Is housing hiding inflation in other sectors of the economy? CPI gives housing a 42 percent weight and this has obscured rising costs in medical care, education, food, and energy. It has also given the Federal Reserve another excuse to digitally print more money.

A question that seems to come up over and over again is how it is possible for the nation to bailout the banking industry with trillions of dollars and for the Federal Reserve to enter into programs like quantitative easing without inflation showing up in the headline figures. The issue of course is how the Bureau of Labor and Statistics measures the housing component in the Consumer Price Index (CPI). Housing is the largest item in the CPI basket yet during the raging housing bubble the home price measure did not show any signs of a bubble. In fact in the peak bubble years of 2004 through 2007 the CPI measure of housing only registered a 4 percent year-over-year change. We can measure this against the Case-Shiller Index that was measuring annual price changes across the United States above 15 percent. Can it be that the crashing housing market is underscoring the rising cost of goods in other sectors of the economy because of the heavy weighting of housing in the CPI? That is what we will explore today.

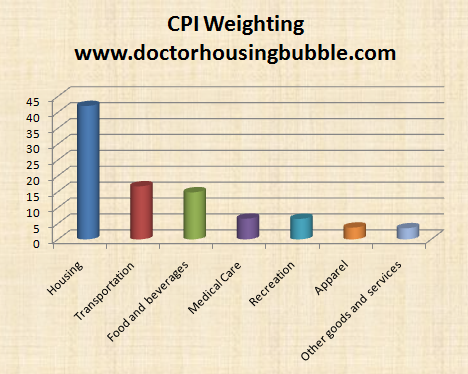

In order to understand how inflation is measured by the BLS we first need to look at the basket of goods used on a monthly basis and their associated weighting in the basket:

Source:Â BLS

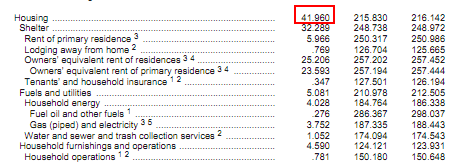

It is rather apparent that housing consumes the largest portion of the basket since housing costs are typically the largest outlay for most Americans. The CPI gives housing the following weight:

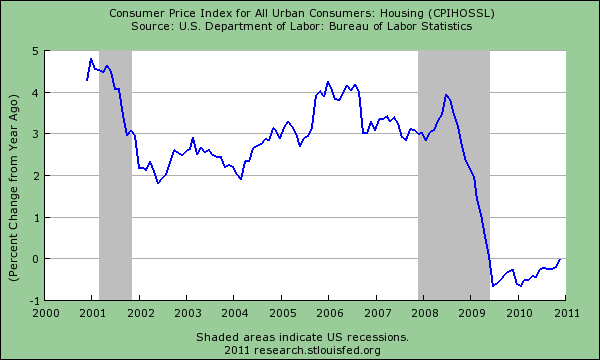

Close to 42 percent of the monthly basket is associated to housing costs including utilities. Yet the reason the CPI missed the entire housing bubble is because of how it looks at housing costs. More importantly, it uses an “owners’ equivalent of rent†for the largest component of the CPI. What this does is basically underplays the actual cost of the home. For example, say your Culver City home would rent for $2,500 but your actual carrying cost is $4,000 then the OER is shown as $2,500. Clearly this underplayed the rising bubble in housing and we see this in the CPI housing component:

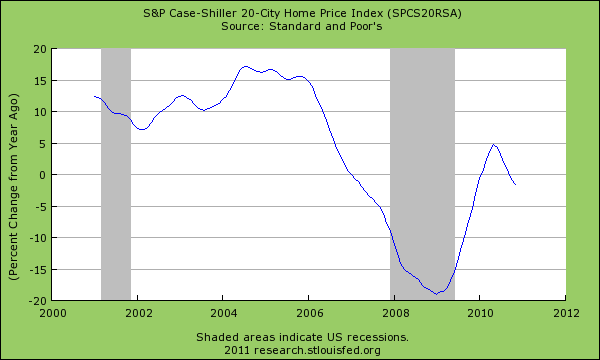

Notice that in the peak years of the bubble it was registering annual gains in housing of slightly above 4 percent. Yet the reality on the ground was much more severe as anyone that followed the housing market closely or just happened to live in a bubble state like California. Nationwide home prices were rising much faster than the CPI figure:

The Case-Shiller Index was registering annual gains of 15 percent and higher during the peak years of the bubble. The Federal Reserve was well aware of the bubble but kept using the CPI and referencing it as a reason for keeping rates artificially low during the bubble. What is interesting about the two charts above is that it also shows that the CPI component has corrected only modestly in regards to housing costs while the Case-Shiller metric plummeted accurately to reflect crashing home values. In other words the CPI which is designed to measure the cost of spending for Americans largely missed the biggest line item by a giant margin. Yet nothing has changed to reflect this new reality but now, the declining values of housing are hiding changes in other sectors of the economy. Just like the CPI missed the housing bubble it is missing the run-up in other sectors.

