A look into a housing inflexion point: 6 charts highlighting a dysfunctional housing market. Living at home into old age not promising for a resurgence in housing.

You would think that with all the surefire bets in housing that people would be dialing up their realtors and heading out every weekend to make those lustful multiple offers presented in PowerPoint format on properties. Yet the overall market data shows a different story. The house horniest of them all, investors, are clearly pulling out of markets including sunny and inflated California. Apparently home prices do matter when making investment decisions. Cash strapped hormonal buyers will keep on buying but housing prices are set on the margin. That margin is becoming razor thin on current volume. I find it interesting that the biggest housing supporter of them all, the National Association of Realtors is also somewhat tepid on this recovery. Why? Because home sales volume is pathetic. Keep in mind they make money on selling and buying. Volume is key. Their model doesn’t work so well with banks holding onto properties like Gollum holding onto the ring and the foreclosure process being dragged out like the forever college student enjoying year 10 at Santa Monica City College. You see this overarching trend occurring in many metro areas across the country. Investors have been propping up the market since 2008. They are now slowly pulling back. You are also starting to see a convergence of analysts putting out their predictions on how overvalued housing is and backing it up with mountains of data. The other side of the argument points to prices. Sure, they’ve gone up but value is created by actual price and that is sort of the point. The answer as always isn’t so simple but using your thinking cap it is important to understand that housing is not a “no brainer†decision in this market.

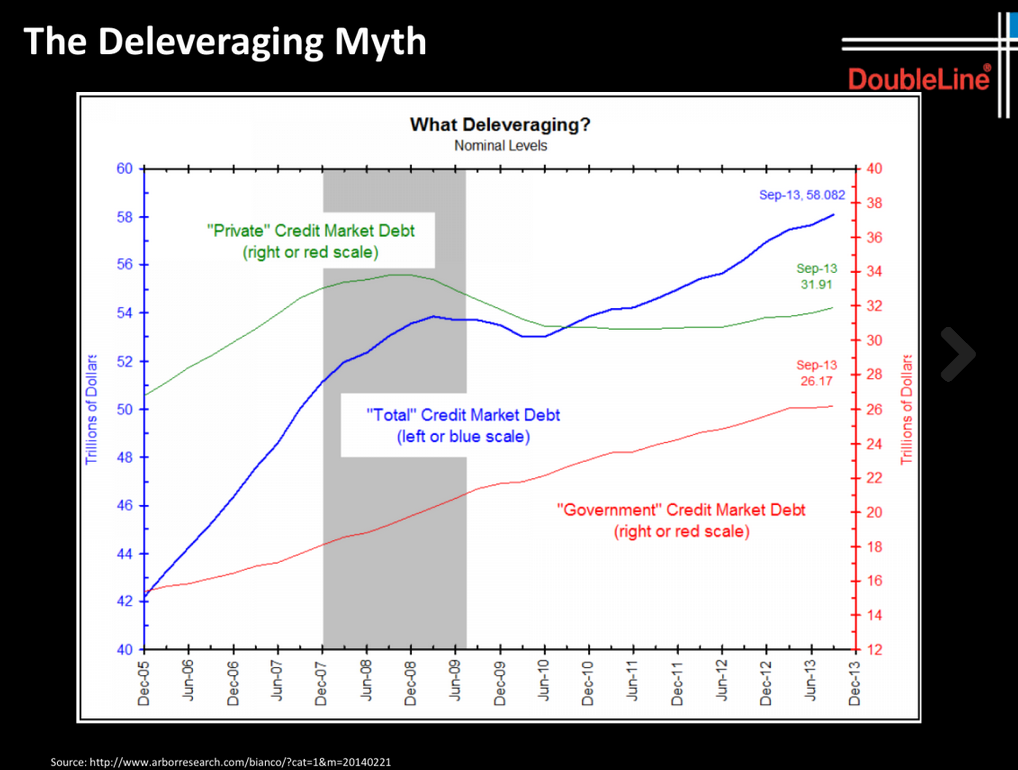

Still going into massive debt

It is interesting how corrections always follow a similar pattern. At first, every market in every area is going up. The euphoria stage. Idiots can buy and make out like bandits. Of course they attribute this to sheer mental agility versus blind luck. Ask the 7,000,000 foreclosure recipients and question them about their mental agility in their buying decision. Slowly the winds change. All of a sudden sales start slowing down. Prices stagnant. Those house horny sellers are not getting their delusional asking prices for simply slapping on a new coat of paint and installing some stainless steel Whirlpool appliances. Didn’t the housing cable show say I would have 10 above list price offers by the first week?

Then you get the hilarious responses of “does anyone really think that prime Manhattan Beach is going to drop in price?†Really? Manhattan Beach has something like 35,000 people but Los Angeles County has 10,000,000. We are talking about a city where 0.35 percent of a county live. Where in the hell will the other 99 percent live? Our focus is on the broader market. Niche super prime areas may correct but even if they do, the plebs will have little luck scoring a Malibu home on the household income figures we are seeing. My point here is that suddenly, the focus is on ignoring the larger trend for easy super prime markets to make the case that hey, housing will always go up. Even today, you have places like Compton, Palmdale, Riverside, all surging up in prices. This happened as well in 2007. The unfolding goes something like this:

“Sure Palmdale went down but this is out from the city hubs.â€

“Sure Paramount went down but this is in a lower income area of Los Angeles County.â€

“Sure Pasadena went down but only in certain parts of the city.â€

“Sure prime Pasadena went down but not as much as other areas.â€

You catch the drift here. One important thing to note is that people are leveraging back up. An interesting presentation was made by Jeff Gundlach on why homeownership is overrated and why he is shorting homebuilders. Some of the slides focus on topics we covered but they are worth looking over:

First, there is really no deleveraging going on. The cheap money from the Fed has been used to inflate the markets back up. It has worked. Households are also back into deep debt and buying homes with little money down or using ARMs to stretch their budgets. The idea that cash is abundant in US households is simply not the case overall. You have a small portion of hyper-rich households but they are not focused on Mar Vista or other hipster markets of Los Angeles. They are looking at Beverly Hills or Santa Monica for example.

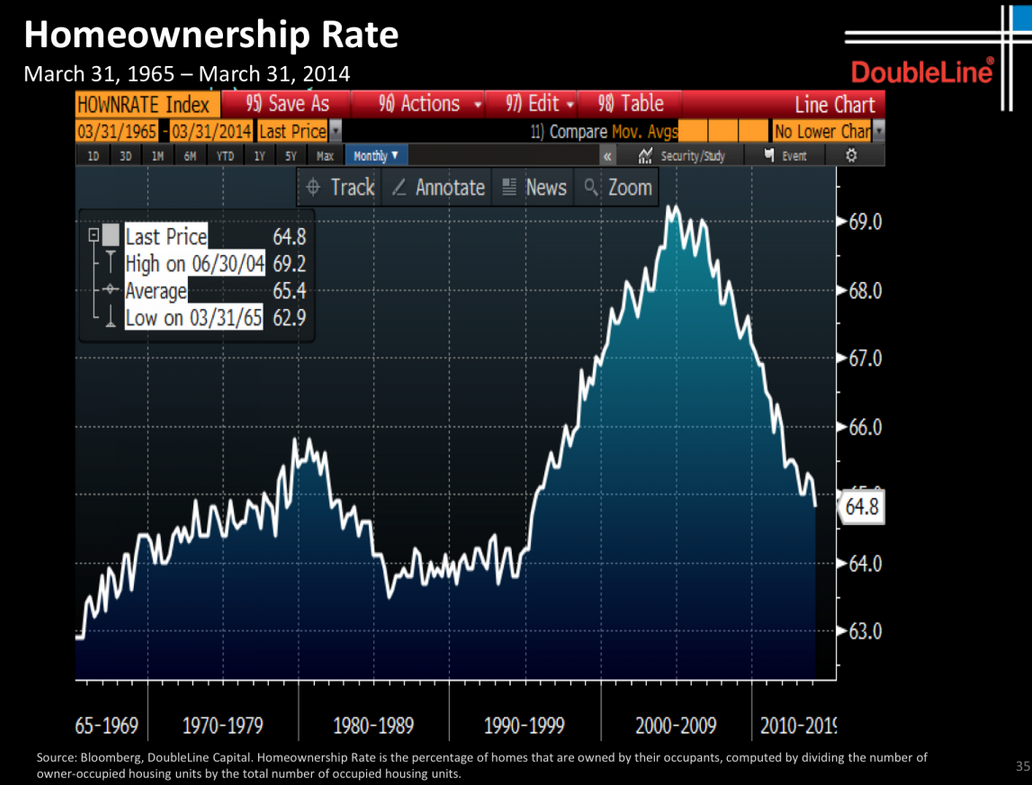

The big money is in the financial markets (bonds and stocks) and real estate is not the main focus at the higher echelons. Because of this, we see a massive plunge in homeownership since household incomes are really weak in the US.

