gas to commute to their job in the meantime? gold? how much is someone wiyh debt buying besides a little here and there like shmigel from lord of the rings. Is there civil war going on in your prediction? Global war? Is our govt tAking utilities back? What about the farms you buy? maybe they would change the taxes there. what if the govt goes around like they did in the past and make it illegal to hold physical gold? Should i start stockpiling gas in my shed bc if hold contracts are worthless (buy the pm) dont i need to store actual gas and oil on my property? I just wanna be prepared. Can i get an approximate date? What do i pack? Of course we should crash and the world is bullsht. Its been bs for a while though, no? Sure. Maybe it comes to roost soon, but there are lots of folks that would prefer the world not to end. They like selling sht to idiots and buying stupid sht themselves. Maybe we go down hard, but maybe not quite mad max thunderdone style.

PS: i live in texas, not cali. During the last crash home prices went down a whopping 10%ish here and it lasted not so long. If it goes down 30%, i dont sell. If my life goes to absolute sht, i guess i blow my brains out. At least i wanna have some fun along the way before your end of the world.

I totally agree. I sold in October 2012, which was a bit early, but I’d be pushing that elephant out the door now if I was still trying to get rid of my house. I remember, back around 2000, thinking that I’d better buy now because housing price increases outpaced my salary increases. Nowadays, I think the simple reality is that wage stagnation is here to stay, so the housing market will have to adjust. There’s a limit on just how many exotic mortgages are going to be created nowadays by non-government lenders.

Not only are the FHA loans getting expensive, the Fed Economic Advisory Board wants to lower the loan limits.

Has anyone been watching what’s going on in the north San Fernando Valley lately? I’m referring to Reseda, Van Nuys, Panorama City, Mission Hills, etc. I’m seeing 5-10 new listings every day for SRFs priced between $300-450k. A lot are recent remodels. Several have price reductions, and some are back on the market after falling out of escrow. I think this influx of new listings is from banks, flippers, and possibly some of the hedge funds starting to dump inventory. It will be interesting to see how this plays out.

I see a bunch of large gates/fences going up along the perimeters of yards, around Resada, Encino, etc. Could be more of an aesthetic trend though.

No inventory has created a $100K jump in prices in my neighborhood

in 1 year. We bought in late 2012 for cash and want things to stabilize

and start to reverse. We’re here for life.

Interesting, that some neighborhood homeowners are renting out their

homes due to job transfers and not selling. They want to own something to

fall back on. They say the house is more important then profit right now. Smart.

This is going to drag on a LONG time.

Easy solution: Rent and sleep at night.

lock your mortgage payment for 30 years and sleep at night :). Who cares what happens to your property value?

On my income properties i keep raising my rent every year like clockwork. I only skipped 2008.

Good for you. Sorry about 2008. Terrible year.

The government successfully creates this new real estate bubble. Enjoy the ride with 20% appreciation this year, and maybe 25% next year. We all know it will end badly, but we all have to participate to make money. Obama’s policies such as loan modification, and debt forgiveness are designed to slow down foreclosure. Ben Bernanke keeps interest rate at zero to make home affordable and promote home buying. Fannie Mae and Freddie Mac become government entities that provide financing in secondary mortgage market. FHA insures all loans with 3.5% downpayment so that banks can make loans and sold to Government later. Starting June 1st, 2013, you can get FHA loan with as low as 580 Fico score. After 3 years foreclosure record, you can buy again using FHA loan. This massive previous foreclosed people will become new buyers. Wall street’s participation in residential real estate keeps inventory low. Builders just wake up and start subdivision to build new homes but inventory won’t hit the market until another 2 years. Regular home owners are still underwater and can not sell yet. In the meantime, where does inventory come from? NO WHERE. Major shortage of homes will explode home price. Have fun making millions in this manipulated market. Don’t find the trend. Just watch yourself and get out on time. It’s a simple math.

I think your math is wrong. Most people who foreclosed learned their lesson and wont sign up again for overvalued and overpriced house. Did you look at the jobs report today, it was worst then expected. We are not creating enough jobs and the ones created are low service or part time jobs. This dead cat bounce won’t last for long.

I’ve been talking to quite a few people lately about the real estate run-up in prices and they are almost all in agreement that they do not trust it as ‘real’. And these are people that do not follow the market. But they still remember 2003 to 2007 and it seems very similar to them. So, perhaps the people that were bitten in the last bubble will not be participating in this one?

I thought your analogy was correct. at least thats the way its supposed to work. im afraid, though, because the fed is printing money, (300% of gdp) when the new crash

comes it will happen sooner than two years out. In 2007 a friend of mine worked making some of the poor loans that we all know about. when he explained the process, i immediately moved investments to bonds. that is no protection now. I just re-fi’ed @ 2.875 on a 15 year note. I believe its the best thing I can do before interest rates explode. Which they simply must. now something interesting is happening in CT where I live. Investors are buying properties to “hold” just as fast and prolifically as possible. None of this made sense to me until I read your post…they are artificialy heating up an otherwise stagnant market. If rates move up quickly though, they’ll be left holding the bag. A friend of mine is tasked with purchasing 10 to 12 properties a week for some “millionare investors”.

