Phantom household formation and the inability of the young to purchase real estate: Will we see a resurgence of young homeowners buying homes?

In most open markets a steady stream of demand will usually trigger a counter response with supply. This of course assumes open channels and healthy competition. Unfortunately this is not the case with heavily subsidized and often politically motivated real estate. The overall theme of housing in the U.S. recently has been one where more Americans are simply being priced out of the market and millions are becoming renters because of financial necessity. There is a simple formula when thinking of true household formation as it pertains to real estate: in a perfectly balanced market you would have home supply in new completions plus excess vacant properties for sale plus manufactured homes being in balance with housing demand in household formation plus demolitions plus second home purchases. Of course this assumes that builders can adequately predict future demand which they cannot. But builders are betting on many future households being renters and they are putting their money in the multi-family housing market. You would think with the big spike in prices in 2013 that builders would be rushing out to build homes to meet this demand. Yet this demand is coming from a fickle group of investors looking for deals rather than a “home†which is typical for most traditional buyers and prices are being pushed up on very low inventory. What happens if household formation doesn’t get back on track?

The never forming families

There are many new trends emerging in this housing market that are bucking historical trends. For example, seeing spiking prices with the homeownership rate plummeting. Another example would be having incredibly low housing inventory yet people battling it out like hyenas over a rotten piece of carcass. Most baby boomers have seen a national housing market that had a fairly good handle on household formation equilibrium. As housing demand grew supply was added in a manner that kept prices in line with actual debt availability and actual income growth. Today people seem to think that having investors (domestic and foreign) dominating the bulk of sales in some markets is somehow the new normal and will remain sustainable for long periods (i.e., 5 to 10+ years). In small markets this can be a big change but the U.S. is a nation of 318 million people so at some point actual Americans are going to need to pick up the slack in the housing market.

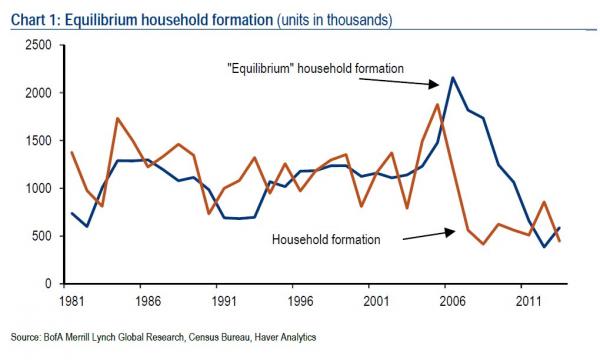

We simply are not seeing households being formed at a healthy pace based on actual population growth:

Household formation continues to be weak. It is so weak in fact that we are seeing it at its lowest level in a generation. In places like California we have 2.3 million adults living at home with parents because they are financially unable to buy (or rent in many cases). Some think this is pent up demand but unless these “kids†have incomes to support $600,000 stucco crap then we have a big change in the wings. The current meme is that prices will remain infinitely high because investors around the world have an insatiable demand for real estate. So far, this has been the wind keeping this housing bird up since 2009.

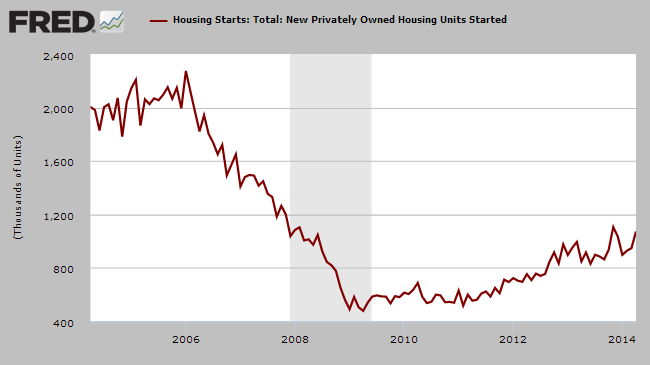

Yet builders are not so anxious to dive into this game:

For the first time since 2008 we have hit the 1 million mark in housing starts. Keep in mind most of this building is happening in more fairly priced states and we’ve slowly worked through nearly a decade of excess building. Investors have been the large buyers since 2008 and this is heavily reflected in the falling homeownership rate.