Homeownership rate plunging

The drop in the homeownership rate is epic:

This is a massive trend here. Since people have to live somewhere, we have simply expanded our market of renters in the US. Some of it has to do with shifting priorities but I assure you, if you gave these Millennials or GenerationX people the ability to access toxic mortgages like interest only loans with no down payment, they would let their house horny juices flow. Thankfully, since the entire mortgage market is virtually government backed, they are checking incomes.

The drop in the homeownership rate largely reflects a weak economy for those future home buyers.

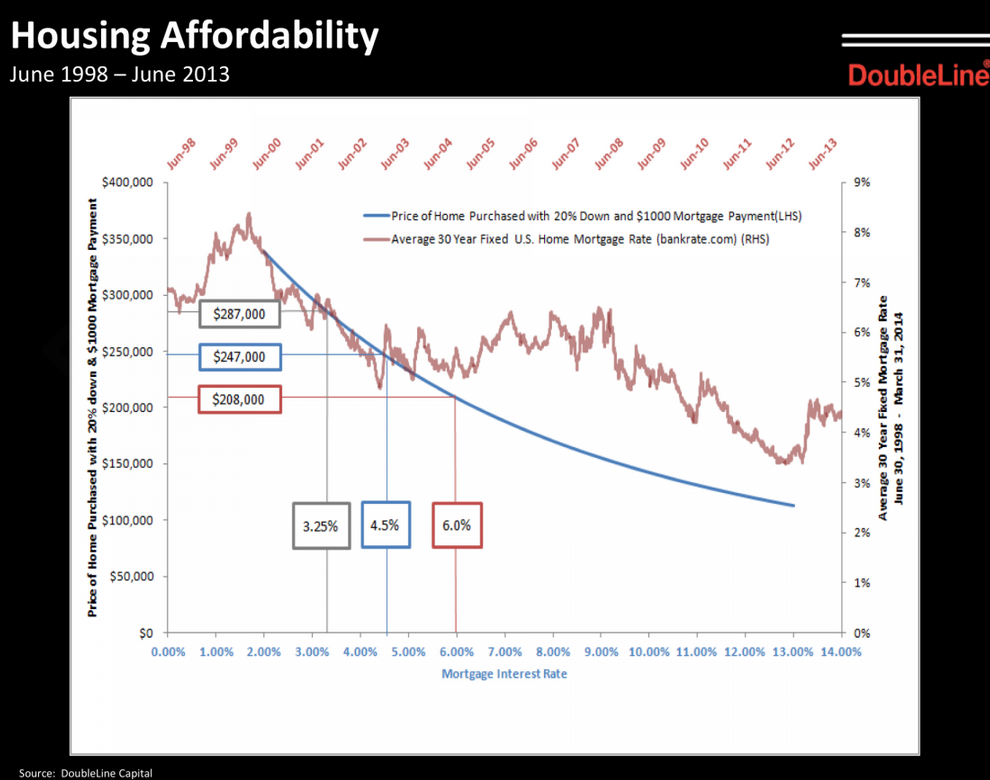

Housing affordability all based on low rates

Housing affordability is all about the monthly nut. That is why the modest 100 basis move in interest rates last summer basically stopped the mania right in the middle of its slobbering delusion:

See how quickly prices change with modest interest changes? The Fed is already telegraphing higher rates and we are already seeing inflation permeate the market in healthcare, college, food, and other important items. The only place that is stagnant is with household income growth. The magic of lower rates is that it boosts house prices even if incomes remain stuck. Investors looking to rent places out realize that rents need to be paid with actual net income from those living in the immediate area.

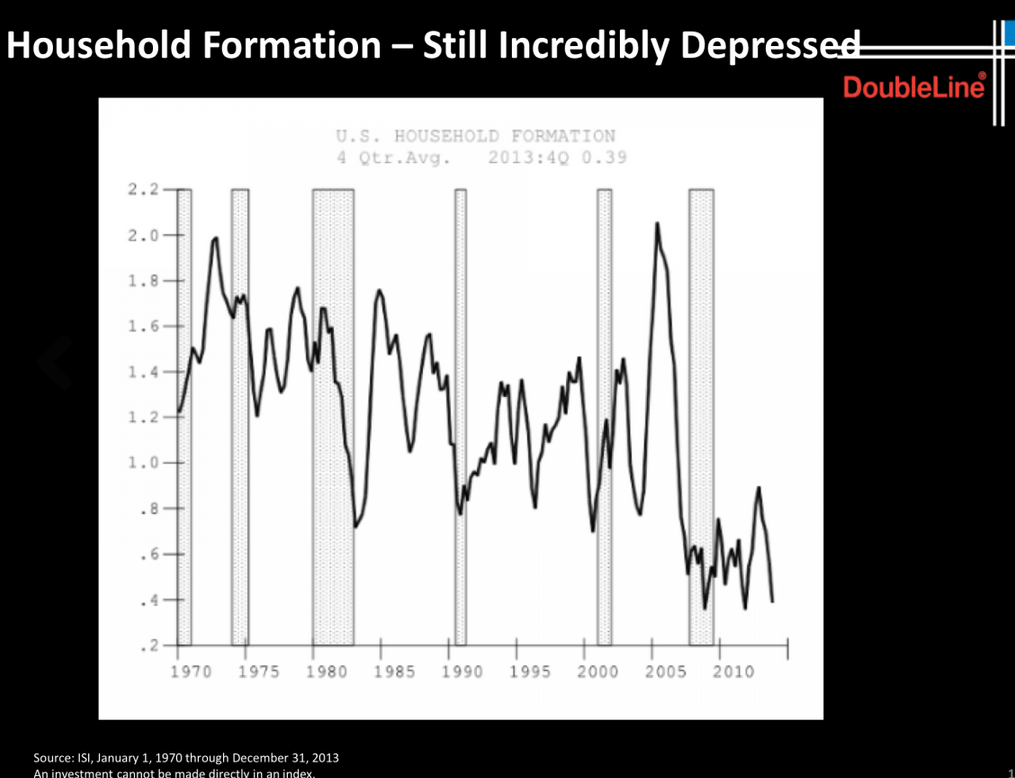

Household formation slow (you know, with kids at home and all)

The most important aspect of this all is the weakness in household formation. We have many folks living a life of arrested development in California. Folks driving around in leased foreign cars yet living with mom and dad deep into their 30s and 40s. They want the trappings of the past but simply cannot afford it. A few of my contacts were telling me that in places like Irvine, you have Asian investors making up a large portion of purchases and also, older households with built up equity (meaning 50+). A similar trend in Culver City although more with older households in their 40s and 50s. Those first time buyers in their 30s are battling it out for condo fodder with massive HOAs that usually aren’t factored into budget considerations. Keep in mind even in these more sought after markets inventory is building up.

Household formation is at multi-generational lows:

California has 2.3 million adult-children living at home, largely because they can’t even afford a rental let alone pay current prices. The above chart is a nationwide chart highlighting that this is a national trend.

