Housing apocalypse prediction of hyperinflation and real estate values – Debunking the hyperinflation argument to purchase housing. Examining real estate in deflation, inflation, and hyperinflation.

I’m not sure why a few are looking at real estate as some safe haven from hyperinflation. Do they even know what hyperinflation looks like? Let us set aside the reality that since the crisis hit with a full frontal attack and the bubble popped in 2007 we have been living through a debt destruction deflationary period. All the Federal Reserve gimmicks and banking bailouts, trillions of dollars of digital funds, have largely gone to the financial sector with little relief to households. The data is rather clear and what we have seen is a shattering of household net worth primarily with real estate while bailout funds have gone to plaster over the Swiss cheese like balance sheet of banks. As absurd as the hyperinflation argument is, I think it is worth examining as a thought experiment what may happen to U.S. real estate going forward under various scenarios.

The hyperinflation allure of real estate

As bad as things are in our economy some people need to look at the data and figure out if we are dealing with a duck or a dog. Hyperinflation as defined by some economists is a cumulative inflation rate over three years approaching 100%. There is absolutely no current evidence of this happening in the U.S. and in fact, if we look at the last decade we are closer to seeing a deflationary pattern similar to the lost decades of Japan. So we might as well speculate what would happen to real estate values should Martians land in California and suddenly find Malibu the place to be. Yet I think this thought experiment holds merit and also demonstrates how little real estate would matter should hyperinflation take hold.

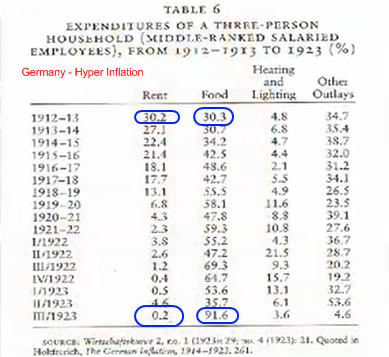

Let us examine one of the most extreme cases of hyperinflation with the Weimar Republic:

In 1912-13 a typical German family was spending 30 percent on rent and 30 percent on food. The typical American family today spends roughly 40 percent on housing and 15 percent on food as a comparison. Yet as you can see from the data, housing is largely irrelevant once hyperinflation started taking a hold from 1915 to 1923. By 1923 this typical family was spending just 0.2 percent on rent while food consumed 91.6 percent of household expenses. Why does this occur? When you have a currency that is largely becoming worthless housing takes a back seat to more pressing expenses like food. We are clearly far away from a scenario like this in the U.S. but those who use hyperinflation as some kind of loophole for housing values largely miss the entire bigger picture should hyperinflation ever take hold (we have absolutely no evidence even remotely showing this of course).

Think about it, who would even be thinking about housing values should something like the above occur where food is consuming the bulk of your wages and the currency is in full turmoil? Talk about delusional housing pundits and those who recently bought trying to justify their purchase by bringing up hyperinflation! Now that takes some psychological power of selective information.

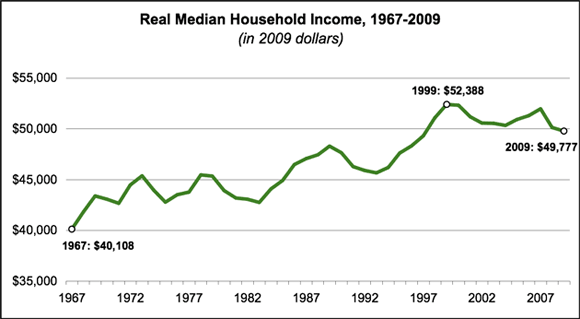

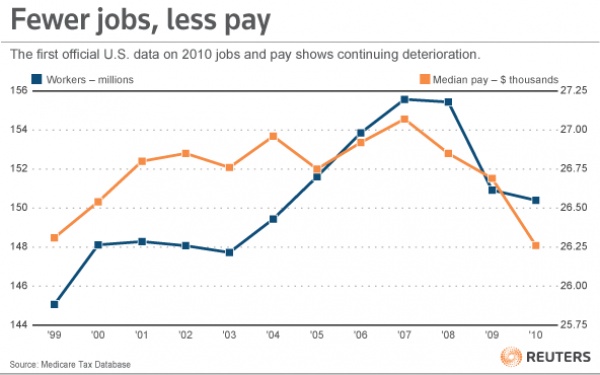

Wages for last decade

Back in reality, household wages have gone negative for the past decade:

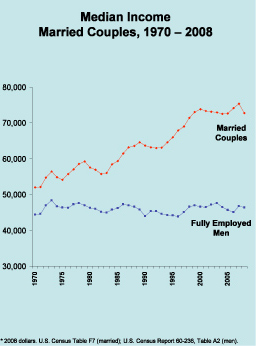

And the large growth from the 1960s to 1999 was largely based on the two income household expanding:

So now with both partners running at full blast household income is still shrinking. The only reason home values don’t move lower is because of the Federal Reserve strangling rates lower and banks flat out aggregating properties in the shadow inventory.  Yet households would be better off with more affordable housing to reflect lost wages.

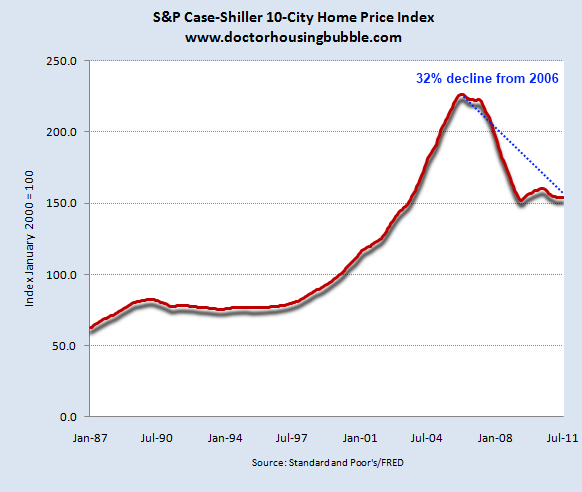

The irony of the situation is that the banks and the government are actually keeping home values unaffordable for many. If wages are dropping in a wealth destruction deflation then this is what would normally happen. This is why with trillions of dollars in quantitative easing, mortgage buy backs, bank robbery, and other toxic waste in the financial system real estate values have done this:

Sure looks like inflation or hyperinflation to me in the real estate sector! Home values across the country are down over 30 percent from their peak.

Household wealth destruction

At the trough in 2009 of this crisis U.S. household wealth fell by a stunning $16.4 trillion dollars. With the stock market recovery the loss is now back to over $7 trillion but guess what? Real estate values, the store of most American’s net worth, are still near the trough. Stocks make up the bulk of wealthy household balance sheets, not real estate:

Source:Â CNN, Fed Flow of Funds

With all this destruction in debt, which is another form of money in our modern day system, U.S. households are still much poorer and are looking like they did over a decade ago. Wage growth is virtually non-existent so where will the power to push real estate values higher come from? I’m not sure some people have thought this through. And with local governments and municipalities hurting, you can rest assured taxes will be going up.