A hint of removing props from financial markets by the FED and panic begins. That should tell people how fragile this “RECOVERY” is. The FED is testing the waters and look what happens. Most markets are now casinos and based on finding a greater fool. We will see how long the FED can keep the game going before players lose confidence and investors demand higher rates. Expect Ben to jawbone back a recovery in the near future. There is no exit and never will be.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

Have to say, am really nervous about new home purchase. Just bought first home in Redondo Beach for about $100,000 more than the previous buyers bought for in 2010. Got a 10 year ARM to lower the monthly payments and Wife and I are planning on staying for 7-8 years until we can hopefully move to Hermosa/Manhattan for the school district by the time we have kids in elementary school.

We panic bought because we lost out on 3 other offers and the market kept rising, so we know we overpaid by probably $20k. It seems since the day after we bought, the market has cooled tremendously in our area. I don’t care about making money on it and since we have an ARM, we can’t hold onto it as an investment asset. I’ll be happy as long as we can sell within $30k of purchase price in 7-8 years.

After this experience, our next home purchase will certainly be our last home purchase, at least util we possibly downgrade at retirement.

Being in one of the more desirable “fringe” areas of LA is a double-edged sword–you’ll maintain your value in relative terms (%) better than more generic and less desirable areas, but since you’re spending more, you might lose as much ($) in absolute terms. (10% loss on $100 is the same as a 20% loss on $50.)

So, if the cycles from 1986-present are any indication, and if I was forced to guess, you’ll see another market hit shortly and some sort of a recovery right around the time you’d want to sell.

This is my piece of advise: see whether you really want to stay in California at that point. You remind me a lot of me–I grew up in PV, overbought in 2005, then bailed for Florida in 2012 as soon as the local market was showing recovery. I still lost around 15%. But it was worth it.

Around the time you want to sell, you’ll be thinking more about retirement and security. Take a trip to Florida (I’m in Naples) and see what bang-for-the-buck you get vs. Redondo/Manhattan/Hermosa. I literally became angry about how my taxes were wasted at both the school district, city, county and state levels. The quality of life is wayyyyy better, overall. You can always find something to nit-pick about Florida (California is naturally the best, right?), but again, in a cost-benefit analysis, it can make a lot of sense to jump off the So. Cal housing roller coaster.

KR, I appreciate your input, but there is a big difference between Florida and California.

I used to live in Georgia, and know most parts of the Sunshine State.

My buddy lives outside Boca Raton. Here is what he tells me:

1) Florida schools are horrible. He is going to put his daughter in a private school, and she has access to one of the best public school systems in the state.

2) The weather in summer is horrible, so 3-4 months of the year is miserable.

3) People on the Atlantic side of Florida are rude and nasty. This was confirmed by my buddy’s friends at his wedding. Everyone is out for themselves.

4) Florida universities don’t compare. Yes, Gainesville is decent, but that’s it. California has Berkeley, UCLA, UCSD, UC Davis, Irvine, and more.

5) Many people are shysters in Florida. One reason is everyone crook moves there because they can’t take your house in a civil suit. The first thing you see entering Florida on I95 are billboards advertising gambling addiction. Plenty of shysters in California too, but as a %, not even close.

Sure, you have no state income tax. That’s nice, but it is made up elsewhere.

My buddy would move, but he is trapped. His house is underwater by $300K, his wife is from South Florida, and his business is there.

South Bay Guy, I assume you didn’t buy in Manhattan or Hermosa due to the higher prices. You mentioned you want to move there in 7 or 8 years for the schools. Are you expecting a giant increase in pay in the next few years? I don’t need to tell anybody, but kids are very expense. All the South Bay beach city markets are joined at the hip, any price increase/decrease will likely be felt in every city. Depending on where you are in Redondo, there are excellent schools available.

South Bay guy, I know Redondo schools, as I have my kids in them. ALL of the Redondo schools are as good as those in Hermosa/Manhattan, if not better. Don’t pay attention to the API scores alone. (If you are fixated on the API scores, you can’t find one of the Redondo elementaries below 900.)

Redondo Union High School is up and coming…it is as good, and will soon be better than Mira Costa.

If you end up moving to Hermosa/Manhattan for the schools alone, you will be wasting your money.

Party is coming to an end. Dow hammered last 2 days and international markets and curriencies getting killed. Next up, the hang over.

It wasn’t just the DOW that got hammered after Bernanke spoke yesterday. The entire global markets got slammed when Bernanke merely mentioned that tapering the Fed’s $85 billion per month quantitative easing programs were possible.