Living at home all the rage

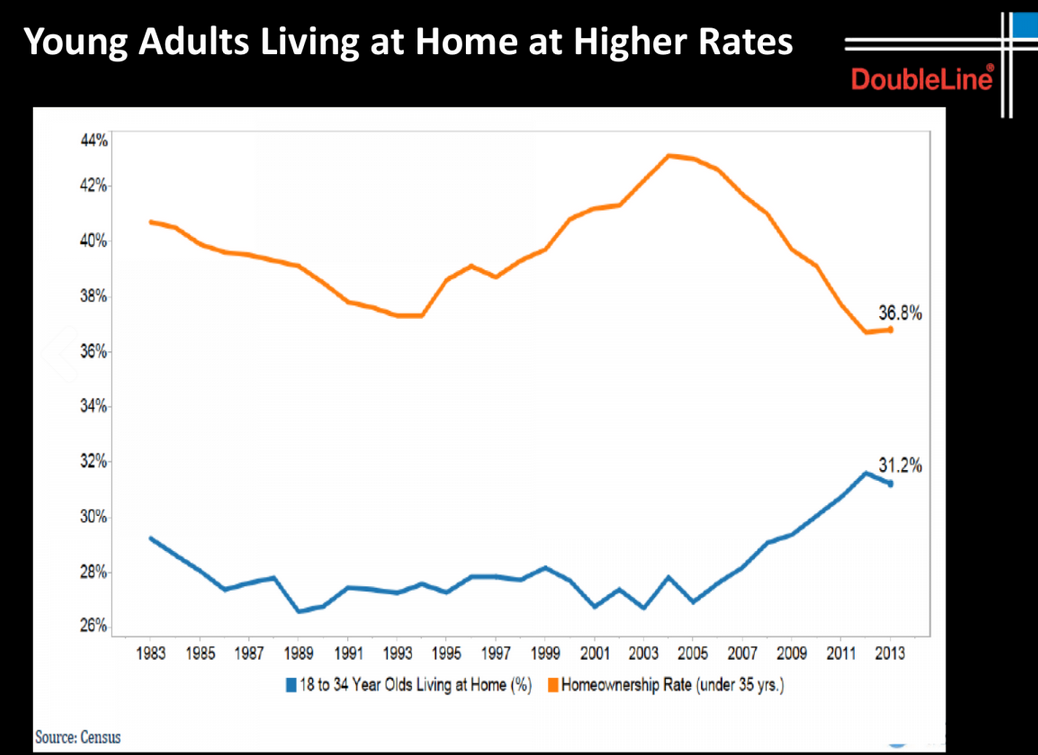

Some might think that living at home is only for expensive markets like L.A. County or San Francisco but this is also a national trend:

The young chewed on the hardest punch of this recession. Many bought during the peak of the housing bubble with some of the funkiest, stench-filled, and financially disastrous loans of all-time. You can see the end result. The homeownership rate collapsed and has yet to recover even though this is year five of the easy money recovery. Yet many did not go out and rent. No. Many are now living back at home. Basically anything that can be juiced with debt (i.e., college tuition, housing, cars, stock market, etc) has been reinflated to record levels. The question is, how much juice is left?

Living at home because of weak employment prospects

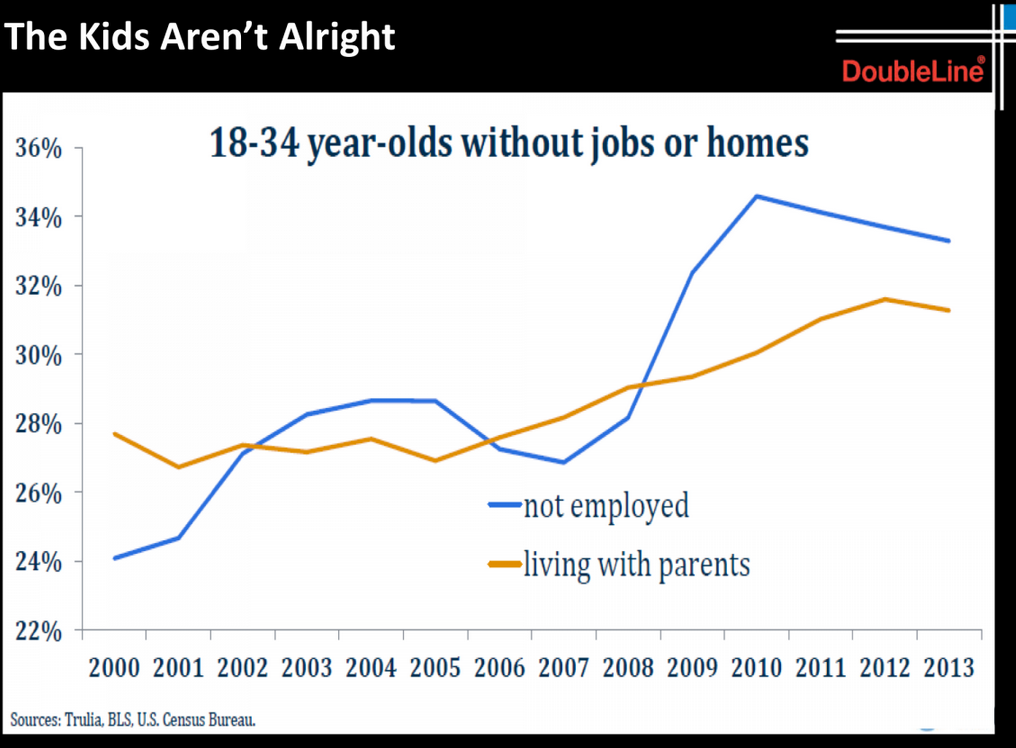

Those making the case that there is this hidden pool of pent up demand fail to look at the actual data of these future buyers. Many are living at home because they are economically struggling:

Roughly 32 percent of 18 to 34 year-olds are not employed. Might be a reason for so many living at home. Keep in mind that the rate continued to rise in the midst of this debt induced rally in stocks and housing. The housing market was pushed up by investors, easy money, and a lack of inventory. For those wanting to buy, inventory is moving back up but in some areas, you still have a good amount of house horny buyers battling it out. Yet prices are made on the margin especially with real estate. The market is definitely hitting an inflexion point. But in real estate, just like the above trends, booms and busts don’t happen with a big bang or pop but with a slow shift like turning around a giant naval ship. The fact that we have many reports discussing the overvalued nature of real estate, investors shorting homebuilders with 40-slide presentations, and household formation cratering you have to realize something else is going on.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

105 Responses to “A look into a housing inflexion point: 6 charts highlighting a dysfunctional housing market. Living at home into old age not promising for a resurgence in housing.”

I really hope that the prices will fall as this blog has been implying for years while the prices have gone up. Unfortunately the market is hotter than ever around the Bay Area. Check out this house that just sold: http://www.zillow.com/homedetails/4530-Garnet-St-Capitola-CA-95010/16130452_zpid/ It is liteally a falling down shack.

Mike…The word cute is RE code, it is really worth about $59,500?

http://www.redfin.com/CA/Hacienda-Heights/16227-Soriano-Dr-91745/home/7835810

The pictures only show the good parts. The house needs a lot of upgrades. The retaining wall at the back yard of the house is failing…may require lots of money to fix it. 75% of the floor is carpet and there is no hard wood floor underneath the carpet. The rooms are small. The ceiling needs repair.

Doesn’t show up as sold, just removed from market.

Q1 home sales were 43% CASH nationwide.

“The restrictive mortgage lending standards are a factor, but the higher levels of cash sales may also come from the aging of the baby boom generation, with more trade-down and retirement buyers paying cash with decades of equity accumulation,” said Lawrence Yun, chief economist for the NAR.

The demand is high, supply is low and that is precisely why more homebuyers today are relying on cash to be competitive. It is not just investors.

Indeed, institutional investors, which bought large swaths of distressed properties in the past few years, are actually slowing their purchases, down to just 5.6 percent of all U.S. residential sales in the first quarter of 2014 from 7 percent one year ago, said RealtyTrac.