The data show a case more similar to Japan for our current trajectory. But let us examine the inflationary argument.

1970s and today

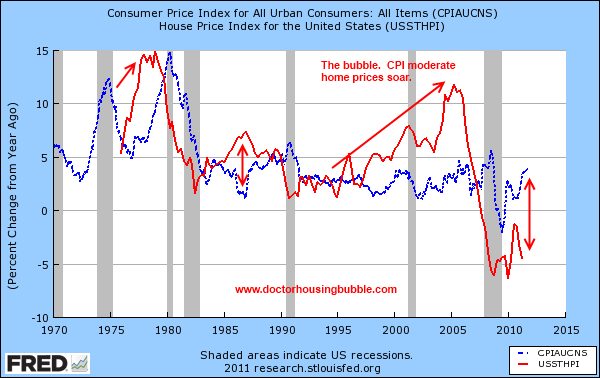

Some people point to the 1970s as a time where real estate values raced higher in conjunction with high inflation. The 1970s also had the rise of the two income household and the flood of baby boomers buying houses. Let us look at inflation and home values during this time:

What you will see is that inflation and home values tracked each other during this time even with double-digit inflation. What the graph doesn’t show is that wages were also growing during this time. That is something we do not have for this decade:

Source:Â Social Security, Reuters

But going back to the previous chart, you will notice in the mid-1990s home values completely disconnect from the inflation rate and this peaked out in 2006. After this period home prices cratered and for the first time in many generations did we see national real estate values fall on a year over year basis. The last time this happened was during the Great Depression. But look what we now have. You will see inflation is slightly ticking up but home prices are still anemic or going lower. Why? There are multiple reasons for this trend but first, wages have gone negative and the job market is still weak. We are 7 million jobs in the hole since the recession started and wages reflect this pain. The U.S. dollar is being devalued by the Fed so imported goods increase a bit in price, food certainly has gone up, and so have other items like the bubble in college and fuel. Yet home values remain stagnant.

So even with slight inflation, unless wages increase home values will likely move lower. More to the point, many markets are still largely in housing bubbles and have yet to even correct in any noticeable fashion. Some make the absurd argument that they will buy and simply walk away should home values move lower again. It may not be so easy down the road and deficiency judgments may be more common down the road especially when the dust settles. Keep in mind the majority of those losing homes in foreclosure don’t have much to their name in resources. Those that make the assertion that they will simply walk away have a few nuts stored away like a squirrel. Think the banks and government won’t come after that especially when you strategically default? What an odd corrupt system we currently have. You have scammers on both ends of the spectrum and the prudent segment of society is getting squeezed dramatically.

With the above evidence we can say that deflation or low grade inflation seems to be the path forward. Hyperinflation is just another dubious argument trying to scare folks into buying with very little rationality. Remember the “homes are going up 15% a year!†or “it has never been a better time to buy†arguments? For some it is always a good time to buy even when they make up history and have no grasp of basic behavioral economics.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

81 Responses to “Housing apocalypse prediction of hyperinflation and real estate values – Debunking the hyperinflation argument to purchase housing. Examining real estate in deflation, inflation, and hyperinflation.”

Hyper inflation is a politically driven event. Govts start it by paying almost all their obligations with money they create out of nowhere. We are nowhere near this. QE is still a debt driven methodology that can take many years of abuse to cause a currency, especially a world reserve currency, to collapse.

What we’re seeing in the world today, as far as rising prices goes, is speculation and a rise in global demand for certain things. But wealth destruction through falling real estate prices is by far the biggest financial force in the US today.

I believe I can put the housing price situation much more succinctly. Housing is almost entirely driven by Credit. Imagine what it would be like if people had to only pay cash for their house. Housing prices would drop like a stone.

Alas, available Credit has been decreasing. And that’s had a huge downward pressure on housing prices. And it will continue to do so, until all of the bad credit is out of the system, and Banks can find worthy borrowers again.

This isn’t going to happen any time soon.

I agree, credit is a major reason for inflated home prices.. and especially education. But you can’t change history… It happened.. we had a bubble.. it burst and now we’ll probably be treading water until the economy turns the corner.

(Name a time in US history that a new innovation didn’t spur growth… The PC/internet was the last big invention.. Green Energy will be the next catalyst.. just wait and see.. It may take a few years.. But we’ll be booming again.. And your electric bills will be basically free in CA when you install those solar panels on your roof).

CaliOwner,

The invention of personal computers and the digital revolution that followed is similar to the industrial revolution brought by the steam turbine. Much like the wheel and the discovery of electricity, these were evolutionary leaps in technology. They are the corner stones of our modern society. The green technology that we have currently are marginal at best. It’s more of a catch phrase than the building blocks of anything tangible. This will not lead the US and Cali out of the hole it’s in now. In fact, there is nothing on the horizon. That’s the whole point and the reason for such dark outlooks for housing as a whole.

Questor – You are right on the money. Argentina forbids mortgages since their economic collapse and hyperinflation. Now you can buy in the best of the best neighborhood in Buenos Aires for about $300k US.

CaliOwner – You are insane. Green energy is nothing more than a parasite on the productive economy. None of the green energy companies can stand on its own without government (ie taxpayer) funding. Solyndra is just the tip of the iceberg. Evergreen, which received $58M in government loan guarantees just went belly up, with others to follow. I work in the waste industry where governments and municipalities have forcing recycling, “diversion”. The government constantly touts that over 100k jobs in California have been created because of recycling. What they don’t tell you is that every one of those jobs is subsidized by the government on the one hand, and on the other hand is costing governments in reduced “franchise fees” collected from waste companies due to less trash being disposed in landfills. Your green utopia isn’t going to happen – at least not without great cost to taxpayers and society.

I am in agreement with CaliOwner. Just came from an event with Scientists in that field. I had been told that we will see large energy shifts in our lifetime.

Ordinarily I wouldn’t say anything about such an assertion as “Hyper inflation is a politically driven event. Govts start it by paying almost all their obligations with money they create out of nowhere. We are nowhere near this,” but this really needs to be cleared up.

First of all, governments always pay all of their obligations with money they create out of nothing (if the money is not backed by a commodity like gold, silver, or cowrey shells). They do not need to tax to do this. Period. Taxation is a way of making the money they issue necessary. For example, in colonial times, the Brits tried to get Nigerians to take their pounds sterling when they took over the country, but the natives were having none of it until the colonial government started charging a hut tax. Then, suddenly, pounds were an object of desire.