Household formation by Americans has been the engine for housing growth starting after World War II. The system is built on this predictable ebb and flow. This entire system is virtually shut down. You have people convinced that homes should sell at current prices but locals can’t afford them. So you have investors buying up what little inventory is out there, for now. Locals are left to either rent, live with others, or pony up and take on a sizable mortgage (we see people stretching budgets by going with ARMs for extra monthly payment support).

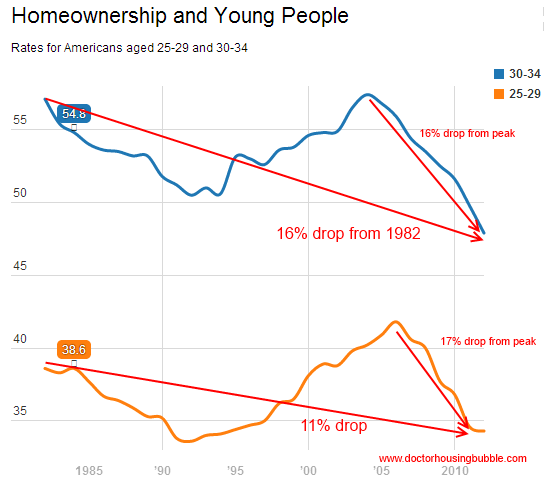

Household formation for young Americans is at generational lows:

If prices in 2012 were already too high for these households, what of the prices of 2014? The push for higher prices is coming from a fickle group and we are already starting to see demand wane. Some seem to think that investors are going to sink their money into a piece of crap home simply because they are investors, either domestic or foreign. While some of these investors are the house horniest of them all, they are not going to chase a money pit with no future. Some will simply follow the herd like a lemming marching to the newest rendition of “it is different this time†by the trendiest DJ.

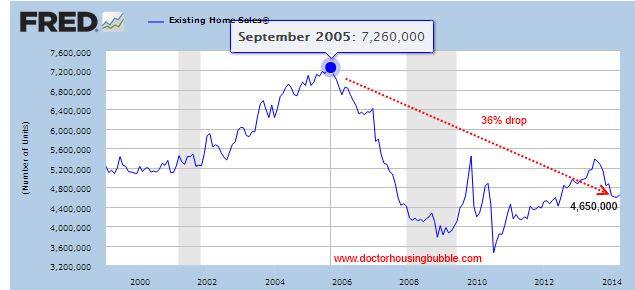

Yet overall, sales volume is weak. This is why existing home sales are still pathetic in spite of this perception that investors can cure all:

Housing prices are up on thinly traded volume, market manipulation, a non-market with the Fed buying up virtually all mortgage backed securities, and household formation not occurring because younger households are simply too poor to buy or rent in many cases. All of us are left to speculate what the black box of the Fed is thinking. Yet some are waking up looking at current prices and gaining their marbles and foregoing a life of debt servitude for an otherwise crap shack for an outrageous price. The financial system is trying to get this mania to spread into the mainstream but it appears the regular Joe and Jane is priced out even with record low interest rates. The only way to get that household formation number picking up at any sizable pace is to bring back the NINJA loans and given the rhetoric I’m hearing, we might not be too far away from hearing these boneheaded ideas being thrown around.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

69 Responses to “Phantom household formation and the inability of the young to purchase real estate: Will we see a resurgence of young homeowners buying homes?”

The housing market is just a part of Darwinism. The smartest figure out which homes will appreciate wildly, purchase them, make a big six or seven figure profit, which allows the financial resources to raise successful bright children.

The dumbest are unable to figure out which homes are good investments, so the either rent or they lose money on their home purchases. They land up in financial ruin, so they are unable to raise successful children.

It is all about survival of the fittest.

fortunately, success does not rely on the satisfied, mediocre, n lazy that often spring from those so well-off…

The Dumbies are sleeping at 2 am while the smarties are trading in foreign markets too.