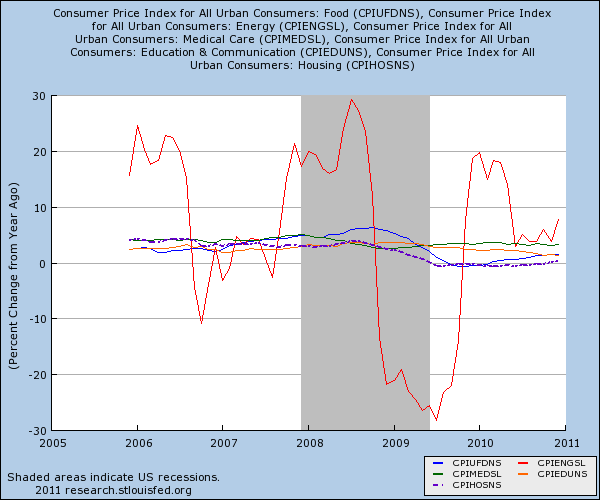

Take a look at some of the areas of the CPI broken out by sector:

You can see the dramatic and seasonal change in energy measured by the red line. Yet housing since early 2009 has been negative for the CPI yet every other sector including food, energy, medical care, and education has been solidly above the 0 percent line. Housing being the largest component is making the entire basket look as if price growth isn’t occurring. Couple this with stagnant wages and persistently high unemployment and you can understand why it is unlikely home values will be going up anytime soon. This also doesn’t reflect the larger changes of the nation because many people have switched to renting or doubling up out of economic necessity. Lower wages or no jobs equates to less housing demand. Large vacancy rates have held rents stagnant or have dropped them in some markets. So the decline in housing values is hiding the costs of daily goods rising. Take for example the cost of a gallon of gas:

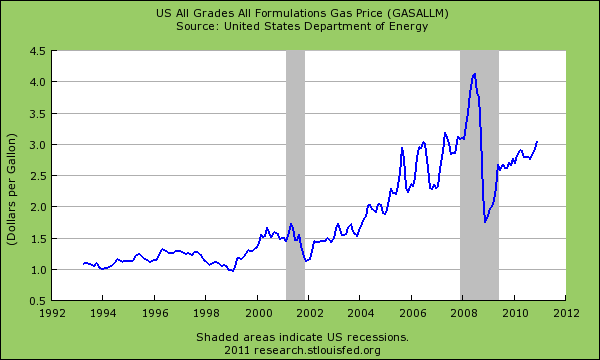

US gas prices are now trending strongly up. Here in Southern California I have seen premium going for $3.80 and we are only entering the time of year when gas goes up even higher and with global uncertainty this is likely to continue. The above graph shows that gas peaked above $4 nationally and fell to below $2 after the massive run-up in 2008. But today it is now over $3. This is a 50 percent increase from the recent trough for a good that is used weekly by all. If you only look at the CPI you would think nothing has changed. Food costs have been going up but manufactures have done a good job hiding inflation by lowering the quantity they give you for the same price:

Source:Â CNN

I thought I was losing my mind when my box of cereal didn’t last as long. Another important thing to mention is the tiny weighting given to medical care which is going to be a large cost for many baby boomers. Why would this weighting be so little if the demographics of the nation will be shifting to this being a large line item of consumption for many? Keep in mind many will rely on Medicare later in life so the money doesn’t necessarily come out of their pocket but someone is paying for this. Just like housing, this inflation is hidden. This is similar to the massive subsidy that is given to the housing market via artificially low rates or large tax credits via mortgage deduction. Why not cap the mortgage deduction at the median price of nationwide housing? Another item that impacts a younger generation is the incredible price rises in education. Take for example the cost of education for a public university in California:

Since income hasn’t gone up in the last decade and state funding is dwindling to institutions of higher education many more students are going to go into deeper debt for a college degree. The weighting for education is tiny on the CPI measure yet if you go to school and come out with $50,000 in debt and your first job pays you $40,000 a year, the cost of your education is going to eat a large portion of your income. You may be paying $600 in rent and $300 in repaying your debt.

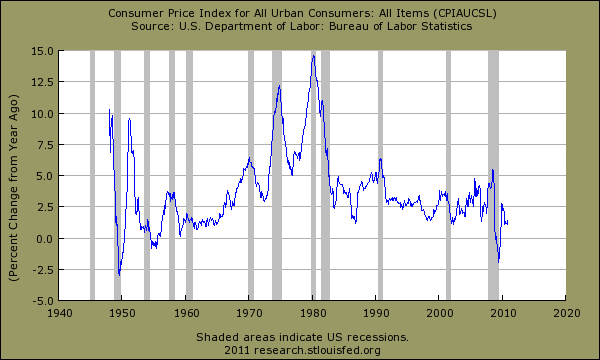

Some will argue that the CPI is merely a reflection of all goods in the economy and over time offers a good measure of consumer inflation. So far for the last decade it has been a very poor measure because of the way housing is measured and its heavy weighting. The Federal Reserve will point to the CPI in support of bailing out the banks and quantitative easing. They have a point when you look at the overall basket:

Yet there is a big caveat here. Price inflation is happening ex-housing. In the early years of the bubble I argued that using the CPI to provide evidence against a housing bubble was naïve because it was understating the true cost of owning a home. The OER measure understated the true carrying cost of owning a home. NINJA loans allowed people with no income to buy homes that had a carrying cost of $3,000 per month! You can’t even measure that kind of weighting. Even worse, you had many folks that over leveraged and had housing eating up 70, 80, and even 90 percent of their take home pay. That is no longer the case but we are using the same CPI measure today with no adjustments.

If the main purpose of the CPI is to get a sense of the impact and feel of consumption for most Americans and it missed the entire housing bubble, then you have to question where things stand today. I’m not saying the entire measure is not worth looking at because it is but you have to be completely aware of how it is designed and what it is measuring. Right now declining home values and more importantly, weak or stagnant rents are holding nearly half the measure down covering up the cost of goods going up in other sectors. How can housing values move up with weak wages and a stagnant employment market? If you want to see what happens when real estate drags down the economy with zombie banks just look at Japan. After two decades they have muted inflation yet 1 out of 3 Japanese workers are employed in contract positions and real estate has moved nowhere but sideways for over two decades. The good news is we have already gone through one decade.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

81 Responses to “Is housing hiding inflation in other sectors of the economy? CPI gives housing a 42 percent weight and this has obscured rising costs in medical care, education, food, and energy. It has also given the Federal Reserve another excuse to digitally print more money.”