In more recent times, the Fed created (again, out of nothing) roughly $16 trillion to bail out the financial sector — and still no sign of hyperinflation, either. My back-of-the-napkin calculation is that they could have purchased every mortgage in the country for only $6 trillion, but the FIRE (finance, insurance and real estate) sector had derivatives to inflate the value of those mortgages, so…$16 trillion. The figure comes from the audit that Ron Paul and Bernie Sanders required as a condition for their votes.

Here’s the reason for this lengthy answer: Now that you know where the money comes from, why not pay off the entire Federal debt by minting a few trillion-dollar coins? It’s possible, and legal. Oh yes, and would not cause hyperinflation, either. What it would do is screw Wall Street royally, which is why it’s not happening.

The entire debt “crisis,” then, was a scam to try to privatize the public realm, including Medicare and Social Security. The Greeks, who do not have a sovereign currency are the ones really up the creek. Their creditors are proposing they securitize the bailout by mortgaging the Parthenon (for reals). Michael Hudson calls it warfare by debt peonage.

If you doubt me, why did the banks get $16 trillion at the drop of a hat, but when it comes to grandma’s pension or medical care…whoops!…we’re out of money!

The artifice is called the “Shock Doctrine”… See this for its application in Iraq: http://harpers.org/archive/2004/09/0080197

For more about hyperinflation, and what *really* causes it, see http://www.nakedcapitalism.com/2011/10/philip-pilkington-exorcising-the-inflation-ghost-%e2%80%93-an-attempt-to-cure-our-european-compatriots-of-their-inflation-phobia-through-regression-therapy.html

Thank you for the great post! Retores my faith in humanity! Just a side Note, the IMF also wants Greece to sell off it’s Islands. Also, another little side Note. Bank of America just moved 43 Trillion dollars of EU derivatives debt from it’s commercial side to it’s FDIC insured depository side. So guess the taxpayers get screwed again to pay back EU investors of the housing scheme that has robbed America of trillions and trillions of dollars. It’s that extra special?

What Adam said. Michael Hudson wrote a cover piece for Harper’s about six years ago where he talked about the US being in a housing bubble rooted in creating debt serfs.

http://michael-hudson.com/wp-content/uploads/2010/03/RoadToSerfdom.pdf

There is no question in my mind that the goal has always been to privatize the public sector and auction it off to the highest bidder(s). THIS is the “innovation” that the US economy, and the global economy, have systematically pursued since Reagan–that pompadoured grandfather-posing mouthpiece of global corporations back to the 1940s.

I.e., the financialization of the commons, to manage it as a source of private gain. This used to be repellent to American sensibilities. That terrain-for-gain model derives from the culture and economics of Euroyalty/celebrity, perma-war, worship of cartoonish authority figures dispensing ultimate truths, and an inherited, not earned, sense of superiority.

Real estate scams posing as something else is not a new concept–my favorite example is how the Communications Act of 1934 turned the physics commons of the broadcast bandwidth into real estate. Since then we’ve invented whole new bandwidths to exploit, and manage in that way. It was a Democratic president who most yogically grabbed his ankles for a vast intensification of telecoms and intellectual property regimes/scams. But then Bubba pandered to corporations in ways that Dutch couldn’t even dream, being a far smarter and more devious person.

The broadcasting industry, working with its advertising and marketing partners, has even managed to turn individuals’ minds into real estate. Hence the ongoing grab for the Killer Patent that will grab as much territory in people’s grey matter/attention span as possible. Yesterday’s dancing hamster is today’s RFID implant is tomorrow’s borgmatrix. And we have already seen that Facebook–where you are the product, not the consumer–is something people flock to chain themselves to.

This is the nuts and bone of agricultural civilization: the powerbrokers’ drive to find out what people’s basic needs are. Develop social-institutional regimes for controlling them. And figure out how to make that a factory of profit.

So it’s no surprise that it seems lately like everything is a real estate scam, from land controlled so that food can be grown and marked up for profit (which guarantees that some portion of humans will go hungry/starve to death), to land controlled so that it can be occupied according to various profit-making terms, to turning even your eye and cursor movements across a glowing screen, as proxies of attention, into an engine of profit.

Even religion is a real estate scam–pie in the sky when you die, in return for serfdom of the body and spirit now.

What DHB describes in the housing market is, in my view, in the DNA of agricultural civilization. Commons-oriented people with a strong value on individual liberty have always rebelled against it. The demands and fetishes of the hive will always be repellent to people who know that they, or they and a few others, can get all they need from their own efforts, and that iCrap is just another kind of manacle. Then there are the vast majority of people, who want nothing but to have daddy take care of them. (This accounts for the vehemence of the “99 percenters” in my view. They aren’t mad at Wall Street. They are mad because they expected Wall Street to take care of them by turning debt into easy instant privilege. Sorry, kids, it doesn’t work that way. Debt is slavery. Always has been. Always will be. It has something to do with the Rule of 72, and the exponential function.)

But don’t worry. The real estate scam meme won’t go away. As the eternal optimist CaliOwner points out, we will innovate our way to a new manifest destiny of profit–some brave new world to occupy, divide up, and manage for private gain. Looks like our very bodies and their ailments are the leading candidate for that, as anyone knows who regularly reads financial reports on the bodice-heaving projections of profits from “health” “care.”

Walking around my LA hood where zillow still values many homes over $1 million and you still see leased luxury cars parked in many driveways you’d think everyone living here is a successful executive bringing home well over $200k per year. Yay, successful America! But the truth is quite different. The vast majority of these households either bought at the peak or cashed in on their peak “equity.” I know so many neighbors who are deep underwater. I know for a fact that our household earns way more than many of them, and we have way more cash savings than any of them. And yet we’re priced out. Too bad there’s no movement to get actual wage earners into homes. Only the debt-tolerant need apply. Taking on massive debt so we can tell people at cocktail parties we’re homeowners just ain’t our thing.

Sounds like my ‘hood. You are smart for sitting tight, screw cocktail parties!

#OWS

I know it’s really just a metaphor, a symbol really, but when was the last time anyone actually went to a cocktail party? The 70’s maybe?

Believe it or not, I know someone here in S. Pas. that likes to have cocktail parties. I don’t go of course, I think it’s silly. Might as well have a Key Party while you’re at it 😉

This phenomenon is causing tension in our neighborhood. Those who came in at the peak have seen 40 or more percent of their houses’ “value” empty out. The ones who borrowed against the inflated equity levels, or counted on it as a wealth mine, are either going deeper into debt to keep up appearances…or they are posing as progressive populists who are mad at Wall Street because Kalle Lasn said they should be. (Most of them have never done anything but occupy various political/institutional niches where you talk your way to a six figure salary and power over others. What a shock, to excavate the rotted foundation of that way of life.)

Some do in fact have cocktail parties, or the new chic equivalent: parties where people engage in communions of artisan comestibles. For sustainability of course.

As for Key Parties, I struggle to suss out whether any of them even has an erotic life whatever. It seems all they live for is consumption. Even their kids are lifestyle accoutrements and ego props.