“but the higher levels of cash sales may also come from the aging of the baby boom generation, with more trade-down and retirement buyers paying cash with decades of equity accumulation,†said Lawrence Yun, chief economist for the NAR.”

So it is the old white folks that are buying with cash and not the Chinese. Take that you racists. Your parents are the ones that are pricing you out of the market. Stop blaming us.

Good grief, that house on Garnet sold for $644,000!! I just looked it up.

What’s the use of making enough money to buy a $644K house, if you aren’t living half as well as someone who makes $40K a year in a place where you can get a decent condo, at least, for $100K or less?

Great read on the realities of Silicon Valley life…

http://www.weeklystandard.com/articles/silicon-chasm_768037.html

Look , we all have our views on this housing situation. Banter back and forth to win points is what the blog and others is about, we all get a little crazy.

But Dr. on a real note it is very evident that a slow down after the last housing recession is a major concern to buyers, sellers, the economy in general.

Homeowners got caught up in a “we can’t lose on a house” investment, builders, banks, loan companies took full advantage and we are now in a serious catch 22.

For the many on this site who are wishing for a correction I say to what. One person’s over priced house is another’s person got to buy it now.

The standoff in my many years in the game, is by far the worse I have seen because so much is riding on the outcome that good jobs return (if the election goes conservative) who knows, Frank-Dodd disappear, banks free up the hordes of cash, interest rates rise slowly, China does something off the wall etc.

This is a lot of if’s, even for me a bullish guy who mad a lot of money, I’m also steeping back after my last investment sale in March and wondering about the folks who may never afford a house, in America this is just a awful, a future of uncertainty .

I’m glad I don’t have to face anymore, but do worry for family, close friends, the general population, this is a serious matter Wash DC better pay attention or 1929, 2008, will be a walk in the park folks?

Robert, that’s nicely put. The last ~50 years of America having a huge middle class that was the envy of the world has just about come to an end. We’re just on our way back to the mean of a small percentage of the mean being ultra rich and all others being poor. The standard of living is on its way down for all but the top 5% or so.

Anybody who disagrees – just try to find job creation where salaries are above say 50 grand or so – just something above the median. Sure there are jobs being created, but none of them pay well.

I agree on your percentages, Jeff.

The average salary for a photo-voltaic installer is ~38 to 60k. There are about 140,000 solar related jobs currently (and 80,000 wind jobs) in the US. The tech is maturing to the point that a recent solar farm installation in TX is offering Austin Energy $0.05 per KWh WITHOUT tax credits, though their margins are slim. I had a pretty decent run up with FSLR where at one point my investment jumped +20% in one trading session.

Been pulling out of small cap growth the last few months incrementally as the probability of bad things happening inches up.

Many real estate analysts quote year-over-year house price changes, which appear positive because prices jumped at the end of 2013. Over the next couple of months, year-over-year price comparisons are going to become negative. Everyone will start crying again and rush out the exits. Prices will drop further. The housing ship is slowing turning around and headed in a very bad direction. Get out of the way.

People don’t get it. We have structural differences in our economy now. Home ownership doesn’t make sense anymore.

You are absolutely right – based on incomes, and today’s prices, buying now makes no sense in most areas of CA and indeed the US. Sure there are areas where it’s cheap enough to buy, but even those areas are inflated above where they should be based on local incomes. Maybe a nice CA income maker (perhaps a telecommuter like me who can live anywhere) can swoop into flyover and buy a house with the checkbook or 1/2 down, but that’s probably not going to happen much. I know I am not there – yet.

“but even those areas are inflated above where they should be based on local incomes”

If your measure of affordability is based solely on income:price ratio, why don’t you pick up a few homes in Detroit with your checkbook. At a .7 ratio, it’s has nowhere to go but up right? Eventually it will regress to the mean, right? Right?!?

Didn’t prices jump around the beginning of last year? I agree that we keep seeing higher YoY numbers quoted in the media because we haven’t reached that same point in the next year where things died the year prior. We’re so close to the other side of the apex that MoM is telling a bigger story. It reminds me a bit of the late 2006 and early 2007 story when holdout sellers were looking at the YoY and being stubborn on asking prices. They just didn’t want to believe that the party was over. I knew too many folks who rode the price wave down selling in 2007.

I’m not claiming that this is exactly the same as or will turn out just like 2007 but things sure do seem awfully familiar.

Prices did not jump much. The MEDIAN prices increased as banksters funneled all the distressed inventory to their linked in buddies so the share of lower priced inventory in the sales figures fell. If you compare sales prices of the SAME or COMPARABLE house year over year the price increase was single digits. If you compare any markets with 39% distressed products to one with 15% distressed product guess which one will have higher prices?

Doc, when we went to school it was Santa Monica City College. I got my AA in 66. They subsequently dropped the word “City” to sound more like a 4 year college. They changed the name when Santa Monica became a city of “posers”. I like your comment about the adult man children with their leased BMW, and MB. So true. What a different world we live in now.

Well it went to 5.2% for unemplyment as the target for good times returning(?).

looks like Miss. Yellen is learning fast, Wash DC has no idea of inflation or debt ratio, let alone if 5.2% at 10.02 hr will inspire the Fed to get off the zero interest rate kick?

Yea doctor, but I have been hearing all this gloom and doom fo-eh-vah! I am still seeing how-zing going up. You are forgetting all the monies on the Fed’s balance sheet which means that we will have hyperinflation just like war torn post WW 1 Germany paying its war debts with freshly actually printed paper monies. Same same. We need to ignore Japan because we speak English which is a Germanic language which means we will be more like post WW 1 Germany than like 1990’s Japan. See my great logic? Makes all kinds of sense huh?

What happened to blert? Blert, please consider posting again. You are being missed.

Women are the reason house prices get out of whack.

####

I knew Obama’s family in Hawaii.

####

Take a history course and re-read your textbooks.

&&&&

Full stop. Period.

If this is all you got from his posts…

I only started reading this blog a month ago, but when I saw the content blert puts out I read his – and his only – comments as far back as I could find.

Yes, his style is different, but the content is worth it – to me, and probably many others too.

I’m sorry, I forgot to add – bread and butter.

And Janet Yellen’s big concern? A housing slowdown:

http://money.cnn.com/2014/05/07/investing/janet-yellen-housing/index.html

The next banking crisis:

http://www.marketwatch.com/story/the-next-banking-crisis-is-already-in-the-making-2014-05-07

43% of 2014 home buyers paid all cash (across America):

http://www.marketwatch.com/story/43-of-2014-home-buyers-paid-all-cash-2014-05-08

From the article:

All-cash purchases accounted for almost 43% of all sales of residential property in the first quarter of 2014, up from almost 38% in the previous quarter and 19% in the first quarter of 2013, according to data released Thursday from real-estate data firm RealtyTrac.

You end up with goof-ball statistics when the normally dominant sector of the market is unable to play.

The total volume of transactions plunges so low that it appears to the mathematically challenged that the all-cash buyer is taking over the market.

You can’t even trust the all-cash buyer to be paying all-cash.

1) Buyer could have leverage back in Red China, Putin Russia. As an alien real estate buyer, our mortgage market is closed to them.

2) Buyer could be laying on a mortgage after the fact. In some areas, buyers are finding that they CAN’T bring a mortgage into the escrow process. It’s a quick close or nothing.

3) The investor crowd is naturally going to go all cash at the buy-in. Leverage is obtained by massive syndications completely outside the normal real estate market. These players are big enough to move even the national figures a tad.

In sum: you can’t trust the metrics when the market is this heavily staged.

The ONE item you can take note of is the crippling of the middle class home market.

It’s an epic change that figures to last for a full generation.

Naturally, the Press and the Administration hasn’t a clue. This blog is one of the very few voices to track this ‘ground truth.’

Yellen’s recent comments are unwise. If she persists, people might start to think.

She should take a page from Greenspan’s lexicon and mumble out confusions.