Darwin award post for evolved thinking. Along that line smarties are born in nations of plenty while dumbies are born with no access to “free and open” housing markets in places such as Myanamar and Somalia – but market forces and social Darwinism should sort those places out too.

probably helps to know to that the banks are stealing the equity of the house is the day you close escrow and that the underlying asset could be anything they don’t care as long as there’s paper to sell helps to know thatup front but the banks don’t tell borrowers that up front they find out after when the housing bubble crashes and they realize their equity was stolen the day they closed. a house is not an asset its a liability, unless you own it. But most of the cash transactions are being refinanced and the cash is being pulled out. with a quadrillion dollars in outstanding derivatives there isn’t enough assets on the planet to pay it all back. Who do you thinks going to get stuck with that bill? Probably all those successful children.

Housing is generally an asset not a liability. ONly if you bought 2004-2008 was your paper a liability….and 2014-?

A house is ALWAYS an Asset!!! The loan on the house is ALWAYS a Liability!!! The value of the Asset minus the outstanding loan equals the Equity. The hope is that the Equity is a positive number… This is really not hard stuff guys! This is first day finance 101. Why do people make up definitions?

RE:What?

They make up definitions because the most difficult thing in the world is making a man undestand something his economic welfare requires him not understanding 😉

I suppose you’re putting yourself in the ‘smart’ camp.

Sign me up for the dumb camp because the last place I want to be is where jt the clown is…

Watch the movie idiocracy

Housing is not about intelligence its about those with capital having the opportunity to exploit the market

jt-

great post. simple and accurate.

Really?

Yes, what, really. The large majority of wealthy that weren’t born into it made their money in real estate. I agree with his comment because the way I read it he is saying it’s all about the specific deal.

As I have mentioned before I think values are far too inflated in many areas and it’s not a good idea to buy (selling is a different story). But when there’s a legitimate screamer of a deal, and you know money can be made, a smart person takes the deal. This little guideline has worked for me in real estate as well as other assets, although buying in today’s real estate “market” is definitely not for the faint of heart.

Also, thanks for pointing out value – loan amount = whether or not it is an asset or a liability. As simple as it is, surprisingly few get it.

The smarties have cash on the sideline, waiting for price discovery.

And tomorrow that cash is worth a little less, and the expected price discovery never happens.

I’ve been waiting for that price discovery for a long time, have plenty of cash on the sideline, and don’t feel particularly smart about it.

I would submit that market discipline is a function of one’s net worth, where the more $$ you have, the less risk you naturally incur, secondary to the rigged system.

The average college graduate leaves school with $29,000 in debt. College costs are still rising ($60,000/year at the elite schools), but incomes are essentially flat (they were up 1.2% last year, about the rate of inflation). Watch for college debt to continue to increase.

There are also studies that say Millennials look at the world differently. Many saw their parents go bust in the mid-2,000s when house prices crashed. They don’t want that experience. They prefer to own digital gadgets; have a car; have mobility, flexibility and freedom. They don’t necessarily buy into the American dream of home ownership.

We’re not going to have the same pool of entry level single family home buyers, which also means fewer buyers will be moving up the ladder. And now institutional investors are pulling back.

Where is this leading? No where good.

Many of the younger generation are also forgoing cars. When I talk to people of this age, I don’t get the impression that it’s about freedom. It’s about a lack of money…

Exactly, I don’t buy the BS that they are somehow “enlightened”. Humans don’t change that much over time. They appear less materialistic because they have less money. The biggest issue they face is the Boomers, as a cohort, are vastly under-capitalized for retirement, so they are working well into their retirement ages, which leaves less room for people entering the workforce.

“Where is this leading? No where good.”

Why do you say that? Would you prefer the status quo, where millions spend way too much for their housing, anchored in one job market, unable to move on to the next career opportunity? What’s wrong with a different direction? Look how it turned out for Mom and Dad, as you say.