I think some folks miss the point that unless businesses have an incentive to hire and raise wages they most certainly will not. The Walton kids can’t think of enough ways to spend all the money coming in. Think they need to give workers a raise? Most business now comes from government contracts and the health and education mafia’s. We also have demographic deflation–older folks don’t generally need more toys and bigger houses. They want simpler lives and to be secure in their retirement. It’s only different this time in that there are no more scams left to try–it’s time to pay the piper, right after QE3 and 4.

Dr. HB,

The last three articles have been excellent. Glass-steagle repeal and the Greenspan free money rate drop legacy has quietly allowed a cadre of the finest Wharton, Harvard et al financeers to pauper the future income streams of the nations middle/working class.

Congress is owned by the banks and mainstream media is the shill. Thanks Goldman and thanks Fed. Hyperinflation huey. Stagnant and deflating certainly. What shock to oil or global supply chains would it take to hyperinflate our subsidized food? Maybe when the Federal Government stops supporting crops for cheap WalMart produce and General Mills cereal to be able to bail out another round of globally byzantine financial collapse when the next AIG bobble head corporate fail rears its stupid ugly head.

Have you been to the grocery store lately? Food prices are soaring these past several years.

Food will track oil prices.

True they are up. But 30-40%, even the doubling of peanut butter due to a bad harvest doesn’t equate to a hyperinflation scenario.

With food it is transport and packaging as well which equals brent crude futures.

Bottom line, food prices jump and there is less money for everything else like monthly home payments.

Soaring? No. Up cynically maybe 20% in three years? This is not hyper inflation. You would know hyperinflation, because each time you go back to the store, you are paying much more for that loaf of bread and it is literally bankrupting you. Are you paying 90% of your income for food? No.

Expect some inflation. Some of the liquidity the Fed is pumping into the market that freezes on contact will thaw out in a rush when inflation finally does return. It’s not going to be hyper inflation though. At worst, it would be a reprise of the late 70s.

It is unlikely that in third world California that the banks will ever go after strategic defaulters. Party on folks. I would not fondly look back at the “good ole days” in Germany as any precedence for today since the world economy has changed so much. Many think that we can learn much from Japan deflation, the great fear of Ben and others. In hyperinflation, people with cash usually buy up non cash assets such as real estate or stocks in companies that produce things(pick wisely).

Americans are different than the Germans. We have our guns. That is what will keep us from going the way of Germany.

The whole American economy is in a bubble and we are going to be a third world country. Look to Latin America for life under hyperinflation(and many other things), not the “old Europe.”

awesome post John! I have a documentary posted in my Playlists on my You Tube Channel “Conspiracy Facts” called “The Argentina economic Collapse of 2001” if anyone is interested in seeing a blueprint for what we are currently experiencing now in our homeland. check it out. http://www.youtube.com/TheeLynnChase Also, I have some wonderful educational videos in my Playlist “Banksters Organized Crime Syndicate” as well as one everyone should see called ‘The Most Important Video You Will Ever See”.

I wish everyone were as educated as you are on this topic. It only takes some research and reading but most people have an aversion to learning and God forbid they discovered that everything they believed was a lie. Which for the most part is.

Hope some people see this and want to learn the truth about why we are in these dire straights. Some #OWS protesters understand, but most just know they are being screwed but don’t really understand how or by whom. They call for more government without realising it’s like Oliver saying “Please sir I want some more”. All that will get us is further beatings.

You said earlier that IMF suggested Greece sell its islands!!!!!!!!!! Your sources please. As far as I know, it is Greece which asked for IMF assistance, and not IMF which insisted on coming to the “rescue”… Or are you one of those who are saying that Greece’s problems (or Italy’s etc) are the IMF’s fault! Unless I am mistaken IMF has had no programs with Spain, Italy, France, Portugal, Greece etc etc for many many years or decades. These countries do NOT have an obligation to call on IMF; they do so on their own volition.

Give me a break. We are not going to be a third world country. We have rule of law. We have the most respected currency anywhere. We have political stability. Compared to the rest of the world, BRICs included, we are in an enviable position.

The problem we have at the moment is that we have been veering toward plutocracy, which has been making life hard for the common man. This will eventually fix itself when the common man gets angry enough. He just isn’t angry enough.

Real estate prices collapsed in Argentina with the hyperinflation.

Lenders—on seeing prices rising and purchasing power deteriorating in an inflationary economy—naturally raise the interest rate they charge, on the future expectation of inflation during the period of their loan. Obvious: If I lend money for a year, and expect the inflation rate to be 10% for that year, I’ll naturally lend out my money at 15% interest—or more, if I think inflation is accelerating.

Borrowers on the other hand—on seeing interest rates rise, while their wages and salaries are at best playing catch-up to rising prices—curtail their borrowing: They either borrow less, or don’t borrow at all.

Therefore, real estate sellers—who depend on lenders to provide their buyers with credit in order to sell their properties—are forced to lower their prices, in order to attract buyers. Law of supply and demand: They cannot force up the price of their real estate to match the pace of inflation, because if they do, they will simply not have any buyers.

Thus, in an inflationary environment, real estate prices either remain static or indeed fall on a nominal basis, even as inflation is debasing the currency, because real estate sellers will not find buyers willing to take on usurious debt in order to buy the property.

This is how real estate prices fall, even as prices for near-term necessities—food, fuel—rise. This is how you have a real estate collapse, even as you have inflation.

When there is severe inflation, real estate prices are either nominally flat or falling, like in the United States during the abovementioned ‘79–‘83 inflationary recession.

And when there is hyperinflation, real estate prices of all sorts—residential, commercial, industrial—go into a free-fall: Their prices crash and burn, completely and utterly.

This situation—crazy though it may sound—is exactly what happened in Argentina, in 2001: The Argentine peso went into a hyperinflationary breakdown, the causes of which are irrelevant to the present discussion. But because of this, no bank would lend money to purchase any real estate.

Thus, real estate prices plunged in Argentina.(Gonzalo Lira)

It does sound crazy, but hyperinflation causes certain necessities to skyrocket, leaving relatively little for other purchases. Not every good goes up by the same proportion, basically the allocation of our spending changes. DHB said currently American households spend 40% on housing and 15% on food. In a hyperinflation environment the ratios could change to 10% for housing and 80% for food, and very unlikely to go the other way. In that scenario how could real estate keep up with inflation? It can’t.

Lots of options to deal with hyperinflation and housing: get cheaper accommodations, move in with family or have them move in with you, even move in with friends or strangers if the situation is dire enough. But you still have to eat. Sure you can eat cheaper and junkier food and eat less (people do lose weight in some times) but there is a hard bottom there, at a certain point food becomes THE priority.

Hyperinflation will drive up the prices of homes as well.. any hard asset will go up. Just because there isn’t consumption of the product does not mean it cannot go up in price…it’s just that most new buyers will not be able to afford homes, but new buyers don’t comprise the vast majority of our population. Most of the population has already bought homes so in a hyperinflationary environment they will not be affected as the value of their home will aslo rise drastically.