We haven’t gone though one decade.

We’ve only gone through two or three years…

Clever how they can make the 24 Ounce bottle of Ivory look bigger than the 30 ounce bottle. I didn’t realize that food containers were getting smaller – will have to check it out more carefully next time I go shopping.

Check out ice cream and coffee (these are ones I’ve noticed in particular)… 1/2 gallon is now 1.75 qts (and this has become standard over the last 2-3 years) and a 1 lb bag of coffee has become 12 oz. I think they bank on most people not knowing their conversion factors, and think we wouldn’t notice that we just lost a quarter quart, or a quarter pound. Ice cream containers had a false bottom thing going on at the start, but I think now they figure we’ve grown accustomed to seeing the smaller container sizes as normal… 🙁

Given that 36.6% of Americans are overweight, with an additional 26.5% being flat-out obese, this may not necessarily be a bad thing.

I just noticed chocolate chips are now bagged at 11.5 oz., not 12 oz.

Just checked ice cream. 1.5 qts. now.

This is by far the best effort at explaining CPI underreporting that I have read.

At the end of WWII, Europe was in shambles, Japan was in shambles, are England was rapidly losing it’s Empire. The U. S. was stronger than all three of these combined.

The 50’s and 60’s reflected growing affluence, as other parts of the world were rebuilding. Now, many jobs will not come back. Bridge toll takers are being replaced on the Golden Gate Bridge, by machines, saving $10,000,000. over the next 8 years.

File clerks are no longer needed, as all files are electronic. And a car plant is now largely automated.

If you are 60, count your lucky stars you made it through. If you are 35,or under,

you will live with a lower standard of living, and some parts of your life will be truely miserable.

That is completely incorrect. Yes times are tough, but automation and efficiency do not hurt standards of living. I’m sorry if sitting in a toll booth for 8hrs a day collecting tolls is a quality life style I’m missing something. The true value of a life is not based upon a dollar figure or a paycheck. Automating a toll booth frees up human capital to do some other productive job for society, thus increasing our net product. Mind you, in these tough times that is not necessarily apparent. But when the economy picks up again, and it will eventually, those very efficiencies pay huge dividends.

Automation and improving efficiencies have greatly improved standards of living over the past 50-60yrs (As they have since the beginning of mankind). Some may pine for the bygone days of the 1950s, but personally I’ll take my 2010 and all the wonders that come with it.

You are correct that productivity enhancements raise the standard of living. When a lazy good for nothing toll taker gets paid 100k plus with benefits, replacing him with a machine is a no-brainer. Unionization increases the rate at which capital replaces labor. However, this presupposes a free market in labor, goods, capital and business. Unfortunately we have none of these at the present time. In addition, we have governments that do everything in their power to destroy incentives to invest savings and capital. As a result, capital flows to where it is treated best and that is certainly not in the US and especially not in Cali. Who in their right mind wants to start a factory in Cali at this time? Instead, you start a hollow company with as many independent contractors as possible. You incorporate in Nevada and run your business out of a mail drop. You take no salary and instead accumulate profits in NV. You outsource all manufacturing, if any, all back office and support jobs to India or the Philipines. As a result, a business that once would employ 20 people in the US, only employs one. And then Obama, not the cause but certainly a major aggravating factor of the above wants to know why you won’t invest your profits and share the wealth with your employees.

Then you know you’re really cooked and start looking at real estate in Panama and Costa Rica. The cost of living there is 1/3 here and you move that business to a tax haven, flip Obama the bird and you’re out of here.

A: Because buying a house is optional, and rents didn’t change much.

Bingo. This is why the lack of upside participation in housing is so much more pronounced than the downside. We all know rents are under pressure in many areas but compared to housing prices, it’s a non-factor. Yes, it is offsetting broader inflation measures to some degree but not massive distortion.

Also, let’s ponder for a moment, velocity of money and real money out there circulating for lending/spending etc.. I don’t care what M1 looks like (it exists to enable our banks to take writeoffs on their resi bookis), our banks are mauled and anything but agency securitization is dead. Many banks in Europe are that much worse. Hell, anything but agency mortgages is dead. Velocity of money since early 2007 basically went away. Now consider consumption. On a global scale is there really a ton of consumption going on? That answer is no. Developed markets and their populations all over the world are pulling back. This commodity rise is about assumed future in China, emerging markets, and related consumers; Chinese stimulus both fiscal and monetary continuing (while they are clearly tightening – look at their stock market), and American monetary stimulus continuing to flow into commodities as an asset class. Look at shipping costs for ore and materials falling like a rock (do we really think the global shipping industry is so bad at managing its order book and is surprised when a new vessel it ordered years ago gets delivered, I’ll give them some in 2010 right before QE2 I would add but not again). Certainly there are some weather events around the globe impacting agg and Egypt isn’t helping oil at all. That said, the world is uncertain and many financial players are pouring money into commodities under the assumed full recovery theme or at least inflation theme while the Fed is still waging a pitched battle against deflation. If things do not truly turn positive soon, there is no small chance of a serious pullback in commodity pricing.

There seems to be a contradiction in the article. On the way up, the housing price was under-reported. CPI did not show the rise properly. If the same metric is used now as it was then, the fall should be under-reported and would not mask the rise in other costs. Sorry if I missed the crucial point. I love this site and quite the Dr. often. He has been so right on so many questions.