I don’t always agree with the blertinator but it is seems strange that I both understood everything he said while simultaneously agreeing. Maybe all of the RE shill BS comments are affecting/effecting (can’t remember which one to use) my perspective…

blert, thank you for posting (I was the one asking you to comment). Again, you cut down to the essence of the matter at hand. Statistics can mislead grossly when used within a wrong context.

LOL! My economic boom is just 5 years old. Rental housing is now where the RE boom has shifted. Plenty of new construction there.

Still don’t see where the price drops will come from.

Investor owned RE will not sell at a loss when they have already passed the loss on to the ‘muppets’

People who are underwater can only sell when the banks let’s a short sale happen, and I never see that done smoothly/quickly if at all.

If the house is paid off, or if the note on the home is low enough, renting it out seems to be a better option.

Unless somebody needs to show a capital loss for tax reasons, I don’t see pricing going down.

I live in SoFL and bought at the top of the bubble, (thanks G-d for my neighbor who bought 40k above me, I am only the 2nd dumbest person in RE) What I see is as follows

1. Overseas money is still flowing in but slowing down. (The RE agents should be getting Cesar Chavez tats in gratitude, CC is the best thing to happen to FL RE since Castro)

2. New construction in over 55 communities is selling well.

3. High end construction still happening.

4. The lower end of the market is stuck. Working people cannot qualify for enough mortgage to buy the houses that are underwater. Short Sales seem to be like bigfoot, lots of sightings, but no one has seen one themselves….

So how will prices drop if the homes have more debt then their worth, and the holders of that debt won’t realize a loss?

The last run up was because the feds made money practically free, then the banks were giving loans to whoever could fog the McMansion’s mirror regardless of their ability to pay for it. Boom.

Current wave are the investors/cash buyers who bought foreclosed homes from banks most likely in bundles, and occupant sellers trying to cash in. When those guys sell or dump and run, party’s over because the metrics of the market don’t make sense and average occupant buyers cannot afford unless prices drop.

No buyers = motivated sellers who will drop prices. The market eventually recovers and prices rise again.

Boca Condo King: “Overseas money is still flowing in but slowing down. (The RE agents should be getting Cesar Chavez tats in gratitude, CC is the best thing to happen to FL RE since Castro)”

Mao and Ho-Chi-Minh also deserve some gratitude.

After the fall of Saigon, my late father made a ton of money in real estate in the latter 1970s. Lots of rich Thais were worried about the domino theory, worried that Thailand would be next to fall to Communism. My father brokered a lot of deals for them, helping them move their money from Thailand into New York real estate.

“…bought at the top of the bubble”

“Still don’t see where the price drops will come from.”

Are you looking through the same pair of glasses as last time?

When I bought in 2008 it was due to my apt. building going condo,

If you owe 2x on a house that is only worth x how do you sell?

If you used opm to buy a house that goes down, why realize the loss?

I am not saying housing is not way overvalued, but unlike a stock or gold, the leverage itself seems to be a brake on a price drop.

Banks have still not dumped all the homes they have non performing loans on from 2008. I have buddy who walked away from his house six years ago and the bank is still not taking it back.

In my condo community we had one guy (I call him the genius) who refi ed over 250% of his initial purchase price out on helocs, never paid a penny after the initial teaser rate expired, then lived in the unit for 4 more years paying only his electric bill.

It was only when we tried to foreclose for unpaid condo fees that the bank took it back.

So again, not saying pricing should go down. But how?

SOL is the only one here that I know of that has a crystal ball so he is the only one I will listen to when he says “I see” or “I don’t see”.

In 2007 people HAD to sell because the banks were foreclosing homes. They were walking away since they had very little equity in the homes and the biggest impact was merely to their credit.

Investors won’t have the same pressure to walk away if housing prices drop. Paper profits aren’t realized until you sell, but neither are paper losses. Sure, maybe an investor may sell a cash-flowing property at a 5% loss, but how many investors would really sell at a 20% loss when they could just cash-flow and hold.

@Boca Condo King wrote: “Still don’t see where the price drops will come from.”

And with those eternal words, you qualify to join the Federal Reserve. Bernanke, Greenspan, Yellen, and many other Fed members have also uttered similar verbage.

The Federal Reserve doesn’t see bubbles until after they have popped. Then they do their post-damage Q&A with comments like “Well…in retrospect we should have seen…”

Housing to Tank Hard in 2014!!@

I smell 2007 fresh out of the oven only this time the Fed has completely run out of yeast

The only reason our QE had a stronger initial impact than Japan’s is because American assets are fundamentally “For Sale” unlike Japan. That combined with reserve currency status allowed some RE assets to go full retard. The problem is now that momentum has ended there is no reason to park dollars in cap rate losing properties. This is why you’re seeing a bifurcation of the housing market. True prime areas where the oligarch class and their sychophants hang their hats are going to hold. EVERYWHERE else is going to adjust. Any property whose rental cap rate doesn’t beat treasury yields SIGNIFICANTLY (liquid assets always get priority) will take a haircut. And as us bears love to remind the specuvestors, incomes are nose diving while food and energy are skyrocketing. If the FED disn’t allow the bubble to pop, which is happening as we speak and in reality they couldn’t stop if they wanted to, the entire economy would snap as you’d have the mother of all demand crashes while over capacity went terminal velocity.

If you’re a home “owner” as opposed to an over leveraged debtor in prime areas you’re likely to be fine. The banking criminal class has tons of liquidity and wants to be your neighbor. If you live ANYWHERE else much of your equity is a FED monetary meth fueled hallucination. The comedown is gonna be a bitch.

“The banking criminal class has tons of liquidity and wants to be your neighbor.”

Please explain “tons of liquidity”. I am not convinced that there really is such a thing but I am open for debate…

RE:What?

Just stating that the Oligarch class has enough cash/liquidity on hand to keep the prime areas out of reach. Where I differ from the Bulls is in the definition of “Prime”. They seem to think it’s anything west of the Mojave Desert while I would argue it’s VERY select areas that are a 30 minute drive from areas that will crater due to local incomes coming nowhere close to justifying these bubblicious prices. In short the well heeled who are buying houses to LIVE IN are likely to do okay in prime areas. The wannabe specuvestors and rentiers are going to get knife raped.

Not on my watch!

oh no you didn’t

Isn’t housing tanking hard right now?

@cwa, housing tanking hard now? Only if you are a real estate salesperson, appraiser or in the mortgage loan industry. For potential buyers, this is a plateau. The plateau will continue until the number of potential buyers becomes exhausted and the available supply of homes starts pushing into the 8 to 10 month supply level.

Tanking normally takes many years. When real estate in desirable SoCal mid-tier areas peaked in 1990, the bottom did not hit until 1996-97. By then homes were 50% off of their 1990 peak. The same is true when the stock market crashed in New York in 1987. Real estate in NYC did not bottom out until 1993-94.

SoCal real estate tanking will be a multi-year process that will make watching paint dry look like a high speed action sport.

In Culver City, Studio City, and Pasadena, I’ve seen some markdowns in price. But I’ve also seen some houses selling for well above list price. So housing is not tanking yet. Rather, prices are all over the place.

It seems house prices are leveling, some rising, some declining, and in the same area.

I agree with robert on this: Many buyers (though not all) are irrational. They’ll buy homes based on how nice the yard is, whether there’s a wine cellar or hardwood floors or built-in bookshelves, etc. So houses that are comparable — same lot size, house size, within blocks of each other — will sell for widely divergent prices. An upgraded house can sometimes sell for way more than the cost of upgrade.

that is profound. Is this based upon experience or research?

It is based on the new hot science guessonomics. Well maybe not so new… and not so hot… actually it is pretty old…

Not!

Yellen is crazy. WTF. Housing and stocks not overvalued by historical levels. Based on what, a dollar price of $2000/oz gold? At $1200/oz I declare this BS but how high are we shooting? At $3000/oz I think prices for housing look pretty good, however, I would need to talk to my boss at this price level ’cause I would be getting jacked. Sucks to work in order to grow wealth in USA these days, or is this even supposed to be related.