Speaking of the Hyperinflation in Argentina in 2001. (Argentina is just one example of the IMF creating a nation of slaves but thats a whole other discussion, I would love to have another discussion about Iceleand and the fisherman turned international financiers) Just so people have somewhat of an understanding as to what it could mean. During that period of time, people were getting paid every few hours, so they could get to the store and buy some food before the prices went up, literallly every hour.

A-F’ing-men! Not only do the facts not support this belief, the math does not support this belief! If we understand the components of interest and inflation, we would never argue that we are going to inflate our way out of this mess. I would look to Japan as the DHB states and not South America for our likely outcome…

I agree we, are way more similar to japan than argentina. Also i was looking to buy durning the 70’s hyper inflation, interest rates running at 16%, and property values going up. My wife was constantly after for us to buy now or be priced out, i held my ground and did not buy, saw friends who lost everything when the bottom feel out. And i scooped one hell of a good deal in 1985, while collecting 8.8% on our savings.

What isn’t addressed is the possibility of having the value of a loan obligation inflated away. If you buy a property for 3% down, it’s basically an option. Should the US lose reserve currency status, and all those dollars overseas suddenly flow back and we have very high inflation, it might be possible that you could pay off your loan with a week’s wages. There are stories of German farmers paying off the mortgage on their farm with proceeds from selling a few dozen eggs. Sure, when the inflation was in full swing, rent or mortgage payments were a trivial part of household spending, but when the inflation ended those who were renters continued to pay rent. Those who had a mortgage and paid it off with a postage stamp’s worth of marks had their property free and clear.

As a bonus, aren’t something like 40% of homes in foreclosure two years behind in payments? If you buy a $200,000 home with 3% down, that’s $6,000 down. If you rented the house your rent might well be near $1000 and your deposit near $2000. The way things have been going, if you stop paying the mortgage because there is deflation in stead of inflation, there’s a pretty good chance you can stay for a year or two “rent free” for the cost of your $6000 down payment. An “option” like that isn’t without its selling points.

That will happen, eventually. But debt destruction is what’s going on now. Just take a look around, and it’s in the Z.1 reports. You also see it show up in the difficulties in getting a loan, and with the fact that the big banks really aren’t writing many loans.

Price inflation in housing is absolutely no where on the horizon, or even on the radar. Neither is there danger of losing Reserve Status in the near future.

You’ll have to survive the debt destruction first, before you can benefit from paying your mortgage off with peanuts. Many here probably think they can. But I also suspect that many here aren’t aware that this is the biggest bubble in human history. We’ve got over a quadrillion (that’s 1,000 trillion) in the House of Cards of the derivatives market to unwind, and that margin call will be like nothing you’ve ever seen. I wouldn’t be surprised at all to see real unemployment (U6) hit 50%, since it’s Credit which drives the world, and not currency.

No danger of losing Reserve Status? Based on what information? I read that Russia and China are no longer recognizing the Federal Reserve Notes as the worlds reserve currency as of November of LAST year! Google it.

Also to benefit from paying off your mortgage with peanuts you have to have the wages increase along with the inflation. If the wages stay flat or falling as they have been, as the cost or everything inflates, you will be lucky to buy a loaf of bread, much less pay off your mortgage.

@Lynn: Re: “Based upon what information?”

Based on basic reality. Internal trade between Russia and China is peanuts compared to the global trade based upon the dollar. There was a lot of talk about dumping the dollar last year, and that’s all it has turned out to be: talk.

You might have noticed what happened to the head of the IMF when he suggested that Countries dump the dollar. Remember that hotel maid affair and how it turned out?

The big boys play rough, and will stop at literally nothing to get their way. Russia and China are still coming up to speed on how the game is played, and still have a long ways to go.

As I’ve said before, the dollar will self destruct. But that time is not now. Thinking otherwise requires a lot of evidence, which just isn’t there.

But if Germany leaves the EU and sets up a trade union with Russia and China, then we might have a contender. Though the U.S. still does have Germany’s gold.

Regarding inflation, I’ve said that I wouldn’t be surprised to see 50% unemployment. That means half the population will have access to cash. Which is right in line with the number who currently have mortgages.

So some are going to win, and some are going to lose. It’s not going to be pleasant. But having access to cash is key if you’re going to survive, let alone come out ahead.

A mortgage seems a crazy debt to take on just to have it maybe pay off in a hyperinflation scenario. With most incomes it seems foolhardy, because a loss of income would be game over for affording buying the house. Maybe stick to something you can buy with savings and not debt like maybe gold coins, you can’t eat or live in them, but at least you haven’t taken on a debt you may have to default on.

Hyper inflation and devaluation go hand in hand. This is what happened in Argentina and Mexico. Export countries can benefit from devaluation but the US is not an export country and never will be. It is an import country, especially with regard to oil. A devaluation of the dollar will destory the economy completely. For the US to work its way out of the current debt debacle will take more than a decade and future growth, when it does come, will be very modest. Unless you think a gadget like an iPhone is a real economy. Take notice that every single aspect of the Apple industry is imported except the idea. You think you can have a work force just sitting around thinking and sending all the work off-shore? Or, a Walmart importing all their products and paying service workers a pittence? Guess who the largest employer is in Mexico, Walmat. But even in this low wage country, almost all products are imported from China except most fresh food. The automobile and road building is what has destoryed the future of the US. Malinvestment to the max that can never be recovered. You better move to within walking distance of work, services and food if you want to survive unless you can provide all those things yourself.

Jake. The USA is one of the worlds largest export countries.

What Ronnie said. The trouble is that all the other Countries have been dependent upon exports, particularly to the US, since the Cold War. This was the strategy to defeat the Communists; grow our allies economies by basically guaranteeing a market for their exports.

The problem is that this needs to change; it is no longer sustainable. That’s what we’re going through now.

Chris Martenson did a superb article about this, and an overview of what’s going on. I strongly recommend it to everyone.

It is also the world’s largest importer and has run a trade deficit for the last ten years. Devaluations do not help net importers.

Hi Jake–I think my view is closer to yours, than any of the other posts on hyperinflation I’ve read here a DHB. I would mention one thing, and that is that, believe it or not, the USA is one of the top 4 or 5 petroleum PRODUCING countries in the world, behind Saudi Arabia, Russia, and maybe one or two others. But our far flung suburbs compel us to import even more oil that than our already gargantuan production.

To the topic at hand, it is my opinion that the USA dollar must lose ‘world reserve currency’ status first, before wages can move up. As long as things, including labor, are priced in USA dollars all over the world, we can’t raise wages here and be competitive in the market place.

Although housing is dropping in price, obediently following the law of ‘supply and demand’, everything else is skyrocketing higher. Been to the grocery store lately? Gas station? Cigarettes? Health insurance? College tuition (well covered by DHB)?