Here’s how he explained it:

the reason the CPI missed the entire housing bubble is because of how it looks at housing costs. More importantly, it uses an “owners’ equivalent of rent†for the largest component of the CPI. What this does is basically underplays the actual cost of the home. For example, say your Culver City home would rent for $2,500 but your actual carrying cost is $4,000 then the OER is shown as $2,500. Clearly this underplayed the rising bubble in housing and we see this in the CPI housing component:

As I understand it, that covered the rise in housing prices. Now that the RE market is tanking, the risi the prices of everything is being counterbalanced by the tanking 42%.

Sorry, I meant “quote the Dr. often.”

Tuition at Beserkley in the early 60’s was under $100/semester and

$134/semester @ UCSB in the early seventies!

—

This year?

“$12,150 per year in tuition and campus fees!”

Reporting from San Francisco — The basic cost of an undergraduate education at the University of California will rise 8%, or $822, next school year after a regents vote Thursday, although officials said that expanded financial aid would shield many students from paying the higher amount.

The UC Board of Regents, meeting in San Francisco, voted 15 to 5 for the increase, together with a one-year reprieve for most families earning less than $120,000 annually. The regents also changed the name of the educational charges to students from “fees” to “tuition,” a linguistic acknowledgment that the amount has tripled in the last decade.

Starting next fall, undergraduates who receive no aid will face about $12,150 per year in tuition and campus fees and an average of about $16,000 more for living expenses and books.

—

UC tuition to rise 8% for next year

Regents vote 15 to 5 for the increase, meaning undergrads will face $12,150 per year in tuition.

Stockholm?

The move meets little outcry!.

Financial aid also is expanded.

Test scores are like the Ivory bottle:

Bigger on the outside,

Inside the skulls, not so much.

I went to CalBerkeley in those days – then took a break and went to Phoenix for a year. There, I was paid $50 a week for an “office manager” job that was fun and allowed me much time for reading.

I paid my landlady $22 a week for room AND board at a lovely co-ed boarding house with a great cook and a swimming pool. All 7 women had rooms on the first floor, the 70 men were scattered over several nearby buildings, but we shared dinner, swimming, and sitting on the front porch playing guitars and talking.

What an education! That made it hard to ever pay for formal “education” again, but I did it, just to get a BA.

These current tuition costs simply show how inflation has proceeded over the past 50 years.

I don’t agree that it’s balanced by inflation. I graduated from UCSC in ’89; when I finished my tuition was $1800 a year. An average first job with a BA/BS at that time paid probably $30,000 a year. Tuition is now seven times what I paid, so if it’s keeping up with inflation, the average first job out of college should pay about $210,000 a year! I’d guess they pay about $45,000. Education is way, way ahead of inflation. Rent and food are significantly more expensive today, but I’d say it’s more like double, not seven times as much.

Doug your report brought to mind a question. If the students get expanded aid (assuming that is in the venue of things like Pell grants) will this be coming from the deficit hampered state of California? So how does that work? Does the money come from furloughs from state workers, including the college staff. I have an active imagination so I picture furloughs to take the money out on one hand and guaranteed raises to give it back on the other. Seems like a slight of hand borne by the students.

Do we import any oil from Egypt?

Could what is going on have any effect on our economy?

Crude from the Middle East come through the Straits of Suez i.e.: the Suez Canal that is controlled by Egypt. Israel had control of the Suez Canal and the Sinai Peninsula but gave those up in exchange for peace.

The only other alternative other than the Suez Canal is for oil tankers to travel around the Cape of Good Hope at the tip of Southern Africa. If this has to be done, the shipping costs would add to the cost of oil and price would be reflected in gasoline prices at the pump, among other things such as costs for products made with petroleum products.

~Misstrial

Bunch of bull here. We’re in California and as far as I know they don’t sail through the canal, down to panama and back to California.

Also we only get a percentage of oil from Saudi anymore. Think it is under 25%.

No real reason beyond monetary easement and speculative buying and manipulation by big money insiders.

Anything actually reported at the canal yet?

@ Paul

Google “Vision Victory” on youtube and listen to a great

guy named Daniel who predcited all of this very early on.

General middle east instability and look at the location of the Suez canal.

It does not matter who we get our oil from, as oil is traded around the whole world, so if the supply of Oil coming from Egypt is lowered, then the markets have less oil supply in the market and prices will rise. (supply and demand)

Exxon profits up 50%!

Egypt isn’t an oil producing country, but the Suez Canal makes it strategically important, especially for cargo to/from Europe.

However, the majority of cargo coming to the Americas goes round the Cape of Good Hope in South Africa and crosses the Atlantic from SE to NW. Very little of it goes via the Medeterranean

Plus, the whole point of using tankers – rather than flying/using trains to ship oil – is that they are slow, but cost effective and dependable. It doesn’t matter how long it takes, as long as they arrive when they’re supposed to.

So, basically, Europe will feel the bite of the canal being closed more than North/South America will. But, doubtless, the oil companies will find a way to make this drama into a crisis and start raising the price of gas as soon as possible…. 0_o

I agree with speedingbullet- the oil companies will use it to raise prices regardless. I was in Egypt several years ago and I know at that time there weren’t as many ships going through the canal as in years past. They had raised the fees so high that it had become cheaper to sail around Africa. I don’t know if they ever got it together to lower the prices enough to bring ships back.