Last month when Bernanke testified in front of Congress and said that the Fed could begin tapering bond purchases within a few meetings of the Fed, 30 year mortgage rates went from 3.2% at the beginning of May to 4.1% by early June.

Imagine what will happen when the Federal Reserve actually scales back QE purchases.

If you would have told me in late 2009 that house prices in many parts of California would be back or near peak levels with bidding wars, stock market at 15,000, gold down from $1900 to $1285, silver down from $50 to $19, I would think you were delusional. I have to give the Fed credit, amazing how printing trillions of dollars, media propaganda that everything is fine, and market manipulation, work. However, I keep getting told that all of this will come crashing down again, you just wait and see.

We’re just waiting. Two years ago we should of bought but everything we saw was TRASHED and the wife did not want a Fixer upper so we stayed in our house. This market may not be stopping yet but I see a lot more houses for sale and a lot if them are simply staying on the market a lot longer. The houses are not being snapped up as quick as they were. I remember seeing houses one day and either that day or the next it went pending. Now I see some price drops and longer active list times. I simply refuse to get sucked in the overbid over spend for a house. I can’t help but be amused t some of he asking prices or houses that were built in the 50s and don’t look like they have been remodeled since the early 80s.

FYI we are no longer in a historically low interest rate environment, they are still low but if things continue we’lll be @ 6% 30 yr fix by end of 2013

and if that happens the price increases will come to a screaching halt, perhaps even dip a little and inventory will come roaring back, the hedge funds renting properties will be able to raise rents too because buying will not only be tough to qualify for but it will be expensive

6% fixed by the end of 2013 could end housing and the united states in general. So homes go down and local govts (many of which are already broke) have less in prop tax revenue and much higher borrowing costs. That would be like a 75% increase in rates in one year off a sub 3.5% rate. Personally i think 6% rates in 2013 has less than a 5% chance of happening but thats just my opinion. If it does happen, scary times could be in store for those in risk assets.

6% rates could end the U.S. in general. What you’ve written cannot be disproved. And, that’s just my opinion.

Sorry dfresh, but i am confused by what you wrote. Let me be clear as to what i meant. Imo, the govt will do everything in its power to keep rates from not rising that high, that quickly. Also, Going up is one thing, going up from 3.5 in may to 6 percent in january would be statistically rare if you think how much of a percent rise (over 75%) in 6.5 months and too a rate not seen in years, in an already delicate economy. I didnt mean the world would end, like the acolyspe, but obama et al would look awful in front of midterm elections so they dont want it either. Basically, imo. rates dont go that high bc if they did, unless economic fundamentals truly are good (which you dont believe is my hunch) the house of cards will be revealed with big market corrections.

And your prediction is……?

All the macro economic pontificating is well and good but the question I have is concerning buyer profiles. The real constraint or impetus I would argue for purchasing activity is the squeamishness or lack thereof amongst the banks. Even though rates are historically low and remain so, the banks are still pretty conservative with their lending. Inevitably they will forget the massacre of the past decade, inevitably they will start lending loosely and stupidly again, inevitably unqualified buyers will start looking to trade up and make money in the market, and inevitably prices will go up for a while. Doesn’t matter what the cost of money is if banks won’t lend it.

And banks have more incentive to lend to worse credit folks in some ways as rates rise because they are paid higher interest payments for their risk. Why loan to risky folks in a low interest rate environment?

Here is another example of the flipper activity in LA, LA, LAnd.

This house sold for $566K in Dec. 2011. Someone paid $566K for this back then? then maybe they defualted, then sold for $385K in March (court room steps?) and after 3 month remodel, now listed for a meager $685K wow. I dont know much about remodels but perhaps $100K in remodel cost? And in a sketchy neighborhood.

If anyone can look at the price history and gleen more on this, I think it would be interesting to know.

(2107 South Curson, LA 90016)

Enjoy

http://www.trulia.com/property/3069359095-2107-S-Curson-Ave-Los-Angeles-CA-90016?ecampaign=con_wknd_openhmsrch_bk&eurl=www.trulia.com%2Fproperty%2F3069359095-2107-S-Curson-Ave-Los-Angeles-CA-90016

Why leave out that is was had for a mere $155k back in ’01?

Shitty granite, cheap ‘stainless’ appliances and original cabinets too boot. I’d be surprised if they put 50k into that place.

Dang, I’m already forgetting about how nutso LA pricing can be. I love the bars on the windows, the penitentiary-style perimeter gate and ready-for-replacement cinder block backyard wall. All for a $180,000 annual salary if you conservatively figure on spending no more than 3x annual income and 20% down.

Here is an attempt at an answer where the inventory is going to come from-while at the same time demand will drop

http://smaulgld.com/the-coming-supplydemand-real-estate-inventory-reversal/

In Santa Clarita the average sale price in December of 2012 was $347,000 and in June 2013 the average sale price was 410,000 an increase of 18%, but we still only have a two months inventory.

Leave a Reply to irony free