When I was 26, I was married with a new baby and owned my first home, (a condo). I have two children. My daughter, who is 30, is going into her 4th year of medical school. She lives in a condo that we paid for cash when the market dropped in 2010 before the Fed started breathing air back into the bubble. When will she form a family? I suspect after residency which is about 4-5 years away. My son is 21 and about to start Law School at Columbia, (Ok, you got me, I am very proud of them). He has stated he is not interested in starting a family until he is making “good” money. I see this in their friends. My son has about 8-12 close friends that he keeps in touch with from High School. Only one has married. Only one! The rest are pursuing grad school, or chasing “big” money in banking and hedge funds. In the 60’s, the teens and twenty somethings made a loud bang out of wanting to live their life different from their parents. I think the current group is doing the same thing, but they are going about it quietly. We were fortunate enough to give both of them a debt free bachelor’s degree. That said, they are both taking on student loans for their graduate level work. As a group, I would say their priorities are very different. World travel, the newest gadget, fun times with friends, trump owning a home. They understand, (from me and DHB), that they do not want to be debt slaves. Making “big” money but living in a 1950’s crap shack in a dubious neighborhood, is NOT quality of life. What good is it if you make 200k but live like you really make 35k? Did you see the Berkeley home that DHB profiled awhile back? A side story…My father sold his 1950’s 3/2 in La Mirada. He never put a dime into it. Since he is my dad and I love him, I won’t call it a crap shack, nuff said. Last year he was told it was worth $260k, this year he sold it for $400k. How is that possible??? I understand that the buyers want to make it a rental. Who is going to pay the rent that they will need to cash flow for La Mirada. Again, I shake my head. Although I am glad my dad was on the winning end of this stick, this does not bode well, period. I read yesterday that there is a guy who wrote a book saying that he can predict earthquakes. When does he say the next big one will hit? July 12th. Interesting…..

Agreed, except they’re preferring big cities with good public transportation rather than owning a car.

“Yet overall, sales volume is weak. This is why existing home sales are still pathetic in spite of this perception that investors can cure all.”

Send in more Chinese!!! We need more Chinese!!!

“All of us are left to speculate what the black box of the Fed is thinking.”

This has led to the new study guessonomics which has replaced the failed study of economics.

All I hear from Yellen and people like her is that they are trying to think of new ways to “help the housing market recover and pick up steam.” Meaning, they are trying to make houses MORE expensive. They say that housing “has started to recover” but they want “more recovery.” I think the people who work at the Fed and others aligned with them, when they think of a “recovery,” they think of rising home prices. Conversely, when buyers think of a “recovery,” they think of “affordability,” i.e., LOWER prices and not “cheaper loan rates.” Mortgage rates are already pretty low, and could go lower, but that is not the ultimate fix. If everyone paid less of their monthly nut towards their housing expenses, EVERYONE benefits – -and that money could be plowed into the economy in another sector. Everyone except the banks, tax collectors, current home owners who are counting on selling their grantie-laden sarcophagi at inflated prices, and lenders, of course. If this mindset stays static, there will continue to be a drop in household formation and new families buying houses – -new or used.

” I think the people who work at the Fed and others aligned with them, when they think of a “recovery,†they think of rising home prices.”

The Fed has a vested interest in rising home prices. That is the only way their trillion dollar investment in MBS’s will pay off. Otherwise kaboom…

Yellin and the Fed aren’t concerned with the price of housing, per se. (I’d like for you to link a quote where she addressed this problem directly, in a public statement) But, they are concerned with the health of our financial markets, who, despite the sunny propaganda otherwise, are still having serious issues with all of the bad debt and derivative positions betting on that bad debt from the housing bubble. This is why the Fed and the Treasury threw so much at the banks after the crash – to keep them breathing. Without that, I’m afraid, we would all be in a real pickle right now.

The powers that be see the housing issue only in terms of availability of credit. Their financial backers have no interest in the sorts of nationalistic policies that would be required to boost incomes. And, they know that allowing nominal housing prices to fall is a recipe for electoral disaster.

However, I disagree with the doctor when he says:

“The only way to get that household formation number picking up at any sizable pace is to bring back the NINJA loans and given the rhetoric I’m hearing, we might not be too far away from hearing these boneheaded ideas being thrown around.”

I’m currently closing on a condo in NC. There is no way to falsify your income and debt-to-income ratio under the current background-check process. Congress is not going to overturn or water down these restrictions.

The only way they can do this is to maintain the income- and debt-verification process, but extend the terms of loans to 40 or 50 years so that 20 and 30 somethings can buy. Graduated payment plans would allow monthly payments to rise with income (ha ha!). Moreover, the GOP will eventually break in favor of reducing immigration restrictions. Immigrants will share rent and mortgages and soak up housing overhead in ways that most native-born Americans simply will not entertain.