A good reference is John Williams’ shadowstats.com. Williams tracks inflation, using the same metrics that the US Dept. of Labor used up until 15 years ago. The true rate of inflation, even with low housing prices, is 7% per year.

A crucial chapter on the coming hyperinflation timeline will upon us in a few weeks. You might recall that Congress tried, and failed miserably, to cut spending last Summer. They did manage to kick the can down the road to a so-called ‘super committee’ that is soon due to report where they will trim a trillion or so of spending from the next 10 years’ worth of pork. If they don’t hit a home run, and put us on some sort of path of debt reduction, look for trouble on the inflation front. I have not heard any signs of progress in the news, though.

We better learn to embrace the pain because it is coming. There is no silver bullet for the not so super super committee. We have 2 choices. Cut spending drastically, go through years of pain, but keep our sovereignty, OR borrow heeps of money by rasing the debt ceiling, and still make drastic cuts to those that need help the most, still go through pain, but lose our sovereignty and become debt slaves for decades and decades and decades to come. I am sure the super committe will choose the latter, since our congress is owned by the International banksters that bought them.

I’m pretty sure how this will play out. First of all, our debt isn’t really that high. The publicly held debt (the rest is a gov’t IOU to itself) is 60% of GDP. While we’d like it to be lower and it is higher than it has been for years, it is nowhere near ruinous like Italy 120% or Greece 160%. Between that and our legal ability to print as much money as we want, there is plenty of time before we are really in a bad debt problem. The debt ceiling debate is theater.

What is really going on is that Medicare and Social security are unsustainable for the next few decades due to demographics. There are no scenarios where we fully fund those things at current rates of spending growth where we don’t absolutely bankrupt the country. Since social programs are not a suicide pact, the government must and WILL reduce those expenditures, on the backs of seniors whether they want us to or not. We’ve known this will happen for 20 years. Recall dire warnings about funding of Social Security in the Clinton Administration. Not much has changed.

The problem is that these programs are also known as the third rail of politics. So, what we have is political theater while each party tries to demonstrate that they’ve cut the rest of the government as much as possible before the axes comes down on those two social programs. They don’t want to get blamed for it, and spend 30 years losing elections as a result. The problem is that the amount that needs to be cut from those programs is on the order of the *entire* federal discretionary budget. These 10’s of billions in cuts they’ve been arguing over the last year are just a drop in the bucket, and will not make much difference. You could eliminate all of the rest government and still have a shortfall in funding medicare and social security.

What will happen is that we will cut some important stuff now that we shouldn’t cut to extend and pretend for a few more years. Eventually, social programs will hit the serious part of the exponential cost ramp up, and at that point the difficult choices will be made and we’ll probably put medicine on a serious diet and cut social real security benefits by 30%. There will probably also be some soaking of the rich.

excellent well informed comment!

The U.S. is a net importer but it still exports some extremely valuable and crucial commodities like coal. Far more crucial than much of the junk we import. Unfortunately those commodities are finite as is oil and environmentally disastrous.

It is true that hyperinflation is destroying wealth,any kind,also real estate,but not value.The first is in monetary terms,the second in real terms.The “value” of land and all what it is needed for housing is growing in the long term.Prices can drop.The example of Weimar refers to a terrible period of world wars.In extreme situations people will prefer to buy food before anything else.But we have to look comparatively:the alternatives for savings or investments relatively to real estate are few or non existing.For owners or buyers of real estate holding mortgages at a fix rate of 7% for example,with inflation of 15%,the one that is loosing the money is the mortgage Bank,and the owner or buyer is paying a negative interest of -8% !

The Wiemar hyperinflation was caused by the victors in WWI(they got paid back with a sequel in 39′). The USA is not in the same position of the Wiemar. We can always extort goods from our neighbors since we have the world’s biggest military and have never been afraid to intimidate the weak.

Now, the Latin American countries have their own reasons for the hyperinflation.

In America, as we know, the banks and the rich (CFR, and Trilateral Com) run the place(Obama is their puppet) and they will never allow us to get in a position of hyperinflation where their wealth would be destroyed. Carry on serfs.

John, your posts resonate big time even now a decade later as I am now finding. Would love to pick your brain either corresponding by email or phone. Watching crypto, bloating stock market and hyperinflation in R/E market seeing what happened to Argentina unfolding. Trying to figure out where this thing is headed – might we shed the leverage/derivative/naked short shadow finance that has enslaved this country?

TAZ,

Your view that Green Energy won’t be the next economic breakthrough that drives our economy forward is very short-sighted. How many internet companies went bankrupt before Apple and Google WOWed the world! To say Solyndra’s failure equates to a failure of solar energy in general is absurd. One of the great things about CALI is the amount of sun we get year round… When solar companies harness that power, CALI home values will soar because of the sunny weather.. Not for superficial comfort reasons.. But because people will be able to power their homes year round using their roofs alone!

Sure it maybe be 10-20 years away.. But that’s gonna be the next huge bubble in CALI housing… When everyone and their mom has solar shingles installed and no longer has electrical bills.

It’s coming… And in reality the government should be subsidizing the HELL out of it… It’s our ONLY chance as a society… Oil is gonna run out in our lifetimes… Or become prohibitively expensive. We need new energy.. I’m open to ideas besides solar.. But for CALIFORNIA.. it seems like the most practical technology to perfect.

Imagine every home in CA had a solar shingle roof? And went off the grid so to speak… First of all… think of all the people that could be put to work installing new solar roofs on homes every home..

I have a roof that probably has 10 years of life left on it… I’m just started researching solar shingles for our next roof… Not sure if they are worth it yet…. But this is something the government should really be subsidizing… It will raise property values of homes that have these roofs installed, helping the local economies by employing contracters again as well… While helping alleviate our electricity problems in CA too…

Win win win…

amen,not only that but if you include 100% electric cars, solar water heaters and hydrogen we would be free from big oil.but the question would be “is the government going to support us,the people, or wall street?”

Hydrogen is not an energy source. There are no large supplies of hydrogen as such to be extracted anywhere in the world. There is plenty in the sun and the outer planets, but extraction is impractical and even if successful would eventually start to burn down the amount of oxygen in our atmosphere which we need to breathe, so isn’t really sustainable.

Hydrogen is merely an energy storage medium. You can use energy harvested from other sources to electrolyze water into hydrogen and oxygen gasses, and later burn the hydrogen (consuming the oxygen) again later to convert back to water and release some of the energy back. When it comes to transportation, most of the energy in the process will likely be lost to Carnot inefficiencies, unless you use a fuel cell. Hydrogen is expensive to store, expensive to make, and inefficient to use. The only reason people even consider hydrogen is because batteries suck even more.