The CPI has only one purpose: To reduce the payout to entitlement programs. Anyone who believes that any statistics are designed provide accurate information is much too trusting. Many here may not be old enough to remember, but we once used a measure called GNP, but they changed to GDP to include foreign companies operating here. Everyone knows that inflation is raging. Many are stuck in homes they can’t sell, are afraid to take another job with health-care costs being a huge consideration, and education has turned into the biggest crime syndacate of them all. Yes, we are in a slow burn with standard of living dropping for the foreseable future. I feel we will soon embrace the multi-adult family structure. We sort of have it already: parents drop their kids off a day care to go to work, they have domestic help because no on is there to clean and maintain the big house. They take their car in for virtually any maintenance because it is not cost-effective to even change your own oil like everyone did years ago. Something’s gotta give. We can’t just work harder and save less indefinately.

Don’t have kids. People in California can not afford to have children. If you choose that life style, go to Texas. Even my Mexican friends(those that remain) are talking about reducing the number of their off springs.(Remember they came here to work, not to take your formerly high paid unionized construction job).

I agree we’ve only been moving sideways for a couple years. I lived in Japan for 7 years in the 90’s and back then hey had 100 year loans @ around 3% and have been moving sideways ever since…so we could be declining or flat for quite some time. I’m actually quite surprised that the gov $8k tax credit and 4% interest rates brought prices up last year. It’ll be interesting to see if anyone bites at the next bait the Feds dangle.

The CPI is heavily weighted in housing because it represents the average persons net worth for the last couple of decades. It also serves a purpose for the FED to keep rates ultra low without causing the country to freak out. Eventually, everyone gets it.

I’ve posted this story, elsewhere:

I just purchased some toilet paper–same brand I always buy (Northern). I put a new roll on the bar and it looked narrower. I measured the new roll and compared it to cardbard center of the old roll.

Difference:

new roll is ~7/16 inch narrower

Other things to watch for price or size: Ice cream (1.75qt used to be standard size), orange juice, canned tuna (standard size used to be >7 oz), candy (getting smaller and pricey–watch those hershey bars)

It’s all obvious, if you’re awake.

@Tyrone

no wonder is seems harder to wipe without getting crap on your hands. that missing 7/16′ makes a big difference!

I believe that ones spending habits can also dictate the amount of inflation they feel. Food seems to be the one that most people complain about. One way to get around food inflation is to forego brand loyalty. I know so many people that just have_to_have their particular cereal/soda/cheese/juice/fruit etc.

For example…

Cereal: I eat raisin bran most of the time. The box has been 20oz for as long as I can remember. I don’t care if it’s Post, Kelloggs or Ralphs brand (yes, the Ralphs brand isn’t *quite* as good but it’s not a big deal as far as I’m concerned. There is always one brand on sale for $2.00 a box. On occasion, I will see a different kind of cereal at crazy low prices so I’ll pick up a few boxes (Most recently it was some kind of Kellogs blueberry cereal).

Orange Juice: I don’t drink much of it but there is always some on sale. Sometimes it’s the store brand, sometimes it isn’t. This past week 1/2 gallon was $1.50.

Soda: Coke vs. Pepsi Last week, Coke products were $1.79 for a 2 liter while Pepsi products were $0.88.

Milk: Buy the gallon size instead of the half gallon size.

Fruit/Vegetables: Buy what’s in season and what’s on sale.

Meat: Buy what’s on sale.

I have known way too many people who complain about the price of food, but in reality, they’re just not being flexible with their diets and brand preferences. I’m actually glad that there are people like this because if everybody shopped the sale items, the sale price would probably not be as cheap.

Shop two stores. What’s on sale at Pavillions won’t be on sale at Ralphs and vice-versa.

“Shop two stores. What’s on sale at Pavillions won’t be on sale at Ralphs and vice-versa.”

Depends on what your time is worth…and the price of gas. Shopping two stores adds a minimum of 1 hr…if it takes me 1 hr to save an add’l $12, it’s not worth it…I net out about $37 an hour at work…not to mention the opportunity cost of leisure time lost…

Fair enough. I go to the store 2x a week and usually switch off between the two.

You are right that there are ways to cut costs if you change what you buy, but it IS inflation when the product you buy is more money now or you get less of it now.

And your standard of living is going down if you choose the product that does not taste “quite” as good.

Hi EconE,

Good advice, however, to save $$ I gave up drinking juice in college, gave up sodas ten years ago, don’t eat cereral, bread, meat. Tap water is cheap and clean (I work for a water agency), I buy food locally, and drink a lot of protein powder. Feel good too. Take care.

I wish I had clean tap water. I live in an 85 year old building with rusty pipes.

Smart-shopping is good advice, just takes a little more effort is all, not always easy in our busy lives. We are lucky to have choices because of free-market competition. I’m glad I’m not Egyptian, stuck with govt subsidized bread which was recently shut-down, along with internet and phone service. Imagine how tasty that stuff is, and having to do without it for a few days or weeks.

Sure you could do that to ease pressure but that is really not the point.

What if a person was doing what you suggest all along? Then odds are they are suffering the same inflation in the off brand as well.

How do you use a gallon of milk though ??? seriously , we are a household of 4 and eat most our meals at home and get through a pint in about 3 days , as far as coke or pepsi goes , I dont think we have ever had a can in the fridge let alone 2 litres …

I don’t pay that much attention to the ‘price,’ I look at the per oz price which is in little letters at the bottom. That’s when you pick up on the change in actual product content. Compare the per oz price versus the optical illusion of packaging. This is particularly true with products such as laundry detergent. And once you take a look at those for toilet paper you’ll be amazed. Two packages may look roughly the same size and price but one will say $6.50 per 100ft while another may be $2.00 per 100ft!

That being said, prices have gone up by and large. I mostly shop and plan according to what’s on sale. Leads to a diverse diet!