As long as current homeowners can continue to soak the generations behind them, the political establishment will thrive. Despite all the talk about Millennials, older Americans are going to have increasing political power in coming decades. As much as I hate to say it, inter-generational redistribution is only going to get worse. If you’re a Millennial with well-to-do parents, start letting them gift you all the money they can for a few years, so that you can bank it and not have to go through all the documentation hassle when it comes time to buy that overpriced house.

“Congress is not going to overturn or water down these restrictions.”

You’ve ascribed a lot of wisdom to Congress that I’m not sure is wholly earned. The modern Congress is in the business of getting re-elected. If they can craft a sales pitch, they’ll do it just to say they’ve solved the problem (by kicking the problem down the road to the next crash).

Democrats can sell it lower credit regulations as aiding in people’s search for affordable housing, and Republicans can sell it as reducing government and promoting business growth. Independents can shake their heads in disbelief all they like, but in the end are still stuck voting for one party or the other.

I guess it’s too much to hope younger people are seeping into financial and political institutions- a bit like Fight Club – who don’t have rich Mommy and Daddy to buy them homes.

It’s same in the UK, under a Conservative Government. Recovery = higher house prices.

“Selfservatives; going for recovery, because we already own homes.”

It’s not a matter of government regulation of the mortgage market. It’s the lack of support from the government. Who in their right mind would loan out money at 4% today for thirty years? It’s stupid. It’s the only mortgage market like it in the world. Most others are variable rate and/or shorter term. Fannie Freddie is a grossly over bloated GSE that already was balled out to the tune of lord knows how many billions, and, even though they absurdly pronounce themselves profitable these days. they are totally owned and backed up by you and me, the taxpayer. They’re trying to fix this in Washington somehow, because it’s such a horrible symbol of waste and distorted markets, an embarrassment to both parties, but, they can’t right now, with the market still pathetically screwed up in most of the country (not you, California. You’re a special kind of messed up, all to your own).

@bler_not_blert: Don’t get me wrong. I don’t attribute any wisdom to Congress. But, I do think they innovate in ways to blow housing bubbles. They won’t do it the same way twice, if only because some interests out there (e.g., the Tea Party, consumer advocates, etc.) will spot a repeat of the way they blew the last one. So long as they can inflate a new one in a novel manner that still raises housing prices for existing owners, landlords, and specuvestors, no one will sound the alarm–at least no one who make a difference.

I don’t think the Fed knows what to do to help the housing market that won’t screw something else up. Government is the 800 pound gorilla that wants to help and has sympathy (whatever passes for government sympathy. Votes?) But is ham-handed and everything it touches gets distorted with a large helping of inflation. I’d like them to stop trying.

Over two and a half months since the Ides of March.

And 2014 is nearly 42% gone.

I’m still waiting for the Hard Tank.

Demand doesn’t create more of a limited resource. It would take a huge demand to create more land, and land prices underlie the price of real estate. The nonsense that economists preach – regulations keep prices high, there is plenty of land, we should build high rises, etc. are just that – nonsense.

Lots of houses are being built in my neighborhood to sell for 1 to 2 million. Builders pay half a million to get a half acre lot (they tear down the existing house).

People want a nice house on a decent sized lot. Period. 60 years ago they could get it.

Population increase is the cause of current high prices.

A) Virtually no population growth.

B) Land doesn’t determine prices, wages do.

C) See Robert Shiller Nobel prize on this.

That’s an interesting thought. The percentages don’t necessarily account for differences in population. If your theory were to be true that’d mean that even though homeownership dropped 16% among 30-34 and 17% among 25-29 year olds we’d likely still see larger numbers of these groups owning homes. Do you have anything that backs that up by comparing home ownership among the different age groups now versus past? I looked at the census and it says that in the 80s our population was around 226.5 million and todays stands at around 317.5 million (so roughly around 90 million more people which IS a significant increase.) It’d be interesting to look and see where demographically those 90 million stand age wise.

ErikKengaard: “Population increase is the cause of current high prices.”