However, batteries are steadily improving. Batteries notwithstanding, electric cars and be much simpler than their internal combustion counterparts. This will make them ultimately cheaper and longer lasting. Moving our transportation to electric seems to be a fait accompli, provided that the battery is eventually improved enough, or some other means such as inductive power from the roadway can be used to augment the battery storage capacity.

Keep drinking the Kool-aid.

Whatever, I’m sure people told Steve Jobs the same thing… “you are what? building a computer in your garage.. haha. People will listen and buy music online and store a tiny touchscreen device? haha…

I’m sure Edison and the Wright Brothers got laughed at also… Taz, you sound like such a Luddite.

Ya the government is going to subsidize it. That means it’s free free free !!!! And after we are done chasing big oil out we are going to defend our shores with sail boats and solar powered tanks. Everything is beautiful.

Why should we be forced to subsidize solar because a few people “know” its the future? Can’t I make my own decision?

From what I can gather, the solar industry as it stands today is predominately composed of crony capitalists. The OWS protesters would be well suited to occupy their offices, and try to get some of our money back…

I’d rather my taxes go toward FORWARD looking technologies than old dirty coal and oil. We’ve milked the teet of oil long enough… Time to “think out of the box” a little.

What’s something that California has that other colder climates don’t? Abundant, nearly year round sunshine. It’s about time we make use of it for something rather than sunbathing.

CaliOwner: Do you know what “dirty old oil and coal” are? Concentrated solar energy! To capture that same amount of solar power, you are basically going to need receptacles equal to the area, mass and time of what was required to produce the fossil fuels. Hope you like solar panels, cuz that’s all California is goin to have, from sea to shining sea.

If I were you, I’d get on the nuclear bandwagon, which is where the environmental movement actually was in the 1970’s. That’s a concentration of energy that truly cannot be beat. That’s all the energy we’ll ever need, if we were only smart.

Solyndra was not a failure…it did what it was supposed to do it extracted hundreds of millions of dollars out of investors and taxpayers pockets and transferred some if them into the pockets of a few insiders. It was inefficient but the Solyndra insiders did very nice for themselves. They won’t have to ‘work’ again if they don’t want to.

If all the Solyndra money were traced, I bet some of it would be found in the Obama campaign coffers.

The difficulty is in the science. PV cells operate at low efficiencies. They only produce a small amount of electric energy compared to the energy of the light falling on the panel. Worse, sunlight really does not have the amount of energy necessary to power the US. An estimate in the 80’s was that we could power the US by capturing the light that falls on Arizona. Imagine the environmental disaster from covering an entire state. Sure the estimate was in the 80 and PV cells have improved. But, our energy consumption had increased far faster than that. Solar is good in certain circumstances, but there just is not enough sunlight striking the earth.

In my opinion, governement subsidization is exactly why we dont have solar roofs and wind energy still isnt perfected. Governement subsidies make a product that is not ready for the market viable in terms of price. If the governement had left the sector alone for the last ten years, everyone probably would have solar because the technology not only in terms of harnessing energy but also in terms of economically manufacturing them would be there. Your idea of subsidies is counter productive….of course we want it now but the government actually allows companies to stop r and d, and give us a substandard product that will not get better as long as those subsidies exist.

The gist of Dr. HB’s post is that hyperinflation will not raise housing prices because it did not work out that way in Weimar Germany. I am not convinced by the charts presented that (a) real estate was not significantly hyperinflated in Weimar Germany or (b) that even if it were not, those circumstances would have some predictive power for 21st Century USA.

But I’m not a housing bull. I’m “just saying” that sooner rather than later, the money supply is going to be devalued to the extent that houses and everything else are going to cost more – much more – in nominal dollars.

If we assume that there is slack in the labor market and the currency is devalued for whatever reason, then I believe we would compete on the world market for food and fuel. If food and fuel inflates relative to wages, there would be less devalued dollars available to the wage earner for other things like housing. Hence, there would be no upward pressure on nominal house prices. This is based on my basic understanding of econ. However, I am under the impression that these times are an anomaly. But similar to the dot.com anomaly when we no longer used EPS as a valuation of a stock because there where no earnings and we tried to justify it with new, new, new math, we will be forced to eventually succumb to the laws of gravity…

Fair points, but USA housing stock would compete on the world market, too, under such a scenario.

I disagree for a number of reasons:

1) Housing is not traded on the world market rather the local market. Sure folks from outside of the country can by American homes but would most likely need a means of income to pay for the home in the US (slack labor market assumption).

2) The amount of foreign rich that would by a US house in such a market is not as big as you think. They would be buying in a falling market with a double whammy of falling nominal price and currency translation value loss (assuming their currency is not pegged to the US dollar). Sure there are dumb people with money and the old adage applies “a fool and his money will always be partedâ€, but there are simply not enough folks with that kind of money to buy up all the houses in the US.

3) A house is not like a banana or barrel of oil that is a fungible asset that can be moved all over the world on a container ship… If you could move the house/land to Asia on a boat then I would agree with your statement.

I think we keep forgetting the main thesis of DHB. Housing needs to eventually get inline with income. This is pretty simple math. I am not sure why so many have drunk the Kool-Aid on perceived paper appreciation backed by vast amounts of debt is equivalent to income. Eventually that fallacy will be painfully corrected time and time again as it was in the 17th century tulip bulb bubble all the way to the current housing bubble…

I’m no expert but my thoughts are we should have hyper inflated by now. So I think we will go the way of Japan. The bankers know the game and will never give up. Hyper inflation is a game ending event. I think the US has built itself up on cheap labor , cheap oil, and huge exports 40 years ago and back. In the last 40 years is been all cheap credit and that is now coming to an end. I don’t see anything “cheap” to keep us going now. So I believe we have as a country, we’ve been living beyond our means for 150 years. Now we are going to be a well off third world country. Multi generations living in a house, trailer might make a come back, small cars like Europe, smaller houses. Things are shaky its possible something like war or a natural disaster could really make a mess out of things. Could become very dangerous.

We have deflation in residential real estate worse than the Great Depression. Ben has reason to be concerned. Household income is also down as well as individual wages.

We live in a global economy and China and India have big demand and they drive up the prices of raw materials and components used in their manufacturing. American Consumers have noticed this.

The American currency has been allowed to slowly draft downwards. This will continue.

John CPA said, “We live in a global economy and China and India have big demand and they drive up the prices of raw materials and components used in their manufacturing.”

Yep, that sums it up nicely, John. Home builders here in the USA are gonna get really squeezed. Bernanke’s money printing is driving up the cost of building materials, due to world wide demand, even as our economy remains sluggish. But USA home builders cannot pass those costs along, since the house price correction still has a few more years to run.

Eventually, they are going to have to stop building almost entirely, except in a few small niches. That will be part of the house price bottoming process. No new supply, plus the slow burn of the foreclosure inventory, will eventually bring supply and demand into balance.