I retired early in 2006 and was angered and frustrated by the horrific home prices in FL, where i hoped to buy a seasonal retirement home. When 2010 riolled around I felt vindicated for refusing to join the lemmings in self-destructive acts of spending and scooped up a beautiful villa 4 miles from the beach for the price of a BMW. I will be subsidized by $6500 in ‘bait’ from the feds and don’t plan to move – ever. The government’s stupid incentives merely stole demand from the future at a cost of billions to US taxpayers, of which i am one. I have little faith in the future of this country unless the free-for-all money-printing ends soon. But i am not counting on it.

1974-San Diego State raised the total fees $10 per semester. It went from $70 to $80 for tuition and fees. There was a protest of 150 people. That over 10% for one year. Of course 10% on $70 is a little different than 10% on $7,000.

Excellent post!

Here in Chicago street metered parking is now $5 hr!

And the (expensive) coffee I’m drinking right now has jumped in the past

week from $11.95/ 12oz to $13.95!

These are huge price increases for most people.

Conversely, the price of homes/ condos in many Chicago neighborhoods has fallen to

1999- 2001 prices. The South Loop area has seen some of the most drastic

price reductions… distressed properties leading the way down.

“Conversely, the price of homes/ condos in many Chicago neighborhoods has fallen to

1999- 2001 prices.”

That is exactly why I don’t agree with the posters who say it has been flat only two or three years.

When my home hasn’t appreciated in 10 years, that is 10 flat years. It doesn’t matter what I thought it was worth four or five years ago.

I’ll go further and add , that the home buyer in 1999/2001 couldn’t save 20% down to buy a house. He required super low interest rates / deffered interest payments / and first time home buyer credits and energy subsidies.

In other words. During the largest construction boom in the history of the world, the working man didn’t make squat. During the largest economic boom the world has ever seen the working man couldn’t afford to buy a house

I believe it’s been flat a whole lot longer than 10 years.

@Rick

You’re damn right. I am under 35 and have left the USA. I do not ever want to come back. I graduated college too late to join the tech boom and me and my friends all had a really hard time finding work in the early part of the decade. I am lucky that I was able to find work and gain some skills, I feel really bad for the younger generation that can’t find jobs or even internships. I understand the pain caused by outsourcing and so forth, but if you can’t beat ’em, join ’em.

Since I have been out of the US, I have met so many people from Asia and Africa. They all tell me that our skills in America are valuable in Asia and other emerging economies. I used to go to job interviews in the US and get told all the time that I didn’t have enough experience, didn’t have the right degree, too young, etc. I don’t think it was really about me as it was about the inept, nepotistic hiring policies of most American companies. For example, was laid off at a big company so new manager could bring in his guys. Problem was that they were all “managers” and didn’t know how to actually do anything. My new Chinese friends tell me that if I wanted to go work in China, companies would roll out the red carpet for me. They desperately want foreigners to come work there and start businesses.

When I first left the US, I always thought I would return in a year or less. Now it’s looking less and less likely. Rest of my siblings are thinking of doing the same. The one thing I have in my favor is that my parents were immigrants, so I understand that sometimes you have to move continents away to provide a good life for yourself and your family. Most “red-blooded, meat n’ potatoes” Americans believe in American exceptionalism and would never make such as move. My options: a future filled with low-paying jobs, high rents, high food prices, Tea Baggers, OR a future of wealth, nice colleagues, and opportunity. It’s not a hard decision.

@LAer: You make a lot of sense. Our generation is very educated yet we never really got to reap the reward of that education. Even though I managed to get a few well-paying jobs in my field, I was pretty ticked off that the home prices skyrocketed to a ridiculous price level at just the time in my life I wanted to buy one. The idea of moving abroad sounds a little tempting. I’m currently seeking dual citizenship with my mother’s country, just to have an option to get out of here if I need to!

@Heathen

Go for it! Don’t wait for dual citizenship! Countries like India and China are waiting for you. Don’t let media images of some emerging countries fool you into thinking that you are accepting a lower standard of living by going to a developing country. You’re not! With the education and skills an American has, you can get a good job or start a business. With the money you earn, you can have a really nice house, a maid, a personal chef, a driver and someone trustworthy to look after your kids in your home! My Indian friends are all young, single tech people. Each one has a maid, a professional chef and a driver to get the to work and back, and they still have plenty of cash left over. My Colombian friends say the same thing. In China, the thing to do is sit around with family and friends for hours, eating and drinking. Then off to karaoke. When do we get the luxury to do that in the States? Also, if you want, some European countries have Visa waiver programs that allow you to work for 12 months after you graduate from any sort of higher education. Europe kinda sucks for jobs right now but if you are educated, there are still more opportunities here than in the States.

You’re right, why go unappreciated here when we can go abroad and get our own piece of the pie? Why struggle when you don’t have to? All the stress of trying to find decent work and surviving in the face of diminishing opportunities only leads to a bad heart and grey hair.

Fully agree, I’m more in love with Freedom, and oppertunity than “america”. Where the heck did you go? Is there good surf there?? Are the chicks hot-looking? Hows the weather? Are the local cops on the take?

Nice, LAer! You’re absolutely right on all counts! BTW, the old saying goes “Those who can’t, teach”. Well here’s the updated version for modern times: “Those who can’t, teach. Those who can’t teach, manage” (or “get an MBA.”)

Don’t knock the MBA. It is a very valuable degree. It has done a lot for me and my career. If more people had MBAs or advanced degrees in Economics, then the financial crisis may not have been as bad. The grunts of society always look at the middle management MBAs as those who get promoted despite a lack of experience knowledge. The truth is that most MBA programs require several years of professional experience before applying. Most MBA programs are rigorous, the completion of which should count for something. . . . .far more than some laborer’s complaint about how his boss doesn’t know anything.