Prices/values in the market are set by what new buyers are willing and able to pay – at the margin. Each day/week and month. When majority of buyers and sellers transact at higher prices in a month, all house prices rise. When majority of buyers and sellers transact at lower prices in a month, all house prices fall.

There’s been a lot of intervention/stimulus to help make fuel a buyer side recently, together with frenzy in stockmarkets making people feel rich and willing to over-pay, and just a general view that you “can’t go wrong with property” and distorted general belief cash is “dead money” vs inflation.

Household formation is important to the other sectors of the economy that depend a steady stream of new buyers such as furniture, Home Depot, kitchen stuff ect. That is why the Fed is concentrating on improving housing so the by product of consumerism will keep pace. They have not started any programs like in Britain the ” help to buy” program yet but watch out. Housing will go through the roof if they bring a similar program online here to “help” buyers who were previously locked out. Housing prices going up helps the banks and the economy in the Feds mind. Homes that are underwater just sit. The banks want you to keep buying the Fed wants you to keep consuming. The fed knows that a rising housing market helps homeowners feel more comfortable buying more stuff. Homeowners that are underwater are not as eager to keep buying like equity winners. Its all win-win in their minds! They can sell us more if they can manipulate us to buy more. It’s all about keeping money moving and flowing. The Fed does not want you saving your money in the bank and not spending it. The US economy depends on consumerism and debt.

“Household formation is important to the other sectors of the economy that depend a steady stream of new buyers such as furniture, Home Depot, kitchen stuff ect. That is why the Fed is concentrating on improving housing so the by product of consumerism will keep pace.”

So are you saying that rich “Red” Chinese and fund managers don’t buy furniture, Home Depots and kitchen stuff?

“They have not started any programs like in Britain the †help to buy†program yet but watch out. Housing will go through the roof if they bring a similar program online here to “help†buyers who were previously locked out.”

So, are you telling me that housing hasn’t already gone through the roof? If not, then I will have to double down on my prediction of 30% growth for 2014.

“Housing prices going up helps the banks and the economy in the Feds mind. Homes that are underwater just sit. The banks want you to keep buying the Fed wants you to keep consuming. The fed knows that a rising housing market helps homeowners feel more comfortable buying more stuff. Homeowners that are underwater are not as eager to keep buying like equity winners. Its all win-win in their minds! They can sell us more if they can manipulate us to buy more. It’s all about keeping money moving and flowing. The Fed does not want you saving your money in the bank and not spending it. The US economy depends on consumerism and debt.”

How has that worked out? Even the government fudged GDP numbers are anemic at best…

Help To Buy is sick in my opinion. You have to hope you don’t get such a scheme in the US.

I’m sick of reading UK newspaper articles with pictures some gurning/smiling young happy couple who’ve taken big Government guarantee to help them pay top whack expensive price for a house – they don’t even haggle on the price. They just pay whatever is asked.

The official line from Gov is these buyers can afford the mortgage, but don’t have the deposit. So sad, too bad. So unfair! Yet loads of us renters have been saving for years for the deposit, waiting for house prices to fall to better value, and now these no-deposit fools outbidding us.

Gov has just ring-fenced £12bn (that’s $20bn US) of money to use as guarantees for these buyers, hoping they will take out £130bn ($217bn) of high-loan-to-value mortgages, until the scheme is scheduled to end in 2016.

The only bit of hope is the new lending standards that have just come in, where lenders taking much closer look at whether borrowers can afford new mortgages – scrutinizing bank statements etc, and actually some applicants now being refused for once. And 2 year fixes ticking up. Money seems to be tightening behind the scenes, in part I hope from the US taper. Also HTB of the past year has pulled forward lot of pent-up demand, and suggestions of a drop off in willing and able future buyers.

with the job $15 dollar an hour to buy 500k home in sol cal .

Next year is an election year so you know Real Estate is going to be the talk of the show for sure.

Real Estate sales always do well right up to the election as history has shown us and stops dead in its tracks just afterwards….

Lets see what the current administration can pull off to make next year a rosy year for Real Estate, right now at this moment…if the interest rates came down a solid 1/2 percentage point it probably wouldn’t make a blind bit off difference.

Sales are slowing at the fastest pace since 2007/2008, so whats next from the fed’s big bag of tricks?