Look Yellen we don’t need any more extraordinary accommodation. 6.3% unemployment isn’t so bad considering the financial crash. Wages will be slow to come up. Give people an alternative to forcing money into risky high leverage markets or we will end up in a precarious position. Also, you won’t be able to control the funds if they ever bleed into Main St.

In the meantime forget about the housing market. Just live. Be chill and forget there are houses for sale. It is a fools game. Better to have a 401K and a kids college fund, than pay 50%+ income for 30 years to live in a shitty SoCal 3bd house. Some games require to much leverage for the average person to play. Hitting your neighbor to play roulette comes to mind. Volume sucks so the house horny enablers are getting F…ed. Silver lining? Broke ass Americans aren’t as broke on paper anymore? That sounds like the foundation for a strong economy.

Okay I need to temporary turn my sarc off.

“…forget there are houses for sale. It is a fools game. Better to have a 401K and a kids college fund…”

WTF? 401k are stocks, bonds and real estate. These are the three biggest bubbles in history like the perfect storm wrapped up into one single “investment”. Who do you think is over bidding for these never to be inhabited shacks in the middle of the dessert? You are my friend via your “contributions” to your 401k and college fund.

okay rant over, I will go back to my RE shill persona now. Turning sarc back on.

You are right everything is bubbly. The difference in these investments is liquidity. If you are right and the sky is falling and all crashes, I might be able to move money out of stocks and bonds before a bottom is found. With a house… I guess you have to grin and bear it. I rather own home builders stocks if I believed in housing than making bids on overpriced SoCal houses.

You are killing me LC,

Okay sarc back off for just one minute…

You really missed some of my comments if you believe that the fund market is as liquid as you think. First, if you read the fine print of a number of funds (especially the REIT funds) they have the right to freeze the fund if there is a liquidity issue (i.e. more redemptions than purchases). This happened to me last go around for me in 2009 when I was liquidating a REIT fund and it was frozen. It took almost a year to get all my money out of the fund. Also, have you ever noticed that it takes days for stock sales to settle in your etrade account? What happens in a crash? First of all HFT has priority over your stock sales. Second, the exchanges will most likely be shut down if there are huge drops. Your 401k is so buried in the market you will not be able to sell as fast as you think. I would argue only have money in a 401k that you are willing to ride out for the long haul for better or worse.

Okay sarc back on.

The sky is not falling, it is blue skies fo-eh-vah!!!!

At least I know you are a true investor what?, but your problems aside there are plenty of investment opportunities besides physical ownership of a house. Many are very liquid. A balanced approach can protect you, but you can’t expect to invest and get a great return without risk. Perhaps you sold your REIT to late. Don’t be a pig.

I don’t make the rules to this game I merely play it. Yellen is playing a risky game to try to reignite growth in an aging, debt riddled society. We will see how housing plays out. Personally if it comes to a housing crash 2.0 the Fed and Govt will react differently. Before it was the sad song about “tricked” “homeowners.” So don’t count on that home to be worth more than a shelter if the extreme pessimists are correct. If you own an investment home than at least you can extract revenue. However I would not go into extreme debt and plan on the one home I live in to be my retirement, anymore than expecting my 401K to be the only source when I retire. You must have a diverse portfolio and again you can play housing without buying the actual lot and still invest in other sectors.

“Housing and stocks not overvalued by historical levels. Based on what,”

The charts the Doc provides here are multi-decade. by comparison elsewhere in the media I see a lot of 10-15 year charts.

If you frame history as just the last 15 years (or particularly the last 10) current values for stocks and housing look quite normal.

That 2006 ‘bubble’ is bubble no more – now it’s baseline! Personally I think it’s insane, but I think that’s the framing being applied, or at least part of how it’s being sold back to us.

I would really like to know who all these “investors” are. I’m in my early 30s. I have a few million saved up from 10 years of hard and focused work and I am in the 1% income range. I am not rich at all in Los Angeles. I can barely afford a semi decent quality starter home (in Los Angeles at current prices in a desirable area those start at $2.5M now). There’s this idea that tons of people are swarming the housing market, buying everything as “investments”. Who are these people? Many of my peers are in the 1% “club” and they are not buying anything for investments. They sit mostly on cash and some stocks, but the majority of them have assets tied up in companies, or have paper value. Who are the buyers of all this real estate? If no one is buying then why are prices rising? It doesn’t make sense to me.

I would love to buy a house but to me it’s disheartening when millions of dollars don’t even get you a decent place. So instead I’m renting. I am spending $4K a month on a very modest house in a lesser area. Why spend any more if it won’t get you your dream house anyway?

So I’m just saving my money hoping that eventually things will level out. Maybe I am an idiot for waiting on the sidelines, and maybe all my savings will be eaten up by inflation. Maybe it’s true, maybe all these buyers are real. Maybe tons of people can afford to pay $2.5M for a 2500 sqft tract home in the pacific palisades. Maybe for these people $2.5M is nothing.

One thing is for sure. Of all my childhood friends, none of them are making that kind of money, and those that I know who do, are not spending their time buying investment properties.

Is Los Angeles a rich mans private club now? Why? I thought the movie industry wasn’t doing so well? Where’s all the money coming from?

The whole thing just smells fishy to me.

I am in a similar boat. I haven’t made it to the top 1% but am close. No house worth investing in that I have seen lately. I do not see how people under the top 10% can buy even with extraordinary leverage. Price is peaking out where it peaked out before. That maybe the max this market can bear. Forgetta ’bout holding RE in this market, the easy gains are gone.

The max the market can bear meaning the max that emotional buyers will shill out with the support of fed monetarist rate policies and money printing.

The sky is apparently not the limit. Despite us chickens, the sky is not falling anytime soon. It will be long and slow and the bottom will probably be shallow.

I hope this chicken is dead wrong.

“I’m in my early 30s. I have a few million saved up from 10 years of hard and focused work and I am in the 1% income range.”

Something about this seems to be missing. You started saving up $300K+ beginning in your early 20’s and this was wholly a result of doing something “hard and focused” – there was nothing else to it?

Meant to put $300K+/yr

Yeah… I believe it. Because I’ve seen it with my own eyes..

Working for somebody else you just get by… even if you have a 6 fig job..

I know late 20s and early 30’s millionaires… It’s called START YOUR OWN BIZ

I know a guy worth a few million dollars because he wrote an App for iphone… in the SFbay Area.

Does he want to shell out 1 to 2 mil to buy in Cali… Absolutely NO. He bought a nice state in Costa Rica, he also bought in Mexico… did it buy in California… NO, NO…

He’s traveling the world while he works on the go… single guy traveling with the girlfriend of the time…

My point here, Yes you can have millions, and not buy in this stoopid US RE bubble, just because you have money…

I can believe it too, but I think the point is being missed.

The inference the OP claimed was that “hard and focused” is what it takes to amass sums of capital that the vast majority of the world’s population has no opportunity to achieve, much less an individual starting out in their early 20’s.

Writing an iPhone app and hitting the jackpot is not “hard” compared to the laborious work many do for a relative pittance.

Yes, I own a small tv production editing facility. It started slow, but has grown over the years. I made most of my money in the last 5 years. There’s no mystery to it. Just hard work, persistence and a bit of luck. Either way it’s hard earned and if I’m shelling out millions for a house it’d better be my absolute dream house, not a starter shack. 2-3 million dollars got you some incredible houses in l.a, even back in 2006. Not anymore.

Americans always tell themselves that their money came from hard work, even if they are connected Freemasons, or sociopathic lying sycophants, or it’s a woman who slept her way to the top. We are fakes, hypocrites, it’s all about appearance for us. Everything in the society tells you that.

I am not saying this is necessarily the case with Tb, but even if he made all his money fair and square, it is very classically American for him to say that he succeeded with only a “bit” of luck. In reality he doesn’t know how much was luck and how much was work.