The price of gold (pog) is trading at about $1800/ounce, up about 27% from a year ago. Any attempt to measure inflation should use the pog as one of the measuring sticks. Not the ONLY measuring stick, but one of them. We are getting very close to hyperinflation. And as you can see, to this point, housing has not been a very good place to protect your wealth from it.

If you own a house and like your neighborhood, then I would not sell. You gotta live somewhere. But it is critical that you diversify your wealth, if you have any. Gold, silver, foreign currencies, etc. Know one knows how this will shake out, so DIVERSIFY.

Paul Krugman was/is right.

Some times I get tired of banging my head against the wall saying if you have two plus two the answer has to be four.

Here I am in San Diego, on of the “smart ones” who sold mid 2004 and ever since hoping to be able to regain the life style I gave up as a result of common sense thinking.

The fact is inventory in San Diego is near record lows. Yeah, right now prices are slipping but I have seen one announcemnet from Washington swing prices by 20% in just a few months.

Meanwhile, the cash I extrated from the bubble continues to dwindle in real pruchasing power, and I am now 7 years closer to the date my heart stops.

Next year is the year I must decide if 2

I’ve lived through a hyperinflation in the former Yugoslavia and let me tell you: real-estate MATTERS. Families there and then spent probably 80% of their money on rent. Those who owned a place spent next to nothing. Probably about a half or so owned their own place. The rest rented. If you had an extra piece of real estate that you could rent (and owned outright), you were pretty much set. Previously existing mortgages were wiped out, after a few years of hyperinflation anyone who had a mortgage could have paid it off with the the same money it took to buy a few loafs of bread. Anyone who lived in hyperinflation can tell you this: if you own something real outright (houses, cars etc), you are the king. Everybody else chases their own tale, never owning anything (especially young people), ever. I don’t think very many people alive in the US (except those who came from other places) truly understand what hyperinflation means. It means first and foremost that ownership of anything real is denied.

The cost to upgrade a bathroom is ridiculous! Like $10-20K to remodel a bathroom with above average craftsmanship and materials. If you want hardwood floors throughout your home.. nice ones.. Add another $10K-20K.. How bout a swimming pool.. try $40-80K. Older homes while they need maintenance.. are a steal right now.

Try building a new tract home now in CALI for under $300K… that has decent craftsmanship..and square footage.. just try.

Ricki, I would love to hear more of your story. Could not agree more. If you own tangible assets in a hyperinflation, you are way better off. As many here in this blog have commented, if you are in debt, you are not free.

Some of the respondents in this blog point out that buying a house prior to hyperinflation setting in is a good thing. I would agree if by buying, you mean paying cash. If you mean a 5% down payment and mortgage, you are in trouble. If you are in a mortgage and your salary/wage moves up then this strategy can work. But in hyperinflation I would suggest that jobs are not secure and that wage inflation will lag. In that case the home borrower might lose everything. Meaning any cash in the bank, and any equity in a house.

And as far as food prices go… I could grow all the vegetables I need to survive in my garden… and even buy some chickens and hens to raise in my backyard. Try doing that in an apartment on concrete. Will save far more on food than a renter in hyperinflation.

Correct me if I’m wrong but I think the argument for evading hyperinflation through the ownership of real assets, including real estate, is alive and kicking despite the good Doctor’s article.

So is the flat earth society (not the Tom Friedman’s flat earth, rather people who believe the earth is flat). The argument for 100 year mortgage on property was live and kicking not too long ago. The argument for reverse amortization mortgage was alive and kicking not so long ago… The argument that housing can only go up was alive and kicking not so long ago. Heck, the argument for buying tulip bulb futures was alive and kicking at one time. I think that people have an uncanny ability to believe in things that make them feel better and validate the decisions that they are making regardless of the facts. The good news is that the few folks that make good decisions most likely will have a better chance at surviving the next few years. However there are no guaranties…

In the aftermath of the Weimar hyperinflation, Germany issued the Rentenmark which was based on the value of real property (the only thing of any real value left in Germany). Look it up. People with things of value can pick up real estate for next to nothing in a hyperinflation, as a barter economy will evolve as the fiat currency goes to zero value. If you think there will be hyperinflation, you should buy lots of tungsten light bulbs (before they are outlawed) and TP, not real estate.

The only green in green energy is the green that the green scamsters line their pockets with at our expense. All forms of energy ever developed have an environmental cost. What matters is the final economic cost to society of the energy (and yes, pollution does have an economic cost). Government subsidies are a distortion, and an invitation for political graft. Governments don’t need to subsidize great inventions. With the existing photovoltaic cell technology, the Chinese have a monopoly on production at low cost, as they don’t seem to be too concerned about the environmental impact of production, low raw materials cost for rare earths, etc, and low labor costs.

My Brother is a computer scientist, and was a member of a team of scientists trying to make wind energy production more efficient. It really turned out to be a big waste of time. (Besides, wind turbines can be massive bird killers. Look it up.) He’s now working on a project for a big agricultural equipment company to increase the productivity of agriculture through monitoring and control systems. Plants are the best solar collectors ever developed!

Joe R.

Just spent an hour researching cutting edge solar power stations. The Lieberose station near Berlin generates 53 M kWh per year on 160 hectares. The Soluca station in Spain generates 48 M kWh per year on 80 hectares. (The Spanish steam technology is cheaper, but less efficient. OTOH Spain gets more sunny days thus relative parity.) US consumption is 2500,000 M kWh. Using the Spanish technology, we would need 1.6 million sq. miles under generation.

That is 1.5 times the size of Arizona.

Thank you DHB for this great article. I have had many discussion with very experienced real estate investors in which I argued that inflation, especially hyper inflation will cause only negative side effects for housing prices. During times of true moderate inflation, housing asset values should increase. However, during time of hyperinflation of stagflation, the affordability of life is so low, that housing values actually depreciate. It is important to differentiate between asset classes as different sectors of the economy will behave differently as some experience price appreciation and some deflate.

For Example:

If hyperinflation takes hold, commodity prices will skyrocket.

Housing will fall as people struggle to pay rent as food will be their first priority.

However, in some asset classes, housing could hold up well. For instance, Mobile Home parks might actually increase in value as people attempt to find affordable housing.

http://www.thecashflowisking.com

Ok it goes like this. You are a investor ,with millions to invest because you had a pipe line to 0% money printed by the FED. You ask your self where can I put this money to get back more? Nobody wants houses any more, Companies are going down hill! Stores are closing. The logical question to ask is what do people (need)

every day to exist? That is Food and energy. Millions of investors invest in your food supply and Gas. This is were hyperinflation comes in. You will have to pay those investors top dollar for your food. The money came from nothing but your wage is going down and no jobs. Now you get the picture of hyper inflation. You may ask I don”t see hyperinflation. Yes not yet ,it depends on the money brokers where they put there money. If it is in Gold only you be ok, but if they put it in food, watch out!

Leave a Reply to Ricki