Give up Boomers. The kids don’t want your debt.

Without question, new entries into buying a home are now taking a hard look at buying with these prices. It does look like boomers who think young college grads are going to take on their grossly underwater debt forgot it.

Moreover, the GOP will eventually break in favor of reducing immigration restrictions. Immigrants will share rent and mortgages and soak up housing overhead in ways that most native-born Americans simply will not entertain.

Silly some immigration peak in 2007 and places like Santa Ana have been doing this for 30 years. You are way behind time. Actually, opposition to legalizing immigrants has lead to the increase since people hire them off the books. In act California and Texas are the two highest states for those off the books. Hispanic immigration has peak. In most places in California and Texas its the same immigrants that have been here for over 10 years fighting for the same service jobs and construcation new group is going to be smaller since Mexico is developing a little and birth rates have dropped.

Last weekend I attended a little brunch at a friend’s home.. four couples all in the 30-35 age range, most newly married, all SoCal natives with upper-middle backgrounds.

Having never spoken to these folks at any real length before I was pretty surprised to find that we had all came to the same conclusion: Local RE pricing is a joke, and we’re not even going to pretend that stretching ourselves that far–for that little–is a good idea. BTW, did you hear about what’s going on in Texas?

I gave up predicting anything, but I think the next ten years will be very interesting. There’s an entire chunk of buyers who have (mentally) removed themselves from the equation, myself included. Good luck, Boomers.

“What’s going on in Texas” is that prices are going through the roof because of the influx of CA emigrants (while wages stay way lower)…

Bub….This is just my wife and I, but we can live just about anyplace we want, Texas was never in the conversation. To me the fact that Texas is a hot item in the topic of places to live, kind of says something to us.

I hope that isn’t to harsh, but culture shock , topography, etc. must be a concern for many i would think, especially coming from CA. or East of the Miss.

you think the average person is stupid? realize the fact that half the world population is even more stupid – george carlin

Ben blogs like this tell a story, no matter what side we all are involved, most people have lives that are so convoluted, they really are just existing in this world.

That is why most can’t understand decisions that people make, they are not engaged and never want to get informed, because they don’t have even a minute to stop and think.

Housing To Tank Hard in 2014!

Housing to go up 30% hard in 2014…

I’m afraid What?’s sarcastic shill persona is right. Wages don’t matter, jobs don’t matter, prices will just continue to go up fo-EVAH. Sure it will all crash eventually but I don’t have forever to wait around. Definitely doesn’t look like there is any “tanking” happening in 2014 as it is already June…

ISM report. ISM report. Need I say more.

Just look back to 2009. What was planned and what came into fruition? Recovery, Greentek jobs, high speed Rail is still a dream, strict environmental regulations have been moved back to a plan where they are being eased in over 15 years, health care is still a mess, and housing afford-ability is just as bad as before. Look at the mess we are in. 2013 birth rate numbers are at all time lows and household formation is abysmal. It doesn’t have to be like this, we just choose it to be. We give too much praise and rights to people who pretend to be rich, be they millennial or boomer.

There is no housing market right now because there is no market. Even the people making bank on housing today are likely worried about being exposed. Why would a peon think differently?

Excellent take….Leaf Crusher

up and down,up and up and down,up and up and up and down.home prices are much like gasoline prices up high but never seems to go down to where it once was.

Nobody….Pretty much once prices go up they don’t come down to a level where most people are comfortable, it is a capitalist thing.

Many of the young people turned gay and they have no intention to be traditional and buy a house. They like apartment living in The City. You need to forget about these old ideas, they are for the older generations.

Something I see constantly is the boomer are NOT downsizing.

They refuse to give up the lifestyle they have become accustomed to. My boss for example: He is retiring soon. They are moving out of state to Washington state. They have been flying up there on weekends to house hunt and guess what they are looking at? 3500 sq ft + mansions. They want the big house, 3 car garage, half an acre of land, swimming pools, the whole nine yards.

3500 sq ft for 2 people in their 60’s?

These are not wealthy people by any means. The only assets they have will be their pension and 401k. All he is concerened about is how much house he can buy on his monthly retirement payment.