Professor,

Can you do an inflation comparison for today using the weights, factors and basket of goods that the government employed in the late 1970’s? I’d like to see what today’s inflation figures are compared to back then. This would expose the ridiculous manipulation of data that the political parties have introduced into the system.

http://www.shadowstats.com/alternate_data/inflation-charts

Hey look…time to buy!! Trulia says so!!!

http://info.trulia.com/index.php?s=43&item=113

to LAer,

Good riddance. Stay there!

My parents were immigrants too. But unlike you, I love and appreciate this country and would lay down my life for it rather than run away like a little coward.

You blame the “inept, nepotistic hiring policies of most American companies”. Maybe you in fact didn’t have the experience, right degree or maturity to get the jobs you sought. That sounds to me like a personal problem that needed to be overcome. Perhaps you should have started your own business instead, and told all of those awful employers to take their jobs and shove em. Instead, you blame everybody else. How typical.

Just because you don’t have the smarts or balls to succeed in the best counrty on earth doesn’t mean that I will tolerate you bad-mouthing my beloved country or my fellow Americans.

Sincerely,

A proud, red-blooded, meat n’ potatoes eating American teabagger who absolutely believes in American exceptionalism !!

@Warpspeed

I see that I was not the only one thinking that way when I read LAer’s comments. I think some people just want to hate America and if thats the case then leave. I really think that LAer fits better somewhere else, I just hope LAer does not advertise himself as an American it whatever country he or she has settled in.

God Bless America……

Where IS There? Is la’r ashamed to answer my initial question? Is he keeping paradise a secret?

Right on WarpSpeed! You’re right, too many people like to hate on the US, for the same reason why nobody likes the guy on top. Once Microsoft surpassed IBM they were villified. It’s happening to Google now. Most people dislike their boss because, quite frankly, they are jealous that they don’t have what it takes to be the boss. The country on top will always get snickers and bs from those countries underneath it. I wonder how China will fare in 20 years? At least the US provides more $$ in food and humanitarian aid than any other country on earth. Will China do the same when their economy surpasses us? Probably not.

I posted this question with the previous story but received no feed back. Has any one else seen the commercials KB Homes has been running on local channels promoting the new projects they are starting all over Southern California? What’s up with this? These new developements will swell the inventorty even more making it harder on seller’s to get out of their “Under Water” mortgages… Does KB Homes really believe that their “Cookie Cutter” homes on tiny lots will sell? What do you all think?

probably builders trying to unload property before the sh!t really hits the fan. we’ll probably see banks start releasing reo’s faster too.

Now remember we all are singing one song for last 2-3 years on this foum that prices will come down and down… DOC showed us every chart indicating that prices must go down. But if inflation kicks in OR Banks decided to play dirty tricks then who know…. how long we have to wait. I have been keeping an eye on 2-3 areas in Southern California and noticed that there is no activity in the market for last couple of weeks. I am afraid that Banks will ultimately decide to let the people (lossers) stay in their homes so that we hard working people can keep renting.

With the cost of capital brought to nearly zero for banks and those with the right connections, I am afraid you are quite right.

Our view of the house market is through the lens of capitalism. When you have zero rates and losses socialised we are no longer dealing with capitalism.

True Capitalism or any form of it cannot exist in the current environment. The current environment began under Bush and continues under Obama.

Republicans nor Democrats run the nation, lobbyists do.

I know what you are saying but the reality is that for housing to inflate you need to increase jobs/income in that inflation. If you get inflation in food and base necessities what happens is that the cost of living goes up and constant rate salaries can afford less house. Even worse if rates go up too as the cost of financing beats up on home prices. Obviously replacement cost and repairs will go up with materials (separate from labor) but if wages don’t move, people are already stretched to the max. Watch homeownership continue to decline in that scenario.

This is very different from the 1970s where the babyboomer demographic was all searching for homes to raise families and shelter themselves from inflation which was also driving their salaries up, even multiple times per year. Recall that this also lead to very high mortgage rates (high teens or more) which you could then refinance out of as they went down and the value of your property increased.

Very different potential dynamic this time around. Of course the other side to this is that if you don’t focus on the last 30-40 years (i.e. those 70s high rates declining) you find that most of the 1900s had dirt cheap mortgage rates. 3% mortgages were common in the 1950s.

little market activity and low inventory is what I noticed in my part of SolCal (San Deigo). Rarely one sees a REO listing which typically is located next to a highway or some undesirable location. Same story for short sales. The price is definitely not moving up but certainly not down either. Sideways is a better term. Everyone including the banks seems to be holding on pretty well and not dumping houses that’s for sure. I am aware San Diego is one of the better markets prices are concerned and it has made it hard to decide when to jump in to buy.

The cost for public university tuition and fees in California has historically been much lower than compared to many other states. While it was probably OK to have lower tuition and fees when the sate allegedly had more cash, the reality is that the state cannot afford it anymore and its not necessarily a bad thing to have California costs more in line with the costs in other states. The tuition and fees for public universities are still way less than they are for private schools for typically the same level of education at the undergraduate level.

However, specializations no longer guarantee successful employment regardless of where you go to school.

The thing is less and less people can afford that education without loans (which of course are readily available, step right up and lock yourself into debt for life at 17). Gotta love the educational industrial complex.

@Somis Guy

These builders likely have their own financing arm(s), plus they’re 1,000 sq. ft. starter homes. I wouldn’t be surprised if these builders are using land with existing uilities, etc., re-platting for higher densities, installing more sewer and water taps in between those already installed, etc. The “dirt” has to be (and is) bought cheap.