Also so much of the money being made is being made in stupid and ephemeral ways, for instance, with the aforementioned trend of apps. The guys who run Twitter probably have a lot of money but Twitter is still a stupid ephemeral fad. Not much is real right now.

If you’re in the 1%, you’re making about $500k / year, and your income has been steadily rising. In fact, you’re probably making so much you’re simply looking for a safe haven to put that money.

If you, like most of your wealthy counterparts had your money invested in stocks, equities, RE or other investments you’ve made huge gains there as well.

If you believe housing is going to “tank” let me ask you where you’re stashing your millions of dollars? If your “peers” in the 1% club have their wealth stored primarily in cash, I’m not sure they’ll stay in that club for much longer.

Hello MB, I have a very conservative stock broker and we have not made much gains over the last years because of that. Another friend of mine got wiped out in the stock exchange, and another one has a retirement account that’s gone from $400K down to $300K and now back up to around $400K again, in over 8 years. My stock broker was worried about the overvaluation of stocks and still is. I’m mostly sitting on cash. I have made most of my money in the last couple of years and have not been able to place it anywhere safe. I don’t trust the stock market. A friend told me never to invest in something that you don’t know anything about. I can’t make sense of the real estate market and find it even more confusing now than ever. I don’t believe it is going to tank, but I think it will have to cool down considerably. Or maybe not. I would like to invest my money wisely but I don’t know what to trust. No one seems to know what’s safe. Stocks are not, nor is the real estate market as we have seen. A lot of people must be really confident in both markets though since there’s so much investment activity. All I know is most my friends have done REALLY badly in the stock market. It’s a gamble to me. I don’t like gambling hard earned money.

TB: “I have a very conservative stock broker and we have not made much gains over the last years because of that”

If you haven’t made much money in the market in the last 5 years, your stock broker hasn’t been conservative, he’s been flat out horrible. Nearly any basket of stocks would have made you a considerable amount of money.

That being said, I can’t fault anybody for not investing in the stock market as it can feel like gambling, though long-term history says otherwise.

re: real estate

We all know incomes for the overall population is stagnant despite a still-growing economy, with the bottom 60% seeing declines, the 20% above that stagnating and the top 20% seeing gains. These gains by the top 20% can be seen in still-rising RE in affluent areas and the additional investor spending. Unless you see incomes in the top 20% falling, I’m not sure how one could predict a tanking of RE at that range. Smaller increases or flat prices? sure.

Since you seem conservative in your investment strategy, I’d make the case that buying a house might be the conservative play. Even if you could afford an all-cash purchase, I’d take out a 30 year fixed. You get to fix your housing payments for the life of the home and not need to worry about the price of RE going forward. At some point, wealth management becomes an exercise in maintaining stability.

MB, that is only conservative if he is sure of keeping his video editing business for thirty years… And anyone who thinks they are sure of keeping any job for thirty years in today’s society is deluding themselves.

Something people seem to forget, an unstable job market, means an unstable job market… And it’s trendy and ephemeral and fake as all get-out also.

So where should he place his money? Well if he has millions he can get quite a few cheap houses in various areas, just to make sure he has SOMEPLACE to live that isn’t Detroit as things keep getting worse.

I have no idea if the stock market and real-estate bubbles will crash or if we will simply remain in this fictional universe. Just because people cannot afford homes, I now realize, does not mean that prices have to drop. What the powers-that-be may be counting on is that people will adjust. Can’t get a job? Become a prostitute. Can’t afford a house? Pool together your money with 30 other people. They give you the problem and expect you to shift for yourself.

By the way, I am, of course, not advocating anyone become a prostitute.

Only “one” job lost to the sequester ( what happen to the many thousands), that is why think long and hard about the next election, all parties are deceiving, but this administration took it to a different level, for that they need to pay the price at the voting box?

Hell yeah, another fake war would be great for me and my cronies in the defense biz. Things have been getting kind of lean in the few years with that pesky Obama pulling out of foreign quagmires and we’re just itching to sell some new multi-billion dollar weapons systems.

apolitical scientist…Totally understand from Vietnam, to Iraq, to Afghan, both parties are awash in war crimes etc. Debating that this administration is business friendly is where I drawn the line, these folks are out and out socialist, it is very evident.

You can’t have a Capitalist built country and continue to punish those who only use the tools that were given them to make untold money. Please ask to abolish the IRS, go to a National Tax or flat tax, and let the 1 or 2% do what they do best, take chances invest, and hope the whole system doesn’t fold, it is better then sitting home looking for a handout from Uncle Sam???

Foreign money wants high high dollar homes – not your dream home – who is going to cash you out in the next 10 years – the chart that shows the rising and now flat but slightly declining 18-32 kids being unemployed – does factor in teh Declining wages = most employement is low wage service industry jobs which are under assualt by more immigration and computer based machines, You can hold on while the market is falt and hope the fed can keep the instrest rates flat till you get out in say 5 years but when the long term implicaions of bad unemployement of thise starting out combined wiht teh spectacualr progress of computers taking over jobs – get ready for the tiered property tax on your home- good luck trying to sell in 10 years.

A carryover from the last thread:

“Roses are red, Violets are blue. My swimming pool has a negative edge, now my mortgage does too.”

This is solid fucking gold! BP, keep the hits coming!

Thousands of potential first time homebuyers are being shut out due to the huge increase in FHA loan fees. FHA reserves were depleted due to DEFAULTS !!

http://www.bloomberg.com/news/2014-05-07/americans-shut-out-of-housing-as-fha-fees-jump-mortgages.html

Brian Chappelle, a former FHA director and partner at Potomac Partners LLC, a consulting firm in Washington. “Yes, the insurance fund needed to raise more revenue, but using the monthly fees wasn’t the way to do it.â€

That earnest lobbyist took the words right out of my mouth!

Hello Doc

I was shocked to see this. From CNN today, RealtyTrac claims that over 40% of all home sales in last quarter were all-cash;

“.. Interestingly, the increase in cash sales is occurring despite a downturn in purchases by institutional investors — firms that have been active in buying foreclosures and short sales with cash.

“As institutional investors pull back, there is still strong demand from other cash buyers — including individual investors, second-home buyers and even owner-occupant buyers — to fill the vacuum,” said Blomquist….”

http://money.cnn.com/2014/05/08/real_estate/cash-home-sales/index.html?hpt=hp_t2

Doc may not be surprised given the attention he’s put into “feudalism nation” posts awhile back.

Article also (correctly) points out that this stat (@ 40%) represents the “soft underbelly” of the housing market.

Keep in mind part of this is a function of the steep decline in overall sales. For example, when CA sales volume was 21,000 (based on a chart in an earlier Doc blog), you needed 6300 investor purchases for it to be 30% of the market.

With volume dropping to 15,000 overall, overall investor purchases can decline to 6000 units and still rise to be 40% of the market.

^ That was the first thing I thought when I read the headlines on the 40 percent cash statistic story that came out in every newspaper today.

Did anyone mention this glaring math in the articles?

No. Just speculation on what is driving cash sales.

I think most people don’t realize the party is over.

90% of the generalk public don’t have any idea of the state of the economy, beyond their own paycheck and household expenses. I don’t think the average person understands the forces at play or the FED’s manipulation magic tricks that have bought the US to this point. Nor do I think they really care. They listen more to the BS NAR commercials and open house RE speels than to Yellen’s reports or forecasts.

IMO the only people that know or care are a small handful, including us DHB bloggers.

I’ve been reading these housing bear blogs since 2006 or so. They have been pretty accurate at predicting which way the RE markets are going and have only been truly wrong in one way: this last recession was WORSE than even they expected. This next round is going to be worse once the investors start dumping properties en masse and head for the exit.

“I’ve been reading these housing bear blogs since 2006 or so. They have been pretty accurate at predicting which way the RE markets are going…”

You’re high.

In my opinoin, the blog that’s been the most accurate over the last decade as been CR.

Bearish up until 2009, started turning bullish in 2011.

There’s a wealth of information there that isn’t a retread of other websites.