I see this as insanity. ME? I’d be buying a small house in a good area. Being buried in debt until you kick the bucket? No thanks. Slaving away maintaining the mansion and grounds and swimming pools in your 60’s and 70’s? Craziness. Since I would be basically too old to earn extra money I plan to be extremely thrifty with my retirement savings.

My current neighborhood, are nice houses about 8 yrs old. My house is the smallest floor plan (thrifty and suits us fine) yet the bigger floor plans were bought by – you guessed it – boomers in their 60’s and 70’s.

Another work friend of mine and her husband sold their house because they grew to hate the HOA. They bought again in the same suburb, just no HOA. They are both in their 50’s, kids grown and gone. Guess what they bought… yep.. the 3000 sq. ft mansion. I asked her why are you buying such a big house? She said “well anything else is too small for us”. Too small for what? And, they can hardly climb the stairs to get to the 4 bedrooms and 3 baths upstairs.

Everyone to their own but to me, this is all nuts.

Bruce…Turned gay??? Don’t know what to do with that statement, please let folks understand how someone all of a sudden decides to be gay just asking?

Bruce was probably born straight, too, but the moment his parents went with the name Bruce he became a gay. I don’t know why my parents named me DFresh, but it’s a conversation starter for sure and it’s a good gay name, too, should I decide to become a male go-go dancer at boots ‘n saddles.

Defresh don’t feel too bad, I was named after an Abbot and Costello skit…

I just had a very good friend phone me this morning about his recent trip to Vegas for a class on real estate investment. This friend is in his early 30’s and has a new family, so a small mom and pop potential investor. He mentioned that they are preaching the use of OPM (Other People’s Money) and using 5/1 ARMS with minimal down payments to purchase several homes at a time for the potential appreciation.

We’re both in the same field of work and have known each other for years. I advised him to watch out for people peddling investment strategies to the public, and especially to avoid leveraging himself to purchase properties out of state on what is essentially a gamble. He’s a pretty smart guy, so i’m hoping he heeds my advice. It looks like the scum are back to their old tricks once again unfortunately. Meanwhile I have been stockpiling a nice cash position for when this house of cards all inevitable comes crashing down once again.

“I just had a very good friend phone me this morning about his recent trip to Vegas for a class on real estate investment.”

“He’s a pretty smart guy, so i’m hoping he heeds my advice.”

How can you rationalize these two sentences? I am willing to bet that this “pretty smart guy” will NOT heed your advice…

This blog and the comments are great entertainment but we’re all strapped-in and handcuffed passengers. Psycho Oily-car-key drivers have the wheel — the 1% of the 1% “deciders”, mostly concentrated in the financial, insurance, real estate, law and health care industries include:

Goldman Sachs $4,670,207

Blackstone $2,236,050

Kirkland and Ellis $1,526,949

Morgan Stanley $1,241,241

Comcast $1,222,705

Akin Gump $1,643,941

Google $1,352,312

Harvard $1,236,391

Microsoft $1,049,667

Podesta Group $1,052,179

Skadden Arps $1,239,387

Patton Boggs $925,528

Elliot Management $4,435,923

Credit Suisse $705,788

Rothman Institute $590,366

Citigroup $746,650

Fidelity $726,414

DLA Piper $864,496

Bain Capital $2,764,306

Brownstein Hyatt $627,016

Public financing of elections should be the law.

http://sunlightfoundation.com/blog/2013/06/24/1pct_of_the_1pct/

wolf-pac.com

Vermont is the first state to call for a constitutional convention to get money out of politics. It’s something both real conservatives and liberals want, and at the state level there are still representatives willing to listen to their constituents. If wolf pack pulls it off, then it’s a new ball game…

I did fairly well in my life, as a owner of Appliance stores , (part)Auto Dealership and mostly income property. I can assure you 1% stack me up against the folks on your list and I’m just another “Joe ” who would be swallowed up in a NY minute.

These lobbyist for major industries here and abroad run the show, like I always said, the G8 countries are the judge and jury on what we buy, how much to charge, and how many years before we all get the idea it was a scam, less is more with these folks, they do the Enron cheer, “all is well?” good post

Leave a Reply to Leaf Crusher