Have also decided to move with my wife to Canada. She just put in her resignation letter today and accepted a job there. This feeling by warpspeed is ridiculous. The individualism that the Teabaggers believe in are not going to fix the problems of the future. It requires collective action, and as gas prices continue to increase no individual response will solve it. It requires investing in clean energy by the government, and developing public transport. I love this country as well, but these idiotic tea partiers are going to destroy what is left.

Nice, so we’ll blame all the problems on those awful teabaggers. How about the commi liberals that have absolutely gang raped and destroyed CA over the last few decades? Or is that the fault of the teabaggers too?

The fact is both sides are to blame. The two party system needs to go if true changes will be made.

@avs

You really want to blame everything on the Tea Party? Really?

If your moving to Canada, will you be giving up your U.S. citizenship, or just jump ship and come back when times are better?

Do us all a favor and stay there…… Forever

Tea movement is backlash to the corrosion of the American culture. AVS is just corroded is all and belongs elsewhere.

This is the best explanation of CPI skullduggery I ever came across. and I’ve been reading a lot ot articles. Doc HB, please keep up the good work!

San Francisco, once a Teflon-coated real estate market, is experiencing more fallout as the housing downturn and foreclosure crisis grind into their fourth year.

Despite enjoying one of the lowest foreclosure rates in California, San Francisco’s incidence of home repossessions and late notices is spreading throughout the city, hitting Pacific Heights mansions as well as Bayview fixers.

“The San Francisco market is completely different from five years ago,” said Alexander Clark, a Zephyr real estate agent and author of the blog TheFrontSteps.com. “There are definitely distressed properties in every neighborhood in every price range.”

Read more: http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/01/29/MNC81HF7UP.DTL#ixzz1CiTN9GW2

It sounds like you are saying owners equivalent rent hid rising costs during the bubble years and I agree with that. But now shouldn’t owners equivalent rent be doing a better job than using home values in the CPI since it isn’t dropping as fast as home prices? So your beef is with the percentage allocated to housing?

Also you should be consistent. If you are against housing subsidy like the interest deduction, should you also be against subsidy for higher ed, like student loans and direct aid to schools? If the student loan scam was ended I think there is an excellent chance the cost of higher ed would fall dramatically. That would be a good thing. There are many who would say the same of housing-that it is good if one can by a house cheaply.

I am a fan of your blog, but i think this post could have been clearer making your points a lot stronger.

One of last week’s homework assignments for my Economics class was to explore the CPI. We perused its tables and the class concluded that inflation was completely normal. I raised my hand, “I’m not sure I buy it, just look at the shelves, our economy has been pretty severely Kudos-ified over the last few years.” My instructor looked at me, amused.

Anyone remember Kudos bars? They were candy bars targeted toward the health-conscious, suburban mom crowd in the 90s.

As if a “healthy” candy bar wasn’t a scam, in and of itself, their marketing scheme was pure genius. You’d see an ad along the lines of “Kudos bars now have 10% fewer calories!” and your next Kudos bar would be 10% smaller. Then a year later you’d see “Kudos bars, 25% fewer calories! Lose weight, buy now!!!” and sure enough, your next Kudos bar would be 25% smaller, but at the same price. Their portions were pretty generous at first, but by the end of it, it was like you were snacking on an individually wrapped, well-used #2 pencil. And I swear, it was a test run for what we’re going through right now.

I explained this to the class and they immediately understood. This entry should give me further ammo, however. Thanks.

Let me reiterate their solutions that the right wing are putting up with don’t reflect the realities of how these problems need to be fixed. They require collective action, and eviscerating government is going to backfire. History will be a judge if I am correct. Getting rid of all government is not the answer, but seems to be a reflex by some.

History has proven socialism wrong; history will render the same verdict on social democracy. It is simply impossible for everybody to live off everybody.

Canada will have a good run: low population density, homogenous culture, healthy work ethic, lots of natural resources. This is why people point to Sweden and declare, “Social democracy works!” As time passes though, the Ponzi scheme unravels: birthrates plummet, net tax consumption increases, and the government uses immigration to try and increase the tax base (not reckoning that immigrants get old and sick and place burdens on infrastructure too). That’s when you know the game is almost over.

Actually, what you call “social democracy” works very well in countries with low populations, but abundant natural resources. The problem is that most of us are not so lucky and said countries rely on the disparity to function.

Take Norway, for instance, a country with four and a half million people. Nearly all natural resources are state-owned, including one of the largest oil stores in the world. Schools are free, medical care is nationalized, housing is less than ours, and while a beer and a pizza may run you $100, but their minimum wage is something like $25/hr. Maternity leave is 56 weeks at 86% of wage, paternity leave is 10 weeks. The country has the highest standard of living in the world.

Of course, it’s all thanks to their oil reserves. The country doesn’t even need to manufacture anything, they can just sit there, sell the rest of the world their oil, toss the extra cash in the bank so they can all be trust fund babies when the wells run dry, and live happily ever after.

Such a system could not exist here, however. Norway works because it has oil and the rest of the world doesn’t.

I should also note that they have one of the strictest immigration policies in the world. You have to live in the country, continuously, for 17 years, to apply for citizenship, and have to speak the language fluently.

I know this because I almost married one.

re costs: Cost of Dependents to age 18

gov. stats report raising one dependent to age 18 eighteen cheapest option

public school, no extra lessons, c. $199,000. 3 k ids can cost us$1m onemilion.

so under 35? dont have dependents.

Leave a Reply to taz