I agree CG, that is why this thing keeps on going much longer than anyone thought…….

Calgirl you are so right, many people work two jobs and many are so bone tired they don’t have the time to find out if the world is in play.

In a country as great as America has been, it is turning rapidly into a social mess of uncertainty, moral and religious values all but dismissed as not important and a “I got mine sorry you didn’t” attitude they can only mean unrest and bewilderment among the citizen’s.

I think we saw this play out before, Roman Empire come to mind?

MB, are you the same MB that posts regularly on CR?

If so, (I haven’t read it in some time) What is Conjure saying these days?

I believe he predicted the end of the world some time ago. What does he say right now about housing?

According to the media, the party is still going strong:

http://www.sacbee.com/2014/05/08/6386684/now-more-than-ever-cash-is-king.html

Doc is spot on!

Lets all hope for a %20 -30 drop in prices by 2015.

Back to 2010 prices will still be to high for most local incomes.

A true correction back to a normal ~3% historic appreciation would be a bit more than a 30% drop. Maybe by 2017, but I was saying, “maybe 2014” in 2008.

I do agree with the poster who quipped “that the yeast has run out of the FED’s bread making.” So not sure how long the inevitable fall of RE will take this time and if it will find a bottom in which the market forces actually dictate prices instead of the market being dictated by free money lending rates, tax credits, and such shennanigans.

My wife and I just opened escrow on our house, 9 days after listing, at list price (high for this area) in Lake View Terrace. At first we thought that everyone was wrong about the state of the market being slow. After the first few days of a flury of showings, however, it settled down to practically nothing. The buyer that came in the second day was desperate for a larger house than what they were living in. When they saw our place, it met their requirements and they lowered the price on their house (on the market for 4 weeks) which they then sold in three days. They moved up (spacewise) which cost them less than they anticicpated and they are coming into our property with 25% down.

What is interesting is that we are moving to Virginia where the small horse farm we purchased last fall was less than what we got for our house. Our new place is 26 acres with a larger home than our current home, and the facilities on the property are more than sufficient for our horses. Both my wife and I will continue our current work as “remote” workers.

The net result of these three transactions is that prices moved “slightly” in all three transactions. Prices in North Hollywood are a little lower, in Lake View Terrace a little higher, and in Roanoke, Virginia a little higher. All parties to the transaction improved their situation. This dynamic will be increasing as people gain more information on what is available inside and outside of California. I think that one driver in this is the rise of the “mobile” worker. The other driver is the increased accessiblity to information on what is available in the market. We conducted a lot of our search on line as well as devoting resources to visiting various parts of the the US to refine our areas of interest. It is people like us that will be making this housing market more fluid and alter the pricing in various areas. It will always be the marginal transaction that sets the market price, even in housing.

The other interesting thing that I think everyone should recognize is that there is a lot of money in MM funds and in other tapable assets. Much more access to chunks of cash that 10 years ago. My wife and I had a nice chunk to work with so that we could easily go in with 20-30% down without a strain. The couple that bought our home also were able to come in with 25%. And they seem to be your average middle class people with a Mom that helped out. I think analysts don’t recognize the extent of the resources that are available to people who are looking for a change in their circumstances. It is more than just having a job. If one can bring down the payments by a large down payment it doesn’t require a 200k + combined income. I think that the increase in available resources is going down into the middle and lower middle classes as well. Not everyone of course, but a large enough proportion to make a difference.

DougS… Yes Doug what you posted is just a piece of the puzzle, because even with lower payments from a large down payment, the bank still has to consider all the variables in the mortgage they are approving.

If to much is put down to lower the payments the bank worries what is left for the rainy day scenario. Also many people livein HOA’s where the monthly fees can be expensive and raised, also some times residents have to dip in for capital improvements. Remember HOA can foreclose on you for non payments.

Of course the property taxes also come into play etc. So you see lower mortgage or even paid off mortgage can still be a monthly burden if all isn’t consider. A healthy bank savings is alwaysr important when considering ownership.

If of course you meet this criteria then by all means get as low as payments or pay in full if at all possible.

SoCal how-zing is closely correlated with S&P index, since both markets are exclusive playgrounds of the 1%. I “see” S&P correcting 10%+ over the next couple of months with how-zing prices in prime areas stalling out as a result.

Did SOL lend you his CB? It “appears” so but I think your “prediction” is cloudy at best. I “see” how-zing going up at least 30% per year from here on out…

You’re the one that must be high. Tech stocks are getting pounded and dragging the markets down with it. S

Silicon Valley billionaire today, flat broke tomorrow.

Thank you for calling out my premise, BP! Techs breaking to the downside while S&P just off 1% from its all-time “high.”

to many people in this world,they all got to live somewhere.Just buy your home and “forget about it”

one clear insight, we are consistantly seeing the home loan programs becoming more relaxed, FHA allowing 1yr out of forclosures and bankrupt. you also need to keep in mind many of the loan program are apporved thru AU systems, basicly computer underwriting. the powers that be can tweek the standards how the choose fit, increase DTI ratios, lower credit standards. they can control a part of the demand side by simple unseen tweeks. also, just recieved this VIA email, wholesale lender, CHF FHA/VA now offers 3% and 5% grants to low income borrwers with up to 50% dti. now keep in mind this program offer a higher interest rate which translate into higher YSP. remeber the days when those loan agents would use the compenstion from a higher interest rate to “sponsor the borrowers downpayment” Fed’s said that was illegal, closed down a few companies. NOW they are doing it and its all ok! we are getting to the broken portion of the golden stairway.

Future real homes of genius: http://www.latimes.com/business/la-fi-foreclosure-registry-20140509-story.html

Absolutely correct Doc, but so much repeated malinvestment since at least year 2000 – I had math teacher give me the toughest time at school, and parents freak me out about risks of debt. Speculators and bubblenomics won.

Thought this might be of interest to you, as reported in one of our UK newspapers.

>>Isn’t that the Peach Pitts! 90210 star Jason Priestley sells his $2 million Toluca Lake home for a $140,000 loss

By CHELSEA WHITE

PUBLISHED: 18:05, 8 May 2014 | UPDATED: 20:50, 8 May 2014<>09 May 2014

Jennifer Love Hewitt Sells Her Toluca Lake House to Jessica Simpson’s Mom, Loses $1.4M On The Deal. <> The Santa Monica Mountains surround the area of Toluca Lake and provide one of the nicer areas of Los Angeles. Toluca Lake even though it is considered prime, has not been immune to the housing bubble busting. The area’s median home price is now down 16.6% when it flirted with the $1 million mark. <<

Hmm the above didn’t post in any format as I intended… retrying.

Thought this might be of interest to you, as reported in one of our UK newspapers.

1. Isn’t that the Peach Pitts! 90210 star Jason Priestley sells his $2 million Toluca Lake home for a $140,000 loss

By CHELSEA WHITE

PUBLISHED: 18:05, 8 May 2014 | UPDATED: 20:50, 8 May 2014<<

Link: http://www.dailymail.co.uk/tvshowbiz/article-2623558/90210-star-Jason-Priestlye-sells-2-million-Toluca-Lake-home-140-000-loss.html

————–

and

————–

09 May 2014

Jennifer Love Hewitt Sells Her Toluca Lake House to Jessica Simpson's Mom, Loses $1.4M On The Deal.

http://www.forbes.com/sites/trulia/2014/05/09/jennifer-love-hewitt-sells-her-toluca-lake-house-to-jessica-simpsons-mom-loses-1-4-m-on-the-deal/

I only know of the area from one of your entries back in 2008 (I'm not in US). Could the above be any signal of renewed softening (sshh perhaps HPC 2.0 signals). Probably not, but thought I'd post it up.

___________

Doc blog 2008: The Santa Monica Mountains surround the area of Toluca Lake and provide one of the nicer areas of Los Angeles. Toluca Lake even though it is considered prime, has not been immune to the housing bubble busting. The area’s median home price is now down 16.6% when it flirted with the $1 million mark.

Leave a Reply to That's What